Attached files

| file | filename |

|---|---|

| EX-10.3 - EXHIBIT 10.3 - BLACK HAWK EXPLORATION | ex10-3.htm |

| EX-23.1 - EXHIBIT 23.1 - BLACK HAWK EXPLORATION | ex23-1.htm |

| EX-23.3 - EXHIBIT 23.3 - BLACK HAWK EXPLORATION | ex23-3.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Black

Hawk Exploration, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada | ||

| (State or other jurisdiction of incorporation or organization) | ||

1041

(Primary

Standard Industrial Classification Code Number)

27-0670160

(I.R.S.

Employer Identification Number)

| 1174 Manito NW, PO Box 363, Fox Island, WA 98333 | ||

| Telephone: (253) 973-7135, Fax: (253)549 4329 |

(Address,

including zip code, and telephone number, including area code, of registrant’s

principal

executive offices)

Southwest

Business Services LLC

9360

W. Flamingo #110-158

Las

Vegas, NV 89147

Tel:

702-382-1714, fax 702-382-1759

(Name,

address and telephone number of agent for service)

Please

send copies of all correspondence to:

William

L. MacDonald

Macdonald

Tuskey Corporate & Securities Lawyers

Suite

#1210, 777 Hornby Street, Vancouver, B.C., V6Z 1S4, Canada

Telephone:

(604) 648-1670, Facsimile: (604)681-4760

Approximate Date of

Commencement of Proposed Sale to the Public: As

soon as practicable after this Registration Statement is declared

effective.

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933, please check the

following box. þ

If this Form is filed to

register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act

Prospectus number of the earlier effective registration statement for the same

offering. o

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act,

check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

o

If this Form is a

post-effective amendment filed pursuant to Rule 462(d) under the Securities Act,

check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company.

Large accelerated

filer o Accelerated

filer o Non-accelerated

filer x

Smaller

reporting company o

CALCULATION

OF REGISTRATION FEE

|

Title

of each class

of

securities to be

registered(1)

|

Amount

to be

registered

|

Proposed

maximum

offering

price

per

share

|

Proposed

maximum

aggregate

offering

price

(US$)

|

Amount

of

registration

fee(2)

|

|

Common

Stock, $0.001 par value

Common

Stock, $0.001 par value

|

21,435,294(3)

18,000,000(4)

|

$ 0.85

$ 0.85

|

$18,219,999.90

$15,300,000

|

$1,299.09

$1,090.89

|

|

Total

Registration Fee

|

$2,389.98

|

|||

(1) An

indeterminate number of additional shares of common stock shall be issuable

pursuant to Rule 416 to prevent dilution resulting from stock splits, stock

dividends or similar transactions and in such an event the number of shares

registered shall automatically be increased to cover the additional shares in

accordance with Rule 416 under the Securities Act.

(2)

Estimated in accordance with Rule 457(c) solely for the purpose of

computing the amount of the registration fee based on a bona fide estimate of

the maximum offering price.

(3)

Represents

shares of our common stock were previously acquired by and issued to the Selling

Shareholders in private transactions directly with us or with one of our

affiliates. All of these shares are offered by the Selling

Shareholders.

(4)

Represents shares of our common stock, par value $0.001 per share, which we are

offering directly through our officers and directors, with a minimum investment

of 5,000 shares.

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON THE DATE OR DATES AS MAY

BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A

FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT

SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE

SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON THE

DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY

DETERMINE.

BLACK

HAWK EXPLORATION, INC.

39,435,294

SHARES OF COMMON STOCK

The

information in this Prospectus is not complete and may be changed. The Selling

Shareholders may not sell these securities until this registration statement is

declared effective by the United States Securities and Exchange Commission. This

Prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any state where the offer or sale is not

permitted.

Subject

to Completion

_________________,

2010

Black

Hawk Exploration, Inc. (the “Company”,

“us”,

“we”,

“our”

is registering a total of 39,435,294 shares of our common stock. Of the shares

being registered, 21,435,294 are being registered for sale by current holders of

our common shares as listed in ‘Selling Shareholders” further in this

Registration Statement (the “Selling Shareholders”), and 18,000,000 are being

registered for sale by us.

The

offering of the 18,000,000 shares is a “best efforts” offering, which means that

our directors and officers will use their best efforts to sell the common stock

and there is no commitment by any person to purchase any

shares. There is no minimum number of shares required to be sold to

close the offering. However, each individual subscriber must purchase a minimum

of 5,000 shares. The offering period will be open for 180 days and our

management at their sole discretion may terminate the offering at any time prior

to the expiration of the initial 180 days of the offering. Proceeds from the

sale of the shares will be used to fund the initial stages of the Company’s

exploration of its mineral properties. This offering will end no later than six

(6) months from the offering date. The offering date is the date by which this

registration statement becomes effective. This is a direct participation

offering since we, and not an underwriter, are offering the stock.

We are

also registering 21,435,294 previously

issued shares

of our common stock, which may be resold from time to time by certain Selling

Shareholders. These shares were acquired by the Selling Shareholders

directly from us in private offerings that were exempt from registration

requirements of the Securities Act of 1933. A registration statement under the

Exchange Act relating to these securities has been filed with the Securities and

Exchange Commission. Our Selling Shareholders may not offer or sell their shares

of our common stock until this registration statement is declared effective. We

have been advised by the Selling Shareholders that they may offer to sell all or

a portion of their shares of common stock being offered in this prospectus from

time to time. Please see “Plan of Distribution” at page 26 for a detailed

explanation of how the securities may be sold. The Selling Shareholders may sell

all or a portion of their shares through public or private transactions at

prevailing market prices or at privately negotiated prices. We will not receive

any of the proceeds from the sale of shares by the Selling Shareholders. The

primary affiliates of our company, Kevin M. Murphy (our President, Chief

Executive Officer, and Director) and Howard Bouch (our Director, Secretary and

Treasurer) will be selling their shares of our common stock in this

offering.

Neither

the Securities and Exchange Commission nor any state regulatory authority has

approved or disapproved of these securities, endorsed the merits of this

offering, or determined that this Prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

An

investment in our securities is speculative. Investors should be able to afford

the loss of their entire investment. See the section entitled “Risk

Factors” beginning on Page 10 of this Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of this Prospectus. Any representation to the contrary is a

criminal offense.

This

Prospectus shall not constitute an offer to sell or the solicitation of an offer

to buy these securities, nor shall the selling security holders sell any of

these securities in any state where such an offer or solicitation would be

unlawful before registration or qualification under such state’s securities

laws.

You

should rely only on the information contained in this prospectus. We have

not authorized anyone to provide you with information different from that

contained in this Prospectus. The selling shareholders are offering to

sell, and seeking offers to buy, their common shares, only in jurisdictions

where offers and sales are permitted. The information contained in this

prospectus is accurate only as of the date of this prospectus, regardless of the

time of delivery of this prospectus or of any sale of our common

shares.

The

date of this prospectus is ________________, 2010

The

following table of contents has been designed to help you find important

information contained in this prospectus. We encourage you to read the entire

prospectus.

TABLE

OF CONTENTS

|

|

||

|

i

|

||

|

3

|

||

|

9

|

||

|

11

|

||

|

11

|

||

|

14

|

||

|

19

|

||

| 20 | ||

| 21 | ||

| 25 | ||

| 33 | ||

| 34 | ||

| F-1 | ||

| 35 | ||

| 41 | ||

| 41 | ||

| 44 | ||

| 46 | ||

| 48 | ||

| 48 | ||

| 49 | ||

| 49 | ||

| 50 | ||

| 50 | ||

|

FORWARD-LOOKING

STATEMENTS

|

||

|

SECURITIES

AND EXCHANGE COMMISSION’S PUBLIC REFERENCE

|

||

|

THE

OFFERING

|

||

|

SELLING

SECURITY HOLDERS

|

||

|

PLAN

OF OPERATION

|

||

|

REPORTS

TO STOCKHOLDERS

|

||

|

DIVIDEND

POLICY

|

||

|

TRANSFER

AGENT AND REGISTRAR

|

||

|

EXPERTS

|

This

Prospectus, and any supplement to this Prospectus include “forward-looking

statements”. To the extent that the information presented in this Prospectus

discusses financial projections, information or expectations about our business

plans, results of operations, products or markets, or otherwise makes statements

about future events, such statements are forward-looking. Such forward-looking

statements can be identified by the use of words such as “intends”,

“anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”,

“plans” and “proposes”. Although we believe that the expectations

reflected in these forward-looking statements are based on reasonable

assumptions, there are a number of risks and uncertainties that could cause

actual results to differ materially from such forward-looking

statements. These include, among others, the cautionary statements in

the “Risk Factors” section beginning on Page 10 of this Prospectus and the

“Management’s Discussion and Analysis of Financial Position and Results of

Operations” section elsewhere in this Prospectus.

This

summary only highlights selected information contained in greater detail

elsewhere in this Prospectus. This summary may not contain all of the

information that you should consider before investing in our common stock. You

should carefully read the entire Prospectus, including “Risk Factors” beginning

on Page 10, and the consolidated financial statements, before making an

investment decision

All

dollar amounts refer to US dollars unless otherwise indicated.

Our

Business

We were

incorporated in the State of Nevada on April 14, 2005. We are engaged

in the acquisition and exploration of mining properties. We have two

wholly owned Nevada subsidiaries: Blue Lithium Energy Inc. and Golden Black Hawk

Inc. We maintain our statutory registered agent’s office at 9360

W. Flamingo #110-158 Las Vegas, NV 89147 and our business office is

located at 1174 Manitou Dr, PO Box 363, Fox Island, WA 98333. Our telephone

number is (253) 973-7135 and our facsimile number is (253) 549-4329. Our

corporate resident agent in Nevada is Southwest Business Services LLC located at

9360 W.

Flamingo, Suite #110-158,

Las Vegas, Nevada 89147. Our fiscal year end is August 31st.

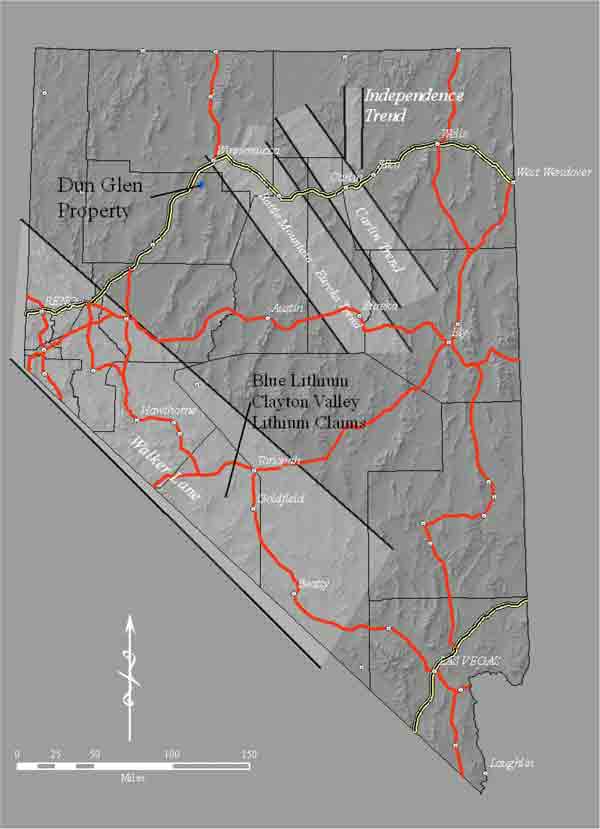

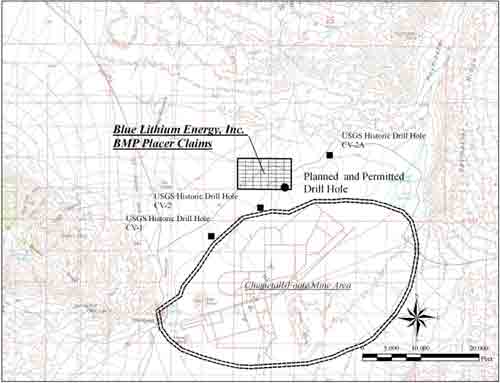

We are an

exploration stage company and are primarily engaged in the exploration and

development of gold, silver and lithium properties. We have acquired

rights to mineral properties in Nevada which we refer to as the Clayton Valley

Claims and the Dun Glen Project. Both of these properties are

described in “Description of Properties” further in this

Prospectus.

i

The

Offering

The

21,435,294 shares of our common stock being registered by this Prospectus for

the Selling Shareholders represent approximately 35.6% of our issued and

outstanding common stock as of March 10, 2010. We are also offering

18,000,000 shares of our common stock in a direct offering. If we

sell all 18,000,000 shares, they will account for approximately 23% of our

issued and outstanding common shares after the close of the

offering.

|

Securities

Offered:

|

39,435,294

shares of our common stock of which 21,435,294 are being offered by the

Selling Shareholders and 18,000,000 are being offered by us in a direct

offering.

|

|

|

Price

Per Share:

|

We

are offering the 18,000,000 shares of our common stock at a price of $0.85

per share.

The

Selling Shareholders may sell all or a portion of their shares through

public or private transactions at prevailing market prices or at privately

negotiated prices

|

|

|

Maximum

and Minimum Number of Securities to be Sold in this

Offering:

|

No

minimum. The Selling Shareholders may sell up to 21,435,294

shares of our common stock and we are offering a maximum of 18,000,000

shares of our common stock.

|

|

|

Securities

Issued and

to

be Issued:

|

As

of March 10, 2010 we had 60,236,722 issued and outstanding shares of our

common stock, and no issued and outstanding convertible

securities.

Our

common stock is quoted on the OTC Bulletin Board under the symbol “BHWX.OB”.

Trading of securities on the OTC Bulletin Board is often sporadic and

investors may have difficulty buying and selling or obtaining market

quotations, which may have a depressive effect on the market price for our

common stock.

|

|

|

Proceeds:

|

We

will not receive any proceeds from the sale of our common stock by the

Selling Shareholders. If we sell all of the 18,000,000 shares

we are offering, we will receive proceeds of $15,300,000 minus any

offering expenses.

|

|

|

Terms

of the Offering

|

This

is a BEST EFFORTS OFFERING. This is a no minimum offering. Accordingly, as

shares are sold we will use the money raised for our business. Each

individual subscriber must purchase a minimum of 5,000 shares. We cannot

be certain that we will be able to sell enough shares to sufficiently fund

our operations.

|

|

|

Plan

of Distribution

|

This

is a direct public offering, with no commitment by anyone to purchase any

shares. Our shares in this offering will be offered and sold by Mr. Kevin

Murphy and Mr. Howard Bouch, our directors and

officers.

|

1

SUMMARY

OF FINANCIAL DATA

The

following table sets forth selected financial information, which should be read

in conjunction with the information set forth in the “Management’s Discussion

and Analysis of Financial Position and Results of Operations” section and the

accompanying financial statements and related notes included elsewhere in this

Prospectus.

|

Three

Months Ended

November

30, 2009

(unaudited)

($)

|

Year

ended

August

31, 2009

($)

|

Period

from inception

on

April 14, 2005 to

November

30, 2009

(unaudited)

($)

|

|

|

Revenues

|

- | - | - |

|

Expenses

|

45,844 | 66,879 | 741,944 |

|

Net

Profit (Loss)

|

(45,844) | (66,879) | (741,944) |

|

Net

Profit (Loss) per share

|

(0.00) | (0.00) | (0.00) |

|

As

at November 30, 2009

(unaudited)

($)

|

Year

ended

August

31, 2009

($)

|

Year

ended

August

31, 2008

($)

|

|

|

Working

Capital (Deficiency)

|

234,184 | 46,500 | 27,079 |

|

Total

Assets

|

268,355 | 50,200 | 31,393 |

|

Total

Current Liabilities

|

(9,000) | - | (4,314) |

2

The

purchase of the shares of common stock being offered pursuant to this prospectus

is speculative and involves a high degree of risk. An investment in our common

stock may result in a complete loss of the invested amount.

RISK

FACTORS

In

addition to other information in this report, the following risk factors should

be carefully considered in evaluating our business because such factors may have

a significant impact on our business, operating results, liquidity and financial

condition. As a result of the risk factors set forth below, actual results could

differ materially from those projected in any forward-looking statements.

Additional risks and uncertainties not presently known to us, or that we

currently consider to be immaterial, may also impact our business, operating

results, liquidity and financial condition. If any such risks occur, our

business, operating results, liquidity and financial condition could be

materially affected in an adverse manner. Under such circumstances, the trading

price of our securities could decline, and you may lose all or part of your

investment.

Risks

Associated with our Business

We

are an exploration stage corporation, lack a business history and have losses

that we expect to continue into the future. If the losses continue we will have

to suspend operations or cease functioning.

We were

incorporated on April 14, 2005, and have only started our proposed business but

have not realized any revenues. We have no business history upon which an

evaluation of our future success or failure can be made. Our net loss since

inception is $741,944.

Our ability to achieve and maintain profitability and positive cash flow is

dependent upon:

|

●

|

our

ability to find a profitable exploration property;

|

|

|

●

|

our

ability to generate revenues; and

|

|

|

●

|

our

ability to reduce exploration

costs.

|

There can

be no assurance that we will be able to achieve any of the above and if our

losses continue we will have to suspend operations or cease

functioning.

Because

of the speculative nature of exploration of mineral properties, we may never

discover a commercially exploitable quantity of minerals, our business may fail

and investors may lose their entire investment.

We are in

the very early exploration stage and cannot guarantee that our exploration work

will be successful, or that any minerals will be found, or that any production

of minerals will be realized. The search for valuable minerals as a business is

extremely risky. We can provide investors with no assurance that

exploration on our properties will establish that commercially exploitable

reserves of minerals exist on our property. Additional potential

problems that may prevent us from discovering any reserves of minerals on our

property include, but are not limited to, unanticipated problems relating to

exploration and additional costs and expenses that may exceed current estimates.

If we are unable to establish the presence of commercially exploitable reserves

of minerals on our property our ability to fund future exploration activities

will be impeded, we will not be able to operate profitably and investors may

lose all of their investment in our company.

3

Because

of the unique difficulties and uncertainties inherent in mineral exploration

ventures, we face a high risk of business failure.

Potential

investors should be aware of the difficulties normally encountered by new

mineral exploration companies and the high rate of failure of such

enterprises. The likelihood of success must be considered in light of

the problems, expenses, difficulties, complications and delays encountered in

connection with the exploration of the mineral properties that we plan to

undertake. These potential problems include, but are not limited to,

unanticipated problems relating to exploration, and additional costs and

expenses that may exceed current estimates. The expenditures to be

made by us in the exploration of the mineral claim may not result in the

discovery of mineral deposits. Problems such as unusual or unexpected

formations and other conditions are involved in mineral exploration and often

result in unsuccessful exploration efforts. If the results of our

exploration do not reveal viable commercial mineralization, we may decide to

abandon our claims. If this happens, our business will likely

fail.

Because

of the inherent dangers involved in mineral exploration, there is a risk that we

may incur liability or damages as we conduct our business.

The

search for valuable minerals involves numerous hazards. As a result, we may

become subject to liability for such hazards, including pollution, cave-ins and

other hazards against which we cannot insure or against which we may elect not

to insure. At the present time we have no coverage to insure against these

hazards. The payment of such liabilities may have a material adverse effect on

our financial position.

We

have no known mineral reserves and we may not find any gold, silver or lithium

if we find gold, silver or lithium it may not be in economic quantities. If we

fail to find any gold, silver or lithium or if we are unable to find gold or

lithium in economic quantities, we will have to suspend operations.

We have

no known mineral reserves. Even if we find gold, silver or lithium, it may not

be of sufficient quantity so as to warrant recovery. Additionally, even if we

find gold, silver or lithium in sufficient quantity to warrant recovery it

ultimately may not be recoverable. Finally, even if any gold, silver or lithium

is recoverable, we do not know that this can be done at a profit. Failure to

locate gold, silver or lithium in economically recoverable quantities will cause

us to suspend operations.

We

may be adversely affected by fluctuations in ore and precious metal prices. If

prices decrease, we may be unable to achieve profitability.

The value

and price of our shares of common stock, our financial results, and our

exploration, development and mining activities, if any, may be significantly

adversely affected by declines in the price of precious metals and

ore. Mineral prices fluctuate widely and are affected by numerous

factors beyond our control such as interest rates, exchange rates, inflation or

deflation, fluctuation in the value of the United States dollar and foreign

currencies, global and regional supply and demand, and the political and

economic conditions of mineral producing countries throughout the

world.

4

The

prices used in making resource estimates for mineral projects are disclosed, and

generally use significantly lower metal prices than daily metals prices quoted

in the news media. The percentage change in the price of a metal cannot be

directly related to the estimated resource quantities, which are affected by a

number of additional factors. For example, a 10% change in price may have little

impact on the estimated resource quantities, or it may result in a significant

change in the amount of resources. If prices decrease, we may be

unable to achieve profitability.

Transportation

difficulties and weather interruptions may affect and delay proposed mining

operations and impact our proposed business.

Our

mining properties are accessible by road. The climate in the area is hot and dry

in the summer but cold and subject to snow in the winter, which could at times

hamper accessibility depending on the winter season precipitation levels. As a

result, our exploration and mining plans could be delayed for several months

each year.

Supplies

needed for exploration may not always be available. If we are unable to secure

exploration supplies we may have to delay our anticipated business

operations.

Competition

and unforeseen limited sources of supplies needed for our proposed exploration

work could result in occasional spot shortages of supplies of certain products,

equipment or materials. There is no guarantee we will be able to obtain certain

products, equipment and/or materials as and when needed, without interruption,

or on favorable terms. Such delays could affect our anticipated business

operations and increase our expenses.

Management

will devote only a limited amount of time to our business. Failure of our

management to devote a sufficient amount of time to our business plans may

adversely affect the success of our business.

Mr. Kevin

M. Murphy and Mr. Howard Bouch will each be devoting approximately 20 hours per

week to our business. Failure of our management to devote a sufficient amount of

time to our business plans may adversely affect the success of our

business.

Management

lacks formal training in mineral exploration. Our business, earnings and

ultimate financial success could suffer irreparable harm as a result of

management’s lack of experience in the industry.

Our

officers and directors have no professional accreditation or formal training in

the business of mineral exploration. With no direct training or experience in

these areas our management may not be fully aware of many of the specific

requirements related to working within this industry. Decisions so made without

this knowledge may not take into account standard engineering management

approaches that experienced exploration corporations commonly make.

Consequently, our business, earnings and ultimate financial success could suffer

irreparable harm as a result of management’s lack of experience in the

industry.

Risks

Associated with our Common Stock

We

do not intend to pay dividends on any investment in the shares of our

stock.

We have

never paid any cash dividends and currently do not intend to pay any dividends

for the foreseeable future. To the extent that we require additional

funding currently not provided for in our financing plan, our funding sources

may prohibit the payment of a dividend. Because we do not intend to

declare dividends, any gain on an investment in our company will need to come

through an increase in the stock’s price. This may never happen and

investors may lose all of their investment in us.

5

Because

we can issue additional shares of common stock, purchasers of our common stock

may incur immediate dilution and may experience further dilution.

We are

authorized to issue up to 300,000,000 shares of common stock, of which

60,236,722 shares are issued and outstanding. Our board of directors has the

authority to cause us to issue additional shares of common stock, and to

determine the rights, preferences and privileges of such shares, without consent

of any of our stockholders. Consequently, the stockholders may experience more

dilution in their ownership of our stock in the future.

A

decline in the price of our common stock could affect our ability to raise

further working capital, it may adversely impact our ability to continue

operations and we may go out of business.

A

prolonged decline in the price of our common stock could result in a reduction

in the liquidity of our common stock and a reduction in our ability to raise

capital. Because we may attempt to acquire a significant portion of

the funds we need in order to conduct our planned operations through the sale of

equity securities, a decline in the price of our common stock could be

detrimental to our liquidity and our operations because the decline may cause

investors to not choose to invest in our stock. If we are unable to

raise the funds we require for all our planned operations, we may be forced to

reallocate funds from other planned uses and may suffer a significant negative

effect on our business plan and operations, including our ability to develop new

products and continue our current operations. As a result, our

business may suffer, and not be successful and we may go out of

business. We also might not be able to meet our financial obligations

if we cannot raise enough funds through the sale of our common stock and we may

be forced to go out of business.

Our

stock is a penny stock. Trading of our stock may be restricted by the

Securities and Exchange Commission’s penny stock regulations which may limit a

stockholder’s ability to buy and sell our stock.

Our stock

is a penny stock. The Securities and Exchange Commission has adopted

Rule 15g-9 which generally defines “penny stock” to be any equity security that

has a market price (as defined) less than $5.00 per share or an exercise price

of less than $5.00 per share, subject to certain exceptions. Our

securities are covered by the penny stock rules, which impose additional sales

practice requirements on broker-dealers who sell to persons other than

established customers and “accredited investors”. The term

“accredited investor” refers generally to institutions with assets in excess of

$5,000,000 or individuals with a net worth in excess of $1,000,000 or annual

income exceeding $200,000 or $300,000 jointly with their spouse. The

penny stock rules require a broker-dealer, prior to a transaction in a penny

stock not otherwise exempt from the rules, to deliver a standardized risk

disclosure document in a form prepared by the SEC which provides information

about penny stocks and the nature and level of risks in the penny stock

market. The broker-dealer also must provide the customer with current

bid and offer quotations for the penny stock, the compensation of the

broker-dealer and its salesperson in the transaction and monthly account

statements showing the market value of each penny stock held in the customer’s

account. The bid and offer quotations, and the broker-dealer and

salesperson compensation information, must be given to the customer orally or in

writing prior to effecting the transaction and must be given to the customer in

writing before or with the customer’s confirmation. In addition, the

penny stock rules require that prior to a transaction in a penny stock not

otherwise exempt from these rules; the broker-dealer must make a special written

determination that the penny stock is a suitable investment for the purchaser

and receive the purchaser’s written agreement to the

transaction. These disclosure requirements may have the effect of

reducing the level of trading activity in the secondary market for the stock

that is subject to these penny stock rules. Consequently, these penny

stock rules may affect the ability of broker-dealers to trade our

securities. We believe that the penny stock rules discourage investor

interest in and limit the marketability of our common stock.

6

FINRA

sales practice requirements may also limit a stockholder’s ability to buy and

sell our stock.

In

addition to the “penny stock” rules promulgated by the Securities and Exchange

Commission, the Financial Industry Regulatory Authority (FINRA) has adopted

rules that require that in recommending an investment to a customer, a

broker-dealer must have reasonable grounds for believing that the investment is

suitable for that customer. Prior to recommending speculative low

priced securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer’s financial status,

tax status, investment objectives and other information. Under

interpretations of these rules, the FINRA believes that there is a high

probability that speculative low priced securities will not be suitable for at

least some customers. The FINRA requirements make it more difficult

for broker-dealers to recommend that their customers buy our common stock, which

may limit your ability to buy and sell our stock.

Our

security holders may face significant restrictions on the resale of our

securities due to state “blue sky” laws.

Each

state has its own securities laws, often called “blue sky” laws, which (i) limit

sales of securities to a state’s residents unless the securities are registered

in that state or qualify for an exemption from registration, and (ii) govern the

reporting requirements for broker-dealers doing business directly or indirectly

in the state. Before a security is sold in a state, there must be a

registration in place to cover the transaction, or the transaction must be

exempt from registration. The applicable broker must be registered in that

state.

We do not

know whether our securities will be registered or exempt from registration under

the laws of any state. A determination regarding registration will be made by

those broker-dealers, if any, who agree to serve as the market-makers for our

common stock. There may be significant state blue sky law

restrictions on the ability of investors to sell, and on purchasers to buy, our

securities. You should therefore consider the resale market for our

common stock to be limited, as you may be unable to resell your shares without

the significant expense of state registration or qualification.

7

Risks

Related to our Financial Results and Need for Additional Financing

Our

auditors’ reports contain a statement that our net loss and limited working

capital raise substantial doubt about our ability to continue as a going

concern.

Our

independent registered public accountants have stated in their report, included

in our annual report on Form 10-K filed with the Securities and Exchange

Commission on November 30, 2009, that our significant operating losses and

working capital deficiency raise substantial doubt about our ability to continue

as a going concern. We had net losses of $66,879 and $283,375, respectively, for

the fiscal years ended August 31, 2009 and 2008. We will be required to raise

substantial capital to fund our capital expenditures, working capital and other

cash requirements since our current cash assets are exhausted. We are currently

searching for sources of additional funding, including potential joint venture

partners, while we continue the initial exploration phase on our mining claims.

The successful outcome of future financing activities cannot be determined at

this time and there are no assurances that, if achieved, we will have sufficient

funds to execute our intended business plan or generate positive operational

results.

We

will need additional capital to achieve our current business strategy and our

inability to obtain additional financing will inhibit our ability to expand or

even maintain our exploration and development efforts.

In

addition to our current accumulated deficit, we expect to incur additional

losses in the foreseeable future. Until we are able to determine if there are

mineral deposits available for extraction on our properties, we are unlikely to

be profitable. Consequently, we will require substantial additional capital to

continue our exploration and development activities. There is no assurance that

we will not incur additional and unplanned expenses during our continuing

exploration and development activities. When additional funding is required, we

intend to raise funds either through private placements or public offerings of

our equity securities. There is no assurance that we will be able to obtain

additional financing through private placements and/or public offerings

necessary to support our working capital requirements. To the extent that funds

generated from any private placements and/or public offerings are insufficient,

we will have to raise additional working capital through other sources, such as

bank loans and/or financings. No assurance can be given that additional

financing will be available, or if available, will be on acceptable

terms.

If we are

unable to secure adequate sources of funds, we may be forced to delay or

postpone the exploration, development and research of our properties, and as a

result, we might be required to diminish or suspend our business plans. These

delays in development would have an adverse effect on our ability to generate

revenues and could require us to possibly cease operations. In addition, such

inability to obtain financing on reasonable terms could have a negative effect

on our business, operating results or financial condition to such extent that we

are forced to restructure, file for bankruptcy protection, sell assets or cease

operations, any of which could put your investment dollars at significant

risk.

8

We are incurring

increased costs as a result of being a publicly-traded company.

As a

public company, we incur significant legal, accounting and other expenses that

we did not incur as a private company. In addition, the Sarbanes-Oxley Act of

2002, as well as new rules subsequently implemented by the Securities and

Exchange Commission, have required changes in corporate governance practices of

public companies. These new rules and regulations have increased our legal and

financial compliance costs and have made some activities more time-consuming and

costly. For example, as a result of becoming a public company, we have created

additional board committees and have adopted policies regarding internal

controls and disclosure controls and procedures. In addition, we have incurred

additional costs associated with our public company reporting requirements.

These new rules and regulations have made it more difficult and more expensive

for us to obtain director and officer liability insurance, which we currently

cannot afford to do. As a result of the new rules, it may become more difficult

for us to attract and retain qualified persons to serve on our board of

directors or as executive officers. We cannot predict or estimate the amount of

additional costs we may incur as a result of being a public company or the

timing of such costs and/or whether we will be able to raise the funds necessary

to meet the cash requirements for these costs.

Because

we may never earn revenues from our operations, our business may fail and then

investors may lose all of their investment in our company.

We have

no history of revenues from operations. We have never had significant

operations and have no significant assets. We have yet to generate

positive earnings and there can be no assurance that we will ever operate

profitably. We have a limited operating history and is in the

exploration stage. The success of our company is significantly

dependent on the uncertain events of the discovery and exploitation of mineral

reserves on our properties or selling the rights to exploit those mineral

reserves. If our business plan is not successful and we are not able

to operate profitably, then our stock may become worthless and investors may

lose all of their investment in our company.

Prior to

completion of the exploration stage, we anticipate that we will incur increased

operating expenses without realizing any revenues. We therefore

expect to incur significant losses into the foreseeable future. We

recognize that if we are unable to generate significant revenues from the

exploration of our mineral claims in the future, we will not be able to earn

profits or continue operations. There is no history upon which to

base any assumption as to the likelihood that we will prove successful, and we

can provide no assurance that we will generate any revenues or ever achieve

profitability. If we are unsuccessful in addressing these risks, our

business will fail and investors may lose all of their investment in our

company.

Please

read this prospectus carefully. You should rely only on the information

contained in this prospectus. We have not authorized anyone to provide you with

different information. You should not assume that the information provided by

the prospectus is accurate as of any date other than the date on the front of

this prospectus.

The

21,435,294 shares

of common stock offered hereby by the Selling Shareholders are being registered

for the account of the Selling Shareholders identified in this Prospectus. All

net proceeds from the sale of this common stock will go to the respective

Selling Shareholders who offer and sell their shares of common stock. We will

not receive any part of the proceeds from such sales of common

stock.

9

The net

proceeds to us from the sale of up to 18,000,000 shares offered at a public

offering price of $0.85 per share will vary depending upon the total number of

shares sold. Regardless of the number of shares sold, we expect to incur

offering expenses estimated at approximately $60,000, $55,000 for legal and

accounting (incurred), and $5,000 for other costs in connection with this

offering (estimated transfer agent fees, filing fee, etc.). The table below

shows the intended net proceeds from this offering we expect to receive for

scenarios where we sell various amounts of the shares. Since we are making this

offering without any minimum requirement, there is no guarantee that we will be

successful at selling any of the securities being offered in this prospectus.

Accordingly, the actual amount of proceeds we will raise in this offering, if

any, may differ.

Percent

of Net Proceeds Received

| 20% | 40% | 70% | 100% | |||||||||||||

|

Shares

Sold

|

3,600,000 | 7,200,000 | 12,600,000 | 18,000,000 | ||||||||||||

|

Gross

Proceeds

|

$3,060,000 | $6,120,000 | $10,710,000 | 15,300,0000 | ||||||||||||

|

Less

Offering Expenses

|

($60,000) | ($60,000) | ($60,000) | ($60,000) | ||||||||||||

|

Net

Offering Proceeds

|

$3,000,000 | $6,060,000 | $10,650,000 | $15,240,000 |

The Use

of Proceeds set forth below demonstrates how we intend to use the funds under

the various percentages of amounts of the related offering. All amounts listed

below are estimates.

| 20% | 40% | 70% | 100% | |||||||||||||

|

Professional

Fees

|

$50,000 | $50,000 | $50,000 | $50,000 | ||||||||||||

|

Development

of Dun Glen Property

|

$1,400,000 | $2,800,000 | $4,900,000 | $7,000,000 | ||||||||||||

|

Development

of Clayton Valley Claims

|

$600,000 | $1,200,000 | $2,100,000 | $3,000,000 | ||||||||||||

|

Working

Capital

|

$950,000 | $2,010,000 | $3,600,000 | $4,840,000 |

Our

offering expenses are comprised of legal and accounting expenses and transfer

agent fees. Our officers and Directors will not receive any compensation for

their efforts in selling our shares.

We intend

to use the proceeds of this offering in the manner and in order of priority set

forth above. We do not intend to use the proceeds to acquire assets or finance

the acquisition of other businesses. At present, no material changes are

contemplated. Should there be any material changes in the projected use of

proceeds in connection with this offering, we will issue an amended prospectus

reflecting the new uses.

In all

instances, after the effectiveness of this registration statement, we will need

some amount of working capital to maintain its general existence and comply with

its public reporting obligations. In addition to changing allocations because of

the amount of proceeds received, we may change the use of proceeds because of

required changes in our business plan. Investors should understand that we have

wide discretion over the use of proceeds. Therefore, management decisions may

not be in line with the initial objectives of investors who will have little

ability to influence these decisions.

There is

no commitment by any person to purchase any or all of the shares of common stock

offered by this prospectus and, therefore, there can be no assurance that the

offering will be totally subscribed for the sale of the maximum 18,000,000

shares of common stock being offered.

10

The

Selling Shareholders will sell their shares at prevailing market prices or

privately negotiated prices. The number of securities that may be actually sold

by a Selling Shareholder will be determined by each Selling Shareholder. The

Selling Shareholders are under no obligation to sell all or any portion of the

securities offered, nor are the Selling Shareholders obligated to sell such

shares immediately under this Prospectus. A security holder may sell securities

at any price depending on privately negotiated factors such as a shareholder’s

own cash requirements, or objective criteria of value such as the market value

of our assets.

We have

arbitrarily established the offering price of the common stock and it should not

be considered to bear any relationship to our assets, book value or net worth

and should not be considered to be an indication of our value.

Among the

factors considered by our management were:

|

●

|

the

market price for our common stock on the OTC Bulletin

Board;

|

|

●

|

the

potential of our mineral

properties;

|

|

●

|

the

proceeds to be raised by the offering;

and

|

|

●

|

our

cash requirements relative to our business

operations.

|

All of

the 21,435,294 shares of our common stock to be sold by the Selling Shareholders

are currently issued and outstanding, and will therefore not cause dilution to

any of our existing stockholders.

Dilution

represents the difference between the offering price and the net tangible book

value per share immediately after completion of this offering. Net tangible book

value is the amount that results from subtracting total liabilities and

intangible assets from total assets. Dilution arises mainly as a result of our

arbitrary determination of the offering price of the shares being offered.

Dilution of the value of the shares you purchase is also a result of the lower

book value of the shares held by our existing stockholder.

As at

November 30, 2009, our last financial statement date, our total net tangible

book value was $259,355, or $0.004 per share based on 60,236,722 shares issued

and outstanding. The proceeds from the sale of the new shares being

offered (up to a maximum of 18,000,000) will vary depending on the total number

of shares actually sold in the offering. If all 18,000,000 shares offered

hereunder are sold, there would be a total of 78,236,722 common shares issued

and outstanding. Dividing our net tangible book value by the number

of shares outstanding after the sale of the maximum offering results in a per

share net tangible book value of approximately 15,499,355 or $0.20 per

share.

Therefore,

the shareholders who purchase shares in this offering will suffer an immediate

dilution in the book value of their shares of approximately $0.65 per share, and

our present shareholders will receive an immediate book value increase of

approximately $0.65 per share.

The

following table demonstrates two scenarios to illustrate the per share dilution

effect of the offering of the new shares. The first scenario assumes the

completion of this offering by the sale of 50% of the maximum of 18,000,000

shares (9,000,000 shares) of common stock for proceeds of $7,650,000, and the

second scenario assumes the completion of the maximum offering of 18,000,000

shares of common stock for proceeds of $15,300,000.

11

| 50% |

100%

(Maximum)

|

|||||||

| 9,000,000 | 18,000,000 | |||||||

|

Initial

public offering price per share

|

$ | 0.85 | $ | 0.85 | ||||

|

Net

tangible book value per share as of November 30, 2009

|

$ | 0.004 | $ | 0.004 | ||||

|

Increase

in net tangible book value per share attributable to new investors

|

$ | 0.106 | $ | 0.196 | ||||

|

Net

tangible book value per share after offering

|

$ | 0.11 | $ | 0.20 | ||||

|

Dilution

per share to new investors

|

$ | 0.74 | $ | 0.65 | ||||

After

completion of the offering by us, the existing shareholders will own

approximately 77% of the total number of shares then outstanding, for which they

will have made an investment of approximately $260,000, or an average of $0.004

per share. Upon completion of a maximum offering, the purchasers of the shares

offered hereby will own 23% of the total number of shares then outstanding, for

which they will have made a cash investment of $15,300,000, or $0.85 per

share.

SELLING

SHAREHOLDERS

The 4

Selling Shareholders are offering for sale of 21,435,294 shares of our issued

and outstanding common stock which they obtained as part of the following

issuances:

|

●

|

On

February 4, 2010, Kevin Murphy acquired 12,000,000 shares of our common

stock from one of our majority shareholders. These shares were

purchased in a private transaction for total consideration of

$10,200,000.

|

|

●

|

In

August 2009, we issued 10,000 shares of our common stock each to Kevin

Murphy and Howard Bouch as consideration for consulting services provided

to us.

|

|

●

|

Wayne

Weaver acquired 20,000,000 of our common shares in private transactions

from our former director and officer. These shares were

initially issued to our former director and officer, Garrett Ainsworth in

April of 2005 for total consideration of $2,000. Mr. Weaver has

also acquired and disposed of other shares of our common stock through

private and open market transactions to bring his total ownership to

9,135,294.

|

|

●

|

On

July 27, 2009 the Company entered into a consulting contract with Wannigan

Consulting Corp to:

|

|

■

|

maintain

the books and records of the Company in accordance with the instructions

of the Company’s Auditors and in accordance of U.S. GAAP if so requested

by the Company;

|

|

■

|

prepare

all necessary regulatory and statutory filings required of the

Company;

|

|

■

|

act

as liaison between the Company and its

Auditor.

|

|

■

|

act

as liaison between the Company and its Transfer

Agent.

|

The

Company issued 280,000 restricted Common Shares of our common stock to Wannigan

Consulting Corp as compensation.

All of

these securities were initially issued in reliance upon an exemption from

registration pursuant to Regulation S under the Securities Act of 1933 (the

“Securities Act”). Our reliance upon Rule 903 of Regulation S was

based on the fact that the sales of the securities were completed in an

“offshore transaction”, as defined in Rule 902(h) of Regulation S. We

did not engage in any directed selling efforts, as defined in Regulation S, in

the United States in connection with the sale of the securities. Each investor

was not a U.S. person, as defined in Regulation S, and was not acquiring the

securities for the account or benefit of a U.S. person.

12

The

Selling Shareholders have the option to sell their shares at prevailing market

prices or privately negotiated prices.

The

following table provides information as of March 10, 2010 regarding the

beneficial ownership of our common stock by each of the Selling Shareholders,

including:

|

●

|

the

number of shares owned by each prior to this

offering;

|

|

●

|

the

number of shares being offered by

each;

|

|

●

|

the

number of shares that will be owned by each upon completion of the

offering, assuming that all the shares being offered are

sold;

|

|

●

|

the

percentage of shares owned by each;

and

|

|

●

|

the

identity of the beneficial holder of any entity that owns the shares being

offered.

|

|

Name

and Address of

Selling

Shareholder

|

Shares

Owned

Prior

to this

Offering

(1)

|

Percent

(2)

|

Maximum

Numbers

of

Shares

Being

Offered

|

Beneficial

Ownership

After

Offering

|

Percentage

Owned

upon

Completion

of

the

Offering

(2)

|

||||||||||

|

Kevin

M. Murphy (3)

1174

Manito Dr, NW

Fox

Island, WA 98333

|

12,010,000 | 20.1% | 12,010,000 | 0 | 0 | ||||||||||

|

Howard

Bouch (4)

Grove

House

13

Low Seaton Workington

Cumbria,

England

CA141PR

UK

|

10,000 | (6) | 10,000 | 0 | 0 | ||||||||||

|

Wayne

Weaver

Maison

de Grant,

Rue

de L’Etocquet,

St.

Ouen, Jersey JE3 2EL, UK

|

9,135,294 | 15.3% | 9,135,294 | 0 | 0 | ||||||||||

|

Wannigan

Consulting Corp.

5466

Canvasback Rd

Blaine,

WA 98230 (5)

|

280,000 | (6) | 280,000 | 0 | 0 | ||||||||||

|

Total

|

21,435,294 | 36% | 21,435,294 |

|

(1)

|

The

number and percentage of shares beneficially owned is determined to the

best of our knowledge in accordance with the Rules of the SEC and. the

information is not necessarily indicative of beneficial ownership for any

other purpose. Under such rules, beneficial ownership includes

any shares as to which the selling security holder has sole or shared

voting or investment power and also any shares which the selling security

holder has the right to acquire within 60 days of the date of this

Prospectus.

|

13

|

(2)

|

The

percentages are based on 60,236,722 shares of our common stock issued and

outstanding and as at March 10,

2010.

|

|

(3)

|

Kevin

Murphy is our director, President and Chief Executive

Officer.

|

|

(4)

|

Howard

Bouch is our director, Chief Financial Officer, Secretary and

Treasurer.

|

|

(5)

|

Wannigan

Consulting Corp. is a consulting company of which Ken Liebscher, a

resident of Blaine WA is President and major shareholder and Howard Bouch

is a common Director and Officer.

|

|

(6)

|

Less

than 1%

|

Except as

otherwise noted in the above list, the named party beneficially owns and has

sole voting and investment power over all the shares or rights to the

shares. The numbers in this table assume that none of the Selling

Shareholders will sell shares not being offered in this Prospectus or will

purchase additional shares, and assumes that all the shares being registered

will be sold.

Other

than as described above, none of the Selling Shareholders or their beneficial

owners has had a material relationship with us other than as a security holder

at any time within the past three years, or has ever been one of our officers or

directors or an officer or director of our predecessors or

affiliates.

None of

the Selling Shareholders are broker-dealers or affiliates of a

broker-dealer.

Offering

of 18,000,000 Shares of our Common Stock

This is a

self-underwritten offering. We are offering to

the public 18,000,000 shares of common stock

on a “$15,300,000 maximum” basis at

a purchase price of $.85 per share. This Prospectus is

part of a prospectus that permits Mr. Kevin M. Murphy, our president and chief

executive officer, to sell the shares directly to the public, with no commission

or other remuneration payable to him. There are no plans or arrangements to

enter into any contracts or agreements to sell the shares with a broker or

dealer. Mr. Murphy will sell the shares and intends to offer them to

friends, family members, acquaintances, and business associates. In offering the

securities on our behalf, he will rely on the safe harbor from broker dealer

registration set out in Rule 3a4-1 under the Securities Exchange Act of

1934.

Mr.

Murphy will not register as broker-dealers pursuant to Section 15 of the

Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth

those conditions under which a person associated with an issuer may participate

in the offering of the issuer’s securities and not be deemed to be a

broker-dealer.

|

1.

|

Mr.

Murphy is not subject to a statutory disqualification, as that term is

defined in Section 3(a)(39) of the Act, at the time of his participation;

and,

|

|

2.

|

Mr.

Murphy will not be compensated in connection with his participation by the

payment of commissions or other remuneration based either directly or

indirectly on transactions in securities;

and

|

|

3.

|

Mr.

Murphy is not, nor will he be at the time of participation in the

offering, an associated person of a broker-dealer;

and

|

14

|

4.

|

Mr.

Murphy meets the conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the

Exchange Act, in that he (A) primarily performs, or is intended primarily

to perform at the end of the offering, substantial duties for or on behalf

of our company, other than in connection with transactions in securities;

and (B) is not a broker or dealer, or been an associated person of a

broker or dealer, within the preceding twelve months; and (C) has not

participated in selling and offering securities for any issuer more than

once every twelve months other than in reliance on Paragraphs (a)(4)(i) or

(a)(4)(iii).

|

Our

officers, directors, control persons and affiliates of same do not intend to

purchase any shares in this offering.

We will

not use public solicitation or general advertising in connection with the

offering. We will use our best efforts to find purchasers for the

shares offered by this prospectus within a period of 180

days from the date of the prospectus.

Resale

of 21,435,294 Shares by Selling Shareholders

We are

registering certain securities on behalf of the Selling Shareholders. The

21,435,294 issued common shares can be sold by the Selling Shareholders at

prevailing market prices or privately negotiated prices. Kevin M.

Murphy and Howard Bouch, our primary affiliates, will be selling their shares as

part of this offering. These sales may be at fixed or negotiated

prices.

The

Selling Shareholders may sell some or all of their securities in one or more

transactions, including block transactions:

|

●

|

on

such public markets as the securities may be

trading;

|

|

●

|

in

privately negotiated transactions;

|

|

●

|

in

any combination of these methods of

distribution.

|

|

The

sales price to the public may be:

|

|

●

|

the

market price prevailing at the time of

sale;

|

|

●

|

a

price related to such prevailing market price;

or

|

|

●

|

such

other price as the Selling Shareholders

determine.

|

We are

bearing all costs relating to the registration of certain securities. The

Selling Shareholders, however, will pay any commissions or other fees payable to

brokers or dealers in connection with any sale of certain

securities.

The

Selling Shareholders must comply with the requirements of the Securities Act and

the Exchange Act in the offer and sale of certain securities. In particular,

during such times as the Selling Shareholders may be deemed to be engaged in a

distribution of certain securities, and therefore be considered to be an

underwriter, they must comply with applicable laws and may, among other

things:

|

●

|

not

engage in any stabilization activities in connection with our

securities;

|

|

●

|

furnish

each broker or dealer through which common stock may be offered, such

copies of this Prospectus, as amended from time to time, as may be

required by such broker or dealer;

and

|

|

●

|

not

bid for or purchase any of our securities or attempt to induce any person

to purchase any of our securities other than as permitted under the

Exchange Act.

|

15

Our

common stock is quoted on the OTC Bulletin Board, under the trading symbol

“BHWX.OB”. The market for our stock is highly volatile. We cannot assure you

that there will be a market in the future for our common stock.

Trading

in stocks quoted on the OTC Bulletin Board is often thin and characterized by

wide fluctuations in trading prices, due to many factors that may have little to

do with a company’s operations or business prospects. The OTC Bulletin Board

should not be confused with the NASDAQ market. OTC Bulletin Board companies are

subject to far fewer restrictions and regulations than are companies traded on

the NASDAQ market. Moreover, the OTC Bulletin Board is not a stock exchange, and

trading of securities on the OTC Bulletin Board is often more sporadic than the

trading of securities listed on a quotation system like the NASDAQ Small Cap or

a stock exchange. In the absence of an active trading market: (a) investors may

have difficulty buying and selling or obtaining market quotations; (b) market

visibility for our common stock may be limited; and (c) a lack of visibility for

our common stock may have a depressive effect on the market price for our common

stock.

None of

the Selling Shareholders will engage in any electronic offer, sale or

distribution of the shares. Further, neither we nor any of the Selling

Shareholders have any arrangements with a third party to host or access our

Prospectus on the Internet.

In the

event of the transfer by any selling stockholder of his or her shares to any

pledgee, donee or other transferee, we will amend this prospectus and the

registration statement of which this prospectus forms a part by the filing of a

post-effective amendment in order to have the pledgee, donee or other transferee

in place of the selling stockholder who has transferred his or her

shares.

In

effecting sales, brokers and dealers engaged by the Selling Shareholders may

arrange for other brokers or dealers to participate. Brokers or dealers may

receive commissions or discounts from the Selling Shareholders or, if any of the

broker-dealers act as an agent for the purchaser of such shares, from the

purchaser in amounts to be negotiated which are not expected to exceed those

customary in the types of transactions involved. Broker-dealers may agree with

the Selling Shareholders to sell a specified number of the shares of common

stock at a stipulated price per share. Such an agreement may also require the

broker-dealer to purchase as principal any unsold shares of common stock at the

price required to fulfill the broker-dealer commitment to the Selling

Shareholders if such broker-dealer is unable to sell the shares on behalf of the

Selling Shareholders. Broker-dealers who acquire shares of common stock as

principal may thereafter resell the shares of common stock from time to time in

transactions which may involve block transactions and sales to and through other

broker-dealers, including transactions of the nature described above. Such sales

by a broker-dealer could be at prices and on terms then prevailing at the time

of sale, at prices related to the then-current market price or in negotiated

transactions. In connection with such re-sales, the broker-dealer may pay to or

receive from the purchasers of the shares, commissions as described

above.

The

Selling Shareholders and any broker-dealers or agents that participate with the

Selling Shareholders in the sale of the shares of common stock may be deemed to

be “underwriters” within the meaning of the Securities Act in connection with

these sales. In that event, any commissions received by the broker-dealers or

agents and any profit on the resale of the shares of common stock purchased by

them may be deemed to be underwriting commissions or discounts under the

Securities Act.

16

From time

to time, the Selling Shareholders may pledge their shares of common stock

pursuant to the margin provisions of their customer agreements with their

brokers. Upon a default by a selling stockholder, the broker may offer and sell

the pledged shares of common stock from time to time. Upon a sale of the shares

of common stock, the Selling Shareholders intend to comply with the prospectus

delivery requirements, under the Securities Act, by delivering a prospectus to

each purchaser in the transaction. We intend to file any amendments or other

necessary documents in compliance with the Securities Act which may be required

in the event any selling stockholder defaults under any customer agreement with

brokers.

To the

extent required under the Securities Act, a post effective amendment to this

registration statement will be filed, disclosing, the name of any

broker-dealers, the number of shares of common stock involved, the price at

which the common stock is to be sold, the commissions paid or discounts or

concessions allowed to such broker-dealers, where applicable, that such

broker-dealers did not conduct any investigation to verify the information set

out or incorporated by reference in this prospectus and other facts material to

the transaction.

We and

the Selling Shareholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations under it, including, without

limitation, Rule 10b-5 and, insofar as the Selling Shareholders are distribution

participants and we, under certain circumstances, may be a distribution

participant, under Regulation M. All of the foregoing may affect the

marketability of the common stock.

All

expenses of the registration statement including, but not limited to, legal,

accounting, printing and mailing fees are and will be borne by us. Any

commissions, discounts or other fees payable to brokers or dealers in connection

with any sale of the shares of common stock will be borne by the Selling

Shareholders, the purchasers participating in such transaction, or

both.

Mr. Kevin

M. Murphy is the underwriter in this offering, as that term is defined in

section 2(a)(11) of Rule 144 the Securities

Act of 1933. Any shares of common stock covered by this prospectus which

qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may

be sold under Rule 144 rather than pursuant to this prospectus.

Regulation

M

During

such time as the Selling Shareholders may be engaged in a distribution of any of

the securities being registered by this Prospectus, the Selling Shareholders are

required to comply with Regulation M under the Exchange Act. In

general, Regulation M precludes any selling security holder, any affiliated

purchaser and any broker-dealer or other person who participates in a

distribution from bidding for or purchasing, or attempting to induce any person

to bid for or purchase, any security that is the subject of the distribution

until the entire distribution is complete.

Regulation

M defines a “distribution” as

an offering of securities that is distinguished from ordinary trading activities

by the magnitude of the offering and the presence of special selling efforts and

selling methods. Regulation M also defines a “distribution

participant” as

an underwriter, prospective underwriter, broker, dealer, or other person who has

agreed to participate or who is participating in a distribution.

17

Regulation M prohibits,

with certain exceptions, participants in a distribution from bidding for or

purchasing, for an account in which the participant has a beneficial interest,

any of the securities that are the subject of the

distribution. Regulation M also governs bids and purchases made in

order to stabilize the price of a security in connection with a distribution of

the security. We have informed

the Selling Shareholders that the anti-manipulation provisions of Regulation M

may apply to the sales of their shares offered by this Prospectus, and we have

also advised the Selling Shareholders of the requirements for delivery of this

Prospectus in connection with any sales of the shares offered by this

Prospectus.

With

regard to short sales, the Selling Shareholders cannot cover their short sales

with securities from this offering. In addition, if a short sale is

deemed to be a stabilizing activity, then the Selling Shareholders will not be

permitted to engage in such an activity. All of these limitations may

affect the marketability of our common stock.

Penny

Stock Rules

The SEC

has adopted rules that regulate broker-dealer practices in connection with

transactions in penny stocks. Penny stocks are generally equity securities

with a price of less than $5.00 (other than securities registered on certain

national securities exchanges, provided that current price and volume

information with respect to transactions in such securities is provided by the

exchange or system).

The penny

stock rules require a broker-dealer, prior to a transaction in a penny stock not

otherwise exempt from those rules, to deliver a standardized risk disclosure

document prepared by the SEC which:

|

●

|

contains

a description of the nature and level of risk in the market for penny

stocks in both public offerings and secondary

trading;

|

|

●

|

contains

a description of the broker’s or dealer’s duties to the customer and of

the rights and remedies available to the customer with respect to

violations of such duties or other requirements of federal securities

laws;

|

|

●

|

contains

a brief, clear, narrative description of a dealer market, including “bid”

and “ask” prices for penny stocks and the significance of the spread

between the bid and ask prices;

|

|

●

|

contains

the toll-free telephone number for inquiries on disciplinary

actions;

|

|

●

|

defines

significant terms in the disclosure document or in the conduct of trading

in penny stocks; and

|

|

●

|

contains

such other information, and is in such form (including language, type

size, and format) as the SEC shall require by rule or

regulation.

|

Prior to

effecting any transaction in a penny stock, a broker-dealer must also provide a

customer with:

|

●

|

the

bid and ask prices for the penny

stock;

|

|

●

|

the