Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 30, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 1-10738

For the transition period from to

ANNTAYLOR STORES CORPORATION

(Exact name of registrant as specified in its charter)

| DELAWARE | 13-3499319 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 7 Times Square, New York, NY | 10036 | |

| (Address of principal executive offices) | (Zip Code) | |

(212) 541-3300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of each exchange on which registered | |

| Common Stock, $.0068 Par Value | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

The aggregate market value of the registrant’s voting stock held by non-affiliates of the registrant as of July 31, 2009 was $686,937,593.

The number of shares of the registrant’s common stock outstanding as of February 26, 2010 was 58,774,071.

Documents Incorporated by Reference:

Portions of the Registrant’s Proxy Statement for the Registrant’s 2010 Annual Meeting of Stockholders to be held on May 19, 2010 are incorporated by reference into Part III.

Table of Contents

ANNUAL REPORT ON FORM 10-K INDEX

| Page No. | ||||

| PART I. | ||||

| ITEM 1. | 2 | |||

| ITEM 1A. | 8 | |||

| ITEM 1B. | 13 | |||

| ITEM 2. | 14 | |||

| ITEM 3. | 14 | |||

| ITEM 4. | 14 | |||

| PART II. | ||||

| ITEM 5. | 15 | |||

| ITEM 6. | 17 | |||

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||

| ITEM 7A. | 38 | |||

| ITEM 8. | 39 | |||

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

40 | ||

| ITEM 9A. | 40 | |||

| ITEM 9B. | 40 | |||

| PART III. | ||||

| ITEM 10. | 41 | |||

| ITEM 11. | 41 | |||

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

41 | ||

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence |

41 | ||

| ITEM 14. | 41 | |||

| PART IV. | ||||

| ITEM 15. | 42 | |||

| SIGNATURES | 43 | |||

| CONSOLIDATED FINANCIAL STATEMENTS | 44 | |||

| EXHIBIT INDEX | 81 | |||

Table of Contents

Statement Regarding Forward-Looking Disclosures

This Annual Report on Form 10-K (this “Report”) includes, and incorporates by reference, certain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements may use the words “expect”, “anticipate”, “plan”, “intend”, “project”, “may”, “believe” and similar expressions. These forward-looking statements reflect the current expectations of AnnTaylor Stores Corporation concerning future events and actual results may differ materially from current expectations or historical results. Any such forward-looking statements are subject to various risks and uncertainties, including without limitation those discussed in the sections of this Report entitled “Business”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. AnnTaylor Stores Corporation does not assume any obligation to publicly update or revise any forward-looking statements at any time for any reason.

| ITEM 1. | Business. |

General

AnnTaylor Stores Corporation, through its wholly-owned subsidiaries, is a leading national specialty retailer of women’s apparel, shoes and accessories sold primarily under the “Ann Taylor” and “LOFT” brands. As used in this report, all references to “we”, “our”, “us” and “the Company” refer to AnnTaylor Stores Corporation and its wholly-owned subsidiaries.

We believe that “Ann Taylor” and “LOFT” are highly recognized national brands with distinct fashion points of view, though both are equally committed to providing clients with feminine, fashionable, high quality merchandise that is highly relevant to all aspects of her lifestyle. Ann Taylor defines what it means to be chic, smart and sophisticated. Relevant and stylish, Ann Taylor offers timeless wear-now and wear-to-work fashion with impeccable quality and irresistible prices. LOFT is the ultimate casual, fashionable and stylish retail destination for women, providing versatile and effortless pieces at surprising prices.

Our Ann Taylor and LOFT stores offer a full range of career and casual separates, dresses, tops, weekend wear, shoes and accessories, coordinated as part of a strategy to provide modern styles that are versatile across all occasions and needs. Our Ann Taylor Factory and LOFT Outlet stores offer past season best sellers from the Ann Taylor and LOFT merchandise collections, respectively, and are extensions of those brands in the outlet environment.

As of January 30, 2010, we operated 907 retail stores in 46 states, the District of Columbia and Puerto Rico, of which 291 were Ann Taylor stores, 506 were LOFT stores, 92 were Ann Taylor Factory stores and 18 were LOFT Outlet stores. See “Stores and Expansion” for further discussion. Our clients can also shop online at www.anntaylor.com and www.LOFTonline.com or by phone at 1-800-DIAL-ANN.

We are dedicated to maintaining the right merchandise mix in our stores and plan the timing of our product offerings to address clients’ needs, anticipating fabric and yarn preferences on a regional and seasonal basis. Our direct marketing efforts are planned to support this merchandising strategy. Our merchandise, marketing and distribution strategies are reinforced by an emphasis on client service, as our sales associates are trained to assist clients in merchandise selection and coordination.

Merchandise Design and Production

Substantially all of our merchandise is developed by our in-house product design and development teams, which design merchandise exclusively for us. Our merchandising groups determine inventory needs for the upcoming season, edit the assortments developed by the design teams, plan monthly merchandise flows and arrange for the production of merchandise by independent manufacturers, primarily through our sourcing group or through private label specialists. A small percentage of our merchandise is purchased through branded vendors, which is selected to complement our in-house assortment.

2

Table of Contents

Our production management and quality assurance departments establish the technical specifications for all merchandise, inspect factories in which the merchandise is produced, including periodic in-line inspections while goods are in production to identify potential problems prior to shipment, and, upon receipt, inspect merchandise on a test basis for uniformity of size and color, as well as for conformity with specifications and overall quality of manufacturing.

In Fiscal 2009, we sourced merchandise from approximately 180 manufacturers and vendors in 18 countries, and no single supplier accounted for more than 7% of our merchandise purchases. Approximately 50% of our merchandise purchases originated in China, 13% in the Philippines, 12% in Indonesia, 10% in India, and 6% in Vietnam. Any event causing a sudden disruption of manufacturing or imports from any of these countries, including the imposition of additional import restrictions, could have a material adverse effect on our operations. Our foreign purchases are negotiated and paid for in U.S. dollars.

We have a social compliance program that requires our suppliers, factories and subcontractors to comply with our Global Supplier Principles and Guidelines as well as the local laws and regulations in the country of manufacture. We also conduct unannounced third-party audits to confirm manufacturer compliance with our compliance standards. We are also a certified and validated member of the United States Customs and Border Protection’s Custom Trade Partnership against Terrorism (“C-TPAT”) program and expect all of our suppliers shipping to the United States to adhere to our C-TPAT requirements. These include standards relating to facility security, procedural security, personnel security, cargo security and the overall protection of the supply chain. Audits are conducted to confirm supplier compliance with our compliance standards.

We generally do not maintain any long-term or exclusive commitments or arrangements to purchase merchandise from any single supplier. We believe we have solid relationships with our suppliers and that, subject to the discussion in “Statement Regarding Forward-Looking Disclosures”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”, we will continue to have adequate sources to produce a sufficient supply of quality goods in a timely manner and on satisfactory economic terms.

Inventory Control and Merchandise Allocation

Our planning department analyzes relevant historical product demand data by size and store location, as well as margins, sales and inventory history of store clusters to assist it in determining the quantity of merchandise to be purchased for, and the allocation of merchandise to, our stores. Merchandise is allocated to achieve an emphasis that is suited to each store’s client base. Merchandise typically is sold at its original marked price for several weeks, with the length of time varying by individual style or color choice and dependent on client acceptance. We review inventory levels on an ongoing basis to identify slow-moving merchandise styles and broken assortments (items no longer in stock in a sufficient range of sizes) and use markdowns to clear this merchandise. Markdowns may also be used if inventory exceeds client demand for reasons of design, seasonal adaptation or changes in client preference, or if it is determined that the inventory will not sell at its currently marked price. We also use planned promotions to attract customers, particularly in a challenging retail environment. Most inventory is cleared in-store, however any residual inventory is liquidated to unaffiliated third parties.

Our core merchandising system is the central repository for inventory data and related business activities that affect inventory levels such as purchasing, receiving, allocation and distribution.

We use a centralized distribution system under which nearly all merchandise is distributed to our stores through our distribution center, located in Louisville, Kentucky. See “Properties” for further discussion of our Louisville distribution center. Merchandise is shipped by the distribution center to our stores several times each week.

3

Table of Contents

Stores and Expansion

Our business strategy includes a real estate expansion program designed to reach new clients through the opening of new stores. We open new stores in markets that we believe have a sufficient concentration of our target clients. We also add stores, or expand the size of existing stores, in markets where we already have a presence, as market conditions warrant and sites become available. In addition, we reinvest in our current store fleet to elevate and modernize the in-store experience we are providing our clients. Store locations are determined on the basis of various factors, including geographic location, demographic studies, anchor tenants in a mall location, other specialty stores in a mall or specialty center location or in the vicinity of a village location and the proximity to professional offices in a downtown or village location. We open our Ann Taylor Factory and LOFT Outlet stores in outlet centers with co-tenants that generally include a significant number of outlet or discount stores operated under nationally recognized upscale brand names. Store size is determined on the basis of various factors, including merchandise needs, geographic location, demographic studies and space availability.

In response to the challenging economic times, we have significantly slowed our new store growth and have aggressively pursued renegotiating or extending existing leases at more favorable occupancy rates. We also completed a study of the top 50 U.S. metropolitan areas for Ann Taylor and LOFT, which has enabled us to develop a store fleet optimization plan in these markets to maximize store productivity. Our store fleet optimization plan has also enabled us to plan our real estate strategy for future growth. In January 2008, we initiated a multi-year, strategic, restructuring program. This program provides for the closing of approximately 225 underperforming stores, of which 102 have closed through January 30, 2010. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” for further discussion of our restructuring program.

As of January 30, 2010, we operated 907 retail stores throughout the United States, the District of Columbia and Puerto Rico, of which 291 were Ann Taylor stores, 506 were LOFT stores, 92 were Ann Taylor Factory stores and 18 were LOFT Outlet stores.

An average Ann Taylor store is approximately 5,300 square feet in size. We also have two Ann Taylor flagship stores, one located in New York City and one located in Chicago, both of which offer the largest assortment of Ann Taylor merchandise. In Fiscal 2009, we did not open any new Ann Taylor stores, and we do not plan to open any new Ann Taylor stores in Fiscal 2010.

LOFT stores average approximately 5,900 square feet. We also have one LOFT flagship store on the ground floor of 7 Times Square, our corporate headquarters, in New York City. In Fiscal 2009, we opened nine LOFT stores that averaged approximately 5,600 square feet and converted 11 Ann Taylor stores to LOFT stores that averaged 5,000 square feet. In Fiscal 2010, we plan to open approximately 10 LOFT stores, which are expected to average approximately 5,200 square feet and convert 7 additional Ann Taylor stores to LOFT stores, which are expected to average 4,800 square feet.

Our Ann Taylor Factory stores average approximately 7,300 square feet. In Fiscal 2009, we opened 1 Ann Taylor Factory store that is approximately 6,500 square feet. In Fiscal 2010, we do not plan to open any Ann Taylor Factory stores.

Our LOFT Outlet stores average approximately 6,800 square feet. In Fiscal 2009, we continued to grow our fleet of LOFT Outlet stores by opening four additional stores, which average approximately 6,600 square feet. In Fiscal 2010, we plan to open 20 LOFT Outlet stores, which are expected to average 6,500 square feet.

Our stores typically have approximately 25% of their total square footage allocated to stockroom and other non-selling space.

We believe that our existing store base is a significant strategic asset of our business. We have invested approximately $443 million in our store base since the beginning of Fiscal 2005; approximately 63% of our stores are either new, expanded or have been remodeled or refurbished in the last five years. Our stores are located in some of the most productive retail centers in the United States.

4

Table of Contents

The following table sets forth certain information regarding store openings, expansions and closings for Ann Taylor stores (“ATS”), LOFT stores (“LOFT”), Ann Taylor Factory stores (“ATF”) and LOFT Outlet stores (“LOS”) over the past five years:

| Fiscal Year |

Total Stores Open at Beginning of Fiscal Year |

No. Stores Opened During Fiscal Year |

No. Stores Closed During Fiscal Year |

No. Stores Converted During Fiscal Year |

No. Stores Open at End of Fiscal Year |

No. Stores Expanded During Fiscal Year | |||||||||||||||||||||||||||

| ATS | LOFT | ATF | LOS | ATS | LOFT | ATF | ATS | LOFT | ATS | LOFT | ATF | LOS | Total | ||||||||||||||||||||

| 2005 |

738 | 9 | 73 | 15 | — | 11 | — | — | — | — | 357 | 416 | 51 | — | 824 | 12 | |||||||||||||||||

| 2006 |

824 | 11 | 52 | 7 | — | 20 | 4 | 1 | — | — | 348 | 464 | 57 | — | 869 | 16 | |||||||||||||||||

| 2007 |

869 | 14 | 52 | 11 | — | 13 | 4 | — | — | — | 349 | 512 | 68 | — | 929 | 14 | |||||||||||||||||

| 2008 |

929 | 4 | 25 | 23 | 14 | 33 | 27 | — | — | — | 320 | 510 | 91 | 14 | 935 | 8 | |||||||||||||||||

| 2009 |

935 | — | 9 | 1 | 4 | 18 | 24 | — | (11 | ) | 11 | 291 | 506 | 92 | 18 | 907 | 1 | ||||||||||||||||

In Fiscal 2009, our real estate plan resulted in an increase in our total square footage of approximately 83,000 square feet, or approximately 2%. This was offset by a decrease in total square footage of approximately 227,000 square feet, or approximately 4%, due to store closings as part of our restructuring program. Overall, total store square footage decreased approximately 144,000 square feet, or approximately 3%, from approximately 5.5 million square feet at the end of Fiscal 2008 to approximately 5.3 million square feet at the end of Fiscal 2009. During Fiscal 2010, we plan to open approximately 30 stores and close approximately 72 stores, for a net reduction in total square footage of approximately 220,000 square feet, or approximately 4%.

Capital expenditures for our Fiscal 2009 store expansion totaled approximately $8 million and expenditures for store remodeling and refurbishment totaled approximately $5 million. We expect that capital expenditures for our Fiscal 2010 store expansion program will be approximately $25 million and expenditures for store renovations and refurbishing will be approximately $20 million.

Our store expansion and refurbishment plans are dependent upon, among other things, general economic and business conditions affecting consumer confidence and spending, the availability of desirable locations and the negotiation of acceptable lease terms. See “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”.

Information Systems

During Fiscal 2009, we continued our investment in information services and technology, enhancing the systems we use to support our online, merchandise sourcing, back office and in-store management functions. These enhancements are generally aimed at driving online sales and operational efficiencies while providing speed, flexibility and cost reduction in our supply chain.

Brand Building and Marketing

We believe that our Ann Taylor and LOFT brands are among our most important assets and that these brands and their relationship with our clients are key to our competitive advantage. We continuously evolve these brands to appeal to the changing needs of our target clients and stay competitive in the market.

We control all aspects of brand development for our retail concepts, including product design, store merchandising and design, channels of distribution and marketing and advertising. We continue to invest in the development of these brands through, among other things, client research, advertising, in-store and direct marketing and our online sites and online marketing initiatives. We also make investments to enhance the overall client experience through the opening of new stores, the expansion and remodeling of existing stores and a focus on client service.

We believe it is strategically important to communicate on a regular basis directly with our current client base and with potential clients, through national and regional advertising, as well as through direct mail marketing and in-store presentation. Marketing expenditures as a percentage of sales were 3.3% in Fiscal 2009, 2.8% in Fiscal 2008 and 2.6% in Fiscal 2007.

5

Table of Contents

Trademarks and Service Marks

The “AnnTaylor®”, “Loft®” and “AnnTaylor Loft®” trademarks are registered with the United States Patent and Trademark Office and with the trademark registries of many foreign countries. Our rights in these marks are a significant part of our business, as we believe they are famous and well-known in the women’s apparel industry. Accordingly, we intend to maintain our trademarks and related registrations and vigorously protect them against infringement.

In July 2009, we acquired the registered trademark in the People’s Republic of China (“PRC”) for the “Ann Taylor” mark in the apparel and footwear class (the “Mark”) pursuant to a Trademark Assignment Agreement (the “Assignment Agreement”). This assignment of the Mark is subject to approval by the PRC Trademark Office, and until that approval is received, our existing trademark license agreement (which expires on June 30, 2015) permitting our use of the Mark remains in effect. The Assignment Agreement provides that if the PRC Trademark Office does not approve the assignment, we will have a perpetual, exclusive, royalty-free license to use the Mark. We believe the Assignment Agreement secures our rights in the Mark and protects our ability to source merchandise from the PRC. See “Statement Regarding Forward-Looking Disclosures” and “Risk Factors”.

Competition

The women’s retail apparel industry is highly competitive. Our stores compete with certain departments in international, national and local department stores and with other specialty stores, catalog and internet businesses that offer similar categories of merchandise. We believe that our focused merchandise selection, exclusive fashions and service distinguish us from other apparel retailers. Our competitors range from smaller, growing companies to considerably larger players with substantially greater financial, marketing and other resources. There is no assurance that we will be able to compete successfully with them in the future. See “Risk Factors” and “Statement Regarding Forward-Looking Disclosures”.

Client Loyalty Programs

In October 2008, we launched an enhanced credit card program, which offers eligible clients the choice of a private label or a co-branded credit card. Both cards can be used at any Ann Taylor or LOFT store location, including Ann Taylor Factory and LOFT Outlet, as well as at anntaylor.com and LOFTonline.com. The co-branded credit card can also be used at any other business where the card is accepted. Both cards are offered in an Ann Taylor version and a LOFT version, depending upon where a client enrolls in the program; however the benefits offered to clients are the same for each.

To encourage clients to apply for the credit card, we provide a discount to approved cardholders on all purchases they make with their new card in any of our stores on the day of application acceptance. All new cardholders are automatically enrolled in our exclusive rewards program, which is designed to recognize and promote client loyalty. These benefits have also been extended to those valued clients who held our private label card prior to the October 2008 re-launch. Under the new Style Rewards program, points are earned on purchases made with the credit card at any of our brands through any of our channels. Co-branded cardholders also earn points on purchases made at other businesses where our card is accepted. Cardholders who accumulate the requisite number of points are issued a Style Rewards Certificate redeemable toward a future purchase at Ann Taylor, LOFT, Ann Taylor Factory, LOFT Outlet or online. In addition to earning points, all participants in the credit card program receive exclusive offers throughout the year. These offers include a Birthday Bonus, special incentives, invitations to shopping events and periodic opportunities to earn bonus points.

Employees

As of January 30, 2010, we had approximately 18,800 employees, of which approximately 1,600 were full-time salaried employees, 1,800 were full-time hourly employees and 15,400 were part-time hourly employees working less than 30 hours per week. None of our employees are represented by a labor union. We believe that our relationship with our employees is good.

6

Table of Contents

Available Information

We make available free of charge on our website, http://investor.anntaylor.com, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such reports are filed electronically with, or otherwise furnished to, the United States Securities and Exchange Commission (the “SEC”). Copies of the charters of each of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, as well as our Corporate Governance Guidelines and Business Conduct Guidelines, are also available on our website.

7

Table of Contents

| ITEM 1A. | Risk Factors. |

The following risk factors should be considered carefully in evaluating our business and the forward-looking information in this document. Please also see “Statement Regarding Forward-Looking Disclosures” in the section immediately preceding Item 1 of this Report. The risks described below are not the only risks our business faces. We may also be adversely affected by additional risks not presently known to us or that we currently deem immaterial.

Our ability to maintain the value of our brands

Our success depends on the value of our Ann Taylor and LOFT brands. The Ann Taylor and LOFT names are integral to our business as well as to the implementation of our strategies for expanding our business. Maintaining, promoting and positioning our brands will depend largely on the success of our design, merchandising, and marketing efforts and our ability to provide a consistent, high quality client experience. Our brands could be adversely affected if we fail to achieve these objectives for one or both of these brands and our public image and reputation could be tarnished by negative publicity. Any of these events could negatively impact sales.

Our ability to anticipate and respond to changing client preferences and fashion trends in a timely manner

Our success largely depends on our ability to consistently gauge fashion trends and provide merchandise that satisfies client demands for each of our brands in a timely manner. Any missteps may affect inventory levels, since we enter into agreements to manufacture and purchase our merchandise well in advance of the applicable selling season. Our failure to anticipate, identify or react appropriately in a timely manner to changes in fashion trends and economic conditions could lead to lower sales, missed opportunities, excess inventories and more frequent markdowns, which could have a material adverse impact on our business. Merchandise misjudgments could also negatively impact our image with our clients and result in diminished brand loyalty.

Our ability to execute brand extensions and new concepts

Part of our business strategy is to grow our existing brands and identify and develop new growth opportunities. Our success with new merchandise offerings or concepts requires significant capital expenditures and management attention. Any such plan is subject to risks such as client acceptance, competition, product differentiation, challenges to economies of scale in merchandise sourcing and the ability to attract and retain qualified associates, including management and designers. There is no assurance that these merchandise offerings or concepts will be successful or that our overall profitability will increase as a result. Our failure to successfully execute our growth strategies may adversely impact our financial condition and results of operations.

Our ability to manage inventory levels and changes in merchandise mix

The long lead time usually required for a substantial portion of our merchandise makes client demand difficult to predict and responding to changes quickly challenging. We must enter into contracts for the purchase and manufacture of merchandise well in advance of the applicable selling season. Our financial condition could be materially adversely affected if we are unable to manage inventory levels and respond to short-term shifts in client demand patterns. Inventory levels in excess of client demand may result in excessive markdowns and, therefore, lower than planned margins. If we underestimate demand for our merchandise, on the other hand, we may experience inventory shortages resulting in missed sales and lost revenues. Either of these events could significantly harm our operating results and brand image. In addition, our margins may be impacted by changes in our merchandise mix and a shift toward merchandise with lower selling prices. These changes could have a material adverse effect on our results of operations.

The effect of competitive pressures from other retailers

The specialty retail industry is highly competitive. We compete with national, international and local department stores, specialty and discount stores, catalogs and internet businesses offering similar categories of merchandise. Many of our competitors are companies with substantially greater financial, marketing and other resources. There is no assurance that we can compete successfully with them in the future. In addition to competing for sales, we compete for favorable store locations, lease terms and qualified associates. Increased competition could reduce our sales and margins and adversely affect our results of operations.

8

Table of Contents

Our reliance on key management and our ability to attract and retain qualified associates

Our success depends to a significant extent both upon the continued services of our current executive and senior management team, as well as our ability to attract, hire, motivate and retain additional qualified management in the future. Competition for key executives in the retail industry is intense, and our operations could be adversely affected if we cannot attract and retain these key individuals.

Our performance also depends in large part on the talents and contributions of skilled associates in all areas of our organization. If we are unable to identify, hire, develop, motivate and retain talented individuals, we may be unable to compete effectively and our business could be adversely impacted.

Our ability to grow through new store openings and existing store remodels and expansions and manage the profitability of our existing fleet of stores

Our continued growth and success depends in part on our ability to open and operate new stores, expand and remodel existing stores on a timely and profitable basis, and optimize store performance by closing under-performing stores. Accomplishing our store expansion goals, which continue to involve opening fewer stores in Fiscal 2010 than in years prior to the economic crisis, depends upon a number of factors, including locating suitable sites and negotiating favorable lease terms. We must also be able to effectively renew and re-negotiate terms in existing store leases. Hiring and training qualified associates, particularly at the store management level, and maintaining overall good relations with our associates, is also important to our store operations. There is no assurance that we will achieve our store expansion goals, manage our growth effectively or operate our stores profitably.

Our reliance on third party manufacturers

We do not own or operate any manufacturing facilities and depend on independent third parties to manufacture our merchandise. We cannot be certain that we will not experience operational difficulties with our manufacturers, such as reductions in the availability of production capacity, errors in complying with merchandise specifications, insufficient quality control and failures to meet production deadlines or increases in manufacturing costs. In addition, world-wide economic conditions are continuing to have a significant negative impact on businesses around the world, and the impact of those conditions on our major suppliers cannot be predicted. Our suppliers may be unable to obtain adequate credit or access liquidity to finance their operations. A manufacturer’s failure to ship merchandise to us on a timely basis or to meet the required product safety and quality standards could cause supply shortages, failure to meet client expectations and damage to our brands, which could adversely impact our sales and operating results.

Our reliance on foreign sources of production

We purchase a significant portion of our merchandise from foreign suppliers. As a result, we are subject to the various risks of doing business in foreign markets and importing merchandise from abroad, such as:

| • | imposition of new legislation relating to import quotas or other restrictions that may limit the quantity of our merchandise that may be imported into the United States from countries in regions where we do business; |

| • | significant delays in the delivery of cargo due to port security considerations; |

| • | imposition of duties, taxes, and other charges on imports; |

| • | imposition of anti-dumping or countervailing duties in response to an investigation as to whether a particular product being sold in the United States at less than fair value may cause (or threaten to cause) material injury to the relevant domestic industry; |

| • | financial or political instability in any of the countries in which our merchandise is manufactured; |

| • | impact of natural disasters and public health concerns on our foreign sourcing offices and vendor manufacturing operations; |

| • | fluctuation in the value of the U.S. dollar against foreign currencies or restrictions on the transfer of funds; |

| • | potential recalls for any merchandise that does not meet our quality standards; and |

| • | disruption of imports by labor disputes and local business practices. |

9

Table of Contents

We cannot predict whether any of the foreign countries in which our merchandise is manufactured, or in which our merchandise may be manufactured in the future, will be subject to import restrictions by the U.S. government. Any sudden disruption of manufacturing or imposition of trade restrictions, such as increased tariffs or more restrictive quotas on apparel or other items we sell could affect the import of such merchandise and could increase the cost or reduce the supply of merchandise available to us and adversely affect our business, financial condition, results of operations and liquidity.

In addition, the raw materials used to manufacture our merchandise are subject to availability constraints and price volatility caused by high demand for fabrics, currency fluctuations, weather conditions, supply conditions, government regulations, labor conditions, transportation or freight costs, economic climate and other unpredictable factors. Increases in the demand for, or the price of, raw materials used to manufacture our merchandise could have a material adverse effect on our cost of sales or our ability to meet our clients’ needs. We may not be able to pass all or a portion of such higher raw material costs onto our clients, which could negatively impact our profitability.

Our ability to successfully upgrade and maintain our information systems to support the needs of the organization

We rely heavily on information systems to manage our operations, including a full range of retail, financial, sourcing and merchandising systems, and regularly make investments to upgrade, enhance or replace these systems. The reliability and capacity of our information systems is critical. Despite our preventative efforts, our systems are vulnerable from time to time to damage or interruption from, among other things, security breaches, computer viruses, power outages and other technical malfunctions. Any disruptions affecting our information systems, or any delays or difficulties in transitioning to new systems or in integrating them with current systems, could have a material adverse impact on our business. Any failure to maintain adequate system security controls to protect our computer assets and sensitive data, including client data, from unauthorized access, disclosure or use could also damage our reputation with our clients.

In addition, our ability to continue to operate our business without significant interruption in the event of a disaster or other disruption depends in part on the ability of our information systems to operate in accordance with our disaster recovery and business continuity plans.

Our dependence on a single distribution facility and third-party transportation companies

We handle merchandise distribution for all of our stores from a single facility in Louisville, Kentucky. Independent third party transportation companies deliver our merchandise to our stores and our clients. Any significant interruption in the operation of the distribution facility or the domestic transportation infrastructure due to natural disasters, accidents, inclement weather, system failures, work stoppages, slowdowns or strikes by employees of the transportation companies, or other unforeseen causes could delay or impair our ability to distribute merchandise to our stores, which could result in lower sales, a loss of loyalty to our brands and excess inventory.

Risks associated with Internet sales

We sell merchandise over the Internet through our websites, www.anntaylor.com and www.LOFTonline.com. Our Internet operations are subject to numerous risks, including:

| • | reliance on third-party computer hardware/software; |

| • | reliance on third-party order fulfillment providers; |

| • | rapid technological change and the implementation of new systems and platforms; |

| • | diversion of sales from our stores; |

| • | liability for online content; |

| • | violations of state or federal laws, including those relating to online privacy; |

| • | credit card fraud; |

| • | the failure of the computer systems that operate our websites and their related support systems, including computer viruses; and |

| • | telecommunications failures and electronic break-ins and similar disruptions. |

There is no assurance that our Internet operations will continue to achieve sales and profitability growth.

10

Table of Contents

The effect of general economic conditions and the recent financial crisis

The Company’s performance is subject to world-wide economic conditions and their impact on levels of consumer spending, which may remain depressed for the foreseeable future. Some of the factors impacting discretionary consumer spending include general economic conditions, wages and employment, consumer debt, reductions in net worth based on recent severe market declines, residential real estate and mortgage markets, taxation, fuel and energy prices, interest rates, consumer confidence and other macroeconomic factors.

Although the recent global financial crisis has eased somewhat from the unprecedented levels reached during Fiscal 2008 and Fiscal 2009, world-wide economic conditions remain troubled and consumer spending remains significantly depressed as compared to pre-crisis levels. Consumer purchases of discretionary items, including our merchandise, generally decline during recessionary periods and other periods where disposable income is adversely affected. The downturn in the economy may continue to affect consumer purchases of our merchandise and adversely impact our results of operations and continued growth. It is difficult to predict how long the current economic, capital and credit market conditions will continue, whether such conditions will further deteriorate and what impact those factors might have on our business.

Fluctuation in our level of sales and earnings growth and stock price

A variety of factors has historically affected, and will continue to affect, our comparable store sales results and profit margins. These factors include fashion trends and client preferences, changes in our merchandise mix, competition, economic conditions, weather, effective inventory management and new store openings. There is no assurance that we will achieve positive levels of sales and earnings growth, and any decline in our future growth or performance could have a material adverse effect on the market price of our common stock.

Our stock price has experienced, and could continue to experience in the future, substantial volatility as a result of many factors, including recent global economic conditions, broad market fluctuations, our operating performance and public perception of the prospects for the women’s apparel industry. Failure to meet market expectations, particularly with respect to comparable store sales, net revenues, operating margins and earnings per share, would likely result in a decline in the market price of our stock.

Failure to comply with legal and regulatory requirements

Our policies, procedures and internal controls are designed to comply with all applicable laws and regulations, including those imposed by the U.S. Securities and Exchange Commission and the New York Stock Exchange, as well as applicable employment laws. Any changes in regulations, the imposition of additional regulations or the enactment of any new legislation, in response to current economic conditions or otherwise, may increase the complexity of the regulatory environment in which we operate and the related cost of compliance. Failure to comply with such laws and regulations may result in damage to our reputation, financial condition and market price of our stock.

Uncertain global economic conditions could have a material adverse effect on the Company’s liquidity and capital resources

The distress in the financial markets has resulted in extreme volatility in security prices and diminished liquidity and credit availability, and there can be no assurance that our liquidity will not be affected by changes in the financial markets and the global economy or that our capital resources will at all times be sufficient to satisfy our liquidity needs. Although we believe that our existing cash and cash equivalents, cash provided by operations and available borrowing capacity under our $250 million Third Amended and Restated Credit Agreement (the “Credit Facility”) will be adequate to satisfy our capital needs for the foreseeable future, any renewed tightening of the credit markets could make it more difficult for us to access funds, enter into agreements for new indebtedness or obtain funding through the issuance of our securities. Our Credit Facility also has financial covenants which, if not met, may further impede our ability to access funds under the Credit Facility.

We have significant amounts of cash and cash equivalents invested in money market funds that are backed by U.S. Treasury Securities or in deposit accounts at FDIC-insured banks. All of our deposit account balances are currently FDIC insured as a result of the government’s Temporary Liquidity Guarantee Program (the “TLGP”). The TLGP currently expires on June 30, 2010. If the TLGP is not renewed, we would consider moving funds from deposit accounts into money market funds backed by U.S. Treasury Securities. With the current financial environment and the instability of financial institutions, we cannot be assured that we will not experience losses on our deposits.

11

Table of Contents

Manufacturer compliance with our social compliance program requirements

We require our independent manufacturers to comply with the Ann Taylor Global Supplier Principles and Guidelines that cover many areas including labor, health and safety and environmental standards. We monitor their compliance with these Guidelines using third-party monitoring firms. Although we have an active program to provide training for our independent manufacturers and monitor their compliance with these standards, we do not control the manufacturers or their practices. Any failure of our independent manufacturers to comply with our Global Supplier Principles and Guidelines or local laws in the country of manufacture could disrupt the shipment of merchandise to us, force us to locate alternative manufacturing sources, reduce demand for our merchandise or damage our reputation.

Our ability to secure and protect trademarks and other intellectual property rights

We believe that our “AnnTaylor”, “AnnTaylor Loft” and “LOFT” trademarks are important to our success. Even though we register and protect our trademarks and other intellectual property rights, there is no assurance that our actions will protect us from the prior registration by others or prevent others from infringing our trademarks and proprietary rights or seeking to block sales of our products as infringements of their trademarks and proprietary rights. Further, the laws of foreign countries may not protect proprietary rights to the same extent as do the laws of the United States. Because we have not registered all of our trademarks in all categories, or in all foreign countries in which we currently manufacture merchandise or may manufacture or sell merchandise in the future, our international expansion and sourcing of merchandise could be limited.

Effects of war, terrorism, public health concerns or other catastrophes

Threat of terrorist attacks or actual terrorist events in the United States and world-wide could cause damage or disruption to international commerce and the global economy, disrupt the production, shipment or receipt of our merchandise or lead to lower client traffic in regional shopping centers. Natural disasters and public health concerns, including severe infectious diseases, could also impact our ability to open and run our stores in affected areas and negatively impact our foreign sourcing offices and the manufacturing operations of our vendors. Lower client traffic due to security concerns, war or the threat of war, natural disasters and public health concerns could result in decreased sales that would have a material adverse impact on our business, financial condition and results of operations.

Our ability to achieve the results of our restructuring program

Our multi-year, strategic, restructuring program is designed to enhance profitability and improve overall operating effectiveness. The key elements of this program include optimization of our store portfolio, organizational streamlining and a broad-based productivity initiative. The anticipated benefits associated with our restructuring program are based on forecasts, which may vary materially based on various factors, including the timing in execution of our restructuring program; outcome of negotiations with landlords and other third parties; and changes in management’s assumptions and projections. As a result of these events and circumstances, delays and unexpected costs may occur, which could result in our not realizing all of the anticipated benefits of our restructuring program or in such benefits taking longer to achieve than expected. Further, to the extent we are unable to improve our financial performance, further restructuring measures may be required in the future. In addition, as part of our store fleet optimization plan, we have, and may continue to, sublease certain closing store locations to third parties. If our sub-lessees default in their rent payment obligations under the sublease agreements, we may be adversely impacted.

Our ability to realize deferred tax assets

If our businesses do not perform well, we may be required to establish a valuation allowance against our deferred income tax assets, which could have a material adverse effect on our results of operations and financial condition. Deferred income tax represents the tax effect of the differences between the book and tax basis of assets and liabilities. Deferred tax assets are assessed periodically by management to determine if they are realizable. Factors in management’s determination include the performance of the business, including the ability to generate taxable income from operations, and tax planning strategies. If, based on available information, it is more likely than not that a deferred tax asset will not be realized, then a valuation allowance would be required with a corresponding charge to income tax expense, thereby reducing net income.

12

Table of Contents

The effect of external economic factors on our Pension Plan

Our future funding obligations with respect to our defined benefit Pension Plan, which was frozen in 2007, will depend upon the future performance of assets set aside for this Pension Plan, interest rates used to determine funding levels, actuarial data and experience and any changes in government laws and regulations. Our Pension Plan holds mutual funds which invest in equity securities. If the market values of these securities decline, our pension expense would increase and, as a result, could materially adversely affect our business. Decreases in interest rates or asset returns could also increase our obligations under the Pension Plan. Although no additional benefits have been earned under the Pension Plan since it was frozen, depending on the pension plan’s funded status there may be ongoing contribution obligations and those contribution obligations could be material.

Our dependence on shopping malls and other retail centers to attract customers to our stores

Many of our stores are located in shopping malls and other retail centers. Sales at these stores benefit from the ability of “anchor” retail tenants, generally large department stores, and other attractions to generate sufficient levels of consumer traffic in the vicinity of our stores. As a result of current economic conditions, overall mall traffic has declined and a number of “anchor” department stores have closed. Further declines in consumer spending and in the volume of consumer traffic at shopping centers may result in reduced sales at our stores and leave us with excess inventory. We may respond by increasing markdowns or initiating marketing promotions to reduce excess inventory, which could materially adversely impact our margins and operating results.

The bankruptcy or significant deterioration of large commercial and retail landlords could have a material adverse affect on our sales and overall retail strategy

The current economic downturn has had a significant negative impact on the commercial real estate sector, including large commercial and retail landlords, such as one of our major national landlords, General Growth Properties, Inc. (“GGP”) and many of its affiliates (collectively “GGP Debtors”), which filed petitions for reorganization relief under Chapter 11 of the U.S. Bankruptcy Code. If the current macro-economic conditions continue or deteriorate further, additional commercial landlords may be similarly impacted which in turn could materially adversely impact our sales and operating results.

| ITEM 1B. | Unresolved Staff Comments. |

None.

13

Table of Contents

| ITEM 2. | Properties. |

As of January 30, 2010, we operated 907 retail stores in 46 states, the District of Columbia and Puerto Rico, all of which were leased. Store leases typically provide for initial terms of ten years, although some leases have shorter or longer initial periods. Some of the leases grant us the right to extend the term for one or two additional five-year periods. Some leases also contain early termination options, which can be exercised by us under specific conditions. Most of the store leases require us to pay a specified minimum rent, plus a contingent rent based on a percentage of the store's net sales in excess of a specified threshold. Most of the leases also require us to pay real estate taxes, insurance and certain common area and maintenance costs. The current terms of our leases expire as follows:

| Fiscal Years Lease Terms Expire |

Number of Stores | |

| 2010 - 2012 |

347 | |

| 2013 - 2015 |

285 | |

| 2016 - 2018 |

258 | |

| 2019 and later |

17 |

We lease our corporate offices at 7 Times Square in New York City (approximately 297,000 square feet) under a lease expiring in 2020. In addition, in Milford, Connecticut, we maintain 42,000 square feet of office space under a lease which expires in 2019 and an additional 15,000 square feet of office space under a lease which expires in March 2010.

The Company’s wholly owned subsidiary, AnnTaylor Distribution Services, Inc., owns our 256,000 square foot distribution center located in Louisville, Kentucky. The distribution center is located on approximately 27 acres, which could accommodate possible future expansion of the facility. Nearly all our merchandise is distributed to stores through this facility.

| ITEM 3. | Legal Proceedings. |

We are subject to various legal proceedings and claims that arise in the ordinary course of our business. Although the amount of any liability that could arise with respect to these actions cannot be determined with certainty, in our opinion, any such liability will not have a material adverse effect on our consolidated financial position, consolidated results of operations or liquidity.

| ITEM 4. | (Removed and Reserved). |

14

Table of Contents

| ITEM 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Our common stock is listed and traded on the New York Stock Exchange under the symbol “ANN”. The number of holders of record of common stock at February 26, 2010 was 607. The following table sets forth the high and low sale prices per share of the common stock on the New York Stock Exchange for the periods indicated:

| Market Price | ||||||

| High | Low | |||||

| Fiscal Year 2009 |

||||||

| Fourth quarter |

$ | 16.26 | $ | 11.59 | ||

| Third quarter |

17.50 | 11.41 | ||||

| Second quarter |

12.26 | 6.33 | ||||

| First quarter |

7.58 | 2.41 | ||||

| Fiscal Year 2008 |

||||||

| Fourth quarter |

$ | 12.88 | $ | 3.74 | ||

| Third quarter |

27.55 | 11.45 | ||||

| Second quarter |

29.23 | 20.13 | ||||

| First quarter |

26.56 | 20.98 | ||||

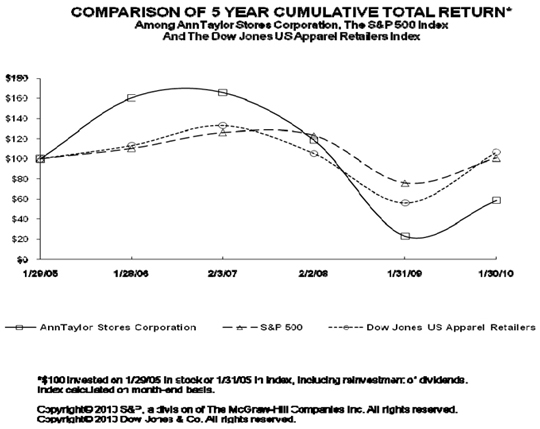

STOCK PERFORMANCE GRAPH

The following graph compares the percentage changes in the cumulative total stockholder return on the Company’s Common Stock for the five-year period ended January 30, 2010, with the cumulative total return on the Standard & Poor’s 500 Stock Index (“S&P 500”) and the Dow Jones U.S. Retailers, Apparel Index for the same period. In accordance with the rules of the SEC, the returns are indexed to a value of $100 at January 28, 2005 and assume that all dividends, if any, were reinvested. This performance graph shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

15

Table of Contents

We have never paid cash dividends on our common stock. Any determination to pay cash dividends is at the discretion of our Board of Directors, which considers it on a periodic basis. In addition, as a holding company, our ability to pay dividends is dependent upon the receipt of dividends or other payments from our subsidiaries, including our wholly owned subsidiary AnnTaylor, Inc. The payment of dividends by AnnTaylor, Inc. to us is subject to certain restrictions under its $250 million Third Amended and Restated Credit Agreement (the “Credit Facility”). We are also subject to certain restrictions contained in the Credit Facility on the payment of cash dividends on our common stock. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources”.

The following table sets forth information concerning purchases of our common stock for the periods indicated which upon repurchase are classified as treasury shares available for general corporate purposes:

| Total Number of Shares Purchased (1) |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Program (2) |

Approximate Dollar Value of Shares that May Yet Be Purchased Under Publicly Announced Program | |||||||

| (in thousands) | ||||||||||

| November 1, 2009 to November 28, 2009 |

7,599 | $ | 13.89 | — | $ | 159,083 | ||||

| November 29, 2009 to January 2, 2010 |

914 | 14.34 | — | 159,083 | ||||||

| January 3, 2010 to January 30, 2010 |

1,208 | 13.06 | — | 159,083 | ||||||

| 9,721 | — | |||||||||

| (1) | These shares represent restricted stock repurchased in connection with employee tax withholding obligations under employee compensation plans, which are not purchases under our publicly announced program. |

| (2) | The $300 million securities repurchase program approved by our Board of Directors on August 23, 2007 will expire when the Company has repurchased all securities authorized for repurchase thereunder, unless terminated earlier by resolution of the Board of Directors. There were no shares purchased under this program during the fourth quarter of Fiscal 2009. |

16

Table of Contents

| ITEM 6. | Selected Financial Data. |

The following historical Consolidated Statements of Operations and Consolidated Balance Sheet information has been derived from our audited consolidated financial statements. The information set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes thereto included elsewhere in this document. All references to years are to our fiscal year, which ends on the Saturday nearest January 31 in the following calendar year. All fiscal years for which financial information is set forth below contain 52 weeks, except for the fiscal year ended February 3, 2007, which includes 53 weeks.

| Fiscal Years Ended | ||||||||||||||||||||

| January 30, 2010 |

January 31, 2009 |

February 2, 2008 |

February 3, 2007 |

January 28, 2006 |

||||||||||||||||

| (in thousands, except per share, per square foot and number of stores data) | ||||||||||||||||||||

| Consolidated Statements of Operations Information: |

||||||||||||||||||||

| Net sales |

$ | 1,828,523 | $ | 2,194,559 | $ | 2,396,510 | $ | 2,342,907 | $ | 2,073,146 | ||||||||||

| Cost of sales |

834,188 | 1,139,753 | 1,145,246 | 1,085,897 | 1,017,122 | |||||||||||||||

| Gross margin |

994,335 | 1,054,806 | 1,251,264 | 1,257,010 | 1,056,024 | |||||||||||||||

| Selling, general and administrative expenses |

966,603 | 1,050,560 | 1,061,869 | 1,031,341 | 924,998 | |||||||||||||||

| Restructuring charges |

36,368 | 59,714 | 32,255 | — | — | |||||||||||||||

| Asset impairment charges |

15,318 | 29,590 | 1,754 | 1,832 | — | |||||||||||||||

| Goodwill impairment charge |

— | 286,579 | — | — | — | |||||||||||||||

| Operating (loss)/income |

(23,954 | ) | (371,637 | ) | 155,386 | 223,837 | 131,026 | |||||||||||||

| Interest income |

935 | 1,677 | 7,826 | 17,174 | 9,318 | |||||||||||||||

| Interest expense (1) |

3,091 | 1,462 | 2,172 | 2,230 | 2,083 | |||||||||||||||

| (Loss)/income before income taxes |

(26,110 | ) | (371,422 | ) | 161,040 | 238,781 | 138,261 | |||||||||||||

| Income tax (benefit)/provision |

(7,902 | ) | (37,516 | ) | 63,805 | 95,799 | 56,389 | |||||||||||||

| Net (loss)/income |

$ | (18,208 | ) | $ | (333,906 | ) | $ | 97,235 | $ | 142,982 | $ | 81,872 | ||||||||

| Basic (loss)/earnings per share (2) |

$ | (0.32 | ) | $ | (5.82 | ) | $ | 1.52 | $ | 1.98 | $ | 1.13 | ||||||||

| Diluted (loss)/earnings per share (2) |

$ | (0.32 | ) | $ | (5.82 | ) | $ | 1.51 | $ | 1.96 | $ | 1.12 | ||||||||

| Weighted average shares outstanding |

56,782 | 57,366 | 62,753 | 70,993 | 71,554 | |||||||||||||||

| Weighted average shares outstanding, assuming dilution |

56,782 | 57,366 | 63,212 | 71,721 | 71,991 | |||||||||||||||

| Consolidated Operating Information: |

||||||||||||||||||||

| Percentage (decrease)/increase in comparable store sales (3) |

(17.8 | )% | (14.8 | )% | (3.3 | )% | 2.8 | % | 0.1 | % | ||||||||||

| Net sales per square foot (4) |

$ | 337 | $ | 402 | $ | 457 | $ | 474 | $ | 461 | ||||||||||

| Number of stores: |

||||||||||||||||||||

| Open at beginning of period |

935 | 929 | 869 | 824 | 738 | |||||||||||||||

| Opened during the period |

14 | 66 | 77 | 70 | 97 | |||||||||||||||

| Closed during the period |

42 | 60 | 17 | 25 | 11 | |||||||||||||||

| Open at the end of the period |

907 | 935 | 929 | 869 | 824 | |||||||||||||||

| Expanded during the period |

1 | 8 | 14 | 16 | 12 | |||||||||||||||

| Total store square footage at end of period |

5,348 | 5,492 | 5,410 | 5,079 | 4,801 | |||||||||||||||

| Capital expenditures (5) |

$ | 35,736 | $ | 100,195 | $ | 145,852 | $ | 165,129 | $ | 174,895 | ||||||||||

| Depreciation and amortization |

$ | 104,351 | $ | 122,222 | $ | 116,804 | $ | 105,890 | $ | 93,786 | ||||||||||

| Working capital turnover (6) |

10.5 | x | 14.0 | x | 8.2 | x | 5.8 | x | 5.4 | x | ||||||||||

| Inventory turnover (7) |

4.9 | x | 5.4 | x | 4.7 | x | 5.0 | x | 4.7 | x | ||||||||||

| Consolidated Balance Sheet Information: |

||||||||||||||||||||

| Working capital |

$ | 229,521 | $ | 118,013 | $ | 195,015 | $ | 391,187 | $ | 418,626 | ||||||||||

| Goodwill, net |

— | — | 286,579 | 286,579 | 286,579 | |||||||||||||||

| Total assets |

902,141 | 960,439 | 1,393,755 | 1,568,503 | 1,492,906 | |||||||||||||||

| Total debt |

2,642 | 7,039 | — | — | — | |||||||||||||||

| Total stockholders’ equity |

417,186 | 416,512 | 839,484 | 1,049,911 | 1,034,482 | |||||||||||||||

(Footnotes on following page)

17

Table of Contents

(Footnotes for preceding page)

| (1) | Includes non-cash interest expense of approximately $0.4 million, $0.4 million, $0.4 million, $0.5 million and $0.8 million, in Fiscal 2009, 2008, 2007, 2006 and 2005, respectively, primarily from amortization of deferred financing costs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”. |

| (2) | The Company adopted amendments to Accounting Standards Codification (“ASC”) 260-10 on February 1, 2009, which impacted the determination and reporting of earnings per share by requiring the inclusion of restricted stock and performance restricted stock as participating securities, since they have the right to share in dividends, if declared, equally with common shareholders. During periods of net income, participating securities are allocated a proportional share of net income determined by dividing total weighted average participating securities by the sum of total weighted average common shares and participating securities (“the two-class method”). During periods of net loss, no effect is given to the participating securities because they do not share in the losses of the Company. Including these shares in the Company’s earnings per share calculation during periods of net income has the effect of diluting both basic and diluted earnings per share. As a result of adopting the amendments to ASC 260-10, prior period basic and diluted shares outstanding, as well as the related per share amounts presented in the preceding table, have been adjusted retroactively. |

The retroactive application of the two-class method resulted in a change to previously reported basic earnings per share for Fiscal 2007, Fiscal 2006, and Fiscal 2005, from $1.55 to $1.52, $2.01 to $1.98, and $1.14 to $1.13, respectively. There was no change to previously reported basic earnings per share for Fiscal 2008 due to the net loss for the period.

The retroactive application of the two-class method resulted in a change to previously reported diluted earnings per share for Fiscal 2007, Fiscal 2006, and Fiscal 2005, from $1.53 to $1.51, $1.98 to $1.96, and $1.13 to $1.12, respectively. There was no change to previously reported diluted earnings per share for Fiscal 2008 due to the net loss for the period.

| (3) | A store is included in comparable store sales in its thirteenth month of operation. A store with a square footage change of more than 15% is treated as a new store for the first year following its reopening. In addition, in a year with 53 weeks, sales in the last week of that year are excluded from comparable store sales. |

| (4) | Net sales per square foot is determined by dividing net sales for the period by the average of the total store square footage at the beginning and end of each period. Unless otherwise indicated, references herein to square footage are to gross square feet, rather than net selling space. |

| (5) | Capital expenditures are accounted for on the accrual basis and include net non-cash transactions totaling $(2.8) million, $(10.1) million, $5.9 million, $(0.8) million and $(14.3) million in Fiscal 2009, 2008, 2007, 2006 and 2005, respectively. The non-cash transactions are primarily related to the purchase of property and equipment on account. |

| (6) | Working capital turnover is determined by dividing net sales by the average of the amount of working capital at the beginning and end of the period. |

| (7) | Inventory turnover is determined by dividing cost of sales by the average of the cost of inventory at the beginning and end of the period. |

18

Table of Contents

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion and analysis should be read together with our consolidated financial statements and related notes thereto included elsewhere in this Annual Report on Form 10-K.

Management Overview

Fiscal 2009 remained challenging from a macroeconomic perspective for the overall retail industry and for our business. The impact of the recession that began in late 2007 continued through most of 2009, resulting in record unemployment and a soft consumer spending environment throughout the year. In anticipation of continued pressure on the economy, we entered Fiscal 2009 with a clear and decisive strategy to re-energize our brands, maximize gross margin performance, maintain a healthy balance sheet and cash position, and further reduce our cost structure through continued execution of our multi-year strategic restructuring program. As a result, our performance over the course of the year improved as these strategies gained traction, underscoring that we had planned appropriately. We ended Fiscal 2009 with a more compelling and relevant product assortment at both brands and a more efficient and streamlined operation with the ability to better leverage sales in Fiscal 2010 and beyond.

Our 2009 focus on maximizing gross margin performance was enabled by a conservative and disciplined approach to inventory management as well as promotional activity that was more focused than the prior year. Our promotional strategy was further supported by more effective product planning for the Fall season, which allowed us to be more selective in the timing and breadth of promotions as compared with Fall 2008. We successfully managed our inventory levels throughout the year, and ended Fiscal 2009 with total inventory per square foot flat versus year-end Fiscal 2008, which was down 32% from the end of Fiscal 2007.

We continued to make progress on our multi-year strategic restructuring program, which was first announced in January 2008, and under which we expect to generate approximately $125 million in ongoing annualized cost savings by the end of Fiscal 2010. In Fiscal 2009, we realized approximately $65 million in incremental restructuring program savings at a cost of approximately $36 million. We were also focused on preserving cash, and ended the year with approximately $204 million in cash and cash equivalents. Early in Fiscal 2009, we borrowed $125 million from our Credit Facility as a precaution against potential disruption in the credit markets, which we paid down in full by the end of the third quarter. We ended the year with no borrowings under our Credit Facility.

We experienced a net loss of $18.2 million in Fiscal 2009. Excluding $25.3 million in after-tax restructuring costs and an additional $10.7 million in after-tax store asset impairment charges, we achieved net income of $17.8 million. We believe that adjusted net income is a better representation of our ongoing business operations, since it removes the impact of restructuring program costs and other non-cash impairment charges.

Business conditions at the Ann Taylor division at the beginning of Fiscal 2009 were challenging, but improved significantly in the latter half of the year. From a product perspective, the Spring 2009 merchandise assortment did not yet reflect the modern look and versatility that our clients desired. Following the introduction of the “new” Ann Taylor product in the Fall 2009 season combined with a more expansive marketing plan, comparable store sales trends improved notably as the season progressed, particularly in the fourth quarter. For the year, net sales declined 33.8%, with comparable store sales down 30.0%. Ann Taylor delivered solid gross margin performance for the year, due to a lean inventory position and the introduction of better product in the back half of Fiscal 2009, both of which supported lower promotional levels in 2009 versus 2008. Although Ann Taylor ended the year with total inventory per square foot up approximately 13%, this was reflective of earlier delivery of Spring product compared with the prior year. Looking ahead, Ann Taylor is expected to continue to evolve and build on the progress made in 2009 to enhance its brand positioning as a modern, chic and sophisticated destination for women.

At LOFT, the brand was increasingly successful as the year progressed, with merchandise assortments that featured compelling fashion that was casual, feminine and stylish, all at surprising prices. Net sales for Fiscal 2009 declined 13.6% versus Fiscal 2008, reflecting a 12.7% decline in comparable store sales. Sales trends improved each quarter throughout the year, and LOFT ended the year with a 2.1% increase in comparable store sales in the fourth quarter of Fiscal 2009, which reflected better product and the impact of enhanced marketing plans. Gross margin was strong for the year, supported by lower inventory levels and lower levels of promotional activity compared with Fiscal 2008. LOFT’s year-end 2009 inventory per square foot increased approximately 6%, reflecting the earlier delivery of Spring goods and following a 37% decrease in inventory per square foot at the end of Fiscal 2008.

19

Table of Contents

Sales in the online and factory channels during the fourth quarter were constrained by light inventories. Despite this, these businesses delivered successfully against our Fiscal 2009 strategy, and generated strong gross margin performance. We increased online and Factory inventory levels at the beginning of Fiscal 2010 as part of our strategy to support top-line growth.

Looking ahead to Fiscal 2010, we are pursuing a strategy for sales growth by: continuing the progress being made at the Ann Taylor brand; investing in our LOFT brand through store growth for both LOFT and LOFT Outlet; growing our online businesses by committing greater resources to both brands; and continuing to elevate the client experience across all of our brands and channels. In addition, we expect to continue to execute against our strategic restructuring program, apply a disciplined approach to inventory, and ensure that our balance sheet and cash position remain strong.

20

Table of Contents

Key Performance Indicators

In evaluating our performance, senior management reviews certain key performance indicators, including:

| • | Comparable store sales – Comparable store sales provide a measure of existing store sales performance. A store is included in comparable store sales in its thirteenth month of operation. A store with a square footage change of more than 15% is treated as a new store for the first year following its reopening. |

| • | Gross margin – Gross margin measures our ability to control the direct costs of merchandise sold during the period. Gross margin is the difference between net sales and cost of sales, which is comprised of direct inventory costs for merchandise sold, including all costs to transport merchandise from third-party suppliers to our distribution center. Buying and occupancy costs are excluded from cost of sales. |

| • | Operating income – Because retailers do not uniformly record supply chain costs as a component of cost of sales or selling, general and administrative expenses, operating income allows us to benchmark our performance relative to other retailers. Operating income represents earnings before interest and income taxes and measures our earnings power from ongoing operations. |

| • | Store productivity – Store productivity, including sales per square foot, average unit retail price (AUR), units per transaction (UPT), dollars per transaction (DPT), traffic and conversion, is evaluated by management in assessing our operating performance. |

| • | Inventory turnover – Inventory turnover measures our ability to sell our merchandise and how many times it is replaced over time. This ratio is important in determining the need for markdowns, planning future inventory levels and assessing client response to our merchandise. |

| • | Quality of merchandise offerings – To monitor and maintain client acceptance of our merchandise offerings, we monitor sell-through levels, inventory turnover, gross margin, returns and markdown rates at a class and style level. This analysis helps identify merchandise issues at an early date and helps us plan future product development and buying. |

Results of Operations

The following table sets forth data from our Consolidated Statements of Operations expressed as a percentage of net sales. All fiscal years presented contain 52 weeks:

| Fiscal Years Ended | |||||||||

| January 30, 2010 |

January 31, 2009 |

February 2, 2008 |

|||||||

| Net sales |

100.0 | % | 100.0 | % | 100.0 | % | |||

| Cost of sales |

45.6 | 51.9 | 47.8 | ||||||

| Gross margin |

54.4 | 48.1 | 52.2 | ||||||

| Selling, general and administrative expenses |

52.9 | 47.8 | 44.3 | ||||||

| Restructuring |

2.0 | 2.7 | 1.3 | ||||||

| Asset impairment charges |

0.8 | 1.4 | 0.1 | ||||||

| Goodwill impairment charge |

0.0 | 13.1 | 0.0 | ||||||

| Operating (loss)/income |

(1.3 | ) | (16.9 | ) | 6.5 | ||||

| Interest income |

0.1 | 0.1 | 0.3 | ||||||

| Interest expense |

0.2 | 0.1 | 0.1 | ||||||

| (Loss)/income before income taxes |

(1.4 | ) | (16.9 | ) | 6.7 | ||||

| Income tax (benefit)/provision |

(0.4 | ) | (1.7 | ) | 2.6 | ||||

| Net (loss)/income |

(1.0 | )% | (15.2 | )% | 4.1 | % | |||

21

Table of Contents

The following table sets forth selected data from our Consolidated Statements of Operations expressed as a percentage change from the prior period. All fiscal years presented contain 52 weeks:

| Fiscal Years Ended | |||||||||

| January 30, 2010 |

January 31, 2009 |

February 2, 2008 |

|||||||

| increase (decrease) | |||||||||

| Net sales |

(16.7 | )% | (8.4 | )% | 2.3 | % | |||

| Operating (loss)/income |

(93.6 | )% | (339.2 | )% | (30.6 | )% | |||

| Net (loss)/income |

(94.5 | )% | (443.4 | )% | (32.0 | )% | |||

Sales and Store Data