Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-23363

American Dental Partners, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 04-3297858 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

American Dental Partners, Inc.

401 Edgewater Place, Suite 430

Wakefield, Massachusetts 01880

(Address of Principal Executive Offices, Including Zip Code)

Registrant’s telephone number, including area code: (781) 224-0880

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

¨ |

Accelerated filer |

x | |||

| Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting stock held by non-affiliates, computed by reference to the closing price of the registrant’s common stock on the Nasdaq Global Select Market on June 30, 2009, amounted to $117,443,575.

There were 16,302,258 shares outstanding of the registrant’s common stock, $0.01 par value, at March 8, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2010 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A are incorporated by reference in Part III, Items 10, 11, 12, 13 and 14 of this Annual Report on Form 10-K.

Table of Contents

AMERICAN DENTAL PARTNERS, INC.

INDEX

Table of Contents

This annual report on Form 10-K includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Section 27A of the Securities Act of 1933, as amended, or the Securities Act. For this purpose, any statements contained in this annual report regarding our strategy, future plans or operations, financial position, future revenues, projected costs, prospects and management objectives, other than statements of historical facts, may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “plans,” “expects” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed or implied in forward-looking statements. There are a number of factors that could cause actual events or results to differ materially from those indicated or implied by forward-looking statements, many of which are beyond our control, including the risk factors discussed in Item 1A of this annual report. In addition, the forward-looking statements contained in this annual report represent our estimates only as of the date of this filing and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, whether to reflect actual results, changes in assumptions, changes in other factors affecting such forward-looking statements or otherwise.

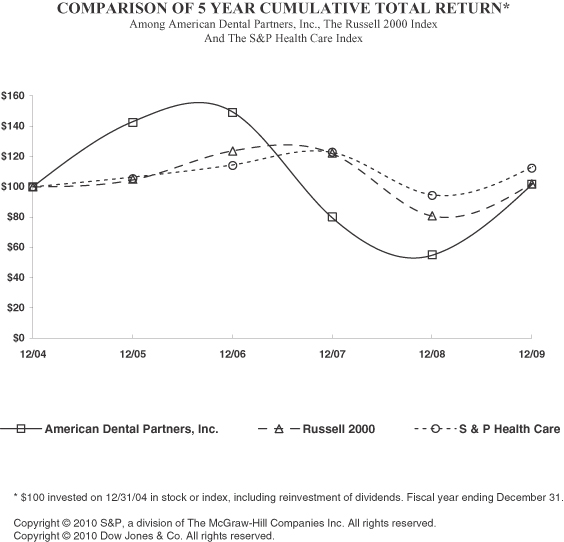

The information included under the heading “Performance Graph” in Item 5 of this annual report is “furnished” and not “filed” and shall not be deemed to be “soliciting material” or subject to Regulation 14A, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act.

As used in this annual report, “practice” refers to a dentist-owned professional corporation, professional association, professional limited liability company or service corporation that is responsible for providing dental care to patients. “Group practice” refers to a practice that employs multiple dentists and typically is owned by more than one dentist. “Affiliated practice” refers to a practice that has entered into a long-term service agreement with one of our subsidiary service companies. “Affiliated dental group” refers collectively to the affiliated practice and service company that are parties to the service agreement. An affiliated dental group typically comprises several dental facilities in a given metropolitan market. The terms “affiliated practice” and “affiliated dental group” also include Arizona’s Tooth Doctor for Kids, “Arizona Tooth Doctor,” a corporation that is 85% owned by us and as permitted by applicable state law, employs dentists.

| ITEM 1. BUSINESS |

Overview

We are a leading provider of business services, support staff and dental facilities to multidisciplinary dental group practices in selected markets throughout the United States. We are committed to the success of the affiliated practices and make substantial investments to support their growth. We provide dental facilities and support staff to the affiliated practices and provide or assist with organizational planning and development, staff recruitment, employee retention and training programs, quality assurance initiatives, facilities development and management, employee benefits administration, procurement, information systems and practice technology, marketing, payor contracting, and financial planning, reporting and analysis. At December 31, 2009, we were affiliated with 27 dental group practices, comprising 533 full-time equivalent dentists practicing in 268 dental facilities in 19 states.

Dental Care Industry

The market for dental care is large and highly fragmented with long-term growth potential. Based on Centers for Medicare & Medicaid Services statistics, estimated expenditures for dental care grew 7% on a compound annual

3

Table of Contents

basis from 1998 to 2008 reaching $101 billion in 2008. Expenditures for dental care are expected to be approximately $161 billion by 2018, representing a 5% annual growth rate from 2008 to 2018. We believe that the growth in expenditures for dental care will continue to be driven by both increases in costs and increases in demand for services due to:

| • | increased enrollment in dental benefits plans, particularly preferred provider organization, or PPO, plans, and to a lesser extent, dental referral plans; |

| • | increased demand for dental care as a result of the aging population and a greater percentage of this population retaining its dentition; |

| • | increased demand for aesthetic dental procedures and the development of new dental materials and procedures that address this demand; and |

| • | increasing awareness of linkages between wellness and oral health. |

We believe that this growth will benefit not only dentists, but also companies that provide services to the dental care industry, including dental management service organizations. However, the failure of any of these factors to materialize could offset increases in demand for dental care, and any such increases may not correlate with growth in our business.

Unlike many other sectors of the health care services industry, the dental care profession remains dominated by practices owned and operated by just one dentist. According to the American Dental Association, or ADA, in 2007, approximately 61% of the 167,000 dentists in the United States were solo practitioners. The percentage of graduating dentists who initially began their career as an owner of a dental practice, however, fell from 31% in 1989 to 18% in 2007 according to the ADA. We believe a greater percentage of dentists will practice as partners or associates in group dental practices rather than practicing as solo practitioners as a result of high educational debt levels and a change in gender profile of graduating dentists. According to the ADA, dental students in 2007 graduated with an average of $242,000 of debt and 44% were female. We believe group dental practice provides economic and professional flexibility advantages to graduating dentists as compared to solo practice.

Most dental care performed in the United States is categorized as general dentistry. According to the ADA, in 2007, approximately 80% of dentists were general dentists. General dentistry includes preventative care, diagnosis and treatment planning, as well as procedures such as fillings, crowns, bridges, dentures and extractions. Specialty dentistry, which includes endodontics, oral surgery, orthodontics, periodontics, prosthodontics and pediatric dentistry, represented the remaining 20% of practicing dentists.

Historically, dental care was not covered by insurers and consequently was paid for by patients on a fee-for-service basis. An increasing number of employers have responded to the desire of employees for enhanced benefits by providing coverage from third-party payors for dental care. These third-party payors offer one or more of the following: indemnity insurance plans, PPO plans, capitated managed care plans and dental referral plans. Under an indemnity insurance plan, the dental provider charges a fee for each service provided to the insured patient, which is typically the same as that charged to a patient not covered by any type of dental insurance. We categorize indemnity insurance plans and patients without dental insurance as fee-for-service. Under a PPO plan, the dentist agrees to accept a discounted fee for each service provided based on a schedule negotiated with the dental benefit provider. Under a capitated managed care plan, the dentist receives a fixed monthly fee from the managed care organization for each member covered under the plan who selects that dentist as his or her provider. Capitated managed care plans also typically require a co-payment by the patient. Dental referral plans are not insurance products but are network-based products that provide access to dental care. Typically, a small monthly fee is paid by an individual or employer for a list of dentists who have agreed to accept certain negotiated fees or a discount from their normal fees. Under dental referral plans, full reimbursement for dental care provided is made directly by a patient to the participating dentist, as compared to indemnity, PPO and capitation plans in which some portion of reimbursement is provided by the payor to the participating dentist.

The National Association of Dental Plans, or NADP, and the Delta Dental Plans Association, or DDPA, estimated that nearly 176 million people, or 57% of the population of the United States, were covered by some

4

Table of Contents

form of dental benefit plan in 2008. This compares with 133 million people, or 52% of the population, in 1996. Of the 176 million people with coverage, 57% were covered by PPO plans, 13% by indemnity insurance plans, 14% by publicly funded benefits such as Medicaid, 8% by dental referral plans, 7% by capitated managed care plans and 1% by direct reimbursement plans. The number of people covered by PPO plans increased from 39 million in 1998 to 102 million in 2008, representing a compound annual growth rate of 10%.

Dental caries is the single most common chronic childhood disease. While, in recent years, dental caries has declined among children as a result of various preventive regimens, dental caries remains a significant problem in certain populations, particularly among poor children. With one in three children being born into households eligible for Medicaid or State Children’s Health Insurance Program, or SCHIP, the number of children eligible under these programs reached 28 million in 2008. According to the Pew Charitable Trusts, just one-third of Medicaid-enrolled children receive any dental care annually. In addition to issues at home contributing to dental disease among children, the Pew Charitable Trusts believes broader, systemic factors play a significant role in the lack of access to care including (i) too few children have access to proven preventive measures, including sealants and fluoridation; (ii) too few dentists are willing to treat Medicaid-enrolled children; and (iii) in some communities there are not enough dentists to provide care.

Business Objective and Strategy

Our objective is to be the leading business partner to dental group practices in selected markets throughout the United States. In order to achieve our objective, our strategy is to provide value-added resources to each affiliated practice so that each may become the market leading, high quality dental provider of its community. Specifically, we provide dental facilities and support staff to the affiliated practices and provide or assist with organizational planning and development, staff recruitment, employee retention and training programs, quality assurance initiatives, facilities development and management, employee benefits administration, procurement, information systems and practice technology, marketing, payor contracting, and financial planning, reporting and analysis. In addition to the resources we currently offer to the affiliated practices, from time to time, we selectively seek to enhance or expand our capabilities and services, including through vertical integration of ancillary activities.

The services we offer to the affiliated practices are designed to foster or support what we believe to be the core attributes that define a leading, high quality dental provider: (i) a common identity and clinical philosophy, (ii) professional recruiting and mentoring programs, (iii) formalized peer review and quality assurance initiatives, (iv) functional and well-maintained dental facilities, (v) advanced information systems, and (vi) a qualified local management team with well-defined responsibilities and accountability. In addition to assisting the affiliated practices achieve or maintain these attributes, our objective is to help the affiliated practices grow their patient revenue eight to ten percent annually.

We believe that successful execution of our strategy will lead to growth in (i) the number of affiliated practices and communities that we service, (ii) the community presence of the affiliated practices, and (iii) our capabilities and resources.

Affiliation Philosophy

Current market trends in health care, including provider demographics and resource requirements, are adding to the complexity of operating a dental group practice. In addition, the principals of many dental group practices are reaching retirement age and are beginning to investigate means for transitioning the non-clinical leadership and management of their dental group practices. Our business model enables dentists to focus on the clinical aspects of their dental group practices, while we manage the non-clinical aspects. We are additionally able to provide the necessary organizational structure, resources and capital for continued growth and success.

Our affiliation model is designed to create a relationship between the affiliated practice and us that allows each party to maximize its strengths and retain its autonomy. The dentists of the affiliated practice continue to have

5

Table of Contents

control over clinical decision-making and patient care while we manage the business aspects of the affiliated dental group. In each affiliation, we strive to maintain the local culture of the affiliated dental group, and we encourage it to continue using the same name, continue its presence in community events, maintain its relationships with patients and local dental benefit providers, and strengthen the existing management organization.

We are constantly evaluating potential affiliations with dental group practices that would expand our business, as well as possible acquisitions of companies that would broaden our business capabilities.

Affiliated Dental Groups

From November 12, 1996 (the date of our first affiliation) through December 31, 2009, we completed 110 acquisition and affiliation transactions, which have resulted in affiliations with 27 affiliated dental groups comprising 268 dental facilities in 19 states. The following table lists our affiliated dental groups as of December 31, 2009.

| Practice Specialties (2) | ||||||||||||||||||||||||||||

| Affiliated Dental Group |

State |

Dental Facilities |

Operatories (1) | General | Endo- dontics |

Oral Surgery |

Ortho- dontics |

Pedo- dontics |

Perio- dontics |

Prosth- odontics | ||||||||||||||||||

| 1st Advantage Dental – New England |

Massachusetts/Vermont | 4 | 33 | ü | ||||||||||||||||||||||||

| 1st Advantage Dental – New York |

New York | 11 | 87 | ü | ü | ü | ü | ü | ||||||||||||||||||||

| Advanced Dental Specialists |

Wisconsin | 2 | 16 | ü | ü | ü | ||||||||||||||||||||||

| American Family Dentistry |

Tennessee | 8 | 57 | ü | ü | ü | ||||||||||||||||||||||

| Arizona’s Tooth Doctor for Kids (3) |

Arizona | 8 | 78 | ü | ü | ü | ||||||||||||||||||||||

| Associated Dental Care Providers (3) |

Arizona | 10 | 102 | ü | ü | ü | ü | |||||||||||||||||||||

| Assure Dental (3) |

Minnesota | 2 | 8 | ü | ||||||||||||||||||||||||

| Carus Dental (3) |

Texas | 22 | 155 | ü | ü | ü | ü | ü | ||||||||||||||||||||

| Chestnut Hills Dental |

Pennsylvania | 8 | 60 | ü | ü | ü | ||||||||||||||||||||||

| Christie Dental |

Florida | 26 | 151 | ü | ü | ü | ü | ü | ü | |||||||||||||||||||

| Cumberland Dental (3) |

Alabama | 3 | 34 | ü | ü | ü | ü | ü | ||||||||||||||||||||

| Deerwood Orthodontics |

Wisconsin | 7 | 35 | ü | ||||||||||||||||||||||||

| Dental Arts Center |

Virginia | 1 | 39 | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||

| ForwardDental (3) |

Wisconsin | 29 | 265 | ü | ü | |||||||||||||||||||||||

| Greater Maryland Dental Partners |

Maryland/Virginia | 6 | 71 | ü | ü | ü | ü | ü | ü | |||||||||||||||||||

| Lakeside Dental Care |

Louisiana | 2 | 15 | ü | ü | |||||||||||||||||||||||

| Metro Dentalcare |

Minnesota | 40 | 343 | ü | ü | ü | ü | ü | ü | |||||||||||||||||||

| Oklahoma Dental Group |

Oklahoma | 4 | 36 | ü | ||||||||||||||||||||||||

| Orthodontic Care Specialists (3) |

Minnesota/Wisconsin | 20 | 104 | ü | ||||||||||||||||||||||||

| Premier Dental Partners |

Missouri | 8 | 78 | ü | ü | |||||||||||||||||||||||

| Redwood Dental Group (3) |

Michigan | 6 | 76 | ü | ü | ü | ü | |||||||||||||||||||||

| Riverside Dental Group (3) |

California | 7 | 121 | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||

| Sacramento Oral Surgery |

California | 5 | 10 | ü | ||||||||||||||||||||||||

| Texas Tooth Doctor for Kids |

Texas | 2 | 12 | ü | ü | |||||||||||||||||||||||

| University Dental Associates (3) (4) |

North Carolina | 12 | 98 | ü | ü | ü | ||||||||||||||||||||||

| Valley Dental Group (3) |

Minnesota | 1 | 15 | ü | ü | ü | ü | ü | ü | |||||||||||||||||||

| Western New York Dental Group (3) |

New York | 14 | 160 | ü | ü | ü | ü | ü | ü | |||||||||||||||||||

| 268 | 2,259 | |||||||||||||||||||||||||||

(1) An operatory is an area where dental care is performed and generally contains a dental chair, a hand piece delivery system and other essential dental equipment.

(2) Services provided by specialists who are board-certified or board-eligible.

(3) Accredited by the Accreditation Association for Ambulatory Health Care (“AAAHC”).

(4) University Dental Associates’ dental residency program is accredited by the American Dental Association.

Operations

Operating Structure

Where permitted by applicable state law, we generally employ the hygienists, dental assistants and administrative staff at each dental facility, but all clinical activities are performed under the supervision of the dentists who are employed by, or have contracted with, an affiliated practice. Each dental facility has a manager or supervisor

6

Table of Contents

who, along with the administrative staff, typically oversees day-to-day business operations, including facility staffing, patient scheduling, on-site patient billing and general office management. Each affiliated dental group has an operations director who oversees all the managers of the dental facilities of the affiliated dental group.

Our shared services teams provide administrative and operational support to one or more affiliated dental groups on either a national, regional or local basis. These teams provide or assist in organizational planning and development; recruiting, hiring and training programs; employee benefits administration and payroll processing; information systems; development of annual operating plans; accounting and financial reporting information; facilities maintenance; procurement; risk management; corporate development; accounts receivable management; dental laboratory services; payor contracting; and marketing.

A regional operations director is responsible for managing the operations directors and monitoring the operating performance of multiple affiliated dental groups in multiple communities. The regional operations directors are responsible for overseeing the development of annual operating plans for the affiliated dental groups and monitoring actual results.

Accreditation Association for Ambulatory Health Care

We have selected the Accreditation Association for Ambulatory Health Care, or AAAHC, as a means for supporting the quality initiatives of the affiliated practices. The AAAHC is a peer-based, not-for-profit organization that is nationally recognized for conducting extensive evaluations of ambulatory health care organizations. The AAAHC evaluates a number of areas in granting accreditation, such as patients’ rights, governance, administration, clinical records, professional development, quality management and improvement, and facilities. We work with the affiliated practices to achieve accreditation. Depending on the level of development and organization, achieving accreditation can take several years of preparation. Currently, twelve affiliated practices have achieved accreditation status from the AAAHC.

Training and Leadership Development

We believe that our long term success requires a significant investment in the development of people at all levels within our company and at the affiliated practices. We have both leadership development and skills training programs.

The American Dental Partners Leadership Institute provides both personal and professional development by bringing dentists and management leaders together to develop effective leadership techniques to create work environments that inspire peak performance from team members. The Leadership Institute is conducted on a national basis with dentists and management from multiple affiliated dental groups in attendance. As part of the learning process, participants receive feedback on the climate they create, their leadership styles and their leadership competencies. Feedback is obtained from the leader’s team members through on-line assessment surveys. Survey results are shared with the leader during the program, and personal action plans are created to enhance leadership effectiveness. We believe creating a high performance climate improves morale, lowers staff turnover and improves productivity.

We also have devoted significant resources to develop innovative, proprietary skills training programs. Training programs exist for improving patient service, such as creating a positive patient arrival/departure experience; improving telephone etiquette and managing unhappy patients; and developing business management competencies, such as improving recruiting skills, developing effective mentoring processes and managing time. These programs are modular and are made available at the affiliated dental groups. We have a national training team composed of training specialists who work with the leadership of the affiliated dental groups to assess the job skills and services of each affiliated dental group in order to implement and maintain continuous training and development programs. Once implemented, the affiliated dental groups have on-going sessions with additional modules as they are developed and with new staff members as they join the affiliated dental group. We believe that by investing in skills training, we empower our team members to assist the affiliated practices in providing exceptional patient care and service.

7

Table of Contents

Payor Relationships and Reimbursement Mix

Although we believe that the clinical philosophy of each affiliated practice should not be compromised by economic decisions, we recognize that the source of payment for dental services affects operating and financial performance. Generally, we believe it is easier to grow patient revenue within a given community when the payor mix of the affiliated practice is aligned with the payor mix in that community. We help the affiliated practices optimize their revenue by analyzing their payor mix on an ongoing basis, as well as by providing assistance with evaluation and negotiation of dental benefit provider contracts for improved reimbursement rates.

We believe it is advantageous to be affiliated with dental group practices that have successfully provided care to patients under all reimbursement methodologies. Since a shift is taking place in the dental benefits market from indemnity insurance plans and capitated managed care plans to PPO plans and dental referral plans, we believe that experience in operating under all of these plans provides an advantage as it relates to increasing community presence. Most of the affiliated practices provide care under traditional fee-for-service plans and non-fee-for-service plans. The following table provides the aggregate payor mix of the affiliated practices for the years ended December 31:

| 2009 | 2008 | 2007 | |||||||

| Fee-for-service |

15 | % | 19 | % | 28 | % | |||

| PPO and dental referral plans |

77 | % | 70 | % | 60 | % | |||

| Capitated managed care plans |

8 | % | 11 | % | 12 | % |

In recent years, many of the affiliated practices have been realigning their reimbursement mix away from deeply discounted dental benefit plans or negotiating improved reimbursement rates. This effort has largely been accomplished with the cooperation of the dental benefit provider community in general.

Facilities Development and Management

The affiliated dental groups operate out of dental facilities that in most instances we lease from third parties under long-term operating leases. Generally, our dental facilities are constructed to be warm, attractive and inviting to patients and typically have between eight and ten operatories, or treatment rooms, which accommodate general and specialty dentists, hygienists and dental assistants, as well as required support staff. Most of the dental facilities are either located within a professional office or medical building or are free standing.

We assist the affiliated dental groups in improving facility utilization by evaluating existing capacity, identifying expansion opportunities and prioritizing facility upgrades. We acquire or construct each dental facility as appropriate for the local community and add or equip additional operatories to meet increases in demand. We use architectural firms that work with each affiliated dental group to improve facility design and establish defined facility standards. These standards create consistency across new dental facilities and thereby shorten the site development process and improve productivity of dentists and support staff.

Financial Planning and Financial Information System

We assist the affiliated practices with financial planning. We develop with each affiliated practice an annual operating plan for the affiliated dental group that sets specific goals for revenue growth, operating expenses and capital expenditures. Once a plan has been approved, we measure forecasted and actual financial performance of each affiliated dental group against the annual operating plan.

Our financial information system enables us to measure, monitor and compare the financial performance of each affiliated dental group on a standardized basis. The system also allows us to track and control costs and facilitates the accounting and financial reporting process. This financial system is used with all affiliated dental groups.

8

Table of Contents

Practice Management Systems

The affiliated dental groups use Improvis®, our proprietary dental practice management software system, to, among other things, facilitate patient scheduling, bill patients and insurance companies and manage facility staffing and timekeeping. Orthodontic Care Specialists and Deerwood Orthodontics, two affiliated dental groups that exclusively provide orthodontic services, utilize a different proprietary practice management system designed specifically for the unique requirements of the orthodontics specialty. We have implemented this orthodontic practice management system at 16 other affiliated dental groups that have a significant orthodontics practice.

We have a software development team that is responsible for development and enhancement of Improvis. Electronic dental record and digital radiography functionality has been incorporated into Improvis. At year end 2009, we were pilot testing the electronic dental record, and in 2010 we intend to pilot test digital radiography functionality.

Service Agreements and Affiliation Structure

Except for Arizona Tooth Doctor, as discussed below, we have entered into a service agreement with each affiliated practice pursuant to which we are responsible for managing all administrative, non-clinical aspects of the affiliated practice. We anticipate that each new practice with which we affiliate will enter into a similar service agreement or become a party to an existing service agreement. We are dependent on our service agreements for a substantial majority of our net revenue. The termination of one or more of our service agreements could have a material adverse effect on us.

Pursuant to the service agreement, the affiliated practice is solely responsible for all clinical aspects of the dental operations of the affiliated dental group. These clinical aspects include recruiting and hiring dentists; selecting, training and supervising other licensed dental personnel and unlicensed dental assistants; providing dental care; implementing and maintaining quality assurance and peer review programs; setting patient fee schedules; entering into dental benefit plan provider contracts; and maintaining professional and comprehensive general liability insurance covering the affiliated practice and each of its dentists. We do not assume any authority, responsibility, supervision or control over the provision of dental care to patients. The service agreement also includes non-competition and confidentiality provisions that prohibit the affiliated practice from owning or operating another dental facility or having any interest in any business that competes with us within the contractually agreed upon service territory.

Pursuant to the service agreement, we are responsible for providing dental facilities, support staff and all services necessary and appropriate for the administration of the non-clinical aspects of the affiliated dental group. These services include assisting with organizational planning and development; providing recruiting, retention and training programs; supporting quality assurance initiatives; providing on-going facilities development and maintenance; administering employee benefits and payroll; procuring supplies and other necessary resources; maintaining necessary information systems; assisting with marketing and payor relations; and providing financial planning, reporting and analysis.

With respect to each affiliated practice other than Christie Dental Practice Group, P.L., the affiliated practice at Christie Dental, we and the practice establish, pursuant to the terms of the service agreement, a joint policy board that is responsible for developing and implementing management and administrative policies. The joint policy board consists of an equal number of representatives designated by us and the affiliated practice. The joint policy board members designated by the affiliated practice must be licensed dentists currently employed by the practice. The joint policy board’s responsibilities include the review and approval of long-term strategic and short-term operational goals, objectives and plans for the affiliated dental groups, annual capital and operating plans, renovation and expansion plans and capital equipment expenditures with respect to the dental facilities, advertising and marketing services, and staffing plans. The joint policy board also reviews and monitors the financial performance of the affiliated dental group. Finally, the joint policy board reviews and makes recommendations with respect to patient fee schedules and contractual relationships with dental benefit

9

Table of Contents

providers, although final decisions regarding these and all other clinical matters, as previously discussed, are made exclusively by the affiliated practice. At Christie Dental, the matters that require policy board agreement or approval at the other affiliated practices generally require agreement between us and Christie Dental Practice Group, P.L.

The affiliated practices reimburse us for actual expenses incurred on their behalf in connection with the operation and administration of the dental facilities or our other services and pay fees to us for management services provided and capital committed. Our fee, depending on the service agreement and affiliated practice, consists of one of the following:

| • | a fixed monthly fee determined by agreement between us and the affiliated practice (but in no event will the total service fee be greater than the affiliated practice’s patient revenue less expenses); |

| • | a monthly fee equal to the prior year’s service fee and an additional performance fee based upon a percentage of the increase in the amount by which the affiliated practice’s patient revenue exceeds expenses as compared to the prior year (but in no event will the total service fee be greater than the affiliated practice’s patient revenue less expenses); |

| • | a monthly fee that is based upon a specified percentage of the amount by which the affiliated practice’s patient revenue exceeds expenses; |

| • | a fixed monthly fee and an additional performance fee based upon a percentage of the amount by which the affiliated practice’s patient revenue exceeds expenses as compared to the planned amount for the current year; or |

| • | a monthly fee based on a specified percentage of patient revenue or a specified percentage of collections on patient revenue. |

The structure of the service fee, whether composed of variable or fixed components, or both, is dependent in part on the laws and regulations of the states in which we operate. The affiliated practice is responsible for its own business expenses, which generally consist of the salaries, benefits and certain other expenses of the dentists. We refer to these expenses as provider expenses.

Pursuant to the terms of the service agreements, we bill patients and third-party payors on behalf of the affiliated practices. These funds, as collected, are applied in the following order of priority:

| • | reimbursement of expenses incurred by us in connection with the operation and administration of the dental facilities; |

| • | repayment of advances, if any, made by us to the affiliated practice; |

| • | payment of the monthly service fee to us; |

| • | payment of provider expenses; and |

| • | payment of the additional variable service fee, if applicable, to us. |

Each of our service agreements has an initial term of 40 years and automatically renews for successive 5-year terms, unless terminated by notice by either party given at least 120 days prior to the end of the initial term or any renewal term, or with respect to Christie Dental, by us at any time upon 180 days advance notice. In addition, the service agreement may be terminated earlier by either party upon the occurrence of certain events involving the other party, such as dissolution, bankruptcy, liquidation or our failure to perform material duties and obligations under the service agreement. In the event a service agreement is terminated, the affiliated practice is required to reimburse us for unpaid expenses incurred in connection with the operation and administration of the dental facilities, repay advances and pay us any unpaid service fees. The affiliated practice may also be required, at our option in nearly all instances, to purchase the unamortized balance of intangible assets at the current book value, repurchase equipment and other assets at the greater of fair value or book value and assume our leases and other liabilities related to the terminated service agreement.

Arizona’s Tooth Doctor for Kids

Arizona Tooth Doctor is a dental group practice that provides dental care to children through eight locations in metropolitan Phoenix, Mesa, Chandler and Globe, Arizona. Approximately 90% of Arizona Tooth Doctor’s

10

Table of Contents

revenue is derived from PPO health plans that are contracted with the Arizona Health Care Cost Containment System, or AHCCCS, the state’s Medicaid program. While we employ the Arizona Tooth Doctor dentists as permitted by applicable state law, we do not exercise control over, or otherwise influence, their clinical judgment, decisions or practice.

Competition

The dental services industry is highly competitive. There are approximately 25 competing dental management companies in our current service areas that provide business services to dentists and dental group practices through contractual arrangements. The principal factors of competition between dental management companies are their affiliation models, the number and reputation of their existing affiliated practices, their management expertise, the quality of support services provided to the affiliated practices and their financial track record. We believe we compete effectively with other companies that provide business services to dental group practices with respect to these factors. The practices affiliated with us compete with other dental practices and individual dentists in their respective communities.

Government Regulation

General

The practice of dentistry is highly regulated. Our operations and those of the affiliated practices are subject to a broad range of state and federal laws, regulations and licensing regimes. Changes to the legal or regulatory environments in which we and the affiliated practices operate could have a material impact on the operation and financial performance of our business. We consequently monitor and, as appropriate, seek to participate in relevant legislative and regulatory activity. Each of our service agreements provides that if any legal or regulatory change, or any ruling or interpretation by any court or administrative body, does, or is reasonably likely to, materially and adversely affect the performance or compensation of us or the affiliated practice under the service agreement, or makes the service agreement unlawful, then we and the affiliated practice are obligated to use best efforts to revise the relationship in a way that is legally compliant and approximates as closely as possible the originally negotiated economic positions of the parties.

State Regulation

Each state imposes licensing and other requirements on dentists. The laws of almost all of the states in which we operate prohibit, either by statute, regulation case law or as a matter of general public policy, entities not wholly-owned or controlled by dentists, such as us, from practicing dentistry; employing dentists and, in certain states, dental hygienists and assistants; exercising control over the provision of dental services; splitting fees; or receiving fees for patient referrals. An exception to the preceding is the State of Arizona, the laws of which permit us to own the dental practice and employ the dentists at Arizona Tooth Doctor. Many states additionally prohibit or restrict the ability of a person other than a licensed dentist to own, manage or control the assets, equipment or facilities used by a dental practice. Certain states also regulate the advertising of dental services, which regulations may include prohibiting the advertising of dental services under a trade or corporate name, requiring all advertisements to be in the name of a dentist or proscribing the content of advertisements and the use of promotional gift items. These laws and regulations and their interpretation vary from state to state and, in many instances, are subject to enforcement by regulatory authorities with broad discretionary authority.

Many state laws and regulations relating to the practice of dentistry were adopted prior to the emergence of dental management service organizations, like us, in the dental industry. The emergence of dental management service organizations has prompted certain states, including some of the states in which we operate, to review laws or regulations relating to the practice of dentistry and the business arrangements between dentists and dental management service organizations. These reviews could potentially result in legal or regulatory changes that could have a material impact on the operations and financial performance of our business.

In certain states, we are additionally subject to regulations pertaining to our role in the negotiation and administration of managed care contracts, plans or arrangements. To the extent that we or any affiliated practice

11

Table of Contents

contracts with a third-party payor, including a self-insured plan, under a capitated or other arrangement that causes us or the affiliated practice to assume a portion of the financial risk of providing dental care, we or the affiliated practice may become subject to state insurance laws. If we or the affiliated practice is determined to be engaged in the business of insurance, we may be required to change our contractual relationships or seek appropriate licensure. Many states also have adopted patient privacy laws similar to the Health Insurance Portability and Accountability Act of 1996, or HIPAA and the Health Information Technology for Economic and Clinical Health Act, or HITECH provisions described below, some of which are more stringent than the federal regulations.

Federal Regulation

Participation by the affiliated practices and their dentists in federal payment programs subjects them, and us with respect to our Arizona Tooth Doctor operation, to federal laws and regulations concerning the provision of dental services to beneficiaries, submission of claims and related matters, certain of which are discussed below. Violation of these laws and regulations can result in liability for overpayments, and civil and criminal penalties, including possible exclusion of individuals and entities from participation in those federal programs.

Federal anti-kickback statutes prohibit, in part, and subject to certain safe harbors, the payment or receipt of remuneration in return for, or in order to induce, referrals, or arranging for referrals, for items or services that are reimbursable under federal payment programs. Other federal laws impose significant penalties for false or improper billings or inappropriate coding for dental services. The federal self-referral law, or Stark law, prohibits dentists from making referrals for certain designated health services reimbursable under federal payment programs to entities with which they have financial relationships unless a specific exception applies. The Stark law also prohibits the entity receiving a proscribed referral from submitting a claim for services provided pursuant to that referral. We may be subject to federal payor rules prohibiting the assignment of the right to receive payment for services rendered unless certain conditions are met. These rules prohibit a billing agent from receiving a fee based on a percentage of collections and may require payments for dental services to be made directly to the dentist providing the services or to a lock-box account held in the name of the dentist or his or her practice. In addition, these rules provide that accounts receivable from federal payors are not saleable or assignable.

The affiliated practices are covered entities under HIPAA, and the recently enacted HITECH. Among other things, these laws include provisions regarding protection of the privacy of patient-identifiable health information and standards for security of electronic protected health information and electronic transactions. HITECH extended the HIPAA privacy and security rules to make them directly applicable to entities, such as us, that are “business associates” of the affiliated practices. Additionally, HITECH expanded the scope of HIPAA by, among other things, mandating individual and United States Department of Health and Human Services notification in instances of a breach of protected health information, and public notices in the event of a breach involving 500 or more patients; providing enhanced penalties for HIPAA violations; and granting enforcement authority to states’ attorneys general in addition to the United States Department of Health and Human Services Office of Civil Rights. We maintain policies and procedures for the handling of patient records and other information in order to comply with these laws. The laws and regulations in this area may continue to evolve, and new health information standards, whether implemented pursuant to HIPAA or otherwise, could have a material effect on how we and the affiliated practices handle health care related data and the cost of compliance. Failure to comply with existing or new laws or regulations related to the privacy or security of patient information could result in criminal or civil sanctions.

In addition to the preceding federal laws and regulations, dental practices are also subject to compliance with federal regulatory standards in the areas of safety, health and access.

Medicaid

Arizona Tooth Doctor is a provider under the Medicaid program in Arizona and Texas Tooth Doctor for Kids, or Texas Tooth Doctor is a provider under the Medicaid program in Texas. As providers under Medicaid programs,

12

Table of Contents

these affiliated practices must comply with extensive state and federal Medicaid laws and regulations, as well as contractual requirements owed to third-party payors that administer claims and reimbursement under those programs. The Medicaid programs include significant penalties for false or improper billings and inappropriate coding for dental services or related services.

Insurance

We maintain insurance coverage that we believe is appropriate for our business, including property, business interruption, workers’ compensation and general liability, among other coverages. In addition, the affiliated practices are required to maintain, or must cause to be maintained, professional liability insurance with us as a named insured. Certain of our insurance programs are reinsured by a wholly-owned captive insurance company licensed in Vermont.

Customers

For the fiscal year ended December 31, 2009, revenue generated from our service agreements with Northland Dental Partners, PLLC, the affiliated practice at Metro Dentalcare, and Wisconsin Dental Group, S.C., the affiliated practice at ForwardDental, represented 22% and 14%, respectively, of our consolidated net revenue. The termination of either service agreement could have a material adverse effect on our business, financial condition and results of operations.

Employees

We do not employ dentists, hygienists or dental assistants in states where laws prohibit us from doing so. As of December 31, 2009, we had 2,585 employees, including 35 dentists (representing 33 full-time equivalent dentists), 449 hygienists, 741 dental assistants and 1,363 administrative personnel at our dental facilities, shared service centers and corporate office. As of December 31, 2009, the affiliated practices, excluding Arizona Tooth Doctor, employed 402 hygienists, 389 dental assistants and employed or contracted with 669 dentists (representing 500 full-time equivalent dentists). We consider our relationships with our employees to be satisfactory.

Available Information

We make available, free of charge, through our website at www.amdpi.com our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, all amendments to these reports and other filings with the United States Securities and Exchange Commission, or SEC, as soon as reasonably practicable after filing. The public can also obtain access to our reports by visiting the SEC Public Reference Room, 100 F Street, NE, Room 1580, Washington, DC 20549, by calling the SEC at 1-800-SEC-0330 or by visiting the SEC’s website at www.sec.gov.

Executive Officers and Senior Management of the Registrant

The following table sets forth information concerning each of our current executive officers and members of senior management, each of whom are elected annually by the Board of Directors:

| Name |

Age | Position | ||

| Gregory A. Serrao* |

47 | Chairman, President and Chief Executive Officer | ||

| Breht T. Feigh* |

43 | Executive Vice President – Chief Financial Officer and Treasurer | ||

| Michael J. Vaughan* |

56 | Executive Vice President – Chief Operating Officer | ||

| Michael J. Kenneally |

49 | Senior Vice President – Regional Operations | ||

| Jesley C. Ruff, D.D.S. |

55 | Senior Vice President – Chief Professional Officer | ||

| Ian H. Brock |

40 | Vice President – Planning and Investment | ||

| Michael W. Hoyt |

46 | Vice President – Information Systems | ||

| Mark W. Vargo* |

58 | Vice President – Chief Accounting Officer |

| * | Designated by the Board of Directors as an executive officer. |

13

Table of Contents

Mr. Serrao founded American Dental Partners, Inc. and has served as our President, Chief Executive Officer and a Director since December 1995 and as Chairman since October 1997. From 1992 through December 1995, Mr. Serrao served as the President of National Specialty Services, Inc., a subsidiary of Cardinal Health, Inc. From 1991 to 1992, Mr. Serrao served as Vice President – Corporate Development of Cardinal Health. Before joining Cardinal Health, Mr. Serrao was an investment banker at Dean Witter Reynolds Inc. from 1985 to 1990. Mr. Serrao serves on the Board of Fellows of the Harvard School of Dental Medicine and the Board of Governors for the Boys and Girls Club of Lawrence, Massachusetts.

Mr. Feigh has served as our Executive Vice President – Chief Financial Officer and Treasurer since November 2003. Mr. Feigh was Vice President – Chief Financial Officer and Treasurer from January 2001 to October 2003, Vice President – Strategic Initiatives from January 2000 to December 2000 and Director – Corporate Development from October 1997 to December 1999. Prior to joining us, Mr. Feigh was employed in various investment banking positions at Dean Witter Reynolds Inc., ING Barings and Robertson, Stephens & Company from 1989 to 1997.

Mr. Vaughan has served as our Executive Vice President – Chief Operating Officer since November 2003. Mr. Vaughan was Senior Vice President – Chief Operating Officer from October 2001 to October 2003, Senior Vice President – Regional Operations from January 2001 to September 2001 and Vice President – Operations from January 2000 to December 2000. From 1996 to December 1999, Mr. Vaughan served as Regional Vice President for Cardinal Distribution, a subsidiary of Cardinal Health. From 1988 to 1995, Mr. Vaughan held the positions of Vice President and General Manager of Cardinal Distribution’s Knoxville, Tennessee and Zanesville, Ohio facilities and also Vice President of Strategic Initiatives. Prior to joining Cardinal Health, Mr. Vaughan worked for McKesson HBOC in various sales management positions.

Mr. Kenneally has served as our Senior Vice President – Regional Operations since February 2005. Mr. Kenneally has also served as Chief Executive Officer of our Minnesota subsidiaries since January 2001. Mr. Kenneally was Chief Operating Officer of PDHC, Ltd. from July 1998 to December 2000, Director of Business Management from 1995 to June 1998, Director of Finance and Information Systems from 1994 to 1995 and Controller from 1988 to 1994.

Dr. Ruff has served as our Senior Vice President – Chief Professional Officer since February 2005. Dr. Ruff was Vice President – Chief Professional Officer from January 1999 to February 2005. From 1992 to December 1998, Dr. Ruff served as President of Wisconsin Dental Group, S.C., one of our affiliated practices, where he was employed as a practicing dentist and held a variety of positions since 1985. In 1994, Dr. Ruff served on the Board of Directors of the National Association of Prepaid Dental Plans. From 1983 to 1991, Dr. Ruff was an Assistant Professor at the Marquette University School of Dentistry and an adjunct faculty member from 1991 to 1996, where he held a variety of clinical faculty and grant-related positions.

Mr. Brock has served as our Vice President – Planning and Investment since February 2005. Mr. Brock was Vice President – Finance from October 2001 to January 2005, Vice President – Financial Planning from January 2001 to September 2001, Director – Financial Planning from February 1998 to December 2000 and Assistant Controller from September 1996 to January 1998. Prior to joining us, Mr. Brock worked for American Medical Response, Inc., or AMR, a national provider of ambulance services, as a corporate financial analyst from 1995 to 1996 and as an accounting manager and financial analyst from 1991 to 1995 with AMR of Connecticut, Inc., one of AMR’s four founding subsidiaries.

Mr. Hoyt has served as Vice President – Information Services since May 2009. From 2001 to May 2009, Mr. Hoyt served as Senior Technology Director for GTECH, an international gaming technology company. From 1985 to 2000, Mr. Hoyt was with Electronic Data Systems, or EDS, in positions of increasing responsibility supporting clients across several industries, including health care claims processing and medical device manufacturing. In his most recent role at EDS, Mr. Hoyt served as Client Delivery Executive.

Mr. Vargo has served as our Vice President – Chief Accounting Officer since May 2003. From May 2000 to August 2002, Mr. Vargo was Vice President of Finance and Administration for International Garden Products,

14

Table of Contents

Inc., or IGP, during which he served as Chief Financial Officer of IGP’s Langeveld business unit from October 2001 to August 2002. From January 1999 to February 2000, Mr. Vargo was Global Controller of EMC, Inc. From 1990 to January 1999, Mr. Vargo served in several senior management positions at Anixter International Inc. including Vice President of Finance of the Structured Cabling Division and North American Controller. Mr. Vargo began his professional accounting career with a predecessor to KPMG LLP.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below in addition to the other information included or incorporated by reference in this annual report before making an investment decision regarding our common stock. If any of the following risks actually occurs, our business, financial condition or operating results would likely suffer, possibly materially, the trading price of our common stock could decline and you could lose part or all of your investment.

Our business is highly dependent on the performance of the affiliated practices, which are predominantly independent third-parties that exercise sole decision-making authority with respect to all clinical matters.

We derive our net revenue primarily from revenue generated by the affiliated practices. The affiliated practices, with the exception of Arizona Tooth Doctor, are independent third parties. We cannot be certain that the affiliated practices will operate their businesses successfully or realize their full revenue potential. The affiliated practices have sole decision-making authority with respect to all clinical matters. Because clinical decisions are made without revenue considerations, we cannot be certain what impact those decisions may have on the revenue of the affiliated practices.

The affiliated practices, other then Arizona Tooth Doctor, control all employment decisions regarding dentists, and, with respect to certain affiliated practices, dental hygienists and assistants. The affiliated practices may, among other things, ineffectively recruit or manage their employees resulting in high employee turnover, loss of key personnel, employment disputes, any of which could negatively affect the revenue of the affiliated practices.

The restrictive covenants that we rely upon to protect, in part, the value of our investments in the affiliated practices may be difficult or costly to enforce.

We invest substantial sums to affiliate with practices and to maintain and support their growth. As part of the affiliation process, we acquire certain assets of the affiliated practice. The asset acquisition agreement typically includes time-limited covenants that restrict, among other things, the sellers from providing competing business services or interfering with our relationships with personnel or business partners. Although we believe that these restrictive covenants are reasonable to protect our investments and we attempt to draft such covenants to be legally enforceable, we cannot guarantee that such covenants will be upheld as reasonable and enforced, in whole or in part, by a court of competent jurisdiction if legally challenged. Additionally, we may incur significant costs defending the legality of the covenants. To the extent any of the restrictive covenants are unenforceable or enforcement proves not to be cost-effective, our investments may diminish in value, our competitive position may be compromised and our results of operation may suffer.

Our business model is dependent upon the enforceability and legality of the service agreements between us and the affiliated practices.

Our net revenue derives primarily from revenue generated by the affiliated practices. The service agreements create the affiliations and establish the terms under which we receive payment for the management services that we provide to the affiliated practices. We structure the service agreement in the context of each affiliation to comply with relevant state laws and regulations, including, without limitation, those concerning the practice of dentistry. We cannot, however, be certain that our interpretations of certain laws and regulations are correct. State regulatory authorities have in the past reviewed, and may in the future review, our service agreement for legal and regulatory compliance. To the extent our service agreement with any affiliated practice were deemed

15

Table of Contents

by a regulatory or judicial authority to be in violation of any law or regulation, our relationship with that affiliated practice might terminate, the service agreement might require material amendments with uncertain consequences, or we might be required to restructure our business model at significant cost.

A significant percentage of our net revenue results from a disproportionately small number of affiliated practices.

Revenue generated from our service agreements with Northland Dental Partners, PLLC, the affiliated practice at Metro Dentalcare, and with Wisconsin Dental Group, S.C., the affiliated practice at ForwardDental, represented 22% and 14%, respectively of our consolidated net revenue in 2009. The termination of either of these service agreements would have a material adverse effect on our business, financial condition and results of operations.

The recent economic downturn has negatively affected consumer demand for dental care, which may negatively affect revenue and profitability.

Our net revenue depends primarily on revenue generated by the affiliated practices. Demand for dental care has declined among patients both with and without dental insurance. We estimate approximately 90% of patients at the affiliated practices have dental insurance. In general, dental insurance covers 100% of preventative care, 80% of basic restorative procedures and 50% of more extensive restorative procedures. In addition, dental insurance often caps benefits at an annual maximum of $1,000 to $1,500. As a result, even patients with dental insurance are financially responsible for a considerable portion of their dental expenditures. The recent economic downturn has caused consumer spending patterns to change. The affiliated practices have observed patients either delaying care or, for those patients with dental insurance, opting for dental procedures that are largely covered by insurance. As a result, revenue growth rates of the affiliated practices have decreased and revenue mix has shifted towards lower cost and lower profitability dental procedures. The effect to us has been lower net revenue and lower profit margins. We anticipate that negative macroeconomic conditions will continue to adversely affect our business in 2010, although we are unable to predict the likely duration or severity of those conditions or the magnitude effect on our business or results of operations. We do not, however, believe that the current economic conditions will lessen the dental care needs of patients and do not therefore expect lasting long-term impact on the dental care industry.

Our net revenue may be adversely affected by third-party payor cost containment efforts.

A significant portion of the payments for dental care that is received by the affiliated practices is paid or reimbursed under insurance programs with third-party payors. To contain reimbursement and utilization rates, third-party payors often attempt to, or do in fact, amend or renegotiate their fee reimbursement schedules. Loss of revenue by the affiliated practices caused by third-party payor cost containment efforts or an inability to negotiate satisfactory reimbursement rates could have a material adverse effect on our revenue and results of operations.

Our net revenue at Arizona Tooth Doctor and Texas Tooth Doctor may be adversely affected by changes in state Medicaid programs.

Arizona Tooth Doctor and Texas Tooth Doctor are largely dependent upon reimbursements from authorized third-party payors operating under state Medicaid programs. Certain states, including Arizona, have recently reduced or proposed reducing Medicaid reimbursement rates in response to state budgetary shortfalls. These reductions generally are passed on to contracted practices and negatively affect revenue and operating results.

We and the affiliated practices are subject to extensive and complex laws and regulations. If we or the affiliated practices fail to comply with existing or new laws or regulations, we or they could suffer civil or criminal penalties.

The practice of dentistry is highly regulated. Our operations and those of the affiliated dental groups are subject to a broad range of state and federal laws, regulations and licensing requirements, including laws and regulations

16

Table of Contents

affecting the structure of our relationships with the affiliated practices, governing the qualifications and conduct of clinical personnel, billing and reimbursement, fee splitting, patient referrals, advertising and regarding privacy and security of protected health information. The substance and enforcement of many of these laws and regulations, particularly at the state level, lack consistency from jurisdiction to jurisdiction. In certain jurisdictions, laws and regulations may be ambiguous or vague without clarifying case law or administrative guidance. Although we strive to maintain a legally-compliant business, our operations may not be in compliance with certain laws or regulations, as written or as may be interpreted. Failure to comply with laws and regulations may subject us or the affiliated practices to civil or criminal penalties, licensing or other sanctions, or refunding of reimbursement, that limit our ability to operate our business or their ability to provide dental services. In addition, the affiliated practices that provide services under Medicaid programs could be excluded from participating in those programs.

Changes to laws and regulations pose two additional risks. First, as described above, failure to comply with changes to law and regulations may subject us or the affiliated practices to civil or criminal penalties, or licensing or other sanctions that limit our ability to operate our business or the ability of the practices to provide dental services. Second, changes to laws or regulations might have the effect of rendering invalid or illegal, in whole or in part, certain aspects of the services agreements between us and the affiliated practices.

Sedation is used extensively by Arizona Tooth Doctor and Texas Tooth Doctor, and harm to a patient resulting from its use could have a material adverse effect on our business.

Arizona Tooth Doctor and Texas Tooth Doctor utilize sedation extensively in providing dental services to patients, including children, ranging from conscious sedation to general anesthesia. Although we believe these affiliated practices have appropriate protocols and procedures in place for the safe and efficient use of sedation, a certain level of risk is inherent with those procedures, and there can be no assurance that harm to a patient will not occur. Any such event could have a material adverse effect on those affiliated practices, as well as our overall reputation.

In addition, the ability of these affiliated practices to continue using sedation to the extent currently in use is dependent upon their ability to retain, credential and supervise a sufficient number of qualified professionals and staff to perform these services, whether anesthesiologists or certified registered nurse anesthetists as may be required under applicable protocols or legal requirements, and to obtain sufficient reimbursement for their services. There can be no assurance that either affiliated practice will be able to continue retaining and utilizing the services of these individuals, or that their services can be obtained on a cost-effective basis.

New affiliations could be difficult to integrate, disrupt our business or impair our financial results.

To the extent we affiliate with new practices, we undertake certain risks that include, but are not limited to: difficulty assimilating the operations, assets and personnel that we acquire from the affiliated practice; potential loss of key employees from the affiliated practice; unidentified issues not discovered in due diligence; and the possibility of incurring impairment losses related to goodwill or other intangible assets that we acquire from the affiliated practice.

We may not realize the expected value of our goodwill and intangible assets.

A significant portion of our total assets are represented by goodwill and intangible assets. Our goodwill and intangible assets will likely increase to the extent we consummate additional affiliations or acquisitions in the future. The amortization expense related to definite lived intangible assets will also likely increase in the future as a result of additional intangible assets being recorded in connection with new affiliations. Management performs an impairment test on goodwill and indefinite lived intangible assets at least annually or when facts and circumstances exist that would suggest that the goodwill or indefinite lived intangible asset is impaired. An impairment test on goodwill and definite lived intangible assets is likewise performed when facts and circumstances exist that would suggest that the definite lived intangible asset may be impaired, such as loss of key personnel or contracts or change in legal factors. Impairment assessment inherently involves judgment as to

17

Table of Contents

assumptions about expected future cash flows and the impact of market conditions on those assumptions. If impairment were determined, we would make the appropriate adjustment to the intangible asset to reduce the asset’s carrying value to fair value. In the event of any sale or liquidation of us or a portion of our assets, there can be no assurance that the value of our intangible assets will be realized. Any future determination requiring the write-off of goodwill, indefinite lived intangibles or a significant portion of unamortized intangible assets could negatively affect our balance sheet.

Our dental benefits third party administrator historically earned a significant percentage of its revenue from administering capitated managed care plans. As a result of the continuing decline of capitated managed care plans in the dental profession, our dental benefits third party administrator has been developing additional product offerings, including dental referral plans, to offset the decline of this part of its business. In 2009, our dental benefits third party administrator experienced a reduction of revenue and incurred an operating loss as a result of the continuing decline of administrative services for capitated managed care plans. Based on its business plan and future projections, we determined the fair value of this business reporting unit exceeded the carrying value of $2,266,000 at October 1, 2009. If this business plan is not successfully executed or projected financial results are not achieved, we may need to record an impairment charge related to the carrying value of the goodwill of this reporting unit.

Our operating results may be adversely affected by professional liability claims against the affiliated practices.

The affiliated practices and/or individual dentists in their employ are subject from time to time to professional liability claims, and it is possible that these claims could also be asserted against us. These claims, if successful, could result in substantial damage awards that could exceed the limits of our applicable insurance coverage. We are named as an insured under the professional liability insurance policy covering the affiliated practices. In addition, we require each affiliated practice to indemnify us for actions or omissions related to the provision of dental care by the affiliated practice. Nonetheless, a successful professional liability claim against an affiliated practice might have a material adverse effect on our business, financial condition and results of operations.

Interruptions in our information systems could limit our ability to operate our business.

Our business is dependent on information systems, which could be vulnerable to damage or interruption from computer viruses, human error, natural disasters, telecommunications failures, intentional acts of vandalism and similar events. A significant or prolonged interruption in our computer network, data center or software applications could have a material adverse effect on our business, financial condition and results of operations.

A catastrophic event may significantly limit our ability and that of the affiliated dental groups to conduct business as normal.

We operate a complex, geographically dispersed business. Disruption or failure of networks or systems, or injury or damage to personnel or physical infrastructure, caused by a natural disaster, public health crisis, terrorism, cyber attack, act of war or other catastrophic event may significantly limit our ability and that of the affiliated practices to conduct business as normal, including our ability to communicate and transact with the affiliated practices, as well as with suppliers and vendors, and the ability of the affiliated practices to provide dental care to patients. We may not be adequately insured for all losses and disruptions caused by catastrophic events, and we may not have a sufficiently comprehensive enterprise-wide disaster recovery plan in place.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

We lease most of our facilities from unrelated third parties. As of December 31, 2009, we leased or owned 268 dental facilities, 3 dental labs and 12 administrative offices, including our corporate headquarters. Our corporate

18

Table of Contents

office is located at 401 Edgewater Place, Suite 430, Wakefield, Massachusetts 01880, and comprises approximately 17,000 square feet of office space. Our lease for our corporate office expires in 2014. We consider our properties in good condition, well maintained and generally suitable and adequate to carry on our business activities. For the year ended December 31, 2009, facility utilization varied from affiliated dental group to affiliated dental group, but overall was at a satisfactory level. The majority of our dental facilities have sufficient capacity to allow for future growth.

Shareholder Litigation

On or about January 25, 2008, February 4, 2008, February 12, 2008 and March 13, 2008, we and certain of our executive officers were named as defendants in four actions respectively entitled “Oliphant v. American Dental Partners, Inc. et. al.,” civil action number 1:08-CV-10119-RGS; “Downey v. American Dental Partners, Inc. et. al.,” civil action number 1:08-CV-10169-RGS; “Johnston v. American Dental Partners, Inc. et. al.,” civil action number 1:08-CA-10230-RGS; and “Monihan v. American Dental Partners, Inc., et. al.,” civil action number 1:08-CV-10410-RGS, all filed in the United States District Court for the District of Massachusetts. The actions each purport to be brought on behalf of a class of purchasers of our common stock during the period August 10, 2005 through December 13, 2007. The complaints allege that we and certain of our executive officers violated the federal securities laws, in particular, Section 10(b) of the Securities Exchange Act, 15 U.S.C. §§ 78, and Rule 10b-5 promulgated thereunder, 17 C.F.R. § 240.10b-5, by making allegedly material misrepresentations and failing to disclose allegedly material facts concerning the lawsuit by Park Dental Group, or PDG, against PDHC, Ltd., titled PDG, P.A. v. PDHC, Ltd., Civ. A. Nos. 27-CV-06-2500 and 27-CV-07-13030, filed in the Fourth Judicial District of Hennepin County, Minnesota on February 3, 2006 and conduct at issue in that action during the class period, which had the effect of artificially inflating the market price of our stock. Each complaint also asserts control person claims under Section 20(a) of the Securities Exchange Act against the executive officers named as defendants. Each plaintiff seeks class certification, an unspecified amount of money damages, costs and attorneys’ fees, and any equitable, injunctive or other relief the Court deems proper.

On or about May 29, 2008, the Court appointed the Operating Engineers Pension Fund as lead plaintiff and its counsel, the law firm of Grant & Eisenhofer P.A., as lead counsel. The Court also ordered that the four pending actions be consolidated under the caption “In re American Dental Partners, Inc. Securities Litigation,” civil action number 1:08-CV-10119-RGS. On or about June 5, 2008, one of the original named plaintiffs, W.K. Downey, agreed to enter an order that dismissed his individual claims with prejudice. On September 29, 2008, the Operating Engineers Pension Fund filed with the Court a consolidated amended complaint that alleges a new class period of February 25, 2004 through December 13, 2007 and asserts violations of the federal securities laws as described above. On December 5, 2008, we and the other defendants filed a motion to dismiss the action. The Court denied the motion on April 2, 2009.