Attached files

| file | filename |

|---|---|

| EX-5.1 - OPINION OF LOYENS & LOEFF N.V. - Sensata Technologies Holding plc | dex51.htm |

| EX-23.2 - CONSENT OF ERNST & YOUNG LLP - Sensata Technologies Holding plc | dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 10, 2010

Registration No. 333-163335

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 7

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SENSATA TECHNOLOGIES HOLDING N.V.

(Exact name of registrant as specified in its charter)

| The Netherlands | 3823 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Number) |

(I.R.S. Employer Identification Number) |

Kolthofsingel 8, 7602 EM Almelo

The Netherlands

Telephone: 31-546-879-555

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation

111 Eighth Avenue

New York, New York 10011

Telephone: (212) 894-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Dennis M. Myers, P.C. | Steven P. Reynolds | Mark G. Borden | ||

| Jeffrey W. Richards, P.C. | General Counsel | Peter N. Handrinos | ||

| Kirkland & Ellis LLP | Sensata Technologies, Inc. | Wilmer Cutler Pickering Hale and Dorr LLP | ||

| 300 North LaSalle | 529 Pleasant Street | 60 State Street | ||

| Chicago, Illinois 60654 | Attleboro, Massachusetts 02703 | Boston, Massachusetts 02109 | ||

| Telephone: (312) 862-2000 | Telephone: (508) 236-3800 | Telephone: (617) 526-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed to register additional securities for an offering pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer x |

Smaller reporting company ¨ | |

| (Do not check if a smaller reporting company) |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information contained in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and neither we nor the selling shareholders are soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to completion)

Issued March 10, 2010

31,600,000 Ordinary Shares

Sensata Technologies Holding N.V., a public limited liability company incorporated under the laws of the Netherlands, is offering 26,315,789 ordinary shares. This is our initial public offering. Prior to this offering, there has been no public market for our ordinary shares. The selling shareholders identified in this prospectus are offering an additional 5,284,211 ordinary shares. We will not receive any proceeds from the sale of these ordinary shares by the selling shareholders. We anticipate that the initial offering price per share will be between $18.00 and $20.00 per share.

Our ordinary shares have been approved for listing on the New York Stock Exchange under the symbol “ST.”

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 12 of this prospectus.

Price $ Per Share

| Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Company |

Proceeds to Selling Shareholders | |||||

| Per Share |

$ | $ | $ | $ | ||||

| Total |

$ | $ | $ | $ |

To the extent that the underwriters sell more than 31,600,000 ordinary shares, the underwriters have a 30-day option to purchase up to an additional 4,740,000 ordinary shares from the selling shareholders identified in this prospectus on the same terms set forth above. See the section of this prospectus entitled “Underwriting.”

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities nor passed upon the accuracy or adequacy of the disclosures in the prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares against payment on or about , 2010.

| Morgan Stanley | Barclays Capital | Goldman, Sachs & Co. |

| BofA Merrill Lynch | J.P. Morgan | |

| Citi |

Credit Suisse | |

| BMO Capital Markets | Oppenheimer & Co. | RBC Capital Markets | ||

, 2010.

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by or on behalf of us or any information to which we have referred you. Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, or any other date stated in this prospectus, regardless of the time of delivery of this prospectus or of any sale of our ordinary shares.

Until (25 days after the commencement of this offering), all dealers that buy, sell or trade our ordinary shares, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Sensata®, Klixon®, Airpax®, and Dimensions™ and other trademarks or service marks of Sensata appearing in this prospectus are the property of Sensata Technologies Holding N.V. and/or its affiliates. This prospectus also contains additional trade names, trademarks and service marks belonging to us and to other companies. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Table of Contents

The following summary is qualified in its entirety by the more detailed information, including the section entitled “Risk Factors” and the consolidated financial statements and related notes, included elsewhere in this prospectus. Because this is a summary, it may not contain all of the information that may be important to you. You should read the entire prospectus and the other documents to which we have referred you before deciding whether to invest in this offering. You should carefully consider, among other things, the matters discussed in “Risk Factors.”

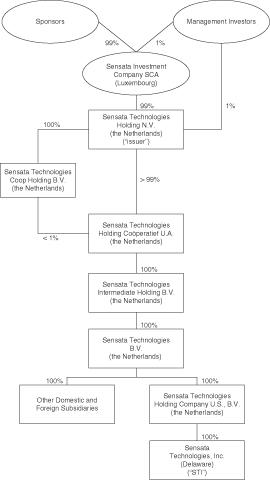

Unless the context specifically indicates otherwise, references in this prospectus to: (i) “we,” “us,” “our,” the “Company” and “Sensata” refer collectively to Sensata Technologies Holding N.V. and its consolidated subsidiaries and their respective predecessors; (ii) “issuer” refers to Sensata Technologies Holding N.V., exclusive of its subsidiaries and after giving effect to its conversion to a public limited liability company; (iii) the “2006 Acquisition” refers to the acquisition of the sensors and controls business, or “S&C business,” of Texas Instruments Incorporated, or “Texas Instruments,” on April 27, 2006 by an investor group led by investment funds advised or managed by the principals of Bain Capital Partners, LLC, or “Bain Capital;” (iv) “Sponsors” refers collectively to Bain Capital and its co-investors; and (v) “Predecessor” for accounting purposes refers to the S&C business with respect to its results of operations for periods prior to the 2006 Acquisition.

SENSATA TECHNOLOGIES HOLDING N.V.

Our Company

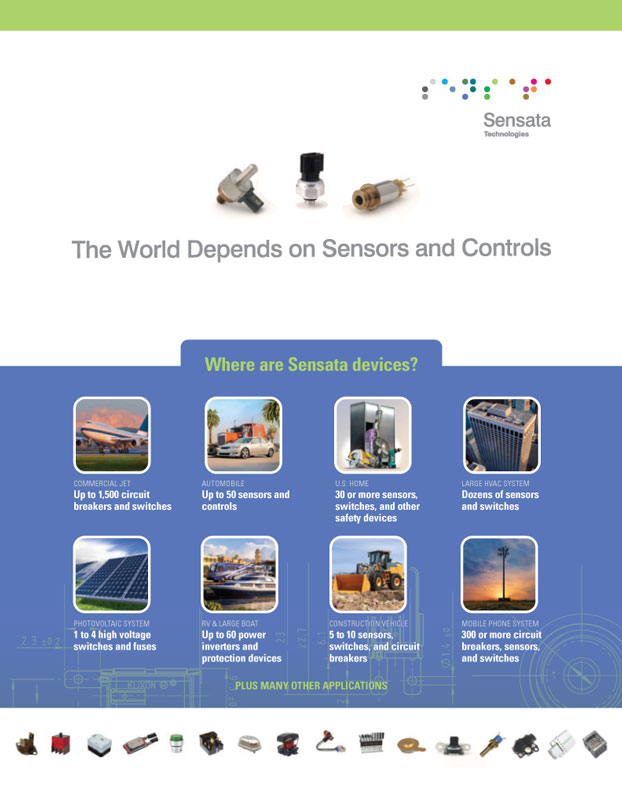

Sensata, a global industrial technology company, is a leader in the development, manufacture and sale of sensors and controls. We produce a wide range of customized, innovative sensors and controls for mission-critical applications such as thermal circuit breakers in aircraft, pressure sensors in automotive systems, and bimetal current and temperature control devices in electric motors. We believe that we are one of the largest suppliers of sensors and controls in the majority of the key applications in which we compete and that we have developed our strong market position due to our long-standing customer relationships, technical expertise, product performance and quality and competitive cost structure. We compete in growing global market segments driven by demand for products that are safe, energy-efficient and environmentally friendly. In addition, our long-standing position in emerging markets, including our 14-year presence in China, further enhances our growth prospects. We deliver a strong value proposition to our customers by leveraging an innovative portfolio of core technologies and manufacturing at high volumes in low-cost locations such as China, Mexico, Malaysia and the Dominican Republic.

Our sensors are customized devices that translate a physical phenomenon such as force or position into electronic signals that microprocessors or computer-based control systems can act upon. Our controls are customized devices embedded within systems to protect them from excessive heat or current. Underlying these sensors and controls are core technology platforms—thermal and magnetic-hydraulic circuit protection, micro electromechanical systems, ceramic capacitance or capacitive, and monosilicon strain gage—that we leverage across multiple products and applications, enabling us to optimize our research, development, and engineering investments and achieve economies of scale.

Our primary products include pressure sensors, force sensors, position sensors, motor protectors, and thermal and magnetic-hydraulic circuit breakers and switches. We develop customized and innovative solutions for specific customer requirements, or applications, across the appliance, automotive, heating, ventilation and air-conditioning, or “HVAC,” industrial, aerospace, defense, data / telecom, and other end-markets. We have long-standing relationships with a geographically diverse base of leading global original equipment manufacturers, or “OEMs,” and other multi-national companies. Our largest end-customers for each of our segments within each of our principal operating regions of the Americas, Asia Pacific and Europe include, in alphabetical order: A.O. Smith, Arcelic, Askol, Continental, Danfoss, Emerson, Ford, GM, Honda, Huawei, LG Group, Peugeot, Renault-Nissan, Samsung Electronics, Volkswagen and Whirlpool.

1

Table of Contents

We develop products that address increasingly complex engineering requirements by investing substantially in research, development and application engineering. By locating our global engineering team in close proximity to key customers in regional business centers, we are exposed to many development opportunities at an early stage and work closely with our customers to deliver the required solutions. Systems development by our customers typically requires significant multi-year investment for certification and qualification, which are often government or customer mandated. We believe the capital commitment and time required for this process significantly increases the switching costs once a customer has designed and installed a particular sensor or control into a system.

We are a global business with a diverse revenue mix by geography, customer and end-market and have significant operations around the world. Our subsidiaries located in the Americas, Europe and the Asia Pacific region generated 45%, 27% and 28%, respectively, of our net revenue for fiscal year 2009. Our largest customer accounted for approximately 7% of our net revenue for fiscal year 2009. Our net revenue for fiscal year 2009 was derived from the following end-markets: 22% from European automotive, 15% from appliances and HVAC, 16% from North American automotive, 14% from industrial, 14% from Asia and rest of world automotive, 5% from heavy vehicle off-road, and 14% from all other end-markets. Within many of our end-markets, we are a significant supplier to multiple OEMs, reducing our exposure to fluctuations in market share within individual end-markets.

We have a history of innovation dating back to our origins. We operated as a part of Texas Instruments from 1959 until we were acquired as a result of the 2006 Acquisition. We then expanded our operations in part through the acquisition of Airpax Holdings, Inc., or “Airpax,” in July 2007 and First Technology Automotive and Special Products, or “First Technology Automotive,” in December 2006.

Our Competitive Strengths

We believe we have a number of competitive strengths that differentiate us from our competitors. These include:

Leading positions in high-growth segments. We believe that we are one of the largest suppliers of sensors and controls in the majority of the key applications in which we compete. We attribute our strong market positions to our long-standing customer relationships, technical expertise, breadth of product portfolio, product performance and quality, and competitive cost structure.

Innovative, highly engineered products for mission-critical applications. Most of our products are highly engineered, critical components in complex systems that are essential to the proper functioning of the product in which they are integrated. Our products are differentiated by their performance, reliability and level of customization, which are critical factors in customer selection.

Long-standing local presence in key emerging markets. We believe that our long-standing local presence in key emerging markets such as China, India and Brazil provides us with significant growth opportunities. Our sales into these markets represented approximately 18% of our net revenue for fiscal year 2009.

Collaborative, long-term relationships with diversified customer base. We have worked with our top 25 customers for an average of 22 years. As a result of the long development lead times and embedded nature of our products, we collaborate closely with our customers throughout the design and development phase of their products.

High switching costs. The technology-driven, highly customized and integrated nature of our products requires customers to invest heavily in certification and qualification over a one- to three-year period to ensure

2

Table of Contents

proper functioning of the system in which our products are embedded. We believe the capital commitment and time required for this process significantly increases the switching costs for customers once a particular sensor or control has been designed and installed in a system. In addition, our products are often relatively low-cost components integrated into mission-critical applications for high-value systems.

Attractive cost structure with scale advantage and low-cost footprint. We believe that our global scale and cost-focused approach have provided us with an attractive cost position within our industry. We currently manufacture approximately 800 million devices per year, with 85% of our production in low-cost countries including China, Mexico, Malaysia and the Dominican Republic.

Operating model with high cash generation and significant revenue visibility. We believe our strong customer value proposition and cost structure enable us to generate attractive operating margins and return on capital. We believe that our current manufacturing base offers significant capacity to support higher revenue levels. In addition, we believe that our business provides us with significant visibility into new business opportunities based on product development cycles that are typically more than one year, our ability to win design awards in advance of OEM system roll-outs and commercialization and our lengthy product life cycles. Additionally, customer order cycles typically provide us with visibility into more than a majority of our expected quarterly revenues at the start of each quarter.

Experienced management team. Our senior management team has significant collective experience both within our business and in working together managing our business. Our CEO, COO and other members of our senior management team have been employed by our company and its predecessor, the S&C business of Texas Instruments, for the majority of their careers.

Our Growth Strategy

We intend to enhance our position as a leading provider of customized, innovative sensors and controls on a global basis. The key elements of our growth strategy include:

Continue product innovation and expansion. We believe our solutions help satisfy the world’s need for safety, energy efficiency and a clean environment, as well as address the demand associated with the proliferation of electronic applications in everyday life. We expect to continue to address our customers’ increased demand for sensor and control solutions with our technology and engineering expertise. We leverage our various core technology platforms across many different products and applications to maximize the impact of our research, development and engineering investments and increase economies of scale.

Expand our presence in significant emerging markets. We believe emerging markets such as China, India, and Brazil represent substantial, rapidly growing opportunities. A growing middle class and rapid industrialization are creating significant demand for electric motors, consumer conveniences (such as appliances), automobiles, and communication infrastructure.

Broaden customer relationships. We believe our global presence and investments in application engineering and support will continue to create competitive advantages in serving multinational and local companies.

Extend low-cost advantage. By focusing on our design-driven cost initiatives and realizing economies of scale in materials and manufacturing, we will continue to strive to significantly reduce costs for our key products. We will also continue to locate our people and processes in the most strategic, cost-effective regions.

3

Table of Contents

Recruit, retain, and develop talent globally. We intend to continue to recruit, develop and retain a highly educated, technically sophisticated and globally dispersed workforce.

Pursue strategic acquisitions to extend leadership and leverage global platform. We intend to continue to opportunistically pursue selective acquisitions and joint ventures to extend our leadership across global end- markets and applications, realize operational value from our global low-cost footprint, and deliver the right technology solutions for emerging markets. We intend to continue to seek acquisitions that will present attractive risk-adjusted returns and significant value-creation opportunities.

Risks Associated with Our Company

Investing in our company entails a high degree of risk, as more fully described in the “Risk Factors” section of this prospectus. You should consider carefully such risks before deciding to invest in our ordinary shares. These risks include, among others:

Our operating results and financial condition have been and may continue to be adversely affected by the current financial crisis and worldwide economic conditions.

Existing worldwide economic conditions make it difficult for our customers, our vendors and us to accurately forecast and plan future business activities. We cannot predict the timing or duration of the economic crisis or the timing or strength of a subsequent economic recovery. If the economy or markets in which we operate experience continued weakness at current levels or deteriorate further, our business, financial condition and results of operations would be materially and adversely affected.

Continued fundamental changes in the industries in which we operate have had and could continue to have adverse effects on our businesses.

Our products are sold to automobile manufacturers and manufacturers of commercial and residential HVAC systems, as well as to manufacturers in the refrigeration, lighting, aerospace, telecommunications, power supply and generation and industrial markets, among others. These are global industries, and they are experiencing various degrees of growth and consolidation. This, in turn, affects overall demand and prices for our products sold to these industries.

We may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against us.

We have been and may continue to be exposed to product liability and warranty claims in the event that our products actually or allegedly fail to perform as expected or the use of our products results in, or is alleged to result in, bodily injury and/or property damage. Accordingly, we could experience material warranty or product liability losses in the future and incur significant costs to defend these claims.

Our substantial indebtedness could adversely affect our financial condition and our ability to operate our business, and we may not be able to generate sufficient cash flows to meet our debt service obligations.

Our substantial indebtedness could have important consequences to you. For example, it could make it more difficult for us to satisfy our debt obligations; limit our flexibility in planning for, or reacting to, changes in our business and future business opportunities, thereby placing us at a competitive disadvantage if our competitors are not as highly leveraged; or increase our vulnerability to general adverse economic and industry conditions.

4

Table of Contents

We have reported significant net losses for periods following the 2006 Acquisition and may not achieve profitability in the foreseeable future.

We incurred a significant amount of indebtedness in connection with the 2006 Acquisition and the subsequent acquisitions of First Technology Automotive and Airpax and, as a result, our interest expense has been substantial for periods following the 2006 Acquisition. Due, in part, to this significant interest expense and the amortization of intangible assets also related to these acquisitions, we have reported significant net losses for each period following the 2006 Acquisition. We will continue to have a significant amount of indebtedness following this offering and, as a result, expect to continue to report net losses for the foreseeable future.

ADDITIONAL INFORMATION

The address of the issuer’s registered office and principal executive office is Kolthofsingel 8, 7602 EM Almelo, the Netherlands, and its telephone number is 31-546-879-555. The issuer’s principal U.S. operating subsidiary is Sensata Technologies, Inc., a Delaware corporation, or “STI.” The address for STI is 529 Pleasant Street, Attleboro, Massachusetts 02703, and its telephone number is (508) 236-3800. Our website address is www.sensata.com. The information on, or accessible through, our website is not part of this prospectus.

5

Table of Contents

THE OFFERING

| Ordinary shares offered by us |

26,315,789 shares. |

| Ordinary shares offered by the selling shareholders |

5,284,211 shares. |

| Ordinary shares to be outstanding immediately after this offering |

171,159,377 shares. |

| Option to purchase additional ordinary shares |

The underwriters have an option to purchase a maximum of 4,740,000 additional ordinary shares from the selling shareholders identified in this prospectus. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We intend to use the net proceeds received by us in connection with this offering for the following purposes and in the following amounts: |

| • | approximately $350.0 million will be used to repay a portion of our indebtedness, including any redemption premiums or discounts, and accrued interest on such indebtedness; |

| • | approximately $2.0 million will be used to pay fees and expenses to complete the tender offer related to such debt repayments; |

| • | approximately $22.1 million will be used to pay management fees associated with an advisory agreement we have with the Sponsors; and |

| • | approximately $84.1 million will be used for general corporate purposes. |

The fees and expenses of this offering will include a 1.0% financing fee on the gross proceeds we receive in this offering payable to the Sponsors pursuant to the terms of our advisory agreement with them. This fee would be approximately $5.0 million based on an assumed initial public offering price of $19.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, and will result in the Sponsors receiving an aggregate of $27.1 million under the advisory agreement in connection with this offering. See “Certain Relationships and Related Party Transactions—Advisory Agreement.”

We will not receive any proceeds from the sale of ordinary shares by the selling shareholders.

| Risk factors |

Investing in our ordinary shares involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of factors you should carefully consider before investing in our ordinary shares. |

| New York Stock Exchange symbol |

“ST” |

6

Table of Contents

The number of ordinary shares that will be outstanding immediately after this offering is based on:

| • | 144,108,686 ordinary shares outstanding as of December 31, 2009, which includes 52,118 ordinary shares that are subject to forfeiture until such shares have vested and are not considered outstanding for accounting purposes; |

| • | 380,900 ordinary shares, not included in the ordinary shares outstanding as of December 31, 2009, which are subject to forfeiture until such shares have vested and are not considered outstanding for accounting purposes; |

| • | 26,315,789 ordinary shares offered by us in connection with this offering; and |

| • | 354,002 ordinary shares to be issued upon the exercise of outstanding stock options by the selling shareholders in connection with this offering at a weighted-average exercise price of $7.10 per share; |

and excludes

| • | 12,571,146 ordinary shares issuable upon the exercise of outstanding stock options at a weighted-average exercise price of $8.06 per share; and |

| • | 5,657,088 ordinary shares reserved for future issuance under our equity incentive plans and employee stock purchase plan following this offering. |

Except as otherwise indicated herein, all information in this prospectus, including the number of ordinary shares that will be outstanding after this offering, assumes:

| • | no exercise of the underwriters’ option; |

| • | the filing of amended articles of association, which will occur prior to the effective date of the registration statement of which this prospectus is a part; and |

| • | reflects our recent conversion to a public limited liability company under the laws of the Netherlands. |

7

Table of Contents

SUMMARY HISTORICAL FINANCIAL DATA

Set forth below is summary historical consolidated financial data of Sensata for the years ended December 31, 2007, 2008 and 2009, which has been derived from our audited historical financial statements which are included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future. This information is only a summary and should be read in conjunction with our historical financial statements and the related notes thereto and other financial information appearing elsewhere in this prospectus, including “Use of Proceeds,” “Capitalization,” “Selected Consolidated and Combined Historical Financial Data,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| For the year ended December 31, | ||||||||||||

| (Amounts in thousands, except per share amounts) | 2007 | 2008 | 2009 | |||||||||

| Statement of Operations Data: |

||||||||||||

| Net revenue |

$ | 1,403,254 | $ | 1,422,655 | $ | 1,134,944 | ||||||

| Operating costs and expenses: |

||||||||||||

| Cost of revenue |

944,765 | 951,763 | 742,080 | |||||||||

| Research and development |

33,891 | 38,256 | 16,796 | |||||||||

| Selling, general and administrative |

166,065 | 166,625 | 126,952 | |||||||||

| Amortization of intangible assets and capitalized software |

131,064 | 148,762 | 153,081 | |||||||||

| Impairment of goodwill and intangible assets |

— | 13,173 | 19,867 | |||||||||

| Restructuring |

5,166 | 24,124 | 18,086 | |||||||||

| Total operating costs and expenses |

1,280,951 | 1,342,703 | 1,076,862 | |||||||||

| Profit from operations |

122,303 | 79,952 | 58,082 | |||||||||

| Interest expense |

(191,161 | ) | (197,840 | ) | (150,589 | ) | ||||||

| Interest income |

2,574 | 1,503 | 573 | |||||||||

| Currency translation (loss)/gain and other, net(1) |

(105,449 | ) | 55,467 | 107,695 | ||||||||

| (Loss)/income from continuing operations before taxes |

(171,733 | ) | (60,918 | ) | 15,761 | |||||||

| Provision for income taxes |

62,504 | 53,531 | 43,047 | |||||||||

| Loss from continuing operations |

(234,237 | ) | (114,449 | ) | (27,286 | ) | ||||||

| Loss from discontinued operations |

(18,260 | ) | (20,082 | ) | (395 | ) | ||||||

| Net loss(2) |

$ | (252,497 | ) | $ | (134,531 | ) | $ | (27,681 | ) | |||

| Net loss per share(3): |

||||||||||||

| Loss from continuing operations per share—basic and diluted |

$ | (1.62 | ) | $ | (0.79 | ) | $ | (0.19 | ) | |||

| Loss from discontinued operations per share—basic and diluted |

(0.13 | ) | (0.14 | ) | — | |||||||

| Net loss per share—basic and diluted |

$ | (1.75 | ) | $ | (0.93 | ) | $ | (0.19 | ) | |||

| Weighted-average ordinary shares outstanding |

144,054 | 144,066 | 144,057 | |||||||||

| Other Financial Data: |

||||||||||||

| Net cash provided by/(used in): |

||||||||||||

| Operating activities |

$ | 155,278 | $ | 47,481 | $ | 187,577 | ||||||

| Investing activities |

(355,710 | ) | (38,713 | ) | (15,077 | ) | ||||||

| Financing activities |

175,736 | 8,891 | (101,748 | ) | ||||||||

| Capital expenditures |

66,701 | 40,963 | 14,959 | |||||||||

| EBITDA(4) (unaudited) |

187,862 | 315,460 | 366,890 | |||||||||

8

Table of Contents

| As of December 31, 2009 | ||||||||||||||||

| (Amounts in thousands) | Actual | As Adjusted(5) | ||||||||||||||

| Balance Sheet Data: |

||||||||||||||||

| Cash and cash equivalents |

$ | 148,468 | $ | 232,610 | ||||||||||||

| Working capital(6) |

245,445 | 337,938 | ||||||||||||||

| Total assets |

3,166,870 | 3,242,471 | ||||||||||||||

| Total debt, including capital lease and other financing obligations |

2,300,826 | 1,943,429 | ||||||||||||||

| Total shareholders’ equity |

387,158 | 828,507 | ||||||||||||||

| (1) | Currency translation gain/(loss) and other, net for the years ended December 31, 2008 and 2009 includes gains of $15.0 million and $120.1 million, respectively, recognized on repurchases of 8% Senior Notes, or “Senior Notes,” and 9% Senior Subordinated Notes and 11.25% Senior Subordinated Notes, together the “Senior Subordinated Notes,” as well as currency translation gain/(loss) associated with the Euro-denominated debt of $53.2 million and $(13.6) million, respectively. Currency translation gain/(loss) and other, net for the year ended December 31, 2007 primarily includes currency translation loss associated with the Euro-denominated debt of $(111.9) million. |

| (2) | Included within net loss for the years presented were the following expenses: |

| (unaudited) | |||||||||

| For the year ended December 31, | |||||||||

| (Amounts in thousands) | 2007 | 2008 | 2009 | ||||||

| Amortization and depreciation expense related to the step-up in fair value of fixed and intangible assets(a) |

$ | 154,296 | $ | 160,594 | $ | 157,797 | |||

| Deferred income tax expense and other tax expense |

46,126 | 29,980 | 26,592 | ||||||

| Amortization expense of deferred financing costs |

9,640 | 10,698 | 9,055 | ||||||

| Interest expense related to uncertain tax positions |

1,747 | 43 | 823 | ||||||

| (a) | Amortization and depreciation expense related to the step-up in fair value of fixed and intangible assets relates to the acquisition of the S&C business of Texas Instruments, First Technology Automotive and Airpax and the step-up in the fair value of these assets through purchase accounting. |

| (3) | Net loss per share is computed based on the weighted-average number of ordinary shares outstanding. |

| (4) | We present EBITDA in this prospectus to provide investors with a supplemental measure of our operating performance. EBITDA is a non-GAAP financial measure. We define EBITDA as net income/(loss) before interest, taxes, depreciation and amortization. We believe EBITDA assists our board of directors, management and investors in comparing our operating performance on a consistent basis because it removes the impact of our capital structure (such as interest expense), asset base (such as depreciation and amortization) and tax structure. The use of EBITDA has limitations and you should not consider this performance measure in isolation from or as an alternative to U.S. GAAP measures such as net income/(loss). |

The following table summarizes the calculation of EBITDA and provides a reconciliation from net loss, the most directly comparable financial measure presented in accordance with U.S. GAAP, for the years presented:

| (unaudited) | ||||||||||||

| For the year ended December 31, | ||||||||||||

| (Amounts in thousands) | 2007 | 2008 | 2009 | |||||||||

| Net loss |

$ | (252,497 | ) | $ | (134,531 | ) | $ | (27,681 | ) | |||

| Provision for income taxes |

62,504 | 53,531 | 43,047 | |||||||||

| Interest expense, net |

188,587 | 196,337 | 150,016 | |||||||||

| Depreciation and amortization |

189,268 | 200,123 | 201,508 | |||||||||

| EBITDA |

$ | 187,862 | $ | 315,460 | $ | 366,890 | ||||||

Following the 2006 Acquisition, our senior management, together with our Sponsors, developed a series of strategic initiatives to better position us for future revenue growth and an improved cost structure. This plan has been modified from time to time to reflect changes in overall market conditions and the competitive environment facing our business. These initiatives have included, among other items, acquisitions, divestitures, restructurings of certain operations and various financing transactions. In connection with these activities, we incurred certain costs and expenses included in EBITDA that we have further described below and believe are important to consider in evaluating our operating performance over this period.

9

Table of Contents

The following table summarizes certain expenses, losses and gains included in EBITDA for the years presented:

| (unaudited) | ||||||||||||

| For the year ended December 31, | ||||||||||||

| (Amounts in thousands) | 2007 | 2008 | 2009 | |||||||||

| Supplemental Information: |

||||||||||||

| Acquisition, integration and financing costs and |

||||||||||||

| Transition costs(a) |

$ | 16,768 | $ | 4,052 | $ | 23 | ||||||

| Litigation costs(b) |

4,006 | 840 | 147 | |||||||||

| Integration and finance costs(c) |

13,649 | 20,931 | 2,813 | |||||||||

| Relocation and disposition costs(d) |

114 | 12,828 | 8,202 | |||||||||

| Pension charges(e) |

— | 3,588 | 4,828 | |||||||||

| Inventory step-up(f) |

4,454 | — | — | |||||||||

| IPR&D write-off(g) |

5,700 | — | — | |||||||||

| Other(h) |

3,123 | 27,106 | 6,972 | |||||||||

| Subtotal |

47,814 | 69,345 | 22,985 | |||||||||

| Impairment of goodwill and intangible assets(i) |

— | 13,173 | 19,867 | |||||||||

| Severance and other termination costs associated with downsizing(j) |

5,166 | 12,282 | 12,276 | |||||||||

| Gain on extinguishment of debt(k) |

— | (14,961 | ) | (120,123 | ) | |||||||

| Currency translation loss/(gain) on debt(l) |

111,946 | (53,209 | ) | 15,301 | ||||||||

| Stock compensation(m) |

2,015 | 2,108 | 2,233 | |||||||||

| Management fees(n) |

4,000 | 4,000 | 4,000 | |||||||||

| Other(o) |

(25 | ) | 123 | 973 | ||||||||

| Total |

$ | 170,916 | $ | 32,861 | $ | (42,488 | ) | |||||

| (a) | Represents transition costs incurred by us in becoming a stand-alone company, one of our subsidiaries becoming an SEC reporting company and complying with Section 404 of the Sarbanes-Oxley Act of 2002. |

| (b) | Represents litigation costs we recognized related to customers alleging defects in certain of our products, which were manufactured and sold prior to April 27, 2006 (inception). |

| (c) | Represents integration and financing costs related to the acquisitions of Airpax, First Technology Automotive and SMaL Camera Technologies, Inc., or “SMaL Camera,” and other consulting and advisory fees associated with acquisitions and financings, whether or not consummated. |

| (d) | Represents costs we incurred to move certain operations to lower-cost Sensata locations, to close certain manufacturing operations and dispose of the SMaL Camera business. |

| (e) | Represents pension curtailment and settlement losses, and amortization of prior service costs associated with various restructuring activities. |

| (f) | Represents the impact on our cost of revenue from the increase in the carrying value of the inventory that was adjusted to fair value as a result of the application of purchase accounting to the acquisitions of the S&C business of Texas Instruments, Airpax and First Technology Automotive. |

| (g) | Represents the charge we recorded for acquired in-process research and development associated with our acquisition of SMaL Camera in March 2007. |

| (h) | Represents other (gains)/losses, including impairment losses associated with certain assets held for sale, losses related to the early termination of commodity forward contracts of $7.2 million during fiscal year 2008, a loss of $13.4 million during fiscal year 2008 associated with a settlement with a significant automotive customer that alleged defects in certain of our products installed in its automobiles, and a reserve associated with the Whirlpool recall litigation. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Legal Proceedings.” |

| (i) | Represents the impairment of goodwill and intangible assets associated with a reporting unit within our controls business segment and relates to products used in the semiconductor business. |

| (j) | Represents severance, outplacement costs and special termination benefits associated with the downsizing of various manufacturing facilities and our corporate office. |

| (k) | Relates to the repurchases of outstanding notes. |

| (l) | Reflects the losses/(gains) associated with the translation of our Euro-denominated debt into U.S. dollars and losses/(gains) on related hedging transactions. |

| (m) | Represents share-based compensation expense recorded in accordance with ASC Topic 718, Compensation—Stock Compensation. |

10

Table of Contents

| (n) | Represents fees expensed under the terms of the advisory agreement with our Sponsors. This agreement will be terminated in connection with the completion of this offering. See “Use of Proceeds” and “Certain Relationships and Related Party Transactions—Advisory Agreement.” |

| (o) | Represents unrealized (gains)/losses on commodity forward contracts and estimated potential penalty expenses associated with uncertain tax positions. |

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information regarding certain of these items.

| (5) | Gives effect to the receipt of the estimated net proceeds from this offering based on an assumed initial public offering price of $19.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and the application of such net proceeds as described under “Use of Proceeds.” A $1.00 increase or decrease in the assumed initial public offering price of $19.00 per share, the midpoint of the range set forth on the cover page of this prospectus, would increase or decrease cash and cash equivalents, working capital, total assets and shareholders’ equity by approximately $24.7 million, assuming that the number of ordinary shares offered by us, as set forth on the cover page of this prospectus, remains the same. |

| (6) | We define working capital as current assets less current liabilities. |

11

Table of Contents

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the risks described below, as well as other information included in this prospectus, before making an investment decision. The risks described below are not the only ones facing us. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition or results of operations. In such case, the trading price of our ordinary shares could decline, and you may lose all or part of your original investment. Before deciding whether to invest in our ordinary shares, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and related notes.

Risk Factors Related To Our Business

Our operating results and financial condition have been and may continue to be adversely affected by the current financial crisis and worldwide economic conditions.

The current financial crisis affecting the banking system and financial markets and the uncertainty in global economic conditions have resulted in a significant tightening of the credit markets, a low level of liquidity in financial markets, decreased consumer confidence, and reduced corporate profits and capital spending. These conditions make it difficult for our customers, our vendors and us to accurately forecast and plan future business activities, and have caused, and may continue to cause, our customers to reduce spending on our products. We cannot predict the timing or duration of the global economic crisis or the timing or strength of a subsequent economic recovery. If the economy or markets in which we operate experience continued weakness at current levels or deteriorate further, our business, financial condition and results of operations would be materially and adversely affected.

Continued fundamental changes in the industries in which we operate have had and could continue to have adverse effects on our businesses.

Our products are sold to automobile manufacturers and manufacturers of commercial and residential HVAC systems, as well as to manufacturers in the refrigeration, lighting, aerospace, telecommunications, power supply and generation and industrial markets, among others. These are global industries, and they are experiencing various degrees of growth and consolidation. Customers in these industries are located in every major geographic market. As a result, our customers are affected by changes in global and regional economic conditions, as well as by labor relations issues, regulatory requirements, trade agreements and other factors. This, in turn, affects overall demand and prices for our products sold to these industries. For example, the significant economic decline beginning in the fourth quarter of 2008 has resulted in a reduction in automotive production and in the sales of many of the other products manufactured by our customers that use our products, and has had an adverse effect on our results of operations. This negative outlook may continue during 2010. This may be more detrimental to us in comparison to our competitors due to our significant levels of debt. In addition, many of our products are platform-specific—for example, sensors are designed for certain of our HVAC manufacturer customers according to specifications to fit a particular model. Our success may, to a certain degree, be connected with the success or failure of one or more of the industries to which we sell products, either in general or with respect to one or more of the platforms or systems for which our products are designed.

Continued pricing and other pressures from our customers may adversely affect our business.

Many of our customers, including automotive manufacturers and other industrial and commercial OEMs, have policies of seeking price reductions each year. Recently, many of the industries in which our products are sold have suffered from unfavorable pricing pressures in North America and Europe, which in turn has led manufacturers to seek price reductions from their suppliers. Our significant reliance on these industries subjects us to these and other similar pressures. If we are not able to offset continued price reductions through improved

12

Table of Contents

operating efficiencies and reduced expenditures, those price reductions may have a material adverse effect on our results of operations and cash flows. In addition, our customers occasionally require engineering, design or production changes. In some circumstances, we may be unable to cover the costs of these changes with price increases. Additionally, as our customers grow larger, they may increasingly require us to provide them with our products on an exclusive basis, which could cause an increase in the number of products we must carry and, consequently, increase our inventory levels and working capital requirements. Certain of our customers, particularly domestic automotive manufacturers, are increasingly requiring their suppliers to agree to their standard purchasing terms without deviation as a condition to engage in future business transactions. As a result, we may find it difficult to enter into agreements with such customers on terms that are commercially reasonable to us.

Conditions in the automotive industry have had and may continue to have adverse effects on our results of operations.

Much of our business depends on and is directly affected by the global automobile industry. Sales to customers in the automotive industry accounted for approximately 52% of our total revenue for fiscal year 2009. Automakers and their suppliers globally continue to experience significant difficulties from a weakened economy and tightening credit markets. Globally, many automakers and their suppliers are in financial distress. Continued adverse developments in the automotive industry, including but not limited to continued declines in demand, customer bankruptcies and increased demands on us for pricing decreases, would have adverse effects on our results of operations and could impact our liquidity position and our ability to meet restrictive debt covenants. In addition, these same conditions could adversely impact certain of our vendors’ financial solvency, resulting in potential liabilities or additional costs to us to ensure uninterrupted supply to our customers.

Our ability to operate our business effectively could be impaired if we fail to attract and retain key personnel.

Our ability to operate our business and implement our strategies effectively depends, in part, on the efforts of our executive officers and other key employees. Our management team has significant industry experience and would be difficult to replace. These individuals possess sales, marketing, engineering, manufacturing, financial and administrative skills that are critical to the operation of our business. In addition, the market for engineers and other individuals with the required technical expertise to succeed in our business is highly competitive and we may be unable to attract and retain qualified personnel to replace or succeed key employees should the need arise. During 2008 and 2009, we completed certain reductions in force at a number of our sites in order to align our business operations with current and projected economic conditions. Additional actions may continue to occur during 2010. The loss of the services of any of our key employees or the failure to attract or retain other qualified personnel could have a material adverse effect on our business.

If we fail to maintain our existing relationships with our customers, our exposure to industry and customer specific demand fluctuations could increase and our revenue may decline as a result.

Our customers consist of a diverse base of OEMs across the automotive, HVAC, appliance, industrial, aerospace, defense and other end-markets in various geographic locations throughout the world. In the event that we fail to maintain our relationships with our existing customers and such failure increases our dependence on particular markets or customers, then our revenue would be exposed to greater industry and customer specific demand fluctuations, and could decline as a result.

We are subject to risks associated with our non-U.S. operations, which could adversely impact the reported results of operations from our international businesses.

Our subsidiaries outside of the Americas generated approximately 55% of our net revenue for fiscal year 2009, and we expect sales from non-U.S. markets to continue to represent a significant portion of our total sales.

13

Table of Contents

International sales and operations are subject to changes in local government regulations and policies, including those related to tariffs and trade barriers, investments, taxation, exchange controls and repatriation of earnings.

A significant portion of our revenue, expenses, receivables and payables are denominated in currencies other than U.S. dollars. We are, therefore, subject to foreign currency risks and foreign exchange exposure. Changes in the relative values of currencies occur from time to time and could affect our operating results. For financial reporting purposes, the functional currency that we use is the U.S. dollar because of the significant influence of the U.S. dollar on our operations. In certain instances, we enter into transactions that are denominated in a currency other than the U.S. dollar. At the date the transaction is recognized, each asset, liability, revenue, expense, gain or loss arising from the transaction is measured and recorded in U.S. dollars using the exchange rate in effect at that date. At each balance sheet date, recorded monetary balances denominated in a currency other than the U.S. dollar are adjusted to the U.S. dollar using the current exchange rate with gains or losses recorded in Currency translation gain/(loss) and other, net. During times of a weakening U.S. dollar, our reported international sales and earnings will increase because the non-U.S. currency will translate into more U.S. dollars. Conversely, during times of a strengthening U.S. dollar, our reported international sales and earnings will be reduced because the local currency will translate into fewer U.S. dollars.

There are other risks that are inherent in our non-U.S. operations, including the potential for changes in socio-economic conditions and/or monetary and fiscal policies, intellectual property protection difficulties and disputes, the settlement of legal disputes through certain foreign legal systems, the collection of receivables through certain foreign legal systems, exposure to possible expropriation or other government actions, unsettled political conditions and possible terrorist attacks against American interests. These and other factors may have a material adverse effect on our non-U.S. operations and, therefore, on our business and results of operations.

Our businesses operate in markets that are highly competitive, and competitive pressures could require us to lower our prices or result in reduced demand for our products.

Our businesses operate in markets that are highly competitive, and we compete on the basis of product performance, quality, service and/or price across the industries and markets we serve. A significant element of our competitive strategy is to manufacture high-quality products at low-cost, particularly in markets where low-cost country-based suppliers, primarily China with respect to the controls business, have entered our markets or increased their sales in our markets by delivering products at low-cost to local OEMs. Some of our competitors have greater sales, assets and financial resources than we do. In addition, many of our competitors in the automotive sensors market are controlled by major OEMs or suppliers, limiting our access to certain customers. Many of our customers also rely on us as their sole source of supply for many of the products we have historically sold to them. These customers may choose to develop relationships with additional suppliers or elect to produce some or all of these products internally, in each case in order to reduce risk of delivery interruptions or as a means of extracting pricing concessions. Certain of our customers currently have, or may develop in the future, the capability of internally producing the products we sell to them and may compete with us with respect to those and other products with respect to other customers. For example, Robert Bosch Gmbh, who is one of our largest customers with respect to our control products, also competes with us with respect to certain of our sensors products. Competitive pressures such as these, and others, could affect prices or customer demand for our products, negatively impacting our profit margins and/or resulting in a loss of market share.

We may not be able to keep up with rapid technological and other competitive changes affecting our industry.

The sensors and controls markets are characterized by rapidly changing technology, evolving industry standards, frequent enhancements to existing services and products, the introduction of new services and products and changing customer demands. Changes in competitive technologies may render certain of our products less attractive or obsolete, and if we cannot anticipate changes in technology and develop and introduce new and enhanced products on a timely basis, our ability to remain competitive may be negatively impacted. The

14

Table of Contents

success of new products depends on their initial and continued acceptance by our customers. Our businesses are affected by varying degrees of technological change, which result in unpredictable product transitions, shortened lifecycles and increased importance of being first to market with new products and services. We may experience difficulties or delays in the research, development, production and/or marketing of new products, which may negatively impact our operating results and prevent us from recouping or realizing a return on the investments required to bring new products to market.

As part of our ongoing cost containment program designed to align our operations with economic conditions, we have had to make, and will likely continue to make, adjustments to both the scope and breadth of our overall research and development program. Such actions may result in choices that could adversely affect our ability to either take advantage of emerging trends or to develop new technologies or make sufficient advancements to existing technologies.

We may not be able to protect our intellectual property, including our proprietary technology and the Sensata, Klixon, Airpax and Dimensions brands.

Our success depends to some degree on our ability to protect our intellectual property and to operate without infringing on the proprietary rights of third parties. If we fail to adequately protect our intellectual property, competitors may manufacture and market products similar to ours. We have sought and may continue from time to time to seek to protect our intellectual property rights through litigation. These efforts might be unsuccessful in protecting such rights and may adversely affect our financial performance and distract our management. We also cannot be sure that competitors will not challenge, invalidate or void the application of any existing or future patents that we receive or license. In addition, patent rights may not prevent our competitors from developing, using or selling products that are similar or functionally equivalent to our products. It is also possible that third parties may have or acquire licenses for other technology or designs that we may use or wish to use, so that we may need to acquire licenses to, or contest the validity of, such patents or trademarks of third parties. Such licenses may not be made available to us on acceptable terms, if at all, and we may not prevail in contesting the validity of third-party rights.

In addition to patent and trademark protection, we also protect trade secrets, know-how and other proprietary information, as well as brand names such as the Sensata, Klixon, Airpax and Dimensions brands under which we market many of the products sold in our controls business, against unauthorized use by others or disclosure by persons who have access to them, such as our employees, through contractual arrangements. These arrangements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. Disputes may arise concerning the ownership of intellectual property or the applicability of confidentiality agreements, and we cannot be sure that our trade secrets and proprietary technology will not otherwise become known or that our competitors will not independently develop our trade secrets and proprietary technology. If we are unable to maintain the proprietary nature of our technologies, our sales could be materially adversely affected.

We may be subject to claims that our products or processes infringe the intellectual property rights of others, which may cause us to pay unexpected litigation costs or damages, modify our products or processes or prevent us from selling our products.

Third parties may claim that our processes and products infringe on their intellectual property rights. Whether or not these claims have merit, we may be subject to costly and time-consuming legal proceedings, and this could divert our management’s attention from operating our business. If these claims are successfully asserted against us, we could be required to pay substantial damages and could be prevented from selling some or all of our products. We may also be obligated to indemnify our business partners or customers in any such litigation. Furthermore, we may need to obtain licenses from these third parties or substantially reengineer or

15

Table of Contents

rename our products in order to avoid infringement. In addition, we might not be able to obtain the necessary licenses on acceptable terms, or at all, or be able to reengineer or rename our products successfully. If we are prevented from selling some or all of our products, our sales could be materially adversely affected.

Increasing costs for manufactured components and raw materials may adversely affect our profitability.

We use a broad range of manufactured components and raw materials in the manufacture of our products, including silver, gold, nickel, aluminum and copper, which may experience significant volatility in their prices. We generally purchase raw materials at spot prices. We first entered into hedge arrangements in 2007 and may continue to do so from time to time in the future. Such hedges might not be economically successful. In addition, these hedges do not qualify as accounting hedges in accordance with U.S. GAAP. Accordingly, the change in fair value of these hedges is recognized in earnings immediately, which could cause volatility in our results of operations from quarter to quarter. The availability and price of raw materials and manufactured components may be subject to change due to, among other things, new laws or regulations, global economic or political events including strikes, terrorist actions and war, suppliers’ allocations to other purchasers, interruptions in production by suppliers, changes in exchange rates and prevailing price levels. It is generally difficult to pass increased prices for manufactured components and raw materials through to our customers in the form of price increases. Therefore, a significant increase in the price of these items could materially increase our operating costs and materially and adversely affect our profit margins.

We may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against us.

We have been and may continue to be exposed to product liability and warranty claims in the event that our products actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in bodily injury and/or property damage. Accordingly, we could experience material warranty or product liability losses in the future and incur significant costs to defend these claims. In addition, if any of our products are, or are alleged to be, defective, we may be required to participate in a recall of the underlying end product, particularly if the defect or the alleged defect relates to product safety. Depending on the terms under which we supply products, an OEM may hold us responsible for some or all of the repair or replacement costs of these products under warranties, when the product supplied did not perform as represented. In addition, a product recall could generate substantial negative publicity about our business and interfere with our manufacturing plans and product delivery obligations as we seek to repair affected products. Our costs associated with product liability, warranty and recall claims could be material.

We may not be successful in recovering damages, including those associated with product liability and warranty and recall claims, from Texas Instruments under the terms of our acquisition agreement entered into with Texas Instruments in connection with the 2006 Acquisition.

Texas Instruments has agreed in the 2006 Acquisition to indemnify us for certain claims and litigation. Texas Instruments is not required to indemnify us for these claims until the aggregate amount of damages from such claims exceeds $30.0 million. If the aggregate amount of these claims exceeds $30.0 million, Texas Instruments is obligated to indemnify us for amounts in excess of the $30.0 million threshold. Texas Instruments’ indemnification obligation is capped at $300.0 million. Based on claims to date, we believe that the aggregate amount of damages from these claims will ultimately exceed $30.0 million. See “Business—Legal Proceedings” included elsewhere in this prospectus. There can be no assurance that we will be successful in recovering amounts from Texas Instruments.

16

Table of Contents

Our substantial indebtedness could adversely affect our financial condition and our ability to operate our business, and we may not be able to generate sufficient cash flows to meet our debt service obligations.

As of December 31, 2009, we had $2,300.8 million of outstanding indebtedness, including $1,468.1 million of indebtedness under our Senior Secured Credit Facility (excluding availability under our revolving credit facility and outstanding letters of credit), $790.8 million of outstanding Senior Notes and Senior Subordinated Notes and $41.9 million of capital lease and other financing obligations. We may also incur additional indebtedness in the future. Our substantial indebtedness could have important consequences. For example, it could:

| • | make it more difficult for us to satisfy our debt obligations; |

| • | restrict us from making strategic acquisitions; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and future business opportunities, thereby placing us at a competitive disadvantage if our competitors are not as highly leveraged; |

| • | increase our vulnerability to general adverse economic and industry conditions; or |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness if we do not maintain specified financial ratios, thereby reducing the availability of our cash flow for other purposes. |

In addition, our Senior Secured Credit Facility and the indentures governing our Senior Notes and Senior Subordinated Notes permit us to incur substantial additional indebtedness in the future. As of December 31, 2009, we had $131.1 million available to us for additional borrowing under our $150.0 million revolving credit facility portion of our Senior Secured Credit Facility. If we increase our indebtedness by borrowing under the revolving credit facility or incur other new indebtedness, the risks described above would increase.

Labor disruptions or increased labor costs could adversely affect our business.

As of December 31, 2009, we had approximately 9,500 employees, of whom approximately 10% were located in the United States. None of our employees are covered by collective bargaining agreements. In various countries, local law requires our participation in works councils. A material labor disruption or work stoppage at one or more of our manufacturing facilities could have a material adverse effect on our business. In addition, work stoppages occur relatively frequently in the industries in which many of our customers operate, such as the automotive industry. If one or more of our larger customers were to experience a material work stoppage, that customer may halt or limit the purchase of our products. This could cause us to shut down production facilities relating to those products, which could have a material adverse effect on our business, results of operations and financial condition.

The loss of one or more of our suppliers of finished goods or raw materials may interrupt our supplies and materially harm our business.

We purchase raw materials and components from a wide range of suppliers. For certain raw materials or components, however, we are dependent on sole source suppliers. We generally obtain these raw materials and components through individual purchase orders executed on an as needed basis rather than pursuant to long-term supply agreements. Our ability to meet our customers’ needs depends on our ability to maintain an uninterrupted supply of raw materials and finished products from our third-party suppliers and manufacturers. Our business, financial condition or results of operations could be adversely affected if any of our principal third-party suppliers or manufacturers experience production problems, lack of capacity or transportation disruptions or otherwise determine to cease producing such raw materials or components. The magnitude of this risk depends upon the timing of the changes, the materials or products that the third-party manufacturers provide and the

17

Table of Contents

volume of the production. We may not be able to make arrangements for transition supply and qualifying replacement suppliers in both a cost effective and timely manner. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Off-Balance Sheet Arrangements.”

In May 2009, STI entered into a transition production agreement with Engineered Materials Solutions, LLC in order to support its Electrical Contact Systems business unit, which is the primary supplier to us for electrical contacts in the manufacturing of certain of our controls products and which was at risk of closing. Although we have been developing a second source supplier, if Engineered Materials Solutions was unable to continue as a supplier, it could have a material adverse effect on our business.

Our dependence on third parties for raw materials and components subjects us to the risk of supplier failure and customer dissatisfaction with the quality of our products. Quality failures by our third-party manufacturers or changes in their financial or business condition which affect their production could disrupt our ability to supply quality products to our customers and thereby materially harm our business.

Non-performance by our suppliers may adversely affect our operations.

Because we purchase various types of raw materials and component parts from suppliers, we may be materially and adversely affected by the failure of those suppliers to perform as expected. This non-performance may consist of delivery delays or failures caused by production issues or delivery of non-conforming products. The risk of non-performance may also result from the insolvency or bankruptcy of one or more of our suppliers.

Our efforts to protect against and to minimize these risks may not always be effective. We may occasionally seek to engage new suppliers with which we have little or no experience. For example, we do not have a prior relationship with all of the suppliers that we are qualifying for the supply of contacts. The use of new suppliers can pose technical, quality and other risks.

We depend on third parties for certain transportation, warehousing and logistics services.

We rely primarily on third parties for transportation of the products we manufacture. In particular, a significant portion of the goods we manufacture are transported to different countries, requiring sophisticated warehousing, logistics and other resources. If any of the countries from which we transport products were to suffer delays in exporting manufactured goods, or if any of our third-party transportation providers were to fail to deliver the goods we manufacture in a timely manner, we may be unable to sell those products at full value, or at all. Similarly, if any of our raw materials could not be delivered to us in a timely manner, we may be unable to manufacture our products in response to customer demand.

A material disruption at one of our manufacturing facilities could harm our financial condition and operating results.

If one of our manufacturing facilities were to be shut down unexpectedly, or certain of our manufacturing operations within an otherwise operational facility were to cease production unexpectedly, our revenue and profit margins would be adversely affected. Such a disruption could be caused by a number of different events, including:

| • | maintenance outages; |

| • | prolonged power failures; |

| • | an equipment failure; |

| • | fires, floods, earthquakes or other catastrophes; |

18

Table of Contents

| • | potential unrest or terrorist activity; |

| • | labor difficulties; or |

| • | other operational problems. |

In addition, approximately 95% of our products are manufactured at facilities located outside the United States. Serving a global customer base requires that we place more production in emerging markets, such as China, Mexico and Malaysia, to capitalize on market opportunities and maintain our low-cost position. Our international production facilities and operations could be particularly vulnerable to the effects of a natural disaster, labor strike, war, political unrest, terrorist activity or public health concerns, especially in emerging countries that are not well-equipped to handle such occurrences. Our manufacturing facilities abroad may also be more susceptible to changes in laws and policies in host countries and economic and political upheaval than our domestic facilities. If any of these or other events were to result in a material disruption of our manufacturing operations, our ability to meet our production capacity targets and satisfy customer requirements may be impaired.

We may not realize all of the revenue or achieve anticipated gross margins from products subject to existing purchase orders or for which we are currently engaged in development.

Our ability to generate revenue from products subject to customer awards is subject to a number of important risks and uncertainties, many of which are beyond our control, including the number of products our customers will actually produce as well as the timing of such production. Many of our customer contracts provide for supplying a certain share of the customer’s requirements for a particular application or platform, rather than for manufacturing a specific quantity of products. In some cases we have no remedy if a customer chooses to purchase less than we expect. In cases where customers do make minimum volume commitments to us, our remedy for their failure to meet those minimum volumes is limited to increased pricing on those products the customer does purchase from us or renegotiating other contract terms. There is no assurance that such price increases or new terms will offset a shortfall in expected revenue. In addition, some of our customers may have the right to discontinue a program or replace us with another supplier under certain circumstances. As a result, products for which we are currently incurring development expenses may not be manufactured by customers at all, or may be manufactured in smaller amounts than currently anticipated. Therefore, our anticipated future revenue from products relating to existing customer awards or product development relationships may not result in firm orders from customers for the same amount. We also incur capital expenditures and other costs, and price our products, based on estimated production volumes. If actual production volumes were significantly lower than estimated, our anticipated revenue and gross margin from those new products would be adversely affected. We cannot predict the ultimate demand for our customers’ products, nor can we predict the extent to which we would be able to pass through unanticipated per-unit cost increases to our customers.

Compliance with Section 404 of the Sarbanes-Oxley Act of 2002, or “Section 404,” may be costly with no assurance of maintaining effective internal controls over financial reporting.

We will likely experience significant operating expenses in connection with maintaining our internal control environment and Section 404 compliance activities. In addition, if we are unable to efficiently maintain effective internal controls over financial reporting, our operations may suffer and we may be unable to obtain an attestation on internal controls from our independent registered public accounting firm when required under the Sarbanes-Oxley Act of 2002. Recent cost reduction actions, including the loss of experienced finance and administrative personnel, may adversely effect our ability to maintain effective internal controls. This, in turn, could have a materially adverse impact on trading prices for our securities and adversely affect our ability to access the capital markets.

19

Table of Contents

Export of our products are subject to various export control regulations and may require a license from either the U.S. Department of State, the U.S. Department of Commerce or the U.S. Department of the Treasury.