Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-50262

INTELSAT S.A.

(Exact name of registrant as specified in its charter)

| Luxembourg | 98-0346003 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 23, avenue Monterey Luxembourg |

L-2086 | |

| (Address of Principal Executive Offices) | (Zip Code) |

+352 24-87-9920

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s voting stock held by non-affiliates is zero. The registrant is a privately held corporation.

As of March 5, 2010, 5,000,000 common shares, par value $1.00 per share, were outstanding.

Documents incorporated by reference: None

Table of Contents

| Page | ||||

| 1 | ||||

| Part I |

||||

| Item 1. |

3 | |||

| Item 1A. |

30 | |||

| Item 1B. |

41 | |||

| Item 2. |

42 | |||

| Item 3. |

43 | |||

| Item 4. |

43 | |||

| Part II |

||||

| Item 5. |

44 | |||

| Item 6. |

44 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

46 | ||

| Item 7A. |

84 | |||

| Item 8. |

85 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

85 | ||

| Item 9A(T). |

85 | |||

| Item 9B. |

86 | |||

| Part III |

||||

| Item 10. |

87 | |||

| Item 11. |

90 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

111 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

112 | ||

| Item 14. |

114 | |||

| Part IV |

||||

| Item 15. |

115 | |||

| 116 | ||||

| F-1 | ||||

Table of Contents

Some of the statements in this Annual Report on Form 10-K, or Annual Report, constitute forward-looking statements that do not directly or exclusively relate to historical facts. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements as long as they are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements.

When used in this Annual Report, the words “may,” “will,” “ might,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “intend,” “potential,” “outlook” and “continue,” and the negative of these terms, and other similar expressions are intended to identify forward-looking statements and information. Examples of these forward-looking statements include, but are not limited to, statements regarding the following: our goal to expand our leading fixed satellite services (“FSS”) business in high growth regions and applications while maintaining our focus on operational discipline; our expectation that our current capital expenditure program will position our network to capitalize on the FSS sector’s best growth opportunities globally, while providing optimal coverage to meet needs across our targeted customer sets; the characteristics of our refreshed fleet when the current investment cycle is completed; our belief that our strategies will position us to continue to deliver high operating margins, and as our current fleet investment program is completed, strong cash flow generation; the trends we believe will increase demand for satellite services and that we believe will allow us to capture new business opportunities in the future; our intent to continue to evaluate and pursue strategic transactions that complement our global fleet, provide growth capacity and allow us to respond to our customer needs; our belief that our network services and media customers increasingly require managed services best addressed by a network that combines space and terrestrial infrastructure; our expectation that the FSS sector will experience moderate growth over the next few years; our expectation that we will benefit from the general trend towards IP-based networking and distribution, including growing use of new media formats, as well as infrastructure applications in emerging regions; our expectation that we will continue to implement compression technologies into our ground network to reduce the bandwidth necessary for network service applications, increasing our customers’ efficiency and expanding our market potential, particularly in emerging regions; our belief that our enhancement of our fully-integrated terrestrial network to an all IP network environment will improve our ground support of high bandwidth applications such as high definition video and will allow us to converge our media and network services terrestrial network infrastructures; the trends that we believe will impact our revenue and operating expenses in the future; our assessments regarding how long satellites that have experienced anomalies in the past should be able to provide service on their transponders; our assessment of the risk of additional anomalies occurring on our satellites; our expectation that certain anomalies will not result in the acceleration of capital expenditures; our plans for satellite launches in the near term; our expected capital expenditures in 2010 and during the next several years; our belief that the diversity of our revenue and customer base allows us to recognize trends, capture new growth opportunities, and gain experience that can be transferred to customers in other regions, enables us to capitalize on changing market conditions and mitigates the impact of fluctuations in any specific customer type or geographic region; our belief that our global scale, diversity, collection of spectrum rights, technical expertise and fully integrated hybrid network form a strategic platform that positions us to identify and capitalize on new opportunities in satellite services; our belief that the scale of our fleet can reduce the financial impact of any satellite failures and protect against service interruption; and the impact on our financial position or results of operations of pending legal proceedings.

The forward-looking statements made in this Annual Report reflect our intentions, plans, expectations, assumptions and beliefs about future events. These forward-looking statements speak only as of their dates and are not guarantees of future performance or results and are subject to risks, uncertainties and other factors, many of which are outside of our control. These factors could cause actual results or developments to differ materially from the expectations expressed or implied in the forward-looking statements and include known and unknown risks. Known risks include, among others, the risks discussed in Item 1A—Risk Factors, the political, economic and legal conditions in the markets we are targeting for communications services or in which we operate and other risks and uncertainties inherent in the telecommunications business in general and the satellite communications business in particular.

1

Table of Contents

Other factors that may cause results or developments to differ materially from the forward-looking statements made in this Annual Report include, but are not limited to:

| • | risks associated with operating our in-orbit satellites; |

| • | satellite launch failures, satellite launch and construction delays and in-orbit failures or reduced performance; |

| • | potential changes in the number of companies offering commercial satellite launch services and the number of commercial satellite launch opportunities available in any given time period that could impact our ability to timely schedule future launches and the prices we have to pay for such launches; |

| • | our ability to obtain new satellite insurance policies with financially viable insurance carriers on commercially reasonable terms or at all, as well as the ability of our insurance carriers to fulfill their obligations; |

| • | possible future losses on satellites that are not adequately covered by insurance; |

| • | domestic and international government regulation; |

| • | changes in our revenue backlog or expected revenue backlog for future services; |

| • | pricing pressure and overcapacity in the markets in which we compete; |

| • | inadequate access to capital markets; |

| • | the competitive environment in which we operate; |

| • | customer defaults on their obligations owed to us; |

| • | our international operations and other uncertainties associated with doing business internationally; |

| • | litigation; and |

| • | other risks discussed under Item 1A—Risk Factors. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee our future results, level of activity, performance or achievements. Because actual results could differ materially from our intentions, plans, expectations, assumptions and beliefs about the future, you are urged not to rely on forward-looking statements in this Annual Report and to view all forward-looking statements made in this Annual Report with caution. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

2

Table of Contents

PART I

| Item 1. | Business |

In this Annual Report unless otherwise indicated or the context otherwise requires, (1) the terms “we,” “us,” “our,” “the Company” and “Intelsat” refer to Intelsat, Ltd. and its subsidiaries on a consolidated basis prior to the Migration (as defined below) and Intelsat S.A. and its subsidiaries on a consolidated basis subsequent to the Migration, (2) the terms “Serafina Holdings” and “Intelsat Global” refer to Intelsat Global, Ltd. (formerly known as Serafina Holdings Limited) prior to the Migration and to Intelsat Global S.A. subsequent to the Migration, (3) the terms “Serafina” and “Intelsat Global Subsidiary” refer to Intelsat Global Subsidiary, Ltd. (formerly known as Serafina Acquisition Limited) prior to the Migration and to Intelsat Global Subsidiary S.A. subsequent to the Migration, (4) the term “Intelsat Holdings” refers to our parent, Intelsat Holdings, Ltd., prior to the Migration and to Intelsat Holdings S.A. subsequent to the Migration, (5) the term “Intelsat Bermuda” refers to Intelsat (Bermuda), Ltd., Intelsat, Ltd.’s direct wholly-owned subsidiary, prior to the Migration and the term “Intelsat Luxembourg” refers to Intelsat (Luxembourg) S.A., Intelsat S.A.’s direct wholly-owned subsidiary, subsequent to the Migration, (6) the term “Intelsat Jackson” refers to Intelsat Jackson Holdings, Ltd., a direct wholly-owned subsidiary of Intelsat Bermuda, prior to the Migration, and to Intelsat Jackson Holdings S.A., Intelsat Luxembourg’s direct wholly-owned subsidiary, subsequent to the Migration, (7) the term “Intermediate Holdco” refers to Intelsat Intermediate Holding Company, Ltd., a direct wholly-owned subsidiary of Intelsat Jackson, prior to the Migration and to Intelsat Intermediate Holding Company S.A. subsequent to the Migration, (8) the term “Intelsat Sub Holdco” refers to Intelsat Subsidiary Holding Company, Ltd., a direct wholly-owned subsidiary of Intermediate Holdco, prior to the Migration and to Intelsat Subsidiary Holding Company S.A. subsequent to the Migration, (9) the term “PanAmSat Holdco” refers to PanAmSat Holding Corporation, and not to its subsidiaries, prior to the PanAmSat Acquisition Transactions (as defined below) and the term “Intelsat Holding Corporation” refers to Intelsat Holding Corporation, and not to its subsidiaries, thereafter, (10) the terms “Intelsat Corp” and “Intelsat Corporation” refer to PanAmSat Corporation prior to the PanAmSat Acquisition Transactions and to Intelsat Corporation thereafter, (11) the term “PanAmSat” refers to PanAmSat Holding Corporation and its subsidiaries on a consolidated basis prior to the PanAmSat Acquisition Transactions, and (12) the term “New Sponsors Acquisition Transactions” refers to the acquisition of Intelsat Holdings by Serafina in February 2008 and related transactions, as discussed under Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Impact of the New Sponsors Acquisition Transactions. We refer to Intelsat General Corporation, our government business subsidiary, as “Intelsat General.” In this Annual Report, unless the context otherwise requires, all references to transponder capacity or demand refer to transponder capacity or demand in the C-band and Ku-band only.

Overview

Intelsat operates the world’s largest fixed satellite services (“FSS”) business, providing a critical layer in the global communications infrastructure. Based on the scale and global coverage of our network, our extensive customer relationships and our reputation for highly reliable services, we believe that we are the leading FSS company in the world. We operate more satellite capacity in orbit, have more satellite capacity under contract, serve more commercial customers and deliver services in more countries than any other commercial satellite operator.

Our business provides mission critical communication services to the world’s leading media companies, wireline and wireless telecommunications operators, data networking service providers, multinational corporations, and Internet service providers (“ISPs”). We are the leading provider of commercial satellite capacity to the U.S. government and other select military organizations and contractors. The span of our business ranges from global distribution of content for media companies to essential network backbones for communications providers in high-growth emerging markets.

3

Table of Contents

Our business is the most diversified in the FSS sector based on types of service offerings, number of customers and revenue concentration by satellite and geography. This diversity reduces our market and operating risk. Our broad customer base and geographic presence also provide us with early opportunities to support new communications applications in a converging world.

Our satellite-based solutions are a critical component of our customers’ infrastructures. Generally, our customers need the connectivity satellites provide so long as they are in business or pursuing their mission. This gives us stability during economic downturns. Our services also provide strong value in support of our customers’ businesses. For instance, for media applications, our satellite services provide efficient broadcast distribution that is difficult for terrestrial services to match. For network services applications, our satellite solutions provide higher reliability than is available from local terrestrial services, and allow our customers to reach geographies that they would otherwise be unable to serve. The Intelsat network supports:

| • | The distribution of television entertainment and news programming; |

| • | The expansion of wireless networks in emerging regions without adequate infrastructure; |

| • | Ubiquitous access to broadband for Internet and fixed and mobile networks used by corporations and other organizations; |

| • | Completion and extension of international, national and regional voice and data networks; and |

| • | Highly specialized fixed and mobile military applications, such as secure communications networks and bandwidth to enable manned and unmanned aerial vehicle missions. |

We provide our infrastructure services on a satellite fleet comprised of over 50 satellites, covering 99% of the earth’s populated regions. Our satellite capacity is complemented by a terrestrial network comprised of leased fiber optic cable and owned and operated teleports. We believe that our hybrid satellite-terrestrial network provides significant differentiation and is an important element of our growth strategy.

We have a reputation for operational and engineering leadership, built on our experience of over 45 years in the FSS sector. The reliability of our network is outstanding, delivering 99.9998% network availability on station-kept satellites to our customers in 2009. We built our centrally operated, fully integrated network using the world’s largest collection of FSS spectrum rights at valuable orbital locations, from which we can deliver services to established regions as well as higher-growth emerging regions.

We operate in an attractive, well-developed sector of the satellite communications industry, which is benefiting from increasing demand for capacity from the commercial sector and governments. The FSS sector is characterized by steady and predictable contracted revenue streams, high operating margins, strong cash flows and long-term contractual commitments. We believe these sector characteristics, coupled with our cost-efficient, fully integrated operating structure and favorable tax profile, provide us with an attractive business model.

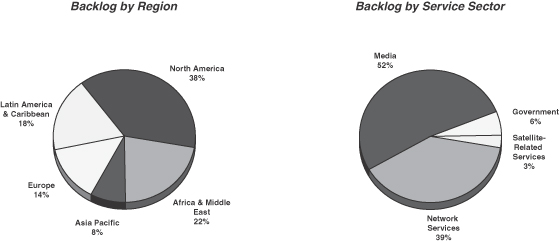

As of December 31, 2009, our revenue backlog, which is our expected future revenue under existing customer contracts, was approximately $9.4 billion. We typically contract with our customers for long-term commitments of up to 15 years. Approximately 96% of this backlog relates to contracts that are non-cancelable or cancelable only upon payment of substantial termination fees. For the year ended December 31, 2009, we generated revenue of $2.5 billion, a growth rate of 6% over the combined year ended December 31, 2008.

We believe that our global scale and efficient operating profile, diversified customer sets and sizeable backlog, together with the growing worldwide demand for entertainment and connectivity, provide us with a platform for success.

4

Table of Contents

The FSS Sector

Fixed satellite services are an integral part of the global communications infrastructure. The global FSS sector is expected to generate revenues of approximately $9.6 billion in 2010 according to NSR, a leading international market research and consulting firm specializing in satellite and wireless technology and applications.

Our customers use our services because of the distinct technical and economic benefits that satellite services provide for certain critical applications. Satellites provide a number of advantages over terrestrial communications systems, including the following:

| • | Satellite beams effectively blanket service regions with bandwidth, enabling any user within a coverage area to have equal access to highly reliable bandwidth; |

| • | Efficient content distribution through the ability to broadcast high quality signals from a single location to many locations simultaneously; |

| • | The ability to extend beyond terrestrial network end points, or provide an alternative path to terrestrial infrastructure, thus avoiding points of congestion or unreliability; |

| • | Fast network deployments, with network performance easily replicated across each site regardless of geography or infrastructure, and efficient centralized control and management; |

| • | Superior end-to-end network availability as compared to the availability of terrestrial networks; and |

| • | Instant communications infrastructure for disaster recovery. |

There is a finite number of geostationary orbital slots in which FSS satellites can be located, and many orbital locations already hold operational satellites. The owners of these satellites operate them under coordination agreements designed to avoid interference with other operators’ satellites.

Today, there are only three FSS operators, including us, providing global services, which is increasingly important as multinationals and governments seek a one-stop solution for obtaining global connectivity. In addition, there are a number of operators with fewer satellites that provide regional and/or national services. Intelsat is the largest of any operator in terms of rights to orbital slots in the most valuable C- and Ku-band spectrums.

We believe a number of trends are creating increasing demand for satellite services, expanding the FSS sector:

| • | Globalization of economic activities is increasing the geographic expansion of corporations and the communications networks that support them and creating new audiences for content. Globalization also increases the communications requirements for governments supporting embassy and military applications. |

| • | Connectivity and broadband access are essential elements of infrastructure supporting the rapid economic growth of developing nations. Globally dispersed organizations are increasingly moving to satellite-based infrastructure to provide better access, reliability and control. |

| • | Proliferation of content and formats is resulting in increased bandwidth requirements as content owners seek to maximize distribution to multiple viewing audiences across multiple technologies. High definition television (“HDTV”), three-dimensional high definition television (“3DTV”), Internet distribution of traditional television programming, Internet protocol television (“IPTV”) and video to the handset are all examples of the expanding format and distribution requirements of media programmers. |

5

Table of Contents

| • | Mobility applications, such as wireless phone services, maritime communications and aerial services, are fueling demand for bandwidth on the move. Rapid growth in cellular services for developing regions is expected to transition demand for voice only services to demand for data and video services over time, resulting in increased network bandwidth requirements. Given the low penetration of fixed-line telephone services in emerging markets and the introduction of smart phones and netbooks, Internet access in these markets may be primarily mobile. Significant technology advancements in aerial data and video services for government applications, such as unmanned aerial vehicles, also is resulting in increased demand for satellite-based bandwidth. |

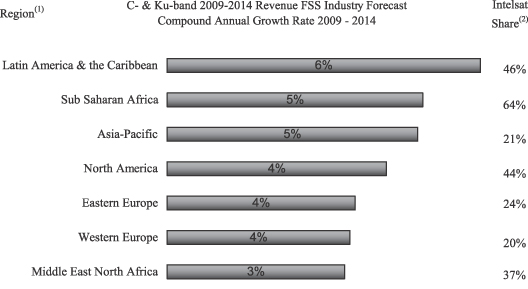

In total, C- and Ku-band transponder service revenue in the FSS sector is expected to grow at a compound annual growth rate (“CAGR”) of 4.1% from 2010 to 2015 according to NSR. The fundamentals of the sector have consistently improved over the past few years, with continued strong demand despite the generally poor economic environment in many regions of the world. The average price per transponder for the period 2009 to 2011 forecasted by NSR in its 2009 study was approximately 12.5% higher than that forecasted for the same period in a similar study issued by NSR in 2006.

Our Customer Sets

We are the largest FSS operator and, based on the number of transponders contracted, we hold the leading position in each of our three customer sectors: network services, media and government. Characteristics of our customer sets are summarized below:

| Year Ended |

% of Total Revenue |

% of Total Backlog(1) |

Backlog to Revenue Multiple |

Representative Customers | ||||||

| Network Services |

49 | % | 39 | % | 3.0x | British Telecommunications, France Telecom, MTN Group, Schlumberger, Verizon, Vodacom | ||||

| Media |

31 | % | 52 | % | 6.3x | Discovery Communications, Fox Entertainment Group, Home Box Office, DIRECTV Latin America, The Walt Disney Company, Turner Broadcasting System | ||||

| Government |

17 | % | 6 | % | 1.2x | Australian Defence Force, National Oceanic and Atmospheric Administration, U.S. Department of Defense, U.S. Department of State, U.S. Navy | ||||

| * | Does not include Satellite Related Services and Other |

| (1) | Backlog as of December 31, 2009 |

We provide satellite capacity and related communications services for the transmission of video, data and voice signals. Our customer contracts offer four different service types: transponder services, managed services, channel services and mobile satellite services and other. We also perform satellite-related consulting and technical services for various third parties, such as operating satellites for other satellite owners.

Network Services

Network services is our largest customer set, and for the year ended December 31, 2009 accounted for 49% of our revenue and a contracted backlog of $3.7 billion at such date. Our business generated from the network services sector is generally characterized by three to five year, and up to 15 year, contracts with many of the world’s leading communications providers, including:

| • | Wireline and wireless telecommunications carriers, including global, regional and national providers; |

| • | Corporate network service providers; |

6

Table of Contents

| • | Value-added services providers, such as those serving the oil and gas and maritime industries; and |

| • | Multinational corporations and entities. |

There is an increasing need for basic and high-speed connectivity in developed and emerging regions around the world. Our satellite capacity, paired with our terrestrial network comprised of leased fiber, teleports, and data networking platforms, enables the transmission of video, data and voice to and from virtually any point on the surface of the earth. We provide an essential element of the infrastructure supporting the rapid expansion of wireless services in many emerging markets. Penetration of 3G wireless services in developing regions is expected to reach over one billion subscribers by 2012 according to the International Telecommunications Union (“ITU”).

Our network services offerings are comprised of three primary categories:

| • | Transponder services—full-time capacity services used by telecom operators, wireless companies, data network operators and value-added network operators for telecom or broadband network infrastructure. |

| • | Managed services—full-time services used by value-added network operators, mobile services operators, telecom operators and ISPs that provide integrated networking platforms comprised of satellite capacity, fiber, teleport and hardware. Operators and service providers use these shared, managed platforms as the basis for, or an economical extension of, their service offerings. |

| • | Channel services—full-time point-to-point service offerings used by telecom operators to supplement international network connectivities where there are no fiber alternatives or as a backup system to fiber routes. |

Our network services offerings are an essential component of our customers’ services, providing backbone infrastructure, expanded service areas and hard-to-reach connectivities. We believe that Intelsat is a preferred provider because of our global service capability and our expertise in delivering service operator-grade network availability and efficient network control.

We have established regional shared data networking platforms at our teleports that are connected to over 40 of our satellites. As a result, our customers can quickly establish highly reliable services across multiple regions, yet operate them on a centralized basis. Our satellite-based solutions allow customers to rapidly expand their service territories, increase the access speed and capabilities for their existing networks and efficiently address new customer and end-user requirements.

Highlights of our network services business include the following:

| • | We are the leading provider of satellite capacity for voice and data applications in every region according to Euroconsult, a leading international research and consulting company specializing in space satellite communications and broadcasting; |

| • | We provide services to many of the world’s largest telecommunications companies. Of the customers we categorize as telecommunications companies, our revenue from the top 25 in aggregate has grown at a CAGR of 11.3% from 2007 to 2009; |

| • | We believe we are the leading provider of satellite capacity for cellular backhaul applications connecting a cellular access point to the telecommunications network, providing network extensions in merging regions. Approximately 60 of our customers use our satellite-based backhaul services as a core component of their network infrastructure due to unreliable or non-existent terrestrial infrastructure. Our cellular backhaul customers include eight of the top ten mobile groups in Africa, such groups representing 64% of the region’s subscribers; and |

| • | Over 200 value-added network operators use our global broadband hybrid infrastructure to deliver regional and global services. Applications for these services include corporate networks for multi-nationals, Internet access and broadband for maritime applications. |

7

Table of Contents

We believe we are the leading provider of satellite capacity for network services, and that we are well positioned to benefit from the growing segments of this market. These segments include:

| • | Satellite-based private data networks, including VSAT networks. C- and Ku-band transponder demand for VSAT services is expected to grow at a CAGR of 6.8% from 2010 to 2015, according to NSR; |

| • | Cellular backhaul via satellite, for which satellite capacity demand is expected to grow by a CAGR of 6.3% from 2010 to 2015, according to NSR; and |

| • | Broadband for maritime applications, which is expected to grow by a CAGR of 9.7% from 2010 to 2015 according to NSR. |

Media

Media customers were the second largest source of our revenue for the year ended December 31, 2009, accounting for 31% of our revenue and a contracted backlog of $4.9 billion at such date. We provide satellite capacity for the transmission of entertainment, news, sports and educational programming for approximately 300 content providers and direct-to-home (“DTH”) platform operators worldwide. Our revenue generated from the media sector is generally characterized by non-cancellable, long-term contracts with terms of up to 15 years with premier customers including:

| • | National broadcasters; |

| • | Content providers and distributors; |

| • | Cable programmers; and |

| • | DTH platform operators. |

Broadcasters, content providers and cable programmers seek efficient distribution of their content to make it easily obtainable by affiliates, cable operators and DTH platforms. Our strong cable distribution neighborhoods offer media customers high penetration of regional and national audiences.

Broadcasters, content providers and cable programmers also select us because our global capabilities enable the distribution or retrieval of content to or from virtually any point on earth. For instance, we regularly provide fully integrated global distribution networks for content providers that need to distribute their products across multiple continents. We believe DTH platform operators turn to us because the scale and flexibility of our fleet lowers their operating risk, as we have multiple satellites serving every region.

Our media sector service offerings are comprised of two primary categories:

| • | Transponder services, which include: |

| • | Video distribution services—full-time services used by programmers and broadcasters to distribute content to cable systems and to affiliates; |

| • | DTH television services—full-time services used by DTH platform operators to distribute their content to consumer set-top boxes; and |

| • | Video contribution services—full-time and part-time services used to gather news and events from a remote location for delivery to a production facility. |

| • | Managed services, which include: |

| • | Hybrid satellite, fiber and teleport managed services – full-time services typically used by programmers to outsource additional elements of their transmission infrastructure, such as uplinking programming in digitally compressed formats; and |

| • | Part-time managed services, including occasional use services for news, sports and entertainment organizations gathering programming from a remote location for delivery to a production facility. |

8

Table of Contents

We believe that we enjoy a strong reputation for delivering the high network reliability required to serve the demanding media sector.

Our fully integrated satellite, fiber and teleport facilities provide enhanced quality control for programmers. We are increasingly offering bundled, value-added services that include managed fiber services, digital encoding of video channels and up-linking and down-linking services to and from our satellites and teleport facilities. Our bundled services address programmers’ interests in delivering content to multiple distribution channels, such as television and Internet, and their needs for launching programs to new regions in a cost-efficient manner.

Highlights of our media business include the following:

| • | Of our 54 satellites, 25 are premium video neighborhoods, offering programmers superior audience penetration, with 10 serving the United States, five serving Latin America, three serving Asia, four serving Europe, and three serving Africa and the Middle East. |

| • | We are positioned as a leading provider of global distribution to our media customers. Our top 20 video distribution customers buy service on our network across three or more geographic regions, demonstrating the value provided by the global reach of our network. |

| • | In North America, we believe that we are the leading provider of FSS capacity for the distribution of high definition and cable programming. Our Galaxy 13 satellite provided the first high definition neighborhood in North America, and today, the Galaxy fleet distributes nearly 150 high definition channels, and we distribute nearly 200 high definition channels on a global basis. In its 2009 study, NSR forecasted that the number of standard and high definition television channels are expected to grow at a CAGR of 6.7% from 2010 to 2015. |

| • | We are a leading provider of FSS capacity for DTH services, delivering programming to millions of viewers and supporting more than 30 DTH platforms around the world. |

| • | We are a leading provider of managed occasional use services for news and sports organizations. In early 2010, we landed a special events team in Haiti within hours of its tragic earthquake, providing a critical link for broadcast teams reporting on the event. In the eleven days following the event, we uplinked over 500 hours of broadcasts from the disaster zone. |

| • | Global C- and Ku-band transponder revenue from FSS video applications is forecasted to grow at an overall CAGR of approximately 4.8% from 2010 to 2015, according to NSR. |

Government

The government sector accounted for 17% of our revenue for the year ended December 31, 2009 and $520 million of our contracted backlog at such date. Our customer base includes many of the leading government communications providers, including:

| • | U.S. military and allied partners; |

| • | Civilian agencies; and |

| • | Commercial customers serving the defense sector. |

We are a leading FSS provider of commercial satellite services to the government sector, and have built a reputation as a trusted partner for the provision of highly customized, secure satellite-based solutions. Our government sector service offerings are comprised of three primary categories:

| • | Transponder services, which include: |

| • | Full time services, for use in private, secure data networks and providing bandwidth for operating unmanned aerial vehicles; |

9

Table of Contents

| • | Managed services, which include: |

| • | Secure access to broadband networking platforms for fast deployments of services; and |

| • | Mobile satellite services and other, which include: |

| • | Resale of full-time and on-demand services for L-band mobile satellite services (“MSS”), X-band and other spectrums not available on our network, as further described below; |

| • | Technical consulting services; and |

| • | Sales of equipment and hardware as part of turn-key satellite solutions. |

We attribute our strength in this area to our global capacity, flexible fleet, specialized security clearances, quality reputation and unique, satellite-specific system integration skills. In responding to customer requirements, we also procure and integrate mobile satellite services provided by other satellite operators, either to supplement our capacity or to obtain capacity in frequencies not available on our fleet, such as L-band MSS, X-band or UHF. These mobile satellite services are low risk in nature and have minimal, if any, associated capital investment. The terms and conditions of the procured capacity are generally matched to contractual commitments from our customers.

Our leading position with the government sector has allowed us to benefit from a number of recent trends. These include:

| • | Growth in demand for secure high bandwidth services related to the surge in use of mobile solutions for intelligence, surveillance and reconnaissance, such as unmanned aerial vehicles; |

| • | Growth in demand for commercial capacity resulting from the cancelation or delay of proprietary government satellite programs; |

| • | Growth in rapid response managed and turn-key, secure communication systems including design, hardware, installation and transmission capacity; and |

| • | Long-term contracts resulting from the use of commercial satellite programs to host proprietary military payloads, providing a shared ride to space and on-going operations and maintenance. |

We believe our reputation as a provider of secure solutions, our global fleet, our customer relationships, our ability to provide turn-key services and our demonstrated willingness to reposition or procure capacity to support specific requirements position us to successfully compete for the increasing demand for satellite solutions for military and civilian applications.

Highlights of our government business include the following:

| • | We are the leading FSS provider of government satellite services in the U.S., according to research consultants, Frost & Sullivan. |

| • | The reliability and scale of our fleet and planned launches of new and replacement satellites allows us to address changing demand for satellite coverage and to provide mission-critical communications capabilities. For instance, our Intelsat 22 satellite will host a UHF payload under a 10-year agreement with the Australian Defense Force. |

| • | Our business generated from the government sector is generally characterized by annual contracts with multi-year renewal options, consistent with U.S. government procurement practices. We have historically been successful in achieving very high renewal rates on our government sector business, which were above 88% on an annual basis in 2008 and 2009. |

10

Table of Contents

| • | The U.S. government and military is one of the largest users of commercial FSS satellites for government/military applications on a global basis. We currently serve more than 200 U.S. government customers, either directly or as a sub-contractor. |

| • | According to Frost & Sullivan, U.S. government and military spending on commercial satellite capacity is expected to grow by a CAGR of 15.6% from 2010 to 2015. |

Our Diverse Business

Our revenue and backlog diversity spans customer sets and applications, as discussed above, as well as geographic regions and satellites. We believe our diversity allows us to recognize trends to capture new growth opportunities, and gain experience that can be transferred to customers in different regions.

We believe we are the sector leader by transponder share in all but one of the geographic regions covered by our network, and our leading positions align to the regions identified by industry analysts as those that either purchase the most satellite capacity or are emerging regions that have the highest growth prospects, such as Africa and Latin America.

| Source: | NSR , Global Assessment of Satellite Demand: 6th Edition, September 2009 |

| (1) | Excludes Atlantic Ocean and Pacific Ocean regions |

| (2) | Based on C-band and Ku-band in-use transponders, share by region as of 12/31/08 |

Our diversity also reduces our business risk. The diversity of our revenue and customer base enables us to capitalize on changing market conditions and mitigates the impact of fluctuations in any specific customer type or geographic region. The scale of our fleet can also reduce the financial impact of satellite failures and protect against service interruption. No single satellite generated more than 4% of our revenue and no single customer accounted for more than 4% of our revenue for the year ended December 31, 2009.

11

Table of Contents

By region and service sector, our backlog as of December 31, 2009 was as follows:

Note: Regional designation for backlog is based on customer billing address.

Our Strategy

We seek revenue growth and increased cash flows by expanding our leading FSS business in high growth regions and applications while maintaining our focus on operational discipline. Given our efficient operating structure, we believe our strategies will position us to continue to deliver high operating margins, and to generate strong cash flow and growth as our current fleet investment program is completed. The key components of our strategy include the following:

Focus our core business on attractive and growing applications

We have an industry-leading position in each of the customer sets served by our business. We believe our global network and regional strengths will allow us to capture new business opportunities as a result of the following:

Network Services:

| • | Growth in multinational enterprise broadband access requirements resulting from globalization; |

| • | The continued expansion of cellular networks and voice and data growth in emerging regions with inadequate infrastructure; and |

| • | New broadband connectivity requirements for aerial and maritime applications. |

Media:

| • | Content and format proliferation, such as standard definition and high definition formats, increasing the capacity needs of our programmer customers; |

12

Table of Contents

| • | New and expanding DTH platforms in fast growing emerging regions; and |

| • | Programmers and broadcasters seeking new global distribution capabilities to deliver content in new regions. |

Government:

| • | The need for broadband and turn-key networks for in-theatre communications; |

| • | Rapidly increasing bandwidth requirements resulting from the use of manned and unmanned aerial vehicles; and |

| • | Hosted payload opportunities as government customers increasingly seek timely and cost efficient access to space, filling capacity gaps by co-locating their space assets on commercial satellites. |

Optimize our space-based assets, including orbital locations and spacecraft

We are conducting a significant capital expenditure fleet investment program during the five-year period from 2008 to 2012. Our program is designed to position the Intelsat satellite network to capitalize on the FSS sector’s best growth opportunities globally, while providing optimal coverage to meet needs across our targeted customer sets. By the conclusion of the current investment cycle in 2012, the characteristics of our refreshed fleet are expected to include the following:

| • | A significant increase in the proportion of high-power, land mass-focused transponders suitable for broadband and video applications, which typically command a higher price, resulting in an opportunity to increase the overall yield on our fleet; |

| • | Expanded capacity to serve our faster-growth network services and government customers, particularly in emerging markets; |

| • | Expanded capacity at our most valuable regional video distribution neighborhoods; |

| • | Reduced risk of anomalies resulting from the replacement of satellites with known health issues; |

| • | No significant increase in the total amount of station-kept transponder capacity; and |

| • | A longer average remaining useful life of our satellite fleet. |

Incorporate new technology into our core network to capture growth from new applications and next generation customer requirements

Our global scale, diversity, collection of spectrum rights, technical expertise and fully integrated hybrid network form a strategic platform that positions us to identify and capitalize on new opportunities in satellite services. Our fleet is large and diversified by coverage, manufacturer and age. As satellites reach the end of their service lives, we have an ongoing opportunity to refresh the technology we use to serve our customers, resulting in flexibility to address new opportunities as they are identified. Our newer assets, including our enhanced terrestrial network, are used to address current market requirements, allowing older assets to be redeployed to serve legacy customer applications still efficiently served by those assets.

As a result, we believe that we are well positioned to accommodate new business models as they are adopted by our customers. We expect to benefit from the general trend towards IP-based networking and distribution, including growing use of new media formats, as well as infrastructure applications in emerging regions.

We are also investing in enhanced technology in our terrestrial network to deliver converging video and IP content, thus expanding the services we provide to the media and telecommunications industries. We intend to continue to implement compression technologies into our ground network to reduce the bandwidth necessary for

13

Table of Contents

network service applications, increasing our customers’ efficiency and expanding our market potential, particularly in emerging regions. Finally, we intend to leverage our frequent satellite launches to offer government and other customers the ability to integrate their payloads with our spacecraft, providing fast and cost-effective access to space.

Opportunistically use acquisitions and creative business structures for cost-efficient growth and attractive returns

Our record of capitalizing on strategic growth opportunities through targeted acquisitions and business ventures is well established. In addition, we have demonstrated our ability to integrate acquisitions efficiently and quickly, due to our scale and our centralized satellite operations philosophy. In 2006, we completed the largest acquisition in the history of the FSS sector with our $6.4 billion acquisition of PanAmSat Holding Corporation. In recent years, we have completed other, smaller transactions involving single satellites with partners in diverse regions, such as JSAT International Inc. (“JSAT”) in Asia, Telenor Inma AS (“Telenor”) in Europe, and Convergence SPV Ltd. (“Convergence Partners”) in Africa. We will continue to evaluate potential asset purchases, joint ventures and creative business and financial structures that complement our global fleet, provide growth capacity and allow us to respond to customer needs.

Our Network

Our global network is comprised of 54 satellites and ground facilities, including teleports and leased fiber that support our commercial services and the operation and control of our satellites.

Our customers depend on our global communications network and our operational and engineering leadership. Highlights of our network include:

| • | Prime orbital locations, reflecting a valuable portfolio of coordinated fixed satellite spectrum rights; |

| • | Highly reliable services, including network availability of 99.9998% on station-kept satellites for the year ended December 31, 2009; |

| • | Flexibility to relocate satellites to other orbital locations as demand patterns change; |

| • | Design features and steerable beams on many of our satellites that enable us to reconfigure capacity to provide different areas of coverage; and |

| • | Resilience, with multiple satellites serving each region, allowing for improved restoration alternatives should a satellite anomaly occur. |

14

Table of Contents

The table below provides a summary of our satellite fleet as of December 31, 2009. It does not include IS-15, which was successfully launched on November 30, 2009 and placed into service in January 2010, and IS-16, which was successfully launched on February 11, 2010 and will be placed into service in March 2010.

| Satellite |

Manufacturer |

Orbital |

Launch Date | Estimated End of Service Life(1) | ||||

| Station Kept: |

||||||||

| IS-701 |

SS/L(2) | 180°E | 10/93 | 1/12 | ||||

| IS-702 |

SS/L | 66°E | 6/94 | 5/12 | ||||

| IS-706 |

SS/L | 54.85°E | 5/95 | 1/13 | ||||

| IS-707 |

SS/L | 307°E | 3/96 | 3/13 | ||||

| IS-709 |

SS/L | 85.15°E | 6/96 | 6/12 | ||||

| IS-802 |

LMC(3) | 32.9°E | 6/97 | 9/10 | ||||

| IS-805 |

LMC | 304.5°E | 6/98 | 6/16 | ||||

| IS-901 |

SS/L | 342°E | 6/01 | 6/19 | ||||

| IS-902 |

SS/L | 62°E | 8/01 | 8/19 | ||||

| IS-903 |

SS/L | 325.5°E | 3/02 | 4/19 | ||||

| IS-904 |

SS/L | 60°E | 2/02 | 1/20 | ||||

| IS-905 |

SS/L | 335.5°E | 6/02 | 6/20 | ||||

| IS-906 |

SS/L | 64.15°E | 9/02 | 9/20 | ||||

| IS-907 |

SS/L | 332.5°E | 2/03 | 2/21 | ||||

| IS-10-02(4) |

EADS Astrium | 359°E | 6/04 | 1/22 | ||||

| Galaxy 19 |

SS/L | 97°W | 9/08 | 9/24 | ||||

| Galaxy 23(5) |

SS/L | 121°W | 8/03 | 8/21 | ||||

| Galaxy 25 |

SS/L | 93.1°W | 5/97 | 5/15 | ||||

| Galaxy 26 |

SS/L | 50.75°E | 2/99 | 3/11 | ||||

| Galaxy 27 |

SS/L | 129°W | 9/99 | 10/11 | ||||

| Galaxy 28 |

SS/L | 89°W | 6/05 | 10/22 | ||||

| HGS-3 |

BSS(6) | 38°E | 2/96 | 9/11 | ||||

| IS-1R |

BSS | 50°W | 11/00 | 2/16 | ||||

| IS-4(7) |

BSS | 72°E | 8/95 | 8/10 | ||||

| IS-5 |

BSS | 169°E | 8/97 | 10/12 | ||||

| IS-7 |

SS/L | 68.65°E | 9/98 | 11/13 | ||||

| IS-8 |

SS/L | 166°E | 11/98 | 1/14 | ||||

| IS-9 |

BSS | 58°W | 7/00 | 10/12 | ||||

| IS-10(8) |

BSS | 68.5°E | 5/01 | 6/16 | ||||

| IS-11 |

ORB(9) | 317°E | 10/07 | 10/23 | ||||

| IS-12 |

SS/L | 45°E | 10/00 | 1/16 | ||||

| IS-14 |

SS/L | 315°E | 11/09 | TBD | ||||

| IS-25 |

SS/L | Drift(10) | 07/08 | 7/24 | ||||

| Galaxy 3C |

BSS | 95.05°W | 6/02 | 9/20 | ||||

| Galaxy 11 |

BSS | 32.8°E | 12/99 | 4/15 | ||||

| Galaxy 12 |

ORB | 123.1°W | 4/03 | 4/20 | ||||

| Galaxy 13/Horizons-1(11) |

BSS | 127°W | 9/03 | 12/18 | ||||

| Galaxy 14 |

ORB | 125°W | 8/05 | 12/20 | ||||

| Galaxy 15 |

ORB | 133°W | 10/05 | 10/22 | ||||

| Galaxy 16 |

SS/L | 99°W | 6/06 | 6/24 | ||||

| Galaxy 17 |

Thales(12) | 91°W | 5/07 | 5/23 | ||||

| Galaxy 18 |

SS/L | 123°W | 5/08 | 5/24 | ||||

| Horizons-2(13) |

ORB | 74.05°W | 12/07 | 12/23 |

15

Table of Contents

| Satellite |

Manufacturer |

Orbital |

Launch Date | Estimated End of Service Life(1) | ||||

| Inclined Orbit: |

||||||||

| IS-601 |

BSS | 47.5°E | 10/91 | 5/12 | ||||

| IS-602 |

BSS | 177.85°E | 10/89 | 8/11 | ||||

| IS-603 |

BSS | 340.05°E | 3/90 | 3/13 | ||||

| IS-705 |

SS/L | 310°E | 3/95 | 11/12 | ||||

| IS-801 |

LMC | 328.5°E | 3/97 | 8/13 | ||||

| Leasat F5(14) |

BSS | 100°E | 1/90 | 3/11 | ||||

| IS-2 |

BSS | 169.1°E | 7/94 | 7/11 | ||||

| Galaxy 9(15) |

BSS | 81°W | 5/96 | 7/10 | ||||

| IS-3R |

BSS | 43.1°W | 1/96 | 7/11 | ||||

| IS-24 |

IAI (16) | 47.3°E | 5/96 | 1/14 | ||||

| IS-26 |

BSS | Drift(17) | 2/97 | 12/14 |

| (1) | Engineering estimates of the service life as of December 31, 2009 as determined by remaining fuel levels, consumption rates and other considerations (including power) and assuming no relocation of the satellite. |

| (2) | Space Systems/Loral, Inc. |

| (3) | Lockheed Martin Corporation. |

| (4) | Telenor owns 18 transponders (measured in equivalent 36 MHz transponders) of this satellite’s Ku-band payload. |

| (5) | EchoStar Communications Corporation owns all of this satellite’s Ku-band transponders and a portion of the common elements of the satellite. |

| (6) | Boeing Satellite Systems, Inc., formerly Hughes Aircraft Company. |

| (7) | On February 1, 2010, the backup spacecraft control processor (“SCP”) on IS-4 failed, resulting in a loss of the spacecraft. |

| (8) | In the first quarter of 2010, IS-10 lost its secondary Xenon-Ion Propulsion System (“XIPS”) and is now operating on its backup bi-propellant system. The revised estimated end of service life is now estimated to be September 2013. See—Satellite Health and Technology—Other Anomalies for a discussion of propulsion system anomalies on our BSS 601 HP satellites. |

| (9) | Orbital Sciences Corporation. |

| (10) | This satellite is drifting to its permanent location at 328.5°E and is expected to arrive in April 2010. |

| (11) | Horizons Satellite Holdings, LLC (“Horizons”), our joint venture with JSAT, owns and operates the Ku-band payload on this satellite. We are the exclusive owner of the C-band payload. |

| (12) | Thales Alenia Space. |

| (13) | Horizons owns and operates the payload on this satellite. |

| (14) | Leasat F5 provides services in the X-band and UHF-band frequencies for military applications. |

| (15) | Galaxy 9 was relocated from 74.15ºW to 81ºW and placed into an inverted North/South attitude in order to serve Latin America. |

| (16) | Israel Aerospace Industries, Ltd. |

| (17) | This satellite is drifting to its permanent location at 50.5°E and is expected to arrive in May 2010. |

Satellite Systems

There are three primary types of commercial communications satellite systems: low-earth orbit systems, medium-earth orbit systems and geosynchronous systems. All of our satellites are geosynchronous satellites and are located approximately 22,300 miles, or 35,700 kilometers, above the equator. These satellites can receive radio frequency communications from an origination point, relay those signals over great distances and distribute those signals to a single receiver or multiple receivers within the coverage areas of the satellites’ transmission beams.

16

Table of Contents

Geosynchronous satellites send these signals using various parts of the radio frequency spectrum. The spectrum available for use at each orbital location includes the following frequency bands in which most commercial satellite services are offered today:

| • | C-band—low power, broad beams requiring use of relatively larger antennae, valued as spectrum least susceptible to transmission impairments such as rain; |

| • | Ku-band—high power, narrow to medium size beams facilitating use of smaller antennae favored by businesses, but somewhat less reliable due to weather-related impairments; and |

| • | Ka-band—very high power, very narrow beams facilitating use of very small transmit/receive antennae, but less reliable due to high transmission impairments such as rain. The Ka-band is utilized for various applications, including broadband services. |

Substantially all of the station-kept satellites in our fleet are designed to provide capacity using the C- and/or Ku-bands of this spectrum.

A geosynchronous satellite is referred to as geostationary, or station-kept, when it is operated within an assigned orbital control, or station-keeping box, which is defined by a specific range of latitudes and longitudes. Geostationary satellites revolve around the earth with a speed that corresponds to that of the earth’s rotation and appear to remain above a fixed point on the earth’s surface at all times. Geosynchronous satellites that are not station-kept are in inclined orbit. The daily north south motion of a satellite in inclined orbit exceeds the specified range of latitudes of its assigned station-keeping box, and the satellite appears to oscillate slowly, moving above and below the equator every day. An operator will typically operate a satellite in inclined orbit toward the end of its service life because the operator is able to save significant amounts of fuel by not controlling the north-south position of the satellite and is thereby able to substantially extend the service life of the satellite. The types of services and customers that can access an inclined orbit satellite have traditionally been limited due to the movement of the satellite relative to a fixed ground antenna, however, recent technology innovations now allow the use of inclined orbit capacity for certain applications. As a result, we anticipate demand for inclined orbit capacity may increase over the next few years if these applications are successfully introduced. As of December 31, 2009, eleven of our satellites were operating in an inclined orbit, with most continuing to earn revenue beyond our original estimated life for each of these satellites.

In-Orbit Satellites

We believe that our strong operational performance is due primarily to our satellite procurement and operations philosophy. Our operations and engineering staff is involved from the design through the decommissioning of each satellite that we procure. Our staff works at the manufacturers’ and launchers’ sites to monitor progress, allowing us to maintain close technical collaboration with our contractors during the process of designing, manufacturing and launching a satellite. We continue our engineering involvement throughout the operating lifetime of each satellite. Extensive monitoring of earth station operations and around-the-clock satellite control and network operations support ensure our consistent operational quality, as well as timely corrections when problems occur. In addition, we have in place contingency plans for technical problems that may occur during the lifetime of a satellite.

These features also contribute to the resilience of our network, which enables us to ensure the continuity of service that is important for our customers and to retain revenue in the event that we need to move customers to alternative capacity. The design flexibility of some of our satellites enables us to meet customer demand and respond to changing market conditions.

As of December 31, 2009 our in-orbit fleet of satellites had 1,231 and 798 36-MHz equivalent transponders available for transmitting in the C-band and the Ku-band, respectively. These totals measure transponders on station-kept satellites. The average system fill factor for our satellites, which represents the percentage of our total available transponder capacity that is in use or that is reserved at a given time (including guaranteed reservations for service), was 83.1% as of December 31, 2009.

17

Table of Contents

The design life of a satellite is the length of time that the satellite’s hardware is designed by the manufacturer to remain operational under normal operating conditions. In contrast, a satellite’s orbital maneuver life is the length of time the satellite has enough fuel to remain operational. A satellite’s service life is based upon fuel levels and other considerations, including power. Satellites launched in the recent past are generally expected to remain in service for the lesser of maneuver life or 16 years. Satellites typically have enough fuel to maintain between 16 and 18 years of station-kept operations. The average remaining service life of our satellites was approximately 8.1 years as of December 31, 2009 weighted on the basis of nominally available capacity for the station-kept satellites we own.

Planned Satellites

As of December 31, 2009 we had orders for the following nine satellites including the Intelsat New Dawn satellite, of which six are replacement satellites. Generally, these satellites are being built over a period of three years. In the following table, a replacement satellite refers to a planned satellite of which certain customers may have the option of continuity of service between the existing satellite operating at the designated role and the planned satellite.

| Satellite |

Manufacturer |

Role |

Earliest Launch Date |

Expected | ||||

| IS-16 |

Orbital | New satellite originally planned to be a ground spare for IS-11 in the event of an unsuccessful launch. IS-11 was launched successfully. IS-16 will be located at 58°W. | Q1 2010(1) |

Proton | ||||

| IS-17 |

SS/L | Replacement satellite for IS-702 located at 66°E. | Q1 2011 | Sea Launch | ||||

| IS-18 |

Orbital | Replacement satellite for IS-701 located at 180°E. | Q1 2011 | Land Launch | ||||

| IS-19 |

SS/L | Replacement satellite for IS-8 located at 166°E. | Q1 2012 | TBD | ||||

| IS-20 |

SS/L | Replacement satellite for IS-10 and IS-7 co-located at 68.5°E. | Q1 2012 | TBD | ||||

| IS-21 |

Boeing | Replacement satellite for IS-9 located at 302°E. | Q2 2012 | TBD | ||||

| IS-22 |

Boeing | Satellite that includes a specialized UHF communications payload built in connection with an agreement with the Australian Defense Force. To be located at 72°E. | Q1 2012 | TBD | ||||

| IS-23 |

TBD | Replacement satellite for IS-707 located at 307°E. | Q1 2012 | TBD | ||||

| Intelsat New Dawn |

Orbital | New satellite of our New Dawn joint venture expected to serve Africa. To be located at 33°E. | Q4 2010 | Arianespace | ||||

| (1) | IS-16 was launched successfully on February 11, 2010 and is expected to be placed into service in March 2010. |

Launch Services Agreements

During the third quarter of 2008, we entered into a launch services agreement with Sea Launch providing for up to four satellite launches. Sea Launch has recently filed a voluntary petition for relief under Chapter 11 of the Bankruptcy Code. See Item 1A—Risk Factors—Risk Factors Relating to Our Industry—Our dependence on outside contractors could result in increased costs and delays related to the launch of our new satellites, which could in turn adversely affect our business, operating results, liquidity and financial condition.

18

Table of Contents

Future Satellites

We would expect to replace other existing satellites, as necessary, with satellites that meet customer needs and that have a compelling economic rationale. We periodically conduct evaluations to determine the current and projected strategic and economic value of our existing and any planned satellites and to guide us in redeploying satellite resources as appropriate.

Network Operations and Current Ground Facilities

We control and operate each of our satellites and manage the communications services for which each satellite is used from the time of its initial deployment through the end of its operational life, and we believe that our technical skill in performing these critical operations differentiates us from our competition. We provide most of these services from our satellite operations centers in Washington, D.C. and Long Beach, California and our customer service center in Ellenwood, Georgia. In the event of a natural disaster or other situation disabling one of the facilities, each satellite operations center has the functional ability to provide instantaneous restoration of services on behalf of the other, demonstrating the efficiency and effectiveness of our network. Utilizing state-of-the-art satellite command and control hardware and software, our satellite operations centers analyze telemetry from our satellites in order to monitor their status and track their location.

Our satellite operations centers use a network of ground facilities to perform their functions. This network includes 17 earth stations (“TT&C stations”) that provide tracking, telemetry and control (“TT&C”) services for our satellites and various other earth stations worldwide. Through our ground facilities, we constantly monitor signal quality, protect bandwidth from piracy or other interference and maintain customer installed equipment.

Our customer service center located in Ellenwood, Georgia includes a specialized video operations center, data operations center, and rapid access center. This facility is responsible for managing the communications services that we provide to our customers and is the first point of contact for customers needing assistance in using our network. We also maintain a back-up operations facility and data center a relatively short distance from our Washington, D.C. facility in Hagerstown, Maryland. This facility provides back-up emergency operational services in the event that our Ellenwood, Georgia customer service center experiences an interruption.

We have invested heavily in our fully integrated terrestrial network which complements our satellite network. Our network includes teleport, leased fiber and network performance monitoring systems and enables us to provide end-to-end managed solutions to our customers. In addition to leased fiber connecting high-density routes, our ground network also features strategically located points of presence, which are drop-off points for our customers’ traffic that are close to major interconnection hubs for telecommunications applications, video transmissions and trunking to the Internet backbone. We are enhancing our terrestrial network to an all IP network environment that will improve our ground support of high bandwidth applications such as HD video. We believe the CISCO-based network architecture will effectively allow us to converge our media and network services terrestrial network infrastructures, resulting in reduced costs, and will provide opportunities for generating additional revenue from existing and new customers by bundling combinations of media and network services products that can be offered through a single access circuit into our network.

Capacity Sparing and Backup and General Satellite Risk Management

As part of our satellite risk management, we continually evaluate, and design plans to mitigate, the areas of greatest risk within our fleet, especially for those satellites with known technical risks. We believe that the availability of spare transponder services capacity, together with the overlapping coverage areas of our satellites and flexible satellite design features described in —Our Network—Satellite Systems above, are important aspects of our ability to provide reliable service to our customers. In addition, these factors could help us to mitigate the financial impact to our operations attributable to the occurrence of a major satellite anomaly, including the loss of a satellite. Although we do not maintain backup for all of our transponder services operating

19

Table of Contents

capacity, we maintain some form of backup capacity for each satellite designated as being in primary operating service. Our restoration backup capacity may include any one or more of the following:

| • | designated reserve transponders on the satellite or other on-board backup systems or designed-in redundancies, |

| • | an in-orbit spare satellite, or |

| • | interim restoration capacity on other satellites. |

In addition, we provide some capacity on a preemptible basis and could preempt the use of this capacity to provide backup capacity in the event of a loss of a satellite.

We typically obtain launch insurance for our satellites at the time of launch and will decide whether or not to obtain such insurance taking into consideration launch insurance rates, terms of available coverage and alternative risk management strategies, including the availability of backup satellites and transponders in the event of a launch failure. Launch insurance coverage is typically in an amount equal to the fully capitalized cost of the satellite, which generally includes the construction costs, the portion of the insurance premium related to launch, the cost of the launch services and capitalized interest (but may exclude any unpaid incentive payments to the manufacturer).

Five of the satellites in our fleet are covered by in-orbit insurance. In-orbit insurance coverage may initially be for an amount comparable to launch insurance levels, generally decreases over time and is typically based on the declining book value of the satellite. We do not currently insure against lost revenue in the event of a total or partial loss of a satellite.

One of the five insured satellites, Galaxy 13/Horizons-1, was covered by an insurance policy with substantial exclusions or exceptions to coverage for failures of specific components identified by the underwriters as at risk for possible failure, primarily related to XIPS related anomalies (“Significant Exclusion Policies”). The Significant Exclusion Policies reduce the probability of an insurance recovery in the event of a loss on this satellite.

Sales, Marketing and Distribution Channels

Our company tagline, “Closer, by far,” describes the close working relationship we strive to build with our customers. Our Intelsat Global Sales & Marketing Ltd. subsidiary (“Intelsat Global Sales”), located in London, England, is our global sales and marketing headquarters. In addition, we have established local sales and marketing support offices in the following locations around the world:

| • Australia |

• Japan | |

| • Brazil |

• Mexico | |

| • China |

• Singapore | |

| • France |

• South Africa | |

| • Germany |

• United Arab Emirates | |

| • India |

• United States | |

By establishing local offices closer to our customers and staffing those offices with experienced personnel, we believe that we are able to provide flexible and responsive service and technical support to our customers. Our sales and marketing organization reflects our corporate focus on our three principal customer sets of network services, media and government. Our sales team includes technical marketing and sales engineering application expertise and a sales approach focused on creating integrated solutions for our customers’ communications requirements.

We use a range of direct and wholesale distribution methods to sell our services, depending upon the region, applicable regulatory requirements and customer application.

20

Table of Contents

Satellite Health and Technology

Our satellite fleet is diversified by manufacturer and satellite type, and as a result, our fleet is generally healthy, with 99.9998% availability of station-kept satellite capacity during the year ended December 31, 2009. We have experienced some technical problems with our current fleet but have been able to minimize the impact of these problems on our customers, our operations and our business in recent years. Many of these problems have been component failures and anomalies that have had little long-term impact to date on the overall transponder availability in our satellite fleet. All of our satellites have been designed to accommodate an anticipated rate of equipment failures with adequate redundancy to meet or exceed their orbital design lives, and to date, this redundancy design scheme has proven effective. After each anomaly we have generally restored services for our customers on the affected satellite, provided alternative capacity on other satellites in our fleet, or provided capacity that we purchased from other satellite operators.

Significant Anomalies

On January 14, 2005, our IS-804 satellite experienced a sudden and unexpected electrical power system anomaly that resulted in the total loss of the satellite. IS-804 was a Lockheed Martin 7000 series (the “LM 7000 series”) satellite, and as of December 31, 2009 we operated three other satellites in the LM 7000 series, IS-801, IS-802 and IS-805. Of these three satellites, only IS-805 remains in a primary role. Based on the report of the failure review board that we established with Lockheed Martin Corporation, we believe that the IS-804 failure was not likely to have been caused by an IS-804 specific workmanship or hardware element, but was most likely caused by a high current event in the battery circuitry triggered by an electrostatic discharge that propagated to cause the sudden failure of the high voltage power system. We therefore believe that although this risk exists for our other LM 7000 series satellites, the risk of any individual satellite having a similar anomaly is low.

On September 21, 2006, our IS-802 satellite experienced a reduction of electrical power capability that resulted in a degraded capability of the satellite. A substantial subset of transponders on IS-802 were subsequently reactivated and are operating normally. The anomaly review board that we established with Lockheed Martin Corporation to investigate the cause of the anomaly concluded that the IS-802 anomaly was most likely caused by an electrical short internal to the solar array harness located on the south solar array boom. The anomaly review board found that this anomaly was significantly different from previous LM 7000 series spacecraft failures and was the first failure of this type on a solar array of the LM 7000 series. We therefore believe that although this risk exists for our other LM 7000 series satellites, the risk of any individual satellite having a similar anomaly is low.

On November 28, 2004, our Galaxy 27 satellite experienced a sudden anomaly in its north electrical distribution system which resulted in the loss of control of the satellite and the interruption of customer services on the satellite. Galaxy 27 is a FS 1300 series satellite manufactured by SS/L. Our engineers were able to regain command and control of Galaxy 27, and it was placed back in service, with reduced payload capacity, following operational testing. We have determined that the north electrical distribution system on Galaxy 27 and the communications capacity associated with it are not operational, and the satellite has lost redundancy in nearly all of its components. As a result, Galaxy 27 faces an increased risk of loss in the future. As of December 31, 2009, a substantial subset of Galaxy 27’s transponders, which are all powered by the south electrical distribution system, have been tested, are performing normally and are available for service to our customers. Some of these transponders are currently being used by our customers.

On June 29, 2008, our Galaxy 26 satellite experienced a sudden and unexpected electrical distribution anomaly causing the loss of a substantial portion of the satellite power generating capability and resulting in the interruption of some of the customer services on the satellite. Galaxy 26 is also a FS 1300 series satellite. Certain transponders continue to operate normally. However, the anomaly resulted in a reduction to the estimated remaining useful life of the satellite.

With respect to both the Galaxy 27 and Galaxy 26 anomalies, the failure review boards that we established with SS/L identified the likely root cause of the anomalies as a design flaw which is affected by a number of

21

Table of Contents

parameters and in some extreme cases can result in an electrical system anomaly. The design flaw also exists on IS-8. This satellite has been in service since November 1998 and has not experienced an electrical system anomaly. Along with the manufacturer, we continually monitor this problem and we have ordered a replacement for IS-8 expected to be launched in 2012.