Attached files

| file | filename |

|---|---|

| EX-23.1 - EX23-1 AUDITORS CONSENT - MICRON SOLUTIONS INC /DE/ | exhibit23-1.htm |

| EX-32.2 - EX32-2 CERTIFICATION OF CFO SEC906 SOX 2002 - MICRON SOLUTIONS INC /DE/ | exhibit32-2.htm |

| EX-32.1 - EX32-1 CERTIFICATION OF CEO SEC906 SOX 2002 - MICRON SOLUTIONS INC /DE/ | exhibit32-1.htm |

| EX-31.1 - EX31-1 CERTIFICATION OF CEO - MICRON SOLUTIONS INC /DE/ | exhibit31-1.htm |

| EX-31.2 - EX31-1 CERTIFICATION OF CFO - MICRON SOLUTIONS INC /DE/ | exhibit31-2.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM 10-K

[x] Annual report

pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

For the fiscal year ended December 31,

2009

[ ] Transition report pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

001-9731

(Commission

file number)

ARRHYTHMIA

RESEARCH TECHNOLOGY, INC.

(Name

of registrant as specified in its charter)

|

Delaware

(State

or other jurisdiction of incorporation of organization)

|

72-0925679

(IRS

Employer Identification Number)

|

|

25

Sawyer Passway, Fitchburg, MA

(Address

of principal executive offices)

|

01420

(Zip

Code)

|

(978)

345-5000

(Registrant's telephone

number)

Securities

Registered pursuant to Section 12 (b) of the Act:

|

Common

Stock, $.01 par value

(Title

of Each Class)

|

NYSE

AMEX

(Name

of each exchange on which

registered)

|

Securities

Registered Pursuant to Section 12 (g) of the Act:

None

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 if the

Securities Act. Yes No X

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or 15(d) of

the Exchange Act. Yes No X

Indicate by check mark whether the

registrant (1) filed all reports required to be filed by Section 13 or 15(d) of

the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90

days. Yes X No X

Indicate by check mark if disclosure of

delinquent filers in response to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of registrant's knowledge, in

definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Web site if

any, every interactive data file required to be submitted and posted pursuant to

Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such

files). Yes _ No

_

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

Large

Accelerated filer [ ] Accelerated filer

[ ] Non-Accelerated filer

[ ] Smaller reporting company [ X

]

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes __ No X

State the aggregate market value of the

voting and non-voting common equity held by non-affiliates computed by reference

to the price at which the common equity was last sold, or the average bid and

asked price of such common equity, as of the last business day of the

registrant’s most recently completed second fiscal quarter.

$7,409,313.

On March 3, 2010 there were 2,675,481

shares of the issuer's common stock, par value $.01, outstanding, which is the

only class of common or voting stock of the issuer.

DOCUMENTS

INCORPORATED BY REFERENCE

The registrant intends to file a

definitive proxy statement pursuant to Regulation 14A within 120 days of the end

of the fiscal year ended December 31, 2009. Portions of such proxy

statement are incorporated by reference into Part III of this Form

10-K.

|

Arrhythmia

Research Technology, Inc.

|

|||

|

TABLE

OF CONTENTS

|

|||

|

1

|

|||

|

|

7

|

||

|

10

|

|||

|

|

10

|

||

|

11

|

|||

|

|

11

|

||

|

12

|

|||

|

12

|

|||

|

18

|

|||

|

18

|

|||

|

18

|

|||

|

18

|

|||

|

19

|

|||

|

20

|

|||

|

20

|

|||

|

20

|

|||

|

20

|

|||

|

20

|

|||

|

20

|

|||

|

21

|

|||

OVERVIEW

Arrhythmia

Research Technology, Inc., a Delaware corporation ("ART"), is engaged in the

development of medical software, which analyzes electrical impulses of the heart

to detect and aid in the treatment of potentially lethal

arrhythmias. ART’s patented product consists of signal-averaging

electrocardiographic (SAECG) software named the PREDICTOR™

series.

Our SAECG

product is currently used in a National Institutes for Health (“NIH”) funded

investigation into “Risk Stratification in MADIT II Type

Patients”. At the completion of this study and assuming favorable

study results, ART expects to establish additional licensing contracts with

original equipment manufacturers for this product.

Sudden

cardiac death afflicts over 300,000 individuals in the United States each

year. Most sudden cardiac deaths are due to sustained ventricular

tachycardia (abnormally rapid heartbeat) or ventricular fibrillation (very fast,

completely irregular heartbeat). Ventricular late potentials may

indicate a risk of life-threatening ventricular arrhythmias. The

SAECG process enables late potentials to be amplified and enhanced, while

eliminating undesired electrical noise, allowing for clinical interpretation of

that risk. Rather than having a direct sales force, our efforts are

focused on marketing ART’s product through licensing to original equipment

manufacturers. Although, there were no sales or licensing of the

software in 2009 or 2008, ART licensed the PREDICTOR software in early

2010.

ART’s

wholly owned subsidiary, Micron Products, Inc., a Massachusetts corporation

(“Micron”), is a manufacturer and distributor of silver plated and non-silver

plated conductive resin sensors ("sensors") used in the manufacture of

disposable integrated electrodes constituting a part of electrocardiographic

diagnostic and monitoring instruments. Micron also acts as a

distributor of metal snap fasteners ("snaps"), another component used in the

manufacture of disposable electrodes. The sensors are a critical

component of the signal pathway in many different types of disposable

electrodes. For example, the disposable electrodes used to capture

the electric impulses of the heart and enable the analysis of late potentials

require sensors which provide for an accurate, low noise signal to be

transmitted to the monitoring device. Micron also manufactures and

sells or leases electrode assembly machines to its sensor and snap

customers.

| ART’s

wholly owned subsidiary, Micron Products, Inc., a Massachusetts

corporation (“Micron”), is a manufacturer and distributor of silver plated

and non-silver plated conductive resin sensors ("sensors") used in the

manufacture of disposable integrated electrodes constituting a part of

electrocardiographic diagnostic and monitoring instruments. Micron also

acts as a distributor of metal snap fasteners ("snaps"), another component

used in the manufacture of disposable electrodes. The sensors are a

critical component of the signal pathway in many different types of

disposable electrodes. For example, the disposable electrodes used to

capture the electric impulses of the heart and enable the analysis of late

potentials require sensors which provide for an accurate, low noise signal

to be transmitted to the monitoring device. Micron also manufactures and

sells or leases electrode assembly machines to its sensor and snap

customers.

Micron is one

of a few companies providing silver / silver-chloride sensors to the

medical device industry. Micron’s customers manufacture

monitoring and transmitting electrodes which are utilized in a variety of

bio-feedback and bio-stimulation applications including, among many

others, electrocardiograms (ECG’s), electroencephalograms (EEG’s),

electro-muscular stimulation (EMS), and thermo-electrical neural

stimulation (TENS). Micron also produces high volume precision

plastic products. These high volume products leverage the

production skills for the resin sensors while providing a diversification

from the dependence on a single product line. |

|

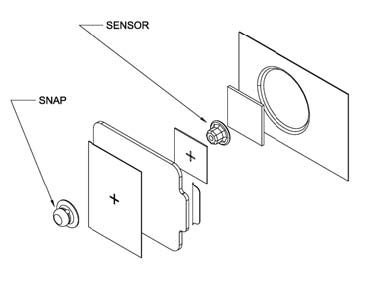

| Figure 1: Schematic of Integrated ECG Electrode |

Micron

Integrated Technologies (“MIT”), a division of Micron formed in January 2006,

specializes in the production of metal and plastic components and assemblies for

the medical and defense industries. In 2009, in order to better

leverage the high quality manufacturing of its New England Molders ("NEM")

division’s plastic production capacity and its Leominster Tool Division’s

(“LTD”) metal machining capabilities, Micron began marketing these divisions as

a complete source of custom manufacturing. The custom manufacturing

arm of Micron, MIT provides its customers with a comprehensive portfolio of

value-added manufacturing, design and engineering services, and complete product

life cycle management: from concept to product development, prototyping, and

volume production.

1

PRODUCTS

The

following table sets forth for the periods specified, the revenue derived from

the products of ART and its subsidiary Micron (collectively the

"Company"):

|

Year

Ended December 31,

|

||||||||||||||||

|

2009

|

%

|

2008

|

%

|

|||||||||||||

|

Sensors

|

$ | 8,837,180 | 42 | $ | 9,398,287 | 42 | ||||||||||

|

Subassembly

and metal component manufacturing

|

7,252,081 | 34 | 7,384,790 | 33 | ||||||||||||

|

Custom

injection molding

|

1,795,490 | 8 | 2,067,213 | 9 | ||||||||||||

|

Custom

manufactured metal medical devices

|

1,568,808 | 7 | 1,186,435 | 5 | ||||||||||||

|

Injection

molding tooling

|

629,595 | 3 | 1,478,970 | 7 | ||||||||||||

|

High

volume precision molded products

|

353,326 | 2 | 507,088 | 2 | ||||||||||||

|

Snaps

and snap machines

|

305,930 | 2 | 203,562 | 1 | ||||||||||||

|

Other

products

|

397,364 | 2 | 255,874 | 1 | ||||||||||||

|

Total

|

$ | 21,139,774 | 100 | $ | 22,482,219 | 100 | ||||||||||

|

|

Sensors

|

Micron is

a manufacturer and distributor of silver-plated and non-silver plated conductive

resin sensors for use in the manufacture of disposable electrodes for ECG

diagnostic, monitoring and related instrumentation. The type of

sensor manufactured by Micron consists of a molded plastic substrate plated with

a silver / silver chloride surface, which is a highly sensitive conductor of

electrical signals. Silver / silver chloride-plated disposable

electrodes are utilized in coronary care units, telemetry units, and for other

monitoring purposes. In addition to the traditional ECG tests,

disposable electrodes incorporating Micron’s sensors are used in connection with

stress tests, holter monitoring, and event recorders.

Micron

also manufactures sensors and conductive plastic studs used in the manufacture

of radio translucent electrodes. The radio translucent conductive

plastic studs are manufactured with uniquely engineered resin to enable

electrical conductivity between the sensor and the recording instrument without

the use of a metal snap. The radio translucent electrodes are

virtually invisible to X-rays and are preferred in some medical environments

such as nuclear medicine, cardiac catheterization laboratories, and certain

stress procedures. Micron also manufactures the mating conductive

resin snaps, which replace traditional metal snap fasteners in the radio

translucent applications.

Other

custom designed sensors are manufactured for specific unique applications in the

EEG, EMG or TENS markets. Recent growth in the volume of highly

engineered EEG sensors reflects the increasing demand for non-invasive measuring

of neurological impulses. Micron’s strength in design and low cost

manufacturing enables customers to grow into unique niche medical applications

and electrophysiological monitoring with custom designed sensors.

|

|

High

Volume Precision Molded Products

|

Micron

also sells high volume precision custom molded component parts. Sales

in these high volume molded products diversify the Company’s existing product

lines while utilizing previously unused manufacturing capacity. To

defray the customer’s upfront tooling costs and remain competitive with global

competition, some high volume customers require the financing of a customer

specific tool over several years. The cost of the tool is guaranteed

by the customer and repaid over time as the molded product is

shipped.

|

|

Snaps

and Snap Machines

|

Metal

Snap Fasteners

Metal

snap fasteners are used as an attachment and conductive connection between the

disposable electrode and the lead wires of an ECG machine. Micron

purchases the metal snap fasteners for resale from multiple suppliers and

performs additional quality assurance tests, repackages and stocks these snap

fasteners for its customers who purchase the snaps in addition to Micron’s

sensors.

2

High

Speed Electrode Assembly Machine

Certain

manufacturers of disposable medical electrodes use the Company’s attaching

machines in the assembly of sensors and snaps into disposable

electrodes. Manufacturing, leasing, selling, and providing

replacement parts to medical sensor and snap application machines provides

Micron with a complementary product to sell to existing sensor and snap

customers. As a value added service, a technician can be dispatched

to troubleshoot and improve the performance of the customers’ fully automated

electrode assembly production lines.

|

|

Other

Products and Services

|

Custom

Injection Molding

The

diversification of custom molding has increased production flexibility, and

dramatically expanded the capability to produce an increased size and complexity

of products. From consumable medical products to medical equipment

components, the MIT division has decreased Micron’s dependence on sensor

production for manufacturing growth. In order to leverage the

division’s thermoplastic injection molding capabilities, the division has

expanded into other value added services including packaging, assembly with

outsourced and internally produced metal components, clean room manufacturing,

and specialty coatings.

Defense

industry subassembly and metal component manufacturing

The MIT

division’s product life cycle management program is focused on the integration

of plastic and metal components into subassemblies. The value added

service of in house production capabilities combined with a network of

subcontracted specialty coatings, metallurgical treatments, and unique

production capabilities has diversified this product line to include defense

industry consumables and equipment subassemblies.

Injection

Molding Tooling

The

design, manufacture, and rehabilitation of injection molding tools for the

customer is part of the service package provided by the MIT

division. The division also provides cost savings to Micron by

vertically integrating mold making and repair into the structure of Micron’s

sensor and custom injection molding businesses. The Company’s

engineers and mold designers work with customers’ product development engineers

to design and produce unique tooling for their products. MIT’s

expertise in cost effective manufacturing creates a sustainable partnership with

the customers as prototyped parts move to full scale production. The

design and manufacture of tooling is a leading indicator of future product

revenue. The division continues to generate revenues from other

customers for similar industrial applications such as metal die casting molds,

investment casting wax molds, and thermoplastic injection/extrusion blow

molds.

Custom

Manufactured Metal Medical Devices

A climate

controlled medical machining cell was built for the custom computer aided design

and computer controlled metal machining of patient specific orthopedic medical

device components. The manufacturing space includes a machine

programming office with the latest technology in computer programming for 5-axis

machining with Computer Numerical Controlled (CNC) vertical milling machines and

a state of the art 5-axis machining center. These products involve

complex machining of wrought and cast cobalt-chromium-molybdenum alloy as well

as high molecular weight polymers into unique customized products. No

two components are identical and require precision manufacturing verified by

complex computer controlled automated coordinate measuring equipment that

measure up to 25 points per square inch. Additional capabilities

added to the cell include laser marking, passivation, automated polishing, and

ultra-sonic cleaning. The space can accommodate a 50% increase in

manufacturing capacity before reaching any physical constraints.

Signal-Averaging

Electrocardiographic (SAECG) Products - PREDICTOR™

In early

2010, the Company successfully converted its proprietary signal-averaged

electrocardiography (SAECG) software, PREDICTOR, that operates on a single

hardware based electrocardiogram acquisition platform, ART 1200-EPX, to a

customizable modular software product that is compatible with a variety of

hardware platforms. The conversion allows PREDICTOR to be used with

customer-specific electrocardiogram acquisition equipment to generate the

signal-averaged ECG analysis. The software can be customized to

interface with a variety of Original Equipment Manufacturer (“OEM”)

hardware. OEM customers can license PREDICTOR and bundle it with

other cardiac diagnostic software packages incorporated in their acquisition

equipment.

3

PREDICTOR

utilizes the unique, patented and proprietary algorithms which have been defined

as the “Standard” by the joint AHA/ACC/ESC task force on Signal-Averaging

Electrocardiography1. PREDICTOR is also capable of

incorporating additional signal processing capabilities included in the

Company’s software library for clinical research. This library

includes IntraSpect, a module that permits detection of ventricular late

potentials in patients with Bundle Branch Block, P-wave signal averaging which

helps predict patients at risk for atrial fibrillation and flutter and a Heart

Rate Variability module.

PREDICTOR

is currently being used in a NIH funded investigation into “Risk Stratification

in MADIT II Type Patients”. The primary objectives of this study

are: 1. To evaluate the predictive value of a multivariate model

consisting of pre-specified clinical and ECG parameters for predicting

arrhythmic events in Multicenter Automatic Defibrillator Implantation Trial II

(“MADIT II”) type post-infarction patients; 2. To develop

a multivariate risk-stratification model, based on a broader spectrum of

pre-specified clinical covariates and ECG parameters, and from it a risk-scoring

algorithm identifying high-risk and low-risk patient groups; this algorithm will

be validated by a cross-validation study. Such an algorithm will

enable an ordering of patients who may benefit most, and benefit least, from

implantable cardiac defibrillator (“ICD”) therapy. Results from this

investigation are expected in late 2011.

GENERAL

|

|

Customers

and Sales

|

During

the year ended December 31, 2009, there were three major customers, each of

which accounted for over 10% of the Company’s sales and a loss of this base may

have a material adverse effect on results. The three largest

customers accounted for 23%, 16%, and 12% of sales in 2009 as compared to 27%,

17%, and 12% of sales for the year ended December 31, 2008.

Micron

manufactures its sensors against purchase orders from electrode

manufacturers. The Company is aware of approximately 20 significant

manufacturers of disposable snap type, radio translucent and pre-wired

electrodes worldwide. Micron sells its sensors to most of these

manufacturers. Sales backlog is not material to Micron’s sensor

business due to the method of ordering employed by its customer base in this

competitive industry. Customers generally purchase on a single

purchase order basis without long-term commitments.

The

majority of the MIT divisions’ customers for injection molded thermoplastic

products are from the medical equipment, medical device and defense

industries. From single use medical or defense consumable products to

equipment components, the engineered production services provide quality design

and production capabilities which exceed the customers’ manufacturing

requirements. Certain customers require that an inventory of their

products be maintained at all times to enable just in time delivery

schedules. A commitment from customers is required by MIT to maintain

the higher level of finished goods inventory and raw material required for their

products. These agreements allow for a more flexible manufacturing

schedule with longer more cost effective production cycles. MIT’s

primary target customer is a medical product or device, defense related

contractor, manufacturer, or development company with a need for complete

product life cycle management from design to full production preferably

combining multiple manufacturing technologies such as plastic injection molding,

metalworking, assembly, and packaging.

The

following table sets forth, for the periods indicated, the approximate

consolidated revenues and percentages of revenues derived from the sales of all

of the Company's products in its geographic markets:

|

Revenues

for the Years Ended December 31,

|

||||||||||||||||

|

2009

|

%

|

2008

|

%

|

|||||||||||||

|

United

States

|

$ | 12,937,615 | 61 | $ | 13,290,098 | 59 | ||||||||||

|

Canada

|

3,684,087 | 17 | 5,118,913 | 23 | ||||||||||||

|

Europe

|

2,644,727 | 13 | 3,091,326 | 14 | ||||||||||||

|

Pacific

Rim

|

818,866 | 4 | 426,764 | 2 | ||||||||||||

|

Other

|

1,054,479 | 5 | 555,118 | 2 | ||||||||||||

|

Total

|

$ | 21,139,774 | 100 | $ | 22,482,219 | 100 | ||||||||||

While

some risks exist in foreign markets, the vast majority of the Company’s

customers are based in historically stable markets. To reduce the

risks associated with foreign shipment and currency exchange fluctuations, the

title to most of the products are transferred to the customers when shipped, and

payment is required in U.S. Dollars.

(1)

AHA/ACC/ESC Policy Statement: "Standards for the Analysis of Ventricular Late

Potentials Using High Resolution or Signal-Averaged Electrocardiography: A

Statement by a Task Force Committee of the European Society of Cardiology, the

American Heart Association and the American College of Cardiology. JACC Vol. 17,

No. 5, April 1991:999-1006

4

To help

offset the risk from fluctuations in the market price of silver, sensor

customers have generally been subject to a silver surcharge or discount based on

the market price of silver at the time of shipment. The Company is

sensitive to the impact of recent increases in silver cost, and continues to

explore options with the sensor customers to help mitigate the resulting

increases in surcharges.

|

|

Marketing

and Competition

|

Micron

sells its sensors to large, sophisticated OEM manufacturers of disposable snap

type and radio translucent ECG electrodes who compete internationally in the

electrode market against other OEM manufacturers as well as manufacturers of

tab-type electrodes. The Company has one major domestic competitor in

the sensor market along with an increasing number of minor competitors

worldwide. The sensor and snap market is extremely price sensitive

and barriers to entry are relatively low. The Company competes with

respect to its sensor products on the basis of pricing, technical capabilities,

quality of service and ability to meet customer requirements. With no

import restrictions, the Company’s foreign competitors with excess capacity can

be expected to expand sales in the U.S. In addition, many of the

major OEM customers, although not currently manufacturing silver-silver chloride

sensors, have the ability to do so with modest investment.

The

Company markets Micron and its MIT division as a highly specialized custom

injection thermoplastic molder to new and existing customers. The

Company believes it competes effectively based on its expertise in low cost

manufacturing of high volume precision products. The complex medical

products produced by the MIT division have expanded the existing customer base

and extensively diversified the product mix. It is the Company’s

intention to continue these efforts to market to the expanded customer base and

further diversify the product offerings. Global competition creates a

highly competitive environment. To meet this challenge, the MIT

division focuses its product development efforts on complex close tolerance

products not readily outsourced to offshore manufacturing. The

Company’s recent ISO 13485:2003 registration, the international quality standard

for medical devices, qualifies the Company to further expand into medical

products. The Company expects to become competitive in more markets

after completion of its registration as a U.S. Food and Drug Administration

(FDA) manufacturing facility in 2010. The Company’s International

Traffic in Arms Regulation (ITAR) registration with the US State Department

allows the Company to compete in defense applications restricted by export

controls and the Department of Defense.

After

success in early 2010, management is currently pursuing licensing arrangements

of its proprietary signal-averaged electrocardiography (SAECG) software,

PREDICTOR, to other Original Equipment Manufacturers for integration into

existing cardio diagnostic equipment. As previously stated, the SAECG

product is currently used in a NIH funded investigation into “Risk

Stratification in MADIT II Type Patients”.

|

|

Product

Suppliers and Manufacturing

|

Micron

manufactures its sensors at its Fitchburg, Massachusetts facility employing a

proprietary non-patented multi-step process. All employees sign

confidentiality agreements to protect this proprietary process. The

raw materials used by Micron are plastic resins used to mold the substrates and

silver-silver chloride chemical solutions for plating the molded plastic

substrates. Both the resins and the chemicals involved in the

silver-silver chloride process are available in adequate supply from multiple

commodity sources. As insulation against unanticipated price

increases, some resins and chemicals used in the production of sensors are

purchased in large quantities to lower or stabilize prices.

Resins

used by the MIT division are purchased for an individual customer order, with

most increases in resin costs passed on to the customer as orders are

acknowledged. Because the customer order determines the quantity of

material required, customers may, and have, guaranteed the purchase of specific

large quantities of product which allows the division to purchase raw material

at a more favorable cost thereby lowering the final cost to the

customer. The metal alloys are subject to the same customer order

limitations, and prices are fixed as the customer guarantees an

order.

Micron

distributes medical grade nickel-plated brass and stainless steel snap fasteners

purchased from multiple domestic and international sources. Micron

buys these snaps in bulk, performs additional quality assurance tests, and

stocks inventory to facilitate just-in-time shipments to its

customers. This business segment has decreased significantly in

revenue as price pressure has forced metal snap customers to buy direct from the

manufacturer to remain competitive.

The

Company’s 116,000 square foot manufacturing facilities are ITAR, ISO 9001:2001

and 13485:2003 registered. Micron’s injection molding machines

capacity ranges from 15 to 300 tons and includes a class 10,000 clean room used

for processes sensitive to environmental particulates. In addition,

this facility includes a climate-controlled space for the manufacture of metal

medical devices utilizing the latest in 5-axis CNC technology.

5

|

|

Inventory

Requirements

|

Larger

customers benefit from the Company’s ability to maintain an inventory of

standard sensors and snaps. This inventory policy allows for

predictable and planned production resulting in cost efficiencies that help to

offset price erosion in the marketplace.

Custom

manufactured product is completed on an order by order

basis. Finished goods inventory is product made in advance of an

acknowledged sales order, part of an annual blanket order quantity, or for a

specific safety stock requested by the customer.

|

|

Research

and Development

|

ART's

research and development efforts focus primarily on maintaining the software

library in the SAECG product lines in a compatible platform. The

Company continues to provide technical support to the NIH’s research project

utilizing ART’s software. Included in this expense is development

work to verify the integrity of the analytical algorithms, and improve the

stability and ease of customization of the software to be compatible with

various hardware and software platforms. For the fiscal years ended

December 31, 2009 and 2008, ART had research and development expenses

of approximately $21,527 and $69,779, respectively.

In 2009

and 2008, Micron’s research and development efforts resulted in $219,967 and

$250,261 of expense. These efforts include the development of a

unique process to eliminate certain hazardous materials from the manufacturing

processes. The 2008 expense included $52,000 for equipment tested in

a process improvement project for the sensor product line as well as the

impairment of equipment used for final product

testing. .

|

|

Patents

and Proprietary Technology

|

ART

acquired three patents related to time and frequency domain analysis of

electrocardiogram signals including U.S. Patent No. 5,117,833 entitled “Bi-Spectral Filtering of

Electrocardiogram Signals to Determine Selected QRS Potentials,” (the

“Bi-Spec Patent”) in 1993. These technologies are utilized in the

current version of PREDICTOR. In March 1997, the U.S. Patent Office

granted United States Patent No. 5,609,158 entitled “Apparatus and Method for Predicting

Cardiac Arrhythmia, by Detection of Micropotentials and Analysis of all ECG

Segments and Intervals” which covers a frequency domain analysis

technique for SAECG data.

The

Company believes that ART's products do not and will not infringe on patents or

violate proprietary rights of others. In the event that ART's

products infringe patents or proprietary rights of others, ART may be required

to modify the design of its products or obtain a license. There can

be no assurance that ART will be able to do so in a timely manner upon

acceptable terms and conditions. In addition, there can be no

assurance that ART will have the financial or other resources necessary to

enforce or defend a patent infringement or proprietary rights violation

action. Moreover, if ART's products infringe patents or proprietary

rights of others, ART could, under certain circumstances, become liable for

damages, which could have a material adverse effect on earnings.

Micron

employs a highly complex, proprietary non-patented multi-step manufacturing

process for its silver / silver chloride-plated sensors. To

maintain trade secrets associated with the manufacture of disposable electrode

sensors, all employees are required to sign non-disclosure and/or

non-competition agreements. Micron uses a patented material in the

production of some sensors. Micron paid $2,966 in 2009, and $4,288 in

2008 in royalties associated with this patent.

|

|

Government

Regulation

|

ART’s

software products are subject to, and ART believes currently comply with,

material clearance and distribution requirements from governmental regulatory

authorities, principally the FDA and the European Union (EU) equivalent

agency. These agencies promulgate quality system requirements under

which a medical device is to be developed, validated and

manufactured. The development of the product line will be managed in

accordance with applicable regulatory requirements.

Micron’s

sensor elements are components used in medical devices designed and manufactured

by original equipment manufacturers. As such, these elements are not

required to be listed with regulatory agencies and do not require regulatory

clearance for distribution. However, because Micron primarily

distributes sensors to manufacturers for use in finished medical devices, Micron

exercises as stringent controls over its manufacturing processes and finished

products as would be required if the sensors were considered medical

devices.

6

The MIT

division manufactures parts for invasive medical devices, components for medical

equipment, patented disposable medical laboratory products, and patented

military applications. Customers own the product designs and are,

therefore, subject to FDA, Department of Defense and EU

regulations. While such products are a part of a medical device or

other regulated equipment, customers are the regulated entity for the clearance

of those products. MIT exercises stringent controls over all their

manufacturing operations, and complies with any special controls required by

their customers.

|

|

Environmental

Regulation

|

Micron’s

operations involve use of hazardous and toxic materials, and generate hazardous,

toxic and other wastes. Its operations are subject to federal, state

and local laws and regulations governing the use, storage, handling and disposal

of such materials and certain waste products. Although management believes that

the safety procedures for using, handling, storing and disposing of such

materials comply with these standards required by state and federal laws and

regulations, the Company cannot completely eliminate the risk of accidental

contamination or injury from these materials.

Since its

inception, Micron has expended significant funds to train its personnel, install

waste treatment and recovery equipment and to retain an independent

environmental consulting firm to regularly review, monitor and upgrade its air

and waste water treatment activities. Management continues to

evaluate and test many possible technological advances that reduce or eliminate

the need for and use of hazardous materials in the manufacturing

processes. The acquisition of equipment to eliminate a hazardous

chemical from the process further emphasizes the commitment to the reduction and

elimination of certain hazardous processes. Costs of compliance are

not currently material to the Company’s operation. Micron believes

that the operation of its manufacturing facility is in compliance with currently

applicable safety, health and environmental laws and regulations.

|

|

Employees

|

As of

December 31, 2009, the Company had 89 full-time and 4 part-time

employees. The employees of the Company are not represented by a

union, and the Company believes its relationship with the employees is

satisfactory.

|

|

Periodic

Reporting and Financial Information

|

The

Company registered its common stock under the Securities Exchange Act of 1934,

as amended, or the Exchange Act, and have reporting obligations, including the

requirement that we file annual and quarterly reports with the

SEC. The public may read and copy materials the Company files with

the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC

20549, on official business days during the hours of 10:00 am to 3:00

pm. You may obtain information about the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. The SEC

maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically

with the SEC at http://www.sec.gov.

In

addition to the other information in this Form 10-K, the following factors

should be considered in evaluating the Company and its business. The

risks and uncertainties described below are not the only ones facing the

Company. Additional risks and uncertainties that the Company does not

presently know or currently deems immaterial may also impair the Company’s

business, results of operations and financial condition.

The

Company’s operating results may fluctuate significantly as a result of a variety

of factors.

The

Company’s operating results may fluctuate significantly in the future as a

result of a variety of factors, many of which are outside of our

control. These factors include:

|

·

|

the

ability to maintain the current pricing model and/or decrease the cost of

sales;

|

|

·

|

the

ability to increase sales of higher margin

products;

|

|

·

|

variations

in the mix of products sold;

|

|

·

|

the

level of demand for our products and services and those that the Comapny

may develop or acquire;

|

|

·

|

volatility

in commodity and energy prices and the ability to offset higher costs with

price increases;

|

|

·

|

variability

of customer delivery requirements;

|

|

·

|

continued

availability of supplies or materials used in manufacturing at competitive

prices;

|

|

·

|

the

amount and timing of investments in capital equipment, sales and

marketing, engineering and information technology resources;

and

|

|

·

|

general

economic conditions.

|

7

As a

strategic response to changes in the competitive environment, the Company may

from time to time make certain pricing, service, technology or marketing

decisions or business or technology acquisitions that could have a material

adverse effect on the quarterly and annual results. Due to all of

these factors, the operating results may fall below the expectations of

securities analysts, stockholders and investors in any future

period.

Large

OEM customers can change their demand on short notice, further adding to the

unpredictability of the quarterly sales and earnings.

The

quarterly results have in the past and may in the future vary due to the lack of

dependable long-term demand forecasts from the larger OEM

customers. In addition to this risk, many of the Company’s OEM

customers have the right to change their demand schedule, either up or down,

within a relatively short time horizon. These changes may result in

the Company incurring additional working capital costs and causing increased

manufacturing expenses due to these short-term fluctuations. In

particular, the quarterly operating results have in the past fluctuated as a

result of some of the larger OEM customers changing their orders within a fiscal

quarter. The expense levels and inventory, to a large extent, are

based on shipment expectations in the quarter. If sales levels fall

below these expectations, through a delay in orders or otherwise, operating

results are likely to be adversely affected. Although the Company

continues to attempt to lessen the dependency on a few large customers, it can

provide no assurance that it will be able to materially alter this dependency in

the immediate future, if at all.

A

significant portion of our revenues are derived from the sale of a single

product line.

In fiscal

years 2009 and 2008, the Company derived 42% of its revenues from medical

electrode sensors for use in disposable electrodes. While the

technology in electrode sensors has been used for many years, there is no

assurance that a new patented or unpatented technology might not replace the

existing disposable electrode sensors. Any substantial technological

advance that eliminates the Company’s products will have a material adverse

effect on the operating results.

The

Company is dependent on a limited number of customers.

In the

fiscal years 2009 and 2008, 51% and 56%, respectively, of the Company’s revenues

were derived from individual customers with 10% or more of the total

sales. The loss of any one or more of these customers might have an

immediate significant adverse effect on our financial results. In an

effort to maintain this customer base, more favorable terms than might otherwise

be agreed to could be granted. Currently, the Company generally does

not receive purchase volume commitments extending beyond several months. Large

corporations can shift focus away from a need for the Company’s products with

little or no warning.

Failure

to comply with Quality System Regulations or industry standards could result in

a material adverse effect on the business and results of

operations.

The

Company’s Quality Management System complies with the requirements of ISO

9001:2000 and ISO 13485:2005. If the Company were not able to comply

with the Quality Management System or industry-defined standards, the Company

may not be able to fill customer orders to the satisfaction of the

customers. Failure to produce products compliant with these standards

could lead to a loss of customers which would have an adverse impact on the

business and results of operations.

If

trade secrets are not kept confidential, the secrets may be used by others to

compete against the Company.

Micron

relies on unpatented trade secrets to protect its proprietary processes and

there are no assurances that others will not independently develop or acquire

substantially equivalent technologies or otherwise gain access to the

proprietary process. Ultimately the meaningful protection of such

unpatented proprietary technology cannot be guaranteed. The Company

relies on confidentiality agreements with its employees. Remedies for

any breach by a party of these confidentiality agreements may not be adequate to

prevent such actions. Failure to maintain trade secret protection,

for any reason, could have a material adverse effect on the

Company.

The

initiatives that the Company is implementing in an effort to improve our

manufacturing productivity could be unsuccessful, which could harm its business

and results of operations.

In an

effort to improve manufacturing productivity, the Company has implemented

several strategic initiatives focusing on improving the manufacturing processes

and procedures. Management believes these initiatives should improve

customer satisfaction as well as revenue and income. However, in the

event these initiatives are not successful, due to systemic failure to fully

embrace the concepts and maximize the benefits of the investments of equipment

and technology, the results of operations will not improve as

expected.

8

If

the Company is unable to keep up with rapid technological changes, the

processes, products or services may become obsolete and

unmarketable.

The

medical device and medical software industries are characterized by

technological change over time. Although the Company attempts to

expand technological capabilities in order to remain competitive, discoveries by

others may make the Company’s processes or products obsolete. If the

Company cannot compete effectively in the marketplace, the potential for

profitability and financial position will suffer.

General

economic conditions, largely out of the Company’s control, may adversely affect

the Company’s financial condition and results of operations.

The

Company’s business may be affected by changes in general economic conditions,

both nationally and internationally. Recessionary economic cycles,

higher interest rates, higher fuel and other energy costs, inflation, higher

levels of unemployment, changes in the laws or industry regulations or other

economic factors may adversely affect the demand for the Company’s

products. Additionally, these economic factors, as well as higher tax

rates, increased costs of labor, insurance and healthcare, and changes in other

laws and regulations may increase the Company’s cost of sales and operating

expenses, which may adversely affect the Company’s financial condition and

results of operations.

The

Company is subject to stringent environmental regulations.

The

Company is subject to a variety of federal, state and local requirements

governing the protection of the environment. These environmental

regulations include those related to the use, storage, handling, discharge and

disposal of toxic or otherwise hazardous materials used in or resulting from the

Company’s manufacturing processes. Failure to comply with

environmental law could subject the Company to substantial liability or force us

to significantly change our manufacturing operations. In addition,

under some of these laws and regulations, the Company could be held financially

responsible for remedial measures if its properties are contaminated, even if it

did not cause the contamination.

A

product liability suit could adversely affect our operating

results.

The

testing, manufacture, marketing and sale of medical devices of the customers

entail the inherent risk of liability claims or product recalls. If the

customers are involved in a lawsuit, it is foreseeable that the Company would

also be named. Although the Company maintains product liability

insurance, coverage may not be adequate. Product liability insurance is

expensive, and in the future may not be available on acceptable terms, if at

all. A successful product liability claim or product recall could have a

material adverse effect on the business, financial condition, and ability to

market product in the future.

The

Company could become involved in litigation over intellectual property

rights.

The

medical device industry has been characterized by extensive litigation regarding

patents and other intellectual property rights. Litigation, which would likely

result in substantial cost to us, may be necessary to enforce any patents issued

or licensed to us and/or to determine the scope and validity of others'

proprietary rights. In particular, competitors and other third

parties hold issued patents, which may result in claims of infringement against

the Comapny or other patent litigation. The Company also may have to

participate in interference proceedings declared by the United States Patent and

Trademark Office, which could result in substantial cost, to determine the

priority of inventions.

The

Company may make acquisitions of companies, products or technologies that may

disrupt the business and divert management’s attention, adversely impacting our

results of operations and financial condition.

The

Company may make acquisitions of complementary companies, products or

technologies from time to time. Any acquisitions will require the

assimilation of the operations, products and personnel of the acquired

businesses and the training and motivation of these

individuals. Management may be unable to maintain and improve upon

the uniform standards, controls, procedures and policies if the Company fails in

this integration. Acquisitions may cause disruptions in operations

and divert management’s attention from day-to-day operations, which could impair

our relationships with current employees, customers and strategic

partners. The Company also may have to, or choose to, incur debt or

issue equity securities to pay for any future acquisitions. The

issuance of equity securities for an acquisition could be substantially dilutive

to our stockholders’ holdings. In addition, profitability may suffer

because of such acquisition-related costs or amortization costs for other

intangible assets. If management is unable to fully integrate

acquired businesses, products, technologies or personnel with existing

operations, the Company may not receive the intended benefits of such

acquisitions. The Company is not currently party to any agreements,

written or oral, for the acquisition of any company, product or

technology.

9

Healthcare

policy changes, including pending proposals to reform the U.S. healthcare

system, may have a material adverse effect on the results.

Healthcare

costs have risen significantly over the past decade. There have been

and continue to be proposals by legislators, regulators and third-party payers

to keep these costs down. Certain proposals, if passed, would impose

limitations on the prices we will be able to charge for our products, or the

amounts of reimbursement available for our products from governmental agencies

or third-party payers. These limitations could have a material

adverse effect on the Company’s financial position and results of

operations.

Changes

in the health care industry in the U.S. and elsewhere could adversely affect the

demand for the products as well as the way in which the Company conducts

business. Significantly, the new administration and Congressional and

state leaders have expressed a strong desire to reform the U.S. healthcare

system. Recently, President Obama and members of Congress have

proposed significant reforms. On November 7, 2009, the House of

Representatives passed and, on December 24, 2009, the Senate passed health

reform legislation which if enacted would require most individuals to have

health insurance, establish new regulations on health plans, create insurance

pooling mechanisms and a government health insurance option to compete with

private plans, and other expanded public health care measures. This

legislation also would reduce Medicare spending on services provided by

hospitals and other providers and the House bill proposes a 2.5 percent tax on

the first taxable sale of any medical device. The Senate bill

included a $2 billion annual fee or excise tax on the medical device

manufacturing sector. If the excise taxes are enacted into law, the

Company’s results of operations may be materially and adversely

affected.

The

Company may be exposed to potential risks relating to internal control over

financial reporting and the ability to have those controls attested to by the

independent registered public accounting firm.

As

directed by Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX 404”), the

Securities and Exchange Commission adopted rules requiring public companies to

include a report of management on the Company’s internal control over financial

reporting in their annual reports, including Form 10-K. In addition,

the independent registered public accounting firm auditing a company’s financial

statements must also attest to and report on the Company’s assessment of the

effectiveness of the company’s internal control over financial reporting as well

as the operating effectiveness of the company’s internal

controls. The Company was subject to the management evaluation and

review portion of these requirements for the fiscal year ended December 31,

2009. Management is evaluating the Company’s internal control systems

in order to allow the independent auditors attest to, management’s internal

controls, as a required part of the Annual Report on Form 10-K beginning with

the report for the fiscal year ended December 31, 2010.

In the

event the Company no longer qualifies as a smaller reporting company at the end

of 2010, it may be subject to more stringent requirements under SOX

404. Accordingly, there can be no assurance that the Company will

receive any required attestation from the independent registered public

accounting firm. In the event the independent register public

accounting firm identifies significant deficiencies or material weaknesses in

the Company’s internal controls that management cannot remediate in a timely

manner or is unable to receive an attestation from the independent registered

public accounting firm with respect to the Company’s internal controls,

investors and others may lose confidence in the reliability of the financial

statements and the Company’s ability to obtain equity or debt financing could

suffer.

None

The

manufacturing facility and offices of the Company are located in two buildings

in an industrial area in Fitchburg, Massachusetts. The first

building, which was purchased in April 1994, consists of a 22,000 square foot,

six story building. The second building, which was purchased in

September 1996, is over 94,000 square feet, including an antique brick three

story mill building. Commencing in 2003, the 40,000 square foot

“Mill” building portion of the second building underwent major renovations to

preserve and create functional space from a previously unusable section of the

facility. The renovations created space currently occupied by the MIT

division. From October 2006 to February 2007, a third building of

approximately 40,000 square feet, a fourth building of 12,000 square feet and

vacant parcel between the buildings that abut the complex were acquired without

any specific requirement for space. The Company believes the

acquisition of the adjacent property positions the Company for continued growth

in its current location. The Company believes its current facilities

are sufficient to meet current and future production needs through fiscal year

ending December 31, 2010.

10

The

Company is from time to time subject to legal proceedings, threats of legal

action and claims which arise in the ordinary course of our

business. Management believes the resolution of these matters will

not have a material adverse effect on the results of operations or financial

condition.

|

|

ART's

Common Stock has been listed on the NYSE AMEX, formerly the American Stock

Exchange, since March 3, 1992 and trades under the ticker symbol

HRT.

The

following table sets forth, for the period indicated, the high and low sale

prices per share for ART's Common Stock as quoted by the NYSE AMEX.

|

High

|

Low

|

|||||||

|

Year

Ended December 31, 2009

|

||||||||

|

1st

Quarter

|

$ | 2.65 | $ | 1.38 | ||||

|

2nd

Quarter

|

3.46 | 2.10 | ||||||

|

3rd

Quarter

|

4.60 | 2.61 | ||||||

|

4th

Quarter

|

4.84 | 3.26 | ||||||

|

Year

Ended December 31, 2008

|

||||||||

|

1st

Quarter

|

$ | 9.30 | $ | 5.00 | ||||

|

2nd

Quarter

|

7.00 | 5.40 | ||||||

|

3rd

Quarter

|

6.03 | 3.25 | ||||||

|

4th

Quarter

|

3.98 | 1.70 | ||||||

As of

March 1, 2010 the number of record holders of ART's common stock is estimated to

be 300 not including beneficial holders of our common stock held in street

name.

|

|

Dividend

Policy

|

No

dividends were declared in 2009 or 2008.

On

January 15, 2010, the Board of Directors declared a cash dividend of $0.06 per

share. The dividend was paid March 1, 2010.

Future

determination as to the payment of cash dividends, if any, will be at the

discretion of the Board of Directors and will be dependent upon the Company’s

financial condition, results of operations, capital requirements, potential

acquisitions, and other such factors as the Board of Directors may deem

relevant, including any restrictions under any credit facilities in place now or

in the future. The Company's demand line of credit agreement contains

conditions including prior notification of the payment of

dividends.

Equity

Compensation Plan Information

The

following table provides information, as of December 31, 2009, with respect to

our equity compensation plans:

|

Plan

Category

|

Number

of securities to be issued upon exercise of outstanding options, warrants

and rights

|

Weighted-average

exercise price of outstanding options, warrants and rights

|

Number

of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in column

(a))

|

|

(a)

|

(b)

|

(c)

|

|

|

Equity

compensation plans approved by security holders

|

179,000

|

$ 9.29

|

268,000

(1)

|

|

Equity

compensation plans not approved by security holders

|

-

|

-

|

-

|

|

Total

|

179,000

|

$ 9.29

|

268,000

(1)

|

|

(1)

|

Includes

168,000 shares available under the 2001 Stock Option Plan and 100,000

shares available under the 2005 Stock Award

Plan.

|

11

Recent

Sales of Unregistered Securities

None

|

|

Purchases

of Equity Securities

|

On

October 3, 2008, our Board of Directors authorized the repurchase in the open

market from time to time of up to $650,000 of our common

stock. Repurchases totaling 12,810 and 23,389 shares were made in

2009 and 2008, respectively, for a total cost of $33,188 and

$53,975. No repurchases were made during the fourth quarter of

2009.

The Company’s purchases are subject to

trading restrictions including average volume of shares traded over the previous

four weeks, which greatly reduced our ability to repurchase shares.

Not Applicable

The

following discussions of the Company’s results of operations and financial

condition should be read in conjunction with the consolidated financial

statements and notes pertaining to them that appear elsewhere in this Form

10-K.

Any

forward-looking statements made herein are based on current expectations of the

Company that involve a number of risks and uncertainties and should not be

considered as guarantees of future performance. These statements are

made under the Safe Harbor Provisions of the Private Securities Litigation

Reform Act of 1995. Forward looking statements may be identified by

the use of words such as “expect,” “anticipate,” “believe,” “intend,” “plans,”

“predict,” or “will”.

Although

the Company believes that expectations are based on reasonable assumptions,

management can give no assurance that the expectations will

materialize. Many factors could cause actual results to differ

materially from our forward looking statements. Several of these

factors include, in addition to those contained in “Factors that may affect

future operating results,” without limitation:

|

·

|

the

ability to maintain our current pricing model and/or decrease the cost of

sales;

|

|

·

|

a

stable interest rate market and/or a stable currency rate environment in

the world, and specifically the countries where the Company is doing

business in or plans to do business

in;

|

|

·

|

continued

availability of supplies or materials used in manufacturing at competitive

prices;

|

|

·

|

volatility

in commodity and energy prices and the Company’s ability to offset higher

costs with price increases;

|

|

·

|

adverse

regulatory developments in the United States or any other country the

Company plans to do business in;

|

|

·

|

entrance

of competitive products in the Company’s

markets;

|

|

·

|

the

ability of management to execute plans and motivate personnel in the

execution of those plans;

|

|

·

|

no

adverse publicity related to the Company and or its

products;

|

|

·

|

no

adverse claims relating to the Company’s intellectual

property;

|

|

·

|

the

adoption of new, or changes in, accounting

principles;

|

|

·

|

the

passage of new, or changes in, regulations; legal

proceedings;

|

|

·

|

the

ability to maintain compliance with the NYSE AMEX requirements for

continued listing of the common

stock;

|

|

·

|

the

costs inherent with complying with statutes and regulations applicable to

public reporting companies, such as the Sarbanes-Oxley Act

of 2002;

|

|

·

|

the

ability to efficiently integrate future acquisitions and other new lines

of business that the Company may enter in the future, if any;

and

|

|

·

|

other

risks referenced from time to time elsewhere in this report and in the

Company’s filings with the SEC.

|

The

Company is under no obligation and does not intend to update, revise or

otherwise publicly release any revisions to these forward-looking statements to

reflect events or circumstances after the date hereof or to reflect the

occurrence of any unanticipated events.

12

Results

of Operations

The

Company’s primary source of revenue relates to the manufacturing of components,

devices and equipment primarily for the medical and defense

industries. The single largest category of revenue relates to

Micron’s production and sale of silver/silver chloride coated and conductive

resin sensors used as component parts in the manufacture of integrated

disposable electrophysiological sensors. These disposable medical

devices are used worldwide in the monitoring of electrical signals in various

medical applications. In an effort to leverage current skills, the

Company has expanded into custom thermoplastic injection molded products and

product life cycle management. This sector includes revenues from

both high volume precision injection molding and custom injection

molding. With the addition of a medical machining cell, the Company

began production of patient specific metal medical

devices. Management continues to identify complementary and/or

synergistic products, technologies and lines of business in an effort to broaden

the Company’s offerings.

The

following table sets forth for the periods indicated, the percentages of the net

sales represented by certain items reflected in the Company's statements of

operations.

|

Years

ended December 31,

|

||||||||

|

2009

|

2008

|

|||||||

|

Net

sales

|

100.0 % | 100.0 % | ||||||

|

Cost of sales

|

83.1 | 81.0 | ||||||

|

Gross

profit

|

16.9 | 19.0 | ||||||

|

Selling and marketing

|

3.2 | 3.5 | ||||||

|

General and

administrative

|

10.0 | 11.3 | ||||||

|

Research and development

|

1.2 | 1.4 | ||||||

|

Income

before income tax provision

|

2.5 | 2.8 | ||||||

|

Income tax provision

|

0.7 | 1.1 | ||||||

|

Net

income

|

1.8 % | 1.7 % | ||||||

Net

Sales

Net sales

for 2009 were $21,139,774, a decrease of $1,342,445 or 6%, when compared to the

total net sales of $22,482,219 in 2008. The disposable electrode sensor business

continues to experience extreme price pressure in an increasingly competitive

market. The revenue associated with the sensor business, including silver

surcharge, decreased by $561,107 as a result of price erosion in Canada and

Europe. The complementary metal snap business increased by

$102,368. The MIT division’s products experienced a net decrease in

revenue of $871,434, this includes the loss of $3,718,000 of sales

related to imported forgings that were phased out in the first three months of

2009. Due to a change in customer demands, the precision molded

products from Micron decreased approximately $153,762 when compared to

2008. The remaining increase of $141,490 was related to the snap

assembly machine business and other miscellaneous revenues, including $54,484 in

non-recurring silver reclaim. There were no sales of SAECG software

in either 2009 or 2008.

Cost

of Sales

Cost of

sales was $17,558,140 (83.1% of net sales) in 2009 compared to $18,204,526 (81%

of net sales) in 2008 a decrease of $646,386 or 3.6%. A significant

portion of the increase in the percentage of cost of sales in relation to net

sales can be attributed to material costs. Gross margin is negatively

affected by the increase in material costs as not all increases can be passed

along to the customer in the form of price increases or

surcharges. Silver pricing has generally been passed on to our

customers in the form of a surcharge, but this does not preclude the Company

from being pressured to reduce its margins as the price continues to

climb. Silver surcharge collected from our customers is approximately

13% of total net sales for years ended December 31, 2009 and 2008,

respectively. The stabilization of manufacturing costs continues to

be a major focus of management efforts. All current products,

services and programs, including those in development, continue to be evaluated

for contribution and value to our overall business strategy and

results. Products, services and programs that are underperforming

from an overall contribution standpoint and not expected to improve will be

phased out or discontinued so that the Company’s resources can be put to use in

developing those of more strategic value.

13

Selling

and Marketing

Selling

and marketing expenses decreased to $682,568 (3.2% of net sales) in 2009 from

$781,456 (3.5% of net sales) in 2008, a decrease of $98,888, or

12.7%. This decrease in selling and marketing expense is mainly

attributable to the reduction in sales and business development personnel being

offset by increased travel and trade show costs incurred. Management

believes this decrease to be nominal and expects the expense as a percentage of

sales to remain stable in the foreseeable future.

General

and Administrative Expenses

General

and administrative expenses were $2,102,461 (10.0% of net sales) in 2009 as

compared to $2,536,648 (11.3% of net sales) in 2008, a decrease of $434,187 or

17.1%. Included in the expense for the year ended December 31, 2008

is a onetime charge of $250,000 for costs associated with a terminated

acquisition following due diligence. Although the delay by the SEC

for outside auditor attestation requirements of SOX Section 404 limited a

previously expected increase in audit fees for 2009, the costs associated with

the related internal control documentation with outside consultants was $46,646

and $88,258 for the twelve months in 2009 and 2008, respectively.

Research

and Development

Research

and development costs decreased to $241,494 (1.2% of net sales) in 2009 from

$320,040 (1.4% of net sales) in 2008, a decrease of $78,546, or

25%. For the fiscal years ended December 31, 2009, and

2008, ART had research and development expenses of approximately $21,527 and

$69,779, respectively. Expenses include the technical support of a

NIH research project utilizing ART’s proprietary Signal Averaged ECG

product. In 2009 and 2008, Micron’s research and development efforts

resulted in $219,967 and $250,261 of expense. The expense is for

process improvements on the Micron sensor and snap product lines and new

processes and capabilities within MIT. The twelve months ended

December 31, 2008 included $52,000 of expense for equipment tested in a process

improvement project with the sensor product line as well as the impairment of

equipment used for final product testing.

Interest

Expense

Interest

expense was $31,699 in 2009 compared to $46,230 in 2008, a decrease of $14,531,

or 31%. This expense is a result of the acquisition note and an

equipment loan, which were paid in full in 2008 and 2009,

respectively. The Company does not incur an unused borrowing base fee

under our unsecured credit facility.

Other

Income

Other

income was $2,757 in 2009 compared to $29,464 in 2008, a decrease of $26,707, or

91%. The majority of other income was bank interest of $12,082 and $29,861, in

2009 and 2008, respectively. Lower average balances and a decrease in

the rate of return account for the decrease in interest income. The

remainder of other income was from miscellaneous expense items including a loss

in the disposal of assets, and currency losses relating to a foreign

government’s import taxes and the timing of the reimbursement.

Income

Taxes

The

Company’s combined federal and state effective income tax rate was 29% and 42%

in 2009 and 2008, respectively. The effective rates in 2009 were

lower than the statutory rates primarily due to the reductions in tax from state

and federal research and development and investment tax credits.

Goodwill

As of

December 31, 2009, the Company’s goodwill of $1,564,966 is related to three

reporting units, $1,244,000 associated with the acquisition of Micron Products,

Inc. in 1992, $235,727 associated with the acquisition of Shrewsbury Molders,

Inc. in 2004, and $85,239 associated with the acquisition of Leominster Tool Co.

Inc. in December 2006. There was no impairment to the goodwill

associated with or expected in any acquisition based on the first quarter annual

impairment test in 2009.

Earnings

Per Share

The basic

earnings per share is $0.14 in 2009 as compared to $0.13 in 2008, an increase of

$0.01, or 8%. The earnings per share for 2008 included non-recurring

charges totaling $302,000, related to an acquisition and research and

development activities. This charge, net of tax, decreased basic

earnings per share for 2008 by $0.07.

14

Off-Balance

Sheet Arrangements

The

Company entered in to a sale lease-back transaction for certain equipment

purchased during 2009 totaling $677,810. A five year operating lease

obligation for the equipment began December 31, 2009 with the first payment due

February 1, 2010. The transaction includes an additional $322,190 of

lease line capacity. The operating lease requires payments totaling

$146,867 in 2010, and $139,690 for each year following until 2014.

Liquidity

and Capital Resources

Working

capital was $8,922,328 as of December 31, 2009 as compared to

$7,440,721 as the same date in 2008. Operating results produced

positive cash flows of $2,386,186 of which $361,195 was spent on capital asset

investment. Cash and cash equivalents were $3,674,179 and $2,320,467

at December 31, 2009, and 2008, respectively. Substantially all of

these funds are invested in fixed rate bank deposit accounts.

Inventories

decreased to $2,956,682 at the end of 2009, a decrease of $770,810 from the end

of 2008. The decreased inventory was primarily the result of the lean

manufacturing programs. These efforts focused production on reducing

inventory in production. The increased unit cost of silver offset the

decreases in volume of sensors in inventory.

Net

capital equipment expenditures were $361,195 in 2009 as compared to $1,015,702

in 2008. In 2009, the majority of the expenditures were for

production equipment. Not included in the net capital expenditures

was production automation equipment for the sensor line costing