Attached files

| file | filename |

|---|---|

| EX-21 - India Globalization Capital, Inc. | ex21.htm |

| EX-23.1 - India Globalization Capital, Inc. | ex23-1.htm |

As

filed with the Securities and Exchange Commission on March

9, 2010

Registration

No. 333-163867

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment

No. 1 to

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

INDIA

GLOBALIZATION CAPITAL, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Maryland

|

1600

|

20-2760393

|

||

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

(Primary

Standard Industrial

Classification

Code Number)

|

(I.R.S.

Employer

Identification

Number)

|

4336

Montgomery Ave.

Bethesda, Maryland

20814

(301) 983-0998

(Address,

Including Zip Code, and Telephone Number,

Including

Area Code, of Registrant’s Principal Executive Offices)

Ram

Mukunda

Chief

Executive Officer and President

India

Globalization Capital, Inc.

4336

Montgomery Ave.

Bethesda,

Maryland, 20814

(301) 983-0998

(Name,

Address, Including Zip Code, and Telephone Number,

Including

Area Code, of Agent for Service)

Copies

to:

Stanley

S. Jutkowitz, Esq.

Seyfarth

Shaw LLP

975

F Street, N.W.

Washington,

D.C. 20004

Telephone:

(202) 463-2400

Facsimile:

(202) 828-5393

Approximate date of commencement of

proposed sale to public: As soon as practicable after this

registration statement becomes effective.

If any of

the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933,

check the following box: o

If this

form is filed to register additional securities for an offering pursuant to

Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration statement number of the earlier effective

registration statement for the same offering: o

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering: o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering: o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer o

(Do

not check if a smaller reporting company)

|

Smaller

reporting company þ

|

CALCULATION

OF REGISTRATION FEE

|

Proposed

Maximum

|

||||||||||

|

Title

of Each Class of

|

Aggregate

Offering

|

Amount

of

|

||||||||

|

Securities

to be Registered

|

Price

|

Registration

Fee

|

||||||||

|

Common

Stock, $0.0001 par value per share

|

(1)

|

$

|

4,000,000

|

(1)

|

$

|

223.20

|

||||

|

(1)

|

Estimated

solely for purposes of calculating the registration fee in accordance with

Rule 457(o) under the Securities Act of 1933, as

amended.

|

The Registrant hereby amends this

Registration Statement on such date or dates as may be necessary to delay its

effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or

until the Registration Statement shall become effective on such date as the

Commission, acting pursuant to said Section 8(a), may

determine.

|

The

information in this Prospectus is not complete and may be changed. We may

not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and is not soliciting an offer to buy these

securities in any state where the offer or sale is not

permitted.

|

SUBJECT

TO COMPLETION, DATED [ ]

[ ], 2010

PROSPECTUS

India

Globalization Capital, Inc.

Common

Stock

This

prospectus relates to the offering of

[ ] shares of common

stock of India Globalization Capital, Inc. (“IGC” or “the Company”), par value

$0.0001 per share. We have retained ___________ as

underwriter in connection with this offering, which is made on a ______

basis.

Our units, shares of common stock and warrants are

currently traded on the NYSE Amex Equities (“NYSE Amex”) under the symbols

“IGC.U,” “IGC” and “IGC.WS,” respectively. As of March 8, 2010, the closing sale

price of our common stock was $1.26, the closing sale price of our units was

$1.30 (the last trade

having occurred on March 2), and the closing sale price of our

warrants was $0.05.

In

reviewing this prospectus, you should carefully consider the matters described

under the heading “Risk Factors” beginning on page 4.

| Per Share |

Total

|

|||||||

|

Price

to public

|

$ | $ | ||||||

|

Underwriting

discount

|

$ | $ | ||||||

|

Proceeds,

before expenses, to India Globalization

Capital, Inc.

|

$ | $ | ||||||

We

have granted the underwriter a 30-day option to purchase up to

[ • ] additional shares of common

stock at the same price, and on the same terms, solely to cover over-allotments,

if any.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a criminal

offense.

The date

of this prospectus is __________, 2010.

|

1

|

|

|

4

|

|

|

11

|

|

|

12

|

|

|

12

|

|

|

12

|

|

|

12

|

|

|

15

|

|

|

19

|

|

|

33

|

|

|

40

|

|

|

47

|

|

|

51

|

|

|

51

|

|

|

53

|

|

|

56

|

|

|

59

|

|

|

59

|

|

|

59

|

|

|

60

|

All

references to “IGC,” “we,” “our,” “us,” and similar terms in this prospectus

refer to India Globalization Capital, Inc.

Some of

the industry data contained in this prospectus are derived from data from

various third-party sources. While we are not aware of any misstatements

regarding any industry data presented herein, such data is subject to change

based on various factors, including those discussed under the heading “Risk

Factors” in this prospectus.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we have filed with the

Securities and Exchange Commission (the “SEC” or the “Commission”) utilizing a

shelf registration process. Under this shelf registration process, we may, from

time to time, offer and sell shares of the common stock of the Company pursuant

to this prospectus. It is important for you to read and consider all of the

information contained in this prospectus and any applicable prospectus

supplement before making a decision whether to invest in the common stock. You

should also read and consider the information contained in the documents that we

have incorporated by reference as described in “Where You Can Find More

Information” and “Incorporation of Certain Documents by Reference” in this

prospectus.

You

should rely only on the information contained in this prospectus and any

applicable prospectus supplement, including the information incorporated by

reference. We have not authorized anyone to provide you with different

information. We are not offering to sell or soliciting offers to buy, and will

not sell, any securities in any jurisdiction where it is unlawful. You should

assume that the information contained in this prospectus or any prospectus

supplement, as well as information contained in a document that we have

previously filed or in the future will file with the SEC and incorporate by

reference into this prospectus or any prospectus supplement, is accurate only as

of the date of this prospectus, the applicable prospectus supplement or the

document containing that information, as the case may be.

The

following is a summary of some of the information contained in this prospectus.

In addition to this summary, we urge you to read the entire prospectus

carefully, especially the risks relating to our business and common stock

discussed under the heading “Risk Factors” and our financial

statements.

India

Globalization Capital, Inc.

Our

Business

Background of India Globalization

Capital, Inc. (IGC)

IGC, a

Maryland corporation, was organized on April 29, 2005 as a blank check

company formed for the purpose of acquiring one or more businesses with

operations primarily in India through a merger, capital stock exchange, asset

acquisition or other similar business combination or acquisition. On March 8,

2006, we completed an initial public offering. On February 19, 2007,

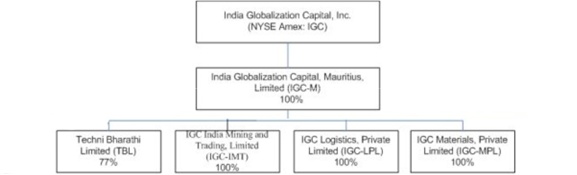

we incorporated India Globalization Capital, Mauritius, Limited (IGC-M), a

wholly owned subsidiary, under the laws of Mauritius. On March 7,

2008, we consummated the acquisition of 63% of the equity of Sricon

Infrastructure Private Limited (Sricon) and 77% of the equity of Techni Bharathi

Limited (TBL). The shares of the two Indian companies, Sricon and TBL, are held

by IGC-M.

Most of

the shares of Sricon and TBL acquired by IGC were purchased directly from the

companies. IGC purchased a portion of the shares from the existing owners of the

companies. The founders and management of Sricon own 78% of Sricon

(after giving effect to the deconsolidation described below) and the founders

and management of TBL own 23% of TBL.

In

connection with the acquisitions, IGC borrowed approximately $17 million from

Sricon. According to the original purchase agreement, if the

loan is not repaid, then the result could be a reduction in IGC’s ownership

percentage of Sricon.

The

acquisitions were accounted for under the purchase

method of accounting. Under this method of accounting, for accounting

and financial purposes, IGC-M, Limited was treated as the acquiring entity and

TBL as the acquired entity

Effective

October 1, 2009 we decreased our ownership in Sricon Infrastructure from 63% to

22.3%. As described earlier, on March 7, 2008 we consummated the

Sricon Acquisition by purchasing 63% for about $29 million (based on an exchange

rate of 40 INR for $1 USD). We subsequently borrowed around $17.9

million (based on 40 INR for 1 USD) from Sricon. Through 2008 and

2009 we expanded our business offerings beyond construction to include a rapidly

growing materials business. We have successfully repositioned the company as a

materials and construction company; with construction activity in our TBL

subsidiary and materials activity in our other subsidiaries. Rather

than continue to owe Sricon $17.9 million, and more importantly, continue to

fund two construction companies, we decreased our ownership in Sricon by an

amount proportionate to the loan. The impact of this is that we no

longer owe Sricon $17.9 million and our corresponding ownership is a

non-controlling interest. The deconsolidation of Sricon from the

balance sheet of IGC, resulted in shrinkage of the IGC balance sheet,

compared to March 31, 2009, and a one-time charge on the P&L in the quarter

ended December 31, 2009. Post deconsolidation, earnings and losses

from Sricon are accounted for using the equity method of

accounting.

The consolidated IGC financial statements provided after the date

of deconsolidation (October 1, 2009) do not include a line by line consolidation

of Sricon. However, the consolidated IGC financials before

October 1, 2009 include a line by line consolidation of

Sricon.

Unless the context requires otherwise, all references in this

report to the “Company”, “IGC”, “we”, “our”, and “us” refer to India

Globalization Capital, Inc, together with its wholly owned subsidiary IGC-M, and

its subsidiaries and non-controlling interests (TBL, IGC-MPL, IGC-LPL, IGC IMT

and Sricon,).

Background

of India based Subsidiaries

Techni

Bharathi Limited (“TBL”) was incorporated as a public (but not listed on the

stock market) limited company on June 19, 1982 in Cochin, India. TBL

is an engineering and construction company engaged in the execution of civil

construction and structural engineering projects. TBL has a focus in

the Indian states of Andhra Pradesh, Karnataka, Assam and Tamil Nadu. Its

present and past clients include various Indian government

organizations.

IGC

Materials, Private Limited (“IGC-MPL”) and IGC Logistics, Private

Limited (“IGC-LPL”), are based in Nagpur India and were incorporated in June

2009. The two companies focus on infrastructure materials like rock

aggregate, bricks, concrete and other material as well as the logistical support

for the transportation of infrastructure material. IGC India Mining

and Trading (“IGC-IMT”) was incorporated in December 2008 in Chennai,

India. IGC-IMT is involved in the

export of iron ore to China. IGC-MPL, IGC-LPL and IGC-IMT are all wholly owned

subsidiaries of IGC-M.

Our

approach is to offer a suite of services to customers involving construction as

well as sale and transportation of materials.

Core Business

Competencies

We offer

an integrated approach in our customer service delivery based on core

competencies that we have demonstrated over the years. This

integrated approach provides us with an advantage over our

competitors.

Our core

business competencies include the following:

|

1)

|

Highway

and heavy construction

|

|

2)

|

Mining

and Quarrying

|

|

3)

|

Construction

and maintenance of high temperature

plants

|

Our

Growth Strategy and Business Model

Our

growth strategy and business model is the following:

|

1)

|

Deepen

our relationships with our existing construction customers by providing

them infrastructure materials like iron ore, rock aggregate, concrete,

coal and associated logistical

support.

|

|

2)

|

Expand

our materials offering by expanding the number of rock aggregate quarries

and other material infrastructure.

|

|

3)

|

Leverage

our expertise in the logistics and supply of iron ore by increasing the

number of shipping hubs we operate from and expand our offering into China

and other Asian countries to take advantage of the infrastructure growth

in India, China and other Asian

countries.

|

|

4)

|

Expand

the number of recurring contracts for infrastructure build out to

customers that can benefit from our portfolio of

offerings.

|

|

5)

|

As

part of our financing plan, aggressively pursue the collection of delay

claims in past projects.

|

Please

see the “Risk Factors” section commencing on page 4 for more information

concerning the risks of investing in our company.

Where

You Can Find More Information

We have

three securities listed on the NYSE Amex: (1) common stock, $.0001 par value

(ticker symbol: IGC), (2) redeemable warrants to purchase common stock (ticker

symbol: IGC.WS) and (3) units consisting of one share of common stock and two

redeemable warrants to purchase common stock (ticker symbol:

IGC.U).

We will

make available on our website, www.indiaglobalcap.com,

our annual reports, quarterly reports, proxy statements as well as up to- date

investor presentations. The registration statement and its exhibits, as

well as our other reports filed with the SEC, can be inspected and copied at the

SEC’s public reference room at 100 F Street, N.E., Washington, D.C.

20549. The public may obtain information about the operation of the public

reference room by calling the SEC at 1-800-SEC-0330. In addition, the SEC

maintains a web site at http://www.sec.gov which contains

the Form S-1 and other reports, proxy and information statements and

information regarding issuers that file electronically with the

SEC.

We have

filed a registration statement on Form S-1 with the SEC registering under

the Securities Act the common stock that may be distributed under this

prospectus. This prospectus, which is a part of such registration statement,

does not include all of the information contained in the registration statement

and its exhibits. For further information regarding us and our common stock, you

should consult the registration statement and its exhibits.

Statements

contained in this prospectus concerning the provisions of any documents are

summaries of those documents, and we refer you to the documents filed with the

SEC for more information. The registration statement and any of its amendments,

including exhibits filed as a part of the registration statement or an amendment

to the registration statement, are available for inspection and copying as

described above.

The

Offering

We are

offering ____________ shares of our common stock pursuant to this

prospectus.

|

Issuer

|

India

Globalization Capital, Inc., a Maryland corporation

|

|

|

Shares

Offered

|

[ ]

shares

|

|

|

Shares

Outstanding

|

12,898,291 shares

|

|

|

Use

of Proceeds

|

We

expect proceeds from this offering to us to be approximately

$[ ], after underwriters’ discounts and before

deducting the estimated expenses for the offering. We intend to use

the proceeds for working capital, operating expenses and other general

corporate purposes. We may also use the proceeds to repay

indebtedness.

|

|

|

NYSE

Amex Symbol for Common Stock:

|

IGC

|

|

|

Risk

Factors

|

You

should carefully consider the matters discussed under the heading “Risk

Factors”

|

You

should carefully consider the following risk factors, together with all of the

other information included in this prospectus in evaluating us and our common

stock and other securities. If any of the following risks and uncertainties

develop into actual events, they could have a material adverse effect on our

business, financial condition or results of operations. In that case, the

trading price of our common stock and other securities also could be

adversely affected. We make various

statements in this section, which constitute “forward-looking statements.” See

“Forward-Looking Statements.”

RISKS

ASSOCIATED WITH OUR INDUSTRY AND DOING BUSINESS IN INDIA

Any downgrading

of India’s debt rating by an international rating agency, or an increase in

interest rates in India, could have a negative impact on our ability to borrow

in India.

As we

scale our operations we may increase the amount of money we borrow for working

capital and leasing of equipment. Any adverse revisions to India’s credit

ratings for domestic and international debt by international rating agencies as

well as an increase in Indian interest rates may adversely impact our ability to

finance growth through debt and could lead to a tightening of our margins,

adversely affecting our operating income.

A

change in government policy, a down turn in the Indian economy or a natural

disaster could adversely affect our business, financial condition, results of

operations and future prospects.

Our

construction business is dependent on the government of India as well as the

state governments for contracts. Their operations and financial

results may be affected by changes in the government’s policy towards building

infrastructure. In addition, the slow down in the Indian economy has

caused the government to slow down the pace of infrastructure building, which if

unchanged could adversely affect our future performance. We foresee

no immediate changes to government policy or market conditions that would

adversely affect our ability to conduct business other than limited access to

credit.

Political,

economic, social and other factors in India may adversely affect

business.

Our

ability to grow our business may be adversely affected by political, economic,

social and religious factors, changes in Indian law or regulations and the

status of India’s relations with other countries. In addition, the economy of

India may differ favorably or unfavorably from the U.S. economy in such respects

as the rate of growth of gross domestic product, the rate of inflation, capital

reinvestment, resource self-sufficiency and balance of payments position.

According to the World Factbook published by the United States Central

Intelligence Agency, the Indian government has exercised and continues to

exercise significant influence over many aspects of the economy, and

privatization of government-owned industries proceeds at a slow pace.

Accordingly, Indian government actions in the future could have a significant

effect on the Indian economy, which could have a material adverse affect on our

ability to achieve our business objective.

Since

mid-1991, the Indian government has committed itself to implementing an economic

structural reform program with the objective of liberalizing India’s exchange

and trade policies, reducing the fiscal deficit, controlling inflation,

promoting a sound monetary policy, reforming the financial sector, and placing

greater reliance on market mechanisms to direct economic activity. A significant

component of the program is the promotion of foreign investment in key areas of

the economy and the further development of, and the relaxation of restrictions

in, the private sector. These policies have been coupled with the express

intention to redirect the government’s central planning function away from the

allocation of resources and toward the issuance of indicative guidelines. While

the government’s policies have resulted in improved economic performance, there

can be no assurance that the economic improvement will be sustained. Moreover,

there can be no assurance that these economic reforms will persist, and that any

newly elected government will continue the program of economic liberalization of

previous governments. Any change may adversely affect Indian laws and policies

with respect to foreign investment and currency exchange. Such changes in

economic policies could negatively affect the general business and economic

conditions in India, which could in turn adversely affect our

business.

Terrorist

attacks and other acts of violence or war within India or involving India and

other countries could adversely affect the financial markets and our

business.

Terrorist

attacks and other acts of violence could have the direct effect of destroying

our plant and property causing a loss and interruption of

business. According to the World Factbook, religious and border

disputes persist in India and remain pressing problems. For example, India has

from time to time experienced civil unrest and hostilities with neighboring

countries such as Pakistan. The longstanding dispute with Pakistan over the

border Indian states of Jammu and Kashmir, a majority of whose population is

Muslim, remains unresolved. If the Indian government is unable to control the

violence and disruption associated with these tensions, the results could

destabilize the economy and, consequently, adversely affect our

business.

Since

early 2003, there have also been military hostilities and civil unrest in

Afghanistan, Iraq, Pakistan and other Asian countries. These events could

adversely influence the Indian economy and, as a result, negatively affect our

business.

While we

may have insurance to cover some of these risks and can file claims against the

contracting agencies, there can be no guarantee that we will be able to collect

in a timely manner. Further, India has seen an increase in

politically motivated insurgencies and a fairly active communist

following. Any uprising from these groups can delay our roadwork and

disrupt our business. Terrorist attacks, insurgencies or the threat

of violence could slow down road building activity and acquisition of materials

which could adversely affect our business.

Exchange controls

that exist in India may limit our ability to utilize our cash flow

effectively.

We are

subject to India’s rules and regulations on currency conversion. In India, the

Foreign Exchange Management Act or FEMA, regulates the conversion of the Indian

rupee into foreign currencies. However, comprehensive amendments have

been made to FEMA to support the economic liberalization. Companies

are now permitted to operate in India without any special restrictions,

effectively placing them on par with wholly Indian owned companies. In addition,

foreign exchange controls have been substantially relaxed. Notwithstanding these

changes, the Indian foreign exchange market is not yet fully developed and we

cannot assure that the Indian authorities will not revert back to regulating

companies and imposing new restrictions on the convertibility of the Indian

rupee. Any future restrictions on currency exchanges may limit our ability to

use our cash flow for the distribution of dividends to our stockholders or to

fund operations we may have outside of India.

Changes in the

exchange rate of the Indian rupee may negatively impact our revenues and

expenses.

Our

operations are primarily located in India and we receive payment in Indian

rupees. As the results of operations are reported in US dollars, to

the extent that there is a decrease in the exchange rate of Indian rupees into

US dollars, such a decrease could have a material impact on our operating

results or financial condition.

Returns

on investment in Indian companies may be decreased by withholding and other

taxes.

Our

investments in India will incur tax risk unique to investment in India and in

developing economies in general. Income that might otherwise not be subject to

withholding of local income tax under normal international conventions may be

subject to withholding of Indian income tax. Under treaties with

India and under local Indian income tax law, income is generally sourced in

India and subject to Indian tax if paid from India. This is true whether or not

the services or the earning of the income would normally be considered as from

sources outside India in other contexts. Additionally, proof of payment of

withholding taxes may be required as part of the remittance procedure. Any

withholding taxes paid by us on income from our investments in India may or may

not be creditable on our income tax returns.

We intend

to avail ourselves of income tax treaties with India and minimize any Indian

withholding tax or local taxes. However, there is no assurance that

the Indian tax authorities will always recognize such treaties and its

applications. We have also created a foreign subsidiary in Mauritius, in

order to limit the potential tax exposure.

RISKS

ASSOCIATED WITH OUR BUSINESS

The

cost of obtaining bank financing may reduce our income.

TBL has restructured some

of its bank debt and may, in the future, face higher interest rates or will

require higher collateral with the banks. This increases the

cost of money for the construction business and could decrease our

margins. IGC expects to provide collateral support for two to three

years, by which time we expect the credit worthiness of the construction

business to increase to adequate levels. Further, collateral that has

been provided to the banks consists mostly of real estate, which has fallen in

value, thus reducing our ability to borrow.

Availability

of raw materials at competitive prices.

Construction

contracts are primarily dependent on adequate and timely supply of raw

materials, such as cement, steel and aggregates, at competitive prices. As the

demand from competing larger and well-established firms increases for procuring

raw materials, we could face an increase in the price of raw materials that may

negatively impact profitability.

Some

of our business is dependent on contracts awarded by the Government and its

agencies.

The

construction business is dependent on central and state budget allocations to

the infrastructure sector. We derive the bulk of our construction revenue from

contracts awarded by the central and state governments of India and their

agencies. If there are delays in the payment of invoices by the

government, our working capital requirements could increase.

Compliance

with the Foreign Corrupt Practices Act could adversely impact our competitive

position. Failure to comply could subject us to penalties and other adverse

consequences.

We are

subject to the United States Foreign Corrupt Practices Act, which generally

prohibits United States public companies from engaging in bribery of or other

prohibited payments to foreign officials to obtain or retain business. While we

will take precautions to educate the employees of our subsidiaries of the

Foreign Corrupt Practices Act, there can be no assurance that we or the

employees or agents of our subsidiaries will not engage in such conduct, for

which we might be held responsible. We could suffer penalties that may have a

material adverse effect on our business, financial condition and results of

operations.

We may issue shares of our capital

stock, including through convertible debt securities, which would reduce the

equity interest of our stockholders and likely cause a change in control of our

ownership.

Our

certificate of incorporation authorizes the issuance of up to

75,000,000 shares of common stock, par value $.0001 per share and

1,000,000 shares of preferred stock, par value $.0001 per share. There

are currently approximately 47,000,000 authorized but unissued shares of our

common stock available for issuance (after appropriate reservation for the

issuance of shares upon full exercise of our outstanding warrants and the

purchase option granted to Ferris, Baker Watts, Inc. and shares authorized for

issuance under our 2008 Omnibus Incentive Plan, including outstanding options

issued there under) and all of the 1,000,000 shares of preferred stock

available for issuance. We have recently issued 1,060,000 shares of our common

stock in connection with a private placement of debt securities and an exchange

of previously issued debt securities for new debt securities and the common

stock and may engage in similar private placements in the future. The

issuance of additional shares of our common stock including upon conversion of

any debt securities:

|

·

|

may

significantly reduce the equity interest of our existing shareholders;

and

|

|

·

|

may

adversely affect prevailing market prices for our common stock, warrants

or units.

|

We

may issue notes or other debt securities, which may adversely affect our

leverage and financial condition.

During

each of 2008 and 2009, we sold debt securities in the principal amount of

$2,000,000 in a private placement and may engage in similar private

placements in the future. The incurrence of this debt:

|

·

|

may

lead to default and foreclosure on our assets if our operating

revenues are insufficient to pay our debt

obligations;

|

|

·

|

may

cause an acceleration of our obligations to repay the debt even if we make

all principal and interest payments when due if we breach the covenants

contained in the terms of the debt

documents;

|

|

·

|

may

create an obligation to immediately repay all principal and accrued

interest, if any, upon demand to the extent any debt securities are

payable on demand; and

|

|

·

|

may

hinder our ability to obtain additional financing, if necessary, to the

extent any debt securities contain covenants restricting our ability to

obtain additional financing while such security is outstanding, or to the

extent our existing leverage discourages other potential

investors.

|

Additional

capital may be costly or difficult to obtain.

Additional

capital, whether through the offering of equity or debt securities, may not be

available on reasonable terms or at all, especially in light of the recent

downturn in the economy and dislocations in the credit and capital markets. If

we are unable to obtain required additional capital, we may have to curtail our

growth plans or cut back on existing business and, further, we may not be able

to continue operating if we do not generate sufficient revenues from operations

needed to stay in business. We may incur substantial costs in

pursuing future capital financing, including investment banking fees, legal

fees, accounting fees, securities law compliance fees, printing and distribution

expenses and other costs. We may also be required to recognize non-cash expenses

in connection with certain securities we issue, such as convertible notes and

warrants, which may adversely impact our financial condition.

Leveled

penalties for time overruns may adversely affect our economic

performance.

TBL

executes construction contracts primarily in the roads and infrastructure

development sectors. TBL typically enters into high value contracts for these

activities, which impose penalties if contracts are not executed in a timely

manner. If TBL is unable to meet the performance criteria

as prescribed by respective contracts, then levied penalties may adversely

affect our financial performance.

Our

business is dependent on continuing relationships with clients and strategic

partners.

Our

business is dependent on developing and maintaining strategic alliances with

contractors that undertake turnkey contracts for infrastructure development

projects as well as government organizations. The business and our

results could be adversely affected if we are unable to maintain continuing

relationships and pre-qualified status with key clients and strategic

partners.

Our

business model relies heavily on our management team and any

unexpected loss of key officers may adversely affect our

operations

The

continued success of our business is largely dependent on the continued services

of key employees. The loss of the services of certain key personnel,

without adequate replacement, could have an adverse effect on our performance.

Our senior management as well as the senior management of our subsidiaries have

played a significant role in developing and executing the overall business plan,

maintaining client relationships, proprietary processes and

technology. While no one is irreplaceable, the loss of the

services of any would be disruptive to our business. Our

strategy, management, financial and operational oversight are heavily dependent

on our Founder and CEO. The loss of our CEO could have a significant adverse

effect on our business. In order to mitigate these risk factors we

are recruiting professional managers and expanding the executive ranks as well

as pursuing succession-planning initiatives, but this will take time and

there can be no guarantees that these mitigation efforts will be

successful.

Quarterly financial

results will vary.

Factors

that may contribute to the variability of quarterly revenue, operating results

or profitability include:

|

·

|

Fluctuations

in revenue due to seasonality: For example, during the monsoon

season, the heavy rains slow down construction work resulting

in an overall slow down of the supply of materials as well as construction

activity. This results in uneven revenue and operating results

through the quarters. In general, the months between June

and September are the rainy seasons and these tend to be slower quarters

than the others.

|

Our

future operating results and the market price of our common stock could be

materially adversely affected if we are required to write down the carrying

value of goodwill associated with any of our businesses in the

future.

We review

our goodwill balance for impairment on at least an annual basis through the

application of a fair value-based test. Our estimate of fair value is based

primarily on projected future results and cash flows and other assumptions. In

addition, we review long-lived assets whenever events or changes in

circumstances indicate that its carrying amount may not be recoverable. In the

fourth quarter of our 2009 fiscal year, we performed our annual test for

goodwill impairment and determined that our goodwill was not impaired. In the

future, if our projected discounted cash flows associated with our businesses do

not exceed the carrying value of their net assets, we may be required to record

write downs of the carrying value of goodwill or other long-lived assets

associated with any of our businesses and our operating results and the market

price of our common stock may be materially adversely affected.

As of March 31 2009 our goodwill balance was $17.5 million and as

of December 31 2009 our goodwill balance

was $6.9 million respectively . We perform an annual goodwill impairment

test during the fourth quarter of each fiscal year, or more frequently if an

event occurs or circumstances change between annual tests that would more likely

than not reduce the fair value of a reporting unit below its carrying amount.

The 2008-2009 recession has impacted our financial results and has reduced

near-term purchases from certain of our key customers. We may determine that our

expectations of future financial results and cash flows from one or more of our

businesses has decreased or a decrease in stock valuation may occur, which could

result in a review of our goodwill associated with these businesses. Since a

large portion of the value of our intangibles has been ascribed to projected

revenues from certain key customers, a change in our expectation of future cash

from one or more of these customers could indicate potential impairment to the

carrying value of our assets.

Our

subsidiaries may become involved in litigation in the future.

Our

subsidiaries are fairly large companies and may have to initiate actions in the

Indian Courts to enforce their rights and may also be drawn into legal

litigation. The expenses of litigation and any judgments against us

could have a material adverse effect on us.

We

face competition in the Indian infrastructure industry.

The

Indian real estate and infrastructure industries are increasingly attracting

foreign capital. We currently have competition from international as

well as domestic companies that operate at the national

level. Smaller localized contractors and companies are also competing

in their respective regions. If we are unable to offer competitive

prices and obtain contracts, there could be a significant reduction in our

revenue.

A

down turn in the economy could adversely affect our business, financial

condition, results of operations and future prospects.

A

generally adverse financial global economy or a regional recession

including one in India and or China could adversely affect commodity prices and

infrastructure build out in Asia, which in turn could adversely affect our

future performance and result in a drop in our stock price.

Our

operations are sensitive to weather conditions.

Our

business activities in India could be materially and adversely affected by

severe weather conditions. Severe weather conditions may require us to evacuate

personnel or curtail services and may result in damage to a portion of our fleet

of equipment or to our facilities, resulting in the suspension of operations,

and may further prevent us from delivering materials to project sites in

accordance with contract schedules or generally reduce our

productivity. Difficult working conditions and extremely high

temperatures also adversely affect our operations during summer months and

during monsoon season, which restrict our ability to carry on construction and

mining activities and fully utilize our resources.

Depending

on the onset of the monsoons, revenue recorded in the first half of our fiscal

year, particularly between June through September, is traditionally lower than

revenue recorded during the second half of our fiscal year. During

periods of curtailed activity due to adverse weather conditions, we may continue

to incur operating expenses as well as build material reserves reducing

profitability.

We incur costs as a result of

operating as a public company. Our management is required to

devote substantial time to new compliance initiatives. Because we

report in USGAAP, we may experience untimely close of our books and records, in

India, and delays in the preparation of financial statements and related

disclosures.

As part

of a public company with substantial operations, we are experiencing an

increase in legal, accounting and other expenses. In addition the

Sarbanes-Oxley Act of 2002 (the “SOX” act), as well as new rules subsequently

implemented by the SEC and the NYSE Amex, have imposed various requirements on

public companies, including requiring changes in corporate governance

practices. Our management and other personnel need to devote a

substantial amount of time to these compliance initiatives. We have

completed the testing of internal controls in all our

subsidiaries. We expect to carry out the evaluations

and install systems and processes as required. However, we cannot be

certain as to the timing of completion of evaluation testing and remediation

actions or the impact of the same on our operations. Further, it is

difficult to hire personnel in India that are familiar with

USGAAP. However, we have hired several reputed consultants to help

review internal reporting and disclosures as well as train our India based staff

in the rigors of SEC reporting and USGAAP. We currently, do not

foresee a problem other than the time required to adequately train and

streamline the processes.

The

audit report provided by Yoganandh and Ram will require a review by a US

firm.

While our

audit firm, Yoganandh & Ram, is registered with the Public Company

Accounting Oversight Board (the “PCAOB”), the SEC requires that the audits

conducted by Yoganandh & Ram, be reviewed by another PCAOB registered

firm. If the review identifies changes to an audit, we will be

required to amend our annual report as filed on Form 10-K incorporating the

audited financial statements. The requirement of the review is

expected to increase our legal, accounting and other

expenses.

RISKS

RELATED TO OUR SECURITIES

The

Company has warrants outstanding, which could dilute the number of shares

outstanding.

At the

time the warrants are exercised, the company will get the exercise price, unless

the exercise is cashless. In either case, such an exercise will

also increase the number of shares outstanding. This may adversely

affect the share price as the supply of shares eligible for sale in the public

market will increase. The increased number of shares offered for sale

in the public market may exceed the public demand to buy shares at a given

market price resulting in the market price adjusting downward to equalize supply

and demand.

Although

we are required to use our best efforts to have an effective registration

statement covering the issuance of the shares underlying the public warrants at

the time that our warrant holders exercise their public warrants, we cannot

guarantee that a registration statement will be effective, in which case our

warrant holders may not be able to exercise our public warrants and such

warrants may expire worthless.

Holders

of our public warrants will be able to exercise the warrants only if a current

registration statement under the Securities Act of 1933 relating to the shares

of our common stock underlying the warrants is then effective. Although we have

undertaken in the warrant agreement, and therefore have a contractual

obligation, to use our best efforts to maintain a current registration statement

covering the shares underlying the public warrants to the extent required by

federal securities laws, and we intend to comply with such undertaking, with

such a registration statement currently effective, we cannot assure you that we

will be able to do so. In no event shall we be liable for, or any registered

holder of any warrant be entitled to receive, (a) physical settlement in

securities unless the conditions and requirements set forth in the warrant

agreement have been satisfied or (b) any net-cash settlement or other

consideration in lieu of physical settlement in securities. The value of the

public warrants may be greatly reduced if a registration statement covering the

shares issuable upon the exercise of the warrants is not kept current. Such

warrants may expire worthless.

Because

the warrants sold in the private placements were originally issued pursuant to

an exemption from registration requirements under the federal securities laws,

the holders of the warrants sold in the private placement will be able to

exercise their warrants even if, at the time of exercise, a prospectus relating

to the common stock issuable upon exercise of such warrants is not current. As a

result, the holders of the warrants purchased in the private placements will not

have any restrictions with respect to the exercise of their warrants. As

described above, the holders of the public warrants will not be able to exercise

them unless we have a current registration statement covering the shares

issuable upon their exercise.

If

equity research analysts do not publish research or reports about our business

or if they issue unfavorable commentary or downgrade our common stock, the price

of our common stock could decline.

The

trading market for our common stock will rely in part on the research and

reports that equity research analysts publish about our business and us. We do

not control these analysts. The price of our stock could decline if one or more

equity analysts downgrade our stock or if those analysts issue other unfavorable

commentary or cease publishing reports about our business or us.

We

do not currently intend to pay dividends, which may limit the return on your

investment in us.

We

currently intend to retain all available funds and any future earnings for use

in the operation and expansion of our business and do not anticipate paying any

cash dividends in the foreseeable future.

We

believe that some of the information in this prospectus constitutes

forward-looking statements within the definition of the Private Securities

Litigation Reform Act of 1995. You can identify these statements by

forward-looking words such as “may,” “should,” “believes,” “expects,” “intends,”

“anticipates,” “thinks,” “plans,” “estimates,” “seeks,” “predicts,” “potential”

or similar words or the negative of these words or other variations on these

words or comparable terminology. You should read statements that contain these

words carefully because they discuss future expectations, contain projections of

future results of operations or financial conditions or state or other forward

looking information.

While we

believe it is important to communicate our expectations to our stockholders,

there may be events in the future that we are not able to accurately predict or

over which we have no control. The risk factors and cautionary language

discussed in this prospectus provide examples of risks, uncertainties and events

that may cause actual results to differ materially from the expectations

described by us in our forward-looking statements, including among other

things:

· Competition in the road building

sector.

· Legislation by the government of

India.

· General economic conditions and the

Indian growth rates.

· Our ability to win licenses, contracts

and execute.

You

should be aware that the occurrence of the events described in these risk

factors and elsewhere in this prospectus could have a material adverse effect on

our business, financial condition and results of operations.

You are

cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this prospectus.

All

forward-looking statements included herein attributable to us or any person

acting on either party’s behalf are expressly qualified in their entirety by the

cautionary statements contained or referred to in this section. Except to the

extent required by applicable laws and regulations, we undertake no obligation

to update these forward-looking statements to reflect events or circumstances

after the date of this prospectus or to reflect the occurrence of unanticipated

events.

Before

you decide to invest in our securities, you should be aware that the occurrence

of the events described in the “Risk Factors” section and elsewhere in this

prospectus could have a material adverse effect on us.

We expect

proceeds from this offering to us to be approximately

$[ ], after underwriters’ discounts and before deducting

the estimated expenses for the offering. We are contractually required to

use 40% of the net proceeds of this offering in excess of $500,000 to repay two

outstanding promissory notes in the principal amount of $2,120,000 and

$2,000,000, respectively. The notes bear no interest and are due and

payable on October 5, 2010 and October 16, 2010 respectively or earlier upon a

change in control of the company or an event of default as set forth in the

notes. The proceeds of the notes were used for general working

capital purposes, primarily for our iron ore export business in the case of the

$2,000,000 note. We intend to use the balance of the proceeds for

working capital, operating expenses and other general corporate purposes. We may

also use the balance of the proceeds to further repay outstanding indebtedness,

although we do not currently expect to do so.

We have

not paid any cash dividends on its common stock to date. It is the

present intention of the board of directors to retain all earnings, if any, for

use in the business operations, and consequently, the board does not anticipate

declaring any dividends in the foreseeable future. The payment of any

dividends will be with the discretion of the board of directors and will be

contingent upon our financial condition, results of operations, capital

requirements and other factors our board deems relevant.

The

following table shows, for the last eight fiscal quarters, the high and low

closing prices per share of the Common Stock, Warrants and Units as quoted on

the NYSE Amex:

|

Common

Stock

|

Warrants

|

Units

|

||||||||||||||||||||||

|

Quarter

Ended

|

High

|

Low

|

High

|

Low

|

High

|

Low

|

||||||||||||||||||

|

December

31, 2007

|

$ | 5.94 | $ | 5.69 | $ | 0.59 | $ | 0.34 | $ | 6.90 | $ | 6.35 | ||||||||||||

|

March

31, 2008

|

$ | 5.90 | $ | 3.60 | $ | 0.73 | $ | 0.25 | $ | 7.45 | $ | 4.15 | ||||||||||||

|

June

30, 2008

|

$ | 5.90 | $ | 3.81 | $ | 1.30 | $ | 0.58 | $ | 8.80 | $ | 5.28 | ||||||||||||

|

September

30, 2008

|

$ | 4.99 | $ | 4.50 | $ | 1.00 | $ | 0.55 | $ | 6.86 | $ | 5.65 | ||||||||||||

|

December

31, 2008

|

$ | 4.78 | $ | 0.70 | $ | 0.53 | $ | 0.01 | $ | 5.75 | $ | 0.01 | ||||||||||||

|

March

31, 2009

|

$ | 1.10 | $ | 0.33 | $ | 0.13 | $ | 0.02 | $ | 1.07 | $ | 0.40 | ||||||||||||

|

June

30, 2009

|

$ | 1.25 | $ | 1.12 | $ | 0.06 | $ | 0.06 | $ | 1.80 | $ | 1.02 | ||||||||||||

|

September

30, 2009

|

$ | 1.86 | $ | 0.88 | $ | 0.20 | $ | 0.05 | $ | 2.32 | $ | 1.00 | ||||||||||||

|

December

31, 2009

|

$ |

2.20

|

$ |

1.33

|

$ |

0.22

|

$ |

0.04

|

$ |

2.50

|

$ |

1.34

|

||||||||||||

A recent

reported closing price for our common stock, warrants and units is

set forth on the cover page of this prospectus. Continental Stock Transfer &

Trust Company is the transfer agent and registrar for our common stock. As of

September 30, 2009, we had 946 holders of record of

our common stock, 173 holders of record of our units and 1,054 holders of

record of our warrants.

Under the

terms and subject to the conditions contained in an underwriting agreement dated

____________ , 2010 , we have agreed to sell to

the underwriter, ____________, the following respective numbers of

shares of common stock:

|

Underwriter

|

Number

of Shares

|

|

The

underwriting agreement provides that the underwriters are obligated to purchase

all the shares of common stock in the offering if any are purchased, other than

those shares covered by the over-allotment option described below. The

underwriting agreement also provides that if an underwriter defaults, the

purchase commitments of non-defaulting underwriters will be

increased.

We have

granted to the underwriters a 30-day option to purchase up to ________

additional shares at the offering price less the underwriting discounts.

The option may be exercised only to cover any over-allotments of common

stock.

The

underwriters propose to offer the shares of common stock at the offering price

on the cover page of this prospectus supplement. After the offering,

_____________ may change the offering price and concession and discount to

broker/dealers.

The

following table summarizes the compensation and estimated expenses we will

pay:

|

Per

Share

|

Total

|

||||||

|

Without

Over-Allotment

|

With

Over-Allotment

|

Without

Over-Allotment

|

With

Over-Allotment

|

||||

|

Underwriting

discounts and commissions paid by us

|

|||||||

We have

agreed that during the period beginning from the date hereof and continuing to

and including the date __ days after the date of the prospectus supplement, we

will not offer, sell, contract to sell or otherwise dispose of any securities of

the Company which are substantially similar to our common stock (other than for

shares or stock options issued under employee stock plans, such plans as are

currently in existence and disclosed in the Prospectus), without the prior

written consent of _____________ (such consent not to be unreasonably

withheld or delayed) other than the sale of the shares to be sold by the Company

hereunder. During the period of __ days after the date of the prospectus

supplement, the Company will not file with the Commission or cause to become

effective any registration statement (other than a registration statement on

Form S-8 filed to register securities issued or to be issued under employee

stock option plans, each such plan as disclosed in the Prospectus) or prospectus

relating to any securities of the Company which are substantially similar to our

common stock without the prior written consent

of _____________

Our

executive officer and directors have agreed that they will not offer, sell,

contract to sell, pledge or otherwise dispose of, directly or indirectly, any

shares of our common stock or securities convertible into or exchangeable or

exercisable for any shares of our common stock, enter into a transaction that

would have the same effect, or enter into any swap, hedge or other arrangement

that transfers, in whole or in part, any of the economic consequences of

ownership of our common stock, whether any of these transactions are to be

settled by delivery of our common stock or other securities, in cash or

otherwise, or publicly disclose the intention to make any such offer, sale,

pledge or disposition, or to enter into any such transaction, swap, hedge or

other arrangement, without, in each case, the

prior written consent of _____________ for a period

__ days after the date of this prospectus supplement, provided, however, that

the foregoing shall not apply to a transfer of shares solely to the extent

necessary to satisfy federal income tax obligations with respect to any shares

of Common Stock issued prior to the date of this offering.

We have

agreed to indemnify the underwriters against liabilities under the Securities

Act, or contribute to payments that the underwriters may be required to make in

that respect.

In

connection with the offering the underwriters may engage in stabilizing

transactions, over-allotment transactions, syndicate covering transactions ad

penalty bids in accordance with Regulation M under the Exchange

Act.

|

|

·

Stabilizing transactions permit bids to purchase the underlying

security so long as the stabilizing bids do not exceed a specified

maximum.

|

|

|

|

|

|

·

Over-allotment involves sales by the underwriters of shares in

excess of the number of shares the underwriters are obligated to purchase,

which creates a syndicate short position. The short position may be

either a covered short position or a naked short position. In a

covered short position, the number of shares over-allotted by the

underwriters is not greater than the number of shares that they may

purchase in the over-allotment option. In a naked short position,

the number of shares involved is greater than the number of shares in the

over-allotment option. The underwriters may close out any covered

short position by exercising their over-allotment option and/or purchasing

shares in the open market.

|

|

|

|

|

|

·

Syndicate covering transactions involve purchases of the common

stock in the open market after the distribution has been completed in

order to cover syndicate short positions. In determining the source

of shares to close out the short position, the underwriters will consider,

among other things, the price of shares available for purchase in the open

market as compared to the price at which they may purchase shares through

the over-allotment option. If the underwriters sell more shares than

could be covered by the over-allotment option, a naked short position, the

position can only be closed out by buying shares in the open market.

A naked short position is more likely to be created if the underwriters

are concerned that there could be downward pressure on the price of the

shares in the open market after pricing that could adversely affect

investors who purchase in the

offering.

|

|

|

|

|

|

·

Penalty bids permit the representatives to reclaim a selling

concession from a syndicate member when the common stock originally sold

by the syndicate member is purchased in a stabilizing or syndicate

covering transaction to cover syndicate short

positions.

|

|

|

|

These

stabilizing transactions, syndicate covering transactions and penalty bids may

have the effect of raising or maintaining the market price of our common stock

or preventing or retarding a decline in the market price of the common

stock. As a result, the price of our common stock may be higher than the

price that might otherwise exist on the open market. These transactions

may be affected on the NYSE Amex or otherwise and if commenced, may be

discontinued at any time.

A

prospectus supplement and prospectus in electronic format may be made available

on the web sites maintained by one or more of the underwriters participating in

this offering.

IGC’s

historical information is derived from its audited financial statements for

the period from its inception (April 29, 2005) to March 31, 2006, for the fiscal

years ended March 31, 2007, 2008 and 2009. In addition, historical

information is derived from its unaudited financial statements for the 6 months

period ended September 30, 2009 and 2008. The information is only a

summary and should be read in conjunction with IGC’s historical financial

statements and related notes and IGC’s respective Management’s Discussion and

Analysis of Financial Condition and Results of Operations contained elsewhere

herein. The historical results included below and elsewhere herein are not

indicative of the future financial performance of IGC.

India

Globalization Capital, Inc.

Selected

Summary Statement of Income Data

(Audited)

Annual

results:

|

Selected

Statement of Operations Data:

|

Year

Ended

|

Year

Ended

|

Year

Ended

|

29-Apr-05

|

||||||||||||

|

31-Mar-09

|

31-Mar-08

|

31-Mar-07

|

To

March 31, 2006

|

|||||||||||||

|

Revenue

|

$

|

35,338,725

|

$

|

2,188,018

|

$

|

$

|

||||||||||

|

Other

Income-Interest, net

|

(577,934

|

)

|

471,698

|

3,171,818

|

210,584

|

|||||||||||

|

Net

Income (loss)

|

(521,576

|

)

|

(5,215,270

|

)

|

1,517,997

|

(443,840

|

)

|

|||||||||

|

Per

Share Data

|

||||||||||||||||

|

Earnings

per share – basic

|

$

|

(0.05

|

)

|

$

|

(0.61

|

)

|

$

|

0.11

|

$

|

(0.14

|

)

|

|||||

|

Earnings

per share - diluted

|

$

|

(0.05

|

)

|

$

|

(0.61

|

)

|

||||||||||

|

Weighted

Average Shares

|

||||||||||||||||

|

Basic

|

10,091,171

|

8,570,107

|

13,974,500

|

3,191,000

|

||||||||||||

|

Diluted

|

10,091,171

|

8,570,107

|

||||||||||||||

India

Globalization Capital, Inc.

Selected

Summary Statement of Income Data

(unaudited)

Most

recent quarterly results:

|

Three

Months Ended

December

31, 2009

|

Three

Months Ended

December

31, 2008

|

Nine

Months Ended

December

31, 2009

|

Nine

Months Ended

December

31, 2008

|

|||||||||||||

|

Revenue:

|

$

|

5,909,024

|

$

|

3,836,428

|

13,994,503

|

$

|

32,263,680

|

|||||||||

|

Other

income (expense)

|

(389,953

|

)

|

(304,602

|

)

|

(1,051,428

|

)

|

(920,288

|

|||||||||

|

Equity

in (gain) loss of affiliates

|

16,446

|

16,446

|

||||||||||||||

|

Net

Income attributable to non-controlling interest

|

(7,574

|

)

|

550,207

|

(72,599

|

)

|

(936,996

|

||||||||||

|

Net

income (loss) attributed to controlling interest

|

$

|

(6,175,518

|

)

|

$

|

(1,734,078

|

)

|

$

|

(7,291,708

|

)

|

$

|

(374,835

|

|||||

|

Weighted

average number of shares outstanding:

|

||||||||||||||||

|

Basic

|

12,898,291

|

8,780,107

|

12,898,291

|

8,780,107

|

||||||||||||

|

Diluted

|

13,559,184

|

8,780,107

|

13,559,184

|

8,780,107

|

)

|

|||||||||||

|

Net

income per share:

|

)

|

|||||||||||||||

|

Basis

|

$

|

(0.48

|

)

|

$

|

(0.20

|

)

|

$

|

(0.56

|

)

|

$

|

(0.04

|

|||||

|

Diluted

|

$

|

(0.45

|

)

|

$

|

(0.20

|

)

|

$

|

(0.54

|

)

|

$

|

(0.04

|

|||||

|

)

|

||||||||||||||||

|

)

|

||||||||||||||||

India

Globalization Capital, Inc.

Selected

Summary Balance Sheet Data

|

31-Dec-09

|

31-Mar-09

|

31-Mar-08

|

31-Mar-07

|

|||||||||||||

|

(unaudited)

|

(audited)

|

(audited)

|

(audited)

|

|||||||||||||

|

ASSETS

|

||||||||||||||||

|

Investments

held in trust fund

|

$

|

$

|

-

|

$

|

-

|

$

|

66,104,275

|

|||||||||

|

Total

Current Assets

|

15,946,918

|

19,498,584

|

32,896,447

|

70,385,373

|

||||||||||||

|

Total

Assets

|

35,965,433

|

51,832,513

|

67,626,973

|

70,686,764

|

||||||||||||

|

LIABILITIES

|

||||||||||||||||

|

Current

Liabilities

|

11,064,632

|

9,446,345

|

17,384,059

|

5,000,280

|

||||||||||||

|

Total

Liabilities

|

12,466,165

|

13,974,638

|

26,755,261

|

5,000,280

|

||||||||||||

|

Common

stock subject to possible conversion

|

12,762,785

|

|||||||||||||||

|

Total

stockholders’ equity

|

$

|

21,860,767

|

$

|

23,595,269

|

$

|

27,326,056

|

$

|

52,923,699

|

||||||||

The

following table sets forth certain selected financial data of Techni Bharathi Limited

(TBL). The selected financial data presented below was derived

from TBL’s audited consolidated financial statements for the

period April 1, 2007 through March 7, 2008 (date of acquisition) and for the

three year period ended March 31, 2007, and from TBL’s unaudited consolidated

financial statements for the year ended March 31, 2004. The

information is only a summary and should be read in conjunction with IGC’s

historical financial statements and related notes and our Management’s

Discussion and Analysis of Financial Condition and Results of Operations

contained elsewhere herein. Additional information regarding TBL’s historical

performance can be found in the Company’s Annual Report on Form 10-KSB for the

year ended March 31, 2008. The historical results included below and elsewhere

herein are not indicative of the future financial performance of IGC and its

subsidiaries.

Techni

Bharathi Limited (Predecessor)

Selected

Summary Statement of Income Data

|

(Amounts

in Thousand US Dollars, except share data and as stated

otherwise)

|

April

1 2007 to March 7, 2008

|

31-Mar-07

|

31-Mar-06

|

|||||||||

|

Revenue

|

$

|

5,321

|

$

|

4,318

|

$

|

2,285

|

||||||

|

Income

(loss) before income taxes

|

2,245

|

401

|

(2,369

|

)

|

||||||||

|

Income

taxes

|

(86

|

)

|

135

|

62

|

||||||||

|

Net

(loss)/income

|

1,988

|

536

|

(2,307

|

)

|

||||||||

|

Per

Share Data

|

||||||||||||

|

Basic

|

$

|

0.46

|

$

|

0.13

|

$

|

(0.54

|

)

|

|||||

|

Diluted

|

$

|

0.22

|

$

|

0.13

|

$

|

(0.54

|

)

|

|||||

|

Weighted

Average Shares

|

||||||||||||

|

Basic

|

4,287,500

|

4,287,500

|

4,287,500

|

|||||||||

|

Diluted

|

9,089,928

|

4,287,500

|

4,287,500

|

|||||||||

| (Amounts in Thousand US Dollars, except share data and as stated otherwise) |

31-Mar-05

|

Unaudited

31-Mar-04

|

|||||

|

Revenue

|

$

|

8,954

|

$

|

8,773

|

|||

|

Income

(loss) before income taxes

|

(3,823

|

)

|

(2,609

|

)

|

|||

|

Income

taxes

|

515

|

(63

|

)

|

||||

|

Net

(loss)/income

|

(3,308

|

)

|

(2,672

|

)

|

|||

|

Per

Share Data

|

|||||||

|

Basic

|

$

|

(0.77

|

)

|

$

|

(0.62

|

)

|

|

|

Diluted

|

$

|

(0.77

|

)

|

$

|

(0.62

|

)

|

|

|

Weighted

Average Shares

|

|||||||

|

Basic

|

4,287,500

|

4,287,500

|

|||||

|

Diluted

|

4,287,500

|

4,287,500

|

Techni

Bharathi Limited (Predecessor)

Selected

Summary Balance Sheet Data

|

(Amounts

in Thousand US Dollars)

|

7-Mar-08

|

31-Mar-07

|

31-Mar-06

|

|||||||||

|

ASSETS

|

||||||||||||

|

Cash

and cash equivalents

|

$

|

736

|

$

|

1,208

|

$

|

69

|

||||||

|

Inventories

|

1,428

|

1,284

|

4,182

|

|||||||||

|

Prepaid

and other assets

|

271

|

1,231

|

1,275

|

|||||||||

|

Property,

plant and equipment (net)

|

1,979

|

2,265

|

2,417

|

|||||||||

|

LIABILITIES

|

||||||||||||

|

Short

term borrowings and current portion of long-term loan

|

2,437

|

6,079

|

8,125

|

|||||||||

|

Trade

payable

|

2,222

|

1,502

|

987

|

|||||||||

|

Long

term debts, net of current portion

|

-

|