Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - DELTA AIR LINES, INC. | delta_8k-030910.htm |

| EX-99.2 - INVESTOR UPDATE - DELTA AIR LINES, INC. | delta_8k-ex9902.htm |

Exhibit 99.1

Delta: A Solid

Flight Plan

Ed

Bastian, President

March

9, 2010

1

This presentation

contains various projections and other forward-looking statements which

represent Delta’s estimates or expectations regarding future events. All forward-looking

statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the

projected results. Factors which could cause such differences include, without limitation,

business, economic, competitive, industry, regulatory, market and financial uncertainties

and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-K filed with

the SEC on February 24, 2010. Caution should be taken not to place undue reliance on

Delta’s forward-looking statements, which represent Delta’s views only as of the date of this

presentation, and which Delta has no current intention to update.

represent Delta’s estimates or expectations regarding future events. All forward-looking

statements involve a number of assumptions, risks and uncertainties, many of which are

beyond Delta’s control, that could cause the actual results to differ materially from the

projected results. Factors which could cause such differences include, without limitation,

business, economic, competitive, industry, regulatory, market and financial uncertainties

and contingencies, as well as the “Risk Factors” discussed in Delta’s Form 10-K filed with

the SEC on February 24, 2010. Caution should be taken not to place undue reliance on

Delta’s forward-looking statements, which represent Delta’s views only as of the date of this

presentation, and which Delta has no current intention to update.

In this

presentation, we will discuss certain non-GAAP financial measures. You can

find the

reconciliations of those measures to comparable GAAP measures on our website at

delta.com.

reconciliations of those measures to comparable GAAP measures on our website at

delta.com.

Safe

Harbor

2

Delta: A Solid

Flight Plan

At

market fuel prices, Delta was the only

profitable network carrier in 2009

profitable network carrier in 2009

Well

positioned for 2010

Creating

a financially successful

airline for the long term

airline for the long term

Strong financial

foundation, premium revenue

opportunities, low cost structure and merger

synergies position Delta to take full advantage of

economic recovery

opportunities, low cost structure and merger

synergies position Delta to take full advantage of

economic recovery

Strong

financial foundation is

unique in the industry

unique in the industry

Minimal capital

requirements enable cash

investment in product quality and in balance

sheet improvement

investment in product quality and in balance

sheet improvement

3

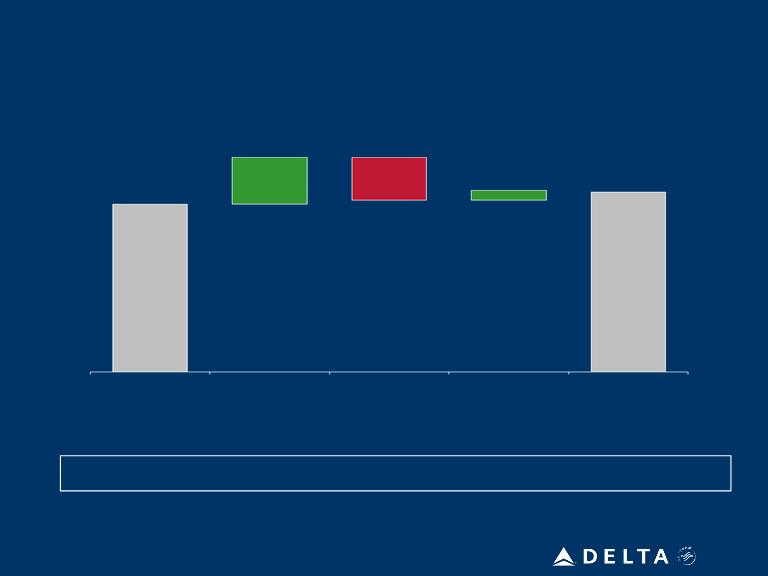

Delta’s

Performance Is Distinguished From Its Peers

2009

Pre-Tax Income,

at Market Fuel Prices ($M)

at Market Fuel Prices ($M)

2009

EBITDAR,

at Market Fuel Prices ($M)

at Market Fuel Prices ($M)

Note: All

results exclude special items. Results

adjusted to a common fuel price of $1.80 per gallon.

At

market fuel prices, Delta was the only profitable network carrier in

2009

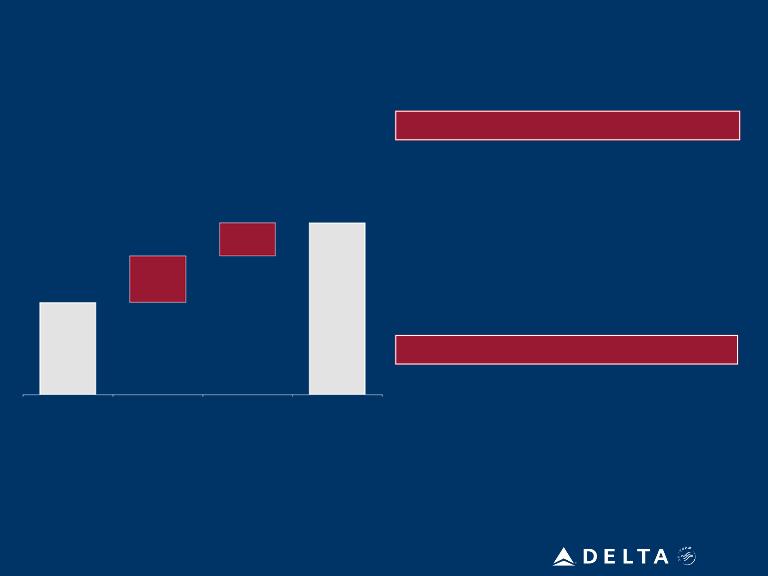

Liquidity Key to

Weathering the Economic Storm

Note:

Liquidity balance includes cash, short term securities and revolving credit

facilities.

Unrestricted

Liquidity December 2008 vs. December 2009 ($B)

Unrestricted

Liquidity

Balance

12/31/08

Unrestricted

Liquidity

Balance

12/31/09

Net

Debt

Issuance

$5.4

$5.0

$0.3

Net

Investing

($1.3)

$1.4

Operating

Cash

Flow

Positive free cash

flow despite $6 billion revenue decline

4

5

Unit

Revenue Momentum is Building

Improvement driven

by prior year comparisons, capacity discipline and

economic

recovery

recovery

Passenger

Unit Revenue - YoY Change

(23%)

16%

Note: Forecasted

value for March 2010

6

Corporate Sales

Trends Improving

Ticket

Volume

Revenue

Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb

34%

32%

2009 2009 2009 2009 2009 2009 2009 2009 2009 2009 2010 2010

7

Delivering on

Merger

Benefits

Benefits

Moving Forward in

2010

$6

billion in free cash flow over next three

years to delever balance sheet

years to delever balance sheet

Strengthening

the

Balance Sheet

Balance Sheet

Generating a

Revenue

Premium

Premium

Integration

substantially complete and on

track to deliver $2 billion in run-rate

synergies by the end of 2011

track to deliver $2 billion in run-rate

synergies by the end of 2011

Drive

industry-leading revenue from

superior network and product

superior network and product

8

• Complete

rebranding of Northwest regional aircraft

• Resolve open

employee representation for flight

attendants and airport workers

attendants and airport workers

• Drive revenue

premium

Integration Of The

Airlines Substantially Complete

Remaining

Integration Items

• Single operating

certificate received

• Reservations

system integrated

• Single revenue

management system

• Frequent flyer

programs integrated

• First joint

cockpit crew

• Expanded

trans-Atlantic joint venture with AF/KLM

• Completed airport

consolidation and rebranding

Merger

Accomplishments

On

track to hit full synergy run-rate by end of 2011

9

Targeting $600

Million in New 2010 Synergies

Revenue

- $350 million

Cost

- $250 million

• Expand fleet

movements across

network

network

• S-curve

benefits

• Integrated revenue

management

technology

technology

• First fully

coordinated schedule with Air

France/KLM

France/KLM

• Improved vendor

terms from renegotiated

contracts

contracts

• Discontinued

freighter flying

• Continued

consolidation of headquarters

functions

functions

• Elimination of

duplicate technology platforms

Single operating

certificate, technology integration unlock significant value

2009

Synergies

Synergies

$700M

Revenue

Cost

2010

Synergies

Synergies

Incremental

Synergies

$250M

$350M

$1.3B

10

Delta: Generating

Revenue Premium

• Optimize fleet

allocations

• Integrated revenue

management technology

• Corporate and

agency sales contracting

• S-curve market

benefits

Targeted

market initiatives

provide additional revenue growth

opportunities

provide additional revenue growth

opportunities

• New York

strategy

• Pacific network

restructuring

Aggressive

capture of merger

synergies

synergies

• Broaden current

alliance relationships

• Attract new

partners

Expanding

global alliances to

build out the network footprint

build out the network footprint

11

Realigning Delta’s

Fleet Drives Network Synergies

SLC

MSP

A320

M90

Ability to

maximize fleet allocations drives incremental value

A320s

moved to

SLC hub, will allow

access to East

Coast markets

SLC hub, will allow

access to East

Coast markets

M90s

moved to MSP

hub, where missions do

not require longer

range aircraft

hub, where missions do

not require longer

range aircraft

International

cross fleeting

builds on successful 2009

routes by adding:

builds on successful 2009

routes by adding:

Atlanta-Paris

Detroit-Frankfurt

New York

(JFK)-Athens

New York (JFK)-Tel

Aviv

Memphis-Amsterdam

12

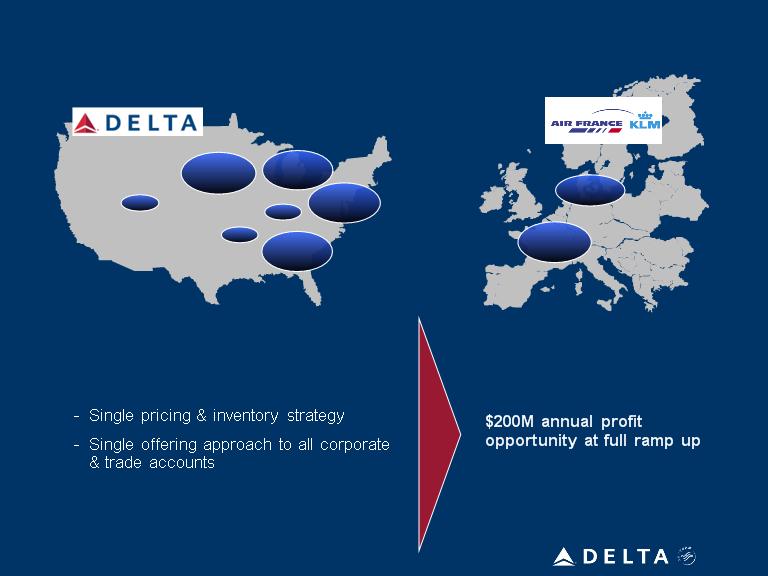

JFK

ATL

CDG

AMS

DTW

MSP

MEM

CVG

SLC

• First fully

coordinated DL/AF/KL summer

schedule will enhance JV profitability in 2010

schedule will enhance JV profitability in 2010

- Fully leveraged

hubs & beyond network

• Joint revenue

management

• Capitalizing on

point-of-sale presence in each

region

region

Leveraging

Trans-Atlantic Joint Venture To

Maximize Profits

Maximize Profits

13

Investing in

Customer Experience, Not Re-Fleeting

Operating cash

funds $1B investment in customer experience and fleet efficiency

• All international

widebody aircraft to

have full flat-bed seats in

BusinessElite

have full flat-bed seats in

BusinessElite

• Expanding in-seat

audio and video on

demand for customers on all wide-

body aircraft

demand for customers on all wide-

body aircraft

• Adding First Class

cabins to all 70-

seat regional jets

seat regional jets

• Completing

conversions of pre-

merger Northwest aircraft to Delta

interiors

merger Northwest aircraft to Delta

interiors

• Installing

winglets on more than 170

additional aircraft to improve fuel

efficiency

additional aircraft to improve fuel

efficiency

• New SkyClub

locations

14

Targeting Flat

Unit Costs Excluding Fuel in 2010

Consolidated

CASM ex Fuel (¢)

8.25

8.28

2009

2010

Key

cost synergies/productivity initiatives

• Improved vendor

contract terms

• Further

streamlining overhead and technology

• Airport

efficiencies

• Savings from

grounding older, less efficient

aircraft

aircraft

• Incremental

benefits of 2009 actions (i.e., freighter

grounding, aligning staffing levels)

grounding, aligning staffing levels)

Expected

cost pressures

• Engine maintenance

volume

• Investments in

employees

• Customer and

product investment initiatives

Benefits from cost

synergies and productivity offset cost pressures

Note: All

figures exclude special items

Mainline

CASM ex Fuel (¢)

7.40

7.40

2009

2010

Managing Fuel

Price Risk Through Systematic

Hedging

Hedging

Downside

Participation

76%

78%

86%

91%

83%

Note: Hedging

portfolio data as of March 5, 2010

• Use of call options

will allow for downside price participation but will

protect against upward cost pressures

protect against upward cost pressures

Avg.

Crude Call

Projected fuel

price

$2.22

$2.33

$2.43

$2.45

$2.36

15

Collars

Swaps

Call

options

47%

49%

29%

20%

36%

16

Free

Cash Flow Will Drive Balance Sheet Delevering

Operating Cash

Flow

Capital

Expenditures

$3 -

$4 billion

Total

Three Year Projection

2010

- 2012

$9 -

$10 billion

Adjusted Net Debt

($B)

12/31/09

12/31/12

Free

Cash Flow

~$6

billion

Strong operating

cash flow, coupled with minimal capital requirements

17

Revenue Strength

Driving Improved March Quarter Expectations

|

|

|

March

quarter 2010

|

|

January

26

guidance |

|

|

Operating

margin

|

1 -

2%

|

|

Breakeven

|

|

|

|

Fuel

price

|

$2.22

|

|

$2.22

|

|

|

|

Total

unrestricted liquidity

|

$5.5

billion

|

|

$5.6

billion

|

|

|

|

|

|

|

|

|

|

|

|

|

March

quarter 2010 vs.

March quarter 2009 |

|

|

|

|

Consolidated

non-fuel

unit

cost

|

Up 1 -

2%

|

|

Flat to up

2%

|

|

|

|

|

|

|

|

|

|

|

System

capacity

|

Down 4 -

5%

|

|

Down 3 -

5%

|

|

|

|

|

Domestic

|

Down 2 -

3%

|

|

Down 1 -

3%

|

|

|

|

International

|

Down 7 -

8%

|

|

Down 5 -

7%

|

|

February storms

net impact expected to be $30 million for the quarter

Note: Fuel

price is net of hedge

impact, and includes approximately $0.24 for taxes, transportation, and option

premiums

18

Progress Being

Made … More Work To Do

Encouraged with

ability to withstand economic headwinds, but improvements

remain to achieve our shareholder return goals

remain to achieve our shareholder return goals

10

- 12% operating margin

$2.5

- $3.0 billion in operating

cash flows

cash flows

Minimize

capital reinvestment

requirements

requirements

Delever

the balance sheet

Generate

10% return on invested capital

Non-GAAP Financial

Measures

Delta

completed its merger with Northwest Airlines on October 29, 2008. Accordingly,

Delta’s financial results prepared in accordance with accounting

principles generally accepted in the U.S. (GAAP) include the results of Northwest Airlines for 2009.Under GAAP, Delta does not include in its financial

results the results of Northwest Airlines prior to the completion of the merger. Accordingly, Delta’s financial results under GAAP for 2008 include the

results of Northwest Airlines for the period from October 30, 2008 through December 31, 2008. This impacts the comparability of Delta’s financial

statements under GAAP for 2009 and 2008.

principles generally accepted in the U.S. (GAAP) include the results of Northwest Airlines for 2009.Under GAAP, Delta does not include in its financial

results the results of Northwest Airlines prior to the completion of the merger. Accordingly, Delta’s financial results under GAAP for 2008 include the

results of Northwest Airlines for the period from October 30, 2008 through December 31, 2008. This impacts the comparability of Delta’s financial

statements under GAAP for 2009 and 2008.

Year-over-year

comparisons in certain presentations assume the 2008 financial statements were

prepared on a combined basis, excluding special

items. “Combined basis” means the company combines the financial results of Delta and Northwest as if the merger had occurred prior to the beginning

of the applicable period. Delta believes presenting this financial information on a combined basis provides a more meaningful basis for comparing

Delta’s year-over-year financial performance than the GAAP financial information.

items. “Combined basis” means the company combines the financial results of Delta and Northwest as if the merger had occurred prior to the beginning

of the applicable period. Delta believes presenting this financial information on a combined basis provides a more meaningful basis for comparing

Delta’s year-over-year financial performance than the GAAP financial information.

Delta is

unable to reconcile certain forward-looking projections to GAAP as the nature or

amount of special items cannot be estimated at this time.

Delta

excludes special items and fuel hedge losses because management believes the

exclusion of these items is helpful to investors to evaluate the

company's recurring operational performance.

company's recurring operational performance.

Earnings

before interest, taxes, depreciation, amortization and aircraft rent (EBITDAR)

has been presented as management believes it is helpful to

investors in utilizing EBITDAR as a proxy for operating cash flow on a period over period basis.

investors in utilizing EBITDAR as a proxy for operating cash flow on a period over period basis.

Delta

presents net investing activities and net debt issuance because management

believes this metric is helpful to investors to evaluate the

company's

investing and financing activities.

investing and financing activities.

Delta

presents consolidated and Mainline cost per available seat mile (CASM) excluding

fuel expense and related taxes because management believes

the volatility in fuel prices impacts the comparability of year-over-year financial performance. Consolidated and Mainline CASM exclude ancillary

businesses not associated with the generation of a seat mile. These businesses include expenses related to Delta’s providing maintenance services

(MRO), staffing services and dedicated freight operations as well as Delta’s vacation wholesale operations.

the volatility in fuel prices impacts the comparability of year-over-year financial performance. Consolidated and Mainline CASM exclude ancillary

businesses not associated with the generation of a seat mile. These businesses include expenses related to Delta’s providing maintenance services

(MRO), staffing services and dedicated freight operations as well as Delta’s vacation wholesale operations.

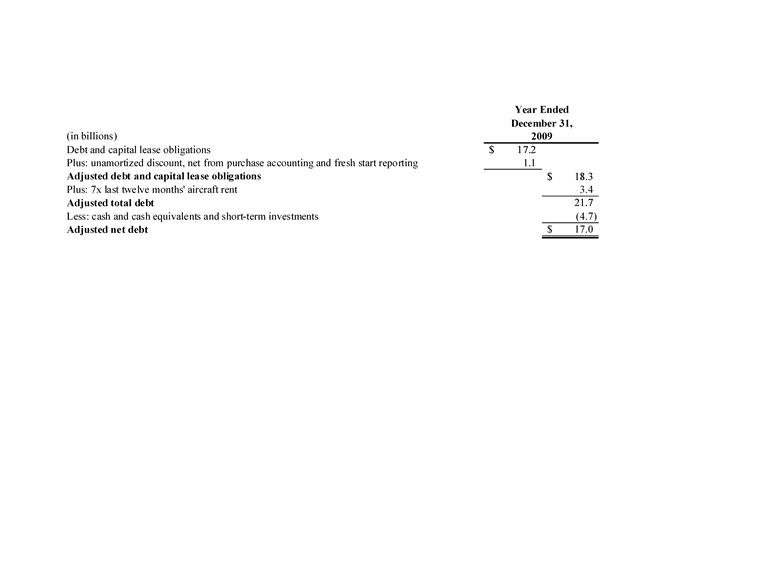

Delta

uses adjusted total debt, including aircraft rent, in addition to long-term

adjusted debt and capital leases, to present estimated financial

obligations.

Delta reduces adjusted total debt by cash and cash equivalents and short-term investments, to present the amount of additional assets needed to satisfy

the debt.

Delta reduces adjusted total debt by cash and cash equivalents and short-term investments, to present the amount of additional assets needed to satisfy

the debt.

The

non-GAAP financial measures should be considered in addition to results prepared

in accordance with GAAP, but should not be considered a

substitute for or superior to GAAP results.

substitute for or superior to GAAP results.

Pre-Tax

Income

EBITDAR

Net

Investing

Net

Debt Issuance

Revenue

Non-Fuel

CASM

Mainline Non-Fuel

CASM

Adjusted Net

Debt