Attached files

Exhibit 99.1

| CNB FINANCIAL CORPORATION & SUBSIDIARIES |

Table of Contents

| Consolidated Financial Highlights | 3 | |

| Message to Shareholders | 4 | |

| Executive Management and Board of Directors | 7 | |

| Officers | 8 | |

| Shareholder Information | 10 | |

| 2009 (ANNUAL REPORT HIGHLIGHTS |

Notes to Consolidated Financial Statements

| (in thousands, except per share data) | |||||||||||

| 2009 | 2008 | % Change | |||||||||

| FOR THE YEAR |

|||||||||||

| Interest Income |

$ | 55,870 | $ | 57,183 | (2.3 | )% | |||||

| Interest Expense |

18,468 | 20,583 | (10.3 | )% | |||||||

| Net Interest Income |

37,402 | 36,600 | 2.2 | % | |||||||

| Non-interest Income |

7,720 | 2,490 | 210.0 | % | |||||||

| Non-interest Expense |

29,791 | 28,801 | 3.4 | % | |||||||

| Net Income |

8,512 | 5,235 | 62.6 | % | |||||||

| Operating Earnings* |

10,100 | 7,811 | 29.3 | % | |||||||

| Net Income Return on: |

|||||||||||

| Average Assets |

0. 79 | % | 0.55 | % | 43.6 | % | |||||

| Average Equity |

12. 86 | % | 7.88 | % | 63.2 | % | |||||

| AT YEAR END |

|||||||||||

| Assets |

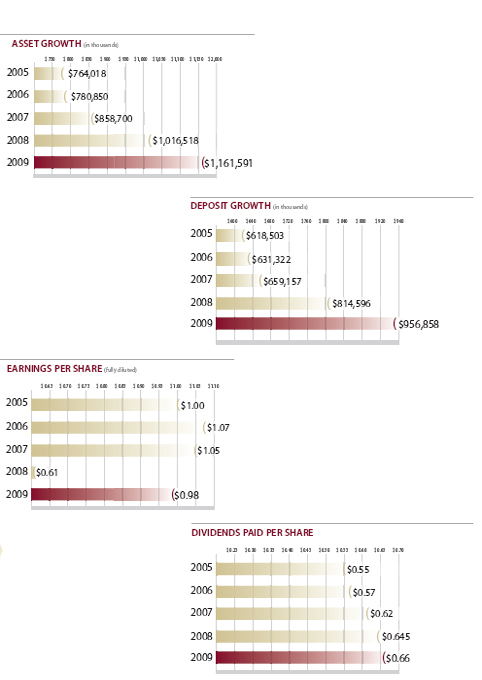

$ | 1,161,591 | $ | 1,016,518 | 14.3 | % | |||||

| Loans, net of unearned |

715,142 | 671,556 | 6.5 | % | |||||||

| Deposits |

956,858 | 814,596 | 17.5 | % | |||||||

| Shareholders’ Equity |

69,409 | 62,467 | 11.1 | % | |||||||

| Trust Assets Under Management (at market value) |

197,233 | 179,223 | 10.0 | % | |||||||

| PER SHARE DATA |

|||||||||||

| Net Income, diluted |

$ | 0.98 | $ | 0.61 | 60.7 | % | |||||

| Dividends |

0.66 | 0.645 | 2.3 | % | |||||||

| Book Value |

7.92 | 7.27 | 8.9 | % | |||||||

| Market Value |

15.99 | 11.19 | 42.9 | % | |||||||

| * | 2009 and 2008 operating earnings amounts are shown before effect of $1,588 and $2,576 (after tax) non-cash charges due to write-downs of other-than-temporarily impaired securities. |

| (3 | CNB FINANCIAL CORPORATION & SUBSIDIARIES |

Message to Shareholders

To Our Shareholders, Customers, Employees & Friends:

As 2009 began, the financial markets, as well as the country, were in very distressed times. CNB Financial Corporation and community banks around the country faced a very uncertain regulatory environment. This uncertainty has subsided considerably throughout the year and the economy is beginning to show some signs of a slow recovery. CNB is prepared to help their markets come out of the recession and begin to grow again.

The Bank’s deposit balances grew at a 17.5% rate in 2009 capping a two year expansion of $297.7 million or 45.2%. Our growth occurred primarily in core checking and saving products as we continue to focus on total relationship banking. Our expansion into the Erie market, including Meadville, has provided much of this growth. These expanded customer relationships have provided the Corporation with more than adequate liquidity to provide the local economy with funding as the recession ends.

Overall, loan growth was much slower in 2009 at 6.5% which was expected as the national and local economies contracted and demand for loans declined. The growth we had came in the residential mortgage area at 7.5% and commercial mortgage at 8.5%. Our primary focus has been to create relationships within the manufacturing base of the commercial market for much of the past ten years. This is the strategy we feel will serve the Corporation well as the factory orders, improve and unemployment levels normalize.

The loan quality continued to show some deterioration during 2009 when compared to prior year results but remains favorable compared to our peer group data. Net charge-offs for the year were $3.4 million, compared to $1.8 million in 2008, representing 0.49% of average loans outstanding. Another key measurement is nonperforming assets, assets in nonaccrual of interest status plus all loans past due over 89 days plus other real estate owned, compared to total assets. Our non-performing assets increased to 1.17% compared to 0.42% for 2008. Although this trend is unfavorable, we remain well below our peer. We attribute this success to our diligent efforts, to remain disciplined in our business planning and in executing those plans. We strive to control our level of charge-offs and non-performing assets while still assisting our borrowers during this time of high unemployment and declining orders for businesses.

Our net income in 2009 was $8.5 million, an increase of 62.6% over 2008. Both 2009 and 2008 were adversely affected by other-than-temporary impairment charges associated with certain corporate investments of $2.4 million and $4.0 million, respectively. In addition, the provision for loan losses was $678,000 or 17.9% higher than 2008. The higher provision is primarily the result of an overall trend in the financial condition of the manufacturing base in the entire region.

| 2009 (ANNUAL REPORT HIGHLIGHTS |

| (5 | CNB FINANCIAL CORPORATION & SUBSIDIARIES |

Message to Shareholders

As we entered into the difficult times late in 2008 with financial giants failing, the uncertainty surrounding federal regulation grew. Much discussion revolved around the need to further layer more regulation on community banks. Thanks to strong public opposition, the government became aware of the vast difference between mega, too big to fail, banks along with non-regulated lenders as compared to community financial institutions, which includes CNB. CNB Financial Corporation has independently maintained its well capitalized status throughout these difficult times and while incurring phenomenal asset growth. Our strong capital position allows us to continue doing community banking very much like we have for our history. CNB strives to be a financial partner in its market. We fund consumer and business needs in the same markets where we accept our deposits and where our employees and directors live. We are very proud of the success of our local communities and of our part in that success.

Finally, 2010 marks the beginning of retirement for William F. Falger. Bill has served this Corporation in an exemplary fashion for 20 years, with the last 16 as President and CEO of both the Corporation and CNB Bank. Bill had the foresight to guide us through significant growth via acquisitions and de novo ventures. While he is retiring from his management role in the Corporation, he will remain active as a member of the Board of Directors. I would like to personally thank Bill for all that he has done and best wishes for the future.

|

| Joseph B. Bower, Jr. |

| President and Chief Executive Officer |

| 2009 (ANNUAL REPORT HIGHLIGHTS |

Executive Management and Board of Directors

| Corporate Officers, CNB Financial Corporation | ||||

| Joseph B. Bower, Jr. | Charles R. Guarino | |||

| President & Chief Executive Officer | Treasurer & Principal Financial Officer | |||

| Richard L. Greslick, Jr. | Vincent C. Turiano | |||

| Secretary | Assistant Secretary | |||

| Executive Officers, CNB Bank | ||||

| Joseph B. Bower, Jr. President & Chief Executive Officer

Mark D. Breakey Executive Vice President & Chief Credit Officer

Charles R. Guarino Vice President & Chief Financial Officer |

Richard L. Sloppy Executive Vice President & Chief Lending Officer

Vincent C. Turiano Senior Vice President/Operations |

|||

| Board of Directors | ||||

| CNB Financial Corporation and CNB Bank | ||||

| Dennis L. Merrey Chairman of the Board Retired, Formerly President, Clearfield Powdered Metals, Inc. (Manufacturer)

Joseph B. Bower, Jr. President and Chief Executive Officer, CNB Financial Corporation; President and Chief Executive Officer, CNB Bank

Robert E. Brown Vice President, E. M. Brown, Inc. (Reclamation, Auto Dealer and Concrete Supplier) |

William F. Falger Retired, Formerly President and Chief Executive Officer, CNB Financial Corporation, CNB Bank

Michael F. Lezzer President, Lezzer Holdings, Inc. (Lumber and Building Supplies Retailer)

Robert W. Montler President & Chief Executive Officer, Lee Industries and Keystone Process Equipment (Manufacturers)

William C. Polacek President & Chief Executive Officer, Johnstown Welding & Fabrication Industries (Manufacturer)

Deborah Dick Pontzer Economic Development and Workforce Specialist, Office of Congressman Glenn Thompson

Jeffrey S. Powell President, J.J. Powell, Inc. (Petroleum Distributor) |

Charles H. Reams President, C.H. Reams & Associates, Inc. (Insurance)

James B. Ryan Retired, Formerly Vice President of Sales, Marketing, Windfall Products, Inc. (Manufacturer)

Peter F. Smith Attorney at Law

DIRECTOR EMERITUS L. E. Soult, Jr. | ||

| (7 | CNB FINANCIAL CORPORATION & SUBSIDIARIES |

Officers

| Administrative Services | ||||

| Mary Ann Conaway Vice President, Human Resources

Richard L. Greslick, Jr. Vice President, Administration

Edward H. Proud Vice President, Information Systems

Thomas J. Ammerman, Jr. Assistant Vice President/Security

Donna J. Collins Assistant Vice President/Compliance |

Leanne D. Kassab Assistant Vice President/Marketing

Susan M. Warrick Assistant Vice President/Operations

Brian W. Wingard Assistant Vice President/Controller

Carol J. Cossick Assistant Controller

Thomas W. Grice Network Administration Officer |

Shannon L. Irwin Human Resources Officer

Susan B. Kurtz Customer Service Officer

Dennis J. Sloppy Information Systems Officer

Carolyn B. Smeal Operations Officer

BJ Sterndale Training Officer

Brenda L. Terry Banking Officer | ||

| Branch Division | ||||

| Vickie L. Baker Assistant Vice President, Regional Branch Administration, Bradford Main Street Office

Ruth Anne Ryan-Catalano Assistant Vice President, Regional Branch Administration, Industrial Park Road Office, Clearfield

Mary A. Baker Assistant Vice President, Northern Cambria Office

Deborah M. Young Assistant Vice President, Washington Street Office, St. Marys |

Denise J. Greene Community Office Manager, DuBois Office

Paul A. McDermott Banking Officer, Community Banking, Clearfield

Francine M. Papa Community Office Manager, Ridgway Office

Larry A. Putt Banking Officer, Community Banking, Clearfield

Mary Ann Roney Banking Officer, Bradford |

Douglas M. Shaffer Community Office Manager, Punxsutawney Office

Susan J. Shimmel Community Office Manager, Old Town Road Office, Clearfield

Theresa L. Swanson Community Office Manager, Warren Office

Gregory R. Williams Community Office Manager, Osceola Mills Office | ||

| Lending Division | ||||

| Robert S. Berezansky Senior Vice President, Corporate Lending

James M. Baker Vice President, Commercial Banking, DuBois

Michael E. Haines Vice President, Commercial Banking, St. Marys

Robin L. Hay Vice President, Commercial Banking

Jeffrey A. Herr Vice President, Commercial Banking, Philipsburg |

Charles C. Shrader Vice President, Commercial Banking, Warren

Joseph H. Yaros Vice President, Commercial Banking Bradford

David W. Ogden Vice President, Credit Administration

Christopher L. Stott Vice President, Retail Lending

Michael C. Sutika Vice President, Commercial Banking |

Gregory M. Dixon Assistant Vice President/Credit Administration

Richard L. Bannon Credit Administration Officer

Jennifer L. Mowery Staff Commercial Lender Johnstown

Eileen F. Ryan Assistant Vice President/Mortgage Lending

Steven C. Tunall Commercial Banking, Kane | ||

| Wealth & Asset Management Services | ||||

| Todd M. Abrams Senior Vice President/Managing Director, Wealth & Asset Management

Craig C. Ball Vice President, Wealth Management

Natalie R. Barnett Financial Consultant, Wealth Management |

Calvin R. Thomas, Jr. Vice President, Trust Officer

Jane M. Gnan Assistant Trust Officer

Glenn R. Pentz Trust Officer |

|||

| 2009 (ANNUAL REPORT HIGHLIGHTS |

Officers & Affiliates

| ERIEBANK, a Division of CNB Bank | ||||

| David J. Zimmer President

Donald W. Damon Senior Vice President

Steven M. Capellino Senior Vice President, Meadville Office

William L. DeLuca Jr. Senior Vice President

Betsy Bort Vice President |

Scott O. Calhoun Vice President

John M. Schulze Vice President

William J. Vitron, Jr. Vice President, Wealth Management

Carla M. LaBoda Regional Retail Administrator, Asbury Office

Kelly S. Buck Community Office Manager, Downtown Office |

Matthew V. Feleppa Community Office Manager, Meadville Office

Katie J. Jones Community Office Manager, Harborcreek Office

Abby L. Mouyard Community Office Manager, Main Office

Paul D. Sallie Commercial Lending Officer | ||

| ERIEBANK Regional Board of Directors | ||||

| Joseph B. Bower, Jr. President and Chief Executive Officer, CNB Financial Corporation, CNB Bank

Mark D. Breakey Executive Vice President & Chief Credit Officer

Harry E. Brown Vice President, Specialty Bar Products, EBC Industries (Manufacturing)

Gary L. Clark Vice President, Chief Financial Officer and Chief Administrative Officer, Snap-tite, Inc. (Manufacturing) |

Thomas L. Doolin President, New Age Business Solutions, LLC (Consulting)

David K. Galey Treasurer, Chief Financial Officer, Greenleaf Corporation (Manufacturing)

Thomas Kennedy President, Professional Development Associates, Inc. (Real estate developer)

Charles H. Reams President, C. H. Reams & Associates, Inc. (Insurance) |

James E. Spoden Esquire, MacDonald Illig Jones & Britton, LLP (Law office)

David J. Zimmer President, ERIEBANK | ||

| Holiday Financial Services Corporation, a Subsidiary of CNB Financial Corporation | ||

| Board of Directors & Corporate Officers

Joseph B. Bower, Jr. Director & President

Richard L. Greslick, Jr. Director & Secretary

Charles R. Guarino Director & Treasurer |

Administrative Services

Joseph P. Strouse Vice President

Jonathan L. Holler Assistant Vice President | |

| CNB Securities Corporation, a Subsidiary of CNB Financial Corporation, Wilmington, DE | ||

| Board of Directors

Brian W. Wingard Director

Glenn R. Pentz Director

Donald R. McLamb, Jr. Wilmington Trust SP Services, Inc. |

Corporate Officers

Richard L. Greslick, Jr. President

Donald R. McLamb, Jr. Treasurer, Wilmington Trust SP Services, Inc.

Elizabeth F. Bothner Secretary, Wilmington Trust SP Services, Inc. | |

| (9 | CNB FINANCIAL CORPORATION & SUBSIDIARIES |

Shareholder’s Information

| Annual Meeting | Corporate Profile

CNB Financial Corporation is a leader in providing integrated financial solutions which creates value for both consumers and businesses. These solutions encompass checking, savings, time and deposit accounts, Private Banking, loans and lines of credit (real estate, commercial, industrial, residential and consumer), credit cards, cash management, online banking, electronic check deposit, merchant credit card processing, on-site banker and accounts receivable handling. In addition, the Corporation provides wealth and asset management services, retirement plans and other employee benefit plans.

CNB Bank

A subsidiary of CNB Financial Corporation, CNB is a regional independent community bank in North Central Pennsylvania with approximately 303 employees who make customer service more responsive and reliable. For over 140 years, the Bank has strived to be more customer-driven than its competitors thus building long-term customer relationships by being reliable and competitively priced.

CNB continually seeks innovative ways to execute a personal, quality customer service strategy and prides itself for being first-to-market many of these innovations. To satisfy customers’ financial needs and expectations, it offers a variety of delivery channels, which includes 21 full-service offices, 19 ATMs, 1 loan production office, telephone banking (1-866-224-7314), Internet banking (www.bankcnb.com) and a centralized customer service center (1-800-492-3221).

ERIEBANK

Headquartered in Erie, Pennsylvania, ERIEBANK is a division of CNB Bank. Presently, there are five full service locations which house its commercial, retail and Private Banking divisions.

Holiday Financial Services

Another subsidiary of CNB Financial Corporation, Holiday Financial Services, a consumer loan company, currently has eight conveniently located offices in Bellefonte, Bradford, Clearfield, Erie, Hollidaysburg, Northern Cambria, Ridgway and Sidman, Pennsylvania.

The common stock of the Corporation trades on the NASDAQ National Market under the symbol CCNE. | |||

|

The Annual Meeting of the Shareholders of CNB Financial Corporation will be held Tuesday, April 20, 2010 at 2:00 p.m. at the Corporation’s Headquarters in Clearfield, PA. |

||||

|

Corporate Address |

||||

|

CNB Financial Corporation 1 S. Second Street P.O. Box 42 Clearfield, PA 16830 (814) 765-9621 |

||||

|

Stock Transfer Agent & Registrar |

||||

|

Registrar and Transfer Company 10 Commerce Drive Cranford, NJ 07016 (908) 497-2300 |

||||

|

Form 10-K |

||||

|

Shareholders may obtain a copy of the Annual Report to the Securities and Exchange Commission on Form 10-K by writing to: |

||||

|

CNB Financial Corporation 1 S. Second Street P.O. Box 42 Clearfield, PA 16830 ATTN: Shareholder Relations |

||||

|

Quarterly Share Data |

||||

|

For information regarding the Corporation’s quarterly share data, please refer to page 12 in the 2009 Form 10-K. |

||||

|

Market Makers |

||||

|

The following firms have chosen to make a market in the stock of the Corporation. Inquiries concerning their services should be directed to: |

||||

|

Boenning & Scattergood, Inc. |

Janney Montgomery Scott |

|||

| 1700 Market Street, Ste 1420 | 484 Jeffers Street | |||

| Philadelphia, PA 19103 | DuBois, PA 15801 | |||

| (800) 842-8928 | (800) 238-0067 | |||

|

Ryan, Beck & Co. |

||||

| 401 City Avenue Ste 902 | ||||

| Bala Cynwyd, PA 19004 | ||||

| (800) 223-8969 | ||||

|

|

||||

| 2009 (ANNUAL REPORT HIGHLIGHTS |

CNB Financial Corporation

1 South Second Street

P.O. Box 42

Clearfield, PA 16830

800-492-3221

www.bankcnb.com