Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON DC, 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

INNOPHOS, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| Delaware | 333-129951 | 20-1380712 | ||

| (state or other jurisdiction of incorporation) |

(Commission File number) | (IRS Employer Identification No.) |

259 Prospect Plains Road

Cranbury, New Jersey 08512

(Address of Principal Executive Officer, including Zip Code)

(609) 495-2495

(Registrants’ Telephone Number, Including Area Code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| None | None |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. x Yes ¨ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

As of February 28, 2010, the registrant had 1,000 shares of Common Stock outstanding.

The registrant meets the conditions set forth in General Instruction I of Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format.

Table of Contents

Page 2 of 94

Table of Contents

FORWARD-LOOKING STATEMENTS

Certain information set forth in this report contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions and other information that is not historical information. In some cases, forward-looking statements can be identified by terminology such as “believes,” “expects,” “may,” “will,” “should,” or “anticipates,” or the negative of such terms or other comparable terminology, or by discussions of strategy. We may also make additional forward-looking statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements.

All forward-looking statements, including without limitation, management’s examination of historical operating trends, are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them, but there can be no assurance that management’s expectations, beliefs and projections will result or be achieved. All forward-looking statements apply only as of the date made. Unless required by law, we undertake no obligation to update or revise forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this report. The following are among the factors that could cause actual results to differ materially from the forward-looking statements. There may be other factors, including those discussed elsewhere in this report, which may cause our actual results to differ materially from the forward-looking statements. Any forward-looking statements should be considered in light of the risk factors specified in this Form 10-K.

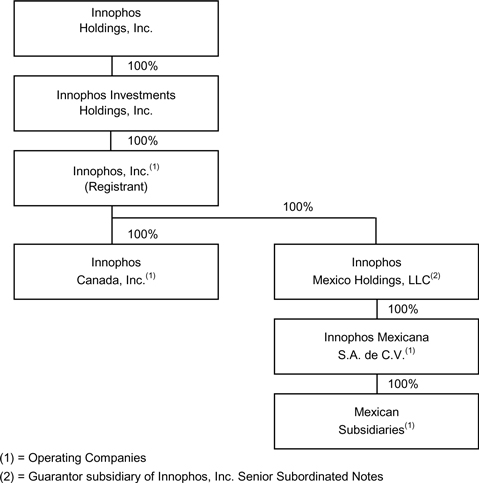

Unless the context otherwise indicates, all references in this report to the “Company,” “Innophos,” “we,” “us” or “our” or similar words are to Innophos, Inc. and its consolidated subsidiaries. Innophos, Inc. is a Delaware corporation and was incorporated July 15, 2004.

Page 3 of 94

Table of Contents

| ITEM 1. | BUSINESS |

Our Company

Innophos, Inc., an indirect wholly-owned subsidiary of Innophos Holdings, Inc. (“Holdings”), commenced operations as an independent company in August 2004 after Holdings purchasing our North American specialty phosphates business from affiliates of Rhodia, S.A., or Rhodia. In November 2006, Holdings completed an initial public offering and listed their Common Stock for trading on the NASDAQ Stock Market under the symbol “IPHS”.

Innophos is a leading North American producer of specialty phosphates. Many specialty phosphates are application-specific compounds engineered to meet customer performance requirements. Specialty phosphates are often critical to the taste, texture and performance of foods, beverages, pharmaceuticals, oral care products and other applications. For example, specialty phosphates act as flavor enhancers in beverages, electrolytes in sports drinks, texture additives in cheeses, leavening agents in baked goods, calcium and phosphorus sources for nutritional supplements, pharmaceutical excipients and cleaning agents in toothpaste.

Key Product Lines

We have three principal product lines: (i) Specialty Salts and Specialty Acids, (ii) Purified Phosphoric Acid, and (iii) Technical Sodium Tripolyphosphate (STPP) & Other Products. Our products serve diverse end-use markets which historically have exhibited stable demand growth.

Specialty Salts and Specialty Acids

Specialty Salts and Specialty Acids are the most highly engineered products in our portfolio. There are a wide range of application-specific products for Specialty Salts, such as flavor enhancers in beverages, electrolytes in sports drinks, texture modifiers in cheeses, leavening agents in baked goods, calcium and phosphorus sources for nutritional supplements, pharmaceutical excipients and abrasives in toothpaste. Specialty Acids are used in industrial applications such as asphalt modification and petrochemical catalysis.

The table below presents a list of the main Specialty Salts and Specialty Acids sold by us in 2009:

| Product |

Description/End-Use Application | |

| Sodium Aluminum Phosphate, Acidic and Basic (“SALP”) | Premier leavening agent for baking mixes, cakes, self-rising flours, baking powders, batter & breadings (acidic). Improves melting properties of cheese (basic). | |

| Sodium Acid PyroPhosphate (“SAPP”) | Leavening agent for baking powders, doughnuts, and biscuits; inhibits browning in potatoes; provides moisture and color retention in poultry and meat. | |

| Sodium HexaMetaPhosphate (“SHMP”) | Water treatment applications; anti-microbial and sequestrant in beverages; cheese emulsifier; improves tenderness in meat, seafood and poultry applications. | |

| Monocalcium Phosphate (“MCP”) | Leavening agent in double-acting baking powder; acidulant; buffering agent. | |

| Dicalcium Phosphate (“DCP”) | Toothpaste abrasive; leavening agent; calcium fortification. | |

| Tricalcium Phosphate (“TCP”) | Calcium and phosphorus fortifier in food and beverage applications (e.g., orange juice, cereals, and cheese); flow aid; additive in expandable polystyrene. | |

Page 4 of 94

Table of Contents

| Product |

Description/End-Use Application | |

| Pharma Calcium Phosphates (“A-Tab®”, “Di-Tab®”, “Tri-Tab®”) | Excipients in vitamins, minerals, nutritional supplements and pharmaceuticals. | |

| Ammonium Phosphates (“MAP”, “DAP”) | High-end fertilizer products for horticultural use; flame retardant; cigarette additives; culture nutrient. | |

| Potassium Phosphates (“TKPP”, “DKP”, “MKP”, “KTPP”) | Water treatment; sports drinks; buffering agent; improves tenderness in meat, seafood and poultry applications; horticulture applications. | |

| Specialty Acids (e.g., Polyacid, High Purity) | Additive improving performance properties of asphalt; electronic applications. | |

| Sodium Blends (e.g., Sodium Tripolyphosphate (STPP (food grade))) | Ingredient improving yield, tenderness, shelf life, moisture and color retention in meat, seafood and poultry applications. | |

| Other (Sodium Bicarbonate, Calcium Acid Pyrophosphate (“CAPP”), Tetrasodium Pyrophosphate (“TSPP”), Mono, Di, & Trisodium Phosphates (“MSP”, “DSP”, “TSP”)) | Baking powders; gelling agent in puddings; cheese emulsifiers. | |

Each salt or acid derivative typically has a number of different applications and end uses. For example, DCP can be used both as a leavening agent in bakery products and as an abrasive in oral care products. However, several food grade salts are unique to the end user in their particular finished product application. Manufacturers often work directly with customers to tailor products to their required specifications.

Our major competitor in the downstream Specialty Salts and Specialty Acids is Israel Chemicals Limited, or ICL.

Purified Phosphoric Acid

Purified Phosphoric Acid (PPA) is a higher-purity form of phosphoric acid, distinct from the agricultural-grade merchant green phosphoric acid used in fertilizer production. PPA is used to manufacture specialty phosphate salts and acids and is also used directly in beverage applications as a flavor enhancer and in water treatment applications. We also sell PPA in the merchant market to third-party phosphate derivative producers.

Our major PPA competitor is Potash Corporation of Saskatchewan Inc., or PCS, a global fertilizer company for which specialty phosphates represents only a small part of its business. We consume the majority of our PPA production in our downstream operations and sell the remainder on the North American merchant market and to other downstream phosphate derivative producers, where we compete with PCS. To the best of our knowledge, PCS does not have any downstream technical or food grade phosphate derivative production capacity, other than a small potassium phosphate salt unit which primarily operates under a contract manufacturing arrangement.

Technical Grade Sodium Tripolyphosphate (STPP) & Other Products

STPP is a specialty phosphate derived from reacting phosphoric acid with a sodium alkali. STPP is a key ingredient in cleaning products, including automatic dishwashing detergents, industrial and institutional cleaners and (outside the U.S.) consumer laundry detergents. In addition to its use in cleaning products, STPP is also used in water treatment, clay processing, and copper ore processing. Over 90% of the end use market for STPP is derived from consumer product applications.

Other Products primarily include phosphate fertilizers produced in Mexico chiefly as co-products of manufacturing PPA.

Our major STPP competitor is Mexichem, S.A.B. de C.V., or Mexichem, in Mexico. Currently, Mexichem produces STPP at two manufacturing locations in Mexico.

Over the past several decades, there have been efforts to reduce the use of STPP in consumer and institutional cleaners. In the 1980’s STPP use in consumer laundry applications was discontinued in the U.S. and Canada. Over the last several

Page 5 of 94

Table of Contents

years momentum has gained in eliminating STPP use in consumer automatic dishwashing applications in the U.S. and Canada. It is expected that most detergent manufacturers will discontinue the use of STPP in automatic dishwashing detergent applications during 2010. The Industrial & Institutional market has also reformulated some of its products to reduce STPP content in an effort to market a lower cost and reduced phosphate content product line. In 2008, a global retailer began an initiative to materially reduce the use of STPP in consumer laundry detergent in Latin America by 2011. In January 2009, our largest customer, Quimir, a division of Mexichem, closed its largest STPP plant. Our Mexican operations have historically dedicated a significant portion of their capacity to the production of STPP directly and have sold purified acid to other producers of STPP. In anticipation of reduced detergent grade STPP related demand Innophos Mexico is investing in upgrading the food grade acid and salts capability of the Coatzacoalcos facility, and consequently substantially reducing the portion of capacity dedicated to detergent grade products.

Our Industry

The North American marketplaces for each of our product lines have seen consolidation to two primary producers and several secondary suppliers. We consider the two key producers in each product category to be: (i) our Company and ICL, which acquired Astaris LLC, or Astaris, in 2005, in Specialty Salts and Specialty Acids; (ii) our Company and PCS, in Purified Phosphoric Acid; and (iii) our Company and Mexichem in Technical STPP. The production of specialty phosphates begins with phosphate rock, which can be processed in two alternative ways to produce Purified Phosphoric Acid (PPA): (i) the thermal acid method, in which elemental phosphorus is combusted in a furnace and subsequently hydrated to produce purified phosphoric acid; or (ii) the purified wet acid method (PWA), in which mined phosphate rock is reacted with sulfuric acid to produce merchant green acid, or MGA, (agricultural grade phosphoric acid), which is then purified through solvent-based extraction into purified phosphoric acid. The conversion of merchant green acid into purified phosphoric acid (PPA) is a technically complex and a capital-intensive process.

The thermal acid method of production is based on the electrolytic production of elemental phosphorus and is therefore electricity intensive, while phosphoric acid made by the purified wet acid process requires the use of significant amounts of sulfuric acid. The relative overall costs of the two methods depend on the availability and cost of their component processes, electricity and coke for the former and sulfur for the latter. Purified phosphoric acid is reacted with appropriate mineral salts or inorganic compounds to produce various specialty phosphate salts or STPP as required. We currently use purified acid manufactured via the wet acid process for all of our Specialty Salts and Specialty Acids manufacturing needs.

Consolidation of producers has been most significant in the Specialty Salts and Specialty Acids market.

In addition to consolidation of producers, uneconomic production capacity has been eliminated in North America across all three major specialty phosphate product categories. For instance, in 2001, Rhodia closed its specialty salts and specialty acids plants in Buckingham, Quebec and Morrisville, Pennsylvania. In 2002, Vicksburg Chemical Company closed a specialty salts plant in Vicksburg, Mississippi. In 2003 and 2004, Astaris closed three manufacturing facilities, eliminating roughly 320,000 metric tons of capacity: a purified wet phosphoric acid plant in Conda, Idaho; a specialty salts plant in Trenton, Michigan; and an STPP plant in Green River, Wyoming. In January 2009, Mexichem closed its Coatzacoalcos facility eliminating approximately 50% of their estimated STPP capacity.

In June 2006, PCS started up a fourth PWA based purified phosphoric acid production train at its Aurora, NC facility, a capacity addition less than the estimated combined level of 2006 North American PPA imports and domestic PPA produced via the thermal process. The PCS capacity increase was also comparable in capacity to the Astaris Idaho plant closed in 2003 following a failed start-up.

Penetration from Imports

Over the past several years, we estimate that imports, including domestically located production facilities owned by foreign based organizations, have accounted for approximately 15-20% of the North American specialty phosphate market. This market share has been fairly stable for the last two years; however, China imports of STPP and Phosphoric acid increased in 2009, off-setting reductions in phosphoric acid imports from Belgium & Israel.

The following are the primary importers of purified phosphoric acid products and derivatives into North America: (i) Prayon SA, or Prayon, and Rotem Amfert Negev Ltd. (a subsidiary of ICL) for purified phosphoric acid, with Prayon primarily supplying acid to its specialty salts manufacturing facility in Augusta, Georgia; and (ii) various Chinese, European, and Israeli specialty phosphate manufacturers such as Chemische Fabrik Budenheim, Thermphos, Hubei Xingfa, Jiangyin Chengxing, Guangxi Mingli and BK Giulini Chemie GmbH & Co. (a subsidiary of ICL) for specialty salts and STPP.

Page 6 of 94

Table of Contents

Our Customers

Our customer base is principally composed of consumer goods manufacturers, distributors and specialty chemical manufacturers. Our customers manufacture products such as soft drinks, sports drinks and juices, various food products, toothpaste and other dental products, petroleum and petrochemical products, and various cleaners and detergents. Our customers include major consumer goods manufacturers with global market recognition in the food, beverage, pharmaceutical and cleaning product markets. We have maintained long-term relationships with the majority of our key customers, with the average customer relationship having lasted over 15 years, and some relationships spanning nearly a century. Our specialty chemical products are often critical ingredients in the formulation of our customers’ products, and typically represent only a small percentage of their total product costs. As a result, we believe that the risks associated with our customers switching suppliers often outweigh the potential gains.

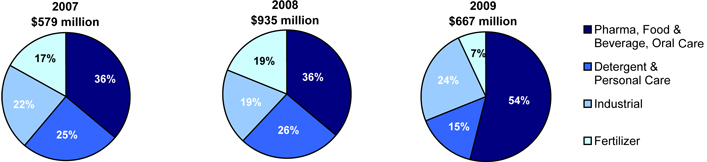

For the years ended December 31, 2007, 2008 and 2009, we generated net sales of $579.0 million, $934.8 million and $666.8 million, respectively. Net sales by end-market were as follows:

The company delivered record revenues in 2008 as we responded to rapidly rising market raw material costs by effectively raising our own selling prices. By early 2009, raw material costs had fallen rapidly together with recessionary economic conditions that also negatively impacted demand in 2009 compared to 2008. We responded with reductions in our own selling prices during 2009. Through this period our continued focus on demonstrating the value of our products and service to high value end markets has enabled us to significantly enhance our mix with now over 50% of our sales into pharmaceutical, food, beverage and oral care applications.

Raw Materials and Energy

We purchase a range of raw materials and energy sources on the open market, including phosphate rock, sulfur and sulfuric acid, agricultural grade phosphoric acid (also known as MGA), PPA, natural gas and electricity. To help secure supply, we purchase several of our key raw materials under long-term contracts generally providing for fixed or minimum quantities of materials, or purchase of our full requirements, and predetermined pricing formulae based on various market indices and other factors. We do not engage in any significant futures or other derivative contracts to hedge against fluctuations of raw material . We are not integrated vertically back to our sources of supply by ownership interests, joint ventures or affiliated companies, as a result of which raw materials acquisition at economical price levels is a major risk of our business. See Item 1A “Raw Materials Availability and Pricing” of this Report Form 10-K.

Phosphate Rock and Merchant Green Acid (MGA). MGA is the main raw material for the creation of our downstream salts and acids. We purchase MGA for processing at our Geismar, LA facility through a long-term agreement with PCS. At our Coatzacoalcos facility in Mexico we typically purchase phosphate rock in order to produce MGA internally; however, we can also process externally purchased MGA, available from various suppliers globally. We have an agreement with OCP, S.A., or OCP, for the supply of phosphate rock to Mexico, which is scheduled to expire on September 10, 2010. The price we pay OCP under this contract was settled annually based on parameters established in the contract and has now been fixed for the remainder of the current contract. During 2008 and 2009 volatility in the market price of phosphate rock led to a dispute between OCP and Innophos over the application of the supply contract pricing clause. Having failed to settle these differences by negotiation the parties began arbitration at the ICC in Paris over the pricing dispute and counterclaims made by OCP asserting a failure by Innophos to meet implied minimum purchase and exclusivity commitments. This dispute was settled on February 24, 2010, details of the settlement are included in Note 16 of Notes to Consolidated Financial Statements in “Item 8. Financial Statements and Supplementary Data.” We are currently in active negotiations with several suppliers for phosphate rock supply once the OCP contract expires.

Page 7 of 94

Table of Contents

Sulfur and Sulfuric Acid. Sulfur is the key raw material used in the production of Sulfuric Acid. Sulfuric acid is a key raw material used in the production of merchant green acid. We produce the vast majority of the sulfuric acid required to operate our Coatzacoalcos facility. The majority of the sulfuric acid required for the production of MGA by PCS, at Geismar is supplied by Rhodia. Our U.S. needs for sulfuric acid and our Mexican needs for sulfur are handled through long term contracts with Rhodia and Pemex-Gas y Petroquimica Basica, or PEMEX, respectively.

Purified Phosphoric Acid. The key raw material input for all of our downstream Specialty Salt and Specialty Acid operations is PPA. We purchase certain quantities of our PPA supply from third parties to optimize our consumption and net sales, including from PCS with whom we have a long-term supply contract. In 2009 Innophos produced approximately 70 percent and purchased approximately 30 percent of its total PPA supply.

Natural Gas and Electricity. Natural gas and electricity are used to operate our facilities and generate heat and steam for the various manufacturing processes. We typically purchase natural gas and electricity on the North American open market at so-called “spot rates.” From time to time, we will enter into longer term natural gas and electricity supply contracts in an effort to eliminate some of the volatility in our energy costs. We also seek to increase the energy efficiencies of our facilities and reduce costs through investments such as the co-generation project for our Coatzacoalcos Plant commissioned into service in March 2008.

Research and Development

Our product engineering and development activities are aimed at developing and enhancing products, processes, applications and technologies to strengthen our position in our markets and with our customers. We focus on:

| • | developing new or improved application-specific specialty phosphate products based on our existing product line and identified or anticipated customer needs; |

| • | creating specialty phosphate products to be used in new applications or to serve new markets; |

| • | providing customers with premier technical services as they integrate our specialty phosphate products into their products and manufacturing processes; |

| • | ensuring that our products are manufactured in accordance with our stringent regulatory, health and safety policies and objectives; |

| • | developing more efficient and lower cost manufacturing processes; and |

| • | expanding existing, and developing new, relationships with customers to meet their product engineering needs. |

Our research expenditures were $1.9 million, $2.3 million and $2.0 million for the years ended December 31, 2009, December 31, 2008 and December 31, 2007, respectively.

Environmental and Regulatory Compliance

Certain of our operations involve manufacturing ingredients for use in food, nutritional supplement and pharmaceutical excipient products, and therefore must comply with stringent U.S. Food and Drug Administration, or FDA or the U.S. Department of Agriculture, or USDA good manufacturing practices as well as the quality requirements of our customers. In addition, our operations that involve the use, handling, processing, storage, transportation and disposal of hazardous materials, are subject to extensive and frequently changing environmental regulation by federal, state, and local authorities, as well as regulatory authorities with jurisdiction over our foreign operations. Our operations also expose us to the risk of claims for environmental remediation and restoration or for exposure to hazardous materials. Our production facilities require operating permits that are subject to renewal or modification. Violations of health and safety and environmental laws, regulations, or permits may result in restrictions being imposed on operating activities, substantial fines, penalties, damages, the rescission of an operating permit, third-party claims for property damage or personal injury, or other costs, any of which could have a material adverse effect on our business, financial condition, results of operations, or cash flows. Due to changes in health and safety and environmental laws and regulations, the time frames when those laws and regulations might be applied, and developments in environmental control technology, we cannot predict with certainty the amount of capital expenditures to be incurred for environmental purposes.

Page 8 of 94

Table of Contents

Some environmental laws and regulations impose liability and responsibility on present and former owners, operators or users of facilities, and sites for contamination at such facilities and sites without regard to causation or knowledge of contamination. Many of our sites have an extended history of industrial use. Soil and groundwater contamination have been detected at some of our sites, and additional contamination might occur or be discovered at these sites or other sites in the future (including sites to which we may have sent hazardous waste). We continue to investigate, monitor or cleanup contamination at most of these sites. The potential liability for all these sites will depend on several factors, including the extent of contamination, the method of remediation, future developments and increasingly stringent regulation , the outcome of discussions with regulatory agencies, the liability of third parties, potential natural resource damage, and insurance coverage. Accruals for environmental matters are recorded in the accounting period in which our responsibility is established and the cost can be reasonably estimated. Due to the uncertainties associated with environmental investigations and cleanups and the ongoing nature of the investigations and cleanups at our sites, we are unable to predict precisely the nature, cost and timing of our future remedial obligations with respect to our sites and, as a result, our actual environmental costs and liabilities could significantly exceed our accruals.

Further information, including the current status of significant environmental matters and the financial impact incurred for the remediation of such environmental matters, is included in Note 14, Commitments and Contingencies, of the Notes to Financial Statements in “Item 8. Financial Statements and Supplementary Data,” and in “Item 1A. Risk Factors”.

Intellectual Property

We rely on a combination of patent, copyright and trademark laws to protect certain key intellectual aspects of our business. In addition, our pool of proprietary information, consisting of manufacturing know-how, trade secrets and unregistered copyrights relating to the design and operation of our facilities and systems, is considered particularly important and valuable. Accordingly, we protect proprietary information through all legal means practicable. However, monitoring the unauthorized use of our intellectual property is difficult, and the steps we have taken may not prevent all unauthorized use by others. While we consider our copyrights and trademarks to be important to our business, ultimately our established reputation and the products and service we provide to the end-customer are more important.

Insurance

In the normal course of business, we are subject to numerous operating risks, including risks associated with environmental, health and safety while manufacturing, developing and supplying products, potential damage to a customer, and the potential for an environmental accident.

We currently have in force insurance policies covering property, general liability, excess liability, workers’ compensation/employer’s liability, product liability, product recall, fiduciary and other coverages. We seek to maintain coverages consistent with market practices and required by those with whom we do business. We believe that we are appropriately insured for the insurable risks associated with our business.

Employees

As of December 31, 2009, we had approximately 990 employees, of whom 693 were unionized hourly wage employees. We currently employ both union and non-union employees at most of our facilities. We believe we have a good working relationship with our employees, which has resulted in high productivity and low turnover in key production positions. We have experienced no work stoppages or strikes at any of our unionized facilities since acquiring them in 2004. We are a party to a collective bargaining agreement with the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, Local No. 7-765 through January 16, 2011 at the Chicago Heights facility; International Union of Operating Engineers, Local No. 912 through April 15, 2010 at the Nashville facility; the Health Care, Professional, Technical, Office, Warehouse and Mail Order Employees Union, affiliated with the International Brotherhood of Teamsters, Local 743 through June 17, 2011 at the Chicago (Waterway) facility; the United Steelworkers of America, Local No. 6304 through April 30, 2011 at the Port Maitland, Ontario facility; and the Sindicato de Trabajadores de la Industria Química, Petroquímica, Carboquímica, Similares y Conexos de la República Mexicana, at the Mexico facilities. The agreement at the Coatzacoalcos, Mexico facility is for an indefinite period, but wages are reviewed every year and the rest of the agreement is subject to negotiation every two years. The current two-year period will expire in June 2010.

Page 9 of 94

Table of Contents

Executive Officers

The following table and biographical material present information about the persons serving as our executive officers, and key employees:

| Name |

Age | Position | ||

| Randolph Gress |

54 | Chairman of the Board, Chief Executive Officer, President and Director | ||

| Neil Salmon |

41 | Vice President and Chief Financial Officer | ||

| William Farran |

60 | Vice President, General Counsel and Corporate Secretary | ||

| Charles Brodheim |

46 | Corporate Controller | ||

| Louis Calvarin |

46 | Vice President—Operations | ||

| Mark Feuerbach |

51 | Vice President—Treasury, Financial Planning & Analysis | ||

| Joseph Golowski |

48 | Vice President—Sales | ||

| Wilma Harris |

64 | Vice President—Human Resources | ||

| Russell Kemp |

50 | Vice President—Research & Development | ||

| Michael Lovrich |

56 | Vice President—Supply Chain | ||

| Abraham Shabot |

48 | Vice President—Director General—Innophos Latin America | ||

| Mark Thurston |

50 | Vice President—Corporate Strategy and Worldwide Business Development | ||

| Timothy Treinen |

59 | Vice President—Phosphates Business |

Biographical Material

Randolph Gress is Chairman of the Board, Chief Executive Officer, President and Director of Innophos. Mr. Gress has served as Chief Executive Officer of Innophos since August 2004. Previously, Mr. Gress joined Rhodia in 1997 and became Vice President and General Manager of the sulfuric acid business. He was named global President of Specialty Phosphates (based in the U.K.) in 2001. Prior to joining Rhodia, Mr. Gress spent fourteen years at FMC Corporation where he worked in various managerial capacities in the Chemical Products, Phosphorus Chemicals and Corporate Development groups. From 1977 to 1980, Mr. Gress worked at Ford Motor Company in various capacities within the Plastics, Paint and Vinyl Division. Mr. Gress earned a B.S.E. in Chemical Engineering from Princeton University and an M.B.A. from Harvard Business School.

Neil Salmon is Vice President and Chief Financial Officer of Innophos. Mr. Salmon joined Innophos in October 2009. Previously he spent around 20 years with Imperial Chemical Industries PLC (ICI), holding a succession of divisional and corporate finance roles across various specialty chemicals businesses in Africa, US, UK and Asia Pacific. Most recently he was CFO of the Adhesives Business Group, a $2 billion division, operating globally. From 2004-2007 he was CFO of the Asia Pacific division of National Starch and Chemical, an ICI subsidiary. Mr. Salmon is a Chartered Management Accountant and earned an M.A. (Hons) in Politics, Philosophy and Economics from Oxford University.

William Farran is Vice President, General Counsel and Corporate Secretary of Innophos. Prior to joining Innophos, Mr. Farran was Assistant General Counsel of Rhodia, Inc., providing and managing a wide range of legal services to various Rhodia North American enterprises. Prior to joining Rhodia in 1987, Mr. Farran was Senior Counsel for UGI Corporation, Valley Forge, PA, and an associate with Morgan, Lewis & Bockius, Philadelphia, PA. Mr. Farran earned his B.S. in Economics from the Wharton School, University of Pennsylvania and his J.D. from Case Western Reserve University. He is a member of the bars of the Supreme Court of Pennsylvania and the Supreme Court of the United States.

Charles Brodheim is Corporate Controller of Innophos. Mr. Brodheim joined Rhodia in 1988 and held various tax, accounting and business analyst positions within Rhodia. Mr. Brodheim was the North American Finance Director for Specialty Phosphates from 2000-2002. After 2002, Mr. Brodheim was a Finance Director for various Rhodia North American Enterprises, including its Eco-Services enterprise. Mr. Brodheim earned a B.B.A. degree in Finance/Accounting from Temple University and is a certified public accountant.

Louis Calvarin is Vice President—Operations of Innophos. Dr. Calvarin joined Rhodia in France in 1986. He has been Director of Manufacturing and Engineering for Specialty Phosphates since January 2004. Prior to that, Dr. Calvarin held the positions of Director of Manufacturing for Specialty Phosphates (U.S.), Mineral Chemicals Industrial Operations Manager for Home, Personal Care and Industrial Ingredients, and Projects Director for Paint, Paper and Construction Materials. Dr. Calvarin earned a Ph.D. degree in Chemical Engineering from the Ecole Nationale Superieure des Mines in France and graduated from Ecole Polytechnique in France.

Page 10 of 94

Table of Contents

Mark Feuerbach was appointed Vice President—Treasury, Financial Planning & Analysis of Innophos in April, 2005 and had previously served as Chief Financial Officer of Innophos from August 2004 through April 2005 and again served as Chief Financial Officer from June through September 2009. Mr. Feuerbach joined Rhodia in 1989 and was Global Finance Director of Specialty Phosphates from 2000 to 2004, including a two-year assignment in the U.K. immediately following the purchase of the phosphates business of Albright & Wilson. Prior to this assignment, Mr. Feuerbach was the Finance Director of Rhodia’s North American phosphates business from 1997 to 2000 and he previously held various finance positions in a number of Rhodia’s businesses. Prior to joining Rhodia, Mr. Feuerbach held various accounting and finance positions in both manufacturing and service companies. Mr. Feuerbach earned a B.A. in Business Administration/Accounting from Rutgers College and an M.B.A. in Finance/Information Systems from Rutgers Graduate School of Management.

Joseph Golowski is Vice President—Sales & Distribution of Innophos. Joining Rhodia in 1989 as Market Development Specialist, Mr. Golowski has since then held progressive roles in business development, sales, marketing and management. From 1997 through 2000, Mr. Golowski served as a Global Market Director for Rhodia based in Paris, France. Returning to the U.S., he became the North American Asset Manager for Phosphoric Acid and subsequently the Director of Sales for the Specialty Phosphate Business. Mr. Golowski has earned a B.S. in Ceramic Engineering from Rutgers University, College of Engineering.

Wilma Harris is Vice President—Human Resources of Innophos. Ms. Harris joined Rhodia in 1986 as Human Resource Manager for the Agricultural Products business located in Research Triangle Park, NC. Since that time she has held various positions in corporate, shared services and business human resources and information technology. From January 2003 until August 2005, she was the Human Resources Director for the Specialty Phosphates and Performance Phosphates and Derivatives businesses. Prior to joining Rhodia, Ms. Harris worked for Union Carbide Corporation in several labor relations and research and development positions. She holds a B.S. degree from West Virginia University, a M.P.A. degree from Marshall University and Masters Degrees in Theological Studies and Divinity from New Brunswick, NJ Theological Seminary.

Russell Kemp is Vice President—Research & Development of Innophos. Mr. Kemp joined Rhodia in 1989, first holding several manufacturing management jobs and – from 1998 through 2007 – fulfilling a business management role. Previously, he worked as a process and production engineer at Monsanto Company. Mr. Kemp earned a BS in Chemical Engineering from the Colorado School of Mines and an MBA from Southern Illinois University – Edwardsville.

Michael Lovrich is Vice President—Supply Chain of Innophos. Mr. Lovrich joined Innophos in August, 2007 from Coach, Inc., where he served as Vice President, Supply Chain from 2004 through 2007 for that specialty leather and women’s accessories manufacturer. Prior to his tenure with Coach, Mr. Lovrich was with Engelhard Corporation where he held various positions in Supply Chain Operations and Information Technology focusing on leading several supply chain transformation initiatives. Prior to Engelhard, Mr. Lovrich held positions with Fisher Scientific, Thompson Medical and Becton-Dickinson. Mr. Lovrich earned his B.A. in History from William Paterson College and his MBA from New York University Stern School of Business.

Abraham Shabot is Vice President and Director General—Innophos Latin America. Mr. Shabot joined Innophos in July 2009. Prior to joining Innophos, he served as Managing Director of Kaltex Fibers, a leading acrylic fiber producer in the Americas, from 2007 to 2009. Before that, he held various positions in Sales and Business Development for Comex, a large Mexican building supplies manufacturer and distributor. In addition, he was Latin American Director for Polyone Corporation, a large publicly held manufacturer and distributor of plastic resin and rubber compounds. He earned a degree in Chemical Engineering from Iberoamericana University in Mexico City.

Mark Thurston is Vice President—Corporate Strategy and Worldwide Business Development. Prior to his appointment to his current role in 2009, Mr. Thurston served as Vice President—Specialties of Innophos from 2004 through 2008. Mr. Thurston joined Rhodia in 1985 working in Fine Organics and has been Business Director of Specialties since February 2004. Previously, Mr. Thurston was a Vice President and General Manager of Food Ingredients North America from 2002 to 2004 and, prior to that, worked in various sales and marketing capacities for Rhodia. Mr. Thurston previously worked at RTZ Corp. as an assistant planning and marketing manager and an assistant production manager. Mr. Thurston earned a B.S. in Chemical Engineering from the University of Aston in Birmingham, England.

Timothy Treinen is Vice President—Phosphates Business of Innophos. Mr. Treinen joined Rhodia in 2000 as the Global Asset Director, Acid and had been a Business Director of Performance Chemicals since February 2004. Prior to joining Rhodia, Mr. Treinen spent thirteen years at Albright & Wilson where he worked as a Vice President and General

Page 11 of 94

Table of Contents

Manager of Industrial Chemicals from 1994 to 2000. Previously, Mr. Treinen worked at Tenneco Inc. in the finance department in various capacities including strategic planning, plant controller and accounting manager. Mr. Treinen earned a B.B.A. in Accounting from the University of Iowa.

Available Information

The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers, including the Company, that file electronically with the SEC. The public can obtain any documents that the Company files with the SEC at http://www.sec.gov. The Company files annual reports, quarterly reports, proxy statements and other documents with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934 (Exchange Act). The public may read and copy any materials that the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Innophos also makes available free of charge through its website (www.innophos.com) the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC.

Page 12 of 94

Table of Contents

| ITEM 1A. | RISK FACTORS |

Investing in our company involves a high degree of risk of varying origins, including from our operations and financial matters. If any of the following risks or uncertainties actually occurs, our business, prospects, financial condition and results of operations could be materially and adversely affected.

Risks Related to Our Business Operations

Raw Materials Availability and Pricing

Our principal raw materials consist of phosphate rock, sulfur and sulfuric acid, MGA, PPA and energy (principally natural gas and electricity). Our raw materials are generally purchased under long-term supply contracts typically priced according to predetermined formulae dependent on price indices or market prices. The prices we pay under these contracts generally may lag the market prices of the underlying raw material. In periods of increasing market prices, these long-term supply contracts tend to be favorable to the Company, possibly by material amounts. Conversely, in periods of decreasing market prices, these long-term supply contracts tend to be unfavorable to the Company, possibly by material amounts. We do not typically engage in futures or other derivatives contracts to hedge against fluctuations in future prices. These effects may also be amplified in the case of supply contracts that have multiple-year durations. The Company may enter into sales contracts where the selling prices for our products (or some of the components within a specific pricing formula) are fixed for a period of one year, exposing us to volatility in raw materials prices that we acquire on a spot market basis.

Various market conditions can affect the price and supply of our raw materials. Because phosphate rock is also used globally for fertilizer production, the cost of that material is heavily influenced by demand conditions in the fertilizer market and freight costs, which traditionally have been volatile, and both of which escalated rapidly during 2007 and 2008, although they have declined since the fourth quarter of 2008 and throughout 2009. We obtain substantially all our phosphate rock for our Coatzacoalcos, Mexico facility from OCP, a state-owned mining company in Morocco under a 1992 supply agreement set to expire September 10, 2010, with an option to take delivery of a portion of the committed volume through December 2010. Our supply of that material could be affected by capacity constraints, political unrest, or weather conditions in the areas where our supplier operates or a failure to reach new supply agreements. Innophos has also been exploring various alternatives for phosphate rock and MGA supplies around the world to reduce our dependence on a single supplier for phosphate rock. Through plant trials at production scale and in our pilot plant, we have made significant progress in confirming our ability to use multiple sources of rock and MGA. At the present time, we do not have committed volume beyond the expiry of our OCP contract; however, we are in active discussions with several suppliers.

New supply arrangements may be on long-term contracts with historical market index pricing similar to OCP or be based on more current market prices. We cannot guarantee that all our production needs in Mexico (at least when measured at historic levels) could be met from alternative rock sources or downstream intermediate products, such as MGA, or, that we could do so without significant purchases at spot market prices. We also cannot guarantee that there will be no material financial impact in the form of higher supply cost from procuring alternative rock and MGA supplies. Alternative grades of rock or MGA could reduce the operating efficiency of the plant and the complexity of handling multiple sources could affect supply chain costs. Nevertheless, based on conditions known thus far, management believes that there are several alternative phosphate rock sources available to us which should meet our current production needs in Mexico.

Natural gas prices have experienced significant volatility in the past several years. Wide fluctuations in natural gas prices may result from relatively minor changes in the supply and demand, market uncertainty, and other factors, both domestic and foreign, that are beyond our control. In addition, natural gas is often a substitute for petroleum-based energy supplies and natural gas prices are positively correlated with petroleum prices. Future increases in the price of petroleum (resulting from increased demand, political instability or other factors) may result in significant additional increases in the price of natural gas. We typically purchase natural gas at spot market prices for use at our facilities which exposes us to that price volatility, except in those instances where, from time to time, we enter into longer term, fixed-price natural gas contracts.

Most of our raw materials are supplied to us by either one or a small number of suppliers. Some of those suppliers rely, in turn, on sole or limited sources of supply for raw materials included in their products. Failure of our suppliers to maintain sufficient capability to meet changes in demand or to overcome unanticipated interruptions in their own sources of supply from force majeure conditions, such as disaster or political unrest, may prevent them from continuing to supply raw materials as we require them, or at all. Our inability to obtain sufficient quantities of sole or limited source raw materials or to develop alternative sources on a timely basis if required could result in increased costs, which may be material, in our operations or our inability to properly maintain our existing level of operations.

Page 13 of 94

Table of Contents

Environmental, Product Regulations and Sustainability Initiative Concerns

Our operations involve the use, handling, processing, storage, transportation and disposal of hazardous materials and some of our products are ingredients in foods, nutritional supplements or pharmaceutical excipients that are used in finished products consumed or used by humans or animals. As a result, we are subject to extensive and frequently changing environmental and other regulatory requirements and periodic inspection by federal, state, and local authorities, including the U.S. Environmental Protection Agency, or EPA, the FDA, and the USDA, as well as other regulatory authorities and those with jurisdiction over our foreign operations. Our operations also expose us to the risk of claims for environmental remediation and restoration or for exposure to hazardous materials. Our production facilities require various operating permits that are subject to renewal or modification. Violations of environmental laws, regulations, or permits may result in restrictions being imposed on operating activities, substantial fines, penalties, damages, the rescission of operating permits, third-party claims for property damage or personal injury, or other costs.

Maintaining compliance with health and safety and environmental laws and regulations has resulted in ongoing costs for us. Currently, we are involved in several compliance and remediation efforts and agency inspections concerning health, safety and environmental matters.

EPA has indicated that compliance at facilities in the phosphate industry is a high enforcement priority. After several years of expressing various concerns (without issuing any notice of violation) about aspects of our Geismar, LA operations, in March 2008, we received notice from the Department of Justice, or DOJ, indicating that EPA had referred the case for civil enforcement, contending, among other things, that we do not qualify for certain exemptions we have claimed, and alleging that we violate the Resource Conservation and Recovery Act, or RCRA at Geismar by failing to manage two materials appropriately. Although the communication stated that EPA/DOJ intended to seek unspecified penalties and corrective action, it proposed discussions to explore possible resolution, which we undertook and are pursuing. In late 2008, the DOJ/EPA demanded that Innophos and its neighboring interconnected supplier, PCS, undertake certain “interim measures” to address DOJ/EPA’s chief environmental concerns. We and PCS have initiated joint technical efforts to explore solutions to the government concerns. Based on our contact with the agencies to date in 2009, we have determined it is probable that one of the process modifications will need to be undertaken in the next several months, and likewise probable that the capital expenditure and future operating expense of that modification will not be material, unless the DOJ adds terms and conditions that could result in the parties not reaching agreement. However, the second measure sought by DOJ/EPA has not yet been fully evaluated from a technological or cost standpoint. The companies have proposed to DOJ/EPA a schedule for such evaluation, and although the government has not formally approved the schedule, the companies are proceeding as proposed. Based upon work so far, there appears to be at least one technically viable approach, but costs of a full scale operation as compared to other approaches are not known at this time. Even though the companies have begun substantial technical work in an attempt to develop a feasible approach to address DOJ/EPA’s concerns, we cannot guarantee that our technical efforts will be successful, whether either party would be willing to implement solutions or, depending on those factors and the agencies’ position, whether this matter will be settled with DOJ/EPA or will require litigation. Should litigation become necessary to defend our operations at Geismar as compliant with environmental laws and regulations, no assurance can be given as to its outcome.

Since similar action has been taken by EPA/DOJ with regard to PCS’s interconnected plant at Geismar from which we obtain acid raw material, it is possible that, in the event of further enforcement, PCS’s operations could be interrupted for an extended time. The impact of any such occurrence would likely be material to our operations, as our Geismar facility may not be able to operate economically under current market conditions without raw materials from that supplier’s plant. Depending upon the facts and circumstances of, and developments arising from, any non-compliance, our long-term raw material supply contract with PCS at Geismar also may be adversely affected. That contract provides important protections that should safeguard Innophos from adverse financial or operating consequences either through continued operations at Geismar or alternative supplies from PCS. Nevertheless, we cannot guarantee that the contract provides full protection against losses we may suffer, or that our operating costs would not increase by a material amount, as a result of the provision.

Some existing environmental laws and regulations impose liability and responsibility on present and former owners, operators or users of facilities and sites for contamination at those locations without regard to causation or knowledge of contamination. Many of our sites have an extended history of industrial use. Soil and groundwater contamination have been detected at some of our sites, and additional contamination might occur or be discovered at these sites or other sites (including sites to which we may have sent hazardous waste) in the future. We continue to investigate, monitor or clean-up contamination at most of these sites. Due to the uncertainties associated with environmental investigations and clean-ups and the ongoing nature of the investigations and clean-ups at our sites, we cannot predict precisely the nature, cost, and timing of our future remedial obligations with respect to our sites.

Page 14 of 94

Table of Contents

Additional laws or regulations focused on phosphate-based products may be implemented in the future. For example, a number of states within the U.S. and the Canadian provinces have moved or are moving to effectively ban the use of phosphate-based products in consumer automatic dishwashing detergents. The trade association that includes major manufacturers of consumer automatic dishwashing detergents has actively supported these efforts in the U.S. and Canada, increasing the likelihood they will become widespread as most of the non-phosphate legislation becomes effective in July 2010. This trend and related changes in consumer preferences has already reduced our requirements for auto dish markets and we have responded with a shift in our capabilities to serve other food and industrial applications. We can not predict the impact and the corresponding responses made by our competitors. Furthermore, although already banned in consumer laundry detergents in many U.S. States, phosphates are still permitted for those applications in many Latin American regions and other parts of the world. We cannot be sure that such a ban for use in consumer laundry detergents may not be implemented in some or all of these markets in the future, or that the same effect may not result from manufacturers reformulating to reduce phosphate levels. Additional laws, regulations or distribution policies focused on reduced use of other phosphate-based products could occur in the future. For example, a global retailer, as part of a corporate sustainability initiative, issued a statement indicating its intent to reduce phosphates in laundry and dish detergents by 70% in its Latin American and Canadian stores. Also, some jurisdictions have threatened to further regulate or ban the use of polyphosphoric acid and orthophosphoric acid in asphalt road construction. During 2008, such restrictions were implemented in New York State, but reversed in Nebraska and in 2009 restrictions were reversed in Wyoming and relaxed in Colorado. In 2009, Colorado allowed the use of polyphosphoric acid in asphalt road construction on an exception basis. Such a ban, if instituted in multiple jurisdictions or throughout the U.S. and Canada, could have a significant impact on our business.

Increased Costs and Pricing May Accelerate Substitution of Competing Products

Prices for raw materials necessary to manufacture our products, particularly phosphate rock and sulfur, rose dramatically from mid-2007 through most of 2008, although falling demand and prices for some raw materials, particularly sulfur, were seen in 2009. Although we have generally been successful in recovering costs and enhancing margins through price increases on prior occasions, there can be no assurance we will be able to do so in the future. See Item 7, Management’s Discussion and Analysis of Results of Operations and Financial Condition “Recent Trends and Outlook”.

As the costs and prices of our products correspondingly rise, certain of those products, particularly those directed at end use markets such as the detergent and oral care markets (where their portion of the end product cost is often larger), face an increasing threat of substitution from cost factors alone. Under circumstances where the costs of known and acceptable substitute non-phosphate chemistries become economically viable for a significant portion of our end use markets, our customers may decide to utilize the substitute chemistries to control their costs. If higher costs and prices result in such substitutions for major products and markets and we are not able to shift our manufacturing capabilities to alternate products we can sell profitably, we could face a loss of volumes, revenues and/or profits from this kind of cost-driven substitution. Although we cannot estimate the pricing levels at which cost substitution will affect us (since it depends on variables such as the duration of price escalations, the availability and costs of our products relative to the substitutes, and future marketing and pricing decisions made by our customers), we believe, based on our understanding of where substitutions become feasible, at least 30% of our current end use markets could be exposed to some level of potential cost substitution. We cannot be sure that actions we take to reduce the effects of cost driven substitution will be effective, nor that those effects ultimately will not be material to our results of operations or financial position.

Competitive Factors

We face significant competition in each of our markets. In the specialty chemicals industry, competition is based upon a number of considerations, including product differentiation and innovation, product quality, technical service, and supply reliability. In addition, in some markets, our products are subject to price competition due to factors such as competition from low-cost producers, import competition, excess industry capacity and consolidation among our customers and competitors. New products or technologies developed by competitors may also have an adverse impact on our competitive position. Future expansions could have a negative impact on our competitive position.

Innophos’ Mexican production is sold across Latin America where, from time to time, it faces strong competition from Chinese materials produced by the thermal method, a process more heavily dependent on energy which may be cost advantaged during periods of low energy costs. The collapse in energy prices, when combined with depressed domestic markets and relaxed export controls in China, has resulted in a shift in Chinese specialty phosphate products into American markets, and has put heavy pressure on our Mexican operations. In the event that prices for Chinese products remain low for an extended time and it is possible that our Mexican operations could be unable to compete effectively with Chinese phosphate products and thus become uneconomic.

Page 15 of 94

Table of Contents

From time to time, we have experienced pricing pressure, particularly from significant customers and often coincident with periods of overcapacity in the markets in which we compete. The pricing environment for 2009, in line with worldwide economic slowdown, substitutions and increased import presence, took that character. In the past, we have taken steps to reduce costs and resist possible price reductions by structuring our contracts and developing strong “value-oriented” non-price related customer service relationships. However, price reductions in the past have adversely affected our sales and margins, and if we are not able to offset price pressure when it arises through improved operating efficiencies, reduced expenditures and other means, we may be subject to those same effects in the future.

Supplier Contract Concentration

Our business activities depend on long-term or renewable contracts to supply materials or products. In particular, we rely to a significant degree on single-source supply contracts and some of these contractual relationships may be with a relatively limited number of suppliers. Although most of our supplier relationships are typically the result of multiple contractual arrangements of varying terms, in any given year, one or more of these contracts may come up for renewal. In addition, from time to time, we enter into toll manufacturing agreements or other arrangements to produce minimum quantities of product for a certain duration. If we experience delays in delivering contracted production, we may be subject to contractual liabilities to the buyers to whom we have promised the products.

Changing Technologies

Our future results will depend on our ability to continue to introduce new products and applications that offer distinct value for our customers. Many of our products could be affected by technological change and new product introductions and enhancements. For example: technical grade STPP (used as a builder in automatic dishwasher detergents) may be substituted by a new builder; Specialty Acids products, such as Polyphosphoric Acid (used in asphalt modification applications), may be substituted by polymers; or Specialty Salts products, such as Calcium Phosphates (used in Calcium fortification), may be substituted by other sources of Calcium such as Calcium Carbonate. We expect to continue to enhance our existing products, to identify, develop, and manufacture new products with improved capabilities, and to make improvements in our productivity in order to maintain our competitive position. We also intend to devote resources to the development of new technologically advanced products and systems and to continue to devote a substantial amount of expenditures to the research and development functions of our business. However, we cannot be sure that we will be successful in achieving our goals in those regards.

Reliance on Rhodia

We depend on Rhodia’s ability to perform its obligations under our 2004 acquisition agreements, primarily to indemnify us (or provide security) against potential liabilities whether asserted or yet to be asserted. Rhodia has experienced financial difficulties in recent years and suffered from margin pressure during the global recession. In its most recent filing, Rhodia reported significantly reduced debt and improving margins; however, there is no assurance that Rhodia will be able to fund its obligations to us when, as and if required. In February 2008, New York State’s highest court affirmed a declaratory judgment we won in the lower courts holding Rhodia liable for taxes asserted by the Mexican National Waters Commission, or CNA, for fresh water extraction, or Fresh Water Claims, at our Coatzacoalcos, Mexico facility dating back to the period 1998-2002, but subsequently the 1998 claim was determined to be beyond the applicable statute of limitations. As now assessed, the claims through 2002 total approximately $23.6 million at current exchange rates as of February 18, 2010, including basic charges of $7.1 million and $16.5 million for interest, inflation and penalties. If the legal proceedings in Mexico under which the CNA taxes are being contested are not successful and Rhodia cannot perform under the judgment, we may have to pay CNA taxes from our own resources.

We also depend on Rhodia’s ability to fulfill its responsibilities under certain operating arrangements, including the sulfuric acid supply agreement providing feedstock to the interconnected PCS facility supplying MGA at our Geismar, LA plant. Adverse financial developments affecting Rhodia’s continued performance under its supply agreement with Innophos could require us to provide replacement sulfuric acid, if available, at significantly higher market prices than provided in the contract with Rhodia.

International Operations

We have significant production operations in Mexico and Canada and believe that revenue from sales outside the U.S. will continue to account for a material portion of our total revenue for the foreseeable future. There are inherent risks in

Page 16 of 94

Table of Contents

international operations, including currency fluctuations and devaluations, economic and business conditions that differ from US cycles, unsettled political conditions and communication and translation errors due to language barriers. Among those additional risks potentially affecting our Mexican operations are changes in local economic conditions, currency devaluations, disruption from political unrest and difficulty in enforcing agreements due to differences in the Mexican legal and regulatory regimes compared to those of the U.S. Risks that our Canadian operations may be subject to include changes in laws or regulations differing from trends in the U.S. and currency fluctuations and devaluations.

Our overall success as a multinational business depends, in part, upon our ability to succeed in differing economic, social and political conditions. Among other things, we are faced with potential difficulties in staffing and managing local operations, and we have to design local solutions to manage credit risks posed by local customers and distributors. We may not continue to succeed in developing and implementing policies and strategies that are effective in each location where we do business. These risks are not limited to just those countries in which we operate facilities. For example, our Mexican operations and indirectly our Geismar operations, (where we recently exercised an option extending to July 2021 our long-term purchase agreement for MGA converted from phosphate rock), are supplied with phosphate rock from Morocco, including territories under disputed Moroccan sovereignty claims, and both could be subject to the risk of adverse affects that may arise from local political unrest.

As a U.S. corporation, we are subject to the regulations imposed by the Foreign Corrupt Practices Act, or FCPA, which generally prohibit U.S. companies and their intermediaries from making improper payments to foreign officials for the purpose of obtaining or keeping business. We sell many of our products in developing countries through sales agents and distributors that are not subject to our disciplinary procedures. While we and our subsidiaries are committed to conducting business in a legal and ethical manner and we communicate our policies to all who do business with us, we cannot be sure that all our third party distributors or agents remain in full compliance with the FCPA at all times.

Product Liability Exposure

Many of our products are additives used in the food and beverage, consumer product, nutritional supplement and pharmaceutical industries. The sale of these additives and our customers’ products that include them involve the risk of product liability and personal injury claims, which may be brought by our customers or end-users of products. While we adhere to stringent quality standards, in the course of their production, storage and transportation, our products could be subject to adverse effects from foreign matter such as moisture, dust, odors, insects, mold, or other substances (organic or inorganic), or from excessive temperature. Historically, we have not been subject to material product liability claims, and none are currently outstanding. However, because our products are used in manufacturing a wide variety of our customers’ products, including those ingested by people, we cannot be sure we will not be subject to material product liability or recall claims in the future.

Production Facility Operating Hazards

Our production facilities are subject to hazards associated with the manufacturing, handling, storage, and transportation of chemical materials and products, including failure of pipeline integrity, explosions, fires, inclement weather and natural disasters, terrorist attacks, mechanical failures, unscheduled downtime, transportation interruptions, remedial complications, chemical spills, discharges or releases of toxic or hazardous substances, storage tank leaks and other environmental risks. We have implemented and installed various management systems and engineering controls and procedures at all our production facilities to minimize these risks. We also insure our facilities to protect against a range of risks. However, these potential hazards do exist and could cause personal injury and loss of life, severe damage to or destruction of property and equipment, and environmental and natural resource damage, and may result in a suspension of operations (or extended shutdowns) and the imposition of civil or criminal penalties, whose nature, timing, severity and non-insured exposures are unknown.

Intellectual Property Rights

We rely on a combination of contractual provisions, confidentiality procedures and agreements, and patent, trademark, copyright, unfair competition, trade secrecy, and other intellectual property laws to protect our intellectual property and other proprietary rights. Nonetheless, we cannot be sure that any pending patent application or trademark application will result in an issued patent or registered trademark, or that any issued or registered patents or trademarks will not be challenged, invalidated, circumvented or rendered unenforceable. The use of our intellectual property by others could reduce any competitive advantage we have developed or otherwise harm our business. Moreover, we cannot be sure that our property rights can be asserted in all cases or that we can defend ourselves successfully or cost-effectively against the assertion of rights by others.

Page 17 of 94

Table of Contents

Contingency Planning

We operate a number of manufacturing facilities in the US, Canada and Mexico, and we coordinate company activities, including our sales, customer service, information technology systems and administrative services and the like, through headquarters operated in those countries. In 2009, the Company launched an enterprise resource planning, or ERP, system and business process redesign project to upgrade its information technology systems including updated contingency plans. We cannot be sure that our plans, intentions or expectations of the business process redesign and information technology systems upgrade will be achieved and we may experience business disruptions as a result of our business process and information technology systems conversions.

Our sites and those of others who provide services to them are subject to varying risks of disaster and follow on consequences, both manmade and natural, that could degrade or render inoperable one or more of our facilities for an extended period of time. Such disaster related risks and effects are not predictable with certainty and, although they can be mitigated, they cannot be avoided. We seek to mitigate our exposures to physical disaster events in a number of ways. For example, where feasible, we design and engineer the configuration of our plants to reduce the consequences of disasters. We also maintain insurance for our facilities against casualties, including extended business interruption, and we continually evaluate our risks and develop contingency plans for dealing with them. Although we have reviewed and analyzed a broad range of risks applicable to our business, the ones that actually affect us may not be those we have concluded most likely to occur. Furthermore, although our reviews have led to more systematic contingency planning, our plans are in varying stages of development and execution, such that they may not be adequate at the time of occurrence for the magnitude of any particular disaster event that befalls us.

Risks Relating to Our Indebtedness

Leverage Issues

Our assets were acquired in 2004 in a transaction with a high proportion of debt. After Holdings initial public offering of equity in 2006, we remained what could be characterized as a highly leveraged company through 2007. However, by December 31, 2009, our total indebtedness, including Holdings, had been reduced to $246.0 million and our stockholders’ equity, including Holdings, had grown to $295.4 million, respectively, reflecting a significant de-leveraging in accordance with our business policy. However, all operations of Holdings and Innophos Investments Holdings, Inc. (“Investments Holdings”) are conducted through Innophos, Inc. and therefore Holdings and Investments Holdings are dependent on us for debt servicing and dividend payments through our operations. Nevertheless, to the extent we are not prohibited by our debt instruments in effect from time to time from incurring additional debt or obligations that do not constitute “indebtedness,” doing so could intensify the risks to our financial condition resulting from a renewed condition of higher leverage. Those risks may include, for example, difficulty satisfying our ongoing obligations directly related to our debt (including complying with restrictive financial covenants), increasing our vulnerability to general adverse economic and industry conditions, requiring us to dedicate a substantial portion of cash flow from operations to payments on our indebtedness (thereby reducing the availability of our cash flow to fund working capital), limiting our flexibility in planning for, or reacting to, changes in our business (thereby placing us at a competitive disadvantage compared to our competitors with less debt), and limiting our ability to borrow additional funds, refinance existing debt or make discretionary use of funds such as the payment of dividends on our stock.

Page 18 of 94

Table of Contents

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

Our headquarters are located in Cranbury, New Jersey, with manufacturing facilities strategically located throughout the United States, Canada, and Mexico. We operate seven facilities which manufacture our three main product lines: Specialty Salts and Specialty Acids, Purified Phosphoric Acid, and STPP & Other Products. Our largest manufacturing facility is located in Coatzacoalcos, Mexico. We operate four medium-size plants in Chicago Heights, Illinois, Nashville, Tennessee, Port Maitland, Canada (Ontario), and Geismar, Louisiana, which collectively produce our major products. We produce additional specialty salts in two plants located in Chicago, Illinois (Waterway), and Mission Hills, Mexico. All the facilities listed above are owned with the exception of Mission Hills, Mexico, where the land is leased long-term. We also lease facilities at Cranbury, New Jersey, Mexico City, Mexico, and Mississauga, Canada (Ontario) which house our executive, commercial, administrative, product engineering and research and development employees, with the Cranbury, New Jersey facility serving as our world headquarters. We also own a distribution facility in Chicago which we use to service our customer base. We do not own and are not responsible for any closed U.S. or Canadian elemental phosphorus or phosphate production sites, as these were not part of the assets or liabilities acquired from Rhodia.

| ITEM 3. | LEGAL PROCEEDINGS |

The information set forth in Note 14 to our consolidated financial statements, “Commitments and Contingencies,” contained in this Annual Report on Form 10-K is incorporated herein by reference.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

The response to this item is omitted pursuant to General Instruction I of Form 10-K.

Page 19 of 94

Table of Contents

| ITEM 5. | MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

There is no market for the common stock of Innophos, Inc. As of December 31, 2009, Innophos Investments Holdings, Inc. was the one holder record of Innophos, Inc. common.

| ITEM 6. | SELECTED FINANCIAL DATA |

The response to this item is omitted pursuant to General Instruction I of Form 10-K.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |