Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Consolidated Communications Holdings, Inc. | f8k_030810.htm |

Bob Currey - Chief Executive Officer

March 2010

2

Safe Harbor

3

Company Overview

§ One of the largest Independent Local Exchange Carrier in the U.S., with

operations in Illinois, Texas and Pennsylvania

operations in Illinois, Texas and Pennsylvania

§ Company history dates back to 1894 with our current Chairman’s great-

grandfather as the founder.

grandfather as the founder.

§ Total connections are 451,830 consisting of 247,235 ILEC access lines, 72,681

CLEC access line equivalents, 100,122 DSL subscribers, 23,127 IPTV

subscribers, and 8,665 VOIP subscribers

CLEC access line equivalents, 100,122 DSL subscribers, 23,127 IPTV

subscribers, and 8,665 VOIP subscribers

§ Providing voice, video and data services for the full triple play in all markets

§ Full year 2009 financial overview:

§ Revenues of $406.2

million

§ Adjusted EBITDA

of $188.8

§ Dividend payout

ratio of 58.4%

4

Well-Established Operating History

1894

1984

2005

1997

2002

2004

CCI was formed and

non-regulated

businesses incorporated

from 1984-1989

non-regulated

businesses incorporated

from 1984-1989

CCI acquired by

McLeodUSA

McLeodUSA

Lumpkin,

Providence and

Spectrum

acquire CCI

Providence and

Spectrum

acquire CCI

Mattoon

Telephone Co.

founded by Dr.

I.A. Lumpkin

Telephone Co.

founded by Dr.

I.A. Lumpkin

CCI acquires

TXUCV and

VOIP deployed in

TX

TXUCV and

VOIP deployed in

TX

Consolidated

completes IPO; IPTV

Launch in Illinois

completes IPO; IPTV

Launch in Illinois

CNSL

acquires

NPSI

acquires

NPSI

2006

IPTV Launch

in TX

in TX

2007

2008

IPTV launch

in PA

in PA

5

CNSL Acquisition Criteria

§ Attractiveness of the markets

§ Quality of the network

§ Ability to integrate efficiently

§ Potential for synergies

§ Cash flow accretive

6

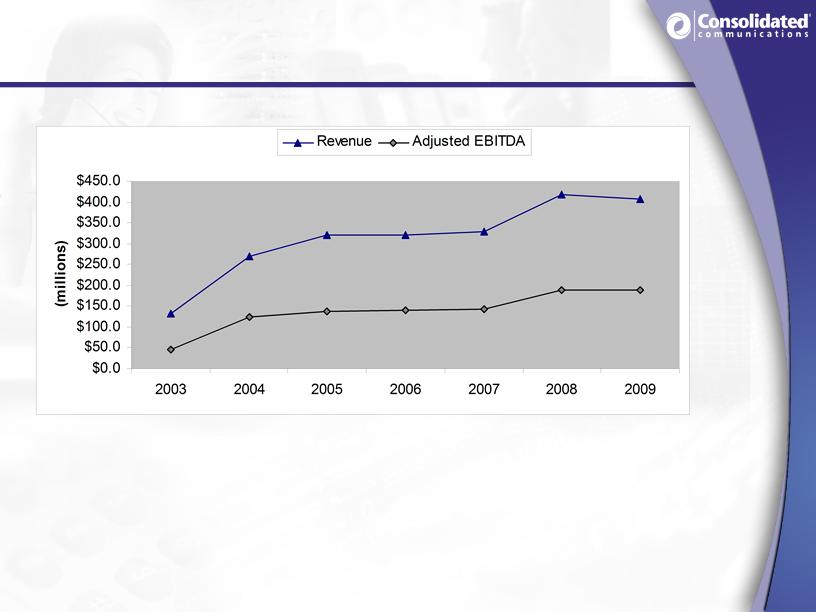

Consistent Organic and Acquisition Growth

§ 2002 - New Consolidated created after acquisition from McLeod.

§ 2004 - Tripled the size of the company with TXU acquisition.

§ 2005 - Initial Public Offering.

§ 2007 - Completed acquisition of North Pittsburgh Systems, Inc.

7

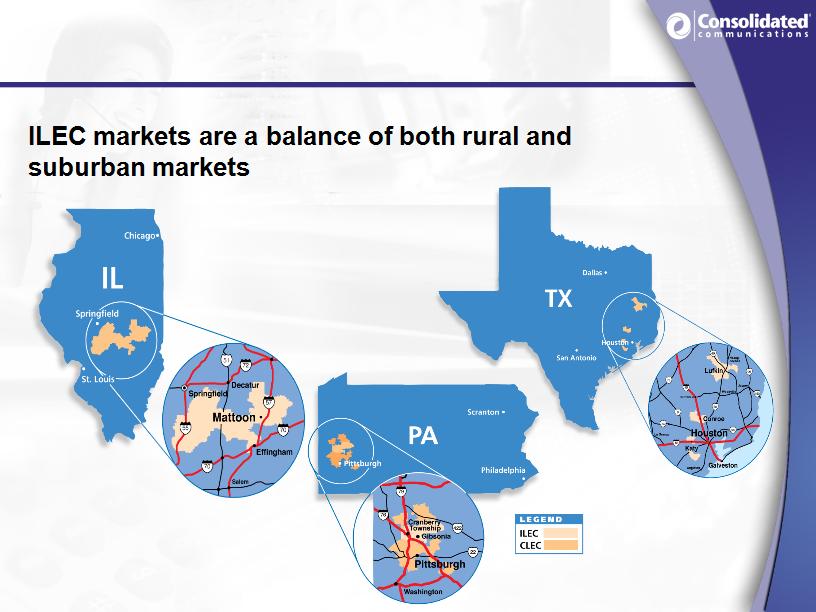

Operations in Illinois, Texas and

Pennsylvania

Pennsylvania

8

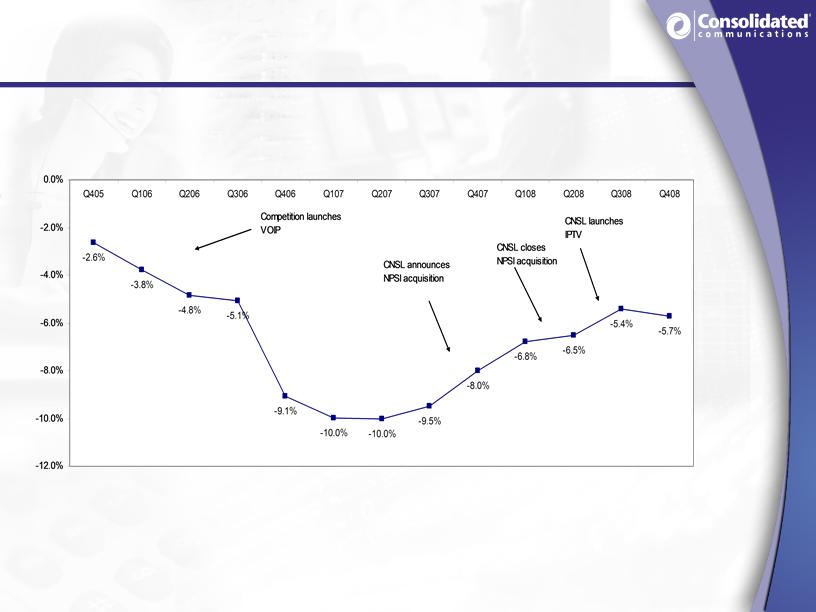

Competitive Landscape

§ With full product suite, we are best positioned RLEC to compete.

§ Competitive pricing has been stable with promotional differentiation as

the driver.

the driver.

§ Illinois markets compete with Mediacom and NewWave

Communications.

Communications.

§ Texas markets compete with Comcast and SuddenLink.

§ Pennsylvania markets compete with Armstrong and Comcast.

§ Competitors are fully launched in our territories.

Executing on our Strategy

9

Sustain

and grow

cash flow

Increase

revenue

per customer

Improve

operating

efficiency

Pursue selective

acquisitions

Maintain

effective capital

deployment

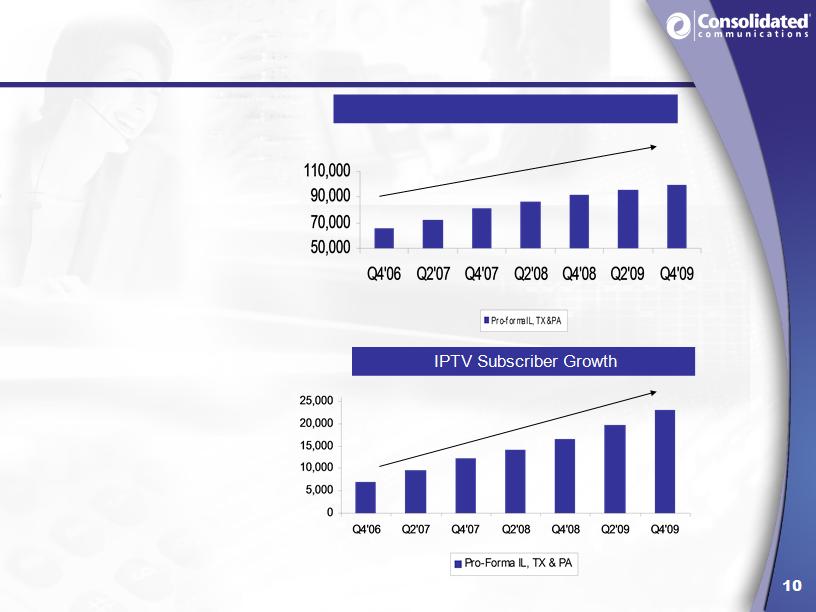

Increase Revenue per Customer

DSL Subscriber Growth

§ Attractive, feature rich

broadband offerings

broadband offerings

– Multiple DSL speeds

and price points

and price points

§ IPTV enables the Triple

Play offering

Play offering

– Enhances the value of

the bundle and

deepens customer

relationships

the bundle and

deepens customer

relationships

– Approx. 21,000 triple

play customers

play customers

IPTV Service in all markets

A robust offering with over 200 all-digital channels,

premium movie packages and over a 1000 hours of

movies on demand

premium movie packages and over a 1000 hours of

movies on demand

12

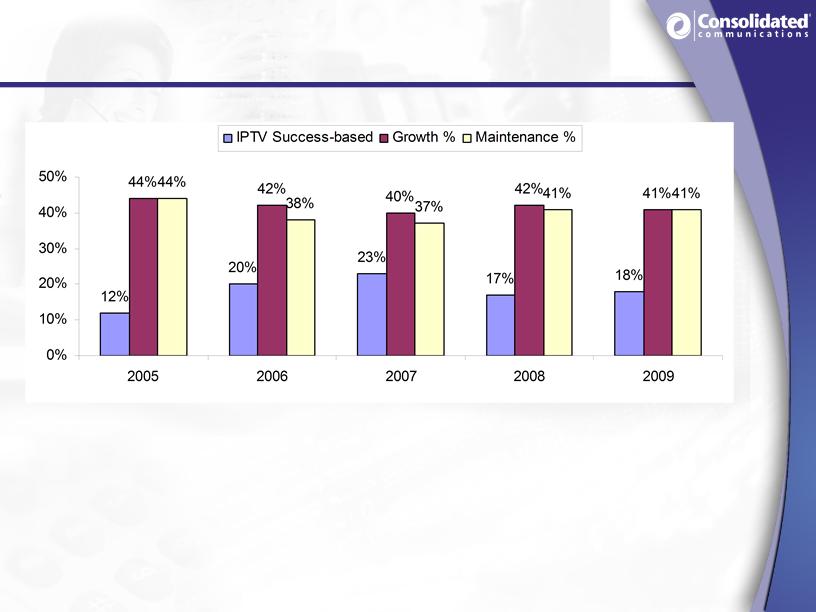

Video Drives Incremental Revenue Per Customer

§ Incremental Product Rollout

§ Leverages existing resources

and IP Backbone/ADSL 2+

§ Future CapEx is success

based

§ Enhances the value of

the bundle and deepens customer

relationships

relationships

§ Service available in all markets

§ 23,127 total video subscribers

§ Passed an additional 45,000

homes in 2009

§ 12% penetration on 187,630

total homes passed

§ Doubled HD channels in 2008 and 2009, adding 20 more in 2010

§ ‘Relaunch’ in July 2009 is set-top box model

– Build to consumer demand.

13

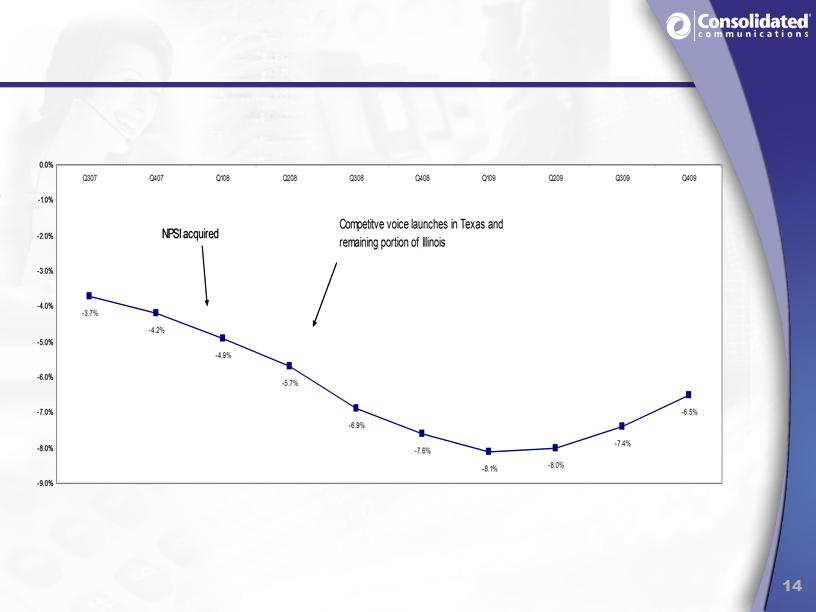

PA ILEC Access Line Trends

Total Company ILEC Access Line Trends

15

CLEC Overview

§ True “edge-out” strategy, which leverages ILEC network, human capital skills

and reputation in the surrounding markets

and reputation in the surrounding markets

§ Cash flow positive due to focus on success-based capital expenditures

§ Focus on small to mid-sized business customers (5 to 500 lines), educational

institutions and healthcare facilities

institutions and healthcare facilities

§ Operates an extensive SONET optical network with over 300 route miles of fiber

optic facilities in the Pittsburgh metropolitan market

optic facilities in the Pittsburgh metropolitan market

§ Focus is on migrating to an on-net, ethernet and VoIP delivery system

16

Disciplined Capital Deployment

§ IP platform supports triple play, increased data speeds and new

products, delivering an all digital video signal over existing

fiber/copper network

products, delivering an all digital video signal over existing

fiber/copper network

§ DSL-capable:

– 3Meg

offering to 100% of DSL capable customers

– 10Meg

offering to 85% of customers

– 20Meg

offering to 65% of customers

§ Technology investments, which enable operating expense reductions

§ Historically capital spending has run 10% -12% of revenue

§ 2010 Cap ex Guidance is $40 million to $42 million, 2009 was $42.4

million

million

Cap ex focused on enhancing revenue, service quality and

efficiency gains

efficiency gains

17

Disciplined Capital Deployment

Total Spend $31.1M $33.4M $33.5M $48.0M $42.4M

18

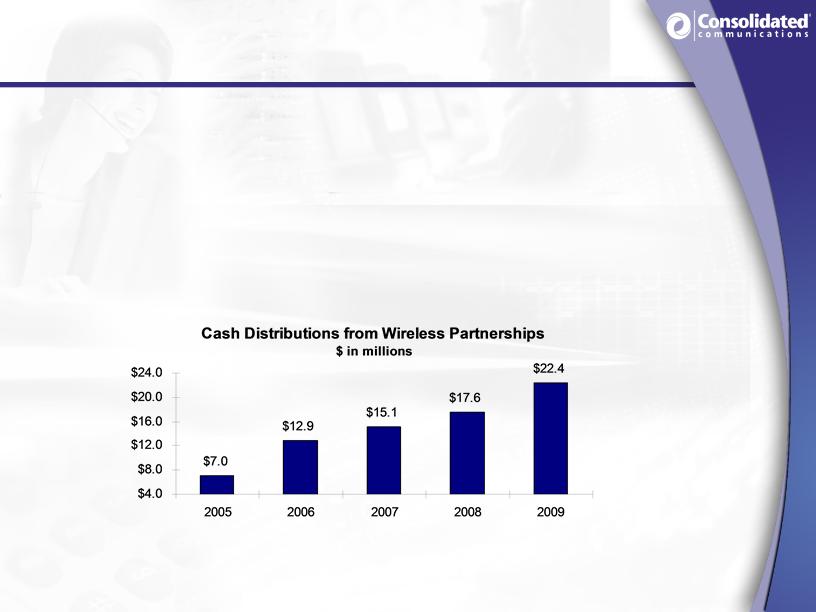

Wireless Partnerships

§ In addition to its core business, CNSL derives a portion of its cash

flow from five wireless partnerships.

flow from five wireless partnerships.

§ All are managed by Verizon Wireless and overlap with our ILEC and

CLEC markets.

CLEC markets.

§ All have experienced solid revenue, operating income, cash

distribution and subscriber growth over the past few years.

distribution and subscriber growth over the past few years.

19

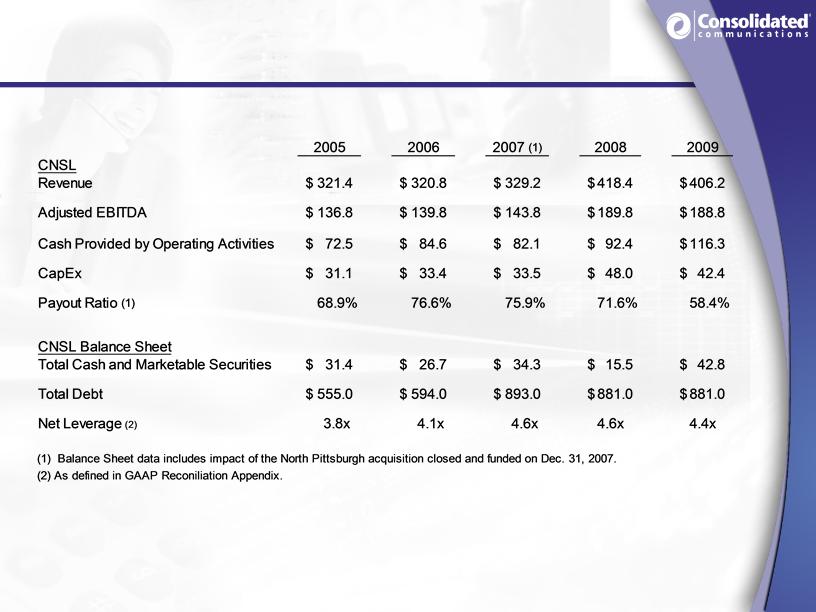

CNSL Delivering Strong Financial Results…

($ in millions)

20

Investment Highlights

§ Attractive dividend yield

– Double digit yield based

on recent share price

– Comfortable payout ratio

of cash available for dividends

§ Sustainable cash available for dividends

– Unique market mix of

rural and high growth areas

– Advance IP quality network

with ‘have to’ Cap ex upgrades behind us

– No debt maturities until

December 2014

– IPTV margins improving

– Wireless partnership

cash distributions have increased every year

§ Growth opportunities

– Commercial developments

planned or underway

– Pair bonding

– IPTV, DSL

and VOIP

– CLEC

– Acquisitions

21

Appendix

22

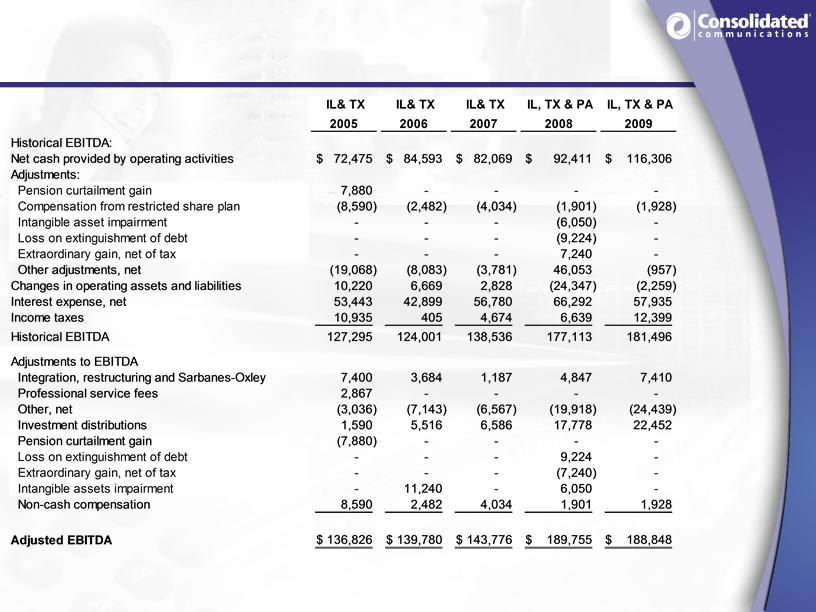

GAAP Reconciliation

23

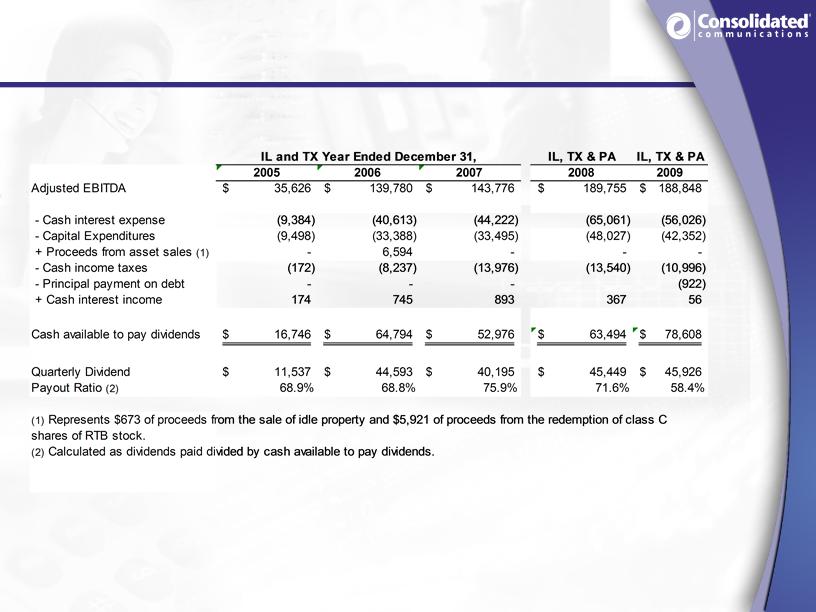

GAAP Reconciliation (con’t)

24

Adjusted EBITDA Reconciliation

($ in thousands)

25

Cash Available to Pay Dividends

($ in thousands)