Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Evercore Inc. | d8k.htm |

| EX-2.1 - PURCHASE AND SALE AGREEMENT - Evercore Inc. | dex21.htm |

| EX-99.1 - PRESS RELEASE - Evercore Inc. | dex991.htm |

Evercore Partners Atalanta Sosnoff Transaction Overview March 5, 2010 Exhibit 99.2 |

1 This presentation contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, which reflect our current views with respect to, among other

things, our operations and financial performance. In some cases, you can identify these forward-looking statements by the use of words such as “outlook”, “believes”,

“expects”, “potential”, “continues”, “may”, “will”, “should”, “seeks”, “approximately”, “predicts”,

“intends”, “plans”, “estimates”, “anticipates” or the negative version of these words or other comparable words. All statements other than

statements of historical fact included in this presentation are

forward-looking statements and are based on various underlying assumptions and expectations and are subject to known and unknown risks, uncertainties and assumptions,

and may include projections of our future financial performance based on

our growth strategies and anticipated trends in our business. Such

forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ

materially from those indicated in these statements. We believe these

factors include, but are not limited to, those described under “Risk Factors” discussed in our Annual Report on Form 10-K for the year ended December 31,

2009. These factors should not be construed as exhaustive and should

be read in conjunction with the other cautionary statements that are included in this discussion. In addition, new risks and uncertainties emerge from time to

time, and it is not possible for us to predict all risks and uncertainties,

nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking

statements. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and we do not assume any responsibility for the accuracy or

completeness of any of these forward- looking statements. We

undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. |

2 Structure Acquisition of 49% interest in Atalanta Sosnoff Capital (ASC) ASC management team will own the remainder of the company and direct all investment

operations Consideration Up to $83.3 million in a combination of cash and shares of EVR common stock

– Upfront Payment of $68.6 million (100% cash) – Up to $14.7 million (50% cash; 50% stock) in the event earnings targets are achieved

for 2010 Financial Impact to EVR The transaction is expected to be 3% - 5 % accretive to earnings under a range of

growth rates for the business Closing Q2 2010 subject to the receipt of required client

consents and other customary closing conditions

Atalanta Sosnoff Overview – Transaction Summary |

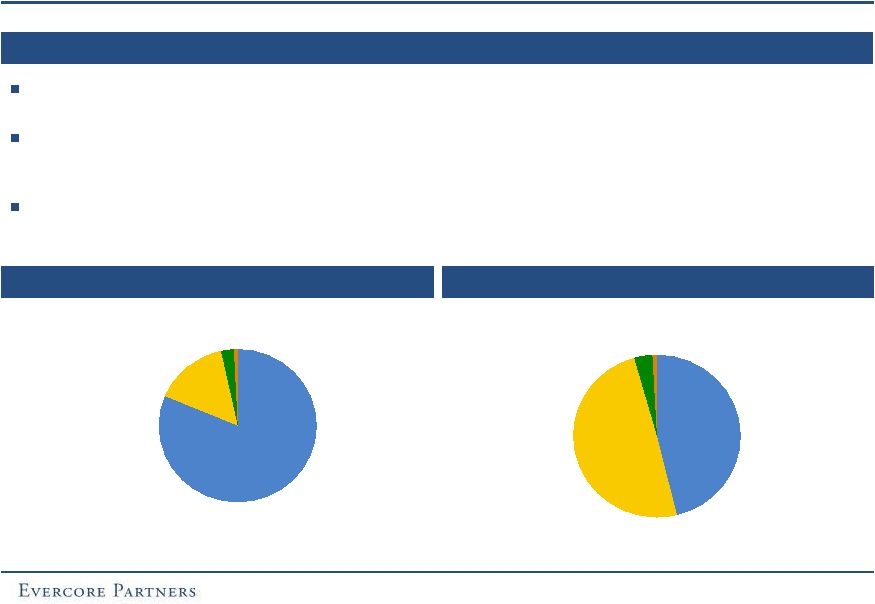

3 Other (2) 1.0% Fixed Income 2% Balanced 15% Large Cap Equity 81% Atalanta Sosnoff – Business Overview Business Description Founded by Martin Sosnoff (“MS”) in 1981, ASC is a large-cap equity and

balanced manager with $10.4 billion of assets under management across

multiple separate accounts The company is located in New York and has a

total of 52 employees. Management, led by Martin Sosnoff and Craig

Steinberg, will own 51% of the company at closing. Management has signed long-term employment contracts ASC invests on behalf of institutional, broker advised and high net worth clients

(1) AUM is as of December 31, 2009 (2) Other includes Value Style and Partnership AUM by Client Type (1) AUM by Product (1) Broker Advised 50% Institutional 46% High Net Worth 3% Other (2) 1% |

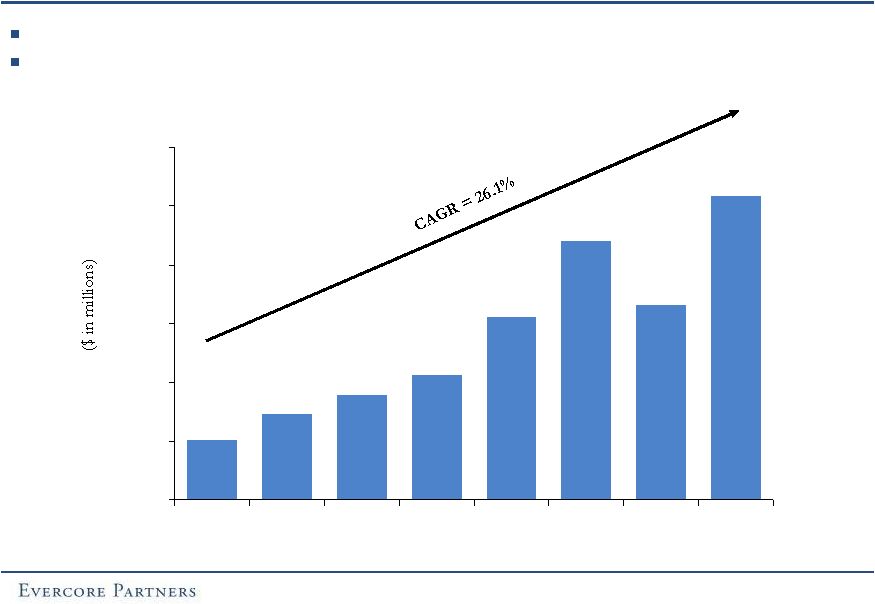

4 Atalanta Sosnoff – Assets Under Management 2009 year end assets under management of $10.4 billion Asset growth has been driven by consistent strong investment performance and client

inflows $2,042 $2,922 $3,566 $4,255 $6,243 $8,800 $6,637 $10,361 0 2,000 4,000 6,000 8,000 10,000 12,000 2002 2003 2004 2005 2006 2007 2008 2009 |

5 Strategic Rationale ASC has a long-term track record of best-in-class investment performance, reflecting a repeatable and disciplined investment process ASC has demonstrated a record of sustained growth, and has substantial additional capacity in its core investment products Strong business and cultural fit – High quality, high integrity, professional team – Strong alignment of interests The transaction is expected to be immediately accretive to earnings

|

Evercore Partners |