Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AUXILIUM PHARMACEUTICALS INC | d8k.htm |

1 March 2010 (NASDAQ: AUXL) Exhibit 99.1 |

2 Safe Harbor Statement We will make various remarks during this presentation that constitute

“forward-looking statements” for purposes of the safe harbor

provisions under The Private Securities Litigation Reform Act of 1995,

including statements regarding the pricing, time to market, size of market, growth potential and therapeutic benefits of the Company’s product candidates, including those for the treatment of

Peyronie’s disease and Frozen Shoulder syndrome; the potential for XIAFLEX to be sued in multiple indications; interpretation of market research data; competition within

certain markets relevant to the Company’s product candidates; interpretation of clinical results, including the efficacy and tolerability of the

Company’s product candidates; the timing of the commencement and completion of clinical trials and the timing of reporting of results therefrom; the timing of the

launch of XIAFLEX for the treatment of Dupuytren’s contracture in the U.S.; the timing of commercial availability of XIAFLEX; the ability to obtain reimbursement; the

timing of new reimbursement codes for XIAFLEX; the average number of cords

that Dupuytren’s contracture patients will have treated with XIAFLEX

and the average number of vials used to treat each cord; the timing of the end-of- phase II meeting and of the initiation of phase III for XIAFLEX for the treatment of

Peyronie’s disease; the Company’s ability to manufacture XIAFLEX at the Company’s Horsham facility in sufficient quantities to meet several years of global

launch expectations given annual capacity at current yields; the approval of

the Marketing Authorization Application for XIAFLEX for the treatment of

Dupuytren’s contracture in the European Union; competitive developments affecting the Company’s products and product candidates, including generic competition; the

success of the Company’s development activities; future Testim market share, prescriptions and sales growth and factors that may drive such growth; size and growth

potential of the testosterone replacement therapy market and the gel

segment thereof and factors that may drive such growth; the protection for Testim

afforded by U.S. Patent No. 7,320,968, and those issued on October 27, 2009 and their listing in the Orange Book, the value of extending patent protection for

Testim through January 2025, the value and likelihood that patents will be granted from the continuation applications filed by CPEX Pharmaceuticals, Inc.; the impact of the filing by Upsher-Smith Laboratories, Inc.

of an ANDA for a testosterone gel; the Company’s development and

operational goals and strategic priorities for fiscal 2010; the ability to

fund future operations; and the Company’s expected financial

performance during 2010 and financial milestones that it may achieve for 2010, including 2010 Testim net revenues, research and development spending, selling, general and administrative expenses, and stock-based

compensation expenses. All remarks other than statements of historical facts made during this presentation, including but not limited to, statements regarding

future expectations, plans and prospects for the Company, statements

regarding forward-looking financial information and other statements containing

the words “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” and similar expressions, as they relate to the Company, constitute forward-looking

statements. Actual results may differ materially from those reflected in

these forward-looking statements due to various factors, including general financial, economic, regulatory and political conditions affecting the biotechnology and pharmaceutical industries and those discussed

in Auxilium's Annual Report on Form 10-K for the year ended December 31,

2009 under the heading "Risk Factors“, which is on file with the Securities and Exchange Commission (the “SEC”) and may be accessed electronically by means of the SEC’s home page on the Internet at http://www.sec.gov or by means of the Company’s home page on the Internet at http://www.auxilium.com under the heading “Investor Relations - SEC Filings.” There may be additional risks that the Company does not presently know or that

the Company currently believes are immaterial which could also cause actual results

to differ from those contained in the forward-looking statements. Given these risks and uncertainties, any or all of these forward-looking statements may

prove to be incorrect. Therefore, you should not rely on any such factors or forward-looking statements. In addition, forward-looking statements provide the Company’s expectations,

plans or forecasts of future events and views as of the date of this

presentation. The Company anticipates that subsequent events and

developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company

specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as

of any date subsequent to the date of this presentation. |

3 Focused on Sustainable Long-term Growth Testim XIAFLEX Dupuytren’s XIAFLEX Peyronie’s XIAFLEX New Indications XIAFLEX New Territories |

4 Pipeline Continues to Advance Note: Seeking partners for Transmucosal film product candidates PRODUCT LATE RESEARCH

PRE-CLINICAL PHASE I PHASE II PHASE

III MARKET TESTIM ® GEL XIAFLEX™ XIAFLEX™ XIAFLEX™ Transmucosal Film AA4010 Transmucosal Film Transmucosal Film Hypogonadism Dupuytren’s Contracture Peyronie’s Disease Frozen Shoulder Syndrome Overactive Bladder Pain Hormone & Urology |

5 XIAFLEX™ |

6 XIAFLEX – Unique, Late-Stage, Blockbuster Opportunity • Potential to be the only effective non-surgical treatment for two high unmet

needs: Approved on February 2, 2010 for Dupuytren’s Contracture in U.S. Promising phase IIb results in Peyronie’s disease • Well-characterized mode of action • State of the art biological manufacturing facility • Worldwide rights generate and support growth Build company in North America Partnered with Pfizer in EU for Dupuytren’s and Peyronie’s Opportunity to add additional indications Rights for other territories or indications could generate additional cash • We believe there are at least 450,000 potential patients annually in U.S. and

EU for Dupuytren’s & Peyronie’s indications or > $1 Billion

opportunity, based on market research and analysis

|

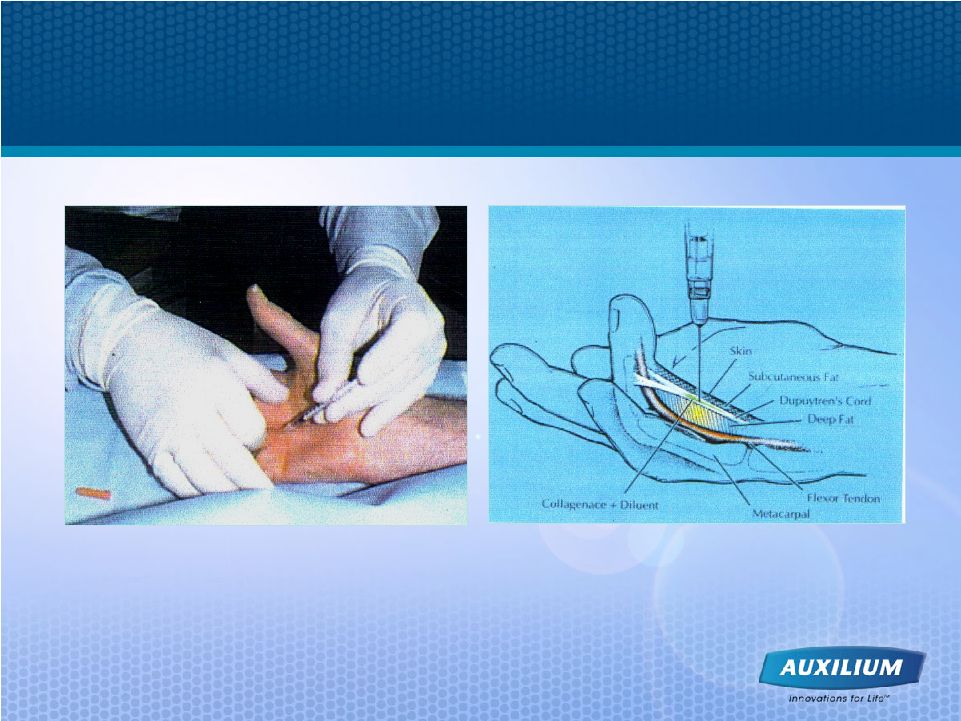

7 Dupuytren’s Contracture is Debilitating for Patients • Excessive collagen deposition in fascia of hand • Nodules represent early, active form • Cords develop over time, are palpable, and result in contractures • Quality of life and daily activities can be significantly affected • Surgery may be reserved for advanced disease due to unpredictable results, complications, long recovery and recurrence/additional surgeries |

8 Current Treatment Options Require Invasive Surgery with Significant Recuperation or Are Unapproved and Ineffective • Surgery • Non-surgical options Splinting Physical therapy Corticosteroids • Needle fasciotomy/ aponeurotomy • Amputation |

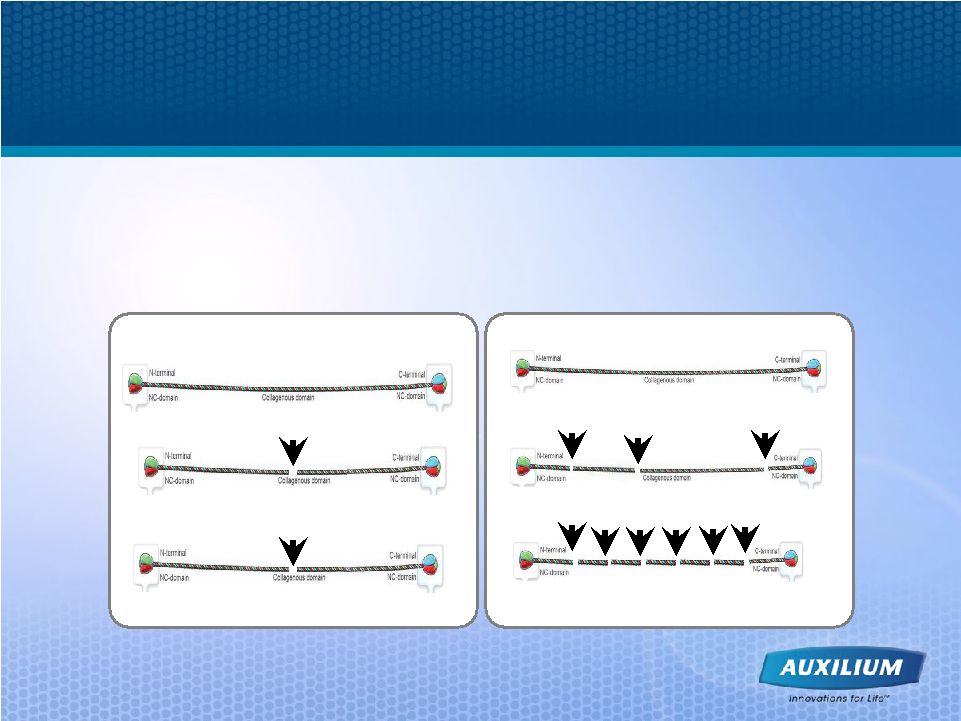

9 XIAFLEX Offers an Improved Mechanism of Action • Clostridial collagenase is faster and more potent than human collagenase – Activity of XIAFLEX further enhanced by optimizing the ratio of collagenases

in the product End products Fast cleavage Human collagenase Human collagenase (MMP) (MMP) Slow cleavage XIAFLEX XIAFLEX End products |

10 • XIAFLEX is indicated for the treatment of adult patients with Dupuytren’s contracture with a palpable cord. • Indicated for treatment of both MP and PIP joints with no minimum or maximum angles • To be injected by a healthcare provider experienced in injection procedures of the hand and in the treatment of patients with Dupuytren’s contracture • REMS program largely in line with our Risk Management Proposals We Believe XIAFLEX Label Is a Positive for Launch |

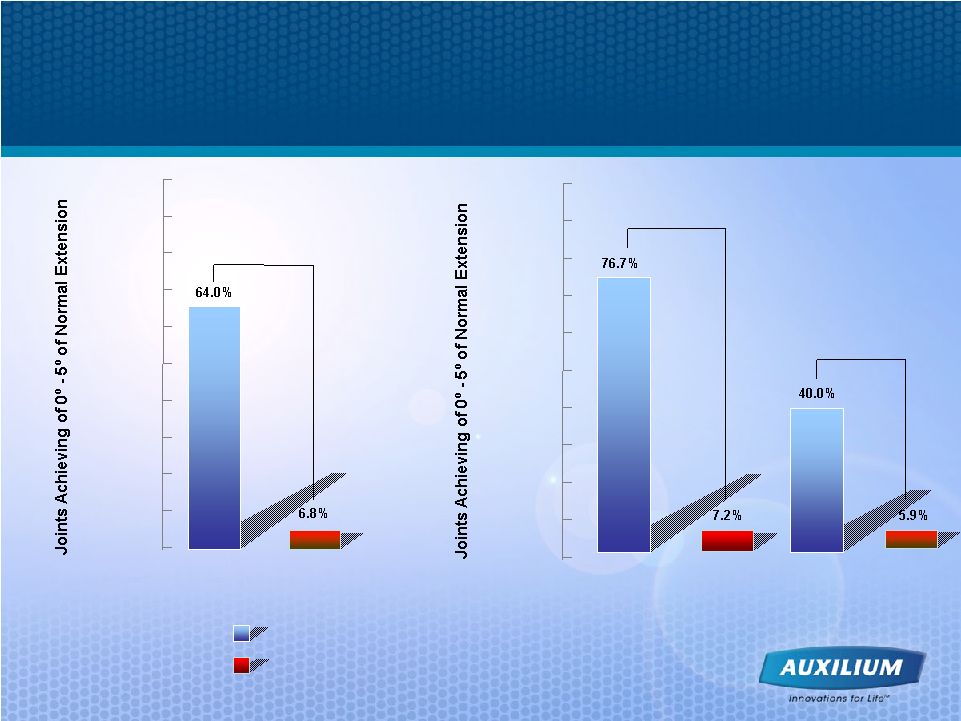

11 XIAFLEX Results Are Comparable to Reported Results for Surgery Hurst et al. NEJM 2009 Collagenase Placebo MP Joints (N=133) PIP Joints (N=70) P < 0.001 P < 0.001 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% XIAFLEX (N=203) Placebo (N=103) P < 0.001 MP = metacarpophalangeal PIP = proximal interphalangeal Placebo (N=34) Placebo (N=69) |

12 • Most treatment related adverse events were mild or moderate in intensity and resolved without intervention within a median of 9 days across studies • Severe Adverse Events possibly related to treatment were limited in number (10 in total; 0.39% of >2600 injections) 4 SAEs were tendon and ligament damage • No deaths, clinically meaningful changes in grip strength, arterial injuries or nerve injuries related to XIAFLEX reported • No clinically meaningful changes in laboratory values • No clinically meaningful systemic allergic reactions XIAFLEX Was Well-Tolerated in Phase III Studies |

13 XIAFLEX is a Potential, First-line Nonsurgical Option for Patients with Dupuytren’s Contracture • Efficacy should compare favorably to surgery Primary endpoint of 5° for both MP and PIP joints reached with statistical significance in multiple studies Secondary endpoints support commercial uptake • Early intervention may be the best treatment approach • A significant number of patients with Dupuytren’s contractures should be

candidates for treatment with XIAFLEX • 12 month estimated recurrence for 830 joints of 6.7% is comparable to earlier single center study • Safety profile compares favorably to surgery No systemic exposure and no systemic hypersensitivity reactions No nerve injuries and no arterial injuries |

14 XIAFLEX Offers a Nonsurgical Treatment for Dupuytren’s Contracture |

15 XIAFLEX I.P. Position for Dupuytren’s Contracture • U.S. Orphan Drug granted on May 23, 1996 provides exclusivity for 7 years post-approval • Market Exclusivity expected in EU for 10 years post-approval Data protection granted for 8 years • Method of Use Patent in U.S. through 2014 • Use Patent in France, UK, Sweden through 2018 Pending in Germany and Denmark • Highly Purified Collagenase product and manufacturing patent filed (if issued, expected expiry 2027) |

16 XIAFLEX Supply Chain • API produced in Horsham, PA 2°- 8°C storage

expected at launch Annual capacity at current yield should be sufficient for

several years of global launch expectations 1 manufacturing train in use and validated; capacity to expand for future demand • Fill and Lyophilization: Hollister-Stier; WA FDA and EMEA-approved facility Supplies U.S. and EU markets with injectable forms |

17 Dupuytren’s Contracture –an Unmet Medical Need 1 NEJM 2009 ² Hueston 1963 ³ Skoog 1948 4 Mikkelsen 1976 5 Tubiana 2006 • Disease prevalence (pits, nodules, or cords) is estimated at 3%-6% 1 of adult Caucasian population, or 13.5 to 27 Million, in U.S. and EU, but occurs in all populations • Higher prevalence in patients of northern-European descent 1 • Hereditary component in approximately 40% of patients 2 • On average, patients have 2.2 affected joints at the time of diagnosis, and about half of patients have bilateral disease 3 • Recurrence rate in surgical patients 4,5 30% during 1st and 2nd postoperative years 55% in 10 years • We believe Dupuytren’s contracture is under-diagnosed and under-treated |

18 Extensive Market Research Performed with Dupuytren’s Surgeons • Multiple prevalence data sets proved to be highly variable in numbers of patients • Two rounds of quantitative primary research have been commissioned by Auxilium on XIAFLEX for Dupuytren’s contracture • A combined 571 Orthopedic Surgeons have been interviewed to estimate market size (401 in U.S.; 170 in Europe) and 391 have given feedback on potential usage of XIAFLEX (221 U.S.; 170 Europe) • Second study (n=444 total & 340 in depth) was designed to provide 95% confidence level and 7.5% margin of error |

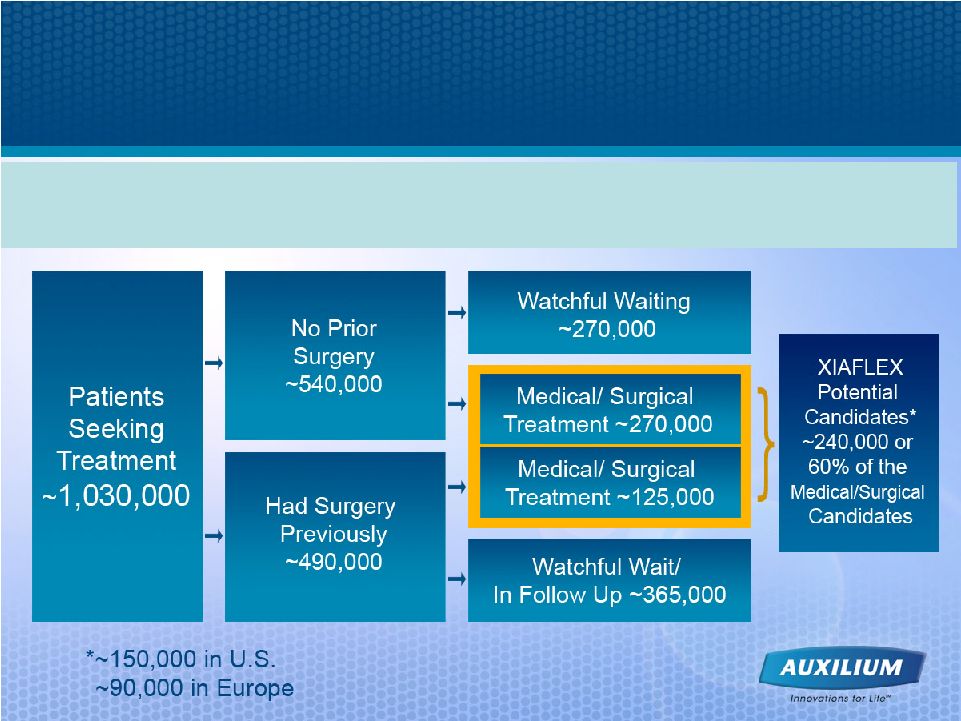

19 Source: 2006 Auxilium research and analysis Annually, >240,000 Dupuytren’s Candidates Could Exist between U.S. & EU Dupuytren’s Disease (pits, nodules or cords) Prevalence: 3-6% of Adult Caucasian Population ~13,500,000 to 27,000,000 |

20 XIAFLEX Commercial Strategy is Tailored to Customer Needs • ~ 7,000 target physicians Hand surgeons, plastic surgeons, orthopedic surgeons, general surgeons, rheumatologists Limited distribution network Buy and bill vs. specialty pharmacy • ~ 100 field representatives sales reps, sales managers, and reimbursement specialists medical science liaisons • In-house reimbursement support |

21 XIAFLEX Price of $3,250 Determined Following Detailed Assessment Of Key Stakeholder Drivers DRIVERS: Financial risk vs. return • Could provide reimbursement on par with surgery • Shorter procedure to allow larger volumes to be treated and free up time for other procedures DRIVERS: Surgery cost vs. value of XIAFLEX DRIVERS: Patients’ out of pocket expense Patient Physician Payer Based on feedback from customers, we believe that an average patient will require 1.1 injections to treat 1.5 cords. |

22 • Miscellaneous J and CPT codes will be used • Establishment of new product specific J code expected for 2011 and procedure codes (CPT) expected in 2012 • Accounts naive to the reimbursement process will need customized support • Claims processing at payer level may be inconsistent throughout 2010 and 2011 Reimbursement Uncertainty May Create Headwinds |

23 • ~20 minute training video and product information on- line at www.XIAFLEX.com • 1-877-XIAFLEX for training and training information • Reimbursement Helpline • Patient assistance program • Co-pay foundation XIAFLEX Training Options and Resources |

24 • Recognize potential and identified risks Potential: Injection related bleeding due to coagulation disorder, allergic reactions Identified: localized reactions and tendon ruptures • Creation and implementation of strategies to minimize those risks Product labeling, physician training, Dear HCP letter, patient product information (Med Guide) and education, safety monitoring, and REMS effectiveness reporting • Information and education for physicians and patients Extensive physician training program and resources Physicians and patients would have multiple portals to access patient specific information XIAFLEX REMS In Line With Our Goal Of Ensuring Appropriate Administration |

25 Sustainable Blockbuster Market for Dupuytren’s Contracture Anticipated • High disease prevalence Based on literature, ~ 13.5M to 27M patients in U.S. and EU have a Dupuytren’s pit, nodule or cord, however only ~1M

patients annually seeking treatment in U.S. and EU • Sustainable patient pool New patients within an ageing population Average of 1.5 cords expected to be treated and average 1.1 injections per cord ~ 50% of patients have bilateral disease Disease progression to additional joints High recurrence rate for surgery 1,2 • No nonsurgical competition • Market development represents upside 1 Mikkelsen 1976 2 Tubiana 2006 |

26 • Begin supplying our distribution partners with XIAFLEX in the week of March 1; shipping to trained physician’s enrolled in XIAFLEX Xperience beginning week of March 8 • Get targeted physicians through training and into distribution database • Achieve high awareness among targeted physicians and diagnosed patients Key Objectives for U.S. XIAFLEX Launch in 2010 |

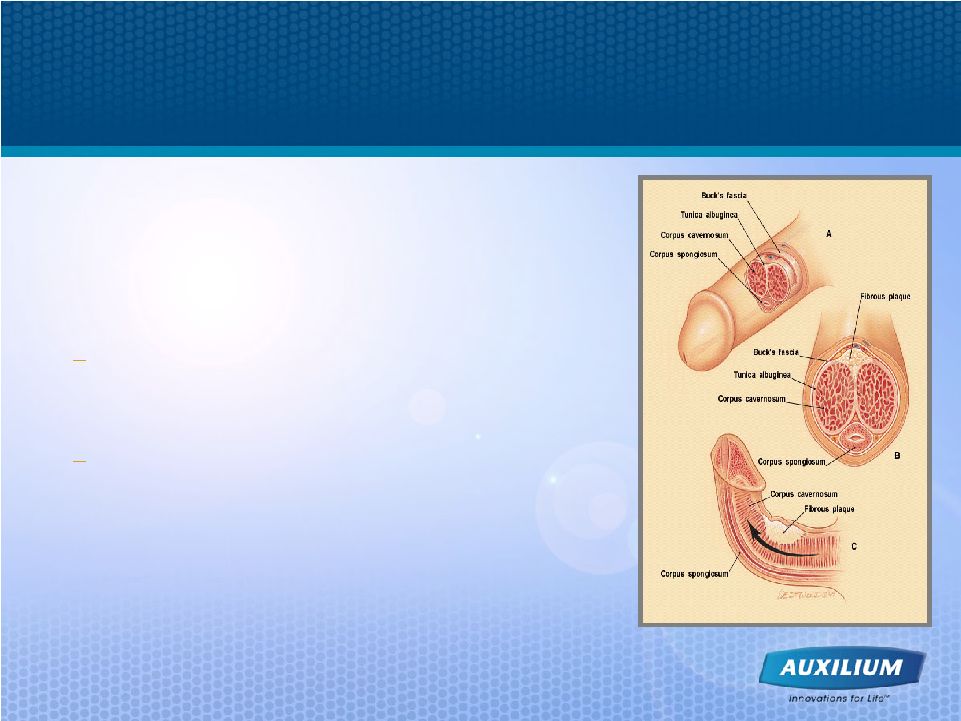

27 1 Smith BH. Am J Clin Pathol. 1966;45:670-678. 2 Somers KD, Dawson DM. J Urol. 1997;157:311-315. Peyronie’s Disease is a Devastating Disorder • Scarring phenomenon affecting the tunica albuginea 1 • Plaques show excessive collagen deposition 2 • Potential Symptoms Pain with erection, penile curvature/ deviation, penile shortening, indentations, and/or erectile dysfunction May experience difficulty with sexual intercourse, loss of self-esteem, and depression • There are no approved therapies for the treatment of Peyronie’s disease |

28 1 Schwarzer U, The prevalence of Peyronie’s disease: Results of a large survey.

BJU Int 2001;88:727-30; Mulhall et al: J Urology

2004:171: 2350 - 2353;Rhoden et al: Int J. Impot Res 2001 :13 : 291 - 293; La Pera et al : EUR Urology 2001: 40 :525 - 530. 2 Smith BH. Am J Clin Pathol. 1966;45:670-678. 3 Lindsay MB, J Urol. 1991;146:1007-1009. 4 Nyberg L, J Urol.128: 48, 1982 • Prevalence of Peyronie’s disease is estimated at 1 in 20 adult men 1 Actual prevalence may be higher, based on autopsies 2 • Prevalence rate increases with age The average age of disease onset is 53 years 3 • High association with other diseases such as: Diabetes, erectile dysfunction (ED), Dupuytren’s contracture, plantar fascial contracture, tympanosclerosis, gout, and Paget’s disease 4 • Surgery is the treatment of last resort and other medical therapies are unproven • We believe Peyronie’s disease is under-diagnosed and under-treated

Peyronie’s Disease - an Unmet Medical Need |

29 Peyronie’s Phase IIb Study Designed To Assess The Safety And Efficacy With XIAFLEX • Study design: XIAFLEX was administered two times a week every six weeks for up to three treatment cycles (2 x 3) 145 patients at 12 U.S. sites • Patients must have been able to maintain a rigid erection with a penile contracture between 30 and 90 degrees. Patients required to have stable disease and be at least 6 months post-diagnosis Stratification occurs by the degree of penile curvature (i.e. 30° to 60° versus >

60°) Effects of modeling vs. not modeling were evaluated |

30 Peyronie’s Phase IIb Trial Utilized a Novel Patient Reported Outcome (PRO) • Study was designed to validate Auxilium’s proprietary Peyronie’s Patient Reported Outcome (PRO) questionnaire. • PRO measured four domains of patients’ sexual quality of life, over a 36 week period: penile pain Peyronie’s disease bother intercourse discomfort intercourse constraint • PRO likely to be used as a primary efficacy endpoint in Phase III clinical trials. |

31 Promising Phase IIb Data in Peyronie’s Disease • Overall – Significant XIAFLEX effect Reduction of penile curvature Improvement in Peyronie’s Disease Bother (PRO Domain) • XIAFLEX With Modeling Significant effect in both penile curvature and Peyronie’s disease bother endpoints • XIAFLEX Without Modeling Not significant - Due to strong placebo response • Safety profile consistent with previous XIAFLEX studies Well tolerated Immunogenicity profile expected Injection site bruising, edema, pain – most common No drug related SAEs No systemic immunologic events |

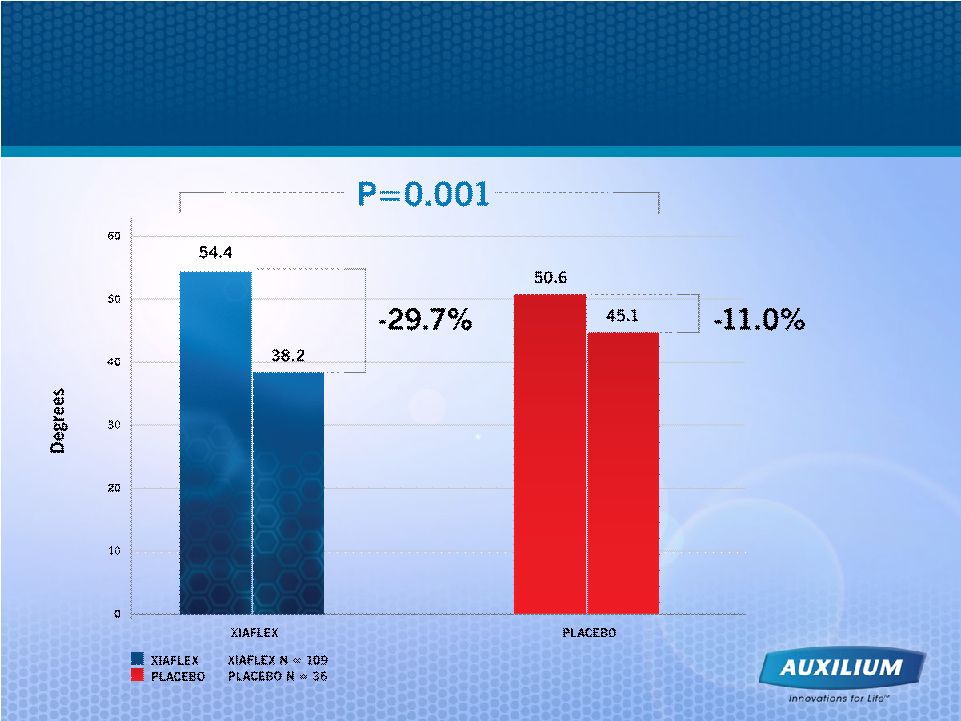

32 At 36 weeks, Mean Penile Curvature Improved Significantly |

33 At 36 weeks, Overall Mean Score Change with Peyronie’s Disease Bother Improved Significantly |

34 • End of Phase II meeting with FDA expected in 2Q10 to discuss: Validation of PRO Phase III trial design • Anticipate commencing U.S. Phase III study in 2H10 Anticipated Next Steps for Peyronie’s disease |

35 Extensive Market Research Performed with Peyronie’s Surgeons • Two rounds of quantitative primary research have been commissioned by Auxilium on XIAFLEX for Peyronie’s disease • A combined 575 Urologists have been interviewed to estimate market size (415 in U.S.; 160 in Europe) and 383 have given feedback on potential usage of XIAFLEX (223 U.S.; 160 Europe) • Second study (n=472 total & 333 in depth) was designed to provide 95% confidence level and 7.5% margin of error

|

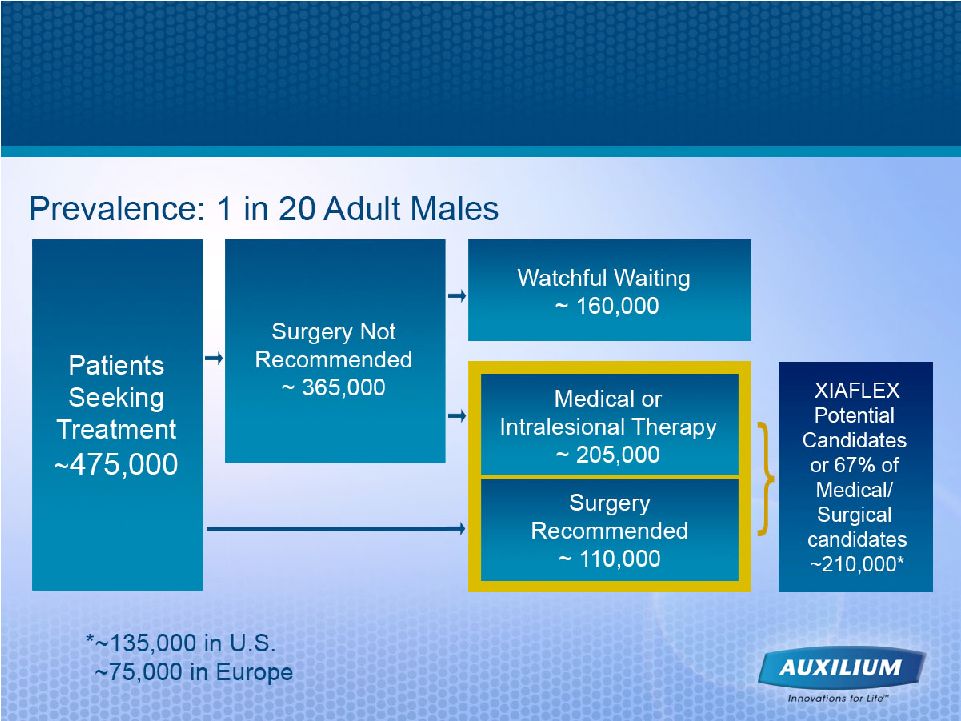

36 Annually, >210,000 Peyronie’s Candidates May Exist in U.S. and Europe Source: 2006 Auxilium research and analysis |

37 XIAFLEX I.P. Position for Peyronie’s Disease • U.S. Orphan Drug granted on March 12, 1996 provides exclusivity for 7 years post-approval • Market Exclusivity in EU could be extended to 11 years on approval of additional indication • Method of Use Patent in U.S. through 2019 • Use Patent Granted in France, UK, and Ireland (expiry 2020) Pending in Germany, Denmark, and Norway • Highly Purified Collagenase product and manufacturing patent filed (if issued, expected expiry 2027) |

38 Strategic Partnership with Pfizer for XIAFLEX in EU • Strong working relationship with goal to obtain EMEA approval • Auxilium is primarily responsible for the global development of XIAFLEX, including all clinical & commercial manufacturing and supply. • Pfizer is primarily responsible for: European territory regulatory activities for Dupuytren’s and Peyronie’s

All European territory commercialization activities for Dupuytren’s and

Peyronie’s All European territory phase IV clinical development for

Dupuytren’s and Peyronie’s • Compelling economics for Auxilium: Up-front payment of $75 million $150 million tied to regulatory milestones ($15M received for MAA acceptance in

1Q10) $260 million based on sales milestones Significant increasing tiered royalties based on sales of XIAFLEX in Pfizer’s

territories • First EU only partnership for Pfizer |

39 Testim ® 1% Testosterone Gel |

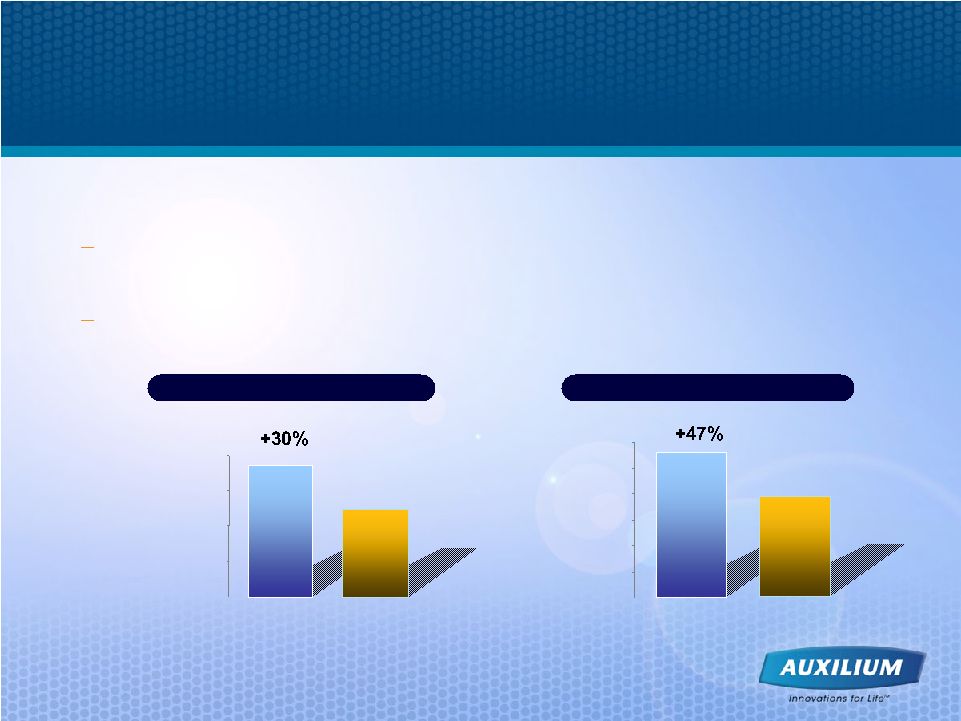

40 Testim ® Maintains Double-Digit Growth in Testosterone Replacement Therapy Market *Mulligan T. et al. Int J. Clin Pract 2006 • Proprietary, topical 1% testosterone gel Once-a-day application Favorable clinical and commercial profile • Recent study indicates 39% of U.S. males over 45 yrs are hypogonadal* We estimate that <10% of affected population receives treatment • We believe diagnosis is increasing through education and awareness |

41 Patient Results Were Proven in Clinical Studies Note: Adjusted geometric means (CV b %) of a single-dose (50 mg testosterone), randomized, complete crossover study of 29 hypogonadal men. Total Testosterone 2,000 3,000 4,000 5,000 6,000 Mean AUC 0-24 (ng*h/dL) Testim AndroGel Free Testosterone 0 50 100 150 200 250 Mean AUC 0-24 (ng*h/dL) Testim AndroGel • 16 clinical studies involving approx. 1,800 patients largest placebo-controlled study ever conducted • Clinical trial of Testim ® vs. AndroGel ® Testim provides 30% higher testosterone absorption (p<0.001)

|

42 Gels Continue to Drive Significant Growth in TRT Marketplace Source: IMS data |

43 Testim® Quarterly Net Revenues and Scripts ($ in millions) Continuing Track Record of Consistent Revenue Growth 4Q09 Net Testim Revenues Y/Y Growth: +24.4% 4Q09 TRX Y/Y Growth: +13.2% Source: Auxilium and IMS data $42.8M $68.9M $95.7M $125.2M $151.9M |

44 Testim Patent Coverage *Note: The referenced Testim patents are owned by CPEX Pharmaceuticals, Inc. U.S. • U.S. Patent # 7,320,968* covering method of use claims for Testim issued January 22, 2008; expires 2025 • 6 additional U.S. Patents (# 7,608,605 through 610*) covering method of use claims

for Testim issued October 27, 2009; expire 2023 • Upsher-Smith Laboratories, Inc. filed an ANDA with paragraph IV certification

referring to the ’968 patent; AUXL filed lawsuit under Hatch-Waxman on

Dec. 4, 2008; 30 month stay intact ROW • Patent issued in Canada; expires 2023 • Patent issued in Europe; expires 2023 • Patents granted and applications pending in numerous countries worldwide

|

45 FDA Has Granted Our Citizen's Petition In Part And Denied It In Part • Auxilium’s Citizen’s Petition was filed in February 2009 and FDA response

was received in August 2009. • FDA has agreed with some of the statements we made in our Citizen's Petition regarding the testing required for generic versions of Testim and disagreed with

other statements. • Although not commenting upon any filing in particular, the FDA did state that

"The practical effect of this determination is that any application for a

testosterone gel product that has different penetration enhancers than the

reference listed drug cannot be submitted as an ANDA and, instead, will have

to be submitted as an NDA under section 505(b) of the Act.“ • We will be interested to see what impact that has in the future.

|

46 2010 Q4 ’09 2009 Guidance Testim Revenues $47.2 $160.4 $185-195 R&D Expense* $11.4 $51.4 $50-60 SG&A Expense* $38.7 $129.2 $160-170 Net Loss ($11.9) ($53.5) N/A Stock – Based Comp Expense (* included) $4.4 $17.9 $22-25 Cash & Cash Equivalents $182.0 2009 Financial Results and 2010 Guidance ($ Millions) Currently, approximately 47.2 million shares are issued & outstanding. An additional

5.5 million shares subject to issuance from stock options &

warrants |

47 Strategic Priorities in 2010 • Execute the launch in the U.S. for XIAFLEX in Dupuytren’s contracture; • Support Pfizer in the ongoing regulatory review of the EU Dupuytren’s submission and prepare for their eventual launch; • Commence phase III for XIAFLEX in Peyronie’s disease, assuming a successful End-of Phase 2 meeting with FDA in Q2; • Advance XIAFLEX new indication(s); and, • Continue to maximize Testim revenues while vigorously defending our intellectual property. |

48 Focused on Sustainable Long-term Growth Testim XIAFLEX Dupuytren’s XIAFLEX Peyronie’s XIAFLEX New Indications XIAFLEX New Territories |

49 Auxilium Management Contact James E. Fickenscher/CFO Auxilium Pharmaceuticals, Inc. (484) 321-5900 jfickenscher@auxilium.com William Q. Sargent Jr./ VP IR Auxilium Pharmaceuticals, Inc. (484) 321-5900 wsargent@auxilium.com March 2010 (NASDAQ: AUXL) |