Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - MLM INDEX FUND | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - MLM INDEX FUND | ex31_2.htm |

| EX-32.2 - EXHIBIT 32.2 - MLM INDEX FUND | ex32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - MLM INDEX FUND | ex32_1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K

(Mark

One)

|

x

|

Annual

report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of

1934 for the fiscal year ended December 31,

2009

|

|

o

|

Transition

report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of

1934

|

For the transition period from

__________________ to ___________________

Commission

file number 0-49767

MLM

INDEX™ FUND

(Exact

name of registrant as specified in its charter)

|

Delaware

|

Unleveraged

Series: 22-2897229

|

|

Leveraged

Series: 22-3722683

|

|

|

Commodity

L/S Unleveraged Series 20-8806944

|

|

|

Commodity

L/N Unleveraged Series 27-1198002

|

|

|

(State

of Incorporation)

|

(I.R.S.

Employer Identification No.)

|

|

405

South State Street

|

|

|

Newtown,

PA

|

18940

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (267) 759-3500

Securities

registered pursuant to Section 12 (b) of the Act:

|

Title

of Each Class

|

Name

of Exchange on Which Registered

|

|

None

|

None

|

Securities

registered pursuant to Section 12 (g) of the Act:

Business Trust Interests – Unleveraged

Series

Business Trust Interests – Leveraged

Series

Business Trust Interests – Commodity

L/S Unleveraged Series

Business Trust Interests – Commodity

L/N Unleveraged Series

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o. No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o. No x.

Note –

Checking the box above will not relieve any registrant required to file reports

pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under

those Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports) and (2) has been subject to such filing requirements for

the past 90 days. Yes x No o.

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting

company. See definition of “accelerated filer”, “large accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one)

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer x

|

Smaller

reporting company o

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). o Yes x No

As of

June 30, 2009 the aggregate fair value of the business trust units of the

Unleveraged Series of the registrant held by non-affiliates of the registrant

was approximately $69.3 million, the aggregate fair value of the business trust

units of the Leveraged Series of the registrant held by non-affiliates of the

registrant was approximately $43.9 million, the aggregate fair value of the

business trust units of the Commodity L/S Unleveraged Series of the registrant

held by non-affiliates of the registrant was approximately $0 million, and the

aggregate fair value of the business trust units of the Commodity L/N

Unleveraged Series of the registrant held by non-affiliates of the registrant

was approximately $0 million.

As of

February 15, 2010 there were 917,775 units outstanding.

Documents

Incorporated by Reference: Certain exhibits in Item 15 are incorporated by

reference in this Form 10-K, as specifically set forth in Item 15.

Forward

Looking Statements

This

Annual Report on Form 10-K contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995 and other

Federal Securities Laws. These forward-looking statements are based on our

present intent, beliefs and expectations as well as assumptions made by and

information currently available to us, but they are not guaranteed to occur and

they may not occur. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, such statements are subject to known

and unknown risks and uncertainties that may be beyond our control, which could

cause actual performance or results to differ materially from projected

performance or results expressed or implied by the forward-looking statements.

Additional information concerning the factors that could cause actual results to

differ materially from those in the forward-looking statements is contained in

Item 1, “Business”, and Item 1A, “Risk Factors”. You should not place undue

reliance upon forward-looking statements. Except as required by law, we

undertake no obligation to update or release any forward-looking statements as a

result of new information, future events or otherwise.

Table of Contents

|

Page

|

||

|

Item

1.

|

4

|

|

|

Item

1B.

|

18

|

|

|

Item

2.

|

18

|

|

|

Item

3.

|

18

|

|

|

Item

4.

|

18

|

|

|

Item

5.

|

19

|

|

|

Item

6.

|

22

|

|

|

Item

7.

|

23

|

|

|

Item

7A.

|

26

|

|

|

Item

8.

|

27

|

|

|

Item

9.

|

29

|

|

|

Item

9A.

|

29

|

|

|

Item

10.

|

29

|

|

|

Item

11.

|

31

|

|

|

Item

12.

|

31

|

|

|

Item

13.

|

32

|

|

|

Item

14.

|

32

|

|

|

Item

15.

|

F1

|

|

Item 1.

|

Business

|

General

and Business Segments

The MLM

Index™ Fund (the “Trust”) is a business trust organized under the laws of

Delaware. The MLM Index Fund has one reportable segment which trades futures

contracts on various futures exchanges in the U.S. and foreign

markets. The Trust engages primarily in the speculative trading of a

diversified portfolio of futures contracts using the MLM Index™ Trading Program

(the “Trading Program”). Futures contracts are standardized contracts made on or

through a commodity exchange and provide for future delivery of commodities,

precious metals, foreign currencies or financial instruments and, in the case of

certain contracts such as stock index futures contracts and Eurodollar futures

contracts, provide for cash settlement. The Trust's objective is the

appreciation of its assets through speculative trading. The Trust began trading

on January 4, 1999.

The Trust

consists of several separate series of interests (each, a “Series”), each with

its own assets and liabilities. Under the Trust Agreement, the Trust may

issue multiple Series of Interests. The Trust maintains separate and

distinct records for each Series and the assets associated with each such Series

are held and accounted for separately from the other assets of the Trust and of

any other Series thereof. The debts, liabilities, obligations and expenses

incurred, contracted for or otherwise existing with respect to a particular

Series are enforceable against the assets of such Series only and not against

the assets of the Trust generally or the assets of any other Series. The

schedules on pages F5-F8 are the sum of the individual schedules for each Series

and are presented for reporting purposes only. A Statement of Financial

Condition and Statement of Operations for each Series can be found on pages

F25-F27.

Mount

Lucas Management Corporation (the “Manager”), a Delaware corporation, acts as

the manager and trading advisor of the Trust. The Manager was formed in 1986 to

act as an investment manager. As of December 31, 2009, the Manager had

approximately $1.7 billion of assets under advisement. The Manager is a

registered investment adviser under the Investment Advisers Act of 1940, a

registered commodity trading advisor and commodity pool operator with the

Commodity Futures Trading Commission (the "CFTC") and a member of the National

Futures Association (the "NFA"). The Manager may from time to time operate other

investment vehicles.

The Trust

and the Manager maintain their principal business office at 405 South Street,

Newtown, PA 18940 and their telephone number is

267-759-3500.

Wilmington

Trust Company, a Delaware banking corporation, acts as trustee for the Trust.

The Trustee's office is located at Rodney Square North, 1100 North Market

Street, Wilmington, Delaware 19890. The Trustee is unaffiliated with the

Manager. The Trustees duties and liabilities are limited to its express

obligations under the Amended and Restated Declaration of Trust and Trust

Agreement, dated as of August 31, 1998, among the Trustee, the Manager and the

Interest Holders from time to time thereunder, as amended (the "Trust

Agreement").

Citigroup

Global Markets currently acts as clearing broker for the Trust. A clearing

broker accepts orders to trade futures on behalf of another party and accepts

money to support such orders. The clearing broker is a futures commission

merchant registered with the CFTC and is a member of the NFA.

Trading

Program

The Trust trades speculatively in a

wide range of futures contracts traded on U.S. and foreign exchanges using the

Trading Program, which is based upon the MLM Index™. The MLM Index™ and the

Trading Program are both proprietary products of the Manager. The Trading

Program attempts to replicate the MLM Index™, before fees and expenses.

Currently the Trust has four series of interests; the Unleveraged Series, the

Leveraged Series, the Commodity L/S Unleveraged Series and the Commodity L/N

Unleveraged Series. The Unleveraged Series attempts to replicate the MLM Index™

without any leverage, while the Leveraged Series trades the Trading Program at

three times leverage. Leverage is the ability to control large dollar amounts of

a commodity with a comparatively small amount of capital. The Leveraged Series

purchases or sells $3 fair value of contracts for every $1 invested in the

Series. The Commodity L/S Unleveraged Series and Commodity L/N Unleveraged

Series attempt to replicate the MLM Commodity Long/Short Index and MLM Commodity

Long/Neutral Index respectively, without

leverage. . The MLM Commodity Long/Short Index is a

subset of the MLM Index and contains only the commodity futures contracts of the

entire MLM Index. The MLM Commodity Long/Neutral Index contains the

same commodity futures contracts, but does not have short positions when the MLM

Index algorithm indicates a short position in a particular

contract.

In

attempting to replicate the MLM Index™, the Manager will invest in the same

markets as the MLM Index™; use the same algorithm to determine long versus short

positions; make the same allocations to each market; and generally execute

positions at almost the same time. The Manager may also use swaps in attempting

to replicate the MLM Index™. These swaps would be agreements with dealers to

provide the returns which are the same as holding a specific number of futures

contracts in a specific market, without holding the actual contracts. The

economic effect on the Trust would be substantially identical to holding futures

contracts. However, since the holder of swaps assumes additional counterparty

risk, swaps are only held infrequently. For the year ended and as of December

31, 2009, the Trust neither held nor holds any swap positions.

The

MLM Index™

In 1988,

the Manager created the MLM Index™ as a benchmark of the returns to speculation

in futures markets. Broadly speaking, the futures markets have two classes of

participants, hedgers and speculators. Hedgers are the commercial businesses

that use the futures markets to transfer unwanted or excessive price risk to

those more willing to absorb that risk. Speculators are position holders who

absorb this price risk. In essence, they provide "insurance" to the commercial

interest so that the commercial interests can focus on their basic business

while being protected from unforeseen changes in commodity prices, interest

rates or foreign exchange rates. Basic finance theory argues that the reduction

in risk experienced by the hedgers exacts a cost, or risk premium, that is

earned by those holding the risk. The intent of the MLM Index™ is to measure

this risk premium. In this general sense it is analogous to an index of stocks

that measures the premium to holding equity risk.

Price

risk in futures markets exists when markets rise and when they fall. For

example, an operator of a wheat storage facility is damaged by a fall in the

price of wheat in that the value of the inventory in their facility falls. On

the other hand, a consumer of wheat, like a baker, incurs financial risk if the

price of wheat rises, as the cost of future operations increases. In both cases,

steady prices are favorable. Thus, an index designed to capture the risk premium

earned must capture returns as markets move up and move down, yet suffer when

markets are stable. The MLM Index™ is designed to measure this effect by taking

long and short positions in the constituent markets. The existence of the long

and short positions in the construction of the MLM Index™ is a significant

innovation and important difference from other risk premium

measurements.

The MLM

Index™ currently invests in futures contracts on the following: Chicago corn,

Chicago soybeans, New York sugar, Chicago wheat, Canadian Government Bonds, Euro

Bunds, Japanese Government Bonds, Long Gilts, 10-year Treasury Notes, crude oil,

heating oil, natural gas, unleaded gasoline, live cattle, New York gold, New

York copper, Australian Dollar, British Pound, Canadian Dollar, Swiss Franc,

Japanese Yen, and Euro Currency. The selection of the markets in the MLM Index™

is made by the Manager. The selection is based on a variety of factors,

including liquidity of the underlying futures contract, the relationship with

the other markets in the MLM Index™, and the reasonableness of including the

market in the MLM Index™. The choice of markets for a calendar year is made in

the December preceding the start of the year, and, except in unusual

circumstances, markets are not normally added to or deleted from the MLM Index™

during a year. An extraordinary event that may lead to the removal of a contract

during the year might be the permanent suspension of normal trading or an abrupt

permanent change in the liquidity of the contract. For example, the Chicago

Mercantile Exchange suspended floor trading of the Deutsche Mark contract in

August of 2000, ahead of the announced schedule. If a commodity is traded on

more than one futures exchange, only the one with the largest open interest is

included in the MLM Index™. The open interest is the number of all long or short

futures contracts in one delivery month for one market that have been entered

into and not yet liquidated by an offsetting transaction or fulfilled by

delivery. For example, Chicago Board of Trade wheat has larger open interest

than Kansas City Board of Trade wheat; consequently, Chicago Board of Trade

wheat is included in the MLM Index™ but Kansas City Board of Trade wheat is

not.

In

addition to the markets in the MLM Index™, the Manager determines which delivery

months will be traded for each market in the MLM Index™. Generally, for each

market, four deliveries are chosen that are both liquid and spaced throughout

the calendar year. For example, for the Wheat market, the deliveries traded are

March, May, July and December. The choice of deliveries is set for each calendar

year, but can change due to similar extraordinary circumstances as with the

market selection.

The

calculation of the MLM Index™ is explained below.

Calculation

of the MLM Index™

1.

Determination of long or short futures position for each market.

The rate

of return of an individual market depends on whether the market position is long

or short. Since a futures contract eventually expires, the MLM Index™ is based

on the unit asset value of a market, rather than on the actual futures price.

This month's unit asset value of a futures market is determined by multiplying

last month's value by 1 plus the percentage change in this month's nearby

futures price. The market position is long during the current month if the

market's closing value on the next-to-last trading day of the prior month is

greater than or equal to the market's 252 business day moving average of closing

values; otherwise, the market position is short.

2.

Calculation of the monthly rate of return for each market.

If the

market position is long, then the market monthly rate of return equals the

percentage change in the market price during the month, i.e., the market monthly

rate of return (%) equals the closing price of the current month divided by the

closing price of the prior month, minus 1, times 100. If the market position is

short, then the market monthly rate of return (%) equals -1 (minus one) times

the percentage change in the market price during the month, i.e., the market

monthly rate of return equals the closing price of the current month divided by

the closing price of the prior month, minus 1, times -100 (minus

100).

3.

Calculation of the monthly rate of return for the MLM Index™.

The

monthly rate of return of the MLM Index™ equals the weighted average of the

individual market monthly rates of return plus the Treasury Bill rate of

return.

4.

Determination of the MLM Index™ value.

The value

of the MLM Index™ is computed by compounding the MLM Index™ monthly rates of

return. The beginning value of the MLM Index™ is defined to be 1000 in January

1961. Each month thereafter, the MLM Index™ is changed by the monthly rate of

return. That is, each month's MLM Index™ value is determined by multiplying the

prior month's value by 1 plus the current percentage monthly rate of

return.

The

annual performance of the MLM Index™ for each of the past ten years is set forth

below.

|

Year

|

Annual

Return

|

|

2000

|

16.20%

|

|

2001

|

3.67

|

|

2002

|

-1.63

|

|

2003

|

3.92

|

|

2004

|

3.52

|

|

2005

|

3.75

|

|

2006

|

0.40

|

|

2007

|

2.87

|

|

2008

|

13.60

|

|

2009

|

-2.71

|

The MLM

Index™ is published daily on the Bloomberg system and is available from the

Manager. Since the development of the MLM Index™, other firms have computed

similar indices, including the CMI of AssetSight Corporation and an index

computed by SAIS in Switzerland. Both indices are variations on the construction

of the MLM Index™, either in the derivation of the long and short positions or

the relative weights of the markets. In addition, there are many "commodity"

indexes, such as the GSCI from Goldman Sachs and AIG Commodity Index. These

indexes are long only, and do not include currencies or financial

instruments.

Fees

and Expenses

Set forth

below is a summary of the basic fees that the each of the Series and Classes is

subject to.

Brokerage

Fee

Each

Series of the Trust pays the Manager a brokerage fee at the annual rates set

forth below.

|

Classes

A and B Unleveraged Series

|

0.85%

of net asset value

|

|

Classes

C and D Unleveraged Series

|

0.40%

of net asset value

|

|

Classes

A and B Commodity L/S Unleveraged Series

|

0.85%

of net asset value

|

|

Classes

C and D Commodity L/S Unleveraged Series

|

0.40%

of net asset value

|

|

Classes

A and B Commodity L/N Unleveraged Series

|

0.85%

of net asset value

|

|

Classes

C and D Commodity L/N Unleveraged Series

|

0.40%

of net asset value

|

|

Classes

A and B Leveraged Series

|

1.75%

of net asset value

|

|

Classes

C and D Leveraged Series

|

0.90%

of net asset value

|

The

brokerage fee is based on net asset value as of the first day of each

month. The net asset value of the Trust equals the sum of all cash,

the fair value (or cost of liquidation) of all futures positions and the fair

value of all other assets of the Trust, less all liabilities of the Trust

(including accrued liabilities), in each case determined per Series by the

Manager in accordance with U.S. generally accepted accounting principles. For

purposes of determining the brokerage fee, there is no reduction

for:

|

|

(1)

|

the

accrued brokerage or management

fees,

|

|

|

(2)

|

any

allocation or reallocation of assets effective as of the day the brokerage

fee is being calculated, or

|

|

|

(3)

|

any

distributions or redemptions as of the day the brokerage fee is being

calculated.

|

No

assurance can be given that the brokerage fee will be competitive with the

charges of other brokerage firms.

The

Manager is responsible for paying all of the Trust's costs of executing and

clearing futures trades, including floor brokerage expenses and give-up charges,

as well as the NFA, exchange and clearing fees incurred in connection with the

Trust's futures trading activities. The Manager may also pay from the brokerage

fees, custody fees or amounts necessary for certain administrative and marketing

assistance provided by broker/dealers who are also authorized selling agents.

NFA fees equal $0.04 per round-turn trade of a futures contract.

Management

Fee

Each

Series is divided into Class A Interests, Class B Interests, Class C Interests

and Class D interests. Class A and C Interests are generally sold through

registered broker-dealers and Class B and D Interests are generally offered

through fee-only advisors. The Trust pays the Manager a monthly management fee

at the annual rates set forth below.

Unleveraged

Series, Commodity L/S Unleveraged Series and Commodity L/N Unleveraged

Series

|

Class

A

|

1.50%

of net asset value

|

|

Class

B

|

0.50%

of net asset value

|

|

Class

C

|

1.00%

of net asset value

|

|

Class

D

|

0.50%

of net asset value

|

|

Leveraged

Series

|

|

|

Class

A

|

2.80%

of net asset value

|

|

Class

B

|

1.30%

of net asset value

|

|

Class

C

|

2.05%

of net asset value

|

|

Class

D

|

1.30%

of net asset value

|

The

management fee is determined and paid as of the first day of each calendar

month. For purposes of determining the management fee, there is no reduction

for:

|

|

(1)

|

accrued

management fees,

|

|

|

(2)

|

any

allocation or reallocation of assets effective as of the day the

management fee is being calculated,

or

|

|

|

(3)

|

any

distributions or redemptions as of the day the management fee is being

calculated.

|

The

Manager pays from the management fee an annual fee for interests sold by

authorized selling agents appointed by the Manager for the Class A Series, in

the amount of 100 basis points for the Unleveraged Series, Commodity L/S

Unleveraged Series and Commodity L/N Unleveraged Series and 150 basis

points for the Leveraged Series of the Trust's net asset value for each

respective series; and for the Class C Series, in the amount of 50 basis points

for the Unleveraged Series, Commodity L/S Unleveraged Series and Commodity L/N

Unleveraged Series and 50 basis points for the Leveraged Series, L/S

Leveraged Series and Commodity L/N Leveraged Series of the Trust's net asset

value for each respective series. As of December 31, 2009, the L/S

Leveraged Series and Commodity L/N Leveraged Series of the Trust have not

commenced trading and have no assets.

Organizational

Fee

Investors

in Classes A and B of each Series will pay an organizational fee of 0.50% of

their initial and any subsequent investment(s) (excluding exchanges) to the

Manager to cover expenses associated with the organization of the Trust and the

offering of interests. This fee will be deducted from each investment in

determining the number of interests purchased. An organizational fee will be

charged until an investor’s total contribution is greater than or equal to

$1,000,000. If the organizational expenses exceed the organizational fees

collected by the Manager, the Manager will pay any costs above the collected

fees. If the organizational fees paid to the Manager exceed actual

organizational expenses, any excess will be retained by the Manager and may be

shared with consultants that the Manager may engage from time to time.

Specifically, consultants who assist the Trust in distributing the interests may

be paid a share of the organizational fees.

Operating

and Administrative Expenses

The Trust

pays the Manager an annual fee of 0.35% of the net asset value as reimbursement

for its legal, accounting and other routine administrative expenses and fees,

including fees to the Trustee. The Trustee is paid an annual fee and reimbursed

for out-of-pocket expenses. Each Series pays its own cash manager

fees, banking fees, and the New Jersey partnership tax. The relevant

series generally pays any extraordinary expenses, including legal claims and

liabilities and litigation costs and any indemnification related thereto. To the

extent the extraordinary expenses arise as a result of the gross negligence or

willful misconduct of the Manager, the Manager may be deemed responsible to pay

the extraordinary expenses to that extent.

Selling

Commission

Investors

who subscribe for Class A Interests and Class C Interests will be charged a

sales commission of 0% to 4% of the subscription amount, payable to the selling

agent from the investor's investment. The amount of the sales commission is

determined by the selling agent. Investors who subscribe for Class B Interests

and Class D Interests will generally not be charged a sales

commission.

Futures

Trading

Futures

Contracts

Futures

contracts are contracts made on or through a commodity exchange and provide for

future delivery of agricultural and industrial commodities, precious metals,

foreign currencies or financial instruments and, in the case of certain

contracts such as stock index futures contracts and Eurodollar futures

contracts, provide for cash settlement. Futures contracts are uniform for each

commodity on each exchange and vary only with respect to price and delivery

time. A contract to buy or sell may be satisfied either by taking or making

delivery of the commodity and payment or acceptance of the entire purchase price

thereof, or by offsetting the obligation with a contract containing a matching

contractual obligation on the same (or a linked) exchange prior to delivery.

United States commodity exchanges individually or, in certain limited

situations, in conjunction with certain foreign exchanges, provide a clearing

mechanism to facilitate the matching of offsetting trades. Once trades made

between members of an exchange have been confirmed, the clearinghouse becomes

substituted for the clearing member acting on behalf of each buyer and each

seller of contracts traded on the exchange and in effect becomes the other party

to the trade. Thereafter, each clearing member firm party to the trade looks

only to the clearinghouse for performance. Clearinghouses do not deal with

customers, but only with member firms, and the guarantee of performance under

open positions provided by the clearinghouse does not run to customers. If a

customer’s commodity broker becomes bankrupt or insolvent, or otherwise defaults

on such broker’s obligations to such customer, the customer in question may not

receive all amounts owed to such customer in respect of his trading, despite the

clearinghouse fully discharging all of its obligations.

Hedgers

and Speculators

Two broad

classifications of persons who trade in commodity futures are (1) hedgers and

(2) speculators. Commercial interests, including banks and other financial

institutions, and farmers, who market or process commodities, use the futures

markets for hedging. Hedging is a protective procedure designed to minimize

losses which may occur because of price fluctuations. The commodity markets

enable the hedger to shift the risk of price fluctuations to the speculator. The

usual objective of the hedger is to protect the expected profit from financial

or other commercial operations, rather than to profit strictly from futures

trading.

The

speculator, such as the Trust, risks its capital with the expectation of making

profits from the price fluctuations in futures contracts. The hedger seeks to

offset any potential loss (measured as the difference between the price at which

he had expected to buy or sell and the price at which he is eventually able to

buy or sell) in the purchase or sale of the commodity hedged. Likewise, losses

in futures trading might be offset by unexpected gains on transactions in the

actual commodity. The speculator assumes the risks which the hedger seeks to

avoid.

Speculators

rarely expect to take or make delivery of the cash or actual physical commodity

in the futures market. Rather, they generally close out their futures positions

by entering into offsetting purchases or sales of futures contracts. Because the

speculator may take either a long or short position in the futures markets, it

is possible for the speculator to earn profits or incur losses regardless of the

direction of price trends.

Trading

Approaches

Commodity

traders generally may be classified as either systematic or discretionary. A

systematic trader will rely primarily on trading programs or models to generate

trading signals. A systematic trader will also rely, to some degree, on

judgmental decisions concerning, for example, what markets to follow and

commodities to trade, when to liquidate a position in a contract month which is

about to expire and how large a position to take in a particular commodity. The

systems utilized to generate trading signals are changed from time to time, but

the trading instructions generated by the then-current systems are generally

followed without significant additional analysis or

interpretation.

In

contrast, discretionary traders, while sometimes utilizing a variety of price

charts and computer programs to assist them in making trading decisions, make

these decisions on the basis of their own judgment. It is possible to describe a

discretionary trader's experience, the type of information which he consults,

the number of commodities he follows or trades and the degree to which he

leverages his accounts. However, in assessing the potential for future

profitability in the case of a discretionary trader, the talents and abilities

of the individual, rather than the profitability of any particular system or

identifiable method, must be evaluated.

Margins

Margins

are good faith deposits which must be made with a commodity broker in order to

initiate or maintain an open position in a futures contract. When futures

contracts are traded in the United States and on most exchanges abroad, both

buyer and seller are required to post margins with the broker handling their

trades as security for the performance of their buying and selling undertakings,

and to offset losses on their trades due to daily fluctuations in the markets.

Minimum margins usually are set by the exchanges.

A

customer's margin deposit is treated as equity in his account. A change in the

market price of the futures contract will increase or decrease the equity. If

this equity decreases below the maintenance margin amount (generally 75% of the

initial margin requirement), the broker will issue a margin call requiring the

customer to increase the account's equity to the initial margin. Failure to

honor such a margin call generally will result in the closing out of the open

position. If, at the time such open position is closed, the account equity is

negative, then the equity in the customer's remaining open positions, if any, in

excess of the required margins, as well as the customer's cash reserves will be

used to offset such debit balance, and if such equities and reserves are not

sufficient the customer will be liable for the remaining unpaid

balance.

United

States Regulations

Commodity

Exchange Act (“the CE Act”). The United States Congress enacted the CE Act to

regulate trading in commodities, the exchanges on which they are traded, the

individual brokers who are members of the exchanges, and commodity professionals

and commodity brokerage houses that trade in these commodities in the United

States.

Commodity

Futures Trading Commission (the “CFTC”). The CFTC is an independent governmental

agency which administers the CE Act and is authorized to promulgate rules

thereunder. A function of the CFTC is to implement the objectives of the CE Act

in preventing price manipulation and excessive speculation and promoting orderly

and efficient commodity futures markets. The CFTC has adopted regulations

covering, among other things:

|

|

·

|

the

designation of contract markets;

|

|

|

·

|

the

monitoring of United States commodity exchange

rules;

|

|

|

·

|

the

establishment of speculative position

limits;

|

|

|

·

|

the

registration of commodity brokers and brokerage houses, floor brokers,

introducing brokers, leverage transaction merchants, commodity trading

advisors, commodity pool operators and their principal employees engaged

in non-clerical commodities activities (associated persons);

and

|

|

|

·

|

the

segregation of customers funds and record keeping by, and minimum

financial requirements and periodic audits of, such registered commodity

brokerage houses and professionals.

|

Under the

CE Act, the CFTC is empowered, among other things, to:

|

|

·

|

hear

and adjudicate complaints of any person (e.g., an Interest Holder) against

all individuals and firms registered or subject to registration under the

CE Act (reparations),

|

|

|

·

|

seek

injunctions and restraining orders,

|

|

|

·

|

issue

orders to cease and desist,

|

|

|

·

|

initiate

disciplinary proceedings,

|

|

|

·

|

revoke,

suspend or not renew registrations

and

|

|

|

·

|

levy

substantial fines.

|

The CE

Act also provides for certain other private rights of action and the possibility

of imprisonment for certain violations.

The CFTC

has adopted extensive regulations affecting commodity pool operators and

commodity trading advisors such as the Manager and their associated persons.

These regulations, among other things, require the giving of disclosure

documents to new customers and the retention of current trading and other

records, prohibit pool operators from commingling pool assets with those of the

operators or their other customers and require pool operators to provide their

customers with periodic account statements and an annual report. Upon request by

the CFTC, the Manager will also furnish the CFTC with the names and addresses of

the interest holders, along with copies of all transactions with, and reports

and other communications to, the interest holders.

United

States Commodity Exchanges. United States commodity exchanges are given certain

latitude in promulgating rules and regulations to control and regulate their

members and clearing houses, as well as the trading conducted on their floors.

Examples of current regulations by an exchange include establishment of initial

and maintenance margin levels, size of trading units, daily price fluctuation

limits and other contract specifications. Except for those rules relating to

margins, all exchange rules and regulations relating to terms and conditions of

contracts of sale or to other trading requirements currently must be reviewed

and approved by the CFTC.

National

Futures Association (the “NFA”). Substantially all commodity pool operators,

commodity trading advisors, futures commission merchants, introducing brokers

and their associated persons are members or associated members of the NFA. The

NFA's principal regulatory operations include:

|

|

·

|

auditing

the financial condition of futures commission merchants, introducing

brokers, commodity pool operators and commodity trading

advisors;

|

|

|

·

|

arbitrating

commodity futures disputes between customers and NFA

members;

|

|

|

·

|

conducting

disciplinary proceedings; and

|

|

|

·

|

registering

futures commission merchants, commodity pool operators, commodity trading

advisors, introducing brokers and their respective associated persons, and

floor brokers.

|

The

regulation of commodities transactions in the United States is a rapidly

changing area of law and the various regulatory procedures described herein are

subject to modification by United States congressional action, changes in CFTC

rules and amendments to exchange regulations and NFA regulations.

|

Item

1A.

|

Risk

Factors

|

Historical

Results of the MLM Index™ may not be indicative of future results

The MLM

Index™ historical results may not be indicative of future results. The MLM

Index™ results are based on the analysis of a particular period of time. The

future performance of the MLM Index™ is entirely unpredictable.

Performance

of the Trust May be Different than the MLM Index™

The Trust

attempts to replicate the MLM Index™. In doing so, the Trust will establish

positions in the futures markets. The prices at which the Trust executes these

positions may be significantly different than the prices used to calculate the

MLM Index™. In addition, the Trust charges various fees and commissions which

will lower the return of the Trust vs. the MLM Index™. All these factors mean

that the Trust performance will be different and in all likelihood lower than

the results of the MLM Index™.

Futures

Trading Involves Substantial Leverage

Futures

contracts are typically traded on margin. This means that a small amount of

capital can be used to invest in contracts of much greater total value. The

resulting leverage means that a relatively small change in the market price of a

futures contract can produce a substantial profit or loss. Leverage enhances the

Trust's sensitivity to market movements that can result in greater profits when

the Trading Program anticipates the direction of the move correctly, or greater

losses when the Trading Program is incorrect. The Unleveraged Series, Commodity

L/S Unleveraged Series and Commodity L/N Unleveraged Series attempt to replicate

the MLM Index™, the MLM Commodity Long/Short Index and the MLM Commodity

Long/Neutral Index respectively without leverage and the Leveraged Series trades

the MLM Index™ at three times leverage.

Futures

Trading Is Speculative, Highly Volatile and Can Result in Large

Losses

A

principal risk in futures trading is the rapid fluctuation in the market prices

of futures contracts. The Trust's profitability depends greatly on the Trading

Program correctly anticipating trends in market prices. If the Trading Program

incorrectly predicts the movement of futures prices, large losses could result.

Price movements of futures contracts are influenced by such factors as: changing

supply and demand relationships; government trade, fiscal, monetary and exchange

control programs and policies; national and international political and economic

events; and speculative frenzy and the emotions of the market place. The Manager

has no control over these factors.

Illiquid

Markets Could Make It Impossible for the Trust to Realize Profits or Limit

Losses

Although

the Trust trades in ordinarily highly liquid markets, there may be circumstances

in which it is not possible to execute a buy or sell order at the desired price,

or to close out an open position, due to market conditions. Daily price

fluctuation limits are established by the exchanges and approved by the CFTC.

When the market price of a futures contract reaches its daily price fluctuation

limit, no trades can be executed at prices outside such limit. The holder of a

commodity futures contract (including the Trust) may be locked into an adverse

price movement for several days or more and lose considerably more than the

initial margin put up to establish the position. Another possibility is the

unforeseen closure of an exchange due to accident or government

intervention.

Speculative

Position Limits May Require the Manager to Modify Its Trading to the Detriment

of the Trust

The

exchanges have established and the CFTC has approved speculative position limits

(referred to as position limits) on the maximum futures position which any

person, or group of persons acting in concert, may hold or control in particular

futures contracts. In addition, certain exchanges, in lieu of speculative

position limits, have adopted position accountability requirements that could

require a person whose positions in a contract exceed a specified level to

provide information to the exchange relating to the nature of such person's

trading strategy. The Manager may be required to reduce the size of the future

positions which would otherwise be taken to avoid exceeding such limits or

requirements. Such modification of the Trust's trades, if required, could

adversely affect the operations and profitability of the Trust.

Trading

of Swaps Could Subject the Trust to Substantial Losses

The Trust

may enter into swap and similar transactions. Swap contracts are not traded on

exchanges and are not subject to the same type of government regulation as

exchange markets. As a result, many of the protections afforded to participants

on organized exchanges and in a regulated environment are not available in

connection with these transactions. The swap markets are "principals' markets,"

in which performance with respect to a swap contract is the responsibility only

of the counterparty which the participant has entered into a contract, and not

of any exchange or clearinghouse. As a result, the Trust is subject to the risk

of the inability or refusal to perform with respect to such contracts on the

part of the counterparties with which the Trust trades. Any such failure or

refusal, whether due to insolvency, bankruptcy, default, or other cause, could

subject the Trust to substantial losses. There are no limitations on daily price

movements in swap transactions. Speculative position limits do not apply to swap

transactions, although the counterparties with which the Trust deals may limit

the size or duration of positions available to the Trust as a consequence of

credit considerations. Participants in the swap markets are not required to make

continuous markets in the swap contracts they trade. Participants could refuse

to quote prices for swap contracts or quote prices with an unusually wide spread

between the price at which they are prepared to buy and the price at which they

are prepared to sell.

Substantial

Expenses Will Cause Losses for the Trust Unless Offset by Profits and Interest

Income

The Trust

is subject to substantial fees and expenses, including brokerage fees,

management fees and operating and administrative expenses. In addition, certain

investors are subject to an organizational charge and/or a selling commission.

Set forth below are tables which set forth the basic fees that each of the

Series and Classes is subject to.

|

Leveraged

Series

|

||||||||||||||||||||||||

|

Brokerage

Fee

|

Management

Fee

|

Organizational

Fee

|

Admin

Fee

|

Selling

Expense

|

Total

Fees and Commissions

|

|||||||||||||||||||

|

Class

A

|

1.75 | % | 2.80 | % | 0.50 | % | 0.35 | % | 4.00 | % | 9.40 | % | ||||||||||||

|

Class

B

|

1.75 | % | 1.30 | % | 0.50 | % | 0.35 | % | N/A | 3.90 | % | |||||||||||||

|

Class

C

|

0.90 | % | 2.05 | % | N/A | 0.35 | % | 4.00 | % | 7.30 | % | |||||||||||||

|

Class

D

|

0.90 | % | 1.30 | % | N/A | 0.35 | % | N/A | 2.55 | % | ||||||||||||||

|

Unleveraged

Series, Commodity L/S Unleveraged Series and Commodity L/N Unleveraged

Series

|

||||||||||||||||||||||||

|

Brokerage

Fee

|

Management

Fee

|

Organizational

Fee

|

Admin

Fee

|

Selling

Expense

|

Total

Fees and Commissions

|

|||||||||||||||||||

|

Class

A

|

0.85 | % | 1.50 | % | 0.50 | % | 0.35 | % | 4.00 | % | 7.20 | % | ||||||||||||

|

Class

B

|

0.85 | % | 0.50 | % | 0.50 | % | 0.35 | % | N/A | 2.20 | % | |||||||||||||

|

Class

C

|

0.40 | % | 1.00 | % | N/A | 0.35 | % | 4.00 | % | 5.75 | % | |||||||||||||

|

Class

D

|

0.40 | % | 0.50 | % | N/A | 0.35 | % | N/A | 1.25 | % | ||||||||||||||

The

Brokerage Fee, the Management Fee and the Organizational Fee shall be paid to

the Manager. It will be necessary for the Trust to achieve gains from trading

and interest income in excess of its charges for investors to realize increases

in the net asset value of their interests. The Trust may not be able to achieve

any appreciation of its assets.

The

Manager Alone Makes the Trust's Trading Decisions

The

Manager makes all commodity trading decisions for the Trust and, accordingly,

the success of the Trust largely depends upon the Manager's judgment and

abilities to make the necessary adjustments to the Trading Program. There is no

guarantee that the Trading Program's trading on behalf of the Trust will prove

successful under all or any market conditions. The performance record of the

Trading Program also reflects significant variations in profitability from

period to period.

You

Have No Right to Remove the Manager

Under the

Trust Agreement, interest holders have no right to remove the Manager as manager

of the Trust for cause or for any other reason.

The

Manager Advises Other Clients

The

Manager may be managing and advising large amounts of other funds for other

clients at the same time as it is managing Trust assets and, as a result, the

Trust may experience increased competition for the same contracts.

Limited

Ability To Liquidate Investment In Interests

You can

only redeem your interests at month-end upon 10 business days advance notice.

The net asset value per interest may vary significantly from month-to-month. You

will not know at the time you submit a redemption request what the redemption

value of your interests will be. The restrictions imposed on redemptions limit

your ability to protect yourself against major losses by redeeming part or all

of your interests.

The

Manager must consent before you can transfer or assign your interests and the

securities laws provide additional restrictions on the transferability of

interests. There will not be a secondary market for interests.

You

Have No Rights Of Control

You will

be unable to exercise any control over the business of the Trust. In addition,

the Manager can cause the Trust to redeem your interests upon 10 business days

prior written notice for any reason in the Manager's sole discretion. The

Manager may elect to cause the Trust to redeem your interests when your

continued holding of interests would or might violate any law or constitute a

prohibited transaction under ERISA or the Internal Revenue Code and a statutory,

class or individual exemption from the prohibited transaction provisions of

ERISA for such transaction or transactions does not apply or cannot be obtained

from the Department of Labor (or the Manager determines not to seek such an

exemption).

You

Have Limited Rights to Inspect Books and Records

You will

have only limited rights to inspect the books and records of the Trust and the

Manager. You will generally only have the right to inspect the books and records

of the Trust and the Manager as are specifically granted under the Delaware

Business Trust Act. In particular, information regarding positions held by a

Series, to the extent deemed proprietary or confidential by the Manager, will

not be made available to you except as required by law.

Limited

Arms-Length Negotiation

The

initial offering price per interest was established arbitrarily. Except for the

agreements with the Trustee, the terms of this offering and the structure of the

Trust have not been established as the result of arms-length

negotiation.

The

Trust Could Lose Assets and Have Its Trading Disrupted Due to the Bankruptcy of

its Clearing Broker or Others

The Trust

is subject to the risk of clearing broker, exchange or clearinghouse insolvency.

Trust assets could be lost or impounded in such an insolvency during lengthy

bankruptcy proceedings. Were a substantial portion of the Trust's capital tied

up in a bankruptcy, the Manager might suspend or limit trading, perhaps causing

the Trust to miss significant profit opportunities.

The

Trust Is Subject to Certain Conflicts of Interest

The

Manager and the clearing broker are subject to certain actual and potential

conflicts of interests.

Although

the Manager is not affiliated with a commodity broker, the Manager may have a

conflict of interest in selecting brokers because of long-standing business

dealings with certain brokers. In addition, the Manager, its principals and

affiliates may have commodity accounts at the same brokerage firms as the Trust,

and, because of the amount traded through such brokerage firms, may pay lower

commissions than the Trust.

The

Manager, the clearing broker, their respective affiliates and each of their

principals, directors, officers, employees and families may be trading and

directing other futures accounts, including their own accounts. Each will not be

aware of what others are doing on behalf of the Trust, and they may take

positions similar or opposite to those of the Trust or in competition with the

Trust. Generally, the Trust will enter orders only once a month. The Manager

will allocate transactions among the Trust and other clients in a manner

believed by the Manager to be equitable to each.

In

certain instances, the clearing broker may have orders for trades from the Trust

and orders from its own employees and it might be deemed to have a conflict of

interest between the sequence in which such orders are transmitted to the

trading floor.

The

Manager and its principals are engaged in substantial activities, including

managing other accounts not involving the Trust, and will devote to the Trust

such amount of their time as they determine reasonable and necessary. The

compensation received by the Manager and its principals from such other accounts

and entities may differ from the compensation it receives from the

Trust.

Investment

advisers and broker-dealers receiving continuing compensation from the Manager

on interests sold by them will have a financial incentive to encourage investors

to purchase and not to redeem their interests.

The

Trust could be Taxed as a Corporation

In the

opinion of the Trust's counsel, under current federal income tax law, the

Unleveraged Series and the Leveraged Series each will be classified as a

partnership and not as an association taxable as a corporation for federal

income tax purposes, and each such Series should not be subject to federal

income taxation as a corporation under the provisions applicable to so-called

publicly traded partnerships. However, you should note that the Trust has not

and will not request a ruling from the Internal Revenue Service to this effect.

If the Trust or a Series were taxed as a corporation for federal income tax

purposes, the net income of the Trust or a Series would be taxed to the Trust or

a Series at corporate income tax rates, no losses of the Trust or a Series would

be allowable as deductions to the interest holders, and all or a portion of any

distributions by the Trust or a Series to the interest holders, other than

liquidating distributions, would constitute dividends to the extent of the

Trust's or a Series' current or accumulated earnings and profits and would be

taxable as such.

You

Are Taxed Every Year on Your Share of a Series' Profits Not Only When You Redeem

as Would Be the Case if You Held Stocks or Bonds

You will

be taxed each year on your investment in a Series, irrespective of whether you

receive distributions or redeem any interests. In contrast, an investor holding

stocks or bonds generally pays no tax on their capital appreciation until the

securities are sold. Over time, the deferral of tax on stock and bond

appreciation has a compounding effect.

Deductibility

of Expenses May be Limited

You could

be required to treat the management fees, as well as certain other expenses of a

Series, as investment advisory fees, which are subject to substantial

restrictions on deductibility for individual taxpayers. The Manager has not, to

date, been classifying the management fee or such expenses as investment

advisory fees, a position to which the Internal Revenue Service might object.

Should the Internal Revenue Service re-characterize the management fee or other

expenses as investment advisory fees, you may be required to pay additional

taxes, interest and penalties.

The

Series' Trading Gains May Be Taxed at Higher Rates

You will

be taxed on your share of any trading profits of a Series at both short- and

long-term capital gain rates. These tax rates are determined irrespective of how

long you hold Interests. Consequently, the tax rate on a Series' trading gains

may be higher than those applicable to other investments you hold for a

comparable period.

Tax

Could Be Due from You on Your Share of a Series' Interest Income Despite Overall

Losses

You may

be required to pay tax on your allocable share of a Series' interest income,

even though the Series incurs overall losses. Trading losses can only be used by

individuals to offset trading gains and $3,000 of interest income each year.

Consequently, if you were allocated $5,000 of interest income net of expenses

and $10,000 of net trading losses, you would owe tax on $2,000 of interest

income even though you would have a $5,000 loss for the year. The $7,000 capital

loss would carry forward, but subject to the same limitation on its

deductibility against interest income.

Possibility

of Tax Audit

There can

be no assurance that tax returns of a Series will not be audited by the Internal

Revenue Service or that such audits will not result in adjustments to such

returns. If an audit results in an adjustment, you may be required to file

amended returns and to pay additional taxes plus interest.

Employee

Benefit Plan Considerations

Although

the Manager will be a fiduciary to the ERISA investors with respect to the

assets of such investors invested in the Trust, neither the Manager, nor the

Trustee, nor any of their affiliates, agents, or employees will act as a

fiduciary to any ERISA investor with respect to the ERISA investor's decision to

invest assets in the Trust. Fiduciaries of prospective ERISA investors, in

consultation with their advisors, should carefully consider the application of

ERISA and the regulations issued there under on an investment in the

Trust.

Absence

of Certain Statutory Registrations

The Trust

is not registered as an investment company or mutual fund, which would subject

it to extensive regulation under the Investment Company Act of 1940, as amended.

If the Trust were required to register as an investment company, it would be

subject to additional regulatory restrictions. Some of these restrictions would

be fundamentally inconsistent with the operation of the Trust, including among

other things, restrictions relating to the liquidity of portfolio investments,

to the use of leverage, to custody requirements, and to the issuance of senior

securities. As a result, it would be impractical for the Trust to continue its

current operations. Consequently, you will not benefit from certain of the

protections afforded by the Investment Company Act of 1940, as amended. However,

the Manager is registered with the Securities and Exchange Commission under the

Investment Advisers Act of 1940, as amended, and thus is an investment manager

for purposes of ERISA. In addition, the Manager is registered as a commodity

pool operator and a commodity trading advisor with the CFTC, is a member of the

NFA and is subject to extensive regulation under the Commodity Exchange

Act.

No

Independent Counsel

No

independent counsel has been selected to represent the interests of the interest

holders and there have been no negotiations between the Manager and any interest

holders in connection with the terms of the offering or the terms of the Trust

Agreement.

|

Item 1B.

|

Unresolved

Staff Comments

|

None

|

Item 2.

|

Properties

|

The Trust

does not own or lease any physical properties. The Trust's office is located

within the office of the Manager at 405 South Street, Newtown, PA 18940.

|

|

|

Item 3.

|

Legal

Proceedings

|

There are

no pending legal proceedings to which the Trust or the Manager is a party or to

which any of their assets are subject.

|

Item 4.

|

Submission

of Matters to a Vote of Security

Holders

|

Not

applicable.

|

Item 5.

|

Market

For Registrant's Common Equity and Related Stockholder

Matters

|

There

currently is no established public trading market for the interests. As of

December 31, 2009, approximately $105 million interests were held by 867

owners.

The

interests are "restricted securities" within the meaning of Rule 144 promulgated

under the Securities Act of 1933, as amended (the "Securities Act"), and may not

be sold unless registered under the Securities Act or sold in accordance with an

exemption therefrom, such as Rule 144. The Trust has no plans to register any of

the interests for resale. In addition the Trust Agreement provides that an

interest holder may transfer its interests only upon the approval of the Manager

in the Manager's sole and absolute discretion.

Pursuant

to the Trust Agreement, the Manager has the sole discretion to determine whether

distributions (other than on redemption of interests), if any, will be made to

interest holders. The Trust has never paid any distribution and does not

anticipate paying any distributions of interest holders in the foreseeable

future.

Recent

Sales of Unregistered Securities

From

October 1, 2009 to December 31, 2009, a total of 102,417 interests were sold for

the aggregate net subscription amount of $10,687,204. Total number of purchasers

was 36. There were no non-accredited investors during this period.

Details of the sale of these interests are as follows:

|

Series

|

Date

|

Subscriptions

|

Units

|

Price

|

#

of Purchasers

|

||||||||||||

|

Leveraged

A Units

|

10/31/2009

|

$ | 0 | 0 | $ | ||||||||||||

|

Leveraged

B Units

|

10/31/2009

|

325,143 | 3,066 | 105.51 | 7 | ||||||||||||

|

Leveraged

C Units

|

10/31/2009

|

0 | 0 | ||||||||||||||

|

Leveraged

D Units

|

10/31/2009

|

25,000 | 234 | 107.02 | 1 | ||||||||||||

|

Unleveraged

A Units

|

10/31/2009

|

33,123 | 282 | 113.54 | 2 | ||||||||||||

|

Unleveraged

B Units

|

10/31/2009

|

646,760 | 5,091 | 126.41 | 5 | ||||||||||||

|

Unleveraged

C Units

|

10/31/2009

|

0 | 0 | ||||||||||||||

|

Unleveraged

D Units

|

10/31/2009

|

115,000 | 1,015 | 113.34 | 2 | ||||||||||||

|

Commodity

L/S D Units

|

11/30/2209

|

1,000 | 9 | 106.68 | 1 | ||||||||||||

|

Commodity

L/N D Units

|

11/30/2009

|

5,001,000 | 50,010 | 100.00 | 2 | ||||||||||||

|

Leveraged

A Units

|

11/30/2009

|

35,000 | 358 | 94.44 | 1 | ||||||||||||

|

Leveraged

B Units

|

11/30/2009

|

29,355 | 266 | 109.71 | 2 | ||||||||||||

|

Leveraged

C Units

|

11/30/2009

|

0 | 0 | ||||||||||||||

|

Leveraged

D Units

|

11/30/2009

|

200,000 | 1,796 | 111.36 | 3 | ||||||||||||

|

Unleveraged

A Units

|

11/30/2009

|

564,000 | 4,815 | 114.91 | 4 | ||||||||||||

|

Unleveraged

B Units

|

11/30/2009

|

16,823 | 131 | 128.03 | 1 | ||||||||||||

|

Unleveraged

C Units

|

11/30/2009

|

0 | 0 | ||||||||||||||

|

Unleveraged

D Units

|

11/30/2009

|

0 | 0 | ||||||||||||||

|

Leveraged

A Units

|

12/31/2009

|

0 | 0 | ||||||||||||||

|

Leveraged

B Units

|

12/31/2009

|

60,000 | 566 | 105.32 | 1 | ||||||||||||

|

Leveraged

C Units

|

12/31/2009

|

0 | 0 | ||||||||||||||

|

Leveraged

D Units

|

12/31/2009

|

50,000 | 466 | 107.20 | 1 | ||||||||||||

|

Commodity

L/N D Units

|

12/31/2009

|

3,500,000 | 34,312 | 102.00 | 1 | ||||||||||||

|

Unleveraged

A Units

|

12/31/2009

|

0 | 0 | ||||||||||||||

|

Unleveraged

B Units

|

12/31/2009

|

0 | 0 | ||||||||||||||

|

Unleveraged

C Units

|

12/31/2009

|

0 | 0 | ||||||||||||||

|

Unleveraged

D Units

|

12/31/2009

|

85,000 | 750 | $ | 113.35 | 2 | |||||||||||

|

Total

|

$ | 10,687,204 | 102,417 | 36 | |||||||||||||

The price

of the interests of each Class reflects the net asset value of interests in the

Class. The interests were sold pursuant to Rule 506 of Regulation D and the

sales were exempt from registration under the Securities Act of 1933. Purchasers

of the interests completed subscription documents in which they represented that

they were accredited investors as defined in Regulation D and a Form D was filed

with the Securities and Exchange Commission in the time periods prescribed by

Regulation D.

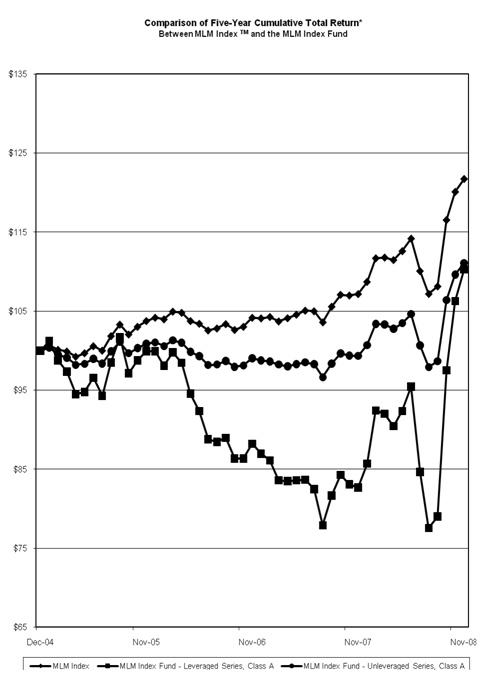

Five

Year Cumulative Performance of the Trust

Since the

Trust does not deal in equities, it cannot compare its return against an

equivalent broad-based equities market index. As set forth below, the Trust has

selected the MLM Index™, with which to compare its cumulative five-year return.

Although the Trust contains multiple classes of interests, it has taken as a

representative example, the highest fee classes in both the Leveraged and

Unleveraged Series. In both cases, the Trust has indicated the cumulative total

return for Class A interests for the Leveraged and Unleveraged

Series.

So as to

comply as much as possible with the promulgated rules, the Trust has used the

MLM Index™ to compare its cumulative total return. Created in 1988, the MLM

Index™ is a benchmark of the returns available to a futures

investor. It is based on daily closing prices of the nearby contract

month of a portfolio chosen from among the most active futures

markets. The Index Committee of Mount Lucas Management Corporation

makes the choice of markets for a calendar year in the December preceding the

start of the year, and, except in unusual circumstances, markets are not

normally added to or deleted from the MLM Index™ during a year. The MLM Index™

is a widely recognized benchmark for evaluating managed futures performance that

is frequently discussed in periodicals such as the Wall Street Journal,

Institutional Investor, Pension World and Pensions & Investments.

Performance of the MLM Index™ is available through Bloomberg™, LP and

Morningstar.

The MLM

Index™ is unique in the industry in that the Index contains long and short

positions in the various futures contracts. Since no other publicly

available, widely distributed, transparent index in the market place has this

feature it is not possible to compare the performance of the MLM Index Fund with

another index.

The

Comparison of Five-Year Cumulative Total Returns Graph, set forth below, assumes

that an investment in units in the Trust, and the MLM Index™, was $100 on

December 31, 2004. The Cumulative Total Return is based on unit price

appreciation (there were no dividends declared or paid during the period) from

December 31, 2004 through December 31, 2009.

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

||||||||||||||||

|

MLM

Index™

|

103.75 | 104.16 | 107.16 | 121.73 | 118.41 | |||||||||||||||

|

MLM

Index Fund - Leveraged Series, Class A

|

99.91 | 88.21 | 82.69 | 110.26 | 101.72 | |||||||||||||||

|

MLM

Index Fund - Unleveraged Series, Class A

|

100.88 | 99.03 | 99.33 | 111.08 | 104.92 | |||||||||||||||

Item

6. Selected

Financial Data

The Trust

began trading on January 4, 1999. Set forth below is certain selected historical

data for the Trust for the 5 years ended December 31, 2009. The selected

historical financial data were derived from the financial statements of the

Trust, which were audited by Grant Thornton LLP for 2005 and Eisner

LLP for years 2006 through 2009. The information set forth below should be read

in conjunction with the Financial Statements and notes thereto contained

elsewhere in this document.

| Years Ended December 31, | ||||||||||||||||||||

|

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

Operations

Data:

|

||||||||||||||||||||

|

Realized

Gains (Losses)

|

$ | 731,923 | $ | 19,104,468 | $ | (6,797,301 | ) | $ | (16,393,552 | ) | $ | (7,520,356 | ) | |||||||

|

Net

Change in Unrealized Gains (Losses)

|

(7,344,607 | ) | 4,488,606 | (484,953 | ) | (7,285,240 | ) | 11,898,155 | ||||||||||||

|

Interest

Income

|

159,900 | 2,923,714 | 8,483,981 | 14,168,270 | 11,572,093 | |||||||||||||||

|

Brokerage

Commissions

|

961,240 | 977,593 | 1,444,771 | 3,089,477 | 4,114,687 | |||||||||||||||

|

Management

Fees

|

1,143,229 | 1,115,615 | 1,536,273 | 3,148,863 | 4,106,132 | |||||||||||||||

|

Operating

Expenses

|

672,497 | 506,440 | 1,399,451 | 1,825,940 | 2,232,080 | |||||||||||||||

|

Net

Income (Loss)

|

$ | (9,229,750 | ) | $ | 23,917,140 | $ | (3,178,768 | ) | $ | (17,574,802 | ) | $ | 5,496,993 | |||||||

|

Financial

Condition Data

|

||||||||||||||||||||

|

Investors'

Interest

|

104,578,954 | 136,196,734 | 117,385,731 | 229,224,557 | 344,124,895 | |||||||||||||||

|

Total

Assets

|

$ | 129,799,051 | $ | 139,610,404 | $ | 120,016,936 | $ | 245,261,022 | $ | 351,371,644 | ||||||||||

|

Net

Asset Value Per Class A Leveraged Series Interest

|

90.73 | 105.12 | 78.88 | 83.94 | 95.09 | |||||||||||||||

|

Net

Asset Value Per Class B Leveraged Series Interest

|

105.53 | 120.43 | 89.06 | 93.36 | 104.18 | |||||||||||||||

|

Net

Asset Value Per Class C Leveraged Series Interest

|

86.24 | 98.31 | 72.63 | 76.06 | 84.79 | |||||||||||||||

|

Net

Asset Value Per Class D Leveraged Series Interest

|

107.20 | 121.29 | 88.95 | 92.46 | 102.30 | |||||||||||||||

|

Net

Asset Value Per Class A Unleveraged Series Interest

|

113.28 | 119.60 | 106.89 | 106.39 | 108.38 | |||||||||||||||

|

Net

Asset Value Per Class B Unleveraged Series Interest

|

126.32 | 132.04 | 116.85 | 115.15 | 116.13 | |||||||||||||||

|

Net

Asset Value Per Class C Unleveraged Series Interest

|

110.99 | 116.06 | 102.77 | 101.32 | 102.23 | |||||||||||||||

|

Net

Asset Value Per Class D Unleveraged Series Interest

|

113.35 | 117.94 | 103.92 | 101.94 | 102.35 | |||||||||||||||

|

Net

Asset Value Per Class D Commodity L/S Unleveraged Series

Interest

|

108.17 | - | - | - | - | |||||||||||||||

|

Net

Asset Value Per Class D Commodity L/N Unleveraged Series

Interest

|

102.00 | - | - | - | - | |||||||||||||||

|

Item 7.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

General

The

purpose of the Trust is to replicate the results of the MLM Index™, an index

designed to measure the risk premium available to futures traders. Designed as

such, the results of the Trust depend on two factors, the results of the MLM

Index™ itself, and the Manager's ability to replicate that Index. It is

important to note that the Manager also calculates the results of the MLM

Index™. Thus, their role is twofold - to calculate the results of the MLM

Index™, and to replicate the results of the MLM Index™ for the Trust. Any

changes made to the composition of the MLM Index™ by the MLM Index™ Committee of

the Manager will affect the trading of the Trust, since the object of the Trust

is to replicate the MLM Index™ as published.

Results

of the MLM Index™

The MLM

Index™ is calculated from the prices of 22 liquid futures markets. These markets

are traded on domestic and foreign exchanges. For each market, the MLM Index™

generally uses the price of 4 different delivery months each year. For example,