Attached files

| file | filename |

|---|---|

| 8-K - JOINT FORM 8-K - KANSAS CITY POWER & LIGHT CO | f8kirdeck3-3_10.htm |

Great Plains Energy

Year-end and Fourth Quarter 2009

Earnings Presentation

February 26, 2010

Exhibit

99.1

1

Statements made in

this presentation that are not based on historical facts are forward-looking,

may involve risks and uncertainties,

and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of

regulatory proceedings, cost estimates of the Comprehensive Energy Plan and other matters affecting future operations. In

connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the registrants are providing a

number of important factors that could cause actual results to differ materially from the provided forward-looking information. These

important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices

and costs, including, but not limited to, possible further deterioration in economic conditions and the timing and extent of any

economic recovery; prices and availability of electricity in regional and national wholesale markets; market perception of the energy

industry, Great Plains Energy and Kansas City Power & Light Company (KCP&L); changes in business strategy, operations or

development plans; effects of current or proposed state and federal legislative and regulatory actions or developments, including, but

not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the

companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax,

accounting and environmental matters including, but not limited to, air and water quality; financial market conditions and performance

including, but not limited to, changes in interest rates and credit spreads and in availability and cost of capital and the effects on

nuclear decommissioning trust and pension plan assets and costs; impairments of long-lived assets or goodwill; credit ratings;

inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy their contractual

commitments; impact of terrorist acts; increased competition including, but not limited to, retail choice in the electric utility industry and

the entry of new competitors; ability to carry out marketing and sales plans; weather conditions including, but not limited to, weather-

related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; ability to achieve

generation planning goals and the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in

-service dates and cost increases of additional generating capacity and environmental projects; nuclear operations; workforce risks,

including, but not limited to, retirement compensation and benefits costs; the timing and amount of resulting synergy savings from the

acquisition of KCP&L Greater Missouri Operations Company; and other risks and uncertainties. This list of factors is not all-inclusive

because it is not possible to predict all factors. Other risk factors are detailed from time to time in Great Plains Energy’s and KCP&L’s

most recent quarterly report on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission.

Each forward-looking statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or

otherwise.

and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of

regulatory proceedings, cost estimates of the Comprehensive Energy Plan and other matters affecting future operations. In

connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the registrants are providing a

number of important factors that could cause actual results to differ materially from the provided forward-looking information. These

important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices

and costs, including, but not limited to, possible further deterioration in economic conditions and the timing and extent of any

economic recovery; prices and availability of electricity in regional and national wholesale markets; market perception of the energy

industry, Great Plains Energy and Kansas City Power & Light Company (KCP&L); changes in business strategy, operations or

development plans; effects of current or proposed state and federal legislative and regulatory actions or developments, including, but

not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the

companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax,

accounting and environmental matters including, but not limited to, air and water quality; financial market conditions and performance

including, but not limited to, changes in interest rates and credit spreads and in availability and cost of capital and the effects on

nuclear decommissioning trust and pension plan assets and costs; impairments of long-lived assets or goodwill; credit ratings;

inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy their contractual

commitments; impact of terrorist acts; increased competition including, but not limited to, retail choice in the electric utility industry and

the entry of new competitors; ability to carry out marketing and sales plans; weather conditions including, but not limited to, weather-

related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; ability to achieve

generation planning goals and the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in

-service dates and cost increases of additional generating capacity and environmental projects; nuclear operations; workforce risks,

including, but not limited to, retirement compensation and benefits costs; the timing and amount of resulting synergy savings from the

acquisition of KCP&L Greater Missouri Operations Company; and other risks and uncertainties. This list of factors is not all-inclusive

because it is not possible to predict all factors. Other risk factors are detailed from time to time in Great Plains Energy’s and KCP&L’s

most recent quarterly report on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission.

Each forward-looking statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or

otherwise.

Forward Looking

Statement

Great Plains Energy

Year-end and Fourth Quarter 2009

Earnings Presentation

February 26, 2010

Mike

Chesser,

Chairman and CEO

Chairman and CEO

3

Impressive

Reliability

Reliability

Solid Safety Record

Tier 1 Customer Service

Stewards

of

the Environment

the Environment

Reliable,

Economical, and

Safe Nuclear

Generation

Economical, and

Safe Nuclear

Generation

Strong Plant

Performance

4

2010

and Beyond

• Improved earnings

outlook

• Completion of Iatan

2

• Continued focus on

regulatory process

• Continued delivery

of GMO synergies and movement toward Tier 1 costs

across the organization

across the organization

• Sound planning to

effectively position the Company financially and

strategically to meet future generation and network requirements and as an

industry leader in energy efficiency

strategically to meet future generation and network requirements and as an

industry leader in energy efficiency

William

H. Downey,

President and COO

President and COO

6

• Successful

completion of Iatan 1 and Sibley 3 Air Quality Control Systems (AQCS)

and

Iatan 1 overhaul

Iatan 1 overhaul

• Constructive

settlements in five rate cases

• Filed rate case

for KCP&L Kansas with flexible procedural schedule

• Major progress on

Iatan 2 construction

• “Strength at the

Core” in utility operations

• Improved

generation fleet performance compared to 2008

• Successful Wolf

Creek refueling outage

• Continued to

capture synergies from GMO acquisition and identified additional

opportunities

opportunities

2009

Operational and Regulatory Highlights

7

q First Fire on

Oil

q First Fire on

Coal

q Synchronization

q Provisional

Acceptance

Steps

to In-Service Date for Iatan 2

KCP&L

Coal Fleet

KCP&L

Nuclear

GMO

Coal Fleet

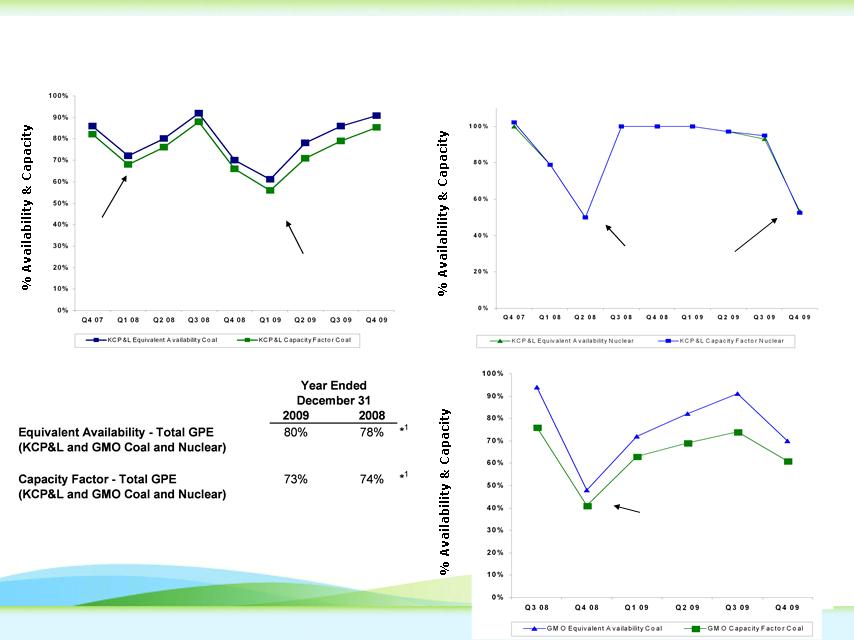

Impact

of refueling outages

Impact

of unplanned

coal

outages

Q4

08 and Q1 09

impact

of Iatan 1 unit

overhaul and AQCS tie-ins

overhaul and AQCS tie-ins

Q4

08 and Q1 09 impact of

Sibley

environmental

upgrade and Iatan 1 unit

upgrade and Iatan 1 unit

overhaul

and AQCS tie-ins

*1 2008 reflects GMO results

for the period July 14 through December 31, 2008

Plant

Performance

9

Source:

J.D. Power and Associates 2010 Electric Utility

Business

Customer Satisfaction StudySM

Source:

J.D. Power and Associates 2009 Electric Utility Residential

Customer

Satisfaction StudySM

“Strength at the

Core” Performance Metrics

10

*

Latest available data

Reliability

Safety

*

*

“Strength at the

Core” Performance Metrics

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

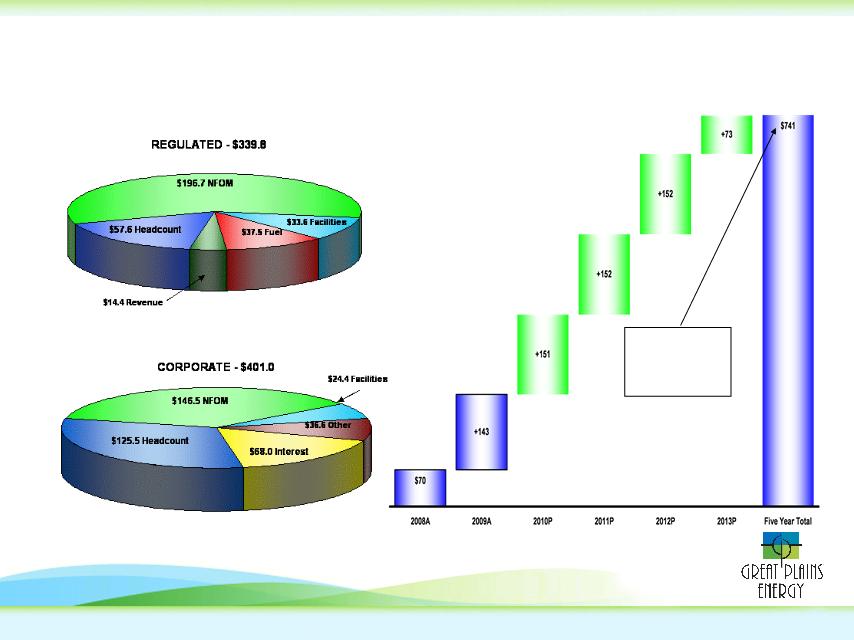

$98M

above initial

projections

above initial

projections

GMO

Acquisition Synergies

Financial

Overview

Terry

Bassham, CFO

Executive Vice President Finance &

Strategic Development

Executive Vice President Finance &

Strategic Development

13

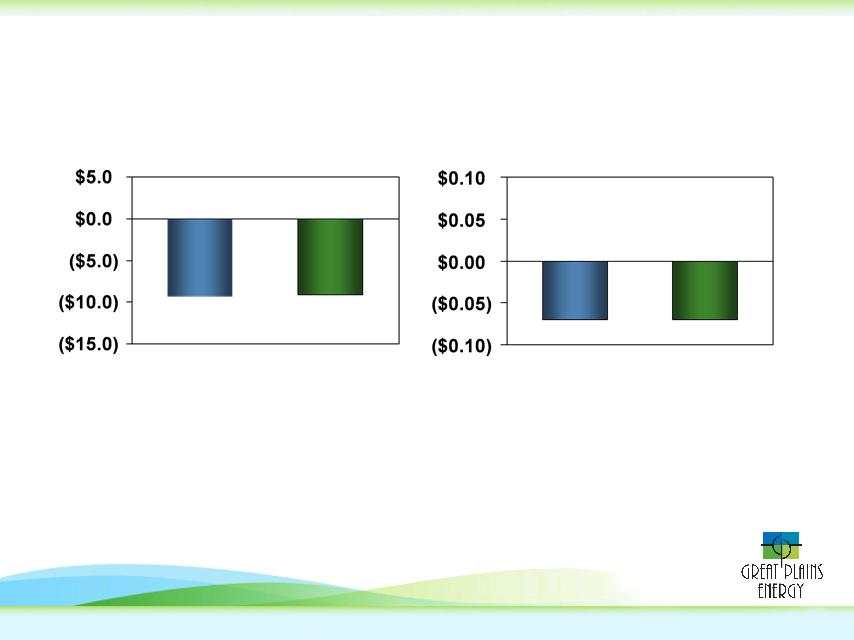

• Increased

Electric Utility segment earnings of $14.7 million mainly attributable to the

inclusion of GMO’s

regulated utility operations for the full period in 2009, new retail rates and lower purchased power expense.

Increase was partially offset by unfavorable weather, decline in weather-normalized customer usage,

decreased wholesale revenues and increased interest expense.

regulated utility operations for the full period in 2009, new retail rates and lower purchased power expense.

Increase was partially offset by unfavorable weather, decline in weather-normalized customer usage,

decreased wholesale revenues and increased interest expense.

• Reduced

Other segment losses of $17.4 million including a $16.0 million tax benefit from

an audit settlement in

GMO’s non-utility operations.

GMO’s non-utility operations.

• Loss

of $1.5 million in 2009 related to the discontinued operations of Strategic

Energy compared to income of

$35.0 million for the full period in 2008.

$35.0 million for the full period in 2008.

• Increase

of 28.6 million average dilutive shares outstanding resulted in dilution of

$0.33 per share.

Note: 2008

reflects GMO results for the period July 14, 2008 through December 31,

2008

(unaudited)

14

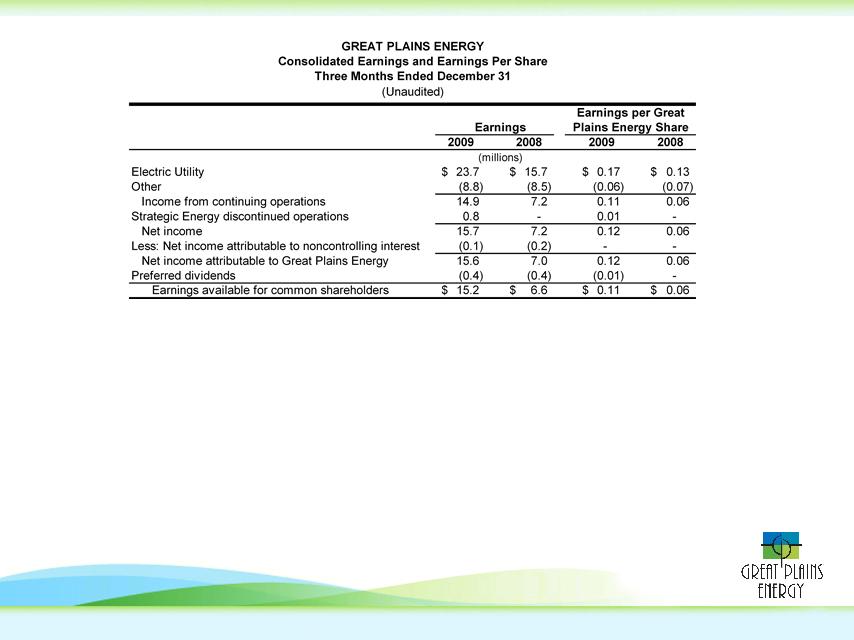

• Electric

Utility segment earnings increased $8.0 million primarily as a result of new

retail rates and decreased

purchased power expense. Increase partially offset by unfavorable weather, lower weather-normalized

customer usage and increased depreciation and amortization expense and higher interest expense.

purchased power expense. Increase partially offset by unfavorable weather, lower weather-normalized

customer usage and increased depreciation and amortization expense and higher interest expense.

• A

17.8 million increase in the average number of shares outstanding since the

fourth quarter of 2008 resulted

in $0.02 per share dilution.

in $0.02 per share dilution.

15

$128.9

$125.2

$28.9

$17.9

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

2009

2008

GMO

KCP&L

(millions

except

where indicated)

where indicated)

Key

Earnings Drivers:

+ GMO

utility earnings increased $11.0 million primarily from inclusion for full year

in 2009

+ Decreased

purchased power expense of $48.2 million at KCP&L

+ Decreased

income taxes of $12.9 million at KCP&L

+ Increase

in KCP&L’s AFUDC equity of $8.2 million

- Reduced

KCP&L revenues of $24.8 million, including $55.3 million drop in

wholesale

- Increased

non-fuel O&M of $6.0 million

- Increased

depreciation and amortization of $25.3 million, including $10.8 million

of

additional

amortization at KCP&L

- Increased

interest expense, net of AFUDC, of $12.6 million at KCP&L

- Dilution

of $0.34 per share caused by additional shares outstanding

$157.8

$143.1

$1.22

$1.41

Earnings

Per Share

Earnings

$1.00

$1.24

$0.22

$0.17

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

2009

2008

Electric Utility

Full-Year Results

16

Key

Earnings Drivers:

+ Increased

retail revenue of $36.5 million driven by new retail rates partially offset by

mild

weather and lower weather-normalized energy consumption

weather and lower weather-normalized energy consumption

+ Decline

in purchased power expense of $27.8 million

- Increased

fuel expense of $14.3 million

- Increased

depreciation & amortization of $13.3 million; including $7.0 million

of

additional amortization

additional amortization

- Increased

interest expense, net of AFUDC, of $4.2 million

- Higher

shares outstanding caused electric utility segment dilution of $0.03 per

share

(millions

except

where indicated)

where indicated)

Earnings

Per Share

$23.7

$15.7

$20.0

$3.7

$16.4

$(0.7)

$0.17

$0.13

$0.14

$0.03

$0.14

$(0.01)

Earnings

17

|

|

4Q

2009 Compared to 4Q 2008

|

YTD

2009 Compared to YTD 2008

|

||||

|

GPE

|

Customers

|

Use/Customer

|

Change

MWh Sales |

Customers

|

Use/Customer

|

Change

MWh Sales |

|

Residential

|

0.3%

|

2.5%

|

2.8%

|

0.4%

|

0.2%

|

0.6%

|

|

Commercial

|

-0.3%

|

-1.2%

|

-1.5%

|

0.0%

|

-0.7%

|

-0.7%

|

|

Industrial

|

-1.5%

|

-3.2%

|

-4.6%

|

-1.5%

|

-6.6%

|

-8.0%

|

|

Weighted

Avg. |

0.2%

|

-0.6%

|

-0.4%

|

0.3%

|

-1.5%

|

-1.2%

|

Retail

MWh Sales by Customer Class - Fourth Quarter 2009

Weather-Normalized

Retail MWh Sales and Customer Growth Rates

Note: Includes

GMO for full periods presented

Electric Utility

Segment

18

Earnings

Earnings

Per Share

Key

Drivers:

+ $16.0

million first quarter GMO non-utility tax benefit

– $11.4

million in after-tax interest expense

2008

included after-tax loss of $5.7 million from a mark-to-market change

on

interest

rate hedges, $3.6 million after-tax income from the reversal of interest expense

and

$3.4

million after-tax income related to the release of a legal

liability

$(7.8)

$(25.2)

(millions

except

where indicated)

where indicated)

2009

2008

2009

2008

$(0.25)

$(0.07)

Other

Segment Full-Year Results

19

Earnings

Earnings

Per Share

$(0.07)

$(0.07)

Key

Earnings Drivers:

+ $2.5

million reduction in losses from GMO non-utility activities

- Increased

after-tax interest of $4.6 million from Equity Units

$(9.3)

$(9.1)

(millions

except

where indicated)

where indicated)

4Q

‘09

4Q

‘08

4Q

‘09

4Q

‘08

Other

Segment Fourth Quarter Results

20

Great

Plains Energy Debt

Long-term

Debt Maturities

Credit

Ratings

*Includes current

maturities

Credit Ratings,

Debt, Capital Structure

21

2010

Earnings Guidance Range

22

• Revenues of

approximately $2.1 - $2.2 billion

• Normal

weather

• Reported retail

MWh sales growth of approximately 1.3% to 2.8%

• Weather-normalized

retail MWh sales decline of approximately 0.2%

• Projected fourth

quarter 2010 approval of KCP&L KS rate request that was

filed in Dec. 2009

filed in Dec. 2009

• Average Equivalent

Availability Factor and Average Capacity Factor for

generation fleet of approximately 85% and 79%, respectively

generation fleet of approximately 85% and 79%, respectively

• Consolidated

capital expenditures of approximately $610 to $680 million

• AFUDC of

approximately $65 to $70 million based on average Construction Work

in

Progress (CWIP) balance of $1.0 - $1.2 billion

• Issuance of

approximately $200 to $400 million in long-term debt; no common

stock issuances

stock issuances

• Effective tax rate

for continuing operations of approximately 30%

Key

2010 Guidance Assumptions

23

Reported

retail MWh sales increase by approximately 1.3 to 2.8 percent

•

Return to normal weather

•

Decrease weather-normalized retail MWh sales of 0.2% compared to

2009

million

MWh

Projected Retail

MWh Sales Assumptions

24

Kansas

• Approval of rate

request filed in December 2009 with new rates effective in 4Q 2010

Missouri

• Expect to file

rate cases in 2Q10 with new rates effective in 2Q11

• New fuel

transportation contract will impact KCP&L MO earnings in 2011 until new

rates are

effective

effective

Requests for

Annual Retail Rate Increases

In

Millions

Effective

Amount

Amount

Rate

Jurisdiction

Date

Requested

Approved

KCP&L-Kansas

8/1/2009

71.6

$

59.0

$

KCP&L-Missouri

9/1/2009

101.5

95.0

GMO-Missouri

Public Service

9/1/2009

66.0

48.0

GMO-St. Joseph

Light & Power (Electric)

9/1/2009

17.1

15.0

GMO-St. Joseph

Light & Power (Steam)

7/1/2009

1.3

1.0

2009

Approved Rate Increases

257.5

$

218.0

$

Pending Rate

Increase: KCP&L - Kansas

4Q

2010

55.2

$

na

Regulatory

Assumptions

25

2010

- 2012 Capital Expenditures

26

• AFUDC anticipated

to represent approximately 30% of consolidated

2010

Earnings Before Taxes

• KCP&L MO and

KS Iatan 2 AFUDC equity rate of 8.25%

2010-2012 CWIP and

AFUDC Assumptions

27

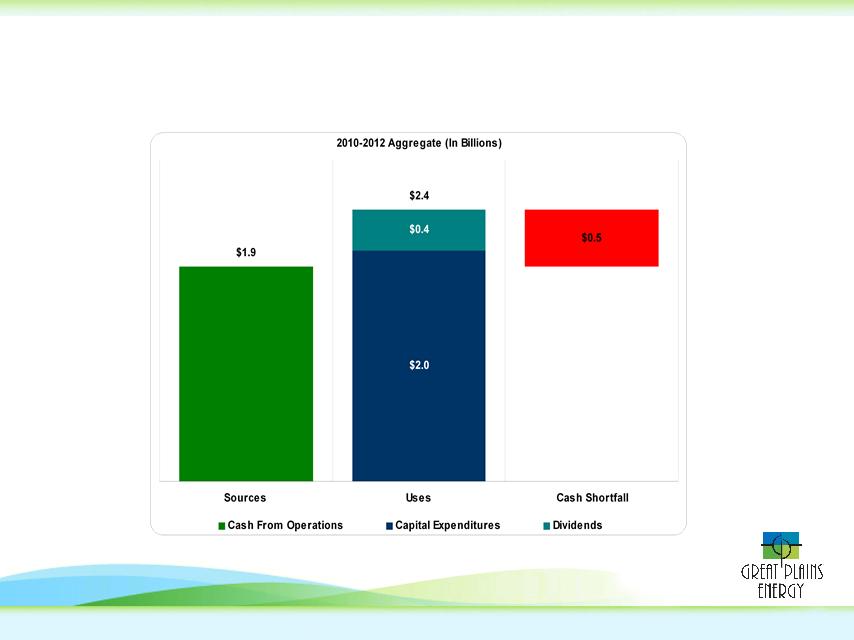

Financing

Requirements - Sources & Uses

of Cash 2010-2012

of Cash 2010-2012

28

Financing:

2010

• $200 - $400

million of new long-term debt

2011

• Refinancing of

approximately $500 million of maturing long-term debt

• $200 - $400

million of new long-term debt

2012

• GXP shares issued

upon conversion of Equity Units

• Proceeds from

Equity Units conversion used to repay portion of maturing $500

million GMO 11.875% issue; balance refinanced with long-term debt

million GMO 11.875% issue; balance refinanced with long-term debt

• Debt component of

equity units remarketed

• Amortization of

GMO debt write-up lowers interest expense by $34 million annually in

2010-11

2010-11

Taxes:

• 39% marginal tax

rate before credits; approximate 33% average effective tax rate across

2010 - 2012, after AFUDC equity and tax credits

2010 - 2012, after AFUDC equity and tax credits

• Utilization of

NOLs reduces cash tax rate to approximately 2% for state and

AMT

payments

Financing and Tax

Assumptions

29

Positioned for

Long-Term Earnings Growth

• Increased rate base

post-Iatan 2;

• Benefit from

economic recovery and increased energy consumption

in our service territory;

in our service territory;

• Continued focus on

strengthening the core; and

• Continued sound

strategic planning to position the Company to meet

future generation and network requirements and as an industry

leader in energy efficiency

future generation and network requirements and as an industry

leader in energy efficiency

Great Plains Energy

Year-end and Fourth Quarter 2009

Earnings Presentation

February 26, 2010