Attached files

| file | filename |

|---|---|

| 8-K - HTCO FORM 8-K - Enventis Corp | form8-k.htm |

Exhibit 99.1

Fourth

Quarter 2009

Earnings Conference Call

Earnings Conference Call

March 2, 2010

NASDAQ: HTCO

“Safe

Harbor” Statement

Information set

forth in this presentation contains financial estimates

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures are

available in our presentation.

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures are

available in our presentation.

4Q’

09 Highlights

• Enventis

Sector fiber and data revenue grew 46%

• Telecom

Sector broadband revenue grew 10%

• Equipment

revenue +2%, yet still impacted by economic pressures

• Debt

reduced $4.4 million, year-end debt balance of $120.5 M

• Aggressive

cost controls in both sectors

• Strategic

investments in fiber network upgrades and expansion,

SMB market plan acceleration

SMB market plan acceleration

• Strong

cash position

Solid

balance sheet, strategic investments in growth

opportunities.

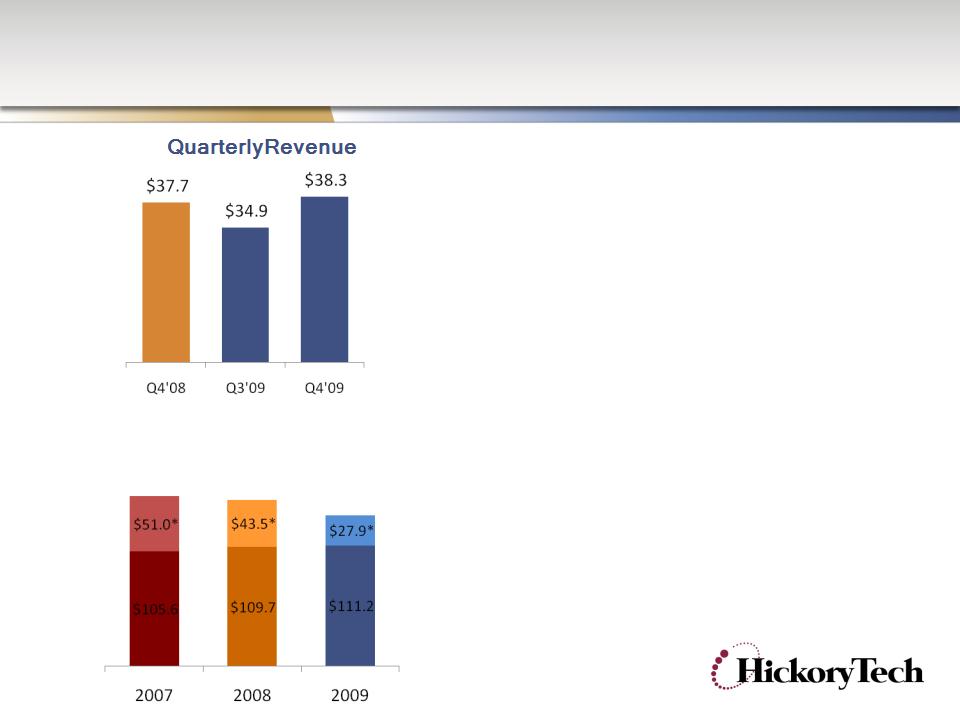

Consolidated

Revenue

Quarterly

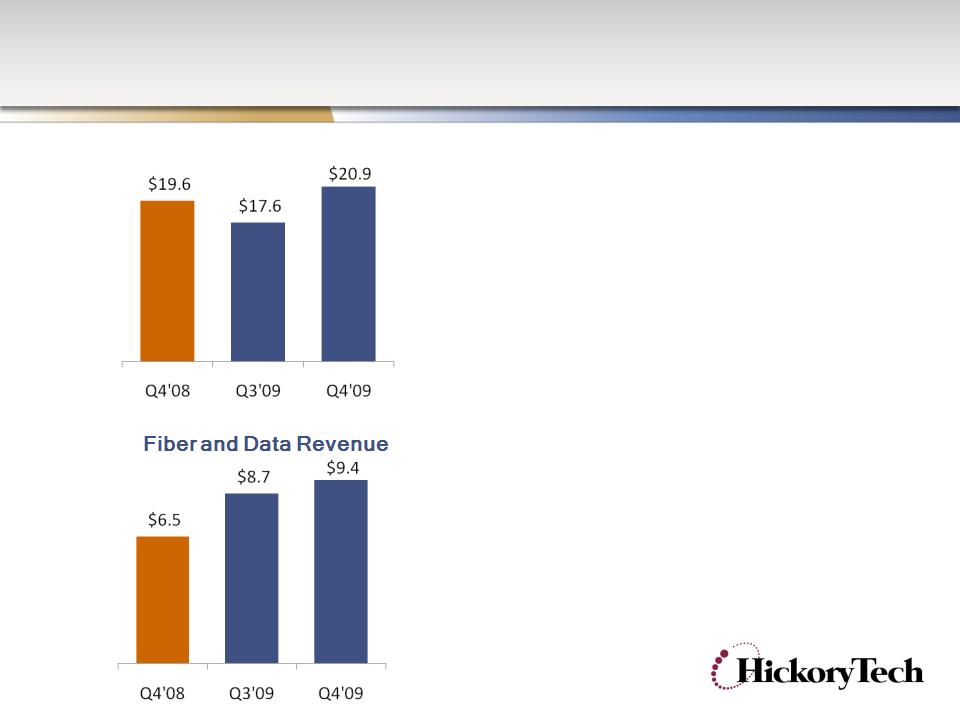

• Fiber

and data revenue +46%

• Broadband

revenue +10%

Annual

• Overall

economic pressures,

specifically in equipment and

services revenue (-33%)

specifically in equipment and

services revenue (-33%)

• Fiber

and data revenue +30%

• Broadband

revenue +10%

Annual

Revenue

*Equipment

$156.6

$153.2

$139.1

comparative

(Dollars in

Millions)

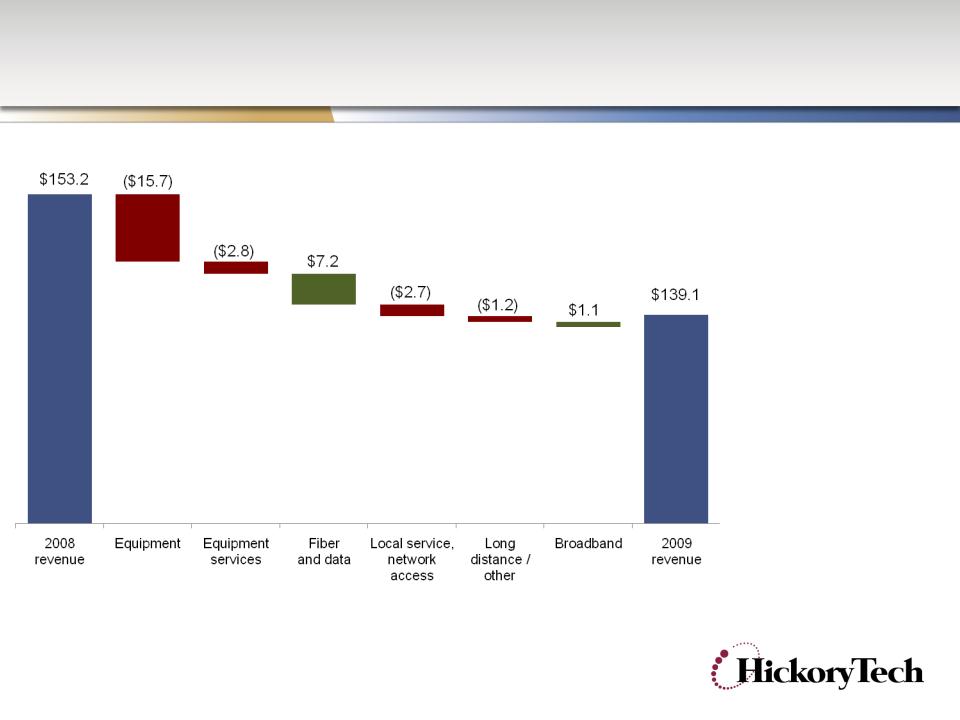

Consolidated

Revenue

Enventis

Sector

Equipment (-$15.7 M)

Equip. Services ($-2.8 M)

Equipment (-$15.7 M)

Equip. Services ($-2.8 M)

Fiber

and Data (+$7.2 M)

Telecom

Sector

Local

Service, Network

Access

(-$2.7 M)

Broadband

(+$1.1 M)

Long

distance/other (-$1.2M)

(Dollars in

Millions)

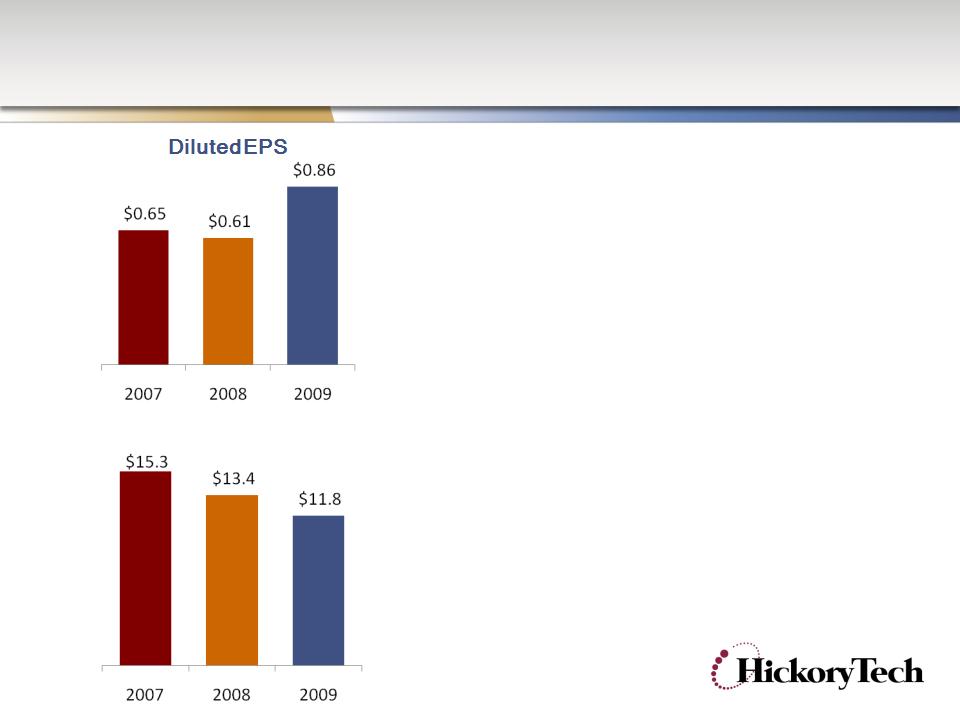

Earnings

and Income

Diluted

EPS

• EPS

in 2009 up 41% due to

income tax reversal in Q3’09

income tax reversal in Q3’09

1

Excluding the tax reversal, EPS in ‘09

would have been $0.52, down15%

would have been $0.52, down15%

Income

before Taxes (continuing

operations)

operations)

• Aggressive

cost controls and

success in broadband, fiber and

data services offset some of the

declines

success in broadband, fiber and

data services offset some of the

declines

• Long-term

growth initiatives added

staffing costs and depreciation of

CAPEX in the near-term

staffing costs and depreciation of

CAPEX in the near-term

Income

before Taxes

(Dollars in

Millions)

1

Enventis

Sector

4Q’09

Highlights

• Fiber

and data revenues +46%

• Equipment

and services

revenue impacted by economy

revenue impacted by economy

Fiber

and Data

• Includes

CP Telecom in Q3

‘09, excluding CPT, Fiber and

Data would have increased

14% in ‘09

‘09, excluding CPT, Fiber and

Data would have increased

14% in ‘09

• Strong

mid-band Ethernet and

FTTT growth opportunities

FTTT growth opportunities

• Continued

growth from service

providers (wireless, regional

and national carriers)

providers (wireless, regional

and national carriers)

Quarterly

Revenue

comparative

comparative

(Dollars in

Millions)

Telecom

Sector

4Q’09

Highlights

• Broadband

revenue +10%

• DSL

subscribers +3%

• Digital

TV subscribers +15%

• Network

Access revenue -5%

• Local

Service revenue -6%

Telecom

Operating Income

• Cost

controls and success in

broadband services have moderated

the decline in Telecom profitability

broadband services have moderated

the decline in Telecom profitability

1

2007

included a settlement from

interexchange carrier of $1.9 M,

excluding this, operating income

would have been $15.9 M

interexchange carrier of $1.9 M,

excluding this, operating income

would have been $15.9 M

comparative

1

(Dollars in

Millions)

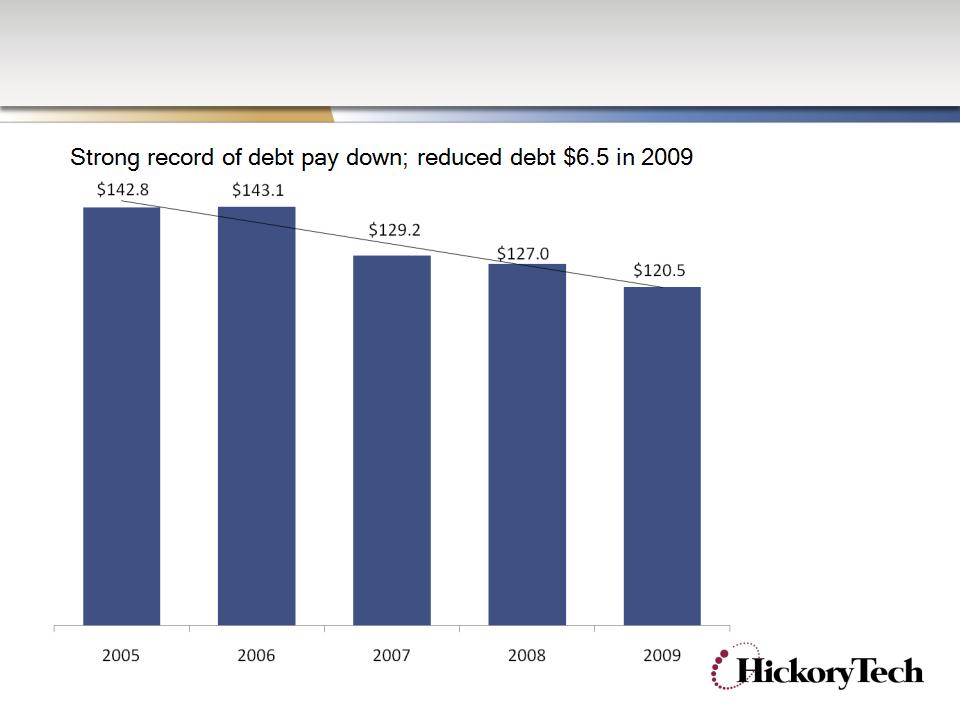

Debt

Balance

(Dollars in

Millions)

2009

Accomplishments

Enventis

• Fiber

and data

revenue up +30%

revenue up +30%

• Added

network

colocations

colocations

• Expanded

Mid-

band Ethernet

services

band Ethernet

services

Telecom

• Broadband

revenue up 10%

revenue up 10%

• Expanded

Digital

TV service area

TV service area

• Cost

controls

drove 4% increase

in operating

income, despite

declining

voice/network

access revenues

drove 4% increase

in operating

income, despite

declining

voice/network

access revenues

Overall

• Completed

CP

Telecom

acquisition

Telecom

acquisition

• Focused

capital

spending on

strategic growth

opportunities

spending on

strategic growth

opportunities

• Reduced

debt $6.5 M

2010

Strategic Initiatives

• Increased

investment and focus on growing business services

Ø Fiber

network expansion

Ø Target

FTTT and data contracts

Ø

Accelerate SMB market plan

Ø Expand

Mid-band Ethernet and data center services

• Grow

broadband services and focus on customer retention

• Increase

capital spending on key strategic initiatives

• Manage

free cash flow, manage costs and potentially increase debt

in short term

in short term

• Long-term

goal to double the value of HickoryTech over next five

years

years

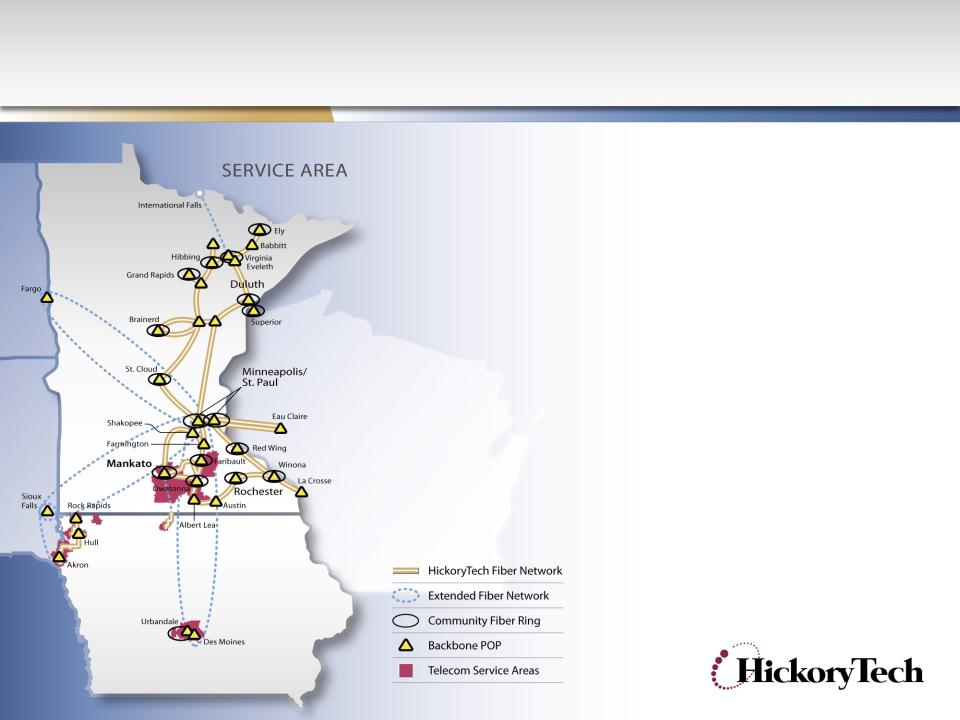

Fiber

Network Expansion

2009

Network Expansion

• Added

network colocations to reach more

customers, cost advantages

customers, cost advantages

• 10G

upgrade of Twin Cities metro network

• Extended

network to select wireless towers

2010 Network Plans

• Expansion

of network to Des Moines, Iowa

and other key markets

and other key markets

• Add

lit buildings, expand Mid-band Ethernet

services and extend network for FTTT

contracts.

services and extend network for FTTT

contracts.

2010

Fiscal Outlook

Targets

ranges as follows:

• Revenue: $150

million to $158 million

• Net

Income: $8.2

million to $9.1 million

• Capital

spending: $22

million to $26 million

• EBITDA:

$40.5 million to $43 million

• Debt

balance (year-end): $117

million to $119 million.

Outlook

provided in fourth quarter earnings release on March 1,

2010.

HTCO

Strengths

• Strong

cash flows

• High level of

recurring revenue, consistent operating income

• Focused

capital spending on strategic growth initiatives

• Long-standing

dividend return

• Committed

to strategic growth plan

• 110+

year Company with strong financial track record

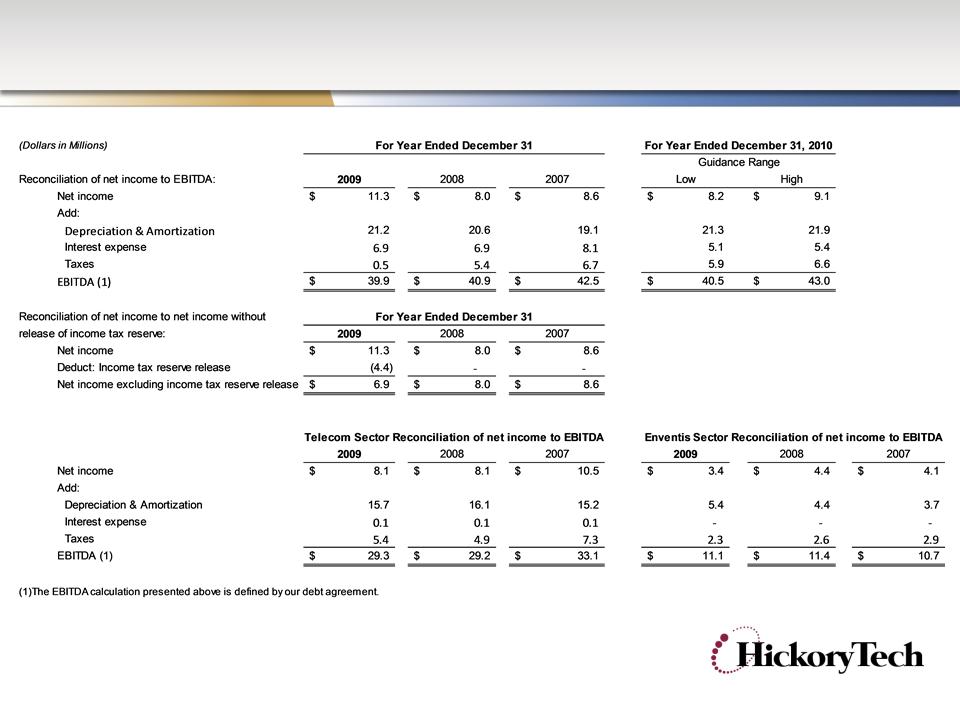

Reconciliation

of Non-GAAP Measures