Attached files

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

þ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934:

For

the fiscal year ended December 31, 2009

Commission

file number 1-14368

|

Titanium

Metals Corporation

|

|

|

|

(Exact

name of registrant as specified in its

charter)

|

||

|

Delaware

|

13-5630895 |

|

|||

|

(State or other jurisdiction of incorporation or

organization)

|

(IRS employer identification no.)

|

||||

5430 LBJ

Freeway, Suite 1700, Dallas, Texas 75240

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (972) 233-1700

Securities

registered pursuant to Section 12(b) of the Act:

| Common Stock ($.01 par value) | New York Stock Exchange |

|

|||

|

(Title of each class)

|

(Name

of each exchange on which

registered)

|

||||

Securities

registered pursuant to Section 12(g) of the Act:

| 6¾% Series A Convertible Preferred Stock ($.01 par Value) |

|

|

|

(Title

of class)

|

||

Indicate by check mark if the

Registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes þ No o

Indicate by check mark if the

Registrant is not required to file reports pursuant to Section 13 or Section

15(d) of the Act. Yes o No þ

Indicate by check mark whether the

Registrant (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12 months and (2)

has been subject to such filing requirements for the past 90

days. Yes þ No o

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Web site, if

any, every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such

files).

* Yes oNo o * the registrant has not yet been phased into the interactive data requirements

* Yes oNo o * the registrant has not yet been phased into the interactive data requirements

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of Registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K o

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer or a

smaller reporting company (as defined in Rule 12b-2 of the

Act).

Large

accelerated filer þ

Accelerated

filer o Non-accelerated

filer o

Smaller reporting company o

Indicate by check mark whether the

Registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No þ

The aggregate market value of the 85.2

million shares of voting stock held by nonaffiliates of Titanium Metals

Corporation as of June 30, 2009 approximated $0.8 billion. There are

no shares of non-voting common stock outstanding. As of February 19,

2010, 179,646,134 shares of common stock were outstanding.

Documents

incorporated by reference: The information required by Part III is incorporated

by reference from the Registrant’s definitive proxy statement to be filed with

the Commission pursuant to Regulation 14A not later than 120 days after the end

of the fiscal year covered by this report.

Forward-Looking

Information

The

statements contained in this Annual Report on Form 10-K (“Annual Report”) that

are not historical facts, including, but not limited to, statements found in the

Notes to Consolidated Financial Statements and in Item 1 - Business, Item 1A –

Risk Factors, Item 2 – Properties, Item 3 - Legal Proceedings and Item 7 -

Management’s Discussion and Analysis of Financial Condition and Results of

Operations (“MD&A”), are forward-looking statements that represent our

beliefs and assumptions based on currently available

information. Forward-looking statements can generally be identified

by the use of words such as “believes,” “intends,” “may,” “will,” “looks,”

“should,” “could,” “anticipates,” “expects” or comparable terminology or by

discussions of strategies or trends. Although we believe that the

expectations reflected in such forward-looking statements are reasonable, we do

not know if these expectations will prove to be correct. Such

statements by their nature involve substantial risks and uncertainties that

could significantly affect expected results. Actual future results

could differ materially from those described in such forward-looking statements,

and we disclaim any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise. Among the factors that could cause actual

results to differ materially are the risks and uncertainties discussed in this

Annual Report, including risks and uncertainties in those portions referenced

above and those described from time to time in our other filings with the

Securities and Exchange Commission (“SEC”) which include, but are not limited

to:

|

|

·

|

the

cyclicality of the commercial aerospace

industry;

|

|

|

·

|

the

performance of our customers and us under our long-term

agreements;

|

|

|

·

|

the

existence or renewal of certain long-term

agreements;

|

|

|

·

|

the

difficulty in forecasting demand for titanium

products;

|

|

|

·

|

global

economic, financial and political

conditions;

|

|

|

·

|

global

productive capacity for titanium;

|

|

|

·

|

changes

in product pricing and costs;

|

|

|

·

|

the

impact of long-term contracts with vendors on our ability to reduce or

increase supply;

|

|

|

·

|

the

possibility of labor disruptions;

|

|

|

·

|

fluctuations

in currency exchange rates;

|

|

|

·

|

fluctuations

in the market price of marketable

securities;

|

|

|

·

|

uncertainties

associated with new product or new market

development;

|

|

|

·

|

the

availability of raw materials and

services;

|

|

|

·

|

changes

in raw material prices and other operating costs (including energy

costs);

|

|

|

·

|

possible

disruption of business or increases in the cost of doing business

resulting from terrorist activities or global

conflicts;

|

|

|

·

|

competitive

products and strategies; and

|

|

|

·

|

other

risks and uncertainties.

|

Should

one or more of these risks materialize (or the consequences of such a

development worsen), or should the underlying assumptions prove incorrect,

actual results could differ materially from those forecasted or

expected.

1

PART

I

ITEM

1: BUSINESS

General. Titanium Metals

Corporation is one of the world’s leading producers of titanium melted and mill

products. We are the only producer with major titanium production

facilities in both the United States and Europe, the world’s principal markets

for titanium consumption. We are currently the largest U.S. producer

of titanium sponge, a key raw material, and a major recycler of titanium

scrap. Titanium Metals Corporation was formed in 1950 and was

incorporated in Delaware in 1955. Unless otherwise indicated,

references in this report to “we”, “us” or “our” refer to TIMET and its

subsidiaries, taken as a whole.

Titanium

was first manufactured for commercial use in the 1950s. Titanium’s

unique combination of corrosion resistance, elevated-temperature performance and

high strength-to-weight ratio makes it particularly desirable for use in

commercial and military aerospace applications where these qualities satisfy

essential design requirements for certain critical parts such as wing supports

and jet engine components. While aerospace applications have

historically accounted for a substantial portion of the worldwide demand for

titanium, other end-use applications for titanium in military and industrial

markets have continued to develop, including the use of titanium-based alloys in

armor plating, structural components, chemical plants, power plants,

desalination plants and pollution control equipment. Demand for

titanium is also increasing in emerging markets with diverse uses including oil

and gas production installations, automotive, geothermal facilities and

architectural applications.

Our

products include titanium sponge, melted products, mill products and industrial

fabrications. The titanium industry is comprised of several

manufacturers that, like us, produce a relatively complete range of titanium

products and a significant number of producers worldwide that manufacture a

limited range of titanium mill products.

Our

long-term strategy is to maximize the value of our core aerospace business while

expanding our presence in non-aerospace markets and developing new applications

and products. Our existing productive capacity and the availability

of our secure third-party conversion capabilities allow us to efficiently

respond to the industry’s demand volatility. As the titanium industry

progresses through its demand cycle, we will continue to evaluate opportunities

to strategically expand our existing production and conversion capacities

through internal expansion and long-term third-party arrangements, as well as

potential joint ventures and acquisitions.

Titanium

industry. We

develop certain industry estimates based on our extensive experience within the

titanium industry as well as information obtained from publicly available

external resources (e.g., United States Geological Survey, International

Titanium Association and Japan Titanium Society). We estimate we

accounted for approximately 16% of 2008 and 18% of 2009 worldwide industry

shipments of titanium mill products and approximately 6% of worldwide titanium

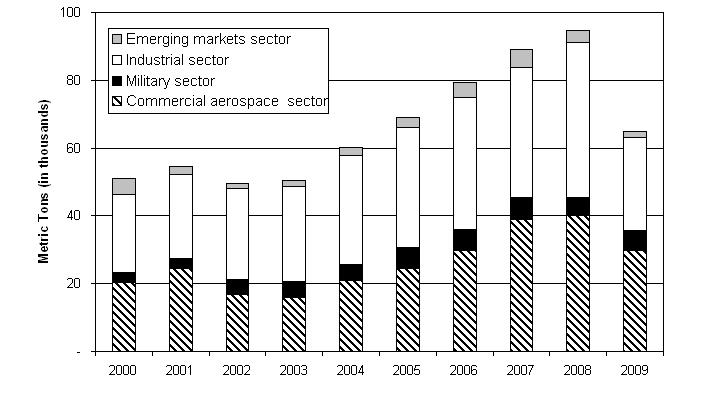

sponge production in each of 2008 and 2009. The following chart

illustrates our estimates of aggregate industry mill product shipments over the

past ten years:

Industry

Mill Product Shipments by Sector

(Volumes

Exclude Shipments within China and Russia)

The

cyclical nature of the commercial aerospace sector has been the principal driver

of the historical fluctuations in titanium mill product shipment

volume. Over the past 30 years, the titanium industry has had various

cyclical peaks and troughs in mill product shipments. Over the last

ten years, titanium mill product demand in the military, industrial and emerging

market sectors has increased, primarily due to the continued development of

innovative uses for titanium products in these industries. Over the

last several years we, and the industry as a whole, have experienced

significantly increased demand with periods of increased

volatility. We estimate that industry shipments approximated 95,000

metric tons in 2008 and 65,000 metric tons in 2009. The estimated 32%

decline in 2009 was driven by significant reductions in the commercial aerospace

and industrial sectors. We currently expect 2010 total industry mill

product shipments to be consistent with 2009 with slight improvements in

commercial aerospace.

Commercial aerospace sector -

Demand for titanium products within the commercial aerospace sector is derived

from both jet engine components (e.g., blades, discs, rings and engine cases)

and airframe components (e.g., bulkheads, tail sections, landing gear, wing

supports and fasteners). The commercial aerospace sector has a

significant influence on titanium companies, particularly mill product

producers. Industry shipments decreased approximately 26% in 2009 due

in part to excess supply chain inventories, particularly as a result of

adjustments to production schedules for Boeing and Airbus, and other factors,

including delays in the completion of development and testing of the Boeing 787,

which suppressed customer demand for titanium products during

2009. Deliveries of titanium generally precede aircraft deliveries by

about one year, and our business cycle generally correlates to this timeline,

although the actual timeline can vary considerably depending on the titanium

product.

Our

business is more dependent on commercial aerospace demand than is the overall

titanium industry. We shipped approximately 67% of our mill products

to the commercial aerospace sector in 2009, whereas we estimate approximately

46% of the overall titanium industry’s mill products were shipped to the

commercial aerospace sector in 2009.

The Airline Monitor, a

leading aerospace publication, traditionally issues worldwide forecasts each

January and July for commercial aircraft deliveries, approximately one-third of

which are expected to be required by the U.S. over the next 20

years. The Airline

Monitor’s most recently issued forecast (January 2010) estimates deliveries of

large commercial aircraft (aircraft with over 100 seats) totaled 1,061

(including 205 twin aisle aircraft which require more titanium) in 2009, and the

following table summarizes the forecasted deliveries of large commercial

aircraft over the next five years:

|

Forecasted

deliveries

|

%

increase (decrease) over

previous year

|

|||||||

|

Year

|

Total

|

Twin

aisle

|

Total

|

Twin

aisle

|

||||

|

2010

|

1,020

|

220

|

(4)%

|

7%

|

||||

|

2011

|

1,070

|

302

|

5%

|

37%

|

||||

|

2012

|

1,065

|

310

|

-

|

3%

|

||||

|

2013

|

1,070

|

335

|

-

|

8%

|

||||

|

2014

|

1,035

|

365

|

(3)%

|

9%

|

||||

The

latest forecast from The

Airline Monitor reflects a moderate 1.6% decrease in forecasted

deliveries over the next five years compared to the July 2009 forecast, mainly

due to The Airline Monitor’s

expectation that in spite of push-outs and cancellations due to the

recent reduction in air travel, demand for more fuel efficient aircraft and

growth within the Asian markets will allow build rates to remain near current

levels. Boeing and Airbus booked orders for 573 planes in 2009, and

The Airline Monitor

forecasts that aggregate new orders in 2010 will be lower than

2009.

2

Changes

in the economic environment and the financial condition of airlines can result

in rescheduling or cancellation of orders. Accordingly, aircraft

manufacturer backlogs are not necessarily a reliable indicator of near-term

business activity, but may be indicative of potential business levels over a

longer-term horizon. The latest forecast from The Airline Monitor estimates

decreases for firm order backlog for both Airbus and Boeing as deliveries are

expected to be higher than orders for the next three years. Airbus’

firm order backlog is estimated at 1,085 twin aisle planes and 2,403 single

aisle planes, and Boeing’s firm order backlog is estimated at 1,299 twin aisle

planes and 2,049 single aisle planes. Boeing has previously announced

that its does not plan to increase its build rates on the 787 aircraft to make

up for delayed deliveries, with the first commercial deliveries expected in late

2010.

At

year-end 2009, a total of 202 firm orders have been placed for the Airbus A380,

and a total of 851 firm orders have been placed for the Boeing

787. The 787 will contain more composite materials than other Boeing

aircraft, and increased utilization of composite materials in an aircraft’s

structural components, such as on the Boeing 787 and other next generation

aircraft, require additional titanium on a per unit basis. In early

years of the manufacturing cycle for the Boeing 787, or with any aircraft model,

we believe additional titanium will be required to produce each aircraft, and as

the program reaches maturity, less titanium will be required for each aircraft

manufactured. During 2006, Airbus officially launched the A350 XWB

program, which is a major derivative of the Airbus A330, with first deliveries

scheduled for 2013. As of December 31, 2009, a total of 505 firm

orders had been placed for the A350 XWB. These A350 XWBs will use

composite materials and new engines similar to those used on the Boeing 787 and

are expected to require significantly more titanium as compared with earlier

Airbus models. However, the final titanium buy weight may change as

the A350 XWB is still in the design phase.

Twin

aisle planes (e.g., Boeing 747, 767, 777 and 787 and Airbus A330, A340, A350 and

A380) tend to use a higher percentage of titanium in their airframes, engines

and parts than single aisle planes (e.g., Boeing 737 and 757 and Airbus A318,

A319 and A320), and new generation models require a significantly higher

percentage of titanium. Additionally, Boeing generally uses a higher

percentage of titanium in its airframes than Airbus. Based on

information we receive from airframe and engine manufacturers and other industry

sources, we estimate approximately 18 metric tons of titanium products are

required to manufacture each Boeing 737, approximately 76 metric tons are

required to manufacture each Boeing 747, approximately 59 metric tons

are required to manufacture each Boeing 777 and approximately 116 metric tons

will be required to manufacture each Boeing 787, including both the airframes

and engines. Additionally, based on these same sources, we estimate

approximately 12 metric tons of titanium products are required to manufacture

each Airbus A320, approximately 18 metric tons are required to manufacture each

Airbus A330, approximately 32 metric tons are required to manufacture each

Airbus A340, approximately 127 metric tons will be required to manufacture each

Airbus A350 XWB and approximately 146 metric tons are required to manufacture

each Airbus A380, including both the airframes and engines.

Military sector - Titanium

shipments into the military sector are largely driven by government defense

spending in North America and Europe. Military aerospace programs

were the first to utilize titanium’s unique properties on a large scale,

beginning in the 1950s. Titanium shipments to military aerospace

markets reached a peak in the 1980s before falling to historical lows in the

early 1990s after the end of the Cold War. Since 2001, titanium

shipments to military aerospace have increased, as discussed

below. Based on its physical and performance properties, titanium has

also become widely accepted for use in applications for ground combat vehicles

as well as in naval vessels. The importance of military markets to

the titanium industry is expected to continue to rise in coming years as defense

spending budgets increase in reaction to terrorist activities and global

conflicts and to replace aging conventional armaments. Defense

spending for most systems is expected to remain strong through at least

2010. Current and anticipated future military strategy leading to

light armament and mobility favor the use of titanium due to light weight and

improved ballistic performance.

As the

strategic military environment demands greater global lift and mobility, the

U.S. military needs more airlift capacity and capability. Airframe

programs are expected to drive the military market demand for titanium through

2015. Several of today’s active U.S. military programs, including the

C-17, F-15, F/A 18 and F-16, are currently expected to continue in production

into the middle of this decade. European military programs also have

active aerospace programs offering the possibility for increased titanium

consumption. Production levels for the Saab Gripen, Eurofighter

Typhoon, Dassault Rafale and Dassault Mirage 2000 are all forecasted to remain

steady through the middle or end of this decade.

In

addition to the established programs, newer U.S. programs offer growth

opportunities for increased titanium consumption. The F/A-22 Raptor

was given full-rate production approval in April 2005, but based on proposed

defense budgets, the Raptor program could be diminished or phased out as early

as 2011. Additionally, the F-35 Joint Strike Fighter, now known as

the Lightning II, has begun low-rate initial production and assembly with

delivery of the first production aircraft planned in 2010. Although

no specific delivery schedules have been announced, according to The Teal Group, a leading

aerospace publication, procurement of the F-35 is expected to extend over the

next 30 to 40 years and may include production of as many as 4,000 planes,

including sales to foreign nations.

Utilization

of titanium on military ground combat vehicles for armor appliqué and integrated

armor or structural components continues to gain acceptance within the military

market segment. Titanium armor components provide the necessary

ballistic performance while achieving a mission critical vehicle performance

objective of reduced weight in new generation vehicles. In order to

counteract increased threat levels globally, titanium is being utilized on

vehicle upgrade programs in addition to new builds. Based on active

programs, as well as programs currently under evaluation, we believe there will

be additional usage of titanium on ground combat vehicles that will provide

continued growth in the military market sector. In armor and

armament, we sell plate and sheet products for fabrication into appliqué plate

and reactive armor for protection of the entire ground combat vehicle as well as

the vehicle’s primary structure.

Industrial and emerging markets

sectors - The number of end-use markets for titanium has expanded

significantly over the past several years. Established industrial

uses for titanium include chemical plants, power plants, desalination plants and

pollution control equipment. Rapid growth of the Chinese and other

Southeast Asian economies has brought unprecedented demand for

titanium-intensive industrial equipment. In November 2005, we entered

into a joint venture with XI'AN BAOTIMET VALINOX TUBES CO. LTD. (“BAOTIMET”) to

produce welded titanium tubing in the Peoples Republic of

China. BAOTIMET's production facilities are located in Xi'an, China,

and production began in January 2007.

Titanium

is widely accepted for many emerging market applications, including

transportation, energy (including oil and gas) and

architecture. Although titanium is often more expensive than other

competing metals, over the entire life cycle of the application, we believe

titanium is a better value alternative due to its durability, longevity and

overall environmental impact. In many cases customers also find the

physical properties of titanium to be attractive from the standpoint of weight,

performance, design alternatives and other factors. The oil and gas

market, a relatively new, potentially large growth area, utilizes titanium in

down-hole casing, critical riser components, tapered stress joints, fire water

systems and saltwater-cooling systems. Additionally, as offshore

development of new oil and gas fields moves into the ultra deep-water depths and

as geothermal energy production expands, market demand for titanium’s

light-weight, high-strength and corrosion-resistance properties is creating new

growth opportunities. We have focused additional resources on

development of alloys and production processes to promote the expansion of

titanium use in this market and in other non-aerospace

applications.

Although

we estimate emerging market demand presently represents less than 5% of the

total industry demand for titanium mill products, we believe emerging market

demand, in the aggregate, will continue to grow over the next several

years. We have ongoing initiatives to actively pursue and expand our

presence in these markets.

Products and operations. We

are a vertically integrated titanium manufacturer whose products

include:

|

|

(i)

|

titanium

sponge, the basic form of titanium metal used in titanium

products;

|

|

|

(ii)

|

melted

products (ingot, electrode and slab), the result of melting titanium

sponge and titanium scrap, either alone or with various

alloys;

|

|

|

(iii)

|

mill

products that are forged and rolled from ingot or slab, including long

products (billet and bar), flat products (plate, sheet and strip) and

pipe; and

|

|

|

(iv)

|

fabrications

(spools, pipe fittings, manifolds, vessels, etc.) that are cut, formed,

welded and assembled from titanium mill

products.

|

All of

our net sales were generated by our integrated titanium operations (our

“Titanium melted and mill products” segment), which is our only business

segment. Business and geographic financial information is included in

Note 17 to the Consolidated Financial Statements.

Titanium

sponge is the commercially pure, elemental form of titanium metal with a porous

and sponge-like appearance. The first step in our sponge production

involves the combination of titanium-containing rutile ores (derived from beach

sand) with chlorine and petroleum coke to produce titanium

tetrachloride. Titanium tetrachloride is purified and then reacted

with magnesium in a closed system, producing titanium sponge and magnesium

chloride as a by-product. Our titanium sponge production facility in

Henderson, Nevada uses vacuum distillation process (“VDP”) technology, which

removes the magnesium and magnesium chloride residues by applying heat to the

sponge mass while maintaining a vacuum in a chamber. The combination

of heat and vacuum boils the residues from the sponge mass, and then the sponge

mass is mechanically pushed out of the distillation vessel, sheared and crushed

to prepare the sponge for incorporation into one of our melted

products. We electrolytically separate and recycle the residual

magnesium chloride, a by-product of the VDP process, to improve cost efficiency

and reduce environmental impact.

Melted

products (ingot, electrode and slab) are produced by melting sponge and titanium

scrap, either alone or with alloys, to produce various grades of titanium

products suited to the ultimate application of the product. By

introducing other alloys such as vanadium, aluminum, molybdenum, tin and

zirconium, the melted titanium product is engineered to produce quality grades

with varying combinations of certain physical attributes such as

strength-to-weight ratio, corrosion-resistance and milling

compatibility. Titanium ingot is a cylindrical solid shape that, in

our case, weighs up to 8 metric tons. Titanium slab is a rectangular

solid shape that, in our case, weighs up to 16 metric tons. The

melting process for ingot and slab is closely controlled and monitored utilizing

computer control systems to maintain product quality and consistency and to meet

customer specifications. In most cases, we use our ingot and slab as

the intermediate material for further processing into mill

products. However, we also sell melted products to our

customers.

Mill

products are forged or rolled from our melted products (ingot or

slab). Mill products include long products (billet and bar), flat

products (plate, sheet and strip) and pipe. Our mill products can be

further machined to meet customer specifications with respect to size and

finish.

3

We send

certain products to outside vendors for further processing (e.g., certain

rolling, forging, finishing and other processing steps in the U.S., and certain

melting and forging steps in France) before being shipped to

customers. In France, our primary processor is also a partner in our

70%-owned subsidiary, TIMET Savoie, S.A. During 2006, we entered into

a 20-year conversion services agreement with a U.S. supplier, whereby they will

provide an annual output capacity of 4,500 metric tons of titanium mill rolling

services until 2026, with our option to increase the output capacity to 9,000

metric tons. Additionally, during 2007, we entered into a long-term

agreement with another U.S. supplier whereby they will provide us dedicated

annual forging capacity of 3,000 metric tons and increasing to 8,900 metric tons

for 2011 through at least 2019. These agreements provide us with

long-term secure sources for processing round and flat products, resulting in a

significant increase in our existing mill product conversion capabilities, which

allows us to assure our customers of our long-term ability to meet their

needs.

During

the production process and following the completion of manufacturing, we perform

extensive testing on our products. Sonic inspection as well as

chemical and mechanical testing procedures are critical to ensuring that our

products meet our customers’ high quality requirements, particularly in

aerospace component production. We certify that our products meet

customer specification at the time of shipment for substantially all customer

orders.

Titanium

scrap is a by-product of the forging, rolling and machining operations, and

significant quantities of scrap are generated in the production process for

finished titanium products and components. Scrap by-products from our

mill production processes, as well as the scrap purchased from our customers or

on the open metals market, is typically recycled and introduced into the melting

process once the scrap is sorted and cleaned. We have the capacity to

recycle 14,000 to 16,000 metric tons of titanium scrap annually at our facility

in Morgantown, Pennsylvania depending on the scrap and end-use product

mix. We believe our capability and expertise in recycling titanium

scrap provides us with a competitive advantage in the titanium

industry.

Distribution. We

sell our products through our own sales force based in the U.S. and Europe and

through independent agents and distributors worldwide. We also own

eight service centers (five in the U.S. and three in Europe), which we use to

sell our products on a just-in-time basis. The service centers

primarily sell value-added and customized mill products, including bar, sheet,

plate, tubing and strip. We believe our service centers provide us

with a competitive advantage because of our ability to foster customer

relationships, customize products to suit specific customer requirements and

respond quickly to customer needs.

Raw

materials. The principal raw materials used in the production

of titanium melted and mill products are titanium sponge, titanium scrap and

alloys. The proportions and grades of sponge and scrap are sometimes

dictated by the product mix or customer requirements for the end-use product;

however, we generally have the operating flexibility to vary the raw material

components to optimize our manufacturing efficiency and maximize our

profitability. The following table summarizes our raw material usage

requirements in the production of our melted and mill products:

|

2007

|

2008

|

2009

|

|||

|

Internally

produced sponge

|

24%

|

24%

|

27%

|

||

|

Purchased

sponge

|

31%

|

31%

|

16%

|

||

|

Titanium

scrap

|

39%

|

39%

|

51%

|

||

|

Alloys

|

6%

|

6%

|

6%

|

||

|

Total

|

100%

|

100%

|

100%

|

Sponge - The primary raw

materials used in the production of titanium sponge are titanium-containing

rutile ore, chlorine, magnesium and petroleum coke. Rutile ore is

currently available from a limited number of suppliers around the world,

principally located in Australia, South Africa and Sri Lanka. We

purchase the majority of our supply of rutile ore from Australia and South

Africa. We believe the availability of rutile ore will be adequate

for the foreseeable future and do not anticipate any interruptions of our rutile

supplies.

We

currently obtain chlorine from a single supplier near our sponge plant in

Henderson, Nevada. While we do not anticipate any chlorine supply

problems, we have taken steps to mitigate this risk in the event of supply

disruption, including establishing the feasibility of certain equipment

modifications to enable us to utilize material from alternative chlorine

suppliers or to purchase and utilize an intermediate product which will allow us

to eliminate the purchase of chlorine if needed. Magnesium and

petroleum coke are generally available from a number of suppliers.

We are

currently the largest U.S. producer of titanium sponge. In 2007, we

completed an expansion of our existing premium-grade titanium sponge facility at

our Henderson plant. This expansion increased our annual productive

sponge capacity to approximately 12,600 metric tons. We operated our

sponge plant significantly below full capacity during 2009, and we anticipate

comparable production volumes during 2010. We supplement our

internally produced sponge with purchases from third parties. From

2006 through 2009, other sponge producers have also undertaken additional

capacity expansion projects. However, we do not know the degree to

which the quality and cost of the sponge produced by our competitors will be

comparable to the premium-grade sponge we produce in our Henderson

facility.

We are

party to long-term sponge supply agreements that require us to make minimum

annual purchases. These long-term supply agreements, together with

our current sponge production capacity in Henderson, should provide us with a

total annual available sponge supply at levels ranging from 19,000 metric tons

up to 24,000 metric tons through 2025, which we expect to meet our sponge supply

requirements. We will continue to purchase sponge from a variety of

sources in 2010, including those sources under existing supply

agreements. We continuously evaluate alternatives to strategically

balance our internal and external sources for titanium sponge.

Scrap - We recycle titanium

scrap into melted products that will be sold to our customers or used as

intermediate feedstock for our mill production process. Our titanium

scrap is generated from our melted and mill product production processes,

purchased from certain of our customers under contractual agreements or acquired

in the open metals market. Such scrap consists of alloyed and

commercially pure solids and turnings. Scrap obtained through

customer arrangements provides a “closed-loop” arrangement resulting in

certainty of supply and price stability, and due to our successful efforts to

increase the volume of scrap obtained through “closed-loop” arrangements and

reduced melting demand in 2009, we were only required to purchase 16% of our

scrap requirement from the open metals market in 2009 compared to 27% in

2008. Externally purchased scrap comes from a wide range of sources,

including customers, collectors, processors and brokers. We expect

our open market scrap purchases to account for 20% to 25% of our scrap

requirement during 2010. We expect our scrap consumption to remain at

high levels as we continue to emphasize the utilization of scrap for our

electron beam cold hearth (“EB”) melting activity. We also

occasionally sell scrap, usually in a form or grade we cannot economically

recycle for use in our production operations.

Overall

market forces can significantly impact the supply or cost of externally produced

scrap, as the amount of scrap generated in the supply chain varies during

titanium business cycles. Early in the titanium cycle, the demand for

titanium melted and mill products begins to increase the scrap requirements for

titanium manufacturers. This demand precedes the increase in scrap

generation by downstream customers and the supply chain. The reduced

availability of scrap at this stage of the cycle places upward pressure on the

market price of scrap. The opposite situation occurs when demand for

titanium melted and mill products begins to decline, resulting in greater

availability of scrap supply and downward pressure on the market price of

scrap. During the middle of the cycle, scrap generation and

consumption are in relative equilibrium, minimizing disruptions in supply or

significant changes in the available supply and market price for

scrap. Increasing or decreasing cycles tend to cause significant

changes in both the supply and market price of scrap. These supply

chain dynamics result in selling prices for melted and mill products which

generally tend to correspond with the changes in raw material

costs.

All of

our major competitors utilize scrap as a raw material in their titanium melt

operations, and steel manufacturers also use titanium scrap as an alloy to

produce interstitial-free steels, stainless steels and high-strength-low-alloy

steels. Prices for all forms and grades of titanium scrap declined

steadily during the first half of 2008 due to increased availability and reduced

demand. The global recession reduced demand for titanium scrap in the

second half of 2008 and the first nine months of 2009, which resulted in sharp

declines in scrap prices over the same period. Overall demand and

prices for titanium scrap increased in late 2009 as a result of the market

forces described above, and we currently believe general economic conditions

will continue to cause the price of titanium scrap to increase in

2010.

Other - Various alloy

additions used in the production of titanium products, such as vanadium and

molybdenum, are also available from a number of suppliers. The

decline in demand from steel manufacturers for vanadium and molybdenum also

resulted in dramatic drops in cost for these alloys in 2009, as compared to

2008. However, we currently believe that demand for alloys will

increase in 2010, likely causing the price of alloys to increase as

well.

Customer

agreements. We have long-term agreements (“LTAs”) with certain

major customers, including, among others, The Boeing Company (“Boeing”),

Rolls-Royce plc and its German and U.S. affiliates (“Rolls-Royce”), United

Technologies Corporation (“UTC,” Pratt & Whitney and related companies), the

Safran companies (“Safran,” Snecma and related companies), Wyman-Gordon Company

(“Wyman-Gordon,” a unit of Precision Castparts Corporation (“PCC”)) and VALTIMET

SAS. These agreements expire at various times through 2017, are

subject to certain conditions and generally provide for (i) minimum market

shares of the customers’ titanium requirements or firm annual volume

commitments, (ii)

formula-determined prices (including some elements based on market

pricing) and (iii) price adjustments for certain raw material, labor and energy

cost fluctuations. Generally, the LTAs require our service and

product performance to meet specified criteria and contain a number of other

terms and conditions customary in transactions of these

types. Certain provisions of these LTAs have been amended in the past

and may be amended in the future to meet changing business

conditions. Our 2009 sales revenues to customers under LTAs were 64%

of our total sales revenues.

In

certain events of nonperformance by us or the customer, an LTA may be terminated

early. Although it is possible that some portion of the business

would continue on a non-LTA basis, the termination or expiration without renewal

of one or more of the LTAs could result in a material adverse effect on our

business, results of operations, financial position or liquidity. The

LTAs were designed to limit selling price volatility to the customer and to us,

while providing us with a committed volume base throughout the titanium industry

business cycles and certain mechanisms to adjust pricing for changes in certain

cost elements.

4

Markets and

customer base. As discussed previously, we produce a wide

range of melted and mill titanium products for our customers, and selling prices

generally reflect raw material and other productions costs as well as reasonable

profit margins. Selling prices are generally influenced by industry

and global economic conditions. For instance, increases in global

capacity and manufacturing activity for titanium products throughout the supply

chain in 2007 and 2008 increased the availability of titanium scrap, which

resulted in declining costs for this raw material through the first nine months

of 2009. This decline in raw material costs has, in turn, contributed

to lower selling prices for certain products under LTAs, due in part to raw

material indexed pricing adjustments included in certain of these agreements, as

well as for our non-contract sales volume.

The

demand for our titanium products is global, and our global productive

capabilities allow us to respond to our customers’ needs. The

following table summarizes our sales revenue by geographical

location:

|

Year

ended December 31,

|

|||||

|

2007

|

2008

|

2009

|

|||

|

(Percentage

of total sales revenue)

|

|||||

|

Sales

revenue to customers within:

|

|||||

|

North America

|

61%

|

59%

|

65%

|

||

|

Europe

|

29%

|

29%

|

27%

|

||

|

Other

|

10%

|

12%

|

8%

|

||

|

Total

|

100%

|

100%

|

100%

|

||

Further

information regarding our external sales, net income, long-lived assets and

total assets can be found in our Consolidated Balance Sheets, Consolidated

Statements of Income and Notes 5 and 17 to the Consolidated Financial

Statements.

Our

concentration of customers, primarily in commercial aerospace, may impact our

overall exposure to credit and other risks because all of these customers may be

similarly affected by the same economic or other conditions. The

following table provides supplemental sales revenue information:

|

Year

ended December 31,

|

|||||||

| 2007 |

2008

|

2009 | |||||

|

(Percentage

of total sales revenue)

|

|||||||

|

Ten largest

customers

|

49%

|

49%

|

57%

|

||||

|

Significant

customers:

|

|||||||

|

Boeing

|

10%

|

12%

|

17%

|

||||

|

PCC and PCC-related entities

(1)

|

11%

|

10%

|

15%

|

||||

|

Total LTAs

|

47%

|

56%

|

64%

|

||||

|

Significant

LTAs:

|

|||||||

|

Boeing

|

10%

|

12%

|

17%

|

||||

|

Rolls-Royce (1)

|

12%

|

13%

|

13%

|

||||

|

(1)

PCC and PCC-related

entities serve as suppliers to certain commercial aerospace manufacturers,

including Rolls-Royce. Certain sales we make directly to PCC

and PCC-related entities also count towards, and are reflected in, the

table above as sales to Rolls-Royce under the Rolls-Royce

LTA.

|

|||||||

The

following table provides supplemental sales revenue information by industry

sector:

|

Year

ended December 31,

|

|||||

|

2007

|

2008

|

2009

|

|||

|

(Percentage

of total sales revenue)

|

|||||

|

Commercial

aerospace

|

55%

|

59%

|

60%

|

||

|

Military

|

19%

|

16%

|

20%

|

||

|

Industrial and emerging

markets

|

16%

|

15%

|

11%

|

||

|

Other titanium

products

|

10%

|

10%

|

9%

|

||

|

Total

|

100%

|

100%

|

100%

|

||

The

primary market for titanium products in the commercial aerospace sector consists

of two major manufacturers of large commercial airframes, Boeing Commercial

Airplanes Group (a unit of Boeing) and Airbus, as well as manufacturers of large

civil aircraft engines including Rolls-Royce, General Electric Aircraft Engines,

Pratt & Whitney and Safran. We sell directly to these major

manufacturers, as well as to companies (including forgers such as Wyman-Gordon)

that use our titanium to produce parts and other materials for such

manufacturers. If any of the major aerospace manufacturers were to

significantly reduce aircraft and/or jet engine build rates from those currently

expected, there could be a material adverse effect, both directly and

indirectly, on our business, results of operations, financial position and

liquidity.

The

market for titanium in the military sector includes sales of melted and mill

titanium products engineered for applications for military aircraft (both

engines and airframes), armor and component parts, armor appliqué on ground

combat vehicles and other integrated armor or structural

components. We sell directly to many of the major manufacturers

associated with military programs on a global basis.

Outside

of commercial aerospace and military sectors, we manufacture a wide range of

products for customers in the chemical process, oil and gas, consumer, sporting

goods, healthcare, automotive and power generation sectors.

In

addition to melted and mill products, which are sold into all market sectors, we

sell certain other products such as titanium fabrications, titanium scrap and

titanium tetrachloride.

Our

backlog was approximately $695 million at December 31, 2008 and $440

million at December 31, 2009. Over 90% of our 2009 year-end backlog

is scheduled for shipment during 2010. Our order backlog may not be a

reliable indicator of future business activity.

We have

explored and will continue to explore strategic arrangements in the areas of

product development, production and distribution. We will also

continue to work with existing and potential customers to identify and develop

new or improved applications for titanium that take advantage of its unique

properties and qualities.

Competition. The

titanium metals industry is highly competitive on a worldwide basis. Producers

of melted and mill products are located primarily in the United States, Japan,

France, Germany, Italy, Russia, China and the United Kingdom. There

are also several producers of titanium sponge in the world that are currently in

some stage of increasing sponge production capacity. We believe entry

as a new producer of titanium sponge would require a significant capital

investment, substantial technical expertise and significant lead

time. Additionally, producers of other metal products, such as steel

and aluminum, maintain forging, rolling and finishing facilities that could be

used or modified to process titanium products.

Our

principal competitors in the aerospace titanium market are Allegheny

Technologies Incorporated (“ATI”) and RTI International Metals, Inc. (“RTI”),

both based in the United States, and Verkhnaya Salda Metallurgical Production

Organization (“VSMPO”), based in Russia. UNITI (a joint venture

between ATI and VSMPO), RTI and certain Japanese producers are our principal

competitors in the industrial and emerging markets. We compete

primarily on the basis of price, quality of products, technical support and the

availability of products to meet customers’ delivery schedules.

In the

U.S. market, the increasing presence of foreign participants has become a

significant competitive factor. Prior to 1993, imports of foreign

titanium products into the U.S. were not significant, primarily attributable to

relative currency exchange rates and, with respect to Japan, Russia, Kazakhstan

and Ukraine, import duties (including antidumping duties). However,

since 1993, imports of titanium sponge, ingot and mill products, principally

from Russia and Kazakhstan, have increased and have had a significant

competitive impact on the U.S. titanium industry.

5

Trade and tariffs -

Generally, imports of titanium products into the U.S. are subject to a 15%

“normal trade relations” tariff. For tariff purposes, titanium

products are broadly classified as either wrought (billet, bar, sheet, strip,

plate and tubing) or unwrought (sponge, ingot and slab). Because a

significant portion of end-use products made from titanium products are

ultimately exported, we, along with our principal competitors and many

customers, actively utilize the duty-drawback mechanism to recover most of the

tariff paid on imports.

From

time-to-time, the U.S. government has granted preferential trade status to

certain titanium products imported from particular countries (notably wrought

titanium products from Russia, which carried no U.S. import duties from

approximately 1993 until 2004). It is possible that such preferential

status could be granted again in the future.

The

Japanese government has raised the elimination or harmonization of tariffs on

titanium products, including titanium sponge, for consideration in multi-lateral

trade negotiations through the World Trade Organization (the so-called “Doha

Round”). As part of the Doha Round, the United States has proposed

the staged elimination of all industrial tariffs, including those on

titanium. The Japanese government has specifically asked that

titanium in all its forms be included in the tariff elimination

program. We have urged that no change be made to these tariffs,

either on wrought or unwrought products. The negotiations are ongoing

and are expected to continue during 2010.

We will

continue to resist efforts to eliminate duties on titanium products, although we

may not be successful in these activities. Further reductions in, or

the complete elimination of, any or all of these tariffs could lead to increased

imports of foreign sponge, ingot, slab and mill products into the U.S. and an

increase in the amount of such products on the market generally, which could

adversely affect pricing for titanium sponge, ingot, slab and mill products and

thus our business, results of operations, financial position or

liquidity.

Section

2533b of Title 10, United States Code, legislation formerly known as the “Berry

Amendment,” requires that subject to certain exceptions the United States

Department of Defense (“DoD”) expend funds for products containing specialty

metals, including titanium, only if the specialty metals have been melted or

produced in the United States. In 2009, the DoD adopted regulations

regarding the implementation of this specialty metals law that may reduce its

effectiveness. We will continue to resist attempts to undermine this

specialty metals law. A weakening in the enforcement of this

specialty metals law could increase foreign competition for sales of titanium

for defense products, adversely affecting our business, results of operations,

financial position or liquidity.

Research and

development. Our research and development activities are

directed toward expanding the use of titanium and titanium alloys in all market

sectors. Key research activities include the development of new

alloys, development of technology required to enhance the performance of our

products in the traditional industrial and aerospace markets and applications

development for emerging markets. In addition, we continue to work in

partnership with the United States Defense Advanced Research Projects Agency

("DARPA") and others to explore means to reduce the cost of titanium

production. The work with DARPA complements our research, development

and exploration of innovative technologies and improvements to the existing

processes such as Vacuum Distillation of sponge and Vacuum Arc Remelting

processes. We conduct the majority of our research and development

activities at our Henderson Technical Laboratory, with additional activities at

our Witton, England facility. We incurred research and development

costs of $4.2 million in 2007, $4.3 million in 2008 and $7.8 million in

2009.

Patents and

trademarks. We hold U.S. and non-U.S. patents applicable to

certain of our titanium alloys and manufacturing technology, which expire at

various times from 2010 through 2026 and we have certain other patent

applications pending. We continually seek patent protection with

respect to our technology base and have occasionally entered into

cross-licensing arrangements with third parties. We believe the

trademarks TIMET® and

TIMETAL®,

which are protected by registration in the U.S. and other countries, are

important to our business. However, the majority of our titanium

alloys and manufacturing technologies do not benefit from patent

protection.

Employees. Our

employee headcount varies due to the cyclical nature of the aerospace industry

and its impact on our business. Our employee headcount includes both

our full and part-time employees. The following table shows our

approximate employee headcount at the end of the past 3 years:

|

Employees

at December 31,

|

|||||

|

2007

|

2008

|

2009

|

|||

|

U.S.

|

1,670

|

1,775

|

1,455

|

||

|

Europe

|

860

|

895

|

750

|

||

|

Total

|

2,530

|

2,670

|

2,205

|

||

Our

production and maintenance workers in Henderson and our production, maintenance,

clerical and technical workers in Toronto, Ohio (approximately half of our total

U.S. employees) are represented by the United Steelworkers of America under

contracts expiring in January 2011 and June 2011,

respectively. Employees at our other U.S. facilities are not covered

by collective bargaining agreements. A majority of the salaried and

hourly employees at our European facilities are represented by various European

labor unions. Our labor agreement with our U.K. managerial and

professional employees expires in March 2011, and our labor agreement with our

U.K. production and maintenance employees expires in December

2011. Our labor agreements with our French and Italian employees are

renewed annually. We currently consider our employee relations to be

good. However, it is possible that there could be future work

stoppages or other labor disruptions that could materially and adversely affect

our business, results of operations, financial position or

liquidity.

Regulatory and

environmental matters. Our operations are governed by various

federal, state, local and foreign environmental, security and worker safety and

health laws and regulations. In the U.S., such laws include the

Occupational, Safety and Health Act, the Clean Air Act, the Clean Water Act, the

Toxic Substances Control Act and the Resource Conservation and Recovery

Act. We use and manufacture substantial quantities of substances that

are considered hazardous, extremely hazardous or toxic under environmental and

worker safety and health laws and regulations. We have used and

manufactured such substances throughout the history of our

operations. Although we have substantial controls and procedures

designed to reduce continuing risk of environmental, health and safety issues,

we could incur substantial cleanup costs, fines and civil or criminal sanctions,

third party property damage or personal injury claims as a result of violations

or liabilities under these laws, common law theories of liability or

non-compliance with environmental permits required at our

facilities. In addition, government environmental requirements or the

enforcement thereof may become more stringent in the future. It is

possible that some, or all, of these risks could result in liabilities that

would be material to our business, results of operations, financial position or

liquidity.

Our

policy is to maintain compliance in all material respects with applicable

requirements of environmental and worker health and safety laws and strive to

improve environmental, health and safety performance. We incurred

capital expenditures related to health, safety and environmental compliance and

improvement of approximately $3.0 million in 2007, $2.1 million in 2008 and $1.7

million in 2009.

From time

to time, we may be subject to health, safety or environmental regulatory

enforcement under various statutes, resolution of which typically involves the

establishment of compliance programs. Occasionally, resolution of

these matters may result in the payment of penalties or the expenditure of

additional funds on compliance. Furthermore, the imposition of more

strict standards or requirements under environmental, health or safety laws and

regulations could result in expenditures in excess of amounts currently

estimated to be required for such matters.

As a result of Environmental Protection

Agency (“EPA”) inspections, in April 2009 the EPA issued a Notice of Violation

(“Notice”) to us alleging that we violated certain provisions of the Resource

Conservation and Recovery Act and the Toxic Substances Control Act at our

Henderson plant. We responded to the EPA and are currently in ongoing

discussions with them concerning the nature and extent of required follow-up

testing and potential remediation that may be required to address the

allegations of non-compliance. We anticipate submitting detailed

proposals for testing during the first quarter of 2010 that will provide the

basis for negotiating the scope and methods of any remediation required by the

Notice.

As part

of our continuing environmental assessment with respect to our plant site in

Henderson, during 2008 we completed and submitted to the Nevada Department of

Environmental Protection (“NDEP”) a Remedial Alternative Study (“RAS”) with

respect to the groundwater located beneath the plant site. The RAS,

which was submitted pursuant to an existing agreement between the NDEP and us,

addressed the presence of certain contaminants in the plant site groundwater

that require remediation. The NDEP completed its review of the RAS

and our proposed remedial alternatives during 2008, and the NDEP issued its

record of decision in February 2009, which selected our preferred groundwater

remedial alternative action plan. We commenced the work to implement

the plan in the fourth quarter of 2009. See Note 15 to the

Consolidated Financial Statements.

Related

parties. At December 31, 2009, Contran Corporation and other

entities or persons related to Harold C. Simmons held approximately 52.2% of our

outstanding common stock. See Notes 1 and 14 to the Consolidated

Financial Statements.

Available

information. We maintain an Internet website at www.timet.com. Our

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K, and any amendments thereto, are or will be available free of charge

on our website as soon as reasonably practicable after they are filed or

furnished, as applicable, with the SEC. Additionally, our (i)

Corporate Governance Guidelines, (ii) Code of Business Conduct and Ethics and

(iii) Audit Committee, Management Development and Compensation Committee and

Nominations Committee charters are also available on our

website. Information contained on our website is not part of this

Annual Report. We will provide these documents to shareholders upon

request. Requests should be directed to the attention of our Investor

Relations Department at our corporate offices located at 5430 LBJ Freeway, Suite

1700, Dallas, Texas 75240.

The

general public may read and copy any materials on file with the SEC at the SEC’s

Public Reference Room at 100 F Street, NE, Washington, DC 20549 and may obtain

information on the operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330. We are an electronic filer, and the SEC maintains an

Internet website at www.sec.gov that

contains reports, proxy and information statements, and other information

regarding issuers that file electronically with the SEC.

6

ITEM

1A: RISK FACTORS

Listed

below are certain risk factors associated with our business. In

addition to the potential effect of these risk factors discussed below, any risk

factor that could result in reduced earnings, liquidity or operating losses,

could in turn adversely affect our ability to meet our liabilities or adversely

affect the quoted market prices for our securities.

The cyclical

nature of the commercial aerospace industry, which represents a significant

portion of our business, creates uncertainty regarding our future

profitability. In addition, adverse changes to, or interruptions in,

our relationships with our major commercial aerospace customers could reduce our

revenues and impact our profitability. The commercial

aerospace sector has a significant influence on titanium companies, particularly

mill product producers. The cyclical nature of the commercial

aerospace sector has been the principal driver of the fluctuations in the

performance of most titanium product producers. Our business is more

dependent on commercial aerospace demand than is the overall titanium

industry. We shipped approximately 67% of our mill products to

commercial aerospace customers in 2009, whereas we estimate approximately 46% of

the overall titanium industry’s mill products were shipped to commercial

aerospace customers in 2009. Our melted and mill product sales to

commercial aerospace customers accounted for 55% of our total sales in 2007, 59%

in 2008 and 60% in 2009. We estimate that 2010 industry mill product

shipments into the commercial aerospace sector will be comparable to 2009

levels. Events that could adversely affect the commercial aerospace

sector, such as future terrorist attacks, world health crises, the general

economic downturn or unforeseen reductions in orders from commercial airlines,

could significantly decrease our results of operations and financial

condition. See “Business – Titanium industry – Commercial aerospace

sector.”

Sales

under LTAs with customers in the commercial aerospace sector accounted for

approximately 42% of our 2009 total sales. These LTAs expire at

various times beginning in 2011 through 2017. If we are unable to

maintain our relationships with our major commercial aerospace customers,

including Boeing, Rolls-Royce, Safran, UTC and Wyman-Gordon, under the LTAs we

have with these customers, our sales could decrease substantially, negatively

impacting our profitability. See “Business – Customer agreements” and

“Business - Markets and

customer base.”

Global economic

conditions may affect pricing and demand for our products which could lead to

reduced revenues and profitability. Pricing and demand for our

products are affected by a number of factors, including changes in demand for

our customer’s products, changes in general economic conditions, availability of

credit, changes in market demand, lower overall pricing due to overcapacity,

lower priced imports and increases in the use of substitute

materials. The recent global economic downturn could continue, which

could lead to further reductions in demand for our products and our customers’

products, excess inventory within the titanium supply chain and excess capacity

throughout the industry, including our manufacturing

locations. Furthermore, reductions in credit generally available in

the financial markets could have adverse impacts to the industry including our

business. In addition to the impact that global economic conditions

have already had on our business, if these conditions persist or worsen, our

financial condition and results of operations may be further

impacted.

The titanium

metals industry is highly competitive, and we may not be able to compete

successfully. The global titanium markets in which we operate

are highly competitive. Competition is based on a number of factors,

such as price, product quality and service. Some of our competitors

may be able to drive down market prices because their costs are lower than our

costs. In addition, some of our competitors' financial, technological

and other resources may be greater than our resources, and such competitors may

be better able to withstand changes in market conditions. Our

competitors may be able to respond more quickly than we can to new or emerging

technologies and changes in customer requirements. Further,

consolidation of our competitors or customers in any of the industries in which

we compete may result in reduced demand for our products. In

addition, producers of metal products, such as steel and aluminum, maintain

forging, rolling and finishing facilities. Such facilities could be

used or modified to process titanium mill products, which could lead to

increased competition and decreased pricing for our titanium

products. In addition, many factors, including excess capacity

resulting from reduced demand in the titanium industry, work to intensify the

price competition for available business at low points in the business

cycle.

Our dependence

upon certain critical raw materials that are subject to price and availability

fluctuations could lead to increased costs or delays in the manufacture and sale

of our products. We rely on a limited number of suppliers

around the world, and principally on those located in Australia and South

Africa, for our supply of titanium-containing rutile ore, one of the primary raw

materials used in the production of titanium sponge. While chlorine,

another of the primary raw materials used in the production of titanium sponge,

is generally widely available, we currently obtain our chlorine from a single

supplier near our sponge plant in Henderson. Also, we cannot supply

all our needs for all grades of titanium sponge and scrap internally and are

therefore dependent on third parties for a substantial portion of our raw

material requirements. All of our major competitors utilize sponge

and scrap as raw materials in their melt operations. Titanium scrap

is also used in certain steel-making operations, and demand for these steel

products, especially from China, also influences demand for titanium

scrap. Purchase prices and availability of these critical materials

are subject to volatility. At any given time, we may be unable to

obtain an adequate supply of these critical materials on a timely basis, on

price and other terms acceptable to us, or at all. To help stabilize

our supply of titanium sponge, we have entered into LTAs with certain sponge

suppliers that contain fixed annual supply obligations. These LTAs

contain minimum annual purchase requirements and, in certain cases, include

take-or-pay provisions which require us to pay penalties if we do not meet the

minimum annual purchase requirements. See “Business – Products and Operations –

Raw materials,”

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations – Liquidity and Capital Resources – Contractual commitments” and

Note 15 to the Consolidated Financial Statements.

Although

overall inflationary trends in recent years have been moderate, during the same

period certain critical raw material costs in our industry, including titanium

sponge and scrap, have been volatile. While we are able to mitigate

some of the adverse impact of fluctuating raw material costs through LTAs with

suppliers and customers, rapid increases in raw material costs may adversely

affect our results of operations.

We may be forced

to decrease prices. We change prices on certain of our

products from time-to-time. Prices for our products are dependent on

market conditions, economic factors, raw material costs and availability,

competitive factors, operating costs and other factors, some of which are beyond

our control. These factors may force us to reduce the prices we

charge our customers. In some instances, we may realize cost savings

in connection with the price reductions, but the cost savings may lag behind due

to long manufacturing lead times and the terms of existing

contracts. Pricing under our LTAs, which were designed to limit

selling price volatility to our customers and us, are generally revised on an

annual basis. These factors have had, and may have, an adverse impact

on our revenues, operating results and financial condition.

Our failure to

develop new markets would result in our continued dependence on the cyclical

commercial aerospace sector, and our operating results would, accordingly,

remain cyclical. In an effort to reduce dependence on the

commercial aerospace market and to increase participation in other markets, we

have devoted certain resources to developing new markets and applications for

our products. Developing these emerging market applications involves

substantial risk and uncertainties due to the fact that titanium must compete

with less expensive alternative materials in these potential markets or

applications. We may not be successful in developing new markets or

applications for our products, significant time may be required for such

development and uncertainty exists as to the extent to which we will face

competition in this regard.

Because we are

subject to environmental and worker safety laws and regulations, we may be

required to remediate the environmental effects of our operations or take steps

to modify our operations to comply with these laws and regulations, which could

reduce our profitability. Various federal, state, local and

foreign environmental and worker safety laws and regulations govern our

operations. Throughout the history of our operations, we have used

and manufactured, and currently use and manufacture, substantial quantities of

substances that are considered hazardous, extremely hazardous or toxic under

environmental and worker safety and health laws and

regulations. Although we have substantial controls and procedures

designed to reduce the risk of environmental, health and safety issues, we could

incur substantial cleanup costs, fines and civil or criminal sanctions, third

party property damage or personal injury claims as a result of violations or

liabilities under these laws or non-compliance with environmental permits

required at our facilities. In addition, government environmental

requirements or the enforcement thereof may become more stringent in the

future. Some or all of these risks may result in liabilities that

could reduce our profitability.

Reductions in, or

the complete elimination of, any or all tariffs on imported titanium products

into the United States could lead to increased imports of foreign sponge, ingot,

slab and mill products into the U.S. and an increase in the amount of such

products on the market generally, which could decrease pricing for our

products. In the U.S. titanium market, the increasing presence

of foreign participants has become a significant competitive

factor. Until 1993, imports of foreign titanium products into the

U.S. had not been significant. This was primarily attributable to

relative currency exchange rates and, with respect to Japan, Russia, Kazakhstan

and Ukraine, import duties (including antidumping duties). However,

since 1993, imports of titanium sponge, ingot and mill products, principally

from Russia and Kazakhstan, have increased and have had a significant

competitive impact on the U.S. titanium industry.

Generally,

imports of titanium products into the U.S. are subject to a 15% “normal trade

relations” tariff. For tariff purposes, titanium products are broadly

classified as either wrought (billet, bar, sheet, strip, plate and tubing) or

unwrought (sponge, ingot and slab). From time-to-time, the U.S.

government has granted preferential trade status to certain titanium products