| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

| FORM 8-K |

| CURRENT REPORT Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

| Date of Report (Date of earliest event reported) | April 30, 2009 | |||

| QUADRA PROJECTS INC. | ||||

| (Exact name of registrant as specified in its charter) | ||||

| Nevada | 000-53156 | 45-0588917 | ||

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer | ||

| incorporation) | Identification No.) | |||

| 6130 Elton Avenue, Las Vegas, NV | 89107 | |||

| (Address of principal executive offices) | (Zip Code) | |||

| Registrant’s telephone number, including area code | 1-888-597-8899 | |||

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the

registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

| FORWARD LOOKING STATEMENTS |

This current report contains forward-looking statements as that term is defined in section 27A of the United States Securities Act of 1933, as amended, and section 21E of the United States Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "intends", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential", or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" on page 24 of this current report, which may cause our or our industry's actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common shares" refer to the common shares in our capital stock.

As used in this current report, the terms “we”, “us”, “our” and the “Company” refer to Quadra Projects Inc. and our wholly-owned subsidiary Quadra Energy Systems Inc.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

As previously disclosed on our Current Report on Form 8-K filed on May 5, 2009, on April 30, 2009, we completed the acquisition of Energy Conversion and Waste Disposal Technology (“Acquired Technologies”) from Quadra Marketing Corp., (“Quadra Marketing”), a company incorporated in Belize, under the Technology Purchase Agreement (the “Agreement”). The Agreement was an arms length transaction. Quadra Marketing acquired the rights to the Energy Conversion and Waste Disposal Technology from the inventor on April 1, 2009.

Acquired Technologies consist of equipment and software for pyrolysis systems consisting of QES 2000S and QES Mobile Systems (the “QES Systems”) which is a non polluting energy conversion and waste disposal system designed to convert organic waste to fuel and valuable by-products such as activated carbon, fertilizer, producing no measurable air pollution or ash to be land filled. The QES Systems are modular in design and fit into a 42 ft container.

The primary applications of the QES Systems consist of converting waste streams into valuable commodities. Depending on which technology we apply and to which feedstock we process, the commodities produced include fuel-gases, diesel fuel, carbon black, thermal energy and electricity. The QES Systems are designed to handle commonly generated waste stream, whether liquid, solid, mixed or unmixed (including whole tires, all types of plastics, e-waste, shredder residues, sewage sludge, animal wastes, biomass, ligneous and infectious biohazard medical waste) and represent an environmentally friendly and commercially viable alternative to traditional methods of processing waste. The solutions are commercially viable ecological recycling models based on the zero-waste philosophy.

| DESCRIPTION OF BUSINESS |

| History |

Our company was incorporated in the State of Nevada on June 7, 2007. From incorporation until 2009 we were a distributor of an electronic non-invasive acupuncture pen (the “Pen”) as an alternative to traditional needles used during acupuncture treatments. We had a distribution agreement which granted to us the right to market and sell the Pen on an exclusive basis throughout Asia (with the exception of China), the Middle East and the Caribbean. We obtained our distribution rights through United Overseas Products Pty., Ltd. (“United”), a company based in Taiwan. We entered into this distribution agreement on November 30, 2007 for a period of 10 years and had ancillary rights to the patent held in China through United. Operations were based in Taiwan, commencing June 2007. We did not generate revenues from appointed sub distributions and minimum quotas were not fulfilled. Upon further market research, it was determined that pursuing the marketing and sale of this product was not as profitable as previously projected. Therefore, all efforts relating to the distribution and marketing of the Pen were ceased.

Effective February 17, 2009, we effected a five (5) for one (1) forward stock split of our authorized and issued and outstanding common stock. As a result, our authorized capital increased from 75,000,000 shares of common stock with a par value of $0.001 to 375,000,000 shares of common stock with a par value of $0.001 and our issued and outstanding shares increased from 3,050,000 shares of common stock to 15,250,000 shares of common stock.

Effective April 16, 2009, we effected a two (2) for one (1) forward stock split of our authorized and issued and outstanding common stock. As a result, our authorized capital increased from 375,000,000 shares of common stock with a par value of $0.001 to 750,000,000 shares of common stock with a par value of $0.001 and our issued and outstanding shares increased from 15,250,000 shares of common stock to 30,500,000 shares of common stock.

Effective September 17, 2009, we filed a Certificate of Amendment with the Secretary of State of Nevada for the creation of 750,000,000 shares of preferred stock, par value of $0.001, for which the directors of the company may fix and determine the designations, rights preferences or other variations of each class or series within each class of preferred stock of the company.

Our board of directors approved the amendment to our articles of incorporation and stockholders representing a majority of the outstanding shares of our corporation gave us their written consent to the amendment to our Articles of Incorporation on July 23, 2009.

On November 2, 2009, the Company filed a Certificate of Designation that pursuant to the authority granted to and vested

- 2 -

in the Board in accordance with the provisions of the Certificate of Incorporation, as amended and restated, created a Series A Preferred Stock, $0.001 par value, with a maximum of 20,000,000 shares authorized of the 750,000,000 Preferred Shares Authorized, which series shall have certain designations and number thereof, powers, preferences, rights, qualifications, limitations and restrictions, in particular, it shall have the following voting rights:

Each share of Series A Preferred Stock shall entitle the holder to One Hundred (100) votes for each share of Series A Preferred Stock. In any vote or action of the holders of the Series A Preferred Stock voting together as a separate class required by law, each share of issued and outstanding Series A Preferred Stock shall entitle the holder thereof to One Hundred (100) vote per share. The holders of Series A Preferred Stock shall vote together with the shares of Common Stock as one class. The holders of the Series A Preferred Stock shall share ratably, with the holders of common stock, in any dividends that may, from time to time may be declared by the board of directors. Series A Preferred Stock are not convertible into common stock. The holders of the Series A Preferred Stock shall rank equally with the holders of common stock in respect of all rights in liquidation, dissolution or winding up with all of said assets being distributed among the holders of the Series A Preferred Stock and other classes of stock ranking equally with the Series A Preferred Stock.

We have not been involved in any bankruptcy, receivership or similar proceeding.

Effective April 30, 2009, we completed the acquisition of our wholly-owned subsidiary, Quadra Energy Systems Inc. (“Energy Systems”). Energy Systems was incorporated under the laws of Belize and prior to our acquisition, had no prior operating history with no assets, liabilities or equity. Energy Systems has an authorized capital of 50,000 common shares, and all of the issued and outstanding share capital, consisting of 5,000 shares was acquired by us for consideration of $5,000.

On April 30, 2009, Energy Systems completed its acquisition of Energy Conversion and Waste Disposal Technology (“Acquired Technologies”) from Quadra Marketing Corp., (“Quadra Marketing”), a company incorporated in Belize, under the Technology Purchase Agreement (the “Agreement”). The Agreement was an arms length transaction. Quadra Marketing acquired the rights to the Energy Conversion and Waste Disposal Technology from the inventor on April 1, 2009.

Acquired Technologies consist of equipment and software for pyrolysis systems consisting of QES 2000S and QES Mobile Systems (the “QES Systems”) which is a non polluting energy conversion and waste disposal system designed to convert organic waste to fuel and valuable by-products such as activated carbon, fertilizer, producing no measurable air pollution or ash to be land filled. The QES Systems are modular in design and fit into a 42 ft container.

The primary applications of the QES Systems consist of converting waste streams into valuable commodities. Depending on which technology we apply and to which feedstock we process, the commodities produced include fuel-gases, diesel fuel, carbon black, thermal energy and electricity. The QES Systems are designed to handle commonly generated waste stream, whether liquid, solid, mixed or unmixed (including whole tires, all types of plastics, e-waste, shredder residues, sewage sludge, animal wastes, biomass, ligneous and infectious biohazard medical waste) and represent an environmentally friendly and commercially viable alternative to traditional methods of processing waste. The solutions are commercially viable ecological recycling models based on the zero-waste philosophy.

The technology being brought into commercial production is currently being independently tested. We have engaged the inventor of the Acquired Technology and a supporting technical team to construct QES Systems. The inventor and technical team have previously built a commercially successful tire conversion plant in Taiwan, which has been operational for more than 3 years. We have a labor contract with the inventor. The term is for a period of 5 years commencing July 1, 2009. The inventor is entitled to a monthly consulting fee in addition to a commission on sales of the QES System in China and Taiwan. The QES System is able to integrate the combined use of steam together with a second stage gasification process into the conventional pyrolysis process, thereby overcoming the deficiencies of the earlier pyrolysis processes.

| Our Current Business |

With the completion of the Technology Purchase Agreement to acquire Energy Conversion and Waste Disposal Technology, we changed our business to the business of marketing the QES System through joint ventures with qualified interests in establishing joint ventures and establishing waste conversion operations.

Our objective is to utilize the market of converting material generally recognized as having little or no value and which are or have been in the past, treated as waste and improperly discharged, discarded or dumped in landfills to saleable products.

- 3 -

By offering an efficient, non-polluting, high quality and comparatively low cost pyrolytic and gasification system to treat the waste as feedstock, the QES System will convert the waste materials into marketable by-products or valuable energy sources - a relatively low cost solution for remediation of environmental problems worldwide.

| Principal Products, Services and Their Markets |

Effective April 30, 2009, Energy Systems completed its acquisition of the Acquired Technologies from Quadra Marketing under the Agreement.

Quadra Marketing transferred to Energy Systems all right, title and interest in and to the Acquired Technologies, along with engineering and design drawings, studies and reports and all information relating to the Acquired Technologies, whether written or oral, and related technologies including the past, present and future versions software, computer programs, data and text (regardless of form including but not limited to the source code version thereof and the batch processor logic module) and all patent rights, copyrights, trade secret rights and other proprietary rights in and thereto, including all documentation for the software, all technical documentation, system designs and specifications, flow charts, record and file layouts, memoranda, correspondence and other such documentation containing or relating to the design, structure or coding or testing of, or algorithms or routines used in, or errors discovered or corrected in, the software and any other type of information or material relating to the software and invention and related technology that was prepared by or for the inventor of the Acquired Technologies.

Quadra Marketing acquired the rights to the Energy Conversion and Waste Disposal Technology from the inventor of such technologies on April 1, 2009. We have engaged the services of the inventor for sourcing the necessary components for construction of the QES Systems of which such components will be assembled by the inventor and technical staff. Our QES System and related technologies are patented in Taiwan under Patent No 285138, with pending patents No. 2006 10066751.9 and No. 2006 10072434.8 in the Peoples Republic of China and pending US patents No. 2007/0231073A1 and No. 2007/0231224A1. Patent application number 11/727,803 filed with the United States Patent Trademark Office for a reaction furnace utilizing high temperature steam and a re-circulated heat source to crack dioxin and organic substances contained in waste, being the basis of the our proprietary technology, has been granted by the United States Patent and Trademark Office effective the 15th day of December 2009 under patent number 7,632,471.

The Agreement provides that the use of the QES System and Acquired Technologies under Patent No. 285138 in Taiwan shall be operated through a Taiwanese Corporation with 40% ownership being allocated to the inventor and the remaining 60% retained by Energy Systems.

For consideration of our acquisition of the Acquired Technologies, we agreed to remit 10% of gross sales generated from use of the Acquired Technologies and 10% of the net proceeds of sales of the QES Systems to Quadra Marketing.

Our objective is to utilize the market of converting material generally recognized as having little or no value and which are or have been in the past, treated as waste and improperly discharged, discarded or dumped in landfills to saleable products. By offering an efficient, non-polluting, high quality and comparatively low cost pyrolytic and gasification system to treat the waste as feedstock, the QES System will convert the waste materials into marketable by-products or valuable energy sources - a relatively low cost solution for remediation of environmental problems worldwide.

Two important environmental issues are global warming and shortages of available clean affordable fuel. Carbon dioxide (“CO2”) emissions are one of the major causes of global warming. Concerns about this global problem and the search for solutions to address the issue of reducing CO2 emissions are universal. Most CO2 emissions are emitted from automotive and transportation vehicles including ships, trains and airplanes. A second major source of CO2 emissions is emitted from incinerators and coal-fired power generators. Therefore the production of affordable clean renewable energies has become a primary concern and currently is a key focus for new and innovative technologies. Another major concern is the development of new sources of clean and affordable energy resources. Pyrolysis technologies are not only sources of renewable energy but also significantly reduce CO2 emissions that are emitted by incinerators.

Heavily populated areas face the problem of disposal of Municipal Solid Waste (“MSW”). In many cases incinerators are used in addition to land fill sites, which require a great deal of preparation. Both methods are costly and have significant negative effects on the environment. The QES System has the ability to dispose of the MSW efficiently with no measurable pollution in addition to creating a secondary source of revenue. Present methods of handling and disposing of a wide variety of waste material, without having negative effects on the environment, is a major challenge.

- 4 -

The QES System has the ability to efficiently dispose of the accumulations of waste products which range from electronic waste, to used tires, municipal waste and hospital waste among the most common types of waste materials.

The pyrolysis process combines direct and indirect steam heat in two stages and this ensures complete penetration and decomposition of organic waste as part of the conversion to marketable by-products.

Part of the decomposition process involves gasification which eliminates contamination and the possibility of polluting residues. Our current pyrolysis technology can also improve the efficiency of coal-fired plants by incorporating the use of gas fired turbines which have a much higher efficiency rating than the steam turbines currently in use in old coal fired plants.

| QES products specification: |

There are two product models based on the QES System technologies. One is the QES2000 which is a full integration modular system and factory based. Installation of a loading and unloading machine and additional equipment in plant operations is required. The second is the QES2000M which is a mobile system.

The QES System has four applications for treatment of waste: tires, plastics, MSW and hospital waste.

| The following is the application range of the QES System: |

- Waste tires or rubber

- Waste plastic

- Agriculture waste

- MSW

- Hospital waste

- Oil sludge, organic sludge

- Carbon black modification

- Petroleum waste

- Electronic waste

- Organic waste

The QES System is able to accommodate all or a single application. The QES System may require additional equipment, depending on the application. We have the ability to provide all additional equipment necessary for all applications.

| How the System Works Pyrolysis technologies: |

Pyrolysis is most commonly used for organic materials. It does not involve reactions with oxygen or any other reagents but can take place in their presence. Extreme pyrolysis, which leaves only carbon as the residue, is called carbonization and is also related to the chemical process of charring.

Pyrolysis is heavily used in the chemical industry, for example, to produce charcoal, activated carbon, methyl alcohol and other chemicals from wood to convert ethylene dichloride into vinyl chloride to make PVC, to produce coke fuel from coal, to convert biomass into synthetic gas, to turn waste into safely disposable substances, and for the cracking of medium-weight hydrocarbons from petroleum into smaller molecules to produce lighter forms like gasoline.

There are two kinds of pyrolysis technologies classified by heat source.

| Direct-Heat Pyrolysis |

This method allows the heat source to make direct contact with the feedstock material. It has the advantage of being the most efficient method of thermal conductivity. Examples of Direct-Heat Pyrolysis systems are; steam pyrolysis systems, nitrogen or argon gas pyrolysis systems. Both steam and gas pyrolysis heat the feedstock material completely thereby decomposing the hydrocarbons. The disadvantage of the Direct-Heat Pyrolysis method is that it requires the consumption of a large amount of energy.

- 5 -

| Indirect-Heat Pyrolysis |

In the Indirect-Heat Pyrolysis method the feedstock material does not make direct contact with the heat source. The material is loaded in a vacuum chamber isolated from air. Then a heat source is applied to heat the chamber. The heat source can be a burner or heat wire.

Indirect-Heat Pyroloysis has a low thermal conductive efficiency because no contact is made with the surface of the feedstock material. To improve efficiency, Catalyst Pyrolysis has been developed. It uses a catalyst to bring the heat in contact with the feedstock material. If more than one catalyst is used the greater the heat contact is made with the surface of the feedstock material and the efficiency is thereby increased. Another method is break down the feedstock material into the small pieces or to grind the feedstock into powder where the feedstock material will react instantly. This technology is called Fast Pyrolysis. No matter how the contact surface of the feedstock material is increased, the heat will always be applied from the surface to the interior of the feedstock material. When heat makes contact with the surface of the feedstock material, it will form a hard shell preventing the heat from penetrating to the interior of the feedstock material resulting in incomplete de-composition of the organic compounds.

| Gasification Technologies: |

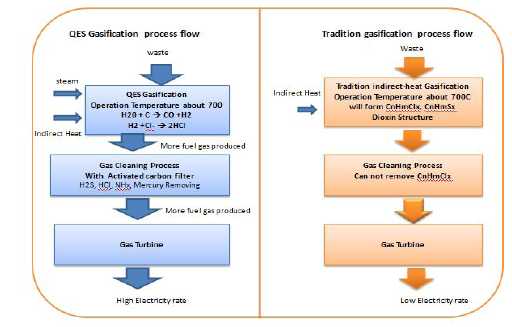

The difference between gasification and pyrolysis processes is the operating temperature and the by-product produced. Gasification operates at higher temperature greater than 600oC. Above this temperature, hydrocarbons will only decompose to fuel gas. Gasification is suitable for converting large amounts of organic waste to fuel gas which is then connected to a gas turbine to generate electricity. Normally the scale of a plant incorporating this technology has the capacity to process 350 tons per day of MSW. Gasification provides a more efficient method of processing MSW compared than existing incinerators and coal fired power plants. It also offers an alternative to incinerators. This process is called “Waste-To-Electricity”.

| QES Technologies: |

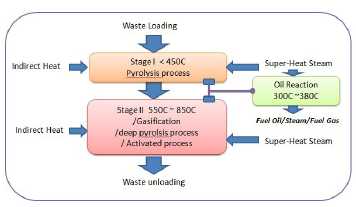

The QES System is a proprietary system which combines the Steam Direct-Heat Pyrolysis and Indirect-Heat Pyrolysis technologies and further incorporates a unique two stage pyrolysis and gasification process into one system.

| In pyrolysis mode: |

We believe that QES System offers a more efficient system than other indirect pyrolysis systems. Further, the QES System has developed a standard system for waste management and production of quality carbon black.

| In gasification mode: |

QES can also operate as a gasification system whereby the system operates at a higher temperature turning all of feedstock into syngas, a form of synthetic gas consisting of various amounts of carbon monoxide, carbon dioxide and hydrogen. To accomplish this, modification of the GASTEC unit, a fuel gas cleaning system and multi-stage condenser and includes a gas cleaner to remove hydrochloric acid, hydrogen sulfide, dust, NHx, and mercury; is required so that it can process a higher volume of gas. When the QES System is used as a gasification system for processing MSW, we recommend that the scale of MSW processed should be in excess of 350 tons per day to be economical. The syngas produced will then be connected to a gas turbine and used as fuel to create electricity.

- 6 -

QES two stage process technology for the purpose of treating the broadest types of waste:

Traditional pyrolysis technology is a one stage process. It is designed and engineered to handle only one kind of uniform organic material during the same process. Also, the thermal conditions will vary based on what type of feedstock material is used; otherwise the feedstock material cannot be decomposed properly. The carbon residue will contain an organic composition. These byproducts are not marketable. As a result, most pyrolysis systems can only process one type of feed stock material. Mixed or varied feedstock materials cannot be processed. For application in the waste management field where there are a variety of waste materials in an unpredictable composition, a one stage process cannot be accommodated. The QES System can process mixed feedstock material based on its two stage pyrolysis technology.

The first stage acts as a pyrolysis mode. It converts most of the organic composition to fuel oil at the critical cracking stage. To obtain the greatest amount of fuel oil is the most important function in this stage. The second stage simulates gasification, deep pyrolysis, carbon activated, and fuel gas synthesis system. The purpose of the second stage is to decompose the residue of organic compounds remaining after completion of the pyrolysis mode and convert it to fuel gas.

Energy efficiency by Steam with indirect thermal pyrolysis technologies:

As mentioned above, traditional pyrolysis technology uses the application of indirect heat to a thermal reaction chamber. Because the thermal conductive surface is small, significantly more time and energy is required to decompose the organic compounds resulting in low efficiency. Another problem is created when heat is applied to the surface of the feedstock material. When heat contacts the surface of the feedstock material, it forms a crust which restricts penetration of the heat to the interior of the feedstock material, resulting in an incomplete decomposition of the organic compounds. The carbon residue will also contain remnants of the organic compounds and becomes a secondary waste.

To solve this problem, the QES System uses steam as the main heat source to directly heat the material. Steam is used to penetrate the feedstock material into the interior in order to decompose the organic compounds. To generate the steam heat source requires more energy however the QES System uses a energy recovery technology to generate the steam required by using the fuel gas generated from the pyrolysis process which creates an indirect heating chamber by the use of the same waste heat source. The reaction chamber is supported by steam and indirect heat at the same time. This process increases the efficiency of energy use. When the pyrolysis system commences to generate fuel gas, enough fuel gas is produced to support the heat source for the system without the need for any external energy source. This creates significant energy cost savings which are not available in competitive systems.

Quality of by-products:

As mentioned above, the traditional pyrolysis system cannot completely decompose organic compounds leaving carbon residue which is flammable. As a result these by-products cannot be sold on the market. It is one of the biggest problems in a tire pyrolysis plant. The QES System with thermal indirect heat technology overcomes this problem with steam penetration. Further, the gasification phase of the QES system eliminates the remaining carbon residue left after the pyrolysis phase by converting it into fuel gas enabling complete decomposition of the feedstock. Further, a higher volume of fuel gas is able to be generated through the reaction of steam with the carbon. The quality of carbon residue can be adjusted by the QES System to produce a variety of carbon by-products ranging from high quality carbon black N220 to activated carbon.

System Safety

There are two conditions necessary in a pyrolysis system. The first is a vacuum condition. During this phase, the organic compounds will decompose to fuel oil and fuel gas. This fuel gas is rich in hydrogen. It is dangerous if contact is made with air and is the major reason why explosions can occur at most pyrolysis plants. The second condition is a high pressure

- 7 -

phase. The higher the pressure, the higher the conversion rate, however, the high pressure creates instability in the system and can be explosive.

In an Indirect Heat pyrolysis system, carbon dust is mixed with oil (called “tar”) vapors. These tar vapors while passing through the pipe to the condenser, stick to the pipe as tar. The tar may eventually plug the pipe and since tar contains sulfur it can corrode the pipe creating leaks causing the explosive fuel gas to leak. This is the most common reason for explosions in traditional pyrolysis systems plants. To prevent such events, the QES System uses steam as protection. The steam reacts with the carbon dust to generate more fuel gas and reduces the tar produced. Also, the steam cleans the pipes to prevent corrosion and forms a protective shell to protect the fuel gas from making contact with the air even if it is leaking. The steam provides protection by preventing the fuel from igniting.

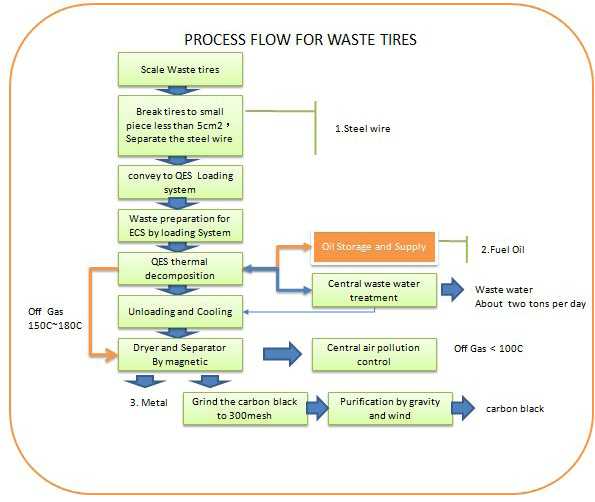

| QES SYSTEM APPLICATIONS: QES System application for waste tire treatment: |

Waste tires are a dominant market for the pyrolysis system. The QES System can produce marketable high quality byproducts from waste tire treatment. These included a high quality carbon black as well as fuel oil.

The QES System for waste tire treatment plant will require additional equipment as suggested in the following flow chart:

The expected percentage rate of the by-products generated is as follows:

- Steel wire : 8~12% depend on the type of tires

- 8 -

- Fuel Oil: 40% ~ 50%, depending on the flash point

- Low quality Carbon black: 5% ~10%

- High quality carbon black: 20% ~ 35%

| The additional equipment required is as follows: |

| 1) Weigh Bridge 2) Breaker and cutting system with steel wire separator 3) Belt Conveyor 4) Loading machine 5) Unloading machine 6) Dryer and magnetic separator 7) Grinder with cyclone selector and bag filter 8) Central Bag filter 9) Waste water treatment system 10) Oil storage tank with oil filter 11) Central control and monitor system |

| QES application of waste plastic: |

Plastic is a rich hydrocarbon product, the only concern is that it may contain Polyvinyl Chloride (“PVC”). Waste plastic material containing PVCs are traditionaly treated by steam pyrolysis in the chemical industry.

The QES System uses a similar method to process waste plastic containing PVCs. During the pyrolysis process the PVCs produce a large amount of Hydrolchloric acid (“HCl)”. It is recommended that PVCs not be processed alone, but rather that PVCs be blended with other waste materials such as used tires because PVCs contain large amounts of chlorine. To remove the chlorine content, the QES System adds a catalyst to prevent the fuel oil combining with the chlorine. In the processing of plastics, the only significant by-product is fuel oil with less than 2% of carbon produced, depending on plastic type. The yield rate of fuel oil is about 30% ~ 70% depending on the plastic type.

The following is a flow chart for the processing of plastic waste.

- 9 -

- 10 -

| The following additional equipment is required: |

| 1) Weigh Bridge 2) Cutting machine 3) Belt Conveyor 4) Loading machine 5) Unloading machine 6) Central Bag filter 7) Waste water treatment system 8) Oil storage tank with oil filter 9) Central control and monitor system |

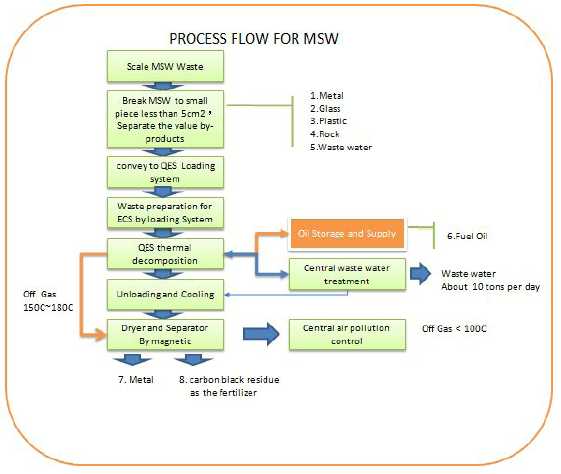

| QES application on the MSW waste: |

MSW is a major problem however it can also be an energy source. Currently, most MSW is land filled or sent to an incinerator for burning. Both the landfill and incinerator solutions cause significant environmental problems such as air and land pollution. Significant amounts of toxic materials are buried under ground including the waste generated from an incinerator.

MSW is a mixed waste containing various composites to be treated and as a result is not suitable for traditional pyrolysis technologies. The only alternative method is to gasify the MSW waste. The QES System offers this method for processing MSW by incorporating pyrolysis technology with gasification in its two stage process.

The QES System, unlike a gasification system does not only convert hydrocarbons to fuel gas solely. The first priority of the QES System is to produce fuel oil, then fuel gas. The QES System can also be used as gasification system by adjusting the processing temperature for Waste to Electricity Processes. However this process is not a cost effective use of the QES System as the cost of generating fuel oil for the gas turbine to generate electricity is in excess of the cost of the QES System itself. Further, the electricity may not be a readily marketable product as it must connect with a transmission network and is also subject to various regulatory approvals.

- 11 -

The following is a flow chart for processing MSW waste.

| The following additional equipment is required: |

| 1) | Weigh Bridge |

| 2) | Cutting machine |

| 3) | Belt Conveyor |

| 4) | Loading machine |

| 5) | Unloading machine |

| 6) | Dryer and Separator system |

| 7) | Central gas cleaning system |

| 8) | Waste water treatment system |

| 9) | Oil storage tank with oil filter |

| 10) | Central control and monitor system |

- 12 -

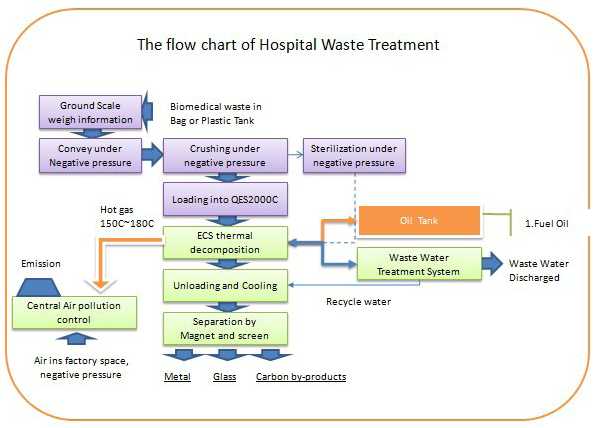

| QES application for hospital waste: |

The term hospital waste covers a wide spectrum and is hazardous in that it has the potential to cause the spread of disease. The highest priority for the remediation of hospital waste is to eliminate the potential of infectious disease. The best method to treat, purify and destroy the bacteria contained in the hospital waste is with the use of high temperatures. Currently, the method used by most countries for treatment of hospital waste is by incineration. However, a significant drawback to incineration is the production of dioxins, a carcinogenic agent. The technology employed by the QES System is called “heat disintegration method”.

During the handling of hospital waste, the concern for the safety of the operator is paramount. Preventing operators from coming into direct contact with any pathogens and the contamination of the environment by the hospital waste is a principal concern. Therefore it is important that an enclosed environment be maintained for hospital waste during transport and handling.

The QES System application for hospital waste can process the following materials:

- General business waste

- Compound containing silver from silver recovery

- Used X-ray film

- Non-contagious waste after sterilization

- PET film (D-2201)

- Film fiber containing acetic acid (D-2202)

- Organic waste

- Mixed film (D-2299)

- Plastic, glass, paper, metal etc.

- Resource recycling products

The following items cannot be handled by the QES System, and need to be properly and separately treated:

- Liquid chemicals, saline etc.

- Spent film developer

- Waste that is radioactive or containing radioactive ingredients

- Liquid waste or sewage

- 13 -

The QES System for Hospital Waste Treatment illustrated below is based on no required sorting and assumes all hospital waste is sealed prior to treatment. The flow chart illustrated herein is based on the standard Regulations and needs to be reviewed in every jurisdiction so as to ensure the system meets the regulatory requirements prevailing in each country.

Additional equipment required for hospital waste application of the QES System is as follows:

| 1) | Weigh Bridge |

| 2) | Vertical Conveyor |

| 3) | Loading system with Breaker machine and sterilization function |

| 4) | Unloading machine |

| 5) | Conveyor, and separation system with magnetic separator |

| 6) | Central gas cleaning system |

| 7) | Waste water treatment system |

| 8) | Oil storage tank with oil filter |

| 9) | Central control and monitor system |

| Pollution control for hospital waste: |

When processing hospital waste, the QES System has a three stage process to prevent any possible air pollution by dioxins, or other toxic gases. The first stage is the pyrolytic process to decompose the organic compounds including dioxins to a fuel gas molecule. The second stage is to remove any toxic material such as hydrogen sulfide, hydrochloric acid, mercury, and any metal by the gas cleaning system and subsequently by an activated carbon fiber filter (HEPA). This generates a clean fuel gas similar to liquefied petroleum gas. The third stage is to generate a hot zone as a system heat source by the use of the clean fuel gas at a temperature over 1200 ºC. This will destroy any possible remaining pathogens, dioxins or organic compounds. We believe that incorporating this three stage process makes the QES System environmentally friendly. To guarantee the system meets the regulations and standards of each country, the installation of additional systems such as, wastewater treatment system and a central air pollution control system are recommended.

The central air pollution control system is designed for air cleaning and carbon dust filtering. It can also extract the air in

- 14 -

the interior of the plant to form a negative pressure so as to eliminate the possibility of air leaks. It also absorbs the vapor and carbon dust to prevent them from being emitted into the atmosphere. The system also has a sterilization system to kill microbes in the plant. The water treatment system is designed to re-treat the waste water to meet the standard draining regulations. The QES System is designed to recycle a substantial amount of water so as to reduce the waste water discharge. The amount of waste water generated depends on the chlorine content.

| QES application for gasification: |

Traditional incinerator plants have been the standard solution to generate electricity. They convert heat to steam, and then use the steam to push a steam turbine to generate electrical power. However, as mentioned earlier, traditional incinerators cause major pollution problems, such as emission of dioxins, air pollution, fly-ash, bottom ash pollution, and CO2 emissions. The new generation of Waste-To-Electricity uses gasification technologies and is designed to replace the incinerator.

When the QES System is used as a gasification system for processing MSW, we recommend that the scale of MSW processed should be in excess of 350 tons per day to be economical. QES can operate as a gasification system whereby the system operates at a higher temperature turning all of feedstock into syngas, a form of synthetic gas consisting of various amounts of carbon monoxide, carbon dioxide and hydrogen. To accomplish this, modification of the GASTEC unit, a fuel gas cleaning system and multi-stage condenser and includes a gas cleaner to remove hydrochloric acid, hydrogen sulfide, dust, NHx, and mercury; is required so that it can process a higher volume of gas. The syngas produced will then be connected to a gas turbine and used as fuel to create electricity.

| The benefits of a gas turbine are: |

- Lower CO2 emissions than an incinerator with higher power generator capabilities

- Free of Dioxins

- Residue of carbon residue can be re-used.

Markets

Joint Ventures

It is our intention to market the QES System through joint ventures with qualified interests in establishing joint ventures and establishing waste conversion operations.

- 15 -

| Renewable Energy Capital LLC |

We are currently in ongoing negotiations to enter into a joint venture with Renewable Energy Capital LLC, a company involved in solar energy installations and an undisclosed supplier of tires, to establish a Waste Tire Conversion Plant. No assurance can be provided that the joint venture will be completed on terms acceptable to our company or will be completed at all.

| Canda Green Industry Inc. |

On December 14, 2009, we signed a Memorandum of Understanding (“MOU”) to enter into a joint venture agreement with Canda Green Industry Inc. ("Canda"), a Chinese real estate development company that has been appointed to develop a large high technology park in the Dalian-Jinzhou District of Liaoning Province to service ecological and environmental industries. The purpose of the proposed joint venture is to establish a plant in China for the assembly of the QES System which will be utilized to process primarily MSW and used tires in the scientific park and elsewhere in China.

Canda is a Chinese real estate development company and is also principals of the Jinda Group involved in industries ranging from real estate development, manufacturing of wood products, electronics, restaurant and hotel operations to sand blasting etc.

We are further negotiating with Canda to determine what documentation and projections are required so that Canda can finalize financing for the joint venture's proposed assembly of MSW and waste tire conversion plant in China. We are currently preparing a MOU to cover these proposed arrangements. No assurance can be provided that the joint venture will be completed on terms acceptable to our company or will be completed at all.

| Bio Earth Inc. |

On December 30, 2009, we entered into a Letter of Intent with Bio Earth Inc. ("Bio Earth") to jointly market quality carbon black produced by our joint venture operations in Malaysia and Indonesia. In particular, Bio Earth has a relationship with the Government of Bangladesh which is one of the prospective purchasers. Bio Earth also has end user customers for carbon black in Australia and other countries in South East Asia. The Letter of Intent calls for the purchasing of all of the carbon black produced from the processing of palm husks from our joint venture operations in Malaysia and Indonesia.

The Letter of Intent further provides for an equal division of profits from the joint marketing efforts equal to the difference of the purchase price paid for the carbon black and the selling price to end users of the product in South East Asia.

Representatives of Bio Earth have recently met with government officials of Bangladesh to finalize arrangements for financing for their environmental water and soil remediation programs for cleaning up sludge deposited in their major rivers and all forms of land based wastes, which are a major pollutant and environmental hazard for Bangladesh. BioEarth has incorporated into its cleanup program the use of the QES System technology for the processing of the sludge and land based wastes.

Once the sludge has been retrieved from the rivers through BioEarth's use of barges and sludge retrieval equipment; the processing of the sludge by our QES Systems will convert the sludge and/or land based wastes into marketable by products and/or alternatively a source for the generation of power with the use of our gasification technology.

| Geetas Infra |

On October 28, 2009, Energy Systems entered into an agreement with Geetas Infra (“GI”), a wholly owned subsidiary of CMR Power Projects Pvt. Ltd. of India, establishing a strategic partnership to market the QES System throughout India. The term of the agreement is 40 years.

Geetas Infra is located in India and is a major supplier of 'clean electrical power’ as well as the developer of ‘alternate energy centers’ throughout the region.

GI and Energy Systems agree to incorporate a joint venture corporation (the “Joint Venture Corporation”), which corporation shall have an authorized share capital of 50,000 common shares or such number of shares as the parties may agree upon. The resulting interest of each party in the Joint Venture Corporation shall be as follows:

- 16 -

| GI | 51% of issued common shares |

| Energy Systems | 49% of issued common shares |

The Joint Venture Corporation will be organized for the purpose of commercializing the QES System and technology described under the trade name the QES2000 System, distributing or joint venturing the QES System with or to third parties and establishing an assembly plant for the assembling of the QES System in India, and for the purpose of engaging in all activities and transactions that are necessary in furtherance of that purpose with the ultimate exit strategy of developing and commercializing the technology. The Joint Venture Corporation shall not engage in any other activity except as set forth above. The parties agree that the Joint Venture Corporation shall have the exclusive distribution rights for India subject to various terms and conditions.

No assurance can be provided that the joint venture will be completed on terms acceptable to our company or will be completed at all.

| Avani Corporation, Zhunger Capital Partners Inc. |

On October 28, 2009, Energy Systems entered into an agreement with Avani Corporation SDN BHD (“Avani”) of Malaysia, and Zhunger Capital Partners Inc. (“Zhunger”) of Taiwan, to exclusively market the QES System conversion system in Korea, Cambodia, Thailand, Malaysia, Indonesia, Saudi Arabia and Egypt (the “Avani/Zhunger Territories”). The agreement also provides that Avani and Zhunger may establish joint ventures with third parties for the establishment of an assembly facility and/or manufacturing plant in the Avani/ Zhunger Territories. Avani and Zhunger will also be granted rights to locate and appoint key distributors and agents.

Energy Systems shall grant Avani and Zhunger the right to locate and appoint key distributors and agents, wherein this will also include the granting of a right to the distributors and agents to, use and demonstrate the QES System, when one is manufactured for the Avani/Zhunger Territories, advertise, market, sell and otherwise distribute the QES System in the Avani/Zhunger Territories to customers who are end users and/or joint venture partners, advertise, market, sell, and otherwise distribute the QES System in the Avani/Zhunger Territories to sub-distributors or sub-agents for further distribution to end users and/or joint venture partners, screen and select a funding group to joint venture in the establishment of an assembly facility and/or manufacturing plant in the Avani/Zhunger Territories for the QES System. The agreement is effective October 30, 2009 for a term of 20 years.

The Joint Venture with Avani would involve the building of several plants to process palm husks in Malaysia and Indonesia. Currently each palm oil plant operating in Malaysia and Indonesia, after extraction of the palm oil, generates between 300 to 1,000 tons of palm husk remnants per day creating a major disposal problem for each palm oil plant. We offer an environmentally friendly solution for dealing with the palm husks by creating marketable by products such as N220 grade carbon black, using the QES System.

| US Waste Tire Plant Operations |

We are in the final stages of completing a long term supply agreement for waste tires for our proposed waste tire plant in the US. Negotiations are expected to be concluded with a 20 year fixed supply agreement. The supply of waste tires will facilitate operations in Joint Ventures established to construct plants for waste tire conversion to carbon black and diesel fuel.

The component parts of the QES System will be outsourced and assembled by our technical team. We intend to build plants to process used tires either through a joint venture or solely owned and operated plants. Currently we are negotiating a joint venture initiative with a prospective partner with an extensive financial background with access to financing as well as waste tires. A plant is tentatively planned to be built in Partrich Alabama.

No assurance can be provided that the joint venture will be completed on terms acceptable to our company or will be completed at all.

- 17 -

| Markets – By Products |

| Market for Used Tire Conversion to Marketable By Products |

In the U.S. the federal Environmental Protection Agency reports that 290 million waste tires are generated each year and an estimated 2 Billion waste tires have accumulated in stockpiles or uncontrolled tire dumps across the country. A variety of pests, including mosquitoes capable of carrying West Nile virus, breed and live in old tires, Tires also take up much-needed landfill space and create a blight on the urban landscape as well as resulting in a large amount of black solid refuse which contaminates the soil and ground water.

Waste tires are a dominant market for the pyrolysis system. The major problem in this market is the quality of the byproducts produced. As mentioned before, the traditional indirect-heat pyrolysis systems cannot completely process waste tires resulting in a carbon black residue containing a significant quantity of organic compounds and is also highly flammable. There is no market for this carbon black. A second problem is the quality of fuel oil produced which contains a significant amount of tar and sulfur. The resulting oil product is not easily marketable. The QES System overcomes these difficulties producing marketable high quality by-products to meet the demand of industry.

| Market for Carbon Black and Fuel Oil |

We anticipate that China and India will account for the largest increases in carbon black and fuel oil demand due to the expanding automobile industry and highway transportation infrastructure resulting in an increased demand for tires, rubber, industrial rubber goods and fuel oil.

The QES System is capable of producing several grades of carbon black through the processing of various feedstock materials. We believe that we can compete favorably by the use of waste materials as feedstock which account for less than 5% of the cost of the selling price of the by products as opposed to a 50% cost compared to those using “old furnace black technology” where the feedstock materials are petroleum based and are subject to the changing market prices of petroleum and natural gas.

Fuel oil is similar to diesel fuel and heating oil which trades on the world commodity markets such as NYMEX. The demand for fuel oil is generated for use as a fuel for diesel engines and for use as a heating fuel to fire commercial furnaces such as required for the leather or die industries or any furnace where heat is to be generated such as home heating. Fuel oil can be blended with conventional diesel for transportation purposes or used directly in diesel powered generators for the production of electricity.

| Electronic Waste By-Products |

Electronic waste is currently one of the biggest problems for the environment in the world. The problems result mostly because electronic waste contains toxic materials such as resin, polychlorinated Dibenzo-p-Dioxin, heavy metal, etc. As a result electronic waste is not suitable for burning by an incinerator. Currently, the most popular method of treating electronic waste is to deposit it at a landfill.

QES provides a new solution. The QES System can convert the plastic, resin, and destroy the dioxin structure to convert it into a marketable fuel. After processing of electronic waste, valuable by-products such as precious metals and silicon can easily be recovered and refined.

It is estimated that one ton of used mobile phones, or approximately 6,000 handsets contain approximately 3.5 kilograms of silver, 340 grams of gold, 140 grams of palladium, and 130 kilograms of copper. The average mobile phone battery contains another 3.5 grams of copper. These commodities are also traded on markets such as NYMEX and can be a source of significant revenues.

| Marketing Strategy |

Our marketing strategy currently implemented throughout China Hong Kong and Macau is through joint efforts with our distributor Fanta International Enterprises (Canada) Inc (“Fanta”). Fanta is an exclusive distributor in these territories. Our exclusive distributor in North America is Ecobiosol Energy Inc. (“EEI”). Both Fanta and EEI are subject to performance quotas. We have marketed the QES System in the Caribbean and have entered into a sales agreement with Imex

- 18 -

International Corp. (“Imex”) for Imex to purchase one Utility Unit subject to various terms. The agreement with Imex does not provide any exclusive distribution or operation rights and Imex is not subject to any performance quotas.

| Distribution Agreement – China, Hong Kong, Macau |

On July 20, 2009, Energy Systems entered into an agreement (the “Fanta Agreement”) with Fanta International Enterprises (Canada) Inc. (“Fanta”) wherein Fanta was appointed as exclusive distributor of the QES System in China, Hong Kong and Macau (the “Fanta Territory”), for a term of 2 years which such term could be extended for an additional 2 year term, provided that Fanta achieves its minimum purchase requirements of one QES System in year 1, three QES Systems in year 2 and ten QES Systems in years 3 and year 4. Thereafter any renewal terms would be subject to mutually acceptable terms, provided however if the parties fail to agree on terms of any renewal, then Energy Systems shall have right to determine the conditions of any subsequent renewal. Provided however, nothing contained herein shall prohibit or restrict Energy Systems or its affiliated companies to be incorporated in Taiwan, or its affiliated companies from establishing their own or joint venturing with third parties a total maximum of ten QES Systems for use in plants in the Fanta Territory.

The Fanta Agreement provides that Fanta can appoint a network of sub-distributors in the Fanta Territory to assist Fanta in the sales and servicing required of the QES Systems in the Fanta Territory. The Fanta Agreement further provides Fanta shall establish a full service distribution and parts center, service maintenance team, sales team to support the sales of QES System in the Fanta Territory and to jointly promote the marketing of the QES System with Energy Systems.

On November 9, 2009, we entered into a development and marketing agreement (“Fanta Marketing Agreement”) with Fanta for the purchase of one QES2000 utility unit (“Utility Unit”) for the purchase price of $ 420,000. Included in this total is a $ 360,000 marketing expense of which was credited to Fanta to assist Fanta in setting up distribution networks and marketing of the QES System in China. The Utility Unit will encompass all applications of the QES System. The Utility Unit is smaller in scale, mobile and will have a lower processing rate compared to the full size QES System. The Utility Unit operates on a batch system and can process 50kg per hour of waste. It has a manual loading and unloading system. With additional equipment installed, the Utility Unit can operate as a continuous system that can process 200kg per hour.

On December 17, 2009, the Utility Unit was completed. The Utility Unit is currently undergoing independent testing by SGS Group, a company specializing in inspection, verification, testing and certification. It is anticipated that testing will be completed May 2010. The Utility Unit is currently available for demonstration purposes at the Dalian - Jinzhou High Technology Park. The demonstration of the Utility Unit will be shown to prospective customers of Fanta and senior government officials, and joint venture partners. Our prospective joint venture partner Canda will be co-hosting the demonstration in its facilities in the Jinzhou High Technology Park.

Initially, the Utility Unit will be used for demonstration purposes to confirm the technical and commercial viability of the technology to interested buyers desiring verification of the technology. As per the Fanta Agreement, we will be granted rights to demonstrate the Utility Unit to prospective buyers upon delivery of the Utility Unit to Fanta’s premises.

| Distribution Agreement – North America |

On July 17, 2009 Energy Systems entered into an agreement (the “Ecobiosol Agreement”) with Ecobiosol Energy Inc. (“EEI”), a Nevada corporation, wherein EEI was appointed as exclusive distributor of the QES Systems in North America (the “Ecobiosol Territory”), provided however, Energy Systems, or its affiliated companies shall be entitled to establish their own or joint venture with third parties up to 10 QES Systems of use in plants in the Ecobiosol Territory. The term of the Ecobiosol Agreement is for 10 years which term could be extended for additional 5 year terms unless written notice of termination is delivered by either party no less than 30 days prior to the expiration of the then current term. The Ecobiosol Agreement requires that EEI purchase a minimum of two QES Systems in year 1 and thereafter a minimum of ten QES Systems in each year during the then current term.

The Ecobiosol Agreement also provides EEI and its affiliates, the right at EEI’s option to become an operator of certain QES Systems used in plants, on the condition that should EEI or any of its affiliates elect to become an operator of one or more QES Systems in plants, a royalty of 5% shall be paid to Energy Systems on all gross revenues exceeding

- 19 -

$1,000,000 generated from each System used in plants operated by EEI.

The Agreement further provides that EEI shall provide a full service distribution center, service maintenance team, sales team and finance department to support credit terms for purchases or leasing of the QES System in the Ecobiosol Territory and to jointly promote the marketing of the System with Energy Systems.

Further, we have entered into an agreement dated the 17th of July 2009 with Energy Systems and EEI wherein EEI agreed to subscribe to a private placement of our shares on the terms presented below, which private placement has not yet been finalized.

| 1. | Upon the first closing date, the purchase of 715,000 shares at a purchase price of $0.35 per share for an aggregate purchase price of $250,250. |

| 2. | Upon the second closing date, the purchase of 715,000 shares at a purchase price of $0.35per share for an aggregate purchase price of $250,250. |

| 3. | Upon the first third closing date, the purchase of 500,000 shares at a purchase price of $0.50 per share for an aggregate purchase price of $250,000. |

| 4. | Upon the forth closing date, the purchase of 500,000 shares at a purchase price of $0.50 per share for an aggregate purchase price of $250,000. |

| Sales Agreement – Jamaica, West Indies |

On February 15, 2010, we entered into a sales agreement with Imex International Corp. (“Imex”), a Nevada Corporation for Imex to purchase one Utility Unity at a cost of approximately $450,000 subject to verification of the technical and commercial viability of the Utility Unit currently available for demonstration in China as mentioned above. The agreement was an arms length transaction. Imex intends on developing waste conversion and disposal centers in Jamaica, West Indies, utilizing waste tires for conversion to fuel oil and carbon black and to also provide a safe method of disposing of organic waste materials.

The purchase of the Utility Unit is subject to us providing a report from an independent party, being SGS Group, (the “Report”) that verifies that the Utility Unit properly meets the claims that we have made; that is, that the Utility Unit functions as a pyrolysis system technology for energy conversion waste disposal method with an efficient method of converting waste organic materials into marketable energy products or by-products or an efficient method of disposing of waste organic materials in a safe, non polluting, non toxic method compatible with environmental standards (the “Functional Claim”).

We must provide the Report to Imex within five business days of receipt by us of the Report, which we expect to receive in May 2010. Upon receipt of the Report, Imex shall have five business days in which to review the Report and provide written confirmation to us as to whether Imex wishes to proceed with the acquisition of the Utility Unit. Imex may at its sole discretion, cancel the agreement in the event that the Report does not fully support the Functional Claim. Imex is not subject to any performance quotas and does not have exclusive rights to distribute or operate in Jamaica, West Indies.

| Distribution Methods and Installation |

In larger and emerging markets, our business model is such that we intend to sell the QES System to a joint venture (to which we are one of the principals) which will then market the QES Systems in that region or develop its own plants. This will allow us to maintain ongoing revenues.

In third world countries, we intend to sell the QES System to distributors and rely on the distributors to penetrate the market. Also in many cases funding for projects in these countries need to be orchestrated through the World Bank and as such require local government participation.

We sub-contract construction of the QES System components and such components are assembled on premises currently being rented on a per use basis. We currently do not have an assembly facility and may establish a facility in China

- 20 -

pending funding. We have engaged the inventor of the QES System to source necessary components and assembly of the QES System.

| New Products |

We are not developing nor do we intend to distribute any other products in the foreseeable future.

| Competition |

Many of our potential competitors have longer operating histories, larger customer or user bases, greater brand recognition and significantly greater financial, marketing and other resources than we have. Competitors have and may adopt aggressive pricing or inventory availability policies and devote substantially more resources to website and systems development than we do. Increased competition may result in reduced operating margins and loss of market share.

We believe that the principal competitive factors in our market are:

| (a) | Quality of by products |

| (b) | Emission standards |

| (c) | Capital cost of plant |

We believe that the QES System addresses these factors by offering quality by products, emitting negligible emissions meeting the regulatory requirements in Europe and the US. We offer the QES System at a significantly lower capital cost.

We believe that we can compete favorably on these factors. However, we will have no control over how successful our competitors are in addressing these factors.

| Availability of Raw Materials Joint Venture Plant Operations |

We are in the final stages of completing a long term supply agreement for waste tires for our proposed waste tire plant in the US. Negotiations are expected to be concluded with a 20 year fixed supply agreement. The supply of waste tires will facilitate operations in Joint Ventures established to construct plants for waste tire conversion to carbon black and fuel oil. The proposed supplier has advised that the Supplier has access of up to 1,200 Tons of waste tires per day in the South Eastern part of the US which will be available for future expansion of the existing plant or the construction of new plants. They have also indicated that we may acquire access up to 5,000 Tons per day of crumb rubber.

Each of the proposed future plants will be able to process a minimum of 150 Tons per day of waste tires. The securing of the long term supply of waste tires or crumb rubber is fundamental for our long range development as well as securing of financing for the construction of the plants.

The component parts of the QES System will be outsourced and assembled by our technical team. We intend to build plants to process used tires either through a joint venture or solely owned and operated plants. We are currently negotiating a joint venture initiative with a prospective partner with an extensive financial background with access to financing to fund the proposed waste tire plant. The location of the plant is tentatively planned to be built in Partrich, Alabama. As of to date, we have not finalized any agreements to secure financing for the proposed waste tire plant. No assurance can be provided that the joint venture or the financing will be completed.

| QES System Construction |

The only significant raw material required for construction of the QES System is steel and it is readily available. Currently we intend to use steel manufactured in China as it is competitively priced and is readily available.

| Inventory |

We do not carry inventory. It is our intention to commence procurement of necessary components of the QES System when we receive financial commitments from interested parties.

We cannot estimate at this time the frequency of our placement of orders as we have not established trends or possible

- 21 -

seasonal aspects which may affect our sub distributor’s business and the resultant increase or lag in number of orders placed with us.

| Orders and Payment |

Payment terms will vary and payments are made by wire transfer, bank draft, or money order.

| Delivery |

Delivery terms are subject to negotiations and are unique in each transaction.

| Returns and Refunds |

Our warranty policy states that the QES System will be free from material defects in materials and workmanship. The foregoing warranty is subject to the proper installation, operation and maintenance of the QES System in accordance to the QES System operating manual. Warranty claims must be made by the customer in writing within 15 days of the manifestation of a problem. Our sole obligation under the foregoing warranty is, at our option, to repair, replace or correct any such defect that was present at the time of delivery, or to remove the QES System and to refund 50% of the purchase price to customer.

The warranty period begins on the date the QES System is delivered and continues for Twelve (12) months.

Any repairs under this warranty must be conducted by our authorized service representative.

Excluded from the warranty are problems due to accidents, misuse, misapplication, storage damage, negligence, or modification to the QES System or its components.

| Patents, Trademarks and Labor Contracts |

| Patents |

Our QES System and related technologies are patented in Taiwan under Patent No 285138, with pending patents No. 2006 10066751.9 and No. 2006 10072434.8 in the Peoples Republic of China and pending US patents No. 2007/0231073A1 and No. 2007/0231224A1.

Patent application number 11/727,803 filed with the United States Patent Trademark Office for a reaction furnace utilizing high temperature steam and a re-circulated heat source to crack dioxin and organic substances contained in waste, being the basis of the our proprietary technology, has been granted by the United States Patent and Trademark Office effective the 15th day of December 2009 under patent number 7,632,471.

| Trademarks |

| We do not have any trademarks on our trade name or logo. |

| Labor Contracts |

We have a labor contract with the inventor of the Acquired Technologies for construction of QES Systems. The component parts of the QES System will be outsourced and assembled by the inventor and technical team.

We do not have contracts with our officers and directors and advisory board.

| Government Regulation |

We are subject to regulations from various federal, state and municipal authorities, each having different environment regulations to deal with waste and emissions. The following are some of the regulatory authorities throughout the world.

In the USA hazard wastes are regulated by the Environmental Protection Agency (“EPA”) through the Resource Conservation and Recovery Act (“RCRA”) which requires that hazard wastes be tracked from the time that they are

- 22 -

generated until their final disposition. Further with the enactment of the Comprehensive Environmental Response, Compensation and Liability Act in 1980, a super fund was created for the clean-up and remediation of closed and abandoned hazardous waste sites. A facility that treats, stores or disposes of hazardous waste must obtain a permit under the RCRA. Individual states may regulate particular wastes more stringently than that mandated by the EPA because the EPA is authorized to delegate primary rulemaking to individual States and most states have implemented such regulations.

The federal government also mandates the requirements for hazardous waste landfill sites together with state and local governmental agencies which may have criteria of their own and which in some cases may be more stringent than the federal regulations.

Worldwide the United Nations Environmental Program (“UNEP”) estimated that more than 400 million tons of hazardous waste is produced annually.

In the United Kingdom the Department for Environment Food and Rural Affairs is the agency responsible for policy and regulations on the environment which includes air quality, waste operations and local authority environmental regulation. In Europe the European Commission is the regulator authority responsible issuing directives for the regulation of hazardous waste.

The EPA is also the regulatory authority governing vehicle emissions and emissions from large Municipal Waste Combusters (“MWC”) (greater than 250 tons per day), small MSWs (less than 150 Tons per day) (MWCs are incinerators which burn household, commercial/retail and or institutional waste), Hazardous Waste Combusters (‘HWC”) and Medical Waste Incinerators. State or federal MWC plans also include source and emission inventories, emission limits, testing, monitoring and reporting requirements or site specific compliance schedules including increments of progress.

The Asian countries also have their own emission and waste treatment regulatory bodies, most of which conform either to the EU or EPA standards.

As worldwide emissions levels have increased dramatically, a greater understanding of the impacts of these emissions have resulted in increased regulation and new development practices have been implemented to reduce emissions in countries worldwide. All of the above are the regulatory environment in which our technology and the proposed applications of the technology are applicable.

| Research and Development |

At this time, we have one demonstration Utility Unit which is being evaluated for its technical and commercial viability to interested buyers desiring verification of the technology.

We intend to establish a research and development facility in each assembly plant with the intention of maintaining the technological lead in terms of product quality and development of new product applications.

We have incurred $Nil on research and development over the last two years. The inventor has incurred research and development expenses with respect to the QES System over the past two years.

| Compliance with Environmental Laws |

To our knowledge, we are not subject to any environmental laws which are cause of concern among management.

The QES System is equipped to address environmental issues. It does not burn waste like an incinerator. To deal with complex wastes such as MSW, E-waste, the QES System has two processes to eliminate air pollution. The first process is pyrolysis. It keeps most of the carbon as a by-product thereby reducing the carbon dioxide emissions and incorporates a fuel gas cleaning system in its GASTEC unit The GASTEC unit is a multi-stage condenser and includes a gas cleaner to remove hydrochloric acid, hydrogen sulfide, dust, NHx, and mercury. The second process is a gasification process which operates between 550 and 800C and converts the carbon residue remaining after the pyrolysis process is complete into fuel gas. The product of this two stage process is clean fuel gas which is used as a heat source. In treating Hospital Waste a hot zone will incorporated as a third process whereby the residue remaining is processed in a 1200ºC heating chamber which destroys any possible pathogens or toxic materials that may remain. . The GASTEC unit includes an oil-water separator, oil filter system, and water treatment system. It treats the waste water and recycles the water back into the system. This waste water can be recycled when processing materials that do not contain chlorine such as used tires, or certain plastics except

- 23 -

PVC. If waste materials contain chlorine such as MSW, Hospital Waste, E-waste, PVC, the recycled water must be chemically treated.

To summarize there are two processes to destroy toxic materials such as dioxins. They are steam pyrolysis, including the GASTEC purification system, and a secondary gasification process which converts residual carbon into fuel gas and if dealing with hospital waste a third process which incorporates a 1200ºC heating chamber. With these processes, the QES System eradicates pathogens, dioxins, air contaminants and other pollutants.

| Dioxins and air pollution control |

Incineration is the most popular system to handle the MSW and hospital waste. The main problem resulting from incineration is air pollution caused by the emission of dioxins and other toxic materials during the incineration process. It is the opinion of management that the QES System is a natural replacement for the incinerator.

Chlorine is the key element to forming dioxins inside the benzene structure. Benzene is produced during organic material decomposition. In the burning process, the organic material is decomposed and oxidized under high temperature. In an ideal case, the material will decompose 100% and be oxidized; otherwise chlorine will replace the hydrogen molecule of Benzene to form dioxins.

The pyrolysis method employed in the QES System prevents chlorine from replacing the hydrogen molecule of Benzene to produce dioxins as a by-product. To achieve this goal, there are two methods. One method is 100% decomposition and oxidization in the burning process. Vapor gas is kept at high temperatures over 600ºC, and enough oxygen is supplied to ensure complete oxidization. Unfortunately this is not easy to achieve under normal operating conditions as the chlorine is always present during the burning process. Most incinerators have a dioxin problem because they cannot completely burn the waste. The second alternative is to remove the chlorine during the decomposition process. The QES pyrolysis system incorporates removal of chlorine in its processes.

There are three methods to prevent the creation of dioxins in the QES System. The first method used by the QES pyrolysis system is to remove chlorine during organic compound decomposition and reforms chlorine into calcium chloride or sodium chloride by catalyst. It also generates enough hydrogen to prevent the benzene from forming dioxins. Only a small amount of chlorine remains to create hydrogen chloride. The second method is to use the gas cleaning system to clean the fuel gas. The gas cleaning system will remove the hydrogen sulfide, hydrogen chloride, and mercury from fuel gas and passes these materials into waste water. The QES System then uses a high efficiency particulate absorbing (“HEPA”) filter technology to remove toxic materials from the fuel gas by an activated carbon filter. After these processes, the fuel gas resembles liquefied petroleum gas. The third method is to burn the fuel gas at a high temperature zone over 1200 ºC. This will destroy any possible missed pathogens or toxic materials.

The QES System may incorporate a central gas cleaning system which is the last step to prevent any possible air pollution. This central gas cleaning system is optional equipment.

The QES System then uses the steam pyrolysis process to decompose waste materials. This process consumes about 20% of recycled fuel gas as a heat source.

| Employees |

During the year ended November 30, 2009 we had no full-time employees and no part-time employees. We have engaged a number of consultants who provide services to our company.

| Principal Business Office & Administrative Branch Office |

Our principal business office is located at 6130 Elton Avenue, Las Vegas, NV. Our administrative office for North American investor relations and U.S. regulatory reporting is located at Suite 200, 245 East Liberty Street, Reno, Nevada, 89501.

| RISK FACTORS |

In addition to other information in this current report, the following risk factors should be carefully considered in evaluating our business because such factors may have a significant impact on our business, operating results, liquidity and financial

- 24 -

condition. As a result of the risk factors set forth below, actual results could differ materially from those projected in any forward-looking statements. Additional risks and uncertainties not presently known to us, or that we currently consider to be immaterial, may also impact our business, operating results, liquidity and financial condition. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, the trading price of our securities could decline, and you may lose all or part of your investment.

| RISKS RELATED TO OUR BUSINESS |

We have a limited operating history upon which an evaluation of our prospects can be made. For that reason, it would be difficult for a potential investor to judge our prospects for success.