Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - COVANCE INC | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - COVANCE INC | a2196597zex-21.htm |

| EX-32.1 - EXHIBIT 32.1 - COVANCE INC | a2196597zex-32_1.htm |

| EX-23.1 - EXHIBIT 23.1 - COVANCE INC | a2196597zex-23_1.htm |

| EX-32.2 - EXHIBIT 32.2 - COVANCE INC | a2196597zex-32_2.htm |

| EX-31.2 - EXHIBIT 31.2 - COVANCE INC | a2196597zex-31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - COVANCE INC | a2196597zex-31_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

Commission File Number: 1-12213

COVANCE INC.

(Exact name of Registrant as specified in its Charter)

| Delaware (State of Incorporation) |

22-3265977 (I.R.S. Employer Identification No.) |

|

210 Carnegie Center, Princeton, New Jersey (Address of Principal Executive Offices) |

08540 (Zip Code) |

Registrant's telephone number, including area code: (609) 452-4440

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Common Stock, $.01 Par Value |

Name of Each Exchange on Which Registered New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act (the "Exchange Act") of 1934. Yes No X

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Registration S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. X

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer X Accelerated Filer Non-Accelerated Filer Smaller Reporting Company

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

The aggregate market value of the shares of common stock held by non-affiliates of the Registrant was $3,125,676,836 on June 30, 2009, the last business day of Registrant's most recently completed second fiscal quarter.

As of February 19, 2010, the Registrant had 64,189,971 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Those portions of the Company's definitive Proxy Statement which are responsive to Items 10, 11, 12, 13, and 14 of Part III of this Form 10-K are incorporated by reference into this Form 10-K.

General

Covance Inc. is a leading drug development services company providing a wide range of early-stage and late-stage product development services on a worldwide basis primarily to the pharmaceutical, biotechnology and medical device industries. We also provide laboratory testing services to the chemical, agrochemical and food industries. We believe Covance is one of the world's largest drug development services companies, based on annual net revenues, and one of a few that are capable of providing comprehensive global product development services. Covance maintains offices in more than 25 countries.

Business Strategy

Drug development services companies like Covance typically derive substantially all of their revenue from the research, development and marketing expenditures of the pharmaceutical, biotechnology and medical device industries. We believe outsourcing of these services has increased in the past and will increase in the future because of several factors, including: pressures to contain costs, limitations on internal capacity, the need for faster development time for new drugs, research in multiple countries simultaneously, stringent government regulation and expertise that customers lack internally. We believe the investment and amount of time required to develop new drugs has been increasing, and that these trends create opportunities for companies that can help make the process of drug development more efficient.

Our strategy is to provide services that will generate high-quality and timely data in support of new drug approval or use expansion. We do this by developing and delivering innovative high-quality services that apply science, technology and global reach to capture, manage and integrate a vast array of drug development data. In early development services, an increasing portion of our business is being provided through strategic, long-term arrangements with clients. These strategic arrangements include dedicated laboratory testing services contracts, in which our clients commit to purchasing a specific dollar amount of services in exchange for guaranteed access to a portion of our facilities. This arrangement benefits our customers by guaranteeing them long-term capacity and infrastructure to run their preclinical studies, and benefits Covance by allowing us to more efficiently utilize our capacity and resources. The trend towards dedicated service agreements and strategic collaborations has been moving into non toxicology work. In 2009, Covance acquired Merck and Co., Inc.'s ("Merck") Seattle, Washington based gene expression laboratory, which performs genomic analysis services, and entered into a five year $145 million contract to supply such services to Merck. Also in 2009, Covance entered into a seven year $42 million agreement with Kellogg Company for the provision of nutritional chemistry services in a facility in Battle Creek, Michigan. In 2008, Covance entered into a strategic research and development collaboration with Eli Lilly and Company ("Lilly"). Under this agreement, Covance acquired Lilly's 450 acre early development campus in Greenfield, Indiana and assumed the employment of over 250 Lilly employees. Covance agreed to provide Lilly with a broad range of drug development services over a ten year period for a minimum agreement value of $1.6 billion. Under this agreement, Lilly transferred responsibility to Covance for its non-GLP (Good Laboratory Practice) toxicology, in vivo pharmacology, quality control laboratory and imaging services. In addition, the agreement includes a committed level of clinical pharmacology, central laboratory, GLP toxicology studies and clinical Phase II-IV services.

Other types of strategic arrangements include multi-year sole source central laboratory services agreements and strategic clinical development alliances. Sole source partnerships for central laboratory services benefit our clients by reducing the time and effort spent contracting services on a project-by-project basis. Under strategic clinical development alliances, a pharmaceutical sponsor selects one or two trusted Phase III clinical development providers to perform all clinical trial management activities, typically within selected therapeutic classes.

Operational Excellence. Our goal is to consistently deliver outstanding service to our clients on a global scale through our platform focused on people, process and clients. As a scientific services company,

1

people are integral to our success. We work to recruit, develop and retain talented people through our "Compelling Offer" program which is designed to provide and encourage highly qualified people to initiate and build a career at Covance. We aim to enhance the effectiveness of these people with superior processes to efficiently deliver a high level of client service. Among other tools, we use Six Sigma to optimize our processes to increase our cost competitiveness, eliminate variability in our client service levels and build competitive advantage. Finally, we seek to leverage consistent outstanding client service by building strategic relationships with our clients that drive growth and help sustain our competitive advantage. Across our people, process and clients platform, we seek to utilize technology to augment the talent of our people, to automate robust processes, and to link us more closely to our clients via proprietary systems such as StudyTracker®, LabLink and Trial Tracker®.

Global Reach. We believe that it is important to provide a broad range of drug research and development services on a global basis. We have offices, regional monitoring sites and laboratories in over 50 locations in more than 25 different countries and conduct field work in many other countries. We believe we are a leader among drug development services companies in our ability to support large, global clinical trial programs.

Acquisitions. In addition to organic development of services, we consider acquisitions that are complementary to our existing services and that expand our ability to serve our clients. While we cannot exclude the possibility that we may opportunistically seek to take advantage of other situations, we generally expect acquisitions to enhance our existing services either qualitatively or geographically or to add new services that can be integrated with our existing services. In 2009, we purchased Swiss Pharma Contract Ltd., a 50 bed clinical pharmacology company located in Basel, Switzerland as well as Merck's gene expression laboratory in Seattle, Washington. In 2008, we enhanced our biomarker service offerings by purchasing a minority stake in Caprion Proteomics, a leading provider of proteomics based services to the pharmaceutical industry.

Services

The services we provide constitute two segments for financial reporting purposes: (1) early development services, which includes preclinical services and clinical pharmacology services, and (2) late-stage development services, which includes central laboratory, clinical development, and commercialization services (periapproval and market access services). Although each segment has separate services within it, they can be and increasingly are combined in integrated service offerings.

Early Development

Preclinical Services

Our preclinical services include toxicology services, pharmaceutical chemistry, nutritional chemistry and related services. Our preclinical area has been a source of innovation by introducing new technologies for client access to data such as StudyTracker®, electronic animal identification, multimedia study reports and animal and test tube measures of induced cell proliferation or reproduction. StudyTracker® is an internet-based client access product which allows customers of toxicology, bioanalytical, metabolism and reproductive and developmental toxicology services to review study data and schedules on a near real-time basis. We have laboratories in locations which include Madison, Wisconsin; Greenfield, Indiana and Vienna, Virginia in the United States and Harrogate, United Kingdom and Muenster, Germany in Europe. We are in the process of completing a preclinical facility near Shanghai, China which is expected to open in the third quarter of 2010. We also have bioanalytical laboratories in the United States in Indianapolis, Indiana and Chantilly, Virginia, and an administrative and a sales office in Tokyo, Japan. In 2007, Covance completed a significant expansion of its Germany facility and opened a nutritional chemistry laboratory in Singapore. In 2008, Covance purchased Lilly's 450 acre research campus in Greenfield, Indiana for cash payments totaling $51.6 million and is currently providing a number of services at that location, including non-GLP toxicology, in vivo pharmacology, quality control laboratory and imaging. Covance also opened an early development facility in Chandler, Arizona. Covance is renovating a facility in Battle Creek, Michigan to be used for nutritional chemistry services. This facility is expected to open in late 2010.

2

Toxicology. Our preclinical toxicology services include in vivo toxicology studies, which are studies of the effects of drugs in animals; genetic toxicology studies, which include studies of the effects of drugs on chromosomes, as well as on genetically modified mice; and other specialized toxicology services. For example, we provide immunotoxicology services in which we assess the impact of drugs or chemicals on the structure and function of the immune system and reproductive toxicology services which help our clients assess the risk that a potential new medicine may cause birth defects.

Pharmaceutical Chemistry. In our pharmaceutical chemistry services, we determine the metabolic profile and bioavailability of drug candidates. We also provide laboratory testing services to the chemical and agricultural chemical industries. We offer a complete range of services to agricultural chemical manufacturers to determine the potential risk to humans, animals and the environment from plant protection products such as pesticides.

Nutritional Chemistry. In our nutritional chemistry services, we offer a broad range of services to the food, nutriceutical and animal feed industries, including nutritional analysis, nutritional content fact labels, safety analysis and stability testing.

Research Products. We provide custom polyclonal and monoclonal antibody services for research purposes and purpose-bred animals for biomedical research. In May 2006, we expanded our offerings in monoclonal antibodies with the purchase of Signet of Dedham, Massachusetts for cash payments totaling $9.1 million. Signet was a leading provider of monoclonal antibodies used in the research of cancer, and infectious and other diseases. The purpose-bred research animals we provide are required by pharmaceutical and biotechnology companies, university research centers and contract research organizations as part of required preclinical animal safety and efficacy testing. Through a variety of processes, technology and specifically constructed facilities, we provide purpose-bred, pre-acclimated and specific pathogen free animals that meet our clients' rigorous quality control requirements. In 2007, Covance opened a dedicated animal biosafety level 2 (ABSL-2) containment vivarium to allow us to provide full service vaccine testing.

Discovery Services. We provide lead optimization services including custom immunology and antibody services, metabolism studies and pharmacokinetic screening as well as non-GLP toxicology, in vivo pharmacology, imaging services and biomarker services. We substantially enhanced our ability to provide discovery services in 2008 with our acquisition of Lilly's Greenfield, Indiana campus and in 2009 with our acquisition of Merck's gene expression laboratory in Seattle, Washington.

Bioanalytical Services. Our bioanalytical testing services, which are conducted in our bioanalytical laboratory in Indianapolis, Indiana and in our immunoanalytical facility in Chantilly, Virginia, as well as in our laboratories in Madison, Wisconsin; Harrogate, United Kingdom and Shanghai, China, help determine the appropriate dose and frequency of drug application from late discovery evaluation through Phase III clinical testing on a full-scale, globally integrated basis.

Clinical Pharmacology Services

We provide clinical pharmacology services, including first-in-human trials, of new pharmaceuticals at our six clinics located throughout the United States and our clinics in Leeds, United Kingdom and Basel, Switzerland and also offer our clients access to specialized patient populations needed for Phase II trials in specific therapeutic areas. We have grown this service offering through acquisitions. In 2009, we acquired Swiss Pharma Contract Ltd. for cash payments totaling $19.4 million. In 2006, we significantly expanded our capacity and capabilities in the United States with the acquisition of Radiant's clinical pharmacology sites and its access to specialized patient populations, for cash payments totaling $66.6 million. In 2005, we acquired GFI for cash payments totaling $6.2 million and in 2008 we relocated and significantly upgraded this Evansville, Indiana clinical pharmacology research unit.

3

Late-Stage Development

Central Laboratory Services

We are the world's largest provider of central laboratory services. We have four central laboratories, one in each of the United States, Switzerland, Singapore and China that provide central laboratory services, including biomarker services, to biotechnology and pharmaceutical customers. In 2007, we opened a new purpose built facility in Shanghai, China.

Our capabilities provide clients the flexibility to conduct studies on a multinational and simultaneous basis. The data we provide is combinable and results in global clinical trial reference ranges because we use consistent laboratory methods, identical reagents and calibrators, and similar equipment globally. Combinable data eliminates the cumbersome process of statistically correlating results generated using different methods and different laboratories on different equipment.

We also employ a proprietary clinical trials management system that enables us to enter a sponsor's protocol requirements directly into our database. The laboratory data can be audited because all laboratory data can be traced to source documents. In addition, the laboratories are capable of delivering customized data electronically within 24 hours of test completion. Covance also offers pharmacogenomic testing and sample storage technologies in conjunction with our central laboratory services. Central laboratory services also offers LabLink, an internet-based client access program that allows customers to review and query clinical trial lab data on a near real-time basis, and the Covance Local Laboratories service, which uses a proprietary system to harmonize laboratory results from local and regional laboratories to help expand the reach of traditional central laboratory services.

Our central laboratories have an automated kit production line that is located in the United States and supplies kits to investigator sites around the world. This system allows the flexibility to expand kit production volume more quickly and uses consistent methods to reduce supply variation for our customers.

In 2009, we purchased Merck's gene expression laboratory for $9.75 million in cash and entered into a contract for the sale of genomic analysis services to Merck for $145 million over five years.

We provide high throughput GLP and non-GLP biomarker services from our central laboratory, bioanalytical and toxicology laboratories, and offer bioimaging capabilities and cardiac related biomarkers for animals and humans. In 2009, Covance formed a biomarker expert team dedicated to the development, validation and testing of biomarkers.

In 2008, we purchased a minority interest in Caprion Proteomics, a leading provider of proteomics-based services to the pharmaceutical industry for $3.1 million in cash. Under the terms of our agreement with Caprion, Covance will serve as the exclusive contract research organization distributor of Caprion's proteomic biomarker services.

Clinical Development Services

We offer a comprehensive range of clinical trial services, including the full management of Phase II and III clinical studies. We have extensive experience in a number of therapeutic areas, and we provide the following core services either on an individual or aggregated basis to meet clients' needs: study design and modeling; study orchestration; trial logistics; enablement of study site performance; clinical data management and biostatistical analysis; and medical writing and regulatory services.

We have extensive experience in managing clinical trials in North America, Europe, Latin America and Asia Pacific. These trials may be conducted separately or simultaneously as part of a multinational development plan. We can manage every aspect of clinical trials from clinical development plans and protocol design to New Drug Applications, among other supporting services. Over the last several years, clinical development services has continued its expansion into Eastern Europe, the Middle East, Asia Pacific and South America.

4

Our clinical development services utilize Trial Tracker®, a web-enabled clinical trial project management and tracking tool which allows both our employees and customers to review and manage all aspects of clinical trial projects.

Clinical Trial Support Services

Cardiac Safety Services. In November 2007, we sold our centralized ECG business to eResearch Technology Inc. for an upfront cash payment of approximately $35 million with the opportunity to receive additional contingent consideration relating to transferred backlog as well as from revenues generated from new contracts secured under a long-term marketing arrangement. We continue to offer this service to our clients through this marketing arrangement.

Interactive Voice and Web Response Services. In 2009, we sold our interactive voice and web response services business to Phase Forward for $10 million in cash. In addition, Covance and Phase Forward entered into a five year marketing agreement with respect to certain of Phase Forward's services which Covance will offer to its clinical development clients.

Commercialization Services

Periapproval Services. Periapproval trials are studies conducted "around the time of NDA approval", generally after a drug has successfully undergone clinical efficacy and safety testing and the New Drug Application has been submitted to the Food and Drug Administration ("FDA"). We offer a range of periapproval services, including: Treatment Investigational New Drug applications; Phase IIIb clinical studies, which involve studies conducted after New Drug Application submission, but before regulatory approval is obtained; Phase IV clinical studies which are studies conducted after initial approval of the drug; and other types of periapproval studies such as post-marketing surveillance studies, FDA mandated post-marketing commitments generally focusing on characterizing a drug's safety in large, diverse patient groups, product withdrawal support services and prescription to over-the-counter switch studies.

Market Access Services. We offer a wide range of reimbursement and healthcare economics consulting services, including outcomes and pharmacoeconomic studies, reimbursement planning, reimbursement advocacy programs, registry services and specialty pharmacy services. Pharmaceutical, biotechnology and medical device manufacturers purchase these services from us to help optimize their return on research and development investments. We offer InTeleCenter® services that employ state of the art phone, internet and electronic media to manage customer communications. InTeleCenter programs include reimbursement hotlines, patient assistance programs and patient compliance programs. We also field and process telephone calls and inquiries relating to adverse experiences with a drug in connection with the performance of periapproval studies.

Customers and Marketing

We provide product development services on a global basis to, among others, the pharmaceutical and biotechnology industries. In 2009, we served in excess of 500 biopharmaceutical companies, ranging from the world's largest pharmaceutical companies and biotechnology companies to small and start-up organizations.

While no single customer accounted for more than ten percent of our aggregate net revenue in 2009, we had three customers accounting for more than five but less than ten percent of our net revenues, and our top five customers accounted for approximately 32 percent of our net revenues. In our early development segment, one customer accounted for more than ten percent of net revenues and one customer accounted for more than five but less than ten percent of its aggregate net revenues. All other customers in our early development segment individually accounted for less than five percent of its aggregate net revenues. In our late-stage development segment, one customer accounted for more than ten percent of net revenues and three customers accounted for more than five but less than ten percent of its aggregate net revenues.

5

For net revenues from external customers, assets attributable to each of our business segments, revenues by significant service area and other segment information for each of the last three fiscal years, please review Note 12 to the audited consolidated financial statements included elsewhere in this Annual Report.

For net revenues from external customers and long-lived assets attributable to operations in the United States, United Kingdom, Switzerland and other countries for each of the last three fiscal years, please review Note 12 to the audited consolidated financial statements included elsewhere in this Annual Report.

Our global sales activities are conducted by sales personnel based in our operations in the United States, Europe and Asia Pacific.

Contractual Arrangements

Many of our contracts with our clients are either fixed price or fee-for-service with a cap. To a lesser extent, some of our contracts are fee-for-service without a cap. In cases where the contracts are fixed price, we may bear the cost of overruns, or we benefit if the costs are lower than we anticipated. In cases where our contracts are fee-for-service with a cap, the contracts contain an overall budget for the trial based on time and cost estimates. If our costs are lower than anticipated, the customer generally keeps the savings, but if our costs are higher than estimated, we may be responsible for the overrun unless the increased cost is a result of a scope change or other factors outside of our control, such as an increase in the number of patients to be enrolled or the type or amount of data to be collected. Contracts may range in duration from a few months to several years or longer depending on the nature of the work performed. Billing schedules and payment terms are generally negotiated on a contract-by-contract basis. In some cases, we bill the client for the total contract value in progress-based installments as we reach certain non-contingent billing milestones over the contract duration. For additional information please refer to Item 7. Critical Accounting Policies—Revenue Recognition.

Most of our contracts may be terminated by the customer either immediately or upon notice. These contracts typically require payment to Covance of expenses to wind down a study, payment to Covance of fees earned to date, and, in some cases, a termination fee or payment to Covance of some portion of the fees or profit that could have been earned under the contract if it had not been terminated early.

We also have dedicated capacity arrangements with certain clients generally ranging in duration from three to ten years. Underlying these arrangements are individual project contracts for the specific services to be provided. Dedicated capacity arrangements enable our clients to secure space in our facilities in exchange for which they agree to provide a guaranteed annual minimum dollar value ("volume") of work. Under these types of arrangements, if the annual minimum volume commitment is not reached, the client is required to pay Covance for the shortfall. Progress towards the achievement of annual minimum volume guarantees is monitored throughout the year. Annual minimum guarantee shortfalls are included in net revenues when the amount of the shortfall is determinable and realization is assured.

Backlog

Some of our studies and projects are performed over an extended period of time, which may exceed several years. We maintain an order backlog to track anticipated net revenues yet to be earned for work that has not yet been performed. However, we do not maintain an order backlog for other services that are performed within a short period of time or where it is not otherwise practical or feasible to maintain an order backlog. Our aggregate backlog at December 31, 2009 and December 31, 2008 was $4.87 billion and $4.33 billion respectively.

Backlog generally includes work to be performed under signed agreements (i.e., contracts and letters of intent). Once work under a signed agreement begins, net revenues are recognized over the life of the project. However, in some cases we will begin work on a project once we conclude we have a legally binding agreement, but before executing a signed agreement, and backlog may include the net revenues expected from that project.

6

We cannot provide any assurance that we will be able to realize all or most of the net revenues included in backlog or estimate the portion expected to be filled in the current year. Although backlog can provide meaningful information to our management with respect to a particular study, we believe that our aggregate backlog as of any date is not necessarily a meaningful indicator of our future results for a variety of reasons. These reasons include the following: studies vary in duration; the scope of studies may change, which may either increase or decrease their value; and studies may be terminated, reduced in scope or delayed at any time by the client or regulatory authorities.

Competition

The contract research organization industry has many participants ranging from hundreds of small, limited-service providers to a limited number of full-service contract research organizations with global capabilities. We primarily compete against in-house departments of pharmaceutical companies, full-service and limited-service contract research organizations and, to a lesser extent, selected universities and teaching hospitals.

In early development services, our most significant competitors include Charles River Laboratories International Inc., PPD, Inc., WIL Laboratories, and MPI Research, among others. In late-stage development services our significant competitors include Quintiles Transnational Corp., PPD, Inc., Parexel International Corporation, Kendle International Inc., Icon PLC., PRA International, i3 Research, WuXi PhamaTech, Pharmanet Development Group Inc. and Quest Diagnostics Incorporated, among others.

There is competition for customers on the basis of many factors, including the following: reputation for on-time quality performance; expertise and experience in specific areas; scope of service offerings; strengths in various geographic markets; price; technological expertise and efficient drug development processes; ability to acquire, process, analyze and report data in a rapid and accurate manner; historic experience and relationship; ability to manage large-scale clinical trials both domestically and internationally; quality of facilities; expertise and experience in reimbursement and healthcare consulting; and size. We believe that we compete favorably in these areas.

Government Regulation

Our laboratory services are subject to various regulatory requirements designed to ensure the quality and integrity of the testing processes. Covance's standard operating procedures are written in accordance with regulations and guidelines appropriate to the region and the nation where they will be used.

The industry standards for conducting preclinical laboratory testing are embodied in the Good Laboratory Practice ("GLP") and for central laboratory operations in the Clinical Laboratory Improvement Amendments of 1988 ("CLIA"). The standards of GLP are required by the FDA, by the Department of Health in the United Kingdom, by the European Agency for the Evaluation of Medicinal Products ("EMEA") in Europe and by similar regulatory authorities in other parts of the world. To help satisfy its compliance obligations, Covance has established quality assurance controls at its laboratory facilities which monitor ongoing compliance with GLP and CLIA.

Our clinical services are subject to industry standards for the conduct of clinical research and development studies that are embodied in the regulations for Good Clinical Practice ("GCP"). The FDA, EMEA and other regulatory authorities require that test results submitted to such authorities be based on studies conducted in accordance with GCP. As with GLP and Good Manufacturing Practice ("GMP"), noncompliance with GCP can result in the disqualification of data collected during the clinical trial.

We strive to perform all clinical research in accordance with the International Conference on Harmonization—Good Clinical Practice Guidelines, and the requirements of the applicable country. Although the U.S. is a signatory to these guidelines, the FDA has not adopted all of these guidelines as statutory regulations, but has currently adopted them only as guidelines. From an international perspective, when applicable, we have implemented common standard operating procedures across regions to assure consistency whenever it is feasible and appropriate to do so.

7

Our animal import and breeding facilities and toxicology facilities are also subject to a variety of federal and state laws and regulations, including The Animal Welfare Act and the rules and regulations promulgated thereunder by the United States Department of Agriculture ("USDA") and corresponding rules and regulations in other jurisdictions. These facilities maintain detailed standard operating procedures and the documentation necessary to comply with applicable regulations for the humane treatment of the animals in their custody. Besides being licensed by the USDA as a dealer and/or research facility, as appropriate, these businesses are also accredited by the Association for Assessment and Accreditation of Laboratory Animal Care International and have registered assurance with the United States National Institutes of Health Office of Laboratory Animal Welfare.

The use of controlled substances in testing for drugs with a potential for abuse is regulated in the United States by the U.S. Drug Enforcement Administration and by similar regulatory bodies in other parts of the world. All Covance United States laboratories using controlled substances for testing purposes are licensed by the U.S. Drug Enforcement Administration.

Our United States laboratories are subject to licensing and regulation under federal, state and local laws relating to hazard communication and employee right-to-know regulations, the handling and disposal of medical specimens and hazardous waste and radioactive materials, as well as the safety and health of laboratory employees. All of our laboratories are subject to applicable federal and state laws and regulations relating to the storage and disposal of all laboratory specimens including the regulations of the Environmental Protection Agency, the Nuclear Regulatory Commission, the Department of Transportation, the National Fire Protection Agency and the Resource Conservation and Recovery Act. Although we believe that Covance is currently in compliance in all material respects with such federal, state and local laws, failure to comply could subject Covance to denial of the right to conduct business, fines, criminal penalties and other enforcement actions.

In addition to its comprehensive regulation of safety in the workplace, the Occupational Safety and Health Administration and similar regulatory authorities in foreign countries have established extensive requirements relating to workplace safety for health care employers, whose workers may be exposed to blood-borne pathogens such as HIV and the hepatitis B virus. Covance employees receive initial and periodic training focusing on compliance with applicable hazardous materials regulations and health and safety guidelines.

In the past few years, both the United States and foreign governments have become more concerned about the disclosure of confidential personal data. The European Union, or EU, prohibits certain disclosures of personal confidential information, including medical information, to any entity that does not comply with certain security safeguards. In the United States various federal and state laws address the security and privacy of health information. We will continue to monitor our compliance with applicable regulations.

The regulations of the U.S. Department of Transportation, the U.S. Public Health Service and the U.S. Postal Service apply to the surface and air transportation of laboratory specimens. Covance's laboratories also must comply with the applicable International Air Transport Association regulations, which govern international shipments of laboratory specimens. Furthermore, when materials are sent to a foreign country, the transportation of such materials becomes subject to the laws, rules and regulations of such foreign country.

Intellectual Property

We have developed certain computer software and technically derived procedures and products intended to maximize the quality and effectiveness of our services. Although our intellectual property rights are important to our results of operations, we believe that such factors as the technical expertise, knowledge, ability and experience of our professionals are more important, and that, overall, these technological capabilities provide significant benefits to our clients.

Employees

At December 31, 2009, we had 10,320 employees, approximately 38% of whom were employed outside of the United States and 9,491 of whom were full time employees. Our records indicate that more than 100 of our employees hold M.D. degrees, more than 500 hold Ph.D. degrees, and more than 1,500 hold masters or other postgraduate degrees. We believe that Covance's relations with its employees are good.

8

Executive Officers

Joseph L. Herring, 54, has been Covance's Chief Executive Officer since January 2005, and Chairman since January 2006. Mr. Herring was President and Chief Operating Officer from November 2001 to December 2004, and was Covance's Corporate Senior Vice President and President—Early Development Services from 1999 to November 2001. From September 1996 to September 1999, Mr. Herring was Corporate Vice President and General Manager of Covance Laboratories North America. Prior to joining Covance, Mr. Herring spent 18 years at the American Hospital Supply/Baxter International/Caremark International family of healthcare service companies where he held a variety of senior leadership positions, culminating in the position of Vice President and General Manager of its oncology business. Mr. Herring has been a member of the Covance Board since 2004.

William E. Klitgaard, 56, has been Covance's Corporate Senior Vice President, Chief Financial Officer and Treasurer since September 2000. From September 1999 to September 2000, Mr. Klitgaard was Covance's Corporate Vice President, Strategy and Corporate Development and Treasurer. From October 1996 to September 1999, Mr. Klitgaard was Covance's Corporate Vice President and Treasurer. Prior to that, Mr. Klitgaard was Treasurer at Kenetech Corporation in San Francisco, and prior to that Mr. Klitgaard spent eleven years in positions of increasing responsibility with Consolidated Freightways Inc.

Wendel Barr, 48, has been Covance's Executive Vice President and Chief Operating Officer since January 1, 2008, prior to which he had served as Corporate Senior Vice President and President—Early Development North America since February 2003. From October 2000 to February 2003, Mr. Barr was Corporate Vice President and General Manager—Covance Laboratories North America. Prior to joining Covance, Mr. Barr was the Global Vice President and General Manager of Service for Marconi Medical Systems, which he joined in October 1999. Prior to that, Mr. Barr was the General Manager of Service for General Electric Medical Systems. Mr. Barr was employed by General Electric Co. from 1984 to 1999, in positions of increasing responsibility in services, marketing and global business.

Richard Cimino, 50, has been Covance's Corporate Senior Vice President and President—Clinical Development, since December 2004. Prior to that, Mr. Cimino was Covance's General Manager of Cardiac Safety Services commencing December 2003. Prior to that, Mr. Cimino was General Manager, America's Health Imaging Group and Corporate Vice President of Eastman Kodak Company. Mr. Cimino serves at Covance's request as a director of BioClinica Inc.

Donald Kraft, 50, has been Covance's Corporate Senior Vice President—Human Resources since July 2002. From January 2001 to June 2002, Mr. Kraft was Corporate Vice President—Human Resources of Covance. From June 2000 to January 2001, Mr. Kraft was Director, Organizational Development of Zurich Financial Services, an insurance company. Prior to June 2000, Mr. Kraft was Director, Organizational Effectiveness of Abbott Laboratories Inc.

James W. Lovett, 45, has been Covance's Corporate Senior Vice President, General Counsel and Secretary since February 2003 and has headed Covance's Nutritional Chemistry and Food Safety Services since January 2008. From December 2001 to February 2003, Mr. Lovett was Corporate Vice President, General Counsel and Secretary of Covance. From 1997 to 2001, Mr. Lovett was with FMC Corporation in positions of increasing responsibility and, prior to that, was a partner in the law firm of McDermott, Will & Emery.

Michael Lehmann, 47, has been Covance's Corporate Senior Vice President and President—Nonclinical Safety Assessment, since January 2008. From September 2005 to January 2007, Mr. Lehmann was General Manager—Covance Laboratories North America. Prior to that, Mr. Lehmann held senior management positions for multiple lines of business over a 17-year career at GE Healthcare. Most recently, he served as General Manger, Multi-Vendor Services, GE Healthcare Technologies.

Deborah L. Tanner, 47, has been Covance's Corporate Senior Vice President and President—Global Central Laboratory Services since February 2006. Prior to that Ms. Tanner was Covance's Global Vice President of Operations in Central Laboratory Services commencing in August 2001 and prior to that was Vice President—Analytical Services for Covance Laboratories—Europe. Ms. Tanner has been with Covance for over 20 years in positions of increasing responsibility.

9

Available Information

Covance makes available free of charge on its website at www.covance.com, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. The charters of the Audit Committee, the Compensation Committee, and the Corporate Governance Committee, as well as the Corporate Governance Guidelines, the Code of Ethics for Financial Professionals and the Company's Business Integrity Program may be accessed through our website at www.covance.com.

This section discusses various risk factors that are attendant with our business and the provision of our services. If the events outlined below were to occur individually or in the aggregate, our business, results of operations, financial condition, and cash flows could be materially adversely affected.

Changes in government regulation or in practices relating to the pharmaceutical industry could decrease the need for the services we provide.

Governmental agencies throughout the world, including in the United States, strictly regulate the drug development process. Our business involves helping pharmaceutical and biotechnology companies navigate the regulatory drug approval process. Changes in regulation, such as a relaxation in regulatory requirements or the introduction of simplified drug approval procedures, or an increase in regulatory requirements that we have difficulty satisfying or that make our services less competitive, could eliminate or substantially reduce the demand for our services. Also, if government efforts contain drug costs and impact pharmaceutical and biotechnology company profits from new drugs, our customers may spend less, or reduce their growth in spending on research and development. If health insurers were to change their practices with respect to reimbursements for pharmaceutical products, our customers may spend less, or reduce their growth in spending on research and development.

Failure to comply with existing regulations could result in a loss of revenue or earnings or in increased costs.

Any failure on our part to comply with applicable regulations could result in the termination of on-going research or the disqualification of data for submission to regulatory authorities. For example, if we were to fail to properly monitor compliance by clinical trial investigators with study protocols, the data collected from that trial could be disqualified. If this were to happen, we could be contractually required to repeat the trial at no further cost to our customer, but at substantial cost to us.

We may bear financial losses because most of our contracts are of a fixed price nature and may be delayed or terminated or reduced in scope for reasons beyond our control.

Many of our contracts provide for services on a fixed price or fee-for-service with a cap basis and they may be terminated or reduced in scope either immediately or upon notice. Cancellations may occur for a variety of reasons, including:

- •

- the failure of products to satisfy safety requirements;

- •

- unexpected or undesired results of the products;

- •

- insufficient patient enrollment;

- •

- insufficient investigator recruitment;

- •

- the client's decision to terminate the development of a product or to end a particular study; and

- •

- our failure to perform properly our duties under the contract.

10

The loss, reduction in scope or delay of a large contract or the loss or delay of multiple contracts could materially adversely affect our business, although our contracts frequently entitle us to receive the costs of winding down the terminated projects, as well as all fees earned by us up to the time of termination. Some contracts also entitle us to a termination fee.

We may bear financial risk if we under price our contracts or overrun cost estimates.

Since our contracts are often structured as fixed price or fee-for-service with a cap, we bear the financial risk if we initially under price our contracts or otherwise overrun our cost estimates. Such under pricing or significant cost overruns could have a material adverse effect on our business, results of operations, financial condition, and cash flows.

We may not be able to successfully develop and market or acquire new services.

We may seek to develop and market new services that complement or expand our existing business or expand our service offerings through acquisition. If we are unable to develop new services and/or create demand for those newly developed services, or to expand our service offerings through acquisition, our future business, results of operations, financial condition, and cash flows could be adversely affected.

Our quarterly operating results may vary.

Our operating results may vary significantly from quarter to quarter and are influenced by factors over which we have little control such as:

- •

- changes in the general global economy;

- •

- exchange rate fluctuations;

- •

- the commencement, completion, delay or cancellation of large projects or groups of projects;

- •

- the progress of ongoing projects;

- •

- the timing of and charges associated with completed acquisitions or other events; and

- •

- changes in the mix of our services.

We believe that operating results for any particular quarter are not necessarily a meaningful indication of future results. While fluctuations in our quarterly operating results could negatively or positively affect the market price of our common stock, these fluctuations may not be related to our future overall operating performance.

We depend on the pharmaceutical and biotechnology industries.

Our revenues depend greatly on the expenditures made by the pharmaceutical and biotechnology industries in research and development. In some instances, companies in these industries are reliant on their ability to raise capital in order to fund their research and development projects. Accordingly, economic factors and industry trends that affect our clients in these industries also affect our business. If companies in these industries were to reduce the number of research and development projects they conduct or outsource, our business could be materially adversely affected.

11

We operate in a highly competitive industry.

Competitors in the contract research organization industry range from small, limited-service providers to full service global contract research organizations. Our main competition consists of in-house departments of pharmaceutical companies, full-service and functional contract research organizations, and, to a lesser degree, universities and teaching hospitals. We compete on a variety of factors, including:

- •

- reputation for on-time quality performance and regulatory compliance;

- •

- expertise and experience in specific areas;

- •

- scope of service offerings;

- •

- strengths in various geographic markets;

- •

- price;

- •

- technological expertise and efficient drug development processes;

- •

- quality of facilities;

- •

- ability to acquire, process, analyze and report data in an accurate manner;

- •

- ability to manage large-scale clinical trials both domestically and internationally;

- •

- expertise and experience in market access services; and

- •

- size.

For instance, our clinical and other development services have from time to time experienced periods of increased price competition which had a material adverse effect on Covance's late-stage development profitability and consolidated net revenues and net income.

There is competition among the larger contract research organizations for both clients and potential acquisition candidates. Additionally, small, limited-service entities considering entering the contract research organization industry will find few barriers to entry, thus further increasing possible competition. These competitive pressures may affect the attractiveness of our services and could adversely affect our financial results.

Unfavorable general economic conditions could negatively impact our operating results and financial condition.

Unfavorable global economic conditions, including the recent recession in the United States and the recent financial crisis affecting the banking system and financial markets, could negatively affect our business. While it is difficult for us to predict the impact of general economic conditions on our business, these conditions could reduce customer demand for some of our services, which could cause our revenue to decline. Also, our customers, particularly smaller biotechnology companies which are especially reliant on the credit and capital markets, may not be able to obtain adequate access to credit or equity funding, which could affect their ability to make timely payments to us. If that were to occur, we could be required to increase our allowance for doubtful accounts, and the number of days outstanding for our accounts receivable could increase. For these reasons, among others, if the economic conditions stagnate or decline, our operating results and financial condition could be adversely affected.

We may expand our business through acquisitions.

We review many acquisition candidates and, in addition to acquisitions which we have already made, we are continually evaluating new acquisition opportunities. Factors which may affect our ability to grow successfully through acquisitions include:

- •

- difficulties and expenses in connection with integrating the acquired companies and achieving the expected benefits;

- •

- diversion of management's attention from current operations;

- •

- the possibility that we may be adversely affected by risk factors facing the acquired companies;

12

- •

- acquisitions could be dilutive to earnings, or in the event of acquisitions made through the issuance of our common stock to the shareholders of the acquired company, dilutive to the percentage of ownership of our existing stockholders;

- •

- potential losses resulting from undiscovered liabilities of acquired companies not covered by the indemnification we may obtain from the seller;

- •

- risks of not being able to overcome differences in foreign business practices, language and other cultural barriers in connection with the acquisition of foreign companies; and

- •

- loss of key employees of the acquired companies.

We may be affected by potential health care reform.

The United States Congress is presently considering a health care reform bill and in recent years it and various state legislatures have considered various types of health care reform in order to control growing health care costs. We are unable to predict what legislative proposals will be adopted in the future, if any. Similar reform movements have occurred in Europe and Asia.

Implementation of health care reform legislation that contain costs could limit the profits that can be made from the development of new drugs. This could adversely affect research and development expenditures by pharmaceutical and biotechnology companies which could in turn decrease the business opportunities available to us both in the United States and abroad. In addition, new laws or regulations may create a risk of liability, increase our costs or limit our service offerings.

We rely on third parties for important services.

We depend on third parties to provide us with services critical to our business. The failure of any of these third parties to adequately provide the needed services could have a material adverse effect on our business.

Our revenues and earnings are exposed to exchange rate fluctuations.

We derive a large portion of our net revenues from international operations. For the years ended December 31, 2009 and 2008, we derived approximately 42% and 40%, respectively, of our net revenues from our operations outside the United States. Since our consolidated financial statements are denominated in U.S. dollars, fluctuations in exchange rates from period to period will have an impact on our reported results. In addition, in certain circumstances, we may incur costs in one currency related to our services or products for which we are paid in a different currency. As a result, factors associated with international operations, including changes in foreign currency exchange rates, could significantly affect our results of operations, financial condition and cash flows.

The loss of our key personnel could adversely affect our business.

Our success depends to a significant extent upon the efforts of our senior management team and other key personnel. The loss of the services of such personnel could adversely affect our business. Also, because of the nature of our business, our success is dependent upon our ability to attract and retain technologically qualified personnel. There is substantial competition for qualified personnel, and an inability to recruit or retain qualified personnel may impact our ability to grow our business and compete effectively in our industry.

13

Contract research services create a risk of liability.

In contracting to work on drug development trials and studies, we face a range of potential liabilities, for example:

- •

- errors or omissions that create harm during a trial to study volunteers or after a trial to consumers of the drug after regulatory approval of the drug;

- •

- general risks associated with clinical pharmacology facilities, including negative consequences from the administration of drugs to clinical trial participants or the professional malpractice of clinical pharmacology medical care providers;

- •

- errors or omissions from tests conducted for the agrochemical and food industries;

- •

- risks that animals in our breeding facilities may be infected with diseases that may be harmful and even lethal to themselves and humans despite preventive measures contained in our company policies for the quarantine and handling of imported animals; and

- •

- errors and omissions during a trial that may undermine the usefulness of a trial or data from the trial or study.

We also contract with physicians, also referred to as investigators, to conduct the clinical trials to test new drugs on human volunteers. These tests can create a risk of liability for personal injury or death to volunteers, resulting from negative reactions to the drugs administered or from professional malpractice by third party investigators. We believe that our risks in this area are generally reduced by the following:

- •

- contract provisions entitling us to be indemnified or entitling us to a limitation of liability;

- •

- insurance maintained by our clients, investigators, and by us; and

- •

- our efforts to comply with various regulatory requirements we must follow in connection with our business.

Contractual indemnifications generally do not protect us against liability arising from certain of our own actions, such as negligence or misconduct. We could be materially and adversely affected if we were required to pay damages or bear the costs of defending any claim which is not covered by a contractual indemnification provision or in the event that a party who must indemnify us does not fulfill its indemnification obligations or which is beyond the level of our insurance coverage. There can be no assurance that we will be able to maintain such insurance coverage on terms acceptable to us.

Hardware and software failures, delays in the operation of our computer and communications systems or the failure to implement system enhancements may harm our business.

Our success depends on the efficient and uninterrupted operation of our computer and communications systems. A failure of our network or data gathering procedures could impede the processing of data, delivery of databases and services, client orders and day-to-day management of our business and could result in the corruption or loss of data. While certain of our operations have appropriate disaster recovery plans in place, we currently do not have redundant facilities everywhere in the world to provide IT capacity in the event of a system failure. Despite any precautions we may take, damage from fire, floods, hurricanes, power loss, telecommunications failures, computer viruses, break-ins and similar events at our various computer facilities could result in interruptions in the flow of data to our servers and from our servers to our clients. In addition, any failure by our computer environment to provide our required data communications capacity could result in interruptions in our service. In the event of a delay in the delivery of data, we could be required to transfer our data collection operations to an alternative provider of server hosting services. Such a transfer could result in delays in our ability to deliver our products and services to our clients. Additionally, significant delays in the planned delivery of system enhancements, improvements and inadequate performance of the systems once they are completed could damage our reputation and harm our business. Finally, long-term disruptions in the infrastructure caused by events such as natural disasters, the outbreak of war, the escalation of hostilities, and acts of terrorism (particularly involving cities in which we have offices) could adversely affect our businesses. Although we carry property and business interruption insurance, our coverage may not be adequate to compensate us for all losses that may occur.

14

Reliance on facilities.

Covance relies on certain of its facilities. In particular, Covance's preclinical and central laboratory facilities are highly specific and would be difficult to replace in a short period of time. Any event that causes a disruption of the operation of these facilities might impact the Company's ability to provide service to its customers and therefore could have a material adverse affect on its financial condition, results of operations and cash flows.

Reliance on air transportation.

Our central laboratories and certain of our other businesses are heavily reliant on air travel for transport of clinical trial kits and other material, products and people, and a significant disruption to the air travel system, or our access to it, could have a material adverse effect on our business.

Certain service offerings and research products are dependent on limited sources of supply of services or products which if interrupted could affect our business.

We depend on a limited number of suppliers for certain services and for certain animal populations. Disruptions to the continued supply of these services or products may arise from export import restrictions or embargoes, foreign political or economic instability, or otherwise. Disruption of supply could have a material adverse effect on our business.

Actions of animal rights extremists may affect our business.

Our early development services utilize animals in preclinical testing of the safety and efficacy of drugs and also breed and sell animals for biomedical research. Such activities are required for the development of new medicines and medical devices under regulatory regimes in the United States, Europe, Japan and other countries. Acts of vandalism and other acts by animal rights extremists who object to the use of animals in drug development could have a material adverse effect on our business.

Our animal populations may suffer diseases that can damage our inventory, harm our reputation, result in decreased sales of research products or result in other liability to us.

It is important that our research products be free of diseases, including infectious diseases. The presence of diseases can distort or compromise the quality of research results, can cause loss of animals in our inventory, can result in harm to humans or outside animal populations if the disease is not contained to animals in inventory, or can result in other losses. Such results could harm our reputation or have a material adverse effect on our financial condition, results of operations, and cash flows.

Item 1B. Unresolved Staff Comments

None.

15

Covance both owns and leases its facilities. Covance owns substantial facilities in the United States in Madison, Wisconsin, in Chandler, Arizona, in Vienna, Virginia, in Greenfield, Indiana, in Europe in Harrogate, United Kingdom and Leeds, United Kingdom and in Muenster, Germany for its early development services. Covance is in the process of renovating a building it owns in Battle Creek, Michigan for use as a nutritional chemistry facility. Covance is in the process of completing a preclinical facility on land it owns near Shanghai, China. Covance owns a substantial facility in Geneva, Switzerland and leases a substantial facility in the United States in Indianapolis, Indiana for its central laboratory services and leases facilities in Indianapolis, Indiana and Chantilly, Virginia for its bioanalytical services. Covance leases substantial facilities for its clinical development services in the United States in Princeton, New Jersey, and in the United Kingdom in Maidenhead. Covance also owns or leases other properties and facilities in the United States, Europe, Asia Pacific and Latin America. Covance believes that its facilities are adequate for its operations and that suitable additional space will be available when needed.

For additional information, please see Note 11 to the audited consolidated financial statements included elsewhere in this Annual Report.

Covance is party to lawsuits and administrative proceedings incidental to the normal course of its business. Covance does not believe that any liabilities related to such lawsuits or proceedings will have a material effect on its financial condition, results of operations or cash flows.

Item 4. Submission of Matters to a Vote of Security Holders

None.

16

Item 5. Market for Registrant's Common Stock and Related Stockholder Matters and Issuer Purchases of Equity Securities

Covance's common stock is traded on the New York Stock Exchange (symbol: CVD). The following table shows the high and low sales prices on the New York Stock Exchange for each of the most recent eight fiscal quarters.

| Quarter | High | Low | |||||

|---|---|---|---|---|---|---|---|

First Quarter 2008 |

$ |

96.81 |

$ |

78.43 |

|||

Second Quarter 2008 |

$ |

88.55 |

$ |

77.53 |

|||

Third Quarter 2008 |

$ |

99.08 |

$ |

82.78 |

|||

Fourth Quarter 2008 |

$ |

88.32 |

$ |

31.47 |

|||

First Quarter 2009 |

$ |

46.68 |

$ |

32.38 |

|||

Second Quarter 2009 |

$ |

49.61 |

$ |

33.72 |

|||

Third Quarter 2009 |

$ |

58.95 |

$ |

45.46 |

|||

Fourth Quarter 2009 |

$ |

57.36 |

$ |

50.09 |

|||

As of February 19, 2010, there were 3,979 holders of record of Covance's common stock.

Covance has not paid any dividends during 2009 or 2008. Covance does not currently intend to pay dividends, but rather, intends to reinvest earnings in its business.

17

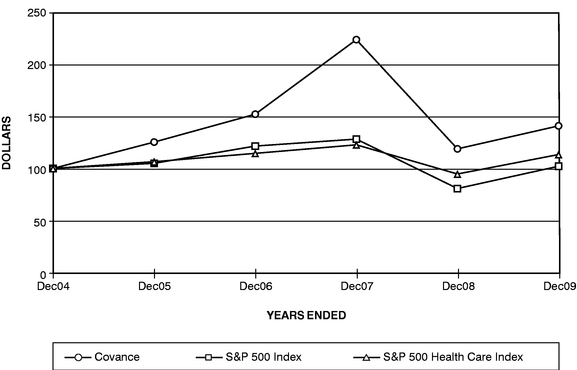

The graph below provides an indicator of cumulative total shareholder returns for Covance as compared with the Standard & Poor's 500 Stock Index® and the Standard & Poor's Health Care Sector Index®. The graph covers the period of time from December 31, 2004 through December 31, 2009 and assumes $100 was invested on December 31, 2004.

Item 6. Selected Financial Data

The following table presents selected historical consolidated financial data of Covance as of and for each of the years ended December 31, 2009, 2008, 2007, 2006 and 2005. This data has been derived from the audited consolidated financial statements of Covance. You should read this selected historical consolidated financial data in conjunction with Covance's audited consolidated financial statements and accompanying notes included elsewhere in this Annual Report. Historical consolidated financial data may not be indicative of Covance's future performance. See also "Management's Discussion and Analysis of Financial Condition and Results of Operations."

The information provided in the following table is on an "as reported" basis for all years presented, and includes the results of Covance's interactive voice and web response service offering ("IVR Services") through its divestiture on August 20, 2009 and Covance's cardiac safety service offering ("Cardiac Safety Services") through its divestiture on November 27, 2007. Items affecting comparability between periods have been noted in the following table.

18

| |

Year Ended December 31 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | 2007 | 2006 | 2005(a) | |||||||||||||

| |

(Dollars in thousands, except per share data) |

|||||||||||||||||

Income Statement Data: |

||||||||||||||||||

Net revenues |

$ | 1,867,634 | $ | 1,728,098 | $ | 1,546,419 | $ | 1,340,203 | $ | 1,192,950 | ||||||||

Reimbursable out-of-pocket expenses |

94,992 | 98,969 | 85,097 | 65,855 | 57,504 | |||||||||||||

Total revenues |

1,962,626 | 1,827,067 | 1,631,516 | 1,406,058 | 1,250,454 | |||||||||||||

Costs and expenses: |

||||||||||||||||||

Cost of revenue |

1,277,142 | 1,142,697 | 1,017,686 | 882,190 | 791,654 | |||||||||||||

Reimbursable out-of-pocket expenses |

94,992 | 98,969 | 85,097 | 65,855 | 57,504 | |||||||||||||

Selling, general and administrative |

270,593 | 250,180 | 233,890 | 207,388 | 178,368 | |||||||||||||

Depreciation and amortization |

91,289 | 71,571 | 66,197 | 57,388 | 47,821 | |||||||||||||

Total |

1,734,016 | 1,563,417 | 1,402,870 | 1,212,821 | 1,075,347 | |||||||||||||

Income from operations |

228,610 | 263,650 | 228,646 | 193,237 | 175,107 | |||||||||||||

Other (income) expense, net: |

||||||||||||||||||

Interest expense (income), net |

201 | (6,461 | ) | (9,801 | ) | (7,564 | ) | (3,637 | ) | |||||||||

Foreign exchange transaction losses (gains) |

245 | (142 | ) | (1,375 | ) | 212 | 1,073 | |||||||||||

Gain on sale of businesses |

(9,681 | ) | (4,070 | ) | (6,590 | ) | — | — | ||||||||||

Other income, net |

(9,235 | )(b) | (10,673 | )(d) | (17,766 | )(e) | (7,352 | ) | (2,564 | ) | ||||||||

Income before taxes and equity investee earnings |

237,845 | (b) | 274,323 | (d) | 246,412 | (e) | 200,589 | 177,671 | ||||||||||

Taxes on income |

62,870 | (b),(c) | 79,415 | (d) | 72,934 | (e) | 57,179 | (f) | 58,786 | (g) | ||||||||

Equity investee earnings |

907 | 1,852 | 2,451 | 1,588 | 734 | |||||||||||||

Net income |

$ | 175,882 | (b),(c) | $ | 196,760 | (d) | $ | 175,929 | (e) | $ | 144,998 | (f) | $ | 119,619 | (g) | |||

Basic earnings per share |

$ |

2.76 |

$ |

3.12 |

$ |

2.76 |

$ |

2.28 |

$ |

1.91 |

||||||||

Diluted earnings per share |

$ | 2.73 | (b),(c) | $ | 3.08 | (d) | $ | 2.71 | (e) | $ | 2.24 | (f) | $ | 1.88 | (g) | |||

Balance Sheet Data: |

||||||||||||||||||

Working capital |

$ | 474,928 | $ | 277,895 | $ | 411,897 | $ | 349,862 | $ | 293,982 | ||||||||

Total assets |

$ | 1,974,944 | $ | 1,753,088 | $ | 1,560,185 | $ | 1,297,678 | $ | 1,056,603 | ||||||||

Stockholders' equity |

$ | 1,411,004 | $ | 1,194,849 | $ | 1,110,188 | $ | 923,295 | $ | 731,771 | ||||||||

Other Financial Data: |

||||||||||||||||||

Gross margin |

31.6 | % | 33.9 | % | 34.2 | % | 34.2 | % | 33.6 | % | ||||||||

Operating margin |

12.2 | % | 15.3 | % | 14.8 | % | 14.4 | % | 14.7 | % | ||||||||

Net income margin |

9.4 | % | 11.4 | % | 11.4 | % | 10.8 | % | 10.0 | % | ||||||||

Current ratio |

2.18 |

1.60 |

2.15 |

2.21 |

2.16 |

|||||||||||||

Book value per share |

22.01 | 18.88 | 17.34 | 14.44 | 11.65 | |||||||||||||

Net days sales outstanding |

40 | 37 | 36 | 49 | 56 | |||||||||||||

- (a)

- 2005

results reflect stock-based compensation expense for the fair value of stock awards and do not include stock-based compensation expense for stock

option grants, in accordance with the accounting standard followed in 2005, as all options were granted with an exercise price equal to the fair market value of the underlying common stock on the date

of grant.

- (b)

- Includes

a $9,026 gain on 2009 sale of IVR Services ($5,867 or $0.09 per diluted share gain, net of tax totaling $3,159) and a $655 gain ($426 or $0.01 per

diluted share gain, net of tax totaling $229) resulting from contingent consideration received in 2009 associated with the 2007 sale of Cardiac Safety Services related to transferred backlog.

- (c)

- Includes

a $2,072 or $0.03 per diluted share income tax gain associated with the reduction of income tax reserves resulting from the completion of an income

tax audit and the recognition of previously unrecognized tax benefits in jurisdictions where the period of review of filings has expired.

- (d)

- Includes

a $4,070 gain ($2,646 or $0.05 per diluted share gain, net of tax totaling $1,424) resulting from contingent consideration received in 2008

associated with the 2007 sale of Cardiac Safety Services related to transferred backlog.

- (e)

- Includes

a $6,590 gain on the sale of Cardiac Safety Services ($4,152 or $0.06 per diluted share gain, net of tax totaling $2,438).

- (f)

- Includes

a $2,467 or $0.04 per diluted share income tax gain associated with the reduction of income tax reserves resulting from favorable income tax

developments in 2006.

- (g)

- Includes a $4,400 or $0.07 per diluted share income tax charge associated with the repatriation of $103 million of accumulated foreign earnings under the American Jobs Creation Act of 2004.

19

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Overview

Covance is a leading drug development services company providing a wide range of early-stage and late-stage product development services on a worldwide basis primarily to the pharmaceutical, biotechnology and medical device industries. Covance also provides services such as laboratory testing to the chemical, agrochemical and food industries. The foregoing services comprise two reportable segments for financial reporting purposes: early development services, which includes preclinical and clinical pharmacology service offerings; and late-stage development services, which includes central laboratory, clinical development, periapproval and market access services. Although each segment has separate services within it, they can be and increasingly are combined in integrated service offerings. Covance believes it is one of the largest drug development services companies, based on annual net revenues, and one of a few that is capable of providing comprehensive global product development services. Covance offers its clients high quality services designed to provide data to clients as rapidly as possible and reduce product development time. We believe this enables Covance's customers to introduce their products into the marketplace faster and as a result, maximize the period of market exclusivity and monetary return on their research and development investments. Additionally, Covance's comprehensive services and broad experience provide its customers with a variable cost alternative to fixed cost internal development capabilities.

Critical Accounting Policies

Covance's consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles ("GAAP"), which require management to make estimates and assumptions about future events that affect the amounts reported in the financial statements and the accompanying notes. Actual results could differ from these estimates. The following discussion highlights what we believe to be the critical accounting policies and judgments made in the preparation of these consolidated financial statements.

Revenue Recognition. Covance recognizes revenue either as services are performed or products are delivered, depending on the nature of the work contracted. Historically, a majority of Covance's net revenues have been earned under contracts which range in duration from a few months to two years, but can extend in duration up to five years or longer. We also have dedicated capacity arrangements with certain clients which generally range in duration from three to ten years. Underlying these arrangements are individual project contracts for the specific services to be provided. Dedicated capacity arrangements enable our clients to secure space in our facilities in exchange for which they agree to provide a guaranteed annual minimum dollar value ("volume") of work. Under these types of arrangements, if the annual minimum volume commitment is not reached, the client is required to pay Covance for the shortfall. Progress towards the achievement of annual minimum volume guarantees is monitored throughout the year. Annual minimum guarantee shortfalls are included in net revenues when the amount of the shortfall is determinable and realization is assured.

We do not have any individual significant contracts as pertains to revenue recognition. By way of background, at any point in time we are working on thousands of active clients projects, which are governed by individual contracts. In addition, we have not had a single customer who accounted for more than ten percent of our aggregate net revenues during any one of the last three years. We serve in excess of 500 biopharmaceutical companies and we have over 12,000 active client projects. Most projects are customized based on the needs of the client, the type of services being provided, therapeutic indication of the drug, geographic locations and other variables. Project specific terms related to pricing, billing milestones and the scope and type of services to be provided are generally negotiated and contracted on a project-by-project basis.

20