Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

| Commission File No. |

Exact name of each Registrant as specified in its charter, state of incorporation, address of principal executive offices, telephone number |

I.R.S. Employer Identification Number | ||

| 1-8180 | TECO ENERGY, INC. (a Florida corporation) TECO Plaza 702 N. Franklin Street Tampa, Florida 33602 (813) 228-1111 |

59-2052286 | ||

| 1-5007 | TAMPA ELECTRIC COMPANY (a Florida corporation) TECO Plaza 702 N. Franklin Street Tampa, Florida 33602 (813) 228-1111 |

59-0475140 | ||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| TECO Energy, Inc. Common Stock, $1.00 par value |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if TECO Energy, Inc. is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if Tampa Electric Company is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES ¨ NO x

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrants have submitted electronically and posted on their corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrants were required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether TECO Energy, Inc. is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer x Accelerated filer ¨ Non-Accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether Tampa Electric Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer ¨ Accelerated filer ¨ Non-Accelerated filer x Smaller reporting company ¨

Indicate by check mark whether TECO Energy, Inc. is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

Indicate by check mark whether Tampa Electric Company is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of TECO Energy, Inc.’s common stock held by non-affiliates of the registrant as of Jun. 30, 2009 was $2,549,968,020 based on the closing sale price as reported on the New York Stock Exchange.

The aggregate market value of Tampa Electric Company’s common stock held by non-affiliates of the registrant as of Jun. 30, 2009 was zero.

The number of shares of TECO Energy, Inc.’s common stock outstanding as of Feb. 22, 2010 was 213,857,116. As of Feb. 22, 2010, there were 10 shares of Tampa Electric Company’s common stock issued and outstanding, all of which were held, beneficially and of record, by TECO Energy, Inc.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement relating to the 2010 Annual Meeting of Shareholders of TECO Energy, Inc. are incorporated by reference into Part III.

Tampa Electric Company meets the conditions set forth in General Instruction (I) (1) (a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format.

This combined Form 10-K represents separate filings by TECO Energy, Inc. and Tampa Electric Company. Information contained herein relating to an individual registrant is filed by that registrant on its own behalf. Tampa Electric Company makes no representations as to the information relating to TECO Energy, Inc.’s other operations.

Cover page of 183

Index to Exhibits begins on page 180

Table of Contents

PART I

| Item 1. | BUSINESS. |

TECO ENERGY

TECO Energy, Inc. (TECO Energy) was incorporated in Florida in 1981 as part of a restructuring in which it became the parent corporation of Tampa Electric Company. TECO Energy and its subsidiaries had approximately 4,073 employees as of Dec. 31, 2009.

TECO Energy’s Corporate Governance Guidelines, the charter of each committee of the Board of Directors, and the code of ethics applicable to all directors, officers and employees, the Standards of Integrity, are available on the Investors section of TECO Energy’s website, www.tecoenergy.com, or in print free of charge to any investor who requests the information. TECO Energy also makes its Securities and Exchange Commission (SEC) (www.sec.gov) filings available free of charge on the Investors section of TECO Energy’s website as soon as reasonably practicable after they are filed with or furnished to the SEC.

TECO Energy is a holding company for regulated utilities and other businesses. TECO Energy currently owns no operating assets but holds all of the common stock of Tampa Electric Company and through its subsidiary TECO Diversified, Inc., owns TECO Coal Corporation and through its subsidiary TECO Wholesale Generation, Inc., owns TECO Guatemala, Inc.

Unless otherwise indicated by the context, “TECO Energy” means the holding company, TECO Energy, Inc., and its subsidiaries, and references to individual subsidiaries of TECO Energy, Inc. refer to that company and its respective subsidiaries. TECO Energy’s business segments, and revenues for those segments for the years indicated, are identified below.

Tampa Electric Company, a Florida corporation and TECO Energy’s largest subsidiary, has two business segments. Its Tampa Electric division (Tampa Electric) provides retail electric service to almost 667,000 customers in West Central Florida with a net winter system generating capability of 4,719 megawatts (MW). Peoples Gas System (PGS), the gas division of Tampa Electric Company, is engaged in the purchase, distribution and sale of natural gas for residential, commercial, industrial and electric power generation customers in Florida. With more than 334,000 customers, PGS has operations in Florida’s major metropolitan areas. Annual natural gas throughput (the amount of gas delivered to its customers, including transportation-only service) in 2009 was 1.4 billion therms.

TECO Coal Corporation (TECO Coal), a Kentucky corporation, has 13 subsidiaries located in Eastern Kentucky, Tennessee and Virginia. These entities own mineral rights, own or operate surface and underground mines and own interests in coal processing and loading facilities.

TECO Guatemala, Inc. (TECO Guatemala), a Florida corporation, owns equity investments in unconsolidated subsidiaries that participate in two contracted power plants and an interest in Distribućion Eléctrica Centro Americana II, S.A. (DECA II), which has an ownership interest in Guatemala’s largest distribution utility, Empresa Eléctrica de Guatemala, S.A. (EEGSA) and other affiliated energy-related companies.

TECO Transport Corporation (TECO Transport), a Florida corporation, was sold on Dec. 4, 2007. During 2007, it owned no operating assets but owned all of the common stock of, or membership interests in, nine subsidiaries which provided waterborne transportation, storage and transfer services of coal and other dry-bulk commodities.

Revenues from Continuing Operations

| (millions) |

2009 | 2008 | 2007 | |||||||||

| Tampa Electric |

$ | 2,194.8 | $ | 2,091.2 | $ | 2,188.4 | ||||||

| PGS |

470.8 | 688.4 | 599.7 | |||||||||

| Total regulated businesses |

2,665.6 | 2,779.6 | 2,788.1 | |||||||||

| TECO Coal |

653.0 | 588.4 | 544.5 | |||||||||

| TECO Guatemala (1) |

8.3 | 8.4 | 8.0 | |||||||||

| TECO Transport |

— | — | 290.3 | |||||||||

| 3,326.9 | 3,376.4 | 3,630.9 | ||||||||||

| Other and eliminations |

(16.4 | ) | (1.1 | ) | (94.8 | ) | ||||||

| Total revenues from continuing operations |

$ | 3,310.5 | $ | 3,375.3 | $ | 3,536.1 | ||||||

| (1) | Revenues are exclusive of entities deconsolidated as a result of accounting standards and include only revenues for the consolidated Guatemalan entities. |

1

Table of Contents

For additional financial information regarding TECO Energy’s significant business segments including geographic areas, see Note 14 to the TECO Energy Consolidated Financial Statements. Also, see Note 19 for additional information regarding the deconsolidation of Guatemala subsidiaries.

Discontinued Operations/Asset Dispositions

TECO Energy’s results for 2007 include amounts related to asset dispositions as part of the company’s business strategy to focus on the electric and gas utilities, eliminate exposure to the merchant power sector and retire parent debt.

In the fourth quarter of 2007, TECO Energy completed its sale of TECO Transport to an unaffiliated investment group. As a result of its continuing involvement via a waterborne transportation contract with Tampa Electric, all results through the date of sale were accounted for in continuing operations. In the second quarter of 2007, a favorable conclusion was reached with taxing authorities regarding the 2005 disposition of Union and Gila merchant power plants. This resulted in after-tax net income of $14.3 million reflected in discontinued operations.

TAMPA ELECTRIC—Electric Operations

Tampa Electric Company was incorporated in Florida in 1899 and was reincorporated in 1949. Tampa Electric Company is a public utility operating within the state of Florida. Its Tampa Electric division is engaged in the generation, purchase, transmission, distribution and sale of electric energy. The retail territory served comprises an area of about 2,000 square miles in West Central Florida, including Hillsborough County and parts of Polk, Pasco and Pinellas Counties, with an estimated population of over one million. The principal communities served are Tampa, Winter Haven, Plant City and Dade City. In addition, Tampa Electric engages in wholesale sales to utilities and other resellers of electricity. It has three electric generating stations in or near Tampa, one electric generating station in southwestern Polk County, Florida and one electric generating station in long-term reserve standby located near Sebring, a city in Highlands County in South Central Florida.

Tampa Electric had 2,324 employees as of Dec. 31, 2009, of which 898 were represented by the International Brotherhood of Electrical Workers and 209 were represented by the Office and Professional Employees International Union.

In 2009, approximately 49% of Tampa Electric’s total operating revenue was derived from residential sales, 31% from commercial sales, 9% from industrial sales and 11% from other sales, including bulk power sales for resale. The sources of operating revenue and megawatt hour sales for the years indicated were as follows:

Operating Revenue

| (millions) |

2009 | 2008 | 2007 | |||||||

| Residential |

$ | 1,082.4 | $ | 981.7 | $ | 1,017.9 | ||||

| Commercial |

689.1 | 639.0 | 653.6 | |||||||

| Industrial—Phosphate |

81.2 | 66.1 | 73.0 | |||||||

| Industrial—Other |

111.0 | 111.2 | 118.2 | |||||||

| Other retail sales of electricity |

204.3 | 185.7 | 178.4 | |||||||

| Total retail |

2,168.0 | 1,983.7 | 2,041.1 | |||||||

| Sales for resale |

42.4 | 69.7 | 69.0 | |||||||

| Other |

(15.6 | ) | 37.8 | 78.3 | ||||||

| Total operating revenues |

$ | 2,194.8 | $ | 2,091.2 | $ | 2,188.4 | ||||

| Megawatt-hour Sales

|

||||||||||

| (millions) |

2009 | 2008 | 2007 | |||||||

| Residential |

8,667 | 8,546 | 8,871 | |||||||

| Commercial |

6,274 | 6,399 | 6,542 | |||||||

| Industrial |

1,995 | 2,205 | 2,366 | |||||||

| Other retail sales of electricity |

1,839 | 1,840 | 1,754 | |||||||

| Total retail |

18,775 | 18,990 | 19,533 | |||||||

| Sales for resale |

440 | 884 | 905 | |||||||

| Total energy sold |

19,215 | 19,874 | 20,438 | |||||||

No significant part of Tampa Electric’s business is dependent upon a single or limited number of customers where the loss of any one or more would have a significant adverse effect on Tampa Electric. Tampa Electric’s business is not highly seasonal, but winter peak loads are experienced due to electric space heating, fewer daylight hours and colder temperatures and summer peak loads are experienced due to the use of air conditioning and other cooling equipment.

2

Table of Contents

Regulation

The retail operations of Tampa Electric are regulated by the Florida Public Service Commission (FPSC), which has jurisdiction over retail rates, quality of service and reliability, issuances of securities, planning, siting and construction of facilities, accounting and depreciation practices and other matters.

In general, the FPSC’s pricing objective is to set rates at a level that allows the utility to collect total revenues (revenue requirements) equal to its cost of providing service, plus a reasonable return on invested capital.

The costs of owning, operating and maintaining the utility system, other than fuel, purchased power, conservation and certain environmental costs, are recovered through base rates. These costs include operation and maintenance expenses, depreciation and taxes, as well as a return on Tampa Electric’s investment in assets used and useful in providing electric service (rate base). The rate of return on rate base, which is intended to approximate Tampa Electric’s weighted cost of capital, primarily includes its costs for debt, deferred income taxes at a zero cost rate and an allowed return on common equity. Base rates are determined in FPSC rate setting hearings which occur at irregular intervals at the initiative of Tampa Electric, the FPSC or other parties.

Tampa Electric’s rates and allowed return on equity (ROE) range of 10.25% to 12.25%, with a midpoint of 11.25%, are in effect until such time as changes are occasioned by an agreement approved by the FPSC or other FPSC actions as a result of rate or other proceedings initiated by Tampa Electric, FPSC staff or other interested parties. These values were set by the FPSC in March 2009 as part of Tampa Electric’s base rate proceeding filed in August 2008.

Prior to August 2008, Tampa Electric had not sought a base rate increase since 1992. As a result of lower customer growth, lower energy sales growth, and ongoing high levels of capital investment, Tampa Electric’s 13-month average regulatory ROE was 8.7% at the end of 2008.

Recognizing the significant decline in ROE, Tampa Electric filed for a $228.2 million base rate increase in August 2008. The filing included a request for an ROE mid-point of 12%, 54.0% equity in the capital structure and rate base of $3.7 billion. The formal hearing before the FPSC was held in late January 2009 and in March 2009, the FPSC approved a total base rate increase of $137.8 million, $104.3 million effective May 2009 and an additional $33.5 million, subject to audit of actual final cost, actual in service dates, need and prudency, effective January 2010 associated with Tampa Electric’s completion of five combustion turbine (CT) generation units and new rail facilities by Dec. 31, 2009. Motions for reconsideration of the FPSC’s decision were filed by Tampa Electric (addressing an incorrect tax calculation) and the intervenors (addressing the appropriateness of the additional rate increase in January 2010). In July 2009, the FPSC approved Tampa Electric’s motion and denied the intervenors’ motion for reconsideration, which increased the approved base rate increase to $147.7 million. Due to the FPSC’s denial of the intervenors’ motion for reconsideration, they have notified the FPSC of their intent to file an appeal with the Florida Supreme Court.

In October 2009, Tampa Electric filed its petition supporting the cost and in service operation of the CTs and rail facilities, the continuing need for the CTs and requesting the proposed rates become effective January 2010 as authorized by the FPSC. The FPSC determined, based in part on its staff audit of the actual costs of the CTs, that the January base rate change should be reduced by $8.4 million to $25.7 million, subject to refund. An evidentiary hearing will be held during 2010 regarding the need for the CTs, the appropriate amount to be recovered and the resulting rates. The intervenor’s appeal to the Florida Supreme Court is independent of the FPSC hearing. The intervenors are expected to file their initial appellate brief with the Florida Supreme Court in February 2010. A decision date in that case is uncertain.

Fuel, purchased power, conservation and certain environmental costs are recovered through levelized monthly charges established pursuant to the FPSC’s cost recovery clauses. These charges, which are reset annually in an FPSC proceeding, are based on estimated costs of fuel, environmental compliance, conservation programs, purchased power and estimated customer usage for a specific recovery period, with a true-up adjustment to reflect the variance of actual costs from the projected costs. The FPSC may disallow recovery of any costs that it considers imprudently incurred.

In November 2008, the FPSC approved Tampa Electric’s originally requested 2009 fuel rates. The rates included the costs for natural gas and coal expected in 2009, and the recovery of fuel and purchased power expenses, which were not collected in 2008. In March 2009, Tampa Electric filed a mid-course correction with the FPSC to adjust its projected 2009 fuel and purchased power costs to reflect the decline in commodity fuel prices, primarily natural gas. The revised forecast reduced fuel and purchased power costs by $191 million for 2009, which when combined with $35 million over recovery in late 2008, resulted in $226 million lower projected fuel and purchased power cost (coincident with the base rate adjustments made as a result of the base rate proceeding). Residential energy rates also reflect a two-block base rate and fuel factor structure with a lower factor for the first 1,000 kilowatt-hours used each month. Tampa Electric’s residential customer rate per 1,000 kilowatt-hours decreased $1.94 from $114.67 in August of 2009 to $112.73 in 2010.

In November 2009, the FPSC approved cost recovery rates for fuel and purchased power, capacity, environmental and conservation costs for the period January through December 2010. The rates include the expected cost for natural gas and coal in 2010 as well as the solid fuel transportation costs associated with the company’s transportation agreements, the net over recovery of fuel, purchased power and capacity clause expenses, which were collected in 2009 following the March adjustment, and the operating cost for and a return on the capital invested in the fourth SCR project to enter service at the Big Bend Power Station as well as the operation and maintenance expense associated with the projects.

3

Table of Contents

The FPSC determined that it was appropriate for Tampa Electric to recover selective catalytic reduction (SCR) operating costs through the environmental cost recovery clause (ECRC) as well as earn a return on its SCR investment installed on the Big Bend coal fired units for NOx control in compliance with the environmental consent decree. The SCR for Big Bend Unit 4 was reported in service in May 2007, the SCR for Big Bend Unit 3 was reported in service in June 2008, the SCR for Big Bend Unit 2 was reported in service in May 2009 and cost recovery started in the respective in service years. The SCR for Big Bend Unit 1 is scheduled to enter service by May 1, 2010, and cost recovery for the capital investment and operating costs for that unit has been approved by the FPSC to start in 2010.

Tampa Electric is also subject to regulation by the Federal Energy Regulatory Commission (FERC) in various respects, including wholesale power sales, certain wholesale power purchases, transmission services, bulk electric system reliability standards, affiliate transactions and accounting and depreciation practices. Regarding reliability standards, a spot audit of Tampa Electric was conducted Nov. 9-13, 2009 by the Florida Reliability Coordinating Council (FRCC). FRCC is a Regional Entity operating under a Delegation Agreement approved by the North American Electric Reliability Corporation (NERC) and FERC. The FRCC audit assessed compliance with the NERC Critical Infrastructure Protection (CIP) or cyber standards. The FRCC Compliance Staff concluded that Tampa Electric was fully compliant with 12 of the 13 NERC CIP requirements subject to the spot audit with one relatively minor finding. See also the Regulation section of MD&A.

The Energy Policy Act of 2005 repealed the Public Utility Holding Company Act of 1935 (PUHCA), which established a regulatory regime overseen by the SEC, and replaced it with a new statute focused on increased access to holding-company books and records to assist the FERC and state utility regulators in protecting customers of regulated utilities. On Dec. 8, 2005, the FERC finalized rules to implement the congressional mandated repeal of the PUHCA of 1935 and enactment of the PUHCA of 2005. FERC issued its final rules effective Feb. 8, 2006. Pursuant to this Act, TECO Energy has a single-state waiver regarding FERC’s access to its holding-company books and records.

Federal, state and local environmental laws and regulations cover air quality, water quality, land use, power plant, substation and transmission line siting, noise and aesthetics, solid waste and other environmental matters (see Environmental Matters section below).

Transactions between Tampa Electric and its affiliates are subject to regulation by the FPSC and FERC, and any charges deemed to be imprudently incurred may be disallowed for recovery from Tampa Electric’s retail and wholesale customers, respectively.

Competition

Tampa Electric’s retail electric business is substantially free from direct competition with other electric utilities, municipalities and public agencies. At the present time, the principal form of competition at the retail level consists of self-generation available to larger users of electric energy. Such users may seek to expand their alternatives through various initiatives, including legislative and/or regulatory changes that would permit competition at the retail level. Tampa Electric intends to retain and expand its retail business by managing costs and providing high quality service to retail customers.

Presently there is competition in Florida’s wholesale power markets, largely as a result of the Energy Policy Act of 1992 and related federal initiatives. However, the state’s Power Plant Siting Act, which sets the state’s electric energy and environmental policy and governs the building of new generation involving steam capacity of 75 megawatts or more, requires that applicants demonstrate that a plant is needed prior to receiving construction and operating permits.

FPSC rules require Investor Owned Utilities (IOUs) to issue Request for Proposals (RFPs) prior to filing a petition for Determination of Need for construction of a power plant with a steam cycle greater than 75 megawatts. These rules provide a mechanism for expedited dispute resolution, allow bidders to submit new bids whenever the IOU revises its cost estimates for its self-build option, require IOUs to disclose the methodology and criteria to be used to evaluate the bids, and provide more stringent standards for the IOUs to recover cost overruns in the event the self-build option is deemed the most cost-effective.

Fuel

Approximately 55% of Tampa Electric’s generation of electricity for 2009 was coal-fired, with natural gas representing approximately 45% and oil representing less than 1%. Tampa Electric used its generating units to meet approximately 91% of the total system load requirements, with the remaining 9% coming from purchased power. Tampa Electric’s average delivered fuel cost per million British thermal unit (Btu) and average delivered cost per ton of coal burned, have been as follows:

| Average cost per million Btu |

2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||

| Coal |

$ | 3.05 | $ | 2.91 | $ | 2.57 | $ | 2.49 | $ | 2.25 | |||||

| Oil |

$ | 16.01 | $ | 20.48 | $ | 13.87 | $ | 13.39 | $ | 10.16 | |||||

| Gas (Natural) |

$ | 8.00 | $ | 10.61 | $ | 9.52 | $ | 9.61 | $ | 9.37 | |||||

| Composite |

$ | 5.02 | $ | 5.56 | $ | 5.05 | $ | 4.75 | $ | 4.79 | |||||

| Average cost per ton of coal burned |

$ | 79.28 | $ | 69.14 | $ | 60.72 | $ | 58.75 | $ | 53.00 | |||||

4

Table of Contents

Tampa Electric’s generating stations burn fuels as follows: Bayside, with units 3 through 6 entering commercial operation in 2009, burns natural gas; Big Bend Station, which has sulfur dioxide scrubber capabilities, burns a combination of high-sulfur coal, a processed oil by-product known as petroleum coke and CT4 which entered commercial operation in August 2009 burns No. 2 fuel oil and natural gas; Polk Unit 1 burns a blend of low-sulfur coal and petroleum coke, which is gasified and subject to sulfur and particulate matter removal prior to combustion, natural gas and oil; and Phillips Station, which burned residual fuel oil and was placed on long-term standby in September 2009.

Coal. Tampa Electric burned approximately 4.2 million tons of coal and petroleum coke during 2009 and estimates that its combined coal and petroleum coke consumption will be about 4.7 million tons for 2010. During 2009, Tampa Electric purchased approximately 67% of its coal under long-term contracts with four suppliers, and approximately 33% of its coal and petroleum coke in the spot market. Tampa Electric attempts to maintain a portfolio of 60% long-term versus 40% spot contracts, but market conditions, actual deliveries and unit performance can change this portfolio on a year-by-year basis. Tampa Electric expects to obtain approximately 79% of its coal and petroleum coke requirements in 2010 under long-term contracts with four suppliers and the remaining 21% in the spot market.

Tampa Electric’s long-term contracts provide for revisions in the base price to reflect changes in several important cost factors and for suspension or reduction of deliveries if environmental regulations should prevent Tampa Electric from burning the coal supplied, provided that a good faith effort has been made to continue burning such coal.

In 2009, approximately 77% of Tampa Electric’s coal supply was deep-mined, approximately 14% was surface-mined and the remaining was petroleum coke. Federal surface-mining laws and regulations have not had any material adverse impact on Tampa Electric’s coal supply or results of its operations. Tampa Electric cannot predict, however, the effect of any future mining laws and regulations.

Natural Gas. As of Dec. 31, 2009, approximately 48% of Tampa Electric’s 850,000 MMBtu gas storage capacity was full. Tampa Electric has contracted for 60% of the expected gas needs for the April 2010 through September 2010 period, 50% for October 2010 and 20% for November 2010 through March 2011. In early March 2010 Tampa Electric expects to issue a RFP and contract for additional gas to meet its generation requirements for these time periods. Additional volume requirements in excess of projected gas needs are purchased on the short-term spot market.

Oil. Tampa Electric has agreements in place to purchase low sulfur No. 2 oil for its Big Bend and Polk power stations. All of these agreements have prices that are based on spot indices.

Franchises and Other Rights

Tampa Electric holds franchises and other rights that, together with its charter powers, govern the placement of Tampa Electric’s facilities on the public rights-of-way as it carries on its retail business in the localities it serves. The franchises specify the negotiated terms and conditions governing Tampa Electric’s use of public rights-of-way and other public property within the municipalities it serves during the term of the franchise agreement, and are irrevocable and not subject to amendment without the consent of Tampa Electric (except to the extent certain city ordinances relating to permitting and like matters are modified from time to time), although, in certain events, they are subject to forfeiture.

Florida municipalities are prohibited from granting any franchise for a term exceeding 30 years. Temple Terrace reserved the right to purchase Tampa Electric’s property used in the exercise of its franchise if the franchise is not renewed. In the absence of such right to purchase, based on judicial precedent, if the franchise agreement is not renewed Tampa Electric would be able to continue to use public rights-of-way within the municipality, subject to reasonable rules and regulations imposed by the municipalities.

Tampa Electric has franchise agreements with 13 incorporated municipalities within its retail service area. These agreements have various expiration dates through November 2039.

Franchise fees payable by Tampa Electric, which totaled $39.4 million in 2009, are calculated using a formula based primarily on electric revenues and are collected on customers’ bills.

Utility operations in Hillsborough, Pasco, Pinellas and Polk Counties outside of incorporated municipalities are conducted in each case under one or more permits to use state or county rights-of-way granted by the Florida Department of Transportation or the county commissioners of such counties. There is no law limiting the time for which such permits may be granted by counties. There are no fixed expiration dates for the Hillsborough County, Pinellas County and Polk County agreements. The agreement covering electric operations in Pasco County expires in 2023.

5

Table of Contents

Environmental Matters

Among our companies, Tampa Electric has a number of significant stationary sources with air emissions impacted by the Clean Air Act and material Clean Water Act implications. Tampa Electric has undertaken major steps to dramatically reduce its air emissions through a series of actions, including technology selection (e.g., Integrated Gasification Combined-Cycle (IGCC) and conversion of coal-fired units to natural-gas fired combined cycle); implementing a responsible fuel mix taking into account price and reliability effects on its customers; a substantial capital expenditure program to add Best Available Control Technology (BACT) emissions controls; implementation of additional controls to accomplish earlier reductions of certain emissions allowing for lower emission rates when BACT was ultimately installed; and enhanced controls and monitoring systems for certain pollutants. All of these improvements represent an investment in excess of $2 billion since 1994.

These actions have allowed Tampa Electric to maintain a diverse fuel supply, essential to power generation reliability and customer economic vitality; while at the same time, achieve significant air pollutant emission reductions, including carbon dioxide.

Consent Decree

Tampa Electric, through voluntary negotiations with the Environmental Protection Agency (EPA), the U.S. Department of Justice (DOJ) and the FDEP, signed a Consent Decree, which became effective Feb. 29, 2000, and a Consent Final Judgment, which became effective Dec. 6, 1999, as settlement of federal and state litigation. Pursuant to these agreements, allegations of violations of New Source Review requirements of the Clean Air Act were resolved, provision was made for environmental controls and pollution reductions, and Tampa Electric began implementing a comprehensive program to dramatically decrease emissions from its power plants.

The emission reduction requirements included specific detail with respect to the availability of flue gas desulfurization systems (scrubbers) to help reduce SO2, projects for NOx reduction on Big Bend Units 1 through 4, and the repowering of the coal-fired Gannon Power Station to natural gas, which was renamed the H. L. Culbreath Bayside Power Station (Bayside Power Station), in 2003 and 2004. Upon completion of the conversion, the station capacity was about 1,800 megawatts (nominal) of natural gas-fueled, combined-cycle electric generation. The repowering has reduced the facility’s NOx and SO 2 emissions by approximately 99% and particulate matter (PM) emissions by approximately 92% from 1998 levels.

In 2004, Tampa Electric made its NOx reduction technology selection and decided to install SCR systems for NO x control on the coal-fired Big Bend units. The first three units at Big Bend Power Station were reported in service in May 2007, June 2008 and May 2009, respectively. The remaining unit, Big Bend Unit 1, is expected to be in service in May 2010. Tampa Electric’s capital investment forecast includes amounts in 2010 for completion of the final NOx control project (see the Capital Expenditures section).

The FPSC has determined that it is appropriate for Tampa Electric to recover the operating costs of and earn a return on the investment in the SCRs to be installed on all four of the units at the Big Bend Power Station and pre-SCR projects on Big Bend Units 1–3 (which are early plant improvements to reduce NOx emissions prior to installing the SCRs) through the ECRC (see the Regulation section). Cost recovery for the SCRs began in each of the years that the units entered service, Big Bend Unit 4 in 2007, Big Bend Unit 3 in 2008 and Big Bend Unit 2 in 2009. In November 2009, the FPSC approved cost recovery for the capital investment on the Big Bend Unit 1 SCR to start in 2010.

In November 2007, Tampa Electric entered into an agreement with the EPA and DOJ for a Second Amendment to the Consent Decree. The Second Amendment: 1) establishes a 0.12 lb/MMBtu NOx limit on a 30-day rolling average for Big Bend Units 1 through 3, which is lower than the original Consent Decree that had a provision for a limit as high as 0.15 lb/MMBtu depending on certain conditions; 2) allows for the sale of NOx allowances gained as a result of surpassing the emission limit goals of the Consent Decree; and 3) calls for Tampa Electric to install a second PM Continuous Emissions Monitoring System and potentially replace the originally installed system if the new system is successful.

Emission Reductions

Projects committed to under the Consent Decree and Consent Final Judgment have resulted in significant reductions in emissions. Since 1998, Tampa Electric has reduced annual SO2, NOx and PM emissions from its facilities by 154,000 tons, 57,000 tons, and 4,000 tons, respectively.

Reductions in SO2 emissions were accomplished through the installation of scrubber systems on Big Bend Units 1 and 2 in 1999. Big Bend Unit 4 was originally constructed with a scrubber. The Big Bend Unit 4 scrubber system was modified in 1994 to allow it to scrub emissions from Big Bend Unit 3 as well. Currently the scrubbers at Big Bend Power Station remove more than 95% of the SO2 emissions from the flue gas streams.

6

Table of Contents

The repowering of the Gannon Station to the Bayside Power Station has resulted in a significant reduction in emissions of all pollutant types. We expect that Tampa Electric’s actions to install NOx emissions controls on all Big Bend units will result in the further reduction of emissions and that by the expected completion of the final unit in 2010, the SCR projects will result in a total phased reduction of NOx by 62,000 tons per year from 1998 levels.

In total, we expect that Tampa Electric’s emission reduction initiatives will result in the annual reduction of SO2, NOx and PM emissions by 88%, 90% and 71%, respectively, below 1998 levels by 2010. With these state-of-the-art improvements in place, Tampa Electric’s activities have helped to significantly enhance the quality of the air in the community. As a result of already completed emission reduction actions, Tampa Electric has achieved the emission reduction levels called for in Phase I of the Clean Air Interstate Rule (CAIR). In July 2008, the U.S. Court of Appeals for the District of Columbia Circuit vacated CAIR on emissions of SO2 and NOx. The federal appeals court reinstated CAIR in December 2008 as an interim solution. The EPA is continuing to work on a replacement rule that is expected to be proposed in 2010 and finalized in 2011. Until a new rule is proposed CAIR will remain intact.

A pollution control benefit from the environmental initiatives taken by Tampa Electric is the significant reduction of mercury emissions. At Bayside Power Station, mercury emissions have decreased by 99% from 1998 levels, essentially resulting in zero mercury emissions. Additional mercury reductions come from the installation of NOx controls at Big Bend Power Station, which are expected to lead to a reduction of mercury emissions of more than 75% from 1998 levels by 2010. The Clean Air Mercury Rule (CAMR) Phase I requirements were scheduled for implementation in 2010. CAMR was vacated by the U.S. Court of Appeals for the District of Columbia Circuit on Feb. 8, 2008. Prior to the court’s decision Tampa Electric expected that it would have been in compliance with CAMR Phase I without additional capital investment. The EPA is expected to propose new or modified rules to address mercury and other hazardous air pollutants by late 2011.

In 2007 the EPA modified the 24-hour coarse and fine PM ambient air standards. Based on the reduced emissions of PM, sulfates and nitrates resulting from projects associated with compliance with the Consent Decree, as well as local ambient air quality data, the Tampa Electric service area is expected to be in compliance with the proposed new PM standards without additional expenditures by Tampa Electric. (See the Environmental Compliance section of MD&A.)

On Sep. 16, 2009, the EPA announced it would reconsider its 2008 decision setting national standards for ground-level ozone. The EPA is reconsidering the standards to ensure they are grounded in science, protect public health with an adequate margin of safety, and are sufficient to protect the environment. Much of Tampa Electric’s service territory is not expected to meet the current ground-level ozone standards and will most likely be deemed non-attainment.

Superfund and Former Manufactured Gas Plant Sites

Tampa Electric Company, through its Tampa Electric and PGS divisions, is a potentially responsible party (PRP) for certain superfund sites and, through its PGS division, for certain former manufactured gas plant sites. While the joint and several liability associated with these sites presents the potential for significant response costs, as of Dec. 31, 2009, Tampa Electric Company has estimated its ultimate financial liability to be approximately $19.9 million (primarily related to PGS), and this amount has been reflected in the company’s financial statements. This amount is higher than prior estimates to reflect a 2009 study for the costs of remediation primarily related to one site. The environmental remediation costs associated with these sites, which are expected to be paid over many years, are not expected to have a significant impact on customer prices. The amounts represent only the estimated portion of the cleanup costs attributable to Tampa Electric Company. The estimates to perform the work are based on actual estimates obtained from contractors or Tampa Electric Company’s experience with similar work, adjusted for site specific conditions and agreements with the respective governmental agencies. The estimates are made in current dollars, are not discounted and do not assume any insurance recoveries.

Allocation of the responsibility for remediation costs among Tampa Electric Company and other PRPs is based on each party’s relative ownership interest in or usage of a site. Accordingly, Tampa Electric Company’s share of remediation costs varies with each site. In virtually all instances where other PRPs are involved, those PRPs are considered credit worthy.

Factors that could impact these estimates include the ability of other PRPs to pay their pro rata portion of the cleanup costs, additional testing and investigation which could expand the scope of the cleanup activities, additional liability that might arise from the cleanup activities themselves or changes in laws or regulations that could require additional remediation. Under current regulation, these additional costs would be eligible for recovery through customer rates.

Capital Expenditures

Tampa Electric’s 2009 capital expenditures included $53 million for the installation of SCR equipment at the coal-fired Big Bend Power Station, and $4 million for other environmental compliance projects.

PEOPLES GAS SYSTEM—Gas Operations

PGS operates as the Peoples Gas System division of Tampa Electric Company. PGS is engaged in the purchase, distribution and sale of natural gas for residential, commercial, industrial and electric power generation customers in the State of Florida.

7

Table of Contents

Gas is delivered to the PGS system through three interstate pipelines. PGS does not engage in the exploration for or production of natural gas. PGS operates a natural gas distribution system that serves more than 334,000 customers. The system includes approximately 11,000 miles of mains and 6,500 miles of service lines. (See PGS’ Franchises section below.)

In 2009, the total throughput for PGS was 1.4 billion therms. Of this total throughput, 9% was gas purchased and resold to retail customers by PGS, 72% was third-party supplied gas that was delivered for retail transportation-only customers, and 19% was gas sold off-system. Industrial and power generation customers consumed approximately 50% of PGS’ annual therm volume, commercial customers used approximately 26%, and the balance was consumed by residential customers.

While the residential market represents only a small percentage of total therm volume, residential operations comprised almost 31% of total revenues.

Natural gas has historically been used in many traditional industrial and commercial operations throughout Florida, including production of products such as steel, glass, ceramic tile and food products. Within the PGS operating territory, large cogeneration facilities utilize gas-fired technology in the production of electric power and steam.

Revenues and therms for PGS for the years ended Dec. 31, are as follows:

| (millions) |

2009 | Revenues 2008 |

2007 | 2009 | Therms 2008 |

2007 | |||||||||

| Residential |

$ | 143.4 | $ | 150.5 | $ | 140.2 | 73.5 | 74.4 | 70.1 | ||||||

| Commercial |

142.2 | 155.6 | 158.4 | 381.7 | 375.9 | 370.9 | |||||||||

| Industrial |

125.8 | 325.7 | 242.4 | 448.7 | 513.3 | 490.2 | |||||||||

| Power generation |

10.0 | 12.7 | 14.6 | 538.3 | 455.6 | 471.7 | |||||||||

| Other revenues |

40.6 | 36.5 | 37.4 | — | — | — | |||||||||

| Total |

$ | 462.0 | $ | 681.0 | $ | 593.0 | 1,442.2 | 1,419.2 | 1,402.9 | ||||||

PGS had 520 employees as of Dec. 31, 2009. A total of 79 employees in six of PGS’ 14 operating divisions are represented by various union organizations.

Regulation

The operations of PGS are regulated by the FPSC separately from the regulation of Tampa Electric. The FPSC has jurisdiction over rates, service, issuance of securities, safety, accounting and depreciation practices and other matters. In general, the FPSC sets rates at a level that allows a utility such as PGS to collect total revenues (revenue requirements) equal to its cost of providing service, plus a reasonable return on invested capital.

The basic costs of providing natural gas service, other than the costs of purchased gas and interstate pipeline capacity, are recovered through base rates. Base rates are designed to recover the costs of owning, operating and maintaining the utility system. The rate of return on rate base, which is intended to approximate PGS’ weighted cost of capital, primarily includes its cost for debt, deferred income taxes at a zero cost rate, and an allowed return on common equity. Base rates are determined in FPSC proceedings which occur at irregular intervals at the initiative of PGS, the FPSC or other parties. For a description of recent proceeding activity, see the Regulation—PGS Rates section of MD&A.

On May 5, 2009, the FPSC approved a base rate increase of $19.2 million that became effective on Jun. 18, 2009, and reflects a return on equity of 10.75%, which is the middle of a range between 9.75% and 11.75%. The allowed equity in capital structure is 54.7% from all investor sources of capital on an allowed rate base of $560.8 million.

PGS recovers the costs it pays for gas supply and interstate transportation for system supply through the purchased gas adjustment (PGA) clause. This charge is designed to recover the costs incurred by PGS for purchased gas, and for holding and using interstate pipeline capacity for the transportation of gas it delivers to its customers. These charges may be adjusted monthly based on a cap approved annually in an FPSC hearing. The cap is based on estimated costs of purchased gas and pipeline capacity, and estimated customer usage for a specific recovery period, with a true-up adjustment to reflect the variance of actual costs and usage from the projected charges for prior periods. In November 2009, the FPSC approved rates under PGS’ PGA for the period January 2010 through December 2010 for the recovery of the costs of natural gas purchased for its distribution customers.

In addition to its base rates and purchased gas adjustment clause charges, PGS customers (except interruptible customers) also pay a per-therm conservation charge for all gas. This charge is intended to permit PGS to recover its costs incurred in developing and implementing energy conservation programs, which are mandated by Florida law and approved and supervised by the FPSC. PGS is permitted to recover, on a dollar-for-dollar basis, prudently incurred expenditures made in connection with these programs if it demonstrates that the programs are cost effective for its ratepayers. The FPSC requires natural gas utilities to offer transportation-only service to all non-residential customers.

8

Table of Contents

In addition to economic regulation, PGS is subject to the FPSC’s safety jurisdiction, pursuant to which the FPSC regulates the construction, operation and maintenance of PGS’ distribution system. In general, the FPSC has implemented this by adopting the Minimum Federal Safety Standards and reporting requirements for pipeline facilities and transportation of gas prescribed by the U.S. Department of Transportation in Parts 191, 192 and 199, Title 49, Code of Federal Regulations.

PGS is also subject to federal, state and local environmental laws and regulations pertaining to air and water quality, land use, noise and aesthetics, solid waste and other environmental matters.

Competition

Although PGS is not in direct competition with any other regulated distributors of natural gas for customers within its service areas, there are other forms of competition. At the present time, the principal form of competition for residential and small commercial customers is from companies providing other sources of energy, including electricity, propane and fuel oil. PGS has taken actions to retain and expand its commodity and transportation business, including managing costs and providing high quality service to customers.

In Florida, gas service is unbundled for all non-residential customers. PGS has a “NaturalChoice” program, offering unbundled transportation service to all eligible customers and allowing non-residential customers to purchase commodity gas from a third party but continue to pay PGS for the transportation. As a result, PGS receives its base rate for distribution regardless of whether a customer decides to opt for transportation-only service or continue bundled service. PGS had approximately 15,250 transportation-only customers as of Dec. 31, 2009 out of approximately 31,400 eligible customers.

Competition is most prevalent in the large commercial and industrial markets. In recent years, these classes of customers have been targeted by companies seeking to sell gas directly by transporting gas through other facilities and thereby bypassing PGS facilities. In response to this competition, PGS has developed various programs, including the provision of transportation-only services at discounted rates.

Gas Supplies

PGS purchases gas from various suppliers depending on the needs of its customers. The gas is delivered to the PGS distribution system through three interstate pipelines on which PGS has reserved firm transportation capacity for delivery by PGS to its customers.

Gas is delivered by Florida Gas Transmission Company (FGT) through 59 interconnections (gate stations) serving PGS’ operating divisions. In addition, PGS’ Jacksonville Division receives gas delivered by the South Georgia Natural Gas Company pipeline through two gate stations located northwest of Jacksonville. Gulfstream Natural Gas Pipeline provides delivery through seven gate stations.

Companies with firm pipeline capacity receive priority in scheduling deliveries during times when the pipeline is operating at its maximum capacity. PGS presently holds sufficient firm capacity to permit it to meet the gas requirements of its system commodity customers, except during localized emergencies affecting the PGS distribution system and on abnormally cold days.

Firm transportation rights on an interstate pipeline represent a right to use the amount of the capacity reserved for transportation of gas on any given day. PGS pays reservation charges on the full amount of the reserved capacity whether or not it actually uses such capacity on any given day. When the capacity is actually used, PGS pays a volumetrically-based usage charge for the amount of the capacity actually used. The levels of the reservation and usage charges are regulated by FERC. PGS actively markets any excess capacity available on a day-to-day basis to partially offset costs recovered through the PGA clause.

PGS procures natural gas supplies using base-load and swing-supply contracts with various suppliers along with spot market purchases. Pricing generally takes the form of either a variable price based on published indices or a fixed price for the contract term.

Neither PGS nor any of the interconnected interstate pipelines have storage facilities in Florida. PGS occasionally faces situations when the demands of all of its customers for the delivery of gas cannot be met. In these instances, it is necessary that PGS interrupt or curtail deliveries to its interruptible customers. In general, the largest of PGS’ industrial customers are in the categories that are first curtailed in such situations. PGS’ tariff and transportation agreements with these customers give PGS the right to divert these customers’ gas to other higher priority users during the period of curtailment or interruption. PGS pays these customers for such gas at the price they paid their suppliers, or at a published index price, and in either case pays the customer for charges incurred for interstate pipeline transportation to the PGS system.

9

Table of Contents

Franchises

PGS holds franchise and other rights with approximately 100 municipalities throughout Florida. These franchises give PGS a right to occupy municipal rights-of-way within the franchise area. The franchises are irrevocable and are not subject to amendment without the consent of PGS, although in certain events, they are subject to forfeiture.

Municipalities are prohibited from granting any franchise for a term exceeding 30 years. Several franchises contain purchase options with respect to the purchase of PGS’ property located in the franchise area, if the franchise is not renewed; otherwise, based on judicial precedent, PGS is able to keep its facilities in place subject to reasonable rules and regulations imposed by the municipalities.

PGS’ franchise agreements with the incorporated municipalities within its service area have various expiration dates ranging from the present through 2038. PGS expects to negotiate 14 franchises in 2010, the majority of which will be renewals of existing agreements. Franchise fees payable by PGS, which totaled $9.5 million in 2009, are calculated using various formulas which are based principally on natural gas revenues. Franchise fees are collected from only those customers within each franchise area.

Utility operations in areas outside of incorporated municipalities are conducted in each case under one or more permits to use state or county rights-of-way granted by the Florida Department of Transportation or the county commissioners of such counties. There is no law limiting the time for which such permits may be granted by counties. There are no fixed expiration dates and these rights are, therefore, considered perpetual.

Environmental Matters

PGS’ operations are subject to federal, state and local statutes, rules and regulations relating to the discharge of materials into the environment and the protection of the environment generally that require monitoring, permitting and ongoing expenditures.

Tampa Electric Company is one of several potentially responsible parties for certain superfund sites and, through PGS, for former manufactured gas plant sites. See the previous discussion in the Environmental Matters section of Tampa Electric—Electric Operations.

Capital Expenditures

During the year ended Dec. 31, 2009, PGS did not incur any material capital expenditures to meet environmental requirements, nor are any anticipated for 2010 through 2014.

TECO COAL

Overview

TECO Coal, with offices located in Corbin, Kentucky, through its subsidiaries operates surface and underground mines as well as coal processing facilities in eastern Kentucky, Tennessee and southwestern Virginia.

TECO Coal owns no operating assets but holds all of the common stock of Gatliff Coal Company, Rich Mountain Coal Company, Clintwood Elkhorn Mining Company, Pike Letcher Land Company, Premier Elkhorn Coal Company, Perry County Coal Corporation, Bear Branch Coal Company, and all of the membership interests in TECO Synfuel Administration, LLC and TECO Synfuel Operations, LLC. The TECO Coal subsidiaries own or control, by lease, mineral rights, and own or operate surface and underground mines and coal processing and loading facilities. TECO Coal produces, processes and sells bituminous, predominately low sulfur coal of steam, industrial and metallurgical grades. TECO Coal uses two distinct extraction techniques: continuous underground mining and dozer and front-end loader surface mining.

TECO Coal subsidiaries currently operate 27 underground mines, which employ the room and pillar mining method, and 13 surface mines. In 2009, TECO Coal subsidiaries sold 8.75 million tons of coal. None of this coal was sold to Tampa Electric. For the reporting period, the TECO Coal operating companies had a combined estimated 262.2 million tons of proven and probable recoverable reserves.

History

In 1967, Cal-Glo Coal Company was formed. It mined a product containing low sulfur, low ash fusion characteristic and high energy content. Realizing the potential for this product to meet its combustion, quality and environmental requirements, Tampa Electric Company purchased Cal-Glo Coal Company in 1974. In 1982, after several years of continued growth and success, TECO

10

Table of Contents

Coal Corporation was formed and Cal-Glo Coal Company was renamed Gatliff Coal Company. Rich Mountain Coal Company was established in 1987, when leases were signed for properties in Campbell County, Tennessee.

1988 saw a marketing change in which Gatliff Coal Company began selling ferro-silicon and silicon grade products. In addition, in that year properties were also acquired in Pike County, Kentucky and Clintwood Elkhorn Mining Company was formed. Premier Elkhorn Coal Company and Pike Letcher Land Company were formed in 1991, when additional property was acquired in Pike and Letcher Counties, Kentucky.

In 1997, Bear Branch Coal Company secured key leases for property located in Perry County and Knott County, Kentucky.

The newest mining company in the TECO Coal family is Perry County Coal Corporation, which was purchased in 2000 and is located in Perry, Knott and Leslie Counties, Kentucky.

TECO Synfuel Holdings, LLC and TECO Synfuel Administration, LLC were formed in 2003 to administer the production and sale of synfuel product at various TECO Coal subsidiaries. Synfuel operations were terminated at the end of 2007 when the tax credit associated with production of non-conventional fuels expired by statute.

In 2004, the acquisition of properties and the Millard Preparation Facilities (currently idle) from American Electric Power and Kentucky Coal, LLC was completed. The property and facility are located in Pike County, Kentucky.

Mining Operations

TECO Coal currently has three mining complexes, all operating in Kentucky with a portion of Clintwood Elkhorn Mining Company operating in Virginia as well. A mining complex is defined as all mines that supply a single wash plant, except in the case of Clintwood Elkhorn Mining Company, which provides production for two active wash plants. Clintwood Elkhorn’s Millard Plant is currently idle. These complexes blend, process and ship coal that is produced from one or more mines, with a single complex handling the coal production of as many as 15 individual underground or surface mines. TECO Coal uses two distinct extraction techniques: continuous underground mining; and dozer and front-end loader surface mining sometimes accompanied by highwall mining.

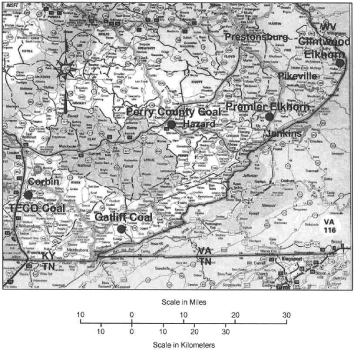

The complexes have been developed at strategic locations in close proximity to the TECO Coal preparation plants and rail shipping facilities. Coal is transported from TECO Coal’s mining complexes to customers by means of railroad cars, trucks, barges or vessels, with rail shipments representing approximately 93.2% of 2009 coal shipments. The map below shows the locations of the three mining complexes and TECO Coal’s offices in Corbin, Kentucky.

11

Table of Contents

Facilities

Coal mined by the operating companies of TECO Coal is processed and shipped from facilities located at each of the operating companies, with Clintwood Elkhorn Mining Company having three facilities. The Clintwood facilities are located at Biggs, Kentucky, Hurley, Virginia and the Millard facility, which is presently idle, located at Millard, Kentucky. The equipment at each facility is in good condition and regularly maintained by qualified personnel. Table 1 below is a summary of the TECO Coal processing facilities:

PROCESSING FACILITIES SUMMARY

Table 1

| COMPANY |

FACILITY |

LOCATION |

RAILROAD SERVICE |

UTILITY SERVICE | ||||

| Gatliff Coal |

Ada Tipple | Himyar, KY | CSXT Railroad | RECC | ||||

| Clintwood Elkhorn |

Clintwood #2 Plant | Biggs, KY | Norfolk Southern | American Electric Power | ||||

| Clintwood Elkhorn |

Clintwood #3 Plant | Hurley, VA | Norfolk Southern | American Electric Power | ||||

| Clintwood Elkhorn |

Millard Plant | Millard, KY | CSXT Railroad | American Electric Power | ||||

| Premier Elkhorn |

Burk Branch Plant | Myra, KY | CSXT Railroad | American Electric Power | ||||

| Perry County Coal |

Perry County Plant | Hazard, KY | CSXT Railroad | American Electric Power |

Significant Projects

Significant projects for 2009 included the following:

Perry County Coal

| • | Added a fourth active mining section to mine E4-2 underground mine. |

| • | Continued site development and began construction on the Second Creek Portals for mine E4-1 and mine E3-1 underground mines. |

Premier Elkhorn Coal

| • | Two company underground mines were closed due to depletion of reserves and market economics. |

| • | Started a new underground mine and began mining with highwall miner on a surface mine. |

Clintwood Elkhorn Mining

| • | Two surface mines were closed due to market economics and a highwall miner was moved to an active surface mine. |

| • | Started two new underground mines and expect to open three additional underground mines early in 2010. |

Mining Complexes

Table 2 below shows annual production for each mining complex for each of the last three years.

MINING COMPLEXES

Table 2

| Mine Type |

Mining Equipment |

Transportation | Tons Produced (in millions) |

Tons Sold (in millions) |

Year Established or Acquired | |||||||||||||

| Location |

2009 | 2008 | 2007 | 2009 | ||||||||||||||

| Gatliff Coal Company |

Bell County, KY/Knox County, KY/Campbell County, TN |

S | D/L | T | 0.16 | 0.31 | 0.26 | 0.14 | 1974 | |||||||||

| Clintwood Elkhorn Mining |

Pike County, KY/ Buchanan County, VA |

U, S | CM, D/L, HM, A |

R, R/V | 2.02 | 2.60 | 2.66 | 2.12 | 1988 | |||||||||

| Premier Elkhorn Coal |

Pike County, KY/ Letcher County, KY/ Floyd County, KY |

U, S | CM, D/L | R,T,R/ B,T/B |

3.22 | 3.19 | 3.15 | 3.40 | 1991 | |||||||||

| Perry County Coal |

Perry County, KY/ Leslie County, KY/ Knott County, KY |

U, S | CM, D/L, HM |

R,T,R/ B,T/B |

3.09 | 3.09 | 3.05 | 3.09 | 2000 | |||||||||

| TOTAL |

8.49 | 9.19 | 9.12 | 8.75 | ||||||||||||||

12

Table of Contents

S—Surface

U—Underground

CM—Continuous Miner

D/L—Dozers and Front-End Loaders

HM—Highwall Miner

A—Auger

R—Rail

R/B—Rail to Barge

R/V—Rail to Ocean Vessel

T—Truck

T/B—Truck to Barge

Gatliff Coal Company

Gatliff Coal Company discontinued surface mine operations in the late autumn of 2009. Poor market conditions and a depletion of the low sulfur content coal that was previously required on its sales contract led to this cessation of mining operations. Gatliff Coal Company produced 0.16 million tons of coal in 2009, leaving a reserve base of 3.4 million recoverable tons of predominantly low sulfur underground mineable coal which may later be recovered by Gatliff or by neighboring competing coal companies for coal royalty considerations. Rich Mountain Coal Company formerly operated as a contractor for Gatliff Coal Company’s Tennessee production, which is currently in non-producing reclamation status.

Clintwood Elkhorn Mining Company

Clintwood Elkhorn Mining Company has three facilities. One is located near Biggs, Kentucky in Pike County and is supplied by 14 underground mines and two surface mines. Principal products at the Biggs, Kentucky location include high volatile metallurgical coals and steam coal. The second Clintwood Elkhorn Mining Company facility is located near Hurley, Virginia and is supplied by two underground mines and two surface mines. The Hurley, Virginia operation facility also supplies high-volatile metallurgical coal as well as steam coal products. Products from both locations are shipped domestically to customers in North America via Norfolk Southern Corporation and vessels via the Great Lakes. International customers receive their products via ocean vessels from Lamberts Point, Virginia. The third facility, located at Millard, Kentucky in Pike County is currently idle. In total, Clintwood Elkhorn Mining Company produced 2.02 million tons of coal in 2009, leaving a reserve base of 50.0 million recoverable tons.

Premier Elkhorn Coal Company

Located near Myra, in Pike County, Kentucky, Premier Elkhorn Coal Company is supplied by production from eight underground mines and eight surface mines. Principal products include high-quality steam coal for utilities, specialty stoker products for ferro-silicon and industrial customers, PCI and metallurgical coal for the steel mills. Facilities include a unit train load-out with a 200 car siding capable of loading at 6,000 tons per hour as well as a single car siding. Products from this location are shipped via CSXT Railroad and trucking contractors to destinations in North America and internationally. All production is performed by Premier Elkhorn Coal Company even though Pike Letcher Land Company controls by fee and lease all of the recoverable reserves. Premier Elkhorn Coal Company produced 3.22 million tons of coal in 2009 leaving a reserve base of 72.8 million recoverable tons.

Perry County Coal Corporation

Located near Hazard, Kentucky in Perry County, Perry County Coal Corporation is supplied by three underground mines and one surface mine. Principal products include high quality steam coal for utilities, industrial stoker and PCI products. Facilities include an upgraded 1,350 ton per hour preparation plant and two unit train load-outs, each capable of loading at 5,000 tons per hour. Products from this location are shipped via CSXT Railroad and trucking contractors to destinations in both North America and internationally. In 2009, Perry County Coal completed a comparable trade of underground reserves with another mining company of 16.0 million tons. During 2010 this boundary of reserves will continue to be core drilled to confirm final reserve quantities and qualities and to finalize a comprehensive mining plan. Perry County Coal Corporation produced 3.09 million tons of coal in 2009. A baseline review of reserves for Perry County Coal Corporation proved an additional 4.2 million tons of reserves which were previously unreported leaving a reserve base of 136.0 million recoverable tons.

Sales and Marketing

The TECO Coal marketing and sales force includes sales managers, distribution/transportation managers and administrative personnel. Primary customers are utility, steel and industrial companies. TECO Coal subsidiaries sell coal under long-term agreements, which are generally classified as greater than 12 months, and on a spot basis, which is generally classified 12 months or less.

The terms of these coal sales contracts result from bidding and extensive negotiations with customers. Consequently, these contracts typically vary significantly in price, quantity, quality, length, and may contain terms and conditions that allow for periodic price reviews, price adjustment mechanisms, recovery of governmental impositions as well as provisions for force majeure, suspension, termination, treatment of environmental legislation and assignment.

13

Table of Contents

Distribution

TECO Coal subsidiaries transport coal from their mining complexes to customers by rail, barge, vessel and trucks. They employ transportation specialists who coordinate the development of acceptable shipping schedules with its customers, transportation providers and mining facilities.

Competition

Primary competitors of TECO Coal’s subsidiaries are other coal suppliers, many of which are located in Central Appalachia. Even though consolidation and bankruptcy have decreased the number of coal suppliers, the industry is still intensely competitive. To date, the TECO Coal subsidiaries have been able to compete for coal sales by mining high quality steam and specialty coals, including coals used for making coke and furnace injection, and by effectively managing production and processing costs.

Employees

As of Dec. 31, 2009, TECO Coal and its subsidiaries employed a total of 1,089 employees.

Regulations

Mine Safety and Health

The operations of underground mines, including all related surface facilities, are subject to the Federal Coal Mine Safety and Health Act of 1969, the 1977 Amendment and the new Miner Act of 2006. TECO Coal’s subsidiaries are also subject to various Kentucky, Tennessee and Virginia mining laws which require approval of roof control, ventilation, dust control and other facets of the coal mining business. Federal and state inspectors inspect the mines to ensure compliance with these laws. TECO Coal believes it is in substantial compliance with the standards of the various enforcement agencies. It is unaware of any mining laws or regulations that would materially affect the market price of coal sold by its subsidiaries, although mining accidents within the industry could lead to new legislation that could impose additional costs on TECO Coal.

Black Lung Legislation

Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981, each coal mine operator must make payment of federal black lung benefits to claimants who are current and former employees, certain survivors of a miner who dies from black lung disease, and to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to Jul. 1, 1973. Historically, a small percentage of the miners currently seeking federal black lung benefits are awarded these benefits by the federal government. The trust fund is funded by an excise tax on coal production of up to $1.10 per ton for deep-mined coal and up to $0.55 per ton for surface-mined coal, neither amount to exceed 4.4% of the gross sales price.

In 2000, the Department of Labor issued amendments to the regulations implementing the federal black lung laws that, among other things, established a presumption in favor of a claimant’s treating physician, limited a coal operator’s ability to introduce medical evidence, and redefined Coal Workers Pneumoconiosis to include chronic obstructive pulmonary disease. These changes in the regulations increased the percentage of claims approved and the overall cost of black lung to coal operators. TECO Coal, with the help of its consulting actuaries, continues to monitor claims very closely.

Workers’ Compensation

The TECO Coal subsidiaries are liable for workers’ compensation benefits for traumatic injury and occupational exposure claims under state workers’ compensation laws. Workers’ compensation laws are administered by state agencies with each state having its own set of rules and regulations regarding compensation that is owed to an employee that is injured in the course of employment.

Environmental Laws

Surface Mining Control and Reclamation Act

Coal mining operations are subject to the Surface Mining Control and Reclamation Act of 1977 which places a charge of $0.15 and $0.35 on every net ton of underground and surface coal mined, respectively, to create a reserve for reclaiming land and water adversely affected by past coal mining. Other provisions establish standards for the control of environmental effects and reclamation of surface coal mining and the surface effects of underground coal mining and requirements for federal and state inspections.

14

Table of Contents

Clean Air Act/Clean Water Act

While conducting their mining operations, TECO Coal’s subsidiaries are subject to various federal, state and local air and water pollution standards. In 2009, TECO Coal spent approximately $3.7 million on environmental protection and reclamation programs. TECO Coal expects to spend a similar amount in 2010 on these programs.

CERCLA (Superfund)

The Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) commonly known as Superfund affects coal mining and hard rock operations by creating liability for investigation and remediation in response to releases of hazardous substances into the environment and for damages to natural resources. Under Superfund, joint and several liabilities may be imposed on waste generators, site owners or operators and others regardless of fault.

Under EPA’s Toxic Release Inventory process, companies are required to report annually listed toxic materials that exceed defined quantities.

Glossary of Selected Mining Terms

Assigned reserves. Coal which has been committed by the coal company to operating mine shafts, mining equipment, and plant facilities, and all coal which has been leased by the company to others.

Bituminous coal. The most common type of coal with moisture content less than 20% by weight and heating value of 10,500 to 14,000 Btu per pound. It is dense and black and often has well-defined bands of bright and dull material.

Btu. (British Thermal Unit). A measure of the energy required to raise the temperature of one pound of water one degree Fahrenheit.

Central Appalachia. Coal producing states and regions of eastern Kentucky, eastern Tennessee, western Virginia and southern West Virginia.

Coal seam. Coal deposits occur in layers. Each layer is called a “seam.”

Coal washing. The process of removing impurities, such as ash and sulfur based compounds, from coal.

Compliance coal. Coal which, when burned, emits 1.2 pounds or less of sulfur dioxide per million Btu, which is equivalent to .72% sulfur per pound of 12,000 Btu coal. Compliance coal requires no mixing with other coals or use of sulfur dioxide reduction technologies by generators of electricity to comply with the requirements of the federal Clean Air Act.

Continuous miner. A machine used in underground mining to cut coal from the seam and load it onto conveyors or into shuttle cars in a continuous operation.

Continuous mining. One of two major underground mining methods now used in the United States. This process utilizes a continuous miner. The continuous miner removes or “cuts” the coal from the seam. The loosened coal then falls on a conveyor for removal to a shuttle car or larger conveyor belt system.

Deep mine. An underground coal mine.

Dozer and front-end loader mining. An open-cast method of mining that uses large dozers together with trucks and loaders to remove overburden, which is used to backfill pits after coal removal.

Ferro-silicon. An alloy of iron and silicon used in the production of carbon steel.

Force majeure. An event that may prevent the company from conducting its mining operations as a result of in whole or in part by: Acts of God, wars, riots, fires, explosions, breakdowns or accidents; strikes, lockouts or other labor difficulties; lack or shortages of labor, materials, utilities, energy sources, compliance with governmental rules, regulations or other governmental requirements; any other like causes.

High vol met coal. Coal that averages approximately 35% volatile matter. Volatile matter refers to a constituent that becomes gaseous when heated to certain temperatures.

Highwall miner. An auger-like apparatus that drives parallel rectangular entries to 1,000 feet into the coal seam.

15

Table of Contents

Industrial coal. Coal used by industrial steam boilers to produce electricity or process steam. It generally is lower in Btu heat content and higher in volatile matter than metallurgical coal.

Long-term contracts. Contracts with terms of one year or longer.

Low ash fusion. Coal that when burned typically produces ash that has a melting point below 2,450 degrees Fahrenheit.

Low sulfur coal. Coal which, when burned, emits 1.6 pounds or less of sulfur dioxide per million Btus.

Metallurgical coal. The various grades of coal suitable for carbonization to make coke for steel manufacture. Also known as “met” coal, it possesses four important qualities: volatility, which affects coke yield; the level of impurities, which affects coke quality; composition, which affects coke strength; and basic characteristics, which affect coke oven safety. Met coal has a particularly high Btu, but low ash content.

Overburden. Layers of earth and rock covering a coal seam. In surface mining operations, overburden is removed prior to coal extraction.

Overburden ratio. The amount of overburden commonly stated in cubic yards that must be removed to excavate one ton of coal.

Pillar. An area of coal left to support the overlying strata in a mine; sometimes left permanently to support surface structures.

Pneumoconiosis. A lung disease caused by long-continued inhalation of mineral or metallic dust.

Preparation plant. Usually located on a mine site, although one plant may serve several mines. A preparation plant is a facility for crushing, sizing and washing coal to prepare it for use by a particular customer. The washing process has the added benefit of removing some of the coal’s sulfur content.

Probable (Indicated) reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart; therefore, the degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.