Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 1-4462

STEPAN COMPANY

(Exact name of registrant as specified in its charter)

| Delaware | 36-1823834 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| Edens and Winnetka Road, Northfield, Illinois | 60093 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number including area code: 847-446-7500

Securities registered pursuant to Section 12 (b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $1 par value | New York Stock Exchange Chicago Stock Exchange | |

| 5 1/2% Convertible Preferred Stock, no par value | New York Stock Exchange Chicago Stock Exchange |

Securities registered pursuant to Section 12 (g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in part III of this Form 10-K or any amendment to this Form 10-K. ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

Aggregate market value at June 30, 2009, of voting and non-voting common stock held by nonaffiliates of the registrant: $342,838,136*

Number of shares outstanding of each of the registrant’s classes of common stock as of January 31, 2010:

| Class |

Outstanding at January 31, 2010 | |

| Common Stock, $1 par value | 9,948,215 |

Documents Incorporated by Reference

| Part of Form 10-K |

Document Incorporated | |

| Part III, Items 10-14 | Proxy Statement dated March 19, 2010 |

| * | Based on reported ownership by all directors, officers and beneficial owners of more than 5% of registrant’s voting stock. However, this determination does not constitute an admission of affiliate status for any of these holders. |

Table of Contents

ANNUAL REPORT ON FORM 10-K

December 31, 2009

Table of Contents

Stepan Company, which was incorporated under the laws of the state of Delaware on February 19, 1959, and its subsidiaries (the “Company”) produce specialty and intermediate chemicals, which are sold to other manufacturers and then made into a variety of end products. The Company has three reportable segments: surfactants, polymers and specialty products. Surfactants refer to chemical agents that affect the interaction between two surfaces; they can provide actions such as detergency (i.e., the ability of water to remove soil from another surface), wetting and foaming, dispersing, emulsification (aiding two dissimilar liquids to mix), demulsification, viscosity modifications and biocidal disinfectants. Surfactants are the basic cleaning agent in detergents for washing clothes, dishes, carpets, fine fabrics, floors and walls. Surfactants are also used for the same purpose in shampoos and conditioners, fabric softeners, toothpastes, cosmetics and other personal care products. Commercial and industrial applications include emulsifiers for agricultural products, emulsion polymers such as floor polishes and latex foams and coatings, wetting and foaming agents for wallboard manufacturing, surfactants for enhanced oil recovery and biodiesel. Polymers, which include two primary product lines, polyols and phthalic anhydride, are used in multiple types of specialty polymers. Specialty products include chemicals used in food, flavoring and pharmaceutical applications.

MARKETING AND COMPETITION

Principal markets for surfactants are manufacturers of detergents, shampoos, lotions, fabric softeners, toothpastes and cosmetics. In addition, surfactants are sold to the producers of emulsifiers, lubricating products and biodiesel fuel. The Company also is a principal provider of polymers used in construction, refrigeration, automotive, boating and other consumer product industries. Polymer products are also used in the flexible foam industry as well as the coatings, adhesives, sealants and elastomer industries. Specialty products are used primarily by food and pharmaceutical manufacturers.

The Company does not sell directly to the retail market, but sells to a wide range of manufacturers in many industries and has many competitors. The principal methods of competition are product performance, price, technical assistance and adaptability to the specific needs of individual customers. These factors allow the Company to compete on a basis other than price alone, reducing the severity of competition as experienced in the sales of commodity chemicals having identical performance characteristics. The Company is a leading merchant producer of surfactants in the United States. In the case of surfactants, much of the Company’s competition comes from several large global and regional producers and the internal divisions of larger customers. In the manufacture of polymers, the Company competes with the chemical divisions of several large companies, as well as with other small specialty chemical manufacturers. In specialty products, the Company competes with several large firms plus numerous small companies.

1

Table of Contents

MAJOR CUSTOMER AND BACKLOG

The Company does not have any one customer whose business represents more than 10 percent of the Company’s consolidated revenue. Most of the Company’s business is essentially on the “spot delivery basis” and does not involve a significant backlog. The Company does have contract arrangements with certain customers, but purchases are generally contingent on purchaser requirements.

ENERGY SOURCES

Substantially all of the Company’s manufacturing plants operate on electricity and interruptable natural gas. During peak heating demand periods, gas service to all plants may be temporarily interrupted for varying periods ranging from a few days to several months. The plants operate on fuel oil during these periods of interruption. The Company’s domestic operations and its wholly-owned subsidiaries have not experienced any plant shutdowns or adverse effects upon its business in recent years that were caused by a lack of available energy sources, other than temporary service interruptions brought on by mechanical failure.

RAW MATERIALS

The most important raw materials used by the Company are of a petroleum or plant nature. For 2010, the Company has commitments from suppliers to cover its forecasted requirements and is not substantially dependent upon any one supplier.

RESEARCH AND DEVELOPMENT

The Company maintains an active research and development program to assist in the discovery and commercialization of new knowledge with the intent that such efforts will be useful in developing a new product or in bringing about a significant improvement to an existing product or process. Total expenses for research and development during 2009, 2008 and 2007 were $23.4 million, $22.1 million, and $19.9 million, respectively. The balance of research and development expenses reflected on the consolidated statements of income relates to technical services, which include routine product testing, analytical methods development and sales support service.

ENVIRONMENTAL COMPLIANCE

Compliance with applicable federal, state and local regulations regarding the discharge of materials into the environment, or otherwise relating to the protection of the environment, resulted in capital expenditures by the Company of approximately $2.6 million during 2009. These expenditures represented approximately six percent of the Company’s capital expenditures in 2009. These expenditures, when incurred, are depreciated and charged on a straight-line basis to pretax earnings over their estimated useful lives, which is typically 10 years. Recurring costs associated with the operation and maintenance of facilities for waste treatment and disposal and managing environmental compliance in ongoing operations at our manufacturing locations were approximately $15.4 million in 2009. Compliance with such regulations is not expected to have a material adverse effect on the Company’s earnings and competitive position in the foreseeable future.

2

Table of Contents

EMPLOYMENT

At December 31, 2009 and 2008, the Company employed 1,594 and 1,578 persons, respectively.

FOREIGN OPERATIONS AND REPORTING SEGMENTS

See Note 17, Segment Reporting, of the Consolidated Financial Statements (Item 8 of this Form 10-K).

WEBSITE

The Company’s website address is www.stepan.com. The Company makes available free of charge on or through its website its code of conduct, annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission. The website also includes the Company’s corporate governance guidelines and the charters for the audit, nominating and corporate governance and compensation and development committees of the Board of Directors.

3

Table of Contents

| Item 1A. | Risk Factors |

The following discussion identifies the most significant factors that may adversely affect the Company’s business, financial condition, results of operations and cash flows. These and other factors, many of which are beyond the Company’s control, may cause future results of operations to differ materially from those currently expected or desired.

The Company’s forecasts and other forward-looking statements are based on a variety of assumptions and estimates that are subject to significant uncertainties. The Company’s performance may not be consistent with these forecasts or forward-looking statements.

From time to time in press releases and other documents filed with the SEC, the Company publishes forecasts or other forward-looking statements regarding its future results, including estimated revenues, net earnings and other operating and financial metrics.

Any forecast or forward-looking statement related to the Company’s future performance reflects various assumptions and estimates, which are subject to significant uncertainties, and the achievement of any forecast or forward-looking statement depends on numerous risks and other factors, including those described in this Annual Report on Form 10-K, many of which are beyond the Company’s control. If these assumptions and estimates prove to be incorrect, or any of the risks or other factors occur, then the Company’s performance may not be consistent with these forecasts or forward-looking statements.

You are cautioned not to base your entire analysis of the Company’s business and prospects upon isolated predictions, but instead are encouraged to utilize the entire mix of publicly available historical and forward-looking information, as well as other available information affecting the Company, the Company’s services and the Company’s industry, when evaluating the Company’s forecasts and other forward-looking statements relating to the Company’s operations and financial performance.

Natural disasters, including earthquakes, fires and flooding, work stoppages and terrorism could severely damage the Company’s systems and facilities or interrupt the Company’s operations and result in a material adverse effect on the Company’s business, financial position, results of operations and cash flows.

Natural disasters, such as fires, flooding, earthquakes and tornadoes, power loss, break-ins, work stoppages, acts of war, terrorism or other similar events, could severely damage the Company’s systems and facilities or interrupt the Company’s operations, potentially resulting in temporary or permanent loss of the Company’s manufacturing capability. Some of the Company’s products cannot currently be made, or made in the volume required, at more than one of the Company’s locations. For some of these products, the Company has access to external market suppliers, but the Company cannot guarantee that these products will be available to it in the market in amounts sufficient to meet its requirements or at a cost that is competitive with the Company’s cost of manufacturing these products. While the Company maintains insurance coverage, there can be no assurance that it would be sufficient to cover any or all losses resulting from the occurrence of any of these events or that carriers would not deny coverage for these losses even if they are insured. There is also a risk, beyond the reasonable control of the Company, that an insurance carrier may not have the financial resources to cover an insurable

4

Table of Contents

loss. As a result, the occurrence of any of these events could have a material adverse effect on the Company’s business, financial position, results of operations and cash flows.

The Company faces significant competition in each of its operating segments. If the Company cannot successfully compete in the marketplace, its profitability, business, financial position, results of operations and cash flows may be materially and adversely affected.

The Company faces significant competition from numerous global companies as well as national, regional and local companies within some or all of its product categories in each market it serves. In addition, some of the Company’s customers have internal manufacturing capabilities that allow them to achieve make-versus-buy economics, which may result at times in the Company gaining or losing business with these customers in volumes that could adversely affect its profitability.

To achieve expected profitability levels, the Company must, among other things, maintain the service levels, product quality and performance and competitive pricing necessary to retain existing customers and attract new customers. The Company’s inability to do so could put it at a competitive disadvantage relative to its competitors, and if the Company cannot successfully compete in the marketplace, its business, financial position, results of operations and cash flows may be materially and adversely affected.

The volatility of raw material, natural gas and electricity costs as well as any disruption in their supply may materially and adversely affect the Company’s business, financial position, results of operations and cash flows.

The costs of raw materials, natural gas and electricity represent a substantial portion of the Company’s operating costs. The principal raw materials used in the Company’s products are petroleum-based or plant-based. Natural gas is used in the Company’s manufacturing sites primarily to generate steam for its manufacturing processes. The prices of many of these raw materials are cyclical, and the market price of natural gas has recently been very volatile. These fluctuations in prices may be affected by supply and demand factors, such as general economic conditions, currency exchange rates, political instability and terrorist attacks, which are beyond the Company’s control. The Company may not be able to pass increased raw material and natural gas prices on to customers through increases in product prices as a result of arrangements the Company has with certain customers and competitive pressures in the market that may not allow us to increase prices. The Company tries to minimize the effect of increases in the prices of raw materials, natural gas and electricity through production efficiency, the use of alternative suppliers and, in the case of natural gas, the use of forward purchase contracts. If the Company is unable to minimize the effects of increased raw material and energy costs or pass such increased costs on to customers, its business, financial position, results of operations and cash flows may be materially and adversely affected. Moreover, the supply of some of these raw materials may be disrupted for many reasons, including but not limited to the manufacturers’ inability to produce these raw materials in amounts sufficient to meet their supply obligations or restrictions on the transport of these raw materials, some of which may be viewed as hazardous.

5

Table of Contents

If the Company is unable to keep and protect its intellectual property rights, the Company’s ability to compete may be negatively impacted.

The Company has intellectual property rights in all three reportable segments. Although most of the Company’s intellectual property rights are registered in the United States and in the foreign countries in which it operates, the Company may not be able to assert these rights successfully in the future or guarantee that they will not be invalidated, circumvented or challenged. Other parties may infringe on the Company’s intellectual property rights, which may dilute the value of such rights. Any infringement on the Company’s intellectual property rights would also likely result in diversion of management’s time and the Company’s resources to protect these rights through litigation or otherwise. In addition, the laws of some foreign countries may not protect the Company’s intellectual property rights to the same extent as the laws of the United States. Any loss of protection of these intellectual property rights could adversely affect the future results of operations and cash flows of the Company.

The Company is subject to risks related to its operations outside the U.S.

The Company has substantial operations outside the U.S. In the year ended December 31, 2009, the Company’s sales outside of the U.S. constituted approximately 37 percent of the Company’s net sales. In addition to the risks described in this Annual Report on Form 10-K that are common to both the Company’s U.S. and non-U.S. operations, the Company faces, and will continue to face, risks related to the Company’s foreign operations such as:

| • | foreign currency fluctuations; |

| • | unstable political, economic, financial and market conditions; |

| • | import and export license requirements; |

| • | trade restrictions; |

| • | increases in tariffs and taxes; |

| • | high levels of inflation; |

| • | restrictions on repatriating foreign profits back to the U.S.; |

| • | greater difficulty collecting accounts receivable and longer payment cycles; |

| • | less favorable intellectual property laws; |

| • | changes in foreign laws and regulations; and |

| • | changes in labor conditions and difficulties in staffing and managing international operations. |

All of these risks have affected the Company’s business in the past and may have a material adverse effect on the Company’s business, financial position, results of operations and cash flows in the future.

The Company is also exposed to fluctuations in exchange rates. The Company’s results of operations are reported in U.S. dollars. However, outside the U.S., the Company’s sales and costs are denominated in a variety of currencies including the European euro, British pound, Canadian dollar, Mexican peso, Colombian peso, Brazilian real and Chinese RMB. Fluctuations in exchange rates may materially and adversely affect the Company’s business, financial position, results of operations and cash flows.

6

Table of Contents

In all jurisdictions in which the Company operates, the Company is also subject to laws and regulations that govern foreign investment, foreign trade and currency exchange transactions. These laws and regulations may limit the Company’s ability to repatriate cash as dividends or otherwise to the U.S. and may limit the Company’s ability to convert foreign currency cash flows into U.S. dollars. A weakening of the currencies in which the Company generates sales relative to the foreign currencies in which the Company’s costs are denominated may lower the Company’s operating profits and cash flows.

We are subject to a variety of environmental, health and safety and product registration laws that expose the Company to potential financial liability and increased operating costs.

The Company’s operations are regulated under a number of federal, state, local and foreign environmental, health and safety laws and regulations that govern, among other things, the discharge of hazardous materials into the air, soil and water as well as the use, handling, storage and disposal of these materials. These laws and regulations include, but are not limited to, the U.S. Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act, as well as analogous state, local and foreign laws, and the Registration, Evaluation, Authorization and Restriction of Chemical Substances Act (REACH). Compliance with these environmental laws and regulations is a major consideration for the Company because the Company uses hazardous materials in some of the Company’s manufacturing processes. In addition, compliance with environmental laws could restrict the Company’s ability to expand its facilities or require the Company to acquire additional costly pollution control equipment, incur other significant expenses or modify its manufacturing processes. The Company has incurred and will continue to incur capital expenditures and operating costs in complying with these laws and regulations. In addition, because the Company generates hazardous wastes during some of its manufacturing processes, the Company, along with any other entity that disposes or arranges for the disposal of the Company’s wastes, may be subject to financial exposure for costs associated with any investigation and remediation of sites at which the Company has disposed or arranged for the disposal of hazardous wastes if those sites become contaminated, even if the Company fully complied with applicable environmental laws at the time of disposal. In the event that new contamination is discovered, the Company may become subject to additional requirements with respect to existing contamination or the Company’s clean-up obligations.

The Company is also subject to numerous federal, state, local and foreign laws that regulate the manufacture, storage, distribution and labeling of many of the Company’s products, including some of the Company’s disinfecting, sanitizing and antimicrobial products. Some of these laws require the Company to have operating permits for the Company’s production facilities, warehouse facilities and operations. Various federal, state, local and foreign laws and regulations also require the Company to register the Company’s products and to comply with specified requirements with respect to those products. If the Company fails to comply with any of these laws and regulations, it may be liable for damages and the costs of remedial actions in excess of the Company’s reserves, and may also be subject to fines, injunctions or criminal sanctions or to revocation, non-renewal or modification of the Company’s operating permits and revocation of the Company’s product registrations. Any such revocation, modification or non-renewal may require the Company to cease or limit the manufacture and sale of its products at one or more of the Company’s facilities, which may limit or prevent the Company’s ability to meet product demand or build new facilities and may have a material adverse effect on the

7

Table of Contents

Company’s business, financial position, results of operations and cash flows. Any such revocation, non-renewal or modification may also result in an event of default under the indenture for the Company’s notes or under the Company’s credit facilities, which, if not cured or waived, may result in the acceleration of all the Company’s indebtedness.

In addition to the costs of complying with environmental, health and safety requirements, the Company has incurred and may incur in the future costs defending against environmental litigation brought by government agencies and private parties. The Company may be a defendant in lawsuits brought by parties in the future alleging environmental damage, personal injury or property damage. A significant judgment against the Company could harm its business, financial position, results of operations and cash flows. Although the Company has insurance that may cover some of these potential losses, there is always uncertainty as to whether such insurance may be available to the Company based on case-specific factors and the specific provisions of the Company’s insurance policies.

The potential cost to the Company relating to environmental, health and safety and product registration matters, including the cost of complying with the foregoing legislation and remediating contamination, is uncertain due to factors such as the unknown magnitude and type of possible contamination and clean-up costs, the complexity and evolving nature of laws and regulations relating to the environment, health and safety and product registration, including those outside of the U.S., and the timing, variable costs and effectiveness of clean-up and compliance methods. Environmental and product registration laws may also become more stringent over time, imposing greater compliance costs and increasing risks and penalties associated with any violation, as well as restricting or prohibiting the sale of existing or new products, which may also negatively impact the Company’s operating results. Without limiting the foregoing, these laws or regulations may restrict or prohibit the use of non-renewable or carbon-based substances, or impose fees or penalties for the use of these substances. Accordingly, the Company may become subject to additional liabilities and increased operating costs in the future under these laws and regulations. The impact of any such changes, which are unknown at this time, may have a material adverse effect on the Company’s business, financial position, results of operations and cash flows.

Other laws and regulations that apply to the Company may be changed to impose additional requirements beyond those that apply under current laws and regulations, and/or impose additional costs or have negative financial effects on the Company. Such changes, which are unknown at this time and beyond the Company’s reasonable control, could have a material impact on the Company.

The Company’s inability to estimate and maintain appropriate levels of reserves for existing and future contingencies may materially and adversely affect the Company’s business, financial position, results of operations and cash flows.

The levels of reserves maintained by the Company for pending and threatened legal proceedings are estimates based on various assumptions. An adverse ruling or external forces such as changes in the rate of inflation, the regulatory environment and other factors that could prove such assumptions to be incorrect may affect the accuracy of these estimates. Given the uncertainties inherent in such estimates, the Company’s actual liabilities could differ significantly from the amounts the Company reserved to cover any existing and future contingencies. If the Company’s actual liability is higher than estimated or any new legal proceeding is initiated, it could materially and adversely affect the Company’s business, financial position, results of operations and cash flows.

8

Table of Contents

We have a material amount of indebtedness and may incur additional indebtedness, or need to refinance existing indebtedness, in the future, which may adversely affect the Company’s business and operations.

The Company has a material amount of indebtedness and may incur additional indebtedness in the future. As of December 31, 2009, the Company’s domestic debt included $73.9 million in unsecured promissory notes with maturities extending from 2010 until 2018 and $28.5 million in a bank term loan. In addition, to provide liquidity, the Company has a $60 million revolving credit facility, under which there were no borrowings as of December 31, 2009.

The Company’s foreign subsidiaries also maintain bank term loans and short-term bank lines of credit in their respective countries to meet working capital requirements as well as to fund capital expenditure programs and acquisitions. As of December 31, 2009, the Company’s foreign subsidiaries’ aggregate outstanding debt totaled $1.7 million.

The Company’s current indebtedness and any additional indebtedness incurred in the future may materially and adversely affect its business and operations. For example, it could:

| • | require the Company to dedicate a substantial portion of cash flow from operations to pay principal and interest on the Company’s debt, which would reduce funds available to fund future working capital, capital expenditures and other general operating requirements; |

| • | limit the Company’s ability to borrow funds that may be needed to operate and expand its business; |

| • | limit the Company’s flexibility in planning for or reacting to changes in the Company’s business and the industries in which the Company operates; |

| • | increase the Company’s vulnerability to general adverse economic and industry conditions or a downturn in the Company’s business; and |

| • | place the Company at a competitive disadvantage compared to its competitors that have less debt. |

The Company’s loan agreements contain provisions, which, among others, require maintenance of certain financial ratios and place limitations on additional debt, investments and payment of dividends. Failure to comply with these loan agreements would require debt restructuring that could be materially adverse to the Company’s financial position, results of operations and cash flows. Additionally, any future disruptions in the credit and financial markets may reduce the availability of debt financing or refinancing and increase the costs associated with such financing. If the Company is unable to secure financing on satisfactory terms, or at all, its financial positions, results of operations and cash flows may be adversely affected.

Downturns in certain industries and general economic downturns may have an adverse effect on the Company’s business, financial position, results of operations and cash flows.

Recent disruptions in the credit markets have had a significant negative impact on global financial markets that have resulted in a global economic downturn. Economic downturns

9

Table of Contents

adversely affect some users of the variety of end products that are manufactured using the Company’s products and the industries in which end products are used. These users may reduce their volume of purchases of such end products during economic downturns, which would reduce demand for the Company’s products. Additionally, current conditions in the credit markets pose a risk to the overall economy that may impact consumer and customer demand of some of the Company’s products, as well as the Company’s ability to manage normal commercial relationships with its customers, suppliers and creditors. Some of the Company’s customers may not be able to meet the terms of sale and suppliers may not be able to fully perform their contractual obligations due to tighter credit markets or a general slowdown in economic activity.

In the event that the current conditions of the financial and credit markets continue or worsen, or result in a prolonged economic downturn or recession, the Company’s results of operations, cash flows and financial position may be materially and adversely affected.

Various liability claims could materially and adversely affect the Company’s financial position, operating results and cash flows.

The Company may be required to pay for losses or injuries purportedly caused by its products. The Company faces an inherent exposure to various types of claims including general liability, product liability, toxic tort and environmental (“claims”), among others, if its products, or the end products that are manufactured with the Company’s products, result in property damage, injury or death. Various claims may be made against the Company even if there is no evidence that its products cause a loss. Claims could result in significant expenses relating to defense costs or damages awards and in a diversion of management’s time and the Company’s resources. Any claim brought against the Company, net of potential insurance recoveries, could materially and adversely affect the Company’s financial position, results of operations and cash flows.

10

Table of Contents

| Item 1B. | Unresolved Staff Comments |

None

| Item 2. | Properties |

The following properties are owned by the Company:

| Name of Plant |

Location |

Site Size |

Product | |||||

| 1. | Millsdale | Millsdale (Joliet), Illinois |

492 acres | Surfactants/Polymers | ||||

| 2. | Fieldsboro | Fieldsboro, New Jersey |

45 acres | Surfactants | ||||

| 3. | Anaheim | Anaheim, California |

8 acres | Surfactants | ||||

| 4. | Winder | Winder, Georgia |

202 acres | Surfactants | ||||

| 5. | Maywood | Maywood, New Jersey |

19 acres | Surfactants / Specialty Products | ||||

| 6. | Stepan France | Grenoble, France |

20 acres | Surfactants | ||||

| 7. | Stepan Mexico | Matamoros, Mexico |

13 acres | Surfactants | ||||

| 8. | Stepan Germany | Cologne, Germany |

12 acres | Surfactants/Polymers | ||||

| 9. | Stepan UK | Stalybridge (Manchester), United Kingdom |

11 acres | Surfactants | ||||

| 10. | Stepan Colombia | Manizales, Colombia |

5 acres | Surfactants | ||||

| 11. | Company’s Headquarters and Central Research Laboratories | Northfield, Illinois |

8 acres | N/A | ||||

| 12. | Company’s Corporate Supply Chain, Human Resources, Legal and Finance Functions | Northbrook, Illinois |

3.25 acres | N/A | ||||

In addition, Stepan Canada Inc., which manufactures surfactants, is located on a 70 acre leased, with an option to purchase, site in Longford Mills, Ontario, Canada. Also, Stepan Canada, Inc. maintains a leased sales office in Burlington, Ontario, Canada. Stepan Mexico maintains a leased sales office in Mexico City, Mexico. Stepan China, a majority-owned joint venture that produces polymers, is located on a four acre leased site in Nanjing, China. Stepan China also maintains a leased sales office in Shanghai, China. Under the terms of the purchase contract for its January 2005 acquisition, Stepan Brazil leases a surfactants manufacturing facility on 27 acres of land in Vespasiano, Minas Gerais, Brazil. At the end of the 10-year lease agreement, the assets will be transferred and assigned to Stepan Brazil. Stepan Brazil also leases a small office in an office building in San Paulo, Brazil. The Company’s 50 percent owned joint venture in the Philippines manufactures surfactants on nine acres of land under a long term lease with the Company’s joint venture partner.

11

Table of Contents

| Item 3. | Legal Proceedings |

There are a variety of legal proceedings pending or threatened against the Company that occur in the normal course of the Company’s business, the majority of which relate to environmental matters. Some of these proceedings may result in fines, penalties, judgments or costs being assessed against the Company at some future time. The Company’s operations are subject to extensive local, state and federal regulations, including the U.S. Comprehensive Environmental Response, Compensation and Liability Act of 1980 (CERCLA) and the Superfund amendments of 1986 (“Superfund”). Over the years, the Company has received requests for information relative to or has been named by the government as a potentially responsible party at a number of waste disposal sites where cleanup costs have been or may be incurred under CERCLA and similar state statutes. In addition, damages are being claimed against the Company in general liability actions for alleged personal injury or property damage in the case of some disposal and plant sites. The Company believes that it has made adequate provisions for the costs it may incur with respect to these sites. For most of these sites, the involvement of the Company is expected to be minimal. The most significant sites are described below:

Maywood, New Jersey Site

The Company’s property in Maywood, New Jersey and property formerly owned by the Company adjacent to its current site and other nearby properties (Maywood site) were listed on the National Priorities List in September 1993 pursuant to the provisions of CERCLA because of certain alleged chemical contamination. Pursuant to an Administrative Order on Consent entered into between USEPA and the Company for property formerly owned by the Company, and the issuance of an order by USEPA to the Company for property currently owned by the Company, the Company completed a Remedial Investigation Feasibility Study (RI/FS) in 1994. The Company submitted the Draft Final Feasibility Study for Soil and Source Areas (Operable Unit 1) in September 2002. In addition, the Company has submitted other documentation and information as requested by USEPA, including a Draft Final FS for Groundwater (Operable Unit 2) in June 2003, additional information regarding groundwater in May 2007, submission of a Draft Feasibility Study for Soil and Groundwater (Operable Units 1 and 2) in March 2009, and additional requested information regarding soil and groundwater in January 2010. The Company is awaiting the issuance of a Record of Decision from USEPA.

The Company believes it has adequate reserves for claims associated with the Maywood site, and has recorded a liability for the estimated probable costs it expects to incur at the Maywood site related to remediation of chemical contamination. However, depending on the results of the ongoing discussions with USEPA, the final cost of such remediation could differ from the current estimates.

In addition, under the terms of a settlement agreement reached on November 12, 2004, the United States Department of Justice and the Company agreed to fulfill the terms of a Cooperative Agreement reached in 1985 under which the United States will take title to and responsibility for radioactive waste removal at the Maywood site, including past and future remediation costs incurred by the United States.

12

Table of Contents

D’Imperio Property Site

During the mid-1970’s, Jerome Lightman and the Lightman Drum Company disposed of hazardous substances at several sites in New Jersey. The Company was named as a potentially responsible party (PRP) in the case United States v. Lightman (1:92-cv-4710 D.N.J.), which involved the D’Imperio Property Site located in New Jersey. In the second quarter of 2007, the Company reached an agreement with respect to the past costs and future allocation percentage in said litigation for costs related to the D’Imperio site, including costs to comply with USEPA’s Unilateral Administrative Orders. The Company paid the settlement amount in the third quarter of 2007. The resolution of the Company’s liability for this litigation did not have a material impact on the financial position, results of operations or cash flows of the Company. In December 2007, the Company received updated remediation cost estimates, which were considered in the Company’s determination of its range of estimated possible losses and reserve balance.

Remediation work is continuing at this site. Based on current information, the Company believes that it has adequate reserves for claims associated with the D’Imperio site. However, actual costs could differ from current estimates.

Ewan Property Site

The case United States v. Lightman (1:92-cv-4710 D.N.J.), described above for the D’Imperio site, also involved the Ewan Property Site located in New Jersey. The agreement described above also included a settlement with respect to the past costs and future allocation percentage in said litigation for costs related to the past costs and allocation percentage at the Ewan site. The Company paid the settlement amount in the third quarter of 2007. The resolution of the Company’s liability for this litigation did not have a material impact on the financial position, results of operations or cash flows of the Company.

In addition, the NJDEP filed a natural resource damages complaint in June 2007 against the Company and other entities regarding the Ewan site. The Company was served with the complaint in May 2008. The parties, including the Company, are engaged in discussions with NJDEP to resolve this litigation.

There is some monitoring and operational work continuing at the Ewan site. Based on current information, the Company believes that it has adequate reserves for claims associated with the Ewan site. However, actual costs could differ from current estimates.

Lightman Drum Company Superfund Site

The Company received a Section 104(e) Request for Information from USEPA dated March 21, 2000, regarding the Lightman Drum Company Superfund Site located in Winslow Township, New Jersey. The Company responded to this request on May 18, 2000. In addition, the Company received a Notice of Potential Liability and Request to Perform RI/FS dated June 30, 2000, from USEPA. The Company participated in the performance of the RI/FS as a member of the Lightman Yard PRP Group. The RI/FS was performed under an interim allocation. The allocation has not yet been finalized by the Lightman Yard PRP Group. The Company believes that it is unlikely that an allocation change would have a material effect on Company financial position, results of operations or cash flows.

13

Table of Contents

In the fourth quarter of 2007, the PRPs who agreed to conduct the interim remedial action entered into an Administrative Settlement Agreement and Order on Consent for Removal Action with USEPA, and these PRPs also entered into a Supplemental Lightman Yard Participation and Interim Funding Agreement to fund the agreed-upon removal action. The Company paid a soil removal assessment upon execution of the agreements which did not have a material impact on the financial position, results of operations or cash flows of the Company. The soil removal action was completed and USEPA approved it in October 2009. A final Feasibility Study was submitted to USEPA in February 2009 and was approved in March 2009. In June 2009, USEPA issued a Proposed Plan for Remediation. In September 2009, USEPA signed the Record of Decision.

The Company believes that based on current information it has adequate reserves for claims associated with the Lightman site. However, actual costs could differ from current estimates.

Wilmington Site

The Company is currently contractually obligated to contribute to the response costs associated with the Company’s formerly-owned site at 51 Eames Street, Wilmington, Massachusetts. Remediation at this site is being managed by its current owner to whom the Company sold the property in 1980. Under the agreement, once total site remediation costs exceed certain levels, the Company is obligated to contribute up to five percent of future response costs associated with this site with no limitation on the ultimate amount of contributions. To date, the Company has paid the current owner $1.8 million for the Company’s portion of environmental response costs through the third quarter of 2009 (the current owner of the site bills the Company one calendar quarter in arrears). The Company has recorded a liability for its portion of the estimated remediation costs for the site. Depending on the ultimate cost of the remediation at this site, the amount for which the Company is liable could differ from the current estimates.

In addition, in response to the special notice letter received by the PRPs in June 2006 from USEPA seeking performance of an RI/FS at the site, certain PRPs, including the Company, signed an Administrative Settlement Agreement and Order on Consent for the RI/FS effective July 2007, which sets forth the obligations of the PRPs to perform the RI/FS.

The Company and other prior owners also entered into an agreement in April 2004 waiving certain statute of limitations defenses for claims which may be filed by the Town of Wilmington, Massachusetts, in connection with this site. While the Company has denied any liability for any such claims, the Company agreed to this waiver while the parties continue to discuss the resolution of any potential claim which may be filed.

The Company believes that based on current information it has adequate reserves for the claims related to this site.

14

Table of Contents

Other Sites

The Company has been named as a de minimis PRP at other sites, and as such the Company believes that a resolution of its liability will not have a material impact on the financial position, results of operations or cash flows of the Company.

15

Table of Contents

| Item 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of stockholders during the fourth quarter of the fiscal year ended December 31, 2009.

Executive Officers of the Registrant

Executive Officers are elected annually by the Board of Directors at the first meeting following the Annual Meeting of Stockholders to serve until the next annual meeting of the Board and until their respective successors are duly elected and qualified.

The Executive Officers of the Company, their ages as of February 26, 2010, and certain other information are as follows:

| Name |

Age | Title |

Year First Elected Officer | |||

| F. Quinn Stepan | 72 | Chairman | 1967 | |||

| F. Quinn Stepan, Jr. | 49 | President and Chief Executive Officer | 1997 | |||

| John V. Venegoni | 51 | Vice President and General Manager – Surfactants | 1999 | |||

| Robert J. Wood | 52 | Vice President and General Manager – Polymers | 2001 | |||

| James E. Hurlbutt | 56 | Vice President and Chief Financial Officer | 2002 | |||

| Frank Pacholec | 54 | Vice President, Research and Development | 2003 | |||

| Gregory Servatius | 50 | Vice President, Human Resources | 2006 | |||

| H. Edward Wynn | 49 | Vice President, General Counsel and Secretary | 2007 |

F. Quinn Stepan is an executive officer of the Company and Chairman of the Company’s Board of Directors. He served the Company as Chairman and Chief Executive Officer from 1984 through 2005.

F. Quinn Stepan, Jr., has served the Company as President and Chief Executive Officer since January 2006. He served the Company as President and Chief Operating Officer from 1999 through 2005.

John V. Venegoni has served the Company as Vice President and General Manager – Surfactants since February 1999.

Robert J. Wood has served the Company as Vice President and General Manager – Polymers since January 2001.

James E. Hurlbutt has served the Company as Vice President and Chief Financial Officer since February 12, 2008. From February 2005 until February 2008, he served the Company as Vice President – Finance. From February 2002 until February 2005, he served the Company as Vice President and Controller.

Frank Pacholec has served the Company as Vice President, Research and Development since April 2003.

16

Table of Contents

Gregory Servatius has served the Company as Vice President, Human Resources since February 2006. From April 2003 until January 2006, he served as Vice President, Surfactant Sales.

H. Edward Wynn has served the Company as Vice President, General Counsel and Secretary since January 9, 2007. From 2005 until 2006, he served as Chief Administrative Officer and General Counsel with Heritage Development Partners, LLC. From 2003 until 2005, he served as Chief Administrative Officer and General Counsel with the Illinois Department of Central Management Services.

Anthony J. Zoglio served the Company as Vice President – Supply Chain from November 2003 until his retirement on February 15, 2010.

17

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

| (a) | The Company’s common stock is listed and traded on both the New York Stock Exchange and the Chicago Stock Exchange. See table below for New York Stock Exchange quarterly market price information. |

| Quarterly Stock Data | ||||||||||||

| Stock Price Range | ||||||||||||

| 2009 | 2008 | |||||||||||

| Quarter |

High | Low | High | Low | ||||||||

| First |

$ | 48.41 | $ | 22.80 | $ | 38.51 | $ | 27.75 | ||||

| Second |

$ | 45.99 | $ | 26.34 | $ | 46.45 | $ | 37.23 | ||||

| Third |

$ | 62.98 | $ | 39.74 | $ | 60.82 | $ | 41.74 | ||||

| Fourth |

$ | 67.98 | $ | 54.23 | $ | 55.27 | $ | 28.62 | ||||

| Year |

$ | 67.98 | $ | 22.80 | $ | 60.82 | $ | 27.75 | ||||

The Company’s 5 1/2 percent convertible preferred stock is listed and traded on the New York Stock Exchange and the Chicago Stock Exchange. See Note 10, Stockholders’ Equity of the Consolidated Financial Statements (Item 8 of this Form 10-K) for a description of the preferred stockholders’ rights.

On February 11, 2009, the Company’s Board of Directors authorized the Company to repurchase up to 500,000 shares of its outstanding common stock, or the equivalent in shares of the Company’s preferred stock. This repurchase authorization replaced the 300,000 share authorization approved on February 10, 2004, of which the remaining unutilized repurchase authorization of 111,256 shares was cancelled. The Company will repurchase shares from time to time for cash in open market or private transactions in accordance with applicable securities and stock exchange rules. The repurchase authorization represents approximately five percent of the Company’s total shares of common stock outstanding. The timing and amount of the repurchases will be determined by the Company’s management based on their evaluation of market conditions and share price. During 2009, 50,474 shares of Company common stock were purchased in the open market, 35,235 shares of common stock were received in lieu of cash from employees exercising stock options, and 13,852 shares of common stock were received to settle employees’ minimum statutory withholding taxes related to performance stock awards. The purchased and received shares were recorded as treasury stock in the Company’s balance sheet. As of December 31, 2009, 400,439 shares remain to be purchased under the repurchase authorization.

| (b) | On January 31, 2010, there were 1,303 holders of record of common stock of the Company. |

18

Table of Contents

| (c) | Below is a summary by month of share purchases by the Company during the fourth quarter of 2009: |

| Period |

Total Number of |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||

| October |

— | — | — | — | ||||||

| November |

10,729 | (a) | $ | 59.86 | — | — | ||||

| December |

1,672 | (a) | $ | 59.95 | — | — | ||||

| (a) | Purchased on the open market. |

| (d) | See table below for quarterly dividend information. Also, see Note 6, Debt and Note 10, Stockholders’ Equity of the Consolidated Financial Statements (Item 8 of this Form 10-K), which sets forth the restrictive covenants covering dividends. |

Dividends Declared Per Common Share

| Quarter |

2009 | 2008 | ||||

| First |

22.00 | ¢ | 21.00 | ¢ | ||

| Second |

22.00 | ¢ | 21.00 | ¢ | ||

| Third |

22.00 | ¢ | 21.00 | ¢ | ||

| Fourth |

24.00 | ¢ | 22.00 | ¢ | ||

| Year |

90.00 | ¢ | 85.00 | ¢ | ||

19

Table of Contents

| (e) | Stock Performance Graph |

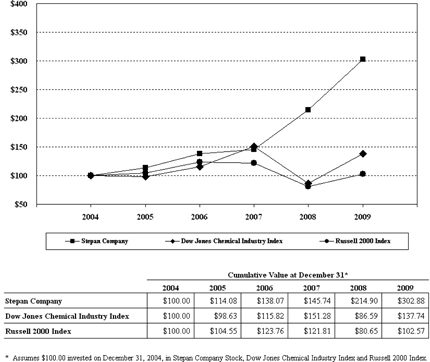

The following stock performance graph compares the yearly change since December 31, 2004, in cumulative return on the Common Stock of the Company on a dividend reinvested basis to the Dow Jones Chemical Industry Index and the Russell 2000 Index. The Dow Jones Chemical Industry Index is a market-capitalization weighted grouping of 37 chemical companies, including major manufacturers of both basic and specialty products. Stepan Company is not included in the Dow Jones Chemical Industry Index. The Russell 2000 Index is a market-capitalization weighted grouping of 2,000 small to medium sized companies in a broad range of industries. Stepan Company was a part of the Russell 2000 Index during 2009. The graph assumes $100 was invested on December 31, 2004, and shows the cumulative total return as of each December 31 thereafter.

20

Table of Contents

| Item 6. | Selected Financial Data |

See the table below for selected financial information.

(In thousands, except per share and employee data)

| For the Year |

2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||

| Net Sales |

$ | 1,276,382 | $ | 1,600,130 | $ | 1,329,901 | $ | 1,172,583 | $ | 1,078,377 | ||||||||||

| Operating Income |

104,888 | 70,680 | 35,095 | 15,853 | 25,468 | |||||||||||||||

| Percent of Net Sales |

8.2 | % | 4.4 | % | 2.6 | % | 1.4 | % | 2.4 | % | ||||||||||

| Income Before Provision for Income Taxes |

97,131 | 54,878 | 23,715 | 7,389 | 17,646 | |||||||||||||||

| Percent of Net Sales |

7.6 | % | 3.4 | % | 1.8 | % | 0.6 | % | 1.6 | % | ||||||||||

| Provision for Income Taxes |

34,028 | 17,615 | 8,687 | 900 | 4,170 | |||||||||||||||

| Income Before Cumulative Effect of Change in Accounting Principle |

63,049 | 37,172 | 15,118 | 6,670 | 13,529 | |||||||||||||||

| Per Diluted Share (a) |

5.84 | 3.52 | 1.50 | 0.63 | 1.39 | |||||||||||||||

| Net Income Attributable to Stepan Company |

63,049 | 37,172 | 15,118 | 6,670 | 13,159 | |||||||||||||||

| Per Diluted Share (a) |

5.84 | 3.52 | 1.50 | 0.63 | 1.35 | |||||||||||||||

| Percent of Net Sales |

4.9 | % | 2.3 | % | 1.1 | % | 0.6 | % | 1.2 | % | ||||||||||

| Percent to Total Stepan Company Stockholders’ Equity (b) |

25.3 | % | 17.9 | % | 7.8 | % | 3.8 | % | 7.9 | % | ||||||||||

| Percent Return on Invested Capital (c) |

14.41 | % | 8.21 | % | 5.92 | % | 4.51 | % | 5.60 | % | ||||||||||

| Cash Dividends Paid |

9,557 | 8,863 | 8,431 | 8,149 | 7,869 | |||||||||||||||

| Per Common Share |

0.9000 | 0.8500 | 0.8250 | 0.8050 | 0.7850 | |||||||||||||||

| Depreciation and Amortization |

37,171 | 36,928 | 37,176 | 38,384 | 38,769 | |||||||||||||||

| Capital Expenditures |

42,631 | 49,778 | 39,815 | 45,970 | 41,519 | |||||||||||||||

| Weighted-average Common Shares Outstanding (Diluted) |

10,796 | 10,549 | 10,113 | 9,284 | 9,725 | |||||||||||||||

| As of Year End |

||||||||||||||||||||

| Working Capital |

$ | 186,297 | $ | 116,288 | $ | 92,954 | $ | 87,974 | $ | 96,344 | ||||||||||

| Current Ratio |

2.1 | 1.5 | 1.5 | 1.5 | 1.6 | |||||||||||||||

| Property, Plant and Equipment, net |

248,618 | 238,166 | 234,062 | 225,604 | 211,119 | |||||||||||||||

| Total Assets |

634,203 | 611,897 | 573,185 | 546,055 | 516,159 | |||||||||||||||

| Long-term Debt Obligations |

93,911 | 104,725 | 96,939 | 107,403 | 108,945 | |||||||||||||||

| Total Stepan Company Stockholders’ Equity |

289,285 | 208,144 | 206,051 | 180,786 | 166,834 | |||||||||||||||

| Per share (d) |

27.36 | 20.27 | 20.69 | 18.33 | 17.19 | |||||||||||||||

| Number of Employees |

1,594 | 1,578 | 1,525 | 1,528 | 1,510 | |||||||||||||||

| (a) | Based on weighted-average number of common shares outstanding during the year. |

| (b) | Based on average equity. |

| (c) | Defined as net operating profit after taxes divided by invested capital. |

| (d) | Based on common shares and the assumed conversion of the convertible preferred shares outstanding at year end. |

21

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Some information contained in the Management’s Discussion and Analysis is forward looking and involves risks and uncertainties. The Company operates in a cyclical industry and the results achieved this year are not necessarily an indication of future prospects for the Company. Actual results in future years may differ materially from the results presented below. Potential risks and uncertainties include, among others, fluctuations in the volume and timing of product orders, changes in demand for the Company’s products, changes in technology, continued competitive pressures in the marketplace, outcomes of environmental contingencies, availability of raw materials, the ability to pass on raw material price increases, foreign currency fluctuations and general economic conditions.

Overview

The Company produces and sells intermediate chemicals that are used in a wide variety of applications worldwide. The overall business comprises three reportable segments:

| • | Surfactants – Surfactants, which accounted for 77 percent of consolidated net sales for 2009, are principal ingredients in consumer and industrial cleaning products such as detergents for washing clothes, dishes, carpets, floors and walls, as well as shampoos, body washes, toothpastes and fabric softeners. Other applications include germicidal quaternary compounds, lubricating ingredients, emulsifiers (for spreading agricultural products), plastics and composites and biodiesel. Surfactants are manufactured at six North American sites (five in the U.S. and one in Canada), three European sites (United Kingdom, France and Germany) and three Latin American sites (Mexico, Brazil and Colombia). The Company holds a 50 percent ownership interest in two joint ventures, Stepan Philippines and TIORCO, LLC, that are excluded from surfactant segment operating results. The joint ventures are accounted for under the equity method. |

| • | Polymers – Polymers, which accounted for 20 percent of consolidated net sales for 2009, include two primary product lines: polyols and phthalic anhydride. Polyols are used in the manufacture of laminate insulation board for the construction industry and are also sold to the appliance, flexible foam and coatings, adhesives, sealants and elastomers (C.A.S.E.) industries. Phthalic anhydride is used in unsaturated polyester resins, alkyd resins and plasticizers for applications in construction materials and components of automotive, boating and other consumer products. In the U.S., polymer product lines are manufactured at the Company’s Millsdale, Illinois, site. Polyols are also manufactured at the Company’s Wesseling (Cologne), Germany facility, as well as at its 80-percent owned joint venture in Nanjing, China (which is included in consolidated results). |

| • | Specialty Products – Specialty products, which accounted for three percent of consolidated net sales for 2009, include flavors, emulsifiers and solubilizers used in the food and pharmaceutical industries. Specialty products are manufactured primarily at the Company’s Maywood, New Jersey, site. |

22

Table of Contents

Despite the continued challenges of the global economic recession, the Company achieved record net income for the year ended December 31, 2009. The economic slowdown continued to negatively affect sales volume, which was down eight percent year over year. Sales volume for the Company’s polymers segment fell 16 percent behind last year’s levels, as activity in the industries into which the segment sells (roofing insulation, construction materials, automotive and recreational vehicles, etc.) was down. Management expects polymer sales volume recovery to be slow. The recession has had a lesser effect on sales volume for the surfactants segment, as surfactants used in cleaning compounds have historically been more recession resistant. Consolidated surfactant sales volume dropped seven percent between years primarily as a result of lower volumes for biodiesel and construction and oilfield applications. Sales volume for the Company’s largest market segment, consumer laundry and personal care, slightly exceeded 2008 levels. Lower year-over-year raw material costs, resulting from the effects of the economic recession on commodities, benefited all segments, as the effect of lower costs more than offset the effect of lower sales volume. During the second half of 2009, the costs of crude and natural oils and their derivative products began to rise, prompting management to increase selling prices for many of the Company’s surfactant and polymer products. During 2009, the Company also implemented cost saving initiatives to reduce spending for items such as overtime, travel and entertainment, outside consulting and temporary help.

Deferred Compensation Plans

The accounting for the Company’s deferred compensation plans can cause period-to-period fluctuations in Company expenses and profits. For 2009, compensation expense related to the Company’s deferred compensation plans, which is reported in the administrative expense line of the consolidated income statement, was $6.8 million and $4.7 million higher than deferred compensation expense reported for 2008 and 2007, respectively. The Company common stock price, to which a large portion of the deferred compensation obligation is tied, was $64.81 at December 31, 2009, compared to $46.99 at December 31, 2008 and $32.53 at December 31, 2007. The pretax effect of all deferred compensation-related activities (which includes realized and unrealized gains and losses on the mutual fund assets held to fund the deferred compensation obligations) and the income statement line items in which the effects were recorded are displayed below (see the ‘Corporate Expenses’ section of this management discussion and analysis for further details):

23

Table of Contents

| (Income) / Expense For the Years Ended December 31 |

||||||||||||

| (Dollars in millions) |

2009 | 2008 | 2007 | |||||||||

| Deferred Compensation (Administrative expense) |

$ | 7.0 | $ | 0.2 | $ | 2.3 | ||||||

| Investment Income (Other, net) |

(0.1 | ) | (0.3 | ) | (1.1 | ) | ||||||

| Realized/Unrealized (Gains) / Losses on Investments (Other, net) (a) |

(1.9 | ) | 5.0 | (0.1 | ) | |||||||

| Net Pre-tax Income Effect |

$ | 5.0 | $ | 4.9 | $ | 1.1 | ||||||

| (a) | On January 1, 2008, the Company elected the fair value option for the mutual fund investment assets held for its deferred compensation plans. As a result, unrealized gains and losses for the mutual funds are recorded in the income statement beginning in 2008. In 2007 and prior years, the unrealized gains were reported in accumulated other comprehensive income in the equity section of the balance sheet. The 2007 amount in the table reflects only the realized gain for the year. See the ‘Critical Accounting Policies’ section of this Management Discussion and Analysis for additional information. |

Effects of Foreign Currency Translation

The Company’s foreign subsidiaries transact business and report financial results in their respective local currencies. As a result, foreign subsidiary income statements are translated into U.S. dollars at average foreign exchange rates appropriate for the reporting period. Because foreign exchange rates fluctuate against the U.S. dollar over time, foreign currency translation affects period-to-period comparisons of financial statement items (i.e. because foreign exchange rates fluctuate, similar period-to-period local currency results for a foreign subsidiary may translate into different U.S. dollar results). For the year ending December 31, 2009, the U.S. dollar strengthened against nearly all the foreign currencies in the locations where the Company does business, when compared to the exchange rates for year ending December 31, 2008. Consequently, reported net sales, expense and income amounts for 2009 were lower than they would have been had the foreign currency exchange rates remained constant with the rates for 2008. Conversely, for the year ending December 31, 2008, the U.S. dollar weakened against nearly all the foreign currencies in the locations where the Company does business, when compared to the exchange rates for year ending December 31, 2007. Below are tables that present the impact that foreign currency translation had on the changes in consolidated net sales and various income line items for 2009 compared to 2008 and for 2008 compared to 2007:

| Year Ended December 31 |

Increase (Decrease) |

Inc (Dec) Due to Foreign Translation |

||||||||||||

| (In millions) |

2009 | 2008 | ||||||||||||

| Net Sales |

$ | 1,276.4 | $ | 1,600.1 | $ | (323.7 | ) | $ | (49.2 | ) | ||||

| Gross Profit |

233.1 | 169.5 | 63.6 | (7.8 | ) | |||||||||

| Operating Income |

104.9 | 70.7 | 34.2 | (5.2 | ) | |||||||||

| Pretax Income |

97.1 | 54.9 | 42.2 | (5.4 | ) | |||||||||

24

Table of Contents

| The Year Ended December 31 |

Increase (Decrease) |

Inc (Dec) Due to Foreign Translation | ||||||||||

| (In millions) |

2008 | 2007 | ||||||||||

| Net Sales |

$ | 1,600.1 | $ | 1,329.9 | $ | 270.2 | $ | 12.0 | ||||

| Gross Profit |

169.5 | 141.4 | 28.1 | 2.6 | ||||||||

| Operating Income |

70.7 | 35.1 | 35.6 | 1.8 | ||||||||

| Pretax Income |

54.9 | 23.7 | 31.2 | 1.5 | ||||||||

Significant Transactions during the Reporting Period

A number of events having significant effects on the Company’s results of operations occurred in 2008 and 2007. The following are descriptions of those events:

Sale of Commodity Polyurethane Systems Product Lines

On July 31, 2008, the Company sold select polyurethane system product lines, which were a part of the polymer segment, to Bayer MaterialScience LLC (Bayer). No manufacturing assets were included in the sale and no employees were terminated. The sold product lines were insulation materials used in appliances, water heaters, doors, roofs, picnic coolers and other similar applications, and represented approximately $16.0 million in Company annual net sales. The products, which are manufactured at the Company’s Millsdale, Illinois, facility, continue to be produced for Bayer during a transition period of up to two years. The sale was for $9.9 million of cash, which the Company reported as a pretax gain in the third quarter ended September 30, 2008. The Company continues to produce and sell polyurethane systems for specialty applications. See Note 19 in the Notes to Condensed Consolidated Financial Statements for additional information.

Sale of Land

In September 2008, the Company sold 88 acres of land at its Millsdale manufacturing facility in Elwood, Illinois, to an industrial park developer for $8.6 million. The land had a cost basis of $0.1 million, so the Company recorded a pretax gain of $8.5 million in the third quarter ended September 30, 2008. The gain was not attributed to any reportable segment. For income tax purposes, the land disposition and the acquisition of an office building near the Company’s corporate headquarters were structured as a tax-deferred like-kind exchange, pursuant to Section 1031 of the Internal Revenue Code. See Note 20 in the Notes to Condensed Consolidated Financial Statements for additional information.

Sale of Specialty Esters Product Line

On April 30, 2007, the Company sold its specialty ester surfactant product line for the personal care market to The HallStar Company (formerly CPH Holding Corporation). No physical assets were included in the sale. The product line represented approximately $15.0 million in Company annual net sales. The sale was for $6.2 million of cash plus the transfer to the Company of a

25

Table of Contents

specialty agricultural surfactant product line. As a result of the sale, the Company reported a $4.2 million pretax gain in 2007. The gain was net of related write-downs for equipment and inventory as well as severance charges and a provision for expected losses on the fulfillment of a manufacturing agreement (completed in 2008) associated with the product line sale. See Note 19 in the Notes to Condensed Consolidated Financial Statements for additional information.

Goodwill Impairment

As a result of performing the annual test of goodwill impairment required by U.S. generally accepted accounting principles in 2007, the Company determined that the goodwill reported for Stepan UK, a reporting unit of the Company’s surfactants segment, was impaired. The amount of the impairment was $3.5 million, the entire balance of goodwill for Stepan UK. As a result, a $3.5 million non-cash goodwill impairment loss was recorded in 2007. The goodwill impairment reflected an estimated reduction in the fair value of Stepan UK’s business as a result of lower discounted cash flow forecasts at that time. Improvements in operating results were lower than previous forecasts used to test for impairments. See Note 4 in the Notes to Condensed Consolidated Financial Statements for additional information.

RESULTS OF OPERATIONS

2009 Compared with 2008

Summary

Net income for 2009 improved 70 percent to a record $63.0 million, or $5.84 per diluted share, compared to $37.2 million, or $3.52 per diluted share, for 2008. Prior year net income benefited from $11.3 million (net of tax) of gains on the previously discussed sales of the polyurethane systems product lines and Millsdale land. Below is a summary discussion of the major factors leading to the year-to-year changes in net sales, profits and expenses. A detailed discussion of segment operating performance for 2009 follows the summary.

Consolidated net sales declined $323.7 million, or 20 percent, between years. A decline in average selling prices, lower sales volume and the effects of foreign currency translation accounted for approximately $142.5 million, $132.0 million and $49.2 million, respectively, of the year-to-year decrease in net sales. Sales volumes fell eight percent, reflecting the effects of the global recession. By segment, polymer and surfactant sales volumes dropped 16 percent and seven percent, respectively, while sales volume for specialty products was up nine percent year over year. The decline in average selling prices was principally the result of falling commodity raw material costs.

Operating income for 2009 was $34.2 million, or 48 percent, greater than operating income for 2008 despite the 2008 $9.9 million and $8.5 million gains reported on the sales of the polyurethane product lines and Millsdale land, respectively. Gross profit was up $63.6 million, or 37 percent. All three segments contributed to the improvement in gross profit. Surfactants segment gross profit was up $48.3 million, or 40 percent; polymers segment gross profit increased $9.7 million, or 23 percent; and gross profit for the specialty products segment was up $7.0 million, or 77 percent. Lower raw material and freight costs and Company cost reduction initiatives benefited all segments. The effects of foreign currency translation reduced the year-to-year consolidated gross profit improvement by approximately $7.8 million.

26

Table of Contents

Operating expenses increased $29.4 million, or 30 percent, between years. Major items accounting for the expense increase were as follows:

| (Dollars in millions) | Increase / (Decrease) |

|||

| 2008 Gain on Sale of Product Lines |

$ | 9.9 | ||

| 2008 Gain on Sale of Land |

8.5 | |||

| Deferred Compensation Expense |

6.8 | |||

| Incentive-based Compensation |

5.3 | |||

| Foreign Currency Translation |

(2.3 | ) | ||

| Transition Pension Expense |

(1.2 | ) | ||

| Legal/Environmental Expense |

1.1 | |||

| Other |

1.3 | |||

| Total |

$ | 29.4 | ||

The gains on sales of product lines and land are explained in the ‘Overview’ section of this MD&A. The increase in deferred compensation expense is discussed in detail in the ‘Corporate Expenses’ section of this MD&A. Improved operating results caused the rise in incentive-based compensation, which includes stock-based pay, bonuses and profit sharing. The decline in transition pension expense was principally attributable to a 2008 acceleration of a portion of discretionary Company contributions established to compensate certain employees for benefits lost when the Company froze its defined benefit plans in 2006 (no such accelerated benefits were paid in 2009). Legal/environmental expenses were up mainly due to increases in estimated environmental remediation reserve requirements for existing sites.

Interest expense for 2009 was $3.2 million, or 34 percent, less than interest expense for 2008. Lower average debt levels, resulting from a decrease in working capital requirements brought on by lower raw material costs, led to the decline.

The loss from equity joint ventures, which includes results for the 50-percent owned SPI and TIORCO joint ventures, increased $1.0 million, or 38 percent, between years. SPI reported an equity loss of $1.2 million for 2009, which was $1.1 million less than the loss reported in the 2008. The current year included $1.2 million of expense to reserve for value added tax receivable balances that are in dispute with Philippine tax authorities. TIORCO, which was formed in September 2008, reported $2.5 million of equity loss, which was $2.1 million higher than the loss reported in 2008. Planned start-up expenses coupled with lower prices for crude oil in the first six months of 2009 caused the TIORCO result.

Other, net was $2.2 million of income for 2009 compared to $3.6 million of expense for 2008. A $6.7 million favorable swing in investment related income, partially offset by a $0.9 million decline in foreign exchange gains, accounted for the $5.8 million year to year favorable other, net change. Unrealized and realized gains related to the mutual funds held for the Company’s deferred compensation plans accounted for the year-to-year change in investment related income as $1.9 million of gains were posted in 2009 compared to losses of $5.0 million for 2008. Dividend income declined $0.2 million between years. Foreign exchange activity resulted in $0.2 million of gains for 2009 compared to $1.1 million of gains for the same period of 2008.

The effective tax rate was 35.0 percent in 2009 compared to 32.1 percent in 2008. The increase in the effective tax rate was primarily attributable to a greater percentage of consolidated

27

Table of Contents

income being generated in the U.S. where the effective tax rate is higher and the reduction of the tax benefit realized on tax credits and deductions as percentage of income. See Note 9 to the consolidated financial statements for a reconciliation of the statutory U.S. federal income tax rate to the effective tax rate.

Segment Results

| (Dollars in thousands) | Surfactants | Polymers | Specialty Products |

Segment Results |

Corporate | Total | ||||||||||||

| For the year ended December 31, 2009 |

||||||||||||||||||

| Net sales |

$ | 972,647 | $ | 260,770 | $ | 42,965 | $ | 1,276,382 | — | $ | 1,276,382 | |||||||

| Operating income |

98,947 | 33,957 | 12,621 | 145,525 | (40,637 | ) | 104,888 | |||||||||||

| For the year ended December 31, 2008 |

||||||||||||||||||

| Net sales |

$ | 1,199,438 | $ | 359,014 | $ | 41,678 | $ | 1,600,130 | — | $ | 1,600,130 | |||||||

| Operating income |

52,261 | 34,103 | 5,949 | 92,313 | (21,633 | ) | 70,680 | |||||||||||

Surfactants

Surfactants net sales for 2009 declined $226.8 million, or 19 percent, from net sales for 2008. A nine percent decline in average selling prices, a seven percent decrease in sales volume and the effects of foreign currency translation accounted for approximately $100.3 million, $81.4 million and $45.1 million, respectively, of the net sales change. A year-to-year comparison of net sales by region follows:

| For the Year Ended | ||||||||||||

| (Dollars in thousands) | December 31, 2009 |

December 31, 2008 |

Increase / (Decrease) |

Percent Change | ||||||||

| North America |

$ | 647,304 | $ | 810,509 | $ | (163,205 | ) | -20 | ||||

| Europe |

226,138 | 269,524 | (43,386 | ) | -16 | |||||||

| Latin America |

99,205 | 119,405 | (20,200 | ) | -17 | |||||||