Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K LONGWEI - LONGWEI PETROLEUM INVESTMENT HOLDING LTD | form8k.htm |

Longwei

Petroleum Investment Holding Limited

February

23, 2010

Confidential

1

Forward

Looking Statements

Statements

contained in this presentation may be considered “forward-looking

statements”

within the meaning of U.S. federal securities laws. The matters discussed herein are based

on current management expectations that involve risks and uncertainties that may result in

such expectations not being realized. Actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements due to numerous

potential risks and uncertainties including such risks and factors described in presentation

prepared by Longwei Petroleum Investment Holding Ltd. (“Longwei” or the “Company”)

management. Such forward-looking statements speak only as of the date on which they are

made and Longwei does not undertake any obligation to update any forward-looking

statements to reflect events or circumstances after the date of the presentation.

within the meaning of U.S. federal securities laws. The matters discussed herein are based

on current management expectations that involve risks and uncertainties that may result in

such expectations not being realized. Actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements due to numerous

potential risks and uncertainties including such risks and factors described in presentation

prepared by Longwei Petroleum Investment Holding Ltd. (“Longwei” or the “Company”)

management. Such forward-looking statements speak only as of the date on which they are

made and Longwei does not undertake any obligation to update any forward-looking

statements to reflect events or circumstances after the date of the presentation.

2

3

Executive

Summary

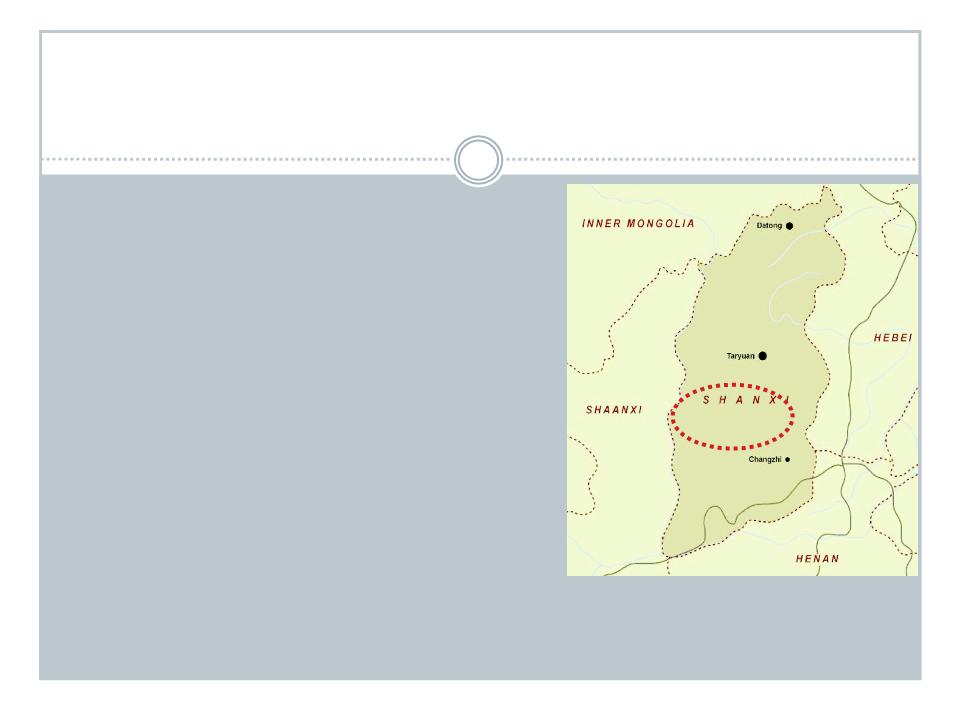

§ Longwei Petroleum

Investment Holding Limited, a Colorado

corporation, is one of the leading distributors/wholesalers of

diesel, gasoline, kerosene and fuel oils in Taiyuan City and

Gujiao City in Shanxi Province, Peoples Republic of China

(PRC).

corporation, is one of the leading distributors/wholesalers of

diesel, gasoline, kerosene and fuel oils in Taiyuan City and

Gujiao City in Shanxi Province, Peoples Republic of China

(PRC).

§ The Company’s

operating subsidiary, Taiyuan Longwei

(“Longwei”), was founded in the PRC in 1995 and is fully

licensed to operate as a finish oil wholesaler in the PRC.

(“Longwei”), was founded in the PRC in 1995 and is fully

licensed to operate as a finish oil wholesaler in the PRC.

§ Longwei purchases

diesel, gasoline, fuel oils and kerosene from oil refineries and other

Chinese suppliers with whom the Company has had long lasting business relations.

Chinese suppliers with whom the Company has had long lasting business relations.

§ The Company’s

customer list includes a diversified grouping of primary fuel

users.

Shanxi

Province

|

Diesel,

Gasoline, Kerosene and Fuel Oils Customers

|

Approx.

Percent of

FY 2009 Revenues |

|

1. Coal

plants and other power supply customers

2. Large-scale gas stations located in Taiyuan City, Shanxi Province 3. Small, independent gas stations located in Taiyuan City, Shanxi Province |

45%

45%

5%

|

4

Executive

Summary (cont.)

§ Since 1995, Longwei

has owned and operated an ISO9000 certified fuel storage facility

with 14 storage tanks with a total capacity of 50,000 metric tons (mt) at Taiyuan City. In

addition, the Company owns a second fuel storage facility that has a total of 8 storage

tanks with a total capacity of 70,000 mt in Gujiao City. The Gujiao facility began

operations in October 2009 and was fully operational on January 1, 2010.

with 14 storage tanks with a total capacity of 50,000 metric tons (mt) at Taiyuan City. In

addition, the Company owns a second fuel storage facility that has a total of 8 storage

tanks with a total capacity of 70,000 mt in Gujiao City. The Gujiao facility began

operations in October 2009 and was fully operational on January 1, 2010.

§ Longwei Petroleum

Investment Holding Limited was incorporated under the laws of the

State of Colorado in 2000 and conducted no business operations until October 16,

2007, when it acquired the business of Longwei in a “reverse merger” transaction.

State of Colorado in 2000 and conducted no business operations until October 16,

2007, when it acquired the business of Longwei in a “reverse merger” transaction.

§ The Company has 65

employees, including three management personnel.

Longwei

Front Gate

Storage

Units

5

Investment Highlights

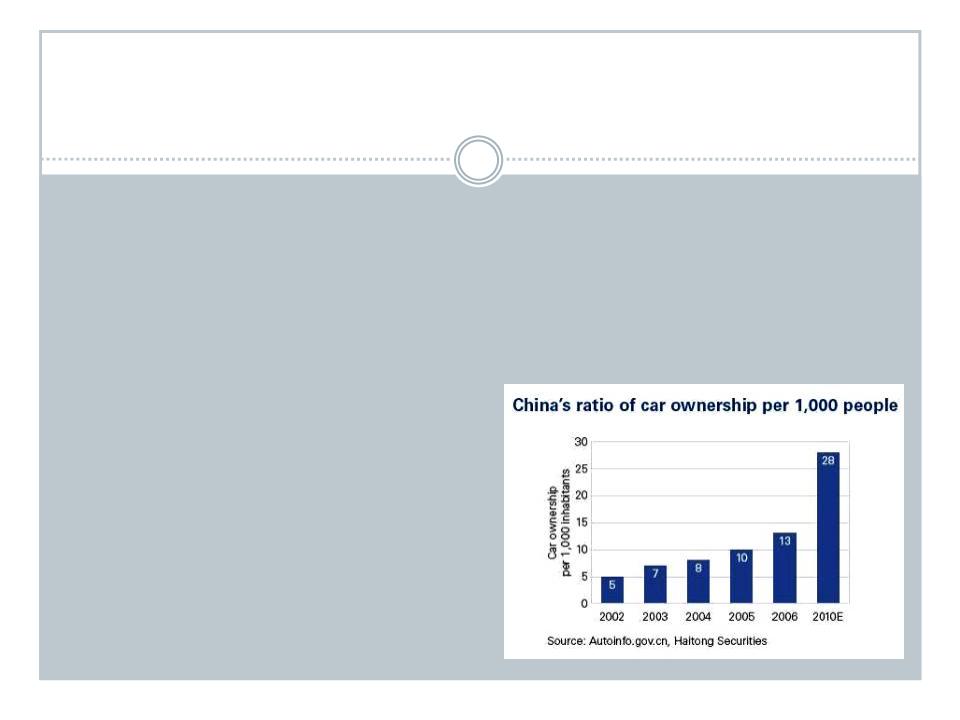

§ Longwei

is well positioned to benefit from strong projected growth in demand

for

refined petroleum products in the PRC

refined petroleum products in the PRC

Per

capita consumption of diesel, gasoline and other refined petroleum products

is

expected to continue to grow strongly throughout the PRC, including Taiyuan City,

Shanxi Province, due to a number of factors, including increased demand for power

supply and significant projected increases in per capital motor vehicle ownership and

continued strong economic growth.

expected to continue to grow strongly throughout the PRC, including Taiyuan City,

Shanxi Province, due to a number of factors, including increased demand for power

supply and significant projected increases in per capital motor vehicle ownership and

continued strong economic growth.

Growth

in the auto industry in China is fairly

well know at this point but the growth has

been stronger than expected in the past

year and in recent months.

well know at this point but the growth has

been stronger than expected in the past

year and in recent months.

According to the

Associated Press, in 2009

China overtook the United States of America

as the largest automobile market in the

world. Total vehicle sales in 2009 were 13.6

million. John Bonnell, a J.D. Power analyst

stated “Its very, very strong growth, far

beyond expectations we had in the early

part of 2009.”

China overtook the United States of America

as the largest automobile market in the

world. Total vehicle sales in 2009 were 13.6

million. John Bonnell, a J.D. Power analyst

stated “Its very, very strong growth, far

beyond expectations we had in the early

part of 2009.”

6

§ Longwei

has a strong competitive position in Shanxi Province

In

1995, Longwei was granted a Finish Oil Wholesale license by the PRC which allows

the

Company to purchase refined petroleum products directly from refineries in China. In

addition, Longwei has a license for Dangerous Chemical Products Business which allows

the Company to transport gasoline and diesel oil products. The Company believes that

such licenses are difficult to obtain and limit new entrants into its business.

Company to purchase refined petroleum products directly from refineries in China. In

addition, Longwei has a license for Dangerous Chemical Products Business which allows

the Company to transport gasoline and diesel oil products. The Company believes that

such licenses are difficult to obtain and limit new entrants into its business.

Due to many factors, including rough terrain, there are no oil pipelines in Shanxi. Yet

Shanxi is providing energy to much of Northern China every day and is a critical player in

the economic growth China has generated in recent years and will continue to be a critical

player in years to come. The lack of a pipeline creates an extreme competitive advantage

whereby storage capacity and solid supply chains win customers more so than price per

unit of product. Longwei has the largest storage capacity of any non-government operated

fuel wholesaler in Shanxi Province.

Longwei

has two significant competitors in Taiyuan (there are only two other

non-

government operated fuel wholesalers).Longwei has no significant competitiors in Gujiao.

government operated fuel wholesalers).Longwei has no significant competitiors in Gujiao.

Investment Highlights

7

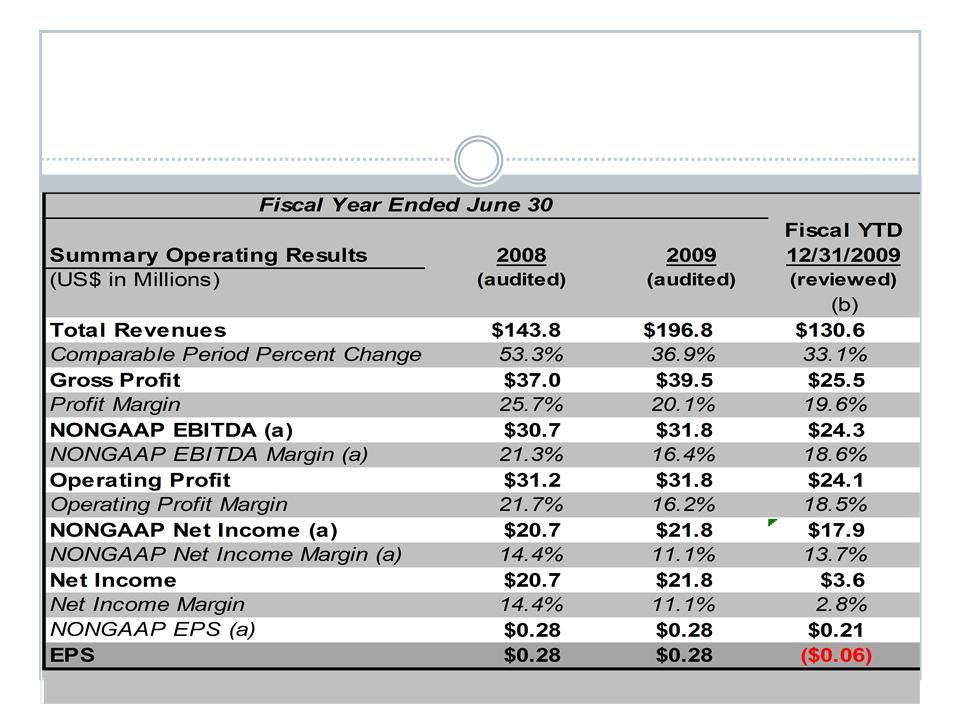

§ Strong

historical revenue growth

Sales

growth attributed to:

- strong economic growth in Shanxi Province

- increased demand for diesel and gasoline

- increased prices for diesel, gasoline, fuel oils and kerosene

- strong economic growth in Shanxi Province

- increased demand for diesel and gasoline

- increased prices for diesel, gasoline, fuel oils and kerosene

Investment Highlights

|

Compounded

Annual Growth

|

Fiscal

Year

‘05-’09

|

Fiscal

Year

‘08-’09 |

|

|

|

|

|

Petroleum

Product Sales Volume

|

43.7%

|

33.4%

|

|

Petroleum

Products Revenue

|

46.4%

|

39.5%

|

|

Total

Revenues

|

48.1%

|

36.9%

|

8

Investment Highlights

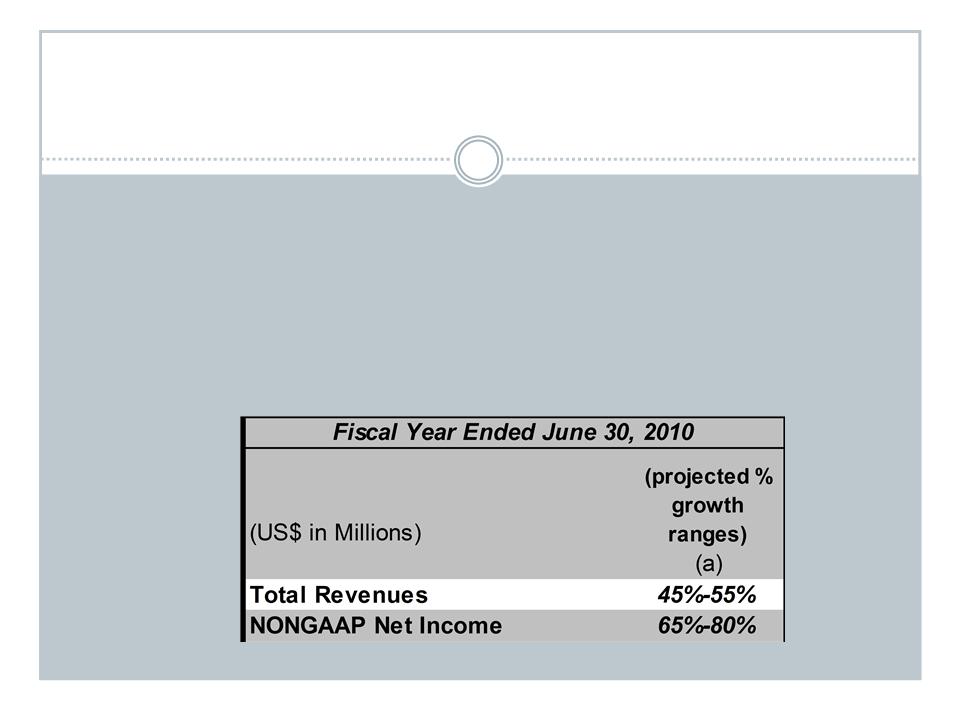

(a) Any references to

"NONGAAP" refer to the exclusion of the

expense associated with the change in the fair market value of

Longwei's outstanding stock warrants, except in the case of

"NONGAAP EPS" which refers to the exclusion of the expense

associated with the change in the fair market value of Longwei's

outstanding stock warrants, as well as the exclusion of the impact

of the one time deemed dividend associated with the October 2009

Financing.

expense associated with the change in the fair market value of

Longwei's outstanding stock warrants, except in the case of

"NONGAAP EPS" which refers to the exclusion of the expense

associated with the change in the fair market value of Longwei's

outstanding stock warrants, as well as the exclusion of the impact

of the one time deemed dividend associated with the October 2009

Financing.

(b) Six Months YTD data

and percentages are compared to the prior

YTD figures reported by Longwei for the period from July 1, 2008

through December 31, 2008 and generally reflect one half of a full

year of operations. NONGAAP EPS is defined above but it is also

important to recognize that EPS for the six months ended

December 31, 2009 was $0.21 as compared to EPS for all of fiscal

2009 of $0.28.

YTD figures reported by Longwei for the period from July 1, 2008

through December 31, 2008 and generally reflect one half of a full

year of operations. NONGAAP EPS is defined above but it is also

important to recognize that EPS for the six months ended

December 31, 2009 was $0.21 as compared to EPS for all of fiscal

2009 of $0.28.

Investment Highlights

9

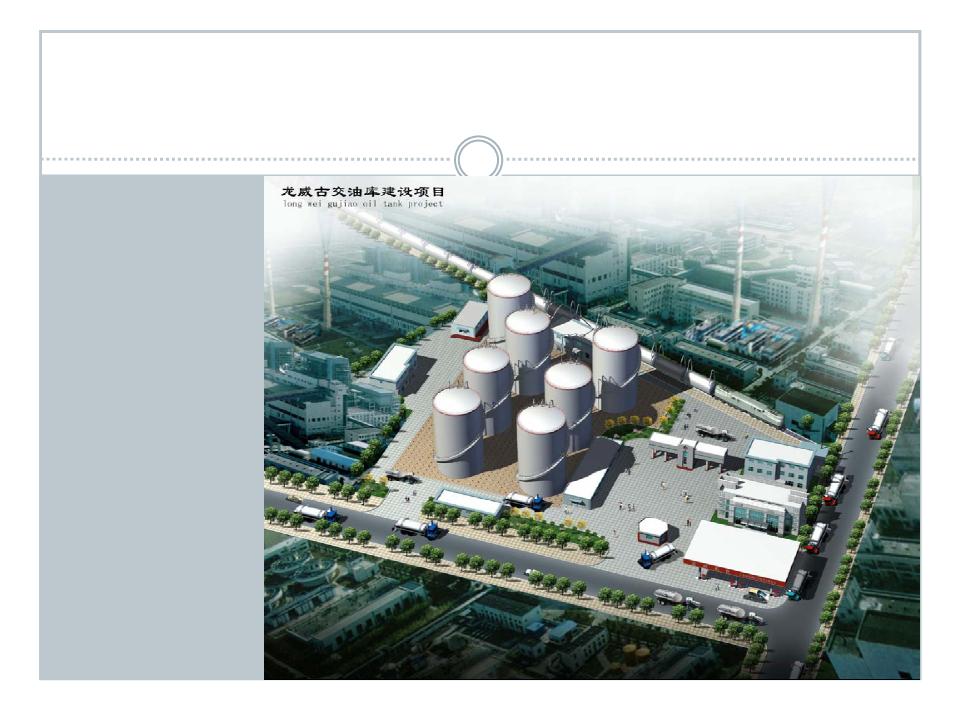

Artistic drawing

of

proposed new plant

and storage tank

facility in Gujiao

City, Shanxi

Province

proposed new plant

and storage tank

facility in Gujiao

City, Shanxi

Province

10

Investment Highlights

§ Longwei is in the

process of revising its financial forecasts to reflect the impact of

the

various accounting issues associated with the October 2009 Financing and the

earlier than expected initial sales at Gujiao. However, Longwei is also intent on

providing its shareholders and potential shareholders with other valuable data, which

we generally refer to as NONGAAP information. Current expectations with regard to

revenue and NONGAAP net income growth are provided below. Additional

forecasting has yet to be completed but the results will be provided once they are

available.

various accounting issues associated with the October 2009 Financing and the

earlier than expected initial sales at Gujiao. However, Longwei is also intent on

providing its shareholders and potential shareholders with other valuable data, which

we generally refer to as NONGAAP information. Current expectations with regard to

revenue and NONGAAP net income growth are provided below. Additional

forecasting has yet to be completed but the results will be provided once they are

available.

11

Investment Highlights

12

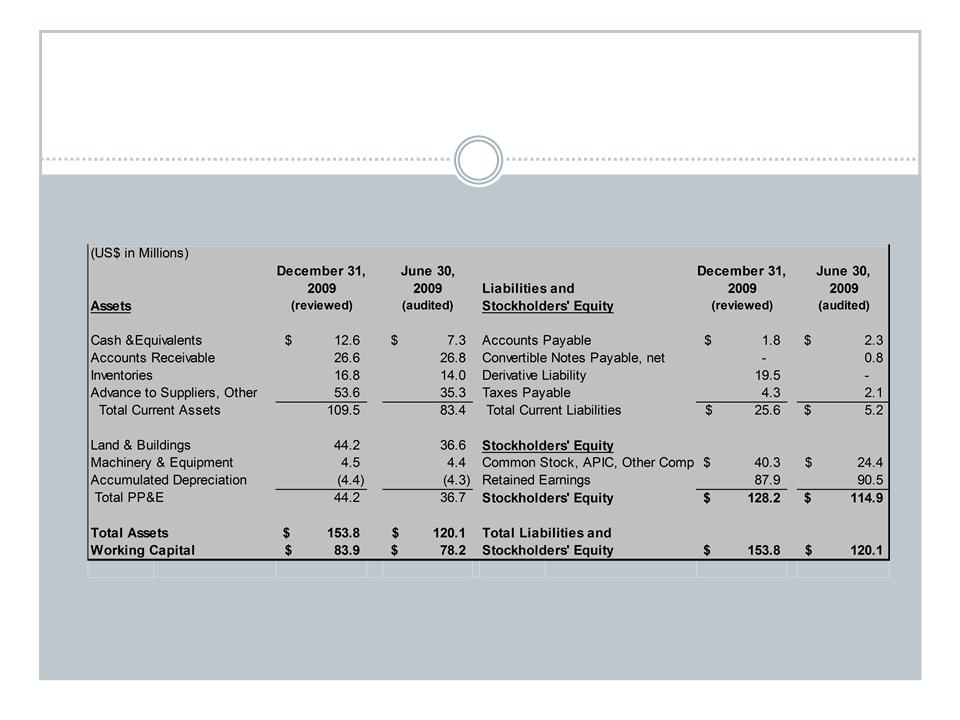

§ Strong

Balance Sheet

Investment Highlights

13

§ Business

Strategy

§ Key components of

the Company’s business strategy include:

§ Pursue internal

growth by attracting new customers through competitive

pricing, timely delivery, and the highest quality products, and

pricing, timely delivery, and the highest quality products, and

§ Pursue internal

growth by expanding the Company’s product storage

capacity, and

capacity, and

§ Expand

geographically.

Investment Highlights

14

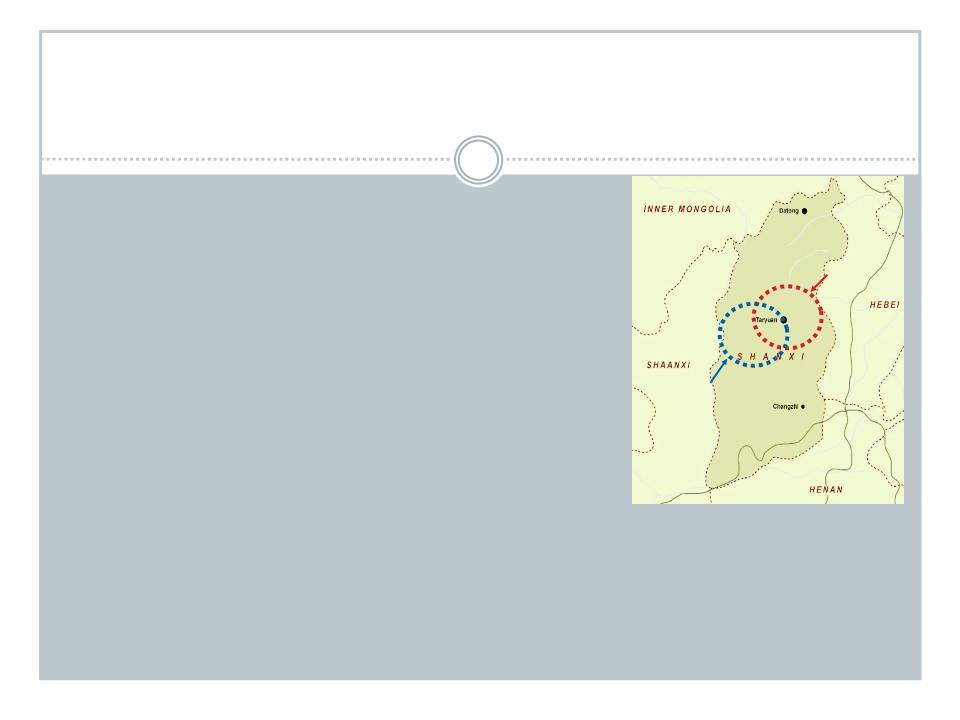

§ Geographic

Expansion

§ Longwei expanded its

finish oil distribution / wholesale

business into the nearby city of Gujiao City, which is

located in Shanxi Province approximately 50 km from

Taiyuan City and is considered to be a key industrial

center in China for energy production.

business into the nearby city of Gujiao City, which is

located in Shanxi Province approximately 50 km from

Taiyuan City and is considered to be a key industrial

center in China for energy production.

§ Longwei has already

established a solid customer base in

Gujiao and generated a total of $8.5 million in revenues at

Gujiao from October 1, 2009 through December 31, 2009.

The revenues generated during this period were not

included in Longwei’s most recent financial projections.

Gujiao is expected to generate at least $40 million in

revenues during the fiscal year ending June 30, 2010.

Gujiao and generated a total of $8.5 million in revenues at

Gujiao from October 1, 2009 through December 31, 2009.

The revenues generated during this period were not

included in Longwei’s most recent financial projections.

Gujiao is expected to generate at least $40 million in

revenues during the fiscal year ending June 30, 2010.

Longwei’s

Current

Storage

Storage

New

Gujiao

Storage

Storage

Investment Highlights

15

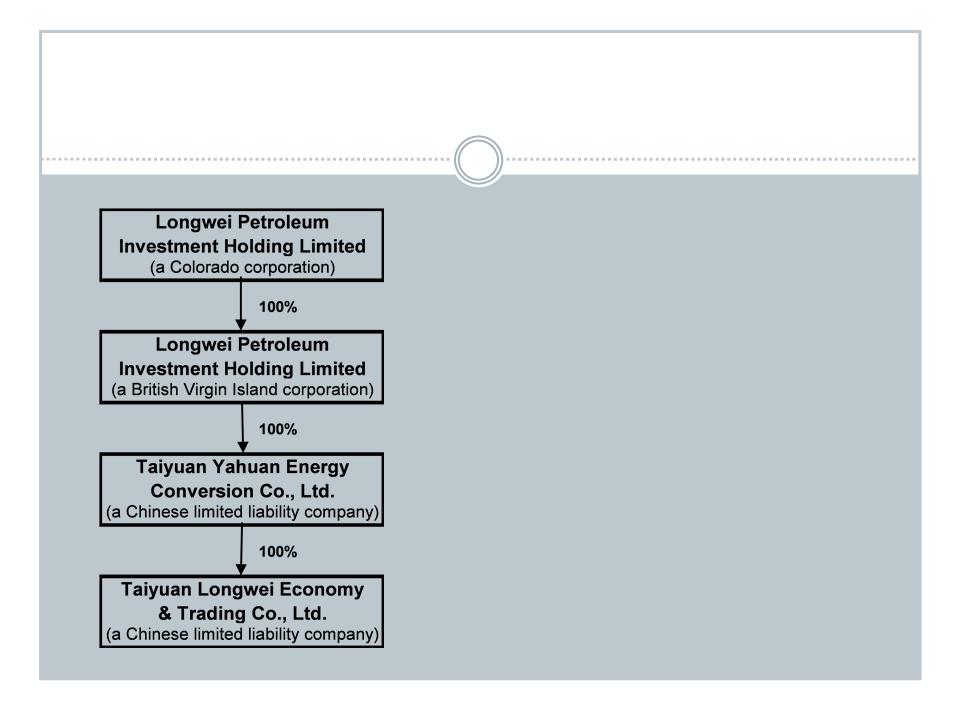

Corporate

Structure

§ July 1995 - Taiyuan

Longwei founded July 1995.

§ March 2000 - Longwei

Petroleum Investment

Holding Limited (“Longwei Petroleum”) incorporated

in Colorado under the name Tabatha II, Inc.

Holding Limited (“Longwei Petroleum”) incorporated

in Colorado under the name Tabatha II, Inc.

§ April 2006 - Longwei

Petroleum Investment Holding

Limited (“Longwei Petroleum BVI”) incorporated in

the British Virgin Islands and acquires 100% of

Taiyuan Yahuan Energy Conversion Co., Ltd. and

its subsidiary.

Limited (“Longwei Petroleum BVI”) incorporated in

the British Virgin Islands and acquires 100% of

Taiyuan Yahuan Energy Conversion Co., Ltd. and

its subsidiary.

§ October 2007 -

Longwei Petroleum, a Colorado

corporation (formerly known as Tabatha II, Inc.)

acquires 100% of Longwei Petroleum BVI in a

“reverse merger” transaction. The shareholders of

Longwei Petroleum BVI received 69 million shares

of common stock in Longwei Petroleum, a Colorado

corporation, representing 92% of the Company’s

outstanding share capitalization.

corporation (formerly known as Tabatha II, Inc.)

acquires 100% of Longwei Petroleum BVI in a

“reverse merger” transaction. The shareholders of

Longwei Petroleum BVI received 69 million shares

of common stock in Longwei Petroleum, a Colorado

corporation, representing 92% of the Company’s

outstanding share capitalization.

16

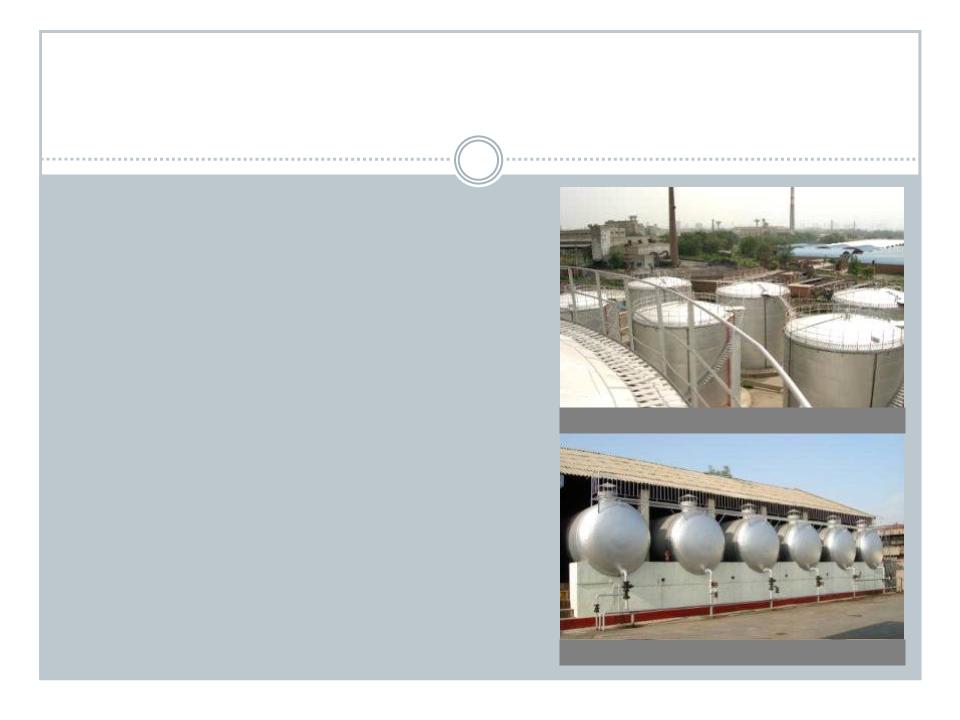

Facilities

§ Longwei currently

owns an ISO9001: 2000

certified fuel & petroleum product storage

facilities with 22 storage tanks with a total

capacity of 120,000 mt.

certified fuel & petroleum product storage

facilities with 22 storage tanks with a total

capacity of 120,000 mt.

§ Longwei has

specially designated railroads at

both of its facilities, stacking bays for its supply

and sale transportations and also 4 large tar

tanks at the Gujiao facility which could

eventually be converted to store oil or

gasonline, thereby expanding our storage

capacity to 140,000 mt. No timetable for

converting the tar tanks to oil or gasoline tanks

has been decided upon.

both of its facilities, stacking bays for its supply

and sale transportations and also 4 large tar

tanks at the Gujiao facility which could

eventually be converted to store oil or

gasonline, thereby expanding our storage

capacity to 140,000 mt. No timetable for

converting the tar tanks to oil or gasoline tanks

has been decided upon.

Stacking

Bays

Storage

Units

17

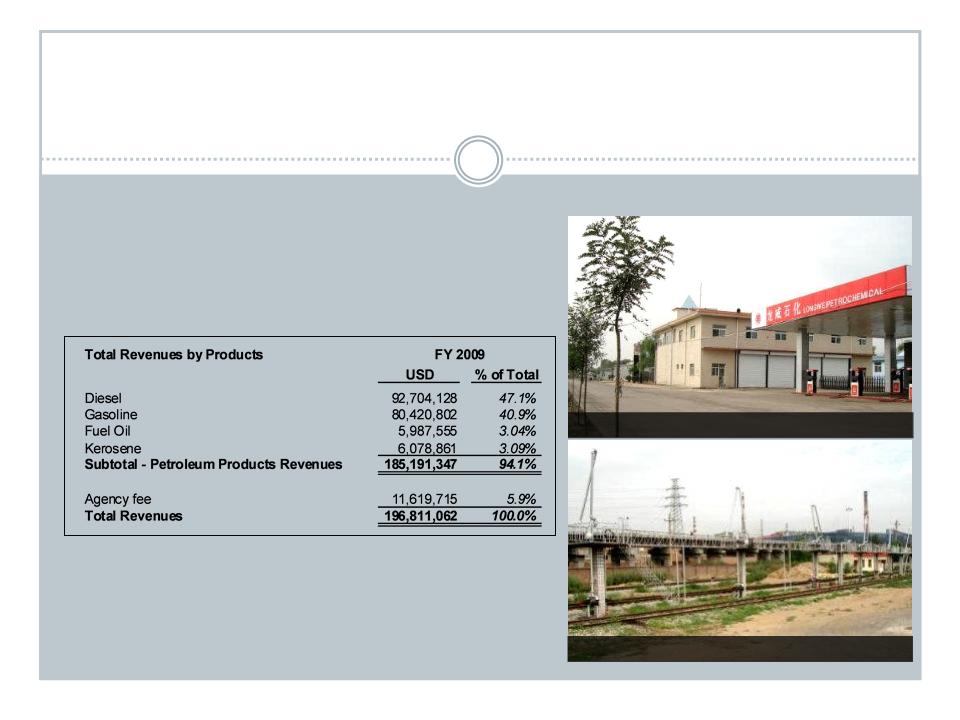

Product

Lines

§ Longwei distributes

petroleum products to

wholesalers as well as to retail and commercial

customers in Shanxi Province. Sales by

product line in fiscal 2009 are summarized

below:

wholesalers as well as to retail and commercial

customers in Shanxi Province. Sales by

product line in fiscal 2009 are summarized

below:

§ Agency fees are

earned for purchasing

petroleum products from refineries on behalf of

wholesalers who lack the necessary licenses to

make such purchases directly themselves.

petroleum products from refineries on behalf of

wholesalers who lack the necessary licenses to

make such purchases directly themselves.

Railroad

Station

Longwei

Gasoline Station

18

Longwei

Suppliers

§ Longwei purchases

diesel, gasoline, fuel oil and kerosene directly from oil

refiners and other suppliers with whom the Company believes it has excellent

relations.

refiners and other suppliers with whom the Company believes it has excellent

relations.

§ Since inception,

Longwei has not experienced any difficulty in obtaining finished

goods or raw materials essential to its business.

goods or raw materials essential to its business.

19

Sales

and Marketing

Direct

Marketing : Longwei employs its

own sales

and marketing staff to directly establish the distribution

and sales networks with its customers. Its sales

representatives regularly visit gas stations and fuel oil

consumption intensive enterprises within its

distribution footprint.

and marketing staff to directly establish the distribution

and sales networks with its customers. Its sales

representatives regularly visit gas stations and fuel oil

consumption intensive enterprises within its

distribution footprint.

Referrals:

Referrals from

existing customers continue

to be a strong source of new customers.

to be a strong source of new customers.

Major

New Customers: In

November 2009, Longwei

entered into contracts with 6 new significant customers

who Longwei will service through the Gujiao facility.

Longwei has identified an additional 7 significant

customers that Longwei will aggressively seek

business with and is hopeful to sign these customers

to contracts for the 2010 calendar year. One of these 7

additional customers has verbally committed to

ordering products through Longwei.

entered into contracts with 6 new significant customers

who Longwei will service through the Gujiao facility.

Longwei has identified an additional 7 significant

customers that Longwei will aggressively seek

business with and is hopeful to sign these customers

to contracts for the 2010 calendar year. One of these 7

additional customers has verbally committed to

ordering products through Longwei.

Distribution

Footprint Covered by

Longwei’s

Storage Locations

20

Management

Cai

Yongjun - Chairman and Chief Executive Officer

§ CEO of Taiyuan

Longwei since its founding in 1995

§ Has over 12 years

experience in the trading, storage and handling of petroleum

products

§ Attended Shanxi

University where he majored in business administration

Xue

Yongping - Secretary and Treasurer

§ Secretary and

Treasurer of Taiyuan Longwei since November 1998

§ Previously served as

Deputy General Manager of Taiyuan Hua Xin Trading Company, a fuel oil

distributor/wholesaler

distributor/wholesaler

§ Received law degree

from Shanxi Law School

James

Crane - Chief Financial Officer

§ Named Chief

Financial Officer on June 30, 2009

§ Certified Public

Accountant

§ Trained at a Big

Four accounting firm in the US

§ Has served as Chief

Financial Officer of a variety of publicly-traded companies, including

companies operating exclusively in the People’s Republic of China

companies operating exclusively in the People’s Republic of China

21

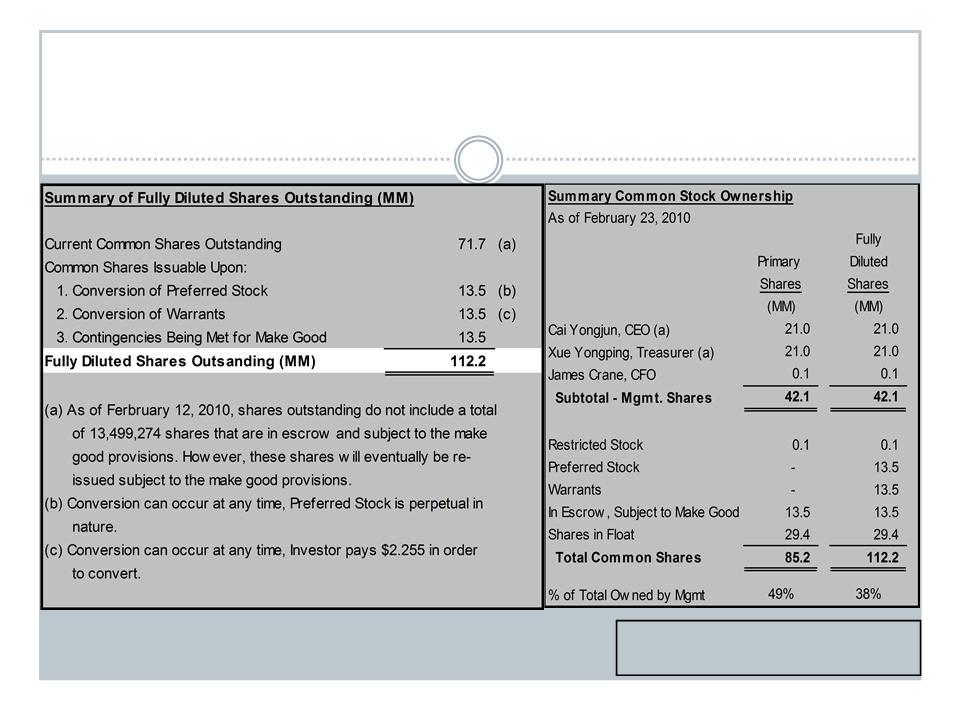

Capital

Structure

This

financial information is qualified in its

entirety by the financial information contained in

the Company’s public filings with the SEC.

entirety by the financial information contained in

the Company’s public filings with the SEC.

22

Summary

§ A

leading wholesaler / distributor of diesel, gasoline, fuel oil and kerosene in

Taiyuan

City, and Gujiao City, inShanxi Province, PRC.

§ Business

founded 1995. Has a

very strong competitive position in a challenging

geographic marketplace in Shanxi Province with 120,000 metric tons (mt) of storage tank

capacity.

geographic marketplace in Shanxi Province with 120,000 metric tons (mt) of storage tank

capacity.

§ Revenues

have increased at a 48+% CAGR% between 2005 and 2009 due to strong

increases in demand for diesel and gasoline in Shanxi Province.

increases in demand for diesel and gasoline in Shanxi Province.

§ Highly

profitable with audited FY 2009 Revenues, Operating Profit and Net Income

of

$196.8 MM, $39.5 MM and $21.8 MM, respectively.

$196.8 MM, $39.5 MM and $21.8 MM, respectively.

§ Operating

Profit is projected to increase to $46.0 MM in FY 2010 (as the new storage

tanks are expected to be placed into service during the second half of this

fiscal year).

§ Strong

balance sheet with Stockholders’ Equity of $128.2 MM and no long-term debt

or

other long-term liabilities as of December 31, 2009.

other long-term liabilities as of December 31, 2009.

§ Management

currently owns 49.4% of the shares outstanding (42.1 MM shares) and has

pledged a total of 13,499,274 shares of common stock (not included in totals above) they

already owned in order to close the October 2009 Financing. Management will receive

pledged a total of 13,499,274 shares of common stock (not included in totals above) they

already owned in order to close the October 2009 Financing. Management will receive

the shares back if without further liability or potential loss of the shares, if

Longwei

generates net income of $23.9 million for the year ending June 30,

2010.

§ Longwei

has announced its

intention to uplist to the NYSE Amex stock exchange

§ Price

to earnings ratio based on trailing twelve months NONGAAP net income is 3.35,

well below industry comparables.