Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 000-50855

Auxilium Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 23-3016883 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 40 Valley Stream Parkway Malvern, PA |

19355 | |

| (Address of principal executive offices) | (Zip Code) | |

(484) 321-5900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, Par Value $0.01 Per Share | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

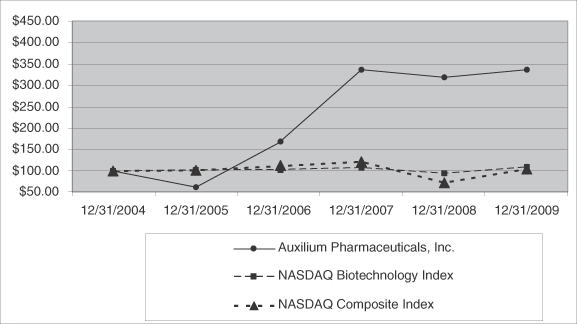

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the last sale price for such stock on The NASDAQ Global Market as of June 30, 2009, was approximately $1.3 billion.

As of February 19, 2010, the number of shares outstanding of the issuer’s common stock, $0.01 par value per share, was 47,243,440.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement for its 2010 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2009.

Table of Contents

AUXILIUM PHARMACEUTICALS, INC.

FORM 10-K

December 31, 2009

TABLE OF CONTENTS

Table of Contents

This Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. All statements other than statements of historical information contained herein are forward-looking statements and may contain projections relating to financial results, economic conditions, trends and known uncertainties. These statements are not guarantees of future performance or events. Our actual results may differ materially from those discussed in this Report. You should review the “Risk Factors” section of this Report for a discussion of the important factors that could cause actual results to differ materially from those described in or implied by the forward-looking statements contained in this Report. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis, judgment, belief or expectation only as of the date hereof. We undertake no obligation to publicly reissue these forward-looking statements to reflect events or circumstances that arise after the date hereof.

We obtained the market and competitive position data used throughout this Report from our own research, surveys or studies conducted by third parties and industry or general publications. Industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we believe that each of these studies and publications is reliable, we have not independently verified such data. Similarly, we believe our internal research is reliable but it has not been verified by any independent sources.

This Report may include discussion of certain clinical studies relating to our products and/or product candidates. These studies typically are part of a larger body of clinical data relating to such products or product candidates, and the discussion herein should be considered in the context of the larger body of data.

As used herein, the terms “Company”, “Auxilium”, “we”, “us”, or “our”, refer to Auxilium Pharmaceuticals, Inc.

| ITEM 1. | Business |

Company Overview

Company Description

We are a specialty biopharmaceutical company with a focus on developing and marketing products to predominantly specialist audiences, such as urologists, endocrinologists, certain targeted primary care physicians, hand surgeons, subsets of orthopedic, general, and plastic surgeons who focus on the hand, and rheumatologists. We currently have approximately 540 employees, including a sales and marketing organization of approximately 315 people. We reported revenues in 2009 of $164 million, an increase of 30.8% over the $125.4 million reported in 2008.

We currently market two products in the United States (“U.S.”):

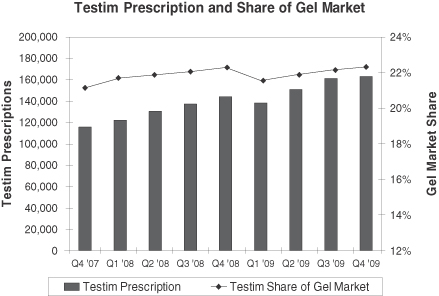

Testim® is a proprietary, topical 1% testosterone once-a-day gel indicated for the treatment of hypogonadism. Hypogonadism is defined as reduced or absent secretion of testosterone which can lead to symptoms such as low energy, loss of libido, adverse changes in body composition, irritability and poor concentration. Testim has been approved in the U.S. by the U.S. Food and Drug Administration (“FDA”) and according to National Prescription Audit (“NPA”) data from IMS Health, Inc. (“IMS”), a pharmaceutical market research firm, Testim’s share of total prescriptions for the gel segment of the U.S. testosterone replacement therapy (“TRT”) market was 22.3% for the month of December 2009, and 22.0% for the full year 2009.

XIAFLEX™ (collagenase clostridium histolyticum) is a proprietary, injectable collagenase enzyme for the treatment of Dupuytren’s contracture (“Dupuytren’s”). XIAFLEX received approval from the FDA on

2

Table of Contents

February 2, 2010 for the treatment of adult Dupuytren’s patients with a palpable cord. Dupuytren’s is a condition that affects the connective tissue that lies beneath the skin in the palm. The disease is progressive in nature. Typically, nodules develop in the palm as collagen deposits accumulate. As the disease progresses, the collagen deposits form a cord that stretches from the palm of the hand to the base of the finger. Once this cord develops, the patient’s fingers contract and the function of the hand is impaired. Prior to approval of XIAFLEX, surgery was the only effective treatment. We expect to begin shipping XIAFLEX to our distribution partners in early March 2010 in advance of a launch planned for the end of March 2010.

We also have received marketing approval for Testim in Belgium, Canada, Denmark, Finland, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden and the United Kingdom (“U.K.”). Ferring International Center S.A. (“Ferring”) and Paladin Labs Inc. (“Paladin”) commercialize Testim on our behalf in certain European countries and Canada, respectively.

Our current product pipeline includes:

Phase II:

| • | XIAFLEX for the treatment of Peyronie’s disease (“Peyronie’s”) |

| • | XIAFLEX for the treatment of Adhesive Capsulitis (“Frozen Shoulder syndrome”) |

Phase I:

| • | AA4010, treatment for overactive bladder using our transmucosal film delivery system |

| • | A Fentanyl pain product using our transmucosal film delivery system. |

In addition to the above, we have the rights to develop other compounds for the treatment of pain using our transmucosal film delivery system and other products using our transmucosal film technology for treatment of urologic disease and for hormone replacement. We also have the option to license additional indications for XIAFLEX other than dermal products for topical administration.

Company Strategy

Our goal is to build a leading specialty biopharmaceutical company by focusing on disease states that we believe can be addressed through sales to predominantly specialist audiences, such as urologists, endocrinologists, certain targeted primary care physicians, hand surgeons, subsets of orthopedic, general and plastic surgeons who focus on the hand, and rheumatologists. We have experienced development, regulatory and commercial teams that have a proven track record. We intend to draw upon our track record and experience to successfully develop our product candidates. Our strategy will focus on developing and commercializing XIAFLEX, optimizing Testim’s commercial success and in-licensing additional product candidates and acquiring companies. We believe that we have in place the commercial infrastructure necessary to commercialize Testim for hypogonadism and XIAFLEX for Dupuytren’s in the U.S. We have entered into a development, commercialization and supply agreement with Pfizer, Inc. (“Pfizer”) for XIAFLEX for the treatment of Dupuytren’s and Peyronie’s in Europe and certain Eurasian countries, and we are currently evaluating how to most effectively commercialize XIAFLEX in these two indications in the other territories of the world. Ferring and Paladin commercialize Testim on our behalf in certain European countries and Canada, respectively.

Developing and Commercializing XIAFLEX. We believe that XIAFLEX has the potential to become a blockbuster. For Dupuytren’s and Peyronie’s, we believe there is a large unmet medical need for a non-surgical solution to these debilitating diseases. On February 2, 2010, we received FDA approval of XIAFLEX for Dupuytren’s, and the data from our well-controlled phase II studies in Peyronie’s are encouraging. The product has received orphan drug designation in the U.S. for both indications, and our preliminary market research leads us to believe that urologists, hand surgeons, subsets of orthopedic, general, and plastic surgeons who focus on the

3

Table of Contents

hand, and rheumatologists would be very likely to use the product to delay or avoid surgery. Based on market research that we conducted several years ago, physicians indicate that there are potentially 450,000 patients on an annual basis in the U.S. and Europe who could be candidates for XIAFLEX with approximately 240,000 for the treatment of Dupuytren’s and approximately 210,000 for the treatment of Peyronie’s. These patients represent an annual market potential in excess of $1 billion.

In 2004, we obtained the exclusive worldwide rights to develop, market and sell products containing XIAFLEX, other than dermal formulations labeled for topical administration. Specifically, our license from BioSpecifics Technologies Corp. (“BioSpecifics”) includes the rights to XIAFLEX for the treatment of Dupuytren’s, Peyronie’s and Frozen Shoulder syndrome with the exclusive option to license additional indications. In December 2008, we entered into a collaboration with Pfizer in which we sub-licensed our commercialization rights for Dupuytren’s and Peyronie’s for the 27 countries which were included in the European Union (“EU”) at that time and 19 additional Eastern European and Eurasian countries. We plan to prioritize our development of additional pipeline indications for XIAFLEX. We have previously taken a license for the development and commercialization of Frozen Shoulder syndrome, but other areas of interest could include cellulite and lipoma.

Launching XIAFLEX in Dupuytren’s. Upon FDA approval of XIAFLEX for Dupuytren’s, we offered full time employment to a new group of field sales representatives and believe that these employees will be adequately trained and prepared for a launch planned for the end of March 2010. We expect to begin shipping XIAFLEX to our distributors the week of March 1, 2010 with product being available for shipment to physicians during the week of March 8, 2010. Our plans for commercializing XIAFLEX include the steps outlined below.

| • | We plan on selling XIAFLEX in the U.S. through a team of approximately 100 professionals, including approximately 75 sales representatives supplemented by sales managers, reimbursement specialists and managed market account directors. |

| • | A staff of 11 medical science liaisons will provide medical support for the product. |

| • | To supplement the efforts of our field organization, we intend to implement a number of marketing and medical education programs. We anticipate that these programs will include: a reimbursement assistance hotline; billing assistance guides; claims tracking assistance; participation at national medical meetings; advertisements in medical journals; launch speaker programs; and a unique computerized simulation system that will allow physicians to gain hands-on experience with the XIAFLEX injection technique. |

| • | Pursuant to a Risk Evaluation and Mitigation Strategy (“REMS”) required by the FDA, XIAFLEX can only be used by healthcare providers with experience in injection procedures of the hand and in the treatment of Dupuytren’s. A physician wishing to use XIAFLEX must attest that they have completed the XIAFLEX training program and the site of care must be enrolled before we will ship XIAFLEX to that physician. As a result, we plan to provide training on the proper use and potential risks of XIAFLEX to hand, orthopedic, plastic and general surgeons and rheumatologists who are familiar with the diagnosis and treatment of Dupuytren’s. We have identified approximately 7,000 of these physicians who will be the focus of our initial commercial effort. The XIAFLEX training materials are available via multiple media platforms and review reconstitution, injection technique, manipulation and the safety profile of XIAFLEX. |

| • | We have established a distribution network that will allow health care providers to access XIAFLEX through specialty distributors and specialty pharmacies, or in the institutional setting, after they have undergone training on XIAFLEX and its administration. |

4

Table of Contents

| • | Our reimbursement specialists will continue working with health care payors, both commercial and Medicare, to establish reimbursement processes. In addition, our reimbursement specialists, reimbursement hotline, managed market account directors and field sales representatives will work closely with physician offices to provide assistance as questions and issues arise with reimbursement. |

| • | We will launch XIAFLEX for Dupuytren’s without product and procedure specific reimbursement codes. In late 2009, we applied for product specific reimbursement codes (commonly referred to as “J” codes and “C” codes), and supplemented these applications with the confirmation of approval by the FDA in February 2010. We believe that we will receive a XIAFLEX specific J code effective beginning January 1, 2011. We have begun the process of working with the various hand professional medical societies that will assist us in applying for XIAFLEX specific procedural reimbursement code(s) (“CPT codes”). We believe that we will apply for these CPT codes prior to the end of 2010 and that we may have CPT codes beginning January 1, 2012. |

We will monitor the effectiveness of the various programs outlined above and may modify, eliminate or develop new programs as we believe are warranted.

Optimizing Testim’s Commercial Success. Testim global revenues for 2009 were $160.5 million, a 28.1% increase over the $125.2 million recorded in 2008. In the U.S., Testim revenues were $151.9 million, a 23.2% increase over 2008’s revenues of $123.3 million. Testim has demonstrated an ability to capture market share in the gel segment of the TRT market and the total TRT market, but in 2009 its market share in the gel segment of the TRT market was consistent with 2008. According to IMS, Testim’s gel share was 22.5% in December 2009 compared to 22.6% in December 2008. Fluctuations in share will occur with wins and losses on the managed care front. We had some losses within our managed care accounts in early 2009 that impacted our share growth adversely, but we were able to overcome that through growth in other managed care accounts. We believe that we can continue to increase sales of Testim by capturing market share, expanding the use of TRT through increased physician and patient awareness and benefiting from the on-going demographic changes that could result in additional patient candidates for TRT treatment.

| • | Increase Testim market penetration. Through on-going evaluation of physician targeting and greater sales efficiencies, we intend to improve the effectiveness of our sales force. We will continue to work with accredited education groups, thought leaders and professional organizations to further educate physicians about the diagnosis of hypogonadism and the benefits of TRT, including Testim. We are focusing approximately 150 sales representatives on urologists, endocrinologists and certain targeted primary care physicians. This allows us to reach the physicians who prescribe approximately 50% of TRT prescriptions. We also have entered into collaborations with partners for the international commercialization of Testim. Paladin launched Testim in Canada during 2007, and Ipsen Pharma GmbH (“Ipsen”) promoted Testim in Europe beginning in 2005. In November 2008, we agreed with Ipsen to terminate the distribution agreement between the parties and transfer all marketing authorizations for Testim in Europe to Ferring. Ferring is now responsible for commercializing Testim in Europe. |

| • | Expand market opportunities for Testim and TRT. A 2006 study that was published in The International Journal of Clinical Practice showed 39% of men over 45 years of age have low testosterone (total testosterone levels below 300 ng / dL). According to the U.S. Census Bureau, there were 43.6 million men aged 45 to 84 with hypogonadism in 2000, and these figures were expected to increase to 54.6 million by 2010. As a result, we expect to see an increase in the number of potential patients over the coming years. |

In addition, it has been demonstrated that low testosterone is a comorbid condition with others such as diabetes, obesity, hyperlipidemia, chronic pain and HIV/AIDS. With improved

5

Table of Contents

medical and patient education around the implications of low testosterone and the favorable risk/benefit profile of treating with TRT, we believe physicians will be more proactive in identifying hypogonadism and treating patients. In 2009, the total prescriptions written in the gel market increased 14.9% over 2008.

We will continue to incorporate focused educational efforts on both physicians and consumers to create an increased awareness of both the prevalence and medical need for identifying and treating hypogonadism.

| • | Continue to defend Testim intellectual property. In October 2008, we and our licensor, CPEX Pharmaceuticals, Inc. (“CPEX”) received notice that Upsher-Smith Laboratories, Inc. (“Upsher-Smith”) filed an abbreviated new drug application (“ANDA”) containing a paragraph IV certification seeking approval from the FDA to market a generic version of Testim prior to the January 2025 expiration of CPEX’s U.S. Patent No. 7,320,968 (the “968 Patent”). The ‘968 Patent, which Bentley Pharmaceuticals, Inc. (“Bentley”) assigned to CPEX in June 2008, covers a method for maintaining effective blood serum testosterone levels for treating a hypogonadal male using Testim and is listed in Approved Drug Products with Therapeutic Equivalence Evaluations (commonly known as the “Orange Book”), published by the FDA. The paragraph IV certification sets forth allegations that the ‘968 Patent will not be infringed by Upsher-Smith’s manufacture, use or sale of the product for which the ANDA was submitted. In December 2008, we filed a patent infringement lawsuit against Upsher-Smith which remains pending. Upsher-Smith has alleged that its proposed generic version of Testim would not infringe the ‘968 patent, and that the ‘968 patent is invalid. Under the Hatch-Waxman Act, final FDA approval of Upsher-Smith’s proposed generic product will be stayed until the earlier of 30 months from receipt of the paragraph IV certification (April 2011) or resolution of the patent infringement lawsuit. Should Upsher-Smith receive a tentative approval of its generic version of Testim from the FDA, it cannot lawfully launch its generic version of Testim in the U.S. before the earlier of the expiration of the currently pending 30-month stay or a district court decision in its favor. In October 2009, six additional patents covering Testim were issued and have been listed in the Orange Book. These additional patents may provide us with further market protection. |

| • | Filing of a Citizen’s Petition. In February 2009, we filed a Citizen’s Petition with the FDA requesting that Upsher-Smith be required to perform a variety of studies to demonstrate that the inactive ingredients and formulation of the proposed product do not compromise its safety or efficacy. An FDA response to our Citizen’s Petition was received in August 2009. The FDA agreed with some of the statements made in the Citizen’s Petition regarding the testing required for generic versions of Testim and disagreed with other statements. Although not commenting upon any filing in particular, the FDA did state that “the practical effect of this determination is that any application for a testosterone gel product that has different penetration enhancers than the reference listed drug cannot be submitted as an abbreviated new drug application (ANDA) and, instead, will have to be submitted as a NDA under section 505(b) of the [Federal Food, Drug, and Cosmetic Act].” |

In-licensing Product Candidates and Acquiring Companies. We believe that we can leverage our expertise in clinical development, regulatory strategy and execution and commercialization of specialty pharmaceutical and bio-pharmaceutical products to in-license additional product candidates or acquire companies with product candidates. Although we may seek to find products that have a therapeutic fit with XIAFLEX or Testim (i.e. products that would be utilized by urologists, endocrinologists, certain targeted primary care physicians, hand surgeons, subsets of orthopedic, general, and plastic surgeons who focus on the hand, and rheumatologists), we believe that the core competencies we have with respect to drug development and commercialization can be applied to a number of specialty focused therapeutic areas.

6

Table of Contents

XIAFLEX Opportunity

XIAFLEX is a proprietary, injectable collagenase enzyme we in-licensed from BioSpecifics. Under our agreement with BioSpecifics, we have exclusive worldwide rights to develop, market and sell certain products containing XIAFLEX, other than dermal formulations labeled for topical administration.

XIAFLEX for Dupuytren’s

On February 2, 2010, we received approval from the FDA to begin the sale of XIAFLEX for Dupuytren’s in adult patients with a palpable cord. Currently, we are preparing for a launch of XIAFLEX for Dupuytren’s planned for the end of March 2010. We expect to begin shipping XIAFLEX to our distributors the week of March 1, 2010 with product being available for shipment to physicians during the week of March 8, 2010.

Dupuytren’s disease state and market: Dupuytren’s is a condition that affects the connective tissue that lies beneath the skin in the palm. The disease is progressive in nature. Typically, nodules develop in the palm as collagen deposits accumulate. As the disease progresses, the collagen deposits form a cord that stretches from the palm of the hand to the base of the finger. Once this cord develops, the patient’s fingers contract and the function of the hand is impaired.

XIAFLEX will offer the first and only approved nonsurgical solution to fulfill the unmet need of physicians and patients who desire a nonsurgical alternative. According to Dupuytren’s Disease by Leclercq published in 2000, the global prevalence of Dupuytren’s among the Caucasian population is estimated to range from 3% to 6%. Common co-morbidities include diabetes, epilepsy, alcoholism or HIV. Dupuytren’s is most common in men. It usually starts in adult life, with a peak incidence in people aged 40 to 60. In about 50% of patients, the disease affects both hands, and recurrence after surgical treatment is common (as high as 30% the first two years post-surgery; and 55% within 10 years of surgery).

We believe XIAFLEX as an alternative to surgery will be desired as it:

| • | delivers improvement to 0 to 5 degrees of normal joint contracture without surgery for many patients; |

| • | safeguards patients from the complications commonly associated with surgery; |

| • | simplifies treatment by offering a convenient in-office procedure alternative; |

| • | streamlines recovery for a rapid return to daily activities; and |

| • | significantly reduces costly and time-consuming physical therapy associated with surgery. |

Prior to approval of XIAFLEX for Dupuytren’s, surgery was the only treatment option. Surgical techniques used to treat patients with Dupuytren’s fall into two major groups: fasciotomy, including needle aponeurotomy, which is simply cutting the Dupuytren’s cord and fasciectomy which is removing the cords of the diseased tissue. There are risks associated with surgery which include scarring, infection, hematoma, skin necrosis, finger stiffness and injury to nerves and blood vessels. Several non-operative treatments, including radiotherapy, steroids, interferon and topical vitamin E, have been tried in Dupuytren’s, but none has been adopted in general use nor proven effective. Although preliminary observations suggest that intralesional interferon gamma may reduce the size of Dupuytren’s cords (Plast Reconstr Surg. 1994 May;93(6):1224-35), further data are needed to assess whether it offers any clinical benefits.

Clinical data supporting efficacy of XIAFLEX for Dupuytren’s: The efficacy of 0.58 mg of XIAFLEX was evaluated in two randomized, double-blind, placebo-controlled, multi-centered trials in 374 adult patients with Dupuytren’s (“CORD I” and “CORD II”). At study entry, patients must have had (1) a finger flexion contracture with a palpable cord in at least one finger (other than the thumb) of 20° to 100° in a metacarpophalangeal (“MP”) joint or 20° to 80° in a proximal interphalangeal (“PIP”) joint and (2) a positive “table top test” defined as the inability to simultaneously place the affected finger(s) and palm flat against a table

7

Table of Contents

top. Patients could not have received a surgical treatment (e.g., fasciectomy, fasciotomy) on the selected primary joint within 90 days before the first injection of study medication and patients could not have received anticoagulation medication (except for up to 150 mg of aspirin per day) within seven days before the first injection of study medication.

The cord affecting the selected primary joint received up to three injections of 0.58 mg of XIAFLEX or placebo on Days 0, 30, and 60. About 24 hours after each injection of study medication, if needed, the investigator manipulated (extended) the treated finger in an attempt to facilitate rupture of the cord (finger extension procedure). Following manipulation, patients were fitted with a splint, instructed to wear the splint at bedtime for up to four months, and instructed to perform a series of finger flexion and extension exercises each day.

The primary endpoint was to evaluate the proportion of patients who achieved a reduction in contracture of the selected primary joint (MP or PIP) to within 0° to 5° of normal, 30 days after the last injection of that joint on days 30, 60, or 90 (after up to 3 injections). A greater proportion of XIAFLEX-treated patients compared to placebo-treated patients achieved the primary endpoint (see Table below).

Percentage of Patients Who Achieved Reduction in Contracture of the

Primary Joint to 0° to 5° After Up to 3 Injections in CORD I and II

| Treated Joint | CORD I | CORD II | ||||||

| XIAFLEX | Placebo | XIAFLEX | Placebo | |||||

| All Joints (MP and PIP) Difference (CIe) |

N=203 | N=103 | N=45 | N=21 | ||||

| 64% 57% (47%, 67%) |

7% — |

44% 40% (14%, 62%) |

5% — | |||||

| MP Joints Difference (CIe) |

N=133 | N=69 | N=20 | N=11 | ||||

| 77% 69% (57%, 79%) |

7% — |

65% 56% (19%, 83%) |

9% — | |||||

| PIP Joints Difference (CIe) |

N=70 | N=34 | N=25 | N=10 | ||||

| 40% 34% (14%, 52%) |

6% — |

28% 28% (-10%, 61%) |

0% — | |||||

| e | 95% confidence interval |

Insurance coverage: In our clinical studies, the average age of diagnosis was 62.3 years, and we believe patients are typically diagnosed after the age of 40 years. As a result, we anticipate approximately an equal split of patients having Medicare and commercial insurance. We believe that Medicare is required to provide reimbursement for this procedure via Medicare Part B coverage, which includes physician administered therapies. With commercial (private) insurance carriers, we believe that the product will require prior authorization in many cases with coverage that will vary based on the individual policies of the payors. However, for both Medicare and commercial insurance, we initially anticipate slow and variable reimbursement for XIAFLEX. This will exist as healthcare providers will be required to utilize miscellaneous J codes and C codes and miscellaneous or proxy CPT codes. This miscellaneous coding will result in manual adjudication of these claims causing slow and variable reimbursement of claims for the product and the physician procedures. We believe that we will obtain a product specific J code that can be utilized in January 2011, and specific CPT procedural codes in January 2012.

8

Table of Contents

Patent coverage. In addition to the marketing exclusivity which comes with its orphan drug status in the U.S., the enzyme underlying XIAFLEX for Dupuytren’s is covered by a use patent in the U.S. that expires in 2014. The patent is limited to the use of the enzyme for the treatment of Dupuytren’s within certain dose ranges. In January 2006, we filed a patent application with regard to the composition and manufacturing process for XIAFLEX. If this patent is granted, it would expire in January 2027, subject to patent term adjustments.

Regulatory. FDA has required a REMS program for XIAFLEX, which consists of a communication plan and a medication guide. This REMS is designed (1) to evaluate and mitigate known and potential risks and serious adverse events; (2) to inform healthcare providers about how to properly inject XIAFLEX and perform finger extension procedures; and, (3) to inform patients about the serious risks associated with XIAFLEX. We plan to market XIAFLEX to physicians who are experienced in injection procedures of the hand and treatment of Dupuytren’s and will only provide access to XIAFLEX after physicians have attested to completion of a training program. The training program is available as a video or written manual and demonstrates proper use and administration of XIAFLEX, as well as an overview of both identified and potential risks with XIAFLEX. As a condition of approval for XIAFLEX for Dupuytren’s, FDA required a REMS. Potential risks and serious adverse events associated with XIAFLEX include tendon rupture, serious adverse reactions affecting the injected extremity, and the potential risk of serious hypersensitivity reactions (including the potential for anaphylaxis).

XIAFLEX Potential Future Indications

Peyronie’s

Disease state and market: Peyronie’s is characterized by a plaque or hard lump that occurs on the penis. It begins as a localized inflammation, which progresses to a hardened scar on the shaft of the penis that reduces flexibility and causes the penis to bend during erection. This may cause pain on erection and a deformity that may prevent sexual intercourse altogether. Our market research indicates that, aside from the physical consequences, depression and loss of self-esteem are common in men with Peyronie’s. According to Peyronie’s Disease, A Guide to Clinical Management by Levine, published in 2007, the prevalence of Peyronie’s has been increasing during the last 30 years and now ranges between 3.7% and 7.1%. However, the actual prevalence may be higher because of patients’ reluctance to report this embarrassing condition to their physicians. The pathogenesis of Peyronie’s appears to be multifactorial, with an interplay of genetic predisposition, trauma, and tissue ischemia. Generally, Peyronie’s is treated by urologists. To date, no medical therapy has been proven effective for the treatment of Peyronie’s. Surgical treatment may be an option for some patients, although complications as well as loss of penile length can occur. Administration of XIAFLEX could be an in-office procedure in which the product is injected directly into the plaque causing the penile curvature.

Current treatment options: There are no medical therapies approved for the treatment of Peyronie’s. However, a number of medical therapies have been used to treat Peyronie’s including Vitamin E, Colchicine, Potassium Aminobenzoate (Potaba), Tamoxifen, Interferon a2a, and Corticosteroids. Current surgical therapies include the following procedures: plication, (which involves gathering tissue on the outer side of the bend usually resulting in shortening and straightening of the penis), graft techniques (which involves replacing scar tissue with grafts of tissue from another site), and prosthetic implants (which involves synthetic cylinders that are implanted in the penis to produce a functional erection).

R&D status: We completed a phase IIb randomized, double-blind, placebo-controlled study designed to assess the safety and efficacy of XIAFLEX when administered two times a week every six weeks for up to three treatment cycles (2 x 3) in subjects with Peyronie’s. The study was conducted at 12 sites throughout the U.S., and patients were monitored for 36 weeks following the first injection. The trial was designed primarily to validate a proprietary Peyronie’s Patient Reported Outcome questionnaire (“PRO”) which will measure several domains of patients’ sexual quality of life over a 36 week period. The four domains measured by the PRO are penile pain, Peyronie’s bother, intercourse discomfort and intercourse constraint. We intend to use the PRO in its entirety, or in part as determined after consultation with the FDA, for our phase III Peyronie’s trials, where it is intended

9

Table of Contents

that it would be the primary or co-primary endpoint. Patients had to have a penile contracture between 30 and 90 degrees to be included in the study. Patients were stratified by the degree of penile curvature (i.e. 30 degrees to 60 degrees versus 60 to 90 degrees) and then randomized into four treatment groups to receive either XIAFLEX or placebo with or without modeling of the penile plaque. Modeling refers to massaging of the plaque after the second injection of a treatment series and is intended to maximize the enzymatic effect of the XIAFLEX injection in the plaque. Patients were randomized in a 3:1 ratio of XIAFLEX to placebo and a 1:1 ratio to receive penile plaque modeling or no modeling.

Top-line data demonstrated that XIAFLEX improved penile curvature when compared to placebo with a mean improvement of 29.7% vs. 11%, respectively (P=0.001). In addition, the PRO domain of Peyronie’s symptom bother was significantly improved in XIAFLEX treated subjects compared to placebo. The use of modeling also demonstrated significant improvement in XIAFLEX subjects compared to placebo, 32.4% improvement in curvature compared to a 2.5% worsening of curvature in placebo subjects (p<0.001). In the no-modeling group, XIAFLEX subjects experienced a 27.1% mean improvement in penile curvature, which was not statistically different from the 27.9% mean improvement for subjects receiving the placebo. The remaining three domains did not show statistical significance between XIAFLEX and placebo. The most common adverse events reported in the phase IIb trial were injection site bruising, injection site pain, injection site edema, contusion, penile edema and penile pain. There was a total of five (3.4%) subjects who experienced eight non-fatal serious adverse events, none of which were considered to be related to XIAFLEX. We were looking to accomplish two goals with this study. First, we wanted to validate the Peyronie’s Disease PRO as a tool that we can use in future pivotal studies. Second, we were looking to establish an acceptable primary endpoint related to the PRO that can be used for those pivotal phase III trials. Although we will need to confirm these positions with the FDA and other regulatory agencies, we believe that we will be able to validate the PRO and move XIAFLEX into phase III development in the second half of 2010. The Company expects to have an end of phase II meeting with the FDA to discuss these issues in the second quarter of 2010.

Frozen Shoulder Syndrome

Disease state and market: Frozen Shoulder syndrome is a disorder of diminished shoulder motion, characterized by restriction in both active and passive range of motion of the shoulder joint. Frozen Shoulder syndrome usually affects patients aged 40-70 years. According to Harrison’s Principles of Internal Medicine, it is estimated that 3% of people develop Frozen Shoulder syndrome over their lifetime and that women tend to be affected more frequently than men. The condition may affect both shoulders, either simultaneously or in sequence, in up to 16% of patients. Recurrence of Frozen Shoulder syndrome is common within five years of the onset of the disorder. According to Dahan et. al. in the 2005 eMedicine article “Adhesive Capsulitis,” a higher incidence of Frozen Shoulder syndrome exists among patients with diabetes (10-20%) compared to the general population (2-5%) and incidence among patients with insulin-dependent diabetes is even higher (36%), with an increased frequency of bilateral shoulder involvement.

Current treatment options: The most common treatment for Frozen Shoulder syndrome is extensive physical therapy, corticosteroids and/or arthroscopy. Drugs are used to manage pain, but none have been demonstrated to have an impact on Frozen Shoulder syndrome.

R&D status: BioSpecifics has conducted a phase II clinical trial using XIAFLEX for the treatment of Frozen Shoulder syndrome. Three different doses of the enzyme were compared to placebo in this prospective, randomized, 60-subject trial. The results from this trial suggest that local injection of the enzyme is well-tolerated and may be effective in patients suffering from Frozen Shoulder syndrome. Additional studies are needed to assess the optimal dose and dosing regimen of XIAFLEX for this indication.

Other

Under our agreement with BioSpecifics, we have exclusive worldwide rights to develop, market and sell products containing XIAFLEX, other than dermal formulations labeled for topical administration. We may

10

Table of Contents

expand our agreement with BioSpecifics, at our option, to cover other indications as they are developed by us or BioSpecifics. We plan to prioritize our development of additional pipeline indications for XIAFLEX. In addition to the indications mentioned above, other areas of interest could include cellulite and lipoma.

Testim Opportunity

Testim is a proprietary, topical 1% testosterone once-a-day gel that treats hypogonadism by restoring testosterone blood levels back to normal for a 24-hour period following application. Testim is packaged in convenient, easy-to-open, single-use tubes. Patients apply Testim once per day to the upper arms and shoulders, enabling Testim’s active ingredient, testosterone, to be absorbed through the skin and into the bloodstream.

Hypogonadism market

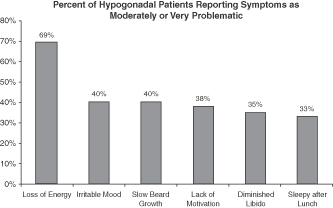

Hypogonadism, or low testosterone, is a disorder that affects millions of men in the U.S. A 2006 study in The International Journal of Clinical Practice showed that 39% of men over 45 years of age have low testosterone (total testosterone levels below 300 ng / dL). Hypogonadism also affects a high percentage of men with certain co-morbidities regardless of age. This study documented associations with other co-morbidities such as: Obesity (52%), Diabetes (50%) and Rheumatoid Arthritis (47%)1. Other articles have highlighted associations with other conditions: HIV (30%)2, Erectile Dysfunction (18%)3 and up to 74% of men being treated with high doses of opioids for chronic pain4. The effects of low testosterone lead to symptoms such as low energy, diminished libido, adverse changes in body composition, irritability and poor concentration. According to a 2004 study in the Journal of Clinical Endocrinology & Metabolism, the impact of these symptoms on an afflicted person can be significant5.

TRT is the standard treatment for hypogonadism. According to IMS, the total number of prescriptions within the TRT market has grown from 1.0 million to 3.9 million prescriptions between 2000 and 2009. Before 2000, the TRT market consisted of oral, injectable and patch therapies. In 2000, the first topical gel was introduced, and this product segment has been the driver of much of the total growth in the TRT market. According to IMS, the gel segment accounted for approximately 71% of the total prescriptions in the TRT market in the fourth quarter of 2009. Despite this growth, we estimate that approximately 10% of men with

| 1 | Mulligan T. et al. Int J. Clin Pract 2006 |

| 2 | Dobs A.S. Clin Endocrinol Metab. 1998 |

| 3 | Bodie J. et al. J. Urol. 2003 |

| 4 | Daniell H.W. J. Pain 2002 |

| 5 | Kelleher S. et al. J. Clin. Endocrinol Metab. 2004 |

11

Table of Contents

hypogonadism currently receive TRT. According to our physician research, this low diagnosis rate stems primarily from low patient and physician awareness of the symptoms, treatment options and monitoring requirements.

Testim has captured a significant portion of the gel prescription growth since its launch in early 2003, and held a 22.3% prescription share of this market in December 2009. In 2009, prescriptions of Testim grew by 14.9% compared to 2008. The gel market continued to be a primary driver of the TRT market in 2009. All other formulations (injectables, patches, orals and buccals) combined increased 24.1% year over year. We believe this growth (primarily in injectables) is attributable to the economic downturn with financially impacted patients opting for lower priced generic injectables.

Source: IMS NPA

We believe Testim’s growth since 2006 has been due to Testim’s favorable clinical profile and our increased sales and marketing efforts. According to IMS, Testim’s market share in the TRT gel market was 22.5% in December 2009 compared to 22.6% in December 2008. Fluctuations in share will occur with wins and losses on the managed care front. We had some losses in managed care accounts in early 2009 that impacted our share growth adversely, but we were able to overcome that through growth in other managed care accounts. Our Testim sales organization of approximately 150 representatives promotes Testim to urologists, endocrinologists and certain targeted primary care physicians. We believe this focused, consistent messaging will continue to drive the recognition of hypogonadism and increase Testim prescriptions.

Clinical data supporting the advantages of Testim. We have designed and conducted our clinical trials to provide prescribing physicians with comprehensive information regarding Testim’s benefits. Since 2001, we have completed 16 clinical studies involving approximately 1,800 patients including the largest placebo controlled study (n=400) ever conducted to evaluate the benefits and risks of TRT. We conducted five of these studies using Testim and other TRT products, including a transdermal patch and the other commercial gel. The results from these five studies, taken together, demonstrate that in patients with hypogonadism, testosterone levels directly correlate with patient symptom improvement.

In October 2007, the manuscript “Efficacy of Testosterone Gel Substitution (Androgel® or Testim) among sub-optimally responsive hypogonadal men” by L. Lipshultz, E. Grober, M. Khera, M. Espinoza was posted in the International Journal of Impotence Research web site and later published in International Journal of Impotence Research. The data from this independent study show improvements in symptoms of decreased libido,

12

Table of Contents

energy levels and erectile function in 76 percent of hypogonadal men after switching brands of TRT gel. Total testosterone levels increased significantly in patients who switched to Auxilium’s Testim 1% (testosterone gel) following suboptimal response to Solvay S.A.’s Androgel (testosterone gel) 1% but did not increase significantly in patients who switched from Testim to Androgel.

Cost effectiveness and convenience. We believe that, based on clinical data regarding testosterone levels in patients, market feedback from physicians, and the results of our clinical trials, a higher percentage of patients are treated with only one tube of Testim per day (one dose per day) compared to patients being treated with the other commercial gel who may need more than one dose of that product per day.

Broad prescription coverage. Currently, we have broad third-party payor reimbursement for Testim and Testim is covered by the majority of reimbursement plans.

Patent coverage. In the U.S., the ‘968 patent, which Bentley assigned to CPEX in June 2008, covers a method for maintaining blood serum testosterone levels for treating a hypogonadal male using Testim and is listed in the Orange Book. The ‘968 patent expires in January 2025. Six additional patents issued covering Testim in October 2009 and have been listed in the Orange Book. These patents expire in April 2023. CPEX also has filed continuation applications that are pending. In October 2008, we and our licensor, CPEX, received notice that Upsher-Smith filed an ANDA containing a paragraph IV certification seeking approval from the FDA to market a generic version of Testim prior to the January 2025 expiration of ‘968 Patent. The paragraph IV certification sets forth allegations that the ‘968 Patent will not be infringed by Upsher-Smith’s manufacture, use or sale of the product for which the ANDA was submitted. In December 2008, we filed a patent infringement lawsuit against Upsher-Smith which remains pending. Upsher-Smith has alleged that its proposed generic version of Testim would not infringe the ‘968 patent, and that the ‘968 patent is invalid. Under the Hatch-Waxman Act, final FDA approval of Upsher-Smith’s proposed generic product will be stayed until the earlier of 30 months beginning on the date of receipt of the paragraph IV certification (April 2011) or resolution of the patent infringement lawsuit. Should Upsher-Smith receive a tentative approval of its generic version of Testim from the FDA, it cannot lawfully launch its generic version of Testim in the U.S. before the earlier of the expiration of the currently pending 30-month stay or a district court decision in its favor. Upsher-Smith will also not be able to lawfully launch a generic version of Testim in the U.S. without the necessary final approval from the FDA.

Regulatory. On May 7, 2009, FDA announced that it was requiring the manufacturers of two prescription topical testosterone gels, Solvay S.A. and Auxilium, to make changes to the prescribing information and develop REMS for the products. FDA stated that it was requiring this action after it became aware, through spontaneous post-marketing adverse event reports and peer-reviewed biomedical literature, of cases of secondary exposure of children to testosterone due to drug transfer from adult males using testosterone gel drug products (“transference”). FDA considered this information to be “new safety information.” We believe that all topical testosterone gels have a potential for transference. Testim’s prescribing information has described the risk and procedures for avoidance of transference since the product was launched in 2003. The changes to the prescribing information for Testim include a “boxed warning”, which is used to highlight warning information that is especially important to the prescriber. The goal of the REMS is to inform patients about the serious risks associated with the use of Testim and AndroGel. The REMS includes assessments and a Medication Guide to inform patients. The revised prescribing information and REMS for Testim was approved on September 18, 2009.

In February 2009, we filed a Citizen’s Petition with the FDA requesting that Upsher-Smith be required to perform a variety of studies to demonstrate that the inactive ingredients and formulation of the proposed product do not compromise its safety or efficacy. An FDA response to our Citizen’s Petition was received in August 2009. The FDA agreed with some of the statements made in the Citizen’s Petition regarding the testing required for generic versions of Testim and disagreed with other statements. Although not commenting upon any filing in particular, the FDA did state that “the practical effect of this determination is that any application for a testosterone gel product that has different penetration enhancers than the reference listed drug cannot be

13

Table of Contents

submitted as an abbreviated new drug application (ANDA) and, instead, will have to be submitted as a NDA under section 505(b) of the [Federal Food, Drug, and Cosmetic Act].”

Transmucosal Film Technology

We are developing product candidates using an oral transmucosal drug delivery system based on patented technology licensed from Formulation Technologies, L.L.C., doing business as PharmaForm. (In 2007, PharmaForm was acquired by AKELA Pharma Inc., formerly known as LAB International Inc.) The basis of this technology is a film that adheres to the upper gum. We have the exclusive worldwide right to use this technology platform in therapeutic products that contain hormones or that treat urologic disorders and in certain pain products. We currently have two product candidates using this technology:

| • | AA4010, our therapy to treat overactive bladder, in phase I of development for which we expect to seek a partner to further develop and commercialize the product; and |

| • | A Fentanyl pain product candidate in the phase I of development for the management of pain for which we expect to seek a partner to further develop and commercialize the product. |

Licensing

We have entered into agreements for the licensing of technology and products. We intend to pursue other licensing agreements and collaborations in the future. We have secured collaboration partners for the sale of products in geographic locations where we do not have our own sales force. We may pursue other collaborations in the future.

XIAFLEX

BioSpecifics

In June 2004, we entered into a development and license agreement with BioSpecifics and amended the agreement in May 2005, December 2005 and December 2008 (the “BioSpecifics Agreement”). Under the BioSpecifics Agreement, we were granted exclusive worldwide rights to develop, market and sell certain products containing BioSpecifics’ enzyme, which we refer to as XIAFLEX. Our licensed rights concern the development and commercialization of products, other than dermal formulations labeled for topical administration, and currently, our licensed rights cover the indications of Dupuytren’s, Peyronie’s and Frozen Shoulder syndrome. We may further expand the BioSpecifics Agreement, at our option, to cover other indications as they are developed by us or BioSpecifics.

The BioSpecifics Agreement extends, on a country-by-country and product-by-product basis, for the longer of the patent life, the expiration of any regulatory exclusivity period or 12 years. We may terminate the BioSpecifics Agreement upon 90 days prior written notice. See “Patents and Proprietary Rights” below for a discussion of the patents we license from BioSpecifics.

We are responsible, at our own cost and expense, for developing the formulation and finished dosage form of products and arranging for the clinical supply of products except for costs paid to third parties to develop the lyophilization of the injection formulation which shall be shared equally by Auxilium and BioSpecifics.

BioSpecifics has the option, exercisable no later than six months after FDA approval of the first New Drug Application (“NDA”) or Biologics License Application (“BLA”) with respect to a product, to assume the right and obligation to supply, or arrange for the supply from a third party other than a back-up supplier qualified by us, of a specified portion of our commercial product requirements for territories outside those licensed to

14

Table of Contents

Pfizer. The BioSpecifics Agreement provides that we may withhold a specified amount of a milestone payment until:

| • | BioSpecifics executes an agreement, containing certain milestones, with a third party for the commercial manufacture of the product; |

| • | BioSpecifics commences construction of a facility, compliant with current Good Manufacturing Practice (“cGMP”), for the commercial supply of the product; or |

| • | 30 days after BioSpecifics notifies us in writing that it will not exercise the supply option. |

If BioSpecifics exercises the supply option, commencing on a specified date, BioSpecifics will be responsible for supplying either by itself or through a third party other than a back-up supplier qualified by us, a specified portion of the commercial supply of the product for territories outside those licensed to Pfizer. If BioSpecifics does not exercise the supply option, we will be responsible for arranging for the entire commercial product supply. In the event BioSpecifics exercises the supply option by August 2, 2010, we and BioSpecifics are required to use commercially reasonable efforts to enter into a commercial supply agreement on customary and reasonable terms and conditions which are not worse than those with back-up suppliers qualified by us.

We must pay BioSpecifics on a country-by-country and product-by-product basis a specified percentage of net sales for products covered by the BioSpecifics Agreement. Such percentage may vary depending on whether BioSpecifics exercises the supply option. In addition, the percentage may be reduced if:

| • | BioSpecifics fails to supply commercial product supply in accordance with the terms of the BioSpecifics Agreement; |

| • | market share of a competing product exceeds a specified threshold; or |

| • | we are required to obtain a license from a third party in order to practice BioSpecifics’ patents without infringing such third party’s patent rights. |

As a result of the December 2008 amendment to our license with BioSpecifics, which became effective when we executed the agreement with Pfizer, we owe BioSpecifics 8.5% of the upfront and milestone payments received from Pfizer. With regard to any other sublicensee, we must pay BioSpecifics a specified percentage of sublicense income we receive from any other sublicensee, including upfront payments and milestone payments, and we must pay BioSpecifics an amount equal to a specified mark-up of the cost of goods sold for products sold by us that are not manufactured by or on behalf of BioSpecifics, provided that, in the event BioSpecifics exercises the supply option, no payment will be due for so long as BioSpecifics fails to supply the commercial supply of the product in accordance with the terms of the BioSpecifics Agreement.

Finally, we will be obligated to make contingent milestone payments upon the filing of regulatory applications and receipt of regulatory approval. As a result of the acceptance of the EU Marketing Authorization Application (“MAA”) for XIAFLEX for Dupuytren’s on January 21, 2010, we are obligated to pay BioSpecifics approximately $1.3 million as their share of the $15 million milestone payment we received from Pfizer in February 2010. As a result of the U.S. approval of XIAFLEX for Dupuytren’s on February 2, 2010, we are obligated to pay BioSpecifics $1 million. Additional milestone obligations will be due upon acceptance of filings or approvals, or if we exercise an option to develop and license XIAFLEX for additional medical indications. Pursuant to the BioSpecifics Agreement, the milestone for each additional indication is $500,000, except for cellulite which is $1 million.

Pfizer

In December 2008, we entered into a development, commercialization and supply agreement with Pfizer (the “Pfizer Agreement”). Under the Pfizer Agreement, we granted to Pfizer the right to develop and

15

Table of Contents

commercialize, with the right to sublicense, XIAFLEX for the treatment of Peyronie’s and Dupuytren’s in the 27 member countries of the EU as it existed as of the effective date of the Pfizer Agreement (Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the U.K.), as well as Albania, Armenia, Azerbaijan, Belarus, Bosnia & Herzegovina, Croatia, Georgia, Iceland, Kazakhstan, Kirghiz Republic, Macedonia, Moldova, Montenegro, Norway, Serbia, Switzerland, Tajikistan, Turkey and Uzbekistan (the “Pfizer Territory”). Subject to each party’s termination rights, the term of the Agreement extends on a country-by-country and product-by-product basis from the date of the Agreement until the latest of (i) the date on which the product is no longer covered by a valid patent or patent application in such country, (ii) the 15th anniversary of the first commercial sale by Pfizer of XIAFLEX in a given country after the receipt of required regulatory approvals and (iii) a generic entry or competitive product containing the same active ingredient with respect to XIAFLEX in such country (the “Term”).

In addition to the $75 million upfront payment we received in December 2008 and the $15 million milestone payment we received in February 2010 for acceptance of the MAA in the EU, Pfizer may make up to an additional $395 million in potential payments upon the achievement of certain specified additional regulatory and commercial milestones for XIAFLEX (on an indication-by-indication basis or for the product as a whole, as the case may be). Subject to the requirement to make certain specified minimum commercialization payments, Pfizer will make commercialization payments to us based on a percentage of the aggregate annual net sales of the Product in the Pfizer Territory on a quarterly basis.

Pfizer will obtain XIAFLEX exclusively from us. We are primarily responsible for development activities prior to granting of product approval, and Pfizer is primarily responsible for development activities in the Pfizer Territory thereafter. We control product development at all times outside of the Pfizer Territory. Development costs will be borne by the party incurring such costs; provided, that the parties will share development costs associated with activities solely associated with obtaining product approval in the Pfizer Territory. However, Pfizer may, on an indication-by-indication basis, recoup its fifty percent (50%) share of such pre-approval development costs by means of an off-set against the milestone payment due upon first commercial sale for such indication. Pfizer is responsible for preparation of regulatory materials necessary for obtaining and maintaining regulatory approvals in the Pfizer Territory, and Pfizer will be responsible for regulatory costs associated with product approval in the Pfizer Territory. Pfizer may also recoup up to $2.5 million with respect to such regulatory costs related to Dupuytren’s. Pfizer is solely responsible for commercializing XIAFLEX in the Pfizer Territory during the term of the Pfizer Agreement and is solely responsible for costs associated with commercializing XIAFLEX in the Pfizer Territory.

Either party may terminate the Pfizer Agreement as a result of the other party’s breach or bankruptcy. Pfizer may terminate the Pfizer Agreement at will; provided that, during a specified period, such termination right is subject to the occurrence of certain specified events relating to the product, product development and regulatory approval.

Testim

CPEX Pharmaceuticals

In May 2000, Bentley granted us an exclusive, worldwide, royalty-bearing license to make and sell products incorporating its patented transdermal gel formulation technology that contains testosterone (the “May 2000 License”). We produce Testim under the May 2000 License. The term of the May 2000 License is determined on a country by country basis and extends until the later of patent right termination in a country or 10 years from the date of first commercial sale. In May 2001, Bentley granted us similar rights for a product containing another hormone, the term of which is perpetual. Under these agreements, we are required to make up-front and milestone payments upon contract signing, the decision to develop the underlying product, and the

16

Table of Contents

receipt of FDA approval. In June 2008, CPEX was spun out of Bentley and is the assignee of certain Bentley assets, including the license agreements and patents we licensed under those agreements. See “Patents and Proprietary Rights” for a discussion of the patents we license from CPEX.

Ipsen

We entered into a license and distribution agreement with Ipsen in March 2004 (the “Ipsen Agreement”). Under the Ipsen Agreement, we granted Ipsen an exclusive license to use and sell Testim on a worldwide basis outside the U.S., Canada, Mexico, and Japan, and in January 2008, we amended that agreement to exclude, in addition, China, Poland, Russia, and South Korea and their territories and possessions (the “Ipsen Territory”). In November 2008, we agreed with Ipsen to terminate the Ipsen Agreement and transfer the marketing authorizations required to promote and sell Testim in the Ipsen Territory to Ferring. In the fourth quarter 2009 the last of the marketing authorizations for the 15 countries included in the Ipsen Territory were transferred to Ferring and the Ipsen Agreement has terminated.

Ferring

In November 2008, we entered into a distribution and license agreement with Ferring (the “Ferring Agreement”). Pursuant to the Ferring Agreement, we appointed Ferring as our exclusive distributor of Testim in Belgium, Denmark, Finland, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, The Netherlands, Norway, Portugal, Spain, Sweden and the U.K. (the “Ferring Territory”). We also granted Ferring an exclusive, royalty-bearing license to import, market, sell and distribute Testim in the Ferring Territory. The exclusive appointment and license commenced on a country-by-country basis upon the transfer of the relevant marketing authorizations from Ipsen. Ferring is required to purchase all Testim supply from us and to make certain sales milestone and royalty payments. In addition, Ferring was required to make certain upfront and milestone payments to the Company related to the transfer of the marketing authorizations in each country within the Ferring Territory.

Paladin

We entered into a license and distribution agreement with Paladin in December 2006. We granted Paladin an exclusive license to use and sell Testim in Canada. The terms of this agreement require Paladin to purchase all Testim supply from us and to make up-front, milestone and royalty payments.

Transmucosal Film Technology

PharmaForm

In June 2003, we entered into a license agreement with PharmaForm. Under this agreement, as amended, we were granted an exclusive, worldwide, royalty-bearing license to develop, make and sell products that contain hormones or that are used to treat urologic disorders incorporating PharmaForm’s oral transmucosal film technology for which there is an issued patent in the U.S. The term of this license agreement is for the life of the licensed patents.

In February 2005, we entered into an additional license agreement with PharmaForm. Under this agreement, we were granted exclusive, worldwide royalty-bearing rights to develop, manufacture and market eight compounds using PharmaForm’s proprietary transmucosal film technology for the management of pain, including acute and chronic pain. As of the fourth anniversary of the effective date, the agreement covers only those compounds for which we have initiated formulation development. The term of this license agreement continues on a product by product and country by country basis until the later of ten years after the first commercial sale or last to expire patent covering the licensed technology. The compounds that may be developed

17

Table of Contents

include opioids as well other types of analgesics. In addition, we will have on-going royalty payment obligations to PharmaForm. The timing of the remaining payments, if any, is uncertain.

Manufacturing

We currently use, and expect to continue to depend on, contract manufacturers to manufacture Testim and handle certain aspects of the manufacture of XIAFLEX. We may depend on contract manufacturers to manufacture any products for which we receive marketing approval and to produce sufficient quantities of our product candidates for use in preclinical and clinical studies. We and our contract manufacturers are subject to an extensive governmental regulation process. Regulatory authorities in our markets require that drugs be manufactured, packaged and labeled in conformity with cGMP. The cGMP requirements govern quality control of the manufacturing process and documentation policies and procedures. We have established an internal quality control and quality assurance program, including a set of standard operating procedures and specifications that we believe is cGMP-compliant.

Testim

DPT. Testim is manufactured for us by DPT Laboratories, Ltd. (“DPT”) pursuant to a manufacturing and supply agreement that expires on December 31, 2010. During the term of the agreement, subject to our right to qualify and order Testim from a back-up supplier, DPT is required to manufacture all of our worldwide commercial requirements of Testim. The manufacturing fees paid to DPT are based upon the specified annual volume of Testim ordered by us. If we order less than a specified amount of Testim in any calendar year, the parties are required to negotiate to establish new manufacturing fees, with the understanding that DPT will continue to produce Testim for a specified minimum period in order to enable us to identify and utilize another supplier. DPT may terminate the agreement only upon our insolvency or bankruptcy or upon our breach of the agreement. We have qualified Contract Pharmaceuticals Limited Canada (“CPL”) as a back-up supplier.

XIAFLEX

Horsham. In September 2006, we leased a 50,000 square foot biological manufacturing facility in Horsham, Pennsylvania that we are using to produce the active ingredient of XIAFLEX. In 2009, we also leased approximately 56,000 square feet of laboratory, warehouse and office space in two other Horsham locations. We believe we have sufficient capacity to manufacture our commercial supply needs for the foreseeable future, and we have the ability to increase capacity at our Horsham facilities if needed.

Subject to BioSpecifics’ option to assume the right and obligation to supply, or arrange for the supply from a third party, of a specified portion of our commercial XIAFLEX requirements (see full discussion of the BioSpecifics Agreement above), we expect to be the supplier of the active pharmaceutical ingredient for commercial supply of XIAFLEX. We use a contract manufacturer, Hollister-Stier Laboratories LLC (“Hollister- Stier”), to fill and lyophilize the XIAFLEX bulk drug substance and produce sterile diluent, and we use a contract packager, Catalent Pharma Solutions, LLC (“Catalent”) to label and package XIAFLEX.

Hollister-Stier. In June 2008, we entered into a supply agreement with Hollister-Stier pursuant to which Hollister-Stier fills and lyophilizes the XIAFLEX bulk drug substance that we manufacture and produces sterile diluent. The initial term of the supply agreement is three years, and it automatically renews for subsequent two year terms, unless terminated earlier.

BioSpecifics. Under the terms of the BioSpecifics Agreement, BioSpecifics has the option, exercisable no later than six months after FDA approval of the first BLA with respect to XIAFLEX, to assume the right and obligation to supply, or arrange for the supply from a third party other than a back-up supplier qualified by us, of

18

Table of Contents

a specified portion of commercial product required by us for territories outside those licensed by Pfizer. The BLA for XIAFLEX for the treatment of Dupuytren’s was approved on February 2, 2010, and BioSpecifics’ supply option is exercisable no later than August 2, 2010. The terms of the BioSpecifics Agreement are summarized above.

Competition

TRT Market Competition

The TRT market is highly competitive. Our success will depend, in part, on our ability to protect our share of the market from the competition. Potential competitors in North America, Europe and elsewhere include major pharmaceutical companies, specialty pharmaceutical companies and biotechnology firms, universities and other research institutions and government agencies.

Other pharmaceutical companies may develop generic versions of Testim or any products that compete with Testim that do not infringe our patents or other proprietary rights, and, as a result, our business may be adversely affected. For example, because the ingredients of Testim are commercially available to third parties, it is possible that competitors may design formulations, propose dosages or develop methods of administration that would be outside the scope of the claims of one or more, or of all, of the patent rights that we in-license. This would enable their products to effectively compete with Testim. Governmental and other pressures to reduce pharmaceutical costs may result in physicians writing prescriptions for these generic products. Increased competition from the sale of competing generic pharmaceutical products could cause a material decrease in revenue from Testim.

AndroGel

The primary competition for Testim in the TRT market is AndroGel (testosterone gel) 1% CIII, marketed by Solvay Pharmaceuticals, Inc. (“Solvay”). In February 2010, Abbot Laboratories, Inc. (“Abbott”) completed an acquisition of Solvay. Solvay launched AndroGel three years prior to Testim giving the brand a significant advantage in the TRT gel market. Watson Pharmaceuticals, Inc. (“Watson”) began co-promoting AndroGel with Solvay in late 2006, and Par Pharmaceutical Companies, Inc. (“Par”) began co-promoting AndroGel in early 2007, each pursuant to patent lawsuit settlement agreements with Solvay. In January 2009, the U.S. Federal Trade Commission (“FTC”) and a number of private parties filed actions against Solvay, Watson and Par alleging that their respective 2006 patent lawsuit settlements related to AndroGel are unlawful. All actions were consolidated in the U.S. District Court for the Northern District of Georgia. In February 2010, the court dismissed the FTC’s claims and some of the private party claims. Certain private party claims remain pending. Solvay and its co-promotion partners collectively had more than 600 sales representatives detailing AndroGel although it remains unclear what resources Abbott will put behind the brand. According to IMS, as of December 31, 2009, AndroGel accounted for 77.7% of the gel prescriptions.

Other Delivery Options

Testim also competes with other TRT products such as short-acting injectables, patches, orals, a buccal tablet and injectable pellets. The injectables have experienced significant growth in the market due to their low cost compared to the transdermal options. This growth coincides with the economic downturn that the U.S. experienced in 2009. There are also a significant number of patients who prefer getting a shot every two to three weeks instead of utilizing a daily application of another product. Physicians perceive the disadvantage of the injectables as being the fact that many patients’ testosterone levels rise past the normal barrier of 1000 ng/dl which leads to a wide fluctuation of testosterone levels in a patient and the potential for side effects such as gynecomastia. Androderm® is a transdermal testosterone patch marketed by Watson. Androderm, the leading patch product, has decreased in share in the last year and accounted for approximately 5.9% of total TRT prescriptions in December 2009, down from 6.5% in December 2008. The buccal therapy accounted for less than 1% of total TRT prescriptions in December 2009. Testopel® is an implantable testosterone pellet that is administered every four to six months.

19

Table of Contents

Generic Competition

In July 2003, Watson and Par filed ANDAs with the FDA to be approved as generics for AndroGel. In response to these ANDAs, Solvay filed patent infringement lawsuits against these two companies to block the approval and marketing of the generic products. In 2006, all the subject companies reached an agreement pursuant to which Watson and Par agreed not to bring a generic to Androgel to the market until August 2015. During this time frame, Solvay, Watson and Par will co-promote AndroGel. In June 2009, Perrigo Israel Pharmaceuticals, Inc. (“Perrigo”) filed an ANDA with a paragraph IV certification seeking the approval of a generic version of Androgel in the United States. The paragraph IV certification procedure challenges a U.S. patent relating to Androgel which runs through the next decade. In its letter to the company, Perrigo asserted that it did not infringe the AndroGel patent because its proposed testosterone gel product contains a different formulation than the formulation protected by the AndroGel patent. In contrast, the proposed testosterone gel products that were the subject of earlier ANDAs filed by other companies, and which were the subject of prior patent litigation brought by the company, purported to be identical to the AndroGel formulation. To date, Solvay has not initiated patent infringement litigation against Perrigo. The introduction of a generic version of Androgel would have an adverse impact on the branded gel market, including taking a significant portion of branded Androgel business. Although Testim has a BX rating, meaning that pharmacists are prohibited from substituting Testim with Androgel, or a generic version of Androgel, a less expensive generic testosterone gel product could still have a material adverse affect on Testim market share and/or Testim’s formulary status, and therefore could have a material negative impact on our financial condition and results of operations.

In October 2008, we and our licensor, CPEX, received notice that Upsher-Smith filed an ANDA containing a paragraph IV certification seeking approval from the FDA to market a generic version of Testim prior to the January 2025 expiration of ‘968 Patent. The ‘968 Patent, which Bentley assigned to CPEX in June 2008, covers a method for maintaining effective blood serum testosterone levels for treating a hypogonadal male using Testim and is listed in the Orange Book, published by the FDA. The paragraph IV certification sets forth allegations that the ‘968 Patent will not be infringed by Upsher-Smith’s manufacture, use or sale of the product for which the ANDA was submitted. In December 2008, we filed a patent infringement lawsuit against Upsher-Smith that remains pending. Upsher-Smith has alleged that its proposed generic version of Testim would not infringe the ‘968 patent, and that the ‘968 patent is invalid. Under the Hatch-Waxman Act, final FDA approval of Upsher-Smith’s proposed generic product will be stayed until the earlier of 30 months from receipt of the paragraph IV certification (April 2011) or resolution of the patent infringement lawsuit. Should Upsher-Smith receive a tentative approval of its generic version of Testim from the FDA, it cannot lawfully launch its generic version of Testim in the U.S. before the earlier of the expiration of the currently pending 30-month stay or a district court decision in its favor. In October 2009, six additional patents covering Testim were issued and have been listed in the Orange Book. These additional patents may provide us with further market protection.