Attached files

| file | filename |

|---|---|

| EX-3.2 - EXHIBIT 3.2 - STRAGENICS, INC. | ex3-2.htm |

| EX-10.1 - EXHIBIT 10.1 - STRAGENICS, INC. | ex10-1.htm |

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported): February 22, 2010

RESOURCE

EXCHANGE OF AMERICA CORP.

(Exact

name of registrant as specified in its charter)

|

Florida

|

333-157565

|

26-4065800

|

|

(State

or other jurisdiction

|

(Commission

File Number)

|

(IRS

Employer

|

|

of

Incorporation)

|

Identification

Number)

|

|

|

27

Fletcher Ave.

Sarasota,

FL 34237

|

||

|

(Address

of principal executive offices)

|

||

|

(941)

312-0330

|

||

|

(Registrant’s

Telephone Number)

|

Mobieyes

Software, Inc.

(Former

name or former address, if changed since last report)

Copy of

all Communications to:

Carrillo

Huettel, LLP

3033

Fifth Avenue, Suite 201

San

Diego, CA 92103

phone:

619.399.3090

fax:

619.399.0120

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

£

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

£

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

£

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

£

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

1

FORWARD

LOOKING STATEMENTS

This

current report contains forward-looking statements as that term is defined in

the Private Securities Litigation Reform Act of 1995. These statements relate to

future events or our future results of operation or future financial

performance. In some cases, you can identify forward-looking statements by

terminology such as “may”, “should”, “intends”, “expects”, “plans”,

“anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue”

or the negative of these terms or other comparable terminology. These statements

are only predictions and involve known and unknown risks, uncertainties and

other factors, including the risks in the section entitled “Risk Factors” in

this current report, which may cause our or our industry’s actual results,

levels of activity or performance to be materially different from any future

results, levels of activity or performance expressed or implied by these

forward-looking statements.

Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity or

performance. You should not place undue reliance on these statements, which

speak only as of the date that they were made. These cautionary statements

should be considered with any written or oral forward-looking statements that we

may issue in the future. Except as required by applicable law, including the

securities laws of the United States, we do not intend to update any of the

forward-looking statements to conform these statements to reflect actual

results, later events or circumstances or to reflect the occurrence of

unanticipated events.

In

this report, unless otherwise specified, all dollar amounts are expressed in

United States dollars and all references to “common shares” refer to the common

shares in our capital stock.

As

used in this current report and unless otherwise indicated, the terms “we”,

“us”, the “Company” and “RexCo” refer to Resource Exchange of America Corp.

(f/k/a Mobieyes Software, Inc.).

On

February 22, 2010, Resource Exchange of America Corp., a Florida corporation

formerly known as Mobieyes Software, Inc., entered into an Asset Purchase

Agreement (the “Purchase Agreement”) with UTP Holdings, LLC, a privately held

Florida limited liability company ("UTP"). In accordance with the

terms and provisions of the Purchase Agreement, the Company acquired one hundred

percent of the assets of UTP in exchange for (i) the assumption of the

outstanding balance of a line of credit issued to Dana J. Pekas, UTP's majority

shareholder, by Regions Bank (f/k/a AmSouth Bank) in an amount of up to $800,000

which shall be fully repaid on or before December 31, 2010; and, (ii) the

issuance of a two hundred fifty thousand dollar ($250,000) 10% Convertible

Promissory Note, with such Note being fully due and payable on or before

December 31, 2010.

The above

description of the Purchase Agreement is intended as a summary only, which is

qualified in its entirety by the terms and conditions set forth therein, a copy

of the Purchase Agreement is filed as an exhibit to this Current Report on Form

8-K (the "Current Report").

The

information set forth above in Item 1.01 of this Current Report on Form 8-K is

incorporated herein by this reference. The Purchase Agreement was accounted for

as a recapitalization wherein RexCo is considered the acquirer for accounting

and financial reporting purposes. The assets and liabilities of the UTP have

been brought forward at their book value. As a result of the Purchase Agreement,

our principal business became the business of UTP, which is more fully described

below.

2

FORM

10 DISCLOSURE

As

disclosed elsewhere in this report, we acquired 100% of the assets and

liabilities of UTP. Item 2.01(f) of Form 8-K states that if the registrant was a

shell company like we were immediately before the transaction disclosed under

Item 2.01, then the registrant must disclose the information that would be

required if the registrant were filing a general form for registration of

securities on Form 10.

Accordingly,

we are providing the following information that would be included in a Form 10

if we were to file a Form 10. Please note that the information provided below

relates to the post Asset Purchase Agreement entity, except that information

relating to periods prior to the date of the transaction relates to the

pre-transaction company, unless otherwise specifically indicated.

ITEM

1. BUSINESS

Historical

We were

incorporated in the State of Florida on January 15, 2009 under the name Mobieyes

Software, Inc.

From

inception through February 22, 2010, our business model was that of a mobile

enterprise software company aimed at improving the productivity of the field

service organization. As such, we planned to revolutionize the efficiencies of

the service chain for high technology products by intending to use its cutting

edge mobile and wireless platform.

On

February 22, 2010, we consummated the Purchase Agreement with UTP Holdings, LLC,

a privately held Florida limited liability company. In accordance

with the terms and provisions of the Purchase Agreement, the Company acquired

one hundred percent of the assets of UTP. The Purchase Agreement

closed on February 22, 2010. As a result of the Purchase Agreement transaction,

our principal business became the business of UTP, which is more fully described

herein.

Accordingly,

the Registrant changed its name to Resource Exchange of America Corp. by way of

Certificate of Amendment to its Articles of Incorporation filed with the Florida

Secretary of State on February 23, 2010.

Overview

Resource

Exchange of America Corp. goal is to become a U.S. based scrap recycling

powerhouse, combining demolition/asset recovery services with sorting,

recycling, brokering and distribution. We intend to initially offer demolition

services in Florida with plans to expand to other states in the Southeastern

United States. RexCo will sell ferrous and nonferrous metal to both U.S. buyers

as well as buyers abroad. Our goal is to deliver reliable, high-quality services

to all our clients, big and small, local, domestic and

international.

RexCo

intends to take full advantage of the present economic climate to acquire a

number of key pieces to realize its vision of becoming a scrap recycling

powerhouse. Research indicates that rough economic periods can create good

opportunities for companies to buy undervalued assets, but that many do just the

opposite: they are more likely to undertake divestments during downturns (and

buy new businesses when times are good). For this reason, the principals of

RexCo have determined that this is potentially an excellent time to consolidate

a number of demolition companies, metals processing yards, a recycling company

and an international trading company specializing in trading ferrous and

nonferrous metals.

Accordingly,

we will seek to acquire companies with key personnel with either in-depth

knowledge of sales to Brazil, Russia, India, China and Korea, or preferably with

a General Administration of Quality Supervision, Inspection, and Quarantine

number ("AQSIQ") which allows for direct trade with China. If we are successful

in rolling these individual companies into one single entity we will achieve

significant economies of scale. Assets can be reused across divisions, newly

purchased assets will have less idle time, stores can be combined and

administrative functions can be gathered, making it possible to vie for bigger

demolition/asset recovery jobs due to bigger cash reserves, tools and

manpower.

3

In the

scrap recycling business there are about 8,000 companies, and the top 50 account

for about only 40% of the market. The remaining, some 7,950 companies, are

primarily small “Mom and Pop” operations with annual turnovers less than five

million dollars. These companies work within small geographic areas, making

them very vulnerable in the present economic climate. As a result, these

companies maybe more than willing to sell equipment, stores or perhaps their

entire operation at less than book value. With the current market situation, we

believe that a consolidation process is the right strategic step, making it

possible to grow the business significantly and capture a segment of the $30

billion recycling industry, of which 60% stems from recycling of ferrous and

nonferrous metals.

We intend

to offer three main products:

|

1.

|

Demolition/Asset

Recovery

|

|

2.

|

Scrap

Sorting, Processing, Shredding and

Baling

|

|

3.

|

Scrap

brokering and sales

|

In order

to be able to offer all three products, we will have to meet four key objectives

within our first year of operation:

|

1.

|

To

acquire the companies needed to fulfill our vision and

mission.

|

|

2.

|

To

improve and build out acquired companies, making the fullest use of their

equipment, human resources and other

assets.

|

|

3.

|

To

create synergies between the companies acquired, so that all entities work

as a cohesive unit within our corporate structure, while actively seeking

to maintain minimal administrative

overhead.

|

|

4.

|

To

constantly improve existing sources of materials for processing and to and

improve sales channels both domestically and

abroad.

|

Management

believes that the aggregated Company will be able to achieve significant

economies of scale, will be able to acquire assets and stores at less than book

value allowing the RexCo to show a positive result within our first year of

operation.

Business

Strategy

We intend

to fulfill our strategic goals by seeking to acquire either successful or

underperforming companies within the scrap industry. RexCo will seek to acquire

companies at different stages of the scrap recycling process chain. RexCo

intends to take advantage of the present climate in the scrap industry, we

believe that in 2010 acquisition costs for underperforming companies are likely

to be very low, while the cyclic nature of the business makes it likely that

business will be blooming again within the next 3-4 years. We have come to the

conclusion that in order to make an acceptable profit within the scrap and

recycling business, it is better to make acquisitions at the bottom of the

cycle, and to control the entire value chain, rather than only one or

some of the phases (demolition/asset recovery, processing, sorting, selling and

distribution).

RexCo

plans to acquire established dismantling and demolition/asset recovery companies

with proven track records showing their ability to handle big and complex

demolitions in a timely manner, with acceptable profit margins and impeccable

safety records. These demolition companies will ensure a steady and viable

inventory stream, which will itself be a source of income. Additionally, we plan

to acquire one or more scrap processing yards with optimal locations between the

demolition companies, major industrial centers and ports and

rail. When identifying potential scrap processing yards we will seek

out companies that have the competencies and space to sort and bale all of the

different kinds of scrap that the demolition companies can provide. Finally,

RexCo will attempt to locate a company that is both proficient in selling both

ferrous and nonferrous scrap in the U.S. and also has in-depth knowledge of

selling to major importers. This way, RexCo will have control of the

entire process and value chain.

4

On the

tactical level the Company has set the following main objectives for its first

three years of operation:

|

1.

|

To

acquire the companies needed to fulfill the Company’s vision and

mission.

|

|

2.

|

To

improve and build out the companies, making the fullest use of their

equipment, human resources and other

assets.

|

|

3.

|

To

create synergies between the companies acquired, so that all companies

work as a cohesive whole within

RexCo.

|

|

4.

|

To

constantly improve existing streams of materials for processing, and

improve sales channels both in the U.S. and

abroad.

|

The first

objective requires significant work and is a prerequisite for the ensuing goals.

At this stage, significant legal, accounting and advisory services are required,

which will require substantial cash reserves and an unimpeded cash flow. All

acquisition targets will be scrutinized and will undergo thorough due diligence

to uncover hidden issues, threats or benefits. Before this step, an intensive

search process will take place, where potential acquisition targets will be

narrowed down until there is a shortlist of companies that fit our description

and that can then be evaluated.

The

second phase will run parallel with the due diligence of the individual company,

so that as soon as the acquisition is finalized the processes within the

individual company can be improved, and its assets can be utilized to the

greatest extent. Human resources will be evaluated through interviews so that

individual strengths can be determined. The RexCo team will utilize these

guidelines to evaluate all targets while accountants and attorneys perform

further due diligence.

The third

step involves assessing each acquired individual company’s strengths, weaknesses

and differences to ensure that synergy can be maximized and intra-company

differences and conflicts can be immediately addressed. Also, administrative

processes will be centralized, lessening the need for administrative staff

within the individual divisions. This task will become increasingly relevant as

new companies are added to RexCo.

The

fourth goal will be met through extensive channel analysis and improvement.

Potential clients will be contacted so that they are aware of the additional

product offerings from RexCo. As the individual companies are rolled into RexCo,

a dedicated team will continually work to meet objectives 3 and 4.

To ensure

that both short and long-term goals can be met, we will focus on four key areas

of success:

1. Experienced Personal

Contacts

At RexCo,

the demolition/asset recovery services lie at the beginning of the value chain,

and dedicated experienced demolition teams are of great importance to the

success of our business. Without excellent demolition services, all other facets

of our business model will be less successful. The demolition business is

heavily fragmented, and there is a great variety between the players in the

market with regards to pricing, adherence to deadlines and integrity. RexCo

demolition will do its utmost to stand out from the competition, and a core

Company value will be to conduct our business honorably, with integrity, and on

time.

Even

though long-term demolition contracts are extremely hard to obtain (demolition

is very often a onetime contract), all potential assignments should be met with

the possibility of future related business in mind. Therefore, initial contact

between a potential client and the demolition experts of RexCo will be handled

by a personal and dedicated representative with the necessary experience to give

the potential client proper advice and project management. It is important that

the demolition contacts are proactive and seek out every possible job, and that

they are generally good at cultivating potential clients.

The

personal contact will have knowledge of all Company staff, their experience and

training, all demolition equipment (shears, balers etc), and of the possible

sorting and transportation options.

5

As the

different companies, forming the entire value chain, are added to RexCo the

personal contact will be able to give further advice, when needed, based on the

different transportation, sorting and selling options that RexCo can provide. As

a company-wide Enterprise Resource Planning system (as further described below)

is launched, the personal contacts will have more information at their

fingertips, enabling them to give even better advice to clients.

2. Controlling the Entire Value

Chain

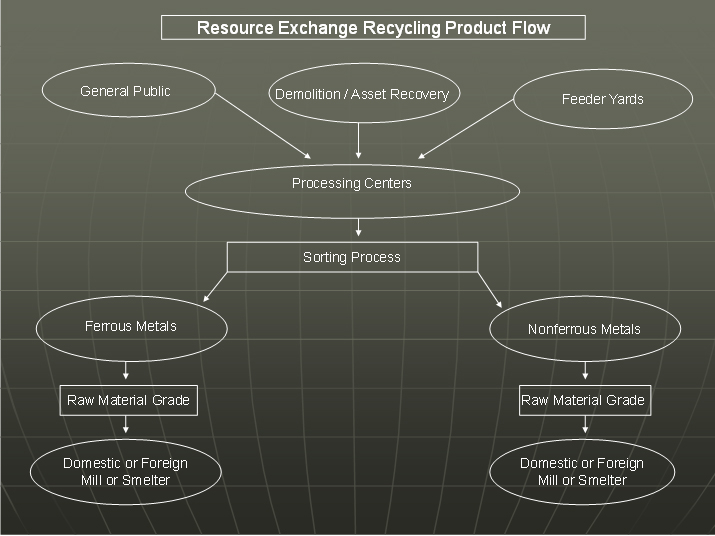

Our

product originates from several sources, depicted in the product flow chart

illustration below. The first product source is the general public,

who arrive at our processing centers with various whole or dismantled objects

containing ferrous and nonferrous metals, which are sometimes pre-sorted, but,

more often, combined with other metallic and non-metallic substances.

Demolition/asset recovery projects of our own, or from other companies, generate

dismantled portions of buildings, factories, agricultural facilities, bridges,

chemical plants, train derailments and other sources, which contain ferrous and

nonferrous metals.

Once the

product arrives at our processing centers, it will be sorted into ferrous or

nonferrous product codes. It is then processed into standard portions

by shearing, torching, and/or shredding. It is then sorted and graded

according to ISRI (Institute of Scrap Recycling Industries) standards and

shipped to domestic or foreign mills or smelters by truck, trains or ocean

containers.

The

product supply chain:

There are

advantages to controlling the entire value chain, not the least of which is

increased profits and because RexCo will control the entire value chain, we

anticipate that there will always be business somewhere along the value chain.

For instance, if the price on the world market for ferrous scrap is at a low

(near the $150 mark), RexCo can still take in demolition jobs (being paid for

taking the scrap metal away when demolishing, instead of paying anything for the

metal at all) and stockpile the scrap metal until the rates go up again.

Likewise, if the rates go up, RexCo will still have its own supply lines through

its own demolition companies, and will not be forced to bid for the scrap

between different demolition companies or scrap yards.

6

3. Development of the Company’s Digital

Infrastructure

Controlling

the entire value chain increases the requirements for a solid resource-planning

tool. The companies that RexCo intends to acquire will almost certainly have

only a few computer tools aiding them in their work. As more stages of the value

chain are integrated, the need for a comprehensive corporate Enterprise Resource

Planning ("ERP") tool increases exponentially.

The ERP

tool will enable the all companies along the value chain to effectively move

resources among them. For instance, demolition teams can be alerted about price

increases for particular metals and projects or portions of projects containing

that metal can be fast-tracked. If there is an oversupply of a metal, sales

teams can be notified of an oversupply so that they can focus on the sale of the

overabundant metals. Or they can try to bundle it at a fair price with imminent

deliveries in order to lower the stock.

In a new

organizational structure where the different divisions are previously separate

entities, it will be a challenge to incorporate a corporate-wide ERP tool due to

inherent resistance against change. This is particularly true in a business as

old as the demolition and scrap business, which has been around since before the

Civil War. It is imperative to implement a well-designed and adaptable ERP

system as early as possible, and to create awareness that the system will

benefit everybody.

A proper

digital infrastructure will also enable potential sellers to “book” a demolition

and potential buyers

can make requests on specific grades of scrap metal online, and get a quote back

almost immediately. And finally, buyers can check the transport online with

regards to delivery date and other important matters.

4. Wide Range of Sales Channels

The

demolition and scrap industries are extremely cyclical, with a long track record

of over 150 years. Often, when the market is down in one part of the world, it

is up in other places.

It is

therefore important for RexCo to have several sales channels at its disposal, so

that the scrap metal can be sold to the buyers that can give the premium price

at that particular time. RexCo can only succeed with a very dedicated sales team

with in-depth insights in the markets both domestic and abroad. Also, the

members of the sales team will have to be able to cultivate the relationships

with the buyers.

Apart

from sales personnel attending to the domestic market, it is also important to

attract people who have the required knowledge of such markets as Korea and BRIC

markets (Brazil, Russia, India and China), which are the greatest net importers

of scrap metal at the present time. Finding an acquisition target with an AQSIQ

number will help the Company immensely, as it will allow for export directly to

China.

In order

to make the best use of potential sales channels, it will be important for RexCo

to be located near a deep-water port in order to sell scrap to buyers outside of

the U.S. Simultaneously, a location near railroad or major highways is needed to

serve clients in the Midwest and other domestic markets.

Finally,

it should be possible for the buyers to follow their delivery online – when and

where it has been loaded, the contents of the containers, and when to expect

delivery.

Services

and the Market Space

RexCo

will undertake demolition/asset recovery of obsolete housing quarters,

refineries, processing plants, hotels, and any other kind of major structure

that needs to be torn down by specialists. Depending on the size and kind of

building, different kinds of demolition tactics will be employed. The different

building materials will be cut down to size, sorted, and recycled depending on

their type. Of particular interest to RexCo will be metal plating, sheets, T-

and I-beams and other structural pieces of metal, as well as nonferrous metals

(copper, alloys, aluminum etc.) that are of widespread use in factories and

processing plants.

Demolition

is a blue-collar, labor-intensive job, and the average pay is 14% below the

median for similar manual labor. As demolishing a building is a rather dangerous

business, RexCo will ensure that everyone at the demolition division is properly

trained in safety measures and precautions. The safety record will in itself be

used as a yardstick that the Company can measure its success by.

7

During

the demolition/asset recovery process, the different materials are diligently

sorted according to international specifications regarding grade, type and size.

At major demolition sites, a mobile shredder could be used to cut the ferrous

and nonferrous metals into smaller size. A mobile baler can create bales

according to various ISRI specifications. The baler and mobile shredder can be

taken to any location to bale ferrous and nonferrous metals on-site, which can

then be put into containers that can be shipped directly to buyers. Baling and

shredding allows for more weight to be put into ocean containers than if the

material is loaded in loose weight. Having mobile equipment will allow RexCo to

optimize utilization of the equipment, acquire smaller processing facilities,

and thereby increase overall profits.

Finally,

RexCo will provide a sales service, getting the best possible quotes for the

ferrous and nonferrous metals acquired through demolition projects or purchased

from others with excess stores. During 2010, RexCo will seek to buy cheap stores

of scrap metal to be sold later at a premium.

The US

scrap industry is composed of approximately 8,000 companies with combined annual

revenues of

approximately $30 billion. The demolition and recycling business is unique in

the sense that it is the only business with data covering almost two centuries.

Analyzing this ancient data it has become evident that the scrap and recycling

business is extremely cyclical. Basically, when times are booming, old

factories, cars, trucks, equipment etc. are demolished and recycled, because

businesses demand new and modernized factories, cars, trucks, equipment, which

in-turn need new metal to be produced. Conversely, in a recession the demand for

new assets is so low that scrap metal prices plummet, and there is less business

justification for demolishing anything. This happened in the wake of the

depression in 1929-1934, after WWII, during the energy crisis in the late

1970’s, again in 2008-2009 and it is likely to continue through 2010 as

well.

Fortunately,

the scrap and recycling business is counter-cyclical in other parts of the

world: Even though the US scrap metal market has plummeted in the past year, the

BRIC countries (Brazil, Russia, India and China) still show significant need for

scrap metal for new projects. Despite the economic development in past years,

there is an ever-increasing demand overseas for scrap metal due to the rapid

growth and expansion of the BRIC countries, as well as in Korea, and this demand

will continue to grow as the world becomes still more

industrialized.

As the

U.S. Scrap industry is extremely fragmented, with the top 50 companies holding

only about 40% share of the market, the remaining 60% of the market space are

struggling to make ends meet. There are approximately 7,950 companies in the

U.S. scrap and recycling industry that are potential acquisition targets for the

Company.

Annually,

the industry processes about 75 million tons of ferrous metals and 10 million

tons of nonferrous metals. Ferrous and non-nonferrous metals account for 60% of

the entire recycling industry.

The

amount of metal being processed is highly demand-driven, so that, at the moment

the amount of recycled metal is significantly less than just two years ago. U.S.

demand for ferrous metal comes mainly from the U.S. steel industry, which is

driven by the auto, machinery and construction industries. As the big three U.S.

automotive companies have been taking some major hits in the past years, demand

for metal has been heavily influenced. Fortunately, the markets abroad have more

than outweighed this development.

As with all

marketing strategies, understanding a client's needs is central to success. The

ability to satisfy a clients’ needs better than the competition will help build

customer loyalty and increase sales.

However,

both customer needs and the business environment in which RexCo operates are

constantly changing. RexCo understands this; this is why the marketing strategy

considers the changes that are taking place, as well as the opportunities and

threats that are emerging. If RexCo is able to adapt to the new market situation

while our competitors are not, RexCo will come out ahead of the

competition.

8

RexCo

intends to have two target markets at each end of the value chain: There is the

market for demolition/asset recovery at one end, and the market for sorted,

processed, baled ferrous and nonferrous metal at the other end of the value

chain. When local demand is low, demolition costs are low too. People will pay

to have their demolished scrap taken away, whereas in an upturn, they will want

a premium for the demolished materials. During 2010 and in the near future, it

should be possible to acquire and stockpile ferrous and nonferrous metal for

sale at a later date, when rates are better. It will be RexCo’s strategy to use

some of its anticipated profits to begin to stockpile low-cost metals for that

purpose.

Controlling

the other end of the value chain will ensure that the scrap can actually be sold

at the right rates to clients wherever they are in the world. Bypassing the

brokers will make it possible for RexCo to always achieve the best rates without

having to share the profits with others – and in turn give RexCo more peace of

mind when bidding for demolition jobs.

The scrap

metal industry is compartmentalized, fragmented and disorganized, with thousands

of smaller companies with revenues of less than five million dollars. At the

other end of the spectrum are 50 companies, who total about 40% of the market.

Of the thousands of smaller companies, many are “mom-and-dad” operations working

locally within a 100-mile radius around their business. Many of these companies

are struggling at the moment.

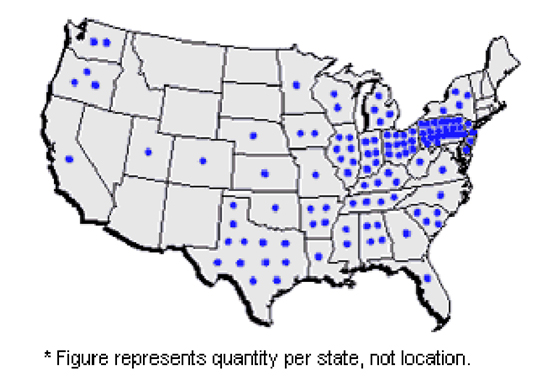

Mini-mills,

smelting scrap metal are primarily placed in the northeast corner of the

country, some in the Midwest and Texas, and fewer towards the east

coast.

Local

mini-mills, integrated steel mills and demolition companies saw a 30-60%

decrease in revenues in 2009 compared to 2007-2008. Competitors are therefore

being weeded out on a daily basis. RexCo will do business in a part of the U.S.

that, while only having few mini-mills nearby, has the advantage of proximity to

deep water harbors where scrap metal can be sent to clients abroad. This is a

significant advantage to RexCo.

We intend

to operate with significant competitive advantages over other recycling and

processing companies. A demolition/asset recovery division brings in large

quantities of material at discounted prices, while RexCo’s location in southern

Florida will provide for numerous sales outlets.

The

demolition division will acquire scrap material at deep discounts from market

price. Historically, demolition projects have produced scrap metal at a discount

of up to 60% of the fair market value. This reduced cost of the scrap metal will

allow RexCo to offer more competitively priced material to buyers. The

demolition division also brings in large quantities of scrap

material.

9

When the

market softens and the amount of material that is brought in from the public

declines, RexCo anticipates continuing to have a steady flow of inventory coming

in from the demolition division. An additional competitive advantage is the

location of the processing yards. Located just outside the deep-water port of

Tampa in Florida, the processing yards provide the opportunity to export

material to overseas mills when domestic markets soften.

RexCo

will seek to have personnel with in-depth knowledge of clients in the BRIC

countries and Korea. Preferably, it might be possible to acquire an AQSIQ

number, which will allow for shipping directly to Chinese steel mills. AQSIQ

numbers are very difficult to acquire and applications for them can take up to

two years for approval. Being able to ship directly to Chinese mills will

eliminate the brokerage network into China, which will increase sales margins by

3% to 10%. Already, RexCo is establishing a diverse customer base to make these

international sales. These competitive advantages will keep RexCo profitable

even during an economic downturn.

Operating

internationally dictates that RexCo must at all times maintain a high level of

integrity and credibility, to stand out from the competition.

RexCo will,

over time, become an aggregate of several companies, as it is the mission of

RexCo to acquire several key companies during the present economic slump. The

following section will go more in-depth with regards to company ownership and

the scalability and profit of the business.

Scalability

The

business model is to expand RexCo’s interests in ferrous and nonferrous metals,

as well as to expand into demolition projects that are larger and more complex.

As the acquisitions move forward, RexCo will have the assets necessary to

accomplish this goal. The market potential is huge; looking at the world markets

as a natural next step makes it even more potent. When it comes to scalability,

it requires little or no extra human resources to substantially increase

revenues.

With

RexCo’s central location in Florida, several deep-water harbors are easily

accessible, for instance in Tampa, Miami, Jacksonville and Savannah. RexCo will

seek to acquire demolition companies, which are located so as to take advantage

of these ports, as well as having the experienced demolition bidding department

and management skills necessary to carry out large demolition

projects. Also, they will seek to have the heavy equipment needed to

perform the demolition and the logistics and processing experience necessary to

transport out the raw materials.

If RexCo

is able to acquire a company with an AQSIQ number, which bypasses the broker

network and provides a direct link to Chinese steel mills, RexCo will be able to

improve its margins significantly. Next in importance will be for the

acquisition target to have staff with a deep understanding of selling to BRIC

countries and Korea. An experienced sales force in both domestic and

international markets and a diverse customer base to sell the raw materials at

the most competitive prices will be major advantages.

When all

of the business segments are combined, RexCo will control several processes

involved in transforming scrap metal into sales. In order to take advantage of

the current favorable market conditions, RexCo will attempt to start

consolidating soon.

Insurance

We do

not currently maintain any insurance. However, we intend to acquire and maintain

insurance appropriate to our new activities in the near future on such terms

that management shall deem to be commercially reasonable.

Intellectual

Property

Although

limited, we will depend on our ability to develop and maintain the proprietary

aspects of our technology to distinguish our services from our competitors’. To

protect our proprietary technology and services we will rely primarily on a

combination of confidentiality procedures. It is our policy to require employees

and consultants to execute confidentiality agreements and invention assignment

agreements upon the commencement of their relationship with us. These agreements

provide that confidential information developed or made known during the course

of a relationship with us must be kept confidential and not disclosed to third

parties except in specific circumstances and for the assignment to us of

intellectual property rights developed within the scope of the employment

relationship.

10

Properties

Our

principal executive office is located at 27 Fletcher Avenue, Sarasota, Florida

34237. Our telephone number is (941) 312-0330. We are currently leasing generic

office space on a month-to-month basis for $3,500 per month. This space is

utilized for office purposes and it is our belief that the space is

adequate for our immediate needs. Additional space may be required as we expand

our business activities. We do not foresee any significant difficulties in

obtaining any required additional facilities.

Employees/Consultants

As of

February 22, 2010, we have 2 consultants that work with us on a full-time basis

and an additional 5 consultants that work with us on a part-time basis. We

frequently use consultants to assist in the completion of various projects. Our

consultants are instrumental to keep the development of projects on time and on

budget.

Where

You Can Get Additional Information

We file

annual, quarterly and current reports, proxy statements and other information

with the SEC. You may read and copy our reports or other filings made with the

SEC at the SEC’s Public Reference Room, located at 100 F Street, N.W.,

Washington, DC 20549. You can obtain information on the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these

reports and other filings electronically on the SEC’s web site, www.sec.gov.

ITEM

1A. RISK

FACTORS

Prices of

commodities we own are volatile, which may adversely affect our operating

results and financial condition.

Although

we will seek to turn over our inventory of raw or processed scrap metals as

rapidly as possible, we will be exposed to commodity price risk during the

period that we have title to products that are held in inventory for processing

and/or resale. Prices of commodities, including scrap metals, have been

extremely volatile and have declined significantly during the current global

economic crisis and we expect this volatility to continue. Such volatility can

be due to numerous factors beyond our control, including:

|

•

|

general

domestic and global economic conditions, including metal market

conditions;

|

|

|

•

|

competition;

|

|

|

•

|

the

financial condition of our major suppliers and

consumers;

|

|

|

•

|

the

availability of imported finished metal products;

|

|

|

•

|

international

demand for U.S. scrap;

|

|

|

•

|

the

availability and relative pricing of scrap metal

substitutes;

|

|

|

•

|

import

duties and tariffs;

|

|

|

•

|

currency

exchange rates; and

|

|

|

•

|

domestic

and international labor costs.

|

The

volatile nature of metal commodity prices makes it difficult for us to predict

future revenue trends as shifting international and domestic demand can

significantly impact the prices of our products, supply and demand for our

products and effect anticipated future results. Most consumers purchase

processed non-ferrous scrap according to a negotiated spot sales contract that

establishes the price and quantity purchased for the month. In addition, the

volatility of commodity prices, and the resulting unpredictability of revenues

and costs, can adversely and materially affect our operating margins and other

results of operations.

11

The

profitability of our scrap recycling operations will depend, in part, on the

availability of an adequate source of supply.

We will

depend on scrap for our operations and will acquire our scrap inventory from

numerous sources. These suppliers generally are not bound by long-term contracts

and have no obligation to sell scrap metals to us. In periods of low industry

prices, suppliers may elect to hold scrap waiting for higher prices. In

addition, the slowdown in industrial production and consumer consumption in the

U.S. during the current economic crisis has reduced and is expected to

continue to reduce the supply of scrap metal available to us. If an adequate

supply of scrap metal is not available to us, we would be unable to recycle

metals at desired volumes and our results of operations and financial condition

would be materially and adversely affected.

The cyclicality

of our industry could negatively affect our sales volume and

revenues.

The

operating results of the scrap metals recycling industry in general are highly

cyclical in nature. The industry tends to reflect, and be amplified by, general

economic conditions, both domestically and internationally. Historically, in

periods of national recession or periods of slowing economic growth, the

operating results of scrap metals recycling companies have been materially and

adversely affected. For example, during recessions or periods of slowing

economic growth, the automobile and the construction industries typically

experience major cutbacks in production, resulting in decreased demand for

steel, copper and aluminum. As a result of the current economic crisis in the

United States and throughout the world and major cutbacks in the automotive and

construction industries, if we experience significant fluctuations in supply,

demand and pricing for our products, this would materially and adversely

affected our results of operations and financial condition.

The volatility of

the import and export markets may adversely affect our future operating results

and financial condition.

Our

business may be adversely affected by increases in steel imports into the United

States which will generally have an adverse impact on domestic steel production

and a corresponding adverse impact on the demand for scrap metals domestically.

Our future operating results could also be negatively affected by strengthening

or weakening in the US dollar. US dollar weakness provides some support to

prices of commodities that are denominated in US dollars but with large non-US

consumption and cost bases. For example, appreciation in the Chinese and Indian

currencies have increased marginal costs of aluminum and iron ore production,

thereby increasing the underlying cost basis for prices. Export markets,

including Asia and in particular China, are important to the scrap metal

recycling industry. Weakness in economic conditions in Asia and in particular

slowing growth in China, could negatively affect us further.

We

may seek to make acquisitions that prove unsuccessful or strain or divert our

resources.

We will

continuously evaluate potential acquisition candidates. We may not be able to

complete any acquisitions on favorable terms or at all. Acquisitions present

risks that could materially and adversely affect our business and financial

performance, including:

|

·

|

the

diversion of our management’s attention from our everyday business

activities;

|

|

·

|

the

contingent and latent risks associated with the past operations of, and

other unanticipated problems arising in, the acquired business, including

managing such acquired businesses either through our senior management

team or the management of such acquired

business; and

|

|

·

|

the

need to expand management, administration, and operational

systems.

|

12

If we make such acquisitions we

cannot predict whether:

|

·

|

we

will be able to successfully integrate the operations and personnel of any

new businesses into our business;

|

|

·

|

we

will realize any anticipated benefits of completed

acquisitions; or

|

|

·

|

there

will be substantial unanticipated costs associated with acquisitions,

including potential costs associated with environmental liabilities

undiscovered at the time of

acquisition.

|

In addition, future acquisitions by us

may result in:

|

·

|

potentially

dilutive issuances of our equity

securities;

|

|

·

|

the

incurrence of additional debt;

|

|

·

|

restructuring

charges.

|

The markets in

which we intend to operate are highly competitive. Competitive pressures from

existing and new companies could have a material adverse effect on our financial

condition and results of operations.

The

markets for scrap metal are highly competitive, both in the purchase of raw

scrap and the sale of processed scrap. We will compete to purchase raw scrap

with numerous independent recyclers, large public scrap processors and smaller

scrap companies. Successful procurement of materials is determined primarily by

the price and promptness of payment for the raw scrap and the proximity of the

processing facility to the source of the unprocessed scrap. We may face

competition for purchases of unprocessed scrap from producers of steel products,

such as integrated steel mills and mini-mills, which have vertically integrated

their operations by entering the scrap metal recycling business. Many of these

producers have substantially greater financial, marketing and other resources.

If we are unable to compete with these other companies in procuring raw scrap,

our operating costs could increase.

We intend

to compete in the global market with regard to the sale of processed scrap.

Competition for sales of processed scrap is based primarily on the price,

quantity and quality of the scrap metals, as well as the level of service

provided in terms of consistency of quality, reliability and timing of delivery.

To the extent that one or more of our competitors becomes more successful with

respect to any key factor, our ability to attract and retain consumers could be

materially and adversely affected. Our scrap metal processing operations will

also face competition from substitutes for prepared ferrous scrap, such as

pre-reduced iron pellets, hot briquetted iron, pig iron, iron carbide and other

forms of processed iron. The availability of substitutes for ferrous scrap could

result in a decreased demand for processed ferrous scrap, which could result in

lower prices for such products.

Unanticipated

disruptions in our operations could materially and adversely affect our revenues

and our relationship with our consumers.

Our

ability to process and fulfill orders and manage inventory depends on the

efficient and uninterrupted operation of our facilities. In addition, our

products will be transported to consumers by third-party truck, rail carriers

and cargo ships. As a result, we will rely on the timely and uninterrupted

performance of third party shipping companies and dock workers. Any interruption

in our operations or interruption or delay in transportation services could

cause orders to be canceled, lost or delivered late, goods to be returned or

receipt of goods to be refused or result in higher transportation costs. As a

result, our relationships with our consumers and our revenues and results of

operations and financial condition could be materially and adversely

affected.

The loss of any

member of our senior management team or a significant number of our managers

could have a material adverse effect on our ability to manage our

business.

Our

operations depend heavily on the skills and efforts of our senior management

team, including Dana J. Pekas, our President and Chief Executive Officer. We

will rely substantially on the experience of the management of our subsidiaries

with regard to day-to-day operations. We face intense competition for qualified

personnel, and many of our competitors have greater resources than we have to

hire qualified personnel. The loss of any member of our senior management team

or a significant number of managers could have a material adverse effect on our

ability to manage our business.

13

A significant

increase in the use of scrap metal alternatives by current consumers of

processed scrap metals could reduce demand for our products.

During

periods of high demand for scrap metals, tightness can develop in the supply and

demand balance for ferrous scrap. The relative scarcity of ferrous scrap,

particularly the “cleaner” grades, and its high price during such periods have

created opportunities for producers of alternatives to scrap metals, such as pig

iron and direct reduced iron pellets, to offer their products to our consumers.

Although these alternatives have not been a major factor in the industry to

date, the use of alternatives to scrap metals may proliferate in the future if

the prices for scrap metals rise or if the levels of available unprepared

ferrous scrap decrease. As a result, we may be subject to increased competition

which could adversely affect our revenues and materially and adversely affect

our operating results and financial condition.

Our

operations are subject to stringent regulations, particularly under applicable

environmental laws, which could subject us to increased costs.

The

nature of our business and previous operations by others at facilities owned or

operated by us make us subject to significant government regulation, including

stringent environmental laws and regulations. Among other things, these laws and

regulations impose comprehensive statutory and regulatory requirements

concerning, among other matters, the treatment, acceptance, identification,

storage, handling, transportation and disposal of industrial by-products,

hazardous and solid waste materials, waste water, storm water effluent, air

emissions, soil contamination, surface and ground water pollution, employee

health and safety, operating permit standards, monitoring and spill containment

requirements, zoning, and land use, among others. Various laws and regulations

set prohibitions or limits on the release of contaminants into the environment.

Such laws and regulations also require permits to be obtained and manifests to

be completed and delivered in connection with the operations of our businesses,

and in connection with any shipment of prescribed materials so that the movement

and disposal of such material can be traced and the persons responsible for any

mishandling of such material can be identified. This regulatory framework

imposes significant actual, day-to-day compliance burdens, costs and risks on

us. Violation of such laws and regulations may and do give rise to significant

liability, including fines, damages, fees and expenses, and closure of a site.

Generally, the governmental authorities are empowered to act to clean up and

remediate releases and environmental damage and to charge the costs of such

cleanup to one or more of the owners of the property, the person responsible for

the release, the generator of the contaminant and certain other parties or to

direct the responsible party to take such action. These authorities may also

impose a penalty or other liens to secure the parties’ reimbursement

obligations.

Environmental

legislation and regulations have changed rapidly in recent years, and it is

possible that we will be subject to even more stringent environmental standards

in the future. For these reasons, future capital expenditures for environmental

control facilities cannot be predicted with accuracy; however, if environmental

control standards become more stringent, our compliance expenditures could

increase substantially. The location of some of any acquired facility in an

urban area may increase the risk of scrutiny and claims. We cannot predict

whether any such future inquiries or claims will in fact arise or the outcome of

such matters.

Moreover,

environmental legislation has been enacted, and may in the future be enacted, to

create liability for past actions that were lawful at the time taken but that

have been found to affect the environment and to create public rights of action

for environmental conditions and activities. If damage to persons or the

environment has been caused, or is in the future caused, by hazardous materials

activities of us or our predecessors, we may be fined and held liable for such

damage. In addition, we may be required to remedy such conditions and/or change

procedures. Thus, liabilities, expenditures, fines and penalties associated with

environmental laws and regulations might be imposed on us in the future, and

such liabilities, expenditures, fines or penalties might have a material adverse

effect on our results of operations and financial condition.

We are

subject to potential liability and may also be required from time to time to

clean up or take certain remedial action with regard to sites currently or

formerly used in connection with our operations. Furthermore, we may be required

to pay for all or a portion of the costs to clean up or remediate sites we never

owned or on which we never operated if we are found to have arranged for

transportation, treatment or disposal of pollutants or hazardous or toxic

substances on or to such sites. We are also subject to potential liability for

environmental damage that our assets or operations may cause nearby landowners,

particularly as a result of any contamination of drinking water sources or soil,

including damage resulting from conditions existing prior to the acquisition of

such assets or operations. Any substantial liability for environmental damage

could materially adversely affect our operating results and financial condition,

and could materially adversely affect the marketability and price of our

stock.

14

Our operations

present significant risk of injury or death. We may be subject to claims that

are not covered by or exceed our insurance.

Because

of the heavy industrial activities conducted at our facilities, there exists a

risk of injury or death to our employees or other visitors, notwithstanding the

safety precautions we take. Our operations are subject to regulation by federal,

state and local agencies responsible for employee health and safety, including

the Occupational Safety and Health Administration (“OSHA”). While we intend to

have in place policies to minimize such risks, we may nevertheless be unable to

avoid material liabilities for any employee death or injury that may occur in

the future. These types of incidents may not be covered by or may exceed our

insurance coverage and may have a material adverse effect on our results of

operations and financial condition.

The Company’s stock price may be

volatile.

The

market price of the Company’s common stock is likely to be highly volatile and

could fluctuate widely in price in response to various factors, many of which

are beyond the Company’s control, including the following:

|

·

|

new

products and services by the Company or its

competitors;

|

|

·

|

additions

or departures of key personnel;

|

|

·

|

the

Company’s ability to execute its business

plan;

|

|

·

|

operating

results that fall below

expectations;

|

|

·

|

loss

of any strategic relationship;

|

|

·

|

industry

developments;

|

|

·

|

economic

and other external factors; and

|

|

·

|

period-to-period

fluctuations in the Company’s financial

results.

|

In

addition, the securities markets have from time to time experienced significant

price and volume fluctuations that are unrelated to the operating performance of

particular companies. These market fluctuations may also materially and

adversely affect the market price of the Company’s common stock.

There is currently no liquid trading

market for the Company’s common stock and the Company cannot ensure that one

will ever develop or be sustained.

The

Company’s common stock is currently approved for quotation on the OTC Bulletin

Board trading under the symbol MOBE.OB. However, there is limited trading

activity and not currently a liquid trading market. There is no assurance

as to when or whether a liquid trading market will develop, and if such a market

does develop, there is no assurance that it will be maintained.

Furthermore, for companies whose securities are quoted on the

Over-The-Counter Bulletin Board maintained by the Financial Industry Regulatory

Authority (the “OTCBB”), it is more difficult (1) to obtain accurate quotations,

(2) to obtain coverage for significant news events because major wire services

generally do not publish press releases about such companies, and (3) to obtain

needed capital. As a result, purchasers of the Company’s common stock may

have difficulty selling their shares in the public market, and the market price

may be subject to significant volatility.

The Company’s common stock is

currently deemed to be “penny stock”, which makes it more difficult for

investors to sell their shares.

The

Company’s common stock is currently subject to the “penny stock” rules adopted

under section 15(g) of the Exchange Act. The penny stock rules apply to

companies whose common stock is not listed on the NASDAQ Stock Market or other

national securities exchange and trades at less than $5.00 per share or that

have tangible net worth of less than $5,000,000 ($2,000,000 if the company has

been operating for three or more years). These rules require, among other

things, that brokers who trade penny stock to persons other than “established

customers” complete certain documentation, make suitability inquiries of

investors and provide investors with certain information concerning trading in

the security, including a risk disclosure document and quote information under

certain circumstances. Many brokers have decided not to trade penny stocks

because of the requirements of the penny stock rules and, as a result, the

number of broker-dealers willing to act as market makers in such securities is

limited. If the Company remains subject to the penny stock rules for any

significant period, it could have an adverse effect on the market, if any, for

the Company’s securities. If the Company’s securities are subject to the penny

stock rules, investors will find it more difficult to dispose of the Company’s

securities.

15

ITEM

1B. Unresolved

Staff Comments

None.

ITEM

2. Management's

Discussion And Analysis Of Plan Of Operations

Management's

Discussion and Analysis of Financial Condition and Result of

Operations

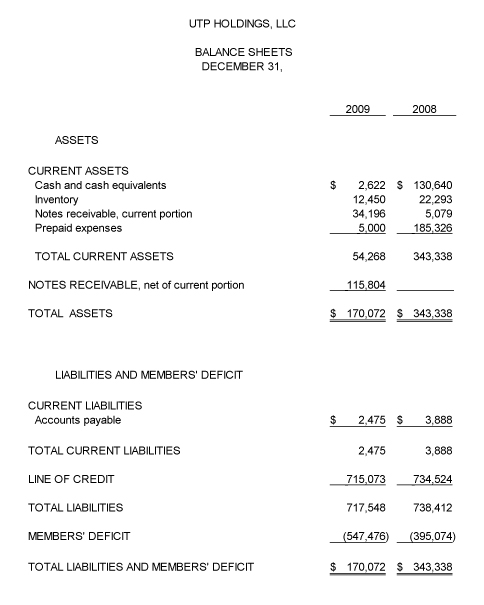

Our

business is highly dependent upon the price of metal commodities, as our

remuneration for these activities is calculated as a percentage of the value of

the commodities traded. When the global economic decline caused the

price of steel to fall 80% in late 2008, our revenues for the ensuing year,

2009, also fell dramatically. Accordingly, our net sales decreased by

2/3 between 2008 and 2009 going from $5,132,722 to $1,617,090 during that

period.

Although

our business plan is to acquire operating facilities, in the past, our

activities have been limited to trading metals. Accordingly, our

assets have been limited to inventories of metal and the cash to buy it with, as

well as notes receivable and some prepaid expenses. Our assets

declined significantly with the decline in the value of the steel we were

holding and with the decline in the amounts of cash generated by the

transactions in which we engaged. As a result, total assets in 2009

(again, mostly cash) were approximately half of the total assets in 2008,

declining from $343,338 to $170,072.

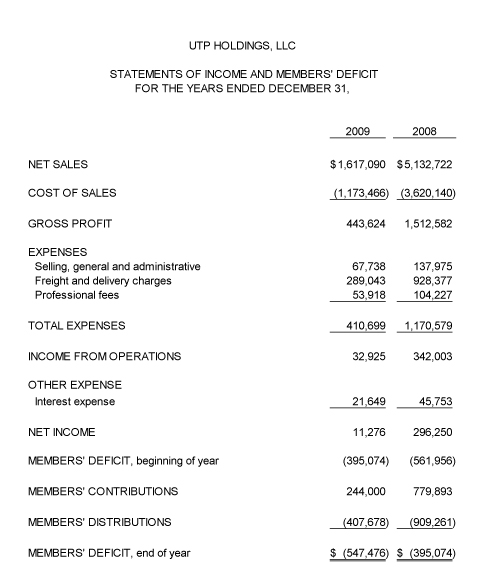

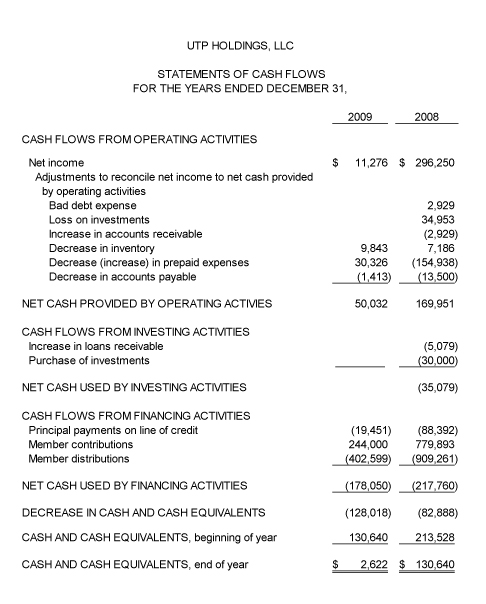

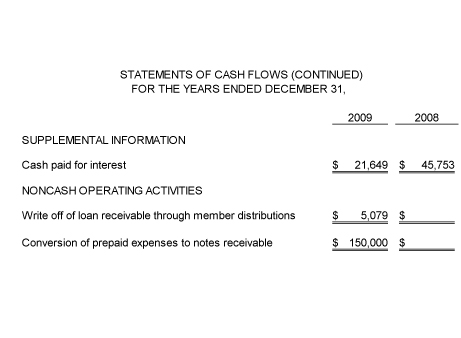

Result

of Operations

In 2008,

our operations generated $5,132,722 in net sales and $1,512,582 gross profit.

Due to the global economic decline and the ensuing decrease in the price of

metals, those figures declined approximately 70% in 2009, net sales dropping to

$1,617,090 and gross profits decreasing to $443,624. Fixed expenses,

such as selling, administrative expenses, professional fees and interest

expense, which do not vary directly with the level of sales, declined by only

about 50% each, thus causing net income to decline by a much larger percentage

than net sales, going from $296,250 in 2008 to $11,276 in 2009.

Liquidity

and Capital Resources

As stated

above, although our business plan calls for us to acquire operating facilities

and the plant and equipment with which to conduct those operations, until now,

the major activity has been trading metals and the primary production tool of

our business has been cash, which is used to buy metals which are then

resold. Because the global economic decline caused an 80% decrease in

the price of metals and because our revenue is a percentage of the value of

metals traded, it took almost the same amount of cash from internal and external

financing activities to achieve the much smaller net sales and gross profit from

those trading activities for 2009. Net cash used by financing

activities declined by only 18% between 2008 and 2009, going from $217,760 to

$178,050 while the net sales and gross profit generated by the use of those sums

of cash declined by 68-70% during those same years. Net cash provided

by operating activities declined by the same approximate percentage as gross and

net revenues, going from $169,951 in 2008 to $50,032 in 2009, a decline of

approximately 70%.

Plan

of Operation and Funding

Existing

working capital, cash flow from operations, further advances from the bank, as

well as debt instruments or stock subscriptions are expected to be adequate to

fund our operations over the next twelve months.

In

connection with our business plan, management anticipates that administrative

expenses will increase over the next twelve months. Additional issuances of

equity or convertible debt securities may be required which will result in

dilution to our current shareholders. Furthermore, such securities might have

rights, preferences or privileges senior to our common stock. Additional

financing may not be available upon acceptable terms, or at all. If adequate

funds are not available or are not available on acceptable terms, we may not be

able to take advantage of prospective new business opportunities, which could

significantly and materially restrict our business operations.

16

Material

Commitments

We do not

have any material commitments for the fiscal years ended January 31, 2010 and

2009.

Off

Balance Sheet Arrangements

We do not

have any off-balance sheet arrangements that have or are reasonably likely to

have a current or future effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources that are material to investors.

Going

Concern

The

independent auditors' report accompanying our January 31, 2010 and January 31,

2009 financial statements, prepared before and without consideration of the

effect of the acquisition of the assets of UTP Holdings, LLC, contains an

explanatory paragraph expressing substantial doubt about our ability to continue

as a going concern. The financial statements have been prepared "assuming that

we will continue as a going concern," which contemplates that we will realize

our assets and satisfy our liabilities and commitments in the ordinary course of

business.

Recent

Accounting Pronouncements

Effective

June 30, 2009, the FASB issued a new accounting standard related to the

disclosure requirements of the fair value of the financial instruments. This

standard expands the disclosure requirements of fair value (including the

methods and significant assumptions used to estimate fair value) of certain

financial instruments to interim period financial statements that were

previously only required to be disclosed in financial statements for annual

periods.

In August

2009, the FASB issued an amendment to the accounting standards related to the

measurement of liabilities that are recognized or disclosed at fair value on a

recurring basis. This standard clarifies how a company should measure the fair

value of liabilities and that restrictions preventing the transfer of a

liability should not be considered as a factor in the measurement of liabilities

within the scope of this standard. The Company does not expect the impact of

this amendment to be material to its financial statements.

On

September 30, 2009, the FASB issued changes to the authoritative hierarchy of

GAAP. These changes establish the FASB Accounting Standards

Codification (Codification) as the source of authoritative accounting principles

recognized by the FASB to be applied by nongovernmental entities in the

preparation of financial statements in conformity with GAAP. Rules

and interpretive releases of the Securities and Exchange Commission (SEC) under

authority of federal securities laws are also sources of authoritative GAAP for

SEC registrants. The FASB will no longer issue new standards in the

form of Statements, FASB Staff Positions, or Emerging Issues Task Force

Abstracts; instead the FASB will issue Accounting Standards

Updates. Accounting Standards Updates will not be authoritative in

their own right as they will only serve to update the

Codification. These changes and the Codification itself do not change

GAAP. Other than the manner in which new accounting guidance is

referenced, the adoption of these changes had no impact on the Financial

Statements.

In

October 2009, the FASB issued an amendment to the accounting standards related

to the accounting for revenue in arrangements with multiple deliverables

including how the arrangement consideration is allocated among delivered and

undelivered items of the arrangement. Among the amendments, this standard

eliminated the use of the residual method for allocating arrangement

considerations and requires an entity to allocate the overall consideration to

each deliverable based on an estimated selling price of each individual

deliverable in the arrangement in the absence of having vendor-specific

objective evidence or other third party evidence of fair value of the

undelivered items. This standard also provides further guidance on how to

determine a separate unit of accounting in a multiple-deliverable revenue

arrangement and expands the disclosure requirements about the judgments made in

applying the estimated selling price method and how those judgments affect the

timing or amount of revenue recognition. This standard, for which the Company is

currently assessing the impact, will become effective for the Company on January

1, 2011.

17

In

October 2009, the FASB issued an amendment to the accounting standards related

to certain revenue arrangements that include software elements. This standard

clarifies the existing accounting guidance such that tangible products that

contain both software and non-software components that function together to

deliver the product’s essential functionality, shall be excluded from the scope

of the software revenue recognition accounting standards. Accordingly, sales of

these products may fall within the scope of other revenue recognition standards

or may now be within the scope of this standard and may require an allocation of

the arrangement consideration for each element of the arrangement. This

standard, for which the Company is currently assessing the impact, will become

effective for the Company on January 1, 2011.

ITEM

2A. QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Market

risk represents the risk of loss that may impact our financial position, results

of operations or cash flows due to adverse changes in foreign currency and

interest rates.

ITEM

3. PROPERTIES

Our

principal executive office is located at 27 Fletcher Avenue, Sarasota, Florida

34237. Our telephone number is (941) 312-0330. We are currently leasing generic

office space on a month-to-month basis for $3,500 per month. This space is

utilized for office purposes and it is our belief that the space is adequate for

our immediate needs. Additional space may be required as we expand our business

activities. We do not foresee any significant difficulties in obtaining any

required additional facilities.

ITEM

5. DIRECTORS

AND EXECUTIVE OFFICERS

Each

director serves until our next annual meeting of the stockholders or unless they

resign earlier. The Board of Directors elects officers and their terms of office

are at the discretion of the Board of Directors.

Each of

our directors serves until his or her successor is elected and qualified. Each

of our officers is elected by the board of directors to a term of one (1) year

and serves until his or her successor is duly elected and qualified, or until he

or she is removed from office. At the present time, members of the board of

directors are not compensated for their services to the board.

Compliance with Section 16(a) of the

Securities Exchange Act of 1934

Section

16(a) of the Securities Exchange Act of 1934 requires our executive officers and

directors, and persons who beneficially own more than 10% of our equity

securities, to file reports of ownership and changes in ownership with the

Securities and Exchange Commission. Officers, directors and greater than 10%

shareholders are required by SEC regulation to furnish the Company with copies

of all Section 16(a) forms they file. We believe that during the fiscal

year ended January 31, 2010 all such filing requirements applicable to our

officers and directors have been met.

Audit

Committee

The

Company intends to establish an audit committee of the board of directors. The

audit committee’s duties would be to recommend to the Company’s board of

directors the engagement of an independent registered public accounting firm to

audit the Company’s financial statements and to review the Company’s accounting

and auditing principles. The audit committee would review the scope, timing and

fees for the annual audit and the results of audit examinations performed by the

internal auditors and independent registered public accounting firm, including

their recommendations to improve the system of accounting and internal controls.

The audit committee would at all times be composed exclusively of directors who

are, in the opinion of the Company’s board of directors, free from any

relationship which would interfere with the exercise of independent judgment as

a committee member and who possess an understanding of financial statements and

generally accepted accounting principles.

18

Compensation

Committee

The

Company intends to establish a compensation committee of the Board of Directors.

The compensation committee would review and approve the Company’s salary and

benefits policies, including compensation of executive officers.

Code

of Ethics

We

adopted a code of ethics. This policy will serve as guidelines in helping

employee to conduct our business in accordance with our values. Compliance

requires meeting the spirit, as well as the literal meaning, of the law, the

policies and the Values. It is expected that employee will use common sense,

good judgment, high ethical standards and integrity in all their business

dealings.

ITEM

6. EXECUTIVE

COMPENSATION

Compensation

of Officers

A summary

of cash and other compensation paid in accordance with management consulting

contracts for our Principal Executive Officer and other executives for the most

recent three years is as follows:

|

Name

and Principal

Position

|

Year

|

Salary

|

Bonus

Awards

|

Stock

Awards

|

Other

Incentive

Compensation

|

Non-Equity

Plan

Compensation

|

Nonqualified

Deferred

Earnings

|

All

Other

Compensation

|

Total

|

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

||

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

(j)

|

|

Dana

J, Pekas

CEO,

President and Director

|

2009

2008

2007

|

0

0

0

|

0

0

0

|

0

0

0

|

0

0

0

|

0

0