Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2009 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 0-19946

Lincare Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 51-0331330 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 19387 US 19 North Clearwater, Florida | 33764 | |

| (Address of principal executive office) | (Zip Code) | |

Registrant’s telephone number, including area code:

(727) 530-7700

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.01 par value | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). (Registrant is not subject to the requirements of Rule 405 of Regulation S-T at this time) Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No x

The aggregate market value of the registrant’s common stock, $.01 par value, held by non-affiliates of the registrant, based on a $23.52 closing sale price of the common stock on June 30, 2009, as reported on the NASDAQ Global Market, was approximately $1,578,716,755.

As of January 29, 2010, there were 65,714,249 outstanding shares of the registrant’s common stock, par value $.01, which is the only class of capital stock of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information called for by Part III of this Form 10-K is incorporated by reference to the definitive Proxy Statement for the 2010 Annual Meeting of Stockholders of Lincare Holdings Inc., which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2009.

Table of Contents

LINCARE HOLDINGS INC. AND SUBSIDIARIES

FORM 10-K

For The Year Ended December 31, 2009

INDEX

Table of Contents

General

Lincare Holdings Inc., together with its subsidiaries (“Lincare,” the “Company,” “we” or “our”), is one of the nation’s largest providers of oxygen and other respiratory therapy services to patients in the home. Our customers typically suffer from chronic obstructive pulmonary disease (“COPD”), such as emphysema, chronic bronchitis or asthma, and require supplemental oxygen or other respiratory therapy services in order to alleviate the symptoms and discomfort of respiratory dysfunction. Lincare currently serves approximately 750,000 customers in 48 states through 1,056 operating centers. Lincare Holdings Inc. was incorporated in Delaware in 1990. Our principal executive offices are located at 19387 US 19 North, Clearwater, Florida 33764, and our telephone number is (727)530-7700.

The Home Respiratory Market

We estimate that the home respiratory market (including home oxygen equipment and respiratory therapy services) represents approximately $6.0 billion in annual sales. Growth in the home respiratory market is driven by increases in the number of persons afflicted with COPD, demographic factors that contribute to an increase in the proportion of the U.S. population over the age of 65 years, and the continued trend toward treatment of patients in the home as a lower cost alternative to the acute care setting.

Business Strategy

Our strategy is to increase our market share through internal growth and strategic business acquisitions. Lincare achieves internal growth in existing geographic markets through the addition of new customers and referral sources to our network of local operating centers. In addition, we expand into new geographic markets on a selective basis, either through acquisitions or by opening new operating centers, when we believe such expansion will enhance our business. In 2009, Lincare acquired two local and regional companies with operations in multiple states.

Revenue growth is dependent upon the overall growth rate of the home respiratory market and on our ability to increase market share through effective delivery of high quality equipment and services and selective business acquisitions. Continued cost containment efforts by government and private insurance reimbursement programs have created an increasingly competitive environment, accelerating consolidation trends within the home health care industry.

We will continue our focus on providing oxygen and other respiratory therapy services to patients in the home and to provide home medical equipment and other services where we believe such services will enhance our primary business. In 2009, oxygen and other respiratory therapy services accounted for approximately 90% of Lincare’s net revenues.

Products and Services

Lincare primarily provides oxygen and other respiratory therapy services to patients in the home. We also provide a variety of durable medical equipment (“DME”) and home infusion therapies in certain geographic markets. When a physician, hospital discharge planner, or other source refers a patient to one of our operating centers, our customer representative obtains the necessary medical and insurance coverage information and assignment of benefits to Lincare, and coordinates the delivery of patient care. The prescribed therapy is delivered by one of our service representatives or clinicians at the customer’s home, where instruction and training are provided to the customer and the customer’s family regarding appropriate equipment use and maintenance and compliance with the prescribed therapy. Following the initial setup, our service representatives and/or clinicians make periodic visits to the customer’s home, the frequency of which is dictated by the type of

1

Table of Contents

therapy prescribed and physician orders. All services and equipment provided by Lincare are coordinated with the prescribing physician. During the period that we provide services and equipment for a customer, the customer remains under the physician’s care and medical supervision. We employ respiratory therapists, nurses and other qualified clinicians to perform certain training and other functions in connection with our services. Clinicians are licensed where required by applicable law.

The principal products and services provided by Lincare are:

Home Oxygen Equipment. The major types of oxygen delivery equipment are oxygen concentrators and liquid oxygen systems. Each method of delivery has different characteristics that make it more or less suitable to specific customer applications.

| • | Oxygen concentrators are stationary units that provide a continuous flow of oxygen by filtering ordinary room air. Customers most commonly use concentrators as their primary source of stationary oxygen. These systems are often supplemented with portable gaseous oxygen cylinders or liquid oxygen systems to meet the ambulatory or emergency needs of the customer. |

| • | Liquid oxygen systems are thermally insulated containers of liquid oxygen, generally consisting of a stationary unit and a portable unit, which are most commonly used by customers with significant ambulatory requirements. |

Other Respiratory Therapy. Other respiratory therapy services offered by Lincare include the following:

| • | Nebulizers and associated respiratory medications provide aerosol therapy for customers suffering from COPD and asthma. |

| • | Continuous positive airway pressure devices maintain open airways in customers suffering from obstructive sleep apnea by providing airflow at prescribed pressures during sleep. |

| • | Non-invasive ventilation provides nocturnal ventilatory support for customers with neuromuscular disease and COPD. This therapy improves daytime function and decreases incidence of acute illness. |

| • | Ventilators support respiratory function in severe cases of respiratory failure where the customer can no longer sustain the mechanics of breathing without the assistance of a machine. |

Home Infusion Therapy. In certain geographic markets, Lincare provides a variety of home infusion therapies, including parenteral nutrition, intravenous antibiotic therapy, enteral nutrition, chemotherapy, dobutamine infusions, immunoglobulin (IVIG) therapy, continuous pain management and central catheter management.

Lincare also supplies home medical equipment, such as hospital beds, wheelchairs and other supplies that may be required by our customers.

Company Operations

Management. We maintain a decentralized approach to management of our local business operations. Decentralization of managerial decision-making enables our operating centers to respond promptly and effectively to local market demands and opportunities. We believe that the personalized nature of customer requirements and referral relationships characteristic of the home health care business mandate that we maintain a localized operating structure.

Each of our operating centers is managed by a center manager who is responsible and accountable for the operating and financial performance of the center. Service and marketing functions are performed at the local operating level, while strategic development, financial control and operating policies are administered at the corporate level. Reporting mechanisms are in place at the operating center level to monitor performance and ensure field accountability.

2

Table of Contents

A team of area managers directly supervises individual operating center managers, serving as an additional mechanism for assessing and improving performance of our operations. Lincare’s operating centers are served by regional billing centers, which control all of our billing and reimbursement functions.

MIS Systems. We believe that our proprietary management information systems are one of our key competitive advantages. The systems provide management with critical information on a timely basis to measure and evaluate performance levels company-wide. Management reviews monthly reports, including revenues and profitability by individual center, accounts receivable and cash collection performance, equipment controls and utilization, customer activity and manpower trends. We have an in-house staff of computer programmers, which enables us to continually enhance our computer systems in order to provide timely financial and operational information and to respond promptly to changes in reimbursement regulations and policies.

Our billing system has both manual and computerized functions and processes that are designed to maintain the integrity of revenue and accounts receivable. Third-party payors, such as Medicare, that can accommodate electronic claims submission are billed electronically on a daily basis from our central computer system. Paper claims and invoices are generated and billed to various state Medicaid agencies, commercial payors and individual customers when electronic billing is unavailable. Electronic billing expedites the billing process and generally allows us to receive payment more quickly. The medical billing process requires the collection of various paper documents from customers and referral sources. Information such as customer demographics, insurance coverage and verification, prescriptions from physicians, delivery receipts, billing authorizations and assignments of benefits to Lincare, is gathered at the local operating centers and forwarded to our regional billing offices for review and manual input into our billing system. Item codes within the system representing specific products supplied to customers are matched against the Healthcare Common Procedure Coding System (“HCPCS”) for verification and accuracy of billing codes. Price tables within the system containing expected allowable payment amounts are maintained and updated by the regional billing offices based on published Medicare and Medicaid fee schedules and bulletins, as well as contracts and supplier notifications from private insurance companies.

Accounts Receivable Management. We derive a substantial majority of our revenue from reimbursement by third-party payors. We accept assignment of insurance benefits from customers and, in most instances, invoice and collect payments directly from Medicare, Medicaid and private insurance carriers, as well as from customers under co-insurance provisions. The following table sets forth, for the periods indicated, the percentage of our revenues derived from different types of payors.

| Year Ended December 31, | |||||||||

| Payors |

2009 | 2008 | 2007 | ||||||

| Medicare and Medicaid programs |

60 | % | 60 | % | 64 | % | |||

| Private insurance |

33 | 33 | 29 | ||||||

| Direct payment |

7 | 7 | 7 | ||||||

| 100 | % | 100 | % | 100 | % | ||||

Third-party reimbursement is a complicated process that involves submission of claims to multiple payors, each having its own specific claim requirements. To operate effectively in this environment, we have designed and implemented a proprietary computer system to decrease the time required for the submission and processing of third-party claims. Our systems are capable of tailoring the submission of claims to the specifications of individual payors. Our in-house information system capabilities also enable reimbursement or regulatory changes to be adjusted quickly. These features serve to decrease the processing time of claims for payment resulting in more rapid collection of accounts receivable.

It is our policy to verify insurance benefits with the responsible third-party payor before or within 48 hours of delivery of products to customers. Medicare beneficiaries provide our service representatives with a Medicare identification card containing the beneficiary’s Health Identification Control Number (“HICN”) at the time of

3

Table of Contents

customer setup and delivery. The existence of an HICN indicates the beneficiary’s eligibility to receive benefits under the Medicare program for covered services. Medicare benefits are verified with the applicable Medicare intermediaries.

Medicare and most other government and commercial payors that provide coverage to Lincare’s customers include a 20 percent co-payment provision in addition to a nominal deductible. Co-payments are generally not collected at the time of service and are invoiced to the customer or applicable secondary payor (supplemental providers of insurance coverage) on a monthly billing cycle as products are provided. A majority of our customers maintain, or are entitled to, secondary or supplemental insurance benefits providing “gap” coverage of this co-payment amount. In the event coverage is denied by the third-party payor, the customer may ultimately be responsible for all services rendered by Lincare.

Sales and Marketing

Favorable trends affecting the U.S. population and home health care have created an environment that has produced increasing demand for the services provided by Lincare. The average age of the American population is increasing and, as a person ages, more health care services are generally required. Further, well-documented changes occurring in the health care industry show a trend toward home care rather than institutional care as a matter of patient preference and cost containment.

Sales activities are generally carried out by our full-time sales representatives located at our local operating centers with assistance from our center managers. In addition to communicating the high quality of our equipment and services, our sales representatives are trained to provide information concerning the benefits of home respiratory care. Sales representatives are often licensed respiratory therapists who are highly knowledgeable in the provision of supplemental oxygen and other respiratory therapies.

Lincare primarily acquires new customers through referrals. Our principal sources of referrals are physicians, hospital discharge planners, prepaid health plans and clinical case managers. Our sales representatives maintain continual contact with these medical professionals.

Lincare’s referral sources recognize our reputation for providing high-quality equipment and service and have historically provided a steady flow of customers. While we view our referral sources as fundamental to our business, no single referral source accounts for more than one percent of our revenues. Lincare has approximately 750,000 active customers, and the loss of any single referral source, customer or group of customers would not materially impact our business.

Lincare has received accreditation from the Community Health Accreditation Program. Accreditation by a national accrediting body represents a marketing benefit to our operating centers and provides for a recognized quality assurance program. Home medical equipment providers are required to be accredited by an authorized accrediting organization in order to participate in Medicare and many private insurance plans.

Acquisitions

In 2009 and 2008, we acquired certain operating assets of two and three companies, respectively, with operations in multiple states. The aggregate purchase prices for these acquisitions were $11.7 million and $29.3 million in 2009 and 2008, respectively.

Quality Control

We are committed to consistently providing high-quality products and services. Our quality control procedures and training programs are designed to promote greater responsiveness and sensitivity to individual customer needs and to assure the highest level of quality and convenience to the customer and the referring physician. Licensed respiratory therapists, registered nurses and other employed clinicians provide professional health care support to our customers and enhance our efforts to provide effective disease management services.

4

Table of Contents

Suppliers

We purchase oxygen and other respiratory equipment from a variety of suppliers. We are not dependent upon any single supplier and believe that our product needs can be met by an adequate number of qualified manufacturers.

Competition

The home respiratory market is a fragmented and highly competitive industry that is served by Lincare, other national providers, and, by our estimates, over 2,000 regional and local providers.

Home respiratory companies compete primarily on the basis of service, not pricing, since uniform reimbursement levels are established by fee schedules promulgated by Medicare and Medicaid or by the individual determinations of private insurance companies. Furthermore, marketing efforts by home respiratory companies are typically directed toward referral sources that generally do not share financial responsibility for the payment of services provided to customers. The relationships between a home respiratory company and its customers and referral sources are highly personal. There is no compelling incentive for either physicians or the patients to alter the relationship, so long as the home respiratory company is providing responsive, professional and high-quality service.

Medicare Reimbursement

As a provider of home oxygen and other respiratory therapy services to the home health care market, we participate in Medicare Part B, the Supplementary Medical Insurance Program, which was established by the Social Security Act of 1965. Providers of home oxygen and other respiratory therapy services have historically been heavily dependent on Medicare reimbursement due to the high proportion of elderly persons suffering from respiratory disease. Durable medical equipment (“DME”), including oxygen equipment, is traditionally reimbursed by Medicare based on fixed fee schedules.

Recent legislation, including the Medicare Improvements for Patients and Providers Act of 2008 (“MIPPA”), the Medicare, Medicaid and SCHIP Extension Act of 2007 (“SCHIP Extension Act”), the Deficit Reduction Act of 2005 (“DRA”) and the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (“MMA”), contain provisions that directly impact reimbursement for the primary respiratory and other DME products provided by Lincare. MIPPA delayed the implementation of a Medicare competitive bidding program for oxygen equipment and certain other DME items that was scheduled to begin on July 1, 2008 and instituted a 9.5% price reduction nationwide for these items as of January 1, 2009. The SCHIP Extension Act reduced Medicare reimbursement amounts for covered Part B drugs, including inhalation drugs that we provide, beginning April 1, 2008. DRA provisions negatively impacted reimbursement for oxygen equipment beginning in 2009 and negatively impacted reimbursement for DME items subject to capped rental payments beginning in 2007. MMA significantly reduced reimbursement for inhalation drug therapies beginning in 2005, reduced payment amounts for five categories of DME, including oxygen, beginning in 2005, froze payment amounts for other covered DME items through 2007, established a competitive acquisition program for DME and implemented quality standards and accreditation requirements for DME suppliers. These legislative provisions, as currently in effect and when fully implemented, have had and will have a material adverse effect on our business, financial condition, operating results and cash flows.

The MIPPA legislation imposed a 9.5% reduction in Medicare payment rates for certain specified product categories, including oxygen, effective January 1, 2009. In addition to the 9.5% reduction, the Centers for Medicare and Medicaid Services (“CMS”), as required by statute, subjected the monthly payment amount for stationary oxygen equipment to additional cuts of 2.3%, thereby reducing the monthly payment rate from $199.28 in 2008 to $175.79 in 2009. We estimate that these price reductions, in aggregate, reduced our net revenues in 2009 by approximately $110.4 million. On November 13, 2009, CMS announced the revised national monthly payment amount for stationary oxygen equipment furnished to Medicare beneficiaries in 2010 of $173.17, a reduction of 1.5%. We estimate that this reduction will negatively impact our revenues in 2010 by approximately $9.0 million.

5

Table of Contents

The SCHIP Extension Act, which became law on December 29, 2007, required CMS to adjust the methodology used to determine Medicare payment amounts for inhalation drugs by using volume-weighted average selling prices (“ASP”) based on actual sales volumes rather than average sales prices. The SCHIP Extension Act also specifically lowered reimbursement for the inhalation drug albuterol. Based on the payment rates published quarterly by CMS for inhalation drugs dispensed in 2009 and 2008, we estimate that our reimbursement for such drugs was reduced by approximately $29.3 million in 2009 and approximately $72.6 million in 2008. We can not determine whether quarterly updates in ASP pricing data will continue to result in ongoing reductions in payment rates for inhalation drugs, or what impact such payment reductions could have on our business in the future.

On February 1, 2006, Congress passed the DRA legislation which changed the reimbursement methodology for oxygen equipment from continuous monthly payment for as long as the equipment is in use by a Medicare beneficiary, which includes payment for oxygen contents, related disposable supplies and accessories and maintenance of equipment, to a capped rental arrangement whereby payment for oxygen equipment may not extend over a period of continuous use of longer than 36 months. Separate payments for oxygen contents continue to be made for the period of medical need beyond the 36th month. Additionally, payment for routine maintenance and service of the oxygen equipment is made following each six-month period after the 36-month rental period ends. The oxygen provisions contained in DRA became effective on January 1, 2006. In the case of beneficiaries receiving oxygen equipment prior to the effective date, the 36-month period of continuous use began on January 1, 2006. Accordingly, the first month in which the new payment methodology impacted our net revenues was January 2009. We estimate that these regulations reduced our net revenues by approximately $135.0 million in 2009.

DRA also changed the reimbursement methodology for items of DME in the capped rental payment category, including but not limited to such items as continuous positive airway pressure (“CPAP”) devices, certain respiratory assist devices, nebulizers, hospital beds and wheelchairs. For such items of DME, payment may not extend over a period of continuous use of longer than 13 months. On the first day that begins after the 13th continuous month during which payment is made for the item, the supplier must transfer title of the item to the beneficiary. Additional payments for maintenance and service of the item are made for parts and labor not covered by a supplier’s or manufacturer’s warranty. The DME capped rental provisions contained in DRA applied to items furnished for which the first rental month occurred on or after January 1, 2006. Accordingly, the first month in which the new payment methodology impacted our net revenues was February 2007.

On December 8, 2003, MMA was signed into law. The MMA legislation directly impacted reimbursement for the primary respiratory and other DME products that we provide. Among other things, MMA:

| (1) | Significantly reduced reimbursement for inhalation drug therapies. Historically, prescription drug coverage under Medicare has been limited to drugs furnished incident to a physician’s services and certain self-administered drugs, including inhalation drug therapies. Prior to MMA, Medicare reimbursement for covered drugs, including the inhalation drugs that we provide, was limited to 95% of the published average wholesale price (“AWP”) for the drug. MMA established new payment limits and procedures for drugs reimbursed under Medicare Part B. Beginning in 2005, inhalation drugs furnished to Medicare beneficiaries are reimbursed at 106% of the volume-weighted average selling price (“ASP”) of the drug, as determined from data provided each quarter by drug manufacturers under a specific formula described in MMA. Implementation of the ASP-based reimbursement formula resulted in dramatic reductions in payment rates for inhalation drugs since 2005. |

| (2) | Established a competitive acquisition program for DME that was expected to commence in 2008, but was subsequently delayed by further legislation. MMA instructs CMS to establish and implement programs under which competitive acquisition areas will be established throughout the United States for contract award purposes for the furnishing of competitively priced items of DME, including oxygen equipment. The program was initially intended to be implemented in phases such that competition under the program would occur in ten of the largest metropolitan statistical areas (“MSAs”) in the first year, 80 of the largest MSAs in the following year, and additional areas thereafter. |

6

Table of Contents

For each competitive acquisition area, CMS is to conduct a competition under which providers will submit bids to supply certain covered items of DME. Successful bidders will be expected to meet certain program quality standards in order to be awarded a contract and only successful bidders can supply the covered items to Medicare beneficiaries in the acquisition area. The applicable contract award prices are expected to be less than would be paid under current Medicare fee schedules and contracts will be re-bid at least every three years. CMS will be required to award contracts to multiple entities submitting bids in each area for an item or service, but will have the authority to limit the number of contractors in a competitive acquisition area to the number needed to meet projected demand. CMS may use competitive bid pricing information to adjust the payment amounts otherwise in effect for an area that is not a competitive acquisition area.

CMS concluded the bidding process for the first round of MSAs in September 2007. On March 20, 2008, CMS completed the bid evaluation process and announced the payment amounts that would have taken effect in the ten competitive bidding areas beginning July 1, 2008. Contracts to provide products within the competitive bid areas were awarded to selected suppliers, including the Company, and took effect on July 1, 2008. On July 15, 2008, Congress enacted the MIPPA legislation which retroactively delayed the implementation of competitive bidding and reduced Medicare prices nationwide by 9.5% beginning in 2009 for the product categories, including oxygen, that were initially included in competitive bidding. As a result of the delay, CMS cancelled all contract awards retroactively to June 30, 2008.

On April 18, 2009, the interim final rule (“IFR”) for competitive bidding became effective. The IFR outlined the process for rebidding the first round of competitive bidding in 2009, including tentative timelines and bidding requirements. Bidder registration began August 17, 2009 and contract bidding occurred from October 21, 2009 through December 21, 2009. Reimbursement rates from the bidding process are expected to be announced by CMS in June 2010 and contract suppliers will be announced in September 2010. The reimbursement rates resulting from the bidding process will go into effect in each competitive acquisition area on January 1, 2011. An expanded bidding process to additional geographical areas is currently scheduled to begin in 2011. We will continue to monitor developments regarding the implementation of the competitive bidding program. We can not predict the outcome of the competitive bidding program on our business when fully implemented nor the Medicare payment rates that will be in effect in future years for the items subjected to competitive bidding.

The United States Congress is currently working on legislation as part of the fiscal budget process that could impact the amounts we are paid by Medicare for services provided to Medicare beneficiaries. As of the date of this filing, no such legislation has been finalized nor can we evaluate the impact of such potential changes on our business.

Federal and state budgetary and other cost-containment pressures will continue to impact the home respiratory care industry. We can not predict whether new federal and state budgetary proposals will be adopted or the effect, if any, such proposals would have on our business.

Government Regulation

The federal government and all states in which we currently operate regulate various aspects of our business. In particular, our operating centers are subject to federal laws that regulate the repackaging of drugs (including oxygen) and interstate motor-carrier transportation. Our operations also are subject to state laws governing, among other things, pharmacies, nursing services, distribution of medical equipment and certain types of home health activities. Certain of our employees are subject to state laws and regulations governing the ethics and professional practice of respiratory therapy, pharmacy and nursing.

As a health care supplier, we are subject to extensive government regulation, including numerous laws directed at preventing fraud and abuse and laws regulating reimbursement under various government programs.

7

Table of Contents

The marketing, billing, documenting and other practices of health care companies are all subject to government scrutiny. To ensure compliance with Medicare and other regulations, regional health insurance carriers often conduct audits and request customer records and other documents to support our claims submitted for payment of services rendered to customers. Similarly, government agencies periodically open investigations and obtain information from health care providers pursuant to the legal process. Violations of federal and state regulations can result in severe criminal, civil and administrative penalties and sanctions, including disqualification from Medicare and other reimbursement programs, which could have a material adverse effect on our business.

Numerous federal and state laws and regulations, including the Federal Health Insurance Portability And Accountability Act of 1996 (“HIPAA”) and the Health Information Technology For Economic And Clinical Health Act (“HITECH Act”), govern the collection, dissemination, security, use and confidentiality of patient-identifiable health information. As part of our provision of, and billing for, health care equipment and services, we are required to collect and maintain patient-identifiable health information. New health information standards, whether implemented pursuant to HIPAA, the HITECH Act, congressional action or otherwise, could have a significant effect on the manner in which we handle health care related data and communicate with payors, and the cost of complying with these standards could be significant. If we do not comply with existing or new laws and regulations related to patient health information, we could be subject to criminal or civil sanctions.

Health care is an area of rapid regulatory change. Changes in the laws and regulations and new interpretations of existing laws and regulations may affect permissible activities, the relative costs associated with doing business, and reimbursement amounts paid by federal, state and other third-party payors. We can not predict the future of federal, state and local regulation or legislation, including Medicare and Medicaid statutes and regulations, or possible changes in national health care policies. Future legislative and regulatory changes could have a material adverse effect on our business.

Employees

As of December 31, 2009, we had 9,867 employees. None of our employees are covered by collective bargaining agreements. We believe that the relations between our management and employees are good.

Environmental Matters

We believe that we are currently in compliance, in all material respects, with applicable federal, state and local statutes and ordinances regulating the discharge of hazardous materials into the environment. We do not believe we will be required to expend any material amounts in order to remain in compliance with these laws and regulations or that such compliance will materially affect our capital expenditures, earnings or competitive position.

Available Information

We maintain an Internet website at http://www.lincare.com. Information contained therein is not incorporated by reference into this annual report, and information contained in the website should not be considered part of this annual report. We make available free of charge through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make these reports available on our website as soon as reasonably practicable after such reports are filed with, or furnished to, the Securities and Exchange Commission (the “SEC”).

Materials filed by us with the SEC are also available to the public to read and copy at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We are an electronic filer with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us, at http://www.sec.gov.

8

Table of Contents

Forward-Looking Statements

Statements in this annual report concerning future results, performance or expectations are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All forward-looking statements included in this document are based upon information available to Lincare as of the date hereof and Lincare assumes no obligation to update any such forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause Lincare’s actual results, levels of activity, performance or achievements to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statements. In some cases, forward-looking statements that involve risks and uncertainties contain terminology such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or variations of these terms or other comparable terminology.

Key factors that have an impact on Lincare’s ability to attain these estimates include potential reductions in reimbursement rates by government and third-party payors, changes in reimbursement policies, the demand for Lincare’s products and services, the availability of appropriate acquisition candidates and Lincare’s ability to successfully complete and integrate acquisitions, efficient operations of Lincare’s existing and future operating facilities, regulation and/or regulatory action affecting Lincare or its business, economic and competitive conditions, access to borrowed and/or equity capital on favorable terms and other risks described below.

In developing our forward-looking statements, we have made certain assumptions relating to reimbursement rates and policies, internal growth and acquisitions and the outcome of various legal and regulatory proceedings. If the assumptions we use differ materially from what actually occurs, then actual results could vary significantly from the performance projected in the forward-looking statements. We are under no duty to update any of the forward-looking statements after the date of this report.

Certain Risk Factors Relating to the Company’s Business

We operate in a rapidly changing environment that involves a number of risks. The following discussion highlights some of these risks and others are discussed elsewhere in this report. These and other risks could materially and adversely affect our business, financial condition, operating results and cash flows.

A MAJORITY OF OUR CUSTOMERS HAVE PRIMARY HEALTH COVERAGE UNDER MEDICARE PART B, AND RECENTLY ENACTED AND FUTURE CHANGES IN THE REIMBURSEMENT RATES OR PAYMENT METHODOLOGIES UNDER THE MEDICARE PROGRAM COULD MATERIALLY AND ADVERSELY AFFECT OUR BUSINESS.

As a provider of home oxygen and other respiratory therapy services for the home health care market, we have historically depended heavily on Medicare reimbursement as a result of the high proportion of elderly persons suffering from respiratory disease. Medicare Part B, the Supplementary Medical Insurance Program, provides coverage to eligible beneficiaries for DME, such as oxygen equipment, respiratory assistance devices, continuous positive airway pressure devices, nebulizers and associated inhalation medications, hospital beds and wheelchairs for the home setting. Approximately 65% of our customers have primary coverage under Medicare Part B. There are increasing pressures on Medicare to control health care costs and to reduce or limit reimbursement rates for home medical equipment and services. Medicare reimbursement is subject to statutory and regulatory changes, retroactive rate adjustments, administrative and executive orders and governmental funding restrictions, all of which could materially decrease payments to us for the services and equipment we provide.

Recent legislation, including the Medicare Improvements for Patients and Providers Act of 2008 (“MIPPA”), the Medicare, Medicaid and SCHIP Extension Act of 2007 (“SCHIP Extension Act”), the Deficit

9

Table of Contents

Reduction Act of 2005 (“DRA”) and the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (“MMA”), contain provisions that directly impact reimbursement for the primary respiratory and other DME products provided by Lincare. MIPPA delayed the implementation of a Medicare competitive bidding program for oxygen equipment and certain other DME items that was scheduled to begin on July 1, 2008 and instituted a 9.5% price reduction nationwide for these items as of January 1, 2009. The SCHIP Extension Act reduced Medicare reimbursement amounts for covered Part B drugs, including inhalation drugs that we provide, beginning April 1, 2008. DRA provisions negatively impacted reimbursement for oxygen equipment beginning in 2009 and negatively impacted reimbursement for DME items subject to capped rental payments beginning in 2007. MMA significantly reduced reimbursement for inhalation drug therapies beginning in 2005, reduced payment amounts for five categories of DME, including oxygen, beginning in 2005, froze payment amounts for other covered DME items through 2007, established a competitive acquisition program for DME and implemented quality standards and accreditation requirements for DME suppliers. These legislative provisions, as currently in effect and when fully implemented, have had and will have a material adverse effect on our business, financial condition, operating results and cash flows. See “MEDICARE REIMBURSEMENT” for a full discussion of the MIPPA, SCHIP Extension Act, DRA and MMA provisions.

The United States Congress is currently working on legislation as part of the fiscal budget process that could impact the amounts we are paid by Medicare for services provided to Medicare beneficiaries. As of the date of this filing, no such legislation has been finalized nor can we evaluate the impact of such potential changes on our business.

A SIGNIFICANT PERCENTAGE OF OUR BUSINESS IS DERIVED FROM THE SALE AND RENTAL OF MEDICARE-COVERED OXYGEN AND DME ITEMS, AND RECENT LEGISLATIVE ACTS IMPOSE SUBSTANTIAL CHANGES IN THE MEDICARE PAYMENT METHODOLOGIES AND REDUCTIONS IN THE MEDICARE PAYMENT AMOUNTS FOR THESE ITEMS.

DRA changed the reimbursement methodology for oxygen equipment from continuous monthly payment for as long as the equipment is in use by a Medicare beneficiary, which includes payment for oxygen contents, related disposable supplies and accessories and maintenance of equipment, to a capped rental arrangement whereby payment for oxygen equipment may not extend over a period of continuous use of longer than 36 months. Separate payments for oxygen contents continue to be made for the period of medical need beyond the 36th month. Additionally, payment for routine maintenance and service of the oxygen equipment is made following each six-month period after the 36-month rental period ends. The oxygen provisions contained in DRA became effective on January 1, 2006. In the case of beneficiaries receiving oxygen equipment prior to the effective date, the 36-month period of continuous use began on January 1, 2006. Accordingly, the first month in which the new payment methodology impacted our net revenues was January 2009. We estimate that these regulations reduced our net revenues by approximately $135.0 million in 2009.

DRA also changed the reimbursement methodology for items of DME in the capped rental payment category, including but not limited to such items as continuous positive airway pressure (“CPAP”) devices, certain respiratory assist devices, nebulizers, hospital beds and wheelchairs. For such items of DME, payment may not extend over a period of continuous use of longer than 13 months. On the first day that begins after the 13th continuous month during which payment is made for the item, the supplier must transfer title of the item to the beneficiary. Additional payments for maintenance and service of the item are made for parts and labor not covered by a supplier’s or manufacturer’s warranty. The DME capped rental provisions contained in DRA applied to items furnished for which the first rental month occurred on or after January 1, 2006. Accordingly, the first month in which the new payment methodology impacted our net revenues was February 2007.

On July 15, 2008, Congress enacted the MIPPA legislation which reduced Medicare payment rates nationwide for certain DME items, including oxygen equipment, by 9.5% beginning in 2009. In addition to the 9.5% reduction, CMS subjected the monthly payment amount for stationary oxygen equipment to additional cuts of 2.3%, thereby reducing the monthly payment rate from $199.28 in 2008 to $175.79 in 2009. We estimate that

10

Table of Contents

these price reductions, in aggregate, reduced our net revenues by approximately $110.4 million in 2009. On November 13, 2009, CMS announced the revised national monthly payment amount for stationary oxygen equipment furnished to Medicare beneficiaries in 2010 of $173.17, a reduction of 1.5%. We estimate that this reduction will negatively impact our revenues in 2010 by approximately $9.0 million.

A SIGNIFICANT PERCENTAGE OF OUR BUSINESS IS DERIVED FROM THE SALE OF MEDICARE-COVERED RESPIRATORY MEDICATIONS, AND RECENT LEGISLATION AND MEDICARE POLICY REVISIONS IMPOSED SIGNIFICANT REDUCTIONS IN MEDICARE REIMBURSEMENT FOR SUCH INHALATION DRUGS.

Recently enacted legislation negatively affected Medicare reimbursement amounts for covered Part B drugs, including inhalation drugs that we provide, beginning April 1, 2008 (See “MEDICARE REIMBURSEMENT”). The SCHIP Extension Act required CMS to adjust the average sales price (“ASP”) calculation methodology used to determine Medicare payment amounts for inhalation drugs by using volume-weighted ASPs based on actual sales volume rather than average sales price. The SCHIP Extension Act also specifically lowered reimbursement for the inhalation drug albuterol. Based on the payment rates published quarterly by CMS for inhalation drugs dispensed in 2009 and 2008, we estimate that our reimbursement for such drugs was reduced by approximately $29.3 million in 2009 and by approximately $72.6 million in 2008. We can not determine whether quarterly updates in ASP pricing data will continue to result in ongoing reductions in payment rates for inhalation drugs, or what impact such payment reductions could have on our business in the future.

RECENT REGULATORY CHANGES SUBJECT THE MEDICARE REIMBURSEMENT RATES FOR OUR EQUIPMENT AND SERVICES TO ADDITIONAL REDUCTIONS AND TO POTENTIAL DISCRETIONARY ADJUSTMENT BY CMS, WHICH COULD REDUCE OUR REVENUES, NET INCOME AND CASH FLOWS.

In February 2006, a final rule governing CMS’ Inherent Reasonableness, or IR, authority became effective. The IR rule establishes a process for adjusting fee schedule amounts for Medicare Part B services when existing payment amounts are determined to be either grossly excessive or deficient. The rule describes the factors that CMS or its contractors will consider in making such determinations and the procedures that will be followed in establishing new payment amounts. To date, no payment adjustments have occurred or been proposed as a result of the IR rule.

The effectiveness of the IR rule itself did not trigger payment adjustments for any items or services. Nevertheless, the IR rule puts in place a process that could eventually have a significant impact on Medicare payments for our equipment and services. We can not predict whether or when CMS will exercise its IR authority with respect to payment for our equipment and services, or the effect that such payment adjustments would have on our financial position or operating results.

FUTURE IMPLEMENTATION OF A COMPETITIVE BIDDING PROCESS UNDER MEDICARE COULD REDUCE OUR REVENUES, NET INCOME AND CASH FLOWS.

CMS is required by law to establish and implement programs under which competitive acquisition areas will be established throughout the United States for contract award purposes for the furnishing of competitively priced items of DME, including oxygen equipment (See “MEDICARE REIMBURSEMENT”). The program was initially intended to be implemented in phases such that competition under the program would occur in ten of the largest MSAs in the first year, 80 of the largest MSAs in the following year, and additional areas thereafter.

For each competitive acquisition area, CMS is to conduct a competition under which providers will submit bids to supply certain covered items of DME. Successful bidders will be expected to meet certain program quality standards in order to be awarded a contract and only successful bidders can supply the covered items to Medicare beneficiaries in the acquisition area. The applicable contract award prices are expected to be less than

11

Table of Contents

would be paid under current Medicare fee schedules, and contracts will be re-bid at least every three years. CMS will be required to award contracts to multiple entities submitting bids in each area for an item or service, but will have the authority to limit the number of contractors in a competitive acquisition area to the number needed to meet projected demand. CMS may use competitive bid pricing information to adjust the payment amounts otherwise in effect for an area that is not a competitive acquisition area.

CMS concluded the bidding process for the first round of MSAs in September 2007. On March 20, 2008, CMS completed the bid evaluation process and announced the payment amounts that would have taken effect in the ten competitive bidding areas beginning July 1, 2008. Contracts to provide products within the competitive bid areas were awarded to selected suppliers, including the Company, and took effect on July 1, 2008. On July 15, 2008, Congress enacted the MIPPA legislation which retroactively delayed the implementation of competitive bidding and reduced Medicare prices nationwide by 9.5% beginning in 2009 for the product categories, including oxygen, that were initially included in competitive bidding. As a result of the delay, CMS cancelled all contract awards retroactively to June 30, 2008.

On April 18, 2009, the interim final rule (“IFR”) for competitive bidding became effective. The IFR outlined the process for rebidding the first round of competitive bidding in 2009, including tentative timelines and bidding requirements. Bidder registration began August 17, 2009 and contract bidding occurred from October 21, 2009 through December 21, 2009. Reimbursement rates from the bidding process are expected to be announced by CMS in June 2010 and contract suppliers will be announced in September 2010. The reimbursement rates resulting from the bidding process will go into effect in each competitive acquisition area on January 1, 2011. An expanded bidding process to additional geographical areas is currently scheduled to begin in 2011. We will continue to monitor developments regarding the implementation of the competitive bidding program. We can not predict the outcome of the competitive bidding program on our business when fully implemented nor the Medicare payment rates that will be in effect in future years for the items subjected to competitive bidding.

FUTURE REDUCTIONS IN REIMBURSEMENT RATES UNDER MEDICAID COULD REDUCE OUR REVENUES, NET INCOME AND CASH FLOWS.

Due to budgetary shortfalls, many states are considering, or have enacted, cuts to their Medicaid programs, including funding for our equipment and services. These cuts have included, or may include, elimination or reduction of coverage for some or all of our equipment and services, amounts eligible for payment under co-insurance arrangements, or payment rates for covered items. Approximately 7% of our customers are eligible for primary Medicaid benefits, and State Medicaid programs fund approximately 13% of our payments from primary and secondary insurance benefits. Continued state budgetary pressures could lead to further reductions in funding for the reimbursement for our equipment and services which, in turn, could have a material adverse effect on our financial position and operating results.

FUTURE REDUCTIONS IN REIMBURSEMENT RATES FROM PRIVATE PAYORS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR FINANCIAL CONDITION AND OPERATING RESULTS.

Payors such as private insurance companies and employers are under pressure to increase profitability and reduce costs. In response, certain payors are limiting coverage or reducing reimbursement rates for the equipment and services we provide. Approximately 27% of our customers and approximately 33% of our primary and secondary payments are derived from private payors. Continued financial pressures on these entities could lead to further reimbursement reductions for our equipment and services that could have a material adverse effect on our financial condition and operating results.

12

Table of Contents

WE DEPEND UPON REIMBURSEMENT FROM THIRD-PARTY PAYORS FOR A SIGNIFICANT MAJORITY OF OUR REVENUES, AND IF WE FAIL TO MANAGE THE COMPLEX AND LENGTHY REIMBURSEMENT PROCESS, OUR BUSINESS AND OPERATING RESULTS COULD SUFFER.

We derive a significant majority of our revenues from reimbursement by third-party payors. We accept assignment of insurance benefits from customers and, in most instances, invoice and collect payments directly from Medicare, Medicaid and private insurance carriers, as well as from customers under co-insurance provisions. Approximately 47% of our revenues are derived from Medicare, 33% from private insurance carriers, 13% from Medicaid and the balance directly from individual customers and commercial entities.

Our financial condition and results of operations may be affected by the reimbursement process, which in the health care industry is complex and can involve lengthy delays between the time that services are rendered and the time that the reimbursement amounts are settled. Depending on the payor, we may be required to obtain certain payor-specific documentation from physicians and other health care providers before submitting claims for reimbursement. Certain payors have filing deadlines and they will not pay claims submitted after such time. We can not ensure that we will be able to continue to effectively manage the reimbursement process and collect payments for our equipment and services promptly.

WE ARE SUBJECT TO EXTENSIVE FEDERAL AND STATE REGULATION, AND IF WE FAIL TO COMPLY WITH APPLICABLE REGULATIONS, WE COULD SUFFER SEVERE CRIMINAL OR CIVIL SANCTIONS OR BE REQUIRED TO MAKE SIGNIFICANT CHANGES TO OUR OPERATIONS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR RESULTS OF OPERATIONS.

The federal government and all states in which we currently operate regulate various aspects of our business. In particular, our operating centers are subject to federal laws that regulate the repackaging of drugs (including oxygen) and interstate motor-carrier transportation. Our operations also are subject to state laws governing, among other things, pharmacies, nursing services, distribution of medical equipment and certain types of home health activities. Certain of our employees are subject to state laws and regulations governing the ethics and professional practices of respiratory therapy, pharmacy and nursing.

As a health care supplier, we are subject to extensive government regulation, including numerous laws directed at preventing fraud and abuse and laws regulating reimbursement under various government programs. The marketing, billing, documenting and other practices of health care companies are all subject to government scrutiny. To ensure compliance with Medicare and other regulations, regional health insurance carriers often conduct audits and request customer records and other documents to support our claims submitted for payment of services rendered to customers. Similarly, government agencies periodically open investigations and obtain information from health care providers pursuant to the legal process. Violations of federal and state regulations can result in severe criminal, civil and administrative penalties and sanctions, including disqualification from Medicare and other reimbursement programs, which could have a material adverse effect on our business.

Health care is an area of rapid regulatory change. Changes in the laws and regulations and new interpretations of existing laws and regulations may affect permissible activities, the relative costs associated with doing business, and reimbursement amounts paid by federal, state and other third-party payors. We can not predict the future of federal, state and local regulation or legislation, including Medicare and Medicaid statutes and regulations, or possible changes in national health care policies. Future legislation and regulatory changes could have a material adverse effect on our business.

13

Table of Contents

WE ARE SUBJECT TO A CORPORATE INTEGRITY AGREEMENT WITH THE OFFICE OF INSPECTOR GENERAL, AND IF WE FAIL TO COMPLY WITH THE TERMS OF THE CORPORATE INTEGRITY AGREEMENT, WE COULD SUFFER SEVERE CRIMINAL, CIVIL OR ADMINISTRATIVE SANCTIONS.

We are subject to a five-year corporate integrity agreement with the Office of Inspector General that began in May 2006. Violations of the terms of the corporate integrity agreement could result in severe criminal, civil and administrative penalties and sanctions, including disqualification from Medicare and other reimbursement programs.

COMPLIANCE WITH REGULATIONS UNDER THE FEDERAL HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA), THE HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH ACT (HITECH ACT) AND RELATED RULES, RELATING TO THE TRANSMISSION, SECURITY AND PRIVACY OF HEALTH INFORMATION COULD IMPOSE ADDITIONAL SIGNIFICANT COSTS ON OUR OPERATIONS.

Numerous federal and state laws and regulations, including HIPAA and the HITECH Act, govern the collection, dissemination, security, use and confidentiality of patient-identifiable health information. HIPAA and the HITECH Act require us to comply with standards for the use and disclosure of health information within our company and with third parties. HIPAA and the HITECH Act also include standards for common health care electronic transactions and code sets, such as claims information, plan eligibility, payment information and the use of electronic signatures, and privacy and electronic security of individually identifiable health information. HIPAA requires health care providers, including us, in addition to health plans and clearinghouses, to develop and maintain policies and procedures with respect to protected health information that is used or disclosed. The HITECH Act expands the notification requirement for breaches of patient-identifiable health information, restricts certain disclosures and sales of patient-identifiable health information and provides a tiered system for civil monetary penalties for HIPAA violations.

If we do not comply with existing or new laws and regulations related to patient health information, we could be subject to criminal or civil sanctions. New health information standards, whether implemented pursuant to HIPAA, the HITECH Act, congressional action or otherwise, could have a significant effect on the manner in which we handle health care related data and communicate with payors, and the cost of complying with these standards could be significant.

WE MAY UNDERTAKE ACQUISITIONS THAT COULD SUBJECT US TO UNANTICIPATED LIABILITIES AND THAT COULD FAIL TO ACHIEVE EXPECTED BENEFITS.

Our strategy is to increase our market share through internal growth and strategic acquisitions. Consideration for the acquisitions has generally consisted of cash, unsecured non-interest bearing obligations and the assumption of certain liabilities.

The implementation of an acquisition strategy entails certain risks, including inaccurate assessment of disclosed liabilities, the existence of undisclosed liabilities, regulatory compliance issues associated with the acquired business, entry into markets in which we may have limited or no experience, diversion of management’s attention and human resources from our underlying business, difficulties in integrating the operations of an acquired business or in realizing anticipated efficiencies and cost savings, failure to retain key management or operating personnel of the acquired business, and an increase in indebtedness and a limitation in the ability to access additional capital on favorable terms. The successful integration of an acquired business may be dependent on the size of the acquired business, condition of the customer billing records, and complexity of system conversions and execution of the integration plan by local management. If we do not successfully integrate the acquired business, the acquisition could fail to achieve its expected revenue contribution or there could be delays in the billing and collection of claims for services rendered to customers, which may have a material adverse effect on our financial position and operating results.

14

Table of Contents

WE FACE INTENSE NATIONAL, REGIONAL AND LOCAL COMPETITION AND IF WE ARE UNABLE TO COMPETE SUCCESSFULLY, WE WILL LOSE REVENUES AND OUR BUSINESS WILL SUFFER.

The home respiratory market is a fragmented and highly competitive industry. We compete against other national providers and, by our estimate, more than 2,000 local and regional providers. Home respiratory companies compete primarily on the basis of service rather than price since reimbursement levels are established by Medicare and Medicaid or by the individual determinations of private health plans.

Our ability to compete successfully and to increase our referrals of new customers are highly dependent upon our reputation within each local health care market for providing responsive, professional and high-quality service and achieving strong customer satisfaction. Given the relatively low barriers to entry in the home respiratory market, we expect that the industry will become increasingly competitive in the future. Increased competition in the future could limit our ability to attract and retain key operating personnel and achieve continued growth in our core business.

INCREASES IN OUR COSTS COULD ERODE OUR PROFIT MARGINS AND SUBSTANTIALLY REDUCE OUR NET INCOME AND CASH FLOWS.

Cost containment in the health care industry, fueled, in part, by federal and state government budgetary shortfalls, is likely to result in constant or decreasing reimbursement amounts for our equipment and services. As a result, we must control our operating cost levels, particularly labor and related costs, which account for a significant component of our operating costs and expenditures. We compete with other health care providers to attract and retain qualified or skilled personnel. We also compete with various industries for administrative and service employees. Since reimbursement rates are established by fee schedules mandated by Medicare, Medicaid and private payors, we are not able to offset the effects of general inflation in labor and related cost components, if any, through increases in prices for our equipment and services. Consequently, such cost increases could erode our profit margins and reduce our net income.

Item 1B. Unresolved Staff Comments

None.

Lincare owns its headquarters facility located in Clearwater, Florida and two of its 1,056 operating center locations. Lincare’s remaining operating center locations are leased from unrelated third parties. Each operating center is a combination warehouse and office, with warehouse space generally comprising about half of the facility. Warehouse space is used for storage of adequate supplies of equipment and accessories necessary to conduct our business. We also lease 34 separate billing office locations from unrelated third parties.

As a health care provider, the Company is subject to extensive government regulation, including numerous laws directed at preventing fraud and abuse and laws regulating reimbursement under various government programs. The marketing, billing, documenting and other practices of health care companies are all subject to government scrutiny. To ensure compliance with Medicare and other regulations, regional carriers often conduct audits and request patient records and other documents to support claims submitted by Lincare for payment of services rendered to customers. Similarly, government agencies periodically open investigations and obtain information from health care providers pursuant to legal process.

Violations of federal and state regulations can result in severe criminal, civil and administrative penalties and sanctions, including disqualification from Medicare and other reimbursement programs.

15

Table of Contents

From time to time, the Company receives inquiries from various government agencies requesting customer records and other documents. It has been the Company’s policy to cooperate with all such requests for information. However, the Company can provide no assurances as to the duration or outcome of these inquiries.

Private litigants may also make claims against health care providers for violations of health care laws in actions known as qui tam suits. In these cases, the government has the opportunity to intervene in, and take control of, the litigation. From time to time we are named as a defendant in such qui tam proceedings. We vigorously defend these suits. The government has declined to intervene for purposes other than dismissal in all unsealed qui tam actions of which we are aware.

Our operating centers are also subject to federal and/or state laws regulating, among other things, interstate motor-carrier transportation, repackaging of oxygen, distribution of medical equipment, certain types of home health activities, pharmacy operations, nursing services and respiratory services and apply to those locations involved in such activities. Certain of our employees are subject to state laws and regulations governing the ethics and professional practice of respiratory therapy, pharmacy and nursing. From time to time, the Company receives inquiries and complaints from various government agencies related to its operations or personnel. It has been the Company’s policy to cooperate with all such inquiries and vigorously defend any administrative complaints. The Company can provide no assurances as to the duration or outcome of these inquiries and/or complaints.

We are also involved in certain other claims and legal actions arising in the ordinary course of our business. The ultimate disposition of all such matters is not currently expected to have a material adverse impact on our financial position, results of operations or liquidity.

The Company is subject to a five-year corporate integrity agreement with the Office of Inspector General that began in May 2006. Violations of the corporate integrity agreement can result in severe criminal, civil and administrative penalties and sanctions, including disqualification from Medicare and other reimbursement programs.

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of our stockholders during the fourth quarter of 2009.

16

Table of Contents

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the NASDAQ Global Market under the symbol LNCR. The following table sets forth the high and low sales prices as reported by NASDAQ for the periods indicated.

| High | Low | |||||

| 2009 |

||||||

| First quarter |

$ | 28.12 | $ | 19.43 | ||

| Second quarter |

25.07 | 19.71 | ||||

| Third quarter |

33.98 | 21.88 | ||||

| Fourth quarter |

38.53 | 29.81 | ||||

| 2008 |

||||||

| First quarter |

$ | 35.36 | $ | 27.71 | ||

| Second quarter |

29.08 | 23.45 | ||||

| Third quarter |

34.68 | 27.10 | ||||

| Fourth quarter |

31.02 | 20.30 | ||||

As of January 29, 2010, there were approximately 387 holders of record of the 65,714,249 outstanding shares of Lincare common stock. The closing price of Lincare common stock on January 29, 2010, was $36.82 per share, as reported on the NASDAQ Global Market.

We have not paid any cash dividends on our capital stock and do not anticipate paying cash dividends in the foreseeable future. It is the present intention of our Board of Directors to retain all earnings in order to support the future growth of our business and, from time to time, when authorized by our Board of Directors, to repurchase our common stock on the open market.

17

Table of Contents

Performance Graph

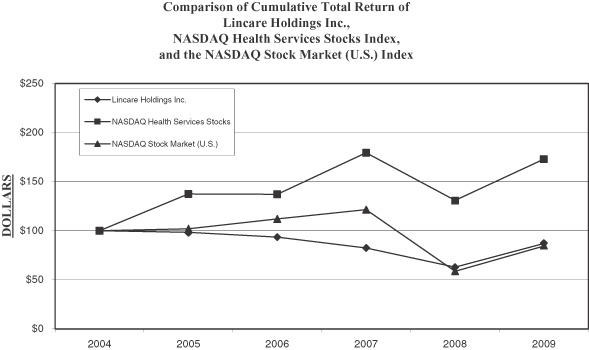

The following graph shows changes over the last five years in the value of $100 invested in Lincare’s common stock, the NASDAQ Health Services Stocks Index, and the NASDAQ Stock Market (U.S.) Index. The value of each investment is based on share price appreciation, with reinvestment of all dividends. The investments are assumed to have occurred at the beginning of the period presented.

The performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this annual report into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

| Dec. 31, 2004 |

Dec. 31, 2005 |

Dec. 31, 2006 |

Dec. 31, 2007 |

Dec. 31, 2008 |

Dec. 31, 2009 | |||||||

| Lincare Holdings Inc. |

100.0 | 98.3 | 93.4 | 82.4 | 63.1 | 87.1 | ||||||

| NASDAQ Health Services Stocks |

100.0 | 137.5 | 137.3 | 179.5 | 131.0 | 173.2 | ||||||

| NASDAQ Stock Market (U.S.) |

100.0 | 102.1 | 112.2 | 121.7 | 58.6 | 84.3 |

18

Table of Contents

During the year ended December 31, 2009, the Company repurchased approximately 12.2 million shares of its common stock at a cost of approximately $343.3 million. The following table sets forth the purchases of our common stock during the fourth quarter of 2009.

ISSUER PURCHASES OF EQUITY SECURITIES

| Period |

Total Number of Shares Purchased |

Average Price | Total Number of Shares Purchased as Part of the Repurchase Program |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Repurchase Program | ||||||

| October 1, 2009 to October 31, 2009 |

1,050,927 | $ | 31.79 | 1,050,927 | $ | 312,287,000 | ||||

| November 1, 2009 to November 30, 2009 |

2,073,983 | 34.18 | 2,073,983 | $ | 255,232,000 | |||||

| December 1, 2009 to December 31, 2009 |

2,418,288 | 36.66 | 2,418,288 | $ | 213,029,000 | |||||

| Total |

5,543,198 | $ | 34.81 | 5,543,198 | ||||||

On February 14, 2006, our Board of Directors authorized a share repurchase plan whereby the Company may repurchase shares of the Company’s common stock in amounts determined pursuant to a formula that takes into account both the ratio of the Company’s net debt to cash flow and its available cash resources and borrowing availability. As of December 31, 2009, $213.0 million of common stock was eligible for repurchase in accordance with the plan’s formula.

The following table sets forth information as of the end of fiscal year 2009 with respect to compensation plans under which equity securities are authorized for issuance.

Securities Authorized for Issuance Under Equity Compensation Plans

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||

| (a) | (b) | (c) | ||||||

| Equity compensation plans approved by security holders |

6,995,637 | (1) | $ | 35.60 | 2,832,702 | |||

| Equity compensation plans not approved by security holders |

None | N/A | None | |||||

| Total |

6,995,637 | (1) | $ | 35.60 | 2,832,702 | |||

| (1) | Includes 5,324,587 shares that are reserved for issuance under various stock option plans and 1,671,050 million shares that were issued under the Company’s Restricted Stock program. |

19

Table of Contents

Item 6. Selected Financial Data

The selected consolidated financial data presented below the caption “Statements of Operations Data” for the years ended December 31, 2009, 2008, 2007, 2006, and 2005, and the caption “Balance Sheet Data” as of December 31, 2009, 2008, 2007, 2006 and 2005 are derived from our consolidated financial statements audited by KPMG LLP, an independent registered public accounting firm.

The data set forth below are qualified by reference to, and should be read in conjunction with, the consolidated financial statements and accompanying notes, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Certain Risk Factors Relating to the Company’s Business included in this report.

| Year Ended December 31, | ||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Statements of Operations Data: |

|

(As adjusted Note 1) |

|

|

(As adjusted Note 1) |

|

||||||||||||||

| Net revenues |

$ | 1,550,477 | $ | 1,664,580 | $ | 1,595,990 | $ | 1,409,795 | $ | 1,266,627 | ||||||||||

| Cost of goods and services |

431,291 | 400,812 | 389,884 | 316,103 | 253,260 | |||||||||||||||

| Operating expenses |

389,759 | 395,706 | 365,016 | 331,897 | 295,807 | |||||||||||||||

| Selling, general and administrative expenses |

330,589 | 326,886 | 317,722 | 291,623 | 251,839 | |||||||||||||||

| Bad debt expense |

23,257 | 24,969 | 23,940 | 21,147 | 18,999 | |||||||||||||||

| Depreciation and amortization expense |

118,120 | 117,527 | 116,280 | 101,966 | 94,942 | |||||||||||||||

| Operating income |

257,461 | 398,680 | 383,148 | 347,059 | 351,780 | |||||||||||||||

| Interest income |

886 | 6,508 | 4,063 | 2,719 | 3,718 | |||||||||||||||

| Interest expense |

(34,960 | ) | (39,644 | ) | (29,056 | ) | (9,935 | ) | (12,432 | ) | ||||||||||

| Income before income taxes |

223,387 | 365,544 | 358,155 | 339,843 | 343,066 | |||||||||||||||

| Income tax expense |

87,291 | 138,278 | 133,666 | 126,862 | 129,370 | |||||||||||||||

| Net income |

$ | 136,096 | $ | 227,266 | $ | 224,489 | $ | 212,981 | $ | 213,696 | ||||||||||

| Income per common share: |

||||||||||||||||||||

| Basic |

$ | 2.00 | $ | 3.11 | $ | 2.69 | $ | 2.26 | $ | 2.16 | ||||||||||

| Diluted (1) |

$ | 1.99 | $ | 3.04 | $ | 2.56 | $ | 2.16 | $ | 2.06 | ||||||||||

| Weighted average number of common shares outstanding |

68,076 | 73,044 | 83,387 | 94,209 | 98,913 | |||||||||||||||

| Weighted average number of common shares and common share equivalents outstanding (1) |

68,497 | 75,616 | 89,688 | 101,106 | 106,306 | |||||||||||||||

| (1) | Figures in 2008, 2007, 2006 and 2005 reflect the application of the “if converted” method of accounting for our 3.0% convertible debentures, effective for reporting periods ending after December 15, 2004. The debentures were redeemed in full at par value in the amount of $275.0 million on June 15, 2008, pursuant to a notice of redemption. |

| At December 31, | |||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| (In thousands) | |||||||||||||||

| Balance Sheet Data: |

|

(As adjusted Note 1) |

|

(As adjusted Note 1) |

|||||||||||

| Total assets |

$ | 1,877,194 | $ | 1,938,809 | $ | 1,926,274 | $ | 1,775,310 | $ | 1,681,236 | |||||

| Long-term obligations, including current installments |

484,871 | 460,947 | 726,157 | 346,047 | 289,141 | ||||||||||

| Stockholders’ equity |

901,915 | 1,028,326 | 802,507 | 1,110,577 | 1,137,876 | ||||||||||

20

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

General