Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHBIIT 99.1 - DYCOM INDUSTRIES INC | ex99_1.htm |

| 8-K - DYCOM 8-K 2-24-2010 - DYCOM INDUSTRIES INC | form8k.htm |

Exhibit 99.2

®

2nd

Quarter Fiscal 2010

Results Presentation

February 24, 2010

Results Presentation

February 24, 2010

1

Participants

|

Steven E.

Nielsen

President & Chief Executive Officer H. Andrew

DeFerrari

Chief Financial Officer Richard B.

Vilsoet

General Counsel |

Forward-Looking Statements and Non-GAAP Information This presentation contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995,

including statements with respect to the Company’s fiscal 2010 third quarter

results. The words “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“forecast,” “may,” “should”, “could”, “project,” “outlook” and similar

expressions identify forward-looking statements. These forward-looking

statements are based on management’s current expectations, estimates and

projections and speak only as of the date of this presentation. Forward-looking

statements are subject to known and unknown risks and uncertainties that may

cause actual results in the future to differ materially from the results

projected or implied in any forward-looking statements contained in this

presentation. The factors that could affect future results and could cause these

results to differ materially from those expressed in the forward-looking

statements include, but are not limited to, those described under Item 1A, “Risk

Factors” of the Company’s Annual Report on Form 10-K for the year ended July 25,

2009, and other risks outlined in the Company’s periodic filings with the

Securities and Exchange Commission (“SEC”). Except as required by law, the

Company may not update forward-looking statements even though its situation may

change in the future. This presentation includes certain “Non-GAAP” financial

measures as defined by SEC rules. As required by the SEC we have provided a

reconciliation of those measures to the most directly comparable GAAP measures

on the Regulation G slides included at slides 10 & 11 of this

presentation.

3

Q2-2010

Overview

n Q2-10 results of

$(0.10) per share

n Revenue of $216.3

million in Q2-10 declined sequentially by

16.5%; Year over year decline was 11.9%.

16.5%; Year over year decline was 11.9%.

n Solid contract

awards and extensions secured during the

quarter

quarter

n Strong operating

cash flows during the quarter

n Net cash position at

January 23, 2010

4

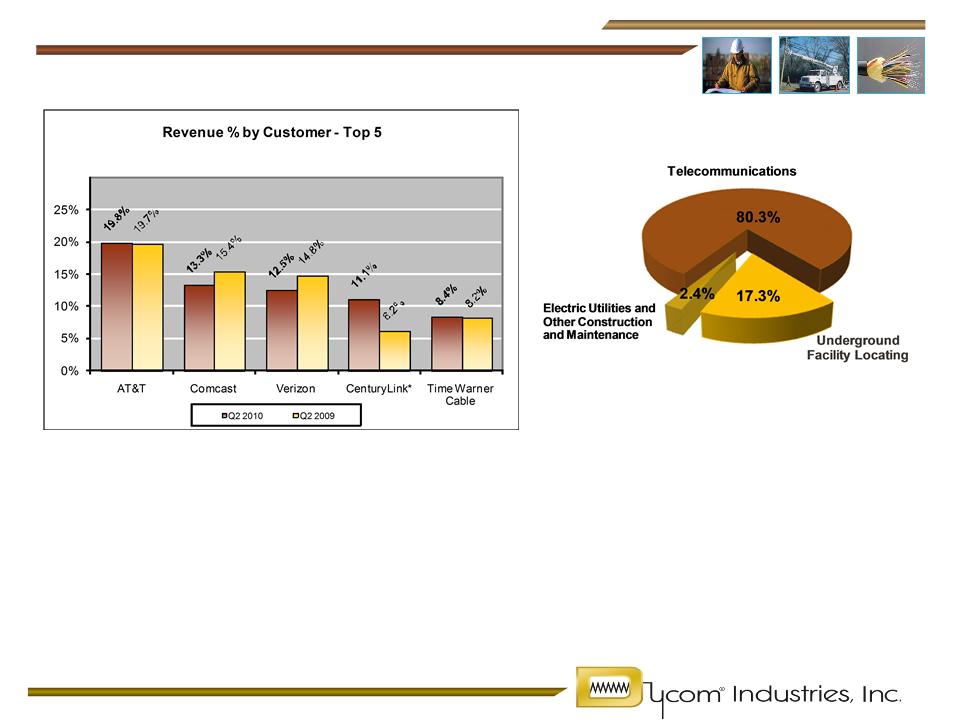

Revenue

by Customer

n Top 5 customers

represented 65.1% of revenue in Q2-10 and 64.3% of revenue

in Q2-09

in Q2-09

n Overall revenue

decline was 11.9%, with top 5 customers down approximately

10.8% and all other customers down approximately 13.9%. Q2-09 included $3.3

million in storm work.

10.8% and all other customers down approximately 13.9%. Q2-09 included $3.3

million in storm work.

*

For comparison purposes, CenturyLink includes combined revenues from CenturyTel,

Inc. and Embarq Corporation for each period presented.

5

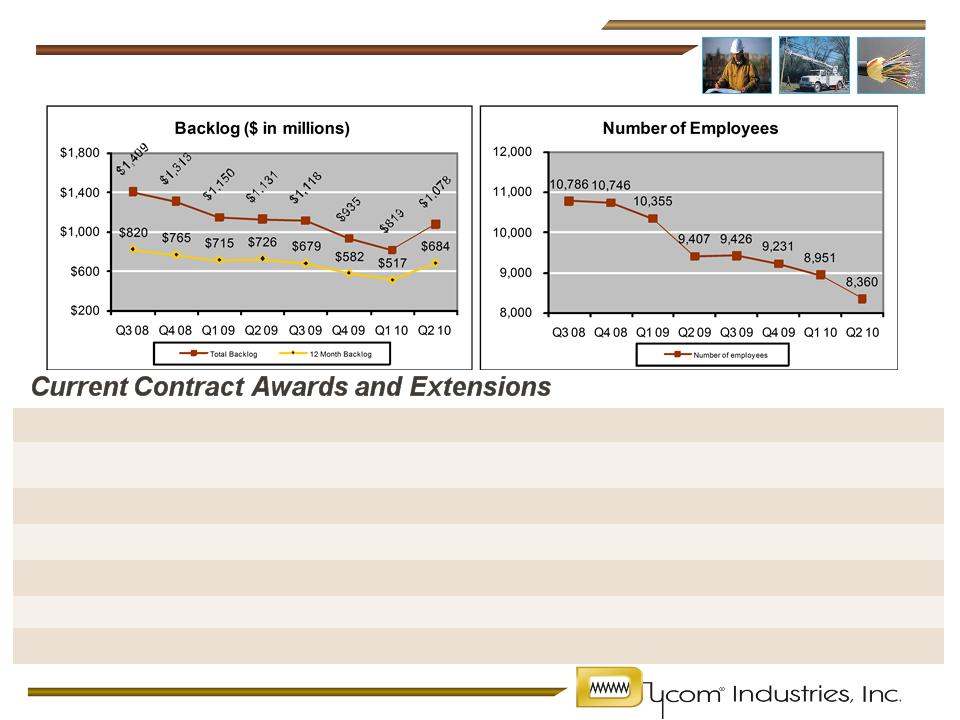

Backlog

and Employees

|

Customer

|

Area

|

Description

|

Term (in

years)

|

|

nAT&T

|

Central

Florida

|

Master Service

Agreement

|

3

|

|

nComcast

|

California

|

Master Service

Agreement

|

3

|

|

nVerizon

|

Northeast

|

Other

Long-Term Agreement

|

1

|

|

nComcast

|

Nationally

|

Various

Long-Term Agreements

|

1

|

|

nCharter

|

Nationally

|

Various

Long-Term Agreements

|

1

|

|

nAT&T

|

Georgia

|

Locating

|

3

|

Summary

Results

Summary Results Year over year revenue decline of 11.9% reflects

customer reductions in capital spending. Revenue in Q2-09 included

$3.3 million of restoration services for storm work compared to none in

Q2-10.Note: See “Regulation G Disclosure” slide 10 for a

reconciliation of GAAP to Non-GAAP financial measures.

8

n Cash flow from

operations was strong at $32.3

million for Q2-10.

million for Q2-10.

n Combined days sales

outstanding on trade

receivables and net unbilled revenues were 56

days in Q2-10 and 60 days in Q1-10 (a).

receivables and net unbilled revenues were 56

days in Q2-10 and 60 days in Q1-10 (a).

n Capital

expenditures, net of disposals at $16.4

million reflecting the replacement cycle of our

assets and new opportunities.

million reflecting the replacement cycle of our

assets and new opportunities.

n Total cash less debt

was $0.2 million at the end

of Q2-10 compared to net debt of $(15.5) million

as of Q1-10.

of Q2-10 compared to net debt of $(15.5) million

as of Q1-10.

n In compliance with

debt covenants as of

January 23, 2010.

January 23, 2010.

(a)

Days sales outstanding is calculated as the summation of current accounts

receivable,

plus costs and estimated earnings in excess of billings, less billings in excess of costs and

estimated earnings, divided by average revenue per day during the respective quarter.

plus costs and estimated earnings in excess of billings, less billings in excess of costs and

estimated earnings, divided by average revenue per day during the respective quarter.

9

Summary

n Challenging economic

environment

n Solid customer

relationships

n At the forefront of

evolving industry opportunities including those resulting from

industry mergers and acquisitions

industry mergers and acquisitions

n Growing market share

as customers consolidate vendors

n Encouraged by

deployment of new technologies by cable operators

n Strong cash flows

support working capital needs and capital investment

n Looking ahead to the

third quarter of fiscal 2010 we expect:

} Revenues which

increase sequentially due to seasonality but still reflect

slow customer activity and weather impacts

slow customer activity and weather impacts

} Margins which

improve but are pressured by poor weather during the

beginning of the quarter

beginning of the quarter

} Earnings per share

that improve sequentially and are near breakeven to a

slight profit

slight profit

10

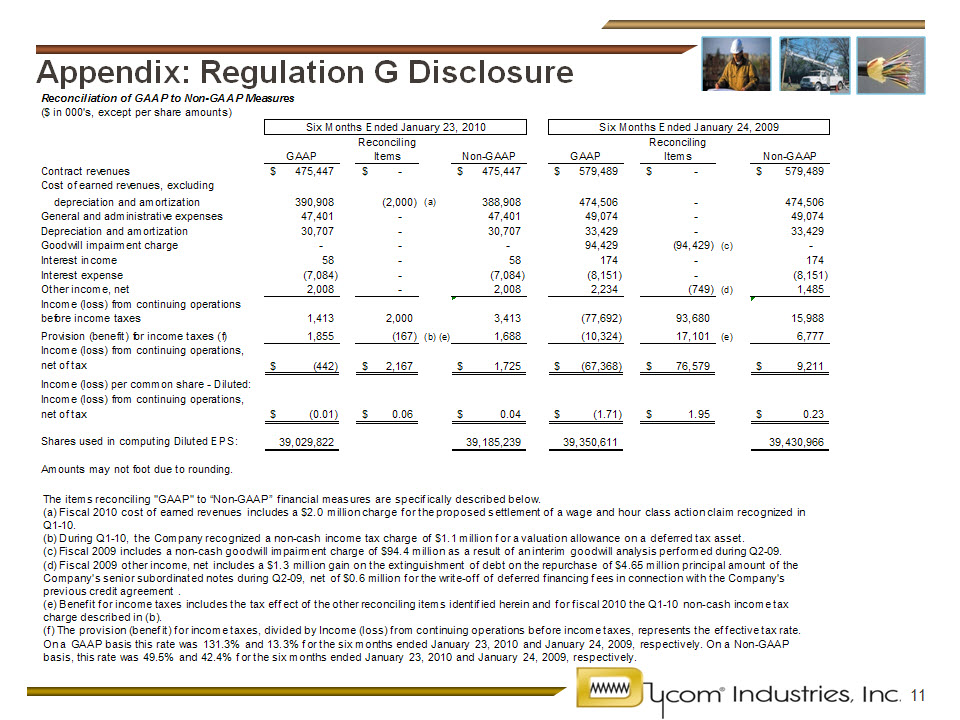

Appendix:

Regulation G Disclosure

11

Appendix:

Regulation G Disclosure

®

2nd

Quarter Fiscal 2010

Results Presentation

February 24, 2010

Results Presentation

February 24, 2010