Attached files

Changing the way you

succeed.

February 24,

2010

Fourth

Quarter 2009 Conference Call

1

Changing the way you

succeed.

Forward-Looking

Statements

2

This

presentation contains forward-looking statements within the meaning of Section

27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, including, without limitation, any projections of financial items; future production volumes, results of exploration,

exploitation, development, acquisition and operations expenditures, and prospective reserve levels of properties or

wells; any statements of the plans, strategies and objectives of management for future operations; any statements

concerning developments, performance or industry rankings; and any statements of assumptions underlying any of

the foregoing. These statements involve certain assumptions we made based on our experience and perception of

historical trends, current conditions, expected future developments and other factors we believe are reasonable and

appropriate under the circumstances. The forward-looking statements are subject to a number of known and

unknown risks, uncertainties and other factors that could cause our actual results to differ materially. The risks,

uncertainties and assumptions referred to above include the performance of contracts by suppliers, customers and

partners; employee management issues; uncertainties inherent in the exploration for and development of oil and gas

and in estimating reserves; complexities of global political and economic developments; geologic risks, volatility of oil

and gas prices and other risks described from time to time in our reports filed with the Securities and Exchange

Commission (“SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2008

and subsequent quarterly reports on Form 10-Q. You should not place undue reliance on these forward-looking

statements which speak only as of the date of this presentation and the associated press release. We assume no

obligation or duty and do not intend to update these forward-looking statements except as required by the securities

laws.

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, including, without limitation, any projections of financial items; future production volumes, results of exploration,

exploitation, development, acquisition and operations expenditures, and prospective reserve levels of properties or

wells; any statements of the plans, strategies and objectives of management for future operations; any statements

concerning developments, performance or industry rankings; and any statements of assumptions underlying any of

the foregoing. These statements involve certain assumptions we made based on our experience and perception of

historical trends, current conditions, expected future developments and other factors we believe are reasonable and

appropriate under the circumstances. The forward-looking statements are subject to a number of known and

unknown risks, uncertainties and other factors that could cause our actual results to differ materially. The risks,

uncertainties and assumptions referred to above include the performance of contracts by suppliers, customers and

partners; employee management issues; uncertainties inherent in the exploration for and development of oil and gas

and in estimating reserves; complexities of global political and economic developments; geologic risks, volatility of oil

and gas prices and other risks described from time to time in our reports filed with the Securities and Exchange

Commission (“SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2008

and subsequent quarterly reports on Form 10-Q. You should not place undue reliance on these forward-looking

statements which speak only as of the date of this presentation and the associated press release. We assume no

obligation or duty and do not intend to update these forward-looking statements except as required by the securities

laws.

References

to quantities of oil or gas may include amounts we believe will ultimately be

produced, but that are not

classified as “proved reserves” under SEC definitions. Statements of oil and gas reserves are estimates based on

assumptions and may be imprecise. Investors are urged to consider closely the disclosure regarding reserves in our

2008 Form 10-K.

classified as “proved reserves” under SEC definitions. Statements of oil and gas reserves are estimates based on

assumptions and may be imprecise. Investors are urged to consider closely the disclosure regarding reserves in our

2008 Form 10-K.

Changing the way you

succeed.

Presentation

Outline

3

• Executive

Summary

Summary of Q4 2009

Results (pg. 4)

Liquidity and

Capital Resources (pg. 8)

2010 Outlook

(pg.

9)

• Operational

Highlights by Segment

Contracting Services

(pg.

13)

Oil & Gas

(pg.

21)

• Non-GAAP

Reconciliations (pg.

26)

• Questions

& Answers

Phoenix

Project DTS buoy loadout

Changing the way you

succeed.

Executive

Summary

4

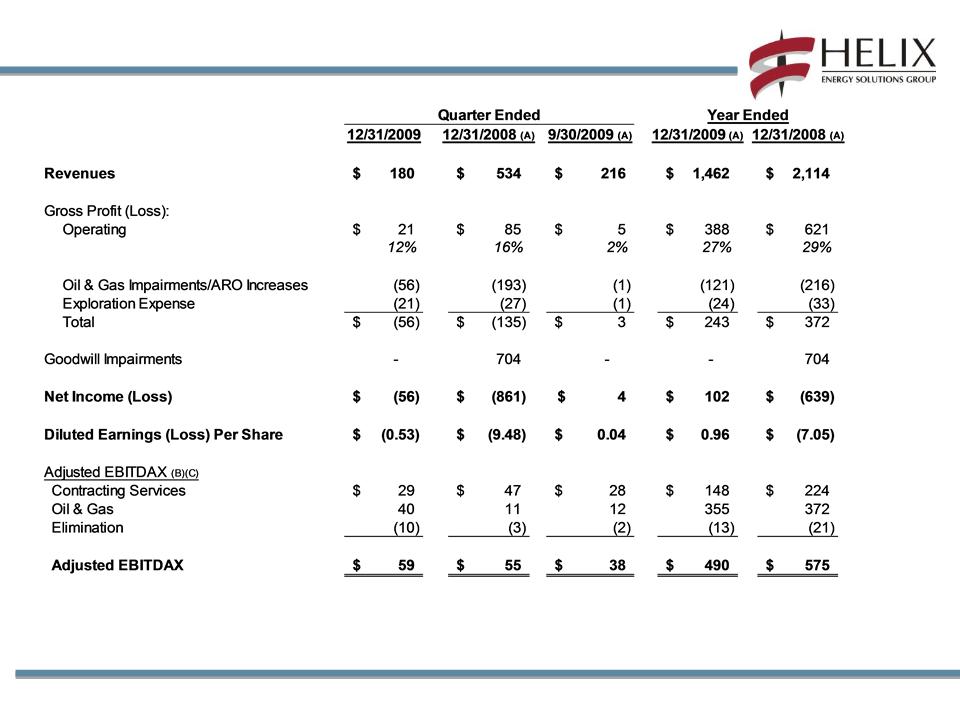

($ in

millions, except per share data)

(A) Results of Cal Dive,

our former Shelf Contracting business, were consolidated through June 10, 2009,

at which time our ownership interest dropped below 50%; thereafter, our

remaining

interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings with the sale of the substantial majority of our remaining interest

in Cal Dive. First half revenues from our Shelf Contracting business totaled $405 million.

interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings with the sale of the substantial majority of our remaining interest

in Cal Dive. First half revenues from our Shelf Contracting business totaled $405 million.

(B) See non-GAAP

reconciliations on slides 25-27.

(C) Excludes Cal Dive

contribution in all periods presented.

Changing the way you

succeed.

Executive

Summary

5

Fourth

quarter results reflect the following matters on a pre-tax basis:

• $55.9 million of

“non-cash” impairment charges due to reserve-related revisions on

oil and gas properties

oil and gas properties

• $22.6 million of

other “non-cash” charges primarily due to the write-off of the

book value associated with certain exploration leases

book value associated with certain exploration leases

• Q4 results excluded

realized hedge gains of approximately $15 million for natural

gas hedge mark-to-market adjustments previously recognized as unrealized gains in

the first three quarters of 2009

gas hedge mark-to-market adjustments previously recognized as unrealized gains in

the first three quarters of 2009

The

after-tax effect of the above two items on EPS totaled $0.49 per

diluted

share.

share.

Changing the way you

succeed.

Executive

Summary

6

• Contracting

Services

• Continued weak

activity levels in general

• Subsea Construction

capacity diverted to internal oil and gas field development

projects - as a result, significant intercompany eliminations

projects - as a result, significant intercompany eliminations

• Well

Enhancer entered fleet in

Q4

• Oil and

Gas

• Continued delay in

start up of transmission line for Noonan gas (January 2010

start up vs. mid-Q4 expectation) reduced expected Q4 production

start up vs. mid-Q4 expectation) reduced expected Q4 production

• Exit year end

production rate of 94 Mmcfe/d

• Current production

rate of 145 Mmcfe/d

• Danny oil production

start-up in early February, 2010

• Noonan gas rates ≈37

Mmcf/d

Changing the way you

succeed.

Executive

Summary

7

• Oil and gas

production totaled 9.7 Bcfe for Q4 2009 versus 9.8 Bcfe in Q3 2009;

43.8

Bcfe in total for 2009

Bcfe in total for 2009

• Avg

realized price for oil of $71.48 / bbl ($68.86 / bbl in Q3 2009), including

effect of

settled hedges

settled hedges

• Avg

realized price for gas of $7.97/ Mcf ($8.02 / Mcf in Q3 2009), including

the

effect of settled hedges

effect of settled hedges

• Balance

sheet remains strong

• Net

debt balance decreased by $713 million in 2009

• Liquidity*

of $657 million at year end

• Credit

facility covenants in compliance

• Q4 2009: Credit

facility extended to November 2012 along with increased

commitments of $435 million through June 2011

commitments of $435 million through June 2011

• Q1 2010: Additional

amendments put into place revising leverage ratio and

adding additional senior secured leverage covenant ratio

adding additional senior secured leverage covenant ratio

*Liquidity is equal

to cash and cash equivalents ($271 million), plus available capacity under our

revolving credit facility ($386 million).

Changing the way you

succeed.

Significant

Balance Sheet Improvements

8

Debt

(A)

Liquidity

(B)

of $657 million at 12/31/09

(A)

Includes impact of debt discount under our Convertible Senior

Notes.

(B)

Defined as available revolver capacity ($386 million) plus cash ($271

million).

Changing the way you

succeed.

2010

Outlook

9

• Contracting Services

demand in 1H 2010 will continue to be soft, with a rebound

anticipated in 2H 2010

anticipated in 2H 2010

• Contracting Services

asset utilization on Danny oil pipeline and Phoenix field

development will continue to impact financial results in Q1

development will continue to impact financial results in Q1

• Capital expenditures

of approximately $200 million planned for 2010

• $85 million relates

to completion of major vessel projects

• Oil and Gas capital

expenditures of approximately $86 million, excluding P&A of

approximately $61 million

approximately $61 million

• Improved liquidity

and debt levels (see slide 8)

•Expect to reduce net

debt levels further by 12/31/2010

•Expect to increase

liquidity further by 12/31/2010

Changing the way you

succeed.

2010

Outlook

10

|

Broad

Metrics

|

2010

Higher End

|

2010

Lower End

|

2009

|

|

Production

Range

|

60

Bcfe

|

50

Bcfe

|

44

Bcfe

|

|

EBITDA

|

$550

million

|

$450

million

|

$490

million

|

|

CAPEX

|

$200

million

|

$200

million

|

$328 million

(A)

|

|

Commodity

Price

Deck |

2010

Higher End

|

2010

Lower End

|

2009

(B)

|

|

|

Hedged

|

Oil

|

$74.75 /

bbl

|

$74.59 /

bbl

|

$67.11 /

bbl

|

|

Gas

|

$5.87 /

mcf

|

$6.00 /

mcf

|

$7.75 /

mcf

|

|

(A) Inclusive of

capitalized interest of $48 million.

(B) Including effect

of settled

natural gas hedge contracts.

Changing the way you

succeed.

2010

Outlook

11

|

Key

Oil and Gas

Assumptions |

Production

Rates

|

||

|

2010 Higher

End

|

2010 Lower

End

|

2009

|

|

|

Noonan

gas

(well performance) |

55

Mmcfe/d

by March 1, 2010 |

35

Mmcfe/d

all year |

20

Mmcfe/d

|

|

Phoenix

expected

start-up |

Mid-

Q2

>70

Mmcfe/d

|

Mid-year

>70 Mmcfe/d |

0

|

|

Hurricanes

|

No

Significant

Disruption |

Significant

Disruption

|

Lingering

2008

Hurricane Effects |

Note:

2009 year end reserve estimate reductions for Noonan gas wells to increase

DD&A rates in 2010 vs. prior expectations

Changing the way you

succeed.

Caesar

departing

for sea trials, Nantong, China

12

Operations

Highlights

Highlights

Changing the way you

succeed.

13

Caesar

superintendent

inspecting pipelay stinger

inspecting pipelay stinger

Contracting

Services

Subsea

Construction

• High utilization,

but significant portion used for internal E&P

development

development

• Express

installed the

36-mile Danny pipe-in-pipe (8x12

-inch) in the GOM for Helix Oil & Gas

-inch) in the GOM for Helix Oil & Gas

• Intrepid

worked

on Helix Phoenix project and various

other projects as DSV

other projects as DSV

• Caesar

in

transit to GOM from China in 4Q2009 (arrived in

Ingleside on 1/31/2010)

Ingleside on 1/31/2010)

• Initial internal

project to install 7 mile, 12-inch gas

pipeline on OCS in Gulf of Mexico in April 2010

pipeline on OCS in Gulf of Mexico in April 2010

• Awarded 46 mile,

20-inch gas pipeline installation

project in Gulf of Mexico for summer 2010

project in Gulf of Mexico for summer 2010

• Outlook

for 2010 expected to improve by mid year

Changing the way you

succeed.

14

Olympic

Triton underway to begin

Anadarko Jubilee project in Ghana

Anadarko Jubilee project in Ghana

Contracting

Services

ROV

- Robotics

• Seasonal low

utilization

• Island

Pioneer with deepwater

trenching spread

transiting from North Sea to GOM and Olympic Triton

transiting from GOM to Ghana

transiting from North Sea to GOM and Olympic Triton

transiting from GOM to Ghana

• Olympic

Canyon continues to operate

for Reliance

offshore India on long term IRM contract

offshore India on long term IRM contract

• Northern

Canyon (North Sea) and

Seacor

Canyon (SEA)

were idle for the majority of the quarter

were idle for the majority of the quarter

• Northern

Canyon

charter not extended

• Outlook

for 2010 is improving

Changing the way you

succeed.

15

Testing

WOAPAC’s Subsea Intervention

Lubricator System

Lubricator System

Contracting

Services

Well

Operations

North

America

• Q4000

installed production

buoy for Phoenix field

• Started 100-day

deepwater well Intervention / P&A campaign for Shell

• Outlook

for 2010 looks positive

North

Sea

• Seasonal low

utilization

• Seawell worked for BP,

Total and Talisman in the NorthSea . Vessel

dry-dock in January / February 2010

dry-dock in January / February 2010

• Well

Enhancer worked approx. 53

days in the quarter for Nexen and

Shell with good operating performance

Shell with good operating performance

• Outlook

for 2010 expected to improve by end of Q1

Asia

Pacific

• Operations

still

being impacted by refurbishment of the Subsea

Intervention Lubricator and Vessel Deployment System

Intervention Lubricator and Vessel Deployment System

• Entered into JV with

Clough Ltd. to provide subsea services in the

Asia Pacific region, using the Normand Clough vessel

Asia Pacific region, using the Normand Clough vessel

• Outlook

for 2010 is expected to improve

Changing the way you

succeed.

16

Caesar

in Ingleside

Marine

Capital Projects

HPI

in Ingleside

Changing the way you

succeed.

17

Phoenix

Green Canyon Block 237

• DTS Buoy has been

installed

• Subsea flowlines,

export pipelines and

umbilicals have been installed

umbilicals have been installed

• Intrepid in DSV mode

to pull-in the flexible

risers and umbilicals through DTS buoy late

February / early March

risers and umbilicals through DTS buoy late

February / early March

• Production scheduled

to start mid-year

Helix

Producer I (HPI)

• Vessel installation

and hook-up of topside

modules, flare boom, external thrusters and

turret completed

modules, flare boom, external thrusters and

turret completed

• Commissioning of

topside processing plant

ongoing

ongoing

• Incline test

successfully completed

• US Coast Guard

Systems acceptance is

ongoing

ongoing

• Expect the vessel to

depart for sea trials

late 1Q 2010

late 1Q 2010

DTS

Buoy being installed by Q4000

Helix

Producer I

HPI

at Kiewit’s yard

Changing the way you

succeed.

18

($

in millions, except percentages)

(A) Results of Cal Dive,

our former Shelf Contracting business, were consolidated through June 10, 2009,

at which time our ownership interest dropped below 50%; thereafter, our

remaining interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings with the sale of the substantial majority of our

remaining interest in Cal Dive.

remaining interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings with the sale of the substantial majority of our

remaining interest in Cal Dive.

(B) See non-GAAP

reconciliation on slides 25-27. Amounts

are prior to intercompany eliminations.

(C) Includes corporate

and operational support overheads.

(D) Amounts primarily

represent equity in earnings of Marco Polo and Independence Hub investments and

equity in earnings from Cal Dive from June 11 through September 23,

2009.

Contracting

Services

Changing the way you

succeed.

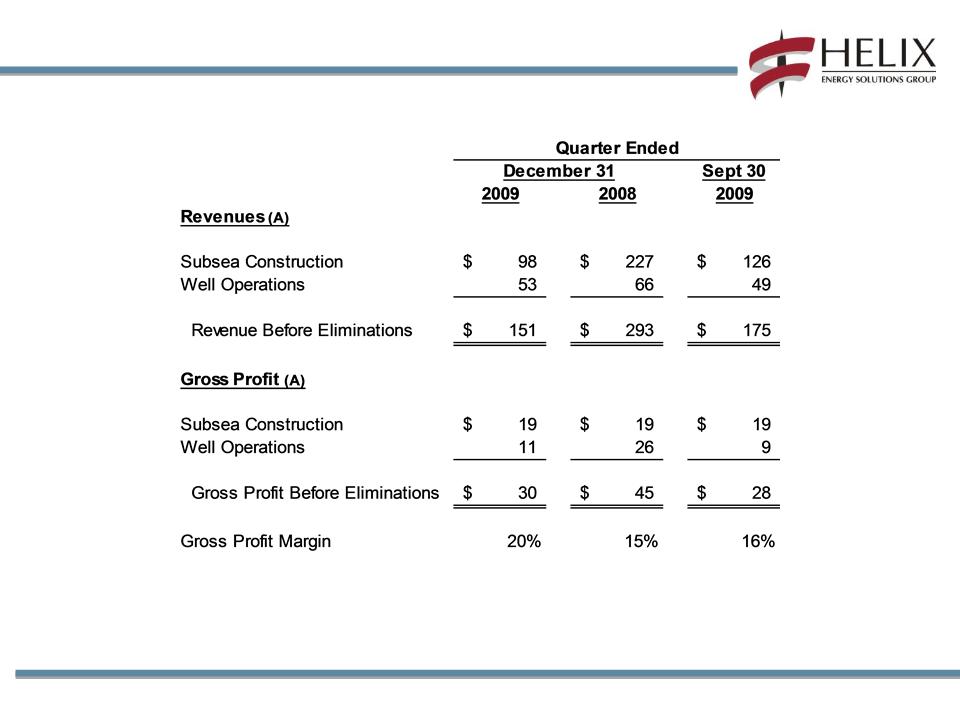

Revenue

and Gross Profit by Division ($ in millions)

19

(A) Amounts are before

intercompany eliminations. See

non-GAAP reconciliation on slides 25-27.

Contracting

Services

Changing the way you

succeed.

Contracting

Services

20

(A) Includes

vessels on long-term charters.

* Utilization

includes internal work.

Changing the way you

succeed.

21

(A) Impairments related

to

reduction in carrying values

of certain oil and gas

properties due to reserve

revisions, including $29.9

million of hurricane-related

impairments in Q4 2008.

reduction in carrying values

of certain oil and gas

properties due to reserve

revisions, including $29.9

million of hurricane-related

impairments in Q4 2008.

(B) Includes $20.1 and

$8.0

million of impairment charges

associated with certain

exploration leases for the

quarters ended December

31, 2009 and December 31,

2008, respectively.

million of impairment charges

associated with certain

exploration leases for the

quarters ended December

31, 2009 and December 31,

2008, respectively.

(C) Including effect of

settled

hedges and MTM derivative

contracts.

hedges and MTM derivative

contracts.

Oil

& Gas

Changing the way you

succeed.

Oil

& Gas

22

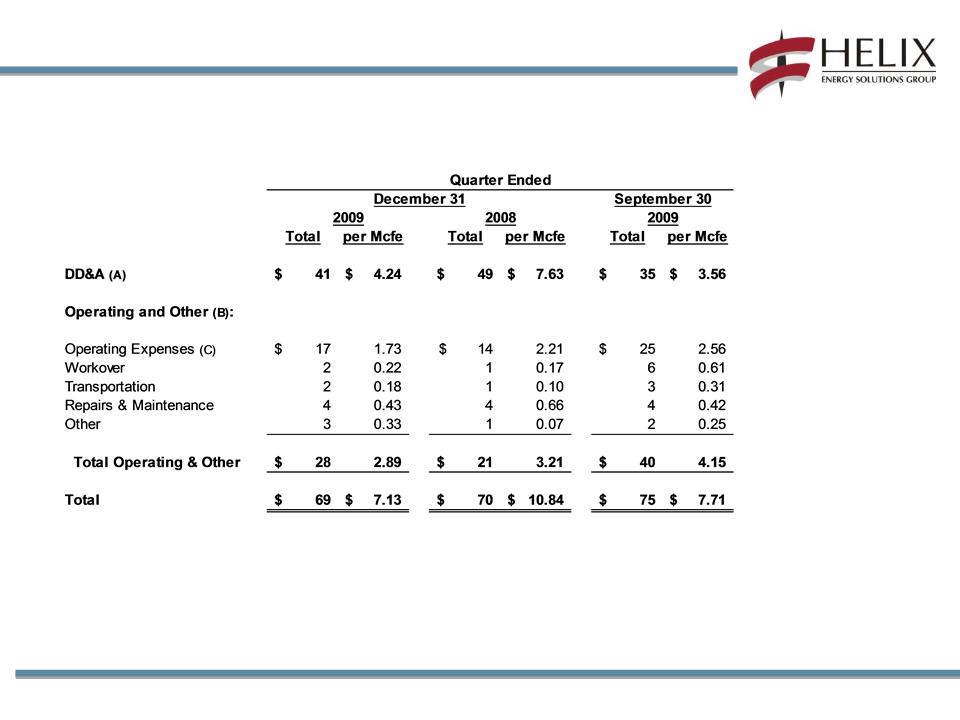

(A) Included accretion

expense.

(B) Excluded

hurricane-related repairs of $0.6, $15.9 and $5.1 million, net of insurance

recoveries, for the quarters ended December 31, 2009, December 31, 2008

and September 30, 2009, respectively.

and September 30, 2009, respectively.

(C) Included $2.5 and

$10.4 million related to a weather derivative contract for the quarters ended

December 31, 2009 and September 30, 2009, respectively.

Excluded exploration expenses of $21.5, $27.1 and $0.9 million, and abandonment of $0.0, $6.0 and $2.9 million for the quarters ended December 31, 2009,

December 31, 2008 and September 30, 2009, respectively.

Excluded exploration expenses of $21.5, $27.1 and $0.9 million, and abandonment of $0.0, $6.0 and $2.9 million for the quarters ended December 31, 2009,

December 31, 2008 and September 30, 2009, respectively.

Operating

Costs

($

in millions, except per Mcfe data)

Changing the way you

succeed.

Oil

& Gas - Reserve Report Highlights

23

|

|

Proved

Developed

|

Proved

Undeveloped

|

Total

|

|

Total

Reserves

(Bcfe)

|

214

|

364

|

578

|

|

Shelf

|

112

|

125

|

237

|

|

Deepwater

|

102

|

239

|

341

|

|

Oil

(mmbbls) |

15

|

15

|

30

|

|

Gas

(Bcf) |

125

|

274

|

399

|

|

SEC Case

PV-10

(pre-tax, in millions) |

$546

|

$746

|

$1,292

|

|

PV-10

Forward Strip Price* (pre-tax, in millions) |

$1,129

|

$1,574

|

$2,703

|

At

December 31, 2009

* Based

on NYMEX Henry Hub gas and WTI oil forward strip prices at December 31,

2009.

Changing the way you

succeed.

Summary

of Jan - Dec 2010 Hedging Positions*

24

Changing the way you

succeed.

25

Non-GAAP

Reconciliations

Reconciliations

Changing the way you

succeed.

Non

GAAP Reconciliations

26

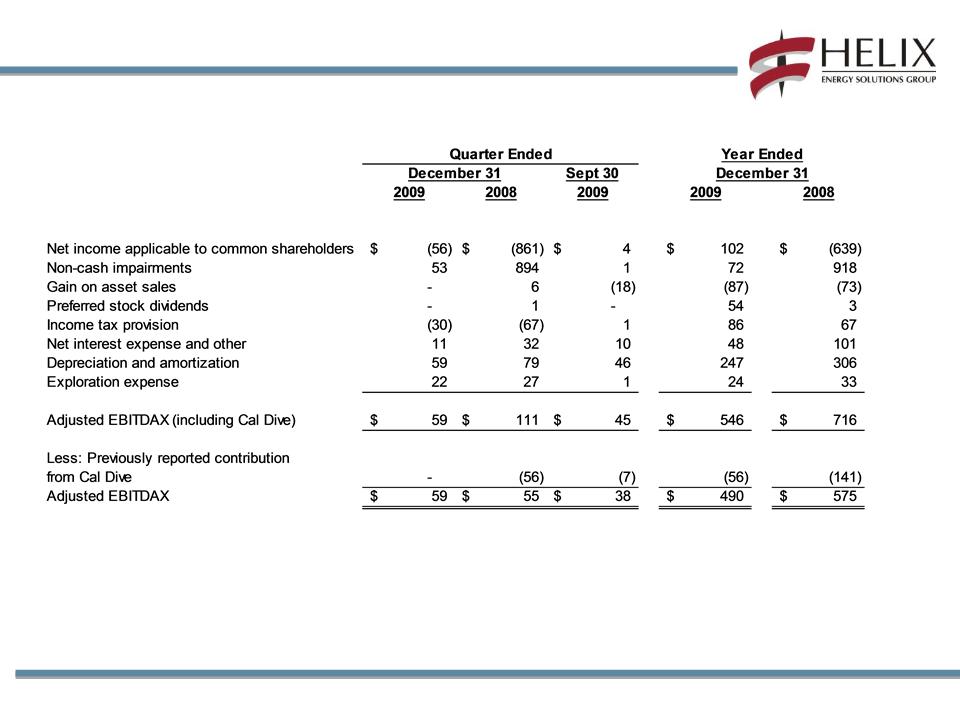

Adjusted EBITDAX

($

in millions)

We

calculate adjusted EBITDAX as earnings before net interest expense, taxes,

depreciation and amortization,

and

exploration expense. Further, we do not include earnings from our former

interest in Cal Dive in any periods presented in our adjusted

EBITDAX calculation. These non-GAAP measures are useful to investors and other internal and external users of our financial statements in

evaluating our operating performance because they are widely used by investors in our industry to measure a company's operating

EBITDAX calculation. These non-GAAP measures are useful to investors and other internal and external users of our financial statements in

evaluating our operating performance because they are widely used by investors in our industry to measure a company's operating

performance

without regard to items which can vary substantially from company to company and

help investors meaningfully compare our results

from period to period. Adjusted EBITDAX should not be considered in isolation or as a substitute for, but instead is supplemental to, income from

operations, net income or other income data prepared in accordance with GAAP. Non-GAAP financial measures should be viewed in addition to,

and not as an alternative to our reported results prepared in accordance with GAAP. Users of this financial information should consider the types

of events and transactions which are excluded.

from period to period. Adjusted EBITDAX should not be considered in isolation or as a substitute for, but instead is supplemental to, income from

operations, net income or other income data prepared in accordance with GAAP. Non-GAAP financial measures should be viewed in addition to,

and not as an alternative to our reported results prepared in accordance with GAAP. Users of this financial information should consider the types

of events and transactions which are excluded.

Changing the way you

succeed.

Revenue

and Gross Profit As Reported ($ in millions)

27

Non

GAAP Reconciliations

Changing the way you

succeed.