Attached files

| file | filename |

|---|---|

| 8-K - FORM8-K - CPG INTERNATIONAL INC. | form8-k_q42009.htm |

| EX-99 - EXHIBIT_99-1 - CPG INTERNATIONAL INC. | exhibit_99-1.htm |

| EX-99 - EXHIBIT_99.2.PDF - CPG INTERNATIONAL INC. | exhibit_99-2.pdf |

2009 Fourth Quarter Earnings Call

February 26, 2010

Exhibit 99.2

Safe Harbor Statement and Use of Non-GAAP and Pro Forma Information

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements made in this

presentation that relate to future events or the Company’s expectations, guidance, projections, estimates, intentions, goals, targets and strategies are forward-

looking statements. You are cautioned that all forward-looking statements are based upon current expectations and estimates and the Company assumes no

obligation to update this information. Because actual results may differ materially from those expressed or implied by the forward-looking statements, the

Company cautions you not to place undue reliance on these statements. For a detailed discussion of the important factors that affect the Company and that

could cause actual results to differ from those expressed or implied by the Company’s forward-looking statements, please see “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and “Risk Factors” in the Company’s current and future Annual Reports on Form 10-K and Quarterly

Reports on Form 10-Q.

ADJUSTED EBITDA STATEMENT

We refer to the term “Adjusted EBITDA” in various places throughout this presentation. Adjusted EBITDA, or earnings (adjusted as described below) before

interest, taxes, depreciation and amortization calculated on a pro forma basis as provided herein, is a material component of the significant covenants

contained in our credit agreements and the indenture governing the notes and accordingly, is important to the Company’s liquidity and ability to borrow under

its debt instruments. Adjusted EBITDA is calculated similarly under both the credit agreements and the indenture by adding consolidated net income, income

taxes, interest expense, depreciation and amortization and other non-cash expenses, income or loss attributable to discontinued operations, amounts payable

pursuant to the management agreement with AEA Investors and the impairment charge for goodwill and other intangibles. In addition, consolidated net income

is adjusted to exclude certain items, including certain nonrecurring or unusual charges. Please see the Company’s December 31, 2008 10-K, which contains a

detailed description of our covenants and a thorough description of our use of Adjusted EBITDA, and the use of Adjusted EBITDA in connection with certain

calculations under the covenants, under our credit agreements and indenture.

While the determination of appropriate adjustments in the calculation of Adjusted EBITDA is subject to interpretation under our debt agreements, management

believes the adjustments are in accordance with the covenants in our credit agreements and indenture, as discussed above. Adjusted EBITDA should not be

considered in isolation or construed as an alternative to our net income or other measures as determined in accordance with GAAP. In addition, other

companies in our industry or across different industries may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative

measure. In future SEC filings, we may be required to change our presentation of Adjusted EBITDA in order to comply with the SEC’s rules regarding the use

of non-GAAP financial measures. In addition, you are cautioned not to place undue reliance on Adjusted EBITDA. For a reconciliation of Adjusted EBITDA to

net income, please see the Appendix to this presentation.

About CPG International

Headquartered in Scranton, Pennsylvania, CPG International is a leading supplier of premium, low-maintenance building products designed to

replace wood, metal and other materials in the residential, commercial and industrial markets. With a focus on manufacturing excellence,

proprietary technologies and quality, CPG has introduced products through distribution networks to sizable markets increasingly converting to low

maintenance materials. The Company has developed and acquired a number of branded products including AZEK® Trim, AZEK® Deck, AZEK®

Moulding, AZEK® Rail, AZEK® Porch, Comtec and Hiny Hiders® bathroom partition systems,and TuffTec™ locker systems. For additional

information on CPG please visit our web site at http:// www.cpgint.com.

Please note:

To access the conference call, please dial (866) 863-6818, and use conference ID code 56466366. An encore presentation will be available for

one week after the completion of the call. In order to access the encore presentation, please dial (800) 642-1687 or (706) 645-9291, and use the

conference ID code 56466366.

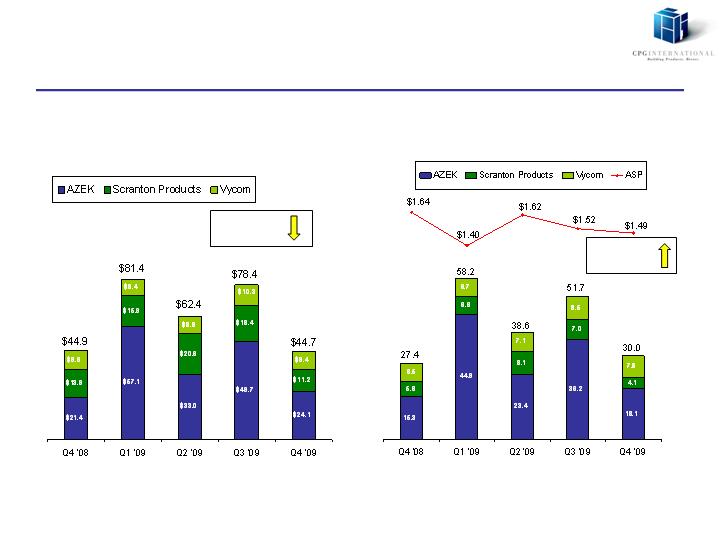

2009 Fourth Quarter Financial Highlights

Market Conditions: Housing starts down 16% from prior year Q4

Repair/remodel markets experiencing double digit

declines

Industrial and commercial markets deteriorated in Q3

Revenue: $44.7mm Q4 2009 vs. $44.9mm in Q4 2008, down 0.4%

AZEK Deck growth partially offset decline in

commercial market

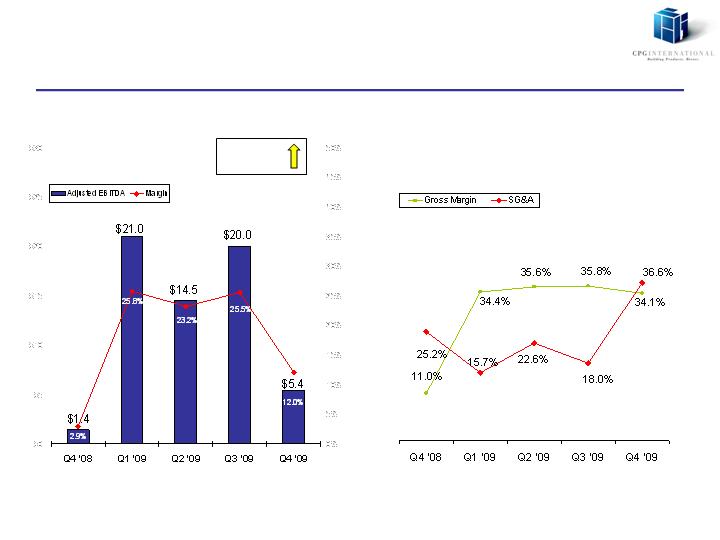

Gross Margin: 34.1% Q4 2009 vs. 11.0% in Q4 2008

Material cost reductions and improved operating

efficiencies

SG&A: $16.3mm Q4 2009 vs. $11.3mm in Q4 2008

Increased expenses primarily from marketing and

product development

Adjusted EBITDA: Up 294.5% to $5.4mm;

12.0% Adjusted EBITDA margin

Net

Income/Loss: $(9.4)mm net loss in Q4 2009, compared to $(48.1)mm

net loss in Q4 2008

Quarter Highlights

Quarterly Revenue

Financial Overview

YOY $(0.2)

or (0.4)%

Revenue

($ in millions)

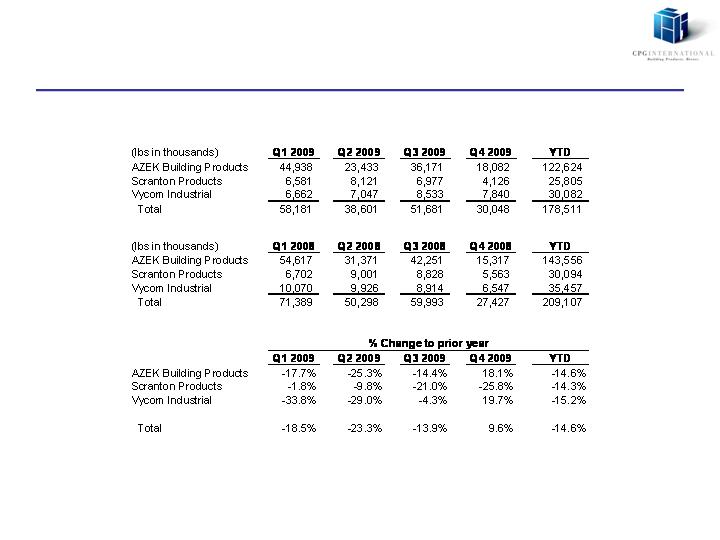

Volume & ASP

(lbs in millions)

YOY 2.6

or 9.4%

Quarterly Earnings

Financial Overview

Adjusted EBITDA

($ in millions)

Gross Margin and SG&A

(% of revenue)

YOY $4.0

or 294.5%

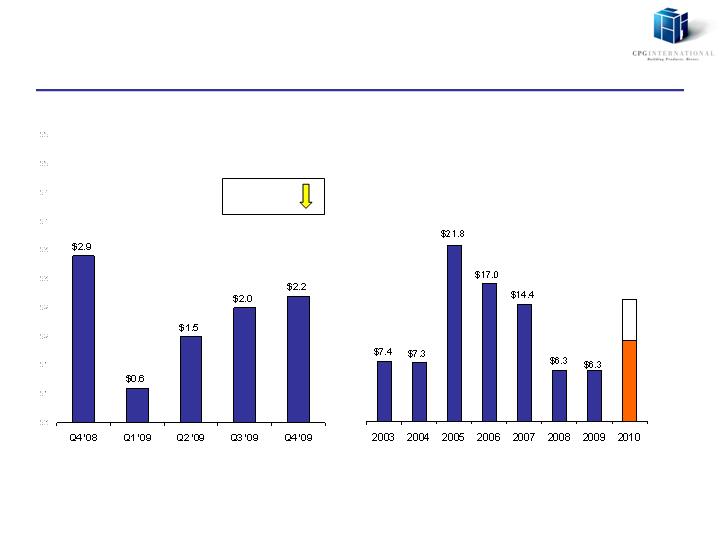

Full Year Results

Financial Overview

Revenue / Pro Forma

($ in millions)

Pro Forma Adj. EBITDA

($ in millions)

YOY $12.8

or 26.6%

YOY $(45.4)

or (14.5)%

Capital Expenditures

Financial Overview

YOY $(0.7)

or (24.1)%

Quarter Cap Ex

($ in millions)

Historical Cap Ex

($ in millions)

$10-$15

Working Capital Management

Tightly managing working capital

Reduced seasonality with soft

winter buy

Focused collections effort on AR

Financial Overview

YOY $12.2

or 36.2%

Inventory and Inv Days(1)

($ in millions)

AR and AR Days(1)

($ in millions)

YOY ($3.2)

or (18.4)%

Inv/AR/Prepaid less AP/Accrued

($ in millions)

Footnote:

(1)

Based on trailing three months annualized

Liquidity Position

Financial Overview

Net Debt(1)& Net Debt/Adj. EBITDA(2)

($ in millions)

Liquidity

($ in millions)

Liquidity position at $68.4mm

Focused on liquidity management

Trailing Twelve Month December 31, 2009 Adjusted EBITDA of

$60.9mm

Footnotes:

(1)

Net debt defined as total debt and capital lease obligations less cash

(2)

Trailing twelve month adjusted EBITDA as defined in Credit Agreements

Low

High

$55mm

$65mm

2009 Guidance

2010 Adjusted EBITDA Guidance(1)

Downside:

Slow economic recovery

Residential repair & remodel activity

New home construction

Industrial markets

Commercial markets/tax revenue

Resin prices escalate beyond

expectations

Increased competition

Upside:

Higher than anticipated economic

activity

Increased market penetration for

AZEK products

Lower material costs

Operational efficiencies

(1) In preparation of our Adjusted EBITDA, we used a basis similar to actual interest, depreciation, amortization and taxes reported in 2009.

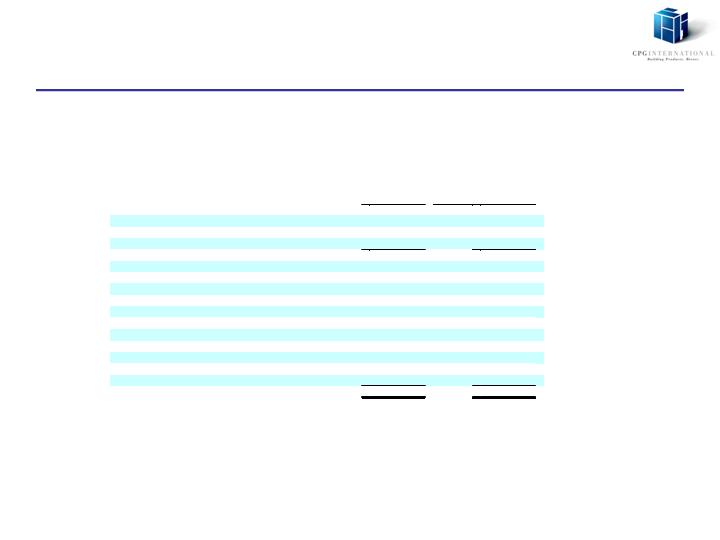

Net Income to Adjusted EBITDA Reconciliation

Appendix

Year Ended

Year

Ended

(Dollars in thousands)

December 31,

December 31

,

200

8

200

9

Net

loss

$

(48,354

)

$

(

10

,

3

0

6

)

Interest expense, net

34,905

3

1

,3

47

Income tax

benefit

(7,095

)

(11

1

)

Depreciati

on and amortization

21,491

21,6

04

EBITDA

947

4

2

,

5

3

4

Impairment of goodwill and other intangibles

40,000

1

4,408

SFAS 141 inventory adjustment

1,505

—

Relocation and hiring costs

802

474

Composatron non

-

recurring charges

606

—

Management fee

and expenses

1,855

1,7

40

Severance costs

171

412

Settlement charges

26

—

Non

-

cash compensation charge

118

97

Disposal

of fixed assets

—

52

5

Lease termination fees

—

657

Registration expenses

relat

ed to Notes

309

26

Adjusted EBITDA

$

46,339

$

6

0

,

8

7

3