Attached files

Exhibit 10.2.32

CONFIDENTIAL

For Private Placement Purposes Only

UNIT 2010 EMPLOYEE OIL AND GAS LIMITED PARTNERSHIP

7130 South Lewis Avenue, Suite 1000

Tulsa, Oklahoma 74136

(918) 493-7700

A PRIVATE OFFERING

OF

UNITS OF LIMITED PARTNERSHIP INTEREST

THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR UNDER APPLICABLE STATE SECURITIES ACTS IN RELIANCE ON EXEMPTIONS PROVIDED BY SUCH ACTS. THESE SECURITIES MAY NOT BE SOLD OR TRANSFERRED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION UNDER SUCH ACTS OR AN OPINION OF COUNSEL ACCEPTABLE TO THE GENERAL PARTNER THAT SUCH REGISTRATION IS NOT REQUIRED. FURTHER, THE RESALE OF A UNIT MAY RESULT IN SUBSTANTIAL TAX LIABILITY TO THE INVESTOR. SEE “FEDERAL INCOME TAX CONSIDERATIONS.” ACCORDINGLY, THESE UNITS SHOULD BE CONSIDERED ONLY FOR LONG-TERM INVESTMENT. SEE “PLAN OF DISTRIBUTION — SUITABILITY OF INVESTORS.”

THE INFORMATION CONTAINED IN THIS PRIVATE OFFERING MEMORANDUM IS PROVIDED BY THE GENERAL PARTNER SOLELY FOR THE PERSONS RECEIVING IT FROM THE GENERAL PARTNER AND ANY REPRODUCTION OR DISTRIBUTION OF THIS PRIVATE OFFERING MEMORANDUM, IN WHOLE OR IN PART, OR THE DIVULGENCE OF ANY OF ITS CONTENTS IS PROHIBITED AND MAY CONSTITUTE A VIOLATION OF CERTAIN STATE SECURITIES LAWS. THE OFFEREE, BY ACCEPTING DELIVERY OF THIS PRIVATE OFFERING MEMORANDUM, AGREES TO RETURN IT AND ALL ENCLOSED DOCUMENTS TO THE GENERAL PARTNER IF THE OFFEREE DOES NOT UNDERTAKE TO PURCHASE ANY OF THE UNITS OFFERED HEREBY.

Private Offering Memorandum Date December 15, 2009.

900 Preformation

Units of Limited Partnership Interest

in the

UNIT 2010 EMPLOYEE

OIL AND GAS LIMITED PARTNERSHIP

$1,000 Per Unit Plus Possible

Additional Assessments of $100 Per Unit

(Minimum Investment - 2 Units)

Minimum Aggregate Subscriptions Necessary

to Form Partnership - 50 Units

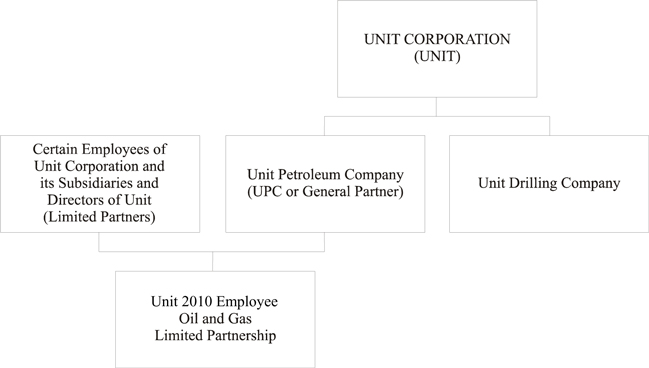

A maximum of 900 (minimum of 50) units of limited partnership interest (“Units”) in the UNIT 2010 EMPLOYEE OIL AND GAS LIMITED PARTNERSHIP, a proposed Oklahoma limited partnership (the “Partnership”), are being offered privately only to certain employees of Unit Corporation (“UNIT”) and its subsidiaries and the directors of UNIT at a price of $1,000 per Unit. Subscriptions shall be for not less than 2 Units ($2,000). The Partnership is being formed for the purpose of conducting oil and gas drilling and development operations. Purchasers of the Units will become Limited Partners in the Partnership. Unit Petroleum Company (“UPC” or the “General Partner”) will serve as General Partner of the Partnership. UPC’s address is 7130 South Lewis Avenue, Suite 1000, Tulsa, Oklahoma 74136, and telephone (918) 493-7700.

THE RIGHTS AND OBLIGATIONS OF THE GENERAL PARTNER

AND THE LIMITED PARTNERS ARE GOVERNED BY THE

AGREEMENT OF LIMITED PARTNERSHIP (THE “AGREEMENT”),

A COPY OF WHICH ACCOMPANIES THIS MEMORANDUM AND IS

INCORPORATED HEREIN BY REFERENCE

AN INVESTMENT IN THE UNITS IS SPECULATIVE AND INVOLVES

A HIGH DEGREE OF RISK. SEE “RISK FACTORS.” CERTAIN

SIGNIFICANT RISKS INCLUDE:

| • | Drilling to establish productive oil and natural gas properties is inherently speculative. |

| • | Participants will rely solely on the management capability and expertise of the General Partner. |

| • | Limited Partners must assume the risks of an illiquid investment. |

| • | Investment in the Units is suitable only for investors having sufficient financial resources and who desire a long-term investment. |

| • | Conflicts of interest exist and additional conflicts of interest may arise between the General Partner and the Limited Partners, and there are no pre-determined procedures for resolving any such conflicts. |

| • | Significant tax considerations to be considered by an investor include: |

| • | possible audit of income tax returns of the Partnership and/or the Limited Partners and adjustment to their reported tax liabilities; |

| • | a Limited Partner will not benefit from his or her share of Partnership deductions in excess of his or her share of Partnership income unless he or she has passive income from other activities; |

ii

| • | the amount of any cash distribution which a Limited Partner may receive from the Partnership could be insufficient to pay the tax liability incurred by such Limited Partner with respect to income or gain allocated to such Limited Partner by the Partnership; and |

| • | the possibility that some or all of the oil and gas tax provisions in the Obama administration’s FY 2010 budget proposal will be enacted. |

| • | There can be no assurance that the Partnership will have adequate funds to provide cash distributions to the Limited Partners. The amount and timing of any such distributions will be within the complete discretion of the General Partner. |

| • | Certain provisions in the Agreement modify what would otherwise be the applicable Oklahoma law as to the fiduciary standards for general partners in limited partnerships. Those standards in the Agreement could be less advantageous to the Limited Partners than the corresponding fiduciary standards otherwise applicable under Oklahoma law. The purchase of Units may be deemed as consent to the fiduciary standards set forth in the Agreement. |

EXCEPT AS STATED UNDER “ADDITIONAL INFORMATION,” NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS PRIVATE OFFERING MEMORANDUM IN CONNECTION WITH THIS OFFERING AND SUCH REPRESENTATIONS, IF ANY, MAY NOT BE RELIED ON. THE INFORMATION CONTAINED IN THIS PRIVATE OFFERING MEMORANDUM IS AS OF THE DATE OF THIS MEMORANDUM UNLESS ANOTHER DATE IS SPECIFIED.

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS PRIVATE OFFERING MEMORANDUM AS LEGAL, BUSINESS, OR TAX ADVICE. EACH INVESTOR SHOULD CONSULT HIS OR HER OWN ATTORNEY, BUSINESS ADVISOR AND TAX ADVISOR AS TO LEGAL, BUSINESS, TAX AND RELATED MATTERS CONCERNING HIS OR HER INVESTMENT. PROSPECTIVE INVESTORS ARE URGED TO REQUEST ANY ADDITIONAL INFORMATION THEY MAY CONSIDER NECESSARY TO MAKE AN INFORMED INVESTMENT DECISION.

THE SECURITIES OFFERED BY THIS MEMORANDUM HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION, THE OKLAHOMA SECURITIES COMMISSION OR BY THE SECURITIES REGULATORY AUTHORITY OF ANY OTHER STATE, NOR HAS ANY COMMISSION OR AUTHORITY PASSED ON OR ENDORSED THE MERITS OF THIS OFFERING OR THE ACCURACY OR ADEQUACY OF THIS PRIVATE OFFERING MEMORANDUM. ANY REPRESENTATION CONTRARY TO THE FOREGOING IS UNLAWFUL.

THESE UNITS ARE BEING OFFERED SUBJECT TO PRIOR SALE, TO WITHDRAWAL, CANCELLATION OR MODIFICATION OF THE OFFER WITHOUT NOTICE AND TO THE FURTHER CONDITIONS SET FORTH HEREIN.

iii

ADDITIONAL INFORMATION

Each prospective investor, or his or her qualified representative named in writing, has the opportunity (1) to obtain additional information necessary to verify the accuracy of the information supplied herewith or hereafter, and (2) to ask questions and receive answers concerning the terms and conditions of the offering. If you desire to avail yourself of the opportunity, please contact:

Mark E. Schell

Senior Vice President and General Counsel

Unit Petroleum Company

7130 South Lewis Avenue, Suite 1000

Tulsa, Oklahoma 74136

(918) 493-7700

The following documents and instruments are available to qualified offerees on written request:

| 1. | Amended and Restated Certificate of Incorporation and By-Laws of UNIT. |

| 2. | Certificate of Incorporation and By-Laws of Unit Petroleum Company. |

| 3. | UNIT’s Employees’ Thrift Plan. |

| 4. | Restated Unit Corporation Amended and Restated Stock Option Plan and related prospectuses covering shares of Common Stock issuable on exercise of outstanding options. |

| 5. | UNIT’s 2000 Non-Employee Directors’ Stock Option Plan, as amended and restated. |

| 6. | UNIT’s Stock and Incentive Compensation Plan. |

| 7. | The Credit Agreement and the notes payable of UNIT. |

| 8. | All periodic reports on Forms 10-K, 10-Q and 8-K and all proxy materials filed by or on behalf of UNIT with the SEC under the Securities Exchange Act of 1934, as amended, during calendar year 2009, the annual report to shareholders and all quarterly reports to shareholders submitted by UNIT to its shareholders during calendar year 2009. |

| 9. | UNIT’s current Registration Statements on Form S-3 and all supplemental prospectuses filed with the SEC under Rule 424. |

| 10. | The agreements of limited partnership for the prior oil and gas drilling programs and prior employee programs of UPC, UNIT and Unit Drilling and Exploration Company (“UDEC”). |

| 11. | All periodic reports filed with the SEC and all reports and information provided to limited partners in all limited partnerships of which UPC, UNIT or UDEC now serves or has served in the past as a general partner. |

| 12. | The agreement of limited partnership for the Unit 1986 Energy Income Limited Partnership. |

iv

SUMMARY OF CONTENTS

| Page | ||

| SUMMARY OF PROGRAM |

1 | |

| Terms of the Offering |

1 | |

| Risk Factors |

2 | |

| Additional Financing |

3 | |

| Proposed Activities |

4 | |

| Application of Proceeds |

4 | |

| Participation in Costs and Revenues |

5 | |

| Compensation |

5 | |

| Federal Income Tax Considerations; Opinion of Counsel |

5 | |

| RISK FACTORS |

6 | |

| INVESTMENT RISKS |

6 | |

| TAX STATUS AND TAX RISKS |

11 | |

| OPERATIONAL RISKS |

12 | |

| TERMS OF THE OFFERING |

14 | |

| General |

14 | |

| Limited Partnership Interests |

14 | |

| Subscription Rights |

15 | |

| Payment for Units; Delinquent Installment |

15 | |

| Right of Presentment |

16 | |

| Rollup or Consolidation of Partnership |

17 | |

| ADDITIONAL FINANCING |

18 | |

| Additional Assessments |

18 | |

| Prior Programs |

18 | |

| Partnership Borrowings |

18 | |

| PLAN OF DISTRIBUTION |

19 | |

| Suitability of Investors |

19 | |

| RELATIONSHIP OF THE PARTNERSHIP, THE GENERAL PARTNER AND AFFILIATES |

20 | |

| PROPOSED ACTIVITIES |

20 | |

| General |

20 | |

| Partnership Objectives |

22 | |

| Areas of Interest |

23 | |

| Transfer of Properties |

23 | |

| Record Title to Partnership Properties |

23 | |

| Marketing of Reserves |

23 | |

| Conduct of Operations |

24 | |

| APPLICATION OF PROCEEDS |

24 | |

| PARTICIPATION IN COSTS AND REVENUES |

25 | |

| COMPENSATION |

26 | |

| Supervision of Operations |

26 | |

| Purchase of Equipment and Provision of Services |

27 | |

| Prior Programs |

27 | |

| MANAGEMENT |

29 | |

| The General Partner |

29 | |

| Officers, Directors and Key Employees |

29 | |

| Prior Employee Programs |

32 | |

| Ownership of Common Stock |

33 | |

| Interest of Management in Certain Transactions |

34 | |

| CONFLICTS OF INTEREST |

34 | |

| Acquisition of Properties and Drilling Operations |

34 | |

| Participation in UNIT’s Drilling or Income Programs |

35 | |

| Transfer of Properties |

36 | |

| Partnership Assets |

36 | |

| Transactions with the General Partner or Affiliates |

37 | |

| Right of Presentment Price Determination |

37 | |

| Receipt of Compensation Regardless of Profitability |

37 | |

| Legal Counsel |

37 | |

| FIDUCIARY RESPONSIBILITY |

37 | |

| General |

37 |

v

| Liability and Indemnification |

38 | |

| PRIOR ACTIVITIES |

39 | |

| Prior Employee Programs |

41 | |

| Results of the Prior Oil and Gas Programs |

42 | |

| federal income tax considerations |

50 | |

| Summary of Conclusions |

51 | |

| General Tax Effects of Partnership Structure |

53 | |

| Ownership of Partnership Properties |

53 | |

| Intangible Drilling and Development Costs Deductions |

54 | |

| Depletion Deductions |

55 | |

| Production Activities Deduction |

55 | |

| Depreciation Deductions |

55 | |

| Transaction Fees |

55 | |

| Basis and At Risk Limitations |

56 | |

| Passive Loss Limitations |

56 | |

| Gain or Loss on Sale of Partnership Property |

57 | |

| Partnership Distributions |

58 | |

| Partnership Allocations |

58 | |

| Administrative Matters |

58 | |

| Proposed Legislation |

60 | |

| Accounting Methods and Periods |

60 | |

| State and Local Taxes |

60 | |

| COMPETITION, MARKETS AND REGULATION |

60 | |

| Marketing of Production |

61 | |

| Regulation of Partnership Operations |

61 | |

| Natural Gas Price Regulation |

62 | |

| Oil Pipeline Regulation |

62 | |

| State Regulation of Oil and Gas Production |

63 | |

| Legislative and Regulatory Production and Pricing Proposals |

63 | |

| Production and Environmental Regulation |

63 | |

| SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT |

64 | |

| Partnership Distributions |

64 | |

| Deposit and Use of Funds |

65 | |

| Power and Authority |

65 | |

| Rollup or Consolidation of the Partnership |

65 | |

| Limited Liability |

66 | |

| Records, Reports and Returns |

66 | |

| Transferability of Interests |

67 | |

| Amendments |

68 | |

| Voting Rights |

68 | |

| Exculpation and Indemnification of the General Partner |

69 | |

| Termination |

69 | |

| Insurance |

70 | |

| COUNSEL |

70 | |

| GLOSSARY |

70 | |

| FINANCIAL STATEMENTS |

74 |

| EXHIBIT A | - AGREEMENT OF LIMITED PARTNERSHIP | A-1 | ||

| EXHIBIT B | - LEGAL OPINION |

vi

SUMMARY OF PROGRAM

This summary is not a complete description of the terms and consequences of an investment in the Partnership and is qualified in its entirety by the more detailed information appearing throughout this Private Offering Memorandum (this “Memorandum”). For definitions of certain terms used in this Memorandum, see “GLOSSARY.”

Terms of the Offering

Limited Partnership Interests. Unit 2010 Employee Oil and Gas Limited Partnership, a proposed Oklahoma limited partnership (the “Partnership”), offers 900 preformation units of limited partnership interest (“Units”) in the Partnership. The offer is made only to certain employees of Unit Corporation (“UNIT”) and its subsidiaries and directors of UNIT (see “TERMS OF THE OFFERING — Subscription Rights”). Unless the context otherwise requires, all references in this Memorandum to UNIT shall include all or any of its subsidiaries. Unit Petroleum Company (“UPC” or the “General Partner”), a wholly owned subsidiary of UNIT, will serve as General Partner of the Partnership.

To invest in the Units, the Limited Partner Subscription Agreement and Suitability Statement (the “Subscription Agreement”) (see Attachment I to Exhibit A to this Memorandum) must be signed and forwarded to the offices of the General Partner at its address listed on the cover of this Memorandum. The Subscription Agreement must be received by the General Partner not later than 5:00 P.M. Central Standard Time on January 15, 2010 (extendable by the General Partner for up to 30 days). Subscription Agreements may be delivered to the office of the General Partner. No payment is required on delivery of the Subscription Agreement. Payment for the Units will be made either (i) in four equal Installments, the first Installment being due on March 15, 2010 and the remaining three Installments being due on June 15, September 15, and December 15, 2010, respectively, or (ii) through equal deductions from 2010 salary commencing immediately after formation of the Partnership.

The purchase price of each Unit is $1,000, and the minimum permissible purchase is two Units ($2,000) for each subscriber. Additional Assessments of up to $100 per Unit may be required (see “ADDITIONAL FINANCING — Additional Assessments”). Maximum purchases by employees (other than directors) will be for an amount equal to one-half of their base salaries for calendar year 2009; provided, however, that the General Partner may, at its discretion, accept subscriptions for greater amounts. Each member of the Board of Directors of UNIT may subscribe for up to 300 Units ($300,000). The Partnership must sell at least 50 Units ($50,000) before the Partnership will be formed. No Units will be offered for sale after the Effective Date (see “GLOSSARY”) except in compliance with the provisions of Article XIII of the Agreement. The General Partner may, at its option, purchase Units as a Limited Partner, including any amount that may be necessary to meet the minimum number of Units required for formation of the Partnership. The Partnership will terminate on December 31, 2040, unless it is terminated earlier under the provisions of the Agreement or by operation of law. See “TERMS OF THE OFFERING — Limited Partnership Interests”; “TERMS OF THE OFFERING — Subscription Rights”; and “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Termination.”

The offering will be made privately by the officers and directors of UPC or UNIT, except that in states which require participation by a registered broker-dealer in the offer and sale of securities, the Units will be offered through such broker-dealer as may be selected by the General Partner. Any participating broker-dealer may be reimbursed for actual out-of-pocket expenses. Such reimbursements will be borne by the General Partner.

Subscription Rights. Only certain salaried employees of UNIT or any of its subsidiaries whose annual base salaries for 2009 have been set at $36,000 or more and directors of UNIT are eligible to subscribe for Units. Employees may not purchase Units for an amount in excess of one-half of their base salaries for calendar year 2009; provided, however, that the General Partner may, at its discretion, accept a subscription for a greater amount. Directors’ subscriptions may not be for more than 300 Units ($300,000). Only employees and directors who are U.S. citizens are eligible to participate in the offering. In addition, employees and directors must be able to bear the economic risks of an investment in the Partnership and must have sufficient investment experience and expertise to evaluate the risks and merits of such an investment. See “TERMS OF THE OFFERING — Subscription Rights.”

1

Right of Presentment. After December 31, 2010, the Limited Partners will have the right to present their Units to the General Partner for purchase. The General Partner will not be obligated to purchase more than 20% of the then outstanding Units in any one calendar year. The purchase price to be paid for the Units will be determined by a specific valuation formula. See “TERMS OF THE OFFERING — Right of Presentment” for a description of the valuation formula and a discussion of the manner in which the right of presentment may be exercised by the Limited Partners.

Risk Factors

An investment in the Partnership has many risks. The “RISK FACTORS” section of this Memorandum contains a detailed discussion of the most important risks, organized into Investment Risks (the risks related to the Partnership’s investment in oil and gas properties and drilling activities, to an investment in the Partnership and to the provisions of the Agreement); Tax Risks (the risks arising from the tax laws as they apply to the Partnership and its investment in oil and gas properties and drilling activities); and Operational Risks (the risks involved in conducting oil and gas operations). The following are certain of the risks which are more fully described under “RISK FACTORS”. Each prospective investor should review the “RISK FACTORS” section carefully before deciding to subscribe for Units.

Investment Risks:

| • | Oil and gas prices have declined significantly during recent months in a deteriorating national and global economic environment. A slowdown in the national and global economy will also result (to varying degrees) in a reduction in the demand for oil and gas products. Significant reductions in demand for oil and gas would result in lower prices for our products and force us to curtail our production of those products which, in turn, would affect our financial results. |

| • | Future oil and natural gas prices are unpredictable. Partnership’s distributions, if any, to the Limited Partners will be adversely affected by declines in oil and natural gas prices. |

| • | The General Partner is authorized under the Agreement to cause, in its sole discretion, the sale or transfer of the Partnership’s assets to, or the merger or consolidation of the Partnership with, another partnership, corporation or other business entity. Such action could have a material impact on the nature of the investment of all Limited Partners. |

| • | Except for certain transfers to the General Partner and other restricted transfers, the Agreement prohibits a Limited Partner from transferring Units. Thus, except for the limited right of the Limited Partners after December 31, 2010 to present their Units to the General Partner for purchase, Limited Partners will not be able to liquidate their investments. |

| • | The Partnership could be formed with as little as $50,000 in Capital Contributions (excluding the Capital Contributions of the General Partner). As the total amount of Capital Contributions to the Partnership will determine the number and diversification of Partnership Properties, the ability of the Partnership to pursue its investment objectives may be restricted in the event that the Partnership receives only the minimum amount of Capital Contributions. |

| • | The drilling and completion operations to be undertaken by the Partnership for the development of oil and natural gas reserves involve the possibility of a total loss of an investment in the Partnership. |

| • | The General Partner will have the exclusive management and control of all aspects of the business of the Partnership. The Limited Partners will have no opportunity to participate in the management and control of any aspect of the Partnership’s activities. Accordingly, the Limited Partners will be entirely dependent on the management skills and expertise of the General Partner. |

| • | Conflicts of interest exist and additional conflicts of interest may arise between the General Partner and the Limited Partners, and there are no pre-determined procedures for resolving any |

2

| conflicts. Accordingly the General Partner could cause the Partnership to take actions to the benefit of the General Partner but not to the benefit of the Limited Partners. |

| • | Certain provisions in the Agreement modify what would otherwise be the applicable Oklahoma law as to the fiduciary standards for a general partner in a limited partnership. The fiduciary standards in the Agreement could be less advantageous to the Limited Partners and more advantageous to the General Partner than corresponding fiduciary standards otherwise applicable under Oklahoma law. The purchase of Units may be deemed as consent to the fiduciary standards set forth in the Agreement. |

| • | There can be no assurances that the Partnership will have adequate funds to provide cash distributions to the Limited Partners. The amount and timing of any such distributions will be within the complete discretion of the General Partner. |

| • | The amount of any cash distributions which Limited Partners may receive from the Partnership could be insufficient to pay the tax liability incurred by such Limited Partners with respect to income or gain allocated to such Limited Partners by the Partnership. |

Tax Risks:

| • | Tax laws and regulations applicable to partnership investments may change at any time and these changes may be applied retroactively. Further, several provisions in the Obama administration’s FY 2010 budget proposal would, if enacted, have an adverse impact on investments in the oil and gas industry. See “FEDERAL INCOME TAX CONSIDERATIONS-Proposed Legislation.” |

| • | Certain allocations of income, gain, loss and deduction between the Partners may be challenged by the Internal Revenue Service (the “Service”). A successful challenge would likely result in a Limited Partner having to report additional taxable income or being denied a deduction. |

| • | It is anticipated that a Limited Partner will be allocated deductions in excess of his or share of Partnership income for the first year(s) of the Partnership. Unless a Limited Partner has substantial current taxable income from trade or business activities in which the Limited Partner does not materially participate, his or her use of deductions allocated from the Partnership may be limited. |

| • | Federal income tax payable by a Limited Partner by reason of his or her allocated share of Partnership income for any year may exceed the Partnership distributions to that Limited Partner for the year. |

Operational Risks:

| • | The search for oil and gas is highly speculative and the drilling activities conducted by the Partnership may result in wells that may be dry or wells that do not produce sufficient oil and gas to produce a profit or result in a return of the Limited Partners’ investment. |

| • | Certain hazards are encountered in drilling wells, some of which could lead to substantial liabilities to third parties or governmental entities. Also, governmental regulations or new laws relating to environmental matters could increase Partnership costs, delay or prevent drilling a well, require the Partnership to cease operations in certain areas or expose the Partnership to significant liabilities for violations of laws and regulations. |

Additional Financing

Additional Assessments. After the Aggregate Subscription has been fully expended or committed and the General Partner’s Minimum Capital Contribution has been fully expended, the General Partner may make one or more calls for Additional Assessments if additional funds are required to pay the Limited Partners’ share of Drilling Costs, Special Production and Marketing Costs or Leasehold Acquisition Costs. The maximum amount

3

of total Additional Assessments which may be called for by the General Partner is $100 per Unit. See “ADDITIONAL FINANCING — Additional Assessments.”

Partnership Borrowings. After the General Partner’s Minimum Capital Contribution has been expended, the General Partner may cause the Partnership to borrow funds required to pay Drilling Costs, Special Production and Marketing Costs or Leasehold Acquisition Costs of Productive properties. The General Partner may also, but is not required to, advance funds to the Partnership to pay those costs. See “ADDITIONAL FINANCING — Partnership Borrowings.”

Proposed Activities

General. The Partnership is being formed for the purposes of conducting oil and gas drilling and development operations and acquiring producing oil and gas properties. The Partnership will, with certain limited exceptions, participate on a proportionate basis with UPC in each producing oil and gas lease acquired and in each oil and gas well participated in by UPC for its own account during the period from January 1, 2010, if the Partnership is formed before that date, or from the date of the formation of the Partnership if formed after January 1, 2010, until December 31, 2010, and will, with certain limited exceptions, serve as a co-general partner with UPC in any drilling or income programs which may be formed by the General Partner in 2010. See “PROPOSED ACTIVITIES.”

Partnership Objectives. The Partnership is being formed to provide eligible employees and directors the opportunity to participate in the oil and gas exploration and producing property acquisition activities of UPC during 2010. UNIT hopes that participation in the Partnership will provide the participants with greater proprietary interests in UPC’s operations and the potential for realizing a more direct benefit in the event these operations prove to be profitable. The Partnership has been structured to achieve the objective of providing the Limited Partners with essentially the same economic returns that UPC realizes from the wells drilled or acquired during 2010.

Application of Proceeds

The offering proceeds will be used to pay the Leasehold Acquisition Costs incurred by the Partnership to acquire those producing oil and gas leases in which the Partnership participates and the Leasehold Acquisition Costs, exploration, drilling and development costs incurred by the Partnership under the drilling activities in which the Partnership participates. The General Partner estimates (based on historical operating experience) that those costs will be expended as shown below based on the assumption of a maximum number of subscriptions in the first column and a minimum number of subscriptions in the second column:

| $900,000 Program |

$50,000 Program | |||||

| Leasehold Acquisition Costs of Properties to Be Drilled |

$ | 45,000 | $ | 2,500 | ||

| Drilling Costs of Exploratory Wells(1) |

45,000 | 2,500 | ||||

| Drilling Costs of Development Wells(1) |

630,000 | 35,000 | ||||

| Leasehold Acquisition Costs of Productive Properties |

180,000 | 10,000 | ||||

| Reimbursement of General Partner’s Overhead Costs(2) |

— | — | ||||

| Total |

$ | 900,000 | $ | 50,000 | ||

| (1) | See “GLOSSARY.” |

| (2) | The Agreement provides that the General Partner will be reimbursed by the Partnership for that part of its general and administrative overhead expense attributable to the conduct of Partnership business and affairs but that any reimbursement will be made only out of Partnership Revenue. See “COMPENSATION.” |

4

Participation in Costs and Revenues

Partnership costs, expenses and revenues will be allocated among the Partners in the following percentages:

| General Partner |

Limited Partners |

|||||

| COSTS AND EXPENSES |

||||||

| Organizational and offering costs of the Partnership and any drilling or income programs in which the Partnership participates as a co-general partner |

100 | % | 0 | % | ||

| All other Partnership costs and expenses |

||||||

| Prior to time Limited Partner Capital Contributions are entirely expended |

1 | % | 99 | % | ||

| After expenditure of Limited Partner Capital Contributions and until expenditure of General Partner’s Minimum Capital Contribution |

100 | % | 0 | % | ||

| After expenditure of General Partner’s Minimum Capital Contribution |

General Partner’s Percentage(1) |

|

Limited Partners’ Percentage(1) |

| ||

| REVENUES |

General Partner’s Percentage(1) |

|

Limited Partners’ Percentage(1) |

| ||

| (1) | See “GLOSSARY.” |

Compensation

The General Partner will not receive any management fees in connection with the operation of the Partnership. The Partnership will reimburse the General Partner for that portion of its general and administrative overhead expense attributable to its conduct of Partnership business and affairs. See “COMPENSATION.”

Federal Income Tax Considerations; Opinion of Counsel

The General Partner has received an opinion from its tax counsel, Conner & Winters, LLP (“Conner & Winters”), concerning all material federal income tax issues applicable to an investment in the Partnership. To be fully understood, the complete discussion of these matters set forth in the full tax opinion in Exhibit B should be read by each prospective investor. Based on current (as of the date of this Memorandum) laws, regulations, interpretations, and court decisions, Conner & Winters has rendered its opinion that (i) the material federal income tax benefits in the aggregate from an investment in the Partnership will be realized; (ii) the Partnership will be treated as a partnership for federal income tax purposes and not as a corporation, an association taxable as a corporation or a publicly traded partnership; (iii) to the extent the Partnership’s wells are timely drilled and its drilling costs are timely paid, then subject to the limitations on deductions discussed in such opinion, the Partners will be entitled to their pro rata shares of the Partnership’s intangible drilling and development costs (“IDC”) paid in 2010; (iv) for most Limited Partners, the Partnership’s operations will be considered a passive activity within the meaning of Section 469 of the Internal Revenue Code of 1986, as amended (the “Code”), and losses generated therefrom will be limited by the passive activity provisions of the Code; and (v) to the extent provided in the

5

opinion, the Partners’ distributive shares of Partnership tax items will be determined and allocated substantially in accordance with the terms of the Partnership Agreement.

Due to the lack of authority regarding, or the essentially factual nature of certain issues, Conner & Winters expresses no opinion on the following: (i) the impact of an investment in the Partnership on an investor’s alternative minimum tax liability; (ii) whether any interest incurred by a Partner with respect to any borrowings incurred to purchase Units will be deductible or subject to limitations on deductibility; and (iii) whether the Partnership will be treated as the tax owner of Partnership Properties acquired by the General Partner as nominee for the Partnership.

The opinion of Conner & Winters was not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be imposed by the Service. The opinion of Conner & Winters was written to support the promotion or marketing of Units in the Partnership. Prospective investors should seek advice based on their particular circumstances from an independent tax advisor.

THIS MEMORANDUM CONTAINS AN EXPLANATION OF THE MORE SIGNIFICANT TERMS AND PROVISIONS OF THE AGREEMENT OF LIMITED PARTNERSHIP WHICH IS ATTACHED AS EXHIBIT A. THE SUMMARY OF THE AGREEMENT CONTAINED IN THIS MEMORANDUM IS QUALIFIED IN ITS ENTIRETY BY SUCH REFERENCE AND ACCORDINGLY THE AGREEMENT SHOULD BE CAREFULLY REVIEWED AND CONSIDERED.

RISK FACTORS

Prospective purchasers of Units should carefully study the information contained in this Memorandum and should make their own evaluations of the probability for the discovery of oil and natural gas through exploration.

INVESTMENT RISKS

Financial Risks of Drilling Operations

The Partnership will participate with the General Partner (including, with certain limited exceptions, other drilling programs sponsored by it) and, in many cases, other parties (“joint interest parties”) in connection with drilling operations conducted on properties in which the Partnership has an interest. It is not anticipated that all, if any, of these drilling operations will be conducted under turnkey drilling contracts and, thus, all of the parties participating in the drilling operations on a particular property, including the Partnership, will be fully liable for their proportionate share of all the costs of those operations even if the actual costs are much more than the original cost estimates. Further, if any joint interest party fails to pay its share of the costs, the other joint interest parties may be required to pay the deficiency until, if ever, it can be collected from the defaulting party. As a result of forced pooling or similar proceedings (see “COMPETITION, MARKETS AND REGULATION”), the Partnership may acquire a larger ownership interest in certain Partnership Properties than originally anticipated and, thus, be required to bear a greater share of the costs of operations. Because of the foregoing, the Partnership could become liable for amounts significantly more than the amounts originally anticipated to be spent in connection with its operations and would have only limited means for providing the additional needed funds (see “ADDITIONAL FINANCING”). Also, if a company that operates a Partnership Well does not or cannot pay the costs and expenses of drilling or operating the well, the Partnership’s interest in that well may become subject to liens and claims of creditors who supplied services or materials in connection with such operations even though the Partnership may have previously paid its share of such costs and expenses to the operator. If the operator is unable or unwilling to pay the amount due, the Partnership might have to pay its share of the amounts owing to such creditors in order to preserve its interest in the well which would mean that it would, in effect, be paying for certain of such costs and expenses twice.

Dependence on General Partner

The Limited Partners will acquire interests in the Partnership, not in the General Partner or UNIT. Limited Partners will not participate in either increases or decreases in the General Partner’s or UNIT’s net worth or the value of either’s common stock. Nevertheless, because the General Partner is primarily responsible for the proper

6

conduct of the Partnership’s business and affairs and is obligated to provide certain funds that will be required in connection with the Partnership’s operations, a significant reversal of the General Partners or UNIT’s finances could have an adverse effect on the Partnership and the Limited Partners’ interests in the Partnership.

Under the Agreement, UPC is designated as the General Partner of the Partnership and is given the exclusive authority to manage and operate the Partnership’s business. See “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Power and Authority”. Accordingly, Limited Partners must rely solely on the General Partner to make all decisions on behalf of the Partnership, since the Limited Partners will have no role in the management of the business of the Partnership.

The Partnership’s success will depend, in part, on the management provided by the General Partner, the ability of the General Partner to select and acquire oil and gas properties on which Partnership Wells capable of producing oil and natural gas in commercial quantities may be drilled, to fund the acquisition of revenue producing properties, and to market oil and natural gas produced from Partnership Wells.

Conflicts of Interest

Certain of UNIT’s subsidiaries have engaged in oil and gas exploration and development and in the acquisition of producing properties for their own account and as the sponsors of drilling and income programs formed with third party investors. It is anticipated that those subsidiaries will continue to engage in those activities. However, with certain exceptions, it is likely that the Partnership will participate as a working interest owner in all producing oil and gas leases acquired and in all oil and gas wells participated in by the General Partner for its own account during the period from January 1, 2010 (if the Partnership is formed before that date) or from the date of the formation of the Partnership, if after January 1, 2010, through December 31, 2010 and, with certain limited exceptions, will be a co-general partner of any drilling or income programs, or both, formed by the General Partner or UNIT in 2010. The General Partner will determine which prospects will be acquired or drilled. With respect to prospects to be drilled, certain of the wells which are drilled for the separate account of the Partnership and the General Partner may be drilled on prospects on which initial drilling operations were conducted by the General Partner before the formation of the Partnership. Further, certain Partnership Wells will be drilled on prospects on which the General Partner and possibly future employee programs may conduct additional drilling operations in years after 2010. Except with respect to its participation as a co-general partner of any drilling or income program sponsored by the General Partner or UNIT, the Partnership will have an interest only in those wells started in 2010 and will have no rights in production from wells started in years other than 2010. Likewise, if additional interests are acquired in wells participated in by the Partnership after 2010, the Partnership will generally not be entitled to share in the acquisition of those additional interests. See “CONFLICTS OF INTEREST — Acquisition of Properties and Drilling Operations.”

The Partnership may enter into contracts for the drilling of some or all of the Partnership Wells with affiliates of the General Partner. Likewise the Partnership may sell or market some or all of its natural gas production to an affiliate of the General Partner. These contracts may not necessarily be negotiated on an arm’s—length basis. The General Partner is subject to a conflict of interest in selecting an affiliate of the General Partner to drill the Partnership Wells and/or market the natural gas therefrom. The compensation under these contracts will be determined at the time each contract is made. The costs to be paid or the sale price to be received under each contract will be competitive with the costs charged or the prices paid by unaffiliated parties in the same general geographic region. The General Partner will make the determination of what are competitive rates or prices. No provision has been made for an independent review of the fairness and reasonableness of such compensation. See “CONFLICTS OF INTERESTS — Transactions with the General Partner or Affiliates.”

Prohibition on Transferability; Lack of Liquidity

Except for certain transfers (i) to the General Partner, (ii) to or for the benefit of the transferor Limited Partner or members of his or her immediate family sharing the same residence, and (iii) by reason of death or operation of law, a Limited Partner may not transfer or assign Units. The General Partner has agreed that it will, if requested at any time after December 31, 2010, buy Units for prices determined either by an independent petroleum engineering firm or the General Partner using the formula described under “TERMS OF THE OFFERING — Right of Presentment.” The General Partner’s obligation to purchase Units is limited and does not assure the liquidity of a Limited Partner’s investment, and the price received may be less than if the Limited Partner

7

continued to hold his or her Units. In addition, similar commitments by the General Partner have been made (and may hereafter be made) to investors in other oil and gas drilling, income and employee programs. There can be no assurance that the General Partner will have the financial resources to honor its repurchase commitments. See “TERMS OF THE OFFERING — Right of Presentment.”

Delay of Cash Distributions

For income tax purposes, a Limited Partner must report his or her distributive (allocated) share of the income, gains, losses and deductions of the Partnership whether or not cash distributions are made. No cash distributions are expected to be made earlier than the first quarter of 2010. In addition, to the extent that the Partnership uses its revenues to repay borrowings or to finance its activities (see “ADDITIONAL FINANCING”), the funds available for cash distributions by the Partnership will be reduced or may be unavailable. It is possible that the amount of tax payable by a Limited Partner on his or her distributive share of the income of the Partnership will exceed his or her cash distributions from the Partnership. See “FEDERAL INCOME TAX CONSIDERATIONS.”

If and when any distributions commence and their subsequent timing or amount cannot be accurately predicted. The decision as to whether or not the Partnership will make a cash distribution at any particular time will be made solely by the General Partner.

Limitations on Voting and Other Rights of Limited Partners

The Agreement, as permitted under the Oklahoma Revised Uniform Limited Partnership Act (the “Act”), eliminates or limits the rights of the Limited Partners to take certain actions, such as:

| • | withdrawing from the Partnership, |

| • | transferring Units without restrictions, or |

| • | consenting to or voting on certain matters such as: |

| (i) | admitting a new General Partner, |

| (ii) | admitting Substituted Limited Partners, and |

| (iii) | dissolving the Partnership. |

Furthermore, the Agreement imposes restrictions on the exercise of voting rights granted to Limited Partners. See “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Voting Rights.” Without the provisions to the contrary which are contained in the Agreement, the Act provides that certain actions can be taken only with the consent of all Limited Partners. Those provisions of the Agreement which provide for or require the vote of the Limited Partners generally permit the approval of a proposal by the vote of Limited Partners holding a majority of the outstanding Units. See “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Voting Rights.” Thus, Limited Partners who do not agree with or do not wish to be subject to the proposed action may nevertheless become subject to the action if the required majority approval is obtained. Notwithstanding the rights granted to Limited Partners under the Agreement and the Act, the General Partner retains substantial discretion as to the operation of the Partnership.

Rollup or Consolidation of Partnership

Under the terms of the Agreement, at any time two years or more after the Partnership has completed substantially all of its property acquisition, drilling and development operations, the General Partner is authorized to cause the Partnership to transfer its assets to, or to merge or consolidate with, another partnership or a corporation or other entity for the purpose of combining the oil and gas properties and other assets of the Partnership with those of other partnerships formed for investment or participation by the employees, directors and/or consultants of UNIT or any of its subsidiaries. Such transfer or combination may be effected without the vote, approval or consent of the Limited Partners. In such event, the Limited Partners will receive interests in the transferee or resulting entity which will mean that they will most likely participate in the results of a larger number of properties but will have proportionately smaller allocable interests therein. Any such transaction is required to be effected in a manner

8

which UNIT and the General Partner believe is fair and equitable to the Limited Partners but there can be no assurance that such transaction will in fact be in the best interests of the Limited Partners. Limited Partners have no dissenters’ or appraisal rights under the terms of the Agreement or the Act. Such a transaction would result in the termination and dissolution of the Partnership. While there can be no assurance that the Partnership will participate in such a transaction, the General Partner currently anticipates that the Partnership will, at the appropriate time, be involved in such a transaction. See “TERMS OF OFFERING,” and “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT.”

Partnership Borrowings

The General Partner has the authority to cause the Partnership to borrow funds to pay certain costs of the Partnership. While the use of financing to preserve the Partnership’s equity in oil and gas properties will be intended to increase the Partnership’s profits, such financing could have the effect of increasing the Partnership’s losses if the Partnership is unsuccessful. In addition, the Partnership may have to mortgage its oil and gas properties and other assets in order to obtain additional financing. If the Partnership defaults on such indebtedness, the lender may foreclose and the Partnership could lose its investment in such oil and gas properties and other assets. See “ADDITIONAL FINANCING — Partnership Borrowings.”

Limited Liability

Under the Act a Limited Partner’s liability for the obligations of the Partnership is limited to such Limited Partner’s Capital Contribution and such Limited Partner’s share of Partnership assets. In addition, if a Limited Partner receives a return of any part of his or her Capital Contribution, such Limited Partner is generally liable to the Partnership for a period of one year thereafter (or six years in the event such return is in violation of the Agreement) for the amount of the returned contribution. A Limited Partner will not otherwise be liable for the obligations of the Partnership unless, in addition to the exercise of his or her rights and powers as a Limited Partner, such Limited Partner participates in the control of the business of the Partnership.

The Agreement provides that by a vote of a majority in interest, the Limited Partners may effect certain changes in the Partnership such as termination and dissolution of the Partnership and amendment of the Agreement. The exercise of any of these and certain other rights is conditioned on receipt of an opinion by Conner & Winters, LLP for the Limited Partners or an order or judgment of a court of competent jurisdiction to the effect that the exercise of such rights will not result in the loss of the limited liability of the Limited Partners or cause the Partnership to be classified as an association taxable as a corporation (see “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Amendments” and “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Termination”). As a result of certain judicial opinions it is not clear that these rights will ever be available to the Limited Partners. Nevertheless, in spite of the receipt of any such opinion or judicial order, it is still possible that the exercise of any such rights by the Limited Partners may result in the loss of the Limited Partners’ limited liability. The Partnership will be governed by the Act. The Act expressly permits limited partners to vote on certain specified partnership matters without being deemed to be participating in the control of the Partnership’s business and, thus, should result in greater certainty and more easily obtainable opinions of Conner & Winters regarding the exercise of most of the Limited Partners’ rights.

If the Partnership is dissolved and its business is not to be continued, the Partnership will be wound up. In connection with the winding up of the Partnership, all of its properties may be sold and the proceeds thereof credited to the accounts of the Partners. Properties not sold will, on termination of the Partnership, be distributed to the Partners. The distribution of Partnership Properties to the Limited Partners would result in their having unlimited liability with respect to such properties. See “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Limited Liability.”

Partnership Acting as Co-General Partner

It is anticipated that the Partnership will serve as a co-general partner in any drilling or income programs formed by the General Partner or UNIT during 2010. See “PROPOSED ACTIVITIES.” Accordingly, the Partnership generally will be liable for the obligation and recourse liabilities of any such drilling or income program formed. While a Limited Partner’s liability for such claims will be limited to such Limited Partners Capital Contribution

9

and share of Partnership assets, such claims if satisfied from the Partnership’s assets could adversely affect the operations of the Partnership.

Past-Due Installments; Acceleration; Additional Assessments

Installments and Additional Assessments (see “ADDITIONAL FINANCING”) are legally binding obligations and past-due amounts will bear interest at the rate set forth in the Agreement; provided, however, that if the General Partner determines that the total Aggregate Subscription is not required to fund the Partnership’s business and operations, then the General Partner may, at its sole option, elect to release the Limited Partners from their obligation to pay one or more Installments and amend any relevant Partnership documents accordingly. It is anticipated that the total Aggregate Subscription will be required to fund the Partnership’s business and operations. In the event an Installment is not paid when due and the General Partner has not released the Limited Partners from their obligation to pay such Installment, then the General Partner may, at its sole option, purchase all Units of the director or employee who fails to pay such Installment, at a price equal to the amount of the prior Installments paid by such person. The General Partner may also bring legal proceedings to collect any unpaid Installments or Additional Assessments not waived by it. In addition, as indicated under “TERMS OF THE OFFERING — Payment for Units; Delinquent Installment,” if an employee’s employment with or position as a director of the General Partner, UNIT or any affiliate thereof is terminated other than by reason of Normal Retirement (see “GLOSSARY”), death or disability prior to the time the full amount of the subscription price for his or her Units has been paid, all unpaid Installments not waived by the General Partner as described above will become due and payable on such termination.

Partnership Funds

Except for Capital Contributions, Partnership funds are expected to be commingled with funds of the General Partner or UNIT. Thus, Partnership funds could become subject to the claims of creditors of the General Partner or UNIT. The General Partner believes that its assets and net worth are such that the risk of loss to the Partnership by virtue of such fact is minimal but there can be no assurance that the Partnership will not suffer losses of its funds to creditors of the General Partner or UNIT.

Compliance with Federal and State Securities Laws

This offering has not been registered under the Securities Act of 1933, as amended, in reliance on exemptions from the registration provisions of that act. Further, these interests are being sold pursuant to exemptions from registration in the various states in which they are being offered and may be subject to additional restrictions in such jurisdictions on transfer. There is no assurance that the offering presently qualifies or will continue to qualify under such exemptions due to, among other things, the adequacy of disclosure and the manner of distribution of the offering, the existence of similar offerings conducted by the General Partner or UNIT or its affiliates in the past or in the future, a failure or delay in providing notices or other required filings, the conduct of other oil and gas activities by the General Partner or UNIT and its affiliates or the change of any securities laws or regulations.

If and to the extent suits for rescission are brought and successfully concluded for failure to register this offering or other offerings under the Securities Act of 1933, as amended, or state securities acts, or for acts or omissions constituting certain prohibited practices under any of said acts, both the capital and assets of the General Partner and the Partnership could be adversely affected, thus jeopardizing the ability of the Partnership to operate successfully. Further, the time and capital of the General Partner could be expended in defending an action by investors or by state or federal authorities even where the Partnership and the General Partner are ultimately exonerated.

Title to Properties

The Partnership Agreement empowers the General Partner, UNIT or any of their affiliates, to hold title to the Partnership Properties for the benefit of the Partnership. As such it is possible that the Partnership Properties could be subject to the claims of creditors of the General Partner. The General Partner is of the opinion that the likelihood of the occurrence of such claims is remote. However, the Partnership Property could be subject to

10

claims and litigation in the event that the General Partner failed to pay its debts or became subject to the claims of creditors.

Use of Partnership Funds to Exculpate and Indemnify the General Partner

The Agreement contains certain provisions which are intended to limit the liability of the General Partner and its affiliates for certain acts or omissions within the scope of the authority conferred on them by the Agreement. In addition, under the Agreement, the General Partner will be indemnified by the Partnership against losses, judgments, liabilities, expenses and amounts paid in settlement sustained by it in connection with the Partnership so long as the losses, judgments, liabilities, expenses or amounts were not the result of gross negligence or willful misconduct on the part of the General Partner. See “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Exculpation and Indemnification of the General Partner.”

The Partnership Agreement May Limit the Fiduciary Obligation of the General Partner to the Partnership and the Limited Partners

The Agreement contains certain provisions which modify what would otherwise be the applicable Oklahoma law relating to the fiduciary standards of the General Partner to the Limited Partners. The fiduciary standards in the Agreement could be less advantageous to the Limited Partners and more advantageous to the General Partner than the corresponding fiduciary standards otherwise applicable under Oklahoma law (although there are very few legal precedents clarifying exactly what fiduciary standards would otherwise be applicable under Oklahoma law). The purchase of Units may be deemed as consent to the fiduciary standards set forth in the Agreement. See “FIDUCIARY RESPONSIBILITY.” As a result of these provisions in the Agreement, the Limited Partners may find it more difficult to hold the General Partner responsible for acting in the best interest of the Partnership and the Limited Partners than if the fiduciary standards of the otherwise applicable Oklahoma law governed the situation.

TAX STATUS AND TAX RISKS

It is possible that the tax treatment currently available with respect to oil and gas exploration and production will be modified or eliminated on a retroactive or prospective basis by legislative, judicial, or administrative actions. The limited tax benefits associated with oil and gas exploration do not eliminate the inherent economic risks. See “FEDERAL INCOME TAX CONSIDERATIONS-Proposed Legislation.”

Partnership Classification

Conner & Winters has rendered its opinion that the Partnership will be classified for federal income tax purposes as a partnership and not as a corporation, an association taxable as a corporation or a “publicly traded partnership.” Such opinion is not binding on the Service or the courts. If the Partnership were classified as a corporation, association taxable as a corporation or publicly traded partnership, any income, gain, loss, deduction, or credit of the Partnership would remain at the entity level, and not flow through to the Partners, the income of the Partnership would be subject to corporate tax rates at the entity level and distributions to the Partners could be considered dividend distributions. See “Federal Income Tax Considerations—General Tax Effects of Partnership Structure.”

Limited Partner Interests

It is anticipated that in the first year(s) of the Partnership, Limited Partners will be allocated deductions in excess of their allocations of income. An investment as a Limited Partner may not be advisable for a person who does not anticipate having substantial current taxable income from passive trade or business activities (not counting dividend or interest income). Most Limited Partners will be subject to the “passive activity loss” rules. A Limited Partner subject to the passive activity loss rules will be unable to use passive losses generated by the Partnership until and unless he or she has realized “passive income”.

Tax Liabilities in Excess of Cash Distributions

A Limited Partner must include in his or her own income tax return his or her share of the items of the Partnership’s income, gain, profit, loss, and deductions whether or not cash proceeds are actually distributed to the

11

Partner to pay any tax resulting from the Partnership’s income or gain. For example, income from the Partnership’s sale of oil and gas production will be taxable to Limited Partners as ordinary income subject to depletion and other deductions whether or not the proceeds from such sale are actually distributed (for example, where Partnership income is used to repay Partnership indebtedness).

Items Not Covered by the Tax Opinion

Due to the lack of authority regarding, or the essentially factual nature of certain issues, Conner & Winters has expressed no opinion as to the following: (i) the impact of an investment in the Partnership on an investor’s alternative minimum tax liability; (ii) whether any of the Partnership’s properties will be considered “proven” for purposes of depletion deductions; and (iii) whether the Partnership will be treated as the tax owner of Partnership Properties acquired by the General Partner as nominee for the Partnership.

Tax Opinion Not Binding on Service

Prospective investors should recognize that an opinion of legal counsel merely represents such counsel’s best legal judgment under existing statutes, judicial decisions, and administrative regulations and interpretations. There can be no assurance that deductions claimed by the Partnership in reliance on the opinion of Conner & Winters will not be challenged successfully by the Service.

The opinion of Conner & Winters was not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be imposed by the Service. The opinion of Conner & Winters was written to support the promotion or marketing of Units in the Partnership. Prospective investors should seek advice based on their particular circumstances from an independent tax advisor.

OPERATIONAL RISKS

Risks Inherent in Oil and Gas Operations

The Partnership will be participating with the General Partner in acquiring producing oil and gas leases and in the drilling of those oil and gas wells commenced by the General Partner from the later of January 1, 2010 or the time the Partnership is formed through December 31, 2010 and, with certain limited exceptions, serving as a co-general partner of any oil and gas drilling or income programs, or both, formed by the General Partner or UNIT during 2010.

All drilling to establish productive oil and natural gas properties is inherently speculative. The techniques presently available to identify the existence and location of pools of oil and natural gas are indirect, and, therefore, a considerable amount of personal judgment is involved in the selection of any prospect for drilling. The economics of oil and natural gas drilling and production are affected or may be affected in the future by a number of factors which are beyond the control of the General Partner, including (i) the general demand in the economy for energy fuels, (ii) the worldwide supply of oil and natural gas, (iii) the price of, as well as governmental policies with respect to, oil and liquefied natural gas imports, (iv) potential competition from competing alternative fuels, (v) governmental regulation of prices for oil and natural gas production, gathering and transportation, (vi) state regulations affecting allowable rates of production, well spacing and other factors such as, but not limited to, regulation of gathering, (vii) proximity to and capacity available on oil and gas pipelines, and (viii) availability of drilling rigs, casing and other necessary goods and services. See “COMPETITION, MARKETS AND REGULATION.” The revenues, if any, generated from Partnership operations will be highly dependent on the future prices and demand for oil and natural gas. The factors enumerated above affect, and will continue to affect, oil and natural gas prices. Recently, prices for oil and natural gas have fluctuated over a wide range.

Operating and Environmental Hazards

Operating hazards such as fires, explosions, blowouts, unusual formations, formations with abnormal pressures and other unforeseen conditions are sometimes encountered in drilling wells. On occasion, substantial liabilities to third parties or governmental entities may be incurred, the payment of which could reduce the funds available for exploration and development or result in loss of Partnership Properties. The Partnership will attempt to maintain customary insurance coverage, but the Partnership may be subject to liability for pollution and other

12

damages or may lose substantial portions of its properties due to hazards against which it cannot insure or against which it may elect not to insure due to unreasonably high or prohibitive premium costs or for other reasons. The activities of the Partnership may expose it to drilling limitations and potential liability for pollution or other damages under laws and regulations relating to environmental matters (see “Government Regulation and Environmental Risks” below).

Competition

The oil and gas industry is highly competitive. The Partnership will be involved in intense competition for the acquisition of quality undeveloped leases and producing oil and gas properties. There can be no assurance that a sufficient number of suitable oil and gas properties will be available for acquisition or development by the Partnership. The Partnership will be competing with numerous major and independent companies which possess financial resources and staffs larger than those available to it. The Partnership, therefore, may be unable in certain instances to acquire desirable leases or supplies or may encounter delays in commencing or completing Partnership operations.

Markets for Oil and Natural Gas Production

Historically, oil and gas prices have been extremely volatile, with significant increases and significant price drops being experienced from time to time. Oil and gas prices have declined significantly during recent months in a deteriorating national and global economic environment. The current economic environment and the recent decline in commodity prices are causing the General Partner (and other oil and gas companies) to reduce their overall level of drilling activity and spending. A slowdown in the national and global economy will also result (to varying degrees) in a reduction in the demand for oil and gas products by those industries and consumers that use those products in their business operations. The degree to which that demand is reduced and for how long it may last are unknown at this time. Significant reductions in demand for oil and gas would result in lower prices for our products and force us to curtail our production of those products which, in turn, would affect our financial results. In the future, various factors beyond the control of the Partnership will have a significant effect on oil and gas prices. Such factors include, among other things, uncertainty in the national and global economic markets, the domestic and foreign supply of oil and gas, the price of foreign imports, the levels of demand for oil and gas products, the price and availability of alternative fuels, the availability of pipeline capacity, changes in existing and proposed federal regulation and price controls, and the volatility of spot prices and commodity markets for oil and gas.

Due to the uncertainty in the energy markets, it is possible that prices for oil produced in the future will be higher or lower than those currently available. There can be no assurance that the oil the Partnership produces can be marketed on favorable price and other contractual terms. See “COMPETITION, MARKETS AND REGULATION — Marketing of Production.”

The natural gas market is also unsettled due to a number of factors. In the past, production from natural gas wells in some geographic areas of the United States was curtailed for considerable periods of time due to a lack of market demand. Over the past several years demand for natural gas has increased greatly limiting the number of wells being shut in for lack of demand. It is possible, however, that Partnership Wells may in the future be shut-in or that natural gas will be sold on terms less favorable than might otherwise be obtained should demand for gas lessen in the future. Competition for available markets has been vigorous and there remains great uncertainty about prices that purchasers will pay. Natural gas surpluses could result in the Partnership’s inability to market natural gas profitably, causing Partnership Wells to curtail production and/or receive lower prices for its natural gas, situations which would adversely affect the Partnership’s ability to make cash distributions to its participants. See “COMPETITION, MARKETS AND REGULATION.”

In the event that the Partnership discovers or acquires natural gas reserves, there may be delays in commencing or continuing production due to the need for gathering and pipeline facilities, contract negotiation with the available market, pipeline capacities, seasonal takes by the gas purchaser or a surplus of available gas reserves in a particular area.

13

Government Regulation and Environmental Risks

The oil and gas business is subject to pervasive government regulation under which, among other things, rates of production from producing properties may be fixed and the prices for gas produced from such producing properties may be impacted. It is possible that these regulations pertaining to rates of production could become more pervasive and stringent in the future. The activities of the Partnership may expose it to potential liability under laws and regulations relating to environmental matters which could adversely affect the Partnership. Compliance with these laws and regulations may increase Partnership costs, delay or prevent the drilling of wells, delay or prevent the acquisition of otherwise desirable producing oil and gas properties, require the Partnership to cease operations in certain areas, and cause delays in the production of oil and gas. See “COMPETITION, MARKETING AND REGULATION.”

Leasehold Defects

In certain instances, the Partnership may not be able to obtain a title opinion or report with respect to a producing property that is acquired. Consequently, the Partnership’s title to any such property may be uncertain. Furthermore, even if certain technical defects do appear in title opinions or reports with respect to a particular property, the General Partner, in its sole discretion, may determine that it is in the best interest of the Partnership to acquire such property without taking any curative action.

TERMS OF THE OFFERING

General

| • | 900 Maximum Units; 50 Minimum Units |

| • | $1,000 Units; Minimum subscription: $2,000 |

| • | Minimum Partnership: $50,000 in subscriptions |

| • | Maximum Partnership: $900,000 in subscriptions |

Limited Partnership Interests

The Partnership hereby offers to certain employees (described under “Subscription Rights” below) and directors of UNIT and its subsidiaries an aggregate of 900 Units. The purchase price of each Unit is $1,000, and the minimum permissible purchase by any eligible subscriber is two Units ($2,000). See “Subscription Rights” below for the maximum number of Units that may be acquired by subscribers.

The Partnership will be formed as an Oklahoma limited partnership on the closing of the offering of Units made by this Memorandum. The General Partner will be Unit Petroleum Company (the “General Partner”, or “UPC”), an Oklahoma corporation. Partnership operations will be conducted from the General Partner’s offices, the address of which is 7130 South Lewis Avenue, Suite 1000, Tulsa, Oklahoma 74136, telephone (918) 493-7700.

The offering of Units will be closed on January 15, 2010, unless extended by the General Partner for up to 30 days, and all Units subscribed will be issued on the Effective Date. The offering may be withdrawn by the General Partner at any time prior to such date if it believes it to be in the best interests of the eligible employees and Directors or the General Partner not to proceed with the offering.

If at least 50 Units ($50,000) are not subscribed prior to the termination of the offering, the Partnership will not commence business. The General Partner may, on its own accord, purchase Units and, in such capacity, will enjoy the same rights and obligations as other Limited Partners, except the General Partner will have unlimited liability. The General Partner may, in its discretion, purchase Units sufficient to reach the minimum Aggregate Subscription ($50,000). Because the General Partner or its affiliates might benefit from the successful completion of this offering (see “PARTICIPATION IN COSTS, AND REVENUES” and “COMPENSATION”), investors should not expect that sales of the minimum Aggregate Subscription indicate that such sales have been made to

14

investors that have no financial or other interest in the offering or that have otherwise exercised independent investment discretion. Further, the sale of the minimum Aggregate Subscription is not designed as a protection to investors to indicate that their interest is shared by other unaffiliated investors and no investor should place any reliance on the sale of the minimum Aggregate Subscription as an indication of the merits of this offering. Units acquired by the General Partner will be for investment purposes only without a present intent for resale and there is no limit on the number of Units that may be acquired by it.

Subscription Rights

Units are offered only to persons who are salaried employees of UNIT or its subsidiaries at the date of formation of the Partnership and whose annual base salaries for 2009 (excluding bonuses) have been set at $36,000 or more and to directors of UNIT. Only employees and directors who are U.S. citizens are eligible to participate in the offering. In addition, employees and directors must be able to bear the economic risks of an investment in the Partnership and must have sufficient investment experience and expertise to evaluate the risks and merits of such an investment. See “PLAN OF DISTRIBUTION — Suitability of Investors.”

Eligible employees and directors are restricted as to the number of Units they may purchase in the offering. The maximum number of Units which can be acquired by any employee is that number of whole Units which can be purchased with an amount which does not exceed one-half of the employee’s base salary for 2009; provided, however, that the General Partner may, at its discretion, accept a subscription for a greater amount. Each director of UNIT may subscribe for a maximum of 300 Units (maximum investment of $300,000). At December 8, 2009 there were approximately 504 people eligible to purchase Units.

Eligible employees and directors may acquire Units through a corporation or other entity in which all of the beneficial interests are owned by them or permitted assignees (see “SUMMARY OF THE LIMITED PARTNERSHIP AGREEMENT — Transferability of Interests”); provided that such employees or directors will be jointly and severally liable with such entity for payment of the Capital Subscription.

The number of Units offered is limited and there will not be sufficient Units available if a substantial number of the eligible employees and directors subscribe for the maximum number of Units. In the event the Units are oversubscribed, Units will be allocated among the respective subscribers in the proportion that each subscription amount bears to total subscriptions obtained.

No employee is obligated to purchase Units in order to remain in the employ of UNIT, and the purchase of Units by any employee will not obligate UNIT to continue the employment of such employee. Units may be subscribed for by a trust for the minor children of eligible employees and directors.

Payment for Units; Delinquent Installment

The Capital Subscriptions of the Limited Partners will be payable either (i) in four equal Installments, the first of such Installments being due on March 15, 2010 and the remaining three of such Installments being due on June 15, September 15, and December 15, 2010, respectively, or (ii) by employees so electing in the space provided on the Subscription Agreement, through equal deductions from 2010 salary paid to the employee by the General Partner, UNIT or its subsidiaries commencing immediately after formation of the Partnership. If an employee or director who has subscribed for Units (either directly or through a corporation or other entity) ceases to be employed by or serve as a director of the General Partner, UNIT or any of its subsidiaries for any reason other than death, disability or Normal Retirement prior to the time the full amount of all Installments not waived by the General Partner as described below are due, then the due date for any such unpaid Installments shall be accelerated so that the full amount of his or her unpaid Capital Subscription will be due and payable on the effective date of such termination.

Each Installment will be a legally binding obligation of the Limited Partner and any past due amounts will bear interest at an annual rate equal to two percentage points in excess of the prime rate of interest of Bank of Oklahoma, N.A., Tulsa, Oklahoma; provided, however, that if the General Partner determines that the total Aggregate Subscription is not required to fund the Partnership’s business and operations, then the General Partner may, at its sole option, elect to release the Limited Partners from their obligation to pay one or more Installments (including the obligation to pay in the amount of any Additional Assessments). If the General Partner elects to waive the payment of an Installment, it will notify all Limited Partners promptly in writing of its decision and

15

will, to the extent required, amend the certificate of limited partnership and any other relevant Partnership documents accordingly. It is currently anticipated that the total Aggregate Subscription will be required, however, to fund the Partnership’s business and operations.