Attached files

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported): February 12, 2010

WOOZYFLY

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-51430

|

20-3678799

|

|

(State

or Other Jurisdiction of Incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification Number)

|

619 West

Texas Avenue, Suite 126, Midland, Texas 79701

(Address

of principal executive offices) (zip code)

432-686-7777

(Registrant's

telephone number, including area code)

Stephen

M. Fleming, Esq.

Law

Offices of Stephen M. Fleming PLLC

49 Front

Street, Suite 206

Rockville

Centre, New York 11570

Phone:

(516) 833-5034

Fax:

(516) 977-1209

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form

8-K and other reports filed by Woozyfly Inc. (“Woozyfly” or the “Company”) from

time to time with the Securities and Exchange Commission (collectively the

"Filings") contain or may contain forward looking statements and information

that are based upon beliefs of, and information currently available to, the

Company's management as well as estimates and assumptions made by the Company's

management. When used in the filings the words "anticipate", "believe",

"estimate", "expect", "future", "intend", "plan" or the negative of these terms

and similar expressions as they relate to the Company’s or Company’s management

identify forward looking statements. Such statements reflect the

current view of the Company with respect to future events and are subject to

risks, uncertainties, assumptions and other factors (including the risks

contained in the section of this report entitled "Risk Factors") relating to the

Company’s industry, the Company’s operations and results of operations and any

businesses that may be acquired by the Company. Should one or more of these

risks or uncertainties materialize, or should the underlying assumptions prove

incorrect, actual results may differ significantly from those anticipated,

believed, estimated, expected, intended or planned.

Although

the Company’s management believes that the expectations reflected in the forward

looking statements are reasonable, the Company cannot guarantee future results,

levels of activity, performance or achievements. Except as required by

applicable law, including the securities laws of the United States, the Company

does not intend to update any of the forward-looking statements to conform these

statements to actual results. The following discussion should be read in

conjunction with the Company's financial statements and the related notes filed

with this Form 8-K.

In this

Form 8-K, references to "we," "our," "us," the "Company," "Woozy" or "Woozyfly"

refer to Woozyfly Inc., a Nevada corporation.

Item

1.01 Entry into a Material Definitive Agreement.

Item

2.01 Completion of Acquisition or Disposition of Assets.

Woozyfly, Inc. was organized September

11, 2003 (Date of Inception) under the laws of the State of Nevada, as GPP

Diversified, Inc. The business of the Company was to sell pet products via

the Internet. We were initially authorized to issue 25,000,000 shares of

its no par value common stock. On November 9, 2005, we amended our

articles of incorporation to increase our authorized capital to 100,000,000

shares with a par value of $0.001. Concurrently, we changed our name from

GPP Diversified, Inc. to Pet Express Supplies, Inc. On July 28, 2008, Pet

Express Supply, Inc. entered into an Exchange Agreement with each of the

shareholders of CJ Vision Enterprises, Inc., a Delaware corporation doing

business as Woozyfly.com, pursuant to which we changed our corporate name to

Woozyfly, Inc. , authorized the issuance of 10,000,000 blank check

preferred shares and effectuated a 6:1 stock split. On January 15,

2009, we ceased operations.

On May

12, 2009, Woozyfly filed a voluntary petition in the United States Bankruptcy

Court for the Southern District of New York (the “Bankruptcy Court”) seeking

reorganization relief under the provisions of Chapter 11 of Title 11 of the

United States Code (the “Bankruptcy Code”). The Chapter 11 case is being

administered under the caption In re Woozyfly, Inc. Case No. 09-13022 (JMP)

(the “Chapter 11 Case”). Woozyfly continued to operate its business as

debtor in possession under the jurisdiction of the Bankruptcy Court and in

accordance with the applicable provisions of the Bankruptcy Code and orders of

the Bankruptcy Court. In connection with the Chapter 11 Case,

the Bankruptcy Court approved the arrangement pursuant to which MKM Opportunity

Master Fund Ltd agreed to provide a DIP loan in the amount up to $100,000 (the

“DIP Loan”).

The

filing of the Chapter 11 Case constituted an event of default or otherwise

triggered repayment obligations under the Company's 6% Secured Convertible Notes

due June 30, 2011 ("Convertible Notes"). As a result, all indebtedness

outstanding under these facilities and the notes became automatically due and

payable, subject to an automatic stay of any action to collect, assert, or

recover a claim against the Company and the application of applicable bankruptcy

law.

On

January 21, 2010, we entered into an Agreement and Plan of Merger (“Merger

Agreement”) with STW Acquisition, Inc. (“Acquisition Sub”), a wholly owned

subsidiary of the Company, STW Resources, Inc. (“Acquiree” or “STW”) and certain

shareholders of STW controlling a majority of the issued and outstanding shares

of STW. Pursuant to the Merger Agreement, STW merged into

the Acquisition Sub resulting in an exchange of all of the issued and

outstanding shares of STW for shares of the Company on a one for one basis. At

such time, STW will become a wholly owned subsidiary of the

Company.

On February 9, 2010, the Court entered

an order confirming the Seconded Amended Plan of Reorganization (the “Plan”)

pursuant to which the Plan and the Merger was approved. It is

expected that the Plan will be effective February 19, 2010 (the “Effective

Date”). The

principal

provisions of the Plan are as follows:

|

·

|

MKM,

the DIP Lender, shall receive 400,000 shares of common stock and 2,140,000

shares of preferred stock;

|

|

·

|

the

holders of the Convertible Notes shall receive 1,760,000 shares of common

stock;

|

|

·

|

general

unsecured claims shall received 100,000 shares of common stock;

and

|

|

·

|

the

Company’s equity interest shall be extinguished and

cancelled.

|

-

2 -

On

February 12, 2009, pursuant to the terms of the Merger Agreement, STW merged

with and into Acquisition Sub, which became a wholly-owned subsidiary of the

Company (the “Merger”). In consideration for the Merger and STW

becoming a wholly-owned subsidiary of the Company, the Company issued an

aggregate of 26,543,075 (the “STW Acquisition Shares”) shares of common stock to

the shareholders of STW at the closing of the merger and all derivative

securities of STW as of the Merger became derivative securities of Woozyfly

including options and warrants to acquire 12,613,002 shares of common stock at

an exercise price ranging from $3.00 to $8.00 with an exercise period ranging

from July 31, 2011 through November 12, 2014 and convertible debentures in the

principal amount of $1,467,903 with a conversion price of $0.25 and maturity

dates ranging from April 24, 2010 through November 12, 2010.

Considering

that, following the merger, the shareholders of STW control the majority of our

outstanding voting common stock and we effectively succeeded our otherwise

minimal operations to those that are theirs, STW is considered the accounting

acquirer in this reverse-merger transaction. A reverse-merger transaction

is considered, and accounted for as, a capital transaction in substance; it is

equivalent to the issuance of STW securities for our net monetary assets, which

are deminimus, accompanied by a recapitalization. Accordingly, we have not

recognized any goodwill or other intangible assets in connection with this

reverse merger transaction. STW is the surviving and continuing entities and the

historical financials following the reverse merger transaction will be those of

STW. We were a "shell company" (as such term is defined in Rule 12b-2

under the Securities Exchange Act of 1934, as amended) immediately prior to our

acquisition of STW pursuant to the terms of the Merger Agreement. As

a result of such acquisition, our operations our now focused on the provision of

customized water reclamation services. Consequently, we believe that

acquisition has caused us to cease to be a shell company as we no longer have

nominal operations.

STW

Overview

STW,

based in Houston, Texas, provides customized water reclamation

services. STW’s core expertise is an understanding of water chemistry

and its application to the analysis and remediation of complex water reclamation

issues. STW provides a complete solution throughout all phases of a water

reclamation project including analysis, design, evaluation, implementation and

operations.

STW’s

expertise is applicable to several market segments including:

|

·

|

Gas

shale hydro-fracturing flowback;

|

|

·

|

Oil

and gas produced water;

|

|

·

|

acid

mine drainage (“AMD”);

|

|

·

|

desalination;

|

|

·

|

brackish

water; and

|

|

·

|

municipal

waste water.

|

Understanding

water chemistry is the foundation of STW’s expertise. STW will provide detailed

chemical analysis of the input stream and of the process output that conforms to

the various environmental and legal requirements. STW becomes an integral part

of the water management process and provides a customized solution that

encompasses analysis, design and operations including pretreatment and

transportation. Simultaneously, STW evaluates the economic impact of

this process to the customer. These processes will use technologies that fit our

customer’s need: fixed, mobile or portable; evaporation, reverse-osmosis or

membrane technology, and any necessary pre-treatment, crystallization and

post-treatment. STW will also supervise construction, testing, and operation of

these systems. Our keystone is determining and optimizing the most appropriate

technology to effectively and economically address our customers’ particular

requirements. As an independent solutions provider STW is

manufacturer-agnostic and is committed to the use of the right technology

demanded by the design process.

Market

Opportunities

Gas shale fracturing

flowback water

STW is

actively pursuing opportunities in all the major shale formations in the United

States. The initial focus, in this sector, is the Marcellus Shale in

Pennsylvania. Presently, we believe there are about 800 producing

wells, the majority being simple vertical wells, and over sixty new wells in

Pennsylvania are being drilled each month. Most of the new wells

being drilled are horizontal, requiring about 3.5 million gallons of water per

well. There are 28 producers in the Marcellus, with the four largest

being Range Resources, Chesapeake Energy, Atlas Energy Resources and Seneca

Resources.

Unconventional

tight gas shales such as Marcellus require millions of gallons of fresh water to

drill and stimulate a new well. The water returns during the fracture

flowback (“frac”) and production (“production”) with salts or TDS at levels

unfit for human consumption. This flowback or produced water is

typically disposed of through various means such as controlled dilution to a

river, or lost from the ecosystem by injection into disposal

wells. STW will target the frac water market in the tight gas

formations first, and approach the produced water market for coal bed methane

and oil and gas production subsequently.

-

3 -

Oil and

gas reservoirs are usually found in porous rocks, which also contain

saltwater. Cross linked gel fracture fluids with high “proppant”

loading (additives that prop open fissures in the geological formation caused by

hydraulic fracturing) have been utilized to fracture these zones in order to

gain permeability, allowing the oil and gas to flow to the well

bore. The unconventional shale formations have been common knowledge

for decades, but the cost of gas production was always considered to be

uneconomical. The wells were drilled and fractured with the same

crossed linked system as discussed above.

All of

the wells were vertical and required stimulation about every three years with a

new fracture. Around 2001, the “slick water fracture” technique was

developed. This change required larger volumes of fresh water (1.2 million

gallons per fracture on a vertical well) to be used in the fracturing process, a

friction reducing polymer additive, and low concentrations of a proppant in the

hydraulic fracture fluid. Wells using this modified technique now can

economically produce gas for over eight years without

re-stimulation. The fresh water is believed to dissolve salts from

the shale over time and open up the natural fractures and fissures in the rock,

allowing more gas to be produced. In 2003, horizontal drilling rigs

were brought into the Barnett Shale and the slick water fracture volume

increased from one to eight plus million gallons per well. The slick

water fracture technique has become the standard for all of the shale formations

for stimulation of the wells.

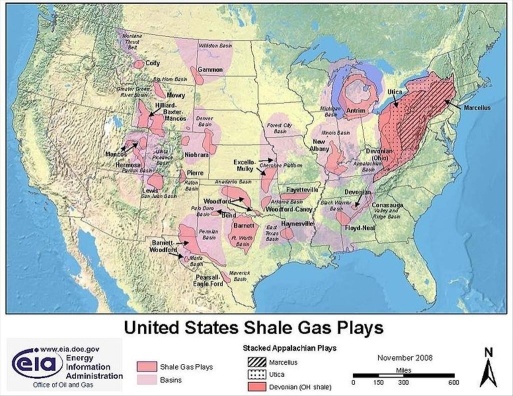

This map

illustrates the location of the major shale formations that are discussed

below:

The Marcellus

Shale

The

Marcellus Shale formation, located in the Appalachian regions of Pennsylvania,

New York and West Virginia, is the major focus of the Company. The

Marcellus covers the largest land mass of any of the known shale zones to date,

and it is located close to the densely populated north-eastern corridor of the

United States. The water returns from the slick water fracture

contain significantly higher TDS levels than the Barnett Shale and also include,

in certain cases, extremely high levels of calcium, barium, strontium and

chloride ions.

At

approximately 200,000 parts per million in TDS, the produced water from these

regions is nearly seven times the salinity of the ocean. The most

common practice utilized by the gas production industry in Pennsylvania for the

disposal of waste water streams produced by gas wells is to remove the oil, some

of the heavy metals and simply discharge this water to the rivers and

streams. The volume of water used in the gas well fracture process

has grown substantially over recent years with growth in both the absolute

number of active wells and with increased volumes of water in each

well. STW believes that today, the initial daily returns of one

Marcellus fracture well often exceed the volume of thousands of older oil and

gas wells.

While

there are about 800 Marcellus gas wells in operation in the Marcellus shale

formation today, gas producers in the region are primarily engaged in

exploratory drilling process activities. The northern portion of the

state reportedly has some of the best geological formations for gas production,

but drilling activity has been curtailed as a result of limited water supply and

limited capacity to dispose of waste water. Because of economic

considerations in local communities, the investment of several billion dollars

by producers in lease acquisition for drilling purposes, and proximity to high

population areas, management believes that drilling activity utilizing hydraulic

fracturing methods will increase significantly in the future.

-

4 -

The

Marcellus Shale Formation is believed to be approximately 30 million plus acres

in size. In comparison, the Barnett Shale Formation is approximately 2 million

acres in size and approximately 140 million barrels of produced water are

disposed of in deep disposal wells annually. Each one of the stationary systems

proposed by STW will be able to process approximately 23,000 barrels of water

per day, and the mobile systems will be capable of processing 1,700 barrels per

day. This is therefore a high priority focus for STW.

With the

mountainous terrain in the Appalachian region, STW believes mobile or portable

evaporation units may provide a key part of the solution in this market by

helping gas producers minimize trucking in and out of production locations and

their neighboring communities. These systems may also be airlifted in

and out of drilling locations. Central evaporation and crystallization would

then be required to handle the remaining water and residual

brine. The central plants would also be equipped to generate calcium

chloride and sodium chloride salts. The sodium chloride would be

processed as rock salt for use in de-icing highways for public

safety. As discussed above, revenue from these salts would impact the

overall cost of reclamation, reinforcing the Company’s competitiveness in the

region.

The Fayetteville

Shale

Producers

in Arkansas’ Fayetteville Shale face similar problems as those operating in the

Marcellus, as there are very limited brine disposal options. Most

disposal wells in the Fayetteville shale are located near Ft. Smith; over a

three hour drive from most of the producing gas wells. Although new disposal

wells are being permitted and are under evaluation in the Conway area, gas

producers remain uncertain as to whether the permitted volumes for these brine

injection wells will be sufficient for current and future production

needs.

The

fracture system typically utilizes 50,000 to 65,000 barrels, or 2.0 to 2.8

million gallons of water. These wells typically flow back 1,000 to 1,500 bpd of

contaminated frac water for the first few days and then decline to under 100 bpd

for the next three months before finally declining to a rate of five bpd or

less. All of this flowback water is disposed of at land farms and

disposal wells. Recently the land farms have come under scrutiny due

to claims that these operations fail to comply with applicable regulations and

laws. Several land farm operations have been shut down because of

contamination of the areas surrounding these operations, significantly raising

the cost of disposal to the producers.

Water

quality varies with the location of the wells and can range from approximately

20,000 mg/l TDS for wells in the Searcy area to over 70,000 mg/l TDS for wells

in the northern and western portionsf. The Company believes water

reclamation coupled with deep well injection could provide a very cost effective

solution to producers in the Fayetteville zone. The lower TDS in this

shale, relative to other shales, would allow water recovery at rates in excess

of 90% at 20,000 mg/l TDS, and 75% at TDS levels of approximately 70,000

mg/l. These rates will dramatically reduce trucking cost to disposal

wells, and will provide fresh water for new wells or other applications such as

steam generation.

As part

of the STW’s strategy in this region, the Company is actively seeking to educate

gas producers on the advantages of water reclamation.

The Barnett

Shale

As

discussed above, the Barnett Shale, located in central and west-central Texas,

was the first shale formation to be developed with production starting nearly 25

years ago. In 2009, drilling activity was flat in the Barnett Shale

at current gas prices. A large influence for this leveling is the

increasing activity in the other gas formation such as the Haynesville,

Fayetteville and Marcellus.

The Piceance

Basin

The

conventional frac process in the Piceance has been to incorporate the typically

low TDS flowback and produced waters as fracture fluids in new

wells. Previously, drilling has been completed throughout the year;

however, several producers only fracture in the summer months. For

these producers, excess water produced in the winter required storage in surface

containment facilities that created substantial environmental

risk. Treatment of this water prior to storage addressed this risk

and resulted in a seasonally high demand for water reclamation during winter

months.

Today,

producers in the Piceance Basin are generally slowing down drilling activity

while natural gas prices remain depressed. Whatever produced water is

currently generated is being hauled to other states for disposal.

Eagleford

ShaleFormation

The

Eagleford Shale is a recently discovered formation located in South

Texas. Several experimental wells have been completed and to date

appear to be very profitable. This area has limited supplies of fresh

water, leading the Company to believe water reclamation will be a required

solution in order for producers to access a sufficient supply of frac water in

this market. Production of natural gas has been reported at levels in excess of

10 million cubic feet (“Mcf”) per day, and hundreds of barrels of condensate at

some of the wells. The Company expects to intensify its efforts to address this

market opportunity.

-

5 -

The Haynesville

Shale

This

shale formation covers the northern half of Louisiana, southern Arkansas and

extends into northeastern Texas. It is the highest pressure zone of

all the shale formations discovered to date. Most of the wells are

horizontal, utilize the slick water fracture system, and each require about 6.5

million gallons of water. Production of natural gas has been reported

at levels in excess of 25 million cubic feet (“Mcf”) per day at some of the

wells in the Haynesville shale formation.

Once

production starts at typical gas wells in this region, a surge of water

production occurs for a few days before water production declines to ten bpd or

less. There appears to be sufficient disposal well capacity in the

Haynesville to handle present production needs. The Company believes

that more disposal wells are being added in southern Arkansas and northeastern

Texas as needed. STW believes that Legislators in Louisiana are

currently reviewing policies on disposal wells and may alter these to increase

the deep injection well disposal capacity.

The

Cotton Valley zone actually produces most of the water in the

area. It has a TDS content of over 200,000 mg/l and therefore does

not lend itself to economical water reclamation. Crystallization

would be required, which is more expensive and would generate a salt cake that

is not required in the area. Consequently, this region is not a

high priority market for STW at this time.

Produced Water

Shale

zones are typically dry geological formations devoid of any formation or connate

water, and hence the fracture flowback water comprises most of water that

returns following gas production. Outside of shale formations, where

most gas and oil production occurs, there is typically a reservoir of connate

water in the production zone that generates “produced” water. Produced water is

primarily salty water trapped in the reservoir rock and brought up along with

oil and/or gas during production, and is the most common oil field

waste. The quality of produced water varies significantly in

different parts of the world depending on the geology of the underlying

formation.

In a

large number of the oil fields in the USA, secondary or tertiary means of

handling produced water storage, such as water floods and steam floods, are

typically utilized. These are operations where the produced water is used to

maintain reservoir pressure, prevent subsidence, and sweep the zone to remove

the oil. Most of these water floods utilize a fresh water source as a supply so

that sufficient volumes are available. As these fields age, less water is

required for the flood, so excess contaminated brines concentrate and require

disposal. As this water could be reclaimed with Thermal Evaporative

Technologies, STW believes that the market for reclaiming produced water outside

the shale reclamation projects represents a considerable opportunity for the

Company.

Texas is

the largest oil and gas production state in the nation and the produced water is

unfit for use, poses a threat to the environment and is typically injected into

deep injection wells. In accordance with Texas Railroad Commission regulations,

water placed in these disposal wells is rendered permanently unavailable for

re-use or consumption. The reclaimed water would available for many beneficial

uses, including agricultural and environmental applications, as well as re-use

in hydraulic fracturing operations. Deep injection well practices in every gas

and oil producing region in the world pose the same detrimental environmental

and resource conservation issues. The water reclamation products and

services offered by the Company could provide a significant part of the solution

to all constituencies concerned.

In the

steam floods of California, a large portion of the water is recycled through the

water treatment facility and converted back to steam. There are some

fields that there is excess water in the millions of gallons per day that is low

in TDS and could very economically be converted back to environmentally usable

water.

Acid mine drainage

(AMD)

AMD is

another sensitive environmental issue in the Appalachian Mountain

regions. We believe it has impaired more than 4,600 miles of

waterways in Pennsylvania alone. Drainage from old abandoned coal mines is

acidic, and insoluble metal oxides precipitate when the drainage enters a river,

lake or stream, damaging the marine ecosystem. The AMD discharge from a single

mine or coal tailing pile can range from 10 to more than 10,000 gallons per

minute. In just one example, the Lackawanna River in northeastern Pennsylvania

is being contaminated from at least seven monitored AMD locations with estimated

peak flow of 40 million gallons per day. STW has identified the state of

Pennsylvania as a customer for AMD purification and the

Marcellus producers (eg Range Resources, Chesapeake Energy, Atlas Energy

Resouces and Seneca Resources) as potential customers for the resultant

reclaimed water.

Acid Mine

Drainage is the number one environmental water issue throughout most of the

Appalachian Mountains. Coal was one of the largest industries in the

region. Unproductive and unprofitable mines were abandoned. Over time a large

number of these mining companies have gone out of business leaving the residual

“dirty coal” and the water flowing from the mines as a responsibility of the

states and federal government. Dirty coal is the coal that lies near

the edge of the main coal seam and contains a high concentration of

dirt.

As the

mines fill up with water overtime, the excess water flows out. Due to

contact with the minerals contained in the dirt, coal, salts and gases, the

water tends to become acidic. This lower pH tends to dissolve more

ions or salts such as iron, aluminum, calcium, and

sulfate. Iron and other metals upon oxidation form

insoluble salts such as iron oxide or rust. Once the acid mine

drainage enters a river, lake or stream, the water precipitates these metal

oxides. This forms an impervious film on the bed of the water

destroying the marine ecosystem.

-

6 -

The

Pennsylvania Department of Environmental Protection (“DEP”) typically constructs

passive treatment plants that require large acreage, where the process is

oxidation in large lagoons allowing the solids to precipitate and altering the

pH level by adding certain chemicals such as lime. The water leaving

these systems will support the growth of plants and animals. This

process is inherently more time-consuming and expensive, and because of the land

requirements, not suitable for all locations.

STW can

provide AMD treatment using a specially-designed mobile unit and sell the

processed AMD to the producers. The state will retain ownership of

the AMD, with STW having ownership rights to the processed water.

STW’s

mobile AMD unit can handle about 250 gpm or about 360,000 gallons per

day. This mobile unit provides the same functionality as the current

passive system, but in minutes compared to weeks and months and with a much

smaller footprint. The state may provide incentives in the form of grants and/or

subsidies that cover the cost of AMD processing. The DEP has permits

in place for the disposal of the filter-pressed sludge. STW is also reviewing

all of the present passive system flow-rates and water quality for potential use

as supply water to producers.

Brackish

Water

World-wide,

there are brackish water zones that contain large volumes of

water. The water contains dissolved salts in the 0.5 to 2% (5,000 to

20,000 mg/l TDS) range and hence unfit for human use. This water can

be treated to reduce the TDS below 500 mg/l or 0.05% TDS making the water fit

for human consumption. Factors such as decreasing supplies of fresh ground and

surface water, increased competition for surface water resources, and changes in

population/demand centers are driving the need for brackish water for water

supply. STW’s potential customers are private companies and

municipalities serving fast growing metropolitan areas where demand for water is

outpacing the available supply. For example, aquifers in the Texas

Gulf Coast contain a large volume of brackish water (less than 10,000 ppm TDS)

that, with desalinization, will help meet increasing demand in the

region.

Legislative and

Regulatory:

Progressively

tighter regulations are demanding a thorough review of the entire water-use

cycle in industrial applications with the ultimate goal of encouraging and/or

mandating reclamation and re-use of water. STW works closely with Federal, State

and local regulators and environmental agencies to share our expertise and

knowledge on this complex issue and discuss our views on potential

solutions. The Company’s intimate knowledge of this process is a key

tool to assist their customers to better understand the legislative and

regulatory elements related to water management and advise them of various

alternatives

Process

STW’s

process is predicated upon a thorough understanding of the customer’s water

needs and related issues. This understanding is developed through a series of

interactive discussions with the customer. The next phase is data gathering and

analysis. STW collects samples at various locations and at different time

intervals which are then tested at independent laboratories and analyzed by STW.

Based upon this analysis, STW would recommend a solution using the most

appropriate technologies and negotiate the acquisition and financing of these

technologies as well as contracts with engineering procurement construction

(“EPC”). Finally, STW oversees the EPC process and operates the

facility.

STW’s

process is based upon a fundamental understanding of the core issue and

developing an appropriate solution using our experience and expertise. It

includes sampling and testing, analysis, design and as required by customers,

implementation and operation. Some of the steps involved are described

below:

|

·

|

The

inlet water quality must be determined and measurement of Total Dissolved

Solids (TDS), hardness, barium, strontium, bromine, sulfate and

hydrocarbon concentrations are

critical.

|

|

·

|

Multiple

samples over time are taken to ensure consistency and accuracy of inlet

water quality measurement.

|

|

·

|

An

understanding and analysis of potential uses for the reclaimed

water.

|

|

·

|

A

site inspection to determine the various vessels needed such as tanks,

pumps, pits, truck off loading racks, and engineering testing of the

land.

|

|

·

|

An

analysis of fluid volumes and their variability over

time.

|

|

·

|

Length

of time the water needs to be reclaimed at this

site.

|

|

·

|

Determination

of appropriate technology: fixed or mobile, evaporation, reverse osmosis

or other.

|

|

·

|

Permitting

as needed

|

|

·

|

An

investigation of the handling of the concentrated brines and any other

residue from the reclamation

process.

|

|

·

|

Disposal

options on the residue including potential use of the

by-products.

|

Technology

STW has

developed relationships with a number of manufacturers that offer best-of-class

technologies applicable to its customer base. These technologies include thermal

evaporation, membrane technology and reverse osmosis and are available as fixed

or mobile units with varying capacities. Various pre and post-treatment options

are available as necessary including crystallizers that process very high TDS

(>150,000 mg/l).

-

7 -

Thermal

Evaporation: This process is capable of handling waters that contain up

to 150,000 mg/l TDS, with fresh water recovery rates from 50 to 90% or

greater depending on inlet water quality. The recovered fresh water, or

“distillate”, is highly purified water from the evaporative process and has

multiple re-use applications. It is particularly applicable in the gas shale and

oil production facilities for reclaiming frac and produced waters.

The

technology is scalable and can be deployed as mobile units that can process

72,000 gallons per day (“gpd”), or as portable units that can process 216,000

gpd, or as fixed central units capable of processing up to 2,880,000

gpd.

Residual

brine concentrate can, depending on local conditions and producer’s priorities,

either be disposed off in deep injection wells or be treated further through a

Crystallizer that reduces it into distillate and commercially valuable salt

residuals.

Reverse

Osmosis: Waters that are below 34,000 mg/l of total dissolved solids and

contain low levels of barium, strontium, bromine, and sulfate can be reclaimed

through a reverse osmosis unit (RO). Reverse osmosis is the process

of forcing a solvent from a region of high solute concentration through a

semi-permeable membrane to a region of low solute concentration by applying a

pressure in excess of the osmotic pressure. The membranes used for

reverse osmosis are generally designed to allow only water to pass through while

preventing the passage of solutes (such as salt ions). This process

is best known for its use in desalination (removing the salt from sea water to

get fresh water), but it has also been used to purify fresh water for medical,

industrial and domestic applications. Recovery rates for seawater to drinking

water are about 50%.

A stream

of concentrated brine or higher TDS is the by-product. This brine can

be properly disposed of or utilized as a feed solution to a brine concentrator

or crystallizer. The latter ensures higher quality water with lower TDS levels

for industrial Uses.

Most

oilfield waters cannot be processed through an RO membrane since they contain

barium, strontium, or bromine. The barium and strontium are very large molecules

and they plug the membrane and create damage or permanent fouling of the

membrane. Bromine and other such halogens react with the membrane and

destroy its integrity. There are few oil field waters that could be

processed through this technology but a thorough study is required to ensure

success. STW Resources will utilize this technology where the water

chemistry can be processed through RO membranes.

Membrane

Bioreactor: A Membrane BioReactor (“MBR”) is a combination of

biological and ultrafiltration technologies. The biological area

provides the same process utilized in all sewage treatment

facilities. Bacteria are maintained in an aerobic condition which

cause decay in all of the organic materials contained in the water, and

oxidizing these organic materials into low molecular weight acids, usually

acetic acid. Maintaining the bacteria in an oxygen rich environment

prevents mutatation or growth of any anaerobic bacteria, which would produce

inorganic acids such as hydrogen sulfide.

A filter

membrane removes the water fraction from the unit. The membrane

provides filtration in the 0.01 microns or lower range which is sufficient

enough to remove viruses, bacteria, and other colloidal

materials. The water exiting the units is potable water and safe for

human consumption.

Marketing &

Sales

STW’s

business proposition is to provide comprehensive, necessary water treatment

solutions. We work closely with our customers to evaluate their water treatment

needs, understand how these may change over time, assess the regulatory and

economic factors and then design an optimal solution. As illustrated

in the chart to the right, STW offers a broad array of technical solutions

coupled with a service suite and financial structuring options that provide our

customers with the ability to obtain a turnkey solution to their waste water

disposal challenges.

Gas Shales:

Most of the natural gas producers in each of the shale formations are

already well known to the Company. STW personnel have developed many,

and in some cases, long standing relationships with key personnel responsible

for well completion and remedial operations at each gas producer. STW

monitors production plans at the producer level, the acreage acquisitions at the

shale formations and trends that relate to the demand for water reclamation by

region. In addition, the Company maintains detailed databases that

monitor drilling permits, rig counts and other key statistics that forecast gas

production rates by geography. These activities allow the Company to

anticipate demand for its services and to prioritize its sales calling effort on

those producers for whom fresh water supply is an issue or where shale water

disposal pose the greatest challenges.

-

8 -

The

foundation of the Company’s sales strategy is to become an integral part of its

customer’s water management function. This involves identifying and

finding solutions to customer needs through a multi–step, consultative

approach:

|

·

|

Evaluate

drilling program and production expansion

plans.

|

|

·

|

Identify

and define fracture water supply needs and waste brine generation

levels.

|

|

·

|

Study

the flowback water volumes and chemistry over

time.

|

|

·

|

Generate

economic models jointly with producers, with full consideration of all

costs of obtaining, utilizing, and disposing of the

water.

|

|

·

|

Evaluate

various water reclamation options, from equipment to logistics,

and develop financial models for all the

options.

|

|

·

|

Provide

a customized presentation comparing present practices to all of the

options of water reclamation available to the customer, for buy-in to the

best scenarios.

|

|

·

|

Jointly

develop a presentation of the best scenarios for water management (present

and future) for use by upper management. Support the

presentation as required.

|

|

·

|

Review

and determine optimal system design, location and financial

structure.

|

|

·

|

Develop

a time line for water reclamation

implementation.

|

|

·

|

Execute

definitive off-take and/or other agreements satisfactory to all

parties.

|

STW is

able to facilitate this part of the sales process through its detailed knowledge

of the gas production process and economics, shale formation geology, frac water

chemistry, well completion techniques and logistics and regional regulatory

landscapes. This expertise reduces the time required during the evaluative stage

of the sales process and fosters a positive working relationship with our

customers. STW then works together with its manufacturing partners to

complete the technical solution, develop ancillary system requirements (balance

of plant) evaluate cost and operating data, model the financial performance of

the system and define remaining project parameters and an installation

timeline.

Water

reclamation is a new paradigm for natural gas producers. Educating them about

the economic, environmental and political benefits is key to long-term

adoption.

Some of

the issues that operators are facing currently in the Marcellus Shale

are:

|

·

|

Water

consumption and usage restrictions on the Susquehanna River are very

restrictive.

|

|

·

|

There

are only 8 deep injection wells in Pennsylvania, all of which are already

at or close to capacity. New deep wells are being drilled, but the

permitting process and actual drilling costs are proving to be

expensive.

|

|

·

|

Trucking

costs from $3.10 to over $10 / barrel, and generate a number of complaints

about truck traffic, noise and the associated wear and tear on the roads.

The cost to dispose of the water into the commercial disposal wells is

$1.50 to $3.00 per barrel in addition to the trucking

costs.

|

|

·

|

Reclaimed

water will not require a consumption permit for use, as it has already

been consumed once. Trucks can bring brine to the Water

Reclamation facility and return with fresh water for the next

fracture.

|

|

·

|

The

crystallization process will produce rock salt that meets the requirements

of ASTM Standards for road salt. PennDOT purchases between 600,000 and

1,000,000 tons of road salt each year and local municipalities purchase an

additional 500,000 tons. An STW 1 million gal/day facility will produce

approximately 88,500 to 106,000 tons of rock salt per

year.

|

|

·

|

By

2011 any new permits for disposal to the rivers will require total

dissolved solids (TDS) removal.

|

At this

time, in the Marcellus Shale, only a couple of operators have the necessary

scale for a captive facility. Most operators are still in the exploratory

drilling stage, with single wells being drilled over a wide region.

Based on

the geographical mountainous terrain, the producers are constructing the well

sites on the higher elevations so that they do not interfere with the

agricultural and cattle ranch business conducted in the valleys. In a

large number of examples a multiple well pad is constructed and then the wells

are directional drilled and completed in the Marcellus. One central

water pit is permitted to hold the drilling and fracture water. As

the fracture is conducted, the flowback and produced water is presently trucked

to an approved disposal facility. In some cases the producers are

recycling some of the early low TDS flowback water by filtration and then

blending into the new fresh water. All of the fresh water utilized by

all of the wells must be trucked to the site and then all of the flowback and

produced water is trucked away.

STW would

locate mobile evaporation equipment at the well site. The flowback

water would be processed and the distilled water generated would be placed into

the fracture water pit. The residual brine from the evaporation

process would be trucked to an approved disposal facility or taken to a STW

central crystallizer. The crystallizer would provide additional fresh

water that could be trucked (2 way freight) back to the fracture

pit. About 98% of the available water from the residual brine or the

high TDS produced water would be recovered. Additional bi-products of

sodium chloride for use in Highway deicing and a solution of calcium chloride

would be generated.

-

9 -

Competition

In the

oil and gas industry, current fracturing and produced water disposal methods –

deep injection wells and surface water disposal – represent the Company’s

greatest source of competition.

Brine Discharge / Deep

Injection Wells

In many

gas shale fields, disposal through a deep injection well offers a cost-effective

(though environmentally questionable) alternative to water reclamation. If

suitable geology exists, high TDS flowback waters can be disposed by injection

into a deep discharge brine well. There are operative brine discharge

wells in each of the major shale formations, particularly in the Barnett shale

formation in Texas where many empty oil wells are converted for brine discharge

use. There are only eight such discharge wells in the state of

Pennsylvania. Management believes these are presently operating at close to

capacity.

Surface Water

Disposal

Similarly,

surface water disposal facilities (rivers, streams and drainage creeks) offer a

competitive alternative to water reclamation. At river discharge

facilities, flowback and produced waters are treated to remove naturally

occurring radioactive materials, some suspended solids and well completion

chemicals before discharge. Dissolved salts are not removed and

therefore are added to surface water systems where they degrade water quality,

pollute the environment and disrupt wildlife habits. Many states have

taken action to reduce or eliminate altogether the availability of surface water

disposal for gas well waste water streams.

In the

Marcellus shale, there are several treatment facilities that remove only the oil

and heavy metals, then discharge the water to certain rivers (where permitted),

and range in size from 20,000 to 200,000 gallons per day. The treatment

does not remove salts, so the waters that are being discharged into the river

system retain high TDS contamination levels. In April of 2009, the

Pennsylvania DEP regulated this type of treatment by limiting it to existing

permitted facilities only through January 2011, at which time treatment to

remove the TDS (salts) will have to be implemented.

The

following companies provide pre-discharge brine treatment

solutions:

The

Company accepts flowback and produced waters from gas producers operating in the

Marcellus and other regions in Pennsylvania, removes the oil, heavy metals, and

discharges the water to certain rivers in Pennsylvania. Advanced Waste

operates one discharge facility in the western part of the Pennsylvania. Sunbury

operates an experimental river discharge site in conjunction with the

Pennsylvania Department of Environmental Protection. Sunbury’s primary

business is the operation of waste coal fired power plants, and it has obtained

a permit to discharge significant volumes of contaminated water into certain

rivers in Pennsylvania. Acid Mine Drainage is presently processed through

large acreage passive systems. These systems provide oxidation

followed by a long settling time for the heavy metals to precipitate and

possibly some pH adjustment before the water enters the river or

stream. There are several companies that construct such facilities

under contract with the governmental agency. At this time there is no

one that provides mobile AMD processing.

Legal

Proceedings

Except

for the current dispute with GE Water & Process Technologies (“GE Water”),

we are currently not a party to any legal or administrative proceedings and are

not aware of any pending or threatened legal or administrative proceedings

against us in all material aspects. We may from time to time become a party to

various legal or administrative proceedings arising in the ordinary course of

our business.

STW

entered into a Memorandum of Understanding with GE Water, a unit of General

Electric Company, dated February 14, 2008 (“MOU”) to jointly develop off-take

agreements with oil and gas operators for the deployment of multiple water

reclamation systems throughout Texas, Arkansas, Louisiana and the Appalachian

Basin. STW and GE Water formalized their relationship on May 22,

2008, by entering into a definitive Teaming Agreement (“Teaming Agreement”),

which superseded the MOU. The Teaming Agreement was drafted in

accordance with the terms of the MOU and provides greater certainty as to each

party’s responsibilities and as to the process of entering into agreements with

and providing services to customers. The Teaming Agreement sets forth

the terms and conditions that will govern STW and GE Water relationship when STW

is successful in selling its services to an identified prospect.

In April

2008, STW entered into a purchase order with GE Water (“Purchase Order”), for

the purchase of a modularized produced water evaporator system (the “Evaporator

System”) capable of processing approximately 720,000 gallons per

day. The total commitment under the Purchase Order was $14.5 million,

to be paid over eight installments. As of September 30, 2009, STW has

paid a total of approximately $4.7 million. Included in this total is

$300,000 of its $1.5 million second installment payment which was due at the end

of June 2008. STW is currently in arrears on the remaining $1.2

million under the second installment payment and is also in arrears in its third

installment payment of $3.6 million which was due on

November 28, 2008, the fourth installment payment of $1.5 million

which was due on February 27, 2009, and the fifth installment payment of

$1.8 million which was due on August 28, 2009. The total of

all amounts invoiced and unpaid, including accrued interest of approximately

$998,000, through September 30, 2009, totaled $9.0 million. In

addition, pursuant to the terms of the Purchase Order, STW is required to post a

letter of credit securing the balance of the payments due under the Purchase

Order, totaling $1.9 million, which STW has not yet done. Finally, in

April 2009, STW issued a change order to the Purchase Order to increase the

overall processing capacity to approximately one million gallons per

day. This change order obligated STW to additional payments totaling

approximately $1.2 million.

-

10 -

On

January 12, 2009, GE Water sent a notice of default with respect to the past due

payments on the Evaporator System, and the required posting of the letter of

credit, as set forth under the Purchase Order, with a requirement that such

default be cured within 30 days from the date of the notices. GE

Water took no further action with respect to the notice of default until

August 13, 2009.

On August

13, 2009, GE Water provided STW a six month additional grace period, through

February 13, 2010. At the end of the additional six month grace

period, if STW has not met its obligations, GE Water represented that it would

meet with STW to determine the state of the investment market and grant or not

grant an additional grace period, as necessary. If, after February

13, 2010, GE Water elected to not extend STW’s payment obligations, GE Water

could foreclose on the Evaporator System, resulting in the loss of payments

advanced to date by STW and future use of the Evaporator System under

construction.

On

October 1, 2009, GE Water sent a letter to STW unilaterally announcing to STW

that GE was canceling STW’s Purchase Order due to STW’s inability to pay the

current amounts due. GE Water also demanded a “termination” payment

of $750,000. In the same letter, GE Water unilaterally announced it

was cancelling the Teaming Agreement citing GE Water’s belief that STW was

insolvent. GE Water prefaced its cancellation of the Purchase Order

and Teaming Agreement on a failure of GE Water and STW to renegotiate a

substitute Teaming Agreement. On October 8, 2009, STW responded to GE

Water in writing rejecting GE Water’s unilateral termination of the Purchase

Order and Teaming Agreements, among other things including that GE Water had the

contractual requirement to arbitrate certain of the disputed matters raised by

GE Water’s October 1, 2009 letter. In discussions in December

2009 between STW management and GE Water, GE Water expressed continued interest

in working with STW by providing technical support and a willingness to resolve

their differences, pending the results of STW’s merger and capital raise in

February2010.

Number of

Employees

Other

than our directors and officers, presently we have one employee including one

full time employee.

Property

Our

principal offices are located at 619 West Texas Avenue, Suite 126, Midland,

Texas 79701, which includes 1,250 square feet in office

space. We pay $1,200 per month in rent and our lease is month to

month.

-

11 -

RISK

FACTORS

Our limited operating history makes

it difficult for us to evaluate our future business prospects and make decisions

based on those estimates of our future performance.

We did

not begin operations of our business until February 2008. We have a

limited operating history and have generated limited revenue. As a

consequence, it is difficult, if not impossible, to forecast our future results

based upon our historical data. Reliance on the historical results may not

be representative of the results we will achieve, particularly in our combined

form. Because of the uncertainties related to our lack of historical

operations, we may be hindered in our ability to anticipate and timely adapt to

increases or decreases in revenues or expenses. If we make poor budgetary

decisions as a result of unreliable historical data, we could be less profitable

or incur losses, which may result in a decline in our stock

price.

STW’s

results of operations have not resulted in profitability and we may not be able

to achieve profitability going forward.

STW

incurred a net loss amounting to $6,310,500 for the period from inception

(January 28, 2008) through September 30, 2009. In addition, as of

September 30, 2009, STW has liabilities of $12,122,949. If we incur additional

significant operating losses, our stock price, may decline, perhaps

significantly.

Our

management is developing plans to alleviate the negative trends and conditions

described above. Our business plan is speculative and unproven. There

is no assurance that we will be successful in executing our business plan or

that even if we successfully implement our business plan, that we will be able

to curtail our losses now or in the future. Further, as we are a new

enterprise, we expect that net losses will continue and our working capital

deficiency will exacerbate.

We

depend upon key personnel and need additional personnel.

Our

success depends on the continuing services of Stanley Weiner, our chief

executive officer and director. The loss of Mr. Weiner could have a

material and adverse effect on our business operations. Additionally,

the success of the Company’s operations will largely depend upon its ability to

successfully attract and maintain competent and qualified key management

personnel. As with any company with limited resources, there can be no guaranty

that the Company will be able to attract such individuals or that the presence

of such individuals will necessarily translate into profitability for the

Company. Our inability to attract and retain key personnel may

materially and adversely affect our business operations.

We must effectively manage the growth

of our operations, or our company will suffer.

To manage

our growth, we believe we must continue to implement and improve our operational

and marketing departments. We may not have adequately evaluated the costs and

risks associated with this expansion, and our systems, procedures, and controls

may not be adequate to support our operations. In addition, our management may

not be able to achieve the rapid execution necessary to successfully offer our

products and services and implement our business plan on a profitable basis. The

success of our future operating activities will also depend upon our ability to

expand our support system to meet the demands of our growing business. Any

failure by our management to effectively anticipate, implement, and manage

changes required to sustain our growth would have a material adverse effect on

our business, financial condition, and results of operations.

Our

business requires substantial capital, and if we are unable to maintain adequate

financing sources our profitability and financial condition will suffer and

jeopardize our ability to continue operations.

We

require substantial capital to support our operations. If we are

unable to maintain adequate financing or other sources of capital are not

available, we could be forced to suspend, curtail or reduce our operations,

which could harm our revenues, profitability, financial condition and business

prospects.

Regulatory

requirements may have a negative impact upon our business.

While our

services are subject to substantial regulation under federal, state, and local

laws, we believe that the services are materially in compliance with all

applicable laws. However, to the extent the laws change, if we introduce new

services in the future or if we commence working in a new area, some or all of

our services may not comply with applicable federal, state, or local laws.

Further, certain federal, state, and local laws and industrial standards

currently regulate electrical and electronics equipment. Although standards for

electric vehicles are not yet generally available or accepted as industry

standards, our products may become subject to federal, state, and local

regulation in the future. Compliance with this regulation could be burdensome,

time consuming, and expensive.

Our

automobile products are subject to environmental and safety compliance with

various federal and state regulations, including regulations promulgated by the

EPA, NHTSA, and various state boards, and compliance certification is required

for each new model year. The cost of these compliance activities and the delays

and risks associated with obtaining approval can be substantial. The risks,

delays, and expenses incurred in connection with such compliance could be

substantial.

-

12 -

Risks

associated with the collection, treatment and disposal of wastewater may impose

significant costs.

Our

wastewater collection, treatment and disposal operations of our subsidiaries are

subject to substantial regulation and involve significant environmental risks.

If collection systems fail, overflow or do not operate properly, untreated

wastewater or other contaminants could spill onto nearby properties or into

nearby streams and rivers, causing damage to persons or property, injury to

aquatic life and economic damages, which may not be recoverable in

rates. Liabilities resulting from such damage could adversely and

materially affect our business, results of operations and financial condition.

Moreover, in the event that we are deemed liable for any damage caused by

overflow, our losses might not be covered by insurance policies, and such losses

may make it difficult for us to secure insurance in the future at acceptable

rates.

If

the Company is unable to reach an agreement with GE, GE will retain possession

of the Evaporator System and retain all payments made to GE to date, which would

significantly reduce the overall value of the Company and may result in the

Company ceasing operations.

STW

entered into a Memorandum of Understanding with GE Water, a unit of General

Electric Company, dated February 14, 2008 (“MOU”) to jointly develop off-take

agreements with oil and gas operators for the deployment of multiple water

reclamation systems throughout Texas, Arkansas, Louisiana and the Appalachian

Basin. STW and GE Water formalized their relationship on May 22,

2008, by entering into a definitive Teaming Agreement (“Teaming Agreement”),

which superseded the MOU. The Teaming Agreement was drafted in

accordance with the terms of the MOU and provides greater certainty as to each

party’s responsibilities and as to the process of entering into agreements with

and providing services to customers. The Teaming Agreement sets forth

the terms and conditions that will govern STW and GE Water relationship when STW

is successful in selling its services to an identified prospect.

In April

2008, STW entered into a purchase order with GE Water (“Purchase Order”), for

the purchase of a modularized produced water evaporator system (the “Evaporator

System”) capable of processing approximately 720,000 gallons per

day. The total commitment under the Purchase Order was $14.5 million,

to be paid over eight installments. As of September 30, 2009, STW has

paid a total of approximately $4.7 million. Included in this total is

$300,000 of its $1.5 million second installment payment which was due at the end

of June 2008. STW is currently in arrears on the remaining $1.2

million under the second installment payment and is also in arrears in its third

installment payment of $3.6 million which was due on

November 28, 2008, the fourth installment payment of $1.5 million

which was due on February 27, 2009, and the fifth installment payment of

$1.8 million which was due on August 28, 2009. The total of

all amounts invoiced and unpaid, including accrued interest of approximately

$998,000, through September 30, 2009, totaled $9.0 million. In

addition, pursuant to the terms of the Purchase Order, STW is required to post a

letter of credit securing the balance of the payments due under the Purchase

Order, totaling $1.9 million, which STW has not yet done. Finally, in

April 2009, STW issued a change order to the Purchase Order to increase the

overall processing capacity to approximately one million gallons per

day. This change order obligated STW to additional payments totaling

approximately $1.2 million.

On

January 12, 2009, GE Water sent a notice of default with respect to the past due

payments on the Evaporator System, and the required posting of the letter of

credit, as set forth under the Purchase Order, with a requirement that such

default be cured within 30 days from the date of the notices. GE

Water took no further action with respect to the notice of default until

August 13, 2009.

On August

13, 2009, GE Water provided STW a six month additional grace period, through

February 13, 2010. At the end of the additional six month grace

period, if STW has not met its obligations, GE Water represented that it would

meet with STW to determine the state of the investment market and grant or not

grant an additional grace period, as necessary. If, after February

13, 2010, GE Water elected to not extend STW’s payment obligations, GE Water

could foreclose on the Evaporator System, resulting in the loss of payments

advanced to date by STW and future use of the Evaporator System under

construction.

On

October 1, 2009, GE Water sent a letter to STW unilaterally announcing to STW

that GE was canceling STW’s Purchase Order due to STW’s inability to pay the

current amounts due. GE Water also demanded a “termination” payment

of $750,000. In the same letter, GE Water unilaterally announced it

was cancelling the Teaming Agreement citing GE Water’s belief that STW was

insolvent. GE Water prefaced its cancellation of the Purchase Order

and Teaming Agreement on a failure of GE Water and STW to renegotiate a

substitute Teaming Agreement. On October 8, 2009, STW responded to GE

Water in writing rejecting GE Water’s unilateral termination of the Purchase

Order and Teaming Agreements, among other things including that GE Water had the

contractual requirement to arbitrate certain of the disputed matters raised by

GE Water’s October 1, 2009 letter. In discussions in December

2009 between STW management and GE Water, GE Water expressed continued interest

in working with STW by providing technical support and a willingness to resolve

their differences, pending the results of STW’s merger and capital raise in

January 2010.

If the

Company is unable to reach an agreement with GE Water whereby STW is again able

to proceed with the Purchase Order and the Teaming Agreement, the Company would

lose its rights to the Evaporator System (this is currently the Company’s only

significant asset), which could result in the Company ceasing operations and, in

turn, would result in a complete loss of your investment.

-

13 -

We

will require significant capital requirements for equipment, commercialization

and overall success.

We will

require additional financing for our operations, to purchase equipment and to

establish a customer base. We anticipate that we will require a

minimum of $10.0 to $15.0 million in additional capital over the next six months

to pursue our business plan. We cannot assure you that we will obtain

any additional financing through any other means. Additional

financing may not be available to us on acceptable terms, if at

all. Unless we raise additional financing, we will not have

sufficient funds to complete the purchase of equipment and commercialization of

our services.

Our

additional financing requirements could result in dilution to existing

stockholders.

We will

require additional financings obtained through one or more transactions which

effectively dilute the ownership interests of holders of our Common

Stock. We have the authority to issue additional shares of Common

Stock and Preferred Stock as well as additional classes or series of ownership

interests or debt obligations which may be convertible into any class or series

of ownership interests in the Company. The Company is authorized to

issue 100,000,000 shares of Common Stock and 10,000,000 shares of Preferred

Stock. Such securities may be issued without the approval or other

consent of the holders of the Common Stock.

A

small number of existing shareholders own a significant amount of our Common

Stock, which could limit your ability to influence the outcome of any

shareholder vote.

Our

executive officers, directors and shareholders holding in excess of 5% of our

issued and outstanding shares, beneficially own over31.9% of our Common Stock,

before giving effect to the Offering. Under our Articles of Incorporation and

Nevada law, the vote of a majority of the shares outstanding is generally

required to approve most shareholder action. As a result, these

individuals will be able to significantly influence the outcome of shareholder

votes for the foreseeable future, including votes concerning the election of

directors, amendments to our Articles of Incorporation or proposed mergers or

other significant corporate transactions.

We

face competition.

We face

competition from existing companies in reclamation of oil and gas waste water

space that provide similar services to the Company’s. Our competitors

may have longer operating histories, greater name recognition, broader customer

relationships and industry alliances and substantially greater financial,

technical and marketing resources than we do. Our competitors may be

able to respond more quickly than we can to new or emerging technologies and

changes in customer requirements.

We

rely on confidentiality agreements that could be breached and may be difficult

to enforce.

Although

we believe that we take reasonable steps to protect our intellectual property,

including the use of agreements relating to the non-disclosure of our

confidential information to third parties, as well as agreements that provide

for disclosure and assignment to us of all rights to the ideas, developments,

discoveries and inventions of our employees and consultants while we employ

them, such agreements can be difficult and costly to

enforce. Although we generally seek to enter into these types of

agreements with our consultants, advisors and research collaborators, to the

extent that such parties apply or independently develop intellectual property in

connection with any of our projects, disputes may arise concerning allocation of

the related proprietary rights. If a dispute were to arise

enforcement of our rights could be costly and the result

unpredictable. In addition, we also rely on trade secrets and

proprietary know-how that we seek to protect, in part, through confidentiality

agreements with our employees, consultants, advisors or others.

Despite

the protective measures we employ, we still face the risk that: agreements may

be breached; agreements may not provide adequate remedies for the applicable

type of breach; our trade secrets or proprietary know-how may otherwise become

known; our competitors may independently develop similar technology; or our

competitors may independently discover our proprietary information and trade

secrets.

We

have not paid dividends in the past and do not expect to pay dividends in the

future. Any return on investment may be limited to the value of our

common stock

We have

never paid cash dividends on our common stock and do not anticipate paying cash

dividends in the foreseeable future. The payment of dividends on our common

stock will depend on earnings, financial condition and other business and

economic factors affecting it at such time as the board of directors may

consider relevant. If we do not pay dividends, our common stock may be less

valuable because a return on your investment will only occur if its stock price

appreciates.

Our

stock price and trading volume may be volatile, which could result in

substantial losses for our stockholders.

The

equity trading markets may experience periods of volatility, which could result

in highly variable and unpredictable pricing of equity securities. The market

price of our common stock could change in ways that may or may not be related to

our business, our industry or our operating performance and financial condition.

In addition, the trading volume in our common stock may fluctuate and cause

significant price variations to occur. We have experienced significant

volatility in the price of our stock over the past few years. We cannot assure

you that the market price of our common stock will not fluctuate or decline

significantly in the future. In addition, the stock markets in general can

experience considerable price and volume fluctuations.

-

14 -

We

have not voluntary implemented various corporate governance measures, in the

absence of which, shareholders may have more limited protections against

interested director transactions, conflict of interest and similar

matters.

Recent

Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in

the adoption of various corporate governance measures designed to promote the

integrity of the corporate management and the securities markets. Some of these

measures have been adopted in response to legal requirements. Others have been

adopted by companies in response to the requirements of national securities

exchanges, such as the NYSE or the NASDAQ Stock Market, on which their

securities are listed. Among the corporate governance measures that are required

under the rules of national securities exchanges are those that address board of

directors' independence, audit committee oversight, and the adoption of a code

of ethics. While we intend to adopt certain corporate governance measures such

as a code of ethics and established an audit committee, Nominating and Corporate

Governance Committee, and Compensation Committee of our board of

directors, we presently do not

have any independent directors. We intend to expand our board membership in

future periods to include independent directors. It is possible that if we were

to have independent directors on our board, stockholders would benefit from

somewhat greater assurances that internal corporate decisions were being made by

disinterested directors and that policies had been implemented to define

responsible conduct. For example, in the absence of audit, nominating and

compensation committees comprised of at least a majority of independent