Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Year ended December 31, 2009

8540 Gander Creek Drive

Miamisburg, Ohio 45342

877.855.7243

| Commission File Number |

Registrant | IRS Employer Identification Number |

State of Incorporation | |||

| 001-32956 | NEWPAGE HOLDING CORPORATION | 05-0616158 | Delaware | |||

| 333-125952 | NEWPAGE CORPORATION | 05-0616156 | Delaware |

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| NewPage Holding Corporation |

Yes | ¨ | No | x | ||||

| NewPage Corporation |

Yes | ¨ | No | x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| NewPage Holding Corporation |

Yes | ¨ | No | x | ||||

| NewPage Corporation |

Yes | ¨ | No | x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| NewPage Holding Corporation |

Yes | x | No | ¨ | ||||

| NewPage Corporation |

Yes | x | No | ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| NewPage Holding Corporation |

Yes | ¨ | No | ¨ | ||||

| NewPage Corporation |

Yes | ¨ | No | ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

| NewPage Holding Corporation x |

NewPage Corporation x |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| NewPage Holding Corporation |

Large accelerated filer ¨ | Accelerated filer ¨ | ||||

| Non-accelerated filer x | Smaller reporting company ¨ | |||||

| NewPage Corporation |

Large accelerated filer ¨ | Accelerated filer ¨ | ||||

| Non-accelerated filer x | Smaller reporting company ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| NewPage Holding Corporation |

Yes | ¨ | No | x | ||||

| NewPage Corporation |

Yes | ¨ | No | x |

The aggregate market value of NewPage Holding Corporation and NewPage Corporation common stock held by non-affiliates were each $0 as of June 30, 2009.

The number of shares of each Registrant’s Common Stock, par value $0.01 per share, as of February 12, 2010:

| NewPage Holding Corporation |

10 | |||

| NewPage Corporation |

100 |

This Form 10-K is a combined annual report being filed separately by two registrants: NewPage Holding Corporation and NewPage Corporation. NewPage Corporation meets the conditions set forth in general instruction I(1)(a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format.

DOCUMENTS INCORPORATED BY REFERENCE—None

References to “NewPage Holding” refer to NewPage Holding Corporation, a Delaware corporation; references to “NewPage” refer to NewPage Corporation, a Delaware corporation and a wholly-owned subsidiary of NewPage Holding. References to “NewPage Group” refer to NewPage Group Inc., a Delaware corporation and the direct parent of NewPage Holding. Unless the context provides otherwise, references to “we,” “us” and “our” refer to NewPage Holding and its subsidiaries. All assets, liabilities, income, expenses and cash flows presented for all periods represent those of NewPage Holding’s wholly-owned subsidiary, NewPage, except for activity related to NewPage Holding’s debt and equity and income tax effects. Unless otherwise noted, the information provided pertains to both NewPage Holding and NewPage. References to “SENA” are to Stora Enso North America Inc., which we acquired from Stora Enso Oyj (“SEO”) on December 21, 2007 (the “Acquisition”). Following the Acquisition, SENA changed its name to NewPage Consolidated Papers Inc., or NPCP. References to both SENA and NPCP are to the acquired business.

FORWARD-LOOKING STATEMENTS

This annual report contains “forward-looking statements” within the meaning of the Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and other related laws. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws. Forward-looking statements may include the words “may,” “plans,” “estimates,” “anticipates,” “believes,” “expects,” “intends” and similar expressions. Although we believe that these forward-looking statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected or assumed in our forward-looking statements. These factors, risks and uncertainties include, among others, the following:

| • | our substantial level of indebtedness |

| • | changes in the supply of, demand for, or prices of our products |

| • | general economic and business conditions in the United States and Canada and elsewhere |

| • | the ability of our customers to continue as a going concern, including our ability to collect accounts receivable according to customary business terms |

| • | the activities of competitors, including those that may be engaged in unfair trade practices |

| • | changes in significant operating expenses, including raw material and energy costs |

| • | changes in currency exchange rates |

| • | changes in the availability of capital |

| • | changes in the regulatory environment, including requirements for enhanced environmental compliance |

| • | the other factors described herein under “Risk Factors” |

Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, either to reflect new developments or for any other reason, except as required by law.

1

INDUSTRY DATA

Information in this annual report concerning the paper and forest products industry and our relative position in the industry is based on independent industry analyses, management estimates and competitor announcements.

PART I

| ITEM 1. | BUSINESS |

General

We believe that we are the largest coated paper manufacturer in North America, based on production capacity. Coated paper is used primarily in media and marketing applications, such as high-end advertising brochures, direct mail advertising, coated labels, magazines, magazine covers and inserts, catalogs and textbooks. For the year ended December 31, 2009, we had net sales of $3.1 billion.

We operate 20 paper machines at ten paper mills located in Kentucky, Maine, Maryland, Michigan, Minnesota, Wisconsin and Nova Scotia, Canada. These mills, along with our distribution centers, are strategically located near major print markets, such as New York, Chicago, Minneapolis and Atlanta. As of December 31, 2009, our mills have total annual production capacity of approximately 4.4 million short tons of paper, including approximately 3.2 million short tons of coated paper, approximately 1 million short tons of uncoated paper and approximately 200,000 short tons of specialty paper.

We have long-standing relationships with many leading publishers, commercial printers, retailers and paper merchants. Our key customers include Condé Nast Publications, The McGraw-Hill Companies, Meredith Corporation, News America Group, Pearson Education, Rodale Inc. and Time Inc. in publishing; Quad/Graphics, R.R. Donnelley & Sons Company and World Color Press Inc. in commercial printing; Sears Holdings Corporation and Williams-Sonoma, Inc. in retailing; and paper merchants Lindenmeyr, a division of Central National-Gottesman Inc., Unisource Worldwide, Inc. and xpedx, a division of International Paper Company. Key customers for specialty paper products include Avery Dennison Corporation and Vacumet Corp.

On December 21, 2007, NewPage acquired all of the issued and outstanding common stock of SENA from SEO. We acquired SENA in order to create a single business platform and to enable us to remain competitive in the marketplace, serve our customers more efficiently and achieve synergies from the Acquisition. The Acquisition more than doubled our production capacity and broadened our product line. In connection with the Acquisition, SEO acquired approximately 20% of the equity in NewPage Group.

2

Organization

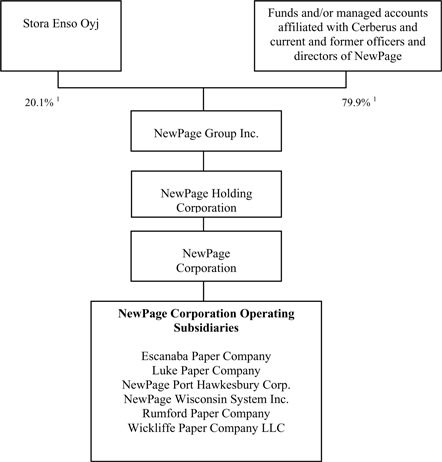

The following chart shows our organizational structure and ownership as of February 12, 2010. Except as indicated below, each entity in the chart owns 100% of the equity interests of the entity appearing immediately below it.

| (1) | Excludes common stock that may be issued upon exercise of options outstanding or that may be granted under the NewPage Group Equity Incentive Plan. |

Industry Overview

The North American paper industry is cyclical and prices for paper, like other cyclical products, are largely affected by the relation of demand to available supply. Demand and supply factors affecting our principal paper products, as well as historical price trends, are discussed below.

3

North American coated paper demand is primarily driven by advertising and print media usage. In particular, the demand for certain grades of coated paper is affected by spending on catalog and promotional materials by retailers and spending on magazine advertising, which affects the number of printed pages in magazines. Advertising spending and magazine and catalog circulation tend to rise when GDP in the United States is robust and typically decline in a sluggish economy. During 2009, North American coated paper demand declined significantly from the prior year reflecting decreased advertising spending and magazine and catalog circulation largely attributable to general economic factors and inventory reductions by customers. North American customers purchased approximately 9 million short tons of coated paper in 2009 compared with approximately 12 million short tons of coated paper in 2008.

In North America, coated paper supply is determined by both local production and imports, principally from Europe and Asia. Imports have become a structural part of the North American coated paper marketplace. The volume of coated paper imports from Europe and Asia is a function of worldwide supply and demand for coated paper, the exchange rate of the U.S. dollar relative to other currencies, especially the Euro, market prices in North America and other markets and the cost of ocean-going freight. Since January 2008, mills and machines in North America with gross coated paper capacity of approximately 2 million tons have been shuttered or switched to other grades. In addition, the industry has also taken significant levels of market-related downtime and temporary shutdowns.

Products

Our portfolio of core paper products includes coated freesheet, coated groundwood, supercalendered, newsprint and specialty papers. Specialty papers are primarily used in labels and packaging. We offer the broadest coated paper product selection of any North American paper manufacturer. We also sell uncoated paper and market pulp. Our brands are some of the most recognized brands in the industry. Substantially all of our 2009 sales were within North America and approximately 91% were within the United States. Our principal product is coated paper, which represented approximately 80% of our net sales for the year ended December 31, 2009.

Coated Paper

We believe that we are the largest coated paper manufacturer in North America based on production capacity. As of December 31, 2009, our mills have total annual production capacity of approximately 3.2 million short tons of coated paper. Coated paper is used primarily in media and marketing applications, including corporate annual reports, high-end advertising brochures, magazines, catalogs and direct mail advertising. Coated paper has a higher level of smoothness than uncoated paper. Increased smoothness is typically achieved by applying a clay-based coating on the surface of the paper and processing that paper under heat and pressure. As a result, coated paper achieves higher reprographic quality and printability.

Coated paper consists of both coated freesheet and coated groundwood, which generally differ in price and quality. The chemically-treated pulp used in freesheet applications produces brighter and smoother paper than the mechanical pulp used in groundwood papers. Coated freesheet papers comprised 58% of the coated paper we produced in 2009. We produce coated freesheet papers in No. 1, No. 2 and No. 3 grades for higher-end uses such as corporate annual reports and high-end advertising, as well as coated one-side paper (C1S), which is used primarily for label and specialty applications.

Coated groundwood papers, which represented 42% of the coated paper we produced in 2009, are typically lighter and less expensive than our coated freesheet products. We produce coated groundwood papers in No. 3, No. 4 and No. 5 grades for use in applications requiring lighter paper stock such as magazines, catalogs and inserts.

4

Each of the paper grades that we manufacture are produced in a variety of weights, sizes and finishes. The coating process changes the gloss, ink absorption qualities, texture and opacity of the paper to meet each customer’s performance requirements. Most of the coated paper that we manufacture is shipped in rolls, with the rest cut into sheets.

Supercalendered Paper

Supercalendered paper is uncoated paper with pigment filler passed through a supercalendering process in which alternating steel and cotton-covered rolls “iron” the paper, giving it a gloss and smoothness similar to coated paper. Our supercalendered paper is primarily used for magazines, catalogs, advertisements, inserts and flyers. We produce supercalendered paper primarily in SC-A and SC-A+ grades.

Newsprint Paper

Newsprint paper is uncoated groundwood paper used primarily for printing daily newspapers and other publications. We are a niche supplier of newsprint paper serving the North American and select international markets in the publishing and printing industry for major end-uses such as inserts and fliers for retail customers.

Specialty Paper

Specialty paper consists of both coated and uncoated paper designed and produced to meet the specific packaging, printing and labeling needs of customers with diverse and specialized paper needs. Specialty papers consist of two primary product lines: technical papers and packaging papers.

Technical papers consist of face papers, thermal transfer, direct thermal base papers and release liners for use in self-adhesive labels. Packaging papers are designed to protect, transport and identify a wide range of products.

Flexible packaging papers are often used as part of a multilayer package construction, in combination with film, foil, extruded coatings, board and other materials. For example, flexible packaging papers are used in pouch, lidding, bag, product packaging and spiral can applications.

Other Products

We also produce uncoated paper and market pulp to enhance our manufacturing efficiency by filling unused capacity, such as when we have excess capacity on a paper machine but not on a coater. Uncoated paper typically is used for business forms and stationery, general printing paper and photocopy paper. We primarily sell uncoated paper to paper merchants, business forms manufacturers and converters.

5

Manufacturing

We operate 20 paper machines at ten paper mills located in Kentucky, Maine, Maryland, Michigan, Minnesota, Wisconsin and Nova Scotia, Canada. All of these paper mills are at least partially-integrated mills, meaning that they produce paper, pulp and energy. Most of the energy produced at these mills is for internal use. As of December 31, 2009, our mills have total annual production capacity of approximately 4.4 million short tons of paper, including approximately 3.2 million short tons of coated paper, approximately 1 million short tons of uncoated paper and approximately 200,000 short tons of specialty paper. With the exception of our Port Hawkesbury, Nova Scotia, mill, substantially all of our long-lived assets are located within the United States. The following table lists the paper products produced at each of our mills, as well as each mill’s approximate annual paper capacity, as of December 31, 2009:

| Mill Location |

Products |

Paper Capacity | ||

| Biron, Wisconsin | Coated paper | 400,000 | ||

| Duluth, Minnesota | Supercalendered paper | 260,000 | ||

| Escanaba, Michigan | Coated and uncoated paper | 845,000 | ||

| Luke, Maryland | Coated and specialty paper | 530,000 | ||

| Port Hawkesbury, Nova Scotia | Supercalendered paper and newsprint | 590,000 | ||

| Rumford, Maine | Coated and specialty paper | 570,000 | ||

| Stevens Point, Wisconsin | Specialty paper | 170,000 | ||

| Whiting, Wisconsin | Coated paper | 260,000 | ||

| Wickliffe, Kentucky | Coated, specialty and uncoated paper | 255,000 | ||

| Wisconsin Rapids, Wisconsin | Coated paper | 520,000 |

During 2008, we shut down six of our less efficient, higher cash cost paper machines. We have reallocated production of paper grades across our remaining combined machine base, resulting in the operation of machines in narrower ranges of paper grades around their peak production. In addition, we completed the shutdown of our Chillicothe, Ohio converting facility in February 2009 and transferred production to our remaining two converting facilities. As a result of the restructuring activities undertaken, we reduced our overall workforce by approximately 11% from December 31, 2007 to December 31, 2009.

Through reallocation of production among our combined mills, we are producing products in closer proximity to our customers to reduce freight costs. In addition, we continue to implement best practices across our combined mill system and focus on increasing our overall profitability, rather than independently at each individual mill.

Paper machines are large, complex systems that operate more efficiently when operated continuously. Paper machine production and yield decline when a machine is stopped for any reason. Therefore, we organize our manufacturing processes so that our paper machines and most of our paper coaters run almost continuously throughout the year. Some of our paper machines also offer the flexibility to change the type of paper produced on the machine, which allows easier matching of production schedules and seasonal and geographic demand swings.

The first step in the production of paper is to produce pulp from wood. Pulp for groundwood and supercalendered paper is produced using a mechanical or thermo-mechanical process. Pulp for freesheet paper is produced by placing wood chips that are mixed with various chemicals into digester “cooking” vessels. The pulp is then washed and bleached. To turn the pulp into paper, it is processed through a paper machine. Hardwood and softwood pulp is blended based on the desired paper characteristics.

6

To produce coated paper, uncoated paper is put through a coating process. Our mills have both on-machine coaters, which are integrated with the paper machines, and separate off-machine coaters. On-machine coaters generally are considered to be more efficient, while off-machine coaters generally are considered to have more flexibility. After the coating process is complete, the coated paper is slit and wound into rolls to be sold to customers. We also have converting facilities at which we convert some of these rolls into sheets.

Paper production is energy intensive. During 2009, we produced approximately 45% of our energy requirements by means of biomass-related fuels, which included black liquor, wood waste and bark. The energy we purchased from outside suppliers consisted of a portion of our electricity, natural gas, fuel oil, steam, petroleum coke, tire-derived fuel and coal. The majority of our coal needs are purchased under long-term supply contracts, while the other purchased fuels are priced based on current market rates. We periodically enter into fixed priced contracts or financial hedges for a portion of our estimated future natural gas requirements.

Our wholly-owned subsidiary, Consolidated Water Power Company, or CWPCo, provides energy to our mills in central Wisconsin. CWPCo has 33.3 megawatts of generating capacity on 39 generators located in five hydroelectric plants on the Wisconsin River. CWPCo is a regulated public utility and also provides electricity to a small number of residential, light commercial and light industrial customers.

We also are the general partner and have a 40% investment in Rumford Cogeneration Company L.P., a joint venture created to generate power for us at our Rumford, Maine, mill and for public sale. During 2009, we purchased the partnership interest of one limited partner. We also entered into an agreement in 2009 to purchase the remaining partnership interests for $6 million by December 31, 2010.

Raw Materials and Suppliers

Pulp and wood fiber are the primary raw materials used in making paper. Pulp is the generic term that describes the cellulose fiber derived from wood. These fibers may be separated by mechanical, thermo-mechanical or chemical processes. The processes we use at our mills to produce pulp for freesheet paper involve removing the lignin, which bind the wood fibers, to leave cellulose fibers. We use most of our pulp production internally to reduce the amount of pulp purchased from third parties. We sell our excess hardwood pulp, which we refer to as market pulp, to third parties in the United States and internationally.

The primary sources of wood fiber are timber and its byproducts, such as wood chips. We are a party to various fiber supply agreements to supply our mills with hardwood, softwood, aspen pulpwood and wood chips. These agreements require the counterparty to sell to the mills, and require the mills to purchase, a designated minimum number of tons of pulpwood and wood chips during the specified terms of the arrangement, which have various expiration dates from December 31, 2010 to December 31, 2053. The aggregate annual purchase requirement under these agreements is approximately 3 million tons in 2010, approximately 2 million tons per year from 2011 to 2015, approximately 1 million tons per year from 2016 to 2020 and approximately 300,000 tons per year from 2021 to 2026. In 2020, all of the agreements terminate with the exception of an agreement with respect to our Rumford, Maine, mill, which terminates in 2053. For all of the pulpwood agreements, we may purchase a substantial portion of any additional pulpwood harvested by the counterparty during each year. The prices to be paid under these agreements are determined by formulas based upon market prices in the relevant regions and are subject to periodic adjustments based on procedures stipulated in each agreement. The amount of timber we receive under these agreements has varied, and is expected to continue to vary, according to the price and supply of wood fiber for sale on the open market and the harvest levels the timberland owners deem appropriate in the management of the timberlands.

7

Our Port Hawkesbury, Nova Scotia mill manages approximately 1,500,000 acres of land licensed from the Province of Nova Scotia and 59,000 acres of land we own in Nova Scotia. All wood harvested from the licensed lands must be used in our Port Hawkesbury mill unless otherwise agreed to by the Province of Nova Scotia. The license is for a 50 year period, renewable every 10 years, and currently expires in July 2051. The license may be terminated by the Province of Nova Scotia if the Port Hawkesbury mill is not operational for a continuous period of two years.

We seek to fulfill substantially all of our wood needs with timber that is harvested by professional loggers trained in certification programs that are designed to promote sustainable forestry. We do not accept wood from old growth forests, forests of exceptional conservation value or rainforests. We do not accept illegally harvested or stolen wood. We have formally notified our outside wood chip suppliers that we expect their wood supply will be produced by trained loggers in compliance with sustainable forestry principles. Our goal is to ensure that sustainable forestry-trained loggers are used to supply essentially all of the wood to our mills. We oppose and, through our participation in the American Forest and Paper Association, World Resources Institute and other organizations, are working to stop illegal logging in the United States and worldwide.

Chemicals used in the production of paper include latex and starch, which are used to affix coatings to paper; calcium carbonate, which brightens paper; titanium, which makes paper opaque; and other chemicals used to bleach or color paper. We purchase these chemicals from various suppliers. We believe that the loss of any one or any related group of chemical suppliers would not have a material adverse effect on our business, financial condition or results of operations.

Customers

We have long-standing relationships with many leading publishers, commercial printers, retailers and paper merchants. Our ten largest customers accounted for approximately half of our net sales for 2009. Our key customers include Condé Nast Publications, The McGraw-Hill Companies, Meredith Corporation, News America Group, Pearson Education, Rodale Inc. and Time Inc. in publishing; Quad/Graphics, R.R. Donnelley & Sons Company and World Color Press Inc. in commercial printing; Sears Holdings Corporation and Williams-Sonoma, Inc. in retailing; and paper merchants Lindenmeyr, a division of Central National-Gottesman Inc., Unisource Worldwide, Inc. and xpedx, a division of International Paper Company. Key customers for specialty paper products include Avery Dennison Corporation and Vacumet Corp.

During 2009, xpedx accounted for 19% of net sales. No other customer accounted for more than 10% of our 2009 net sales.

Sales, Marketing and Distribution

We sell our paper products primarily in the United States and Canada, using three sales channels:

| • | direct sales, which consist of sales made directly to end-use customers, primarily large companies such as publishers, printers and retailers |

| • | merchant sales, which consist of sales made to paper merchants and brokers, who in turn sell to end-use customers |

| • | specialty sales, which consist of sales made to packaging and label manufacturers |

Across the three channels of our sales network, sales professionals are compensated with a salary and bonus plan based on account profitability and individual assignments. As part of our customer service, we seek to provide value-added services to customers. For example, within the merchant channel, we work closely with customers to meet specifications and to utilize joint marketing efforts when appropriate.

8

We also emphasize technical support as part of our commitment to customers. We seek to enhance efficiency for customers by enabling them to interact with us online, including through order access, planning, customer data exchange and consumption estimation tools.

The locations of our paper mills and distribution centers also provide certain logistical advantages as a result of their close proximity to several major print markets, including New York, Chicago, Minneapolis and Atlanta, which affords us the ability to more quickly and cost-effectively deliver our products to those markets. We have two major distribution facilities located in Bedford, Pennsylvania and Sauk Village, Illinois. In total, we own one warehouse and lease space in approximately 50 warehouses. Paper merchants also provide warehouse and distribution systems to service the needs of commercial print customers. We use third parties to ship our products by truck and rail. In addition, we utilize integrated tracking systems that track all of our products through the distribution process. Customers can access order tracking information over the internet. Most of our products are delivered directly to printers or converters, regardless of sales channel.

Competition

The North American paper industry is highly competitive. We compete based on a number of factors, including price, product availability, quality, breadth of product offerings, customer service and distribution capabilities. When a coated paper manufacturer announces a price increase, it generally takes effect over time. Whether a price increase is successful depends on supply, demand and other competitive factors in the marketplace.

Our primary competitors for coated paper are AbitibiBowater Inc., Appleton Coated LLC, Sappi Limited, UPM-Kymmene Corporation and Verso Paper, Inc. Our primary competitors for supercalendered paper are AbitibiBowater Inc., Catalyst Paper Corporation and Irving Paper Ltd. Our primary competitors for newsprint are AbitibiBowater Inc. and Catalyst Paper Corporation.

The competition in the specialty paper category is diverse and highly fragmented, varying by product end use. Our primary competitors for specialty paper products are Boise Cascade LLC, Dunn Paper Inc., Fraser Papers Inc., International Paper Company, UPM-Kymmene Corporation and Wausau Paper Corp.

Some of our competitors have greater financial and other resources than we do or may be better positioned than we are to compete for certain opportunities. We also believe that our competitors in China and Indonesia have been selling their products in our markets at less than fair value and have been subsidized by their governments. In September 2009, NewPage, along with two other U.S. paper producers and the United Steelworkers, filed antidumping and countervailing duty petitions with the U.S. Department of Commerce and the U.S. International Trade Commission alleging that manufacturers of certain coated paper in China and Indonesia are dumping their products in the United States and that these manufacturers have been subsidized by their governments in violation of U.S. trade laws. The petitions also allege that the U.S. industry producing comparable coated paper is being injured as a result of unfairly traded imports from these countries. The U.S. International Trade Commission, by unanimous vote on November 6, 2009, determined that there is reasonable indication that the U.S. industry is being materially injured by unfairly traded Chinese and Indonesian imports. As a result, the U.S. Department of Commerce has commenced a full investigation of coated paper imports from China and Indonesia. We expect that the Department of Commerce will issue its preliminary determinations by the end of April 2010. We expect that final determinations in the cases will be completed by the end of 2010.

9

Information Technology Systems

We use integrated information technology systems that help us manage our product pricing, customer order processing, customer billing, raw material purchasing, inventory management, production controls and shipping management, as well as our human resources management and financial management. Our information technology systems utilize principally third-party software. As part of the reorganization plan associated with the Acquisition, we migrated the acquired mills to our existing information technology system and integrated NPCP’s order management, purchasing, inventory and finance information systems with our existing systems and completed this action during the third quarter of 2009.

Intellectual Property

In general, paper production does not rely on proprietary processes or formulas, except in highly specialized or custom grades. We hold foreign and domestic patents as a result of our research and product development efforts and also have the right to use certain other patents and inventions in connection with our business. We also own registered trademarks for some of our products. Although, in the aggregate, our patents and trademarks are important to our business, financial condition and results of operations, we believe that the loss of any one or any related group of intellectual property rights would not have a material adverse effect on our business, financial condition or results of operations.

Employees

As of December 31, 2009, we had approximately 7,500 employees. Approximately 70% of our employees were represented by labor unions, principally by the United Steelworkers, the International Brotherhood of Electrical Workers, the Communications, Energy and Paperworkers Union of Canada, the International Association of Machinists and Aerospace Workers, the United Association of Journeymen and Apprentices of the Plumbing and Pipefitting Industry of the United States and Canada, the Teamsters, Chauffeurs, Warehousemen and Helpers, and the Office & Professional Employees’ International Union.

We have 17 collective bargaining agreements expiring at various times through December 1, 2012. Approximately 925 employees at the Escanaba, Michigan, mill are covered under three contracts that expired in June and July of 2008 and are currently under renegotiation. In addition, three contracts covering an aggregate of approximately 550 employees at our Port Hawkesbury, Nova Scotia, mill expired on May 31, 2009. The unions at this mill engage in pattern bargaining, which means that they negotiate a new contract with one industry participant before negotiating with others. The unions currently are negotiating with another paper company and have not yet initiated negotiations with us.

We have not experienced any significant work stoppages or employee-related problems that had a material effect on our operations over the last five years. We consider our employee relations to be good. Our Port Hawkesbury, Nova Scotia, mill was closed from December 2005 until October 2006, before our ownership of the mill, due to a labor dispute.

Environmental and Other Governmental Regulations

Our operations are subject to federal, state, provincial and local environmental laws and regulations in the United States and Canada, such as the Federal Water Pollution Control Act of 1972, the Federal Clean Air Act, the Federal Resource Conservation and Recovery Act, and the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, or CERCLA. Among the activities subject to environmental regulation are the emissions of air pollutants; discharges of wastewater and stormwater; generation, use, storage, treatment and disposal of, or exposure to, materials and waste; remediation of soil, surface water and ground water contamination; and liability for damages to natural resources. In addition, we are required to obtain and maintain environmental permits and approvals in connection with our operations. Many environmental laws and regulations provide for substantial fines or penalties and criminal sanctions for failure to comply with orders and directives requiring that certain measures or actions be taken to address environmental issues.

10

Certain of these environmental laws, such as CERCLA and analogous state and foreign laws, provide for strict liability, and under certain circumstances joint and several liability, for investigation and remediation of releases of hazardous substances into the environment, including soil and groundwater. These laws may apply to properties presently or formerly owned or operated by or presently or formerly under the charge, management or control of an entity or its predecessors, as well as to conditions at properties at which wastes attributable to an entity or its predecessors were disposed. Under these environmental laws, a current or previous owner or operator of real property or a party formerly or previously in charge, management or control of real property, and parties that generate or transport hazardous substances that are disposed of at real property, may be held liable for the cost to investigate or clean up that real property and for related damages to natural resources.

We handle and dispose of wastes arising from our mill operations, including by the operation of a number of landfills. We may be subject to liability, including liability for investigation and cleanup costs, if contamination is discovered at one of these mills, landfills, or at another location where we have disposed of, or arranged for the disposal of, waste. While we believe, based upon current information, that we are in substantial compliance with applicable environmental laws and regulations, we could be subject to potentially significant fines or penalties for failing to comply with environmental laws and regulations. MeadWestvaco and SEO have separately agreed to indemnify us for certain environmental liabilities related to the properties acquired from them, subject to certain limitations. We agreed to indemnify the purchaser of our carbonless paper business for certain environmental liabilities, subject to certain limitations.

Compliance with environmental laws and regulations is a significant factor in our business. We did not incur any capital expenditures in 2009 to maintain compliance with applicable environmental laws and regulations and to meet new regulatory requirements. We do not expect to incur any environmental capital expenditures in 2010. Environmental compliance may require significant capital or operating expenditures over time as environmental laws or regulations, or interpretation thereof, change or the nature of our operations require us to make significant additional expenditures.

Our operations also are subject to a variety of worker safety laws in the United States and Canada. The Occupational Safety and Health Act, U.S. Department of Labor Occupational Safety and Health Administration regulations and analogous state and provincial laws and regulations mandate general requirements for safe workplaces for all employees. We believe that we are operating in material compliance with applicable employee health and safety laws.

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are available without charge on our website, www.newpagecorp.com, as soon as is reasonably practicable after they are filed electronically with the SEC. We will also provide a free copy of any of our filed documents upon written request to: General Counsel, NewPage Corporation, 8540 Gander Creek Drive, Miamisburg, Ohio 45342.

The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC (http://www.sec.gov).

11

| ITEM 1A. | RISK FACTORS |

The risks discussed below, any of which could materially affect our business, financial condition or results of operations, are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition or results of operations.

Our substantial level of indebtedness could adversely affect our business, financial condition or results of operations.

We have substantial indebtedness. As of December 31, 2009, we had $3,338 million of total indebtedness, of which $52 million consisted of borrowings under our revolving credit facility (excluding letters of credit), and we had up to $354 million available for borrowing under our revolving credit facility (after deducting for $94 million in outstanding letters of credit and not taking into account any borrowing base limitations). Total indebtedness for NewPage was $3,131 million at December 31, 2009. We may incur additional indebtedness subject to restrictions in our existing debt instruments. If additional debt is added to our and our subsidiaries’ current debt levels, the related risks that we now face could intensify.

Our substantial indebtedness could have important consequences, including the following:

| • | it may be more difficult for us to satisfy our obligations with respect to our outstanding indebtedness |

| • | our ability to obtain additional financing for working capital, debt service requirements, general corporate or other purposes may be impaired |

| • | we must use a substantial portion of our cash flow to pay interest and principal on our indebtedness, which reduces the funds available to us for other purposes |

| • | we are more vulnerable to economic downturns and adverse industry conditions |

| • | our ability to capitalize on business opportunities and to react to competitive pressures and changes in our industry as compared to our competitors may be compromised due to our high level of indebtedness |

| • | our ability to refinance our indebtedness may be limited |

In addition, we cannot assure you that we will be able to refinance any of our debt on commercially reasonable terms or at all. If we were unable to make payments on or refinance our debt or obtain new financing under these circumstances, we would have to consider other options, such as:

| • | sales of assets |

| • | reduction or delay of capital expenditures |

| • | sales of equity |

| • | negotiations with our lenders to restructure the applicable debt |

| • | cash equity contributions from our controlling equity owner or others |

| • | commencement of voluntary bankruptcy proceedings |

12

Our debt instruments may restrict, or market or business conditions may limit, our ability to use some of our options.

A portion of our debt bears interest at variable rates. If market interest rates increase, it could adversely affect our cash flow, compliance with our debt covenants or the amount of our cash interest payments.

As of December 31, 2009, we had $484 million of indebtedness consisting of borrowings that bear interest at variable rates, representing 14% of our total indebtedness. Variable-rate indebtedness at NewPage was $277 million at December 31, 2009, representing 9% of its total indebtedness. If market interest rates increase, variable-rate debt will create higher debt service requirements, which would adversely affect our cash flow and compliance with our debt covenants. As of December 31, 2009, weighted average interest rates were 5.0% on borrowings under the revolving credit facility, 6.5% on the NewPage floating rate senior secured notes due 2012 and 7.6% on the NewPage Holding floating rate senior unsecured PIK Notes due 2013 (the “NewPage Holding PIK Notes”). Each one-eighth percentage-point change in LIBOR would result in a $0.3 million change in annual interest expense on the floating rate notes, a $0.3 million change in annual interest expense on the NewPage Holding PIK Notes and, assuming the entire revolving credit facility were drawn, a $0.6 million change in interest expense on the revolving credit facility, in each case, without taking into account any interest rate derivative agreements. While we may from time-to-time enter into agreements limiting our exposure to higher market interest rates, these agreements may not offer complete protection from this risk.

Servicing our indebtedness will require a significant amount of cash. Our ability to generate sufficient cash depends on numerous factors beyond our control, and we may be unable to generate sufficient cash flow to service our debt obligations.

Our ability to make payments on and to refinance our indebtedness will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, political, financial, competitive, legislative, regulatory and other factors that are beyond our control.

During 2009, we expended approximately $305 million to service our indebtedness as compared to approximately $267 million during 2008. For the year ended December 31, 2009, our interest expense was $438 million (including a loss on extinguishment of debt of $85 million and a reclassification adjustment of $48 million of unrealized losses on our interest rate swaps from accumulated other comprehensive income (loss)), compared to $298 million for the year ended December 31, 2008. Interest expense for NewPage was $418 million for the year ended December 31, 2009 compared to $277 million for the year ended December 31, 2008. We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings will be available to us under the revolving credit facility in an amount sufficient to enable us to pay our indebtedness or to fund our other liquidity needs. If our cash flows and capital resources are insufficient to allow us to make scheduled payments on our indebtedness or to fund our other liquidity needs, we may need to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance all or a portion of our indebtedness on or before maturity. We cannot assure you that we will be able to refinance any of our indebtedness, or that we will be able to refinance on commercially reasonable terms or that these measures would satisfy our scheduled debt service obligations. If we are unable to generate sufficient cash flow or refinance our debt on favorable terms it could have a material adverse effect on our financial condition, the value of the outstanding debt and our ability to make any required cash payments under our indebtedness.

13

Our debt instruments impose significant operating and financial restrictions on us.

The indentures and other agreements governing our debt instruments impose significant operating and financial restrictions on us. These restrictions limit our ability to, among other things:

| • | incur additional indebtedness or guarantee obligations |

| • | repay indebtedness prior to stated maturities |

| • | pay dividends or make certain other restricted payments |

| • | make investments or acquisitions |

| • | create liens or other encumbrances |

| • | transfer or sell certain assets or merge or consolidate with another entity |

| • | engage in transactions with affiliates |

| • | engage in certain business activities |

In addition to the covenants listed above, our revolving credit facility requires the maintenance of at least $50 million of borrowing availability under the revolving credit facility through the date of the delivery of the compliance certificate with respect to the fiscal quarter ending March 31, 2011 and limits our ability to make capital expenditures. Subsequent to March 31, 2011, we would have to comply with various other specified financial ratios and tests, including minimum interest and fixed charge coverage ratios and total and senior leverage ratios to the extent that NewPage’s unused borrowing availability under the revolving credit facility is below $50 million for 10 consecutive business days or $25 million for three consecutive business days.

Our ability to comply with these covenants may be affected by events beyond our control, and an adverse development affecting our business could require us to seek waivers or amendments of covenants, alternative or additional sources of financing or reductions in expenditures. We cannot assure you that such waivers, amendments or alternative or additional financings could be obtained on acceptable terms or at all.

A breach of any of the covenants or restrictions contained in any of our existing or future financing agreements, including our inability to comply with the required financial covenants in our revolving credit facility, could result in an event of default under those agreements. Such a default could allow the lenders under our financing agreements, if the agreements so provide, to discontinue lending, to accelerate the related debt as well as any other debt to which a cross acceleration or cross default provision applies, and to declare all borrowings outstanding thereunder to be due and payable. In addition, the lenders could terminate any commitments they had made to supply us with further funds. If the lenders require immediate repayments, we will not be able to repay them, or the other holders of our debt, in full.

We cannot assure you that we will be in compliance with these covenants in the periods required or that we will be able to refinance the revolving credit facility in the event it cannot comply with the applicable covenants.

Lenders under our revolving credit facility may not fund their commitments.

Under the credit agreement governing our revolving credit facility, if a lender’s commitment is not honored, that portion of the lender’s commitment under the revolving credit facility will be unavailable to the extent that the lender’s commitment is not replaced by a new commitment from an alternate lender.

14

Lenders under our revolving credit facility are well-diversified, totaling eleven lenders at December 31, 2009. We currently anticipate that these lenders will participate in future requests for funding. However, there can be no assurance that further deterioration in the credit markets and overall economy will not affect the ability of our lenders to meet their funding commitments. Additionally, our lenders have the ability to transfer their commitments to other institutions, and the risk that committed funds may not be available under distressed market conditions could be exacerbated to the extent that consolidation of the commitments under our facilities or among its lenders were to occur.

Our controlling equity holder may take actions that conflict with interests of the debtholders.

A substantial portion of the voting power of our equity is held indirectly by affiliates of Cerberus. Accordingly, Cerberus indirectly controls the power to elect our directors and officers, to appoint new management and to approve all actions requiring the approval of the holders of our equity (subject to certain specified consent rights of SEO under the security holders agreement between NewPage Group and SEO), including adopting amendments to our constituent documents and approving mergers, acquisitions or sales of all or substantially all of our assets. The directors have the authority, subject to the terms of our debt, to issue additional indebtedness or equity, implement equity repurchase programs, declare dividends and make other such decisions about our equity.

In addition, the interests of our controlling equity holder could conflict with those of our debtholders if, for example, we encounter financial difficulties or are unable to pay our debts as they mature. Our controlling equity holder also may have an interest in pursuing acquisitions, divestitures, financings or other transactions that, in its judgment, could enhance its equity investment, even though these transactions might involve risks to our debtholders.

Demand for coated paper has declined due to recent general economic events. Further declines in demand could have a material adverse effect on our business, financial condition and results of operations.

Deteriorating general economic conditions have had an adverse effect on the demand for our products since the second half of 2008. North American coated paper demand is primarily driven by advertising and print media usage. In particular, the demand for certain grades of coated paper is affected by spending on catalog and promotional materials by retailers and spending on magazine advertising, which affects the number of printed pages in magazines. Since the second half of 2008, advertising and print media usage has declined. As a result of lower demand in the current economic environment, sales prices began to decline during the fourth quarter of 2008 and throughout much of 2009, until stabilizing during the fourth quarter of 2009. Further declines in the general economic environment could have a material adverse effect on our business, financial condition and results of operations.

We have limited ability to pass through increases in our costs. Increases in our costs or decreases in our paper prices could adversely affect our business, financial condition and results of operations.

Our earnings are sensitive to changes in the prices of our paper products. Fluctuations in paper prices, and coated paper prices in particular, historically have had a direct effect on our net income (loss) and EBITDA for several reasons:

| • | Market prices for paper products are a function of supply and demand, factors over which we have limited influence. We therefore have limited ability to control the pricing of our products. Market prices of grade No. 3 coated paper, 60 lb. weight, which is an industry benchmark for coated freesheet paper pricing, have fluctuated since 2000 from a high of $1,100 per ton to a low of $705 per ton. Market prices of grade No. 4 coated paper, 50 lb. weight, which is an industry benchmark for coated groundwood paper pricing, and grade SC-A, 35 lb. weight, which is an industry benchmark for supercalendered paper pricing, have generally followed similar trends. Because market conditions determine the price for our paper products, the price for our products could fall below our production costs. |

15

| • | Market prices for paper products typically are not directly affected by raw material costs or other costs of sales, and consequently we have limited ability to pass through increases in our costs to our customers absent increases in the market price. Thus, even though our costs may increase, our customers may not accept price increases for our products, or the prices for our products may decline. |

| • | Paper manufacturing is highly capital-intensive and a large portion of our and our competitors’ operating costs are fixed. Additionally, paper machines are large, complex systems that operate more efficiently when operated continuously. Consequently, we typically continue to run our machines whenever marginal sales exceed the marginal costs. |

Our ability to achieve acceptable margins is, therefore, principally dependent on managing our cost structure and managing changes in raw materials prices, which represent a large component of our operating costs and fluctuate based upon factors beyond our control. If the prices of our products decline, or if our raw material costs increase, or both, it could have a material adverse effect on our business, financial condition and results of operations. For a further discussion of the variability of our paper prices and our costs and expenses, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Selected Factors That Affect Our Operating Results.”

During 2009 the U.S. Internal Revenue Code allowed a refundable excise tax credit for alternative fuel mixtures produced for sale or for use as a fuel in a trade or business for which we recognized income of $304 million in 2009. Weighted-average coated paper prices decreased to $911 per ton in 2009 compared to $983 per ton in 2008. We believe that generally the industry passed on most of the benefits of the alternative fuel mixture credit to customers in the form of lower prices. At this time, we view any extension of this credit, or the introduction of any similar program in the foreseeable future, as unlikely. If, as a result of expiration of this credit, the prices of our products do not increase, it could have a material adverse effect on our business, financial condition and results of operations.

Most of the raw material, labor and other cost of sales at our Port Hawkesbury, Nova Scotia, mill are denominated in Canadian dollars. North American sales prices for the products produced at Port Hawkesbury are determined primarily by the U.S. dollar price per ton charged by U.S. producers. If the U.S. dollar were to weaken significantly against the Canadian dollar, it would impair the ability of the Port Hawkesbury mill to compete profitably.

The markets in which we operate are highly competitive and imports could materially adversely affect our business, financial condition and results of operations.

Our business is highly competitive. Competition is based largely on price. We compete with numerous North American paper manufacturers. We also face competition from foreign producers, some of which we believe are lower cost producers than us. Foreign overcapacity could result in an increase in the supply of paper products available in the North American market. Certain Asian producers, in particular, have significantly increased imports to the U.S. in recent years, and we believe that producers in China and Indonesia have been selling in our markets at less than fair value and have been subsidized by their governments.

16

Our non-U.S. competitors may develop a competitive advantage over us and other U.S. producers if the U.S. dollar strengthens in comparison to the home currency of those competitors, if the home currency of those competitors (particularly in China) is maintained by their governments at a low value compared to the U.S. dollar, if those competitors receive governmental subsidies or incentives or if ocean shipping rates decrease. If the U.S. dollar strengthens, if foreign currencies are maintained at low values, if shipping rates decrease, if foreign producers receive governmental subsidies or incentives or if overseas supply exceeds demand, imports may increase, which, in turn, would cause the supply of paper products available in the North American market to increase. An increased supply of paper could cause us to lower our prices or lose sales to competitors, either of which could have a material adverse effect on our business, financial condition and results of operations.

In addition, the following factors will affect our ability to compete:

| • | product availability |

| • | the quality of our products |

| • | our breadth of product offerings |

| • | our ability to maintain plant efficiencies and high operating rates and thus lower our average manufacturing costs per ton |

| • | our ability to provide customer service that meets customer requirements and our ability to distribute our products on time |

| • | costs to comply with environmental laws and regulations |

| • | our ability to produce products that meet customer requirements for the use of sustainable forestry principles, recycled content and environmentally friendly energy sources |

| • | the availability or cost of chemicals, wood, energy and other raw materials and labor |

Furthermore, some of our competitors have greater financial and other resources than we do or may be better positioned than we are to compete for certain opportunities.

If we are unable to obtain raw materials, including petroleum-based chemicals, at favorable prices, or at all, it could adversely affect our business, financial condition and results of operations.

We have no significant timber holdings and purchase wood, chemicals and other raw materials from third parties. We may experience shortages of raw materials or be forced to seek alternative sources of supply. If we are forced to seek alternative sources of supply, we may not be able to do so on terms as favorable as our current terms or at all. The prices for many chemicals, especially petroleum-based chemicals, have had significant fluctuations over the past several years. Chemical prices have historically been and are expected to continue to be volatile. In addition, chemical suppliers that use petroleum-based products in the manufacture of their chemicals may, due to a supply shortage, ration the amount of chemicals available to us or we may not be able to obtain the chemicals we need at favorable prices, if at all. Chemical suppliers also may be adversely affected by, among other things, hurricanes and other natural disasters. Certain specialty chemicals that we purchase are available only from a small number of suppliers. We may experience additional cost pressures if merger and acquisition activity occurs among our major chemical suppliers. If any of our major chemical suppliers were to cease operations or cease doing business with us, we may be unable to obtain these chemicals at favorable prices, if at all.

In addition, wood prices are dictated largely by demand. The primary source for wood fiber is timber. Environmental litigation and regulatory developments have caused, and may cause in the future, significant reductions in the amount of timber available for commercial harvest in Canada and the United States. In addition, future domestic or foreign legislation, litigation advanced by aboriginal groups, litigation concerning the use of timberlands, the protection of threatened or endangered species, the promotion of forest biodiversity and the response to and prevention of catastrophic wildfires and campaigns or other measures by environmental activists could also affect timber supplies. Availability of harvested timber may further be limited by factors such as fire and fire prevention, insect infestation, disease, ice and wind storms, drought, floods and other natural and man-made causes, thereby reducing supply and increasing prices. We buy wood chips from lumber producers as a byproduct of their lumber production. Declines in their business conditions could affect the availability and price of wood chips.

17

Any disruption in the supply of chemicals, wood or other inputs could affect our ability to meet customer demand in a timely manner and could harm our reputation. As we have limited ability to pass through increases in our costs to our customers absent increases in market prices for our products, material increases in the cost of our raw materials could have a material adverse effect on our business, financial condition and results of operations.

We are involved in continuous manufacturing processes with a high degree of fixed costs. Any interruption in the operations of our manufacturing facilities may affect our operating performance.

We seek to run our paper machines and pulp mills on a nearly continuous basis for maximum efficiency. Any unplanned plant downtime at any of our paper mills results in unabsorbed fixed costs that negatively affect our results of operations. Due to the extreme operating conditions inherent in some of our manufacturing processes, we may incur unplanned business interruptions from time to time and, as a result, we may not generate sufficient cash flow to satisfy our operational needs. In addition, many of the geographic areas where our production is located and where we conduct our business may be affected by natural disasters, including snow storms, tornadoes, forest fires and flooding. These natural disasters could disrupt the operation of our mills, which could have a material adverse effect on our business, financial condition and results of operations. Furthermore, during periods of weak demand for paper products or periods of rising costs, we may need to schedule market-related downtime, which could have a material adverse effect on our financial condition and results of operations. We took 515,000 tons of market-related downtime of coated paper during 2009 in response to lower customer demand and in an effort to manage our inventory levels of finished goods to match customer requirements.

Our operations require substantial ongoing capital expenditures, and we may not have adequate capital resources to fund all of our required capital expenditures.

Our business is capital intensive, and we incur capital expenditures on an ongoing basis to maintain our equipment and comply with environmental laws and regulations, as well as to enhance the efficiency of our operations. We expect to spend approximately $75 million in 2010 on capital expenditures. In addition, our revolving credit facility limits our ability to make capital expenditures. We anticipate that cash generated from operations will be sufficient to fund our operating needs and capital expenditures for the foreseeable future and that the revolving credit facility limitation will not impair our ability to make necessary investments in capital expenditures. However, if we require additional funds to fund our capital expenditures, we may not be able to obtain them on favorable terms, or at all. If we cannot maintain or upgrade our facilities and equipment as we require or to ensure environmental compliance, it could have a material adverse effect on our business, financial condition and results of operations.

18

Rising energy or chemical prices or supply shortages could adversely affect our business, financial condition and results of operations.

Although a significant portion of our energy requirements is satisfied by steam produced as a byproduct of our manufacturing process, we purchase natural gas, coal and electricity to run our mills. We experienced a decrease in our transportation, chemical and other raw material costs in 2009, as compared to 2008, primarily as a result of lower crude oil prices. Overall, we expect crude oil and energy costs to remain volatile for the foreseeable future. In addition, energy suppliers and chemical suppliers that use petroleum-based products in the manufacture of their chemicals may, due to supply shortages, ration the amount of energy or chemicals available to us and we may not be able to obtain the energy or chemicals we need to operate our business at acceptable prices or at all. Any significant energy or chemical shortage or significant increase in our energy or chemical costs in circumstances where we cannot raise the price of our products due to market conditions could have a material adverse effect on our business, financial condition and results of operations. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Selected Factors That Affect Our Operating Results—Cost of Sales.” Furthermore, we are required to post letters of credit or other financial assurance obligations with certain of our energy and other suppliers, which could limit our financial flexibility. Additionally, we have experienced some fuel surcharges (primarily diesel fuel) by suppliers, distributors and freight carriers. If suppliers, distributors or freight carriers impose or increase fuel surcharges, and we are not able to pass these costs through to our customers, they could have a material adverse effect on our business, financial condition and results of operations.

In addition, an outbreak or escalation of hostilities between the United States and any foreign power and, in particular, events in the Middle East, or weather events such as hurricanes, could result in a real or perceived shortage of oil or natural gas, which could result in an increase in energy or chemical prices.

We depend on a small number of customers for a significant portion of our business.

Our largest customer, xpedx, a division of International Paper Company, accounted for 19% of 2009 net sales. Our ten largest customers (including xpedx) accounted for approximately 50% of 2009 net sales. The loss of, or significant reduction in orders from, any of these customers or other customers could have a material adverse effect on our business, financial condition and results of operations, as could significant customer disputes regarding shipments, price, quality or other matters.

Furthermore, we extend trade credit to certain of our customers to facilitate the purchase of our products and rely on their creditworthiness and ability to obtain credit from lenders. Accordingly, a bankruptcy or a significant deterioration in the financial condition of any of our significant customers could have a material adverse effect on our business, financial condition and results of operations, due to a reduction in purchases, a longer collection cycle or an inability to collect accounts receivable.

Litigation could be costly and harmful to our business.

We may be involved in various claims and legal actions that arise in the ordinary course of business, including claims and legal actions related to environmental laws and regulations. Any of these claims or legal actions could materially adversely affect our business, results of operations and financial condition.

See “Legal Proceedings” for further information concerning pending legal proceedings.

Rising postal costs could weaken demand for our paper products.

A significant portion of paper is used in periodicals, catalogs, fliers and other promotional materials. Many of these materials are distributed through the mail. Future increases in the cost of postage could reduce the frequency of mailings, reduce the number of pages in advertising materials or cause advertisers to use alternate methods to distribute their advertising materials. Any of the foregoing could decrease the demand for our products, which could materially adversely affect our business, financial condition and results of operations.

19

Developments in alternative media could adversely affect the demand for our products.

Trends in advertising, electronic data transmission and storage and the internet could have adverse effects on traditional print media, including our products and those of our customers, but neither the timing nor the extent of those trends can be predicted with certainty. Our magazine and catalog publishing customers may increasingly use, and compete with businesses that use, other forms of media and advertising and electronic data transmission and storage, particularly the internet, instead of paper made by us. As the use of these alternatives grows, demand for our paper products could decline. In addition, electronic formats for textbooks could cause demand to decline for paper textbooks.

The failure of our information technology and other business support systems could have a material adverse effect on our business, financial condition and results of operations.

Our ability to effectively monitor and control our operations depends to a large extent on the proper functioning of our information technology and other business support systems. If our information technology and other business support systems were to fail it could have a material adverse effect on our business, financial condition and results of operations.

A large percentage of our employees are unionized. Wage increases or work stoppages by our unionized employees may have a material adverse effect on our business, financial condition and results of operations.

As of December 31, 2009, we had approximately 7,500 employees. Approximately 70% of our employees were represented by labor unions. We have 17 collective bargaining agreements expiring at various times through December 1, 2012. Approximately 925 employees at the Escanaba, Michigan, mill are covered under three contracts that expired in June and July of 2008 and are currently under renegotiation. In addition, three contracts covering an aggregate of approximately 550 employees at our Port Hawkesbury, Nova Scotia, mill expired on May 31, 2009. The unions at this mill engage in pattern bargaining, which means that they negotiate a new contract with one industry participant before negotiating with others. The unions currently are negotiating with another paper company and have not yet begun negotiations with us. Our Port Hawkesbury, Nova Scotia, mill was closed from December 2005 until October 2006, before our ownership of the mill, due to a labor dispute.

We may become subject to material cost increases or additional work rules imposed by agreements with labor unions. This could increase expenses in absolute terms and as a percentage of net sales. In addition, work stoppages or other labor disturbances may occur in the future. Any of these factors could negatively affect our business, financial condition and results of operations.

We depend on third parties for certain transportation services.

We rely primarily on third parties for transportation of our products to our customers and transportation of our raw materials to us, in particular, by train and truck. If any of our third-party transportation providers fail to deliver our products in a timely manner, we may be unable to sell them at full value. Similarly, if any of our transportation providers fail to deliver raw materials to us in a timely manner, we may be unable to manufacture our products on a timely basis. Shipments of products and raw materials may be delayed due to weather conditions, labor strikes or other events. Any failure of a third-party transportation provider to deliver raw materials or products in a timely manner could harm our reputation, negatively affect our customer relationships and have a material adverse effect on our business, financial condition and results of operations. In addition, our ability to deliver our products on a timely basis could be adversely affected by the lack of adequate availability of transportation services, especially rail capacity, whether because of work stoppages or otherwise. Additionally, we have experienced some fuel surcharges (primarily diesel fuel) by suppliers, distributors and freight carriers. If suppliers, distributors or freight carriers impose or increase fuel surcharges, and we are not able to pass these costs through to our customers, they could have a material adverse effect on our business, financial condition and results of operations.

20

We are subject to various regulations that could impose substantial costs upon us and may adversely affect our operating performance.

Our operations are subject to a wide range of federal, state, provincial and local general and industry specific environmental, health and safety laws and regulations, including those relating to air emissions, wastewater discharges, solid and hazardous waste management and disposal and site remediation. Compliance with these laws and regulations is a significant factor in our business and we may be subject to increased scrutiny and enforcement actions by regulators as a result of changes in federal or state administrations. We have made, and will continue to make, significant expenditures to comply with these requirements. Significant expenditures also could be required for compliance with any future laws or regulations relating to greenhouse gas or other emissions. In addition, we handle and dispose of wastes arising from our mill operations and operate a number of landfills to handle that waste. While we believe, based upon current information, that we are currently in substantial compliance with all applicable environmental laws and regulations, we could be subject to potentially significant fines, penalties or criminal sanctions for failure to comply, including with respect to the matters discussed in “Litigation could be costly and harmful to our business.” Moreover, under certain environmental laws, a current or previous owner or operator of real property, and parties that generate or transport hazardous substances that are disposed of at real property, may be held liable for the cost to investigate or clean up that real property and for related damages to natural resources. We may be subject to liability, including liability for investigation and cleanup costs, if contamination is discovered at one of our paper mills or other locations where we have disposed of, or arranged for the disposal of, wastes. MeadWestvaco and SEO have separately agreed to indemnify us, subject to certain limitations, for certain environmental liabilities. There can be no assurance that MeadWestvaco or SEO will perform under any of their respective environmental indemnity obligations or that the indemnity will adequately cover us in the event of any environmental liabilities, which could have a material adverse effect on our financial condition and results of operations. Furthermore, we agreed to indemnify the purchaser of our carbonless paper business for certain environmental liabilities, subject to certain limitations. We also could be subject to claims brought pursuant to applicable laws, rules or regulations for property damage or personal injury resulting from the environmental impact of our operations, including due to human exposure to hazardous substances. Increasingly stringent environmental requirements, more aggressive enforcement actions or policies, the discovery of unknown conditions or the bringing of future claims may cause our expenditures for environmental matters to increase, and we may incur material costs associated with these matters.

Some of our operations are subject to Canadian government regulation and we are subject to foreign currency risk.