Attached files

Table of Contents

Index to Financial Statements

Exhibit 99.2

Annual Report on

Form 10-K

of

Enbridge Energy Partners, L.P.

Table of Contents

Index to Financial Statements

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended DECEMBER 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-10934

ENBRIDGE ENERGY PARTNERS, L.P.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 39-1715850 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

1100 Louisiana Street, Suite 3300

Houston, Texas 77002

(Address of Principal Executive Offices) (Zip Code)

(713) 821-2000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |||

| Class A Common Units | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large Accelerated Filer x | Accelerated Filer ¨ | |||

| Non-Accelerated Filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the Registrant’s Class A common units held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2009, was $2,932,968,652.

As of February 18, 2010 the Registrant has 97,443,352 Class A common units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: NONE

Table of Contents

Index to Financial Statements

This Annual Report on Form 10-K contains forward-looking statements. Forward-looking statements are typically identified by words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “position,” “project,” “strategy,” “target,” “could,” “should” or “will” and similar words or statements, express or implied, suggesting future outcomes or statements regarding an outlook or the negative of those terms. Although we believe that these forward-looking statements are reasonable based on the information available on the dates these statements are made and processes used to prepare the information, these statements are not guarantees of future performance and readers are cautioned against placing undue reliance on these statements. By their nature, these statements involve a variety of assumptions, unknown risks, uncertainties, and other factors, which may cause actual results, levels of activity and performance to differ materially from those expressed or implied by these statements. Material assumptions may include: the expected supply and demand for crude oil, natural gas and natural gas liquids, or NGLs; prices of crude oil, natural gas and NGLs; inflation rates; interest rates; the availability and price of labor and pipeline construction materials; operational reliability; anticipated in-service dates and weather.

Our forward-looking statements are subject to risks and uncertainties pertaining to operating performance, regulatory parameters, weather, economic conditions, interest rates and commodity prices including but not limited to those risks and uncertainties discussed in this Annual Report on Form 10-K and our other reports filed with the Securities and Exchange Commission. The impact of any one risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty as these are independent and our future course of action depends on our management’s assessment of all information available at the relevant time. Except to the extent required by law, we assume no obligation to publically update or revise any forward-looking statements made herein whether as a result of new information, future events or otherwise. All subsequent forward-looking statements, whether written or oral, attributable to us or persons actions on our behalf are expressly qualified in their entirety by these cautionary statements. For additional discussion of risks, uncertainties and assumptions, see “Item 1A. Risk Factors” included elsewhere in this Annual Report on Form 10-K.

1

Table of Contents

Index to Financial Statements

Glossary

The following abbreviations, acronyms and terms used in this Form 10-K are defined below:

| AEUB |

Alberta Energy and Utilities Board | |

| Anadarko system |

Natural gas gathering and processing assets located in western Oklahoma and the Texas panhandle which serve the Anadarko Basin. | |

| AOCI |

Accumulated other comprehensive income | |

| AOSP |

Athabasca Oil Sands Project, located in northern Alberta, Canada | |

| Bbl |

Barrel of liquids (approximately 42 U.S. gallons) | |

| Bpd |

Barrels per day | |

| CAA |

Clean Air Act | |

| CNRL |

Canadian Natural Resources Limited, an unrelated energy company | |

| CAPP |

Canadian Association of Petroleum Producers, a trade association representing a majority of our Lakehead system’s customers | |

| CERCLA |

Comprehensive Environmental Response, Compensation, and Liability Act | |

| CAD |

Amount denominated in Canadian dollars | |

| CWA |

Clean Water Act | |

| DOT |

United States Department of Transportation | |

| East Texas system |

Natural gas gathering, treating and processing assets in East Texas that serve the Bossier trend and Haynesville shale areas. Also includes a system formerly known as the Northeast Texas system. | |

| Enbridge |

Enbridge Inc., of Calgary, Alberta, Canada, the ultimate parent of the General Partner | |

| Enbridge Management |

Enbridge Energy Management, L.L.C. | |

| Enbridge system |

Canadian portion of the System | |

| Enbridge Pipelines |

Enbridge Pipelines Inc. | |

| EnCana |

EnCana Corporation, an unrelated producer of natural gas and crude oil | |

| EP Act |

Energy Policy Act of 1992 | |

| EPACT |

Energy Policy Act of 2005 | |

| EPA |

Environmental Protection Agency | |

| ERCB |

Energy Resource Conservation Board, a successor regulatory body to the Alberta Energy Utility Board | |

| Exchange Act |

Securities Exchange Act of 1934, as amended | |

| FASB |

Financial Accounting Standards Board | |

| FERC |

Federal Energy Regulatory Commission | |

| General Partner |

Enbridge Energy Company, Inc., general partner of the Partnership | |

| HCA |

High consequence area | |

| ICA |

Interstate Commerce Act | |

| KPC |

Kansas Pipeline system, sold on November 1, 2007. | |

| Lakehead Partnership |

Enbridge Energy, Limited Partnership, a subsidiary of the Partnership | |

| Lakehead system |

U.S. portion of the System | |

| LIBOR |

London Interbank Offered Rate—British Bankers’ Association’s average settlement rate for deposits in U.S. dollars. | |

| M3 |

Cubic meters of liquid = 6.2898105 Bbl | |

| MLP |

Master Limited Partnership | |

| MMBtu/d |

Million British Thermal units per day | |

| MMcf/d |

Million cubic feet per day | |

| Midcoast system |

Natural gas gathering, treating, processing, transmission and marketing assets acquired October 17, 2002. | |

| Mid-Continent system |

Crude oil pipelines and storage facilities located in the mid-continent region of the U.S. and including the Cushing tank test farm and Ozark pipeline. |

2

Table of Contents

Index to Financial Statements

| NEB |

National Energy Board, a Canadian federal agency that regulates Canada’s energy industry | |

| NGA |

Natural Gas Act | |

| NGL or NGLs |

Natural gas liquids | |

| NGPA |

Natural Gas Policy Act | |

| NOPR |

Notice of Proposed Rulemaking issued by the FERC | |

| North Dakota system |

Liquids petroleum pipeline gathering system and common carrier pipeline in the Upper Midwest United States that serves the Bakken formation within the Williston Basin. | |

| North Texas system |

Natural gas gathering and processing assets located in the Fort Worth Basin serving the Burnett shale area. | |

| NYMEX |

The New York Mercantile Exchange where natural gas futures, options contracts and other energy futures are traded. | |

| NYSE |

New York Stock Exchange | |

| OCSLA |

Outer Continental Shelf Lands Act | |

| OSHA |

Occupational Safety and Health Administration | |

| OPA |

Oil Pollution Act | |

| OPS |

Office of Pipeline Safety | |

| PADD |

Petroleum Administration for Defense Districts | |

| PADD I |

Consists of Connecticut, Delaware, District of Columbia, Florida, Georgia, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia and West Virginia | |

| PADD II |

Consists of Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Tennessee and Wisconsin | |

| PADD III |

Consists of Alabama, Arkansas, Louisiana, Mississippi, New Mexico and Texas | |

| PADD IV |

Consists of Idaho, Montana, Wyoming and Colorado | |

| PADD V |

Consists of Washington, Oregon, California, Arizona, Alaska, Hawaii and Nevada | |

| Partnership Agreement |

Fourth Amended and Restated Agreement of Limited Partnership of Enbridge Energy Partners, L.P. | |

| Partnership |

Enbridge Energy Partners, L.P. and its consolidated subsidiaries | |

| PHMSA |

Pipeline and Hazardous Materials Safety Administration (formerly OPS) | |

| PIPES of 2006 |

Pipeline Inspection, Protection, Enforcement, and Safety Act of 2006 | |

| PIPES Act |

Pipeline Safety Act Reauthorization of 2006 | |

| PPIFG |

Producer Price Index for Finished Goods | |

| PSA |

Pipeline Safety Act | |

| PSI Act |

Pipeline Safety Improvement Act | |

| RCRA |

Resource Conservation & Recovery Act | |

| SAGD |

Steam assisted gravity drainage | |

| SEC |

United States Securities and Exchange Commission | |

| SEP II |

System Expansion Program II, an expansion program on our Lakehead system | |

| Settlement Agreement |

A FERC approved settlement agreement, signed October 1996. | |

| SFPP |

Santa Fe Pacific Pipelines, L.P., an unrelated pipeline company | |

| Suncor |

Suncor Energy Inc., an unrelated energy company | |

| Syncrude |

Syncrude Canada Ltd., an unrelated energy company | |

| Synthetic crude oil |

Product that results from upgrading or blending bitumen into a crude oil stream which can be readily refined by most conventional refineries. |

3

Table of Contents

Index to Financial Statements

| System |

The combined liquid petroleum pipeline operations of our Lakehead system and the Enbridge system. | |

| Tariff Agreement |

A 1998 offer of settlement filed with the FERC | |

| Terrace |

Terrace Expansion Program, an expansion program on our Lakehead system. | |

| TSX |

Toronto Stock Exchange | |

| WCSB |

Western Canadian Sedimentary Basin |

4

Table of Contents

Index to Financial Statements

PART I

OVERVIEW

In this report, unless the context requires otherwise, references to “we,” “us,” “our,” or the “Partnership” are intended to mean Enbridge Energy Partners, L.P. and its consolidated subsidiaries. We are a publicly traded Delaware limited partnership that owns and operates crude oil and liquid petroleum transportation and storage assets, and natural gas gathering, treating, processing, transportation and marketing assets in the United States of America. Our Class A common units are traded on the New York Stock Exchange, or NYSE, under the symbol “EEP.”

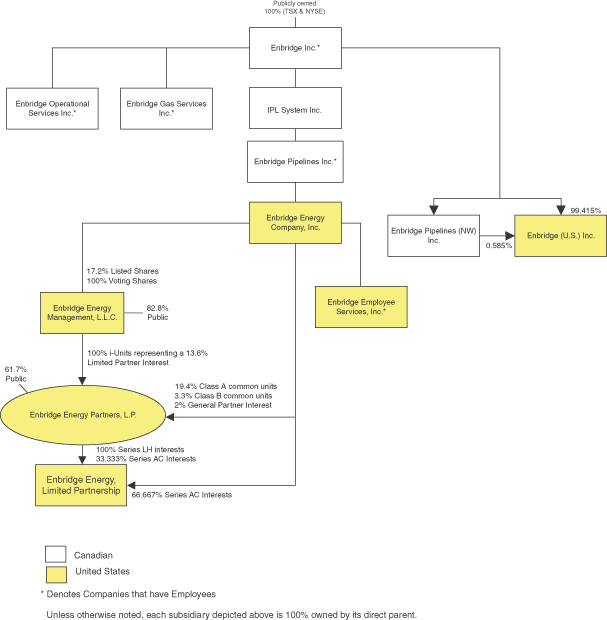

The following chart shows our organization and ownership structure as of December 31, 2009. The ownership percentages referred to below illustrate the relationships between us, Enbridge Management, our general partner and Enbridge and its affiliates:

5

Table of Contents

Index to Financial Statements

Our ownership at December 31, 2009 and 2008 is comprised of the following:

| 2009 | 2008 | |||||

| Class A common units owned by the public |

61.7 | % | 51.2 | % | ||

| Class A common units owned by our General Partner |

19.4 | % | 13.9 | % | ||

| Class B common units owned by our General Partner |

3.3 | % | 3.4 | % | ||

| Class C units owned by our General Partner(1) |

— | 5.5 | % | |||

| Class C units owned by institutional investors(1) |

— | 11.3 | % | |||

| i-units owned by Enbridge Management |

13.6 | % | 12.7 | % | ||

| General Partner interest |

2.0 | % | 2.0 | % | ||

| 100.0 | % | 100.0 | % | |||

| (1) | The Class C units converted to Class A common units in October 2009. |

We were formed in 1991 by Enbridge Energy Company, Inc., our general partner, to own and operate the Lakehead system, which is the U.S. portion of a crude oil and liquid petroleum pipeline system extending from western Canada through the upper and lower Great Lakes region of the United States to eastern Canada (the “System”). A subsidiary of Enbridge Inc., or Enbridge, owns the Canadian portion of the System. Enbridge, which is based in Calgary, Alberta, Canada provides energy transportation, distribution and related services in North America and internationally. Enbridge is the ultimate parent of our general partner.

We are a geographically and operationally diversified partnership consisting of interests and assets that provide midstream energy services. As of December 31, 2009, our portfolio of assets included the following:

| • | Approximately 5,900 miles of crude oil gathering and transportation lines and 28.9 million barrels, or Bbl, of crude oil storage and terminaling capacity; |

| • | Natural gas gathering and transportation lines totaling approximately 10,000 miles; |

| • | Nine natural gas treating and 22 natural gas processing facilities with an aggregate capacity of approximately 2,900 million cubic feet per day, or MMcf/d. The above amounts include plants we may idle from time to time based on current volumes; |

| • | Trucks, trailers and railcars for transporting natural gas liquids, or NGLs, crude oil and carbon dioxide; and |

| • | Marketing assets that provide natural gas supply, transmission, storage and sales services. |

Enbridge Management L.L.C., (“Enbridge Management”), is a Delaware limited liability company that was formed in May 2002 to manage our business and affairs. Under a delegation of control agreement, our general partner delegated substantially all of its power and authority to manage our business and affairs to Enbridge Management. Our general partner, through its direct ownership of the voting shares of Enbridge Management, elects all of the directors of Enbridge Management. Enbridge Management is the sole owner of a special class of our limited partner interests, which we refer to as “i-units.”

BUSINESS STRATEGY

Our primary objective is to provide stable and sustainable cash distributions to our unitholders, while maintaining a relatively low risk investment profile. Our business strategies focus on creating value for our customers, which we believe is the key to creating value for our investors. To accomplish our objective, we focus on the following key strategies:

| 1. | Focus on operational excellence |

| • | We continue to operate our existing infrastructure to maximize cost efficiencies, provide flexibility for our customers and ensure the capacity is reliable and available when required. We will continue to focus on safety, environmental integrity, innovation and effective stakeholder relations. |

6

Table of Contents

Index to Financial Statements

| 2. | Expand existing core asset platforms |

| • | We intend to develop energy transportation assets and related facilities that are complementary to our existing systems. Our core businesses provide plentiful opportunities to achieve our primary business objectives. |

| 3. | Develop new asset platforms |

| • | We plan to develop and acquire new gathering, processing, transportation and storage assets to meet customer needs by expanding capacity into new markets with favorable supply and demand fundamentals. |

Our current business strategy emphasizes developing and expanding our existing Liquids and Natural Gas businesses while remaining focused on the effective and efficient operation of our current assets. We are well positioned to pursue opportunities for accretive acquisitions in or near the areas in which we have a competitive advantage. We anticipate initially funding long-term cash requirements for expansion projects and acquisitions first from operating cash flows, second, from borrowings under our Second Amended and Restated Credit Agreement, referred to as the Credit Facility, and from borrowings under our credit agreement with Enbridge (U.S.) Inc., or Enbridge U.S., a wholly-owned subsidiary of Enbridge and from other potential sources of capital.

Enbridge, as the ultimate parent of our general partner, has been and continues to be supportive of our efforts in executing our capital expenditure program as some of these projects are beneficial to our mutual customers and operational asset bases. In addition to Enbridge’s recent liquidity support and investment through our general partner, Enbridge has the capacity to provide further support in the form of participation in public and private equity transactions and other forms of investment in our operations.

Liquids

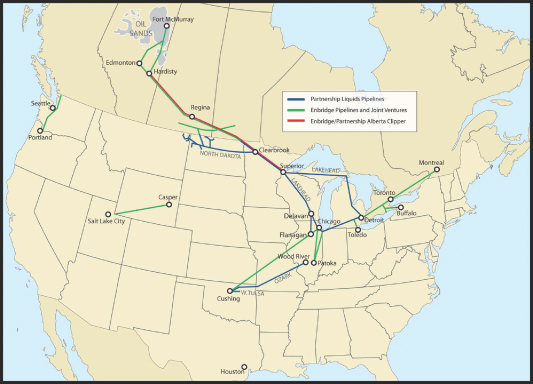

The map below presents the locations of our current Liquids systems assets and projects being constructed. This map depicts some assets owned by Enbridge and projects being constructed to provide an understanding of how they interconnect with our Liquids systems.

7

Table of Contents

Index to Financial Statements

Western Canadian crude oil is an important source of supply for the United States. According to the latest available data for 2009 from the U.S. Department of Energy’s Energy Information Administration, Canada supplied approximately 1.2 million barrels per day, or Bpd, of crude oil to the U.S., the largest source of U.S. imports. Approximately 68 percent of the Canadian crude oil moving into the U.S. was transported on the System. We have developed and are well positioned to further develop additional infrastructure to deliver growing volumes of crude oil that are expected from the Alberta Oil Sands. Relative to recent years, development of the Alberta Oil Sands has slowed due to changed economic circumstances and volatile commodity prices. The Canadian Association of Petroleum Producers’, which we refer to as CAPP, in their June 2009 forecast of future production from the Alberta Oil Sands continued to expect steady growth in supply during the next 10 years albeit at a slower pace than previously forecast, with an additional 1.4 million Bpd of incremental supply available by 2019, based on a subset of currently approved applications and announced expansions.

We completed construction on our Southern Access expansion project, which we refer to as the Southern Access Project, in the first quarter of 2009, increasing heavy crude oil capacity of the System into the Chicago, Illinois region by an additional 400,000 Bpd. The Southern Access Project expanded heavy crude oil capacity primarily by the installation of a 42-inch diameter pipeline between Superior, Wisconsin and Chicago. The project was completed as planned and is supported by a system-wide rate surcharge. The design permits an additional 800,000 Bpd increase in capacity for minimal additional cost, in conjunction with a corresponding expansion upstream of Superior. The Southern Access Project also involves expansion on the Canadian portion of the system owned by Enbridge.

The Alberta Clipper pipeline expansion project, which we refer to as the Alberta Clipper Project, is under construction and nearing completion. The Alberta Clipper Project involves construction of a new 36-inch diameter pipeline from Hardisty, Alberta to Superior generally within or alongside our existing rights-of-way in the United States and Enbridge’s existing rights-of-way in Canada. The Alberta Clipper Project will interconnect with our existing mainline system in Superior where it will provide access to our full range of delivery points and storage options, including Chicago, Toledo, Ohio, Sarnia, Ontario, Patoka, Illinois and Cushing, Oklahoma. The completed pipeline will have an initial capacity of 450,000 Bpd, is expandable to 800,000 Bpd and will form part of the existing Enbridge System in Canada and our Lakehead system in the United States. Construction on the Canadian segment of the Alberta Clipper Project was mechanically completed in December 2009, and remains on schedule to be ready for service on April 1, 2010. As of January 2010, we are approximately 90% complete with construction of the United States segment and it also remains on schedule to be ready for service by April 1, 2010.

Along with Enbridge, we are actively working with our customers to develop options that will allow Canadian crude oil to access new markets in the United States. The market strategy we are undertaking is to provide timely, economical, integrated transportation solutions to connect growing supplies of production from the Alberta Oil Sands to key refinery markets in the United States. The strategy involves further penetration into the Midwest area of the United States, also referred to as PADD II, in addition to expanded and new access to other refining markets in the United States.

8

Table of Contents

Index to Financial Statements

Natural Gas

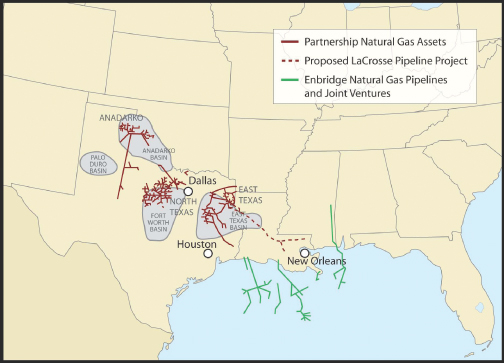

The map below presents the locations of assets for our Natural Gas systems. This map depicts some assets owned or proposed by Enbridge to provide an understanding of how they relate to our Natural Gas systems.

Our natural gas assets are primarily located in Texas, which continues to maintain its status as one of the most active natural gas producing areas in the United States. Our three systems in Texas are located in basins that have experienced active drilling production over the last several years. These core basins are known as the East Texas basin, the Fort Worth Basin and the Anadarko basin. Our focus has primarily been on developing and expanding the service capability of our existing pipeline systems.

One of our key goals is to become the premier midstream energy company in the U.S. Gulf Coast region. To achieve this end, the operations and commercial activities of our gathering and processing assets and intrastate pipelines are integrated to provide better service to our customers. From an operations perspective, our key strategies are to provide safe and reliable service at reasonable costs to our customers, enhance our reputation and capitalize on opportunities for attracting new customers. From a commercial perspective, our focus is to provide our customers with a greater value for their commodity. We intend to achieve this latter objective by increasing customer access to preferred natural gas markets. We have made significant progress on achieving this objective with the construction of our East Texas Expansion project, otherwise known as Clarity, which includes an intrastate pipeline connecting our East Texas system at Bethel, Texas to multiple downstream interconnects and physically connecting a number of our systems. The aim is to be able to move significant quantities of natural gas from our Anadarko, North Texas and East Texas systems to the major market hubs in Texas and Louisiana, which Clarity provides. From these market hubs, natural gas can be used in the local Texas markets or transported to consumers in the Midwest, Northeast and Southeast United States.

Our Natural Gas business also includes trucking, rail and liquids marketing operations that we use to enhance the value of the NGLs produced at our processing plants. Our Natural Gas Marketing business provides us with the ability to maximize the value received for the natural gas we transport and purchase by identifying customers with consistent demand for natural gas.

9

Table of Contents

Index to Financial Statements

The growth prospects in our core areas are primarily the result of historically strong commodity prices, rig utilization rates and improvements in technology to produce natural gas from tight sand and shale formations. As a result, many expansions and extensions have been made on our three main gathering and processing systems in Texas, including well-connects, processing plant re-activations, new plant construction, added compression, new pipelines and treating plant re-activations. However, growth prospects in some of our core areas have been hindered by the current commodity price environment. The volume of gas produced in all three regions has declined as a result of reduced drilling in the area. However, we believe that all three regions continue to have the resource potential to further grow their production volume in the future. The economic return to natural gas producers on horizontal wells in the regions we serve with our pipelines remains attractive when compared to most other gas producing basins. The Haynesville Shale in particular has tremendous potential for growth, and although development of this play first began in Western Louisiana, it is now apparent that the Haynesville Shale extends into several counties in East Texas served by our East Texas system.

We continue to coordinate extensively with our customers to develop and enhance access for Texas natural gas production, to additional markets. One such example is the Clarity project which was successfully completed in late 2008 and had its final compressor station brought on-line in early 2009. The project was designed to be expandable and is positioned for potential upstream and downstream extension.

In addition to the expansions of our transportation capacity to meet the needs of our customers, we have also expanded the processing and treating capacity on our East Texas system to meet the growing demand for these services and to capture the additional revenue these services provide. In the second quarter of 2009, we completed construction on a $60 million expansion project to add compression at the Carthage Hub and on the Shelby County lateral sections of our East Texas system. As part of the expansion project, we also increased the capacity of our East Texas system by installing approximately 26 miles of 20-inch pipeline. Additional compression capacity was also added in late 2009.

BUSINESS SEGMENTS

We conduct our business through three business segments:

| • | Liquids; |

| • | Natural Gas; and |

| • | Marketing. |

These segments have unique business activities that require different operating strategies. For information relating to revenues from external customers, operating income and total assets for each segment, refer to Note 17 of our consolidated financial statements beginning on page F-1 of this report.

Liquids Segment

Lakehead system

Our Lakehead system consists primarily of crude oil and liquid petroleum common carrier pipelines and terminal assets in the Great Lakes and Midwest regions of the United States. Our Lakehead system, together with the Enbridge system in Canada, forms the longest liquid petroleum pipeline system in the world. The System, which spans approximately 3,300 miles, has been in operation for 60 years and is the primary transporter of crude oil and liquid petroleum from western Canada to the United States. The System serves all the major refining centers in the Great Lakes and Midwest regions of the United States and the Province of Ontario,

10

Table of Contents

Index to Financial Statements

Canada. We and Enbridge have undertaken the Southern Access Project, Alberta Clipper Project and other expansion projects to increase the capacity of our Lakehead and Enbridge’s mainline systems in an effort to capitalize on the expected increases in crude oil supplies from previously announced heavy crude oil and oil sands projects in the Province of Alberta, Canada.

Our Lakehead system is an interstate common carrier pipeline system regulated by the Federal Energy Regulatory Commission, or FERC. Our Lakehead system spans a distance of approximately 1,900 miles, and consists of approximately 4,700 miles of pipe with diameters ranging from 12 inches to 48 inches, 60 pump station locations with a total of approximately 846,450 installed horsepower and 66 crude oil storage tanks with an aggregate capacity of approximately 12.1 million barrels. The System operates in a segregation, or batch mode, allowing the transport of 44 crude oil commodities including light, medium and heavy crude oil (including bitumen, which is a naturally occurring tar-like mixture of hydrocarbons), condensate and NGLs.

Customers. Our Lakehead system operates under month-to-month transportation arrangements with our shippers. During 2009, approximately 36 shippers tendered crude oil and liquid petroleum for delivery through our Lakehead system. We consider multiple companies that are controlled by a common entity to be a single shipper for purposes of determining the number of shippers delivering crude oil and liquid petroleum on our Lakehead system. Our customers include integrated oil companies, major independent oil producers, refiners and marketers.

Supply and Demand. The Lakehead system is well positioned as the primary transporter of western Canadian crude oil and continues to benefit from the growing production of crude oil from the Alberta Oil Sands. Similar to U.S. domestic conventional crude oil production, western Canada’s conventional crude oil production is declining. Over the last several years, development of the Alberta Oil Sands has more than offset declining conventional production. The NEB estimated that total production in 2009 from the Western Canadian Sedimentary Basin, or WCSB, averaged approximately 2.5 million Bpd compared with 2.4 million Bpd in 2008. Volumes of WCSB crude oil production are comparable with production volumes from Kuwait and Venezuela, key members of the Organization of Petroleum Exporting Countries, or OPEC.

Remaining established conventional oil reserves in western Canada were estimated to be approximately 3.72 billion barrels at the end of 2007. During 2007, the latest period for which data is available, approximately 97 percent of conventional production was replaced with reserve additions. Remaining established reserves from the Alberta Oil Sands as of the end of 2008 are approximately 170 billion barrels. Canada’s combined conventional and oil sands estimated proved reserves of approximately 175 billion barrels compares with Saudi Arabia’s estimated proved reserves of approximately 260 billion barrels.

According to CAPP, an estimated $95 billion Canadian Dollars, or CAD, has been spent on oil sands development from 1997 through 2008. Development of the Alberta Oil Sands is expected to moderate due to declining demand and commodity prices, and it is unlikely that all announced and planned oil sands projects will proceed as planned. CAPP’s June 2009 Growth Forecast estimates future production from the Alberta Oil Sands is expected to grow steadily during the next 10 years, with an additional 1.4 million Bpd of incremental production available by 2019.

The near-term growth in crude oil supply comes from the completion and ramp up of major expansion projects at existing synthetic crude oil upgraders and growth of bitumen production from both existing and new Steam Assisted Gravity Drainage, or SAGD, facilities. Over the next year, synthetic crude oil production is expected to increase from the ramp up of the joint venture between Opti Canada, Inc. and Nexen, Inc. at their 58,500 Bpd Long Lake upgrader project and Canadian Natural Resources Limited, or CNRL, 114,000 Bpd Horizon upgrader project.

Suncor completed expansion on one of its upgraders in the third quarter of 2008, resulting in total upgrading capacity of approximately 357,000 Bpd. Synthetic production averaged approximately 285,000 Bpd in 2009, which was 59,000 Bpd higher than in 2008. Suncor plans on completing its Firebag Stage 3 expansion as well as Firebag Stage 4 with in-service dates of second quarter 2011 and late 2012, respectively.

Syncrude completed its 100,000 Bpd Stage 3 expansion in 2006, increasing total production capacity to 350,000 Bpd. An extended turnaround in the second quarter of 2009 and operational reliability issues led to

11

Table of Contents

Index to Financial Statements

average production of 280,000 Bpd, which is 9,000 Bpd lower than 2008. Syncrude’s next expansion is the Stage 3 debottleneck to increase their current system synthetic production by approximately 40,000 Bpd, with a projected in-service date that has not been published.

The Athabasca Oil Sands Project, or AOSP, owned by Shell Canada Limited (60%), Chevron Canada Limited (20%) and Marathon Oil Corporation (20%), reached full production capacity in 2004. An expansion of the AOSP project moved forward with ERCB’s conditional approval of the AOSP Expansion 1 project in 2006. Construction of the AOSP Expansion 1 is in process, and is expected to increase the current production capacity of 158,000 Bpd of synthetic crude oil to 249,000 Bpd by 2010.

Over the next two years, over four individual projects are expected to come on-line that should start or increase the production of unblended bitumen. Notable projects include the expansions at MEG Energy Corp’s Christina Lake, StatoilHydro’s Kai Kos Dehseh, Suncor’s Firebag Stage 3 and Cenovus Energy’s Christina Lake. Based on the ERCB forecast, unblended bitumen production is expected to increase by roughly 76,000 Bpd by the end of 2011.

Although the crude oil and liquid petroleum delivered through our Lakehead system originate primarily in oilfields in western Canada, the Lakehead system also receives approximately five percent of its receipts from domestic sources including:

| • | U.S. production at Clearbrook, Minnesota through a connection with our North Dakota system; |

| • | U.S. production at Lewiston, Michigan; and |

| • | Both U.S. and offshore production in the Chicago area. |

Based on forecasted growth in western Canadian crude oil production and completion of upgrader expansions and increased bitumen production, as well as a 435,000 Bpd competitor pipeline coming on-line in 2010, the Lakehead system deliveries are expected to average 1.61 million Bpd in 2010 compared with 1.65 million Bpd in 2009. This decrease is partially due to crude oil volumes needed for line fill for both our Alberta Clipper pipeline as well the competitor’s pipeline.

The ability to increase deliveries and to expand the Lakehead system in the future will ultimately depend upon numerous factors. The investment levels and related development activities by crude oil producers in conventional and oil sands production directly impacts the level of supply from the WCSB. Investment levels are influenced by crude oil producers’ expectations of crude oil and natural gas prices, future operating costs, U.S. demand and availability of markets for produced crude oil. Higher crude oil production from the WCSB should result in higher deliveries on our Lakehead system. Deliveries on our Lakehead system are also affected by periodic maintenance, turnarounds and other shutdowns at producing plants that supply crude oil to, or refineries that take delivery from, our Lakehead system.

Although demand for Canadian crude oil in PADD II was fairly consistent with last year, it is expected that demand for WCSB crude oil production will continue to increase. Refinery configurations and crude oil requirements in PADD II continue to be an attractive market for western Canadian supply. According to the U.S. Department of Energy’s Energy Information Administration, 2009 demand for crude oil in PADD II was relatively flat when compared to levels in 2008 with an average of 3.13 million Bpd. At the same time, production of crude oil within PADD II increased by 52,000 Bpd to 579,000 Bpd.

The projected growth in western Canadian crude oil production will require construction of new pipelines to ensure expanding oil supplies can be transported to markets in the United States. We and Enbridge are actively working with our customers to develop transportation options that will allow Canadian crude oil greater access to markets in the United States. Periods of low or volatile crude oil pricing in 2009 have caused some oil sands producers to cancel or defer projects that were planned to commence over the next decade. Cancellations and project deferrals of oil sands projects are expected to temper the rate of growth over the next several years relative to prior forecasts. If the rate of crude oil production from the WCSB declines, immediate need for new pipeline infrastructure will likely decline and our Alberta Clipper Project may provide sufficient capacity for the near-term. In the event the rate of crude oil production from the WCSB does indeed decline, we expect expansion

12

Table of Contents

Index to Financial Statements

activities in and around our Lakehead system to be modest relative to that experienced over the last several years. As a result, further expansion activities in and around our liquids systems will primarily focus on additional storage opportunities in the Cushing region and further development of our North Dakota system. For an overview of our projects refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations by Segment—Liquids—Future Prospects for Liquids.”

Competition. The Lakehead system, along with the Enbridge system, is the main crude oil export route from the WCSB. WCSB production in excess of western Canadian demand moves on existing pipelines into PADD II, the Rocky Mountain states (PADD IV), the Anacortes area of Washington State (PADD V) and the U.S. Gulf Coast (PADD III). In each of these regions, WCSB crude oil competes with local and imported crude oil. As local crude oil production declines and refineries demand more imported crude oil, imports from the WCSB should increase.

For 2009, the latest data available shows that PADD II total demand was 3.13 million Bpd while it produced only 579,000 Bpd and thus imported 2.5 million Bpd. The 2009 data indicate PADD II imported approximately 1.2 million Bpd of crude oil from Canada, a majority of which was transported on the Lakehead system. The remaining barrels were imported from PADDs III and IV as well as from offshore sources through the U.S. Gulf Coast. Lakehead system deliveries of Canadian crude oil to PADD II were 36,000 Bpd higher than delivery volumes for 2008. Total deliveries on our Lakehead system averaged 1.65 million Bpd in 2009, meeting approximately 75 percent of Minnesota refinery capacity; 70 percent of the refinery capacity in the greater Chicago area; and 77 percent of Ontario’s refinery demand.

Considering all of the pipeline systems that transport western Canadian crude oil out of Canada, the System transported approximately 68 percent of the total western Canadian crude oil exports in 2009 to the United States. The remaining production was transported by systems serving the British Columbia, PADD II, PADD IV and PADD V markets.

Given the expected increase in crude oil production from the Alberta Oil Sands over the next 10 years, alternative transportation proposals have been presented to crude oil producers. These proposals and projects range from expansions of existing pipelines that currently transport western Canadian crude oil, to new pipelines and extensions of existing pipelines. These proposals and projects are in various stages of development, with some at the concept stage and others that are proceeding with line fill. Some of these proposals will be in direct competition with our Lakehead system.

Enbridge has proposed construction of the Gateway Pipeline with an in-service date in the 2015 to 2016 timeframe, which includes both a condensate import pipeline and a petroleum export pipeline. The condensate line would transport imported diluent from Kitimat, British Columbia to the Edmonton, Alberta area. The petroleum export line would transport crude oil from the Edmonton area to Kitimat and would compete with our Lakehead system for production from the Alberta Oil Sands.

We and Enbridge believe that the Southern Access Project, Alberta Clipper Project, and other initiatives to provide access to new markets in the Midwest, Mid-Continent and Gulf Coast, offer flexible solutions to future transportation requirements of western Canadian crude oil producers.

The following provides an overview of other proposals and projects put forth by competing pipeline companies that are not affiliated with Enbridge:

| • | Construction of a new 435,000 Bpd crude oil pipeline from Hardisty to Wood River, Illinois and Patoka, with capacity subsequently updated to 590,000 Bpd with an expansion to Cushing. The project is expected to receive line fill sometime in 2010. |

| • | Commercial support has been announced to construct a 36-inch crude oil pipeline extension to the pipeline described above that will begin at Hardisty and extend down to Cushing and then to Nederland, Texas. The extension will add an additional 500,000 Bpd of capacity with a targeted in-service date of 2012. The proposed pipeline extension received 380,000 Bpd of shipper support in the third quarter of 2008. An application has been filed with the NEB, and a variety of regulatory approvals will be required in the United States and Canada before the proposed extension can proceed. |

13

Table of Contents

Index to Financial Statements

These competing alternatives for delivering western Canadian crude oil into the United States and other markets could erode shipper support for further expansion of our Lakehead system beyond the Alberta Clipper Project. They could also affect throughput on and utilization of the System. However, together the Lakehead and Enbridge systems offer significant cost savings and flexibility advantages, which are expected to continue to favor the System as the preferred alternative for meeting shipper transportation requirements to the Midwest United States and beyond.

The following table sets forth average deliveries per day and barrel miles of our Lakehead system for each of the periods presented.

| Deliveries | ||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||

| (thousands of Bpd) | ||||||||||

| United States |

||||||||||

| Light crude oil |

467 | 388 | 346 | 327 | 241 | |||||

| Medium and heavy crude oil |

834 | 876 | 852 | 872 | 791 | |||||

| NGL |

4 | 3 | 4 | 5 | 4 | |||||

| Total United States |

1,305 | 1,267 | 1,202 | 1,204 | 1,036 | |||||

| Ontario |

||||||||||

| Light crude oil |

197 | 183 | 184 | 160 | 146 | |||||

| Medium and heavy crude oil |

73 | 80 | 62 | 63 | 59 | |||||

| NGL |

75 | 90 | 95 | 90 | 98 | |||||

| Total Ontario |

345 | 353 | 341 | 313 | 303 | |||||

| Total Deliveries |

1,650 | 1,620 | 1,543 | 1,517 | 1,339 | |||||

| Barrel miles (billions per year) |

423 | 432 | 408 | 400 | 338 | |||||

Mid-Continent system

Our Mid-Continent system, which we have owned since 2004, is located within the PADD II district and is comprised of our Ozark pipeline, our West Tulsa pipeline and storage terminals at Cushing and El Dorado, Kansas. Our Mid-Continent system includes over 480 miles of crude oil pipelines and 15.9 million barrels of crude oil storage capacity. Our Ozark pipeline transports crude oil from Cushing to Wood River where it delivers to ConocoPhillips’ Wood River refinery and interconnects with the WoodPat Pipeline and the Wood River Pipeline, each owned by unrelated parties. Our West Tulsa pipeline moves crude oil from Cushing to Tulsa, Oklahoma where it delivers to Holly Corporation’s Tulsa refinery, formally owned by Sinclair Oil Corporation.

The storage terminals consist of 96 individual storage tanks ranging in size from 55,000 to 575,000 barrels. Of the 15.9 million barrels of storage capacity on our Mid-Continent system, the Cushing terminal accounts for 14.8 million barrels. A portion of the storage facilities are used for operational purposes, while we contract the remainder of the facilities with various crude oil market participants for their term storage requirements. Contract fees include fixed monthly capacity fees as well as utilization fees, which we charge for injecting crude oil into and withdrawing crude oil from the storage facilities.

Customers. Our Mid-Continent system operates under month-to-month transportation arrangements and both long-term and short-term storage arrangements with its shippers. During 2009, approximately 37 shippers tendered crude oil for service on our Mid-Continent system. We consider multiple companies that are controlled by a common entity to be a single shipper for purposes of determining the number of shippers delivering crude oil and liquid petroleum on our Mid-Continent system. These customers include integrated oil companies, independent oil producers, refiners and marketers. Average deliveries on the system were 238,000 Bpd for 2009 and 231,000 Bpd for 2008.

14

Table of Contents

Index to Financial Statements

Supply and Demand. Our Mid-Continent system is positioned to capitalize on increasing near-term demand for crude oil from West Texas and imported crude oil delivered to the U.S. Gulf Coast, as well as third-party storage demand. In 2009, PADD II imported 2.5 million Bpd from outside of the PADD II region. The 2009 data indicates PADD II imported approximately 1.2 million Bpd of crude oil from Canada, a majority of which was transported on our Lakehead system. The remaining barrels of crude oil were imported from PADDs III and IV as well as offshore sources. We expect the gap between local supply and demand for crude oil in PADD II to continue to widen, encouraging imports of crude oil from Canada, PADD III and foreign sources.

Competition. Our Ozark pipeline system currently serves an exclusive corridor between Cushing and Wood River. However, refineries connected to Wood River have crude supply options available from Canada via our Lakehead system. These same refineries also have access to the U.S. Gulf Coast and foreign crude oil supply through the Capline pipeline system, which is an undivided joint interest pipeline that is owned by unrelated parties. In addition, refineries located east of Patoka with access to crude oil through our Ozark system, also have access to west Texas supply through the West Texas Gulf / Mid-Valley pipeline systems owned by unrelated parties. Our Ozark pipeline system could face a significant increase in competition when a competitor’s new pipeline from Hardisty to Patoka commences operation in 2010. However, when that situation occurs, we will consider potential alternative uses for our Ozark system. In addition, our Ozark pipeline system provides crude oil types and grades that are generally lighter and with lower sulfur relative to that expected to be transported on the new pipeline.

In addition to movements into Wood River, crude oil in Cushing is transported to Chicago and El Dorado on third-party pipeline systems. With the reversal of the Spearhead pipeline, western Canadian crude oil moving on Spearhead is increasing the importance of Cushing as a terminal and pipeline origination area.

Competition to our West Tulsa pipeline is by way of unrelated parties shipping portions of a local refinery’s supply through a pipeline reactivated in mid-2008. This new line was created by modifying existing infrastructure.

The storage terminals rely on demand for storage service from numerous oil market participants. Producers, refiners, marketers and traders rely on storage capacity for a number of different reasons: batch scheduling, stream quality control, inventory management, and speculative trading opportunities. Competitors to our storage facilities at Cushing include large integrated oil companies and other midstream energy partnerships.

North Dakota system

Our North Dakota system is a crude oil gathering and interstate transportation system servicing the Williston Basin in North Dakota and Montana, which includes the Bakken shale formation. The crude oil gathering pipelines of our North Dakota system collect crude oil from points near producing wells in approximately 22 oil fields in North Dakota and Montana. Most deliveries from our North Dakota system are made at Clearbrook to our Lakehead system and to a third-party pipeline system. Our North Dakota system includes approximately 240 miles of crude oil gathering lines connected to a transportation line that is approximately 730 miles long, with a capacity of approximately 161,000 Bpd. We recently completed a 51,000 Bpd increase in capacity resulting from the Phase VI expansion of the system, which we completed in December 2009. This expansion was necessary to meet increased crude oil production from the Montana and North Dakota region. The related tolling surcharge has been adjusted to include costs of this phase of the expansion that became effective January 1, 2010. The commercial structure for this expansion is a cost-of-service based surcharge that was added to the existing transportation rates. Our North Dakota system also has 21 pump stations, one delivery station and 11 storage facilities with an aggregate working storage capacity of approximately 810,000 barrels.

Customers. Customers of our North Dakota system include refiners of crude oil, producers of crude oil and purchasers of crude oil at the wellhead, such as marketers, that require crude oil gathering and transportation services. Producers range in size from small independent owner/operators to the largest integrated oil companies.

Supply and Demand. Similar to our Lakehead system, our North Dakota system depends upon demand for crude oil in the Great Lakes and Midwest regions of the United States and the ability of crude oil producers to

15

Table of Contents

Index to Financial Statements

maintain their crude oil production and exploration activities. Due to increased exploration of the Bakken and Three Forks Formations within the Williston Basin, the state of North Dakota has seen increased production levels up to 245,000 Bpd in November 2009. The U.S. portion of the Williston Basin now produces more than 300,000 Bpd.

Competition. Competitors of our North Dakota system include integrated oil companies, interstate and intrastate pipelines or their affiliates and other crude oil gatherers. Many crude oil producers in the oil fields served by our North Dakota system have alternative gathering facilities available to them or have the ability to build their own assets, including some existing rail loading facilities.

Natural Gas Segment

We own and operate natural gas gathering, treating, processing and transportation systems as well as trucking, rail and liquids marketing operations. We purchase and gather natural gas from the wellhead and deliver it to plants for treating and/or processing and to intrastate or interstate pipelines for transmission to wholesale customers such as power plants, industrial customers and local distribution companies.

Natural gas treating involves the removal of hydrogen sulfide, carbon dioxide, water and other substances from raw natural gas so that it will meet the standards for pipeline transportation. Natural gas processing involves the separation of raw natural gas into residue gas and NGLs. Residue gas is the processed natural gas that ultimately is consumed by end users. NGLs separated from the raw natural gas are either sold and transported as NGL raw mix or further separated through a process known as fractionation and sold as their individual components, including ethane, propane, butanes and natural gasoline. At December 31, 2009, we had nine active treating plants and 22 active processing plants, including three hydrocarbon dewpoint control facilities, or HCDP plants. We may idle some of these plants from time to time based on current volumes. Our treating facilities have a combined capacity that approximates 1,200 MMcf/d while the combined capacity of our processing facilities approximates 1,800 MMcf/d, including 550 MMcf/d provided by the HCDP plants.

Our natural gas business consists of the following systems:

| • | East Texas system: Includes approximately 3,400 miles of natural gas gathering and transportation pipelines, nine natural gas treating plants and seven natural gas processing plants, including three HCDP plants. |

| • | Anadarko system: Consists of approximately 1,800 miles of natural gas gathering and transportation pipelines in southwest Oklahoma and the Texas panhandle and six natural gas processing plants. The Anadarko system also includes the Palo Duro system. |

| • | North Texas system: Includes approximately 4,500 miles of natural gas gathering pipelines and nine natural gas processing plants located in the Fort Worth Basin. |

In November 2009, we divested non-core natural gas assets located predominantly outside of Texas, which included over 1,400 miles of pipeline, including interstate and intrastate gas transmission pipelines, and several small gathering and processing assets.

Customers. Customers of our natural gas pipeline systems include both purchasers and producers of natural gas. Purchasers are comprised of marketers, including our Marketing business, and large users of natural gas, such as power plants, industrial facilities and local distribution companies. Producers served by our systems consist of small, medium and large independent operators and large integrated energy companies. We sell NGLs resulting from our processing activities to a variety of customers ranging from large petrochemical and refining companies to small regional retail propane distributors.

Our natural gas pipelines serve customers predominantly in the U.S. Gulf Coast region of the United States. Customers include large users of natural gas, such as power plants, industrial facilities, local distribution companies, large consumers seeking an alternative to their local distribution company, and shippers of natural gas, such as natural gas producers and marketers.

16

Table of Contents

Index to Financial Statements

Supply and Demand. Demand for our gathering, treating and processing services primarily depends upon the supply of natural gas reserves and the drilling rate for new wells. The level of impurities in the natural gas gathered also affects treating services. Demand for these services also depends upon overall economic conditions and the prices of natural gas and NGLs. Due to the current economic conditions and surplus of natural gas, we expect that near-term demand for our services may decrease. Falling drilling rates appear to have stabilized near the end of 2009 and in some regions the number of drilling rigs is rising slightly.

The economic crisis combined with a surplus of natural gas supply expected from the lower 48 states has led to lower prices and lower drilling rates. However, our natural gas assets remain in basins that have the opportunity to grow even in a moderate pricing environment. All three of our natural gas systems exist in regions that have shale or tight sands formations where horizontal fracturing technology can be utilized to increase production from the natural gas wells.

Our East Texas system is primarily located in the East Texas Basin. The Bossier trend, which is located on the western side of our East Texas system within the East Texas Basin, has been the driver of growth on our East Texas system for the past several years. Production in the Bossier trend grew from under 390 MMcf/d in 1997 to 2,400 MMcf/d in March of 2009. However, with the drop in natural gas prices, the Bossier trend has seen a significant drop in development with production falling to 1,950 MMcf/d in October 2009, with modest declines experienced in the remainder of the East Texas Basin. This decreased drilling activity in the Bossier trend is expected to be more than offset by the increased activity focused in and around the Haynesville Shale. The Haynesville Shale is a formation that runs from western Louisiana into eastern Texas, and has the potential of being the largest natural gas discovery in the United States. If proven, the discovery could create more drilling activity around our East Texas system increasing the demand for our services. We are undertaking expansions to provide gathering, treating and transportation services to several producers in counties west and south of Carthage.

In a further effort to address the continuing strong growth in natural gas production occurring in east Texas, we successfully completed expansion and extension of our East Texas system, referred to as the Clarity project. The Clarity project included the following portions of expansion which were completed throughout 2008 and 2009:

| • | Construction of the Orange County compressor station was completed and placed into service in late February 2009; |

| • | The Goodrich compressor station was constructed and placed into service in December 2008; |

| • | A 20-inch segment from Orange County, Texas to a downstream interconnect near Beaumont, Texas, enabling deliveries into the interconnect, was placed into service in December 2008; and |

| • | A 36-inch diameter pipeline segment that extends from Kountze, Texas to Orange County was placed into service in July 2008. |

Now that our Clarity project has been completed, we are able to provide service to major industrial companies in southeast Texas with interconnects to interstate pipelines, intrastate pipelines and wholesale customers. The Clarity project was designed to be expandable and is positioned for potential upstream and downstream extensions to meet the growing demand for natural gas transportation capacity.

In the second quarter of 2009, we completed an expansion project to add compression at the Carthage Hub and on the Shelby County lateral sections of our East Texas system. As part of the expansion project, we also increased the capacity of our East Texas system in the area by installing approximately 26 miles of 20-inch pipeline. The completed expansion provides an additional 160 MMcf/d of capacity for this growing region.

A substantial portion of natural gas on our North Texas system is produced in the Barnett Shale area within the Fort Worth Basin Conglomerate. The Fort Worth Basin Conglomerate is a mature zone that is experiencing slow production decline. In contrast, the Barnett Shale area is one of the most active natural gas plays in

17

Table of Contents

Index to Financial Statements

North America. While abundant natural gas reserves have been known to exist in the Barnett Shale area since the early 1980s, technological advances in fracturing the shale formation allows commercial production of these natural gas reserves. Based on the latest information available for 2008, Barnett Shale production has risen from approximately 110 MMcf/d in 1999 to approximately 5,000 MMcf/d by the end of 2008. With substantially reduced drilling in the first half of 2009, production volume was down to 4,750 MMcf/d by October 2009, although the number of drilling rigs began to increase in late 2009. We anticipate that throughput on the North Texas system will increase modestly in each of the next several years as a result of continued Barnett Shale development. The expected increase in throughput is a result of producers balancing the economics of lower commodity prices with the prolific drilling opportunities of the Barnett Shale.

Our Anadarko system is located within the Anadarko basin and has experienced considerable growth as a result of the rapid development of the Granite Wash play in Hemphill and Wheeler counties in Texas. However, with rig counts down by 63% during the first half of 2009, production of natural gas in the region fell. Recently volume has begun to rise slightly. While rig counts are still well below the peak levels of 2008, a notable difference is that producers are drilling considerably more horizontal wells in the region, and the early results have been promising with high initial production rates. This development may lead to enhanced recoveries from new and existing wells in this region. An additional factor regarding the development of the wells in this region is the high natural gas liquids content, which enhances the economics of these wells due to the value of the natural gas liquids.

While capital markets have stabilized and our cost of capital approximates pre-financial crisis levels, we will continue to be cautious regarding our capital program. The expansion programs we are undertaking in East Texas to serve the Haynesville Shale developments are being supported by long-term contracts and include demand payments as a significant element of the contractual structure. Other potential expansions may arise as more producers begin actively developing this region and commit for additional capacity. Neither the Anadarko nor the North Texas systems have any major capital programs planned in the near term. However, we will continue to pursue connections for new wells as rig counts increase and will monitor developments closely if volumes appear to rise resulting in the need for added capacity. We will opportunistically evaluate strategic prospects to further expand the service capabilities of our existing system.

Results of our Natural Gas business depend upon the drilling activities of natural gas producers in the areas we serve. We expect that the rate of decline of natural gas production has slowed or halted due to the increase in rig activity. We expect the volumes on our Anadarko system to stay level or possibly rise slightly due to high prices for NGLs and the increased use of horizontal drilling in the Midcontinent region of the United States. Our East Texas and North Texas systems are located in two areas where we believe producers are likely to remain active due to the higher probability of success associated with resource developments in these areas. We believe the higher success rate in these two areas, coupled with the recent natural gas discovery of the Haynesville Shale, should temper the impact of lower natural gas production that generally results from a reduction in drilling activity.

Competition. Competition from other pipeline companies is significant in all the markets we serve. Competitors of our gathering, treating and processing systems include interstate and intrastate pipelines or their affiliates and other midstream businesses that gather, treat, process and market natural gas or NGLs. Some of these competitors are substantially larger than we are. Competition for the services we provide varies based upon the location of gathering, treating and processing facilities. Most natural gas producers and owners have alternate gathering, treating and processing facilities available to them. In addition, they have alternatives such as building their own gathering facilities or, in some cases, selling their natural gas supplies without treating and processing. In addition to location, competition also varies based upon pricing arrangements and reputation. On the sour natural gas systems, such as our East Texas system, competition is more limited due to the infrastructure required to treat sour natural gas.

Competition for customers in the marketing of residue natural gas is based primarily upon the price of the delivered natural gas, the services offered by the seller and the reliability of the seller in making deliveries. Residue natural gas also competes on a price basis with alternative fuels such as crude oil and coal, especially for

18

Table of Contents

Index to Financial Statements

customers that have the capability of using these alternative fuels, and on the basis of local environmental considerations. Competition in the marketing of NGLs comes from other NGL marketing companies, producers, traders, chemical companies and other asset owners.

Because pipelines are generally the only practical mode of transportation for natural gas over land, the most significant competitors of our natural gas pipelines are other pipelines. Pipelines typically compete with each other based on location, capacity, price and reliability. Many of the large wholesale customers we serve have multiple pipelines connected or adjacent to their facilities. Accordingly, many of these customers have the ability to purchase natural gas directly from a number of pipelines or third parties that may hold capacity on the various pipelines. In addition, a number of new interstate natural gas pipelines are being constructed in areas currently served by some of our intrastate pipelines. When completed, these new pipelines may compete for customers with our existing pipelines.

Trucking and Liquids Marketing Operations

We also include our trucking and liquids marketing operations in our Natural Gas segment. These operations include the transportation of NGLs, crude oil and other products by truck and railcar from wellheads and treating, processing and fractionation facilities to wholesale customers, such as distributors, refiners and chemical facilities. In addition, our trucking and liquids marketing operations resell these products. A key component of our business is ensuring market access for the liquids extracted at our processing facilities. On average, this accounts for approximately half of the volumes transported by our trucking and liquids marketing business and is a major source of its growth in this area.

Our services are provided using trucks, trailers and rail cars, product treating and handling equipment and NGL storage facilities. In 2008, we expanded our fleet by acquiring the assets of a common carrier trucking company to meet the growing supply of NGLs, crude oil and carbon dioxide from our processing facilities, as well as to capitalize on the opportunity to better serve our U.S. Gulf Coast customers. This acquisition increased the size of our truck fleet from 120 to 250 trucks and trailers.

Customers. Most of the customers of our trucking and liquids marketing operations are wholesale customers, such as refineries and propane distributors. Our trucking and liquids marketing operations also market products to wholesale customers such as petrochemical plants.

Supply and Demand. Supply is sourced from a variety of areas in the U.S. Gulf Coast, with a significant amount of the NGL volume coming from our own gathering and processing facilities. Crude oil and natural gas prices and production levels affect the supply of these products. The demand for our services is affected by the demand for NGLs and crude oil by large industrial refineries and similar customers in the regions served by this business.

Competition. Our trucking and liquids marketing operations have a number of competitors, including other trucking and railcar operations, pipelines, and, to a lesser extent, marine transportation and alternative fuels. In addition, the marketing activities of our trucking and liquids marketing operations have numerous competitors, including marketers of all types and sizes, affiliates of pipelines and independent aggregators.

Marketing Segment

Our Marketing segment’s primary objectives are to maximize the value of the natural gas purchased by our gathering systems and the throughput on our gathering and intrastate wholesale customer pipelines and to mitigate financial risk. To achieve this objective, our Marketing segment transacts with various counterparties to provide natural gas supply, transportation, balancing, storage and sales services.

Since our gathering and intrastate wholesale customer pipeline assets are geographically located within Texas and Oklahoma, the majority of activities conducted by our Marketing segment are focused within these areas, or points downstream of this location.

Customers. Natural gas purchased by our Marketing business is sold to industrial, utility and power plant end use customers. In addition, gas is sold to marketing companies at various market hubs. These sales are

19

Table of Contents

Index to Financial Statements

typically priced based upon a published daily or monthly price index. Sales to end-use customers incorporate a pass-through charge for costs of transportation and additional margin to compensate us for associated services.

Supply and Demand. Supply for our Marketing business depends to a large extent on the natural gas reserves and rate of drilling within the areas served by our Natural Gas business. Demand is typically driven by weather-related factors with respect to power plant and utility customers and industrial demand.

Our Marketing business uses third-party storage capacity to balance supply and demand factors within its portfolio. Our Marketing business pays third-party storage facilities and pipelines for the right to store gas for various periods of time. These contracts may be denoted as firm storage, interruptible storage or parking and lending services. These various contract structures are used to mitigate risk associated with sales and purchase contracts and to take advantage of price differential opportunities. Our Marketing business leases third-party pipeline capacity downstream from our Natural Gas assets under firm transportation contracts, which capacity is dependent on the volumes of natural gas from our natural gas assets. This capacity is leased for various lengths of time and at rates that allow our Marketing business to diversify its customer base by expanding its service territory. Additionally, this transportation capacity provides assurance that our natural gas will not be shut in, which can result from capacity constraints on downstream pipelines.

Competition. Our Marketing segment has numerous competitors, including large natural gas marketing companies, marketing affiliates of pipelines, major oil and natural gas producers, independent aggregators and regional marketing companies.

REGULATION

FERC Allowance for Income Taxes in Interstate Common Carrier Pipeline Rates

In December 2005, the FERC released its first case-specific review of the income tax allowance issue reaffirming its income tax allowance policy and directing the pipeline under review to provide certain evidence necessary to determine its income tax allowance. The FERC’s BP West Coast remand decision and the new tax allowance policy were appealed to the United States Court of Appeals for the District of Columbia Circuit, or the D.C. Circuit Court.

In May 2007, the D.C. Circuit Court upheld the income tax allowance policy adopted by the FERC for master limited partnerships, or MLPs, and other non-taxable entities. On the basis of the Santa Fe Pacific Pipeline, L.P., or SFPP, order, the D.C. Circuit Court concluded that the FERC’s new policy statement applied to SFPP and resolved the principal defect of the Lakehead policy, which was the inadequately explained differential treatment of the tax liability of the individual and corporate partners. On that basis, the D.C. Circuit Court affirmed the FERC’s tax allowance policy as being reasonable and in accordance with the FERC’s statutory discretion. As such, the D.C. Circuit Court affirmed that an allowance should be permitted on all partnership interests, or similar legal interest, if the owner of that interest has an actual or potential income tax liability on the public utility income earned though the interest. We believe that all applicable assets will be entitled to a tax allowance to the extent a pipeline’s partners have income tax liability on the income they receive from the pipeline. In August 2007, the D.C. Circuit Court denied a request for rehearing of its May 2007 decision, and the decision is now final and cannot be appealed.

FERC Return on Equity Policy for Oil Pipelines

On April 17, 2008, the FERC issued a Policy Statement regarding the inclusion of MLPs in the proxy groups used to determine the return on equity, or ROE, for oil pipelines. Composition of Proxy Groups for Determining Gas and Oil Pipeline Return on Equity, 123 FERC ¶ 61,048 (2008), rehearing denied, 123 FERC ¶ 61,259 (2008). No petitions for review of the Policy Statement were filed with the D.C. Circuit Court. The Policy Statement largely upheld the prior method by which ROEs were calculated for oil pipelines, explaining that MLPs should continue to be included in the ROE proxy group for oil pipelines, and that there should be no ceiling on the level of distributions included in the FERC’s current discounted cash flow, or DCF, methodology. The Policy Statement further indicated that the Institutional Brokers Estimated System, or IBES,

20

Table of Contents

Index to Financial Statements

forecasts should remain the basis for the short-term growth forecast used in the DCF calculation and there should be no modification to the current respective two-thirds and one-third weightings of the short- and long-term growth factors. The primary change to the prior ROE methodology was the Policy Statement’s holding that the gross domestic product, or GDP, forecast used for the long-term growth rate should be reduced by 50 percent for all MLPs included in the proxy group. Everything else being equal, that change will result in somewhat lower ROEs for oil pipelines than would have been calculated under the prior ROE methodology. The actual ROEs to be calculated under the new Policy Statement, however, are dependent on the companies included in the proxy group and the specific conditions existing at the time the ROE is calculated in each case.

Accounting for Pipeline Assessment Costs

In June 2005, the FERC issued an order in Docket AI05-1 describing how FERC-regulated companies should account for costs associated with implementing the pipeline integrity management requirements of the United States Department of Transportation’s Office of Pipeline Safety. The order took effect on January 1, 2006. Under the order, FERC-regulated companies are generally required to recognize costs incurred for performing pipeline assessments that are part of a pipeline integrity management program as a maintenance expense in the period in which the costs are incurred. Costs for items such as rehabilitation projects designed to extend the useful life of the system can continue to be capitalized to the extent permitted under the existing rules. The FERC denied rehearing of its accounting guidance order on September 19, 2005.

Prior to 2006, we capitalized first time in-line inspection programs, based on previous rulings by the FERC. In January 2006, we began expensing all first-time internal inspection costs for all our pipeline systems, whether or not they are subject to the FERC’s regulation, on a prospective basis. We continue to expense secondary internal inspection tests consistent with the previous practice. Refer to Note 2—Summary of Significant Accounting Policies included in our consolidated financial statements beginning at page F-1 of this annual report on Form 10-K for additional discussion.

Regulation by the FERC of Interstate Common Carrier Liquids Pipelines