Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2009 |

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file Number 0-18490

K•SWISS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 95-4265988 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 31248 Oak Crest Drive, Westlake Village, California |

91361 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (818) 706-5100

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Name of each exchange on which registered | |

| Class A Common Stock, par value $0.01 per share | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the Class A Common Stock of the Registrant held by non-affiliates of the Registrant as of June 30, 2009, the last business day of the Registrant’s most recently completed second fiscal quarter, based on the closing price of the Class A Common Stock on the Nasdaq Global Select Market on such date was $227,604,636.

The number of shares of the Registrant’s Class A Common Stock outstanding at February 17, 2010 was 27,098,140 shares. The number of shares of the Registrant’s Class B Common Stock outstanding at February 17, 2010 was 8,039,524 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the Registrant’s 2010 Annual Stockholders Meeting are incorporated by reference into Part III.

Table of Contents

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

Table of Contents

PART I

| Item 1. | Business |

Company History and General Strategy

K•Swiss Inc. designs, develops and markets an array of athletic footwear for high performance sports use, fitness activities and casual wear under the K•Swiss brand. We also design and manufacture footwear under the Palladium brand. Palladium designs, develops and markets footwear for adventurers for all terrains. Sales of the Palladium brand were approximately 9.8% of total sales in 2009.

K•Swiss was founded in 1966 by two Swiss brothers, who introduced one of the first leather tennis shoes in the United States. The shoe, the K•Swiss “Classic,” has remained relatively unchanged from its original design, and accounts for a significant portion of our sales. The Classic has evolved from a high-performance shoe into a casual, lifestyle shoe. In our marketing, we have consistently emphasized our commitment to produce products of high quality and enduring style and we plan to continue to emphasize the high quality and classic design of our products as we introduce new models of athletic footwear.

On December 30, 1986, K•Swiss was purchased by an investment group led by our current Chairman of the Board and President, Steven Nichols. Thereafter we recruited experienced management and reduced manufacturing costs by increasing offshore production and entering into new, lower cost purchasing arrangements. Our products are manufactured to our specifications by overseas suppliers predominately in the People’s Republic of China (“China”). In June 1991 and September 1992, we established operations in Taiwan and Europe, respectively, to broaden our distribution on a global scale.

In November 2001, we acquired the worldwide rights and business of Royal Elastics, an Australian-based designer and manufacturer of elasticated footwear. The purchase excluded distribution rights in Australia, which were retained by Royal Management Pty, Ltd. In April 2009, we sold certain Royal Elastics assets, consisting of its inventory located in Taiwan and its intangible trademarks to Royal Elastics Holdings Ltd. (“REH”), a third party, in an arm’s length transaction. Operations of the Royal Elastics brand have been accounted for and presented as a discontinued operation in the accompanying financial information.

In July 2008, we purchased a 57% equity interest in Palladium for a total purchase price of €5.3 million, or approximately $8.5 million (including a loan of €3.65 million, or approximately $5.8 million). In June 2009, we purchased the remaining 43% equity interest in Palladium for €5,000,000 plus a variable future price. The future purchase price is equal to an amount calculated in accordance with a formula driven by Palladium’s EBITDA for the twelve months ended December 31, 2012 less €3,300,000, but not to exceed €6,700,000. The fair value of this new liability (the “Contingent Purchase Price” or “CPP”) will be determined each quarter based on the current quarter’s projection of Palladium’s EBITDA for the twelve months ended December 31 of the current year, less €3,300,000, but not less than zero. The change in CPP is based on the current quarter’s EBITDA projection and will be recognized as interest income or interest expense during the current quarter. The fair value of the CPP at December 31, 2009 was zero.

The discussion during the remainder of this Item 1, other than the discussion relating to backlog, trademarks and patents, and employees, relates solely to the K•Swiss brand.

K•Swiss is a corporation that was organized under the laws of the State of Delaware on April 16, 1990. The Company is successor in interest to K•Swiss Inc., a Massachusetts corporation, which in

3

Table of Contents

turn was successor in interest to K•Swiss Inc., a California corporation. Unless the context otherwise indicates, the terms “we,” “us,” “K•Swiss” and the “Company” as used herein refers to K•Swiss Inc. and its consolidated subsidiaries.

Products

Footwear

Our primary product is footwear. Starting in 2008, we reclassified our footwear products into two product categories: lifestyle and performance. Historically our product categories were: Classic, tennis/court, training and children’s footwear. Each product category has certain styles designated as core products. Our core products offer style continuity and often include on-going improvement. We believe our core product program is a critical factor in attempting to achieve our goal of becoming the “retailers’ most profitable vendor.” The core program tends to minimize retailers’ markdowns and maximizes the effectiveness of marketing expenditures because of longer product life cycles.

Because of our reclassification of our product categories in 2008, we present below in two separate tables the revenue attributable to our K•Swiss brand footwear by product category. Each table sets forth the approximate contribution to revenues (in dollars and as a percentage of revenues) attributable to each footwear category utilized by us during the periods indicated preceded by a discussion of the applicable product categories.

The reclassification was a result of our brand position being directed more towards a performance orientation. Our lifestyle category will continue to emphasize the Classic and its derivatives. The performance category will now emphasize performance running, as well as tennis and training. In 2008, we entered the performance running segment with an emphasis on performance innovation. In 2009, we entered into a three year agreement to be the Official Run Course Sponsor (for footwear and apparel) of the Ford Ironman World Championship, the Foster Grant Ironman World Championship 70.3, Ford Ironman Louisville, Amica Ironman 70.3, Ironman 70.3 Boise, Ironman European Championship (Ironman 70.3 Germany), Ironman UK and Ironman 70.3 Hawaii. In 2009, we also entered into a three year agreement (through 2012) to be the Presenting Sponsor of the Los Angeles Marathon.

Revenues, by product category, for the years ended December 31, 2009 and 2008, are as follows (dollar amounts in thousands). Most styles within the lifestyle and performance categories are offered in men’s (approximately 59% of 2009 revenues), women’s (approximately 25% of 2009 revenues) and children’s (approximately 16% of 2009 revenues). There were no customers that accounted for more than 10% of total revenues during 2009. See Note M to our Consolidated Financial Statements.

| 2009 | 2008 | |||||||||||

| K•Swiss Footwear Category |

$ | % | $ | % | ||||||||

| Lifestyle |

$ | 152,905 | 73 | % | $ | 253,787 | 83 | % | ||||

| Performance |

47,811 | 23 | 48,451 | 16 | ||||||||

| Other (1) |

8,961 | 4 | 4,851 | 1 | ||||||||

| Total (2) |

$ | 209,677 | 100 | % | $ | 307,089 | 100 | % | ||||

| Domestic (2, 3) |

$ | 99,482 | 47 | % | $ | 137,141 | 45 | % | ||||

| Foreign (2, 3) |

$ | 110,195 | 53 | % | $ | 169,948 | 55 | % | ||||

| (1) | Other consists of apparel, accessories, sport sandals and blemished shoes. |

| (2) | For purposes of this table, revenues do not include other domestic income and fees earned on sales by foreign licensees and distributors. |

| (3) | Included in “Total.” |

4

Table of Contents

Historically, our product categories were the Classic, tennis/court, training and children’s footwear. The Classic category evolved from a shoe called the Classic, which was originally developed in 1966 as a high-performance tennis shoe. Since that time, the Classic has become a popular casual shoe. The upper of the Classic includes only three separate pieces of leather, which allows for a relatively simple manufacturing process and yields a product with few seams. This simple construction improves the shoe’s comfort, fit and durability. We have from time to time incorporated certain technical advances in materials and construction, but the Classic has remained relatively unchanged in style since 1966, and continues to be the Company’s single most important product. In 2000, we successfully launched the Classic Luxury Edition which is currently sold in the market today. In 2009, we re-mastered and re-launched the original Classic.

The Classic category consisted of several collections, including the Classic collection and the Limited Edition collection, of contemporary sportstyle or casual products that gave the K•Swiss brand the ability to stay relevant and on trend. The Classic collection is comprised of products that we intend to carry in our product assortment for several years. They generally have K•Swiss shoe characteristics such as d-rings and five stripes, and, because they are long-term products, we maintain significant inventory positions of this collection. Significant inventory positions allow for effective electronic data interchange programs with retailers that fit into our strategy of attempting to become the retailers’ most profitable vendor. The Limited Edition collection is an example of contemporary or modern sportstyle footwear from the late 1990’s onward and is generally meant as a one-season offering as they are generally fashionable type shoes that are purchased from factories based only on futures orders received from retailers.

Our tennis and training categories through 2007 offered several types of specialty footwear, emphasizing footwear for tennis and training, respectively. K•Swiss has had a steady performance tennis business for many years that includes the 7.0 collection, which is specifically targeted to the elite tennis player and the specialty tennis market. In 2000, we successfully entered the training market with moderately priced products.

The Children’s category consisted primarily of takedowns of adult shoes from the Classic, tennis/court and training categories.

| 2007 | ||||||

| K•Swiss Footwear Category |

$ | % | ||||

| Classic |

$ | 267,362 | 69 | % | ||

| Tennis/Court |

25,854 | 7 | ||||

| Training |

19,822 | 5 | ||||

| Children’s |

69,732 | 18 | ||||

| Other (1) |

4,650 | 1 | ||||

| Total (2) |

$ | 387,420 | 100 | % | ||

| Domestic (2, 3) |

$ | 194,949 | 50 | % | ||

| Foreign (2, 3) |

$ | 192,471 | 50 | % | ||

| (1) | Other consists of apparel, accessories, sport sandals and blemished shoes. |

| (2) | For purposes of this table, revenues do not include other domestic income and fees earned on sales by foreign licensees and distributors. |

| (3) | Included in “Total.” |

5

Table of Contents

Apparel and Accessories

We market a limited line of K•Swiss branded apparel and accessories. The products are designed with the same classic strategies used in the footwear line. Classic styling allows us to appeal to a variety of markets, from consumers wanting performance apparel and accessories to the casual sportstyle consumers.

K•Swiss introduced apparel in 1999, with a new 7.0 collection of high tech tennis apparel to complement our performance 7.0 collection of footwear. Our tennis and running collections continue to offer world-class performance apparel (skirts, shorts, tops, polos, dresses and warm-ups) for both men and women. Since our introduction of the 7.0 collection of tennis apparel, we have added full collections of fitness, training and running apparel to round out the performance offering. In addition, we also offer a collection for the casual athletic consumer consisting of jackets, sweaters, sweatshirts, track jackets, tee shirts, caps, socks and bags.

The apparel line is distributed through better specialty stores, resorts and fitness centers, as well as sporting goods chains and sporting goods dealers worldwide. The tennis apparel line is sold primarily through tennis specialty and tennis pro shops. We also outfit professional and celebrity figures which offers us global branding exposure. As discussed in “Products—Footwear,” K•Swiss has entered into three year agreements as the Official Run Course Sponsor of certain Ironman Events and the Presenting Sponsor of the Los Angeles Marathon. K•Swiss sells its apparel and footwear at these events and markets all products globally.

Sales

We sell our products in the United States through our sales executives and independent sales representatives primarily to a limited number of specialty athletic footwear stores, pro shops, sporting good stores and department stores. See “Risk Factors: Our financial success is limited to the success of our customers and The loss of a significant customer, or a significant reduction in our sales to such customer, could adversely affect our sales and results of operations.” We also sell our products through our website which is increasingly becoming an important sales channel to us particularly in light of our limited distribution. We also sell our products to a number of foreign distributors. We now have sales offices or distributors throughout the world. In 1991 and 1992, we established sales offices, sales teams and distributors in Asia and Europe, respectively.

We believe the athletic and casual footwear industry experiences seasonal fluctuations, due to increased sales during certain selling seasons, including Easter, back-to-school and the year-end holiday seasons. We present full-line offerings for the Easter season for delivery during the first and second quarters and back-to-school season for delivery during the third quarter, but only limited offerings for the year-end holiday season.

Financial information relating to domestic and international operations is presented as part of Item 8 of this report. See Note N to our Consolidated Financial Statements.

Marketing

Advertising and Promotion

We believe our strategy of designing products with longer life cycles and introducing fewer new models relative to our competition enhances the effectiveness of our advertising and promotions. Our current marketing strategy emphasizes distribution to retailers whose marketing strategies are consistent with our reputation for high quality and service. We have an integrated advertising plan with print, online initiatives, outdoor and television. Traditional media such as print and television is still an

6

Table of Contents

important part of our media plan but online and outdoor mediums are becoming increasingly more important to our advertising strategy given the changing media landscape and consumer preferences.

The K•Swiss website (www.kswiss.com) was created in 1999 to provide consumers an opportunity to purchase our footwear, apparel and accessories online at prices competitive with our retailers and have the product shipped directly to them. Our website reflects the premium sport positioning of K•Swiss and leverages the assets of our advertising campaigns.

We offer a “futures” program, under which retailers are offered discounts on orders scheduled for delivery more than five months after the order is made. There is no guarantee that such orders will not be canceled prior to acceptance by the customer. See “Backlog” and “Risk Factors—Our current backlog of open orders may not be indicative of our level of future sales.” This program is similar to programs offered by other athletic shoe companies. The futures program has a positive effect on inventory costs, planning and production scheduling. See “Distribution.” In addition, we engage in certain sales programs from time to time that provide for extended payment terms on initial orders of new styles.

Domestic Marketing

Domestically, our marketing uses a variety of traditional media, including television, cinema, out-of-home advertising and sports, music and general interest/fashion magazines, as well as non-traditional media, including the internet and social media networks, public relations, sports marketing, endorsements, in-store merchandising, product seeding and sponsorship.

Our footwear products are sold domestically through 31 independent regional sales representatives and 15 Company-employed sales managers. The independent sales representatives are paid on a commission basis, and are prohibited by contract from representing other brands of athletic footwear and related products. These sales personnel sold to approximately 2,300, 2,300 and 2,200 separate accounts as of December 31, 2009, 2008 and 2007, respectively.

We maintain a customer service department consisting of 10 persons at our Westlake Village, California facility. The customer service department accepts orders for our products, handles inquiries and notifies retailers of the status of their orders. We have made a substantial investment in computer equipment for general customer support and service, as well as for distribution. See “Distribution.”

International Marketing

In 1991, we established a sales management team in Asia which provides certain regional marketing materials and print and television advertising to our distributors. We have distributors in certain Pacific Rim countries and other international markets. Distributors of our products are generally contractually obligated to spend specific amounts on advertising and promotion of our products. We control the nature and content of these promotions. Certain distributors operate retail stores that sell exclusively K•Swiss branded product.

To expand the sales and marketing of our products into Europe, we opened our own office in the Netherlands in 1992. Our product is sold through Company-employed sales managers, independent sales representatives and distributors. Our European marketing uses a variety of media distribution including television advertisements, which are distributed through each region’s major network channels, print media in fashion magazines, in-store merchandising and local publicity events and sponsorships.

Internationally, at the end of 2009, K•Swiss had the exclusive right to market our products in 124 countries through 10 international subsidiaries and 29 distributors.

7

Table of Contents

Distribution

We purchase footwear from independent manufacturers located predominantly in China. The time required to fill new orders placed by us with our manufacturers is approximately five months. Such footwear is generally shipped in ocean containers and delivered to our facilities.

We maintain 309,000 square feet of warehouse space at a leased facility in Mira Loma, California. See “Item 2. Properties.” In some cases, large customers may receive containers of footwear directly from the manufacturer. We ship by package express or truck from California, depending upon the size of order, customer location and availability of inventory. Distribution to European customers and certain other European distributors is based out of the public distribution facility in the Netherlands. We generally arrange shipment of other international orders directly from our independent manufacturers.

We maintain an open-stock inventory on certain products which permits us to ship to retailers on an “at-once” basis in response to orders placed by mail, fax, toll-free telephone call or electronically. We have made a significant investment in computer equipment that provides on-line capability to determine open-stock availability for shipment. Additionally, products can be ordered under our “futures” program. See “Marketing—Advertising and Promotion.”

Product Design and Development

We maintain offices in California, Taiwan and the Netherlands that include a staff of individuals responsible for the product direction for each regional market. All design activities occur in our Corporate Office in Westlake Village, California. Additionally, individuals located in our Taiwan, China and Thailand offices are responsible for the execution of the design and detailed development of new styles for all global regions. The staff receives guidance from our management team in California, who meet regularly to review sales, consumer and market trends.

Manufacturing

In 2009, approximately 78% of our footwear products were manufactured in China, approximately 21% in Thailand and approximately 1% in Taiwan. Although we have no long-term manufacturing agreements and compete with other athletic shoe companies for production facilities (including companies that are much larger than us), we believe our relationships with our footwear producers are satisfactory and that we have the ability to develop, over time, alternative sources for our footwear. Our operations, however, could be materially and adversely affected if a substantial delay occurred in locating and obtaining alternative producers. See “Risk Factors: Because we rely on independent manufacturers to produce our products, our sales and profitability may be adversely affected if our independent manufacturers fail to meet pricing, product quality and timeliness requirements or if we are unable to obtain some components used in our products from limited supply sources or experience supply chain disruptions” and “Risk Factors: Because a large portion of our imported products are manufactured in China, our profitability may be adversely affected if the United States government takes action against China for its concern over the level of intellectual property rights protection and enforcements available in China.”

All manufacturing of footwear is performed in accordance with detailed specifications furnished by us and is subject to quality control standards, and we retain the right to reject products that do not meet our specifications. The bulk of all raw materials used in such production are purchased by manufacturers at our direction. Our inspectors at the manufacturing facilities test and inspect footwear products prior to shipment from those facilities.

During 2009, our apparel and accessory products were manufactured in China, Hong Kong, Korea, Malaysia, Singapore, Taiwan, Thailand, Turkey and the United States by certain manufacturers selected by us.

8

Table of Contents

Our operations are subject to compliance with relevant laws and regulations enforced by the United States Customs Service and other international customs service departments from which we import product and to the customary risks of doing business abroad, including fluctuations in the value of currencies, increases in customs duties and related fees resulting from position changes by the United States Customs Service or other international customs service departments, import controls and trade barriers (including the unilateral imposition of import quotas), restrictions on the transfer of funds, work stoppages and, in certain parts of the world, political instability causing disruption of trade. These factors have not had a material adverse impact upon our operations to date. Imports are also affected by the cost of transportation, the imposition of import duties, and increased competition from greater production demands abroad. The United States or the countries in which our products are manufactured may, from time to time, impose new quotas, duties, tariffs or other restrictions, or adjust presently prevailing quotas, duty or tariff levels, which could affect our operations and ability to import products at current or increased levels. We cannot predict the likelihood or frequency of any such events occurring. A change in any such duties, quotas or restrictions could result in increases in the costs of such products generally and might adversely affect the sales or profitability of K•Swiss and the athletic footwear industry as a whole.

Our use of common elements in raw materials, lasts and dies gives us flexibility to duplicate sourcing in various countries in order to reduce the risk that we may not be able to obtain products from a particular country.

Our footwear products entering the United States are subject to customs duties which range from 8.5% to 10.0% of factory cost on footwear made principally of leather, to duties on synthetic and textile footwear ranging from 6.0% to 20.0% plus, for certain styles, $0.90 per pair. Our footwear products, manufactured in China, entering the European Union are subject to customs duties which range from 7.0% to 8.0% of landed cost on sports/technical footwear with uppers made principally of leather, a duty rate of 16.8% for synthetic upper footwear and a duty rate ranging from 23.5% to 24.5% for leather upper footwear that is considered non-sports/non-technical or has a landed cost of under €7.50. Our footwear products, manufactured in Thailand, entering the European Union are subject to customs duties which range from 3.5% to 4.5% of landed cost on footwear with uppers made principally of leather and a duty rate of 11.9% for synthetic upper footwear. Currently, approximately 91% of our footwear volume is derived from sales of leather footwear and approximately 9% of our footwear volume is derived from sales of synthetic and textile footwear.

Backlog

“Backlog,” as of any date, represents orders scheduled to be shipped within the next six months. Backlog does not include orders scheduled to be shipped on or prior to the date of determination of backlog. At December 31, 2009 and 2008, total futures orders with start ship dates from January through June 2010 and 2009 were approximately $80,924,000 and $92,566,000, respectively, representing a decrease of 12.6% at December 31, 2009. The 12.6% decrease in total futures orders is comprised of a 22.6% decrease in the first quarter 2010 futures orders offset by a 14.4% increase in the second quarter 2010 futures orders. At December 31, 2009 and 2008, domestic futures orders with start ship dates from January through June 2010 and 2009 were approximately $29,583,000 and $31,689,000, respectively, representing a decrease of 6.6% at December 31, 2009. At December 31, 2009 and 2008, international futures orders with start ship dates from January through June 2010 and 2009 were approximately $51,341,000 and $60,877,000, respectively, representing a decrease of 15.7% at December 31, 2009.

The mix of “futures” and “at-once” orders can vary significantly from quarter to quarter and year to year and therefore “futures” are not necessarily indicative of revenues for subsequent periods. Orders may be canceled by customers without financial penalty.

9

Table of Contents

Competition

The athletic footwear industry is highly competitive. There are several marketers of footwear larger than us, including Nike and adidas. Each of these companies has substantially greater financial, distribution and marketing resources as well as greater brand awareness than us.

We have increased our emphasis on product lines beyond our Classic model. In the past, we have introduced products in such highly competitive categories as court, boating, outdoor and children’s shoes and we entered the higher end priced running category in 2008. See “Products.” There can be no assurance that we will penetrate these or other new markets or increase the market share we have established to date.

The principal elements of competition in the athletic footwear market include brand awareness, product quality, design, pricing, fashion appeal, marketing, distribution, performance and brand positioning. Our products compete primarily on the basis of technological innovations, quality, style and brand awareness among consumers. While we believe that our competitive strategy has resulted in increased brand awareness and market share, there can be no assurance that we will be able to retain or increase our market share or respond to changing consumer preferences.

Trademarks and Patents

We utilize trademarks on all our products and believe our products are more marketable on a long-term basis when identified with distinctive markings. K•Swiss® is a registered trademark in the United States and certain other countries. Our name is not registered as a trademark in certain countries because of restrictions on registering names having geographic connotations. However, since K•Swiss is not a geographic name, we have often secured registrations despite such objections. Our shield emblem and the five-stripe design are also registered in the United States and certain foreign countries. The five-stripe design is not presently registered in some countries because it has been deemed ornamental by regulatory authorities in those countries. We selectively seek to register the names of our shoes, logos and the names given to certain of our technical and performance innovations, including Aosta® rubber and Shock Spring® cushioning. We have obtained patents in the United States regarding the Bio Feedback® ankle support system, the Shock Spring® cushioning system incorporated into K•Swiss’ 7.0 System® performance tennis shoes and training line, the stability design incorporated into the Si-18® tennis shoe, and other features. The PALLADIUM trademark is registered in many jurisdictions, including the United States, Canada, China and key European markets. Applications to register the mark are pending in many other countries. The Company is taking steps to strengthen protection for the PALLADIUM trademark and other marks related to the Palladium business. We vigorously defend our trademarks and patent rights against infringement worldwide and employ independent security consultants to assist in such protection. To date, we are not aware of any significant counterfeiting problems regarding our products.

Employees

At December 31, 2009, we employed 207 persons in the United States, 194 persons in Singapore, Thailand, Taiwan, Hong Kong and China, 107 persons in the United Kingdom, Germany, France and the Netherlands and 11 persons elsewhere.

Available Information

K•Swiss’ internet address is www.kswiss.com. We make available free of charge on or through our internet website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the

10

Table of Contents

Securities and Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“S.E.C.”). Materials K•Swiss files with or furnishes to the S.E.C. may be read and copied at the S.E.C.’s Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549. This information may also be obtained by calling the S.E.C. at 1-800-SEC-0330. The S.E.C. also maintains an internet website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the S.E.C. at www.sec.gov. The Company will provide a copy of any of the foregoing documents to stockholders upon request.

| Item 1A. | Risk Factors |

The Company operates in a changing environment that involves numerous known and unknown risks and uncertainties that could materially adversely affect our operations. The risks described below highlight some of the factors that have affected, and in the future could affect our operations. Additional risks we do not yet know of or that we currently think are immaterial may also affect our business operations. If any of the events or circumstances described in the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected.

The market for athletic footwear is intensely competitive and if we fail to compete effectively, we could lose our market position and our business could be harmed.

The athletic footwear industry is intensely competitive. Certain of our competitors have substantially greater financial, distribution and marketing resources as well as greater brand awareness than us. Their greater capabilities in these areas may enable them to better withstand periodic downturns in the footwear industry, compete more effectively on the basis of price and production and more quickly develop new products. Further, a major marketing or promotional success or technological innovation by one of our competitors could adversely impact our competitive position. In addition, the availability of overseas manufacturing opportunities and capacity more readily allows for the introduction of competitors with new products. In countries where the athletic footwear market is mature, our ability to maintain and increase our market share can principally come at the expense of our competitors, which may be difficult to accomplish. Our results of operations and market position may be adversely impacted by our competitors and the competitive pressures in the athletic footwear industry.

We believe our ability to compete effectively depends on a number of factors, including anticipating and responding to changing consumer demands in a timely manner, maintaining brand reputation and authenticity, developing high quality products that appeal to consumers, appropriately pricing our products, providing strong and effective marketing support, ensuring product availability and maintaining and effectively assessing our distribution channels, as well as many other factors beyond our control. Because many of these factors are not within our control, we may not be able to compete successfully in the future. Increased competition may result in price reductions, reduced profit margins, loss of market share, and an inability to generate cash flows that are sufficient to maintain or expand our development and marketing of new products, each of which would adversely affect our business.

The athletic footwear business is subject to consumer preferences and unanticipated shifts in consumer preferences that could adversely affect our sales and results of operations.

The athletic footwear industry is subject to rapid changes in consumer preferences. Consumer demand for athletic footwear and apparel is heavily influenced by brand image. Our initiatives to strengthen our brand image, which include conducting market research, introducing new and innovative products and initiating focused advertising campaigns, may not be successful. Our current

11

Table of Contents

products may not continue to be popular and new products we introduce may not achieve adequate consumer acceptance for us to recover development, manufacturing, marketing and other costs. Our failure to anticipate, identify and react to shifts in consumer preferences and maintain a strong brand image could have an adverse effect on our sales and results of operations. Also, if our customers purchase our products and do not have success in selling our products at retail, they may request a return or price adjustment to assist them in marking down the selling price to make the products more attractive to retail consumers.

Purchasing patterns are influenced by consumers’ disposable income, which is affected by economic conditions.

Consumer purchasing patterns are influenced by consumers’ disposable income. Consequently, the success of our operations may depend to a significant extent upon a number of factors affecting disposable income, including general economic conditions, level of employment, salaries and wage rates, consumer confidence, consumer perception of economic conditions, interest rates and taxation. Many of these factors are outside of our control and may have a negative impact on our sales and margins.

The consumer environment has been particularly challenging over the last several years. The recent disruptions in the overall economy and financial markets could further reduce consumer income, liquidity, credit and confidence in the economy and result in further reductions in consumer spending. Further deterioration of the consumer spending environment may result in reduced demand for our products, which would be harmful to our financial position and results of operations.

If we fail to accurately forecast consumer demand, we may experience difficulties in handling customer orders or in liquidating excess inventories and our sales and brand image may be adversely affected.

The athletic footwear industry has relatively long lead times for the design and production of products. Consequently, we must commit to production tooling, and in some cases to production, in advance of orders based on our forecasts of consumer demand. The current economic downturn makes it increasingly difficult for us to accurately forecast product demand trends. If we fail to forecast consumer demand accurately, we may under-produce or over-produce our products. If we under-produce our products, we may experience inventory shortages which might delay shipments to customers, negatively impact retailer and distributor relationships, negatively impact our sales results and diminish brand awareness. Conversely, if we over-produce our products based on an aggressive forecast of consumer demand, retailers may not be able to sell the product and may seek to return the unsold quantities and cancel future orders. These outcomes could have an adverse effect on our sales and brand image.

Our current backlog of open orders may not be indicative of our level of future sales.

Our “futures” program allows our customers to order our products five months or more prior to delivery of product. Our current backlog position may not be indicative of future sales. The mix of “futures” and “at-once” orders can vary significantly from quarter to quarter and year to year and therefore “futures” are not necessarily indicative of revenues for subsequent periods. Orders may be cancelled by customers without financial penalty. Customers may also reject nonconforming goods. If we experience adverse developments in customer cancellations, product returns or bad debts of customers, such developments could have a material adverse impact on our business, financial condition or results of operations.

12

Table of Contents

Fluctuations in the price, availability and quality of raw materials could cause delay and increase costs.

Fluctuations in the price, availability and quality of the fabrics, leather or other raw materials used by us in our manufactured products and in the price of materials used to manufacture our footwear could have a material adverse effect on our cost of sales or our ability to meet our customers’ demands. The price and availability of such raw materials may fluctuate significantly, depending on many factors, including natural resources, such as oil and electricity, increased freight costs, increased labor costs and weather conditions. In the future, we may not be able to pass all or a portion of such higher raw materials prices on to our customers.

The loss of a significant customer, or a significant reduction in our sales to such a customer, could adversely affect our sales and results of operations.

While no customer accounted for more than 10% of our total revenues in 2009, we do have significant customers. The loss of any of these customers, or a significant reduction in our sales to any of such customers, could adversely affect our sales and results of operations. In addition, if any of such customers became insolvent or otherwise failed to pay its debts, it could have an adverse affect on our results of operations.

Our financial success is limited to the success of our customers.

Our financial success is directly related to the success of our customers and the willingness and financial resources of our customers to continue to buy our products. We do not have long-term contracts with any of our customers. Sales to our customers are generally on an order-by-order basis and are subject to rights of cancellation and rescheduling by our customers. If any of these customers experience a significant downturn in its business, insolvency, difficulty in obtaining financing in the capital and credit markets to purchase our products or fail to remain committed to our products or brands, then these customers may defer, reduce, cancel or discontinue purchases from us and/or fail to meet their payment obligations to us. Such conditions could decrease our revenues, or cause higher accounts receivables, reduced cash flows, greater expense associated with collection efforts or increased bad debt expense, any or all of which could have a material adverse effect on our business, results of operations and financial condition.

If we decrease the price that we charge for our products, we may earn lower gross margins and our revenues and profitability may be adversely affected.

The prices we are able to charge for our products depend on the type of product offered, the consumer and retailer response to the product and the prices charged by our competitors. To the extent that we are forced to lower our prices, our gross margins will be lower and our revenues and profitability may be adversely affected.

Our business is subject to economic conditions in our major markets. Consequently, adverse changes in economic conditions could have a negative effect on our business.

Our business is subject to economic conditions that may fluctuate in the major markets in which we operate. Factors that could cause economic conditions to fluctuate include, without limitation, recession, inflation, higher interest borrowing rates, higher levels of unemployment, higher consumer debt levels, general weakness in retail markets and changes in consumer purchasing power and preferences.

Significant volatility and disruption in the global capital and credit markets and an economic downturn in 2008 and 2009 have resulted in a tightening of business credit and liquidity, a contraction

13

Table of Contents

of consumer credit, business failures, increased unemployment and declines in consumer confidence and spending. If global economic and financial market conditions remain weak for an extended period of time, any of the following factors, among others, could have a material adverse effect on our financial condition and results of operations:

| • | slower consumer spending may result in reduced demand for our products, reduced orders from customers for our products, order cancellations, lower revenues, increased inventories, and lower gross margins; |

| • | continued volatility in the global markets and fluctuations in exchange rates for foreign currencies and contracts in foreign currencies could negatively impact our reported financial results and condition; |

| • | continued volatility in the prices for commodities and raw materials we use in our products could have a material adverse effect on our costs, gross margins, and ultimately our profitability; |

| • | if our customers experience declining revenues, or experience difficulty obtaining financing in the capital and credit markets to purchase our products, this could result in reduced orders for our products, order cancellations, inability of customers to timely meet their payment obligations to us, extended payment terms, higher accounts receivable, reduced cash flows, greater expense associated with collection efforts and increased bad debt expense; |

| • | a severe financial difficulty experienced by our customers may cause them to become insolvent or cease business operations, which could reduce the availability of our products to consumers; and |

| • | any difficulty or inability on the part of manufacturers of our products or other participants in our supply chain in obtaining sufficient financing to purchase raw materials or to finance general working capital needs may result in delays or non-delivery of shipments of our products. |

Our international sales and manufacturing operations are subject to the risks of doing business abroad, which could affect our ability to sell or manufacture our products in international markets, obtain products from foreign suppliers or control the cost of our products.

We operate offices and sell products in numerous countries outside the United States. In recent years, our percentage of revenue earned from international markets has increased. Additionally, all of our footwear products are manufactured abroad and we have suppliers located in China, Thailand and Taiwan. Our athletic footwear sales and manufacturing operations are subject to the risks of doing business abroad. These risks include:

| • | fluctuations in currency exchange rates; |

| • | political instability; |

| • | limitations on conversion of foreign currencies into U.S. Dollars; |

| • | restrictions on dividend payments and other payments by our foreign subsidiaries and other restrictions on transfers of funds to or from foreign countries; |

| • | import duties, tariffs, regulations, quotas and other restrictions on free trade, particularly as these regulations may affect our operations in China; and |

| • | investment regulation and other restrictions by foreign governments. |

If these risks limit or prevent us from selling or manufacturing products in any significant international market, prevent us from acquiring products from our foreign suppliers or significantly increase the cost of our products, our operations could be seriously disrupted until alternative suppliers

14

Table of Contents

are found or alternative markets are developed. Although we enter into certain forward currency exchange contracts to hedge the risk of exchange rate fluctuations, these steps may not fully protect us against this risk and we may incur losses.

The potential imposition of additional duties, quotas, tariffs and other trade restrictions could have an adverse impact on our sales and profitability.

All of the products we manufacture overseas and import into the United States, the European Union and other countries are subject to shipment inspections, audits and customs duties collected by customs authorities. Customs information submitted by the Company is routinely subject to review by customs authorities. Further, additional U.S. or foreign inspections, audits, customs duties, quotas, tariffs, anti-dumping duties, safeguard measures, cargo restrictions to prevent terrorism or other trade restrictions may be imposed on the importation of our products in the future. The imposition of such restrictions in foreign countries where we operate, as well as in countries where our third party distributors and licensees operate, could result in increases in the costs of our products generally and could, as a result, adversely affect our sales and profitability.

Our financial position, cash flow or results may be adversely affected by the threat of terrorism and related political instability and economic uncertainty.

The threat of potential terrorist attacks on the United States and throughout the world and political instability has created an atmosphere of economic uncertainty in the United States and in foreign markets. Our results may be impacted by the macroeconomic effects of those events. Also, a disruption in our supply chain as a result of terrorist attacks or the threat thereof may significantly affect our business and its prospects. In addition, such events may also result in heightened domestic security and higher costs for importing and exporting shipments of components and finished goods. Any of these occurrences may have a material adverse effect on our financial position, cash flow or results in any reporting period.

Because we rely on independent manufacturers to produce our products, our sales and profitability may be adversely affected if our independent manufacturers fail to meet pricing, product quality and timeliness requirements or if we are unable to obtain some components used in our products from limited supply sources or experience supply chain disruptions.

We depend upon independent manufacturers to manufacture our products in a timely and cost-efficient manner while maintaining specified quality standards. We also compete with other larger companies for production capacity of independent manufacturers that produce our products. We rely heavily on manufacturing facilities located in China. In 2009, approximately 78% of our footwear manufacturing occurred in China. We also rely upon the availability of sufficient production capacity at our manufacturers. Timely delivery of product may be impacted by factors such as weather conditions, disruption of the transportation systems or shipping lines used by our suppliers, or uncontrollable factors such as natural disasters, epidemic diseases, terrorism and war. It is essential that our manufacturers deliver our products in a timely manner and in accordance with our quality standards because our orders may be cancelled by customers if agreed-upon delivery windows are not met or products are not of agreed-upon quality. A failure by one or more of our manufacturers to meet established criteria for pricing, product quality or timely delivery could adversely impact our sales and profitability.

15

Table of Contents

Because a large portion of our imported products are manufactured in China, our profitability may be adversely affected if the United States government takes action against China for its concern over the level of intellectual property rights protection and enforcements available in China.

We rely heavily on manufacturing facilities located in China. The United States government has expressed serious concern over the level of intellectual property rights protection and enforcement available in China and the United States Trade Representative has in turn included China on its Priority Watch List. If the United States government takes action against China for its failure to adequately protect intellectual property rights, the result of that action could, among other things, include the imposition of trade sanctions that could affect the ability of the Company to continue to import products from China, which in turn could affect the costs of products purchased and sold by the Company and lead to a decline in the Company’s profitability.

Our competitive position could be harmed if we are unable to protect our intellectual property rights. Counterfeiting of our brands can divert sales and damage our brand image.

We believe that our trademarks, patents and proprietary technologies and designs are of great value. From time to time third parties have challenged, and may, in the future, try to challenge our ownership or the validity of our intellectual property. A successful challenge to any of our significant intellectual property rights could adversely affect our business and ability to generate revenue.

Our brands and designs are constantly at risk for counterfeiting and infringement of our intellectual property rights, especially in China where a large portion of our imported products are manufactured, and we find counterfeit products and products that infringe on our intellectual property rights in our markets as well as domain names that use our trade names or trademarks without our consent. We have not always been successful, particularly in some foreign countries, in combating counterfeit products and stopping infringements or other misappropriation of our intellectual property rights. Counterfeit and infringing products can cause us to lose significant sales and can also harm the integrity of our brands by associating our trademarks or designs with lesser quality or defective goods. Additionally, the scope of protection of our proprietary intellectual property rights can vary significantly from country to country, and can be quite narrow in some countries because of local law or practices. This is especially the case in China where the United States government has elevated China to its Priority Watch List, as discussed above. We may need to resort to litigation in the future to enforce our intellectual property rights. This litigation could result in substantial costs and may require the devotion of substantial resources.

We rely on our warehouses and if there is a natural disaster or other serious disruption at any of these facilities, we may be unable to deliver product effectively to our customers.

We rely on warehouses in Mira Loma, California and Rotterdam, the Netherlands. We also rely on the timely performance of services provided by third parties (i.e. Netherlands public distribution facility, freight delivery carriers) at these facilities. Any natural disaster or other serious disruption at either of these facilities due to fire, earthquake, flood, terrorist attack or any other natural or manmade cause could damage a portion of our inventory or impair our ability to use our warehouse as a docking location for product. Any of these occurrences could impair our ability to adequately supply our customers and negatively impact our operating results.

We depend on independent distributors to sell our products in certain international markets.

We sell our products in certain international markets mainly through independent distributors. If a distributor fails to meet annual sales goals, it may be difficult and costly to locate an acceptable substitute distributor. If a change in our distributors becomes necessary, we may experience increased costs, as well as a substantial disruption and loss of sales.

16

Table of Contents

We may be subject to periodic litigation and other regulatory proceedings and may be affected by changes in government regulations.

From time to time we may be a party to lawsuits and regulatory actions relating to our business. Due to the inherent uncertainties of litigation and regulatory proceedings, we cannot accurately predict the ultimate outcome of any such proceedings. An unfavorable outcome could have a material adverse impact on our business, financial condition and results of operations. In addition, regardless of the outcome of any litigation or regulatory proceedings, such proceedings could result in substantial costs and may require that we devote substantial resources to defend the Company. Further, changes in government regulations both in the United States and in the countries in which we operate could have adverse affects on our business and subject us to additional regulatory actions.

Our net income may be adversely affected by an increase in our effective tax rate.

At any point in time, many tax years are subject to audit by various taxing jurisdictions. The results of these audits and negotiations with tax authorities may affect tax positions taken by us. Additionally, our effective tax rate in a given financial statement period may be materially impacted by changes in the geographic mix or level of earnings. We have not recorded United States income tax expense on earnings of selected foreign subsidiary companies as these are intended to be permanently invested, thus reducing our overall income tax expense. The amount of earnings designated as permanently invested is based upon our expectations of the future cash needs of our subsidiaries. Income tax considerations are also a factor in determining the amount of earnings to be permanently invested. Because the declaration involves our future plans and expectations of future events, the possibility exists that amounts declared as permanently invested may ultimately be repatriated. This would result in additional income tax expense in the year we determined that amounts were no longer permanently invested which in turn would adversely affect our results of operations.

We depend on attracting and retaining qualified personnel, whose loss would adversely impact our business.

Our success is largely dependent upon the efforts of Steven Nichols, our President, Chief Executive Officer and Chairman, and certain other key executives. Although we have entered into an employment agreement with Mr. Nichols that expires in December 2010, the loss of his and/or other key executive’s services would have a material adverse effect on our business and prospects. Our success also depends to a significant degree upon the continued services of our personnel. Our continued success will depend on our ability to attract, retain and motivate qualified management, marketing, technical and sales personnel. These people are in high demand and often have competing employment opportunities. The labor market for skilled employees is highly competitive due to limited supply, and we may lose key employees or be forced to increase their compensation. Employee turnover could significantly increase our training and other related employee costs. The loss of the services of any key personnel or our inability to attract additional personnel could have a material adverse effect on our ability to manage our business.

A limited number of our stockholders can exert significant influence over the Company.

At December 31, 2009, the Company’s President, Chief Executive Officer and Chairman of the Board, Steven Nichols, held approximately 92.7% of the voting power of our Class B Common Stock taken as a whole and approximately 69.3% of total voting power. This voting power permits Mr. Nichols to exert significant influence over the outcome of stockholder votes, including votes concerning the election of a certain class of directors, by-law amendments, possible mergers, corporate control contests and other significant corporate transactions.

17

Table of Contents

We depend on our computer and communications systems.

We extensively utilize computer and communications systems to operate our Internet business and manage our internal operations including without limitation, demand and supply planning, and inventory control. Any interruption of this service from power loss, telecommunications failure, failure of our computer system or other interruption caused by weather, natural disasters or any similar event could disrupt our operations and result in lost sales. In addition, hackers and computer viruses have disrupted operations at many major companies. We may be vulnerable to similar acts of sabotage, which could have a material adverse effect on our business and operations.

We rely on our management information systems to operate our business and to track our operating results. Our management information systems will require modification and refinement as our business needs change. If we experience a significant system failure or if we are unable to modify our management information systems to respond to changes in our business needs, then our ability to properly run our business could be adversely affected.

During 2008 and early 2009, we completed our implementation of the SAP information management software in a majority of our worldwide operations. During the next several years, we will continue to rollout various modules of SAP that were not implemented during our initial worldwide implementation. We may encounter computer and operational complications in connection with maintaining and implementing the SAP information system that could have a material adverse affect on our business, financial condition or results of operations.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

In 1998, we moved into our headquarters facility in Westlake Village, California. This facility, which is owned by us, is approximately 50,000 square feet. We occupy approximately eighty-five percent of this facility and lease approximately fifteen percent of this facility.

We lease a 309,000 square foot distribution facility in Mira Loma, California. We use this facility as our main distribution center. The effective monthly commitment for this facility is approximately $91,000. In July 2008, we exercised an option under the lease to extend the term of the lease until January 2015.

We also lease office space of approximately 14,000 square feet in Haarlem, the Netherlands, which is our primary European headquarters. The effective monthly commitment for this office space is approximately $34,000. The lease expires in March 2011 and can be renewed for an additional five years. In addition, we contract with a third party public distribution facility in Rotterdam, the Netherlands, to manage our inventory destined to European customers.

| Item 3. Legal | Proceedings |

The Company is, from time to time, a party to litigation which arises in the normal course of our business operations. We do not believe that we are presently a party to litigation which will have a material adverse effect on our business or operations.

| Item 4. Submission | of Matters to a Vote of Security Holders |

None.

18

Table of Contents

Executive Officers of the Registrant

The executive officers of K•Swiss are as follows:

| Name |

Age at December 31, 2009 |

Position | ||

| Steven Nichols |

67 | Chairman of the Board, Chief Executive Officer and President | ||

| Edward Flora |

58 | Chief Operating Officer | ||

| Lee Green |

56 | Corporate Counsel | ||

| David Nichols |

40 | Executive Vice President | ||

| George Powlick |

65 | Vice President of Finance, Chief Administrative Officer, Chief Financial Officer, Secretary and Director | ||

| Kimberly Scully |

42 | Corporate Controller | ||

| Brian Sullivan |

56 | Vice President of National Accounts |

Officers are appointed by and serve at the discretion of the Board of Directors.

Steven Nichols has been President, Chief Executive Officer and Chairman of the Board of K•Swiss since 1987. From 1980 to 1986, Mr. Nichols was a director and Vice President—Merchandise of Stride Rite Corp., a footwear manufacturer and holding company. In addition, Mr. Nichols was President of Stride-Rite Footwear from 1982 to 1986. From 1979 to 1982, Mr. Nichols served as an officer and President of Stride Rite Retail Corp., the largest retailer of branded children’s shoes in the United States. From 1962 through 1979, Mr. Nichols was an officer of Nichols Foot Form Corp., which operated a chain of New York retail footwear stores.

Edward Flora, Chief Operating Officer since January 2009, joined K•Swiss as a consultant in June 1990 and served as Director—Administration from October 1990 to February 1994 and Vice President—Operations from March 1994 to January 2009. Prior to joining the Company, Mr. Flora was Vice President—Distribution for Bugle Boy Industries, a manufacturer and distributor of men’s, women’s, and children’s apparel, from 1987 through May 1990.

Lee Green, Corporate Counsel since December 1992, joined K•Swiss in December 1992. Mr. Green was formerly a partner in the international law firm of Baker & McKenzie. He worked in the firm’s Taipei office from 1985 to 1988 and its Palo Alto office from 1988 to 1992.

David Nichols, Executive Vice President since May 2004, has held various positions with K•Swiss since joining the Company in November 1995, including Executive Vice President of K•Swiss Sales Corp., President of K•Swiss Europe BV and President of K•Swiss Direct Inc.

George Powlick, Vice President of Finance, Chief Financial Officer and Secretary of the Company since January 1988, Director of the Company since 1990, Chief Operating Officer of the Company from September 2004 until January 2009, and Chief Administrative Officer since January 2009 joined the Company in January 1988. Mr. Powlick is a certified public accountant and was an audit partner in the independent public accounting firm of Grant Thornton LLP from 1975 to 1987.

Kimberly Scully, Corporate Controller since April 2003, joined K•Swiss in April 2003. Ms. Scully is a certified public accountant. From 2000 through April 2003, Ms. Scully was the Corporate Controller of SMTEK International, Inc., an electronics manufacturing services provider. From 1995 through 1999, Ms. Scully was a Corporate Accounting Manager of Home Savings of America, FSB, a $50 billion savings institution, which was acquired in 1998. From 1989 through 1995, Ms. Scully was an auditor in the independent accounting firm of KPMG LLP and became an audit manager in 1994.

19

Table of Contents

Brian Sullivan, Vice President of National Accounts since December 1989, joined K•Swiss in December 1989. From 1986 to 1989, he was Vice President and General Manager of Tretorn, Inc., a manufacturer and distributor of tennis shoes. From 1984 through 1985, Mr. Sullivan was Vice President of Sales of Bancroft/Tretorn, a tennis shoe manufacturer and distributor and predecessor to Tretorn. From 1978 to 1984, Mr. Sullivan held various positions at Bancroft/Tretorn, including Field Salesperson, Marketing and Sales Planning Manager and National Sales Manager.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

K•Swiss Inc.’s Class A Common Stock began trading June 4, 1990 on the National Market System maintained by the National Association of Securities Dealers (now the Nasdaq Global Select Market) upon completion of our initial public offering. Per share high and low sales prices (in dollars) for the quarterly periods during 2009 and 2008 as reported by Nasdaq were as follows:

| March 31, | June 30, | September 30, | December 31, | |||||||||

| 2009 |

||||||||||||

| Low |

$ | 6.44 | $ | 7.43 | $ | 8.70 | $ | 7.68 | ||||

| High |

12.13 | 10.98 | 11.23 | 10.25 | ||||||||

| 2008 |

||||||||||||

| Low |

$ | 13.88 | $ | 14.00 | $ | 14.04 | $ | 9.87 | ||||

| High |

19.49 | 18.38 | 20.67 | 17.73 | ||||||||

The Class A Common Stock is listed on the Nasdaq Global Select Market under the symbol KSWS.

The number of stockholders of record of the Class A Common Stock on December 31, 2009 was 131. However, based on available information, we believe that the total number of Class A Common stockholders, including beneficial stockholders, is approximately 4,600.

There is currently no established public trading market for our Class B Common Stock. The number of stockholders of record of the Class B Common Stock on December 31, 2009 was 9.

20

Table of Contents

Stock Price Performance Graph

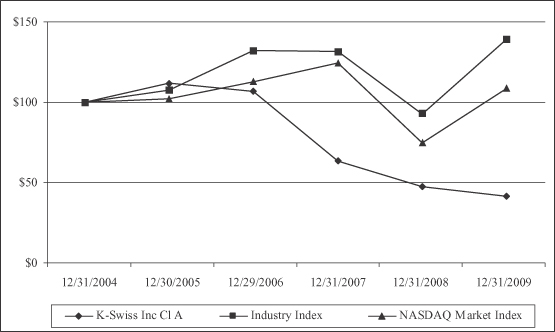

The Stock Price Performance Graph below represents a comparison of the five year total return of K•Swiss Inc. Class A Common Stock, the NASDAQ Market Index and the Hemscott Industry Group 321 Index—Textile—Apparel Footwear and Accessories. The graph assumes $100 was invested on December 31, 2004 and dividends are reinvested for all years ending December 31.

Dividend Policy

The Board of Directors declared a quarterly dividend of 5 cents ($0.05) per share in each quarter of 2008 to all stockholders of record as of the close of business on the last day of the applicable quarter. In addition, in November 2008, the Board of Directors declared a special dividend of $2.00 per share to all stockholders of record as of the close of business on December 10, 2008. On March 3, 2009, the Board of Directors suspended the payment of dividends for the foreseeable future to preserve liquidity and enhance the strength of the Company’s balance sheet. The payment of any future dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our revolving credit agreement, future earnings, operations, capital requirements, our general financial condition and general business conditions.

Purchases of Equity Securities by the Issuer

In October 2004, the Board of Directors approved a 5 million share repurchase program which expired in December 2009. In November 2009, the Board of Directors approved a new stock repurchase program to purchase through December 31, 2014 up to $70 million of the Company’s Class A Common Stock.

During the fourth quarter of 2009, the Company did not repurchase any shares of K•Swiss Class A Common Stock.

21

Table of Contents

| Item 6. | Selected Financial Data |

The selected consolidated financial data presented below for each of the five years in the period ended December 31, 2009 have been derived from audited financial statements which for the most recent three years appear elsewhere herein. The data presented below should be read in conjunction with such financial statements, including the related notes thereto and the other information included herein. Certain reclassifications have been made in the 2008, 2007, 2006 and 2005 presentations to conform to the 2009 presentation. These reclassifications had no impact on previously reported results of operations or stockholders’ equity and do not affect previously reported cash flows from operations, investing and financing activities or net change in cash and cash equivalents.

| Year ended December 31, | ||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Income Statement Data |

||||||||||||||||||||

| Revenues |

$ | 240,729 | $ | 327,405 | $ | 394,540 | $ | 489,271 | $ | 498,929 | ||||||||||

| Cost of goods sold |

154,558 | 195,385 | 210,910 | 255,865 | 265,031 | |||||||||||||||

| Gross profit |

86,171 | 132,020 | 183,630 | 233,406 | 233,898 | |||||||||||||||

| Selling, general and administrative expenses |

118,303 | 139,899 | 148,283 | 130,811 | 123,801 | |||||||||||||||

| Impairment on intangibles and goodwill |

4,830 | — | — | — | — | |||||||||||||||

| Operating (loss)/profit |

(36,962 | ) | (7,879 | ) | 35,347 | 102,595 | 110,097 | |||||||||||||

| Other (expense)/income, net |

(1,249 | ) | 30,000 | 5,232 | — | — | ||||||||||||||

| Interest income, net |

1,050 | 8,216 | 11,184 | 8,275 | 4,131 | |||||||||||||||

| (Loss)/Earnings before income taxes and discontinued operations |

(37,161 | ) | 30,337 | 51,763 | 110,870 | 114,228 | ||||||||||||||

| Income tax (benefit)/expense |

(9,663 | ) | 5,882 | 9,868 | 31,759 | 36,766 | ||||||||||||||

| (Loss)/Earnings from continuing operations |

(27,498 | ) | 24,455 | 41,895 | 79,111 | 77,462 | ||||||||||||||

| Loss from discontinued operations, less applicable income taxes (1) |

(464 | ) | (3,570 | ) | (2,822 | ) | (2,247 | ) | (2,214 | ) | ||||||||||

| Net (Loss)/Earnings |

$ | (27,962 | ) | $ | 20,885 | $ | 39,073 | $ | 76,864 | $ | 75,248 | |||||||||

| (Loss)/Earnings per share |

||||||||||||||||||||

| Basic: |

||||||||||||||||||||

| (Loss)/Earnings from continuing operations |

$ | (0.79 | ) | $ | 0.70 | $ | 1.21 | $ | 2.30 | $ | 2.26 | |||||||||

| Loss from discontinued operations |

(0.01 | ) | (0.10 | ) | (0.08 | ) | (0.07 | ) | (0.06 | ) | ||||||||||

| Net (Loss)/Earnings |

$ | (0.80 | ) | $ | 0.60 | $ | 1.13 | $ | 2.23 | $ | 2.20 | |||||||||

| Diluted: |

||||||||||||||||||||

| (Loss)/Earnings from continuing operations |

$ | (0.79 | ) | $ | 0.69 | $ | 1.18 | $ | 2.23 | $ | 2.17 | |||||||||

| Loss from discontinued operations |

(0.01 | ) | (0.10 | ) | (0.08 | ) | (0.06 | ) | (0.06 | ) | ||||||||||

| Net (Loss)/Earnings |

$ | (0.80 | ) | $ | 0.59 | $ | 1.10 | $ | 2.17 | $ | 2.11 | |||||||||

| Dividends declared per common share |

$ | — | $ | 2.20 | $ | 0.20 | $ | 0.20 | $ | 0.175 | ||||||||||

| Weighted average number of shares outstanding |

||||||||||||||||||||

| Basic |

34,962 | 34,785 | 34,705 | 34,401 | 34,220 | |||||||||||||||

| Diluted (2) |

34,962 | 35,407 | 35,472 | 35,378 | 35,626 | |||||||||||||||

| Balance Sheet Data (at period end) |

||||||||||||||||||||

| Current assets |

$ | 287,986 | $ | 332,776 | $ | 405,617 | $ | 373,440 | $ | 312,747 | ||||||||||

| Current liabilities |

28,335 | 52,139 | 50,401 | 49,062 | 46,924 | |||||||||||||||

| Total assets |

344,150 | 394,290 | 446,353 | 404,560 | 336,236 | |||||||||||||||

| Total debt (3) |

4,207 | 5,376 | — | — | — | |||||||||||||||

| Stockholders’ equity |

301,783 | 324,762 | 384,233 | 345,903 | 275,321 | |||||||||||||||

| (1) | On April 30, 2009, the Company sold certain Royal Elastics assets. Operations of the Royal Elastics brand have been accounted for and presented as a discounted operation. |

| (2) | Includes common stock and dilutive potential common stock (options). |

| (3) | Includes all interest-bearing debt, but excludes outstanding letters of credit ($700,000, $1,399,000, $1,831,000, $196,000 and $675,000 as of December 31, 2009, 2008, 2007, 2006 and 2005, respectively). |

22

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Note Regarding Forward-Looking Statements and Analyst Reports