Attached files

| file | filename |

|---|---|

| EX-31.1 - HUB GROUP CEO CERTIFICATION - Hub Group, Inc. | hgceocertification.htm |

| EX-31.2 - HUB GROUP CFO CERTIFICATION - Hub Group, Inc. | hgcfocertification.htm |

| EX-32.1 - HUB GROUP SARBANES OXLEY CERTIFICATION - Hub Group, Inc. | hgsection906certification.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

[X]

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

For the

fiscal year ended December 31, 2009

OR

[ ]

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934

Commission

File No. 0-27754

__________________

HUB

GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

36-4007085

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

of organization)

|

Identification

No.)

|

3050 Highland Parkway, Suite

100

Downers

Grove, Illinois 60515

(Address

and zip code of principal executive offices)

(630)

271-3600

(Registrant's

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Class

A Common Stock, $.01 par value

(Title of

Class)

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes X No

__

Indicate

by check mark if Registrant is not required to file reports pursuant to Section

13 or Section 15(d) of the Act. Yes X No

__

Impairment of Property and Equipment, Goodwill and Indefinite-Lived Intangibles

We are subject to income tax in the U.S. federal jurisdiction and numerous state

jurisdictions. Our 2006 tax year was the subject of our most recent

IRS examination. The examination was concluded in 2009 and resulted

in the issuance of a no-change letter. The examination by Illinois of

our 2005 and 2006 tax years concluded in 2009 and resulted in our payment of

approximately $17,000 to Illinois of combined income tax, penalty and

interest. Maryland commenced an examination of our 2006 through 2008

tax years in December 2009. Although no other significant

examinations are currently in effect, tax years 2006 through 2008 generally

remain open to examination (with the exceptions noted above for the federal and

Illinois jurisdictions) by the major tax jurisdictions to which we are

subject. During the next twelve months, it is reasonably possible we

will both reduce unrecognized tax benefits by approximately $0.1 million as a

result of expiration of state statutes of limitations and increase unrecognized

tax benefits by approximately $0.1 million as a result of state income tax

apportionment uncertainty.

23.1 Consent

of Ernst & Young LLP

31.1 Certification of David P. Yeager, Chairman and Chief Executive Officer, Pursuant to Rule 13a-4(a) promulgated

Indicate

by check mark whether the Registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the Registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes X No

__

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes

__ No __

Indicate by check mark if disclosure of

delinquent filers pursuant to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of Registrant's knowledge, in

definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K. X

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting

company. See definitions of “large accelerated filer”, “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act. (Check one):

Large Accelerated

Filer X

Accelerated

Filer Non-Accelerated

Filer Smaller

Reporting Company

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes

No X

The

aggregate market value of the Registrant’s voting stock held by non-affiliates

on June 30, 2009, based upon the last reported sale price on that date on the

NASDAQ Global Select Market of $20.64 per share, was $740,375,975.

On February 12, 2010, the Registrant had 37,405,371 outstanding

shares of Class A Common Stock, par value $.01 per share, and 662,296

outstanding shares of Class B Common Stock, par value $.01 per share.

Documents

Incorporated by Reference

The

Registrant's definitive Proxy Statement for the Annual Meeting of Stockholders

to be held on May 6, 2010 (the “Proxy Statement”) is incorporated by reference

in Part III of this Form 10-K to the extent stated herein. Except with respect

to information specifically incorporated by reference in this Form 10-K, the

Proxy Statement is not deemed to be filed as a part hereof.

PART

I

Item

1.

BUSINESS

General

Hub

Group, Inc. (“Company”, “we”, “us” or “our”) is a Delaware corporation that was

incorporated on March 8, 1995. We are one of North America’s leading

asset-light freight transportation management companies. We offer

comprehensive intermodal, truck brokerage and logistics

services. Since our founding in 1971, we have grown to become the

largest intermodal marketing company (“IMC”) in the United States and one of the

largest truck brokers.

We

operate through a network of operating centers throughout the United States,

Canada and Mexico. Each operating center is strategically located in

a market with a significant concentration of shipping customers and one or more

railheads. Through our network, we have the ability to move freight

in and out of every major city in the United States, Canada and

Mexico. We service a large and diversified customer base in a broad

range of industries, including consumer products, retail and durable

goods. We utilize an asset-light strategy in order to minimize our

investment in equipment and facilities and reduce our capital

requirements. We arrange freight movement for our customers through

transportation carriers and equipment providers.

Services

Provided

Our

transportation services can be broadly placed into the following

categories:

Intermodal. As an

IMC, we arrange for the movement of our customers’ freight in containers and

trailers, typically over long distances of 750 miles or more. We

contract with railroads to provide transportation for the long-haul portion of

the shipment and with local trucking companies, known as “drayage companies,”

for pickup and delivery. In certain markets, we supplement third

party drayage services with Company-owned drayage operations. As part

of our intermodal services, we negotiate rail and drayage rates, electronically

track shipments in transit, consolidate billing and handle claims for freight

loss or damage on behalf of our customers.

We use our network to access

containers and trailers owned by leasing companies, railroads and steamship

lines. We are able to track trailers and containers entering a

service area and reuse that equipment to fulfill the customers’ outbound

shipping requirements. This effectively allows us to “capture”

containers and trailers and keep them within our network. As of

December 31, 2009, we also have exclusive access to approximately 7,355

rail-owned containers for our dedicated use on the Union Pacific (“UP”) and the

Norfolk Southern (“NS”) rail networks and approximately 1,375 rail-owned

containers for our dedicated use on the Burlington Northern Santa Fe (“BNSF”)

and the NS rail networks. In addition to these rail-owned containers,

we currently have a total of 6,225 53’ private containers for use on the UP and

NS. We financed these containers with operating leases. These

arrangements are included in Note 8 to the consolidated financial

statements.

Our

drayage services are provided by our subsidiary, Comtrak, which assists us in

providing reliable, cost effective intermodal services to our

customers. Comtrak has terminals in Atlanta, Bensalem (Philadelphia),

Birmingham, Charleston, Charlotte, Chattanooga, Chicago, Cleveland, Columbus,

Dallas, Harrisburg, Huntsville, Jacksonville, Kansas City, Memphis, Nashville,

Ontario (Los Angeles), Perry, Saint Louis, Savannah, Stockton, and

Tampa. As of December 31, 2009, Comtrak owned 283 tractors, leased 20

tractors, leased or owned 553 trailers, employed 301 drivers and contracted with

1,007 owner-operators.

Truck Brokerage (Highway

Services). We are one of the largest truck brokers in the

United States, providing customers with another option for their transportation

needs. We match the customers’ needs with carriers’ capacity to

provide the most effective service and price combinations. We have

contracts with a substantial base of carriers allowing us to meet the varied

needs of our customers. As part of the truck brokerage services, we

negotiate rates, track shipments in transit and handle claims for freight loss

and damage on behalf of our customers.

Our truck brokerage operation also

provides customers with specialized programs. Through the Dedicated

Trucking Program, certain carriers have informally agreed to move freight for

our customers on a continuous basis. This arrangement allows us to

effectively meet our customers’ needs without owning the equipment.

Logistics. Our logistics business operates under the name of

Unyson Logistics. Unyson Logistics is comprised of a network of

logistics professionals dedicated to developing, implementing and operating

customized logistics solutions. Unyson offers a wide range of

transportation management services and technology solutions including shipment

optimization, load consolidation, mode selection, carrier management, load

planning and execution and web-based shipment visibility. Our

multi-modal transportation capabilities include small parcel, heavyweight,

expedited, less-than-truckload, truckload, intermodal and

railcar. Unyson Logistics operates throughout North America,

providing operations through its main operating location in St. Louis with

additional support locations in Boston, Chicago, Cleveland and

Minneapolis.

2

Hub

Network

Our

entire network is interactively connected through our proprietary Network

Management System. This enables us to move freight into and out of every major

city in the United States, Canada and Mexico.

In a typical intermodal transaction, the customer contacts one of our intermodal

operating centers to place an order. The operating center consults with the

centralized pricing group, obtains the necessary intermodal equipment, arranges

for it to be delivered to the customer by a drayage company and, after the

freight is loaded, arranges for the transportation of the container or trailer

to the rail ramp. Relevant information is entered into our Network Management

System by the assigned operating center. Our predictive track and trace

technology then monitors the shipment to ensure that it arrives as scheduled and

alerts the customer service personnel if there are service delays. The assigned

operating center then arranges for and confirms delivery by a drayage company at

destination. After unloading, the empty equipment is made available for

reloading by the operating center for the delivery market.

We provide truck brokerage services to our customers in a similar manner. In a

typical truck brokerage transaction, the customer contacts one of our highway

operating centers to obtain a price quote for a particular freight movement. The

customer then provides appropriate shipping information to the operating center.

The operating center makes the delivery appointment and arranges with the

appropriate carrier to pick up the freight. Once it receives confirmation that

the freight has been picked up, the operating center monitors the movement of

the freight until it reaches its destination and the delivery has been

confirmed. If the carrier notifies us that after delivering the load it will

need additional freight, we may notify the operating center located nearest the

destination of the carrier’s availability. Although under no

obligation to do so, that operating center then may attempt to secure additional

freight for the carrier.

Marketing

and Customers

We believe that fostering long-term

customer relationships is critical to our success. Through these

long-term relationships, we are able to better understand our customers’ needs

and tailor our transportation services to the specific customer, regardless of

the customer’s size or volume. We currently have full-time marketing

representatives at various operating centers and sales offices with primary

responsibility for servicing local, regional and national

accounts. These sales representatives directly or indirectly report

to our Chief Marketing Officer. This model allows us to provide our

customers with both a local marketing contact and access to our competitive

rates as a result of being a large, national transportation service

provider.

Our marketing efforts have produced a

large, diverse customer base, with no one customer representing more than 5% of

our total revenue in 2009. We service customers in a wide variety of

industries, including consumer products, retail and durable goods.

Management

Information Systems

A primary component of our business

strategy is the continued improvement of our Network Management System and other

technology to ensure that we remain a leader among transportation providers in

information processing for transportation services. Our Network

Management System consists of proprietary software running on a combination of

platforms which includes the IBM iSeries and Microsoft Windows Server

environments located at a secure offsite data center. All of our

operating centers are linked together with the data center using an MPLS

(“Multi-Protocol Label Switching”) network. This configuration

provides a real time environment for transmitting data among our operating

centers and headquarters. We also make extensive use of electronic

commerce (“e-Commerce”), allowing each operating center to communicate

electronically with each railroad, many drayage companies, certain trucking

companies and those customers with e-Commerce capabilities.

Our Network Management System is the

primary mechanism used in our operating centers to handle our intermodal and

truck brokerage business. The Network Management System processes

customer transportation requests, tenders and tracks shipments, prepares

customer billing, establishes account profiles and retains critical information

for analysis. The Network Management System provides connectivity with each of

the major rail carriers. This enables us to electronically tender and track

shipments in a real time environment. In addition, the Network Management

System’s e-Commerce features offer customers with e-Commerce capability a

completely paperless process, including load tendering, shipment tracking,

billing and remittance processing. We aggressively pursue

opportunities to establish e-Commerce interfaces with our customers, railroads,

trucking companies and drayage companies.

To manage our logistics business, we

use specialized software that includes planning and execution

solutions. This sophisticated transportation management software

enables us to offer supply chain planning and logistics managing, modeling,

optimizing and monitoring for our customers. We use this software

when offering logistics management services to customers that ship via multiple

modes, including intermodal, truckload, and less-than-truckload, allowing us to

optimize mode and carrier selection and routing for our

customers. This software is integrated with Hub Group’s Network

Management System and our accounting system.

3

Our website, www.hubgroup.com, is

designed to allow our customers and vendors to easily do business with us

online. Through Vendor Interface, we tender loads to our drayage

partners using the Internet rather than phones or faxes. Vendor

Interface also captures event status information, allows vendors to view

outstanding paperwork requirements and helps facilitate paperless invoicing. We

currently tender substantially all of our drayage loads using Vendor Interface

or e-Commerce. Through Trucker Advantage, we exchange information on

available Hub loads, available carrier capacity and updates to event status

information with our truck brokerage partners. Through Customer

Advantage, customers receive immediate pricing, place orders, track shipments,

and review historical shipping data through a variety of reports over the

Internet. All of our Internet applications are integrated with the

Network Management System.

Relationship

with Railroads

A key element of our business

strategy is to strengthen our close working relationship with the major

intermodal railroads in the United States. We view our relationship with the

railroads as a partnership. Due to our size and relative importance, many

railroads have dedicated support personnel to focus on our day-to-day service

requirements. On a regular basis, our senior executives and each of the

railroads meet to discuss major strategic issues concerning intermodal

transportation.

We have relationships with each of

the following major railroads:

|

Burlington

Northern Santa Fe

|

Florida

East Coast

|

|

Canadian

National

|

Kansas

City Southern

|

|

Canadian

Pacific

|

Norfolk

Southern

|

|

CSX

|

Union

Pacific

|

We also have relationships with each

of the following major service providers: CMA CGM (America) Inc., Express System

Intermodal Inc., Hanjin Shipping, Hyundai Merchant Marine, K-Line America,

Maersk Sea-Land, Mitsui O.S.K. Lines (America) Inc. and Pacer

International.

Transportation rates are market

driven. We sometimes negotiate with the railroads or other major

service providers on a route or customer specific basis. Consistent with

industry practice, some of the rates we negotiate are special commodity

quotations (“SCQs”), which provide discounts from published price lists based on

competitive market factors and are designed by the railroads or major service

providers to attract new business or to retain existing business. SCQ rates are

generally issued for the account of a single IMC. SCQ rates apply to

specific customers in specified shipping lanes for a specific period of time,

usually up to 12 months.

Relationship

with Drayage Companies

We have a “Quality Drayage Program,”

which consists of agreements and rules that govern the framework by which many

drayage companies perform services for us. Participants in the

program commit to provide high quality service along with clean and safe

equipment, maintain a defined on-time performance level and follow specified

procedures designed to minimize freight loss and damage. We negotiate

drayage rates for transportation between specific origin and destination

points.

We also supplement third-party

drayage services with our own drayage operations, which we operate through our

subsidiary Comtrak. Our drayage operations employ their own drivers

and also contract with owner-operators who supply their own trucks.

Relationship

with Trucking Companies

Our truck brokerage operation has a

large and growing number of active trucking companies that we use to transport

freight. The local operating centers deal daily with these carriers

on an operational level. Our corporate headquarters handles the

administrative and regulatory aspects of the trucking company

relationship. Our relationships with these trucking companies are

important since these relationships determine pricing, load coverage and overall

service.

Risk Management and

Insurance

We require all drayage companies participating in the Quality Drayage Program to

carry at least $1.0 million in general liability insurance, $1.0 million in

truckman’s auto liability insurance and a minimum of $100,000 in cargo

insurance. Railroads, which are self-insured, provide limited cargo

protection, generally up to $250,000 per shipment. To cover freight

loss or damage when a carrier's liability cannot be established or a carrier's

insurance is insufficient to cover the claim, we carry our own cargo insurance

with a limit of $1.0 million per container or trailer and a limit of $20.0

million in the aggregate. We also carry general liability insurance

with limits of $1.0 million per occurrence and $2.0 million in the aggregate

with a companion $50.0 million umbrella policy on this general liability

insurance.

4

We maintain separate insurance

policies to cover potential exposure from our company-owned drayage operations.

We carry commercial general liability insurance with a limit of $1.0 million per

occurrence, subject to a $2.0 million policy aggregate limit, and truckers

automobile liability insurance with a limit of $1.0 million per occurrence.

Additionally, we have an umbrella excess liability policy with a limit of $19.0

million. We also maintain motor truck cargo liability insurance with

a limit of $1.0 million per occurrence.

Government

Regulation

Hub Group, Inc. and various

subsidiaries are licensed by the Department of Transportation as brokers in

arranging for the transportation of general commodities by motor vehicle. To the

extent that the operating centers perform truck brokerage services, they do so

under these licenses. The Department of Transportation prescribes qualifications

for acting in this capacity, including a $10,000 surety bond that we have

posted. To date, compliance with these regulations has not had a

material adverse effect on our results of operations or financial condition.

However, the transportation industry is subject to legislative or regulatory

changes that can affect the economics of the industry by requiring changes in

operating practices or influencing the demand for, and cost of providing,

transportation services.

Competition

The transportation services industry

is highly competitive. We compete against other IMCs, as well as logistics

companies, third party brokers, trucking companies and railroads that market

their own intermodal services. Several larger trucking companies have entered

into agreements with railroads to market intermodal services nationwide.

Competition is based primarily on freight rates, quality of service,

reliability, transit time and scope of operations. Several

transportation service companies and trucking companies, and all of the major

railroads, have substantially greater financial and other resources than we

do.

General

Employees: As of

December 31, 2009, we had 1,329 employees or 1,028 employees excluding drivers.

We are not a party to any collective bargaining agreement and consider our

relationship with our employees to be satisfactory.

Other: No material

portion of our operations is subject to renegotiation of profits or termination

of contracts at the election of the federal government. None of our

trademarks are believed to be material to us. Our business is

seasonal to the extent that certain customer groups, such as retail, are

seasonal.

Periodic

Reports

Upon written request, our annual

report to the Securities and Exchange Commission on Form 10-K for the fiscal

year ended December 31, 2009, our quarterly reports on Form 10-Q and current

reports on Form 8-K will be furnished to stockholders free of charge; write to:

Public Relations Department, Hub Group, Inc., 3050 Highland Parkway, Suite 100,

Downers Grove, Illinois 60515. Our filings are also accessible

through our website at www.hubgroup.com as

soon as reasonably practicable after we file or furnish such reports to the

Securities and Exchange Commission.

Item

1A. RISK

FACTORS

Because our

business is concentrated on intermodal marketing, any decrease in demand for

intermodal transportation services compared to other transportation services

could have an adverse effect on our results of operations.

We

derived 70% of our revenue from our intermodal services in 2009 as compared to

71% in 2008 and 73% in 2007. As a result, any decrease in demand for

intermodal transportation services compared to other transportation services

could have an adverse effect on our results of operations.

Because

we depend on railroads for our operations, our operating results and financial

condition are likely to be adversely affected by any reduction or deterioration

in rail service.

We depend

on the major railroads in the United States for virtually all of the intermodal

services we provide. In many markets, rail service is limited to one

or a few railroads. Consequently, a reduction in, or elimination of,

rail service to a particular market is likely to adversely affect our ability to

provide intermodal transportation services to some of our

customers. In addition, the railroads are relatively free to adjust

shipping rates up or down as market conditions permit. Rate increases

would result in higher intermodal transportation costs, reducing the

attractiveness of intermodal transportation compared to truck or other

transportation modes, which could cause a decrease in demand for our

services. Further, our ability to continue to expand our intermodal

transportation business is dependent upon the railroads’ ability to increase

capacity for intermodal freight and provide consistent service. Our

business could also be adversely affected by a work stoppage at one or more

railroads or by adverse weather conditions or other factors that hinder the

railroads’ ability to provide reliable transportation services. In

the past, there have been service issues when railroads have merged. As a

result, we cannot predict what effect, if any, further consolidation among

railroads may have on intermodal transportation services or our results of

operations.

5

Because

our relationships with the major railroads are critical to our ability to

provide intermodal transportation services, our business may be adversely

affected by any change to those relationships.

We have

important relationships with the major U.S. railroads. To date, the

railroads have chosen to rely on us, other IMCs and other intermodal competitors

to market their intermodal services rather than fully developing their own

marketing capabilities. If one or more of the major railroads were to

decide to reduce their dependence on us, the volume of intermodal shipments we

arrange would likely decline, which could adversely affect our results of

operations and financial condition.

Because we rely on drayage companies

in our intermodal operations, our ability to expand our business or maintain our

profitability may be adversely affected by a shortage of drayage

capacity.

In many

of the markets we serve, we use third-party drayage companies for pickup and

delivery of intermodal containers. Most drayage companies operate

relatively small fleets and have limited access to capital for fleet

expansion. In some of our markets, there are a limited number of

drayage companies that can meet our quality

standards. This could limit our ability to expand our intermodal

business or require us to establish our own drayage operations in some markets,

which could increase our operating costs and could adversely affect our

profitability and financial condition. Also, the trucking industry

chronically experiences a shortage of available drivers, which may limit the

ability of third-party drayage companies to expand their fleets. This

shortage also may require them to increase drivers’ compensation, thereby

increasing our cost of providing drayage services to our

customers. Therefore, the driver shortage could also adversely affect

our profitability and limit our ability to expand our intermodal

business.

Because

we depend on trucking companies for our truck brokerage services, our ability to

maintain or expand our truck brokerage business may be adversely affected by a

shortage of trucking capacity.

We

derived 19% of our revenue from our truck brokerage services in 2009 as compared

to 20% in 2008 and 19% in 2007. We depend upon various third-party

trucking companies for the transportation of our customers’ loads. Particularly

during periods of economic expansion, trucking companies may be unable to expand

their fleets due to capital constraints or chronic driver shortages, and these

trucking companies also may raise their rates. If we face

insufficient capacity among our third-party trucking companies, we may be unable

to maintain or expand our truck brokerage business. Also, we may be

unable to pass rate increases on to our customers, which could adversely affect

our profitability.

Because we use a significant number

of independent contractors in our businesses, proposals from legislative,

judicial or regulatory authorities that change the independent contractor

classification could have a significant impact on our gross margin and operating

income.

We use a

significant number of independent contractors in our businesses, consistent with

long-standing industry practices. There can be no assurance that

legislative, judicial, or regulatory (including tax) authorities will not

introduce proposals or assert interpretations of existing rules and regulations

that would change the independent contractor classification of a significant

number of independent contractors doing business with us. The costs

associated with potential reclassifications could have a material adverse effect

on results of operations and our financial position.

We

depend on third parties for equipment essential to operate our business, and if

we fail to secure sufficient equipment, we could lose customers and

revenue.

We depend

on third parties for transportation equipment, such as containers and trailers,

necessary for the operation of our business. Our industry has

experienced equipment shortages in the past, particularly during the peak

shipping season in the fall. A substantial amount of intermodal freight

originates at or near the major West Coast ports, which have historically had

the most severe equipment shortages. If we cannot secure sufficient

transportation equipment at a reasonable price from third parties to meet our

customers’ needs, our customers may seek to have their transportation needs met

by other providers. This could have an adverse effect on our

business, results of operations and financial position.

Our

business could be adversely affected by strikes or work stoppages by draymen,

truckers, longshoremen and railroad workers.

There has

been labor unrest, including work stoppages, among draymen. We could

lose business from any significant work stoppage or slowdown and, if labor

unrest results in increased rates for draymen, we may not be able to pass these

cost increases on to our customers. In the summer of 2008, an

owner-operator work stoppage in Northern California caused us to incur an

additional $1.0 million in transportation costs. In the fall of 2002,

all of the West Coast ports were shut down as a result of a dispute with the

longshoremen. The ports remained closed for nearly two weeks, until

reopened as the result of a court order under the Taft-Hartley Act. Our

operations were adversely affected by the shutdown. A new contract

was agreed to through 2014 by the International Longshoremen and Warehouse Union

and the Pacific Maritime Association. In the past several years,

there have been strikes involving railroad workers. Future strikes by railroad

workers in the United States, Canada or anywhere else that our customers’

freight travels by railroad could adversely affect our business and results of

operations. Any significant work stoppage, slowdown or other

disruption involving ports, railroads, truckers or draymen could adversely

affect our business and results of operations.

6

Our

results of operations are susceptible to changes in general economic conditions

and cyclical fluctuations.

Economic

recession, customers’ business cycles, changes in fuel prices and supply,

interest rate fluctuations, increases in fuel or energy taxes and other general

economic factors affect the demand for transportation services and the operating

costs of railroads, trucking companies and drayage companies. We have

little or no control over any of these factors or their effects on the

transportation industry. Increases in the operating costs of

railroads, trucking companies or drayage companies can be expected to result in

higher freight rates. Our operating margins could be adversely

affected if we were unable to pass through to our customers the full amount of

higher freight rates. Economic recession or a downturn in customers’

business cycles also may have an adverse effect on our results of operations and

growth by reducing demand for our services. Therefore, our results of

operations, like the entire freight transportation industry, are cyclical and

subject to significant period-to-period fluctuations.

Relatively

small increases in our transportation costs that we are unable to pass through

to our customers are likely to have a significant effect on our gross margin and

operating income.

Transportation

costs represented 88% of our consolidated revenue in 2009, 87% in 2008 and 86%

in 2007. Because transportation costs represent such a significant

portion of our costs, even relatively small increases in these transportation

costs, if we are unable to pass them through to our customers, are likely to

have a significant effect on our gross margin and operating income.

Our

business could be adversely affected by heightened security measures, actual or

threatened terrorist attacks, efforts to combat terrorism, military action

against a foreign state or other similar event.

We cannot

predict the effects on our business of heightened security measures, actual or

threatened terrorist attacks, efforts to combat terrorism, military action

against a foreign state or other similar events. It is possible that one or more of these events could be directed at U.S. or

foreign ports, borders, railroads or highways. Heightened security

measures or other events are likely to slow the movement of freight through U.S.

or foreign ports, across borders or on U.S. or foreign railroads or highways and

could adversely affect our business and results of operations. Any of

these events could also negatively affect the economy and consumer confidence,

which could cause a downturn in the transportation industry.

If

we fail to maintain and enhance our information technology systems, we may be at

a competitive disadvantage and lose customers.

Our

information technology systems are critical to our operations and our ability to

compete effectively as an IMC, truck broker and logistics

provider. We expect our customers to continue to demand more

sophisticated information technology applications from their

suppliers. If we do not continue to enhance our Network Management

System and the logistics software we use to meet the increasing demands of our

customers, we may be placed at a competitive disadvantage and could lose

customers.

Our

information technology systems are subject to risks that we cannot control and

the inability to use our information technology systems could materially

adversely affect our business.

Our

information technology systems are dependent upon global communications

providers, web browsers, telephone systems and other aspects of the Internet

infrastructure that have experienced significant system failures and electrical

outages in the past. Our systems are susceptible to outages from

fire, floods, power loss, telecommunications failures, break-ins and similar

events. Our servers are vulnerable to computer viruses, break-ins and similar

disruptions from unauthorized tampering with our computer

systems. The occurrence of any of these events could disrupt or

damage our information technology systems and inhibit our internal operations,

our ability to provide services to our customers and the ability of our

customers and vendors to access our information technology

systems. This could result in a loss of customers or a reduction in

demand for our services.

The

transportation industry is subject to government regulation, and regulatory

changes could have a material adverse effect on our operating results or

financial condition.

Hub

Group, Inc. and various subsidiaries are licensed by the Department of

Transportation as motor carrier freight brokers. The Department of

Transportation prescribes qualifications for acting in this capacity, including

surety bond requirements. Our Comtrak subsidiary is licensed by

the Department of Transportation to act as a motor carrier. To date,

compliance with these regulations has not had a material adverse effect on our

results of operations or financial condition. However, the

transportation industry is subject to legislative or regulatory changes, including potential limits on carbon emissions under climate change

legislation, that can affect the economics of the industry by requiring changes

in operating practices or influencing the demand for, and cost of providing,

transportation services. We may become subject to new or more

restrictive regulations relating to fuel emissions or limits on vehicle weight

and size. Future laws and regulations may be more stringent and

require changes in operating practices, influence the demand for transportation

services or increase the cost of providing transportation services, any of which

could adversely affect our business and results of operations.

7

We are

not able to accurately predict how new governmental laws and regulations, or

changes to existing laws and regulations, will affect the transportation industry generally, or us in particular. Although

government regulation that affects us and our competitors may simply result in

higher costs that can be passed to customers, there can be no assurance that

this will be the case.

Our

operations are subject to various environmental laws and regulations, the

violation of which could result in substantial fines or penalties.

From time

to time, we arrange for the movement of hazardous materials at the request of

our customers. As a result, we are subject to various environmental

laws and regulations relating to the handling of hazardous

materials. If we are involved in a spill or other accident involving

hazardous materials, or if we are found to be in violation of applicable laws or

regulations, we could be subject to substantial fines or penalties and to civil

and criminal liability, any of which could have an adverse effect on our

business and results of operations.

We

derive a significant portion of our revenue from our largest customers and the

loss of several of these customers could have a material adverse effect on our

revenue and business.

Our

largest 20 customers accounted for approximately 40%, 36% and 36% of our revenue

in 2009, 2008 and 2007, respectively. A reduction in or termination

of our services by several of our largest customers could have a material

adverse effect on our revenue and business.

Insurance

and claims expenses could significantly reduce our earnings.

Our

future insurance claims expenses might exceed historical levels, which could

reduce our earnings. If the number or severity of claims increases,

our operating results could be adversely affected. We maintain

insurance with licensed insurance companies. Insurance carriers have

recently raised premiums. As a result, our insurance and claims

expenses could increase when our current coverage expires. If these

expenses increase, and we are unable to offset the increase with higher freight

rates, our earnings could be materially and adversely affected.

Our

success depends upon our ability to recruit and retain key

personnel.

Our

success depends upon attracting and retaining the services of our management

team as well as our ability to attract and retain a sufficient number of other

qualified personnel to run our business. There is substantial

competition for qualified personnel in the transportation services

industry. As all key personnel devote their full time to our

business, the loss of any member of our management team or other key person

could have an adverse effect on us. We do not have written employment

agreements with any of our executive officers and do not maintain key man

insurance on any of our executive officers.

Our

growth could be adversely affected if we are not able to identify, successfully

acquire and integrate future acquisition prospects.

We believe that future acquisitions

and/or the failure to make such acquisitions could significantly impact

financial results. Financial results most likely to be impacted

include, but are not limited to, revenue, gross margin, salaries and benefits,

selling general and administrative expenses, depreciation and amortization,

interest expense, net income and our debt level.

An

economic downturn could materially adversely affect our business.

Our

operations and performance depend significantly on economic conditions.

Uncertainty about global economic conditions poses a risk as consumers and

businesses may postpone spending in response to tighter credit, negative

financial news and/or declines in income or asset values, which could have a

material negative effect on demand for transportation services. We

are unable to predict the likely duration and severity of the current

disruptions in the financial markets and the adverse global economic conditions,

and if the current uncertainty continues or economic conditions further

deteriorate, our business and results of operations could be materially and

adversely affected. Other factors that could influence demand include

fluctuations in fuel costs, labor costs, consumer confidence, and other

macroeconomic factors affecting consumer spending behavior. There

could be a number of follow-on effects from a credit crisis on our business,

including the insolvency of key transportation providers and the inability of

our customers to obtain credit to finance development and/or manufacture

products resulting in a decreased demand for transportation

services. Our revenues and gross margins are dependent upon this

demand, and if demand for transportation services declines, our revenues and

gross margins could be adversely affected.

Although

we believe we have adequate liquidity and capital resources to fund our

operations internally our inability to access the capital markets on favorable

terms, or at all, may adversely affect our ability to engage in strategic

transactions. The inability to obtain adequate financing from debt or

capital sources could force us to self-fund strategic initiatives or even forgo

certain opportunities, which in turn could potentially harm our

performance.

Uncertainty

about global economic conditions could also continue to increase the volatility

of our stock price.

8

We

are exposed to credit risk and fluctuations in the market values of our

investment portfolio.

Although

we have not recognized any material losses on our cash and cash equivalents,

future declines in their market values could have a material adverse effect on

our financial condition and operating results. The value or liquidity

of our cash and cash equivalents could decline which could have a material

adverse effect on our financial condition and operating results.

Item

1B. UNRESOLVED

STAFF COMMENTS

None.

Item

2. PROPERTIES

We directly,

or indirectly through our subsidiaries, operate 43 offices

throughout the United States, Canada and Mexico, including our headquarters in

Downers Grove, Illinois and our Company-owned drayage operations headquartered

in Memphis, Tennessee. All of our office space is

leased. Most office leases have initial terms of more than one year,

and many include options to renew. While some of our leases expire in

the near term, we do not believe that we will have difficulty in renewing them

or in finding alternative office space. We believe that our offices are adequate

for the purposes for which they are currently used.

Item

3. LEGAL

PROCEEDINGS

We are a

party to litigation incident to our business, including claims for personal

injury and/or property damage, freight lost or damaged in transit, improperly

shipped or improperly billed. Some of the lawsuits to which we are

party are covered by insurance and are being defended by our insurance

carriers. Some of the lawsuits are not covered by insurance and we

defend those ourselves. We do not believe that the outcome of this

litigation will have a materially adverse effect on our financial position or

results of operations. See Item 1 Business - Risk Management and

Insurance.

Item

4. SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

There

were no matters submitted to a vote of our security holders during the fourth

quarter of 2009.

9

Executive

Officers of the Registrant

In

reliance on General Instruction G to Form 10-K, information on executive

officers of the Registrant is included in this Part I. The table sets

forth certain information as of February 1, 2010 with respect to each person who

is an executive officer of the Company.

|

Name

|

Age

|

Position

|

|

David

P. Yeager

|

56

|

Chairman

of the Board of Directors and Chief Executive Officer

|

|

Mark

A. Yeager

|

45

|

Vice

Chairman of the Board of Directors, President and Chief Operating

Officer

|

|

Christopher

R. Kravas

|

44

|

Chief

Intermodal Officer

|

|

David

L. Marsh

|

42

|

Chief

Marketing Officer

|

|

Terri

A. Pizzuto

|

51

|

Executive

Vice President, Chief Financial Officer and Treasurer

|

|

James

B. Gaw

|

59

|

Executive

Vice President-Sales

|

|

Dwight

C. Nixon

|

47

|

Executive

Vice President-Highway

|

|

Donald

G. Maltby

|

55

|

Executive

Vice President-Logistics

|

|

Dennis

R. Polsen

|

56

|

Executive

Vice President-Information Services

|

|

David

C. Zeilstra

|

40

|

Vice

President, Secretary and General

Counsel

|

David P.

Yeager has served as our Chairman of the Board since November 2008 and as Chief

Executive Officer since March 1995. From March 1995 through November

2008, Mr. Yeager served as Vice Chairman of the Board. From

October 1985 through December 1991, Mr. Yeager was President of Hub Chicago.

From 1983 to October 1985, he served as Vice President, Marketing of Hub

Chicago. Mr. Yeager founded the St. Louis Hub in 1980 and served as its

President from 1980 to 1983. Mr. Yeager founded the Pittsburgh Hub in 1975 and

served as its President from 1975 to 1977. Mr. Yeager received a Masters in

Business Administration degree from the University of Chicago in 1987 and a

Bachelor of Arts degree from the University of Dayton in 1975. Mr. Yeager is the

brother of Mark A. Yeager.

Mark A.

Yeager has served as Vice Chairman of the Board since November

2008. He became the President of the Company in January 2005 and has

been our Chief Operating Officer and a Director since May 2004. From

July 1999 to December 2004, Mr. Yeager was President-Field

Operations. From November 1997 through June 1999, Mr. Yeager was

Division President, Secretary and General Counsel. From March 1995 to

November 1997, Mr. Yeager was Vice President, Secretary and General

Counsel. From May 1992 to March 1995, Mr. Yeager served as our Vice

President-Quality. Prior to joining us in 1992, Mr. Yeager was an associate at

the law firm of Grippo & Elden from January 1991 through May 1992 and an

associate at the law firm of Sidley & Austin from May 1989 through January

1991. Mr. Yeager received a Juris Doctor degree from Georgetown University in

1989 and a Bachelor of Arts degree from Indiana University in 1986. Mr. Yeager

is the brother of David P. Yeager.

Christopher

R. Kravas has been our Chief Intermodal Officer since October

2007. Prior to this promotion, Mr. Kravas was Executive Vice

President-Strategy and Yield Management from December 2003 through September

2007. From February 2002 through November 2003, Mr. Kravas served as

President of Hub Highway Services. From February 2001 through

December 2001, Mr. Kravas was Vice President-Enron Freight

Markets. Mr. Kravas joined Enron after it acquired Webmodal, an

intermodal business he founded. Mr. Kravas was Chief Executive

Officer of Webmodal from July 1999 through February 2001. From 1989

through June 1999 Mr. Kravas worked for the Burlington Northern Santa Fe Railway

in various positions in the intermodal business unit and finance

department. Mr. Kravas received a Bachelor of Arts degree in 1987

from Indiana University and a Masters in Business Administration in 1994 from

the University of Chicago.

David L.

Marsh has been our Chief Marketing Officer since October 2007. Prior

to this promotion, Mr. Marsh was Executive Vice President-Highway from February

2004 through September 2007. Mr. Marsh previously served as President

of Hub Ohio from January 2000 through January 2004. Mr. Marsh joined

us in March 1991 and became General Manager with Hub Indianapolis in 1993, a

position he held through December 1999. Prior to joining Hub Group,

Mr. Marsh worked for Carolina Freight Corporation, a less than truckload

carrier, starting in January 1990. Mr. Marsh received a Bachelor of

Science degree in Marketing and Physical Distribution from Indiana

University-Indianapolis in December 1989. Mr. Marsh has been a member

of the American Society of Transportation and Logistics, the Indianapolis

Traffic Club, the Council for Logistics Management and served as an advisor to

the Indiana University-Indianapolis internship program for transportation and

logistics. Mr. Marsh was honored as the Indiana Transportation Person

of the Year in 1999.

Terri A.

Pizzuto has been our Executive Vice President, Chief Financial Officer and

Treasurer since March 2007. Prior to this promotion, Ms. Pizzuto was

Vice President of Finance from July 2002 through February 2007. Prior

to joining us, Ms. Pizzuto was a partner in the Assurance and Business Advisory

Group at Arthur Andersen LLP. Ms. Pizzuto worked for Arthur Andersen

LLP for 22 years holding various positions and serving numerous transportation

companies. Ms. Pizzuto received a Bachelor of Science in Accounting

from the University of Illinois in 1981. Ms. Pizzuto is a CPA and a

member of the American Institute of Certified Public Accountants.

10

James B.

Gaw has been our Executive Vice President-Sales since February

2004. From December 1996 through January 2004, Mr. Gaw was President

of Hub North Central, located in Milwaukee. From 1990 through late

1996, he was Vice President and General Manager of Hub Chicago. Mr.

Gaw joined Hub Chicago as Sales Manager in 1988. Mr. Gaw’s entire

career has been spent in the transportation industry, including 13 years of

progressive leadership positions at Itofca, an intermodal marketing company, and

Flex Trans. Mr. Gaw received a Bachelor of Science degree from

Elmhurst College in 1973.

Dwight C.

Nixon has been our Executive Vice President-Highway since October

2007. Mr. Nixon previously served as Regional Vice President of

Highway’s Western Region from April 2004 through September

2007. Prior to joining us, Mr. Nixon was a Senior Corporate Account

Executive for Roadway Express, Inc. and spent 19 years in various operational,

sales and sales management positions. Mr. Nixon was also a California

Gubernatorial appointee and member of the California Workforce Investment Board

from November 2005 through December 2007. Mr. Nixon received a

Bachelor of Science degree in Finance from the University of Arizona in

1984.

Donald G.

Maltby has been our Executive Vice President-Logistics since February

2004. Mr. Maltby previously served as President of Hub Online, our

e-commerce division, from February 2000 through January 2004. Mr.

Maltby also served as President of Hub Cleveland from July 1990 through January

2000 and from April 2002 to January 2004. Prior to joining Hub Group,

Mr. Maltby served as President of Lyons Transportation, a wholly owned

subsidiary of Sherwin Williams Company, from 1988 to 1990. In his

career at Sherwin Williams, which began in 1981 and continued until he joined us

in 1990, Mr. Maltby held a variety of management positions including

Vice-President of Marketing and Sales for their Transportation Division. Mr.

Maltby has been in the transportation and logistics industry since 1976, holding

various executive and management positions. Mr. Maltby received a

Masters in Business Administration from Baldwin Wallace College in 1982 and a

Bachelor of Science degree from the State University of New York in

1976.

Dennis R.

Polsen has been our Executive Vice President-Information Services since February

2004. From September 2001 to January 2004, Mr. Polsen was Vice

President-Chief Information Officer and from March 2000 through August 2001, Mr.

Polsen was our Vice-President of Application Development. Prior to

joining us, Mr. Polsen was Director of Applications for Humana, Inc. from

September 1997 through February 2000 and spent 14 years prior to that

developing, implementing, and directing transportation logistics applications at

Schneider National, Inc. Mr. Polsen received a Masters in Business

Administration in May of 1983 from the University of Wisconsin Graduate School

of Business and a Bachelor of Business Administration in May of 1976 from the

University of Wisconsin-Milwaukee. Mr. Polsen is a past member of the

American Trucking Association.

David C.

Zeilstra has been our Vice President, Secretary and General Counsel since July

1999. From December 1996 through June 1999, Mr. Zeilstra was our

Assistant General Counsel. Prior to joining us, Mr. Zeilstra was an

associate with the law firm of Mayer, Brown & Platt from September 1994

through November 1996. Mr. Zeilstra received a Juris Doctor degree

from Duke University in 1994 and a Bachelor of Arts degree from Wheaton College

in 1990.

Directors

of the Registrant

In addition to David P. Yeager and

Mark A. Yeager, the following three individuals are also on our Board of

Directors: Gary D. Eppen – currently retired and formerly the Ralph and Dorothy

Keller Distinguished Service Professor of Operations Management and Deputy Dean

for part-time Masters in Business Administration Programs at the Graduate School

of Business at the University of Chicago; Charles R. Reaves – Chief Executive

Officer of Reaves Enterprises, Inc., a real estate development company, and

Martin P. Slark – Vice Chairman and Chief Executive Officer of Molex,

Incorporated, a manufacturer of electronic, electrical and fiber optic

interconnection products and systems.

11

PART

II

|

Item

5.

|

MARKET

FOR REGISTRANTS COMMON EQUITY AND RELATED SHAREHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

Our Class A Common Stock (“Class A

Common Stock”) trades on the NASDAQ Global Select Market tier of the NASDAQ

Stock Market under the symbol “HUBG.” Set forth below are the high

and low closing prices for shares of the Class A Common Stock for each full

quarterly period in 2009 and 2008.

|

2009

|

2008

|

||||

|

High

|

Low

|

High

|

Low

|

||

|

First

Quarter

|

$28.27

|

$15.83

|

$35.17

|

$22.77

|

|

|

Second

Quarter

|

$25.52

|

$17.42

|

$36.32

|

$30.90

|

|

|

Third

Quarter

|

$24.76

|

$18.34

|

$41.75

|

$31.31

|

|

|

Fourth

Quarter

|

$27.82

|

$22.48

|

$36.50

|

$21.82

|

|

On

February 12, 2010, there were approximately 309 stockholders of record of

the Class A Common Stock and, in addition, there were an estimated 9,482

beneficial owners of the Class A Common Stock whose shares were held by brokers

and other fiduciary institutions. On February 12, 2010, there were 13

holders of record of our Class B Common Stock (the “Class B Common Stock”

together with the Class A Common Stock, the “Common Stock”).

We were incorporated in 1995 and have

never paid cash dividends on either the Class A Common Stock or the Class B

Common Stock. The declaration and payment of dividends are subject to

the discretion of the Board of Directors. Any determination as to the

payment of dividends will depend upon our results of operations, capital

requirements and financial condition of the Company, and such other factors as

the Board of Directors may deem relevant. Accordingly, there can be

no assurance that the Board of Directors will declare or pay cash dividends on

the shares of Common Stock in the future. Our certificate of

incorporation requires that any cash dividends must be paid equally on each

outstanding share of Class A Common Stock and Class B Common

Stock. Our credit facility prohibits us from paying dividends on the

Common Stock if there has been, or immediately following the payment of a

dividend there would be, a default or an event of default under the credit

facility. We are currently in compliance with the covenants contained

in the credit facility.

On

October 26, 2006, our Board of Directors authorized the purchase of up to $75.0

million of our Class A Common Stock. During the fourth quarter of

2007, we completed the authorized purchase of $75.0 million of our Class A

Common Stock. On November 14, 2007, our Board of Directors authorized

the purchase of up to $75.0 million of our Class A Common Stock. We

purchased 38,800 shares at an average price of $36.12 during 2008. No additional

shares were purchased before the authorization expired June 30,

2009.

12

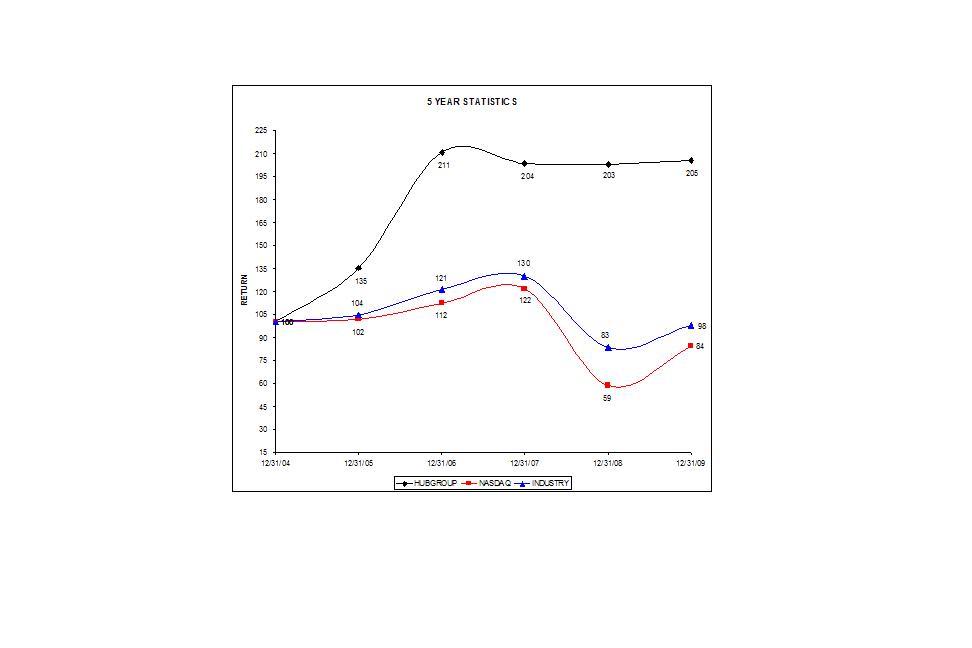

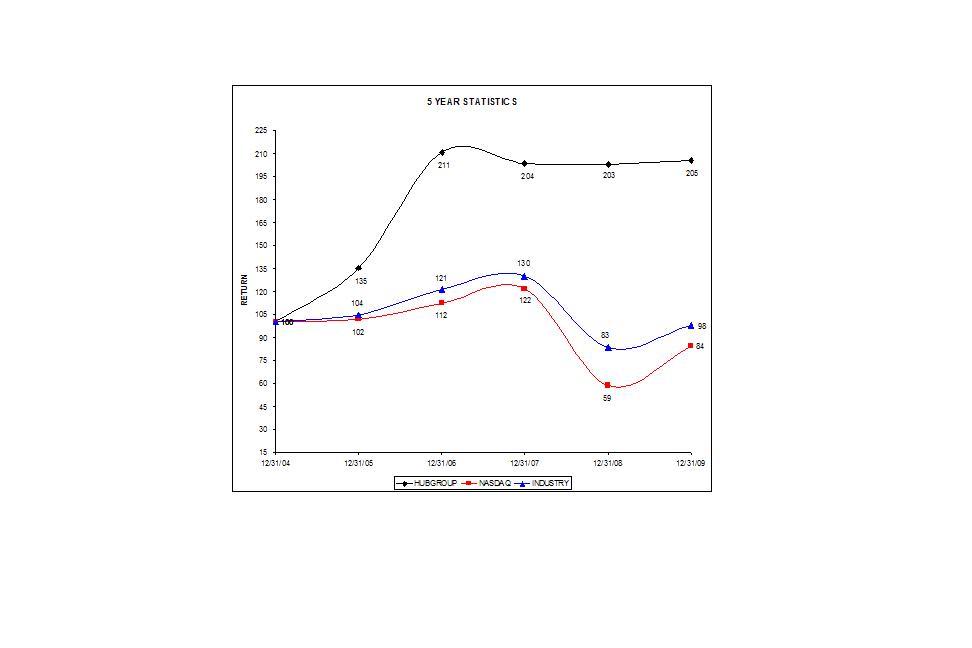

Performance

Graph

The

following line graph compares the Company’s cumulative total stockholder return

on its Class A Common Stock since December 31, 2004 with the cumulative total

return of the Nasdaq Stock Market Index and the Nasdaq Trucking and

Transportation Index. These comparisons assume the investment of $100 on

December 31, 2004 in each index and in the Company’s Class A Common Stock and

the reinvestment of dividends.

13

Item

6. SELECTED

FINANCIAL DATA

|

Selected

Financial Data

|

||||||||||||||||||||||

|

(in

thousands except per share data)

|

||||||||||||||||||||||

|

Years

Ended December 31,

|

||||||||||||||||||||||

|

2009

|

2008 | 2007 | 2006 (2) |

2005

|

|

|||||||||||||||||

|

Statement

of Income Data:

|

||||||||||||||||||||||

|

Revenue

|

$ | 1,510,970 | $ | 1,860,608 | $ | 1,658,168 | $ | 1,609,529 | $ | 1,481,878 | ||||||||||||

|

Gross

margin

|

185,690 | 234,311 | 232,324 | 218,418 | 174,742 | |||||||||||||||||

|

Operating

income

|

55,531 | 95,462 | 90,740 | 77,236 | 47,904 | |||||||||||||||||

|

Income

from continuing operations before taxes

|

55,885 | 96,326 | 93,228 | 79,508 | 48,871 | |||||||||||||||||

|

Income

from continuing operations after taxes

|

34,265 | 59,245 | 59,799 | 47,705 | 29,176 | |||||||||||||||||

|

Income

from discontinued operations, net of tax (1)

|

- | - | - | 981 | 3,770 | |||||||||||||||||

|

Net

income

|

$ | 34,265 | $ | 59,245 | $ | 59,799 | $ | 48,686 | $ | 32,946 | ||||||||||||

|

Basic

earnings per common share

|

||||||||||||||||||||||

|

Income

from continuing operations

|

$ | 0.92 | $ | 1.59 | $ | 1.55 | $ | 1.19 | $ | 0.73 | ||||||||||||

|

Income

from discontinued operations

|

$ | - | $ | - | $ | - | $ | 0.03 | $ | 0.10 | ||||||||||||

|

Diluted

earnings per common share

|

||||||||||||||||||||||

|

Income

from continuing operations

|

$ | 0.91 | $ | 1.58 | $ | 1.53 | $ | 1.17 | $ | 0.71 | ||||||||||||

|

Income

from discontinued operations

|

$ | - | $ | - | $ | - | $ | 0.02 | $ | 0.09 | ||||||||||||

|

As

of December 31,

|

||||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||||

|

Balance

Sheet Data:

|

||||||||||||||||||||||

|

Total

assets

|

$ | 573,348 | $ | 528,231 | $ | 491,967 | $ | 484,548 | $ | 444,418 | ||||||||||||

|

Long-term

debt, excluding current portion

|

- | - | - | - | - | |||||||||||||||||

|

Stockholders'

equity

|

353,841 | 315,184 | 250,899 | 258,844 | 242,075 | |||||||||||||||||

|

(1)

|

HGDS

disposed of May 1, 2006

|

|

(2)

|

Comtrak

was acquired February 28, 2006

|

14

Item

7. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION

AND RESULTS OF OPERATIONS

FORWARD

LOOKING STATEMENTS

The

information contained in this annual report contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of

1995. Words such as “expects,” “hopes,” “believes,” “intends,”

“estimates,” “anticipates,” and variations of these words and similar

expressions are intended to identify these forward-looking

statements. Forward-looking statements are inherently uncertain and

subject to risks. Such statements should be viewed with

caution. Actual results or experience could differ materially from

the forward-looking statements as a result of many factors. We assume

no liability to update any such forward-looking statements contained in this

annual report. Factors that could cause our actual results to differ

materially, in addition to those set forth under Items 1A “Risk Factors,”

include:

|

·

|

the

degree and rate of market growth in the domestic intermodal, truck

brokerage and logistics markets served by

us;

|

|

·

|

deterioration

in our relationships with existing railroads or adverse changes to the

railroads’ operating rules;

|

|

·

|

changes

in rail service conditions or adverse weather

conditions;

|

|

·

|

further

consolidation of railroads;

|

|

·

|

the

impact of competitive pressures in the marketplace, including entry of new

competitors, direct marketing efforts by the railroads or marketing

efforts of asset-based carriers;

|

|

·

|

changes

in rail, drayage and trucking company

capacity;

|

|

·

|

railroads

moving away from ownership of intermodal

assets;

|

|

·

|

equipment

shortages or equipment surplus;

|

|

·

|

changes

in the cost of services from rail, drayage, truck or other

vendors;

|

|

·

|

increases

in costs for independent contractors due to regulatory, judicial and legal

changes;

|

|

·

|

labor

unrest in the rail, drayage or trucking company

communities;

|

|

·

|

general

economic and business conditions;

|

|

·

|

significant

deterioration in our customers’ financial condition, particularly in the

retail and durable goods sectors;

|

|

·

|

fuel

shortages or fluctuations in fuel

prices;

|

|

·

|

increases

in interest rates;

|

|

·

|

changes

in homeland security or terrorist

activity;

|

|

·

|

difficulties

in maintaining or enhancing our information technology

systems;

|

|

·

|

changes

to or new governmental regulation;

|

|

·

|

loss

of several of our largest

customers;

|

|

·

|

inability

to recruit and retain key

personnel;

|

|

·

|

inability

to recruit and maintain drivers and owner

operators;

|

|

·

|

changes

in insurance costs and claims

expense;

|

|

·

|

changes

to current laws which will aid union organizing efforts;

and

|

|

·

|

inability

to close and successfully integrate any future business

combinations.

|

CAPITAL

STRUCTURE

We have

authorized common stock comprised of Class A Common Stock and Class B Common

Stock. The rights of holders of Class A Common Stock and Class B

Common Stock are identical, except each share of Class B Common Stock entitles

its holder to approximately 80 votes, while each share of Class A Common Stock

entitles its holder to one vote. We have authorized 2,000,000 shares

of preferred stock.

EXECUTIVE

SUMMARY

Hub

Group, Inc. (“we”, “us” or “our”) is the largest intermodal marketing

company (“IMC”) in the United States and a full service transportation provider

offering intermodal, truck brokerage and logistics services. We

operate through a nationwide network of operating centers.

As an

IMC, we arrange for the movement of our customers’ freight in containers and

trailers over long distances. We contract with railroads to provide

transportation for the long-haul portion of the shipment and with local trucking

companies, known as “drayage companies,” for local pickup and

delivery. As part of the intermodal services, we negotiate rail and

drayage rates, electronically track shipments in transit, consolidate billing

and handle claims for freight loss or damage on behalf of our

customers.

15

Our

drayage services are provided by our subsidiary, Comtrak, which assists us in

providing reliable, cost effective intermodal services to our

customers. Comtrak has terminals in Atlanta, Bensalem (Philadelphia),

Birmingham, Charleston, Charlotte, Chattanooga, Chicago, Cleveland, Columbus,

Dallas, Harrisburg, Huntsville, Jacksonville, Kansas City, Memphis, Nashville,

Ontario (Los Angeles), Perry, Saint Louis, Savannah, Stockton, and

Tampa. As of December 31, 2009, Comtrak owned 283 tractors, leased 20

tractors, leased or owned 553 trailers, employed 301 drivers and contracted with

1,007 owner-operators.

We also arrange for the transportation of freight by truck, providing customers

with another option for their transportation needs. We match

the customers’ needs with carriers’ capacity to provide the most effective

service and price combinations. As part of our truck brokerage

services, we negotiate rates, track shipments in transit and handle claims for

freight loss or damage on behalf of our customers.

Our

logistics service consists of complex transportation management services,

including load consolidation, mode optimization and carrier

management. These service offerings are designed to take advantage of

the increasing trend for shippers to outsource all or a greater portion of their

transportation needs.

We have

full time marketing representatives throughout North America who service local,

regional and national accounts. We believe that fostering long-term

customer relationships is critical to our success and allows us to better

understand our customers’ needs and specifically tailor our transportation

services to them.

Our yield

management group works with pricing and operations to enhance customer

margins. We are working on margin enhancement projects including

matching up inbound and outbound loads, reducing our drayage costs and improving

our recovery of accessorial costs. Our top 50 customers’ revenue

represents approximately 59% of our revenue.

We use

various performance indicators to manage our business. We closely

monitor margin and gains and losses for our top 50 customers and loads that are

not beneficial to our network. We also evaluate on-time performance,

cost per load and daily sales outstanding by customer account. Vendor

cost changes and vendor service issues are also monitored closely.

RESULTS

OF OPERATIONS

Year

Ended December 31, 2009 Compared to Year Ended December 31, 2008

The

following table summarizes our revenue by service line (in

thousands):

|

Twelve

Months Ended

|

||||||||||||

|

December

31,

|

||||||||||||

|

%

|

||||||||||||

|

2009

|

2008

|

Change

|

||||||||||

|

Revenue

|

||||||||||||

|

Intermodal

|

$ | 1,054,862 | $ | 1,329,382 | (20.7 | %) | ||||||

|

Brokerage

|

292,639 | 372,051 | (21.3 | %) | ||||||||

|

Logistics

|

163,469 | 159,175 | 2.7 | % | ||||||||

|

Total

revenue

|

$ | 1,510,970 | $ | 1,860,608 | (18.8 | %) | ||||||

16

The

following table includes certain items in the consolidated statements of income

as a percentage of revenue:

|

Twelve

Months Ended

|

|||

|

December

31,

|

|||

|

2009

|

2008

|

||

|

Revenue

|

100.0

%

|

100.0

%

|

|

|

Transportation

costs

|

87.7

|

87.4

|

|

|

Gross

margin

|

12.3

|

12.6

|

|

|

Costs

and expenses:

|

|||

|

Salaries

and benefits

|

5.9

|

5.0

|

|

|

General

and administration

|

2.4

|

2.3

|

|

|

Depreciation

and amortization

|

0.3

|

0.2

|

|

|

Total

costs and expenses

|

8.6

|

7.5

|

|

|

Operating

income

|

3.7

|

5.1

|

|

|

Other

income (expense):

|

|||

|

Interest

and dividend income

|

0.0

|

0.1

|

|

|

Total

other income

|

0.0

|

0.1

|

|

|

Income

before provision for income taxes

|

3.7

|

5.2

|

|

|

Provision

for income taxes

|

1.4

|

2.0

|

|

|

Net

income

|

2.3%

|

3.2%

|

|

Revenue

Revenue decreased 18.8% to $1,511.0

million in 2009 from $1,860.6 million in 2008. Intermodal revenue

decreased 20.7% to $1,054.9 million from $1,329.4 million due to an 11% decline

for fuel, a 5% decrease in volume, a 3% price decrease and a 2% decrease for

mix. Truck brokerage revenue decreased 21.3% to $292.6 million from

$372.1 million due to a 2% decrease in volume, an 11% decline for fuel and an 8%

decline due to price and mix. Logistics revenue increased 2.7% to

$163.5 million from $159.2 million due to increases in business from both new