Attached files

| file | filename |

|---|---|

| EX-32 - UIL EXHIBIT 32 - CERTIFICATION - UIL HOLDINGS CORP | uil_exh32.htm |

| EX-23 - UIL EXHIBIT 23 - PWC CONSENT - UIL HOLDINGS CORP | uil_exh23.htm |

| EX-4.3 - UIL EXHIBIT 4.3 - UIL NOTE PURCHASE AGREEMENT - UIL HOLDINGS CORP | uil_exh4-3.htm |

| EX-31.2 - UIL EXHIBIT 31.2 - CERTIFICATION - UIL HOLDINGS CORP | uil_exh31-2.htm |

| EX-31.1 - UIL EXHIBIT 31.1 - CERTIFICATION - UIL HOLDINGS CORP | uil_exh31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

[X]

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

FOR

THE FISCAL YEAR ENDED DECEMBER 31,

2009

|

OR

|

[ ]

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the transition period from

to

Commission

File Number 1-15052

(Exact

name of registrant as specified in its charter)

|

Connecticut

|

06-1541045

|

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

157

Church Street, New Haven, Connecticut

|

06506

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 203-499-2000

______________________________________________________

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each

class

|

Name of each exchange

on which registered

|

|

Common

Stock, no par value

|

New

York Stock Exchange

|

Securities

registered pursuant to Section 12(g) of the

Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes [X

] No [ ]

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the

Act. Yes [ ] No [X]

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90

days. Yes [X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this

chapter) during the preceding 12 months (or for shorter period that the

registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of

“accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large

accelerated filer [X]

|

Accelerated

filer [ ]

|

Non-accelerated

filer [ ] Smaller

reporting company [ ]

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the

Act). Yes [ ] No [X]

The

aggregate market value of the registrant’s voting stock held by non-affiliates

on June 30, 2009 was $659,462,217 computed on the basis of the price at which

the said stock was last sold reported in the listing of composite transactions

for New York Stock Exchange listed securities, published in The Wall Street Journal on

July 1, 2009.

The

number of shares outstanding of the registrant’s only class of common stock, as

of February 12, 2010 was 29,929,591.

DOCUMENTS

INCORPORATED BY REFERENCE

Document Part of this Form 10-K into

which document is incorporated

Definitive

Proxy Statement for Annual Meeting of the Shareowners to be held on May 11,

2010III

UIL

HOLDINGS CORPORATION

FORM

10-K

December 31,

2009

| Page | ||

|

Glossary

|

3

|

|

|

Part

I

|

6

|

|

|

Item

1.

|

Business

|

6

|

|

General

|

6

|

|

|

Utility

Business

|

6

|

|

|

Franchises

|

7

|

|

|

Regulation

|

7

|

|

|

Rates

|

7

|

|

|

Power Supply

Arrangements

|

9

|

|

|

Arrangements with Other

Industry Participants

|

9

|

|

|

ISO-NE and

RTO-NE

|

9

|

|

|

Middletown/Norwalk Transmission

Project

|

10

|

|

|

Hydro-Quebec

|

10

|

|

|

Environmental

Regulation

|

10

|

|

|

Non-Utility

Activities

|

11

|

|

|

Financing

|

11

|

|

|

Employees

|

12

|

|

|

Item

1A.

|

Risk

Factors

|

12

|

|

Item

1B.

|

Unresolved

Staff Comments

|

14

|

|

Item

2.

|

Properties

|

14

|

|

Transmission and Distribution

Plant

|

14

|

|

|

Administrative and Service

Facilities

|

15

|

|

|

Item

3.

|

Legal

Proceedings

|

15

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

15

|

|

Executive

Officers

|

15

|

|

|

Part

II

|

17

|

|

|

Item

5.

|

Market

for UIL Holdings’ Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

17

|

|

Item

6.

|

Selected

Financial Data

|

19

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

20

|

|

Overview and

Strategy

|

20

|

|

|

The United Illuminating

Company

|

20

|

|

|

United Capital Investments,

Inc.

|

21

|

|

|

Major Influences on Financial

Condition

|

21

|

|

|

UIL Holdings

Corporation

|

21

|

|

|

The United Illuminating

Company

|

21

|

|

|

Xcelecom, Inc.

|

28

|

|

|

Liquidity and Capital

Resources

|

28

|

|

|

Financial

Covenants

|

30

|

|

|

2010 Capital Resource

Projections

|

31

|

|

|

Contractual and Contingent

Obligations

|

32

|

|

|

Critical Accounting

Policies

|

33

|

|

|

Off-Balance Sheet

Arrangements

|

35

|

|

|

New Accounting

Standards

|

35

|

|

|

Results of

Operations

|

35

|

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

41

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

44

|

|

Consolidated Financial

Statements

|

44

|

- 1 -

TABLE

OF CONTENTS (continued)

|

Part

II (continued)

|

||

|

Consolidated Statement of

Income (Loss) for the Years Ended December 31, 2009, 2008

and

2007

|

44

|

|

|

Consolidated Statement of

Comprehensive Income (Loss) for the Years Ended

December 31, 2009,

2008 and 2007

|

44

|

|

|

Consolidated Statement of Cash

Flows for the Years Ended December 31, 2009, 2008

and

2007

|

45

|

|

|

Consolidated Balance Sheet as

of December 31, 2009 and 2008

|

46

|

|

|

Consolidated Statement of

Changes in Shareholders’ Equity for the Years Ended December 31,

2009, 2008 and 2007

|

48

|

|

|

Notes to Consolidated Financial

Statements

|

49

|

|

|

Statement of Accounting

Policies

|

49

|

|

|

Capitalization

|

56

|

|

|

Regulatory

Proceedings

|

59

|

|

|

Short-Term Credit

Arrangements

|

68

|

|

|

Income Taxes

|

69

|

|

|

Supplementary

Information

|

72

|

|

|

Pension and Other

Benefits

|

73

|

|

|

Related Party

Transactions

|

78

|

|

|

Lease

Obligations

|

79

|

|

|

Commitments and

Contingencies

|

79

|

|

|

Connecticut Yankee Atomic Power

Company

|

79

|

|

|

Hydro-Quebec

|

81

|

|

|

Environmental

Concerns

|

81

|

|

|

Middletown/Norwalk Transmission

Project (the Project)

|

83

|

|

|

Property Tax

Assessment

|

83

|

|

|

Cross-Sound Cable Company,

LLC

|

83

|

|

|

Fair Value of Financial

Instruments

|

84

|

|

|

Quarterly Financial Data

(Unaudited)

|

90

|

|

|

Segment

Information

|

91

|

|

|

Discontinued

Operations

|

93

|

|

|

Report

of Independent Registered Public Accounting Firm

|

94

|

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

95

|

|

Item

9A.

|

Controls

and Procedures

|

95

|

|

Item

9B.

|

Other

Information

|

96

|

|

Part

III

|

96

|

|

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

96

|

|

Item

11.

|

Executive

Compensation

|

96

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

96

|

|

Item

13.

|

Certain

Relationships and Related Transactions and Director

Independence

|

96

|

|

Item

14.

|

Principal

Accounting Fees and Services

|

97

|

|

Part

IV

|

97

|

|

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

97

|

|

Signatures

|

102

|

|

- 2 -

GLOSSARY

OF TERMS AND ABBREVIATIONS

AFUDC (Allowance

for Funds Used During Construction) – The cost of utility equity and debt funds

used to finance construction projects that is capitalized as part of

construction cost.

ASC (Accounting Standards

Codification) – The single source of authoritative United States generally

accepted accounting principles.

BFMCC (Bypassable

Federally Mandated Congestion Charges) – A federally mandated charge, as defined

by Connecticut electric industry restructuring legislation, related to the

generation of electricity.

C&LM

(assessment/charge) (Conservation and Load Management) –

Statutory assessment on electric utility retail customer bills placed in a State

of Connecticut fund used to support energy conservation and load management

programs.

CTA (Competitive

Transition Assessment) – The component of electric utility retail customer bills

assessed to allow utilities in the State of Connecticut to recover allowable

Stranded Costs, as determined by the DPUC.

CDEP

– Connecticut Department of Environmental Protection.

CfD – Contract for

Differences

Distribution

Division - The United Illuminating Company’s (UI’s) operating division

that provides distribution services to the its retail electric customers and

manages all components related to such service, including the C&LM, CTA, GSC

and REI. The Distribution Division does not include UI’s transmission

operations.

DOE

– United States Department of Energy.

DPUC (Connecticut

Department of Public Utility Control) – State agency that regulates certain

ratemaking, services, accounting, plant and operations of Connecticut

utilities.

EIA

- Energy Independence Act adopted by the State of Connecticut in

2005.

EPA

– United States Environmental Protection Agency.

EPS

– Earnings Per Share.

ESOP

– Employee Stock Ownership Plan.

FASB (Financial

Accounting Standards Board) – A rulemaking organization that establishes

financial accounting and reporting standards.

FERC (Federal

Energy Regulatory Commission) – Federal agency that regulates interstate

transmission and wholesale sales of electricity and related

matters.

FMCC

(Federally Mandated Congestion Charges) – A federally mandated charge, as

defined by Connecticut electric industry restructuring legislation, related to

the supply of electricity or the reliability of supply in the electricity

market.

GAAP

– Generally accepted accounting principles in the United States of

America.

GSC (Generation

services charge) – The rate, as determined by the DPUC, charged to electric

utility retail customers for the generation service and ancillary products

purchased at wholesale and delivered by UI as part of fully bundled

services.

- 3 -

ISO–NE (ISO-New

England Inc.) – An independent system operator contracted by NEPOOL to operate

the regional bulk power system (generation and ancillary products, and

transmission) in New England.

ITC

– Investment tax credit.

kV (kilovolt)

– 1,000 volts. A volt is a unit of electromotive force.

kW (kilowatt)

– 1,000 watts.

kWh (kilowatt-hour)

– The basic unit of electric energy equal to one kilowatt of power supplied to

or taken from an electric circuit steadily for one hour.

KSOP

– 401(k)/Employee Stock Ownership Plan.

LIBOR

–London Interbank Offered Rate.

MVA

(megavoltampere) – 1,000 kilovoltamperes.

MW (megawatt)

– 1,000 kilowatts.

NBFMCC (Non-Bypassable

Federally Mandated Congestion Charges) – A federally mandated charge, as defined

by Connecticut electric utility restructuring legislation, related to the

delivery of electricity.

NEPOOL (New

England Power Pool) – Entity operating in accordance with the New England Power

Pool Agreement, as amended and as approved by the FERC, to provide economic,

reliable operation of the bulk power system in the New England

region.

O&M (Operation and Maintenance) -

Costs incurred in running daily business activities and maintaining

infrastructure.

OPEB (Other Postretirement

Benefits) – Benefits (other than pension) consisting principally of health care

and life insurance provided to retired employees and their

dependents.

PCB

(Polychlorinated Biphenyl) – Additive to oil used in certain electrical

equipment up to the late-1970s; now classified as a hazardous

chemical.

PTF

– Pool Transmission Facilities.

RCRA

– The federal Resource Conservation and Recovery Act.

REI (Renewable

Energy Investment) – Statutory assessment on electric utility retail customer

bills placed in a State of Connecticut fund to support renewable energy

projects.

RMR

– (Reliability-Must-Run) – Resources scheduled to operate out-of-merit order and

identified by ISO-NE as necessary to preserve the reliability of a Reliability

Region. RMR resources provide local voltage or VAR support or meet local

regulation or operating-reserve requirements.

RTO-NE

(Regional Transmission Organization New England) – Organization jointly proposed

by ISO-NE and the New England transmission owners to strengthen the independent

oversight of the region’s bulk power system and wholesale electricity

marketplace. The RTO commenced operation effective February 1,

2005.

SBC

(Systems Benefits Charge) – The component of electric utility retail customer

bills, in the State of Connecticut, representing public policy costs such as

generation decommissioning and displaced worker protection costs, as determined

by the DPUC.

- 4 -

SEC

- United States Securities and Exchange Commission.

Stranded

Costs – Costs that are recoverable from retail customers, as determined

by the DPUC, including above-market long-term purchased power obligations,

regulatory assets, and above-market investments in power plants.

Transmission

Division – UI’s

operating division that provides transmission services and manages all related

transmission operations.

TSO

(Transitional Standard Offer) – UI’s obligation under Connecticut electric

industry restructuring legislation, to offer a regulated “transitional standard

offer” retail service from January 1, 2004 through December 31, 2006 to each

customer who did not choose an alternate electricity supplier.

VEBA

(Voluntary Employee Benefit Association Trust) – Trust accounts for health and

welfare plans for future payments to employees, retirees or their

beneficiaries.

Watt

– A unit of electrical power equal to one joule per second.

Part

I

Item

1. Business.

GENERAL

The

primary business of UIL Holdings Corporation (UIL Holdings) is ownership of its

operating regulated utility. The utility business consists of the

electric transmission and distribution operations of The United Illuminating

Company (UI). UI is also a 50-50 joint venturer, together with NRG

Energy, Inc., in GenConn Energy LLC (GenConn), a project selected by the

Connecticut Department of Public Utility Control (“DPUC”) to build new peaking

generation plants to help address the state’s growing need for more power

generation during the heaviest load periods. UIL Holdings also has

non-utility activities which recently included the operations of Xcelecom, Inc.

(Xcelecom) until the substantial completion of the sale of that business

effective December 31, 2006. UIL Holdings is headquartered in New

Haven, Connecticut, where its senior management maintains offices and is

responsible for overall planning, operating and financial

functions.

UIL

Holdings files electronically with the United States Securities and Exchange

Commission (SEC): required reports on Form 8-K, Form 10-Q and Form 10-K;

proxy materials; ownership reports for insiders as required by Section 16 of the

Securities and Exchange Act of 1934; and registration statements on Forms S-3

and S-8, as necessary. The public may read and copy any materials UIL

Holdings has filed with the SEC at the SEC’s Public Reference Room at 100 F

Street, N.E., Washington, DC 20549. The public may also obtain

information on the operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information

statements, and other information regarding issuers that file electronically

with the SEC. Copies of UIL Holdings’ annual report on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments

to these reports filed with the SEC may be requested, viewed, or downloaded

on-line, free of charge, at (www.uil.com).

UIL

Holdings makes available on its website (www.uil.com) the charters of its Audit Committee,

Corporate Governance and Nominating Committee, Compensation and Executive

Development Committee and Finance Committee, as well as its corporate

governance guidelines, code of business conduct for its employees, code of

ethics for financial officers, and code of business conduct for the Board of

Directors.

Due to

the requirements of Accounting Standards Codification (ASC) 280 “Segment

Reporting”, UIL Holdings has divided its regulated business into distribution

and transmission operating segments for financial reporting

purposes. See Part II, Item 8, “Financial Statements and

Supplementary Data – Notes to Consolidated Financial Statements – Note (M),

Segment Information,” of this Form 10-K, which is hereby incorporated by

reference.

UTILITY

BUSINESS

UI is a

regulated operating electric public utility established in 1899. It

is engaged principally in the purchase, transmission, distribution and sale of

electricity for residential, commercial and industrial purposes in a service

area of about 335 square miles in the southwestern part of the State of

Connecticut. The population of this area is approximately 736,000,

which represents approximately 21% of the population of the

State. The service area, largely urban and suburban, includes the

principal cities of Bridgeport (population approximately 137,000) and New Haven

(population approximately 124,000) and their surrounding

areas. Situated in the service area are retail trade and service

centers, as well as large and small industries producing a wide variety of

products, including helicopters and other transportation equipment, electrical

equipment, chemicals and pharmaceuticals. As of December 31, 2009, UI

had approximately 325,000 customers. Of UI’s 2009 retail electric

revenues, approximately 59.5% were derived from residential sales, 34.3% from

commercial sales, 5.0% from industrial sales and 1.2% from street lighting and

other sales. UI’s retail electric revenues vary by season, with the

highest revenues typically in the third quarter of the year reflecting seasonal

rates, hotter weather and air conditioning use. For additional

information regarding UI’s revenues refer to Part II, Item 6, “Selected

Financial Data,” of this Form 10-K which is hereby incorporated by

reference.

Franchises

UI has

valid franchises to engage in the purchase, transmission, distribution and sale

of electricity in its service area, the right to erect and maintain certain

facilities over, on and under public highways and grounds, and the power of

eminent domain. These franchises are subject to alteration, amendment

or revocation by the Connecticut legislature, and revocation by the DPUC under

circumstances specified by statute, and subject to certain approvals, permits

and consents of public authorities and others prescribed by

statute.

Regulation

UI is

subject to regulation by several regulatory bodies, including the

DPUC. The DPUC has jurisdiction with respect to, among other things,

retail electric service rates, accounting procedures, certain dispositions of

property and plant, construction of certain electric facilities, mergers and

consolidations, the issuance of securities, the condition of plant and equipment

and the manner of operation in relation to safety, adequacy and suitability to

provide service to customers, including efficiency.

The

location and construction of certain electric facilities, including electric

transmission lines and bulk substations, are subject to regulation by the

Connecticut Siting Council with respect to environmental compatibility and

public need.

UI is a

“public utility” within the meaning of Part II of the Federal Power Act

(FPA). Under the FPA, the Federal Energy Regulatory Commission (FERC)

governs the rates, terms and conditions of transmission of electric energy in

interstate commerce (including transmission service provided by UI),

interconnection service in interstate commerce (which applies to independent

power generators, for example), and the rates, terms and conditions of wholesale

sales of electric energy in interstate commerce (which includes cost-based rates

and market-based rates and regional capacity and electric energy markets

administered by an independent entity, ISO-New England, Inc.

(ISO-NE). FERC approves UI’s transmission revenue requirements, which

are collected through UI’s retail transmission rates. The FERC also

has authority to ensure the reliability of the high voltage electric

transmission system, monitor and investigate wholesale electric energy markets

and entities that have been authorized to sell wholesale power at market-based

rates, impose civil and criminal penalties for violations of the FPA (including

market manipulation) and require public utilities subject to its jurisdiction to

comply with a variety of accounting, reporting and record-keeping

requirements. See Part I, Item 1, “Business” - “Arrangements with

Other Industry Participants.”

UI is

also required to comply with reliability standards issued by the North American

Electric Reliability Corporation (NERC), a not-for-profit corporation whose

mission is to improve the reliability and security of the bulk power

system. NERC reliability standards may be enforced by NERC, FERC

(which oversees NERC), and by a regional reliability organization as approved by

FERC.

Connecticut

Yankee Atomic Power Company, in which UI has a 9.5% common stock ownership

interest, is subject to the jurisdiction of the United States Nuclear Regulatory

Commission and the FERC. The Connecticut Yankee nuclear unit was

retired in 1996 and has been decommissioned. See Part II, Item 8,

“Financial Statements and Supplementary Data – Notes to Consolidated Financial

Statements – Note (J), Commitments and Contingencies – Connecticut Yankee Atomic

Power Company,” of this Form 10-K, which is hereby incorporated by

reference.

Rates

UI’s

retail electric service rates are subject to regulation by the

DPUC. UI’s present general retail rate structure consists of various

rate and service classifications covering residential, commercial, industrial

and street lighting services.

Utilities

are entitled by Connecticut law to charge rates that are sufficient to allow

them an opportunity to cover their reasonable operating and capital costs, to

attract needed capital and maintain their financial integrity, while also

protecting relevant public interests.

The

revenue components of UI’s retail charges to customers, effective as of January

1, 2010, reflect a total average price of 19.9490¢ per kilowatt-hour

(kWh) and consist of the following:

|

Unbundled

Revenue Component

|

Description

|

Authorized

Return on Equity

|

Average

Price Per kWh

|

|

Distribution

|

The

process of delivering electricity through local lines to the customer’s

home or business.

|

8.75%(1)

|

5.0848¢

|

|

Transmission

|

The

process of delivering electricity over high voltage lines to local

distribution lines.

|

12.3-12.5%(2)

|

1.6716¢

|

|

Competitive

Transition Assessment (CTA) (3)

|

Component

of retail customer bills determined by the DPUC to recover Stranded

Costs.

|

8.75%(3)

|

1.5065¢

|

|

Generation

Services Charge (GSC) (4)

|

The

average rate charged, as determined by the DPUC, to retail customers for

the generation services purchased at wholesale by UI for standard service

and last resort service.

|

None

|

11.0388¢

|

|

Systems

Benefits Charge (SBC) (5)

|

Charges

representing public policy costs, such as generation decommissioning and

displaced worker protection costs, as determined by the

DPUC.

|

None

|

0.3375¢

|

|

Conservation

& Load Management (C&LM) (6)

|

Statutory

assessment used to support energy conservation and load management

programs.

|

None

|

0.3000¢

|

|

Non-Bypassable

Federally Mandated Congestion Charges (NBFMCC) (7)

|

Federally

mandated charge, as defined by Connecticut electric industry restructuring

legislation, related to the reliability of supply delivered by the

electric system.

|

None

|

(0.0903)¢

|

|

Renewable

Energy Investment (REI) (8)

|

Statutory

assessment used to support renewable energy projects.

|

None

|

0.1000¢

|

|

(1)

|

DPUC

authorized return on equity. Earnings above 8.75% will be

shared 50% to customers and 50% to

shareowners.

|

|

(2)

|

Weighted

average estimate based upon FERC authorized

rates.

|

|

(3)

|

UI

earns the authorized distribution return on equity on CTA rate

base. UI defers or accrues additional amortization to achieve

the authorized return on equity on unamortized CTA rate

base.

|

|

(4)

|

This

rate includes $0.002 per kWh for retail access and load settlement

costs. GSC has no impact on results of operations, because

revenue collected equals expense incurred (which is referred to as a

“pass-through” in this filing on Form

10-K).

|

|

(5)

|

SBC

has no impact on results of operations, because SBC billing is a

“pass-through” with the exception of carrying charges which are applied to

deferred balances, if any.

|

|

(6)

|

UI

has the opportunity to earn a nominal “incentive” for managing the

C&LM programs. Except for the incentive, C&LM has no

impact on results of operations, because C&LM billing is a

“pass-through.”

|

|

(7)

|

NBFMCC

rate includes funding of customer initiatives such as distributed

generation resulting from the Energy Independence Act. Part of

the funding is an incentive to UI helping to bring those customer

initiatives on-line. Except for the incentive, NBFMCC has no

impact on results of operations, because NBFMCC billing is a

“pass-through.” The 2010 NBFMCC rate is a credit on customers’

bills reflecting the refund of prior years’

over-collections.

|

|

(8)

|

REI

has no impact on results of operations, because REI billing is a

“pass-through.”

|

For

further information refer to Part II, Item 8, “Financial Statements and

Supplementary Data – Notes to Consolidated Financial Statements – Note (C),

Regulatory Proceedings,” of this Form 10-K, which information is hereby

incorporated by reference.

Power

Supply Arrangements

UI’s

retail electricity customers are able to choose their electricity

supplier. Since January 1, 2007, UI has been required to offer

standard service to those of its customers who do not choose a retail electric

supplier and have a maximum demand of less than 500 kilowatts. In

addition, UI is required to offer supplier of last resort service to customers

who are not eligible for standard service and who do not choose to purchase

electric generation service from a retail electric supplier licensed in

Connecticut.

UI must

procure its standard service power pursuant to a procurement plan approved by

the DPUC. The procurement plan must provide for a portfolio of

service agreements procured in an overlapping pattern over fixed time periods (a

“laddering” approach). In June 2006, the DPUC approved a procurement

plan for UI. As required by Connecticut statute, a third party

consultant retained by the DPUC works closely with UI in the procurement process

and to provide a joint recommendation to the DPUC as to selected

bids.

UI has

wholesale power supply agreements in place for the supply of all of UI’s

standard service customers for all of 2010, 80% for 2011 and 20% for

2012. Supplier of last resort service is procured on a quarterly

basis. UI determined that its contracts for standard service and

supplier of last resort service are derivatives under Accounting Standards

Codification (ASC) 815 “Derivatives and Hedging” and elected the “normal

purchase, normal sale” exception under ASC 815 “Derivatives and

Hedging”. As such, UI regularly assesses the accounting treatment for

its power supply contracts. These wholesale power supply agreements

contain default provisions that include required performance assurance,

including certain collateral obligations, in the event that UI’s credit rating

on senior debt was to fall below investment grade. In October 2009,

Moody’s Investor Services (Moody’s) released its updated credit opinion for UI

and maintained its Baa2 rating with a stable outlook. In

December 2009, Standard & Poors’ Investor Services (S&P) reinitiated

coverage on UI and rated it BBB with a stable outlook. UI’s credit

rating would have to decline two ratings to fall below investment grade at

either rating service. If this were to occur, monthly amounts due and

payable to the power suppliers would be accelerated to semi-monthly payments and

UI would have to deliver collateral security in an amount equal to the

receivables due to the sellers for the thirty day period immediately preceding

the default notice. If such a situation was in effect as of

December 31, 2009, UI would have had to post approximately $26 million

in collateral.

As a

result of an April 2008 DPUC decision, UI is permitted to seek long-term

contracts for up to 20% of standard service requirements, the goal of which is

to obtain long-term energy supply contracts and Connecticut Class I Renewable

Energy Certificates for UI’s standard service customers that will result in

economic benefit to ratepayers, both in terms of risk and cost

mitigation. UI is exploring long-term contract

alternatives.

Arrangements

with Other Industry Participants

ISO-NE

and RTO-NE

ISO New

England, Inc. (ISO-NE), an independent, not-for-profit corporation, was approved

by the FERC as the regional transmission organization for New England (RTO-NE)

on February 1, 2005. ISO-NE is responsible for the reliable operation

of the region’s bulk electric power system and fair administration of the

region’s wholesale electricity marketplace. ISO-NE is also

responsible for the management of the comprehensive bulk electric power system

and transmission system planning processes that address the region's long-term

electricity needs.

Transmission

Return on Equity (ROE)

In March

2008, the FERC issued an order on rehearing (Rehearing Order) establishing

allowable ROEs for transmission projects of transmission owners in New England,

including UI. In the Rehearing Order, the FERC established the

base-level ROE of 11.14% beginning in November 2006. The Rehearing

Order also confirmed a 50 basis point ROE adder on Pool Transmission Facilities

(PTF) for participation in the RTO-NE and a 100 basis point ROE incentive for

projects included in the ISO-NE Regional System Plan that were

completed and on line as of December 31, 2008. The Middletown/Norwalk

Transmission Project received this 100 basis point ROE

adder. For projects placed in service after December 31,

2008, incentives may be requested from the FERC, through a specific showing

justifying the incentive, on a project specific basis.

In May

2008, several public entities, including the DPUC, filed a petition with the

United States Court of Appeals for the District of Columbia Circuit (U.S. Court

of Appeals) challenging the Rehearing Order. On January 29, 2010, the

U.S. Court of Appeals issued a decision upholding the FERC order.

UI’s

overall transmission ROE is determined by the mix of UI’s transmission rate base

between new and existing transmission assets, and whether such assets are PTF or

non-PTF. UI’s transmission assets are primarily PTF. For

2009, UI’s overall allowed weighted-average ROE for its transmission business

was 12.52%.

Middletown/Norwalk

Transmission Project

In

December 2008, the 345-kilovolt (kV) transmission line from Middletown,

Connecticut, to Norwalk, Connecticut (the Project) was completed and the

transmission assets were placed in service. As a result, UI’s

transmission rate base increased by approximately $300 million, an increase of

more than 200% relative to UI’s net transmission assets existing prior to the

Project receiving approval from the Connecticut Siting Council

(CSC).

In a May

2007 Order, FERC approved rate incentives for the Project. The

Project was allowed to include Construction Work In Progress (CWIP) expenditures

in rate base. For project costs incurred before August 8, 2005,

the FERC allowed UI to include 50% of CWIP expenditures in rate base, and for

project costs incurred after August 8, 2005, the FERC allowed UI to

include 100% of CWIP expenditures in rate base. The FERC also

accepted a 50 basis point adder which will be applied only to costs associated

with advanced transmission technologies.

Certain

parties requested rehearing of the FERC May 2007 order, but in January 2009, the

FERC denied those requests. Also, in January 2009, the DPUC and

the Attorney General of Connecticut filed a petition with the U.S. Court of

Appeals seeking judicial review of the FERC’s May 2007 and January 2009

orders. UI is unable to predict the outcome of these appeals at this

time.

UI and

CL&P filed a transmission cost allocation application relating to the

Project with ISO-NE in April 2008. ISO-NE will determine which costs

of the Project, if any, will be included in the New England regional

transmission rate. UI will seek to recover any non-pool supported costs of the

Project, or Localized Costs, in transmission revenues from customers throughout

the State of Connecticut.

Hydro-Quebec

UI is a

participant in the Hydro-Quebec transmission tie facility linking New England

and Quebec, Canada. UI has a 5.45% participating share in this

facility, which has a maximum 2,000 megawatt-equivalent generation capacity

value.

Environmental

Regulation

The

National Environmental Policy Act (the Act) requires that detailed statements of

the environmental effect of UI’s facilities be prepared in connection with the

issuance of various federal permits and licenses. Federal agencies

are required by that Act to make an independent environmental evaluation of the

facilities as part of their actions during proceedings with respect to these

permits and licenses. In Connecticut, the Connecticut Siting Council

serves as the designated authority to ensure UI’s facilities are in compliance

with the Act, except as otherwise specified in certain permits, such as those

required by the Army Corps of Engineers.

Under the

federal Toxic Substances Control Act (TSCA), the United States Environmental

Protection Agency (EPA) has issued regulations that control the use and disposal

of Polychlorinated Biphenyls (PCBs). PCBs had been widely used as

insulating fluids in many electric utility transformers and capacitors

manufactured before TSCA prohibited any further manufacture of such PCB

equipment. Fluids with a concentration of PCBs higher than 500 parts

per million and materials (such as electrical capacitors) that contain such

fluids must be disposed of through burning in high temperature incinerators

approved by the EPA. Presently, no equipment having fluids with

levels of PCBs higher than 500 parts per million are known by UI to remain in

service in its system.

Under the

federal Resource Conservation and Recovery Act (RCRA), the generation,

transportation, treatment, storage and disposal of hazardous wastes are subject

to regulations adopted by the EPA. Connecticut has adopted state

regulations that parallel RCRA regulations but are more stringent in some

respects. UI has complied with the notification and application

requirements of present regulations, and the procedures by which UI handles,

stores, treats and disposes of hazardous waste products comply with these

regulations.

RCRA also

regulates underground tanks storing petroleum products or hazardous substances,

and Connecticut has adopted state regulations governing underground tanks

storing petroleum and petroleum products that, in some respects, are more

stringent than the federal requirements. UI currently owns eight

underground storage tanks, used primarily for gasoline and fuel oil, which are

subject to these regulations. A testing program has been implemented

to detect leakage from any of these tanks, and substantial costs may be incurred

for future actions taken to prevent tanks from leaking, to remedy any

contamination of groundwater, and to modify, remove and/or replace older tanks

in compliance with federal and state regulations.

In

accordance with applicable regulations, UI has disposed of residues from

operations at landfills. In recent years it has been determined that

such disposal practices, under certain circumstances, can cause groundwater

contamination. Although UI has no current knowledge of the existence

of any such contamination, UI or regulatory agencies may determine that remedial

actions must be taken in relation to past disposal practices.

In

complying with existing environmental statutes and regulations and further

developments in these and other areas of environmental concern, including

legislation and studies in the fields of water and air quality, hazardous waste

handling and disposal, toxic substances, electric and magnetic fields, and

global climate change, UI may incur substantial capital expenditures for

equipment modifications and additions, monitoring equipment and recording

devices, and it may incur additional operating expenses. Litigation

expenditures may also increase as a result of ongoing scientific investigations,

speculation and debate concerning the possibility of harmful health effects of

electric and magnetic fields. The total amount of these expenditures

is not now determinable.

If any of

the aforementioned events occurs, UI may experience substantial costs prior to

seeking regulatory recovery. Additional discussion regarding

environmental issues may be found in Part II, Item 8 of this Form 10-K under the

caption, “Financial Statements and Supplementary Data” – Notes to Consolidated

Financial Statements – Note (J), Commitments and Contingencies – Environmental

Concerns,” which information is hereby incorporated by reference.

NON-UTILITY

ACTIVITIES

UIL

Holdings’ non-utility activities primarily consist of United Capital

Investments, Inc. (UCI) which holds a passive, minority equity position in The

Ironwood Mezzanine Fund, an investment fund. Ironwood is a regional

Small Business Investment Company (SBIC) fund committed to investing a portion

of its capital in women-owned and minority-owned businesses and businesses

located in low and moderate income areas. The carrying value of UCI’s

investment in The Ironwood Mezzanine Fund as of December 31, 2009 was $0.8

million. UCI also

has a lease agreement that conveys the right to a third party to a specific area

located in New Haven, Connecticut. UCI’s investment represents the

net present value of future cash flows related to a portion of the

area. In 1999, UCI paid $1.5 million for the net future lease

payments and is amortizing the amount over the life of the

lease. UCI’s investment in the lease at December 31, 2009 was $1.2

million.

FINANCING

Information

regarding UIL Holdings’ capital requirements and resources and its financings

and financial commitments may be found in Part II, Item 7 of this Form 10-K

under the caption, “Management’s Discussion and Analysis of Financial Condition

and Results of Operations – Liquidity and Capital Resources,” which information

is hereby incorporated by reference.

EMPLOYEES

As of

December 31, 2009, UIL Holdings and its subsidiaries had a total of 1,066

employees, of which 480 were members of Local 470-1, Utility Workers Union of

America, AFL-CIO. UI and Union Local 470-1 are parties to a six-year

collective bargaining agreement which expires on May 15, 2011.

Item

1A. Risk Factors.

The

financial condition and results of operations of UIL Holdings are subject to

various risks, uncertainties and other factors, some of which are described

below. Additional risks, uncertainties and other factors not

presently known or currently deemed not to be material may also affect UIL

Holdings’ financial condition and results of operations.

Legislation

and regulation can significantly affect UI’s structure, operations and financial

results.

UI is an

electric transmission and distribution utility whose structure and operations

are significantly affected by legislation and regulation. UI’s rates

and authorized returns on equity are regulated by the FERC and the

DPUC. Legislation and regulatory decisions implementing legislation

establish a framework for UI’s operations. Such legislation and

regulatory decisions may result in the establishment of revenue requirements

that are insufficient for UI to maintain customer services at current levels

while still earning its allowed return. Legislation and regulatory

decisions could negatively impact UI’s ability to reach earnings targets and to

access debt and equity financing at reasonable cost. For a further

discussion of legislative and regulatory actions, refer to Part II, Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations – Major Influences on Financial Condition – The United Illuminating

Company – Legislation & Regulation,” of this Form 10-K.

UIL

Holdings’ ability to maintain future cash dividends at the level currently paid

to shareowners is dependent upon the ability of its subsidiaries, primarily UI,

to pay dividends to UIL.

UIL

Holdings is dependent on dividends from its subsidiaries and from external

financings to provide the cash in excess of the amount currently on hand that is

necessary for debt service, to pay administrative costs, and to pay common stock

dividends to UIL Holdings’ shareholders. As UIL Holdings’ sources of

cash are limited to dividends from its subsidiaries and external borrowings, the

ability to maintain future cash dividends at the level currently paid to

shareowners will be primarily dependent upon sustained earnings from current

operations of UI.

Volatility

in the capital markets could negatively impact UIL Holdings’ ability to access

capital in the debt and equity markets, thus impacting its ability to meet its

financing requirements and fund its capital program.

All of

UIL Holdings’ and UI’s financing and capital requirements that exceed available

cash will be provided by external financing. Although there is no

commitment to provide such financing from any source of funds, other than the

short-term credit facilities currently available to UI and UIL Holdings, future

external financing needs are expected to be satisfied by the issuance of

additional short-term and long-term debt and equity securities. The

continued availability of these methods of financing will be dependent on many

factors, including conditions in the securities and credit markets and economic

conditions generally, as well as the debt ratings, current debt levels and

future income and cash flow of UIL Holdings and UI. See Part II, Item

8, “Financial Statements and Supplementary Data – Notes to Consolidated

Financial Statements – Note (B), Capitalization and Note (D), Short Term Credit

Arrangements” of this Form 10-K for a discussion of UIL Holdings’ financing

arrangements.

Increases

in interest rates could have an adverse impact on the financial condition and

results of operations of UIL Holdings and UI.

Credit

market trends impact the cost of UIL Holdings’ and UI’s

borrowings. Increases in interest rates could result in increased

cost of capital in the refinancing of fixed rate debt at maturity and in the

remarketing of multi-annual tax-exempt bonds. As a result of the

remarketing of tax exempt bonds in February 2009, described in Part II, Item 7A,

“Quantitative and Qualitative Disclosures About Market Risk” of this Form 10-K,

interest rates are higher than the interest rates on the bonds prior to the

remarketing. In addition, UIL Holdings and UI have short-term

revolving credit agreements that permit borrowings at fluctuating interest rates

determined by reference to Citibank’s New York base rate

and the

Federal Funds Rate (as defined in the agreements), and also permit borrowings

for fixed periods up to six months as specified by UIL Holdings and UI at fixed

interest rates (London Interbank Offered Rate or LIBOR) determined by the

Eurodollar Interbank Market in London. Changes in LIBOR

or the prime or Federal Funds lending markets will have an impact on interest

expense. For further discussion of UIL Holdings’ cost of capital and

interest rate risk, see Part II, Item 7, “Management’s Discussion and Analysis

of Financial Condition and Results of Operations – Liquidity and Capital

Resources,” and Item 7A, “Quantitative and Qualitative Disclosures About

Market Risk,” of this Form 10-K. For further discussion of

UI and UIL Holdings’ revolving credit facilities, see Part II, Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations – Liquidity and Capital Resources,” and Part II, Item 8, “Financial

Statements and Supplementary Data – Notes to Consolidated Financial Statements –

Note (D) Short-Term Credit Arrangements.”

UIL

Holdings and its subsidiaries may incur substantial capital expenditures and

operating expenses in complying with environmental regulations, which could have

an adverse impact on the results of operations and financial condition of UIL

Holdings.

In

complying with existing environmental statutes and regulations and further

developments in areas of environmental concern, UIL Holdings and its

subsidiaries may incur substantial capital expenditures for equipment

modifications and additions, monitoring equipment and recording devices, and it

may incur additional operating expenses. Environmental damage claims

may also arise from the operations of UIL Holdings’ subsidiaries. For

further discussion of significant environmental issues known to UIL Holdings at

this time, see Part II, Item 8, “Financial Statements and Supplementary Data –

Notes to Consolidated Financial Statements – Note (J), Commitments and

Contingencies – Environmental Concerns,” of this Form 10-K.

In

addition, governmental policy makers, industry representatives and scientists

continue to discuss global climate change and potential legislation to reduce

greenhouse gases. Due to the high level of uncertainty regarding the

character and timing of any legislation or regulations that may be adopted,

management is unable to evaluate the potential economic impact of any such

measures at this time. Additional regulation in this area could

result in UI and GenConn incurring additional capital spending and higher

operating expenses.

The

recent economic downturn has reduced and could further reduce the demand for

electricity and impair the financial soundness of customers, which could

adversely affect our results of operation. The economic downturn

could also impair the financial soundness of UI’s vendors and service

providers.

The

slowing of the Connecticut and national economies has reduced, and could in the

future further reduce, the demand for electricity. In Connecticut,

the economic slow-down has included a sustained decline in the housing market

and rising unemployment. Although it remains below the national

average unemployment rate of 10.0%, Connecticut’s seasonally-adjusted

unemployment rate had risen to 8.9% in December

2009. Furthermore, as a result of the continued economic downturn

affecting the economies of the state of Connecticut, the United States and other

parts of the world, UI’s vendors and service providers could experience serious

cash flow problems. As a result UI’s vendors and service providers

may be unable to perform under existing contracts or may significantly increase

their prices or reduce their output or performance on future

contracts.

The

loss of key personnel or the inability to hire and retain qualified employees

could have an adverse effect on the operations of UI.

A

significant portion of UI’s workforce, including many workers with specialized

skills maintaining and servicing the electrical infrastructure, may retire over

the next five years. The inability to replace these employees could

negatively impact UI’s ability to maintain system reliability at its current

levels. For further discussion refer to Part II, Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations – Major Influences on Financial Condition,” of this Form

10-K.

The

inability of management to maintain good relations and effectively negotiate

future collective bargaining agreements with the bargaining unit could have a

material adverse impact on UI’s financial condition and results of

operations.

Significant

portions of the workforce at UI are covered by collective bargaining agreements

that expire in May 2011. The inability of management to maintain good relations

and effectively negotiate future collective bargaining agreements with the

bargaining unit could have a material adverse impact on UI’s financial condition

and results of operations, as a result of increased expenses related to wages

and benefits, poor working performance or organized work stoppages.

The

inability of GenConn to complete its two peaking generation projects, the

inability to meet the contractual commercial operation dates, and the potential

for unrecovered costs could adversely impact UIL Holdings’ financial condition

and results of operations.

Borrowings

by UI under an equity bridge loan (EBL) will be lent to GenConn and be converted

into an equity investment upon the attainment of commercial operation by GenConn

for its two peaking generation facilities. The inability of GenConn

to complete construction of and attain commercial operation for its two peaking

generation facilities, or a significant delay in obtaining commercial operation

by the contractual dates, or the inability to recover the related operating

costs after commercial operation has been obtained, could adversely impact UIL

Holdings’ financial condition and results of operations.

Grid

disturbances, disruption in our networks, severe weather, security cyber

attacks, or acts of war or terrorism could negatively impact UIL Holdings’

operating systems.

A

disruption or black-out caused by an event that impacts the regional grid or

UI’s local system, such as, but not limited to a severe storm, transmission

facility outage, security breach, cyber attack, or terrorist action, could

negatively impact the operation and sustainability of our

systems. Any such disruption or attack could result in a significant

decrease in revenues and significant additional costs to repair assets, which

could have a material adverse impact on our financial

condition

and results of operations. Severe weather, such as ice and snow

storms, hurricanes and other natural disasters, may cause outages and

substantial property damage which may require us to incur additional costs that

are generally not insured.

UIL

Holdings may be required to make payments under its indemnification agreements

with the buyers of former Xcelecom companies, which could adversely impact UIL

Holdings’ financial condition and results of operations.

UIL

Holdings is obligated to indemnify the buyers of Xcelecom’s former companies for

breaches of representations, warranties and covenants made in the transaction

documents with those buyers, and for certain actions by, and obligations of, the

companies. A requirement that UIL Holdings pay an indemnity claim

could negatively impact UIL Holdings’ cash flow.

Item

1B. Unresolved Staff Comments.

None

Item

2. Properties.

Transmission

and Distribution Plant

The

transmission lines of UI consist of approximately 101 circuit miles of overhead

lines and approximately 28 circuit miles of underground lines, all operated at

345-kV or 115-kV and located within or immediately adjacent to the territory

served by UI. These transmission lines are part of the New England

transmission grid. A major portion of UI’s transmission lines is

constructed on railroad rights-of-way pursuant to two Transmission Line

Agreements. One of the agreements expires in May 2030 and will be

automatically extended for up to two successive renewal periods of 15 years

each, unless UI provides timely written notice of its election to reject the

automatic extension. The other agreement will expire in May

2040.

UI owns

and operates 26 bulk electric supply substations with a capacity of 1,827

megavoltampere (MVA), and 21 distribution substations with a capacity of 107

MVA. UI has 3,166 pole-line miles of overhead distribution lines and

132 conduit-bank distribution miles.

See Part

II, Item 7, “Management’s Discussion and Analysis of Financial Condition and

Results of Operations - Liquidity and Capital Resources,” of this Form 10-K

concerning the estimated cost of additions to UI’s transmission and distribution

facilities, which information is hereby incorporated by reference.

Administrative

and Service Facilities

The

corporate headquarters of both UIL Holdings and UI are located in New Haven,

Connecticut. Additionally, UI occupies several facilities within its

service territory for administrative and operational purposes.

Item

3. Legal Proceedings.

The

general contractor and two subcontractors responsible for civil construction

work in connection with the installation of UI’s portion of the

Middletown/Norwalk Transmission Project’s underground electric cable system have

filed a lawsuit seeking payment for change order requests for approximately

$34.5 million plus interest and costs. UI has evaluated the change

order requests and lawsuits and, in doing so, has retained the services of an

independent third party to review the requests and supporting

information. UI intends to defend the litigation

vigorously. To the extent that any of the change order requests are

valid, UI would seek recovery through its transmission revenue

requirement.

Item

4. Submission of Matters to a Vote of Security Holders.

There

were no matters submitted to a vote of security holders, through the

solicitation of proxies or otherwise, during the fourth quarter of the fiscal

year ended December 31, 2009.

EXECUTIVE

OFFICERS

The names

and ages of all executive officers of UIL Holdings, including

certain officers of its subsidiary UI, and the period during which he or

she has held the corporate office indicated, are as follows:

|

Name

|

Age*

|

Position

(1)

|

Effective

Date

|

|

James

P. Torgerson

|

57

|

President

and Chief Executive Officer

|

(2)

|

|

Anthony

J. Vallillo

|

60

|

President

and Chief Operating Officer UI

|

January

1, 2001

|

|

Richard

J. Nicholas

|

54

|

Executive

Vice President and Chief Financial Officer

|

March

1, 2005

|

|

Linda

L. Randell

|

59

|

Senior

Vice President, General Counsel and Corporate Secretary

|

(3)

|

|

Steven

P. Favuzza

|

56

|

Vice

President and Controller

|

July

23, 2007

|

|

Richard

J. Reed

|

59

|

Vice

President - Engineering and Project Excellence UI

|

(4)

|

|

John

J. Prete

|

52

|

Vice

President - Transmission Business UI

|

October

1, 2007

|

|

Anthony

Marone III

|

46

|

Vice

President - Client & External Relations UI

|

(5)

|

*Age as

of December 31, 2009

(1) Messrs.

Vallillo, Reed, Prete and Marone hold corporate offices of UI but have also been

designated as executive officers of UIL Holdings by the board of directors of

UIL Holdings in light of the policy-making role each fulfills for UIL

Holdings.

(2) As

previously disclosed in UIL Holdings’ filing on Form 8-K dated January 10, 2006,

James P. Torgerson was appointed President of UIL Holdings, effective January

23, 2006. As previously disclosed in UIL Holdings’ filing on Form 8-K

dated July 3, 2006, Mr. Torgerson was appointed Chief Executive Officer of UIL

Holdings, effective July 1, 2006.

(3) As

previously disclosed in UIL Holdings’ filing on Form 8-K dated March 5, 2007,

Linda L. Randell was appointed Senior Vice President and General Counsel of UIL

Holdings commencing March 26, 2007. As previously disclosed in UIL

Holdings’ filing on Form 8-K dated July 24, 2007, Ms. Randell was appointed

Corporate Secretary, effective July 23, 2007.

(4)

Richard J. Reed was appointed Vice President – Electric System of UI on

January 1, 2001. Mr. Reed’s job title was changed to Vice

President – Engineering and Project Excellence of UI, effective January 1,

2010.

(5)

Anthony Marone III was appointed Vice President – Client Services of UI on

October 1, 2007. Mr. Marone’s job title was changed to Vice President

– Client & External Relations of UI effective July 1, 2009.

There is

no family relationship between any director, executive officer, or person

nominated or chosen to become a director or executive officer of UIL

Holdings. All of the above executive officers and persons chosen to

become executive officers have entered into employment

agreements. There is no arrangement or understanding between any

executive officer of UIL Holdings and any other person pursuant to which such

officer was selected as an officer.

A brief

account of the business experience during the past five years of each executive

officer of UIL Holdings is as follows:

James P.

Torgerson. Mr. Torgerson served as President and Chief

Executive Officer of the Midwest Independent Transmission System Operator, Inc.,

prior to January 23, 2006. Mr. Torgerson was appointed President of

UIL Holdings on January 23, 2006, Chief Executive Officer of UI on April

24, 2006 and Chief Executive Officer of UIL Holdings on July 1,

2006.

Richard J.

Nicholas. Mr. Nicholas served as Vice President, Finance and

Chief Financial Officer of UI from November 2002 until March

2005. Mr. Nicholas was appointed Executive Vice President and Chief

Financial Officer of UIL Holdings and UI on March 1, 2005.

Linda L.

Randell. Ms. Randell served as a Partner of Wiggin and Dana

LLP from 1980 to March 26, 2007. Ms. Randell was appointed Senior

Vice President and General Counsel of UIL Holdings and UI on March 26, 2007 and

was appointed Corporate Secretary of UIL Holdings and UI on July 23,

2007.

Anthony J.

Vallillo. Mr. Vallillo has served as President and Chief

Operating Officer of UI since January 2001.

Richard J.

Reed. Mr. Reed served as Vice President – Electric System of

UI from January 2001 until December 2009. Mr. Reed’s job title was

changed to Vice President – Engineering and Project Excellence of UI on January

1, 2010.

Steven P.

Favuzza. Mr. Favuzza served as Director – Financial Compliance

of UI from January 2003 to February 2005. Mr. Favuzza served as

Assistant Vice President – Corporate Planning of UI and of UIL Holdings from

March 2005 to July 2007. Mr. Favuzza was appointed Vice President and

Controller of UI and of UIL Holdings on July 23, 2007.

John J. Prete. Mr.

Prete served as Project Director for the Middletown/Norwalk Transmission Project

from January 2003 to April 2006. Mr. Prete served as Associate

Vice President – Transmission Business of UI from April 2006 to October

2007. Mr. Prete was appointed Vice President of UI on October 1,

2007.

Anthony Marone

III. Mr. Marone served as Senior Director – Client Services of

UI from January 2003 to February 2005. Mr. Marone served as Associate

Vice President – Client Services of UI from February 2005 to October

2007. Mr. Marone served as Vice President – Client Services of UI

from October 2007 to July 2009. Mr. Marone’s job title was changed to

Vice President – Client and External Relations of UI on July 1,

2009. Mr. Marone is also the President of GenConn Energy LLC

(GenConn), a 50-50 joint venture of UI and NRG. See Part II, Item 8,

“Financial Statements and Supplementary Data – Notes to Consolidated Financial

Statements – Note (H), Related Party Transactions,” of this Form 10-K, which is

hereby incorporated by reference.

Part

II

Item

5. Market for UIL Holdings’ Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities.

UIL

Holdings’ common stock is traded on the New York Stock Exchange, where the high

and low closing sale prices during 2009 and 2008 were as follows:

|

2009 Sale

Price

|

2008 Sale

Price

|

|||

|

High

|

Low

|

High

|

Low

|

|

|

First

Quarter

|

$30.93

|

$17.15

|

$35.17

|

$27.66

|

|

Second

Quarter

|

$24.20

|

$20.69

|

$31.65

|

$28.37

|

|

Third

Quarter

|

$27.22

|

$21.92

|

$34.78

|

$27.84

|

|

Fourth

Quarter

|

$28.63

|

$25.57

|

$34.76

|

$26.80

|

Quarterly

dividends on the common stock have been paid since 1900. The

quarterly cash dividends declared in 2009 and 2008 were at a rate of $0.432 per

share.

UIL

Holdings expects to continue its policy of paying regular cash dividends,

although there is no assurance as to the amount of future dividends which

depends on future earnings, capital requirements, and financial

condition.

Further

information regarding payment of dividends is provided in Part II, Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations – Liquidity and Capital Resources,” of this Form 10-K.

As of

December 31, 2009, there were 7,899 common stock shareowners of

record.

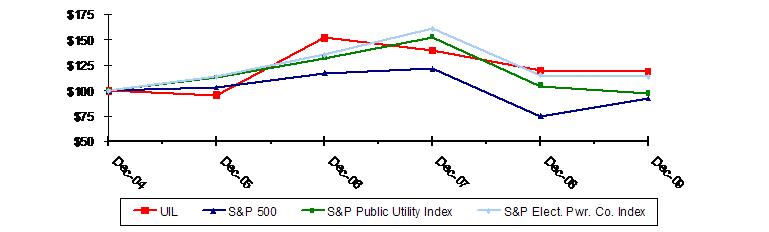

The line

graph appearing below compares the yearly change in UIL Holdings’ cumulative

total shareowner return on its common stock with the cumulative total return on

the S&P Composite-500 Stock Index, the S&P Public Utility Index and the

S&P Electric Power Companies Index for the period of five fiscal years

commencing 2005 and ending 2009.

|

Dec-04

|

Dec-05

|

Dec-06

|

Dec-07

|

Dec-08

|

Dec-09

|

|

|

UIL

|

$100

|

$95

|

$152

|

$139

|

$120

|

$119

|

|

S&P

500

|

$100

|

$103

|

$117

|

$121

|

$74

|

$92

|

|

S&P

Public Utility Index

|

$100

|

$113

|

$132

|

$153

|

$105

|

$97

|

|

S&P

Elect. Pwr. Co. Index

|

$100

|

$114

|

$135

|

$161

|

$115

|

$114

|

|

*

|

Assumes

that the value of the investment in UIL Holdings’ common stock and each

index was $100 on December 31, 2004 and that all dividends were

reinvested. For purposes of this graph, the yearly change in

cumulative shareowner return is measured by dividing (i) the sum of (A)

the cumulative amount of dividends for

the

|

|

|

year,

assuming dividend reinvestment, and (B) the difference in the fair market

value at the end and the beginning of the year, by (ii) the fair market

value at the beginning of the year. The changes displayed are

not necessarily indicative of future returns measured by this or any other

method.

|

|

Equity

Compensation Plan Information

|

|||

|

Plan

Category

|

Number

of Securities to Be Issued Upon Exercise of Outstanding Options, Warrants

and Rights

(a)

|

Weighted

Average Exercise Price of Outstanding Options, Warrants and

Rights

(b)

|

Number

of Securities Remaining Available for Future Issuance Under Equity

Compensation Plans [Excluding Securities Reflected in Column

(a)]

(c)

|

|

Equity

Compensation Plans Approved by Security Holders

|

807,665

(1)

|

$30.32

(2)

|

648,194

|

|

Equity

Compensation Plans Not Approved by Security Holders

|

None

|

-

|

-

|

|

Total

|

807,665

(1)

|

$30.32

(2)

|

648,194

|

|

(1)

|

Includes

168,501 shares to be issued upon exercise of outstanding options, which

include reload rights, 470,765 performance shares to be issued upon

satisfaction of applicable performance and service requirements, and

168,399 shares of restricted stock subject to applicable service

requirements.

|

|

(2)

|

Weighted

average exercise price is applicable to outstanding options

only.

|

UIL

Holdings repurchased 20,316 shares of common stock in open market transactions

to satisfy matching contributions for participants’ contributions into UIL

Holdings 401(k) in the form of UIL Holdings stock as follows:

|

Period

|

Total

Number of Shares Purchased*

|

Average

Price Paid Per Share

|

Total

Number of Shares Purchased as Part of Publicly Announced

Plans

|

Maximum

Number of Shares That May Yet Be Purchased Under the

Plans

|

|

October

|

7,163

|

$26.14

|

None

|

None

|

|

November

|

6,262

|

$27.08

|

None

|

None

|

|

December

|

6,891

|

$28.33

|

None

|

None

|

|

Total

|

20,316

|

$27.17

|

None

|

None

|

*

All shares were purchased in open market transactions. The effects of

these transactions did not change the number of outstanding shares of UIL

Holdings’ common stock.

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

Financial

Results of Operation ($000's)

|

||||||||||||||||||||

|

Sales

of electricity

|

||||||||||||||||||||

|

Utility

|

||||||||||||||||||||

|

Retail

|

||||||||||||||||||||

|

Residential

|

$ | 473,813 | $ | 495,440 | $ | 483,847 | $ | 356,652 | $ | 357,351 | ||||||||||

|

Commercial

|

273,759 | 302,765 | 350,158 | 316,866 | 312,239 | |||||||||||||||

|

Industrial

|

39,524 | 47,918 | 56,257 | 86,055 | 87,558 | |||||||||||||||

|

Other

|