Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-34243

tw telecom inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 84-1500624 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

10475 Park Meadows Drive

Littleton, CO 80124

(Address of principal executive offices)

(303) 566-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of exchange on which registered | |

| Common Stock $.01 par value | Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated Filer ¨ | Smaller Reporting Company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) YES ¨ NO x

As of June 30, 2009, the aggregate market value of the Registrant’s voting stock held by non-affiliates of the Registrant was approximately $1.5 billion, based on the closing price of the Registrant’s common stock on the NASDAQ Stock Market reported for such date. Shares of common stock held by each executive officer and director have been excluded since those persons may under certain circumstances be deemed to be affiliates. This determination of executive officer or affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of tw telecom inc.’s common stock as of January 31, 2010 was 150,162,606 shares.

Table of Contents

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required in Part III of this Annual Report on Form 10-K is incorporated herein by reference to our definitive proxy statement for the 2010 Annual Meeting of our stockholders, which we will file with the U.S. Securities and Exchange Commission on or before April 30, 2010.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding, among other items, our expected financial position, expected capital expenditures, the impact of the economic downturn, activities and results, expected revenue mix, expected revenue growth, the impact of accounting changes, growth or stability from particular customer segments, building penetration plans, the effects of consolidation in the telecommunications industry, customer disconnections, expected churn, Modified EBITDA trends, expected network expansion and business, potential changes in certain accounting reserves and allowances and financing plans. These forward-looking statements are based on management’s current expectations and are naturally subject to risks, uncertainties, and changes in circumstances, certain of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements.

The words “believe,” “plan,” “target,” “expect,” “intend,” and “anticipate,” and expressions of similar substance identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that those expectations will prove to be correct. Important factors that could cause actual results to differ materially from the expectations described in this report are set forth under “Risk Factors” in Item 1A. and elsewhere in this report. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

TELECOMMUNICATIONS DEFINITIONS

In order to assist the reader in understanding certain terms relating to the telecommunications business that are used in this report, a glossary is included following Part III.

1

Table of Contents

| PAGE | ||||

| Item 1. | 3 | |||

| Item 1A. | 17 | |||

| Item 1B. | 25 | |||

| Item 2. | 25 | |||

| Item 3. | 25 | |||

| Item 4. | 25 | |||

| Item 5. | 26 | |||

| Item 6. | 28 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

31 | ||

| Item 7A. | 49 | |||

| Item 8. | 50 | |||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

50 | ||

| Item 9A. | 50 | |||

| Item 9B. | 50 | |||

| Item 10. | 52 | |||

| Item 11. | 52 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

52 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

52 | ||

| Item 14. | 52 | |||

| 53 | ||||

| Item 15. | 57 | |||

2

Table of Contents

| Item 1. | Business |

Overview

tw telecom inc. (the “Company”) is a leading national provider of managed network services, specializing in Ethernet and data networking, Internet access, local and long distance voice, virtual private network (“VPN”), voice over Internet protocol (“VoIP”) and network security services to enterprise organizations and communications services companies throughout the U.S and, for our Internet Protocol or “IP” VPN services, to their global locations. Our customers include, among others, enterprise organizations in the distribution, health care, finance, and manufacturing industries, state, local and federal government entities, system integrators, communications service providers including incumbent local exchange carriers (“ILECs”), competitive local exchange carriers (“CLECs”), wireless communications companies and Internet service providers (“ISPs”). Through our subsidiaries, we operate in 75 U.S. metropolitan markets. As of December 31, 2009, our fiber networks spanned approximately 27,000 route miles, directly connecting to over 10,000 buildings served by our metropolitan fiber facilities (“on-net”) excluding inactive buildings and LEC local servicing offices. We continue to expand our footprint within our existing markets by connecting our network into additional buildings. We substantially expanded our footprint in 2006 through the acquisition of Xspedius Communications, LLC (“Xspedius”), which added networks in 31 additional metropolitan markets and increased our network density in 12 markets that we already served. This acquisition provided us with additional opportunities to serve multi-city and multi-location customers and to provide our full product portfolio in additional markets. We also have continued to expand our IP backbone data networking capability between our markets, supporting end-to-end Ethernet and VPN connections for customers, and have selectively interconnected existing service areas within regional clusters with fiber optic facilities that we own or lease. We operate in one segment across the U.S.

From our formation until September 26, 2006, we had two classes of common stock outstanding, Class A common stock with one vote per share and Class B common stock with ten votes per share that was convertible, at the option of the holder, into Class A common stock on a one-for-one basis. The Class B common stock was collectively owned directly or indirectly by Time Warner Inc., Advance Telecom Holdings Corporation and Newhouse Telecom Holdings Corporation, (collectively, the “Class B Stockholders”). On March 29, 2006 and September 26, 2006, the Class B Stockholders converted their Class B common shares into Class A common shares and completed underwritten offerings of 22.3 million shares and 43.5 million shares, respectively, of our Class A common stock. As a result, we have not had shares of Class B common stock outstanding since September 26, 2006. We did not receive any proceeds from the offerings nor did our total shares outstanding change as a result of the offerings. In June 2007, our stockholders approved an amendment to our Restated Certificate of Incorporation eliminating references to Class A and Class B common stock. Accordingly, no shares of Class B common stock were authorized as of December 31, 2009 or 2008.

We were organized as a Delaware limited liability company in 1998 and converted to a Delaware corporation in 1999. Our principal executive offices are located at 10475 Park Meadows Drive, Littleton, Colorado 80124, and our telephone number is (303) 566-1000. Our Internet address is http://www.twtelecom.com. The information contained on our website is not part of, nor is it incorporated by reference into, this Annual Report on Form 10-K. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and amendments to these reports are available on our website free of charge, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission. In addition, we have posted, and intend to disclose on our website, any amendments to or waivers from, our Code of Ethics applicable to our principal executive officer, principal financial officer, chief accounting officer, controller and treasurer and other persons performing similar functions within four business days following the date of such amendment or waiver.

We amended our Restated Certificate of Incorporation to change our corporate name from Time Warner Telecom Inc. to tw telecom inc. in March 2008. On July 1, 2008, we began using tw telecom inc. as our name and tw telecom as our brand.

3

Table of Contents

Business Strategy

Our primary objective is to be the leading provider of high quality managed data and telecommunications services in each of our service areas, on a national basis, principally utilizing our fiber facilities and our national multipurpose IP backbone network to offer high quality and reliable voice, data, Internet, and dedicated services to become the carrier of choice for business enterprises, governmental agencies, and other carriers. By delivering a suite of scalable integrated and managed network solutions to our customers, we can meet their specific network management needs throughout the U.S., and create efficiencies for the customer through the management of their disparate networks and services. The key elements of our business strategy include the following:

Leverage Existing Fiber Networks. We have built, licensed or acquired local and regional fiber networks to serve metropolitan geographic markets in the U.S. where management believes there are large numbers of potential customers. We provide multi-site and multi-city solutions through our fully managed, nationwide IP backbone network with capacity ranging up to 10 Gbps on any particular link, depending on the specific route. We believe that our extensive network expertise and capacity allow us to:

| • | Emphasize our metropolitan fiber facilities-based services integrated with our IP backbone, which allows us to realize higher gross margins than carriers that do not operate their own metropolitan fiber facilities; |

| • | Focus on selling services in our metropolitan markets, but also provide a national reach with multi-location and multi-city end-to-end solutions; |

| • | Provide a reliable and diverse network to customers seeking further network diversity as industry consolidation among wireline carriers has reduced the choices available to customers; and |

| • | Design and deliver scalable and efficient solutions that enable our customers’ business applications and networks to operate more effectively. |

Focus Our Service Offerings to Meet the Sophisticated Data Needs of Our Customers. We continue to place significant focus on serving the growing demand for high-speed, high-quality enhanced data networking services such as our Ethernet and IP VPN services, our Internet-based services and converged voice and data services bundles. Our suite of Ethernet services provides the foundation for network solutions, enabling multipoint connectivity for customers within and between given metropolitan areas. To further expand our multi-site and multi-city capabilities, in 2009, we enhanced our managed services portfolio by launching a managed IP VPN service available with or without Class of Service functionality, which allows customers to group types of traffic and assign a different priority level to each traffic type. (See “Services—Data and Internet Services—Managed Services.”)

We also provide a broad range of switched voice services throughout our service area. We utilize high-capacity digital end office switches to provide both local and toll services. Further, we have deployed digital switching equipment that enables us to combine Internet access in a bundle with voice and provide a dynamic bandwidth allocation feature which allows our customers to increase their voice or Internet bandwidth on demand, based upon their telecommunications usage and needs. Our customers can utilize our carrier grade VoIP network and product suite without costly upgrades to their voice premises equipment. This approach also enables us to offer multi-location organizations a consistent user experience regardless of the equipment they maintain at each location and enables a variety of voice applications inside the network.

Pursue Selected Opportunities to Expand Our Network Reach. We continue to extend our network in our present markets in order to reach additional office buildings and business parks directly with our fiber facilities. In addition, we have deployed technologies such as dense wave division multiplexing (“DWDM”) to provide additional bandwidth and higher speed in our networks without the need to add additional fiber capacity. We may expand our networks beyond our existing 75 markets if we find attractive opportunities to do so organically or

4

Table of Contents

through acquisitions. We also provide services to locations outside our current market areas through the use of leased facilities and our IP backbone. In 2009, we launched our global IP VPN capabilities, which allow us to reach certain of our enterprise customers’ locations at certain international sites by connecting our IP backbone to the international fiber footprint of our partners.

Deliver a Proactive and Comprehensive Customer Care Strategy that Differentiates Us from Our Competitors. We strive to deliver a consistent and comprehensive customer experience that differentiates us from our competitors through coordinated local and national support. We also differentiate the level of service that various customer segments receive to better meet their needs. Our online customer care self-help platform known as MyPortal offers our customers self-service capabilities to enhance their experience.

Continue Disciplined Expenditure Program. Our sales and marketing strategy for adding customers is designed to maximize revenue growth while maintaining attractive rates of return on capital invested to connect customers to our networks. Our focus on using our fiber facilities-based services, rather than reselling network capacity of other providers, requires that we make significant capital investments to reach new and existing customer locations. We invest selectively in growth prospects that often require that we install fiber in buildings, purchase electronics, construct fiber rings, and invest in product expansion. We also seek to increase operating efficiencies by investing selectively in strategic enhancements to our back office and network management systems. We maintain a disciplined approach to capital and operating expenditures. Our capital expenditure program requires that prior to making expenditures for new sales opportunities, the project must be evaluated against certain financial criteria such as projected minimum recurring revenue, cash flow margins and rate of return. During the economic downturn, our strategy has been to continue to make strategic investments in our business in order to position us for long term growth.

Services

We provide our customers with a wide range of telecommunications and managed data services, including network, local and long distance voice services, data transmission services, high-speed dedicated Internet access and intercarrier services. Our revenue by major product categories for the years ended December 31, 2009, 2008 and 2007 is as follows:

| Years Ended December 31, | ||||||||||||||||||

| 2009 | 2008 | 2007 | ||||||||||||||||

| (amounts in thousands) | ||||||||||||||||||

| Revenue: |

||||||||||||||||||

| Data and Internet services |

$ | 472,647 | 39 | % | $ | 399,928 | 35 | % | $ | 318,269 | 30 | % | ||||||

| Network services |

370,859 | 31 | 387,339 | 33 | 393,569 | 36 | ||||||||||||

| Voice services |

333,274 | 27 | 334,692 | 29 | 327,246 | 30 | ||||||||||||

| Intercarrier compensation |

34,610 | 3 | 37,060 | 3 | 44,595 | 4 | ||||||||||||

| Total revenue |

$ | 1,211,390 | 100 | $ | 1,159,019 | 100 | $ | 1,083,679 | 100 | |||||||||

Our broad service portfolio provides solutions to enterprise customers, ranging from small businesses to Fortune 500 companies, city, state and federal government entities, as well as communications service providers. Our primary service offerings are:

Data and Internet Services

Data Services

We offer our customers a broad array of enhanced data services that enable them to connect their own internal computer networks and access external computer networks at very high speeds using the Ethernet protocol.

5

Table of Contents

We offer the following native local area network or “NLAN” services:

| • | Switched NLAN. Switched NLAN service incorporates data Ethernet switching technology into the NLAN product suite. This service allows multiple customer locations to interconnect using 10 megabits per second (“Mbps”) to 1 gigabit per second (“Gbps”) interfaces over a shared metropolitan Ethernet infrastructure that allows us to compete with legacy high speed transmission services such as frame relay and ATM. |

| • | Elite NLAN (Point-to-Point). Point-to-point NLAN service provides dedicated protected Ethernet transport service between two locations in a metropolitan area at bandwidth speeds of 10, 100, 600, or 1000 Mbps, and 10 Gbps. |

| • | Extended NLAN. Extended NLAN service provides Ethernet connectivity between distant locations in the markets we serve through our national IP backbone and is available in either point-to-point or multi-point configurations. |

| • | IP VPN Services. Our IP VPN service connects multiple sites by creating a virtual network for the customer within the U.S. and to 64 other countries. Class of Service functionality is available on Premium IP VPN service. Connection speeds are from 1.5 Mbps to 1 Gbps. |

| • | Integrated NLAN. Integrated NLAN service converges voice and Internet service with an optional Ethernet feature to transfer private data between multiple locations locally or nationally. |

| • | Regional Ethernet. Point-to-point private lines between select markets with the advantage of Ethernet interfaces. |

| • | Storage Transport Solutions. This service provides links offering a variety of industry-standard protocols, allowing customers to avoid protocol translation while securely transporting their data to distant storage locations. |

Internet Services

Our dedicated high capacity Internet service enables customers to access the Internet and other external networks. We offer a wide range of Internet services to our business customers with bandwidth speeds ranging from 1.5 Mbps to 10 Gbps transported via traditional Time Division Multiplexing (“TDM”) or Ethernet connectivity. Our traditional TDM-based Internet services are available via industry standard transport facilities: DS-1, DS-3, OC-3, OC-12 and OC-48 connectivity. Our Ethernet Internet services are delivered using Ethernet connections with offerings of Ethernet (10 Mbps), Fast Ethernet (100 Mbps), Gigabit Ethernet (1 Gbps), and 10 Gigabit Ethernet (10 Gbps).

Managed Services

We offer a suite of managed services described below that complement our customers’ data and Internet networking solutions. These services allow our customers to reduce the overall management burden of their data systems.

| • | Managed IP VPN. Our Managed IP VPN service is a turnkey solution that provides connectivity to our secure Multi-Protocol Label Switching or MPLS IP VPN network with customer premises-based routers that we procure, configure, maintain and manage. The service includes active monitoring and alarming, on-site installation and hardware maintenance. |

| • | Managed Internet. This service bundles our Internet access service with customer premises-based routers that we procure and configure based on our customer’s requirements. The service includes on-site installation and hardware maintenance. |

| • | Distributed Denial of Service Mitigation. This service monitors, identifies and mitigates denial of service attacks aimed at taking down a customer’s business critical Internet-based applications (i.e., website, email servers, etc.) by flooding the target network with high volumes of unauthorized traffic. |

6

Table of Contents

| • | Managed Security Services. This service uses security devices placed within our network to establish a firewall to prevent unauthorized traffic from entering a customer’s network. We also offer a managed security solution through equipment placed at the customer’s premises that provides security to its network through firewall, spam relay, integrated URL filtering, anti-virus and encrypted VPN functionality. |

Voice Services

Our voice services provide our customers with local and long distance calling capabilities. We own, manage, and maintain the switches used to provide the services. Our voice services include the following:

| • | Bundled Services. Our bundled offerings enable customers to purchase one to three DS-1 facilities that combine lines, trunks, long distance, and Internet services to provide an integrated service offering. This product can dynamically allocate bandwidth for maximum network efficiency, and eliminates the customer’s need for multiple vendors. We offer an integrated low-speed Ethernet routing feature in multi-site and city configurations to provide private data networking capabilities for multiple customer locations. |

| • | Access Trunks. These trunks, typically DS-1, are utilized by private branch exchange (“PBX”) customers that own and operate a switch on their own premises to provide access to the local, regional, and long distance telephone networks. |

| • | Long Distance Service. Long distance service provides the capability for a customer to place a voice call from one local calling area to another, including international calling and is offered as a bundle with other voice and converged solutions as well as package plans for various committed levels of usage. |

| • | Local Toll Service. This service provides customers with a competitive alternative to ILEC service for intraLATA toll calls. |

| • | Local Telephone Service. Local telephone calling areas are widely defined to provide ease of use for our customers. Additional features include operator and directory assistance services and custom calling features such as call waiting and caller ID. |

| • | Business Access Line Service. This service provides customers with quality analog voice grade telephone lines. |

| • | IP Trunks. IP trunks converge voice traffic with Internet traffic over a single connection for a more efficient and scalable access network. This service supports new IP PBX devices and local and long distance calling to the public switched telephone network (“PSTN”). |

Network Services

We provide a complete range of network access services with transmission speeds up to 10 Gbps to satisfy our customers’ needs for voice, data, image, and video transmission. Each service uses technologically advanced fiber optics and is available as:

| • | Private Line. Dedicated telecommunications lines connecting various locations of a customer’s operations, suitable for transmitting voice and data traffic among customer locations. |

| • | Special Access. Dedicated telecommunications lines linking the points of presence (“POPs”) of one or more interexchange carriers (“IXC”), or between enterprise customers and the local POPs of IXCs. |

| • | Transport Arrangements. Dedicated transport between the local exchange carrier (“LEC”) central offices and the IXC POP for voice and data applications. |

| • | Metropolitan and Regional Connectivity. Each transport service is available on our metropolitan fiber networks. Most are also available between cities on our inter-city, regional networks. |

7

Table of Contents

These services are available in a wide variety of configurations and capacities:

| • | Private Network Transport Services. A premium quality, fully redundant, and diversely routed service on Synchronous Optical Network (“SONET”) standards that is dedicated to the private use of individual customers with multiple locations. |

| • | SONET Services. Full duplex transmission of digital data on SONET standards allowing multipoint transmission of voice, data, or video over protected fiber networks. Available capacities include DS-1, DS-3, STS-1, OC-3, OC-12, OC-48, and OC-192. |

| • | Wavelength or “Lambda” Services. High capacity, point-to-point transmission services allowing customers to have access to multiple full-bandwidth channels of 2.5 Gbps and 10 Gbps. |

| • | Collocation Services. Secure space, climate and power collocation services where customers can locate their equipment to connect to our network in facilities adjacent to our central offices. |

Intercarrier Services

Because we are interconnected with other telecommunications carriers, we provide traffic origination and termination services to other carriers. These services consist of the origination and termination of long distance calls and the termination of local calls.

| • | Switched Access Service. The connection between a long distance carrier’s POP and an end user’s premises that is provided through the switching facilities of a LEC is referred to as switched access service. Switched access service provides long distance carriers with a switched connection to their customers for the origination and termination of long distance telephone calls or provides large end users with dedicated access to their carrier of choice. Under our tariffs, we receive per-minute terminating switched access compensation when our network is used for the origination or termination of the carriers’ traffic. |

| • | Local Traffic Termination Services. Pursuant to interconnection agreements with other carriers, we accept traffic that originates on another LEC’s facilities and carry that traffic over our facilities to our customers in order to complete calls. Generally, under applicable regulations, we are entitled to receive compensation—referred to as “reciprocal compensation”—from the originating LECs for those services. |

Telecommunications Networks and Facilities

Overview. We utilize advanced technologies and network architectures to provide a highly reliable platform for delivering high speed and high quality digital transmissions of voice, data and Internet services. Our primary transmission facilities are provisioned on fiber optic rings that provide path diversity and automatically re-route traffic when a fiber cut or other impairment occurs, thus ensuring high network availability and reliability. We use a variety of electronics in our metropolitan networks in order to meet our customers’ needs for multiple types of network applications. Our Ethernet network equipment supports Ethernet and other data and IP-enabled applications. Our core network utilizes advanced MPLS with fully redundant routers enabling us to deliver Internet traffic and VPN services to our customers. We also have a VoIP network that utilizes soft switches and gateways that are smaller and more cost effective than traditional PSTN end office switches. Our local voice markets are interconnected using a private, VoIP enabled, IP backbone. This network allows us to manage all site-to-site, or “on-net” calls, between customer locations and reduce our costs. This network architecture also supports complex disaster recovery services for customers with mission critical voice requirements. We continually evaluate new technologies, applications and suppliers to make sure that we are in step with next generation technologies.

We serve our customers from one or more central offices that are strategically positioned throughout our markets. The central offices house the transmission, switching, and Internet equipment needed to interconnect

8

Table of Contents

customers with each other, with the long distance carriers, and with other local exchange and Internet networks. We also install Ethernet switches, routers, soft switches, DWDM, gateways and other digital electronics in our central offices. Redundant electronics and power supplies, with automatic switching to backup equipment in the event of equipment failure or power outages, help to protect against signal deterioration and service interruptions. In order to deliver the telecommunication services to the customer, we install electronics either in the customer’s suite or in the common telecommunications room in the building occupied by the customer.

Our networks are interconnected with multiple ILECs and long distance carrier switches to provide our customers ubiquitous access to the PSTN. Our MPLS backbone also is connected to multiple networks around the nation at multiple connection points. To serve a new customer who is not in a building where we have existing facilities, we may use various transitional links, such as leased circuits from another LEC. When a customer’s monthly spend increases to a sufficient level, we may invest additional capital to connect our own fiber to the customer’s premises in order to accommodate the customer’s bandwidth needs and to increase our operating margins. We have developed the capability to provide IP VPN service to certain of our customers’ international locations through arrangements with international network providers.

Capacity License Agreements. We currently license fiber capacity from Time Warner Cable in 16 markets, Comcast Corporation, as successor to Time Warner Cable, in three markets, and Bright House Networks, LLC (“Bright House”), in four markets. Time Warner Cable was previously affiliated with companies that held our Class B common stock until September 2006, and Bright House is affiliated with another former Class B stockholder. None of these licensors is presently affiliated with or related to us. Each of our local operations in those markets is party to a Capacity License Agreement with one of the local cable television operations of Time Warner Cable, Comcast Corporation or Bright House (collectively the “Cable Operations”) that provide us with an exclusive right to use all of the capacity of specified fiber-optic cable owned by the Cable Operations. The Capacity License Agreements expire in 2028. The Capacity License Agreements for networks that existed as of July 1998 have been fully paid and do not require additional license fees. However, we must pay maintenance fees and fees for splicing and similar services. Since 1998, the Cable Operations have provided additional fiber-optic cable capacity for which we pay an allocable share of the cost of construction of the fiber upon which capacity is provided, plus permitting and other fees. The Cable Operations are not obligated to provide such fiber capacity and we are not obligated to take fiber capacity from them. We are permitted to use the capacity for telecommunications services and any other lawful purpose, but not for the provision of residential services and content services. If we violate the limitations on our business activities, the Cable Operations may terminate the Capacity License Agreements. We do not currently have plans to offer residential or content services in any of our service areas.

The Capacity License Agreements do not restrict us from licensing fiber-optic capacity from parties other than the Cable Operations. Although the Cable Operations have agreed to negotiate renewal or alternative provisions in good faith upon expiration of the Capacity License Agreements, we cannot assure that the parties will agree on the terms of any renewal or alternative provisions or that the terms of any renewal or alternative provisions will be favorable to us. If the Capacity License Agreements are not renewed in 2028, we will have no further interest in the fiber capacity covered by those agreements and will likely need to build, lease, or otherwise obtain transmission capacity to replace the capacity previously licensed under the Capacity License Agreements. The terms of such arrangements may be materially less favorable to us than the terms of the Capacity License Agreements. We have the right to terminate a Capacity License Agreement in whole or in part at any time upon 180 days notice. The Cable Operations have the right to terminate the Capacity License Agreements prior to their expiration under certain circumstances (see Item 1A Risk Factors “We must obtain access to rights-of-way and pole attachments on reasonable terms and conditions”).

9

Table of Contents

Telecommunication Networks. The following map shows the areas where we have local markets:

Network Monitoring and Management. We provide a single point of contact for our customers and consolidate our systems support, expertise, and technical training for the networks at our two network operations centers in Greenwood Village, Colorado, a suburb of Denver, and O’Fallon, Missouri, a suburb of St. Louis. These two centers offer capability for redundancy and overlap coverage for our customer networks. We provide 24 hours per day, 7 days a week surveillance and monitoring of networks to achieve a high level of network reliability and performance. Network analysts monitor real-time alarm, status, and performance information for network circuits, which allows us to react swiftly to repair network trouble.

Information Technology Solutions. We continue to focus on systems that provide high business value with a solid return on investment. Our strategy is to blend the purchase of proven, commercially available software that can be tailored to our business processes, and in-house developed applications that conform to our architectural framework. Where such commercially “off-the-shelf” products are not suitable for our business needs, we employ internal resources and contract with third party integrators to develop custom applications. All of our systems must be flexible enough to conform to a rapidly changing environment, while being scalable, and easily maintained and enhanced. We have integrated several of our enterprise applications so that data flows from one to the other, in order to improve data accuracy and increase efficiency. We also use customized workflow software to manage the exchange of data in a timely manner between applications and users. As further described under “Customer Service” below, we have also developed a customer care self-help platform that uses web portal technology to provide automated customer service.

Information Systems Infrastructure. We manage our desktop technology assets centrally to ensure software compatibility between all corporate locations and field offices. Our information systems infrastructure also provides real time support of network operations and delivers data to meet customer needs. Our systems utilize open system standards and architectures, allowing interoperability with third party systems.

10

Table of Contents

Network Development and Application Laboratory. We have a laboratory located in Greenwood Village, Colorado that is equipped with state of the art systems and equipment, including those we use in the operation of our local, regional and national networks. The center is designed to provide a self-contained testing and integration environment, fully compatible with our networks, for the purposes of:

| • | Verifying the technical and operational integrity of new equipment prior to installation in the networks; |

| • | Developing new services and applications; |

| • | Providing a realistic training environment for technicians, engineers, and others; and |

| • | Providing a network simulation environment to assist in fault isolation and recovery. |

Billing Systems. We have licensed software from outside vendors for end user billing that operates on our own equipment and have contracted with the billing vendor for operations support and development. In addition, we have a service bureau arrangement with another vendor for interconnection billing.

Customers and Sales and Marketing

Customers. Our customers have telecommunications-intensive businesses and are comprised of enterprises, government, and other public institutions, system integrators, and carriers. For the year ended December 31, 2009, enterprise, government and other public customers, and system integrators represented 75% of total revenue, carriers represented 22% of total revenue and intercarrier compensation represented 3% of total revenue. We served approximately 28,000 customers as of December 31, 2009. No customer accounted for 10% or more of total revenue in 2009.

Our top 10 customers accounted for 21% of our total revenue for the year ended December 31, 2009, and approximately 23% for the year ended December 31, 2008. The change was attributable to the increase in sales to enterprise customers, service disconnections, re-pricing of renewed contracts and a reduction in intercarrier compensation from our 10 largest customers. A portion of the revenue from our top 10 customers includes intercarrier compensation resulting from end users that have selected those customers as their long distance carriers. Our revenue from certain carriers within our 10 largest customers that were parties to industry mergers and consolidations in 2006 has decreased since then because of service disconnections due to their network grooming and optimization. We expect additional disconnections combined with pricing changes in connection with contract renewals as carriers determine their leased network strategies in 2010. Although disconnections and re-pricing of services upon contract renewals resulting from consolidations have resulted in lower overall carrier revenue in 2009 as compared to 2008, we believe that consolidation has also resulted in additional opportunities to provide high quality IP and Ethernet services in our markets to carriers as they serve the evolving needs of their customers and seek redundancy in their networks.

Sales and Marketing. Our service offerings are part of a diversified portfolio of competitively priced products and solutions designed to support the evolving needs of our existing customers and to attract new customers. Our sales and marketing strategy emphasizes our:

| • | Reliable and high quality facilities-based metropolitan networks and national IP backbone; |

| • | Converged data and IP (including voice) solutions supporting customer network trends; |

| • | Leading customer experience strategy, including local support in the customer’s city and a responsive national customer service orientation; |

| • | Comprehensive product suite; |

| • | Strong network management and online customer care self-help capabilities; and |

| • | Multi-site and multi-city network solutions, including expansion of our managed IP VPN services to global customer locations. |

11

Table of Contents

We engage in direct sales in the majority of our local markets with support from our national sales organization. Some of our smaller local markets are supported by personnel in regional and adjacent areas. Our national sales organization includes sales groups focused on four types of national customers: enterprise, communications service providers, public sector and systems integrators. These teams have sales engineering and support resources. As of December 31, 2009, we had a total of 522 sales account executives and customer relationship specialists. We continue to expand our sales force with hires strategically targeted at high opportunity markets. Commissions for our sales representatives are linked to incremental revenue from services installed. We provide additional incentives for executing service contracts with terms of greater than one year and for certain products and solutions as well as for sales of services on our fiber facilities. Our customer relationship specialists specifically focus on sales to existing customers and increasing customer retention, freeing our primary sales force to focus on increasing sales to large volume customers and attaining new customers.

In addition to our direct sales channels, we have marketed our services through teaming arrangements focused on data products and through an indirect channel selling mainly our lower capacity and less complex integrated products. We market our services through database marketing techniques, customer seminars, advertisements, trade journals, media relations, direct mail and participation in conferences.

Customer Service

We strive to deliver a consistent, differentiated, valuable customer experience through local and national support. Our local account representatives and customer relationship specialists work with local operations teams, central network operations centers and customer care teams to support our customers. We process customer requests to order, upgrade or change their services through our coordinated local and national support. Our Customer Service Center is available to all of our customers to answer their questions regarding billing, order status or maintenance concerns. In addition, our network operations centers provide 24 hours per day, 7 days a week trouble reporting and surveillance and monitoring of networks to maintain network reliability and performance (see “Telecommunications Networks and Facilities—Network Monitoring and Management”).

Our online customer care self-help platform, MyPortal, offers our customers self-service capabilities that support our customer experience strategy. MyPortal enables customers to easily register on-line and choose various capabilities including the ability to view and pay their bills on-line, view orders, create and view billing disputes, receive scheduled maintenance notifications, alert us of their internal scheduled maintenance activities, create and view trouble tickets, create and view various accounts and enter certain types of service change requests. Customers can also access their own network performance data on a circuit level basis for certain services.

Competition

We believe that the principal factors affecting our competitive position are:

| • | Our local and regional fiber networks; |

| • | Our customer service and network quality; |

| • | Our pricing; |

| • | Our product portfolio; |

| • | Our agility and flexibility and the capabilities of our local teams to design customer network solutions on site; |

| • | Our ability to connect customers’ multiple locations; and |

| • | Regulatory decisions and policies that impact competition. |

12

Table of Contents

We compete with other carriers primarily on service quality and customer service rather than price. However, significant price competition for certain products such as long distance service, inter-city point-to-point services, POP to POP dedicated services, high capacity Internet access and integrated service bundles for small customers has driven down prices for these products. We typically price our services to be competitive to the local market for those services. Competition varies across local markets and products, depending on the number and type of competitors in the market and customer segment. We believe that the ILECs and some CLECs continue to be aggressive in pricing competition particularly for large enterprise customers that we also target. With several facilities-based carriers providing similar services in a given market, price competition is likely to continue.

Our primary competition comes from the ILECs, CLECs and cable companies. The ILECs, primarily AT&T Inc., Verizon Communications, Inc., and Qwest Communications Inc., and some of the other CLECs offer services that are substantially similar to those we offer. We believe that the ILECs may have some competitive advantages over us because of their name recognition, technical capabilities, greater financial resources, broader geographic coverage and potential to bundle and subsidize services of the type we offer with revenue from other services. However, we believe that customers are increasingly interested in competitive facilities-based providers like us because we are more flexible in providing critical business solutions with our robust data and IP capabilities, our enhanced service capabilities, and diversity and our disaster recovery capabilities. We believe that our focus on customer service and our operational execution provides us with a competitive advantage with respect to ILECs, other CLECs and cable companies. Our extensive on-net facilities connecting to multiple buildings in each of our markets, and between markets, also provides us with a competitive advantage over most other CLECs. In addition, many of the other CLECs compete with us mainly on price, which may reduce their margins. The cable companies’ services and networks are still evolving with fewer fiber connections to commercial enterprise locations.

Regulatory environments at both the state and federal level differ widely and have considerable influence on our markets, economic opportunities and resulting investment decisions. We believe we must continually monitor regulatory developments and actively participate in regulatory issues. Some regulatory decisions have or may in the future have negative impacts on our revenue and/or expenses, and may favor certain classes of competitors over us. (See “Government Regulation.”)

To the extent we interconnect with and use ILEC networks to service our customers, we depend on the technology and capabilities of the ILECs to meet certain telecommunications needs of our customers and to maintain our service standards. We also use ILEC special access services, unbundled network element (“UNE”) loops, Ethernet loops and ILEC and other carrier long haul and local circuits to reach certain customer locations that are not served by our network. Although regulation of ILEC performance standards exists with respect to UNE loops, there is minimal regulatory oversight of the quality of ILEC special access and Ethernet services. We also depend on large ISPs for Internet peering, which is unregulated, to allow our customers to connect with certain ISPs with which we do not directly connect, and we rely on carriers with international facilities to provide connections in certain international locations. Our ability to compete for customer locations that we do not serve directly on our network is dependent in part on the quality of service we receive from these other carriers and our ability to obtain their services at a reasonable cost.

Seasonality

Although our business is not inherently seasonal in nature, historically our revenue and expense in the first and third quarters of the year have been impacted by some seasonal factors that may cause fluctuations from the prior quarter. First quarter installations and the associated revenue may be impacted by the slowing of our customers’ purchasing activities at the end of the fourth quarter. In addition, revenue from our usage based services such as long distance may be subject to seasonal fluctuations in the first and third quarters resulting from seasonal changes in our customers’ usage patterns. Our expenses also are impacted in the first quarter by the resetting of payroll taxes and other employee related costs.

13

Table of Contents

Name and Branding Change

We amended our Restated Certificate of Incorporation to change our corporate name from Time Warner Telecom Inc. to tw telecom inc. in March 2008. On July 1, 2008 we began using tw telecom inc. as our name and tw telecom as our brand.

Government Regulation

Historically, interstate and foreign communication services were subject to the regulatory jurisdiction of the Federal Communications Commission, or “FCC”, and intrastate and local telecommunications services were subject to regulation by state public service commissions. With enactment of the Telecommunications Act of 1996 (the “1996 Act”), competition in all telecommunications market segments, including local, toll, and long distance, became matters of national policy even though the states continue to have a significant role in administering policy. We believe that the national policy fostered by the 1996 Act has contributed to significant market opportunities for us. However, since 1996, various ILEC legal challenges and lobbying efforts have resulted in federal and state regulatory decisions affecting implementation of the 1996 Act that favor the ILECs and other competitors. Since federal and state regulatory commissions have largely implemented the provisions of the 1996 Act, we believe that future regulatory activity relating to the 1996 Act will focus largely on enforcement and refinement of carrier-to-carrier requirements under the law and on consumer protection measures. Although we have described the principal regulatory factors that currently affect our business, the regulation of telecommunications services is still evolving and regulatory changes could occur in the future that we cannot presently anticipate.

Telecommunications Act of 1996. The 1996 Act is intended to increase competition in local telecommunications services by requiring ILECs to interconnect their networks with CLECs. The 1996 Act imposes a number of access and interconnection requirements on all LECs, including CLECs, with additional requirements imposed on ILECs. In August 1996, the FCC promulgated rules to govern interconnection, resale, dialing parity, UNEs, and the pricing of those facilities and services, including the Total Element Long Run Incremental Cost (“TELRIC”) standard for UNEs. Under the 1996 Act and the FCC rules, ILECs are required to negotiate with CLECs that want to interconnect with their networks. We have negotiated interconnection agreements with the ILECs in each of the markets where we offer switched services and have negotiated, or are negotiating, secondary interconnection arrangements with carriers whose territories are adjacent to ours for intrastate intraLATA toll traffic and extended area services. As these agreements approach expiration, we negotiate extensions or new agreements. Typically, expired agreements allow us to continue to exchange traffic with the other carrier pending execution of an extension or a new agreement.

Reciprocal compensation revenue is an element of intercarrier compensation revenue that represents compensation from LECs for local exchange traffic terminated on our facilities originated by other LECs. As a result of various regulatory rulings beginning in 2001, our reciprocal compensation revenue has generally been declining. Reciprocal compensation represented less than 1% of total revenue for the year ended December 31, 2009.

As a result of the FCC’s triennial review of unbundling, the FCC adopted permanent rules in 2004 governing the UNEs that ILECs must continue to provide to competitive carriers under the 1996 Act. These rules set forth specific marketplace triggers that eliminate the ILECs’ obligation to provide unbundled loops and transport in particular locations. Several ILECs have filed petitions with the FCC for forbearance from the obligation to provide UNEs that would otherwise apply under these rules. Qwest was granted partial forbearance for the Omaha market, but was denied forbearance in four other markets. Verizon appealed an FCC decision that denied its request to eliminate the obligation to provide loop and transport UNEs in six of its markets. That decision has been remanded back to the FCC by the court for further justification for the FCC order. The acquired Xspedius operations use UNEs as well as special access circuits to reach customers that are not directly connected to our network, but we have not used UNEs extensively in our other markets. Changes in the regulation of UNEs could either negatively or positively affect the availability and cost of UNEs to us.

14

Table of Contents

Other Federal Regulation. Switched access is the connection between a long distance carrier’s POP and an end user’s premises provided through the switching facilities of a LEC. Switched access is a component of our intercarrier compensation revenue and represented 2% of total revenue for the year ended December 31, 2009. The FCC subjected CLECs’ interstate switched access charges to regulation beginning in 2001, and subsequent regulatory actions have resulted in reductions in the per-minute rates we received for switched access service for the period June 2001 through June 2004. Our ongoing obligation to charge switched access rates that are no higher than those charged by the ILECs has and will continue to result in further reductions to our switched access revenue as ILEC rates are reduced.

The FCC has been considering significant intercarrier compensation and Universal Service reforms since 2001. Changes being considered generally include a unified rate for intrastate switched access, interstate switched access and reciprocal compensation over a transition period and establishment of a new cost methodology that would produce significantly lower rates. Carriers are required to make contributions to the federal Universal Service Fund, which provides support to promote access to telecommunications services at reasonable rates for those living in rural and high-cost areas, income-eligible consumers, rural health care facilities, schools and libraries. The FCC has proposed a new Universal Service Fund contribution method based on telephone numbers, rather than the current revenue-based method. It also has proposed to classify VoIP calls terminating on the PSTN as an information service subject to reciprocal compensation but not switched access termination charges and to preempt states from regulation of VoIP services. These are highly contentious issues that previous FCC administrations have been unable to resolve. At this time, we do not know what specific actions the FCC will take, or the impact on us of any such action.

The FCC is currently reviewing its regulation of special access services in a pending proceeding opened in 2005. We purchase special access circuits and other services from ILECs to expand the reach of our network and also provide special access services over our fiber facilities in competition with the ILECs. We have advocated that the FCC modify its special access pricing flexibility rules to return these services to price–cap regulation to protect against unreasonable price increases for carriers such as us. If ILEC special access prices increase, our costs may increase but we may experience less pricing pressure on our special access services. If ILEC price reductions were to occur, we would likely experience downward pressure on the prices we charge our customers for special access services and reductions in the prices we pay ILECs for special access services that we purchase. The FCC’s order that approved the merger of BellSouth Corporation into AT&T included a number of conditions that provided us with rate stability and modest cost savings for special access and UNEs until mid-2010. We are currently negotiating a new agreement with AT&T to take effect in mid-2010 to replace an existing contract that expires at that time. This new agreement could result in higher prices for special access services that we purchase from AT&T. The FCC has recently asked for public comment on a framework for analysis of the special access market, and on the data the FCC needs to assess the reasonableness of ILEC prices. We expect that the FCC will issue a data request sometime in the first half of 2010, but we do not know when or if the FCC will act on interstate special access regulation in 2010.

In addition, the ILECs have filed numerous petitions for forbearance from regulation of their broadband special access services, including Ethernet services offered as special access. The FCC has generally granted these petitions with the result that prices for Ethernet and OC-n high capacity data services of these carriers, which we have purchased in limited quantities, are no longer price regulated. We and several of our competitors appealed these FCC rulings, but the D.C. Circuit Court of Appeals upheld the FCC’s decision. These FCC actions did not impact the availability of the tariffed TDM special access circuits that we use for off-net building access. We expect that the ILECs will continue to advocate deregulation of all forms of special access services, and we cannot predict the outcome of the FCC’s proceedings in this regard or the impact of that outcome on our business.

In a February 1999 order, the FCC allowed for increases to commingled cable and telephony pole attachment rates beginning in February 2001. Following this order, we experienced higher pole attachment fees and could experience future rate increases if it is determined that we should pay the telephony rates, which are

15

Table of Contents

significantly higher than cable rates either retroactively or in the future, in all areas where cable and telephony pole attachments are commingled. We are experiencing increased competition from cable companies for certain broadband services. Under the FCC’s pole attachment regulations, cable companies are permitted to pay lower cable rates for pole attachments than the rate to which we are subject as a telecommunications carrier for the provision of some of the same services. In 2007, we filed a request with the FCC to eliminate this discriminatory rate treatment in its pole attachment regulations. The FCC has released a notice of proposed rulemaking with a tentative conclusion that the pole attachment rates for all providers of broadband networks should be equal. There has been considerable public comment in the proceeding, but the FCC has not yet taken action. We cannot predict the outcome of this initiative at this time.

State Regulation. We have obtained all state government authority needed to conduct our business as currently contemplated. Most state public service commissions require carriers that seek to provide local and other common carrier services provided within the state to be authorized to provide such services. Our operating subsidiaries and affiliates are authorized as common carriers in 36 states and the District of Columbia. In the vast majority of states, these certifications cover the provision of switched services including local basic exchange service, point-to-point private line, competitive access services, and long distance services. Similar to the FCC’s rules regarding interstate switched access, a number of state public service commissions have ruled that CLEC intrastate switched access rates may not exceed certain caps. Currently, 12 states in which we provide switched services have benchmarking rules that limit the switched access rates that we charge other carriers. We anticipate that additional states will promulgate similar rules in the future, which could result in reduction of the switched access rates that we charge other carriers in those states.

Local Government Authorizations. We may be required to obtain street opening and construction permits and other rights-of-way from municipal authorities in order to install and expand our networks in certain cities. In some cities, our fiber licensors or subcontractors already possess the requisite authorizations to construct or expand our networks. Any increase in the difficulty or cost of obtaining these authorizations and permits could adversely affect us, particularly in locations where we compete with companies that already have the necessary permits.

In some of the metropolitan areas where we provide network services, we pay right-of-way or franchise fees based on a percentage of gross revenue or other measures such as the number of access lines. Municipalities that do not currently impose fees may seek to impose fees in the future, and following the expiration of existing franchises, fees may be increased. Under the 1996 Act, municipalities are required to impose such fees on a competitively neutral and nondiscriminatory basis. Municipalities that have fee structures that currently favor the ILECs may or may not conform their practices in a timely manner or without legal challenges by us or other CLECs. Moreover, ILECs with which we compete may be exempted from such local franchise fee requirements by previously enacted legislation that allows the ILECs to utilize rights-of-way throughout their states without having to pay franchise fees to local governments.

We are party to various regulatory and administrative proceedings. Subject to the discussion above, we do not believe that these proceedings will have a material adverse effect on our business.

Employees

As of December 31, 2009, we had 2,870 employees compared to 2,844 employees at December 31, 2008. We believe that our relations with our employees are good. By succession to certain operations of Time Warner Cable at our inception, our operation in New York City is party to a collective bargaining agreement that covers seven of our technicians. We believe that our success depends in part on our ability to attract and retain highly qualified employees and maintain good working relations with our current employees.

Financial Information

See Part II Item 8 for our financial results and information.

16

Table of Contents

| Item 1A. | Risk Factors |

The current economic environment in the U.S. and globally could affect our future operating results.

Beginning in late 2007 and throughout 2008 and 2009, the economic downturn had some impact on our business, reflected primarily in longer sales cycles, decreased sales and revenue growth and higher customer disconnections mostly by customers in our acquired customer base, other smaller customers, mortgage-related customers and carriers, that dampened our revenue growth. If current conditions persist or worsen, there is risk that customer disconnections may accelerate, bad debt could increase, prices and new sales may decline or sales may be delayed due to decreased demand for our services, customer cash flow constraints, customer credit deteriorations and other factors. Our operating results and financial condition could be materially and adversely affected if there were to be a material adverse change in any of these factors. The economic downturn could also amplify the effect on our results of normal fluctuations in our revenue, margins and cash flow due to the timing of sales and installations, disputes and dispute resolutions and pricing declines upon contract renewals and seasonality in sales and usage-based services. In addition, the economic downturn could also impact key vendors that supply critical equipment and software or other goods and services that we rely upon in the provision of our services. There is no assurance that we could replace key products or services with alternate providers on a timely basis if our key vendors face a financial crisis.

We may be unable to sustain our revenue and cash flow growth despite the implementation of several initiatives designed to do so.

We must grow our business and revenue in order to generate sufficient cash flow that, together with funds available under our credit facility, will be sufficient to fund our capital expenditures and our debt service requirements. We have pursued several growth initiatives, including:

| • | Increasing network investments in existing markets to expand our network reach; |

| • | Launching new products and services, especially products and services that support customers’ data and IP needs; |

| • | Customer care initiatives targeted at customer retention activities; |

| • | Enhancing our ability to compete for multi-location customers; |

| • | Increasing our network reach through acquisitions; |

| • | Increasing sales force productivity; and |

| • | Advancing our network and systems to create increased efficiencies, capabilities and customer control over their services. |

Our ability to manage this expansion depends on many factors, including our ability to:

| • | Attract new customers and sell new services to existing customers; |

| • | Acquire and install transmission facilities and related equipment at reasonable costs; |

| • | Employ new technologies; |

| • | Obtain required permits and rights-of-way; |

| • | Enhance our financial, operating, and information systems to effectively manage our growth; |

| • | Accurately predict and manage the cost and timing of our capital expenditure programs; and |

| • | Remain competitive against much larger, better-funded incumbent carriers. |

There is no assurance that our growth initiatives will continue to result in an improvement in our financial position or our results of operations. Prior to 2009, we incurred net losses even during periods of increasing revenue. Although we had net income in 2009, certain factors could cause losses including, among others, economic conditions, industry consolidations, decreased demand, customers disconnecting services, regulatory and contractual rate reductions, revenue disputes, significant increases in our special access costs due to adverse

17

Table of Contents

regulatory changes or otherwise, increases in federal or state tax expense and changes in accounting standards (see Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recently Adopted Accounting Pronouncements”).

Our revenue, margins and cash flow are subject to fluctuations that may be magnified by impact of the current or a future economic downturn.

We have historically experienced and expect to continue to experience fluctuations in our revenue, margins, and cash flow in the normal course of business from customer and service disconnections, the timing of sales and installations, including seasonality of sales and usage, customer and carrier disputes and dispute resolutions, repricing of services upon contract renewals, and expenses and capital expenditures. The current economic climate may magnify the impacts of these factors. However, we cannot predict the total impact on revenue, margins, and cash flows from these items.

Several customers account for a significant portion of our revenue, and some of our customers may disconnect their services due to customer consolidations, financial difficulties or other factors.

We have substantial business relationships with a few large customers, especially other carriers. For the year ended December 31, 2009, our top 10 customers accounted for approximately 21% of our total revenue. The highly competitive environment in the long haul carrier sector, including interexchange carriers, has challenged the financial condition and growth prospects of some of our carrier customers and could lead to reductions in our revenue in the future.

Our service agreements with customers that have already satisfied their initial terms are subject to termination by the customer on short notice and do not require the customer to maintain the services at current levels. After expiration of their current agreements, customers may not choose to continue to purchase the same services or level of services. Increasing consolidation in the telecommunications industry has occurred in recent years, and if any of our customers are acquired we may lose a significant portion of their business.

Average lost recurring monthly billing from customers’ partial or complete service disconnections was 1.3%, 1.2%, and 1.1% of total monthly revenue in 2009, 2008 and 2007, respectively. We continue to experience customer and service disconnections in the normal course of business primarily associated with industry consolidation, customer network optimization, cost cutting, business contractions, customer financial difficulties, discontinuance of certain acquired products or price competition from other providers. We believe that the economic downturn contributed to an increase in churn beginning in late 2007 and throughout 2008 and 2009. We expect revenue churn to remain elevated at least until the economy recovers and to continue to pressure revenue growth. While we expect that some customers will continue to disconnect services for the reasons mentioned above, we cannot predict the total impact on revenue from these disconnections or the timing of such disconnections. Replacing this revenue with new revenue from other customers may be difficult. Among other factors, individual enterprise customers tend to place smaller service orders than some of our larger carrier customers. In addition, pricing pressure on some of our services, particularly with respect to smaller bandwidth customers with single-site needs and very large customers, as well customers’ heightened cost cutting initiatives due to the economy, may challenge our ability to grow our revenue. In addition, we expect revenue will continue to be impacted by pricing declines to current levels for some existing customers that renew services with expired terms.

The market for our services is highly competitive, and many of our competitors have significant advantages that may adversely affect our ability to compete with them.

We operate in an increasingly competitive environment and some companies may have competitive advantages over us. Most ILECs offer substantially the same services as we offer, in some cases at higher prices and in some cases at lower prices. ILECs benefit from:

| • | Their name recognition; |

| • | Greater financial and technical resources; |

18

Table of Contents

| • | Broader network coverage; |

| • | The ability to bundle and subsidize services that compete with ours from other services; and |

| • | Regulatory decisions that decrease regulatory oversight of ILECs. |

Consolidations involving ILECs, CLECs and others may result in fewer, but much larger and more effective competitors. We also face competition from other CLECs and cable television companies. Our revenue and margins may also be reduced from price cutting by other telecommunications service providers that may pressure our pricing or require us to adjust prices for existing services upon contract renewals. In the past year, our revenue was impacted by competitive pricing pressure from other telecommunications service providers on certain products such as integrated service bundles for small customers, high capacity Internet access and inter-city POP to POP dedicated services. In some of the markets in which we operate we may experience intense competition for particular customers, which could adversely affect our future revenue and margins.

If we do not adapt to rapid changes in the telecommunications industry and continue to offer services that satisfy customers’ needs, we could lose customers or market share.

The telecommunications industry continues to experience rapid and significant changes in technologies and architectures to deliver new services to customers. We expect that trend to continue into the foreseeable future. Additionally, we expect that these new technologies will enable new applications that will facilitate new services both in our networks as well as at customers’ premises. We believe that our future success will depend in part on our ability to anticipate or adapt to these changes and integrate them into the infrastructure and operations of our business, in order to offer services that meet customer needs and demands on a timely basis. Our failure to obtain and integrate new technologies and applications and other factors could impact the breadth of our service portfolio resulting in gaps, a less differentiated service suite and a less compelling offering to customers, which could have a material adverse impact on our business, financial condition and results of operations.

Our substantial existing debt and debt service requirements could impair our financial condition and our ability to fulfill our obligations under our debt.

As of December 31, 2009, our total long term debt and capital lease obligations were approximately $1.3 billion. Our level of debt may affect our operations and our ability to make payments on our outstanding indebtedness. Subject to certain covenants in our credit agreement and the indentures for our outstanding senior notes, we may incur significant additional indebtedness in the future.

Our substantial indebtedness could, for example:

| • | Limit our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions or other corporate purposes; |

| • | Make us more vulnerable to the current and future economic downturns or other adverse developments than less leveraged competitors; and |

| • | Decrease our ability to withstand competitive pressures. |

Our revolving credit facility, Term Loan B and the indenture relating to our senior notes contain restrictive covenants that may limit our flexibility, and breach of those covenants may cause us to be in default under those agreements.

The credit agreement for our revolving credit facility, Term Loan B (“Term Loan”), and the indenture relating to our senior notes limit, and in some circumstances prohibit, our ability to, among other things:

| • | Incur additional debt; |

| • | Pay dividends; |

19

Table of Contents

| • | Make capital expenditures, investments or other restricted payments; |

| • | Engage in sale-leaseback transactions; |

| • | Engage in transactions with stockholders and affiliates; |

| • | Guarantee debts; |

| • | Create liens; |

| • | Sell assets; |

| • | Repurchase our common stock; and |

| • | Engage in mergers and acquisitions. |

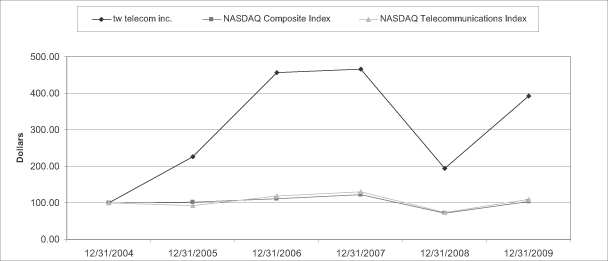

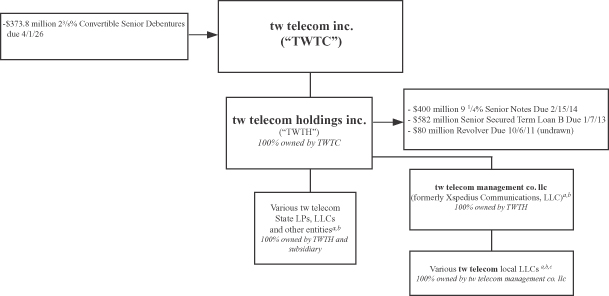

These restrictions could limit our ability to obtain future financing, make acquisitions or needed capital expenditures, withstand the current or future economic downturns, conduct operations or otherwise take advantage of business opportunities that may arise. In addition, if we do not comply with these restrictions and financial covenants in our credit agreement that require us to maintain certain minimum financial ratios if we draw on our revolving credit facility, the indebtedness outstanding under our credit agreement, and by reason of cross-acceleration or cross-default provisions, our senior notes and any other outstanding indebtedness we may then have, could become immediately due and payable. If we are unable to repay those amounts, the lenders under the credit agreement could initiate a bankruptcy proceeding or liquidation proceeding or proceed against the collateral granted to them to secure that indebtedness. If the lenders under our credit agreement were to accelerate the repayment of outstanding borrowings, we might not have sufficient assets to repay our indebtedness.