Attached files

| file | filename |

|---|---|

| 8-K - Rosca, Inc. | form8k.htm |

| EX-99.2 - Rosca, Inc. | proformafinancials.htm |

SECURE

PATH TECHNOLOGY, LLC.

(A

DEVELOPMENT-STAGE COMPANY)

NOTES

TO FINANCIAL STATEMENTS

SECURE

PATH TECHNOLOGY LLC

TABLE

OF CONTENTS

PAGE #

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM F-2

CONSOLIDATED

BALANCE

SHEETS F-3

CONSOLIDATED

STATEMENTS OF OPERATIONS F-4

CONSOLIDATED

STATEMENT OF MEMBERS’ EQUITY (DEFICIT) F-5

CONSOLIDATED

STATEMENTS OF CASH FLOWS

F-6

NOTES

TO CONSOLIDATED FINANCIAL

STATEMENTS F-7

F-1

SECURE

PATH TECHNOLOGY, LLC.

(A

DEVELOPMENT-STAGE COMPANY)

NOTES

TO FINANCIAL STATEMENTS

REPORT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board

of Directors and Members

Secure

Path Technology LLC

We have

audited the accompanying consolidated balance sheets of Secure Path Technology

LLC and subsidiary (collectively the “Company”) as of June 30, 2009 and 2008,

and the related consolidated statements of operations, member’ equity (deficit),

and cash flows for the years then ended. These consolidated financial statements

are the responsibility of the Company’s management. Our responsibility is to

express an opinion on these consolidated financial statements based on our

audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we plan

and perform the audit to obtain reasonable assurance about whether the

consolidated financial statements are free of material misstatement. The Company

was not required to have, nor were we engaged to perform, an audit of its

internal control over financial reporting. Our audits included consideration of

internal control over financial reporting as a basis for designing audit

procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the Company’s internal control

over financial reporting. Accordingly, we express no such opinion. An audit also

includes examining, on a test basis, evidence supporting the amounts and

disclosures in the consolidated financial statements, assessing the accounting

principles used and significant estimates made by management, as well as

evaluating the overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

In our

opinion, the consolidated financial statements referred to above present fairly,

in all material respects, the financial position of Secure Path Technology LLC

and subsidiary as of June 30, 2009 and 2008, and the results of their operations

and their cash flows for the years then ended, in conformity with accounting

principles generally accepted in the United States of America.

The

accompanying consolidated financial statements have been prepared assuming the

Company will continue as a going concern. As discussed in Note 2 of the

consolidated financial statements, the Company has incurred losses since

inception, and has significant working capital and accumulated

deficits. These factors raise substantial doubt about the Company's

ability to continue as a going concern. Management's plans with

respect to these matters are also discussed in Note 2. The consolidated

financial statements do not include any adjustments that might result from the

outcome of this uncertainty.

|

Newport

Beach, California

|

|

|

January

6, 2010

|

F-2

SECURE

PATH TECHNOLOGY LLC

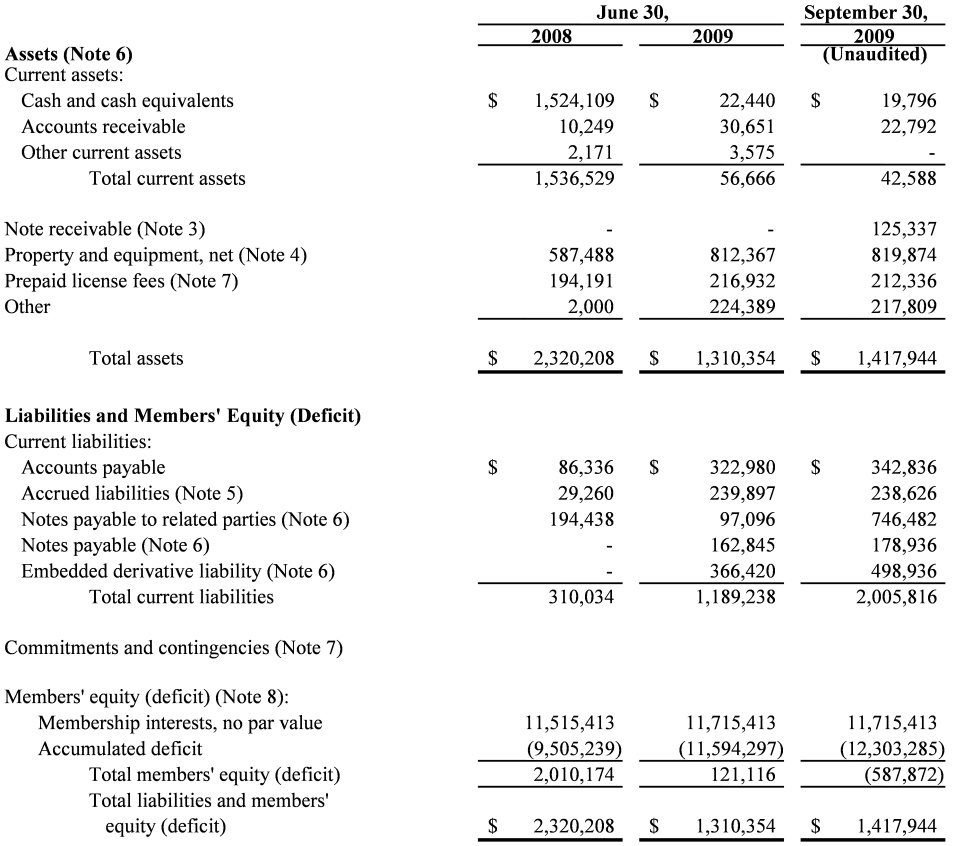

CONSOLIDATED

BALANCE SHEETS

See notes

to accompanying consolidated financial statements

F-3

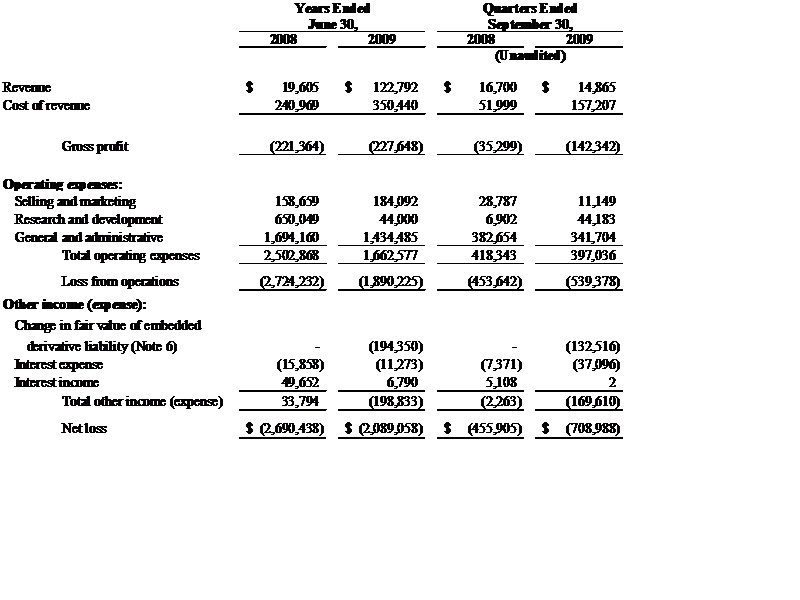

SECURE

PATH TECHNOLOGY LLC

CONSOLIDATED

STATEMENTS OF OPERATIONS

See notes

to accompanying consolidated financial statements

F-4

SECURE

PATH TECHNOLOGY LLC

CONSOLIDATED

STATEMENT OF MEMBERS’ EQUITY (DEFICIT)

YEARS

ENDED JUNE 30, 2008 AND 2009 AND QUARTER ENDED SEPTEMBER 30, 2009

See notes

to accompanying consolidated financial statements

F-5

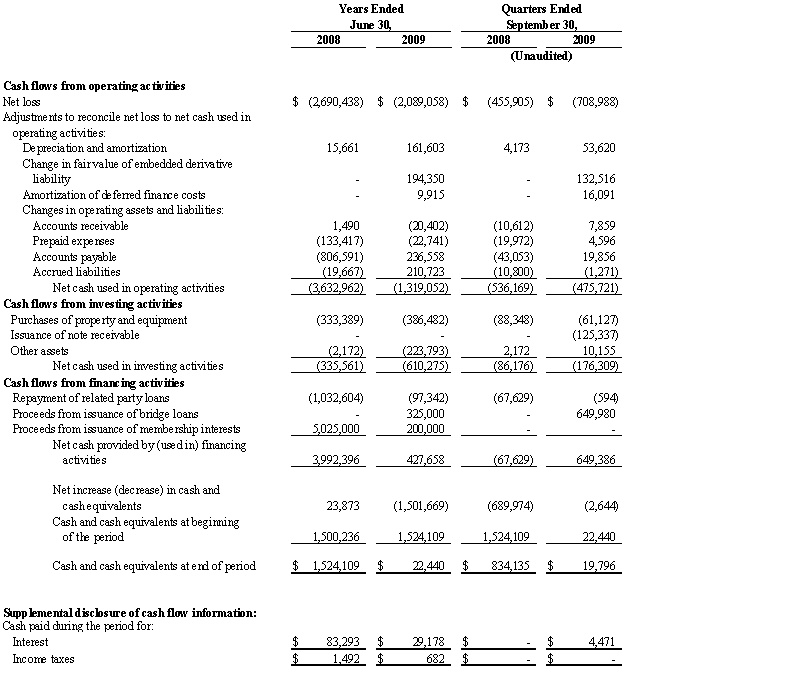

SECURE

PATH TECHNOLOGY LLC

CONSOLIDATED

STATEMENTS OF CASH FLOWS

See notes

to accompanying consolidated financial statements

F-6

SECURE

PATH TECHNOLOGY LLC

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

Note

1 – Nature of the Business

Secure

Path Technology LLC (formerly known as Secure Path Media LLC) is a California

limited liability company which was formed on November 29, 2005. The

Company conducts its operations primarily from facilities located in Los

Angeles, California.

Secure

Path Technology LLC and its 95% owned subsidiary, Media Metro LLC, a California

limited liability company (collectively the “Company”), is the primary

registration agency for the International Standard Audiovisual Number (“ISAN”)

in North America and is the exclusive global licensing agency providing

commercial access to the ISAN database.

ISAN is

an ISO (International Standards Organization) standard which provides a unique,

permanent and internationally recognized reference number for the identification

of every audiovisual work, including film, television, online and mobile

content, regardless of the format in which the work is distributed. The ISAN

code was developed to be the identifier for the audiovisual (“AV”) industry’s

supply chain, just as the International Standard Book Number (“ISBN”) code is

the unique identifier for publications and the foundation for all tracking for

the global publishing industry.

MediaDNS™

is the Company’s flagship technology offering that empowers content providers,

resource providers, and metadata consumers by supplying them with a synchronized

relationship to their metadata. This powerful tool can aggregate media data from

many sources, transform data into Master Data Records, and syndicate data to and

from many distribution points while reporting back critical metadata consumer

information. It is through this platform that the Company also provides

all ISAN related products and services.

The

Company commenced its intended operations providing audiovisual asset

registrations during the year ended June 30, 2008.

Note

2 – Summary of Significant Accounting Policies

Basis of

Presentation

The

Company has sustained significant losses since inception and has an accumulated

deficit of $12,303,285 and a working capital deficit of $1,963,228 as of

September 30, 2009. The Company’s ability to continue as a going

concern is dependent upon obtaining additional capital and financing, and

generating positive cash flows from operations. These factors raise substantial

doubt about the Company's ability to continue as a going

concern. Management intends to seek additional capital either through

debt or equity offerings and is attempting to increase sales

volume. The consolidated financial statements do not include any

adjustments relating to the recoverability and classification of asset carrying

amounts or the amount and classification of liabilities that might result should

the Company be unable to continue as a going concern.

F-7

Unaudited Interim Financial

Information

The

accompanying consolidated balance sheet as of September 30, 2009, the

consolidated statements of operations and cash flows for the quarters ended

September 30, 2008 and 2009, and the consolidated statement of members'

equity (deficit) for the quarter ended September 30, 2009 are unaudited.

The unaudited interim consolidated financial statements have been prepared on

the same basis as the annual consolidated financial statements and, in the

opinion of management, reflect all adjustments, which include only normal

recurring adjustments, necessary to present fairly the Company's consolidated

financial position, results of operations and cash flows for the quarters ended

September 30, 2008 and 2009. The financial data and other information

disclosed in these notes to the consolidated financial statements related to the

quarterly periods are unaudited. The results of the quarter ended

September 30, 2009 are not necessarily indicative of the results to be

expected for the year ending June 30, 2010 or for any other interim period or

for any other future year.

Principles of

Consolidation

The

accompanying consolidated financial statements include the accounts of the

Company and its majority-owned subsidiary, which is currently

inactive. All intercompany balances and transactions have been

eliminated in consolidation.

Estimates

The

preparation of consolidated financial statements in conformity with accounting

principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and the disclosure of contingent assets and liabilities

at the dates of the consolidated financial statements, and the reported amounts

of revenues and expenses during the reporting period. Actual results

could differ from those estimates. Assets and liabilities which are

subject to significant judgment and use of estimates include valuation

allowances with respect to recoverability of long-lived assets, useful lives

associated with property and equipment, and assumptions underlying an embedded

derivative liability. On an ongoing basis, Management evaluates its estimates

compared to historical experience and trends, which form the basis for making

judgments about the carrying value of assets and liabilities.

Fair Value of Financial

Instruments

The

carrying amounts (or in the case of notes payable, the face value) of cash and

cash equivalents, accounts receivable, accounts payable, accrued liabilities,

and notes payable approximate fair value because of the short-term maturity of

these items. Also see Recent Accounting Pronouncements

below.

Concentrations of Credit

Risk

Cash

and Cash Equivalents

Financial

instruments that potentially subject the Company to credit risk consist

principally of cash and cash equivalents and accounts receivable. The Company,

at times, maintains cash balances at financial institutions in excess of amounts

insured by United States government agencies or payable by the United States

government directly. The Company places its cash and cash equivalents with high

credit quality financial institutions.

F-8

Concentrations,

Credit and Allowances for Doubtful Accounts

The

Company provides credit in limited circumstances to customers throughout the

United States. In these instances, the Company performs limited credit

evaluations of its customers and does not obtain collateral with which to secure

its accounts receivable. Accounts receivable, if any, are reported net of an

allowance for doubtful accounts, which is management’s best estimate of

potential credit losses. The Company’s allowance for doubtful accounts is based

on historical experience, but management also takes into consideration customer

concentrations, creditworthiness, and current economic trends when evaluating

the adequacy of the allowance for doubtful accounts. Historically, Management

has not recorded an allowance.

Two

customers made up 52% of the Company’s accounts receivable as of June 30, 2008

and four customers made up 75% of the Company’s total revenue for the year ended

June 30, 2008. Three customers made up 40% of the Company’s accounts receivable

as of June 30, 2009 and one customer made up 20% of the Company’s total revenue

for the year ended June 30, 2009.

Three

customers made up 71% of the Company’s total revenue for the quarter ended

September 30, 2008. Four customers made up 65% of the Company’s

accounts receivable as of September 30, 2009 and three customers made up 62% of

the Company’s total revenue for the quarter ended September 30,

2009.

The

Company does not believe the loss or cancelation of business from these

customers would materially or adversely affect the Company’s consolidated

financial position, results of operations, or cash flows due to the minimal

amount of revenue and related receivables that have been earned to

date.

Risks and

Uncertainties

The

Company's operations are subject to new innovations in product and service

design and function. Significant technical changes can have an adverse effect on

the Company’s business model. Design, development, and adaptation of products

and services are important elements to achieve and maintain profitability in the

Company's business model.

Cash and Cash

Equivalents

The

Company considers all highly liquid investments purchased with a maturity of

three months or less to be cash equivalents. The Company had no cash

equivalents as of June 30, 2008 and 2009 and September 30, 2009.

Property and

Equipment

Property

and equipment are stated at cost, less accumulated depreciation and

amortization. Depreciation is computed using the straight-line method

over the estimated useful lives of the assets, which is three years for computer

equipment and five years for furniture, fixtures, and internal use

software. Maintenance and repairs are expensed as incurred.

Significant renewals and betterments are capitalized. When assets are

retired or otherwise disposed of, the cost and related accumulated depreciation

are removed from the accounts and any resulting gain or loss is reflected in the

Company’s consolidated results of operations.

F-9

Long-Lived

Assets

Long-lived

assets, which consist primarily of property and equipment, are reviewed for

impairment whenever events or changes in circumstances indicate that the

carrying amounts may not be recoverable. An impairment loss is

recognized when estimated undiscounted future cash flows expected to result from

the use of the asset and its eventual disposition are less than its carrying

value. If an asset is determined to be impaired, the impairment is

measured by the amount that the carrying value of the asset exceeds its fair

value. The Company uses quoted market prices in active markets to

determine fair value whenever possible. When quoted market prices are

not available, Management estimates fair value based on the best alternative

information available, which may include prices charged for similar assets or

other valuation techniques such as using cash flow information and present value

accounting measurements. As of June 30, 2008 and 2009 and September

30, 2009, there were no impairment charges identified on the Company’s

long-lived assets.

Internal Use

Software

Computer

software development costs are expensed as incurred, except for internal use

software development costs that qualify for capitalization as described below,

and include compensation and related expenses, costs of computer hardware and

software, and costs incurred in developing features and

functionality.

The

Company accounts for the costs of computer software obtained or developed for

internal use in accordance with Accounting Standards Codification 350, Intangibles – Goodwill and

Other (formerly Statement of Position No.

98-1). Accordingly, the Company expenses costs incurred in the

preliminary project and post implementation stages of software development and

capitalizes costs incurred in the application development stage and costs

associated with significant enhancements to existing internal use software

applications. Costs incurred related to less significant

modifications and enhancements as well as maintenance are expensed as

incurred.

As of

June 30, 2008 and 2009, the Company had capitalized internal use software costs

of $558,678 and $945,160, respectively. As of June 30, 2008, there

was no accumulated amortization in connection with these costs as the software

had not been placed into service. As of June 30, 2009, there was

$145,316 in accumulated amortization in connection with these

costs. As of September 30, 2009, the Company had $1,006,286 and

$195,884 in capitalized internal use software costs and related accumulated

amortization, respectively.

Capitalization of

Interest

The

Company capitalizes interest incurred in connection with the development of

internal use software, during the application development

stage. Capitalized interest is recorded as an increase to internal

use software included in property and equipment. The Company

capitalized $66,443 and $22,180 of interest during the years ended June 30, 2008

and 2009, respectively. The Company did not capitalize any interest

during the quarter ended September 30, 2008, but did capitalize $4,461 during

the quarter ended September 30, 2009.

F-10

Revenue

Recognition

The

Company currently derives its revenue from fees charged to customers for the

registration of audiovisual works. These registration fees are due at

the time the registration is completed by the customer. The Company

recognizes revenue in accordance with Accounting Standards Codification 605,

Revenue Recognition

(formerly Staff Accounting Bulletin No. 104). Accordingly, the

Company recognizes revenue when (i) persuasive evidence of an arrangement

exists, (ii) delivery has occurred or services have been rendered, (iii) the

fees are fixed or determinable, and (iv) collectability is reasonably

assured. In general, the revenue recognition criteria are met at the

time the registration is completed. Prepayments for registrations

will be deferred, and revenues will recorded based on actual registrations to

the total estimated registrations over the contract period. If the

number of registrations cannot be reasonably estimated, revenue deferrals will

be amortized to revenues over the contract period on a straight-line

basis.

Revenue

is recognized net of estimated sales returns and allowances. If

actual sales returns and allowances are greater than estimated by management,

additional expense may be incurred. In determining the estimate for

sales allowances, the Company relies upon historical experience and other

factors, which may produce results that vary from estimates. To date, the

estimated sales returns and allowances have varied within ranges consistent with

management's expectations and have not been significant.

Cost of

Revenue

Cost of

revenue primarily consists of expenses relating to licenses, royalties, and

depreciation on property and equipment.

Research and

Development

Research

and development costs on the accompanying consolidated statements of operations

were $650,049 and $44,000 for the years ended June 30, 2008 and 2009,

respectively, and $6,902 and $44,183 for the quarters ended September 30, 2008

and 2009, respectively.

Selling and

Marketing

Selling

and marketing consists of those costs which are related to personnel, marketing,

public relations, advertising, and other promotional activities. All

advertising costs are expensed as incurred. The Company had no

advertising costs for the years ended June 30, 2008 and 2009, or for the

quarters ended September 30, 2008 and 2009.

General and

Administrative

The

Company's general and administrative expenses relate primarily to the

compensation and associated costs for general and administrative personnel,

professional fees, and other general overhead and facility costs.

F-11

Stock-Based

Compensation

The

Company recognizes stock-based compensation expense related to employee option

and restricted stock grants in accordance with Accounting Standards

Codification 718 Compensation – Stock

Compensation (“ASC 718”), (formerly Statement of Financial Accounting

Standards (“SFAS”) No. 123(R)). This standard requires the

Company to record compensation expense equal to the fair value of awards granted

to employees.

The

Company determines the fair value of share-based payment awards on the

grant-date using the Black-Scholes option pricing model.

Compensation

expense for non-employee stock-based awards will also be recognized in

accordance with ASC 718 (formerly Emerging Issues Task Force

No. 96-18). Stock option awards issued to non-employees will be

accounted for at fair value using the Black-Scholes option-pricing

model. The Company will record compensation expense based on the

then-current fair values of the stock options at each financial reporting

date. Compensation recorded during the service period will be

adjusted in subsequent periods for changes in the stock options’ fair value

until the earlier of the date at which the non-employee’s performance is

complete or a performance commitment is reached, which is generally when the

stock vests.

Income

Taxes

The

Company’s members are taxed on their proportional share of the Company’s taxable

income or loss. For state tax purposes, in addition to taxation at the

member level, the Company is taxed at 1.5% of net income or the minimum tax of

$800, whichever is greater. Accordingly, the accompanying consolidated

financial statements do not include a provision for income taxes.

Recent Accounting

Pronouncements

Accounting

Standards Codification

In June

2009, the Financial Accounting Standards Board (“FASB”) issued SFAS No.

168, The FASB Accounting

Standards Codification and the Hierarchy of Generally Accepted Accounting

Principles, which has been codified into Accounting Standards

Codification 105. This guidance establishes the FASB Accounting Standards

Codification (the “Codification”) as the single source of authoritative,

nongovernmental generally accepted accounting principles in the United States of

America (“U.S. GAAP”). The Codification did not change U.S. GAAP. All existing

accounting standards were superseded and all other accounting literature not

included in the Codification is considered non-authoritative. This guidance is

effective for interim and annual periods ending after September 15, 2009.

Accordingly the Company has adopted this guidance during the quarter ended

September 30, 2009. The adoption did not have a significant impact on the

Company’s consolidated results of operations, cash flows, or financial

position.

F-12

Accounting

for Uncertainty in Income Taxes

In

July 2006, the FASB issued Interpretation No.48, Accounting for Uncertainty in Income

Taxes, which has been codified into Accounting Standards Codification

740. This pronouncement clarifies the accounting for uncertainty in

income taxes recognized in the financial statements. This

pronouncement also provides a recognition threshold and measurement process for

recording in the financial statements uncertain tax positions taken or expected

to be taken in the Company’s tax return. This standard further provides guidance

on derecognition, classification, interest and penalties, accounting in interim

periods and disclosure requirements for uncertain tax

positions. These new accounting standards were to become effective

for the Company beginning July 1, 2008; however, the FASB deferred the

effective date until July 1, 2009. The adoption did not have a

significant impact on the Company’s consolidated results of operations, cash

flows, or financial position.

Embedded

Derivatives

In April

2008, the Emerging Issues Task Force reached a consensus on Issue No. 07-5,

Determining whether an

Instrument (or Embedded Feature) Is Indexed to an Entity's Own Stock,

which has been codified into Accounting Standards Codification

815. This pronouncement applies to any freestanding financial

instruments or embedded features that have the characteristics of a derivative,

as defined by SFAS No. 133, and to any freestanding financial instruments that

are potentially settled in an entity's own common stock. The new

accounting standard is effective for financial statements issued for fiscal

years beginning after December 15, 2008. The adoption did not have

significant impact on the Company’s consolidated results of operations, cash

flows, or financial position.

Fair

Value Measurements

Effective

July 1, 2008, the Company adopted SFAS No. 157, Fair Value Measurements, which has been

codified into Accounting Standards Codification 820 (“ASC 820”). This

standard defines fair value, establishes a framework for measuring fair value,

establishes a fair value hierarchy based on the quality of inputs used to

measure fair value and enhances disclosure requirements for fair value

measurements. The implementation of this guidance did not change the method

of calculating the fair value of assets or liabilities. The primary impact

from adoption was additional disclosures. The portion of this guida nce

that defers the effective date for one year for certain non-financial assets and

non-financial liabilities measured at fair value, except those that are

recognized or disclosed at fair value in the financial statements on a recurring

basis, was implemented July 1, 2009, and did not have an impact on the

Company’s consolidated results of operations, cash flows, or financial

position.

F-13

Fair

value is defined as the exchange price that would be received for an asset or

paid to transfer a liability (an exit price) in the principal or most

advantageous market for the asset or liability in an orderly transaction between

market participants on the measurement date. Valuation techniques used to

measure fair value must maximize the use of observable inputs and minimize the

use of unobservable inputs. ASC 820 describes a fair value hierarchy based on

three levels of inputs, of which the first two are considered observable and the

last unobservable, that may be used to measure fair value which are the

following:

· Level

1—Quoted prices in active markets for identical assets or

liabilities.

|

·

|

Level

2—Inputs other than Level 1 that are observable, either directly or

indirectly, such as quoted prices for similar assets or liabilities;

quoted prices in markets that are not active; or other inputs that are

observable or can be corroborated by observable market data for

substantially the full term of the assets or

liabilities.

|

|

·

|

Level

3—Unobservable inputs that are supported by little or no market activity

and that are significant to the fair value of the assets or

liabilities.

|

As of

June 30, 2009 and September 30, 2009, the Company had no Level 1, 2, or 3

financial assets, nor did it have any financial liabilities, except for an

embedded derivative liability which is reflected at fair value on the

accompanying consolidated balance sheets. The following table

summarizes the changes in Level 3 financial instruments measured at fair value

on a recurring basis for the year ended June 30, 2009 and the quarter ended

September 30, 2009:

[Missing Graphic Reference]

The

Company determined the fair value of the embedded derivative liability using a

discounted cash flow model, the assumptions for which are more thoroughly

described in Note 6.

Purchase

Method of Accounting for Business Combinations

In

December 2007, the FASB issued SFAS No. 141 (Revised 2007), Business Combinations, which

has been codified into Accounting Standards Codification 805. This guidance

retains the purchase method of accounting for acquisitions, but requires a

number of changes, including changes in the way assets and liabilities are

recognized in the purchase accounting as well as requiring the expensing of

acquisition-related costs as incurred. Additionally, it provides guidance for

recognizing and measuring the goodwill acquired in the business combination and

determines what information to disclose to enable users of the financial

statements to evaluate the nature and financial effects of the business

combination. Furthermore, this guidance requires any adjustments to acquired

deferred tax assets and liabilities occurring after the related allocation

period to be made through earnings for both acquisitions occurring prior and

subsequent to its effective date. This guidance is to be applied prospectively

by the Company to business combinations beginning July 1,

2009. The adoption did not have a significant impact on

the Company’s consolidated results of operations, cash flows, or financial

position.

F-14

Noncontrolling

Interests

In

December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in

Consolidated Financial Statements – an amendment of ARB No. 51,

which has been codified into Accounting Standards Codification 810. This

guidance establishes new accounting and reporting standards for the

noncontrolling interest in a subsidiary and for the deconsolidation of a

subsidiary. The standard also clarifies that changes in a parent’s

ownership interest in a subsidiary that do not result in deconsolidation are

equity transactions if the parent retains its controlling financial interest and

requires that a parent recognize a gain or loss in net income when a subsidiary

is deconsolidated. The gain or loss will be measured using the fair

value of the noncontrolling equity investment on the deconsolidation

date. Moreover, the standard includes expanded disclosure

requirements regarding the interests of the parent and its noncontrolling

interest. The new guidance is effective for the Company beginning

July 1, 2009. Early adoption is prohibited, but upon adoption,

the standard requires the retroactive presentation and disclosure related to

existing minority interests. The adoption did not have a

significant impact on the Company’s consolidated results of operations, cash

flows, or financial position.

Subsequent

Events

In May

2009, the FASB issued SFAS No. 165, Subsequent Events, which has

been codified into Accounting Standards Codification 855. The

guidance includes new terminology for considering subsequent events and has

required disclosure on the date through which an entity has evaluated subsequent

events. The standard is effective for interim or annual periods

ending after June 15, 2009. The adoption did not have a

significant impact on the Company’s consolidated results of operations, cash

flows, or financial position.

Note

3 – Note Receivable

As of

September 30, 2009, the Company had a note receivable from ISAN in the amount of

$125,337 (the “ISAN Note”). The ISAN Note is non-interest bearing and

is due no later than December 31, 2015. The terms of the ISAN Note

provide for interim principal payments from the excess profits of ISAN, as

defined, beginning with the year ending December 31, 2010.

Note

4 – Property and Equipment

Property

and equipment consists of the following:

[Missing Graphic Reference]

F-15

During

the years ended June 30, 2008 and 2009, the Company recorded depreciation and

amortization expense of $15,661 and $161,603, respectively. During

the quarters ended September 30, 2008 and 2009, the Company recorded

depreciation and amortization expense of $4,173 and $53,620,

respectively.

The

Company’s property and equipment are used as collateral to Bridge Loans, as

stated in Note 6.

Note

5 – Accrued Liabilities

Accrued

liabilities consists of the following:

[Missing Graphic Reference]

Note

6 – Notes Payable

Notes

Payable to Related Parties

On March

14, 2006, the Company recorded a liability for a loan in the amount of

$2,350,000 from a company that is considered a related party. The

loan included (i) certain Secure Path expenses which were paid by the related

party on behalf of the Company, and (ii) cash proceeds which were advanced to

the Company. This note was recorded as a current liability as it was

due on demand. This note bears interest at 17.5% per annum and no

interim principal or interest payments are required. As of June 30,

2008 and 2009, there was $194,438 and $97,096 outstanding under the loan,

respectively. As of September 30, 2009, there was $96,502 outstanding

under the loan. There are no scheduled future minimum annual

principal payments.

Between

July 1, 2009 and September 25, 2009, the Company raised cash proceeds of

$649,980 by securing demand loans from related parties. These demand

loans bear interest at 8% per annum and are due on demand at the close of a

contemplated merger (see Note 9). There are no provisions for interim

principal or interest payments.

Bridge

Note

The

Company entered into a loan agreement on April 27, 2009 to obtain $325,000 in

bridge financing from an unrelated party (the “Note”). The terms of

the loan provided for interest at 8% per annum for the first three months, after

which time the interest rate would increase to 24% per

annum. Interest is compounded monthly. The Note matures at the

earlier of (i) April 20, 2011 or (ii) the date of certain defined events such as

a sale of the Company or a qualified financing. All principal and

accrued interest are due at maturity; there are no provisions for interim

principal or interest payments. The Note is collateralized by

substantially all of the assets of the Company.

F-16

Under the

terms of the Note, there was a provision which would entitle the lender to

receive a cash payment of $975,000 if certain events occurred such as a sale of

the Company or a qualified financing, as defined (the “Payment”). The

Payment would include the original principal amount of $325,000, the accrued and

unpaid interest at the contractual rate, and an additional interest amount as a

result of the occurrence of the defined event. The Company determined

that the Note contained an embedded derivative under Accounting Standard

Codification 815 (“ASC 815”), Derivatives and Hedging

(formerly SFAS No. 133, as amended), primarily as a result of the potential for

a scenario where the interest rate would at least double the lenders initial

rate of return. Accordingly, Management determined the fair value of

the derivative feature and recorded an embedded derivative liability on the

accompanying consolidated balance sheet based on the relative fair values of the

Note and the embedded derivative. Management will record any

increases or decreases in the fair value of the embedded derivative liability at

each reporting date as other income (expense). The Company is

amortizing the difference between the $325,000 face value of the Note and its

$152,930 initial carrying value to interest expense under the effective interest

method through the contractual maturity date of April 20,

2011. During the year ended June 30, 2009 and the quarter ended

September 30, 2009, the Company recognized interest expense of $9,915 and

$16,091, respectively, due to the accretion of the note discount. To date, there

have been no principal or interest payments made under the Note

agreement.

The

Company determined the fair value of the embedded derivative liability using a

discounted cash flow model with the following significant

assumptions:

Note

7 – Commitments and Contingencies

Operating

Leases

The

Company leases its office space under a month-to-month operating lease agreement

which can be terminated at any time.

Rent

expense for the years ended June 30, 2008 and 2009 was $26,943 and $30,418,

respectively. Rent expense for the quarters ended September 30, 2008

and 2009 was $9,228 and $10,410, respectively.

ISAN

Licensing Agreement

The

Company has entered into various license agreements with ISAN whereby the

Company has rights to (i) execute registrations of audiovisual works with ISAN,

(ii) access the ISAN database, and (iii) distribute certain ISAN data, as

defined. Under the ISAN license agreement, the Company is required to

make license fee payments on a quarterly basis. These license fees

include (i) a fixed quarterly license fee and (ii) 5% of net

sales. In connection with the licensing agreement, the Company was

required to make certain license fee prepayments to which the 5% variable

license fee obligation could be applied. As of June 30, 2008 and 2009

and September 30, 2009, the Company had recorded prepaid license fees of

$194,191, $216,932, and $212,336 on the accompanying consolidated balance

sheets, respectively.

F-17

On July

1, 2009, the Company entered into an additional international license agreement

with ISAN to expand its license rights. As of July 1, 2009, the

license agreements collectively provide for (i) fixed quarterly license fees and

(ii) 10% of net sales under the international license agreement. As

of July 1, 2009, the following table reflects the minimum future license fee

payments which are required under the ISAN license agreements for each of the

fiscal years ending June 30:

[Missing Graphic Reference]

In

connection with the additional license entered into on July 1, 2009, the Company

capitalized $197,389 as of June 30, 2009, which is included in other assets in

the accompanying balance sheet. Costs are being amortized over 90

months. During the quarter ended September 30, 2009, company

recognized $6,580 in amortization expense. The remaining capitalized

legal costs as of September 30, 2009 are $190,809.

Legal

Proceedings

The

Company is aware of a former service provider that may claim it is due

consideration in connection with the merger. Management believes that if it must

enter into a settlement with such service provider, the maximum liability should

not exceed $40,000.

From time

to time, the Company may become subject to legal proceedings, claims and

litigation arising in the ordinary course of business. The Company is

not currently a party to any material legal proceedings, nor is the Company

aware of any pending or threatened litigation that would have a material adverse

effect on the Company’s business, consolidated operating results, cash flows or

financial position should such litigation be resolved unfavorably.

Indemnifications

In the

ordinary course of business, the Company may provide indemnifications of varying

scope and terms to customers, vendors, lessors, investors, directors, officers,

employees and other parties with respect to certain matters, including, but not

limited to, losses arising out of the Company’s breach of such agreements,

services to be provided by the Company, or from intellectual property

infringement claims made by third-parties. These indemnifications may

survive termination of the underlying agreement and the maximum potential amount

of future payments the Company could be required to make under these

indemnification provisions may not be subject to maximum loss

clauses. The maximum potential amount of future payments the Company

could be required to make under these indemnification provisions is

indeterminable. The Company has never paid a material claim, nor has

the Company been sued in connection with these indemnification

arrangements. As of June 30, 2008 and 2009 and September 30, 2009,

Management has not accrued a liability for these guarantees, because the

likelihood of incurring a payment obligation, if any, in connection with these

guarantees is not probable or reasonably estimable.

F-18

Note

8 – Members’ Equity

From

inception through June 30, 2007, the Company raised gross proceeds of $5,000,000

through the issuance of membership interests in Secure Path Technology

LLC. In addition, from inception through June 30, 2007, the Company

recorded stock-based compensation of approximately $1,490,000 related to

membership interests given to additional individuals for services

provided.

During

the years ended June 30, 2008 and 2009, the Company raised gross proceeds of

$5,025,000 and $200,000 through the issuance of additional membership interests,

respectively. As of June 30, 2008 and 2009 and September 30, 2009,

there were no limitations on the Company’s authorized capital.

Founder

Warrants

Pursuant

to the Company’s Amended and Restated Operating Agreement dated June 20, 2006,

the founders were authorized to receive rights to purchase membership interests

at a 20% discount from sales prices paid in the private placement discussed

above. The founder warrants were not acknowledged by the managing

members of the Company nor were the warrants issued upon completion of the

private placement of membership interests. The founder warrants were

never issued by the Company, and the founders waived all their rights to such

warrants.

Note

9 – Subsequent Events

Between

October 1, 2009 and December 11, 2009, the Company raised cash proceeds of

$210,533 by securing demand loans from related parties. These demand

loans bear interest at 8% per annum and are due on demand at the close of a

contemplated merger, more thoroughly described below. There are no

provisions for interim principal or interest payments.

On

December 17, 2009, the Company entered into an Agreement and Plan of Merger (the

“Merger Agreement”) with Rosca, Inc., a Nevada corporation

(“Rosca”). Under the Merger Agreement, the Company will be merged

with and into Rosca. The members of the Company will receive

4,650,000 shares of Rosca’s common stock in exchange for all of the outstanding

member interests in the Company. The merger will not be effective

until certain conditions have been met. These conditions, among other

things, include (i) Merger Agreement approval by the members of the Company,

(ii) approval by Rosca’s Board of Directors for issuance of Rosca’s common stock

as purchase consideration, and (iii) filing of Form 8-K with the United States

Securities and Exchange Commission, which, among other things, includes the

Company’s audited and unaudited consolidated financial

statements. The Merger Agreement may be terminated, among other

things, if certain conditions to closing have not been waived or met by January

31, 2010.

On

December 22, 2009, the Company received a $300,000 up-front payment in

connection with a three-year ISAN license agreement. The up-front

payment covers all ISAN and Version ISAN (“V-ISAN”) content and library content

registrations for the registrant, during the three-year period.

The

Company has evaluated subsequent events through January 6,

2010.

F-19