Attached files

| file | filename |

|---|---|

| EX-4.3 - EXHIBIT 4.3 - AURORA GOLD CORP | ex4_3.htm |

| EX-4.1 - EXHIBIT 4.1 - AURORA GOLD CORP | ex4_1.htm |

| EX-4.2 - EXHIBIT 4.2 - AURORA GOLD CORP | ex4_2.htm |

| EX-23.2 - EXHIBIT 23.2 - AURORA GOLD CORP | ex23_2.htm |

As

filed with the Securities and Exchange Commission on February 5,

2010

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Aurora

Gold Corporation

(Exact

name of registrant as specified in its charter)

|

Delaware

|

1040

|

13-3945947

|

||

|

(State

or Other Jurisdiction of incorporation or organization

|

(Primary

Standard Industrial Classification Code Number)

|

(IRS

Employer Identification Number)

|

|

Baarerstrasse

10, 1st

Floor, Zug

6300

Switzerland

Telephone:

(+41) 7887-96966

Facsimile: (+41)

44 274 2818

|

Lars

Pearl

Baarerstrasse

10, 1st

Floor, Zug

6300

Switzerland

Telephone:

(+41) 7887-96966

Facsimile: (+41)

) 44 274 2818

|

|

|

(Address,

including zip code and telephone number, including area code, of

registrant's principal executive offices)

|

(Address,

including zip code and telephone number, including area code, of agent for

service)

|

Copies of

all communications and notices to:

Joseph

Sierchio, Esq.

Sierchio

& Company, LLP

430

Park Avenue

7th

Floor

New

York, New York 10022

Telephone:

(212) 246-3030

Facsimile:

(212) 246-3039

Approximate date of commencement of

proposed sale to the public: As soon as practicable after this

Registration Statement becomes effective.

--------------------

If

any of the securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 of the Securities Act of 1933,

as amended, check here: S

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. £

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. £

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. £

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

Accelerated Filer

|

£

|

Accelerated

Filer

|

£

|

|

Non-accelerated

Filer

|

£ (Do not

check if a smaller reporting company)

|

Smaller

reporting company

|

S

|

Calculation

of Registration Fee

|

Securities

to be Registered

|

Number

of Shares Registered

|

Proposed

Maximum Offering Price Per Share (1)

|

Proposed

Maximum Offering Price (1)

|

Registration

Fee

|

|

Common

Stock Par Value $0.001

|

12,451,467

(2)

|

US$0.41

|

$5,105,101

|

$364

|

|

Total

|

12,451,467

(3)

|

$5,105,101

|

$364

|

(1)

Estimated solely for the purpose of computing the registration fee pursuant to

Rule 457(c) under the Securities Act of 1933; the closing sale price of our

stock on February 1, 2010, as quoted on the Pink Sheets was $0.41. It is not

known how many shares will be purchased under this registration statement or at

what price shares will be purchased.

(2) The

12,451,467 shares

were issued in private placements effected by the Registrant pursuant to

Regulation S as promulgated pursuant to the Securities Act of 1933 (the “Securities Act”) and Section

4(2) of the Securities Act prior to the filing of this registration

statement.

(3) All

of the 12,451,467 shares

being registered are offered by the Selling

Stockholders. Accordingly, this registration statement includes an

indeterminate number of additional shares of common stock issuable for no

additional consideration pursuant to any stock dividend, stock split,

recapitalization or other similar transaction effected without the receipt of

consideration, which results in an increase in the number of outstanding shares

of our common stock. In the event of a stock split, stock dividend or similar

transaction involving our common stock, in order to prevent dilution, the number

of shares registered shall be automatically increased to cover the additional

shares in accordance with Rule 416(a) under the Securities Act.

Registrant

hereby amends this registration statement on such date or dates as may be

necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall

thereafter become effective in accordance with section 8(a) of the Securities

Act, or until the registration statement shall become effective on such date as

the commission, acting under said section 8(a), may determine.

|

Subject

to Completion, Dated February 5, 2010

The

information in this Prospectus is not complete and may be changed. These

securities may not be sold until the registration statement filed with the

Securities and Exchange Commission is effective. This Prospectus is not an

offer to sell these securities and we are not soliciting offers to buy

these securities in any state where the offer or sales is not

permitted.

|

Prospectus

Aurora

Gold Corporation

12,451,467 Shares Common

Stock

This

Prospectus (the “Prospectus”) relates to the

resale by certain of our stockholders named in the section of this Prospectus

titled “Selling Stockholders” (the “Selling Stockholders”) of up

to 12,451,467 shares of

our common stock (the “Shares”). The Shares were

purchased by the Selling Stockholders in transactions with us pursuant to

exemptions from the registration requirements of the Securities Act of 1933 as

amended (the “Securities

Act”)

The

Selling Stockholders may sell common stock from time to time in the principal

market on which the stock is traded at the prevailing market price or in

negotiated transactions. The shares may be sold directly or through agents or

broker-dealers acting as agents on behalf of the Selling Stockholders. The

Selling Stockholders may engage brokers, dealers or agents, who may receive

commissions or discounts from the Selling Stockholders. The Selling Stockholders

and any underwriter, broker-dealer or agent that participates in the sale of the

shares or interests therein may be deemed "underwriters" within the meaning of

Section 2(11) of the Securities Act. Any discounts, commissions, concessions,

profit or other compensation any of them earns on any sale or resale of the

shares, directly or indirectly, may be underwriting discounts and commissions

under the Securities Act. The Selling Stockholders who are "underwriters" within

the meaning of Section 2(11) of the Securities Act will be subject to the

Prospectus delivery requirements of the Securities Act.

Our

common stock is presently quoted for trading under the symbol “ARXG.PK” on the

Pink OTC Markets Inc.’s over the counter Pink Sheets market (the “Pink Sheets”). On February 1,

2010 the closing price of the common stock, as reported on the Pink Sheets was

$0.41 per share. The Selling Stockholders have advised us that they will sell

the shares of common stock from time to time in the open market, on the Pink

Sheets, in privately negotiated transactions or a combination of these methods,

at market prices prevailing at the time of sale, at prices related to the

prevailing market prices, at negotiated prices, or otherwise as described under

the section of this Prospectus titled “PLAN OF

DISTRIBUTION.”

The

purchase of the shares offered through this Prospectus involves a high degree of

risk. Please refer to “RISK

FACTORS” beginning on page 6.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of this Prospectus. Any representation to the contrary is a criminal

offense.

The Date of This Prospectus Is

_____,

1

TABLE OF CONTENTS

|

Page

|

|

|

3

|

|

|

6

|

|

|

10

|

|

|

10

|

|

|

11

|

|

|

11

|

|

|

12

|

|

|

20

|

|

|

38

|

|

|

40

|

|

|

42

|

|

|

43

|

|

|

44

|

|

|

47

|

|

|

49

|

|

|

51

|

|

|

52

|

|

|

52

|

|

|

52

|

|

|

52

|

|

|

52

|

|

|

53

|

|

|

CONSOLIDATED

FINANCIAL STATEMENTS

|

F-1

TO F-27

|

You

should rely only on the information contained in this Prospectus. We have not

authorized anyone to provide you with different information. We are not making

an offer to sell these securities in any jurisdiction where the offer or sale is

not permitted. You should assume that the information contained in this

Prospectus is accurate as of the date on the front of this Prospectus only. Our

business, financial condition, results of operations and prospects may have

changed since that date.

Information

contained on our web site does not constitute part of this

Prospectus.

We

obtained statistical data and certain other industry forecasts used throughout

this Prospectus from market research, publicly available information and

industry publications. Industry publications generally state that they obtain

their information from sources that they believe to be reliable, but they do not

guarantee the accuracy and completeness of the information. Similarly, while we

believe that the statistical and industry data and forecasts and market research

used herein are reliable, we have not independently verified such data. We have

not sought the consent of the sources to refer to their reports or articles in

this Prospectus.

Prospectus Summary

This

summary contains material information about us and the offering which is

described in detail elsewhere in the Prospectus. Since it may not

include all of the information you may consider important or relevant to your

investment decision, you should read the entire Prospectus carefully, including

the more detailed information regarding our company, the risks of purchasing our

common stock discussed under "Risk Factors" on page 6, and

our financial statements and the accompanying notes.

Unless

the context otherwise requires, the terms “we,” “our,” “us,” the “Company” and

“Aurora Gold” refer to Aurora Gold Corporation, a Delaware corporation, and not

to the Selling Stockholders.

Our

Business

We were

incorporated under the laws of the State of Delaware on October 10, 1995, under

the name "Chefs Acquisition

Corp." Initially formed for the purpose of engaging in the food

preparation business, we redirected our business efforts in late 1995 following

a change of control, which occurred on October 30, 1995, to the acquisition,

exploration and, if warranted, the development of mineral mineralized material

properties. We changed our name to “Aurora Gold Corporation” on

August 20, 1996 to more fully reflect our mineralized material exploration

business activities.

Our

general business strategy is to acquire mineral properties either directly or

through the acquisition of operating entities. Our continued

operations and the recoverability of mineral property costs is dependent upon

the existence of economically recoverable mineral reserves, confirmation of our

interest in the underlying properties, our ability to obtain necessary financing

to complete the development and upon future profitable production.

Since

1996 we have acquired and disposed of a number of properties. We have not

established reserves on any of the properties that we owned or in which we have

or have had an interest.

We

currently have interest in four (4) properties none of which contain any

reserves. Please refer to “Description of Our Business and

Property.” We have no revenues, have sustained losses since inception,

have been issued a going concern opinion by our auditors and rely upon the sale

of our securities to fund operations. We will not generate revenues even if any

of our exploration programs indicate that a mineral deposit may exist on our

properties. Accordingly, we will be dependent on future financings in order to

maintain our operations and continue our exploration activities. Please refer to “RISK FACTORS.”

Our

principal and technical office, from which we conduct our exploration and

property acquisition activities, is located at Baarerstrasse 10, 1st

Floor, Zug 6300 Switzerland. The telephone number is

(+41) 7887-96966.

Risk

Associated With Our Business

The

search for valuable minerals as a business is extremely risky. We can provide

investors with no assurance that the exploration of any of the properties in

which we have or may acquire an interest will uncover commercially exploitable

mineral reserves. It is likely that such properties will not contain any

reserves and, in all likelihood, any funds spent on exploration will probably be

lost. In addition, problems such as unusual or unexpected geological formations

or other variable conditions are involved in exploration and, often result in

unsuccessful exploration efforts.

In

addition, due to our limited capital and mineralized materials, we are limited

in the amount of exploration work we can do. As a result, our already low

probability of successfully locating mineral reserves will be reduced

significantly further. Therefore, we may not find a commercial mineable ore

deposit prior to exhausting our funds. Furthermore, exploration costs may be

higher than anticipated, in which case, the risk of utilizing all of our funds

prior to locating any ore deposits shall be greatly increased. Factors that

could cause exploration costs to increase are: adverse conditions, difficult

terrain and shortages of qualified personnel. Please refer to “RISK FACTORS.”

The

Offering

Selling

Stockholders

The

12,451,467 shares

being offered hereby were issued to the Selling Stockholders in private

placements for cash and in consideration of debt settlement (collectively, the

“Private Placements”)

pursuant to an exemption from the registration requirements of the Securities

Act afforded by Regulation S as promulgated by the U.S. Securities and Exchange

Commission (the “SEC”). None of the

Selling Stockholders are affiliated with us. Please refer to “SELLING

STOCKHOLDERS.”

Securities

Being Offered

The

Selling Stockholders named in this Prospectus are offering for resale up to

12,451,467 shares

of our common stock to the public by means of this Prospectus. Although we have

agreed to pay the costs and expenses related to the preparation and filing of

the registration statement of which this Prospectus is part, we will receive

none of the proceeds from the sale of the shares by the Selling

Stockholders.

The

Selling Stockholders are offering an aggregate of 12,451,467 shares. These shares

constitute approximately 18.2% of our issued and outstanding common stock. The

Selling Stockholders holders will determine if, when, and how they will sell

the common stock offered in this Prospectus. Please refer to “Plan of

Distribution.” The offering will conclude upon the earlier to occur

of:

|

|

·

|

The

sale of all of the 12,451,467 shares of common

stock being offered;

|

|

|

·

|

The

second anniversary date of the effective date of this Prospectus;

or

|

|

|

·

|

The

earlier termination of the registration statement covering the shares

being offered.

|

Only the

shares of our common stock, issued to the Selling Stockholders in the Private

Placements have been registered by the registration statement of which this

Prospectus is a part. The Selling Stockholders may sell some or all of their

shares immediately after they are registered. Please refer to “PLAN OF

DISTRIBUTION.”

Number

of Shares Outstanding

At

January 31, 2010 we had 68, 408,522 shares issued and outstanding, inclusive of

the shares being offered by the Selling Stockholders. Our common stock is

currently quoted on the Pink Sheets under the symbol “ARXG.” There is only a limited

trading market for our common stock. Please refer to “Risk Factors” and to

“Market for Common Equity and Related Stockholder Matters.”

Selected

Financial Data

The

Company has not generated any operating revenues to date. Since incorporation it

has been inactive as far as mining activities are concerned. The

Company’s plans, funding requirements, sources and alternatives relating thereto

are presented and discussed in “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.”

The

following table sets forth, for the periods and the dates indicated selected

financial data for the Company. This information should be read in

conjunction with the Company's Audited Consolidated Financial Statements and

Notes thereto for the period ended December 31, 2008 and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations”

included elsewhere herein.

The

selected financial data provided below are not necessarily indicative of the

future results of operations or financial performance of the

Company. To date the Company has not paid any dividends on the Common

Shares and it does not expect to pay dividends in the foreseeable

future.

The

Financial Statements of the Company have been prepared in accordance with

accounting principles generally accepted in the United States ("US

GAAP").

|

FIVE

YEAR COMPARATIVE SUMMARY OF SELECTED FINANCIAL DATA

(expressed

in U.S. dollars)

|

||||||||||||||||||||

|

Period

Type

|

12

Months

|

12

Months

|

12

Months

|

12

Months

|

12

Months

|

|||||||||||||||

|

Fiscal

Year End

|

Dec

31, 2008

|

Dec

31, 2007

|

Dec

31, 2006

|

Dec

31, 2005

|

Dec

31, 2004

|

|||||||||||||||

|

Current

Assets

|

$ | 47,066 | $ | 27,165 | $ | 320,670 | $ | 197,640 | $ | 1,475 | ||||||||||

|

Total

Assets

|

136,039 | 161,708 | 423,471 | 198,319 | 5,412 | |||||||||||||||

|

Current

Liabilities

|

1,139,066 | 1,414,602 | 1,155,673 | 32,588 | 190,296 | |||||||||||||||

|

Long

term Liabilities

|

552,513 | - | - | - | - | |||||||||||||||

|

Common

Stock

|

12,168,850 | 11,987,650 | 9,183,355 | 4,618,355 | 3,805,855 | |||||||||||||||

|

Other

Equity

|

(13,724,390 | ) | (13,240,544 | ) | (9,915,557 | ) | (4,452,624 | ) | (3,990,739 | ) | ||||||||||

|

Total

Liabilities and Equity

|

136,039 | 161,708 | 423,471 | 198,319 | 5,412 | |||||||||||||||

|

Other

Expenses

|

520,105 | 3,259,732 | 5,463,855 | 457,271 | 223,763 | |||||||||||||||

|

Income

(Loss) Pre-tax

|

(520,105 | ) | (3,259,732 | ) | (5,463,855 | ) | (457,271 | ) | (223,763 | ) | ||||||||||

|

Net

Income (Loss)

|

(520,105 | ) | (3,259,732 | ) | (5,463,855 | ) | (457,271 | ) | (223,763 | ) | ||||||||||

|

EPS

Basic

|

(0.01 | ) | (0.07 | ) | (0.13 | ) | (0.02 | ) | (0.01 | ) | ||||||||||

|

EPS

Diluted

|

(0.01 | ) | (0.07 | ) | (0.13 | ) | (0.02 | ) | (0.01 | ) | ||||||||||

|

Common

Shares Issued and Outstanding

|

58,071,855 | 55,218,522 | 45,468,522 | 36,218,522 | 19,534,431 | |||||||||||||||

Risk Factors

You should carefully consider the

risks described below before purchasing any shares. Our most significant risks

and uncertainties are described below; if any of the following risks actually

occur, our business, financial condition, or results of operations could be

materially adversely affected, the trading of our common stock could decline,

and you may lose all or part of your investment therein. You should acquire the

shares only if you can afford to lose your entire investment. Our filings with

the Securities and Exchange Commission also contain forward-looking statements

that involve risks and uncertainties. Our actual results could differ materially

from those anticipated in these forward-looking statements as a result of

certain factors, including the risks we have described below. Please refer

to “Special Note

Regarding Forward-Looking Statements” on page <> of this

Prospectus.

Risks

Related to Our Business, Property and Industry

We

are an exploration stage company and have incurred substantial losses since

inception.

We have

never earned any revenues. In addition, we have incurred net losses of

$15,211,213 for the period from our inception (October 10, 1995) through

September 30, 2009 and, based upon our current plan of operation, we expect that

we will incur losses for the foreseeable future.

Potential

investors should be aware of the difficulties normally encountered by mineral

exploration companies and the high rate of failure of such companies. We are

subject to all of the risks inherent to an exploration stage business

enterprise, such as limited capital mineralized materials, lack of manpower, and

possible cost overruns associated with our exploration programs. Potential

investors must also weigh the likelihood of success in light of any problems,

complications, and delays that may be encountered with the exploration of our

properties.

Because

we are small and do not have much capital, we must limit our exploration

activity. As such we may not be able to complete an exploration program that is

as thorough as we would like. In that event, an existing ore body may go

undiscovered. Without an ore body, we cannot generate revenues and you will lose

your investment.

Our

independent registered public accounting firm has expressed substantial doubt

about our ability to continue as a going concern, which may hinder our ability

to obtain future financing.

Our

independent registered public accounting firm has issued its report, which

includes an explanatory paragraph for going concern uncertainty on our

consolidated financial statements as of and for the year ended December 31,

2008. Because we have not yet generated revenues from our operations our ability

to continue as a going concern is currently heavily dependent upon our ability

to obtain additional financing to sustain our operations. Such financing may

take the form of the issuance of common or preferred stock or debt securities,

or may involve bank financing. Although we have completed several equity

financings, the fact that our auditors have issued a “going concern” opinion may

hinder our ability to obtain additional financing in the future. Currently, we

have no commitments to obtain any additional financing, and there can be no

assurance that financing will be available in amounts or on terms acceptable to

us, if at all.

Because

we do not have any revenues, we expect to incur operating losses for the

foreseeable future.

We have

never generated revenues and we have never been profitable. Prior to completing

exploration on our mineral properties, we anticipate that we will incur

increased operating expenses without realizing any revenues. We therefore expect

to incur significant losses into the foreseeable future. If we are unable to

generate financing to continue the exploration of our properties, we will fail

and you will lose your entire investment in this offering.

None

of the properties in which we have an interest or the right to earn an interest

have any known reserves.

We

currently have an interest or the right to earn an interest in five (5)

properties, none of which have any reserves. Based on our exploration

activities through the date of this Prospectus, we do not have sufficient

information upon which to assess the ultimate success of our exploration

efforts. If we do not establish reserves we may be required to

curtail or suspend our operations, in which case the market value of our common

stock may decline and you may lose all or a portion of your

investment.

We have

only completed the initial stages of exploration of our properties, and thus

have no way to evaluate whether we will be able to operate our business

successfully. To date, we have been involved primarily in organizational

activities, acquiring interests in properties and in conducting preliminary

exploration of properties. We have not earned any revenues and have not achieved

profitability as of the date of this Prospectus.

We

are subject to all the risks inherent to mineral exploration, which may have an

adverse affect on our business operations.

Potential

investors should be aware of the difficulties normally encountered by mineral

exploration companies and the high rate of failure of such enterprises. The

likelihood of success must be considered in light of the problems, expenses,

difficulties, complications and delays encountered in connection with the

exploration of the mineral properties that we plan to undertake. These potential

problems include, but are not limited to, unanticipated problems relating to

exploration and additional costs and expenses that may exceed current estimates.

If we are unsuccessful in addressing these risks, our business will likely fail

and you will lose your entire investment.

We are

subject to the numerous risks and hazards inherent to the mining industry and

resource exploration including, without limitation, the following:

|

|

·

|

interruptions

caused by adverse weather

conditions;

|

|

|

·

|

unforeseen limited sources

of supplies resulting

in shortages of materials, equipment and

availability of

experienced manpower.

|

The

prices and availability of such equipment, facilities, supplies and manpower may

change and have an adverse effect on our operations, causing us to suspend

operations or cease our activities completely.

It

is possible that our title for the properties in which we have an interest will

be challenged by third parties.

We have

not obtained title insurance for our properties. It is possible that

the title to the properties in which we have our interest will be challenged or

impugned. If such claims are successful, we may lose our interest in such

properties.

Our

failure to compete with our competitors in mineral exploration for financing,

acquiring mining claims, and for qualified managerial and technical employees

will cause our business operations to slow down or be suspended.

Our

competition includes large established mineral exploration companies with

substantial capabilities and with greater financial and technical mineralized

materials than we have. As a result of this competition, we may be unable to

acquire additional attractive mining claims or financing on terms we consider

acceptable. We may also compete with other mineral exploration companies in the

recruitment and retention of qualified managerial and technical employees. If we

are unable to successfully compete for financing or for qualified employees, our

exploration programs may be slowed down or suspended.

Compliance

with environmental regulations applicable to our operations may adversely affect

our capital liquidity.

All

phases of our operations in Brazil and Canada, where our properties are located,

will be subject to environmental regulations. Environmental

legislation in Brazil and Canada is evolving in a manner which will require

stricter standards and enforcement, increased fines and penalties for

non-compliance, more stringent environmental assessments of proposed projects

and a heightened degree of responsibility for companies and their officers,

directors and employees. It is possible that future changes in

environmental regulation will adversely affect our operations as compliance will

be more burdensome and costly.

Because

we have not allocated any money for reclamation of any of our mining claims, we

may be subject to fines if the mining claims are not restored to its original

condition upon termination of our activities.

Our

directors may face conflicts of interest in connection with our participation in

certain ventures because they are directors of other mineral mineralized

material companies.

Mr.

Montgomery, who in addition to Mr. Pearl, serves as a director, may also be a

director of other companies (including mineralized material exploration

companies) and, if those other companies participate in ventures in which we may

participate, our directors may have a conflict of interest in negotiating and

concluding terms respecting the extent of such participation. It is

possible that due to our directors’ conflicting interests, we may be precluded

from participating in certain projects that we might otherwise have participated

in, or we may obtain less favorable terms on certain projects than we might have

obtained if our directors were not also directors of other participating mineral

mineralized materials companies. In an effort to balance their

conflicting interests, our directors may approve terms equally favorable to all

of their companies as opposed to negotiating terms more favorable to us but

adverse to their other companies. Additionally, it is possible that

we may not be afforded certain opportunities to participate in particular

projects because those projects are assigned to our directors’ other companies

for which the directors may deem the projects to have a greater

benefit

Our

future performance is dependent on our ability to retain key personnel, loss of

which would adversely affect our success and growth.

Our

performance is substantially dependent on performance of our senior

management. In particular, our success depends on the continued

efforts of Mr. Pearl. The loss of his services could have a material adverse

effect on our business, results of operations and financial condition as our

potential future revenues would most likely dramatically decline and our costs

of operations would rise. We do not have employment agreements in

place with any of our officers or our key employees, nor do we have key person

insurance covering our employees.

The

value and transferability of our shares may be adversely impacted by the limited

trading market for our shares.

There is

only a limited trading market for our common stock on the Pink Sheets. This may

make it more difficult for you to sell your stock if you so

desire.

Our

common stock is a penny stock and because "penny stock” rules will apply, you

may find it difficult to sell the shares of our common stock you acquired in

this offering.

Our

common stock is a “penny stock” as that term is defined under Rule 3a51-1 of the

Securities Exchange Act of 1934. Generally, a "penny stock" is a common stock

that is not listed on a national securities exchange and trades for less than

$5.00 a share. Prices often are not available to buyers and sellers and the

market may be very limited. Penny stocks in start-up companies are among the

riskiest equity investments. Broker-dealers who sell penny stocks must provide

purchasers of these stocks with a standardized risk-disclosure document prepared

by the Securities and Exchange Commission. The document provides information

about penny stocks and the nature and level of risks involved in investing in

the penny stock market. A broker must also give a purchaser, orally or in

writing, bid and offer quotations and information regarding broker and

salesperson compensation, make a written determination that the penny stock is a

suitable investment for the purchaser, and obtain the purchaser's written

agreement to the purchase. Consequently, the rule may affect the ability of

broker-dealers to sell our securities and also may affect the ability of

purchasers of our stock to sell their shares in the secondary

market. It may also cause fewer broker dealers to make a market in

our stock.

Many

brokers choose not to participate in penny stock transactions. Because of the

penny stock rules, there is less trading activity in penny stock and you are

likely to have difficulty selling your shares.

In

addition to the "penny stock" rules promulgated by the Securities and Exchange

Commission, Financial Industry Regulatory Authority (the “FINRA”) has adopted

rules that require that in recommending an investment to a customer, a

broker-dealer must have reasonable grounds for believing that the investment is

suitable for that customer. Prior to recommending speculative low-priced

securities to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer's financial status,

tax status, investment objectives and other information. Under interpretations

of these rules, FINRA believes that there is a high probability that speculative

low priced securities will not be suitable for at least some customers. FINRA

requirements make it more difficult for broker-dealers to recommend that their

customers buy our common stock, which may limit your ability to buy and sell our

stock and have an adverse effect on the market for our shares.

Sales

of a substantial number of shares of our common stock into the public market by

the Selling Stockholders may result in significant downward pressure on the

price of our common stock and could affect the ability of our stockholders to

realize any current trading price of our common stock.

Sales of

a substantial number of shares of our common stock in the public market could

cause a reduction in the market price of our common stock, when and if such

market develops. When this registration statement is declared effective, the

Selling Stockholders may be reselling up to 12,451,467 or approximately 18.20% of

the issued and outstanding shares of our common stock. As a result of such

registration statement, a substantial number of our shares of common stock which

have been issued may be available for immediate resale when and if a market

develops for our common stock, which could have an adverse effect on the price

of our common stock. As a result of any such decreases in price of our common

stock, purchasers who acquire shares from the Selling Stockholders may lose some

or all of their investment.

Future

sales of shares by us may reduce the value of our stock.

If

required, we will seek to raise additional capital through the sale of our

common stock. Future sales of shares by us could cause the market

price of our common stock to decline and may result in further dilution of the

value of the shares owned by our stockholders.

Note Regarding Forward Looking Statements

This

Prospectus contains forward-looking statements which involve assumptions and

describe our future plans, strategies, and expectations, are generally

identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of

these words or other variations on these words or comparable terminology. These

statements are expressed in good faith and based upon a reasonable basis when

made, but there can be no assurance that these expectations will be achieved or

accomplished.

Such

forward-looking statements include statements regarding, among other things, (a)

the potential markets for our technologies, our potential profitability, and

cash flows (b) our growth strategies, (c) expectations from our ongoing

sponsored research and development activities (d) anticipated trends in the

technology industry, (e) our future financing plans and (f) our anticipated

needs for working capital. This information may involve known and unknown risks,

uncertainties, and other factors that may cause our actual results, performance,

or achievements to be materially different from the future results, performance,

or achievements expressed or implied by any forward-looking statements. These

statements may be found under “MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” and “DESCRIPTION OF OUR BUSINESS AND

PROPERTY,” as well as in this Prospectus generally. Actual events or

results may differ materially from those discussed in forward-looking statements

as a result of various factors, including, without limitation, the risks

outlined under “RISK

FACTORS” and matters described in this Prospectus generally. In light of

these risks and uncertainties, there can be no assurance that the

forward-looking statements contained in this filing will in fact occur. In

addition to the information expressly required to be included in this filing, we

will provide such further material information, if any, as may be necessary to

make the required statements, in light of the circumstances under which they are

made, not misleading.

Although

forward-looking statements in this report reflect the good faith judgment of our

management, forward-looking statements are inherently subject to known and

unknown risks, business, economic and other risks and uncertainties that may

cause actual results to be materially different from those discussed in these

forward-looking statements. Readers are urged not to place undue reliance on

these forward-looking statements, which speak only as of the date of this

report. We assume no obligation to update any forward-looking statements in

order to reflect any event or circumstance that may arise after the date of this

report, other than as may be required by applicable law or regulation. Readers

are urged to carefully review and consider the various disclosures made by us in

our reports filed with the Securities and Exchange Commission which attempt to

advise interested parties of the risks and factors that may affect our business,

financial condition, results of operation and cash flows. If one or more of

these risks or uncertainties materialize, or if the underlying assumptions prove

incorrect, our actual results may vary materially from those expected or

projected. We will have little

likelihood of long-term success unless we are able to continue to raise capital

from the sale of our securities until, if ever, we generate positive cash flow

from operations.

Use Of Proceeds

This

Prospectus relates to shares of our common stock that may be offered and sold

from time to time by the Selling Stockholders. Although we will pay

the costs and expenses incurred in connection with the preparation and filing of

this Prospectus, we will receive no proceeds from the sale of shares of common

stock in this offering.

Determination of Offering Price

The

Selling Stockholders will determine at what price they may sell the offered

shares, and such sales may be made at prevailing market prices, or at privately

negotiated prices. Please refer

to “PLAN OF DISTRIBUTION.”

Market PRICE of and Dividends on Our Common Stock And

Related Stockholder Matters

Our

Common Stock is quoted on the Pink Sheets. The following table sets forth the

high and low bid prices for the Common Stock for the calendar quarters indicated

as reported by the Pink Sheets for the last two years. These prices represent

quotations between dealers without adjustment for retail mark-up, markdown or

commission and may not represent actual transactions. Our stock is also quoted

on the Frankfurt Exchange under the symbols “A4G.FSE,” and “A4G.ETR” and on the

Berlin-Bremen Exchange under the symbol “A4G.BER.”

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

|||||||||||||

|

2010

– High

|

$ | 0.55 | (1) | |||||||||||||

|

2010

– Low

|

$ | 0.38 | (1) | |||||||||||||

|

2009

– High

|

$ | 0.50 | $ | 0.33 | $ | 0.50 | $ | 0.70 | ||||||||

|

2009

– Low

|

$ | 0.16 | $ | 0.17 | $ | 0.06 | $ | 0.26 | ||||||||

|

2008

– High

|

$ | 0.51 | $ | 0.26 | $ | 0.12 | $ | 0.50 | ||||||||

|

2008

– Low

|

$ | 0.21 | $ | 0.05 | $ | 0.04 | $ | 0.04 | ||||||||

|

2007

– High

|

$ | 0.75 | $ | 0.61 | $ | 0.50 | $ | 0.40 | ||||||||

|

2007

– Low

|

$ | 0.54 | $ | 0.26 | $ | 0.26 | $ | 0.23 | ||||||||

|

2006

– High

|

$ | 2.10 | $ | 2.00 | $ | 1.20 | $ | 1.09 | ||||||||

|

2006

– Low

|

$ | 0.69 | $ | 0.77 | $ | 0.46 | $ | 0.60 | ||||||||

|

2005

– High

|

$ | 0.23 | $ | 0.12 | $ | 0.83 | $ | 0.73 | ||||||||

|

2005

– Low

|

$ | 0.09 | $ | 0.06 | $ | 0.06 | $ | 0.47 | ||||||||

(1) The

high and low bid prices for our Common Stock for the First Quarter of 2010 were

for the period January 1, 2010 to January 31, 2010. The closing price

on February 1, 2010 was $0.41.

As of

January 31, 2010, there were 718 holders of record of the Common

Stock.

No cash

dividends were paid in 2008 or 2007. No cash dividends have been paid subsequent

to December 31, 2008. The amount and frequency of cash dividends are

significantly influenced by metal prices, operating results and our cash

requirements.

We do not

have securities authorized for issuance under an equity compensation

plan.

There are

2,300,000 shares reserved for issuance pursuant to options granted under the

Company’s stock option plan.

During

the fourth quarter of 2008, 2,603,333 shares were issued in connection with debt

settlements in December 2008 at $0.06 per share. The shares were issued to

individuals and companies who reside outside the United States of America (in

accordance with the exemption from registration requirements afforded by

Regulation S as promulgated thereunder).

In

September 2009, 3,000,000 common shares were issued at $0.10 per share for net

cash proceeds of $300,000. The shares were issued to individuals and

companies who reside outside the United States of America (in accordance with

the exemption from registration requirements afforded by Regulation S as

promulgated thereunder).

In

September 2009, convertible notes payable and related accrued interest

aggregating $739,152 (AUD $850,479) were settled through the issuance of

5,000,000 shares of common stock of the Company at $0.15 per share. The shares

were issued to individuals and companies who reside outside the United States of

America (in accordance with the exemption from registration requirements

afforded by Regulation S as promulgated thereunder).

In

November 2009, 100,000 shares were issued in connection with debt settlements at

$0.18 per share. The shares were issued to individuals and companies who reside

outside the United States of America (in accordance with the exemption from

registration requirements afforded by Regulation S as promulgated

thereunder).

In

November 2009, 150,000 shares were issued in connection with debt settlements at

$0.24 per share. The shares were issued to individuals and companies who reside

outside the United States of America (in accordance with the exemption from

registration requirements afforded by Regulation S as promulgated

thereunder).

In

December 2009, 1,666,667 common shares were issued at $0.30 per share for net

cash proceeds of $500,000. The shares were issued to individuals and

companies who reside outside the United States of America (in accordance with

the exemption from registration requirements afforded by Regulation S as

promulgated thereunder).

We did

not effect any repurchases of our securities during the fourth quarter of Fiscal

2008 or the subsequent period to January 31, 2010.

Dividend

Policy

We have

never paid cash dividends on our capital stock and do not anticipate paying any

cash dividends in the foreseeable future, but intend to retain our capital

mineralized materials for reinvestment in our business. Any future determination

to pay cash dividends will be at the discretion of the Board of Directors and

will be dependent upon our financial condition, results of operations, capital

requirements and other factors as the board of directors deems

relevant.

Management’s Discussion And Analysis Or Plan Of

Operations

The

following information should be read in conjunction with our interim unaudited

consolidated financial statements and notes thereto for the three and nine month

periods ended September 30, 2009 and 2008 and our audited consolidated financial

statements and related notes thereto for the years ended December 31, 2008 and

2007 included elsewhere in this Prospectus. We also urge you to review and

consider our disclosures describing various risks that may affect our business,

which are set forth under the heading “RISK

FACTORS.”

General

We are a

mineral exploration company engaged in the exploration of base, precious metals

and industrial minerals worldwide. We were incorporated under the

laws of the State of Delaware on October 10, 1995, under the name "Chefs

Acquisition Corp." We conduct our exploration and property acquisition

activities through our head office which is located at is located at

Baarerstrasse 10, 1st

Floor, Zug, 6300 Switzerland. The telephone number is (+41) 7887-96966. Our

Field office for exploration activities in Brazil is located at Estrada Do Bis,

476, Bairro, Bom Jardim, Itaituba, in the Tapajos gold province of the State of

Para, Brazil.

We had no

revenues during the nine month periods ended September 30, 2009 and 2008 and

during the fiscal 2008 and 2007. Funds raised in fiscal 2008 and 2007 were used

for exploration of our properties and general administration.

Significant

developments during the nine months ended September 30, 2009 and Subsequent

Events to January 31, 2010

We are a

mineral exploration company engaged in the exploration of base, precious metals

and industrial minerals worldwide.

We have

no revenues, have sustained losses since inception, have been issued a going

concern opinion by our auditors and rely upon the sale of our securities to fund

operations. We will not generate revenues even if any of our exploration

programs indicate that a mineral deposit may exist on our properties.

Accordingly, we will be dependent on future financings in order to maintain our

operations and continue our exploration activities. Funds raised in fiscal 2008

and 2009 were used for exploration of our properties and general

administration.

During

2009 we have been evaluating our property holdings in order to determine whether

to implement exploration programs on our existing properties or to acquire

interests in new properties.

In

September 2009, convertible notes payable and related accrued interest

aggregating US $739,152 (AUD $850,479) were settled through the issuance of

5,000,000 shares of common stock of the Company. The issuance price of the

shares issued on settlement was lower that the stated conversion price in the

loan agreements of $0.30 per share. Thus, this transaction was considered an

inducement to convert and accounted for as such resulting in a loss of

$1,014,465 being recorded in the three and nine months ended September 2009

related to this settlement.

During

the month of September 2009, we raised $300,000 through a private placement of

3,000,000 shares at a price of $0.10 per share to eight persons. Our

placement agent was paid a

commission of 420,000 shares of

common stock of the Company. Proceeds from the private placement will be used

for general working capital.

The

Company has two separate unsecured loans payable of $250,000, bearing interest

at 6% per annum, due on demand unsecured.

In

November 2009, we signed a letter agreement with Global Minerals Limited to

acquire an initial 70% interest in the Front Range Gold Project located in

Boulder County, Colorado. We paid $100,000 on signing the letter agreement. A

further $400,000 is due on signing of the formal agreement on or before February

28, 2010. We are currently conducting due diligence and also

further discussions with the vendors as to decide on the future of the

project.

In

December 2009, 1,666,667 common shares were issued at $0.30 per share for net

cash proceeds of $500,000. These shares were issued to one individual

who resides outside the United States of America.

We

conduct exploration activities from our principal and technical office located

at Baarerstrasse 10, 1st

Floor, Zug, 6300 Switzerland. We believe that these offices are adequate for our

purposes.

Our

strategy is to concentrate our efforts on: (i) existing operations where an

infrastructure already exists; (ii) properties presently being developed and/or

in advanced stages of exploration which have potential for additional

discoveries; and (iii) grass-roots exploration opportunities.

We are

currently concentrating our property exploration activities in Brazil and

Canada. We are also examining data relating to the potential acquisition of

other exploration properties in the United States, Latin America and South

America.

Our

properties are in the exploration stage only and are without a known body of

mineral reserves. Development of the properties will follow only if satisfactory

exploration results are obtained. Mineral exploration and development involves a

high degree of risk and few properties that are explored are ultimately

developed into producing mines. There is no assurance that our

mineral exploration and development activities will result in any discoveries of

commercially viable bodies of mineralization. The long-term profitability of our

operations will be, in part, directly related to the cost and success of our

exploration programs, which may be affected by a number of factors.

For the

nine months period ended September 30, 2009, we recorded exploration expenses of

$51,562 compared to $88,199 for the same period in 2008. The following is a

breakdown of the exploration expenses by property: Brazil $49,545 (2008 -

$85,649) and Canada, Kumealon property $2,017 (2008 - $2,550).

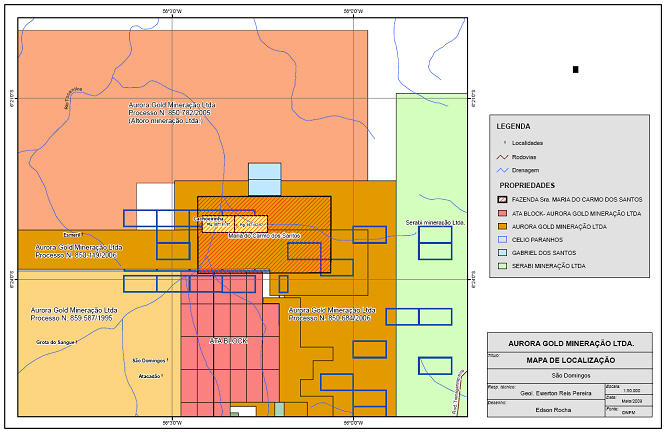

We

initially had 10 properties under Memorandum of Understanding (“MOU”) or under

option of which we currently have retained three (3) properties, São Domingos,

São João and Comandante Araras in the Tapajos Gold Province, State of Pará,

Brazil.

Between

December 21, 2005 and May 26, 2006 we signed four MOUs covering the Piranhas,

Branca de Neve, Bigode (option since relinquished) and Santa Lúcia properties in

the Municipality of Itaituba, Tapajos gold province, State of Para, Brazil.

During the first quarter of 2007 we signed a MOU covering the Comandante Araras

property. The MOUs provide us with a review period, ranging from two months to

six months, to access the mineral potential of the properties. We have since

cancelled the Piranhas, Branca de Neve and Santa Lúcia agreements.

Between

January 1 and March 31, 2006 we signed five option agreements covering the Novo

Porto (since cancelled due to governmental land use management changes), Ouro

Mil (option since relinquished), Santa Isabel (option since relinquished), São

Domingos and São João mineral exploration licenses located in the Municipality

of Itaituba, in the Tapajos gold province of the State of Pará,

Brazil.

Access to

all of the property areas in which we have an interest is by airstrips, rivers

in season and the Trans Garimpeiro Highway. Regional infrastructure

to the property areas is serviced from our offices in the city of Itaituba and

the field office located at the São Domingos property.

The São

Domingos cluster of properties covers an area of 6.100 hectares and is located

approximately 250km south of the regional center of Itaituba and approximately

40 km north of our previous Santa Isabel property.

São

João – Samba Minerals earning an 80% interest by funding to

feasibility

The São

João property area is located approximately 20km west of our São Domingos

property and covers an area of approximately 5.160 hectares.

Santa

Isabel – option since relinquished

The Santa

Isabel Property lies in the southwestern region of the Tapajos Gold Province,

Para State, Brazil and comprises an area of 3.650 hectares.

In March

2007 we decided not to follow up our preliminary exploration program on the

Santa Isabel property and decided not to exercise our option to acquire the

property.

Novo

Porto - option since relinquished

The Novo

Porto property lies approximately 180km south of Itaituba and covered an area of

approximately 6.600 hectares. Due to changes in the Government land

management the area that encompassed the Nova Porto project and our property

interest was deemed to be in a non active commercial mining zone.

In March

2006 we decided not to follow-up our preliminary exploration program on the Novo

Porto property and decided not to exercise our option to acquire the

property.

Ouro

Mil - option since relinquished

The Ouro

Mil property is located approximately 20 km south of Santa Isabel property area

and approx 300km South of Itaituba, and covers an area of 9.794

hectares.

In

October 2006 we decided not to follow up our preliminary exploration program on

the Ouro Mil property and decided not to exercise our option to acquire the

property.

Branca

de Neve - option since relinquished

The

Branca de Neve property adjoins our Piranhas property and is located

approximately 50 km NE of our São Domingos property, and covers an area of

approximately 2.210 hectares

Piranhas

- option since relinquished

The

Piranhas property adjoins the South western boundary of our Branca de Neve

property and covers an area of approximately 9.341 hectares.

Bigode-

option since relinquished

The 4.150

hectare Bigode property adjoins the southeast portion of our São Domingos

property, and is approximately 30 km north of our Santa Isabel

property.

Santa

Lúcia - option since relinquished

The 1.600

hectare Santa Lúcia property is located 1,270 km SSW of the main regional centre

of Itaituba. The property is located 10 km south west of the

Company’s Santa Isabel property.

Comandante

Araras - Samba Minerals earning an 80% interest by funding to

feasibility

The 2.750

hectare Comandante Araras property is located 10 km west of the Company’s São

João property.

British

Columbia, Canada

The 741

acre Kumealon limestone project is located on the north shore of Kumealon Inlet,

54 kilometres south-southeast of Prince Rupert, British Columbia,

Canada.

Front

Range Gold Project – Currently under Due Diligence

The Front

Range Gold JV property is located about 16 km west of the city of Boulder

Colorado, USA, and consists of 85 patented and 21 unpatented lode claims,

totalling approximately 480 acres (about 3/4 square mile). The property lies in

the Gold Hill Mining District of Boulder County, and includes eighteen past

producing mines. These mines produced gold, silver, and gold-tellurides from

narrow quartz veins hosted in Precambrian granites and gneisses.

Results

of Operations

Three

and Nine months ended September 30, 2009 versus Three and Nine months ended

September 30, 2008

The

Company has yet to generate any revenues or establish any history of profitable

operations. For the three and nine months ended September 30, 2009 we recorded a

net loss of $1,232,548 (2008 net loss - $74,540) and $1,519,511 (2008 net loss -

$520,788) or $(0.02) [2008 – $(0.00)] and $(0.03) [2008 - $(0.01)] per

share.

Expenses – Our general and

administrative expenses consist primarily of personnel costs, legal costs,

investor relations costs, stock based compensation costs, accounting costs and

other professional and administrative costs. For the three and nine months ended

September 30, 2009 we recorded expenses of $193,102 (2008 - $52,046) and

$453,484 (2008 - $432,589) respectively. This amount includes, professional fees

- accounting $4,063 (2008 - $4,936) and $16,063 (2008 - $48,218) respectively

and legal $0 (2008 - $9,350) and $10,788 (2008 - $136,125) respectively. Recent

developments in capital markets have restricted access to debt and equity

financing for us. As a result, we reduced our 2009 capital spending requirements

in light of the current and anticipated, global economic

environment.

Exploration expenditures –

Exploration expenses are charged to operations as they are incurred. For the

three and nine months ended September 30, 2009 we recorded exploration expenses

of $24,981 (2008 - $22,494) and $51,562 (2008 - $88,199) respectively. The

following is a breakdown of the exploration expenses by property: Brazil $24,981

(2008 – $22,494) and $49,545 (2008 - $85,649) respectively and Canada, Kumealon

property $0 (2008 - $0) and $2,017 (2008 - $2,550) respectively. Exploration

expenditures for our Brazil properties are down in comparison with the same

period in the previous year while we evaluate the data from the 2008 work

programs. Recent developments in capital markets have restricted access to debt

and equity financing for us. As a result, we reduced our 2009 exploration

spending requirements in light of the current and anticipated, global economic

environment

Depreciation expense –

Depreciation expense charged to operations for the three and nine months ended

September 30, 2009 were $3,485 (2008 - $3,920) and $9,431 (2008 - $11,560)

respectively.

Year

Ended December 31, 2008 (Fiscal 2008) versus Year Ended December 31, 2007

(Fiscal 2007)

For the

year ended December 31, 2008 we recorded a loss of $520,105 or $0.01 per share,

compared to a loss of $3,259,732 or $0.07 per share in 2007.

General and administrative

expenses – For the year ended December 31, 2008 we recorded general and

administrative expenses of $442,832 (fiscal 2007 - $1,225,857). The fiscal 2008

amount includes professional fees - accounting $56,898 (fiscal 2007 - $53,509)

and legal $79,540 (fiscal 2007 - $180,253).

Exploration expenditures - For

the year ended December 31, 2008 we recorded exploration expenses of $77,273

compared to $2,033,875 in fiscal 2007. The following is a breakdown of the

exploration expenses by property: Brazil $74,723 (2007 - $2,031,700) and Canada,

Kumealon property $2,550 (2007 - $2,175).

Depreciation expense – For the

year ended December 31, 2008 we recorded depreciation expense of $14,426

compared to $12,326 in fiscal 2007.

Capital

Resources and Liquidity

September

30, 2009 versus December 31, 2008

At

September 30, 2009, we had cash of $155,046 (December 31, 2008 - $16,511) and a

working capital deficiency of $1,182,803 (December 31, 2008 - $1,092,000). Total

liabilities as of September 30, 2009 were $1,372,400 as compared to $1,691,579

on December 31, 2008, a decrease of $319,179.

Our

general business strategy is to acquire mineral properties either directly or

through the acquisition of operating entities. Our consolidated financial

statements have been prepared in accordance with generally accepted accounting

principles in the United States of America and applicable to a going concern

which contemplates the realization of assets and the satisfaction of liabilities

and commitments in the normal course of business. As discussed in note 1 to the

September 30, 2009 interim consolidated financial statements, we have incurred

recurring operating losses since inception, have not generated any operating

revenues to date and used cash of $170,900 from operating activities in 2009

through September 30. We will require additional funds to meet its obligations

and maintain its operations. We do not have sufficient working

capital to (i) pay our administrative and general operating expenses through

September 30, 2010 and (ii) to conduct our preliminary exploration programs.

Without cash flow from operations, we may need to obtain additional funds

(presumably through equity offerings and/or debt borrowing) in order, if

warranted, to implement additional exploration programs on our properties. While

we may attempt to generate additional working capital through the operation,

development, sale or possible joint venture development of its properties, there

is no assurance that any such activity will generate funds that will be

available for operations. Failure to obtain such additional financing

may result in a reduction of our interest in certain properties or an actual

foreclosure of its interest. We have no agreements or understandings with any

person as to such additional financing.

Our

exploration properties have not commenced commercial production and we have no

history of earnings or cash flow from its operations. While we may attempt to

generate additional working capital through the operation, development, sale or

possible joint venture development of its property, there is no assurance that

any such activity will generate funds that will be available for

operations.

Plans

for Year 2010

During

the next 12 months we intend to raise additional funds through equity offerings

and/or debt borrowing to meet our administrative/general operating expenses and

to conduct work on our exploration properties. There is, of course, no assurance

that we will be able to do so and we do not have any agreements or arrangements

with respect to any such financing.

Our

exploration properties have not commenced commercial production and we have no

history of earnings or cash flow from its operations. While we may attempt to

generate additional working capital through the operation, development, sale or

possible joint venture development of its property, there is no assurance that

any such activity will generate funds that will be available for

operations.

We will

concentrate our exploration activities on the Brazilian Tapajos properties and

examine data relating to the potential acquisition or joint venturing of

additional mineral properties in either the exploration or development stage in

Brazil, United States, Canada and other South American countries. Additional

employees will be hired on a consulting basis as required by the exploration

properties.

Our

exploration work program in 2010 will focus on the Brazilian properties and will

entail surface mapping of geology, sampling of soils on a grid basis to

delineate geochemical anomalies, stream sediment sampling, geophysical surveying

and drilling.

We have

set up a field operations center at the São Domingos property and intend to

continue to focus our exploration activities on anomalies associated with the

São Domingos Property. We selected the São Domingos property based on

its proximity to our other properties, and the logistics currently in

place. Access to the São Domingos property is by light aircraft to a

well-maintained strip, by road along the government maintained Trans Garimpeiro

highway, and by boat along the multitude of waterways in the Amazon

Basin.

In late

May 2006 we followed up previous exploration of the Sao Domingos property with

the initiation of a projected 5,000 metre diamond-drilling

program. Drilling targeted various soil anomalies and lithogical

trends outlined by mapping and sampling of out cropping

rocks. Drilling tested areas around the Atacadau gold occurrence, the

Esmeril occurrence and Fofoca area. These areas have been the focus

of both alluvial and relatively shallow underground hard rock (oxidized)

mining. The lithology is porphyritic Pararui granite containing

stockwork quartz veins. Limited historical underground production was carried

out via shafts sunk in the oxidized material peripheral to the dominant quartz

veins. No dewatering was utilized and generally mining ceased, as

water became a problem. Drilling completed during 2006 resulted in a volume of

mineralized material which was calculated on the first 17 drill holes targeting

high grade gold in quartz veins and altered host rocks. Drill hole line spacing

of 40m was used in the initial appraisal.

After

reviewing the geology and grade continuity from 2006 drilling on the Mineralized

material at the Sao Domingos- Fofoca project, the Company initiated further

drilling during July 2007 to test target extensions of the current mineralized

material as well as to infill current drilling to increase the confidence

levels. The initial calculation resulted in a volume of mineralized material

containing approximately 130,000 ounces of gold at 2.0 g/t using a cut off 0f

0.5 g/t.

Currently

the mineralized material still remains open along strike in both directions and

at depth. Aurora will continue to evaluate the potential, and is confident that

Fofoca could evolve along strike and link up with other noted targets further

along strike. To test the strike continuity a ground geophysical survey was

conducted during the third quarter of 2007 along the Fofoca mineralized

structure. The results demonstrated that geophysical anomalism,

similar to that recognized over the known mineralization of the Fofoca

mineralization, was noted and the anomaly continues further west to join up with

the known mineralization of the Cacheira area. The results also show

that this mineralization may split into other loads of mineralization of similar

proportions to that known over the current mineralization. This has

the potential to increase the known resource by at least 50%.

In 2010,

we will continue to follow up exploration on the Fofoca area and to initiate

further exploration programs on other areas of the Sao Domingos

property. It is anticipated that we will drill a series of holes

within the Fofoca area for engineering and metallurgical test work as well as to

test for depth extensions of the known mineralization. Other

Exploration on the São Domingos property areas will involve further mapping of

the outcrop geology and sampling soils and scree from shafts of previous workers

in order to confirm lithologies and structural trends noted from drilling and

published government maps. Currently, four anomalous areas on the Sao

Domingos property have been identified from soil and rock chip sampling, at

Atacadao, Esmeril, Fofoca and Cachoeira, and we plan to conduct further

investigation.

A recent

discovery was made on the Atatcadau area and has been called

Colibri. Here artisanal miners uncovered an area of stock work

mineralization that was subsequently sampled and returned some high-grade

assays. Further sampling of material that was exposed by artisanal

activity around the Colibri occurrence was conducted. Whilst

monitoring the artisanal activity mapping and measurements of the structures and

orientations of theoretical mineralization channels were

conducted. The results showed that there are possible correlations to

the Atacadau mineralization noted from previous mapping and

drilling. We intend to cut trenches across the strike of the

mineralizing structures to better understand the size both laterally and along

strike. We will then test the strike extent with geophysics in a

similar manner as that conducted on the in the Fofoca area.

Exploration

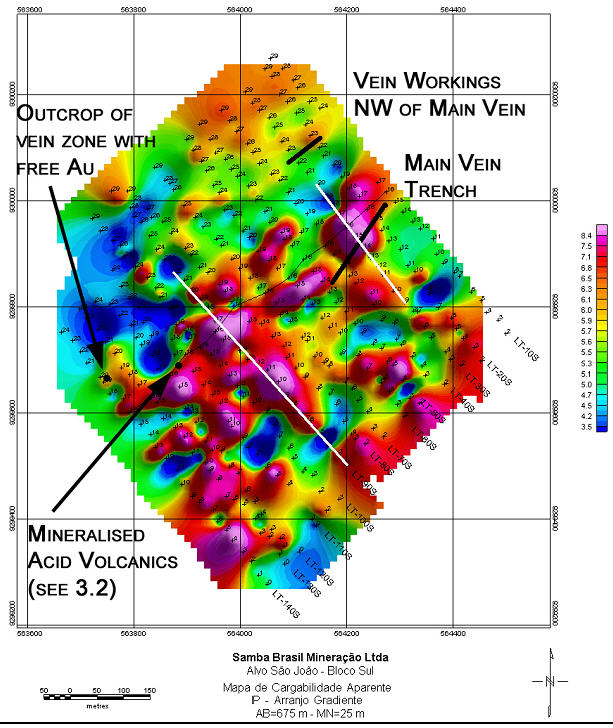

on the Sao Joao, and the adjoining Comandante Araras properties during early

2007 included trenching and mapping. Sample results of a trench on

the main vein resulted in 80m at 30.94 g/t gold. Recent sampling and mapping has

shown this vein system to be extensive and a series of other veins have been

located and sampled.

Together

with our partner, Samba, we completed a ground geophysics program on the Sao

Joao property. The program targeted areas of known mineralization and covered

the area along to the northeast to link up with other known

mineralization. Results to date show that the area has a geophysical

trend continuing on from the known mineralization. During the

geophysics program, other veins were noted and sampled and returned anomalous

gold grades. Together with Samba, in 2010, we intend to evaluate the

geophysics and determine various targets to test the sub surface extent of the

known mineralization, and to test the geophysical anomalies within the

area.

We have

decided not to pursue the Bigode project and have returned this back to the

vendors.

We are

not planning to do any exploration work on the British Columbia Kumealon

limestone property in 2010.

We are

currently conducting due diligence on the Front Range Property in Boulder

Colorado and should we go forward with the acquisition Aurora plans to update

all permits and schedule operations with a view to recommencing the production

of gold concentrate.

Application

of Critical Accounting Policies

The

accounting policies and methods we utilize in the preparation of our

consolidated financial statements determine how we report our financial

condition and results of operations and may require our management to make

estimates or rely on assumptions about matters that are inherently uncertain.

Our accounting policies are described in note 2 to our December 31, 2008

consolidated financial statements. Our accounting policies relating to mineral

property and exploration costs and depreciation and amortization of property,

plant and equipment are critical accounting policies that are subject to

estimates and assumptions regarding future activities.

Depreciation

is based on the estimated useful lives of the assets and is computed using the

straight-line method. Equipment is recorded at

cost. Depreciation is provided over the following useful lives:

vehicles 10 years and office equipment, furniture and fixtures 2 to 10

years.

Exploration

costs are charged to operations as incurred until such time that proven reserves

are discovered. From that time forward, the Company will capitalize all costs to

the extent that future cash flow from mineral reserves equals or exceeds the

costs deferred. The deferred costs will be amortized over the recoverable

reserves when a property reaches commercial production. As at September 30, 2009

and December 31, 2008, the Company did not have proven reserves.

Exploration

activities conducted jointly with others are reflected at the Company's

proportionate interest in such activities.

Costs related to site restoration programs are accrued

over the life of the project.

US GAAP

requires us to consider at the end of each accounting period whether or not

there has been an impairment of the capitalized property, plant and equipment.

This assessment is based on whether factors that may indicate the need for a

write-down are present. If we determine there has been an impairment, then we

would be required to write-down the recorded value of its property, plant and

equipment costs which would reduce our earnings and net assets.

Off-balance

Sheet Arrangements and Contractual Obligations

We do not

have any off-balance sheet arrangements or contractual obligations that are

likely to have or are reasonably likely to have a material current or future

effect on our financial condition, changes in financial condition, revenues or

expenses, results of operations, liquidity, capital expenditures or capital