Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20100204.htm |

EXHIBIT

99.1

February

4, 2010

February

4, 2010

Stephen

I. Chazen

Stephen

I. Chazen

President

and

President

and

Chief

Financial Officer

Chief

Financial Officer

Credit

Suisse

Credit

Suisse

2010

Energy Summit

2010

Energy Summit

1

2

($

in millions, except EPS data)

($

in millions, except EPS data)

Full

Year 2009 Results - Summary

Full

Year 2009 Results - Summary

2009 2008

• Core Results 1 $3,083 $7,348

• Core

EPS (diluted) $3.78 $8.94

• Net Income $2,915 $6,857

• Reported EPS

(diluted) $3.58 $8.34

• Oil

and Gas sales volumes (mboe/day) 714 675

• +5.8%

year-over-year

• Capital

Spending $3,581 $4,664

• Cash

Flow from Operations $5,800 $10,700

• ROE 10.3% 27%

• ROCE 9.6% 25%

1See attached for GAAP

reconciliation.

2

3

Corporate

Strategy/Philosophy

• Focus on core areas

- long-term production growth

of 5 - 8% CAGR

of 5 - 8% CAGR

• US - Permian

Basin, California, and Midcontinent Gas

• Middle East/North

Africa

• Latin

America

• Maintain strong

balance sheet

– Maintain “A” credit

rating

– Maintain investment

discipline

– Create

value

– Capture EOR projects

with large volumes of oil in place

– Acquire assets with

upside potential

– Maintain top

quartile financial returns

• Maximize free cash

flow from chemicals

• Continue to increase

the dividend regularly

3

4

*Assumes Moderate

Product Prices

What

Are Our Goals & Current Objectives?

• Allocate and deploy

capital with a focus on achieving strong

financial returns.

financial returns.

• Pursue only those

opportunities which meet our standards

for ROCE and complement our existing assets.

for ROCE and complement our existing assets.

– Return

Targets*

• Domestic -

15+%

• International -

20+%

• Focus on further

delineating and developing our significant

oil and gas discovery in CA, while continuing our exploration

program in the state.

oil and gas discovery in CA, while continuing our exploration

program in the state.

• Focus on our large

inventory of oil and gas properties and

projects in order to achieve profitable growth.

projects in order to achieve profitable growth.

• Continue to make

decisions based on creating long-term

value for shareholders.

value for shareholders.

4

5

Worldwide Oil &

Gas Operations

Worldwide Oil &

Gas Operations

5

6

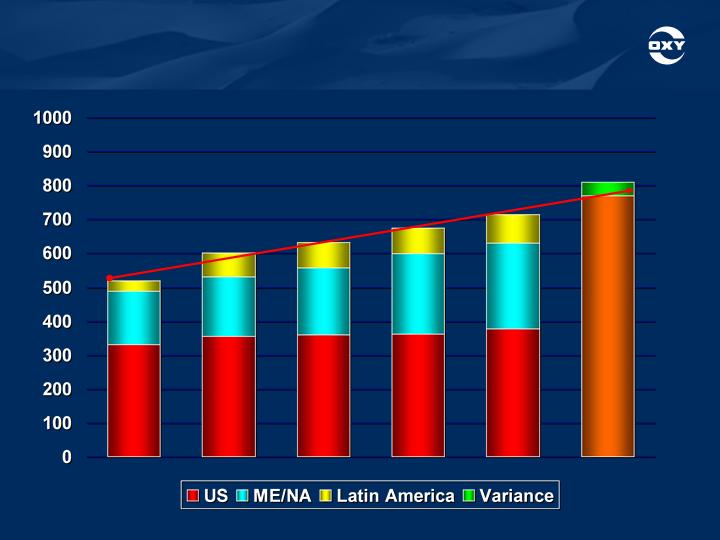

Thousand

BOE/Day

Thousand

BOE/Day

519

601

633

675

2005

2006

2007

2008

Note: This

schedule reflects what production volumes would have been for the past 5 years

if all production had been represented on a pre

-tax basis. Importantly this forecast is based only on existing projects and does not contemplate any new projects or future acquisitions.

-tax basis. Importantly this forecast is based only on existing projects and does not contemplate any new projects or future acquisitions.

Note: This

schedule reflects what production volumes would have been for the past 5 years

if all production had been represented on a pre

-tax basis. Importantly this forecast is based only on existing projects and does not contemplate any new projects or future acquisitions.

-tax basis. Importantly this forecast is based only on existing projects and does not contemplate any new projects or future acquisitions.

2009

750

2010E

770

714

CAGR

= 7.9%

= 7.9%

CAGR

= 7.9%

= 7.9%

Worldwide Production

Outlook

6

7

ü

ü

Low

ü

ü

Middle

Risk

Factor

Exploratory

Commodity

Political

Engineering

Reinvestment

Financial

High

Level

of Risk Acceptable to Occidental

Level

of Risk Acceptable to Occidental

ü

ü

Business Risk

Factors

7

8

2009

Reserve Replacement

• We estimate that we

replaced approximately 206% of our oil

and gas production in 2009.

and gas production in 2009.

• We estimate that we

replaced approximately 206% of our oil

and gas production in 2009.

and gas production in 2009.

• 2009 year-end proved

reserves were 3.23 billion BOE, an

increase of 8%.

increase of 8%.

• 2009 year-end proved

reserves were 3.23 billion BOE, an

increase of 8%.

increase of 8%.

• Oxy had a three-year

reserve replacement ratio of 160%.

• Oxy had a three-year

reserve replacement ratio of 160%.

• Our finding and

development costs in 2009 were $7.90 per

BOE.

BOE.

• Our finding and

development costs in 2009 were $7.90 per

BOE.

BOE.

• Three-year finding

and development costs averaged about

$15.10 per BOE.

$15.10 per BOE.

• Three-year finding

and development costs averaged about

$15.10 per BOE.

$15.10 per BOE.

• At 12/31/09, Oxy’s

proved reserves consisted of 73% oil and

27% gas, with 64% located in the US and 36% internationally.

27% gas, with 64% located in the US and 36% internationally.

• At 12/31/09, Oxy’s

proved reserves consisted of 73% oil and

27% gas, with 64% located in the US and 36% internationally.

27% gas, with 64% located in the US and 36% internationally.

• Approximately 23% of

the proved reserves were proved

undeveloped and 77% were proved developed.

undeveloped and 77% were proved developed.

• Approximately 23% of

the proved reserves were proved

undeveloped and 77% were proved developed.

undeveloped and 77% were proved developed.

8

9

2009

2009

2008

2008

2007

2007

2006

2006

2005

2005

3-Year

Average

3-Year

Average

5-Year

Average

5-Year

Average

323

323

126

126

182

182

180

180

241

241

210

210

210

210

160

160

210

210

60

60

326

326

139

139

143

143

179

179

483

483

336

336

242

242

506

506

380

380

353

353

389

389

206

206

153

153

116

116

243

243

212

212

160

160

185

185

Organic

Organic

Growth

Growth

Acquisitions

Acquisitions

Total

Total

Reserve

Reserve

Replace

%

Replace

%

Million

BOE

Million

BOE

235

235

220

220

208

208

208

208

179

179

221

221

210

210

Worldwide

Worldwide

Production

Production

(million

boe)

(million

boe)

Reserve

Replacement

Reserve

Replacement

9

10

Growth

Capital

Base

Capital

Total

Oil & Gas, and Midstream Capital

1,030

2,310

3,340

1,570

2,485

4,055

2009

2010E

($

in millions)

($

in millions)

• We

currently anticipate total year 2010 capex to be about

$4.3 billion compared to $3.6 billion spent in 2009.

$4.3 billion compared to $3.6 billion spent in 2009.

• We

currently anticipate total year 2010 capex to be about

$4.3 billion compared to $3.6 billion spent in 2009.

$4.3 billion compared to $3.6 billion spent in 2009.

– Our capital

program will continue to focus on ensuring that our returns remain

well above our cost of capital.

well above our cost of capital.

– Our capital

program will continue to focus on ensuring that our returns remain

well above our cost of capital.

well above our cost of capital.

– The increase in

capital vs. 2009 will be allocated to the Oil & Gas segment.

Of this:

Of this:

– The increase in

capital vs. 2009 will be allocated to the Oil & Gas segment.

Of this:

Of this:

• about a quarter each

will go to California and Iraq, and;

• about a quarter each

will go to California and Iraq, and;

• about 15% to Bahrain

and 10% to Midcontinent Gas.

• about 15% to Bahrain

and 10% to Midcontinent Gas.

– As a result, the

capital allocation will be approximately 82% in Oil & Gas with

the remainder being spent in Midstream and Chemical.

the remainder being spent in Midstream and Chemical.

– As a result, the

capital allocation will be approximately 82% in Oil & Gas with

the remainder being spent in Midstream and Chemical.

the remainder being spent in Midstream and Chemical.

Oil

& Gas, and Midstream Capital

Oil

& Gas, and Midstream Capital

Capital

Spending Program

Capital

Spending Program

10

11

Pipeline of Future

Growth Projects

• California - Oxy is the

largest acreage holder in the state, and is

continuing to pursue recent exploration successes.

continuing to pursue recent exploration successes.

• Permian

Basin

- opportunity to deploy additional sources of CO2

to improve recovery and boost oil production.

to improve recovery and boost oil production.

• Midcontinent

Gas -

most of our gas production in the Piceance

Basin, non-associated gas in the Permian Basin, and the

Hugoton field has been combined into a single business unit.

Basin, non-associated gas in the Permian Basin, and the

Hugoton field has been combined into a single business unit.

• Oman - recently

awarded new gas and condensate development

opportunities and have initiated drilling.

opportunities and have initiated drilling.

• Bahrain - have created a

new joint operating company and

signed a Development and Production Sharing Agreement for

the further development of the Bahrain Field.

signed a Development and Production Sharing Agreement for

the further development of the Bahrain Field.

• Iraq - Oxy is part of

an Eni-led consortium that has been

awarded the license for development of the giant Zubair oil field.

awarded the license for development of the giant Zubair oil field.

11

12

2009

net production

• 377

mboe/day

• 58% of worldwide

total

2009

reserves

• 2.07 billion

boe

• 64% of worldwide

total

US Oil

& Gas Operations

12

13

331

354

359

2005

2006

2007

Thousand

BOE/Day

Thousand

BOE/Day

US

Oil and Gas Production

US

Oil and Gas Production

**ROANCC = Return

On Average Net Capitalized Costs.

361

377

2008

2009

A-T

Cash = Income from continuing operations after US income

taxes, plus DD&A, and minus exploration and development costs

incurred.

taxes, plus DD&A, and minus exploration and development costs

incurred.

1See attached for GAAP

reconciliation.

1See attached for GAAP

reconciliation.

US Oil

& Gas Operations

Key

Operations/Assets:

– California/Elk Hills

Field

– Permian

Basin

– Midcontinent

Gas

2009

Financial Data1

Pre-tax

Income $2.2

Billion

After-tax Cash $1.6

Billion

Capital $1.2

Billion

ROANCC** 9%

13

14

New

Mexico

New

Mexico

Colorado

Colorado

Bravo

Dome

Bravo

Dome

Salt

Creek

Salt

Creek

Hugoton

Hugoton

Sheep

Mountain

Sheep

Mountain

Kansas

Kansas

• Large resource

inventory — Oxy

holds 2.2 mm net acres

holds 2.2 mm net acres

• Large resource

inventory — Oxy

holds 2.2 mm net acres

holds 2.2 mm net acres

• 2009 production of

185 mboe/day

• 2009 production of

185 mboe/day

• 1.1 billion boe of

net proved

reserves (34% of Oxy total)

reserves (34% of Oxy total)

• 1.1 billion boe of

net proved

reserves (34% of Oxy total)

reserves (34% of Oxy total)

• Low decline rate

& long-lived

properties

properties

• Low decline rate

& long-lived

properties

properties

• Generates

significant free cash flow

• Generates

significant free cash flow

• Significant

investment in long-lead

CO2 projects (Century plant)

CO2 projects (Century plant)

• Significant

investment in long-lead

CO2 projects (Century plant)

CO2 projects (Century plant)

• Operating

efficiency

• Operating

efficiency

– 6 rig drilling

program focused on

exploitation of recent "bolt-on"

acquisitions

exploitation of recent "bolt-on"

acquisitions

– 6 rig drilling

program focused on

exploitation of recent "bolt-on"

acquisitions

exploitation of recent "bolt-on"

acquisitions

– Running 65

workover rigs focused

on highest productivity wells

on highest productivity wells

– Running 65

workover rigs focused

on highest productivity wells

on highest productivity wells

• Natural area for

consolidation

• Natural area for

consolidation

Texas

Texas

Midland

Midland

Hobbs

Hobbs

Indian

Basin

Indian

Basin

Area

Area

Sharon

Ridge

Sharon

Ridge

Cogdell

Cogdell

Seminole

Seminole

Oxy

Acreage

Oxy

Acreage

CO2 Pipelines

CO2 Pipelines

New

Centurion Pipelines

New

Centurion Pipelines

Old

Centurion Pipelines

Old

Centurion Pipelines

To

Cushing, OK

To

Cushing, OK

Permian

Basin Operations

14

15

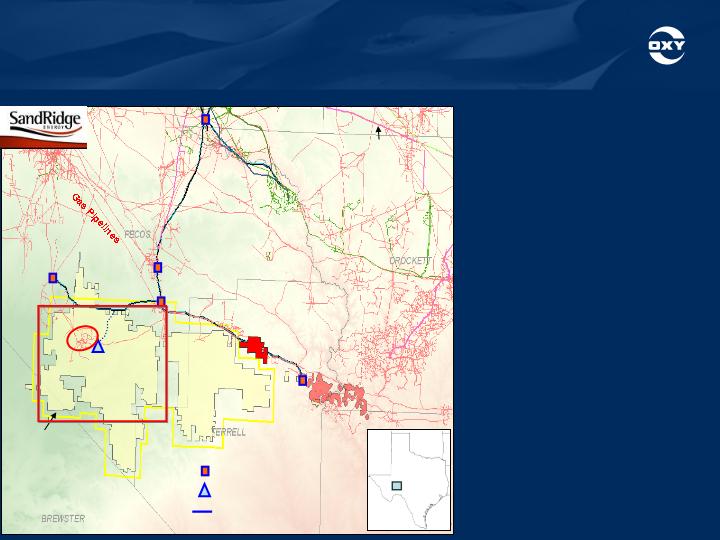

SandRidge

Acreage

1,300

mi2 3D

5

phases

Oxy

Pakenham

Oxy

JM

- Brown Bassett

Oil

Pipelines

CO2

Pipelines

County

County

NGL

Pipelines

Terrell

(Oxy)

Mitchell

Gray

Ranch

New

Plant

“Century”

Pikes

Peak

Pinon

Field

SD

Plant

Gas

Plants

McCamey

Hub

Hub

CO2 Pipelines

TX

Permian

- Century CO2 Plant

Project

• Oxy to invest $850

mm

in CO2 plant and

pipeline facilities.

in CO2 plant and

pipeline facilities.

• Oxy to invest $850

mm

in CO2 plant and

pipeline facilities.

in CO2 plant and

pipeline facilities.

• CO2 to be used in

Oxy’s

Permian EOR projects.

Permian EOR projects.

• CO2 to be used in

Oxy’s

Permian EOR projects.

Permian EOR projects.

• New CO2 resources

expected to expand

Oxy’s Permian

production by at least 50

mb/day within 5 years.

expected to expand

Oxy’s Permian

production by at least 50

mb/day within 5 years.

• New CO2 resources

expected to expand

Oxy’s Permian

production by at least 50

mb/day within 5 years.

expected to expand

Oxy’s Permian

production by at least 50

mb/day within 5 years.

• Allows Oxy to

exploit at

least 3.5 tcf of CO2 for

EOR use.

least 3.5 tcf of CO2 for

EOR use.

• Allows Oxy to

exploit at

least 3.5 tcf of CO2 for

EOR use.

least 3.5 tcf of CO2 for

EOR use.

• Enables Oxy

to

accelerate and enhance

development of existing

assets.

accelerate and enhance

development of existing

assets.

• Enables Oxy

to

accelerate and enhance

development of existing

assets.

accelerate and enhance

development of existing

assets.

15

16

Qatar

UAE

Oman

Yemen

Libya

2009

net production

• 254

mboe/day

• 35% of worldwide

total

2009

reserves

• 924 million

boe

• 29% of worldwide

total

Bahrain

Middle

East/North Africa Oil & Gas

16

17

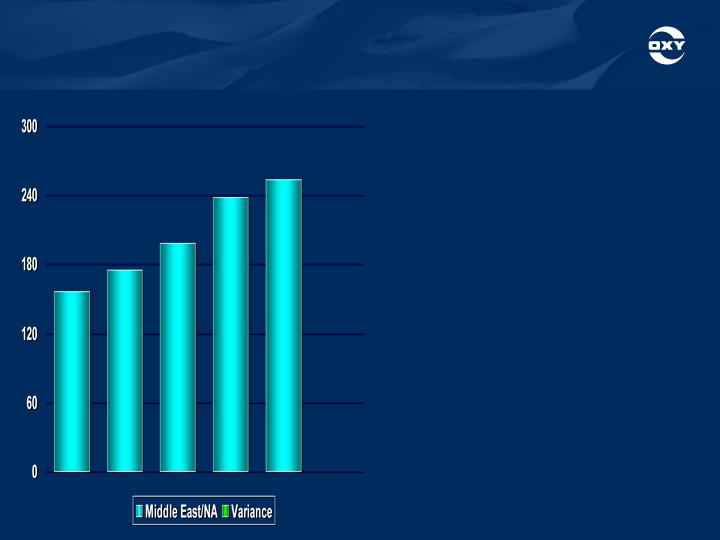

157

175

198

2005

2006

2007

Thousand

BOE/Day

Thousand

BOE/Day

Middle East/North

Africa

Middle East/North

Africa

Oil

and Gas Production

Oil

and Gas Production

**ROANCC = Return

On Average Net Capitalized Costs.

238

254

2008

2009

A-T

Cash = Income from continuing operations after foreign income

taxes,

plus

DD&A minus exploration and development costs incurred.

1See attached for GAAP

reconciliation.

1See attached for GAAP

reconciliation.

Middle

East/North Africa Oil & Gas

Key

Operations/Assets:

– Dolphin

Project

– Qatar

ISND

– Oman/Mukhaizna

– Bahrain

2009

Financial Data1

Pre-tax

Income $2.5

Billion

After-tax Cash $1.2

Billion

Capital $1.0

Billion

ROANCC** 22%

17

18

Oxy

Blocks

Oxy

Blocks

Oman -

Mukhaizna Project

• Continuing large

scale steam flood

EOR project - drilled 665+ wells

thru 2009

EOR project - drilled 665+ wells

thru 2009

• Gross production at

year-end 2009

was more than 10x higher vs. Sept.

2005

was more than 10x higher vs. Sept.

2005

• Expect to drill

approximately 320

new wells in 2010

new wells in 2010

• Exceeded target 2009

production

exit rate of 80 mb/d (gross)

exit rate of 80 mb/d (gross)

• Completing all

multiple water

treatment facilities to supply the

steam generators in order to:

treatment facilities to supply the

steam generators in order to:

– Increase gross

production to year-

end 2010 exit rate of 100 mb/d;

end 2010 exit rate of 100 mb/d;

– Expect to increase

gross

production to 150 mb/d.

production to 150 mb/d.

18

19

• PSA signed on

11/24/08

– Newly formed

contract area -

“Habiba” - Block 62

“Habiba” - Block 62

– 20-year agreement

covers 2,269

km2

km2

– Development of

four gas fields

– Exploration

potential

• Partners

– Oxy (operator)

48%, Mubadala

32%, Oman 20%

32%, Oman 20%

• Development

Plan

– First production

in 2010

– Gross production

approximately

27 to 28 mboe/d by year-end 2011

27 to 28 mboe/d by year-end 2011

Oxy

Blocks

Oxy

Blocks

Oman -

Gas Project

19

20

• Oxy, Mubadala, and

NOGA announced

the creation of a new joint operating

company, Tatweer Petroleum, which will

serve as operator for the Bahrain Field.

the creation of a new joint operating

company, Tatweer Petroleum, which will

serve as operator for the Bahrain Field.

• The company will

operate under a

Development and Production Sharing

Agreement (DPSA) signed and approved

in late 2009.

Development and Production Sharing

Agreement (DPSA) signed and approved

in late 2009.

• Oxy will hold a

48% interest, with

Mubadala holding 32%, and NOGA 20%.

Mubadala holding 32%, and NOGA 20%.

• We expect to

increase oil production to

about 3x the current level to reach 100

mb/d within 7 years, and increase gas

production by more than 65% to

approximately 2.5 bcf/d.

about 3x the current level to reach 100

mb/d within 7 years, and increase gas

production by more than 65% to

approximately 2.5 bcf/d.

• Gross capital

investment is expected to

be approximately $1.5 billion over the

initial 5 years of the DPSA.

be approximately $1.5 billion over the

initial 5 years of the DPSA.

Bahrain

Field Development Project

20

21

Iran

Saudi

Arabia

Syria

Kirkuk

Reserves

17B

Bai

Hassan

Reserves

5B

Mansuriya

Reserves

1.6TCF

West

Qurna 1

ExxonMobil/Shell

Reserves

6B

Rumaila

BP/CNPC

Reserves

21B

Akkas

Reserves

2.5TCF

Iraq

Zubair

Eni/Oxy/Kogas

Reserves

4.2B+

Missan

Reserves

2.2B

Iraq -

Zubair Field

21

22

Iraq -

Zubair Field

• Oxy is part of an

Eni-led consortium that has been awarded the license

for development of the giant Zubair oil field in Iraq.

for development of the giant Zubair oil field in Iraq.

• Iraq holds the

world’s second-largest reserves of oil with about 115

billion barrels estimated - second only to Saudi Arabia.

billion barrels estimated - second only to Saudi Arabia.

• We are now one of

the few companies on the ground floor of this world-

class opportunity.

class opportunity.

• Zubair has

significant proved reserves estimated at more than 4.2

billion bbls and current production of 195 mb/d.

billion bbls and current production of 195 mb/d.

• Development of

Zubair will be a multi-year, multi-phased project with

production expected to reach approx. 1.2 mm b/d in the next 6 years.

production expected to reach approx. 1.2 mm b/d in the next 6 years.

• We expect Oxy’s net

share of peak production from the field to be

approximately 90 mb/d.

approximately 90 mb/d.

• Zubair will give us

the opportunity to learn, and give us the insight to

effectively evaluate future developments in Iraq.

effectively evaluate future developments in Iraq.

• We hope to expand

our position and continue our involvement in Iraq

while meeting our standards for security and rate of return.

while meeting our standards for security and rate of return.

22

23

*Production and

producing wells as of each of the quarterly earnings disclosure

dates.

California - Kern

County Discovery

California - Kern

County Discovery

KERN

COUNTY DISCOVERY AREA

KERN

COUNTY DISCOVERY AREA

4Q09 3Q09 2Q09 1Q09

4Q09 3Q09 2Q09 1Q09

Gross

Production*

Gross

Production*

– Natural Gas

(mmcf/d) 145 105 74 28

– Natural Gas

(mmcf/d) 145 105 74 28

– Liquids (mb/d) 7.5 8.5 5 3

– Liquids (mb/d) 7.5 8.5 5 3

– Total mboe/d 31.7 26.0 17.3 7.7

– Total mboe/d 31.7 26.0 17.3 7.7

Number

of producing wells* 15 10 6 4

Number

of producing wells* 15 10 6 4

• We believe there are

150 mm to 250 mm gross boe of reserves within the

small producing area.

small producing area.

• We believe there are

150 mm to 250 mm gross boe of reserves within the

small producing area.

small producing area.

• Approximately

two-thirds of the discovery is believed to be natural gas.

• Approximately

two-thirds of the discovery is believed to be natural gas.

• The discovery, which

is near Elk Hills, is not below any producing zones.

• The discovery, which

is near Elk Hills, is not below any producing zones.

• Oxy’s interest in

the discovery area is approximately 80%.

• Oxy’s interest in

the discovery area is approximately 80%.

23

24

San

Joaquin

Valley

OXY

Producing Properties

Exploration

Acreage

Elk

Hills

Long

Beach

&

Tidelands

San

Francisco

Sacramento

Bakersfield

Los

Angeles

Sacramento

Valley

California - Kern

County Discovery

California - Kern

County Discovery

• Cumulative gross

production

since the start of production

through 12/31/09 has been 19.4

bcf of gas and 1.5 mm barrels of

liquids;

since the start of production

through 12/31/09 has been 19.4

bcf of gas and 1.5 mm barrels of

liquids;

• Cumulative gross

production

since the start of production

through 12/31/09 has been 19.4

bcf of gas and 1.5 mm barrels of

liquids;

since the start of production

through 12/31/09 has been 19.4

bcf of gas and 1.5 mm barrels of

liquids;

• We expect to drill 8

wells in the

first half of 2010 focusing on oil

drilling and exploring the limits of

the field;

first half of 2010 focusing on oil

drilling and exploring the limits of

the field;

• We expect to drill 8

wells in the

first half of 2010 focusing on oil

drilling and exploring the limits of

the field;

first half of 2010 focusing on oil

drilling and exploring the limits of

the field;

• We also expect to

add skid

mounted gas processing facilities

by 2Q-10;

mounted gas processing facilities

by 2Q-10;

• We also expect to

add skid

mounted gas processing facilities

by 2Q-10;

mounted gas processing facilities

by 2Q-10;

• We expect to add to

our gas

production once these facilities

are installed.

production once these facilities

are installed.

• We expect to add to

our gas

production once these facilities

are installed.

production once these facilities

are installed.

24

25

California

Exploration

California

Exploration

• Excluding

the Kern County

discovery:

discovery:

• Excluding

the Kern County

discovery:

discovery:

– Over the course of

a couple of years,

we have drilled 39 exploration wells

seeking non-traditional hydrocarbon

bearing zones in California.

we have drilled 39 exploration wells

seeking non-traditional hydrocarbon

bearing zones in California.

– Over the course of

a couple of years,

we have drilled 39 exploration wells

seeking non-traditional hydrocarbon

bearing zones in California.

we have drilled 39 exploration wells

seeking non-traditional hydrocarbon

bearing zones in California.

– Of these wells, 12

are commercial

and 10 are currently being evaluated;

and 10 are currently being evaluated;

– Of these wells, 12

are commercial

and 10 are currently being evaluated;

and 10 are currently being evaluated;

– Oxy holds 1.3 mm

acres of net fee

minerals and leasehold in CA, which

have been acquired in the last few

years to exploit these opportunities.

Discoveries similar to the Kern

County discovery are possible in this

net acre position.

minerals and leasehold in CA, which

have been acquired in the last few

years to exploit these opportunities.

Discoveries similar to the Kern

County discovery are possible in this

net acre position.

– Oxy holds 1.3 mm

acres of net fee

minerals and leasehold in CA, which

have been acquired in the last few

years to exploit these opportunities.

Discoveries similar to the Kern

County discovery are possible in this

net acre position.

minerals and leasehold in CA, which

have been acquired in the last few

years to exploit these opportunities.

Discoveries similar to the Kern

County discovery are possible in this

net acre position.

– Additionally, we

continue to pursue

shale production which is expected to

produce oil on this acreage.

shale production which is expected to

produce oil on this acreage.

– Additionally, we

continue to pursue

shale production which is expected to

produce oil on this acreage.

shale production which is expected to

produce oil on this acreage.

25

26

Other

Value Enhancing Initiatives

• Chemicals

Operations

– consistent free cash

generator

• Midstream Assets -

Marketing and Pipelines

– adds value and is

complimentary to Oil & Gas operations

• Dividend

Growth

– consistent track

record of dividend increases

26

27

3-Year* 5-Year*

Average Average

2009

Period

ending 12/31/09*

($

millions)

1 See attached for GAAP

reconciliation.

1 See attached for GAAP

reconciliation.

Chemicals

Operations

Pre-tax

Earnings $583 $688 $389

Free

Cash Flow1 $657 $758 $480

Capital

Spending $230 $221 $205

27

28

The

assets are comprised of the following businesses:

Marketing; Gas processing plants; Pipelines; Power

generation, and; CO2 source fields and facilities.

Marketing; Gas processing plants; Pipelines; Power

generation, and; CO2 source fields and facilities.

The

assets are comprised of the following businesses:

Marketing; Gas processing plants; Pipelines; Power

generation, and; CO2 source fields and facilities.

Marketing; Gas processing plants; Pipelines; Power

generation, and; CO2 source fields and facilities.

Midstream

Data 2009 2008 2007

Midstream

Data 2009 2008 2007

Pre-tax

earnings $235 $520 $367

Pre-tax

earnings $235 $520 $367

Net

Book Value $3,840 $2,930 $1,935

Net

Book Value $3,840 $2,930 $1,935

Capex

& Acquisition costs $885 $880 $430

Capex

& Acquisition costs $885 $880 $430

• Funds will be

spent enhancing our CO2

production, investing in construction of the

W. Texas gas processing plant, and expanding our pipeline capacity.

W. Texas gas processing plant, and expanding our pipeline capacity.

• Funds will be

spent enhancing our CO2

production, investing in construction of the

W. Texas gas processing plant, and expanding our pipeline capacity.

W. Texas gas processing plant, and expanding our pipeline capacity.

($

in millions)

Midstream, Marketing

and Other

28

29

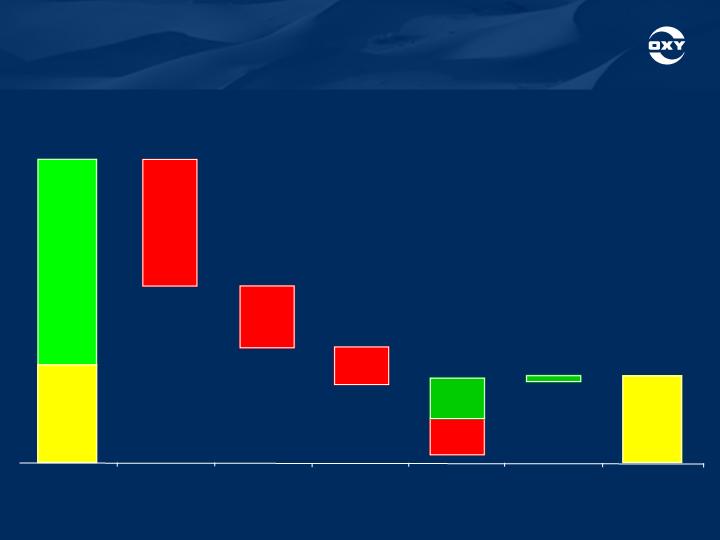

$7,600

$40

$1,065

$1,750

$1,230

Available

Cash

Capex

Net

Debt

Issuance

Dividends

Acquisitions

&

Foreign

Bonuses

Ending

Cash

Balance

12/31/09

Cash

Flow

From

Operations

$5,800

($

in millions)

Beginning

Cash

$1,800

12/31/08

$3,600

Other

$5

Debt

Issuance

$740

Debt

Reduction

$700

Full

Year 2009 Cash Flow

Full

Year 2009 Cash Flow

29

30

2009

($

in millions)

Uses of

Capital - (In Order of Priority)

1. Base/Maintenance

Capital -

$2,550

2. Dividends - $1,065

3. Growth

Capital - $1,030

4. Acquisitions

- $1,750

5. Share

Repurchase - $ -

30

31

$0.52

$0.52

$0.55

$0.55

$0.645

$0.645

$0.80

$0.80

Annual

Dividend Payout per share

$0.50

$0.50

$0.94

$0.94

An

established track record of consistent dividend increases

An

established track record of consistent dividend increases

$1.21

$1.21

$1.31

$1.31

Creating Shareholder

Value - Dividends

31

32

Change

In

Change

In

Equity

Market Value

Equity

Market Value

Change

In

Change

In

Shareholders’

Equity

Shareholders’

Equity

9.5

9.5

2.6

2.6

2.3

2.3

2.3

2.3

Oxy’s

Shareholder Equity versus Equity Market Value

1 -

Year

1 -

Year

3 -

Year

3 -

Year

5 -

Year

5 -

Year

10 -

Year

10 -

Year

• Building a History

of Generating Shareholder Value

• Building a History

of Generating Shareholder Value

($

in millions)

($

in millions)

Market

Value per $ of Equity Retained

Market

Value per $ of Equity Retained

$17,443

$17,443

$1,834

$1,834

$25,037

$25,037

$9,555

$9,555

$42,897

$42,897

$18,562

$18,562

Financial Data for

period ending December 31, 2009.

Financial Data for

period ending December 31, 2009.

$58,096

$58,096

$25,636

$25,636

Creating Shareholder

Value

32

33

Future

Growth Areas to Watch

• Bahrain

-

• Oman/Mukhaizna

-

• Middle

East -

• California

-

• Permian

Basin -

• Midcontinent

Gas -

33

34

Occidental Petroleum

Corporation

Statements in this

presentation that contain words such as “will,” “expect” or “estimate,”

or

otherwise relate to the future, are forward-looking and involve risks and uncertainties that could

significantly affect expected results. Factors that could cause actual results to differ materially

include, but are not limited to: global commodity price fluctuations and supply/demand

considerations for oil, gas and chemicals; not successfully completing (or any material delay in)

any expansions, field development, capital projects, acquisitions, or dispositions; higher-than-

expected costs; political risk; operational interruptions; changes in tax rates; exploration risks,

such as drilling of unsuccessful wells; and commodity trading risks. You should not place undue

reliance on these forward-looking statements which speak only as of the date of this

presentation. Unless legally required, Occidental does not undertake any obligation to update

any forward-looking statements as a result of new information, future events or otherwise.

Finding and Development cost calculations inherently compare costs and reserves additions

from separate periods. You can see the elements of our calculation of such costs in our

reserves release on our website. The United States Securities and Exchange Commission

(SEC) permits oil and natural gas companies, in their filings with the SEC, to disclose only

reserves anticipated to be economically producible, as of a given date, by application of

development projects to known accumulations. We use certain terms in this presentation, such

as estimated reserves, recoverable reserves and oil in place, that the SEC’s guidelines strictly

prohibit us from using in filings with the SEC. U.S. investors are urged to consider carefully the

disclosures in our Form 10-K, available through the following toll-free telephone number, 1-888-

OXYPETE (1-888-699-7383) or on the Internet at http://www.oxy.com.

otherwise relate to the future, are forward-looking and involve risks and uncertainties that could

significantly affect expected results. Factors that could cause actual results to differ materially

include, but are not limited to: global commodity price fluctuations and supply/demand

considerations for oil, gas and chemicals; not successfully completing (or any material delay in)

any expansions, field development, capital projects, acquisitions, or dispositions; higher-than-

expected costs; political risk; operational interruptions; changes in tax rates; exploration risks,

such as drilling of unsuccessful wells; and commodity trading risks. You should not place undue

reliance on these forward-looking statements which speak only as of the date of this

presentation. Unless legally required, Occidental does not undertake any obligation to update

any forward-looking statements as a result of new information, future events or otherwise.

Finding and Development cost calculations inherently compare costs and reserves additions

from separate periods. You can see the elements of our calculation of such costs in our

reserves release on our website. The United States Securities and Exchange Commission

(SEC) permits oil and natural gas companies, in their filings with the SEC, to disclose only

reserves anticipated to be economically producible, as of a given date, by application of

development projects to known accumulations. We use certain terms in this presentation, such

as estimated reserves, recoverable reserves and oil in place, that the SEC’s guidelines strictly

prohibit us from using in filings with the SEC. U.S. investors are urged to consider carefully the

disclosures in our Form 10-K, available through the following toll-free telephone number, 1-888-

OXYPETE (1-888-699-7383) or on the Internet at http://www.oxy.com.

You

also can obtain a copy from the SEC by calling 1-800-SEC-0330. Oxy posts or

provides

links to important information on its website including investor and analyst presentations, certain

board committee charters and information the SEC requires companies and certain of its

officers and directors to file or furnish. Such information may be found in the “Investor

Relations” and “Social Responsibility” portions of the website.

links to important information on its website including investor and analyst presentations, certain

board committee charters and information the SEC requires companies and certain of its

officers and directors to file or furnish. Such information may be found in the “Investor

Relations” and “Social Responsibility” portions of the website.

34

35

35

36

Appendix

36

37

40

5

—

44

11

100

2004

34

31

—

27

8

100

2005

Capital

Acquisitions

Share

Repurchase

Debt

Reduction & Cash

Dividends

2006

Percentage

of Total

Percentage

of Total

41

26

21

3

9

100

2007

40

16

14

21

9

100

2008

39

40

13

—

8

100

2009

54

27

—

3

16

100

Gross

Cash Flow Uses

37

38

California - Kern

County Discovery

California - Kern

County Discovery

Conventional

vs. Non-conventional - What does this mean?

Conventional

vs. Non-conventional - What does this mean?

• Oxy’s discovery is

Conventional, which means it is non-shale, is analogous

to a deep water discovery, and bears no relationship at all to so called

resource plays.

to a deep water discovery, and bears no relationship at all to so called

resource plays.

• Oxy’s discovery is

Conventional, which means it is non-shale, is analogous

to a deep water discovery, and bears no relationship at all to so called

resource plays.

to a deep water discovery, and bears no relationship at all to so called

resource plays.

• This is a classic

oil and gas field with large pay

zones and with high

permeability.

permeability.

• This is a classic

oil and gas field with large pay

zones and with high

permeability.

permeability.

• Flow rates are high

without stimulation because of the high permeability of

the reservoir.

the reservoir.

• Flow rates are high

without stimulation because of the high permeability of

the reservoir.

the reservoir.

• Decline rates are

relatively low (compared with frac’d wells) because each

well can drain a large area.

well can drain a large area.

• Decline rates are

relatively low (compared with frac’d wells) because each

well can drain a large area.

well can drain a large area.

• In a

Non-conventional field the source rock and the producing zone are

often the same. In a Conventional field a trapping mechanism is needed to

contain the migrated oil and/or gas, which reduces the statistical nature of

the drilling results.

often the same. In a Conventional field a trapping mechanism is needed to

contain the migrated oil and/or gas, which reduces the statistical nature of

the drilling results.

• In a

Non-conventional field the source rock and the producing zone are

often the same. In a Conventional field a trapping mechanism is needed to

contain the migrated oil and/or gas, which reduces the statistical nature of

the drilling results.

often the same. In a Conventional field a trapping mechanism is needed to

contain the migrated oil and/or gas, which reduces the statistical nature of

the drilling results.

38

39

California - Kern

County Discovery

California - Kern

County Discovery

Conventional

vs. Non-conventional - What does this mean?

Conventional

vs. Non-conventional - What does this mean?

• In a

Non-conventional play drilling efficiencies and cost burden determines

the outcome. In a Conventional discovery the value is created by the

discovery process.

the outcome. In a Conventional discovery the value is created by the

discovery process.

• In a

Non-conventional play drilling efficiencies and cost burden determines

the outcome. In a Conventional discovery the value is created by the

discovery process.

the outcome. In a Conventional discovery the value is created by the

discovery process.

• In a

Non-conventional field, reserves for the play are determined by

statistical inference. In the Non-conventional wells, decline curves tend to

be steep, making ultimate reserves difficult to estimate early in the play's

history. Conventional fields can often be determined volumetrically with

the area and pay thickness being relatively easy to determine while the

recovery factor can usually be bracketed by analogy.

statistical inference. In the Non-conventional wells, decline curves tend to

be steep, making ultimate reserves difficult to estimate early in the play's

history. Conventional fields can often be determined volumetrically with

the area and pay thickness being relatively easy to determine while the

recovery factor can usually be bracketed by analogy.

• In a

Non-conventional field, reserves for the play are determined by

statistical inference. In the Non-conventional wells, decline curves tend to

be steep, making ultimate reserves difficult to estimate early in the play's

history. Conventional fields can often be determined volumetrically with

the area and pay thickness being relatively easy to determine while the

recovery factor can usually be bracketed by analogy.

statistical inference. In the Non-conventional wells, decline curves tend to

be steep, making ultimate reserves difficult to estimate early in the play's

history. Conventional fields can often be determined volumetrically with

the area and pay thickness being relatively easy to determine while the

recovery factor can usually be bracketed by analogy.

• As a result of the

large drainage areas and the lack of need for high cost

completions, Conventional fields can have dramatically lower F&D costs

than Non-conventional fields.

completions, Conventional fields can have dramatically lower F&D costs

than Non-conventional fields.

• As a result of the

large drainage areas and the lack of need for high cost

completions, Conventional fields can have dramatically lower F&D costs

than Non-conventional fields.

completions, Conventional fields can have dramatically lower F&D costs

than Non-conventional fields.

39

40

40

|

Occidental

Petroleum Corporation

|

|||||||||||||||

|

Reconciliation

to Generally Accepted Accounting Principles (GAAP)

|

|||||||||||||||

|

For

the Twelve Months Ended December 31,

|

|||||||||||||||

|

($

Millions)

|

|||||||||||||||

|

2009

|

2008

|

||||||||||||||

|

Diluted

|

Diluted

|

||||||||||||||

|

EPS

|

EPS

|

||||||||||||||

|

Reported

Income

|

$

|

2,915

|

$

|

3.58

|

$

|

6,857

|

$

|

8.34

|

|||||||

|

Add:

significant items affecting earnings

|

|||||||||||||||

|

Asset

impairments

|

170

|

599

|

|||||||||||||

|

Rig

contract terminations

|

8

|

58

|

|||||||||||||

|

Plant

closure and impairment

|

-

|

90

|

|||||||||||||

|

Railcar

leases

|

15

|

-

|

|||||||||||||

|

Severance

accrual

|

40

|

-

|

|||||||||||||

|

Tax

effect of pre-tax adjustments

|

(77

|

)

|

(238

|

)

|

|||||||||||

|

Discontinued

operations, net *

|

12

|

(18

|

)

|

||||||||||||

|

Core

Results

|

$

|

3,083

|

$

|

3.78

|

$

|

7,348

|

$

|

8.94

|

|||||||

|

*

Amount shown after-tax

|

|||||||||||||||

|

Average

Diluted Common Shares Outstanding

|

813.8

|

820.5

|

|||||||||||||

|

Chemicals

Free Cash Flow

|

||||||||||

|

Reconciliation

to Generally Accepted Accounting Principles (GAAP)

|

||||||||||

|

($

Millions)

|

||||||||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

||||||

|

Occidental

Petroleum Consolidated Statement of Cash Flows

|

||||||||||

|

Cash

flow from operating activities

|

5,337

|

6,353

|

6,798

|

10,652

|

5,813

|

|||||

|

Cash

flow from investing activities

|

(3,161

|

)

|

(4,383

|

)

|

(3,128

|

)

|

(9,457

|

)

|

(5,327

|

)

|

|

Cash

flow from financing activities

|

(1,187

|

)

|

(2,819

|

)

|

(3,045

|

)

|

(1,382

|

)

|

(1,033

|

)

|

|

Change

in cash

|

989

|

(849

|

)

|

625

|

(187

|

)

|

(547

|

)

|

||

|

Chemicals

Free Cash Flow

|

||||||||||

|

Core

results (see reconciliation below)

|

784

|

906

|

601

|

759

|

389

|

|||||

|

Depreciation

& amortization expense

|

268

|

279

|

304

|

311

|

298

|

|||||

|

Roundings

|

1

|

(2

|

)

|

-

|

-

|

(2

|

)

|

|||

|

Capital

expenditures (excluding acquisitions)

|

(168

|

)

|

(248

|

)

|

(245

|

)

|

(240

|

)

|

(205

|

)

|

|

Free

cash flow

|

885

|

935

|

660

|

830

|

480

|

|||||

|

Core

|

Cash

|

Capital

|

||||||||

|

Results

|

Flow

|

Spending

|

||||||||

|

3-Year

Average (2007-2009)

|

583

|

657

|

230

|

|||||||

|

5-Year

Average (2005-2009)

|

688

|

758

|

221

|

|||||||

|

Segment

income

|

614

|

906

|

601

|

669

|

389

|

|||||

|

Add:

significant items affecting earnings

|

||||||||||

|

Plant

closure and impairments

|

-

|

-

|

-

|

90

|

-

|

|||||

|

Hurricane

insurance charges

|

11

|

-

|

-

|

-

|

-

|

|||||

|

Write-off

of plants

|

159

|

-

|

-

|

-

|

-

|

|||||

|

Core

results

|

784

|

906

|

601

|

759

|

389

|

|||||

|

Occidental

Petroleum Corporation

|

||||||||||||

|

Reconciliation

to Generally Accepted Accounting Principles (GAAP)

|

||||||||||||

|

For

the Year Ended December 31, 2009

|

||||||||||||

|

United

|

Latin

|

Middle

East

|

||||||||||

|

States

|

America

|

North

Africa

|

TOTAL

|

|||||||||

|

Capitalized

Costs

|

||||||||||||

|

Proved

properties

|

24,488

|

5,743

|

10,909

|

41,140

|

||||||||

|

Unproved

properties

|

1,709

|

-

|

158

|

1,867

|

||||||||

|

26,197

|

5,743

|

11,067

|

43,007

|

|||||||||

|

Accumulated

DD&A

|

(7,956

|

)

|

(2,490

|

)

|

(4,826

|

)

|

(15,272

|

)

|

||||

|

Capitalized

cost

|

18,241

|

3,253

|

6,241

|

27,735

|

||||||||

|

Costs

Incurred

|

||||||||||||

|

Property

Acquisition Costs

|

||||||||||||

|

Proved

Properties

|

569

|

-

|

158

|

727

|

||||||||

|

Unproved

Properties

|

100

|

-

|

3

|

103

|

||||||||

|

Exploration

Costs

|

131

|

26

|

50

|

207

|

||||||||

|

Development

Costs

|

1,223

|

560

|

996

|

2,779

|

||||||||

|

Cost

Incurred

|

2,023

|

586

|

1,207

|

3,816

|

||||||||

|

Results

of Operations

|

||||||||||||

|

Revenues

|

5,832

|

1,538

|

4,195

|

11,565

|

||||||||

|

Production

costs

|

1,452

|

409

|

601

|

2,462

|

||||||||

|

Taxes

other than on income

|

399

|

22

|

-

|

421

|

||||||||

|

Exploration

expenses

|

156

|

28

|

83

|

267

|

||||||||

|

Other

operating expenses

|

389

|

116

|

208

|

713

|

||||||||

|

Impairment

of suspended costs

|

-

|

170

|

-

|

170

|

||||||||

|

DD&A

|

1,237

|

628

|

823

|

2,688

|

||||||||

|

Pretax

income

|

2,199

|

165

|

2,480

|

4,844

|

||||||||

|

Income

taxes

|

670

|

6

|

1,151

|

1,827

|

||||||||

|

Results

of operations

|

1,529

|

159

|

1,329

|

3,017

|

||||||||

|

After-tax

Cash

|

||||||||||||

|

After-tax

income

|

1,529

|

159

|

1,329

|

3,017

|

||||||||

|

+

DD&A

|

1,237

|

628

|

823

|

2,688

|

||||||||

|

+

Impairment of suspended costs

|

-

|

170

|

-

|

170

|

||||||||

|

+

Exploration expense

|

156

|

28

|

83

|

267

|

||||||||

|

-

Costs incurred (development)

|

(1,223

|

)

|

(560

|

)

|

(996

|

)

|

(2,779

|

)

|

||||

|

-

Costs incurred (exploration)

|

(131

|

)

|

(26

|

)

|

(50

|

)

|

(207

|

)

|

||||

|

After-tax

cash

|

1,568

|

399

|

1,189

|

3,156

|

||||||||

|

Return

on Average Net Capitalized Costs

|

||||||||||||

|

Capitalized

costs

|

||||||||||||

|

2009

|

18,241

|

3,253

|

6,241

|

27,735

|

||||||||

|

2008

|

17,611

|

3,484

|

5,886

|

26,981

|

||||||||

|

Average

|

17,926

|

3,369

|

6,064

|

27,358

|

||||||||

|

After-tax

income

|

1,529

|

159

|

1,329

|

3,017

|

||||||||

|

Return

%

|

9%

|

5%

|

22%

|

11%

|

||||||||