Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LIGHTPATH TECHNOLOGIES INC | form_8-k.htm |

|

|

|

|

LIGHTPATH TECHNOLOGIES, INC. (NASDAQ: LPTH) FEBRUARY

2010

|

|

|

|

|

Orlando Headquarters (manufacturing, engineering,

direct sales) China Facility (manufacturing, engineering, direct sales)

Direct sales o Publicly traded since Feb 1996 (NASDAQ: LPTH) Catalog

Distributors o Presently 51 employees USA, 92 employees China

Representatives o Headquartered in Orlando, Florida o 58 US Patents Issued

o OEM Sales - Orlando, FL - Huntsville, AL - Phoenix, AZ - Shanghai, China

o Reps / Distributors: US, Canada, Europe, Israel, China, Japan, Korea,

India, Singapore, Thailand, Malaysia, Hong Kong, Philippines o ITAR DTC

Code 090617976 o GSA Contract Number is GS-35F-0425S

|

|

|

|

|

Our Facilities ORLANDO, FL o 22,500 square feet o 6,000

sq. ft. of clean room o ISO 9001-2000 Registered o Sales & Marketing

for US and Europe o Research & Development o Manufacturing - PMO -

Prototype, Small Volume and ITAR Projects. - Molded Infrared Optics

JIADING, CHINA o LightPath Optical Instrumentation (Shanghai) Co., Ltd. -

Wholly owned facility of LightPath Technologies USA o 17,000 sq. ft. o

7,000 sq. ft. of Clean Room o ISO 9001-2000 Certified o Sales - Asia sales

headquarters o Purchasing - Material consolidation o Manufacturing - High

volume, higher labor content, low labor cost o Products - Precision Molded

Aspheric Optics, GRADIUM, Isolators, Optical Assemblies

|

|

|

|

|

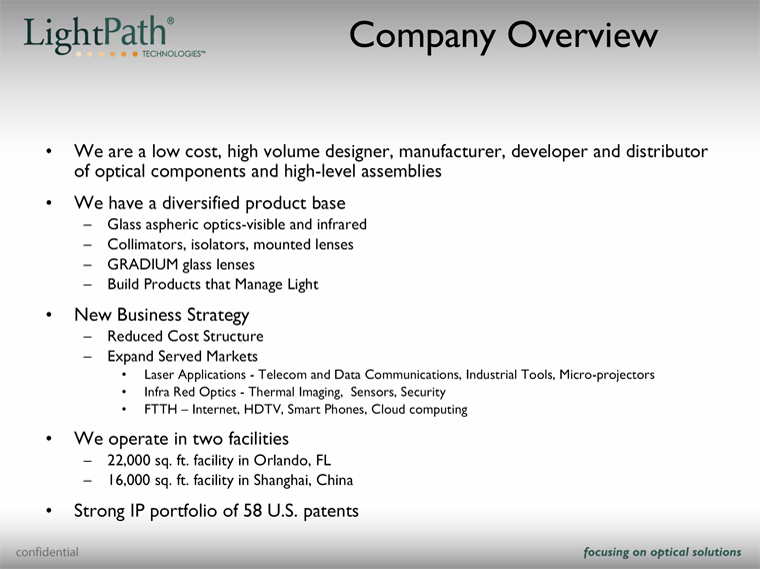

Company Overview o We are a low cost, high volume

designer, manufacturer, developer and distributor of optical components

and high-level assemblies o We have a diversified product base - Glass

aspheric optics-visible and infrared - Collimators, isolators, mounted

lenses - GRADIUM glass lenses - Build Products that Manage Light o New

Business Strategy - Reduced Cost Structure - Expand Served Markets o Laser

Applications - Telecom and Data Communications, Industrial Tools,

Micro-projectors o Infra Red Optics - Thermal Imaging, Sensors, Security o

FTTH - Internet, HDTV, Smart Phones, Cloud computing o We operate in two

facilities - 22,000 sq. ft. facility in Orlando, FL - 16,000 sq. ft.

facility in Shanghai, China o Strong IP portfolio of 58 U.S. patents

|

|

|

|

|

Shanghai Production Floor

|

|

|

|

|

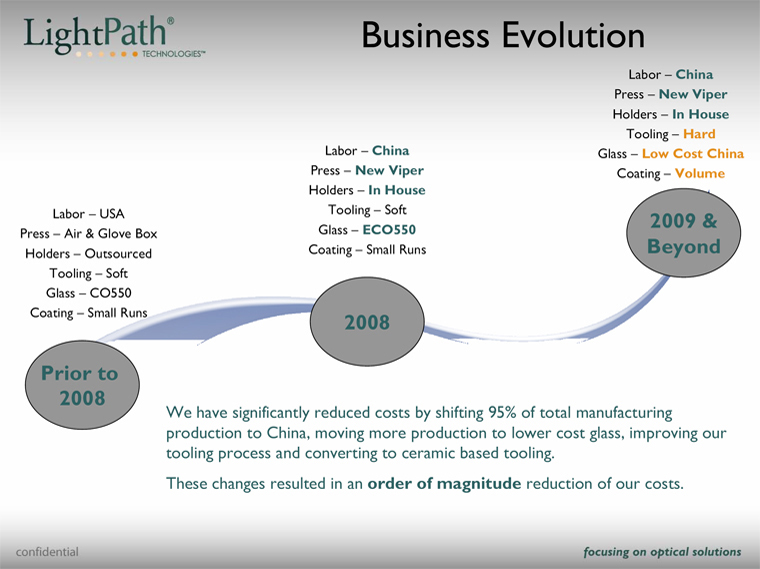

Business Evolution Labor - China Press - New Viper

Holders - In House Labor - China Tooling - Hard Press - New Viper Glass -

Low Cost China Holders - In House Coating - Volume Tooling - Soft Labor -

USA Glass - ECO550 Press - Air & Glove Box Coating - Small Runs 2009

& Holders - Outsourced Beyond Tooling - Soft Glass - CO550 2008

Coating - Small Runs Prior to 2008 We have significantly reduced costs by

shifting 95% of total manufacturing production to China, moving more

production to lower cost glass, improving our tooling process and

converting to ceramic based tooling. These changes resulted in an order of

magnitude reduction of our costs.

|

|

|

|

|

Products o Precision Molded Optics - All-glass aspheric

Lenses, RoHS compliant - Diameters 200um to 25mm, NA up to 0.85 o Molded

MWIR/LWIR Aspheric Lenses & Assemblies - Wavelength range of glasses

1- 14um - Single & multi element assembly with Athermalized design o

Valued Added Products - Mounted Aspheres, OEM Modules, Shaped Lenses o

Speciality Products - Gradium Optics - Optical Isolators and Isolator

Assemblies - Collimators

|

|

|

|

|

Competitive Advantage Growth - World Class Design

Centers in US and Asia - Recognized Brand - Capacity in Place Responsive -

Quick to Market - Quick to Volume - Flexible Process (Machines - Tools -

Glass) - Proprietary Technology Low Cost - Low Operating Cost China

Facility - Supply Agreement with CDGM Glass Company - Low Design cost

technology - (MIP, Hybrid)

|

|

|

|

|

Key Market Overview Market Opportunity Targeted o

Thermal Imaging Market - to exceed $2.5B o Consumer Market for Micro

Projectors - to exceed $1.1B o Laser Tool Market - to exceed $50M o FTTH

Market - to exceed $60M o Market Drivers: o Digital Cameras, Security,

Sensors o Laser Projectors o Industrial Laser Tools o Internet, HDTV,

Smart Phones, Cloud Computing o Asphere Market Expected to exceed $1.5B

within 5 years o Asphere vs. Spherical Lens Solution o Performance o

Simplicity o Packaging

|

|

|

|

|

Management Team J. James Gaynor, Chief Executive

Officer - Mr. Gaynor was appointed Interim Chief Executive Officer on

September 18, 2007 and President & CEO on February 1, 2008. He

formerly was the Corporate Vice President Operations since July 2006. Mr.

Gaynor is a mechanical engineer with 25 years of business and

manufacturing experience in volume component manufacturing in electronics

and optics industries. Prior to joining LightPath from August 2002 to July

2006, Mr. Gaynor was Director of Operations and Manufacturing for Puradyn

Filter Technologies. Previous to that he was Vice president of Operations

and General Manager for JDS Uniphase Corporation's Transmission Systems

Division from March 2000 to April 2002. He has also held executive

positions with Spectrum Control, Rockwell International and Corning Glass

Works. His experience includes various engineering, manufacturing and

management positions in specialty glass, electronics, telecommunications

components and mechanical assembly operations. His global business

experience encompasses strategic planning, budgets, capital investment,

employee development, cost reduction, acquisitions and business start-up

and turnaround success. Mr. Gaynor holds a Bachelors of Science degree in

Mechanical Engineering from the Georgia Institute of Technology and has

worked in manufacturing industries since 1976. Dorothy Cipolla, Chief

Financial Officer - Ms. Cipolla has been Corporate Vice President, Chief

Financial Officer, Secretary and Treasurer since February 2006. Ms.

Cipolla has served as a CFO for both public and private companies. Ms.

Cipolla was Chief Financial Officer and Secretary of LaserSight

Technologies, Inc., from March 2004 to February 2006. Prior to joining

LaserSight, she served in various financial management positions. From

1994 to 1999, she was Chief Financial Officer and Treasurer of Network

Six, Inc., a NASDAQ-listed professional services firm. From 1999 to 2002,

Ms. Cipolla was Vice President of Finance with Goliath Networks, Inc., a

privately held network consulting company. From 2002 to 2003, Ms. Cipolla

was Department Controller of Alliant Energy Corporation, a regulated

utility. She received a Bachelor of Science degree in Accounting from

Northeastern University and she is a certified public accountant in

Massachusetts. Robert Ripp Chairman of the Board - Mr. Ripp has served as

Chairman of LightPath since November 1999. During portions of fiscal years

2002 and 2003 he also served as the Company's Interim President and Chief

Executive Officer. Mr. Ripp was Chairman and CEO of AMP Incorporated from

August 1998 until April 1999, when AMP was sold to TYCO International Ltd.

Mr. Ripp held various executive positions at AMP from 1994 to August 1999.

Mr. Ripp previously spent 29 years with IBM of Armonk, NY. He held

positions in all aspects of operations within IBM culminating in the last

four years as Vice President and Treasurer and he retired from IBM in

1993. Mr. Ripp graduated from Iona College and received a Masters of

Business Administration from New York University. Mr. Ripp is currently on

the board of directors of Ace, Ltd. and PPG Industries, all of which are

listed on the New York Stock Exchange. Mr. Ripp also serves on the

Company's Compensation and Finance Committees.

|

|

|

|

|

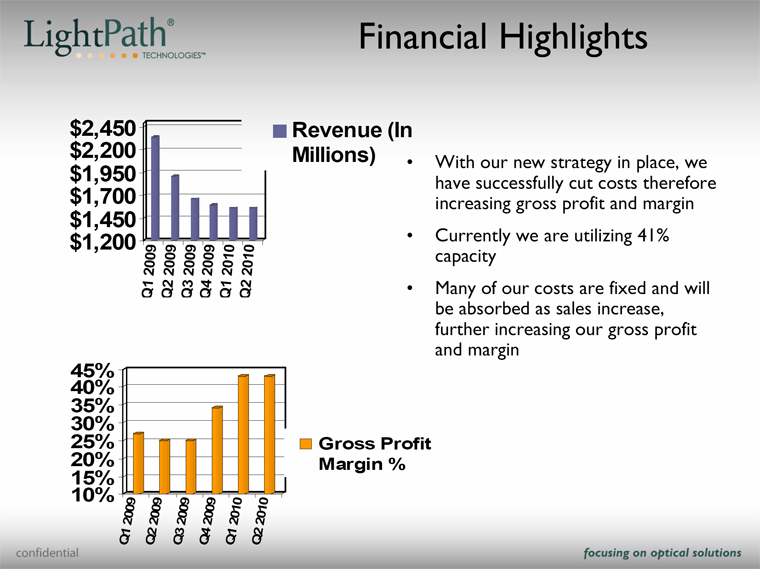

Financial Highlights Q1 2009 $2,450 o Revenue (In

Millions) Q2 2009 $2,200 o With our new strategy in place, we have Q3 2009

$1,950 successfully cut costs therefore Q4 2009 $1,700 increasing gross

profit and margin Q1 2010 $1,450 Q2 2010 $1,200 o Currently we are

utilizing 41% capacity Q1 2009 45% o Many of our costs are fixed and will

be Q2 2009 40% absorbed as sales increase, further Q3 2009 35% increasing

our gross profit and margin Q4 2009 30% Q1 2010 25% o Gross Profit Margin

% Q2 2010 20% 15% 10%

|

|

|

|

|

Investment Highlights o Low cost, high volume

manufacturer of optical components o US public company with wholly owned

China manufacturing facility o Low Cost Manufacturing Platform o Access to

Asian market o Strategy - Low Cost Structure / Access New Markets o

Thermal Imaging, Industrial Laser Tools, FTTH o Growth strategy - China

facility is currently at 41% capacity o Increase revenue with little

capital expenditure o Diversified product mix o Strong IP Portfolio - 58

U.S. patents issued o Competitive advantage o Quick to market, quick to

volume, world class designer, etc. o Large market opportunity

|