Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JONES LANG LASALLE INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - JONES LANG LASALLE INC | dex991.htm |

EXHIBIT 99.2

Exhibit 99.2

Supplemental Information Fourth Quarter 2009 Earnings Call

Market & Financial Overview

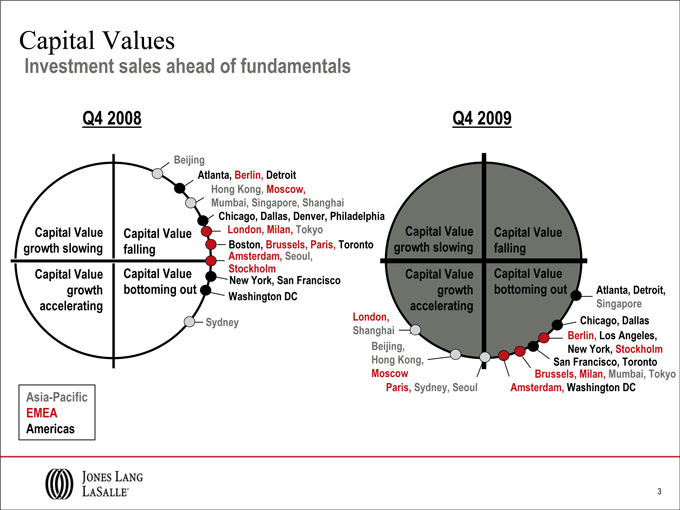

Capital Values

Investment sales ahead of fundamentals

Q4 2008

Beijing

Atlanta, Berlin, Detroit Hong Kong, Moscow, Mumbai, Singapore, Shanghai

Chicago, Dallas, Denver, Philadelphia

London, Milan, Tokyo

Boston, Brussels, Paris, Toronto Amsterdam, Seoul, Stockholm New York, San Francisco Washington DC

Sydney

Capital Value growth slowing

Capital Value growth accelerating

Capital Value falling Capital Value bottoming out

Asia-Pacific EMEA Americas

Q4 2009

Capital Value growth slowing Capital Value growth accelerating

Capital Value falling Capital Value bottoming out

London, Shanghai Beijing, Hong Kong, Moscow

Paris, Sydney, Seoul

Atlanta, Detroit, Singapore Chicago, Dallas Berlin, Los Angeles, New York, Stockholm

San Francisco, Toronto Brussels, Milan, Mumbai, Tokyo Amsterdam, Washington DC

3

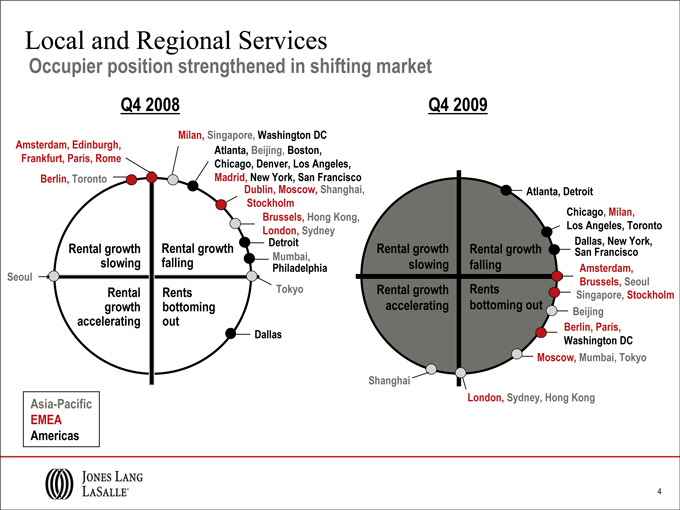

Local and Regional Services

Occupier position strengthened in shifting market

Q4 2008

Amsterdam, Edinburgh, Frankfurt, Paris, Rome Berlin, Toronto

Milan, Singapore, Washington DC Atlanta, Beijing, Boston, Chicago, Denver, Los Angeles, Madrid, New York, San Francisco Dublin, Moscow, Shanghai,

Stockholm

Brussels, Hong Kong, London, Sydney Detroit Mumbai, Philadelphia Tokyo

Dallas

Seoul

Rental growth slowing

Rental growth accelerating

Rental growth falling

Rents bottoming out

Asia-Pacific EMEA Americas

Q4 2009

Rental growth slowing Rental growth accelerating

Rental growth falling Rents bottoming out

Atlanta, Detroit

Chicago, Milan, Los Angeles, Toronto

Dallas, San Francisco New York, Amsterdam, Brussels, Seoul Singapore, Stockholm Beijing

Berlin, Paris, Washington DC

Moscow, Mumbai, Tokyo

London, Sydney, Hong Kong

Shanghai

4

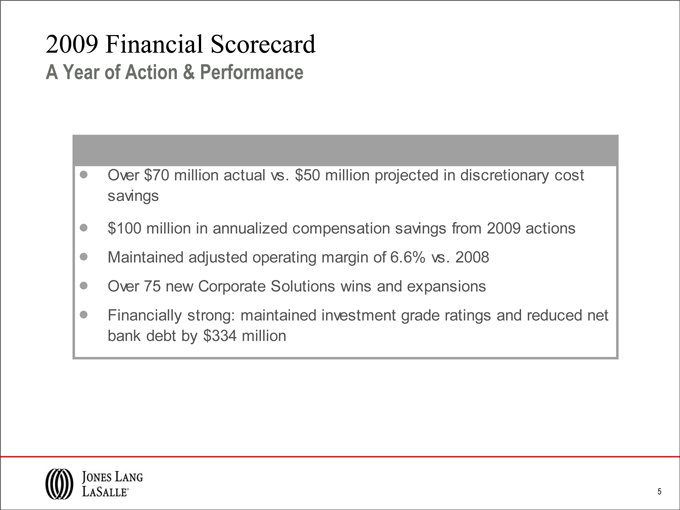

2009 Financial Scorecard

A Year of Action & Performance

Over $70 million actual vs. $50 million projected in discretionary cost savings

$100 million in annualized compensation savings from 2009 actions

Maintained adjusted operating margin of 6.6% vs. 2008

Over 75 new Corporate Solutions wins and expansions

Financially strong: maintained investment grade ratings and reduced net bank debt by $334 million

5

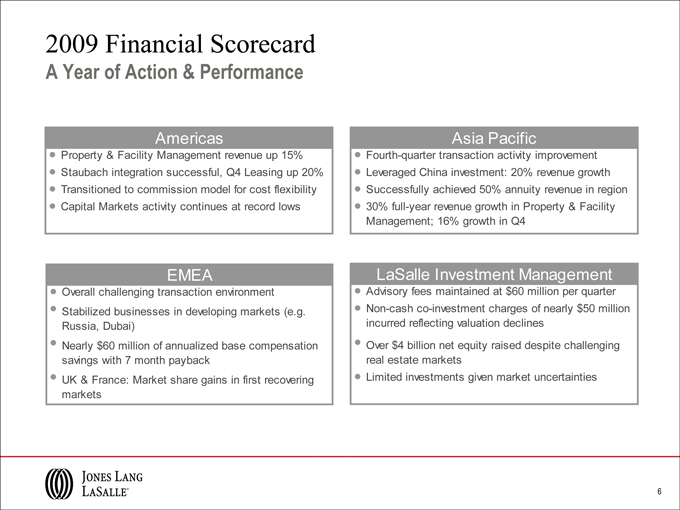

2009 Financial Scorecard

A Year of Action & Performance

Americas

Property & Facility Management revenue up 15%

Staubach integration successful, Q4 Leasing up 20%

Transitioned to commission model for cost flexibility

Capital Markets activity continues at record lows

EMEA

Overall challenging transaction environment

Stabilized businesses in developing markets (e.g. Russia, Dubai)

Nearly $60 million of annualized base compensation savings with 7 month payback

UK & France: Market share gains in first recovering markets

Asia Pacific

Fourth-quarter transaction activity improvement

Leveraged China investment: 20% revenue growth

Successfully achieved 50% annuity revenue in region

30% full-year revenue growth in Property & Facility Management; 16% growth in Q4

LaSalle Investment Management

Advisory fees maintained at $60 million per quarter

Non-cash co-investment charges of nearly $50 million incurred reflecting valuation declines

Over $4 billion net equity raised despite challenging real estate markets

Limited investments given market uncertainties

6

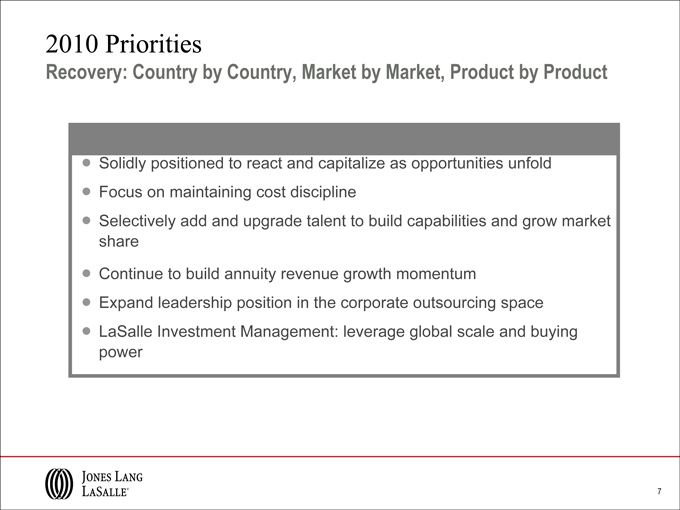

2010 Priorities

Recovery: Country by Country, Market by Market, Product by Product

Solidly positioned to react and capitalize as opportunities unfold

Focus on maintaining cost discipline

Selectively add and upgrade talent to build capabilities and grow market share

Continue to build annuity revenue growth momentum

Expand leadership position in the corporate outsourcing space

LaSalle Investment Management: leverage global scale and buying power

7

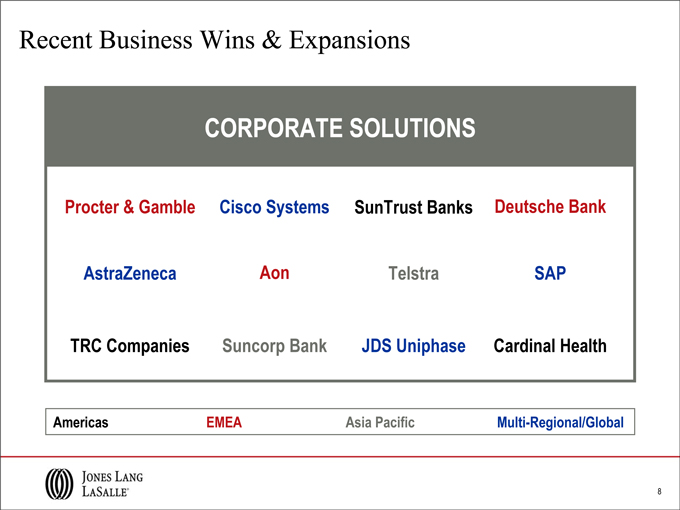

Recent Business Wins & Expansions

CORPORATE SOLUTIONS

Procter & Gamble

Cisco Systems

SunTrust Banks

Deutsche Bank

AstraZeneca Aon Telstra SAP TRC Companies Suncorp Bank JDS Uniphase Cardinal Health

Americas EMEA Asia Pacific Multi-Regional/Global

8

Recent Business Wins & Expansions

INVESTMENT SALES

Pacific Century Place, Tokyo Shanghai Racquet Club, $145M Clementi Mall, Singapore, $387M

RBS Tower @ Aurora Place, Sydney, $ 685M Silverburn Shopping Centre, Glasgow, £300M

5 Churchill Place, Canary Wharf, London, £200M

A10 Shopping Centre, Berlin, €200M

7 Dutch Government Buildings, €200M

4 French transactions, €350M

Brandywine Realty, $85M

Americas EMEA Asia Pacific

9

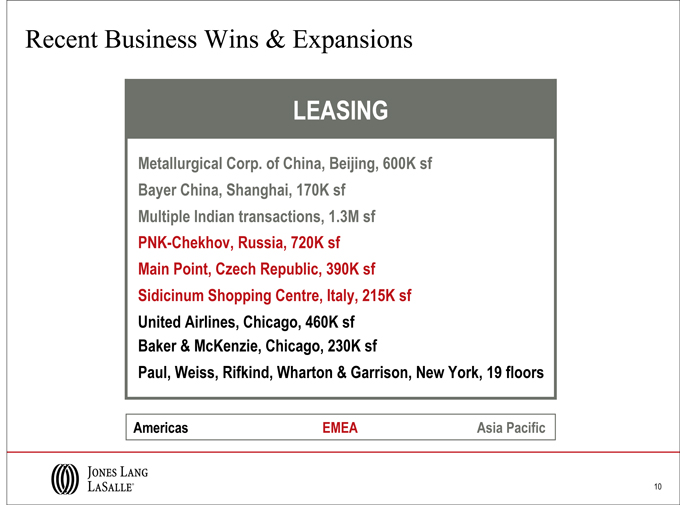

Recent Business Wins & Expansions

LEASING

Metallurgical Corp. of China, Beijing, 600K sf Bayer China, Shanghai, 170K sf Multiple Indian transactions, 1.3M sf PNK-Chekhov, Russia, 720K sf Main Point, Czech Republic, 390K sf Sidicinum Shopping Centre, Italy, 215K sf United Airlines, Chicago, 460K sf Baker & McKenzie, Chicago, 230K sf

Paul, Weiss, Rifkind, Wharton & Garrison, New York, 19 floors

Americas EMEA Asia Pacific

10

Fourth Quarter Financial Information

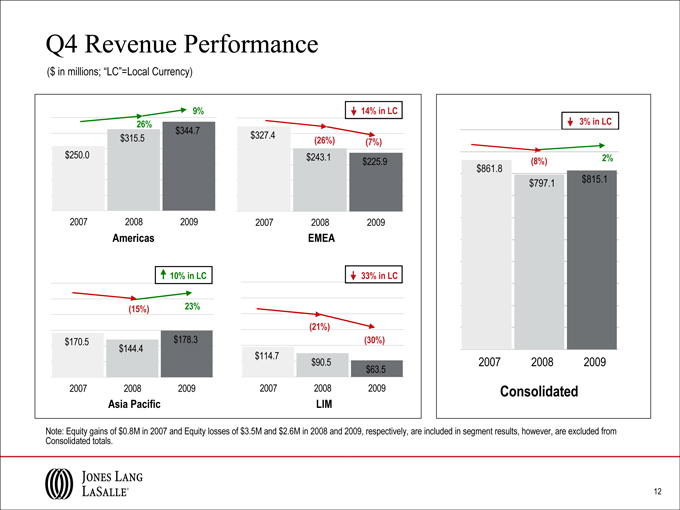

Q4 Revenue Performance

($ in millions; “LC”=Local Currency)

9% 14% in LC

26% $344.7

$315.5 $327.4(26%)(7%)

$250.0 $243.1 $225.9

2007 2008 2009 2007 2008 2009

Americas EMEA

10% in LC 33% in LC

(15%) 23%

(21%)

$170.5 $178.3(30%)

$144.4

$114.7 $90.5

$63.5

2007 2008 2009 2007 2008 2009

Asia Pacific LIM

3% in LC

(8%) 2%

$861.8

$797.1 $815.1

2007 2008 2009

Consolidated

Note: Equity gains of $0.8M in 2007 and Equity losses of $3.5M and $2.6M in 2008 and 2009, respectively, are included in segment results, however, are excluded from Consolidated totals.

12

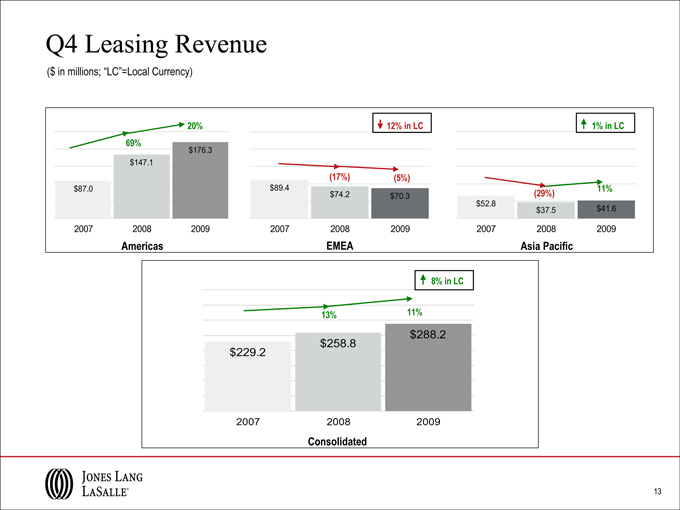

Q4 Leasing Revenue

($ in millions; “LC”=Local Currency)

20% 12% in LC 1% in LC

69%

$176.3

$147.1

(17%)(5%)

$87.0 $89.4 11%

$74.2 $70.3(29%)

$52.8 $37.5 $41.6

2007 2008 2009 2007 2008 2009 2007 2008 2009

Americas EMEA Asia Pacific

8% in LC

13% 11%

$288.2

$258.8

$229.2

2007 2008 2009

Consolidated

13

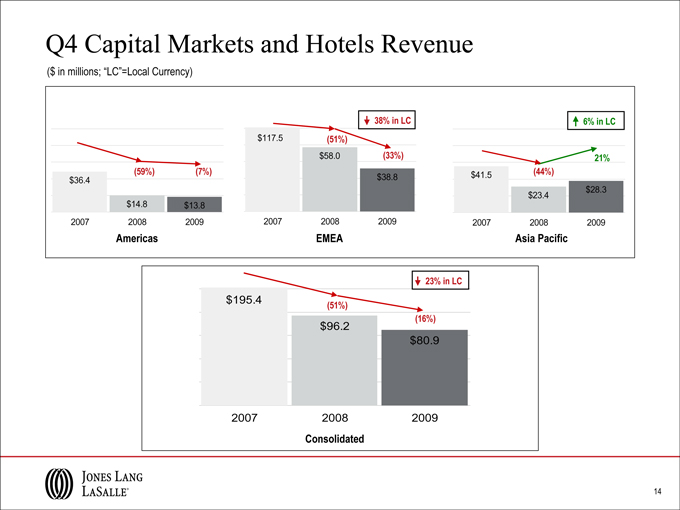

Q4 Capital Markets and Hotels Revenue

($ in millions; “LC”=Local Currency)

38% in LC 6% in LC

$117.5(51%)

$58.0(33%) 21%

(59%)(7%) $38.8 $41.5(44%)

$36.4

$23.4 $28.3

$14.8 $13.8

2007 2008 2009 2007 2008 2009 2007 2008 2009

Americas EMEA Asia Pacific

23% in LC

$195.4(51%)

(16%)

$96.2

$80.9

2007 2008 2009

Consolidated

14

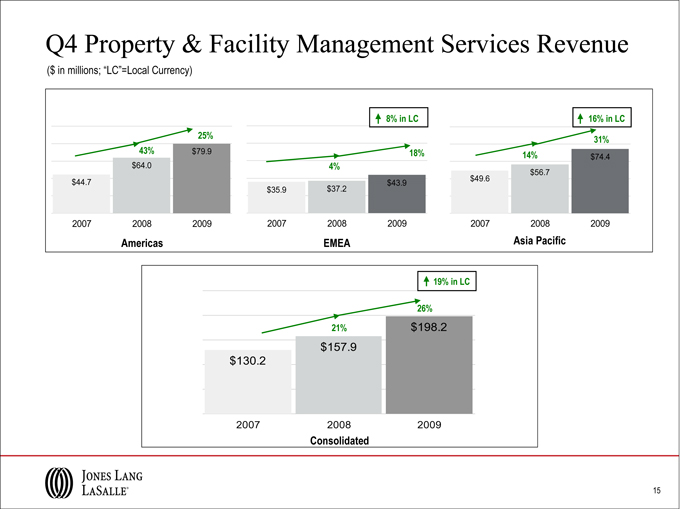

Q4 Property & Facility Management Services Revenue

($ in millions; “LC”=Local Currency)

8% in LC 16% in LC

25% 31%

43% $79.9 18% 14% $74.4

$64.0 4% $56.7

$44.7 $43.9 $49.6

$35.9 $37.2

2007 2008 2009 2007 2008 2009 2007 2008 2009

Americas EMEA Asia Pacific

19% in LC

26%

21% $198.2

$157.9

$130.2

2007 2008 2009

Consolidated

15

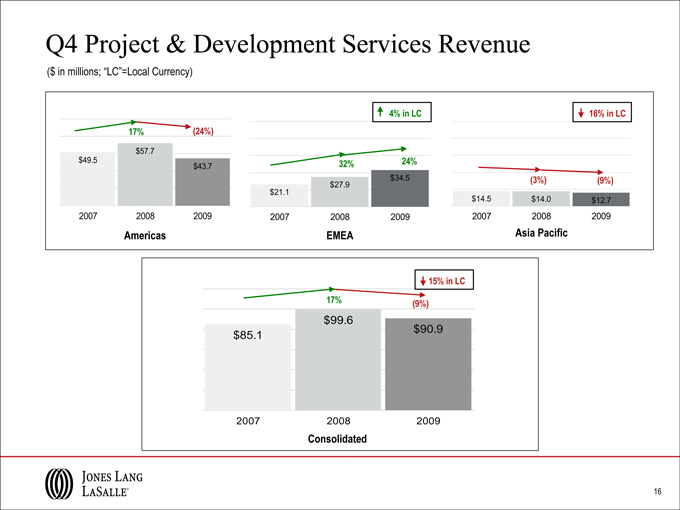

Q4 Project & Development Services Revenue

($ in millions; “LC”=Local Currency)

4% in LC 16% in LC

17%(24%)

$57.7

$49.5 $43.7 32% 24%

$27.9 $34.5(3%)(9%)

$21.1

$14.5 $14.0 $12.7

2007 2008 2009 2007 2008 2009 2007 2008 2009

Americas EMEA Asia Pacific

15% in LC

17%(9%)

$99.6

$85.1 $90.9

2007 2008 2009

Consolidated

16

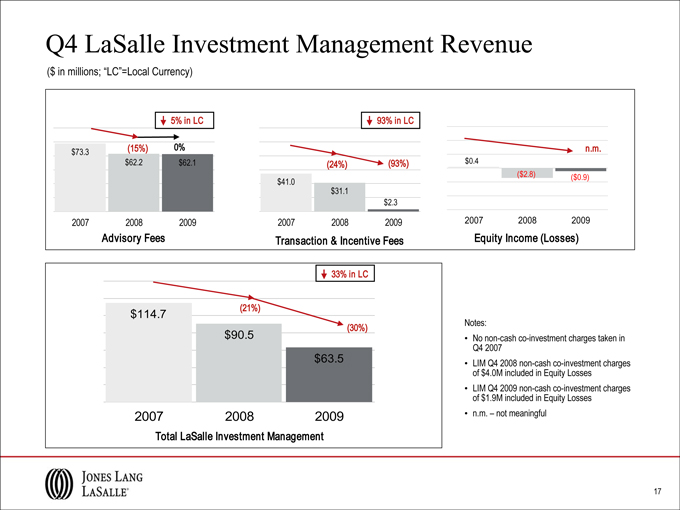

Q4 LaSalle Investment Management Revenue

($ in millions; “LC”=Local Currency)

5% in LC

(15%) 0%

$73.3

$62.2 $62.1

2007 2008 2009

Advisory Fees

93% in LC

(24%)(93%)

$41.0

$31.1

$2.3

2007 2008 2009

Transaction & Incentive Fees

n.m.

$0.4

($2.8)($0.9)

2007 2008 2009

Equity Losses

33% in LC

$114.7(21%)

$90.5(30%)

$63.5

2007 2008 2009

Total LaSalle Investment Management

Notes:

No non-cash co-investment charges taken in Q4 2007

LIM Q4 2008 non-cash co-investment charges of $4.0M included in Equity Income (Losses)

LIM Q4 2009 non-cash co-investment charges of $1.9M included in Equity Losses • n.m. – not meaningful

17

Full Year Financial Information

18

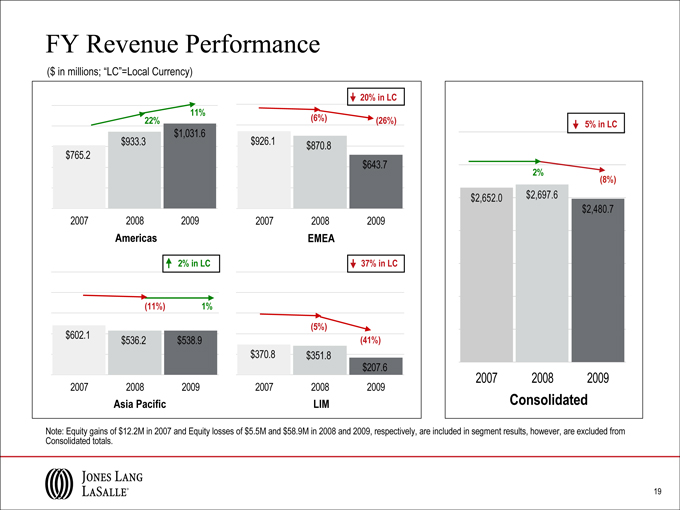

FY Revenue Performance

($ in millions; “LC”=Local Currency)

20% in LC

11%

22%(6%)(26%)

$1,031.6

$933.3 $926.1 $870.8

$765.2

$643.7

2007 2008 2009 2007 2008 2009

Americas EMEA

2% in LC 37% in LC

(11%) 1%

(5%)

$602.1 $536.2 $538.9(41%)

$370.8 $351.8

$207.6

2007 2008 2009 2007 2008 2009

Asia Pacific LIM

5% in LC

2%

(8%)

$2,652.0 $2,697.6

$2,480.7

2007 2008 2009

Consolidated

Note: Equity gains of $12.2M in 2007 and Equity losses of $5.5M and $58.9M in 2008 and 2009, respectively, are included in segment results, however, are excluded from Consolidated totals.

19

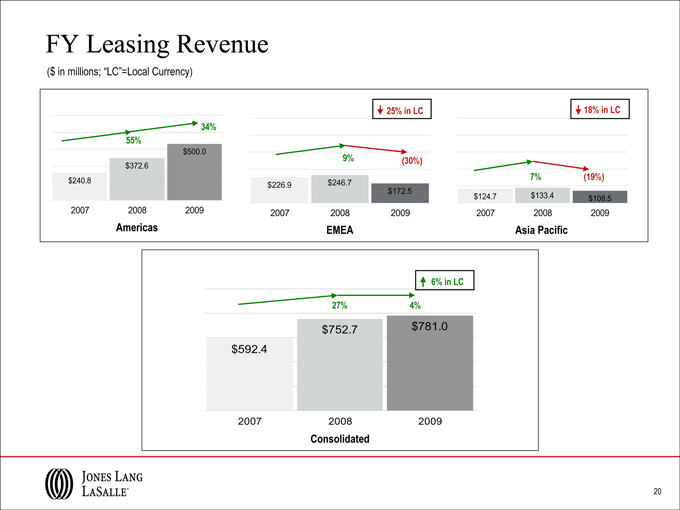

FY Leasing Revenue

($ in millions; “LC”=Local Currency)

25% in LC 18% in LC

34%

55%

$500.0

$372.6 9%(30%)

$240.8 $246.7 7%(19%)

$226.9

$172.5 $124.7 $133.4 $108.5

2007 2008 2009 2007 2008 2009 2007 2008 2009

Americas EMEA Asia Pacific

6% in LC

27% 4%

$752.7 $781.0

$592.4

2007 2008 2009

Consolidated

20

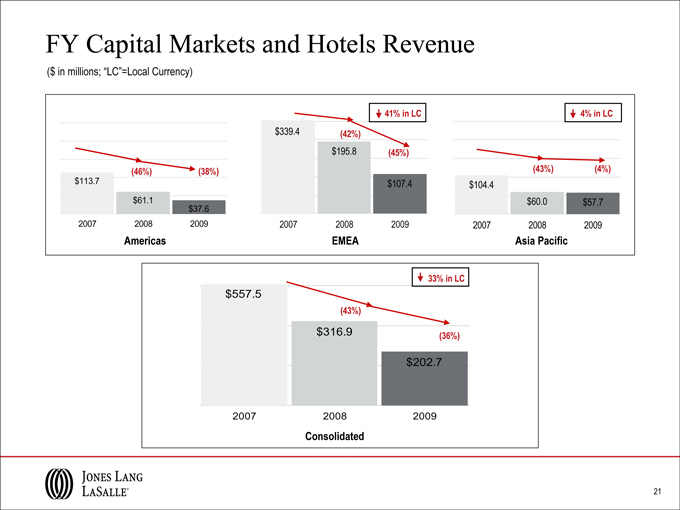

FY Capital Markets and Hotels Revenue

($ in millions; “LC”=Local Currency)

41% in LC 4% in LC

$339.4(42%)

$195.8(45%)

(46%)(38%)(43%)(4%)

| $113.7 |

|

$107.4 $104.4 |

| $61.1 |

|

$60.0 $57.7 |

$37.6

2007 2008 2009 2007 2008 2009 2007 2008 2009

Americas EMEA Asia Pacific

33% in LC

$557.5

(43%)

$316.9(36%)

$202.7

2007 2008 2009

Consolidated

21

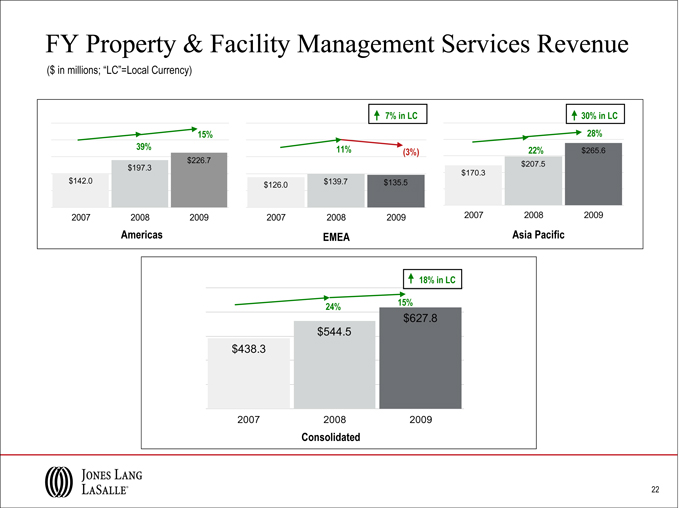

FY Property & Facility Management Services Revenue

($ in millions; “LC”=Local Currency)

7% in LC 30% in LC

15% 28%

39% 11%(3%) 22% $265.6

$226.7 $207.5

$197.3 $170.3

$142.0 $126.0 $139.7 $135.5

2007 2008 2009 2007 2008 2009 2007 2008 2009

Americas EMEA Asia Pacific

18% in LC

24%

15%

$627.8

$544.5

$438.3

2007 2008 2009

Consolidated

22

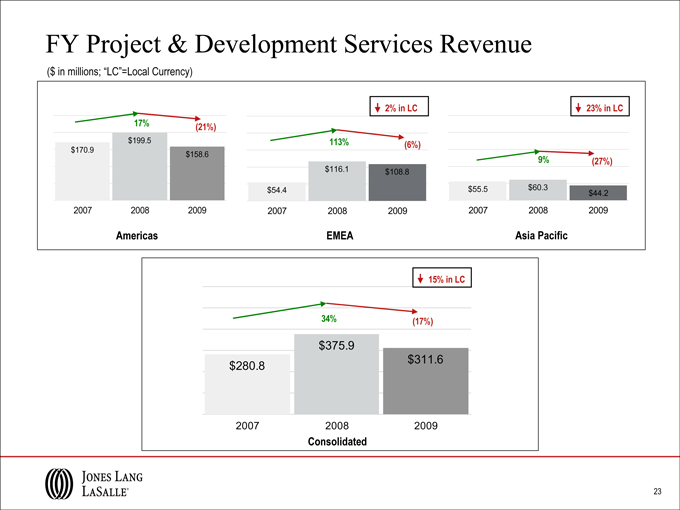

FY Project & Development Services Revenue

($ in millions; “LC”=Local Currency)

2% in LC 23% in LC

17%(21%)

$199.5 113%(6%)

$170.9 $158.6

9%(27%)

$116.1 $108.8

$54.4 $55.5 $60.3 $44.2

2007 2008 2009 2007 2008 2009 2007 2008 2009

Americas EMEA Asia Pacific

15% in LC

34%(17%)

$375.9

$280.8 $311.6

2007 2008 2009

Consolidated

23

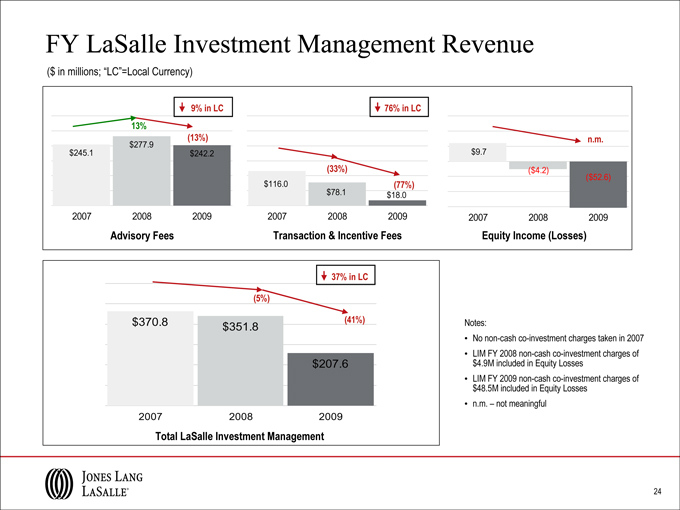

FY LaSalle Investment Management Revenue

($ in millions; “LC”=Local Currency)

9% in LC 76% in LC

13%

$277.9(13%) n.m.

$245.1 $242.2 $9.7

(33%)($4.2)

($52.6)

$116.0(77%)

$78.1 $18.0

2007 2008 2009 2007 2008 2009 2007 2008 2009

Advisory Fees Transaction & Incentive Fees Equity Losses

37% in LC

(5%)

$370.8 $351.8(41%)

$207.6

2007 2008 2009

Total LaSalle Investment Management

Notes:

No non-cash co-investment Impairment charges taken in 2007

LIM FY 2008 non-cash co-investment charges of $4.9M included in Equity Income (Losses)

LIM FY 2009 non-cash co-investment charges of $48.5M included in Equity Losses • n.m. – not meaningful

24

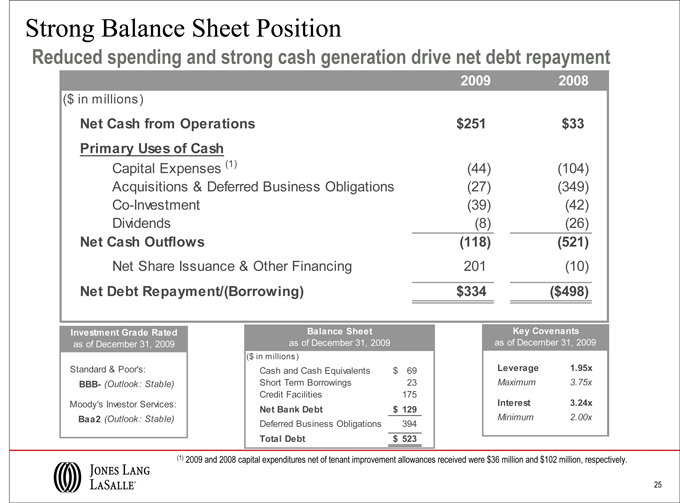

Strong Balance Sheet Position

Reduced spending and strong cash generation drive net debt repayment

2009 2008

($ in millions)

Net Cash from Operations $251 $33

Primary Uses of Cash

Capital Expenses (1) (44) (104)

Acquisitions & Deferred Business Obligations (27) (349)

Co-Investment (39) (42)

Dividends (8) (26)

Net Cash Outflows (118) (521)

Net Share Issuance & Other Financing 201 (10)

Net Debt Repayment/(Borrowing) $334 ($498)

Standard & Poor’s: Investment Grade Rated as of December 31, 2009

BBB- (Outlook: Stable)

Moody’s Investor Services:

Baa2 (Outlook: Stable)

Balance Sheet as of December 31, 2009

($ in millions)

Cash and Cash Equivalents $ 69

Short Term Borrowings 23

Credit Facilities 175

Net Bank Debt $ 129

Deferred Business Obligations 394

Total Debt $ 523

Key Covenants as of December 31, 2009

Leverage 1.95x

Maximum 3.75x

Interest 3.24x

Minimum 2.00x

(1) 2009 and 2008 capital expenditures net of tenant improvement allowances received were $36 million and $102 million, respectively.

25

Appendix

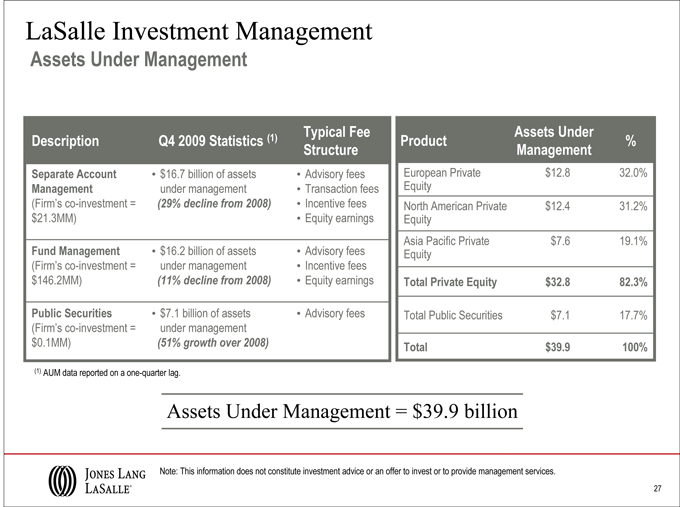

LaSalle Investment Management

Assets Under Management

Description Q4 2009 Statistics (1) Typical Fee

Structure

Separate Account • $16.7 billion of assets • Advisory fees

Management under management • Transaction fees

(Firm’s co-investment =(29% decline from 2008) • Incentive fees

$21.3MM) • Equity earnings

Fund Management • $16.2 billion of assets • Advisory fees

(Firm’s co-investment = under management • Incentive fees

$146.2MM)(11% decline from 2008) • Equity earnings

Public Securities • $7.1 billion of assets • Advisory fees

(Firm’s co-investment = under management

$0.1MM)(51% growth over 2008)

Assets Under

Product%

Management

European Private $12.8 32.0%

Equity

North American Private $12.4 31.2%

Equity

Asia Pacific Private $7.6 19.1%

Equity

Total Private Equity $32.8 82.3%

Total Public Securities $7.1 17.7%

Total $39.9 100%

(1) AUM data reported on a one-quarter lag.

Assets Under Management = $39.9 billion

Note: This information does not constitute investment advice or an offer to invest or to provide management services.

27

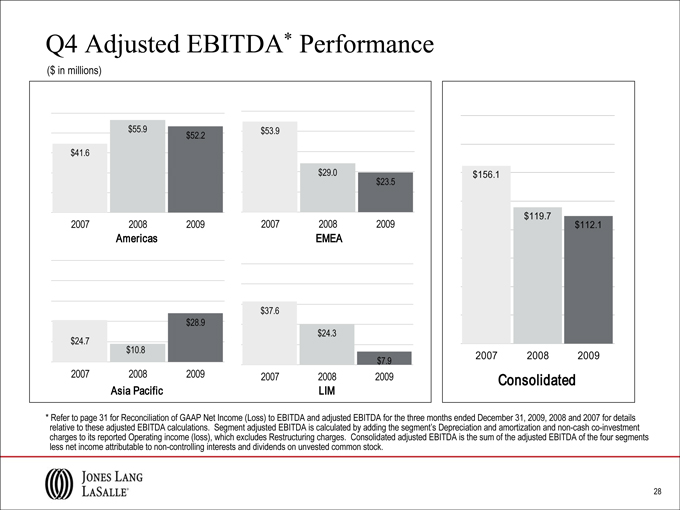

Q4 Adjusted EBITDA* Performance

($ in millions)

$55.9 $53.9

$52.2

$41.6

$29.0

$23.5

2007 2008 2009 2007 2008 2009

Americas EMEA

$37.6

$28.9

$24.3

$24.7

$10.8

$7.9

2007 2008 2009 2007 2008 2009

Asia Pacific LIM

$156.1

$119.7

$112.1

2007 2008 2009

Consolidated

* Refer to page 31 for Reconciliation of GAAP Net Income (Loss) to EBITDA and adjusted EBITDA for the three months ended December 31, 2009, 2008 and 2007 for details relative to these adjusted EBITDA calculations. Segment adjusted EBITDA is calculated by adding the segment’s Depreciation and amortization and non-cash co-investment charges to its reported Operating income (loss), which excludes Restructuring charges. Consolidated adjusted EBITDA is the sum of the adjusted EBITDA of the four segments less net income attributable to non-controlling interests and dividends on unvested common stock.

28

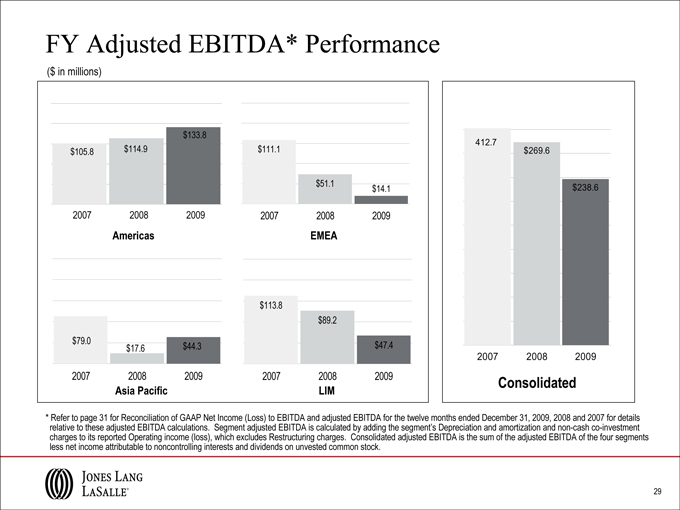

FY Adjusted EBITDA* Performance

($ in millions)

$133.8

$105.8 $114.9 $111.1

$51.1 $14.1

2007 2008 2009 2007 2008 2009

Americas EMEA

$113.8

$89.2

$79.0 $17.6 $44.3 $47.4

2007 2008 2009 2007 2008 2009

Asia Pacific LIM

412.7

$269.6

$238.6

2007 2008 2009

Consolidated

* Refer to page 31 for Reconciliation of GAAP Net Income (Loss) to EBITDA and adjusted EBITDA for the twelve months ended December 31, 2009, 2008 and 2007 for details relative to these adjusted EBITDA calculations. Segment adjusted EBITDA is calculated by adding the segment’s Depreciation and amortization and non-cash co-investment charges to its reported Operating income (loss), which excludes Restructuring charges. Consolidated adjusted EBITDA is the sum of the adjusted EBITDA of the four segments less net income attributable to noncontrolling interests and dividends on unvested common stock.

29

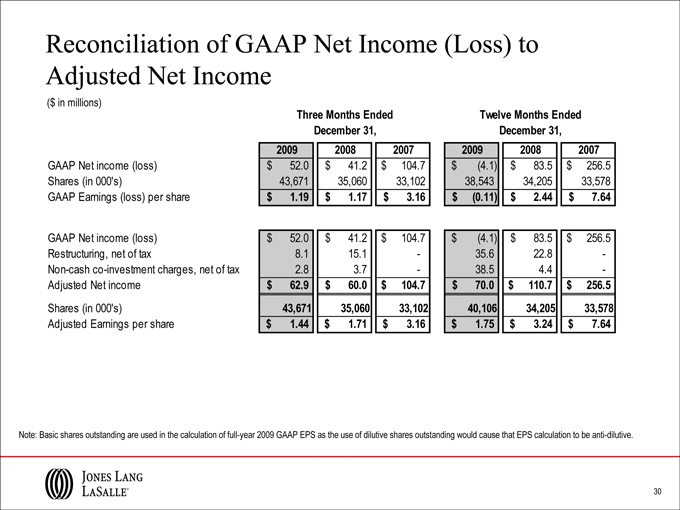

Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income

($ in millions)

Three Months Ended Twelve Months Ended

December 31, December 31,

2009 2008 2007 2009 2008 2007

GAAP Net income (loss) $ 52.0 $ 41.2 $ 104.7 $(4.1) $ 83.5 $ 256.5

Shares (in 000’s) 43,671 35,060 33,102 38,543 34,205 33,578

GAAP Earnings (loss) per share $ 1.19 $ 1.17 $ 3.16 $(0.11) $ 2.44 $ 7.64

GAAP Net income (loss) $ 52.0 $ 41.2 $ 104.7 $(4.1) $ 83.5 $ 256.5

Restructuring, net of tax 8.1 15.1—35.6 22.8 -

Non-cash co-investment charges, net of tax 2.8 3.7—38.5 4.4 -

Adjusted Net income $ 62.9 $ 60.0 $ 104.7 $ 70.0 $ 110.7 $ 256.5

Shares (in 000’s) 43,671 35,060 33,102 40,106 34,205 33,578

Adjusted Earnings per share $ 1.44 $ 1.71 $ 3.16 $ 1.75 $ 3.24 $ 7.64

Note: Basic shares outstanding are used in the calculation of full-year 2009 GAAP EPS as the use of dilutive shares outstanding would cause that EPS calculation to be anti-dilutive.

30

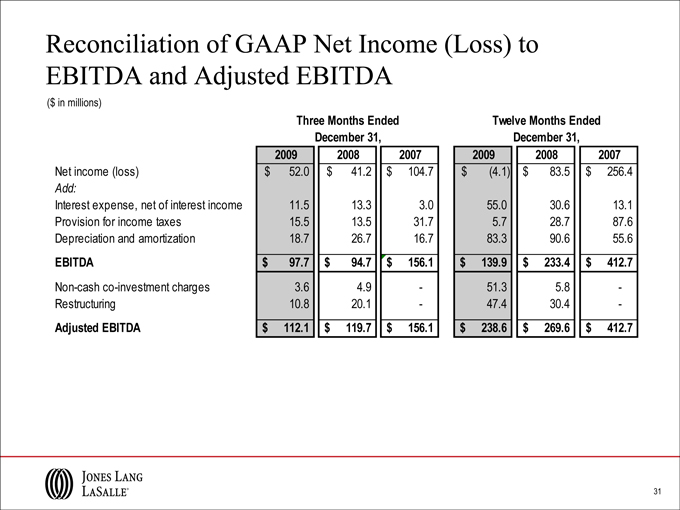

Reconciliation of GAAP Net Income (Loss) to EBITDA and Adjusted EBITDA

($ in millions)

Three Months Ended Twelve Months Ended

December 31, December 31,

2009 2008 2007 2009 2008 2007

Net income (loss) $ 52.0 $ 41.2 $ 104.7 $(4.1) $ 83.5 $ 256.4

Add:

Interest expense, net of interest income 11.5 13.3 3.0 55.0 30.6 13.1

Provision for income taxes 15.5 13.5 31.7 5.7 28.7 87.6

Depreciation and amortization 18.7 26.7 16.7 83.3 90.6 55.6

EBITDA $ 97.7 $ 94.7 $ 156.1 $ 139.9 $ 233.4 $ 412.7

Non-cash co-investment charges 3.6 4.9—51.3 5.8 -

Restructuring 10.8 20.1—47.4 30.4 -

Adjusted EBITDA $ 112.1 $ 119.7 $ 156.1 $ 238.6 $ 269.6 $ 412.7

31