Attached files

| file | filename |

|---|---|

| 8-K - BOK FINANCIAL 8-K 2-2-2010 - BOK FINANCIAL CORP | form8k.htm |

© 2009

BOK Financial Corporation.

Morgan

Stanley Financial Services Conference

February

2 - 3, 2010

© 2009

BOK Financial Corporation.

12/31/08 12/31/09 Change*

BOK

Financial ($

in thousands)

Strategy Produced Strong Results Despite The Recession

Strategy Produced Strong Results Despite The Recession

2

• Annualized

where appropriate

• Market cap as

of 1/26/10

© 2009

BOK Financial Corporation.

Consistent

Strategies

Proven to Deliver Solid Results

Proven to Deliver Solid Results

ü Utilize a decision

making framework based on long-term economic benefit

ü Develop long-term

relationships with commercial customers

ü Deliver diverse

fee-based services in a personalized responsive manner

ü Originate quality

loans while maintaining a consistent mix in the portfolio

ü Build the franchise

through deliberate branching and disciplined acquisition

strategies

strategies

ü Prudently manage

risk and control expenses in relation to revenue growth

ü Actively pursue

talent acquisition

3

© 2009

BOK Financial Corporation.

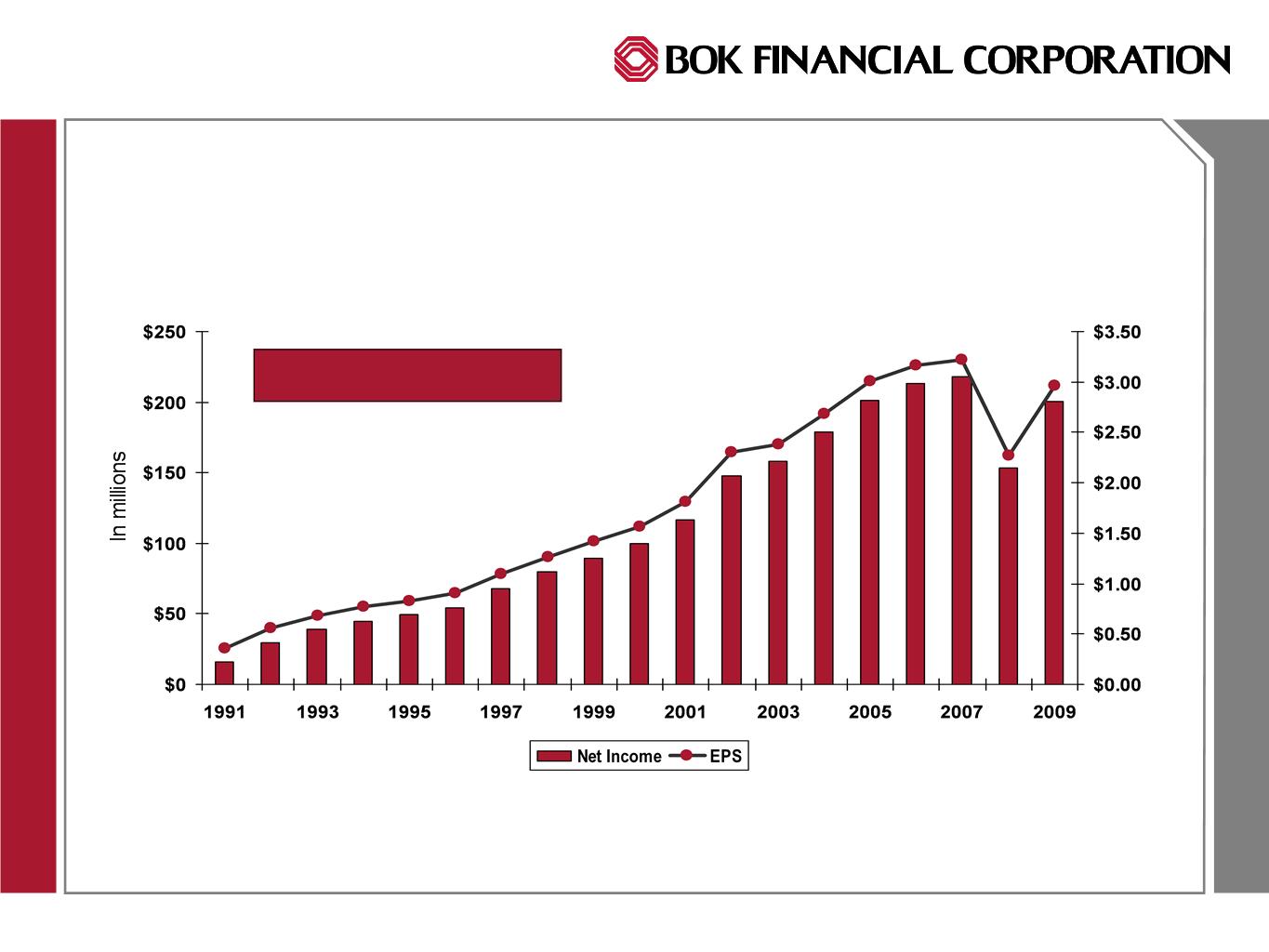

Earnings

History

Profitable Through All Cycles

Profitable Through All Cycles

Source: SNL

Financial

EPS

have been restated for stock dividends and for a 2-for-1 split

EPS

CAGR 12%

4

© 2009

BOK Financial Corporation.

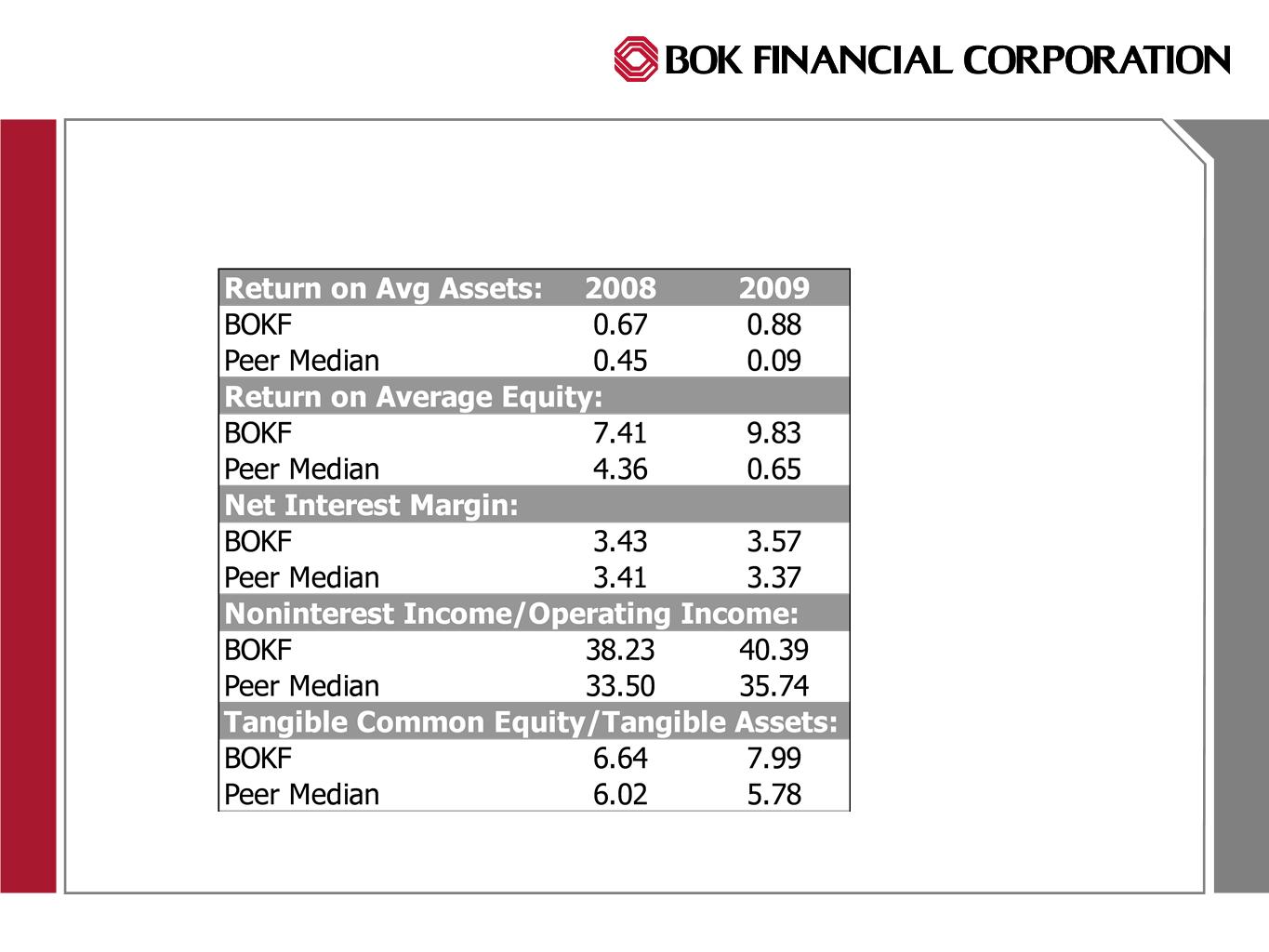

Peer

Analysis

A Standout Among Peers

A Standout Among Peers

5

Note: Peers

are defined as 20 US publicly traded banks, 10 immediately larger and 10

immediately smaller as

measured by total assets at 12/31/09. Two peers had not reported when this presentation was prepared.

measured by total assets at 12/31/09. Two peers had not reported when this presentation was prepared.

© 2009

BOK Financial Corporation.

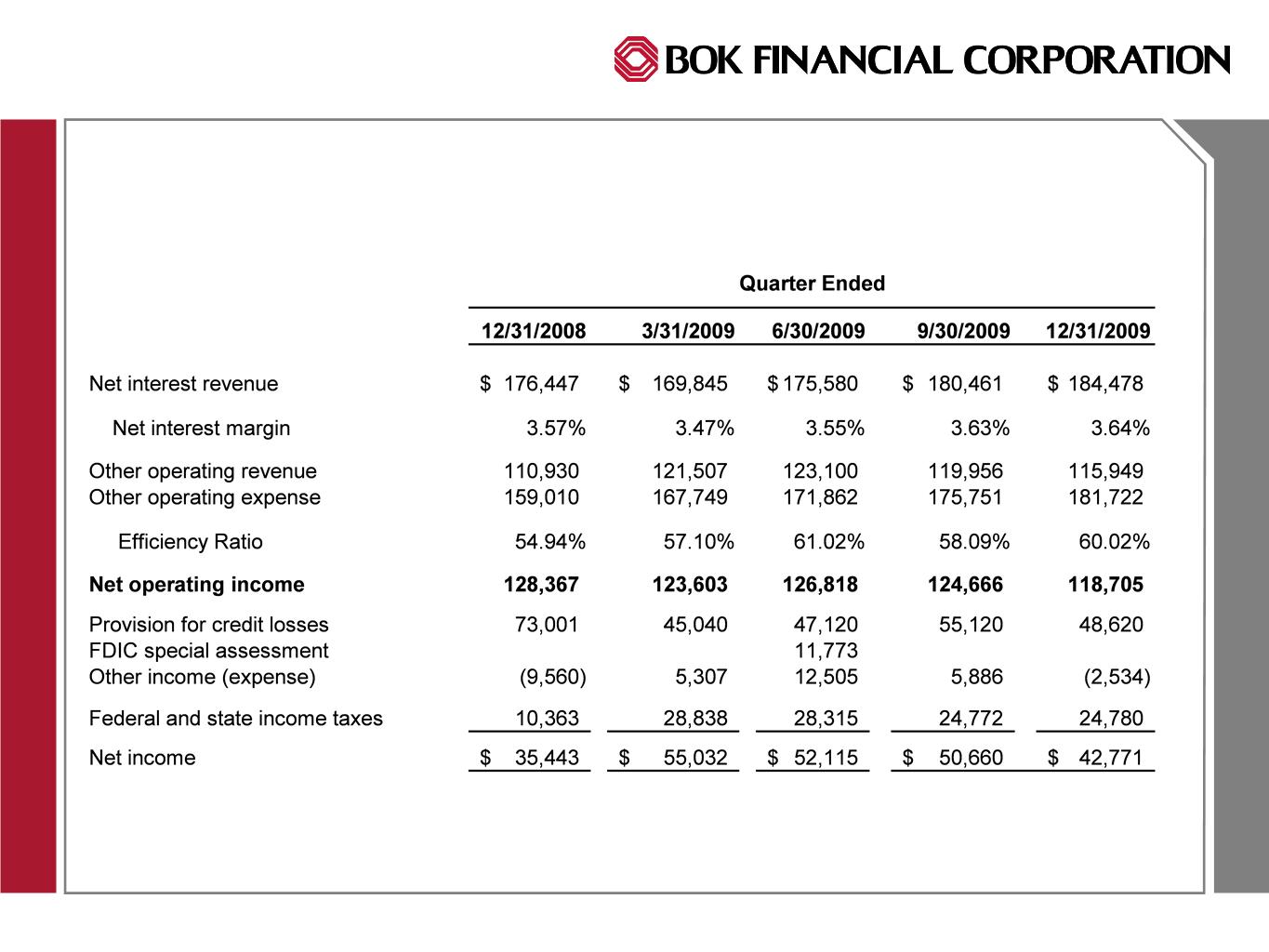

2009

Results

6

© 2009

BOK Financial Corporation.

Quarterly

Results (in

000s)

Nearly $500 Million in Pre-tax Pre-Provision Income in 2009

Nearly $500 Million in Pre-tax Pre-Provision Income in 2009

7

Note: Other

includes gains/losses on securities including OTTI and changes in the value of

MSRs and

related hedge

related hedge

© 2009

BOK Financial Corporation.

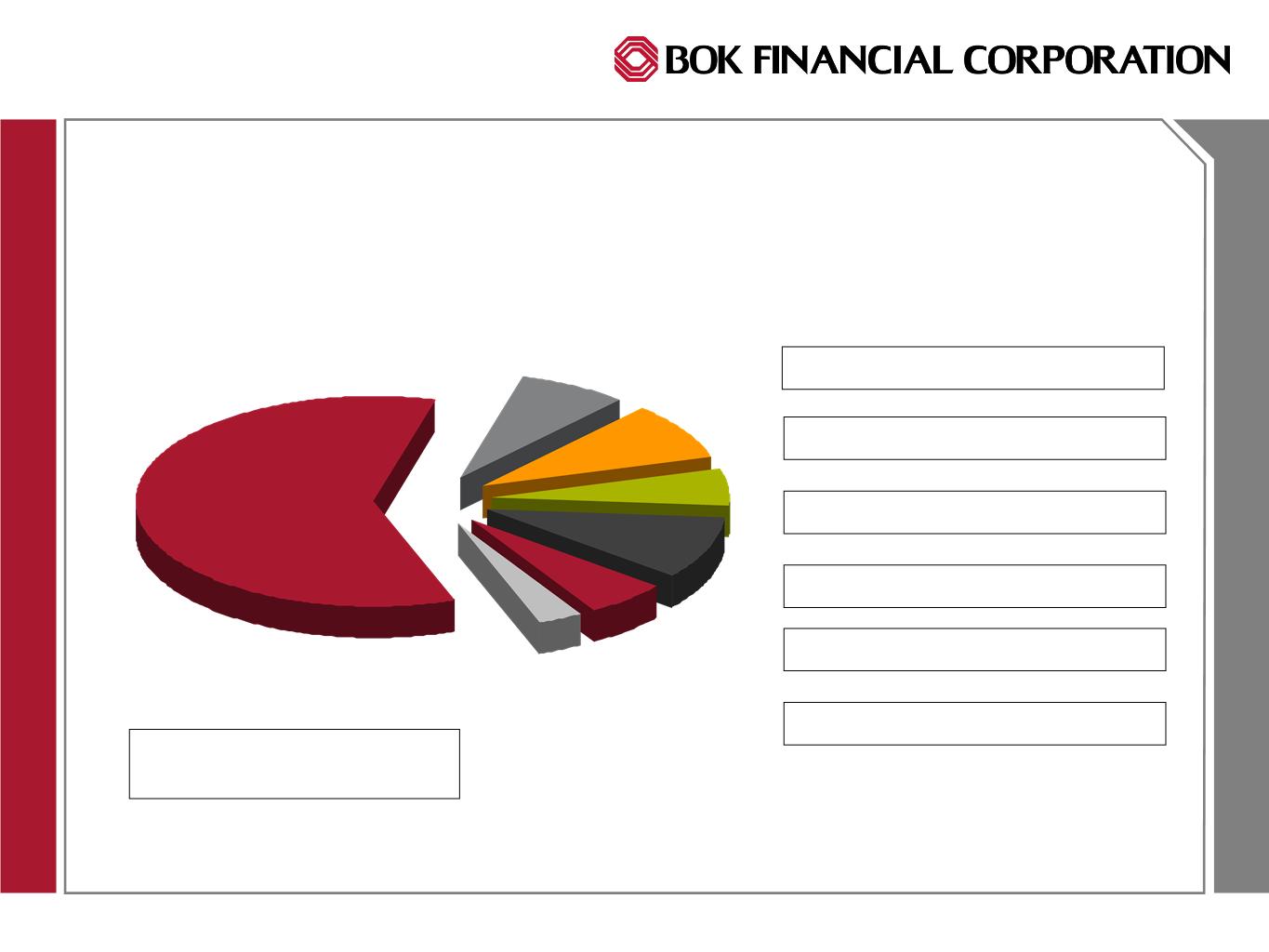

Components

of Revenue

Fee Revenue Consistently Represents At Least 40% of Total Revenue

Fee Revenue Consistently Represents At Least 40% of Total Revenue

8

Net

Interest Revenue =

59% of Total Revenue

59% of Total Revenue

Deposit

Service Charges 10%

Transaction

Card 9%

Brokerage

& Trading 8%

Mortgage

Banking 5%

Other 4%

Trust

Fees 5%

© 2009

BOK Financial Corporation.

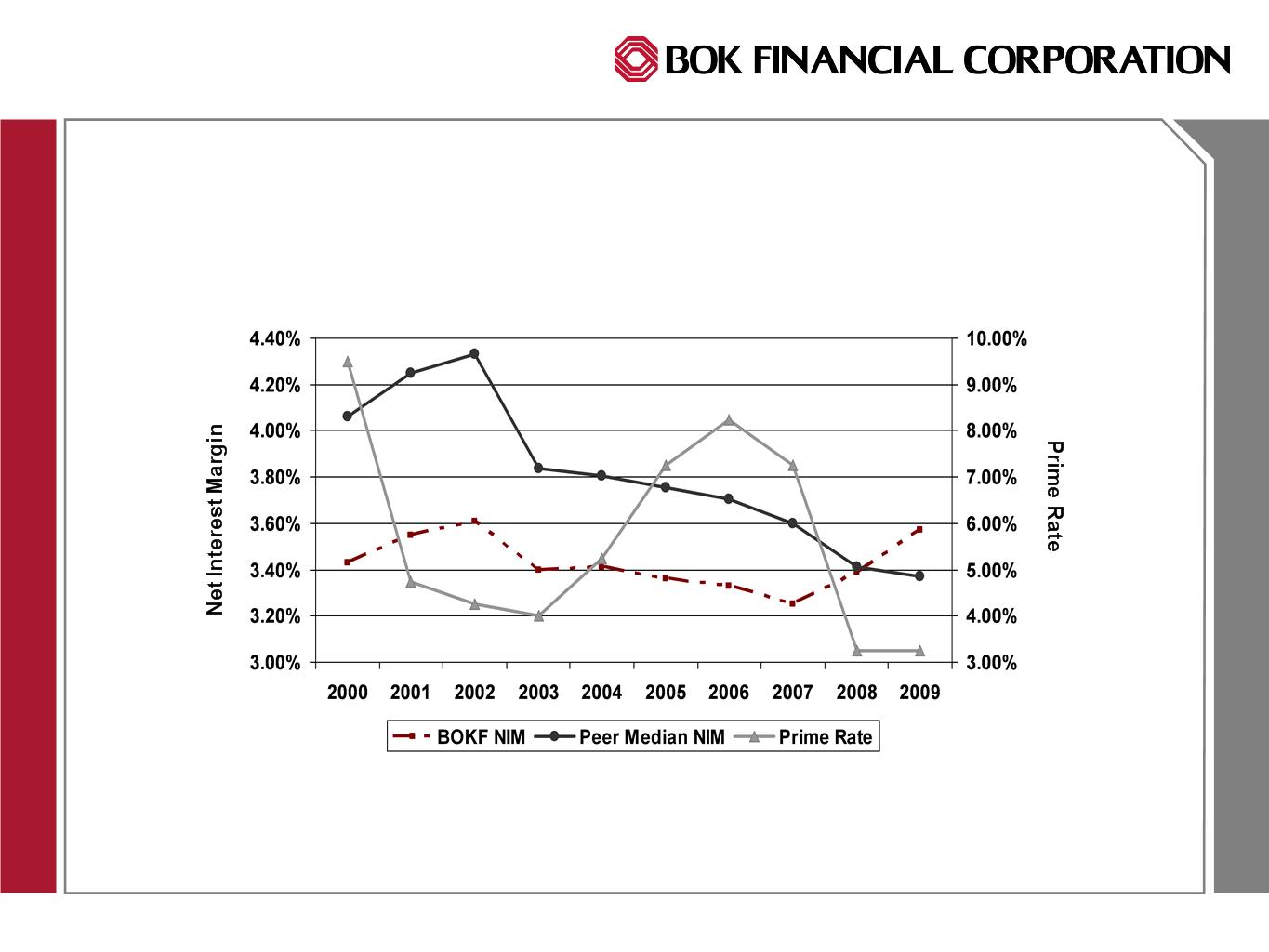

9

Net

Interest Margin

More Stable Through Economic Cycles

More Stable Through Economic Cycles

Source:

SNL data as of 1/27/10. Two

peers had not reported when this presentation was

prepared.

© 2009

BOK Financial Corporation.

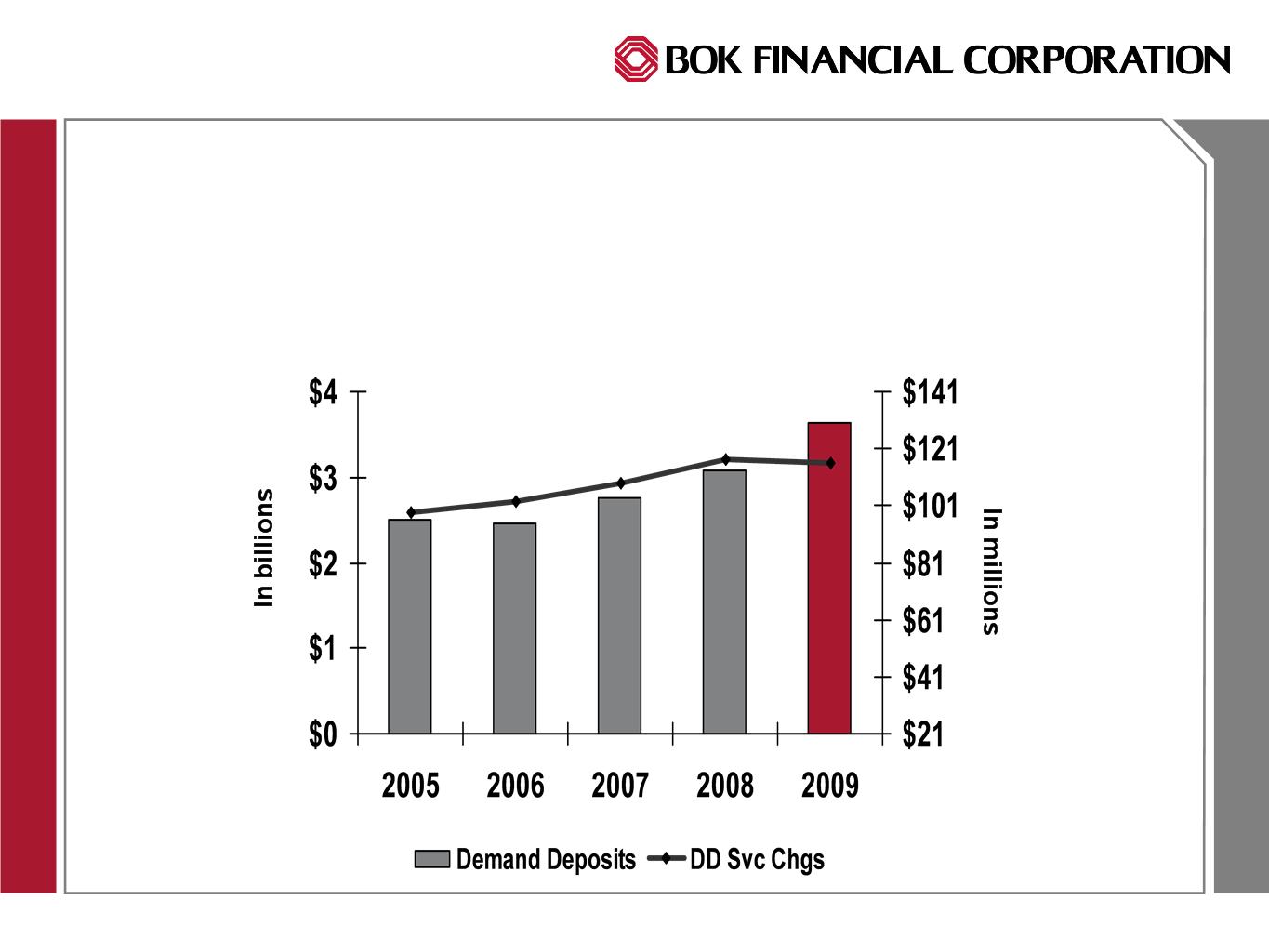

Service

Charges

Likely to Decrease Due to Changes in Regulation

Likely to Decrease Due to Changes in Regulation

Demand

Deposits and Fee Income

10

© 2009

BOK Financial Corporation.

11

Transaction

Card Revenue

Consistent Solid Contributor

Consistent Solid Contributor

© 2009

BOK Financial Corporation.

12

Brokerage

& Trading Revenue

Tremendous Growth in Investment Banking & Trading Fees

Tremendous Growth in Investment Banking & Trading Fees

© 2009

BOK Financial Corporation.

Mortgage

Originations

46% of Production In Regional Markets

46% of Production In Regional Markets

13

© 2009

BOK Financial Corporation.

Trust

Revenue

$30B in Trust Assets

$30B in Trust Assets

14

© 2009

BOK Financial Corporation.

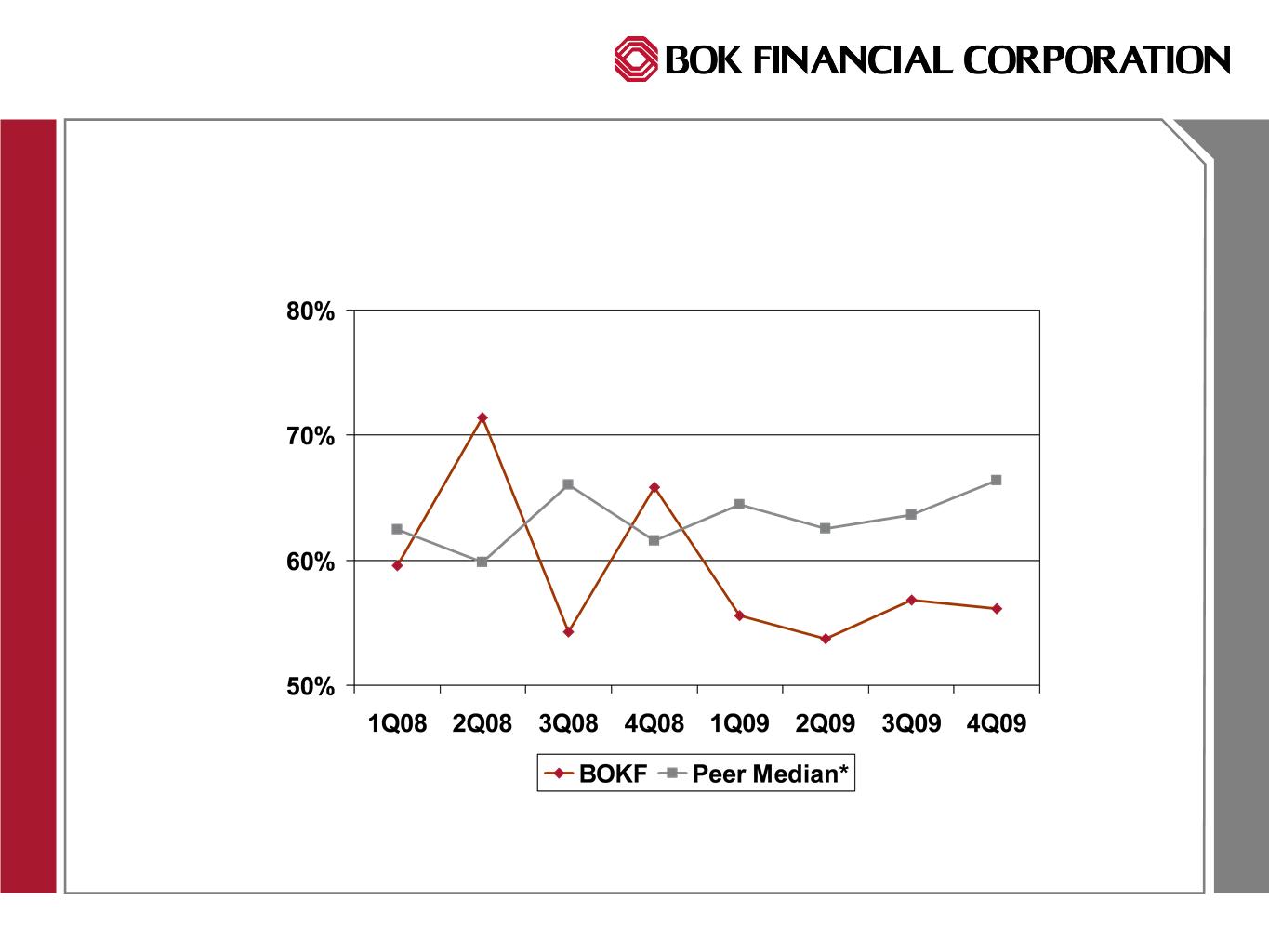

Efficiency

Ratio

15

* For purposes of this

comparison, peers are defined as the subset of the peer group of 20 with

fee

revenue over 35% of total revenue; Source: SNL as of 1/27/10. Two peers had not yet reported.

revenue over 35% of total revenue; Source: SNL as of 1/27/10. Two peers had not yet reported.

© 2009

BOK Financial Corporation.

Earning

Assets

16

© 2009

BOK Financial Corporation.

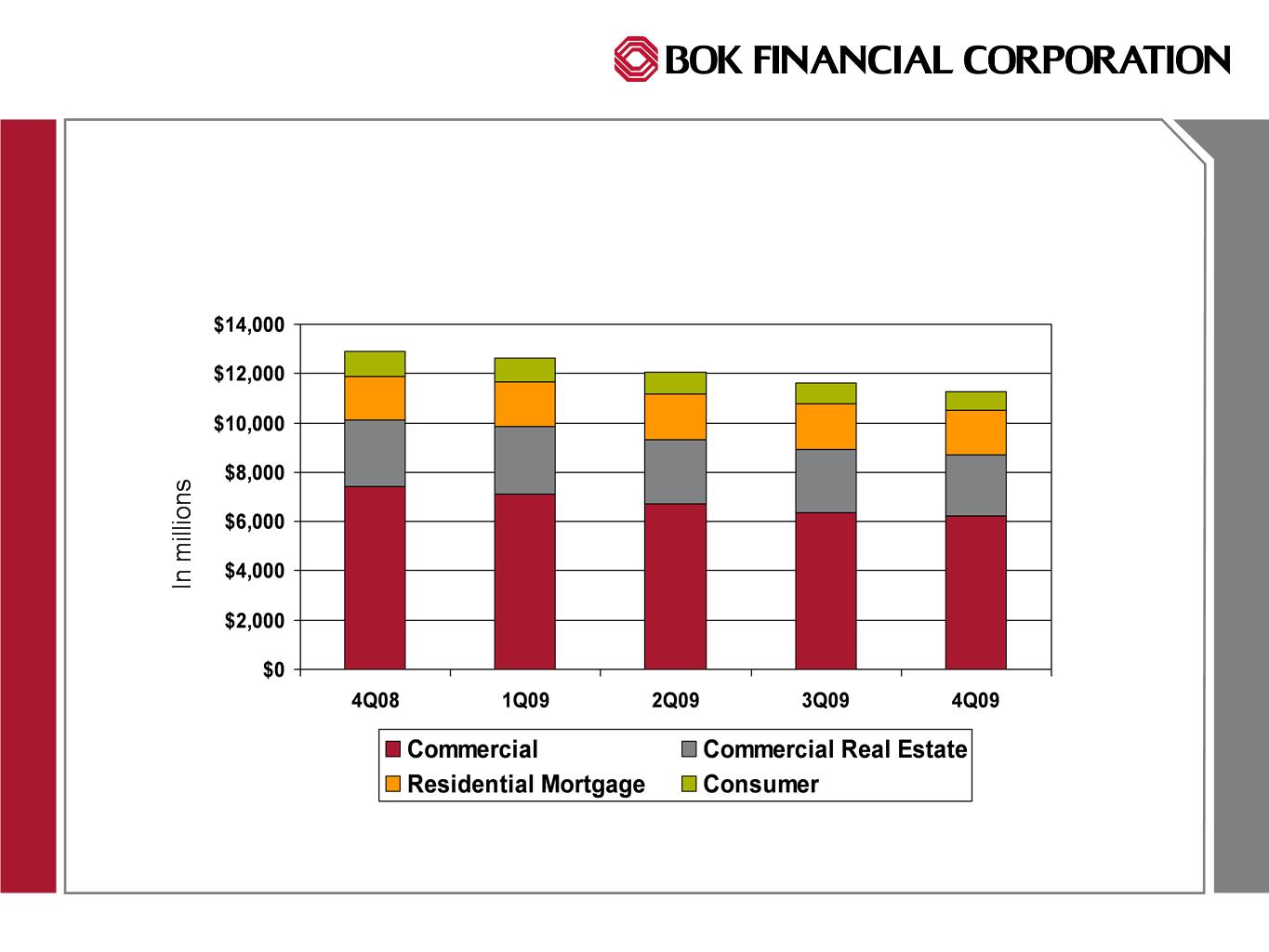

Loan

Trends

Consistent Portfolio Mix

Consistent Portfolio Mix

7%

17

55%

22%

16%

57%

21%

14%

8%

56%

22%

14%

8%

56%

22%

15%

7%

7%

55%

22%

16%

© 2009

BOK Financial Corporation.

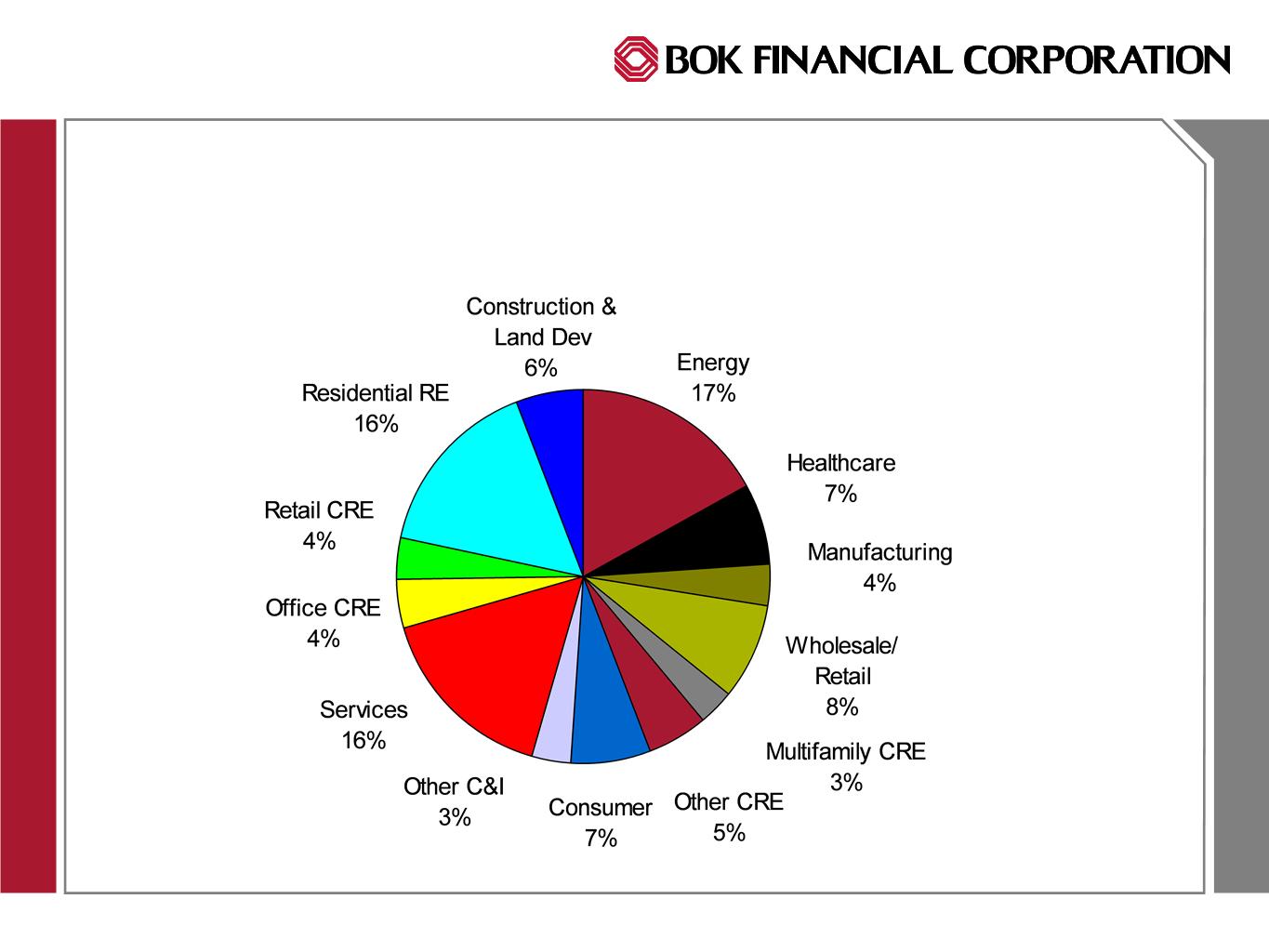

$11.2

Billion Loan

Portfolio

Diversified by Sector and Geography

Diversified by Sector and Geography

18

© 2009

BOK Financial Corporation.

Energy

Portfolio

Core Competency

Core Competency

19

© 2009

BOK Financial Corporation.

CRE

by Market

75% of Exposure is in Stable Markets

75% of Exposure is in Stable Markets

20

Market $ in

000s % of

Total

Oklahoma 820,578 33

Texas 735,338

30

New

Mexico 305,061

12

Colorado 239,

970

10

Arizona 227,249 9

Arkansas 132,

436 5

Kansas 30,802 1

© 2009

BOK Financial Corporation.

Additional

Loan Detail in

millions

Permanent Mortgage

Loans $1,303

Home

Equity Loans 490

Total

Residential Mortgage $1,793

Consumer Loans $455

Indirect Auto

Loans 332

Total

Consumer Loans $787

Off-Balance Sheet

Obligations

Related

to CRA Loans Sold with Recourse $331

21

© 2009

BOK Financial Corporation.

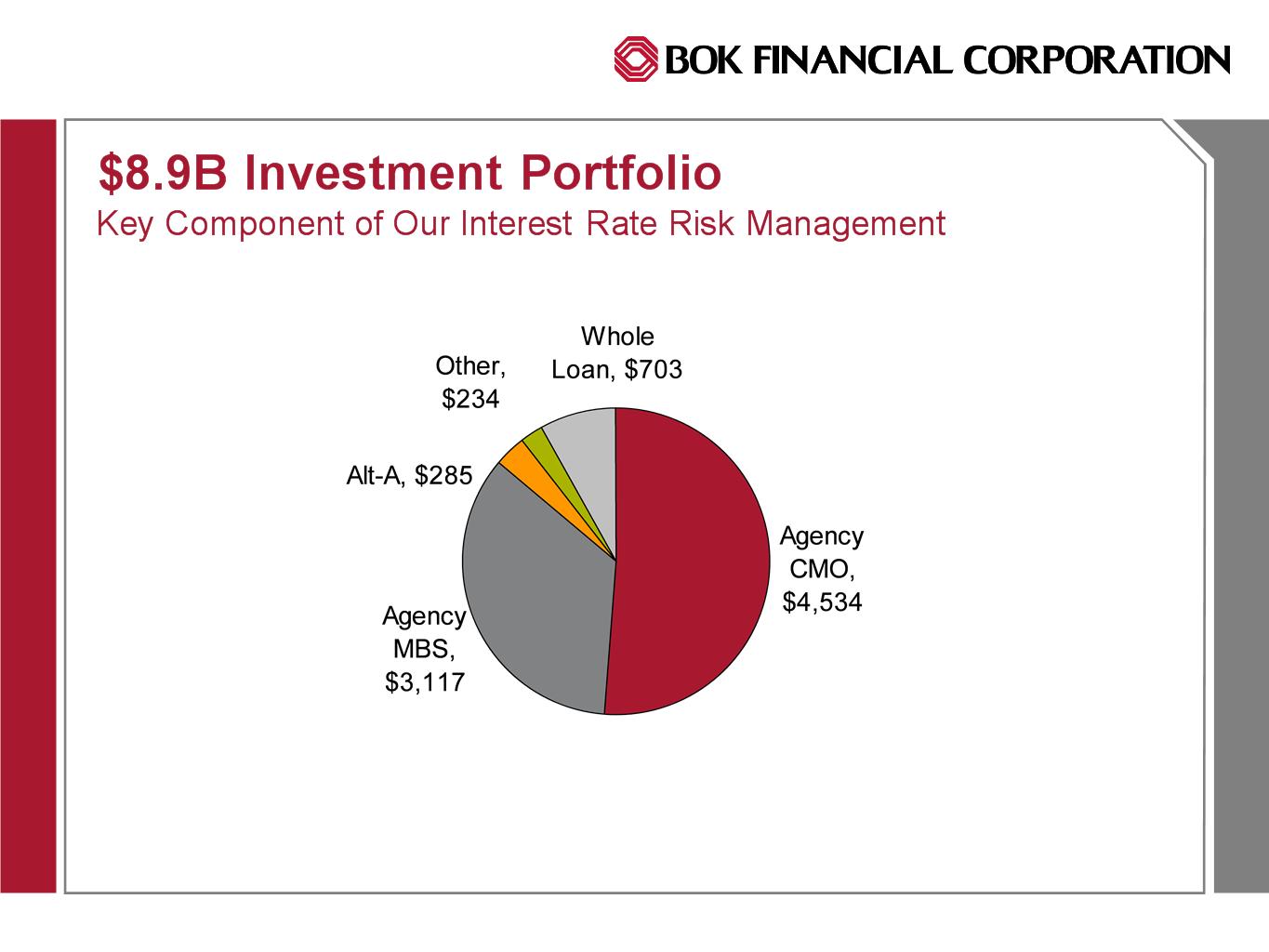

22

$ in

millions

© 2009

BOK Financial Corporation.

Other

Than Temporary Impairment on Debt

Securities

Securities

Summary

($ in millions)

Amortized cost of

private issue MBS $961

Amortized cost of

securities rated AAA

182

Amortized cost of

securities rated >investment grade and 190

Amortized cost of

securities rated < investment

grade

by at least one rating agency

589

OTTI

charges against earnings in 2009 26.4

23

© 2009

BOK Financial Corporation.

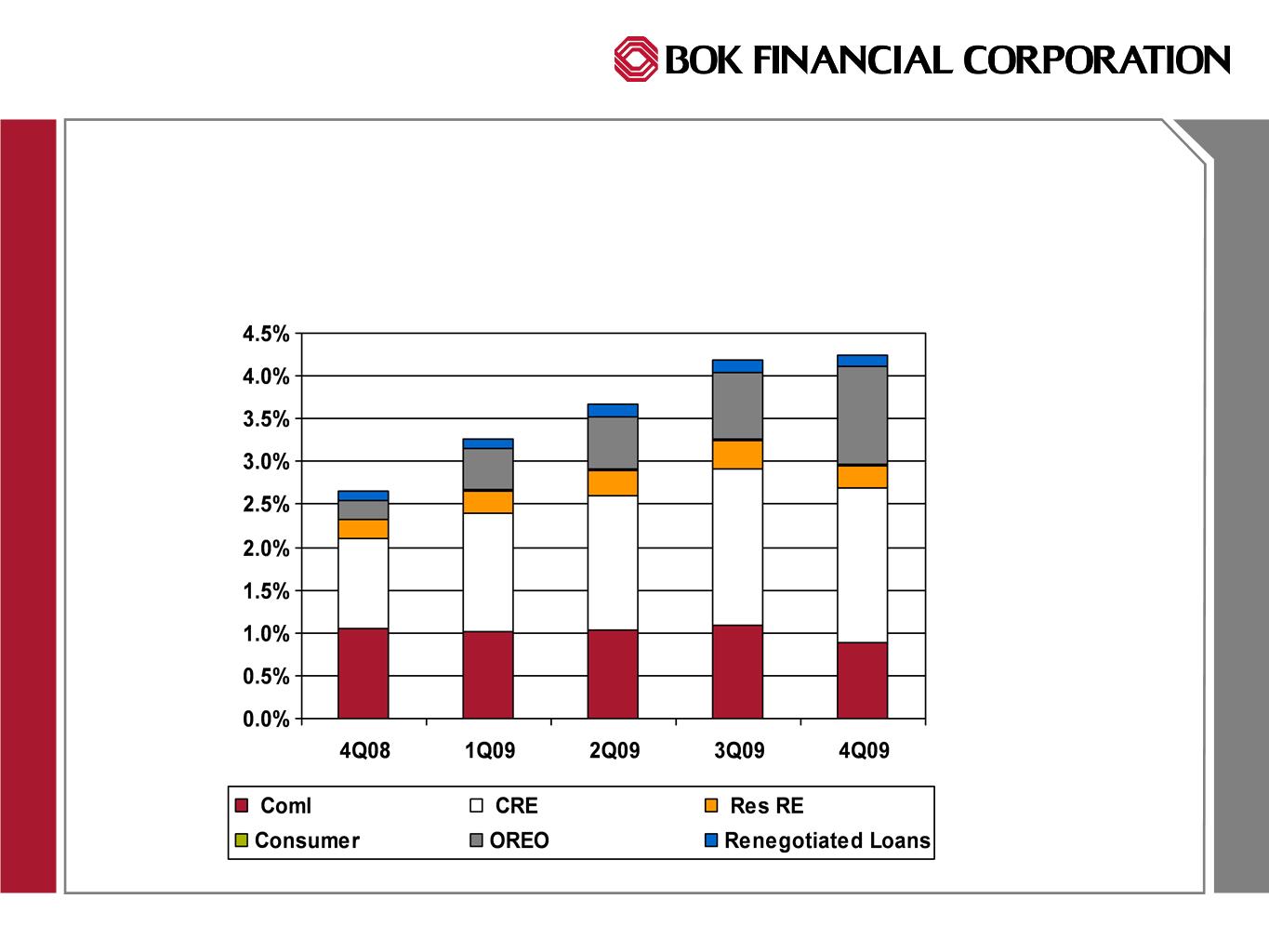

Asset

Quality

24

© 2009

BOK Financial Corporation.

Nonperforming

Assets

Reduce Level But Maximize Total Return

Reduce Level But Maximize Total Return

25

© 2009

BOK Financial Corporation.

Nonperforming

Assets / Loans & OREO

26

Source:

SNL; Two peers had not reported when this presentation was

prepared.

© 2009

BOK Financial Corporation.

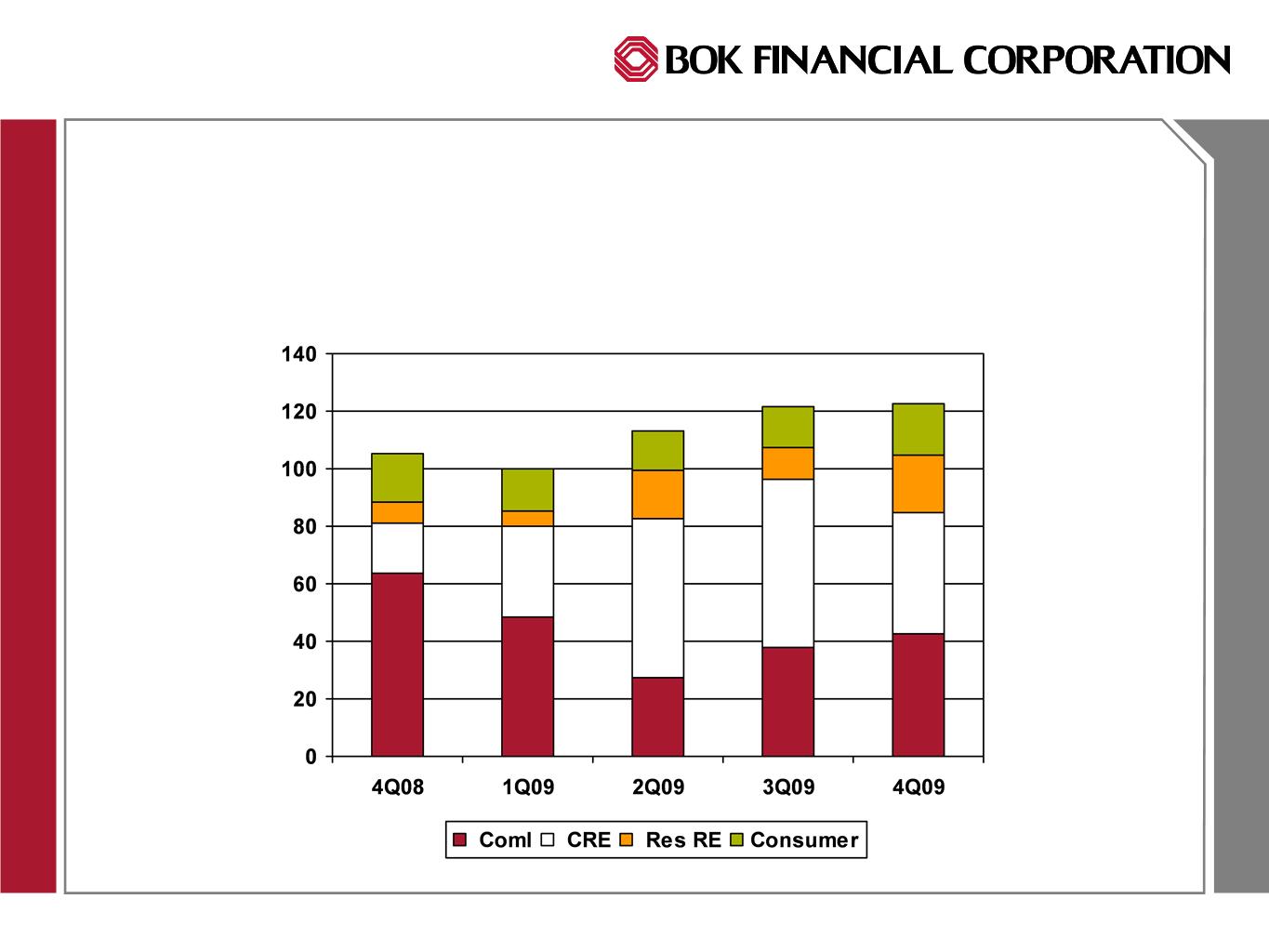

Net Charge-Offs in Basis Points

CRE Charge-offs Decreased in 4Q

27

© 2009

BOK Financial Corporation.

Net

Charge-offs as a % of Average Loans

(annualized)

Consistently Lower Than the Peer Median

Consistently Lower Than the Peer Median

* 62% of

2Q08 charge-offs consisted of a $26 million charge related to one energy

company

28

Source:

SNL; Two peers had not reported when this presentation was

prepared.

© 2009

BOK Financial Corporation.

Other

Real Estate Owned $ in

millions

OREO & Related Expenses Likely to Remain Elevated

OREO & Related Expenses Likely to Remain Elevated

29

© 2009

BOK Financial Corporation.

Liquidity

and Capital

30

© 2009

BOK Financial Corporation.

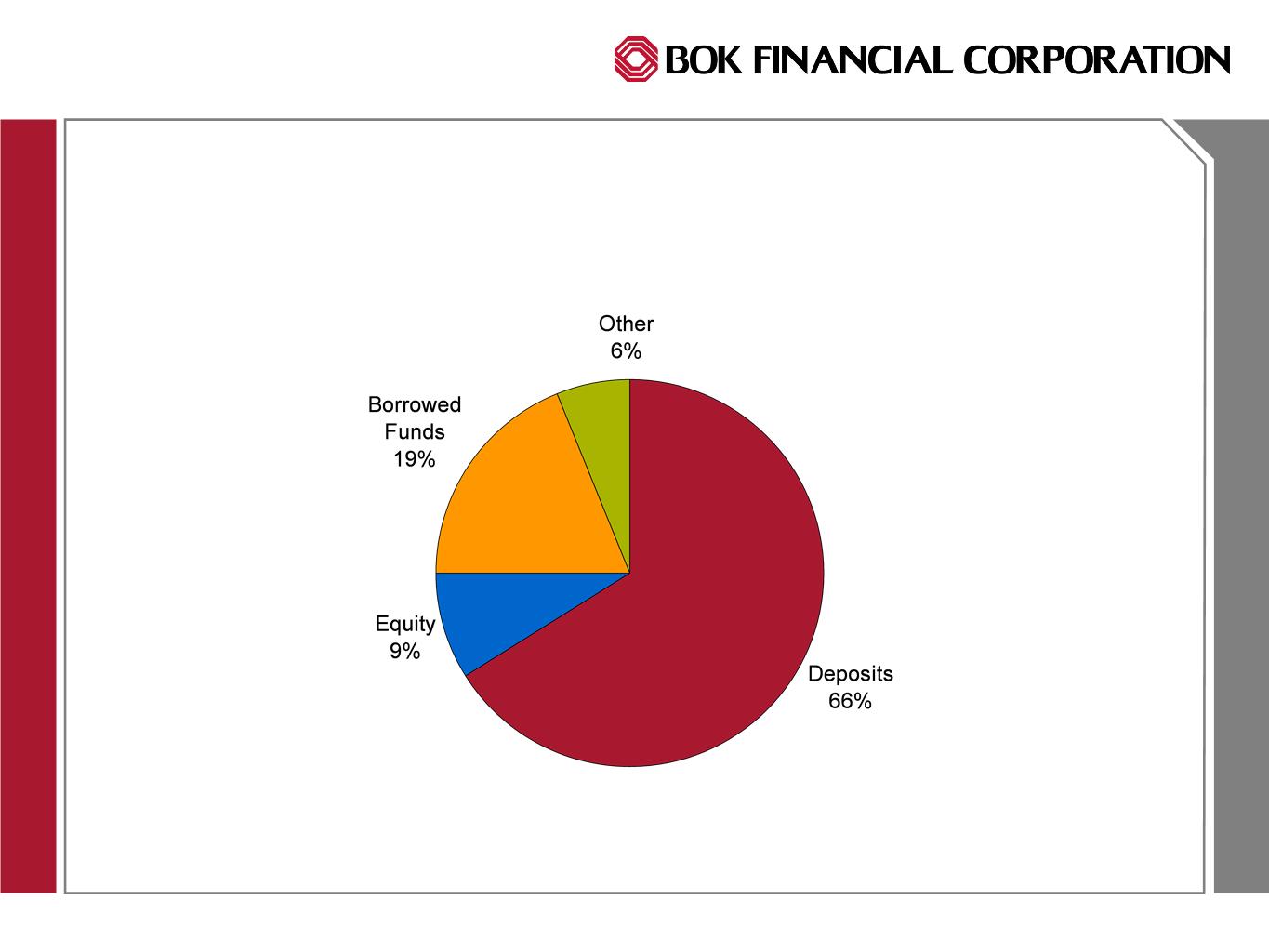

Funding

Sources

Diverse Sources By Type and Region

Diverse Sources By Type and Region

31

© 2009

BOK Financial Corporation.

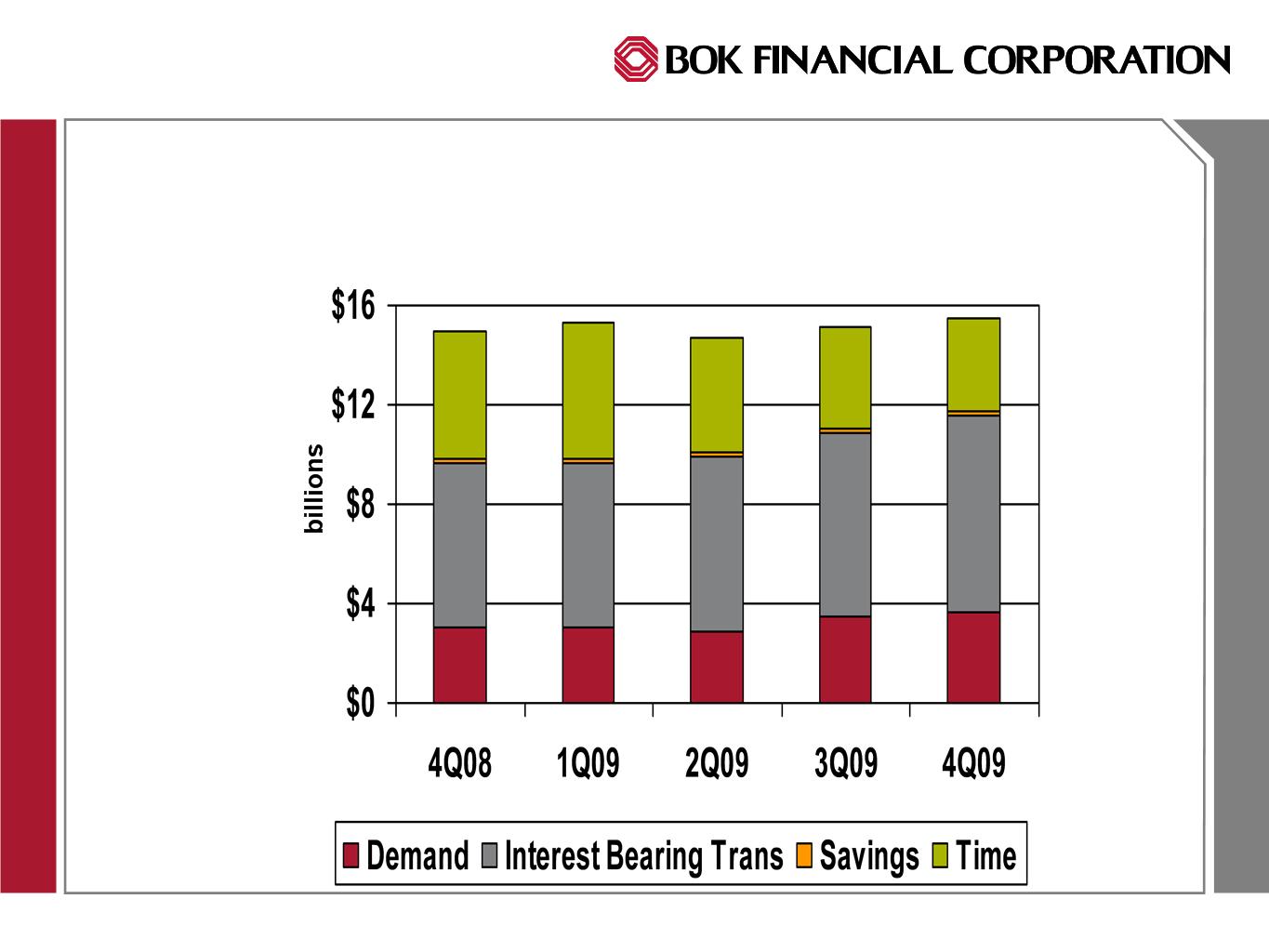

Deposits

Dominated by Core Deposit Relationships

Dominated by Core Deposit Relationships

32

© 2009

BOK Financial Corporation.

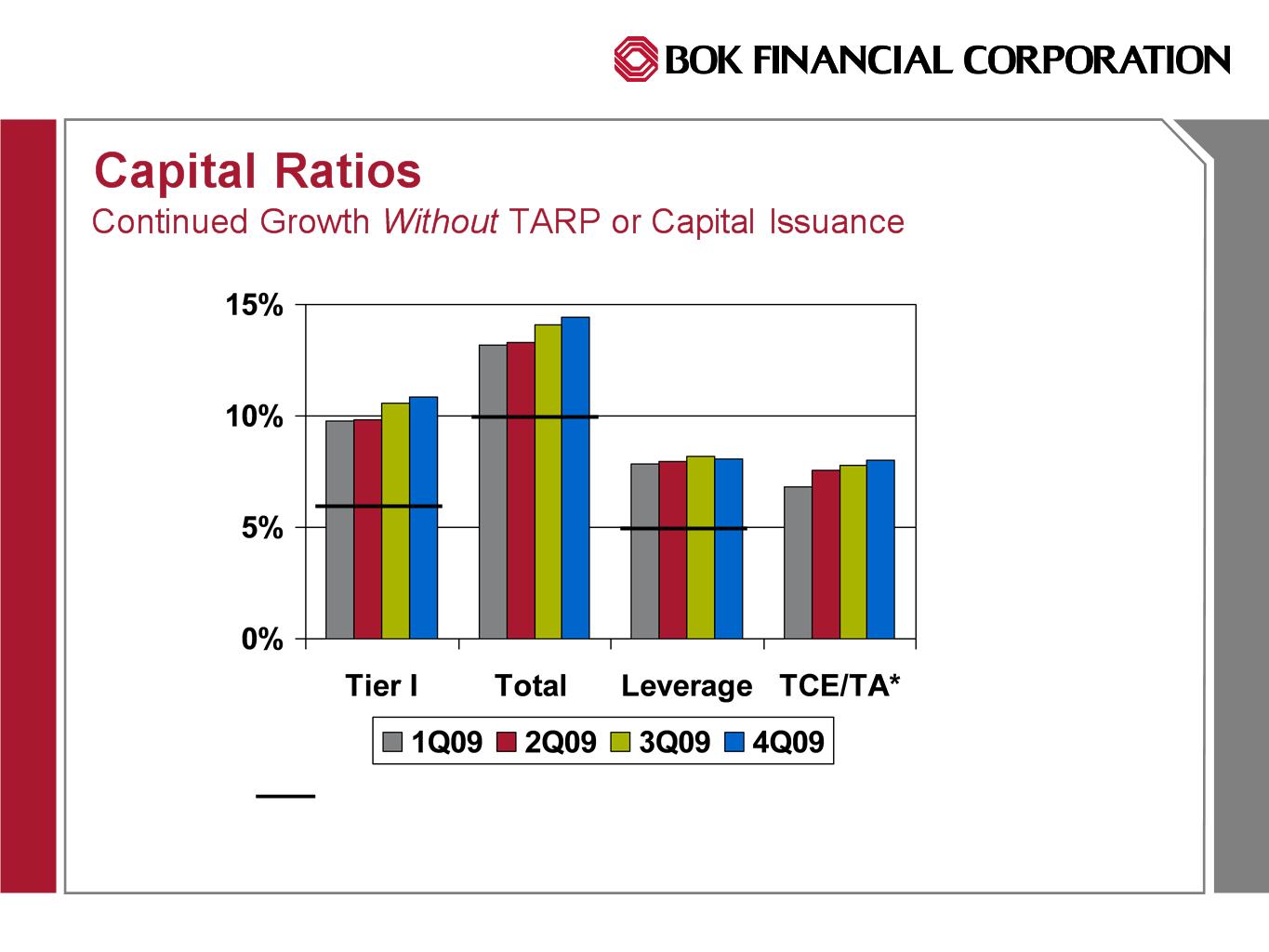

33

Well

capitalized level as defined by regulators

* Tangible

common equity ratio is a non-GAAP measure of capital strength based on equity as

defined by GAAP

minus intangible assets and equity that does not benefit common shareholders. BOKF did not participate in TARP

minus intangible assets and equity that does not benefit common shareholders. BOKF did not participate in TARP

© 2009

BOK Financial Corporation.

Well

Positioned to Take Advantage of

Opportunities

Opportunities

34

© 2009

BOK Financial Corporation.

Current

Focus

ü Aggressively

address credit quality

ü Renew

the focus on profitable loan growth

ü Employ

team based selling and other initiatives to generate

additional fee revenue

additional fee revenue

ü Retain

and grow deposits

ü Secure

the savings from expense control initiatives

completed in 2009

completed in 2009

ü Seek

opportunistic acquisitions within our footprint through

the FDIC and other channels

the FDIC and other channels

35

© 2009

BOK Financial Corporation.

How

We Are Different

ü Balanced

strategy with long term focus successfully creates

shareholder value through varying economic cycles

shareholder value through varying economic cycles

ü Diversified

mix of fee revenue

ü Strong

core earnings

ü Diversified

loan portfolio with consistent mix

ü Attractive

footprint

ü Excess

capital to fund opportunistic acquisitions within our

footprint

footprint

ü Outstanding

talent throughout the organization

36

© 2009

BOK Financial Corporation.

Forward-Looking

Statements

This

presentation contains forward-looking statements that are

based on management’s

beliefs, assumptions, current expectations, estimates, and projections about BOK Financial

Corporation, the financial services industry, and the economy generally. Words such as

“anticipates”, “believes”, “estimates”, “expects”, “forecasts”, “plans”, “projects”, variations of

such words, and similar expressions are intended to identify such forward-looking

statements. Management judgments relating to, and discussion of the provision and

allowance for credit losses involve judgments as to future events and are inherently forward-

beliefs, assumptions, current expectations, estimates, and projections about BOK Financial

Corporation, the financial services industry, and the economy generally. Words such as

“anticipates”, “believes”, “estimates”, “expects”, “forecasts”, “plans”, “projects”, variations of

such words, and similar expressions are intended to identify such forward-looking

statements. Management judgments relating to, and discussion of the provision and

allowance for credit losses involve judgments as to future events and are inherently forward-

looking

statements. Assessments

that BOK Financial’s acquisitions and other growth

endeavors will be profitable are necessary statements of belief as to the outcome of future

events, based in part on information provided by others which BOKF has not independently

verified. These statements are not guarantees of future performance and involve certain

risks, uncertainties, and assumptions which are difficult to predict with regard to timing,

extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may

materially differ from what is expressed, implied or forecasted in such forward-looking

statements. Internal and external factors that might cause such a difference include, but are

endeavors will be profitable are necessary statements of belief as to the outcome of future

events, based in part on information provided by others which BOKF has not independently

verified. These statements are not guarantees of future performance and involve certain

risks, uncertainties, and assumptions which are difficult to predict with regard to timing,

extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may

materially differ from what is expressed, implied or forecasted in such forward-looking

statements. Internal and external factors that might cause such a difference include, but are

not

limited to, (1) the ability to fully realize expected cost savings from

mergers within the

expected time frames, (2) the ability of other companies on which BOKF relies to provide

goods and services in a timely and accurate manner, (3) changes in interest rates and

interest rate relationships, (4) demand for products and services, (5) the degree of

competition by traditional and non-traditional competitors, (6) changes in banking regulations,

tax laws, prices, levies, and assessments, (7) the impact of technological advances, and (8)

trends in customer behavior as well as their ability to repay loans. BOK Financial

Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-

looking statements, whether as a result of new information, future events, or otherwise.

expected time frames, (2) the ability of other companies on which BOKF relies to provide

goods and services in a timely and accurate manner, (3) changes in interest rates and

interest rate relationships, (4) demand for products and services, (5) the degree of

competition by traditional and non-traditional competitors, (6) changes in banking regulations,

tax laws, prices, levies, and assessments, (7) the impact of technological advances, and (8)

trends in customer behavior as well as their ability to repay loans. BOK Financial

Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-

looking statements, whether as a result of new information, future events, or otherwise.

37

© 2009

BOK Financial Corporation.

Steven

E. Nell, EVP & Chief Financial Officer

Steven

G. Bradshaw, SEVP

Q

& A

38