Attached files

| file | filename |

|---|---|

| EX-31.1 - BLACKSANDS PETROLEUM, INC. | ex31_1.htm |

| EX-32.2 - BLACKSANDS PETROLEUM, INC. | ex32_2.htm |

| EX-32.1 - BLACKSANDS PETROLEUM, INC. | ex32_1.htm |

| EX-31.2 - BLACKSANDS PETROLEUM, INC. | ex31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended October 31, 2009 |

||

|

OR |

||

|

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-51427

BLACKSANDS PETROLEUM, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada |

|

20-1740044 |

|

(State of other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

401 Bay Street, Suite 2700 |

|

|

|

Toronto, Ontario, Canada |

|

M5H 2Y4 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(416) 359-7805

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: Common Stock, par value $.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See definition of “accelerated filer” and “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one)

|

Large Accelerated Filer o |

Accelerated Filer o |

|

Non-Accelerated Filer o |

Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes o No x

The aggregate market value of the Common Stock of the registrant’s common equity (both voting and non-voting) held by non-affiliates, based on the closing price of $1.10 as quoted on the OTCBB, on January 26, 2010, is $49,340,170. For purposes of this computation all officers, directors and 5% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such officers, directors and beneficial owners are, in fact, affiliates of the registrant.

|

Common Shares outstanding as of October 31, 2009: |

44,854,700 |

TABLE OF CONTENTS

|

|

Forward-Looking Statements |

1 |

| Currency and Exchange Rates |

2 |

|

|

PART I |

|

3 |

|

Item 1. |

Description and Development of Business |

3 |

|

Item 1A. |

Risk Factors and Uncertainties |

11 |

|

Item 2. |

Description of Property |

25 |

|

Item 3. |

Legal Proceedings |

27 |

|

Item 4. |

Submission of Matters To A Vote of Security Holders |

27 |

|

|

|

|

|

PART II |

|

28 |

|

Item 5. |

Market for Common Equity and Related Stockholder Matters |

28 |

|

Item 6. |

Selected Financial Data |

29 |

|

Item 7. |

Management’s Discussion and Analysis |

30 |

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

40 |

|

Item 8. |

Financial Statements |

40 |

|

Item 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure |

66 |

|

Item 9A. |

Controls and Procedures |

66 |

|

Item 9B. |

Other Information |

67 |

|

|

|

|

|

PART III |

|

68 |

|

Item 10. |

Directors and Executive Officers |

68 |

|

Item 11. |

Executive Compensation |

71 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters |

77 |

|

Item 13. |

Certain Relationships and Related Transactions and Director Independence |

78 |

|

Item 14. |

Principal Accountant Fees and Services |

78 |

|

Item 15. |

Exhibits |

80 |

|

|

Signatures |

82 |

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Such forward-looking statements include, among others, those statements including the words “expects”, “anticipates”, “intends”, “believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the section “Risk Factors.” We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this report.

Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These factors include among others:

|

|

• |

Risks associated with conventional and unconventional oil and gas exploration and operations; |

|

|

• |

Our ability to raise capital to fund capital expenditures;

|

|

|

• |

Our ability to find, acquire, market and develop conventional and unconventional oil and gas properties; |

|

|

• |

Receipt of all necessary rights, permits and licenses to carry out work;

|

|

|

• |

Oil and gas price volatility;

|

|

|

• |

Uncertainties in the estimation of oil and gas reserves;

|

|

|

• |

Operating hazards attendant to the conventional and unconventional oil and gas business;

|

|

|

• |

Actions or inactions of third-party operators of our properties;

|

|

|

• |

Our ability to find and retain skilled personnel;

|

|

|

• |

Regulatory developments;

|

|

|

• |

Environmental risks; and

|

|

|

• |

General economic conditions. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled “Risk Factors and Uncertainties”, “Description of the Business” and “Management’s Discussion and Analysis” of this registration statement. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

We qualify all the forward-looking statements contained in this annual report on Form 10-K by the foregoing cautionary statements.

CURRENCY AND EXCHANGE RATES

Unless otherwise indicated, references in this Form 10-K to “Cdn.$” and Canadian dollars are to the lawful currency of Canada, and references to “US$” and “United States dollars” are to the lawful currency of the United States.

On January 26, 2010, the noon rate of exchange for one Canadian dollar in United States dollars as reported by the Bank of Canada was Cdn $1.00 = US$0.9429.

Blacksands prepares its consolidated financial statements in United States dollars. The following table sets forth, for each period indicated, the average exchange rate for United States dollars expressed in Canadian dollars on each business day during such period, and the exchange rate at the end of such period, based upon the noon rate of exchange on each business day as reported by the Bank of Canada.

|

Twelve months ended October 31, |

|

|

|

|

|

|

|

2009 |

2008 |

2007 |

2006 |

2005 |

|

|

|

|

|

|

|

|

High |

1.3000 |

$1.1030 |

$1.0527 |

$0.9100 |

$0.8613 |

|

Low |

1.0292 |

$0.7695 |

$0.8437 |

$0.8361 |

$0.7872 |

|

Period End |

1.0819 |

$0.8302 |

$1.0527 |

$0.8907 |

$0.8474 |

|

Average |

1.1693 |

$1.0269 |

$0.9068 |

$0.8827 |

$0.8216 |

PART I

|

ITEM 1. |

DESCRIPTION AND DEVELOPMENT OF BUSINESS |

Name and Incorporation

Blacksands Petroleum, Inc. was formed under the laws of the State of Nevada on October 12, 2004.

Our principal business office, which also serves as our administration and financing office, is located in Canada at 401 Bay Street, Suite 2700, PO Box 152, Toronto, Ontario, Canada M5H 2Y4, and our telephone number there is (416) 359-7805.

We own 75% of the issued and outstanding shares of our operating subsidiary, Access Energy Inc. (“Access” or “Access Energy”) and 100% of Blacksands Petroleum Texas LLC (“BSPE Texas”). Access is a private company, formed under the laws of Ontario, Canada on August 26, 2005, and BSPE Texas was formed under the laws of Texas on November 9, 2009.

History and Background of Company

We were incorporated in the State of Nevada on October 12, 2004 as Lam Liang Corp. In November 2004, we acquired 99.94% ownership in a privately-held Thai company which was dissolved on June 5, 2006. On May 6, 2006, three of our directors resigned and two new directors were appointed to our Board of Directors, and we amended our business plan.

To indicate our new business focus, that of making a strategic acquisition in the unconventional oil industry, we filed an amendment to our Articles of Incorporation with the Nevada Secretary of State on June 9, 2006 which changed our name to “Blacksands Petroleum, Inc.” (“Blacksands” or the “Company”) and increased our authorized capital stock from 75,000,000 shares of common stock, par value $0.001, to 310,000,000 shares, comprised of 300,000,000 shares of common stock, par value $0.001, and 10,000,000 shares of preferred stock, par value $0.001.

On June 21, 2006, we effected a 30:1 forward stock split in the form of a dividend. The dividend was paid to stockholders of record as of the close of business on June 21, 2006. Immediately prior to the split, we had 2,100,000 shares of common stock issued and outstanding. Immediately following the split, we had 63,000,000 shares of common stock issued and outstanding.

To further our business plan, on May 6, 2006, we issued $1 million of convertible debentures to two non-affiliates on a private placement basis in reliance on Regulation D under the United States Securities Act of 1933, as amended (the “Securities Act”). Effective August 9, 2006, the debentures were converted into an aggregate of 1,000,000 units (“Units”). Each Unit consisted of one share of our common stock and one common stock purchase warrant to purchase a share of our common stock at a price of $3.00 per share at any time during the two year period that commenced on October 1, 2006. The 1,000,000 warrants expired September 30, 2008.

Also on August 9, 2006, we issued an aggregate of 10,854,700 Units at $1 per Unit to 49 persons on a private placement basis in reliance on Section 4(2), Regulation D or Regulation S under the Securities Act. We derived total gross proceeds of $10,854,700 from this sale of Units which was placed into a restricted cash escrow account pending our making a strategic acquisition in the unconventional oil industry. Each Unit consisted of one share of our common stock and one common stock purchase warrant to purchase a share of our common stock at a price of $3.00 per share at any time during the two year period that commenced on October 1, 2006. The 10,854,700 warrants expired September 30, 2008.

On November 6, 2006, the Company purchased 30,000,000 shares of common stock from Darren Stevenson, the President & CEO, CFO and a director of the Company at the time, for $50,000 cash in accordance with the terms of the stock repurchase agreement. The 30,000,000 shares of common stock repurchased have been cancelled.

On August 3, 2007, pursuant to a Common Stock Purchase Agreement (“Purchase Agreement”), we purchased (the “Purchase”) 600 newly issued shares of common stock of Access, representing 75.0% of its common stock for an

aggregate sum of Cdn$3,427,935.23 (approximately US$3,213,000), and common stock purchase warrants to acquire 1,500,000 of our shares of common stock. Prior to the Purchase, we considered ourselves a “shell” company as that term is defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). By consummating the Purchase, we succeeded at our business plan which was to enter the unconventional petroleum industry by acquiring a suitable target company. The unconventional petroleum industry is generally understood to mean the recovery of oil from oil sands or tar sands together with natural gas deposits located in proximity to the oil sands.

Access was formed in August 2005 for the purpose of acquiring rights for conventional and unconventional oil and gas exploration and development on lands in Western Canada and the United States, including the traditional lands of the Buffalo River Dene Nation in Northern Saskatchewan (the “BRDN”). Access secured initial financing to continue negotiations with the BRDN, but as negotiations progressed, additional financing was required. We were introduced to Access through investors interested in its potential.

On March 23, 2006, Access signed an Authorization and Access Permit with the BRDN to provide Access with the right to complete non-invasive exploration on the BRDN’s land, including mapping macroseepage and bitumen deposits visible on the surface.

In April 2006, Darren R. Stevenson signed an employment agreement with us to become our President, Chief Executive Officer, Chief Financial Officer, and Secretary. For the duration of 2006, he assisted in raising capital for Blacksands from sophisticated and institutional investors based in Europe and North America, and evaluating various conventional and unconventional oil and gas opportunities of which Access was one.

On November 3, 2006, Access and the Buffalo River Dene Development Corporation (“BRDDC”), a wholly-owned subsidiary of the BRDN, signed a joint venture agreement (the “Joint Venture Agreement”) which, among other things, granted Access exclusive and binding rights to explore and develop oil and gas reserves on certain of the BRDN’s traditional lands.

On November 10, 2006, we entered into an Exclusivity Agreement (“Exclusivity Agreement”) with Access where it agreed that in exchange for Cdn$100,000, Access would refrain from soliciting or encouraging the submissions of proposals or offers from any person other than us relating to the purchase of equity in Access or all or a significant portion of its assets until March 10, 2007. The expiration date of the agreement was subsequently extended on two occasions for no additional consideration. The agreement expired on August 7, 2007. A copy of the Exclusivity Agreement, and its amendments, are incorporated by reference as Exhibits 10.2, 10.3 and 10.4 respectively.

As Access’ negotiations with the BRDN continued, it sought an amendment to the Joint Venture Agreement (the “Amendment”) which would grant it exclusive and enforceable rights to conduct exploration and development on the BRDN’s traditional land. To assist the negotiations with the BRDN, and to fulfill one of their negotiating requirements, on May 17, 2007, we placed Cdn$250,000 into escrow along with a loan agreement (“Loan Agreement”) and a promissory note (“Note”), which evidenced Access’ obligations to us. By the terms of the Loan Agreement, if we consummated the Purchase, the proceeds of the loan would be paid to Access as part of the purchase price and the Note would be cancelled. The escrow agreement provided that unless we and Access issued joint written instructions to release the funds to Access by June 1, 2007, the escrow agent was to return the funds to us and destroy the Note and Loan Agreement. On June 11, 2007, the escrow agent released Cdn$100,000 of the loan proceeds to the BRDN (through Access) which was used to pay for work performed by BRDN contractors and an additional $125,000 on August 2, 2007. Copies of the Loan Agreement, Note, and Escrow Agreement are incorporated by reference as Exhibits 10.6, 10.7 and 10.8 respectively. On the closing date, we consummated the Purchase of Access, and the funds remaining in the Escrow Account were released to Access as part of the purchase price.

On May 9, 2007, Access and the BRDDC executed an amendment (“Amendment”) (incorporated by reference as Exhibit 10.5) to the Joint Venture Agreement (incorporated by reference as Exhibit 10.1), and further amended it on March 17, 2008, (incorporated by reference as Exhibit 10.5.1) which granted Access exclusive, enforceable rights to access the BRDN’s land for the purpose of oil and gas exploration and development.

On May 24, 2007, our representatives and those from Access and the BRDN attended a signing ceremony for the Impact/Benefit Agreement (incorporated by reference as Exhibit 10.14) signed by the BRDN and the A10 Project (as described below) which was further amended on March 17, 2008 (incorporated by reference as Exhibit 10.14.1).

The Impact/Benefit Agreement (and its amendment of March 17, 2008, collectively referred to as the Impact/Benefit Agreement or “IBA”) sets forth the framework for several obligations of Access in favor of the BRDN. The term of the Impact/Benefit Agreement will be for a period of twenty (20) years from the date of execution. The parties agree that one year prior to the expiration of the initial term, A10 Project will initiate a review of the Impact/Benefit Agreement with the BRDN. Either party may terminate the Impact/Benefit Agreement by providing the other party with 30 days’ notice of an intention to terminate.

The initial exploration project for Access is named “A10 Project” and lies on a portion of the traditional land of the Buffalo River Dene Nation (the “BRDN”) subject to Treaty 10 (“Treaty 10”) in western Saskatchewan on the border with Alberta (the “Project Land”). The BRDN is a party to Treaty 10 with Her Majesty the Queen in the Right of Canada (the “Crown”) which recognizes lands and water belonging to the BRDN whose territory is situated partly in the Province of Saskatchewan and partly in the Province of Alberta. Upon entering into Treaty 10, the BRDN did not cede, release, surrender or yield to the Crown any or all rights, titles and privileges whatsoever to the BRDN’s traditional territories. Lands and waters described in Treaty 10 form a part of the traditional territories of the BRDN.

Pursuant to the terms of the JV Agreement, the Company is responsible for 100% of the costs to explore and develop any project within the traditional lands. After all costs relating to a specific project have been recouped, the Company will retain a 90% interest and the BRDDC will be entitled to the remaining minority interest of the Project. Furthermore, the BRDDC is entitled to earn up to an additional 20% interest in any project(s) by contributing its pro rata share of the costs to explore and develop any project(s). Even if the BRDDC chooses to participate to the full extent permitted by the JV Agreement, the Company would continue to hold a majority of the working interest in the project.

In connection with its entry into the Joint Venture Agreement with the BRDN, Access paid the BRDN Cdn$375,000 as a non-refundable deposit. An additional $125,000 was paid to the BRDN upon Access receiving standard post closing documents. On Access’ behalf, BRDN contractors performed work such as road construction. At the closing date of the Purchase of Access, Access owed such contractors approximately Cdn$189,000 for such work which was paid for out of the purchase price.

In addition, pursuant to the Impact/Benefit Agreement and its Amendment, the Company is committed to make certain contributions to the BRDN on or before May 24 of every year for capacity and infrastructure building and for reimbursement of costs for traditional lands staffing and to support training and development of the BRDN community in the range of Cdn$1,000,000 to Cdn$1,300,000 per year. Additionally, the Company is committed to expend up to Cdn$1,000,000 to assist BRDN forestry contractors to transition to approved contractors for the A10 Project. Finally, the Company is committed to providing a loan of up to Cdn$5,000,000 to assist the BRDDC to fund an increase in ownership of the A10 Project up to 30% (from the current 10% interest) when production is to commence. All amounts paid or advanced are potentially recoverable as part of the Company’s earned working interest in the A10 Project.

As at October 31, 2009, the Company had paid or accrued a total of approximately Cdn$3,098,500 (approximately US$2,864,000) to the BRDN and is committed to further payments totalling in the aggregate of approximately Cdn$24,000,000 over the 20-year term of the agreement.

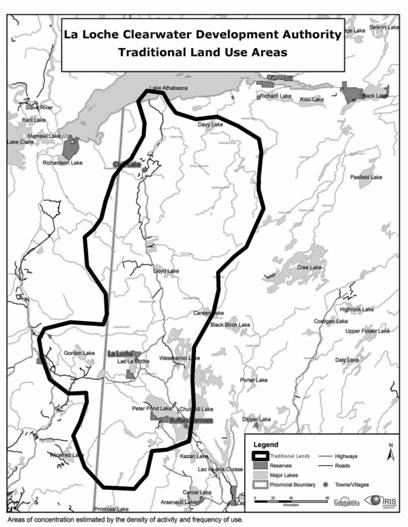

On October 15, 2008, Access signed a Joint Venture Agreement and an Impact Benefit Agreement incorporated by reference herein as Exhibit 10.16 (the “Agreements”) with La Loche Clearwater Development Authority. The Agreements were subject to the ratification by the aboriginal residents of the area (the La Loche “Community”) before they became effective.

On February 14, 2009, the Community ratified the Joint Venture Agreement and the Impact Benefit Agreement signed by Access and the La Loche Clearwater Development Authority (“LLCDA”) on October 15, 2008.

The Agreements cover approximately 3,000,000 hectares of La Loche Traditional Lands (the “Traditional Lands”) in north western Saskatchewan, north and west of the town of La Loche, Saskatchewan (the “La Loche Project”). They allow Access to exclusively participate in the acquisition, exploration and development of certain surface and subsurface rights in and to the Traditional Lands with respect to petroleum and mining products (the “Products”).

The terms of the Agreements are for twenty years from the date of signing (October 15, 2008), and automatically renew for consecutive terms of twenty years if Access provides notice of renewal to LLCDA before the expiration of the Agreements. Pursuant to the terms of the Agreements, Access paid Cdn$15,000 (approximately US$12,500) on the signing of the Agreements, and is obligated to pay to the LLCDA Cdn$75,000 (approximately US$62,300) at the start of each three-month period upon ratification of the Agreements (or Cdn$300,000 annually – approximately US$277,300). The amounts of Cdn$300,000 (approximately US$277,300) for the periods from February 14, 2009 to October 31, 2009 have been accrued but not paid. As well, Access is obligated to pay a 5% gross overriding royalty to LLCDA from the production of any Products.

Access’ Business

Access is an exploration stage company engaged in the business of conventional and unconventional oil and gas exploration in Western Canada and the United States whose only operations to date have been to negotiate the Joint Venture Agreement and the Amendments thereto, and sign a Impact/Benefit Agreement (“Impact/Benefit Agreement”) with the BRDN on May 24, 2007, amended March 17, 2008. Access also signed Joint Venture and Impact Benefit Agreements with La Loche Clearwater Development Authority on October 15, 2008, which required ratification of the La Loche community members before they were final – such ratification was obtained on February 14, 2009 as discussed above.

Access will have overall supervision, direction and control of contemplated exploration and development of various projects (each project, a “Project”). Access is permitted to select, subject to a formal bid process, and direct a suitable engineering firm to manage the startup, management, and ongoing requirements of each project, and to engage in actual extraction efforts of petroleum deposits.

The Company announced in April 2009 that it plans to sell 2/3rds of its interest in Access to the minority shareholder of Access, and to seek stockholder approval for this disposition at the next annual general meeting of stockholders.

Purchase of Access’ Common Stock

We paid the purchase price in four segments: (i) Cdn$3,077,935 in cash; (ii) release of approximately Cdn$250,000 held in escrowed funds in exchange for cancellation of the Note; (iii) $100,000 that we paid Access pursuant to the Exclusivity Agreement; and (iv) the Burden Warrants. The Burden Warrants were granted to H. Reg F. Burden, the sole stockholder of Access prior to the Purchase. We obtained the cash portion of the purchase price from funds released from restricted cash held in an escrow account. See Management’s Discussion and Analysis—Liquidity.

Stockholders Agreement

As a condition to the Purchase, we entered into a Unanimous Stockholders Agreement (the “Stockholders Agreement”) with Access and Mr. Burden (we, Mr. Burden and any future stockholder is a “Stockholder”). During the term of the Stockholders Agreement, and except as described below, no Stockholder can transfer, sell, assign or otherwise dispose (each a “Transfer”) of any of their shares of Access’ common stock shares other than pursuant to the terms of the Stockholders Agreement and any Transfers in violation of the Stockholders Agreement are null and void. The Stockholders Agreement is incorporated by reference herein as Exhibit 10.10.

Other provisions of the Stockholders Agreement include the following:

Annual Budget

Blacksands is required to make sufficient capital contributions to Access according to its annual plan and budget until Access’ internal resources are adequate to fund its annual plan without such contributions.

Corporate Governance

Access’ Board of Directors now consists of four members. Provided that we own at least 30% of Access’ issued and outstanding common stock (together with his affiliates and permitted transferees; the “Blacksands Threshold”), we may designate (and remove at will) three members of the Board (each a “Blacksands Designee”). Our initial designees were the members of our own Board of Directors at that time, Mr. Stevenson, Mr. Rick Wilson and Mr. Bruno Mosimann. Provided that Mr. Burden owns at least 10% of Access’ issued and outstanding common stock (together with his affiliates and permitted transferees; the “Burden Threshold”), he may nominate (and remove at will) one member of the Board (the “Burden Designee”). His initial designee is Mr. Paul A. Parisotto who has also become a member of our Board of Directors. In August 2008, Mr. Mark Holcombe replaced Mr. Stevenson as a director of Access.

Where a transaction is required by law to be approved by a vote of Access’ stockholders, when approved by Access’ Board of Directors and where the Burden Designee has voted to approve such transaction, all Access’ stockholders shall be required to vote their shares in favor of the transaction.

Other than as described above, no arrangements or understandings exist among Access’ stockholders with respect to the election of members of Access’ Board of Directors.

Preemptive Rights

Subject to certain exclusions, the Stockholders Agreement grants Stockholders which own at least 10% of common stock certain preemptive rights such that Access may not issue or sell its equity securities or rights to acquire its equity securities to a third party unless it first offers its Stockholders the right to purchase on a proportional basis, such equity securities on the same terms as it proposes to issue or sell to a third party. This provision does not apply if the issuance or sale is pursuant to Access’ initial public offering. In the event that Stockholders do not elect to purchase all of the offered securities, Access may then sell all or any part of the remaining offered securities to such third party.

Rights of First Refusal

Subject to certain limitations, a Stockholder wishing to make a transfer (a “Transferring Stockholder”) of any or all of its shares of Access common stock (the “Transfer Shares”) must provide advance written notice thereof to the other Stockholders and Access. Thereafter, Access has 15 days to exercise a right of first refusal for all or a portion of the Transfer Shares on the same terms on which the Transferring Stockholder is proposing to sell to a third party. If Access fails or declines to fully exercise such right, other Stockholders have an additional 15 days to exercise their own proportional right of first refusal.

Mr. Burden has the right to transfer shares of Access’ common stock to officers and directors of Access without such transfers being subject to our right of first refusal. He may also do so to persons who executed a consulting contract with Access which has been approved by its Board of Directors. Mr. Parisotto, the President and sole stockholder of Coniston Investment Corp. (“Coniston”), a consultant to Access, has similar rights. We have similar rights to transfer shares of Access’ common stock to officers, directors, and consultants of ours and of Access.

Rights of Co-Sale

Subject to certain limitations, if neither Access nor the other Stockholders exercise their rights of first refusal with respect to all of the Transfer Shares, the Transferring Stockholder must, within seven days, give further notice to the other Stockholders that they have rights of co-sale (a “Co-Sale Right”) to sell their own co-sale allocation to the proposed purchaser in place of the Transfer Shares on the same terms and price as the Transferring Stockholder is proposing to transfer its shares. A Stockholder’s Co-Sale Allocation is defined as the number of Shares owned by the Stockholder on the date of the notice, multiplied by a fraction, the numerator of which is the total number of Shares held by such Stockholder on the date of the notice, and the denominator of which shall be the total number of Shares held by all Stockholders on the date of the notice.

Pull-Along Rights

The Stockholders Agreement also contains a pull along right (the “Pull Along Right”) which provides that if Stockholders who own in the aggregate at least 50% of the outstanding common shares have received an offer from any non-affiliate to buy all of the outstanding common stock and common stock equivalents of Access, which would directly or indirectly result in all Stockholders receiving cash in exchange for their common stock or common stock equivalents, as the case may be, equal to or greater than the fair market value (as defined) for such stock or common stock equivalents (including, without limitation, pursuant to a merger), the selling Stockholders shall be deemed to have accepted the offer.

Third Party Purchase Option

So long as the Blacksands Threshold is met, if we receive a bona fide offer, which, if consummated, would result in a change of control of Blacksands, then Blacksands shall have the right, to purchase up to 100% of Access’ common stock and common stock equivalents that it does not then own. The purchase price for such securities shall be determined by the trading price on a national securities exchange or as established by Access’ Board of Directors in good faith. Blacksands must give at least 90 days’ notice to the other stockholders before exercising this option. Blacksands is not permitted to exercise this option if another third party offer at a higher price has been received and discussions regarding it are ongoing or if Access has filed (and not withdrawn) a registration statement for a public offering.

Termination

The Stockholders Agreement shall terminate upon the earliest of (i) Access’ initial public offering, (ii) the consummation of a sale of all or substantially all of its assets; (iii) the merger, consolidation, or reorganization in which Stockholders immediately prior to such transaction own immediately following such transaction less than 50% of the surviving entity or its parent or (iv) the written consent of at least a majority of Stockholders including us (if the Blacksands Threshold is met) or Mr. Burden (if the Burden Threshold is met).

Acquisition of J.E. Pettus Gas Unit (known as “Cabeza Creek Field”) November 2009

In late fiscal 2009, and with the planned disposition of 75% of the Company’s interest in Access Energy, the Board approved the purchase of a gas property in Texas. Effective November 9th, 2009, the Company purchased, for approximately US$430,000 including legal and other costs, through its newly-formed Texan subsidiary, Blacksands Petroleum Texas, LLC (“BSPE Texas”), the J.E. Pettus Gas Unit located in Goliad County, Texas, previously owned by Pioneer Natural Resources USA, Inc. The Gas Unit includes four (4) active gas wells and 24 non producing gas wells located on 3688.77 acres in Goliad County, Texas. The interest acquired by BSPE Texas is 100% all right, title and interest from the surface to 8,500 feet below the surface and 10.67% below 8,500 feet. The other interest owners with rights below 8,500 feet beneath the surface are: XTO Energy Inc. with a 35% interest, ConocoPhillips Company with a 45.67% interest, and Anadarko Petroleum Corp. with a 8.66% interest. We are operator of all depth rights. The gas and oil production is from conventional Gulf Coast sand-stone formations. The Company intends to retain the services of NRG Assets Management, LLC - a third party Texas-registered contract operating company - to facilitate regulatory and administrative requirements for this Gas Unit for a monthly fee of US$500 per gas well, as well as the services of a consultant to act as Director of Operations of the gas wells for a monthly fee of US$8,000.

The Gas Unit was purchased with the objective of providing cash flow to the Company in the near and long term, to enhance stockholder value of the Company, with the Company intending to increase production through (i) reworking and recompleting existing oil and gas wells, (ii) utilization of industry technology such as compression and artificial lift, and (iii) further exploration in order to define additional reserves.

Business Objectives of the Company

Blacksands’ mission, is to acquire, explore, and develop oil and gas properties in North America. Through our investment in Access Energy, we are focused on the exploration, delineation, and ultimate exploitation of bitumen on the A10 Project, and completion of the acquisition of surface rights with the La Loche Clearwater Development Authority to explore the traditional lands of La Loche in northwestern Saskatchewan.

In addition, with the recent acquisition of the J.E. Pettus Gas Unit, the Company is focused on acquiring producing conventional and unconventional oil and gas fields with development, exploitation and exploration upside located in North America. The Company has been structured to acquire and operate these fields with experienced Gulf Coast operators and exploration specialists.

Corporate Strengths

We believe that we have the following business strengths that will enable us to achieve our objectives:

|

|

• |

our management team has direct conventional and unconventional resource industry experience; This includes operations, exploration and production experience in the United States and Canada. |

|

• |

we have a Joint Venture and Impact/Benefit Agreement (amended) with the BRDN covering approximately 3,000,000 acres of their traditional land in northwestern Saskatchewan; |

|

|

• |

we have entered into a Joint Venture Agreement and an Impact Benefit Agreement with the La Loche Clearwater Development Authority, covering approximately 3,000,000 hectares of their traditional land in northwestern Saskatchewan; and, |

|

|

• |

We purchased the J.E. Pettus Gas Unit located in Goliad County, Texas which includes four (4) active gas wells and 24 non producing gas wells located on 3688.77 acres in Goliad County, Texas. |

Number of Employees

The Company has no employees. All work is done by contractors.

Competition

The petroleum industry is highly competitive. See “Risk Factors.” We compete with other exploration and early stage operating companies for financing from a limited number of investors prepared to make investments in junior companies exploring for conventional and unconventional oil and gas resources. The presence of competing oil and gas exploration companies, both major and independent, may impact our ability to raise additional capital in order to fund our exploration program if investors are of the view that investments in competitors are more attractive based on the merit of the properties under investigation, and the price of the investment offered to investors.

Many of the oil and gas exploration companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of properties of merit and on exploration of their properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of resource properties. This competition could result in our competitors having resource properties of greater quality and interest to prospective investors who may finance additional exploration, and to senior exploration companies that may purchase resource properties or enter into joint venture agreements with junior exploration companies. This competition could adversely impact our ability to finance property acquisitions and further exploration.

Competition to reserve oil drilling rigs, other equipment, and qualified personnel is intense.

Rights of the BRDN and LLCDA to Surface and Subsurface Access of Land

Treaty 10, which applies to the traditional lands of the BRDN Nation and the Project Land, recognizes the BRDN’s right to control surface access to their land. Current law reserves the right of the Province of Saskatchewan (the “Province”) to grant rights to access the subsurface of the BRDN’s land. Any subsurface rights granted by the Province would be encumbered by the BRDN who control surface access rights, which have been granted exclusively to Access pursuant to the Joint Venture Agreement and Amendments, and the Impact/Benefit Agreement and its amendment of March 17, 2008 incorporated by reference herein as Exhibits 10.14 and 10.14.1 respectively. The

BRDN are a nation of over 1,500 people whose traditional land encompasses 85,800 square miles within the area of Treaty 10 (“Treaty 10”).

The Impact Benefit Agreement and its amendment of March 17, 2008 set out the obligations and commitments of Access with regard to respecting the BRDN’s traditional way of life, culture, livelihood, and the environment and ecosystems of the BRDN’s traditional lands. Without an IBA, a subsurface rights holder would not be able to gain access to the land in order to carry out exploration, development or production activities.

The LLCDA has unextinguished Aboriginal Rights and Title to both the surface and the minerals, including all hydrocarbons within its Traditional Lands, located within an area governed by a treaty with the Canadian federal government (Treaty 8) as well as Treaty 10 territory. The Joint Venture and Impact Benefit Agreements of October 15, 2008 set out the obligations and commitments of Access with regard to respecting the La Loche traditional way of life, culture, livelihood, and the environment and ecosystems of the La Loche traditional lands. Without an IBA, a subsurface rights holder would not be able to gain access to the land in order to carry out exploration, development or production activities.

Environmental Regulations

The oil and gas industry is heavily regulated. See “Risk Factors.” This industry is also subject to regulation and intervention by governments in such matters as land tenure, royalties, taxes including income taxes, government fees, production rates, environmental protection controls, the reduction of greenhouse gas emissions, the export of crude oil, natural gas and other products, the awarding or acquisition of exploration and production, oil sands or other interests, the imposition of specific drilling obligations, control over the development and abandonment of fields and mine sites (including restrictions on production) and possibly expropriation or cancellation of contract rights.

Before proceeding with most major projects, we must obtain regulatory approvals. The regulatory approval process can involve stakeholder consultation, environmental impact assessments and public hearings, among other things. In addition, regulatory approvals may be subject to conditions including security deposit obligations and other commitments. Failure to obtain regulatory approvals, or failure to obtain them on a timely basis on satisfactory terms, could result in delays, abandonment or restructuring of projects and increased costs.

Changes in environmental regulation could have an adverse effect on us from the standpoint of product demand, product reformulation and quality, methods of production and distribution and costs, and financial results. For example, requirements for cleaner-burning fuels could cause additional costs to be incurred, which may or may not be recoverable in the marketplace. The complexity and breadth of these issues make it extremely difficult to predict their future impact on us. Management anticipates that the implementation of new and increasingly stringent environmental regulations will increase necessary capital expenditures and operating expenses from present estimates. Compliance with environmental regulation can require significant expenditures and failure to comply with environmental regulation will result in the imposition of fines and penalties, liability for clean up costs and damages and the loss of important permits.

The cost of compliance with environmental regulations for the Company is unknown, but could be significant.

Other Government Regulations

Our business is affected by numerous laws and regulations, including energy, conservation, tax and other laws and regulations relating to the energy industry. Any extraction operations will require permits or authorizations from federal, provincial or local agencies. See “Risk Factors.”

|

ITEM 1A. |

RISK FACTORS AND UNCERTAINTIES |

Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in shares of our common stock.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

As an enterprise engaged in the business of conventional and unconventional oil and gas extraction and development, the business of acquiring, developing and producing oil and gas reserves is inherently risky. This section is organized as follows:

|

|

• |

Risks related to our business; |

|

|

|

• |

Risks related to our financial condition; |

|

|

|

• |

Risks relating to our industry; and |

|

|

|

• |

Risks related to our common stock. |

|

Risks Related To Our BSPE Texas Business

A substantial or extended decline in oil and natural gas prices or demand for oil and gas products may adversely affect our business, financial condition, cash flow, liquidity or results of operations and our ability to meet our capital expenditure obligations and financial commitments and to implement our business strategy.

The price we receive for our oil and natural gas production heavily influences our revenue, profitability, access to capital, and future rate of growth. Recent extremely high prices have affected the demand for oil and gas products, and that demand has declined on a worldwide basis. If the decline in demand continues, the ability of the Company to command higher prices for its oil and gas products will be endangered. Oil and natural gas are commodities, and, therefore, their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand. Historically, the markets for oil and natural gas have been volatile. These markets will likely continue to be volatile in the future. The prices we receive for our production, and the levels of our production, and the revenue we will receive, depend on numerous factors beyond our control. These factors include the following:

|

§ |

changes in global supply and demand for oil and natural gas; |

|

|

§ |

the actions of the Organization of Petroleum Exporting Countries (“OPEC”) and other organizations and government entities; |

|

|

§ |

the price and quantity of imports of foreign oil and natural gas; |

|

|

§ |

political conditions and events worldwide, including rules concerning production and environmental protection, and political instability in countries with significant oil production such as the Congo and Venezuela, all affecting oil-producing activity; |

|

|

§ |

the level of global oil and natural gas exploration and production activity; |

|

|

§ |

the short and long term levels of global oil and natural gas inventories; |

|

|

§ |

weather conditions; |

|

|

§ |

technological advances affecting the exploitation for oil and gas, and related advances for energy consumption; and |

|

|

§ |

the price and availability of alternative fuels. |

Lower oil and natural gas prices may not only decrease our revenues on a per unit basis but may also reduce the amount of oil and natural gas that we can produce economically. A substantial or extended decline in oil or natural gas prices is likely to materially and adversely affect our future business, financial condition, results of operations, liquidity or ability to finance planned capital expenditures.

We Plan To Conduct Exploration, Exploitation and Production Operations, Which Present Additional Unique Operating Risks.

There are additional risks associated with oil and gas investment which involve production and well operations and drilling. These risks include, among others, substantial cost overruns and/or unanticipated outcomes that may result in uneconomic projects or wells. Cost overruns could materially reduce the funds available to the Company, and cost overruns are common in the oil and gas industry. Moreover, drilling expense and the risk of mechanical failure can be significantly increased in wells drilled to greater depths and where one is more likely to encounter adverse conditions such as high temperature and pressure.

We May Not Be Able To Control Operations Of The Wells We Acquire.

We may not be able to acquire the operations for properties that we invest in. As a result, we may have limited ability to exercise influence over the operations for these properties or their associated costs. Our dependence on another operator and other working interest owners for these projects and our limited ability to influence operations and associated costs could prevent the realization of our targeted returns on capital in drilling or acquisition activities. The success and timing of development and exploitation activities on properties operated by others depend upon a number of factors that will be largely outside of our control, including:

|

|

§ |

the timing and amount of capital expenditures; |

|

|

§ |

the availability of suitable drilling rigs, drilling equipment, production and transportation infrastructure and qualified operating personnel; |

|

|

§ |

the operator’s expertise and financial resources; |

|

|

§ |

approval of other participants in drilling wells; and |

|

|

§ |

selection of technology |

We May Need Additional External Capital.

We may need substantial additional capital for acquisitions or for development in order to implement any proposed capital expenditure program. We may attempt to obtain sufficient funds, including through borrowing against the reserves of the Company to further implement our business plan. However, there is no assurance that we will be able to obtain sufficient funds on terms acceptable to us or at all. If adequate additional funding is not available, we may be forced to limit our activities.

Our Reserve Estimates And Projections Are Inherently Imprecise, And Actual Production, Revenues And Expenditures May Differ Materially From Such Estimates And Projections.

There are numerous uncertainties inherent in estimating quantities of reserves and their values, including many factors beyond our control. Estimates of oil and gas reserves, by necessity, are projections based on engineering data, and there are uncertainties inherent in the interpretation of such data as well as the projection of future rates of production and the timing of development expenditures. Reserve engineering is a subjective process of estimating underground accumulations of oil and gas that are difficult to measure. The accuracy of any reserve estimate is a function of the quality of available data, engineering and geological interpretation and judgment. Estimates of economically recoverable oil and gas reserves and of future net cash flows necessarily depend upon a number of variable factors and assumptions, such as historical production from the area compared with production from other producing areas, the assumed effects of regulations by governmental agencies and assumptions concerning future oil and gas prices, future operating cost, severance and excise taxes, development costs, workover and remedial costs and the costs of plugging and abandoning wells, all of which may in fact vary considerably from actual results. For these reasons, estimates of the economically recoverable quantities of oil and gas attributable to any particular group of properties, classifications of such reserves based on risk of recovery, and estimates of the future net cash flows expected therefrom may vary substantially. Moreover, there can be no assurance that our reserves will ultimately be produced or that our proved undeveloped, probable, or possible reserves will be developed within the periods anticipated. Any significant variance in the assumptions could materially affect the estimated quantity and value of our reserves. Actual production, revenues and expenditures with respect to our reserves will likely vary from estimates, and such variances may be material.

We May Not Be Successful In Identifying Or Developing Recoverable Reserves.

Our future success depends upon our ability to acquire and develop oil and gas reserves that are economically recoverable. Our proved reserves will generally decline as reserves are depleted, except to the extent that we can replace those reserved by exploration and development activities or acquisition of properties containing proved reserves, or both. In order to increase reserves and production, we must undertake development and exploration drilling and recompletion programs or other replacement activities. Our current strategy includes increasing our reserve base through development, exploitation, exploration and acquisition. There can be no assurance that our planned development and exploration projects or acquisition activities will result in significant additional reserves or that we will have continuing success drilling productive wells at economical values in terms of their finding and development costs. Furthermore, while our revenues increase if oil and gas prices increase significantly, finding costs for additional reserves have increased during the last few years. It is possible that product prices will continue to, or recommence their plunge while the Company is in the middle of executing its plans, while costs of drilling remain high. There can be no assurance that we will replace reserves or replace our reserves economically.

Our Future Drilling Activities May Not Be Successful.

Drilling activities are subject to many risks, including the risk that no commercially productive reservoirs will be encountered. There can be no assurance that new wells drilled by us will be productive or that we will recover all or any portion of our investment. Drilling for oil and gas may involve unprofitable efforts, not only from dry wells, but from wells that are productive but do not produce sufficient net revenues to return a profit after drilling, operating and other costs. The cost of drilling, completing and operating wells is often uncertain, and the cost associated with these activities has risen significantly during the past year. Our drilling operations may be curtailed, delayed or canceled as a result of numerous factors, many of which are beyond our control, including economic conditions, mechanical problems, title problems, weather conditions, governmental requirements and shortages or delays in the delivery of equipment and services. Our future drilling activities may not be successful and, if unsuccessful, such failure may have a material adverse effect on our future results of operations and financial condition.

Our Operations Are Subject To Risks Associated With Drilling Or Producing And Transporting Oil And Gas.

Our operations are subject to hazards and risks inherent in drilling or producing and transporting oil and gas, such as fires, natural disasters, explosions, encountering formations with abnormal pressures, blowouts, cratering, pipeline ruptures and spills, any of which can result in the loss of hydrocarbons, environmental pollution, personal injury claims and other damage to our properties.

The Unavailability Or High Cost Of Drilling Rigs, Equipment, Supplies, Personnel And Oil Field Services Could Adversely Affect Our Ability To Execute Our Exploration And Exploitation Plans On A Timely Basis And Within Our Budget.

Shortages or the high cost of drilling rigs, equipment, supplies or personnel could delay or adversely affect our exploitation and exploration operations, which could have a material adverse effect on our business, financial condition or results of operations. If the unavailability or high cost of rigs, equipment, supplies or personnel were particularly severe in Texas, especially as a result of an active hurricane season, we could be materially and adversely affected because our operations and properties are concentrated in that area.

Compliance With Government Regulations May Require Significant Expenditures.

Our business is subject to federal, state and local laws and regulations relating to the exploration for, and the development, production and transportation of oil and gas, as well as safety matters. Although we will attempt to conduct due diligence concerning standard compliance issues, there is a heightened risk that our target properties are not in compliance because of lack of funding. We may be required to make significant expenditures to comply with governmental laws and regulations that may have a material adverse affect on our financial condition and results of operations. Even if the properties are in substantial compliance with all applicable laws and regulations, the requirements imposed by such laws and regulations are frequently changed and are subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Environmental Regulations And Costs Of Remediation Could Have A Material Adverse Affect On Our Operations.

Our operations are subject to complex and constantly changing environmental laws and regulations adopted by federal, state and local government authorities. The implementation of new, or the modification of existing, laws or regulations could have a material adverse affect on our operations. The discharge of oil, gas or other pollutants into the air, soil, or water may give rise to significant liabilities on our part to the government and third parties, and may require us to incur substantial costs of remediation. We will be required to consider and negotiate the responsibility of the Company for prior and ongoing environmental liabilities. We may be required to post or assume bonds or other financial guarantees with the parties from whom we purchase properties or with governments to provide financial assurance that we can meet potential remediation costs. There can be no assurance that existing environmental laws or regulations, as currently interpreted or reinterpreted in the future, or future laws or regulations will not materially adversely affect our results of operation and financial condition or that material indemnity claims will not arise against us with respect to properties acquired by us.

We Operate In A Highly Competitive Environment.

We operate in the highly competitive areas of oil and gas exploration, development, acquisition and production with other companies. In seeking to acquire desirable producing properties or new leases for future exploration, and in marketing our oil and gas production, we face intense competition from both major and independent oil and gas companies. Many of these competitors have financial and other resources substantially in excess of those available to us. Our inability to effectively compete in this environment could materially and adversely affect our financial condition and results of operations.

The Producing Life Of Company Wells Is Uncertain, And Production Will Decline.

It is not possible to predict the life and production of any well with accuracy. The actual life could differ significantly from that anticipated. Sufficient oil or natural gas may not be produced for investors to receive a profit or even to recover their initial investments. In addition, production from the Company’s oil and natural gas wells, if any, will decline over time, and current production does not necessarily indicate any consistent level of future production. A production decline may be rapid and irregular when compared to a well’s initial production.

Our Lack Of Diversification Will Increase The Risk Of An Investment In Us, As Our Financial Condition May Deteriorate If We Fail To Diversify.

The Company, through its wholly owned subsidiary, BSPE Texas LLC, currently focuses on the conventional oil and gas industry. BSPE Texax LLC currently only owns a single property. Larger companies have the ability to manage their risk by diversification. However, we lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate. The Company only has one revenue generating property. This revenue generating property historical revenue is derived from Natural Gas and Oil. Therefore, the price we receive for our oil and natural gas production heavily influences our revenue, profitability, access to capital and future rate of growth

An Increase In Royalties Payable May Make Our Operations Unprofitable.

The Cabeza Creek Field is subject to 20 percent royalties payable to private mineral/royalty owners. In addition, all oil and gas production is subject to Texas Severance Taxes. The Company intends to retain the services of NRG Assets Management, LLC - a third party Texas-registered contract operating company - to facilitate regulatory and administrative requirements for this Gas Unit for a monthly fee of US$500 per gas well, as well as the services of a consultant to act as Director of Operations of the gas wells for a monthly fee of US$8,000.

Related to the Company’s Tar Sands (Un-Conventional) Oil and Gas Assets

We Have No Operating History. Accordingly, Investors Have No Basis Upon Which To Evaluate Our Ability To Achieve Our Business Objectives.

The Company’s unconventional oil and gas projects, through its 75% owned subsidiary, Access Energy Inc., represent exploration stage projects, with no current operations. We, through Access, have only the rights and obligations set forth in the Joint Venture Agreement and its Amendments and Impact/Benefit Agreement and its Amendment with the BRDN, and the rights and obligations set forth in the Joint Venture Agreement and the Impact Benefit Agreement with La Loche Clearwater Development Authority. As an unconventional oil exploration and development company with no operating history, property interests, or related assets, it is difficult for potential investors to evaluate our business. Our proposed operations are therefore subject to all of the risks inherent in the establishment of a new business enterprise and must be considered in light of the expenses, difficulties, complications and delays frequently encountered in connection with the formation of any new business, as well as those risks that are specific to the unconventional oil industry. Investors should evaluate us in light of the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

Access’s Business Plan Is Highly Speculative And Its Success Depends, In Part, On Exploration Success.

Our business is speculative and dependent upon the implementation of our business plan and our ability to enter into agreements with third parties for the rights to exploit unconventional oil reserves on terms that will be commercially viable for us. Our business plan is focused primarily on the exploration for oil sands deposits in the Province of Saskatchewan. Exploration itself is highly speculative. We are subject to all of the risks inherent in oil sands exploration and development, including identification of commercial projects, operation and revenue uncertainties, regulatory requirements, market sizes, profitability, market demand, commodity price fluctuations and the ability to raise further capital to fund activities. There can be no assurance that we will be successful in overcoming these risks. These risks are further exacerbated by our dependence on the A10 Project and the La Loche Project as its primary assets.

Our Assets Have Limited Value By Themselves.

Through the Joint Venture Agreement and Amendments and the Impact/Benefit Agreement and its amendment, the BRDN granted Access exclusive rights to access the A10 Project’s surface to explore and develop oil and gas reserves. Neither the Joint Venture Agreement nor its Amendments nor the Impact/Benefit Agreement purport to grant any licenses, leases, permits, or agreements with other third parties, including any government entity or other First Nations’ peoples, necessary for the exploration, development, and exploitation of any such deposits. We have not obtained any such rights from other parties, some of which may not be able to be secured on acceptable terms to us if at all. Failure to obtain such rights could prevent us from executing our business plan.

Through the Joint Venture Agreement and the Impact Benefit Agreement with LLCDA, the LLCDA granted Access the exclusive right to participate in the acquisition, exploration and development of certain surface and subsurface rights in and to the La Loche Community’s Traditional Lands with respect to petroleum and mining products (“Products”). Neither the Joint Venture Agreement nor the Impact Benefit Agreement with LLCDA purport to grant any licenses, leases, permits, or agreements with other third parties, including any government entity or other First Nations’ peoples, necessary for the exploration, development, and exploitation of any such deposits. We have not obtained any such rights from other parties, some of which may not be able to be secured on acceptable terms to us if at all. Failure to obtain such rights could prevent us from executing our business plan.

We Have Not Yet Established Any Reserves On The Project Lands and There Is No Assurance That We Ever Will.

There are numerous uncertainties inherent in estimating quantities of bitumen resources, including many factors beyond our control, and no assurance can be given that the recovery of bitumen will be realized. In general, estimates of recoverable bitumen resources are based upon a number of factors and assumptions made as of the date on which the resource estimates were determined, such as geological and engineering estimates which have inherent uncertainties and the assumed effects of regulation by governmental agencies and estimates of future commodity

prices and operating costs, all of which may vary considerably from actual results. All such estimates are, to some degree, uncertain and classifications of resources are only attempts to define the degree of uncertainty involved. For these reasons, estimates of the recoverable bitumen, the classification of such resources based on risk of recovery, prepared by different engineers or by the same engineers at different times, may vary substantially. No estimates of commerciality or recoverable bitumen resources can be made at this time, if ever.

Our Business May Suffer If We Do Not Attract And Retain Talented Personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting our intended business. We presently have a small management team which we intend to expand in conjunction with our planned operations and growth. The loss of a key individual, or our inability to attract suitably qualified staff could materially adversely impact our business.

Failure to Obtain and/or Retain Obligations in Joint Venture/Impact Benefit Agreements with First Nations.

The Impact Benefit Agreement together with the Joint Venture Agreement set out the obligations and commitments of the Company with regard to respecting a First Nation’s traditional way of life, culture, livelihood and the environment and ecosystems of a First Nation’s traditional lands. Failure to fulfill the obligations and commitments pursuant to such agreements could result in the early termination of such agreements, and the Company not being able to access a First Nation’s traditional lands in order to carry out activities.

As well, failure to obtain an Impact Benefit Agreement/Joint Venture Agreement with a First Nation could preclude the Company from gaining access to the land in order to carry out exploration, development or production activities.

We May Never Obtain Subsurface Rights for the Tar Sands Projects.

In order to explore the lands of the Projects, we require the subsurface rights, or “oilsands exploratory permits” to be issued by the Province of Saskatchewan. These oilsands exploratory permits must be posted by the Province, and bid for, and run for a period of five years. Although the Province has posted the oilsands exploratory permits for some of the A10 Project area, and Access has bid on those permits, twice in August and December 2008, we have not yet been successful with our bids (nor has any other company), and may never be successful in obtaining the required permits.

It is also possible that another company could acquire the oilsands exploratory permits (the subsurface rights) for the Projects. However, if another company were to be successful in obtaining the permits, that company would be required to negotiate with Access for the right to access the ground.

It May be Difficult to Procure Necessary Equipment or Personnel To Conduct Our Programs.

The Purchase (of Access) was completed on August 3, 2007. Competition to reserve oil drilling rigs, other equipment, and qualified personnel is intense. We may need additional time and resources to contract the right people and the requisite equipment once the required oilsands exploratory permits are in hand.

We May Not Be Able To Establish Unconventional Oil Operations or Manage Our Growth Effectively, Which May Harm Our Profitability.

Our strategy envisions establishing and expanding our unconventional oil business. If we fail to effectively establish unconventional oil operations and thereafter manage our growth, our financial results could be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes, and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

|

|

• |

meet our capital needs; |

|

|

• |

expand our systems effectively or efficiently or in a timely manner; |

|

|

• |

allocate our human resources optimally; |

|

|

• |

identify and hire qualified employees or retain valued employees; or |

|

|

• |

incorporate effectively the components of any business that we may acquire in our effort to achieve growth. |

If we are unable to manage our growth, our operations and our financial results could be adversely affected by inefficiency, which could diminish our profitability.

Our Lack Of Diversification Will Increase The Risk Of an Investment In Us, As Our Financial Condition May Deteriorate If We Fail To Diversify.

Access’s business currently focuses on the unconventional oil industry with two projects in very early stages. Larger companies have the ability to manage their risk by diversification. However, we lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Relationships Upon Which We May Rely Are Subject To Change, Which May Diminish Our Ability To Conduct Our Operations.

To develop our business, it will be necessary for us to establish business relationships which may take the form of joint ventures with private parties and contractual arrangements with other unconventional oil companies, including those that supply equipment and other resources that we expect to use in our business. We may not be able to establish these relationships, or if established, we may not be able to maintain them. In addition, the dynamics of our relationships with strategic partners may require us to incur expenses or undertake activities we would not otherwise be inclined to in order to fulfill our obligations to these partners or maintain our relationships. If our strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

An Increase In Royalties Payable May Make Our Operations Unprofitable.

Any development project of our resource assets will be directly affected by the royalty regime applicable. The economic benefit of future capital expenditures for the project is, in many cases, dependent on a satisfactory royalty regime. There can be no assurance that the provincial governments will not adopt a new royalty regime that will make capital expenditures uneconomic or that the royalty regime currently in place will remain unchanged.

In addition to royalties payable to the Province, we have granted a 1.25% nonconvertible overriding royalty based on 100% production from the A10 Project’s production to Coniston pursuant to the Coniston Agreement. See “Executive Compensation—Agreements With Officers, Directors And Consultants—Paul Parisotto.” As well, the La Loche Project has provision for a 5% gross overriding royalty for Products from the La Loche Project, payable to LLCDA.

Access May Sell Interests in the Projects.

In the future, Access may sell, lease, farmout, or otherwise transfer a portion of its working interest or carried interest in a given Project. It may also transfer a portion of its rights under the relevant Joint Venture Agreement and any Amendments. Any reduction of Access’ interests will result in lower revenues once a Project enters production. In addition, there can be no assurance that any or all of these transfers will be on economically beneficial terms.

Our Management Team Does Not Have Extensive Experience In U.S. Public Company Matters, Which Could Impair Our Ability To Comply With Legal And Regulatory Requirements.

Our management team has had limited U.S. public company management experience or responsibilities, which could impair our ability to comply with legal and regulatory requirements such as the Sarbanes-Oxley Act of 2002 and applicable U.S. federal securities laws, including filing required reports and other information required on a timely basis. There can be no assurance that our management will be able to implement and affect programs and policies in

an effective and timely manner that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and result in the deterioration of our business.

Because Management Has Other Business Interests, He May Not Be Able To Devote A Sufficient Amount Of Time To Our Business Operation, Causing Our Business To Fail.

Mr. Holcombe is involved with other mineral and petroleum exploration companies and other business interests and unable to devote all of his business time and effort to us. He presently possesses adequate time to attend to our interests. In the future, our management will use their best efforts to devote sufficient time to the management of our business and affairs and, provided additional staff may be retained on acceptable terms, our management will engage additional officers and other staff should additional personnel be required. However, it is possible that our demands on management’s time could increase to such an extent that they come to exceed their available time, or that additional qualified personnel cannot be located and retained on commercially reasonable terms. This could negatively impact our business development.

Because Our Officers And Directors Are Involved Or Affiliated With Other Oil and Gas Exploration Companies, They May Have Conflicts Of Interest With Us.

Mr. Holcombe and Mr. Wilson are involved or affiliated with one or more other oil and gas resource exploration companies. As a result of this relationship, they may have or may develop a conflict of interest with us.

Competition In Obtaining Rights To Acquire and Develop Conventional and Unconventional Oil and Gas Reserves and To Market Our Production May Impair Our Business.