Attached files

| file | filename |

|---|---|

| 8-K - COPANO ENERGY, L.L.C. FORM 8-K - Copano Energy, L.L.C. | form8-k.htm |

Copano

Energy

January

Investor Presentation

NASDAQ: CPNO

NASDAQ: CPNO

January

26, 2010

Copano

Energy

2

Disclaimer

Statements made by

representatives of Copano Energy, L.L.C. (“Copano”) during this

presentation will include “forward-looking statements,” as defined in the federal securities laws.

All statements that address activities, events or developments that Copano expects, believes or

anticipates will or may occur in the future are forward-looking statements. Underlying these

forward-looking statements are certain assumptions made by Copano’s management based on

their experience and perception of historical trends, current conditions, expected future

developments and other factors management believes are appropriate under the circumstances.

presentation will include “forward-looking statements,” as defined in the federal securities laws.

All statements that address activities, events or developments that Copano expects, believes or

anticipates will or may occur in the future are forward-looking statements. Underlying these

forward-looking statements are certain assumptions made by Copano’s management based on

their experience and perception of historical trends, current conditions, expected future

developments and other factors management believes are appropriate under the circumstances.

Whether

actual results and developments in the future will conform to Copano’s

expectations is

subject to a number of risks and uncertainties, many of which are beyond Copano’s control. If

one or more of these risks or uncertainties materializes, or if underlying assumptions prove

incorrect, then Copano’s actual results may differ materially from those implied or expressed by

forward-looking statements made during this presentation. These risks and uncertainties include

the volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability

to complete any pending acquisitions and integrate any acquired assets or operations; Copano’s

ability to continue to obtain new sources of natural gas supply; the ability of key producers to

continue to drill and successfully complete and attach new natural gas supplies; Copano’s ability

to retain key customers; the availability of local, intrastate and interstate transportation systems

and other facilities to transport natural gas and natural gas liquids; Copano’s ability to access

sources of liquidity when needed and to obtain additional financing, if necessary, on acceptable

terms; the effectiveness of Copano’s hedging program; unanticipated environmental or other

liability; general economic conditions; the effects of government regulations and policies; and

other financial, operational and legal risks and uncertainties detailed from time to time in the Risk

Factors sections of Copano’s annual and quarterly reports filed with the Securities and Exchange

Commission.

subject to a number of risks and uncertainties, many of which are beyond Copano’s control. If

one or more of these risks or uncertainties materializes, or if underlying assumptions prove

incorrect, then Copano’s actual results may differ materially from those implied or expressed by

forward-looking statements made during this presentation. These risks and uncertainties include

the volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability

to complete any pending acquisitions and integrate any acquired assets or operations; Copano’s

ability to continue to obtain new sources of natural gas supply; the ability of key producers to

continue to drill and successfully complete and attach new natural gas supplies; Copano’s ability

to retain key customers; the availability of local, intrastate and interstate transportation systems

and other facilities to transport natural gas and natural gas liquids; Copano’s ability to access

sources of liquidity when needed and to obtain additional financing, if necessary, on acceptable

terms; the effectiveness of Copano’s hedging program; unanticipated environmental or other

liability; general economic conditions; the effects of government regulations and policies; and

other financial, operational and legal risks and uncertainties detailed from time to time in the Risk

Factors sections of Copano’s annual and quarterly reports filed with the Securities and Exchange

Commission.

Copano

undertakes no obligation to update any forward-looking statements, whether as a

result

of new information or future events.

of new information or future events.

Copano

Energy

3

Introduction to

Copano

• Founded in 1992 as

an independent midstream company

• Serves natural gas

producers in three producing areas

Texas

South

Texas and

North

Texas

Oklahoma

Central

and Eastern Oklahoma

Rocky

Mountains

Wyoming’s Powder

River Basin

Copano

Energy

4

Key

Metrics

• Service throughput

volumes

approximate 2 Bcf

per day of natural

gas(1)

gas(1)

• Approximately 6,700

miles of active pipelines

• 7 natural gas

processing plants with over 1 Bcf/d of combined

processing capacity

processing capacity

• Equity market cap:

$1.5 billion(2)

• Enterprise value:

$2.3 billion(2)

(1) Based

on 3Q09 results. Includes

unconsolidated affiliates.

(2) As

of January 21, 2010.

Copano

Energy

5

Copano’s LLC

Structure

|

Characteristic

|

Typical

MLP

|

Copano

Energy

|

Typical

Corporation |

|

Non-Taxable

Entity |

|

|

|

|

Tax Shield

on

Distributions |

|

|

|

|

Tax

Reporting

|

|

|

|

|

General

Partner

|

|

|

|

|

Incentive

Distribution Rights |

|

|

|

|

Voting

Rights

|

|

|

|

Schedule

K-1

Schedule

K-1

Form

1099

Copano

Energy

6

Agenda

Throughput

Volume Outlook

Volume Outlook

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Capital

and

Liquidity

Liquidity

Distribution

Policy

and Outlook

and Outlook

Copano

Energy

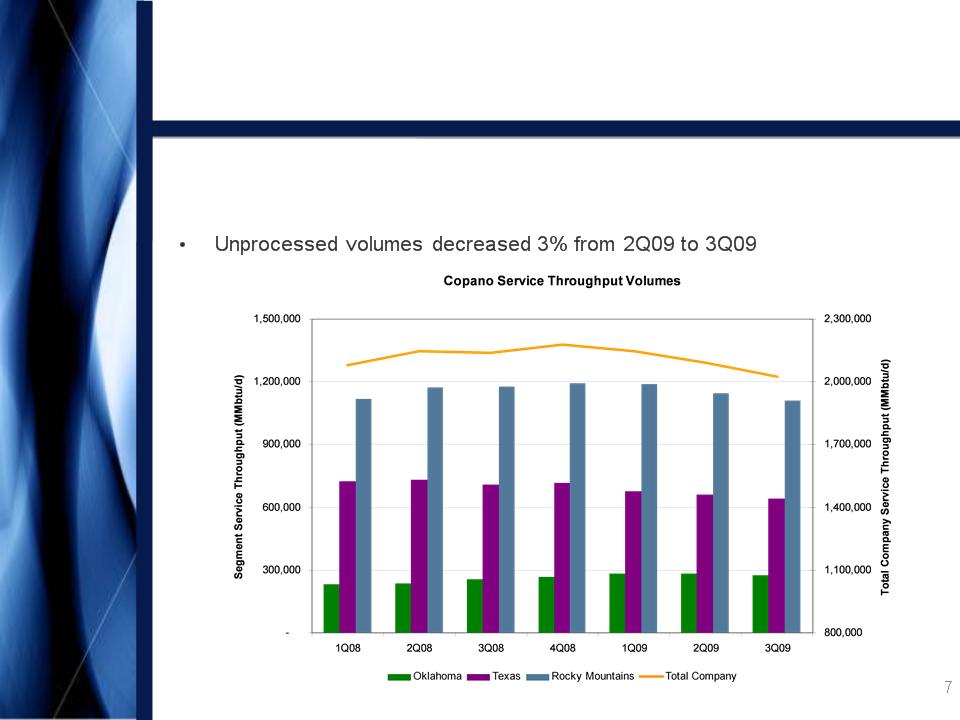

• Total service

throughput volumes decreased 3% from 2Q09 to 3Q09

• Processed volumes

decreased 2% from 2Q09 to 3Q09

Total

Volume Trends

Note:

Includes affiliates, net of intercompany volumes.

Copano

Energy

8

• Rich gas (primarily

Hunton de-watering play)

– Drilling activity

remains steady with current commodity prices

and long-term price outlook

and long-term price outlook

– 2 rigs currently

running in the Hunton and 8 rigs in other rich

gas areas

gas areas

– High BTU gas,

processing upgrade and low geologic risk

enhance drilling economics, but activity remains subject to

market conditions

enhance drilling economics, but activity remains subject to

market conditions

– 4Q09 volumes are

expected to be down vs. 3Q09 due to

delayed down-hole repair schedules, shut-in volumes and

weather related issues

delayed down-hole repair schedules, shut-in volumes and

weather related issues

• Lean gas (primarily

Woodford Shale and Coalbed methane)

– Drilling activity

slightly increasing with current commodity

prices and long-term price outlook

prices and long-term price outlook

– 8 rigs currently

running

– 4Q09 volumes are

expected to be slightly down from 3Q09

due to normal declines and lag between drilling and production

due to normal declines and lag between drilling and production

Oklahoma Volume

Outlook

Copano

Energy

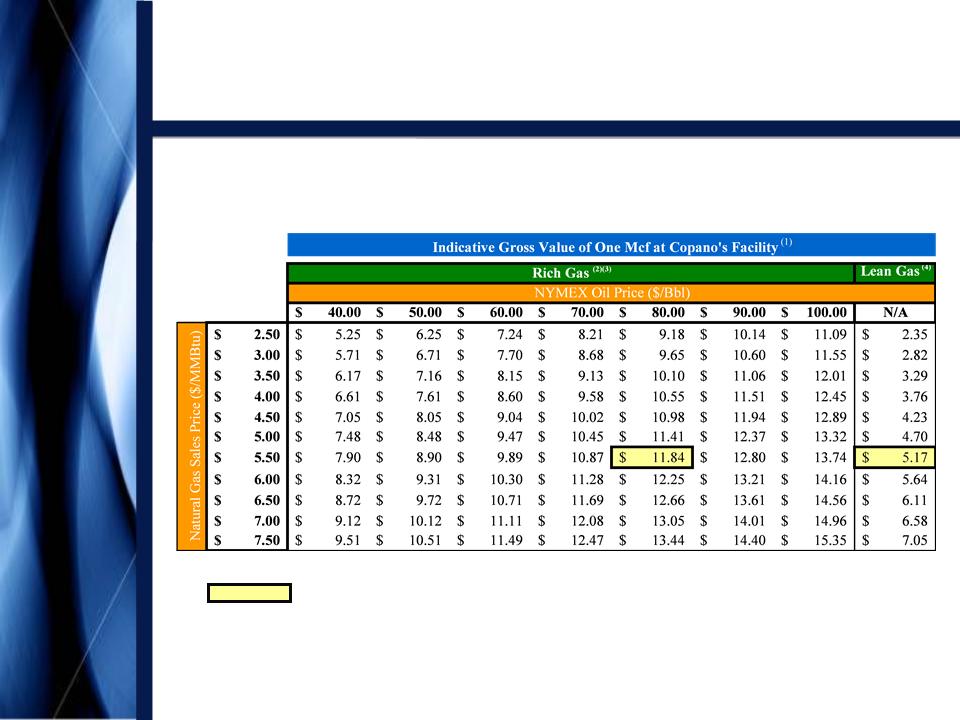

Oklahoma Rich Gas

vs. Lean Gas

(1) Full

value prior to deduction of Copano’s margin. Excludes

value of condensate and crude oil recovered by the

producer at the wellhead.

producer at the wellhead.

(2) Implied

NGL prices are based on a six-year historical regression analysis.

(3) Assumes

9 GPM gas with a Btu factor of 1.375 processed at Copano’s cryogenic plant, and

field fuel of 6.25%.

(4) Assumes

unprocessed gas with a Btu factor of 1.0 and field fuel of 6%.

9

Prices

as of 1/21/10

Copano

Energy

10

South

Texas Volume Outlook

• Recently connected a

third Eagle Ford Shale well, which IP’d at

17 MMcf/d

17 MMcf/d

• In 4Q09, announced

plans for a joint venture with Kinder Morgan

to provide gathering, transportation and processing services to

gas producers in the Eagle Ford Shale

to provide gathering, transportation and processing services to

gas producers in the Eagle Ford Shale

• 4Q09 volumes are

expected to be slightly down from 3Q09

• In December 2009,

FERC issued an order denying Transco

authority to abandon its McMullen Lateral pipeline in South Texas

by sale to Copano. Copano and Transco will not file for rehearing

authority to abandon its McMullen Lateral pipeline in South Texas

by sale to Copano. Copano and Transco will not file for rehearing

Copano

Energy

11

Texas

Fractionation Strategy

• Capacity at NGL

fractionation facilities along the Texas Gulf Coast

remains constrained

remains constrained

• Utilizing Houston

Central’s fractionation unit and extensive tailgate

NGL pipelines, Copano plans to produce purity products by 2Q10

NGL pipelines, Copano plans to produce purity products by 2Q10

– Copano is expanding

its de-ethanization capacity in order to produce

purity ethane and propane

purity ethane and propane

– Iso-butane and

normal butane will be sold as purity products by tank

truck

Copano

Energy

12

North

Texas Volume Outlook

• 9 rigs running in

the area with

an additional 2-4 rigs

anticipated in 1Q10

an additional 2-4 rigs

anticipated in 1Q10

• Drilling economics

are driven

by associated crude oil

production

by associated crude oil

production

• Production from this

area

requires a full slate of

midstream services

requires a full slate of

midstream services

• Based on producer

drilling

schedule, plant inlet volumes

are expected to steadily

increase in 2010

schedule, plant inlet volumes

are expected to steadily

increase in 2010

Copano

Energy

13

Rocky

Mountains Volume Outlook

• Drilling and

dewatering will be driven by producer economics and

commodity prices

commodity prices

• 4Q09 volumes are

expected to be flat vs. 3Q09 due to previously

drilled wells

drilled wells

• For Bighorn, 130

previously drilled wells can be connected with

minimal capital expenditures

minimal capital expenditures

– An additional 70

drilled wells can be connected with moderate capital

expenditures

expenditures

• On Fort Union,

during the third and fourth quarters, roughly 150

MMcf/d was temporarily shut in by producers due to commodity prices;

by mid-October, volumes were back to near pre-shut-in levels

MMcf/d was temporarily shut in by producers due to commodity prices;

by mid-October, volumes were back to near pre-shut-in levels

Copano

Energy

14

Commodity Prices and

Margin

Sensitivities

Sensitivities

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Distribution

Policy

and Outlook

and Outlook

Capital

and

Liquidity

Liquidity

Throughput

Volume Outlook

Volume Outlook

Copano

Energy

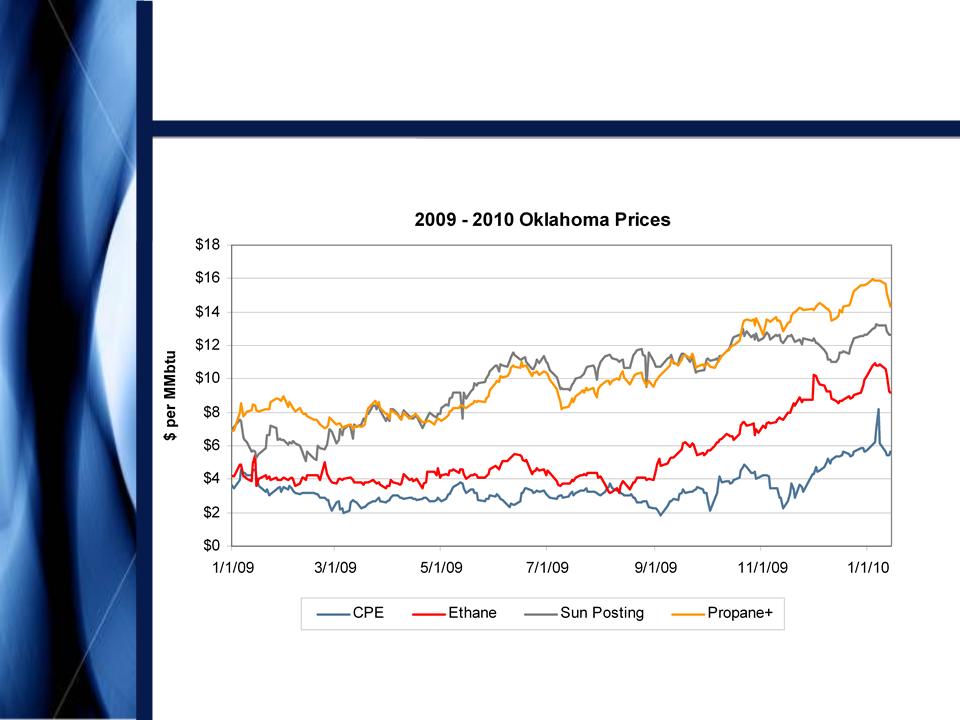

Oklahoma Commodity

Prices

15

Copano

Energy

16

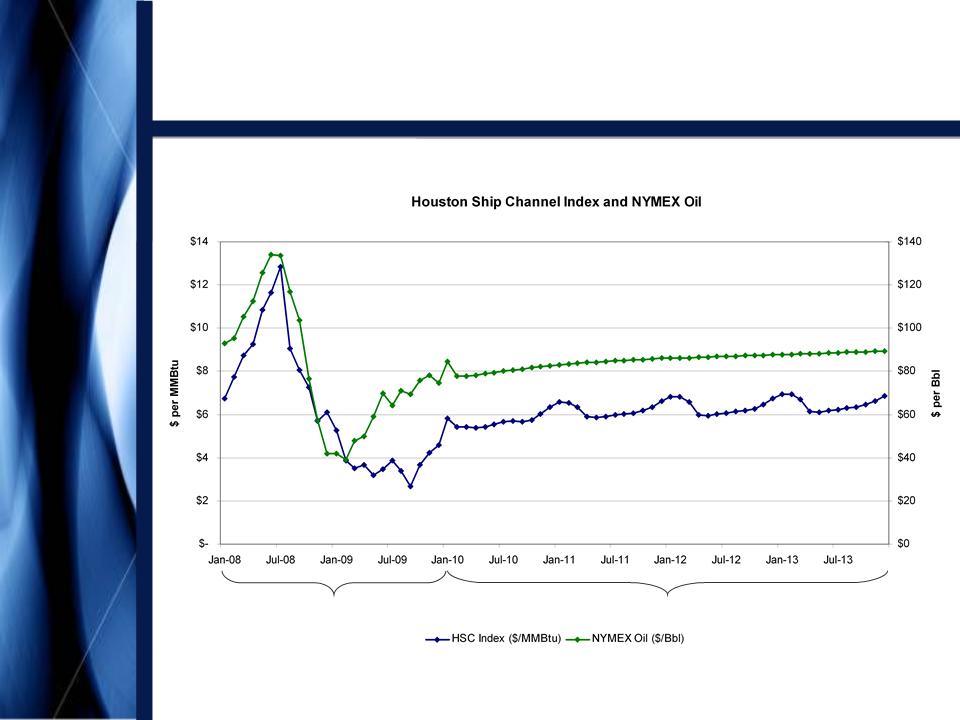

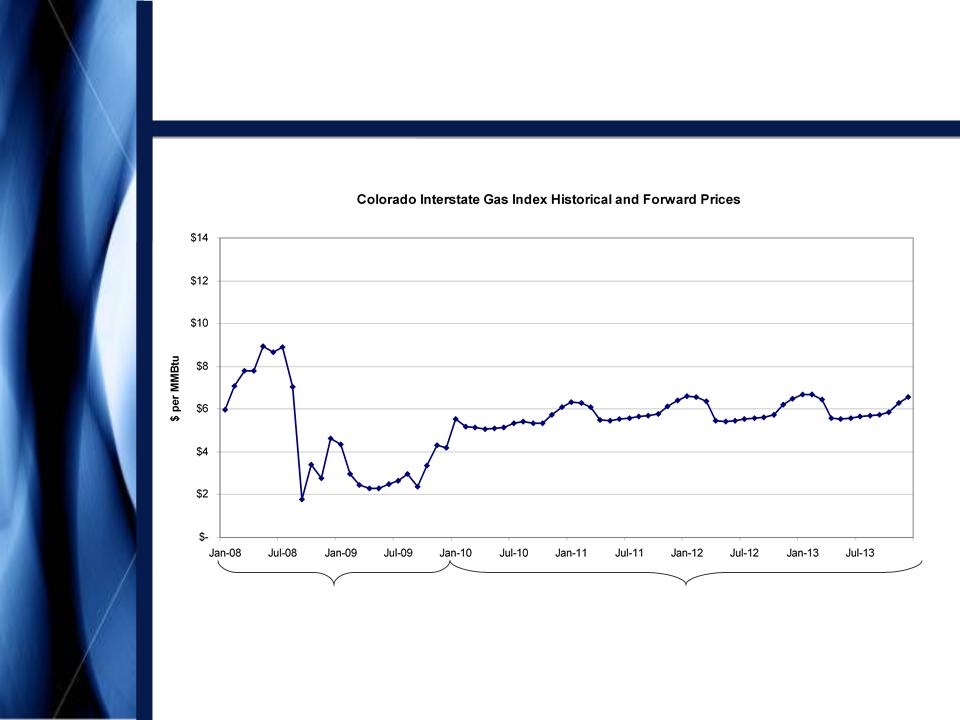

Actual

Prices: 1/08 - 1/10

Forward

Prices as of 1/21/10: 2/10 - 12/13

Oklahoma Natural Gas

Price

Outlook

Outlook

Copano

Energy

17

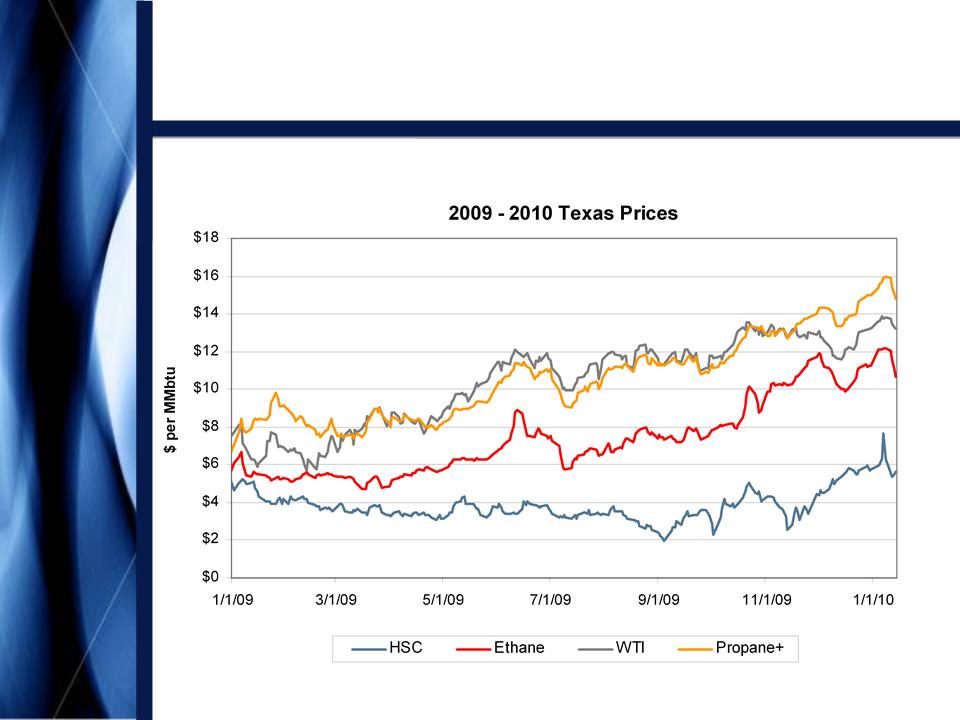

Texas

Commodity Prices

Copano

Energy

18

Actual

Prices: 1/08 - 1/10

Forward

Prices as of 1/21/10: 2/10 - 12/13

South

Texas Natural Gas Price

Outlook

Outlook

Copano

Energy

19

Actual

Prices: 1/08 - 1/10

Forward

Prices as of 1/21/10: 2/10 - 12/13

Rocky

Mountains Natural Gas Price

Outlook

Outlook

Copano

Energy

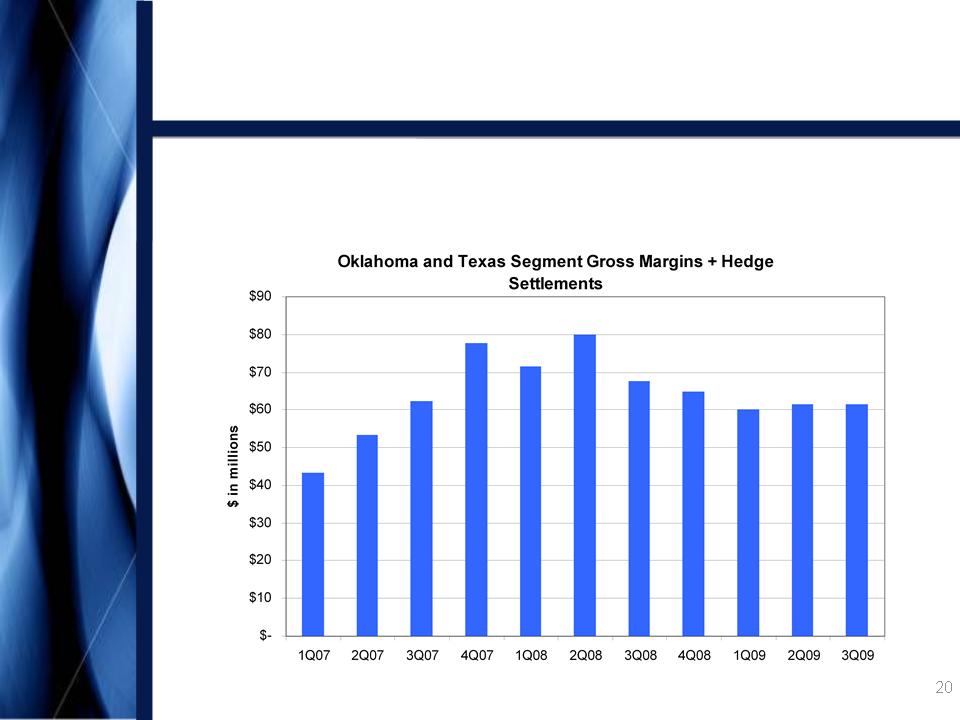

Combined

Commodity-Sensitive Segment Margins

and Hedging Settlements

and Hedging Settlements

• Copano’s hedge

portfolio supports cash flow stability based on

combined segment gross margins and cash hedging settlements

combined segment gross margins and cash hedging settlements

Copano

Energy

21

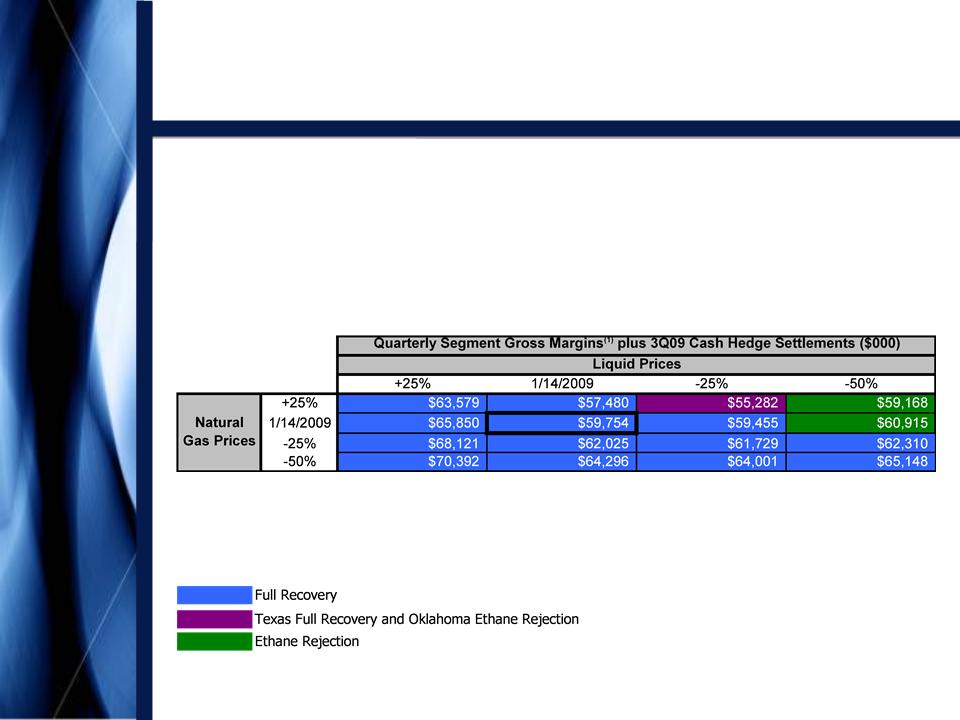

Commodity-Related

Margin

Sensitivities

Sensitivities

Note: Please

see Appendix for definitions of processing modes and additional

details.

• Matrix reflects 3Q09

wellhead and plant inlet volumes,

adjusted using Copano’s 2009 planning model

adjusted using Copano’s 2009 planning model

(1) Consists

of Texas and Oklahoma Segment gross margins.

Copano

Energy

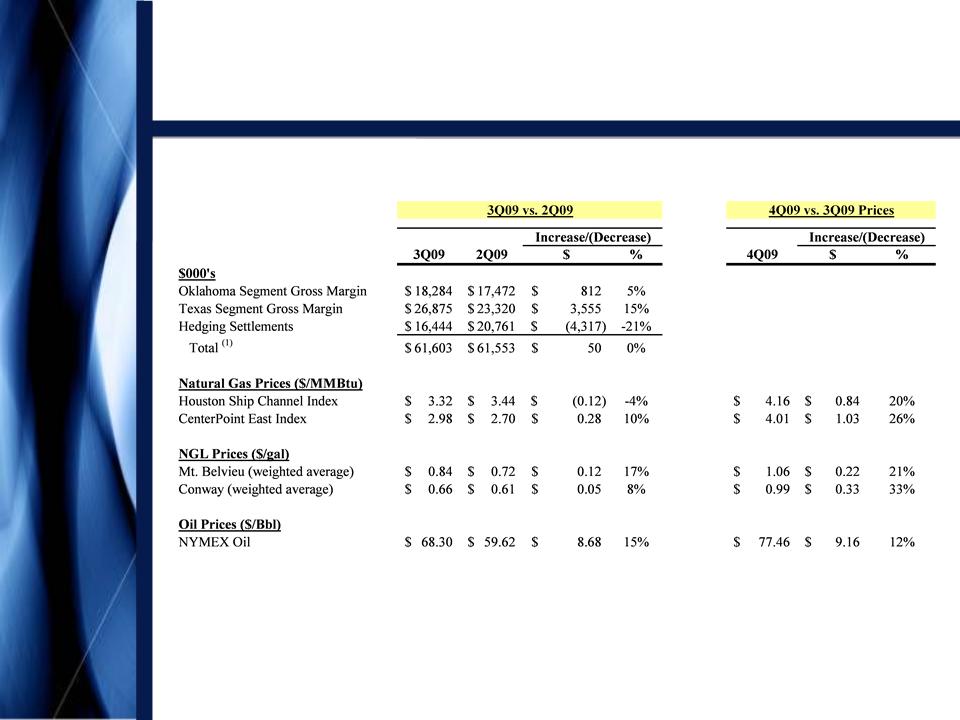

22

Combined

Commodity-Sensitive Segment Margins

and Hedging Settlements

and Hedging Settlements

(1) Does

not include non-cash expenses included in Corporate and Other for purposes of

calculating Total Segment

Gross Margin. See Appendix for reconciliation of Total Segment Gross Margin.

Gross Margin. See Appendix for reconciliation of Total Segment Gross Margin.

Copano

Energy

23

Capital

and Liquidity

Capital

and

Liquidity

Liquidity

Distribution

Policy

and Outlook

and Outlook

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Throughput

Volume Outlook

Volume Outlook

Copano

Energy

24

2010

Expansion Capital

• Copano has

approximately $105 million(1) in approved

expansion capital projects for 2010. Major areas of focus

include:

expansion capital projects for 2010. Major areas of focus

include:

– Eagle Ford Shale and

Houston Central processing plant in

south Texas

south Texas

– Saint Jo processing

plant and pipelines in north Texas

– Additional pipeline

and processing capacity in Oklahoma

• Financing to be

consistent with Copano’s historical policy -

balance of debt and equity

balance of debt and equity

(1) Includes

Copano’s net share for unconsolidated affiliates. Does not

include future potential acquisitions.

Copano

Energy

25

Liquidity and Debt

Facilities

• At September 30,

2009:

– Cash: $35

million

– $550 million

revolving credit facility

• Approximately $290

million available

• Remaining term:

approximately 3.1 years

• LIBOR + 175

bps

– $582 million senior

notes

• $332,665,000 8 ⅛%

due 2016

• $249,525,000 7 ¾%

due 2018

• Weighted average

rate: 7.96%

• Weighted average

maturity: 7.4 years

Copano

Energy

• Senior Secured

Revolving Credit Facility

– $550 million

facility with $100 million accordion

– Maintenance

tests:

• 5x total debt to

defined EBITDA(1)

limitation

§ 3.99x at September

30, 2009

• Minimum required

interest coverage 2.5x defined EBITDA

§ 3.41x at September

30, 2009

• Defined EBITDA adds

back hedge amortization and other non-cash

expenses

expenses

– Following an

acquisition, Copano may increase total debt to defined

EBITDA limitation to 5.5x for three quarters

EBITDA limitation to 5.5x for three quarters

• Senior

Notes

– Incurrence

tests:

• Minimum defined

EBITDA to interest test of 2.00x for debt incurrence

• Minimum defined

EBITDA to interest test of 1.75x for restricted payments

• Defined EBITDA is

similar to that for credit facility

26

Key

Debt Terms and Covenants

(1) See

Appendix for reconciliation of defined EBITDA, which is referred to in our

credit facility as “Consolidated

EBITDA.”

EBITDA.”

Copano

Energy

27

Distribution Policy

and Outlook

Distribution

Policy

and Outlook

and Outlook

Capital

and

Liquidity

Liquidity

Commodity

Prices and

Margin

Sensitivities

Prices and

Margin

Sensitivities

Throughput

Volume Outlook

Volume Outlook

Copano

Energy

28

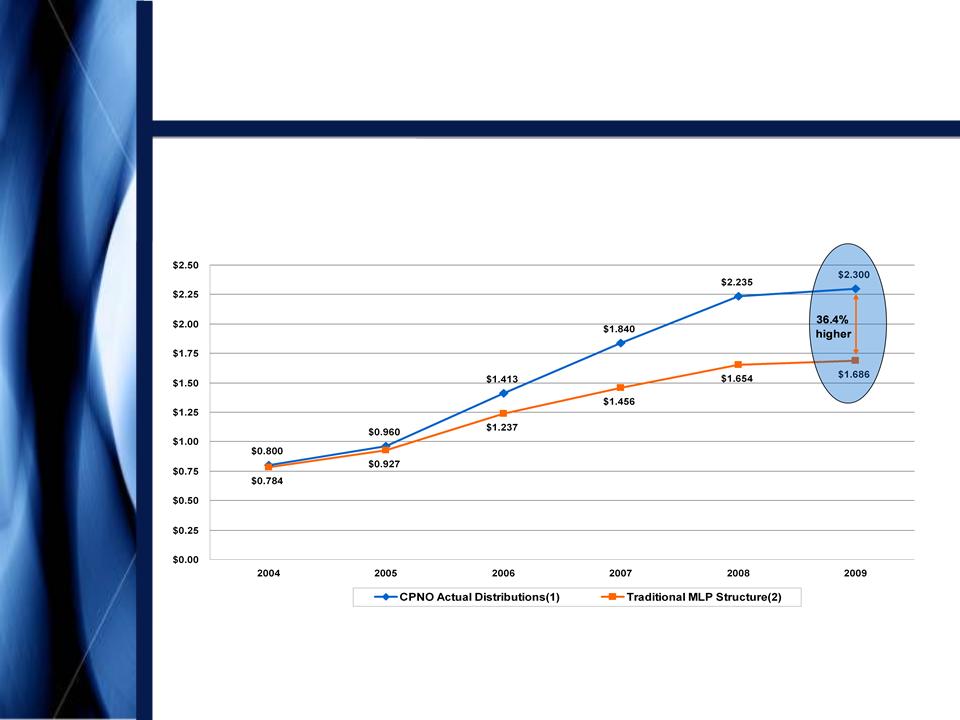

Distribution Track

Record

• On January 13, 2010,

Copano announced a cash distribution for

the fourth quarter of 2009 of $0.575 per common unit

the fourth quarter of 2009 of $0.575 per common unit

(3)(4)

(1) All

pre-1Q 2007 distributions are adjusted to reflect Copano’s 3/30/07 two-for-one

unit split.

(2) Assumes

generic MLP splits with 10%, 25% & 50% increases in distributable cash flow

to LP units resulting in

incremental 13%, 23% and 48% increases in the percentage of total distributable cash flow applicable to the GP.

incremental 13%, 23% and 48% increases in the percentage of total distributable cash flow applicable to the GP.

(3) Actual

$0.10 distribution per unit was for the period from November 15, 2004 through

December 31, 2004.

(4) 4Q

2004 annualized.

Copano

Energy

29

Distribution

Outlook

|

Driver

|

Potential

2011 - 2012

Annual Incremental Total DCF Impact(1) ($

in millions)

|

Comments

and Risk

Factors |

|

Forward

Commodity Prices

(3Q09 vs. 2012 forward curve(2) and without hedges) |

$60

|

• Reflects

January 2010

forward curve(2) • Future market

conditions

|

|

North

Texas

|

$35 -

$45

|

• Resource

play

• Drilling

activity

• Product

prices

|

|

South Texas

Fractionation

Expansion and Development Projects (2) |

$25 -

$30

|

• Eagle Ford

Shale

development • Drilling

activity

• Product

prices

• New

attachments

|

(1) Compared

to 3Q09 annualized levels. See

Appendix for an explanation of how we calculate total distributable

cash flow.

cash flow.

(2) Reflects

January 2010 forward price curves with regression-based NGL

prices.

Copano

Energy

30

Distribution

Outlook

|

Driver

|

Potential

2011 - 2012

Annual Incremental Total DCF Impact(1) ($

in millions)

|

Comments

and Risk

Factors |

|

Oklahoma

Volumes(2)

|

$15 -

$20

|

• Resource

play

• Drilling

activity

• Product

prices

|

|

Rocky

Mountains

|

$10 -

$20

|

• Resource

play

• Drilling

activity

• Dewatering

rates

• New

projects

|

|

Future

Acquisitions and Major

Projects |

TBD

|

• Build-out of

Corporate

Development team • Opportunities

• Execution

|

(1) Compared

to 3Q09 annualized levels. See

Appendix for an explanation of how we calculate total distributable

cash flow.

cash flow.

(2) Reflects

January 2010 forward price curves with regression-based NGL

prices.

Copano

Energy

• On October 14, 2009,

EnergyPoint Research, Inc. announced

results of its Natural Gas Midstream Services Survey

results of its Natural Gas Midstream Services Survey

• Copano placed first

overall among 16 midstream energy

companies. Copano also rated first in many categories for

gathering and processing/treating

companies. Copano also rated first in many categories for

gathering and processing/treating

31

#1 in

Customer Satisfaction

Copano

Energy

• Current cash flow

trends remain solid

• Forward market

prices should support continued drilling activity in

our cost-competitive operating regions

our cost-competitive operating regions

• Copano’s liquidity

and access to capital remain strong

• Copano continues to

enjoy an abundant opportunity environment

32

Conclusions

Copano

Energy

33

Appendix

Copano

Energy

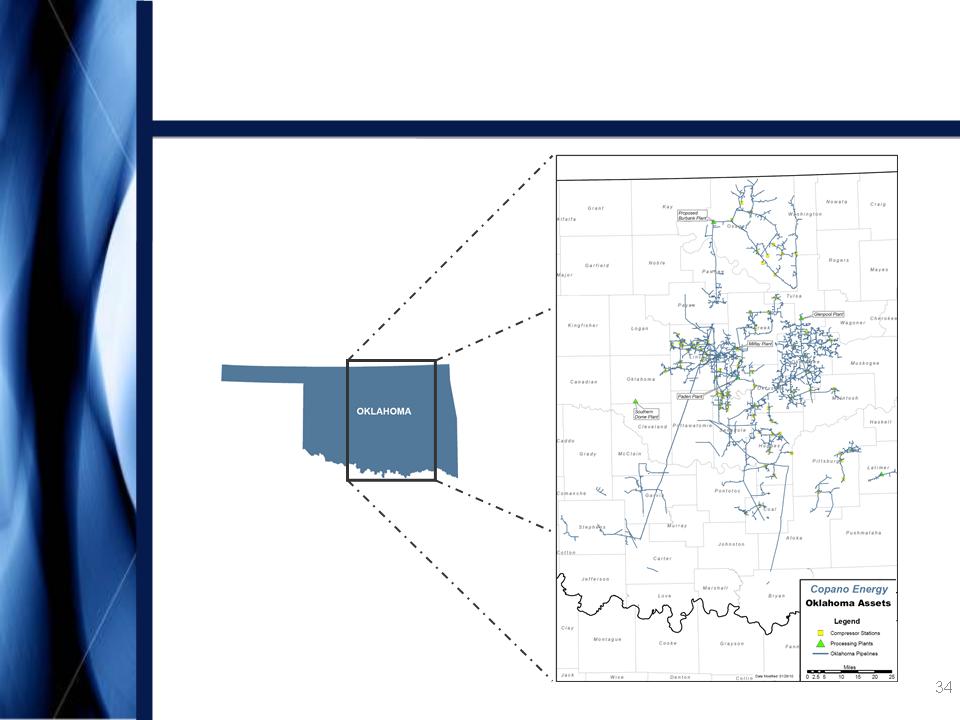

Oklahoma

Assets

Appendix

Copano

Energy

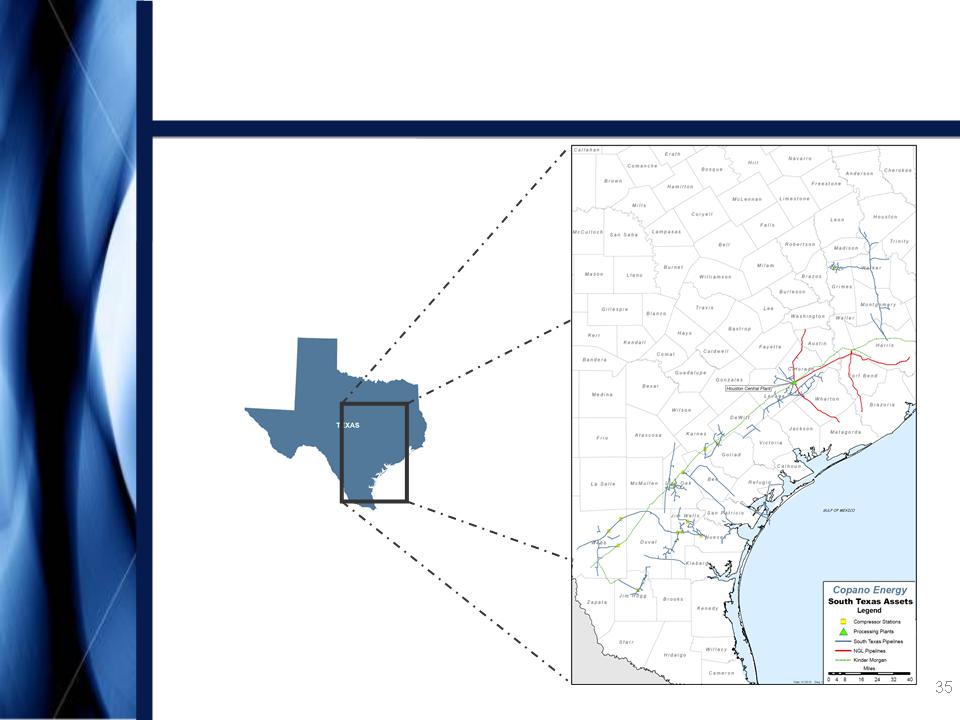

South

Texas Assets

Appendix

Copano

Energy

36

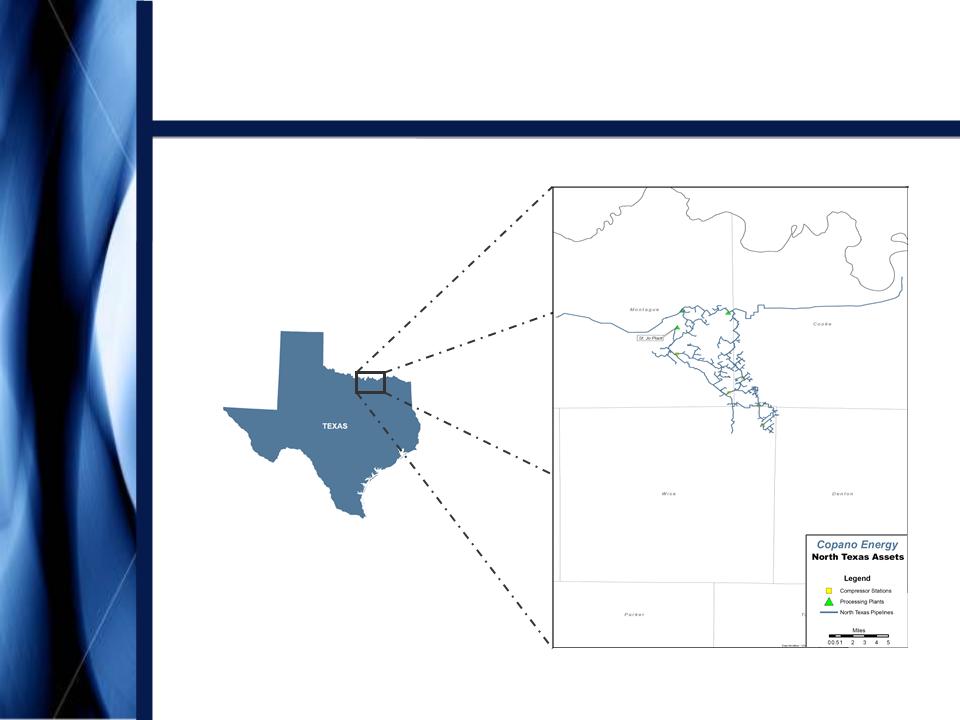

North

Texas Assets

Appendix

Copano

Energy

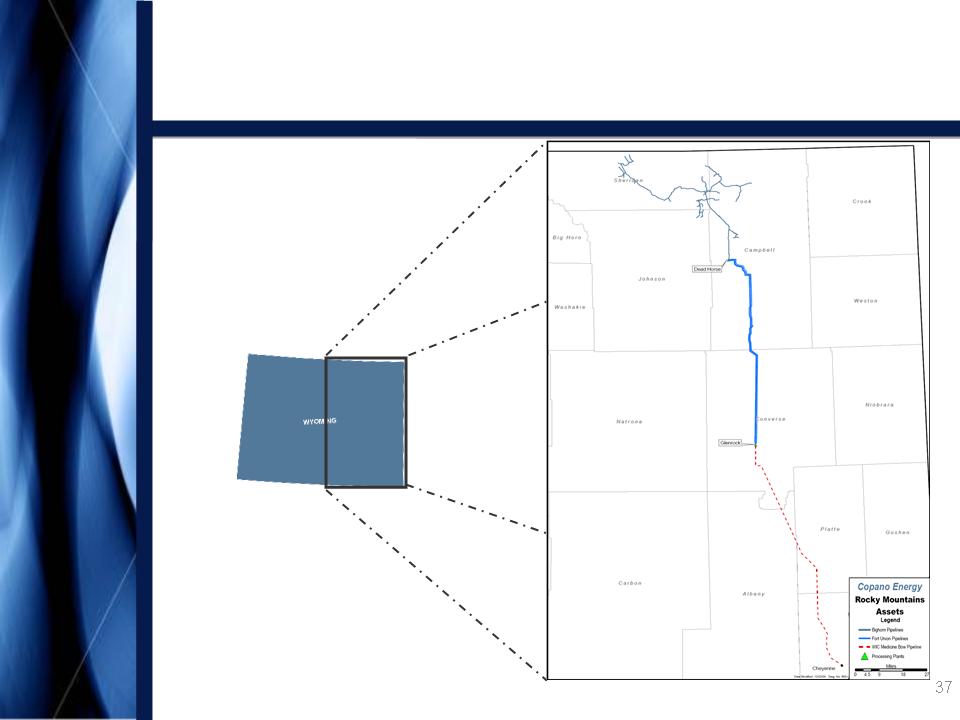

Rocky

Mountains Assets

Appendix

Copano

Energy

38

Processing

Modes

• Full

Recovery

• Ethane

Rejection

• Conditioning

Mode

→ Texas and Oklahoma -

If the value of

recovered NGLs exceeds the fuel and gas

shrinkage costs of recovering NGLs

recovered NGLs exceeds the fuel and gas

shrinkage costs of recovering NGLs

→ Texas - If the value

of recovered NGLs is less

than the fuel and gas shrinkage cost of

recovering NGLs (available at Houston

Central plant and at Saint Jo plant in North

Texas)

than the fuel and gas shrinkage cost of

recovering NGLs (available at Houston

Central plant and at Saint Jo plant in North

Texas)

→ Texas and Oklahoma -

If the value of ethane

is less than the fuel and shrinkage costs to

recover ethane (in Oklahoma, ethane

rejection at Paden plant is limited by nitrogen

rejection facilities)

is less than the fuel and shrinkage costs to

recover ethane (in Oklahoma, ethane

rejection at Paden plant is limited by nitrogen

rejection facilities)

Appendix

Copano

Energy

39

Oklahoma Commercial

Update

• Third Quarter

2009

– Total service

throughput volumes: 260,000 MMBtu/d(1)

– Unit margin:

$0.76/MMBtu(2)

– Margins from

approximately 75% of contract volumes are directly

correlated with NGL prices

correlated with NGL prices

– Significant

percentage of contract volumes (51%) contain fee-based

components, including volumes subject to minimum margin provisions

components, including volumes subject to minimum margin provisions

• Operated in full

processing mode for third and fourth quarter 2009

(1) Excludes

13,857

MMBtu/d service throughput for Southern Dome, a majority-owned

affiliate.

(2) Refers

to Oklahoma segment gross margin ($18.3

million) divided by Oklahoma service throughput volumes

(268,000 MMBtu/d) for the period. See this Appendix for reconciliation of Oklahoma segment gross margin.

(268,000 MMBtu/d) for the period. See this Appendix for reconciliation of Oklahoma segment gross margin.

Appendix

Copano

Energy

40

Oklahoma Contract

Mix

• Third quarter 2009

contract mix(1)

(1) Source:

Copano Energy internal financial planning models for consolidated

subsidiaries.

(2) Excludes

13,857 MMBtu/d service throughput for Southern Dome, a majority-owned

affiliate.

Appendix

Copano

Energy

41

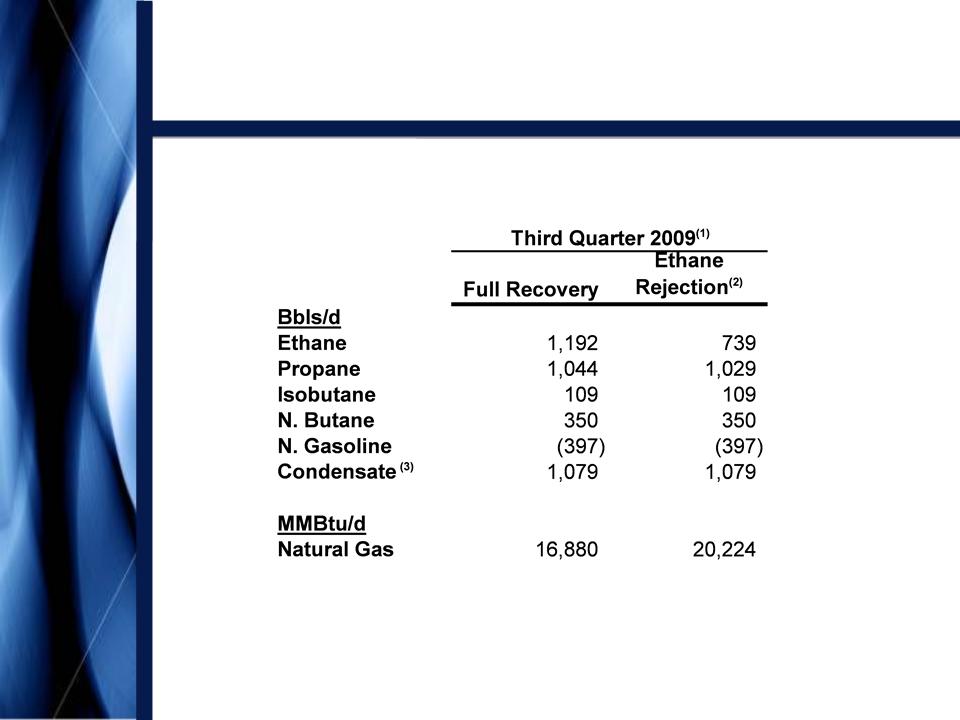

Oklahoma Net

Commodity

Exposure

Exposure

Note: See

explanation of processing modes in this Appendix. Values

reflect rounding.

(1) Source: Copano

Energy internal financial planning models for consolidated

subsidiaries.

(2) Ethane

rejection at Paden plant is limited by nitrogen rejection

facilities.

(3) Reflects

impact of producer delivery point allocations, offset by field condensate

collection and stabilization.

Appendix

Copano

Energy

42

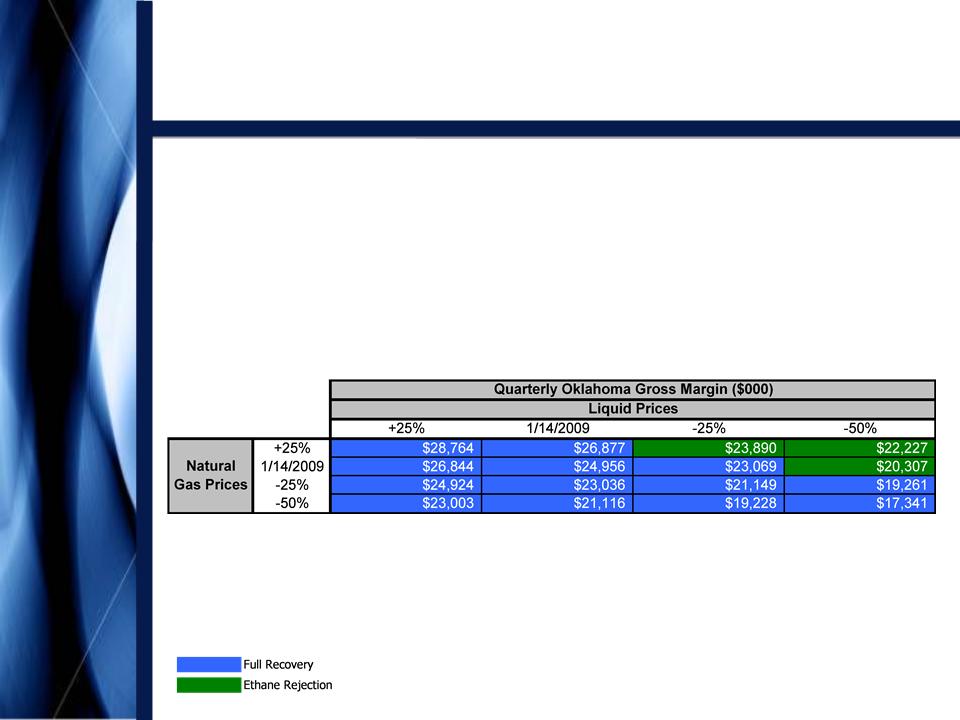

Oklahoma Commodity

Price

Sensitivities

Sensitivities

• Oklahoma segment

gross margins excluding hedge

settlements

settlements

– Matrix reflects 3Q09

volumes, adjusted using Copano’s 2009

planning model

planning model

Appendix

Copano

Energy

43

Texas

Commercial Update

• Third Quarter

2009

– Total service

throughput volumes:

613,000 MMBtu/d(1)

– Unit margin:

$0.48/MMBtu(2)

– Margins from

approximately 85% of contract volumes are directly

correlated with NGL prices

correlated with NGL prices

– Approximately 91% of

contract volumes have fee-based components,

including volumes subject to minimum margin provisions

including volumes subject to minimum margin provisions

• Operated in full

processing mode for third and fourth quarter 2009

(1) Excludes

72,985

MMBtu/d service throughput for Webb Duval, a majority-owned

affiliate.

(2) Refers

to Texas segment gross margin ($26.9 million) divided by Texas service

throughput volumes (613,000

MMBtu/d) for the period. See this Appendix for reconciliation of Texas segment gross margin.

MMBtu/d) for the period. See this Appendix for reconciliation of Texas segment gross margin.

Appendix

Copano

Energy

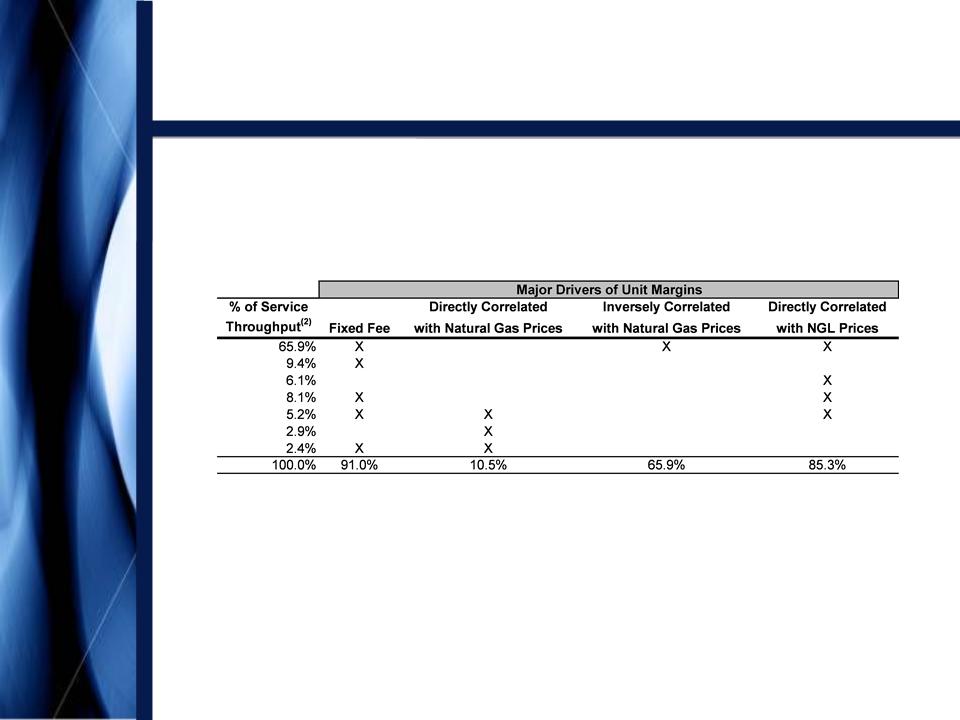

44

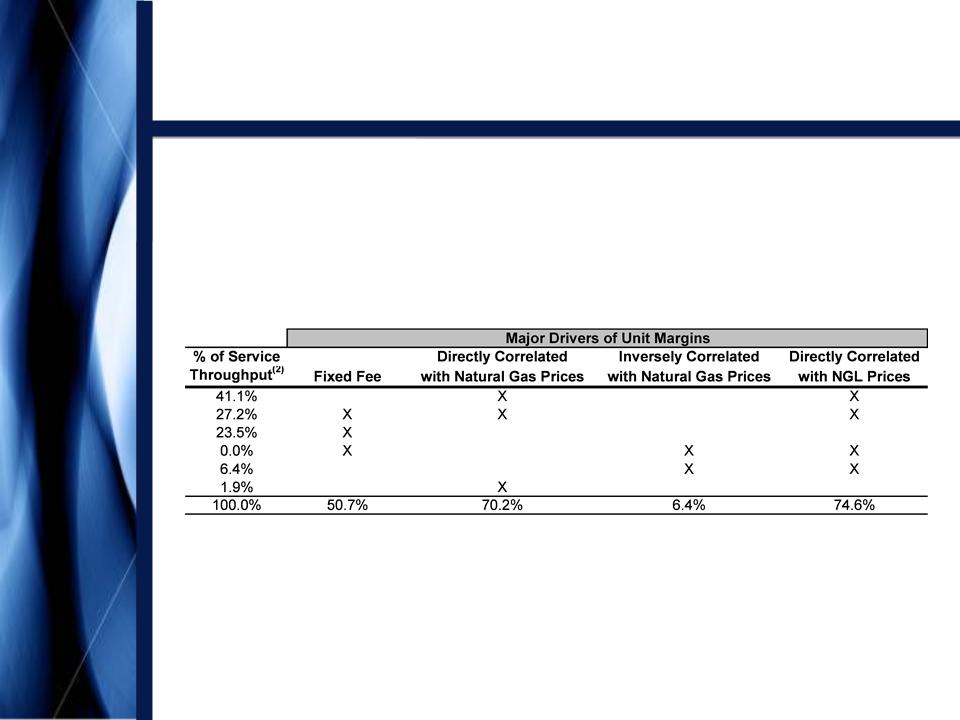

Texas

Contract Mix

• Third quarter 2009

contract mix(1)

Appendix

(1) Source: Copano

Energy internal financial planning models for consolidated

subsidiaries.

(2) Excludes

72,985 MMBtu/d service throughput for Webb Duval, a majority-owned

affiliate.

Copano

Energy

45

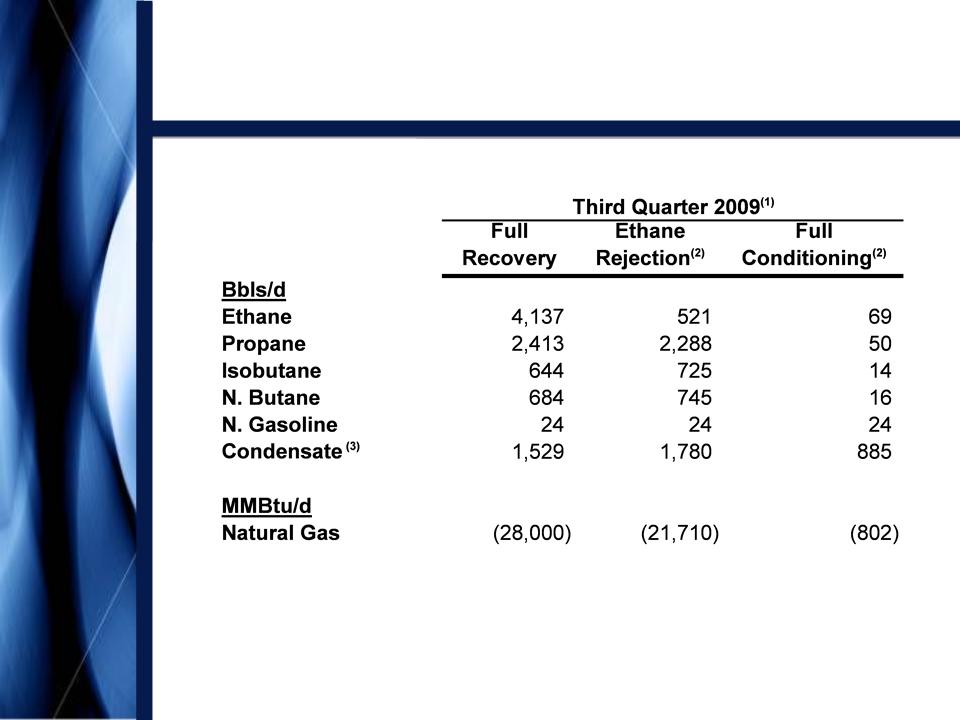

Texas

Net Commodity Exposure

Note: See

explanation of processing modes in this Appendix.

(1) Source: Copano

Energy internal financial planning models for consolidated subsidiaries. Based on

3Q09 daily

wellhead/plant inlet volumes.

wellhead/plant inlet volumes.

(2) Fractionation

at Houston Central processing plant permits significant reductions in ethane

recoveries in ethane

rejection mode and full ethane rejection in conditioning mode. To optimize profitability, plant operations can

also be adjusted to partial recovery mode.

rejection mode and full ethane rejection in conditioning mode. To optimize profitability, plant operations can

also be adjusted to partial recovery mode.

(3) At

the Houston Central processing plant, pentanes+ may be sold as

condensate.

Appendix

Copano

Energy

46

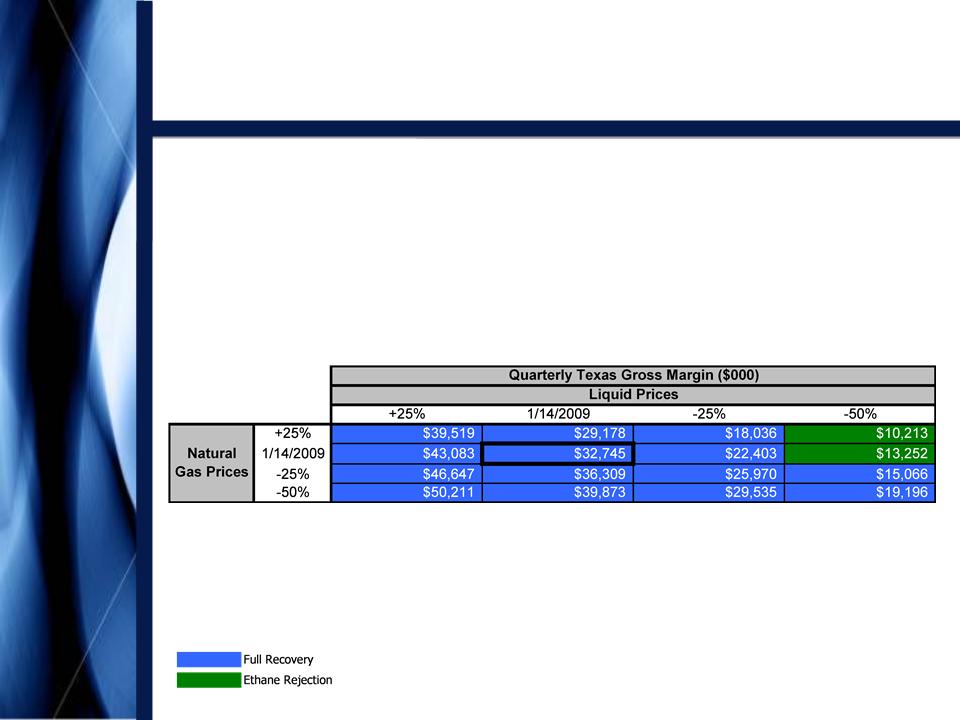

Texas

Commodity Price

Sensitivities

Sensitivities

• Texas segment gross

margins excluding hedge settlements

– Matrix reflects 3Q09

volumes and operating conditions,

adjusted using Copano’s 2009 planning model

adjusted using Copano’s 2009 planning model

Appendix

Copano

Energy

47

Rocky

Mountains Commercial

Update

Update

• Third Quarter

2009

– Total service

throughput volumes:

• Consolidated

affiliates (producer services): 157,000 MMBtu/d

• Unconsolidated

affiliates:

§ Bighorn: 190,000

MMBtu/d

§ Fort Union: 762,000

MMBtu/d

• All Bighorn and Fort

Union margins are fixed fee

• Virtually all

producer services margins are fixed margin

Appendix

Copano

Energy

48

Rocky

Mountains Sensitivities

Appendix

Note: See this

Appendix for reconciliation of Adjusted EBITDA. Values

reflect rounding.

(1) Impact

on Adjusted EBITDA based on Copano’s interest in the unconsolidated

affiliate.

• Third Quarter

2009

– Adjusted EBITDA

volume sensitivity (positive or negative impact)

• Consolidated

(producer services): 10,000 MMBtu/d = $28,000

• Unconsolidated

affiliates:

§ Bighorn: 10,000

MMBtu/d = $249,000(1)

§ Fort Union: 10,000

MMBtu/d = $70,000(1)

Copano

Energy

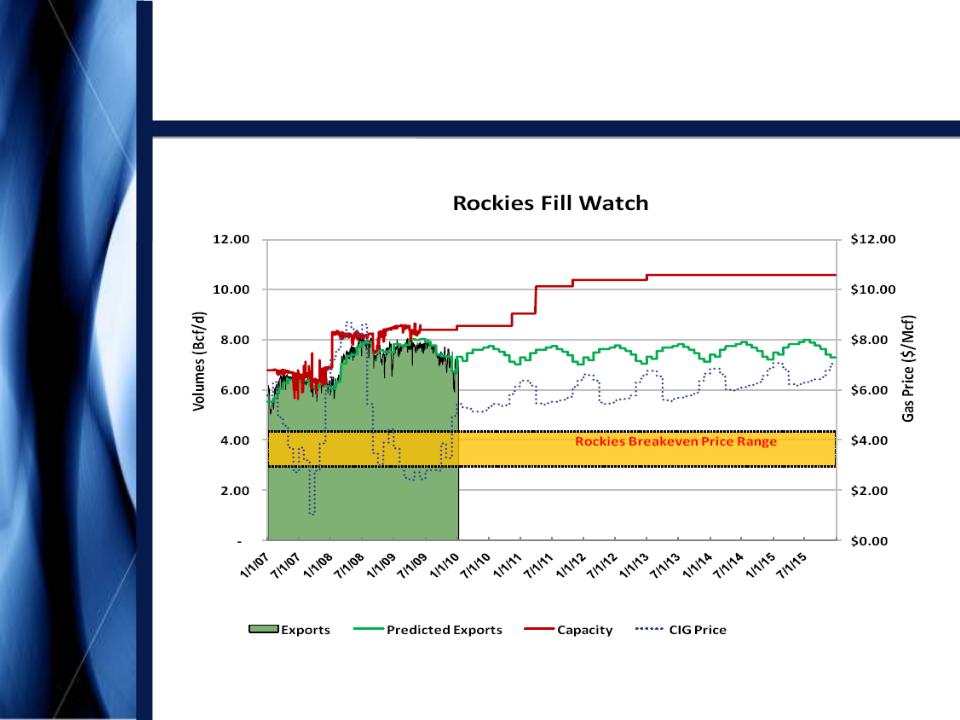

Rocky

Mountains Takeaway

Capacity Outlook

Capacity Outlook

Source:

Bentek Energy, LLC

(1) Historical

and future prices as of 1/5/10. 1/21/10

spot: $5.095/Mcf

49

(1)

Appendix

Copano

Energy

50

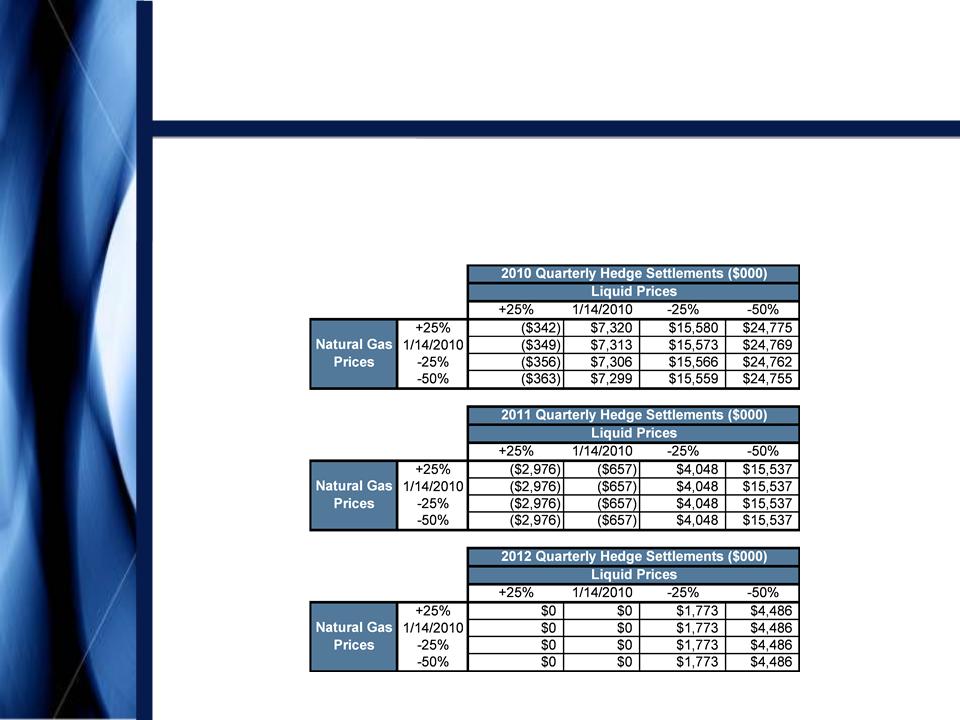

Hedging

Impact

of Commodity Price Sensitivities

of Commodity Price Sensitivities

• Commodity hedging

program supplements cash flow in 2010

through 2012 during less favorable commodity price periods

through 2012 during less favorable commodity price periods

Appendix

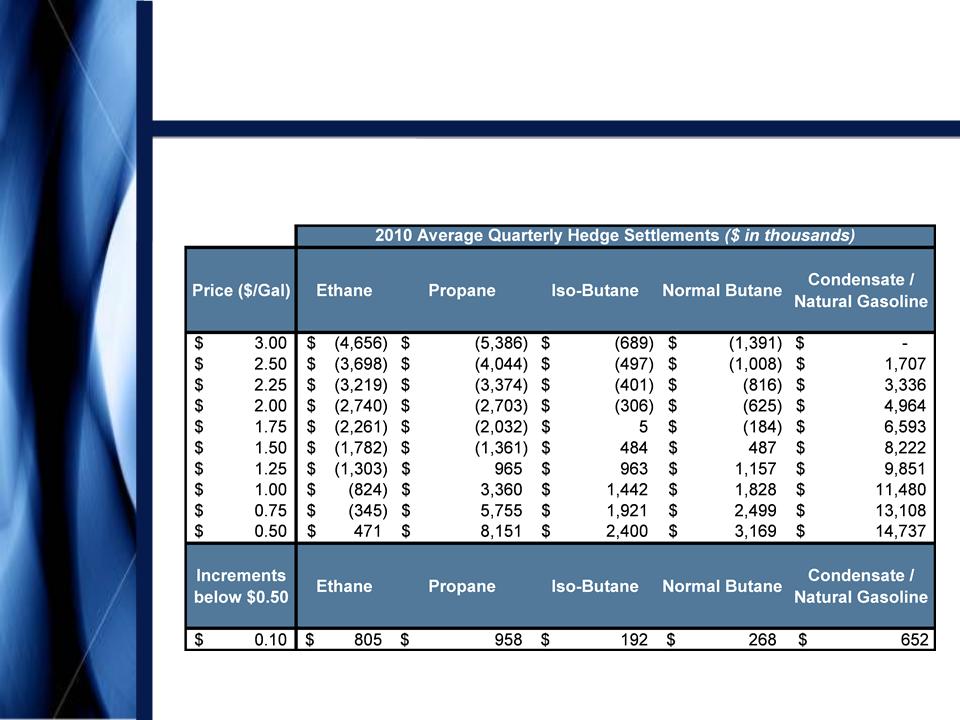

Copano

Energy

51

Hedging

Impact

• 2010 NGLs Hedge

Settlement Matrix

Note: All

hedge instruments are reported in Copano’s SEC filings. Hedge

settlements are based on monthly average

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Appendix

Copano

Energy

52

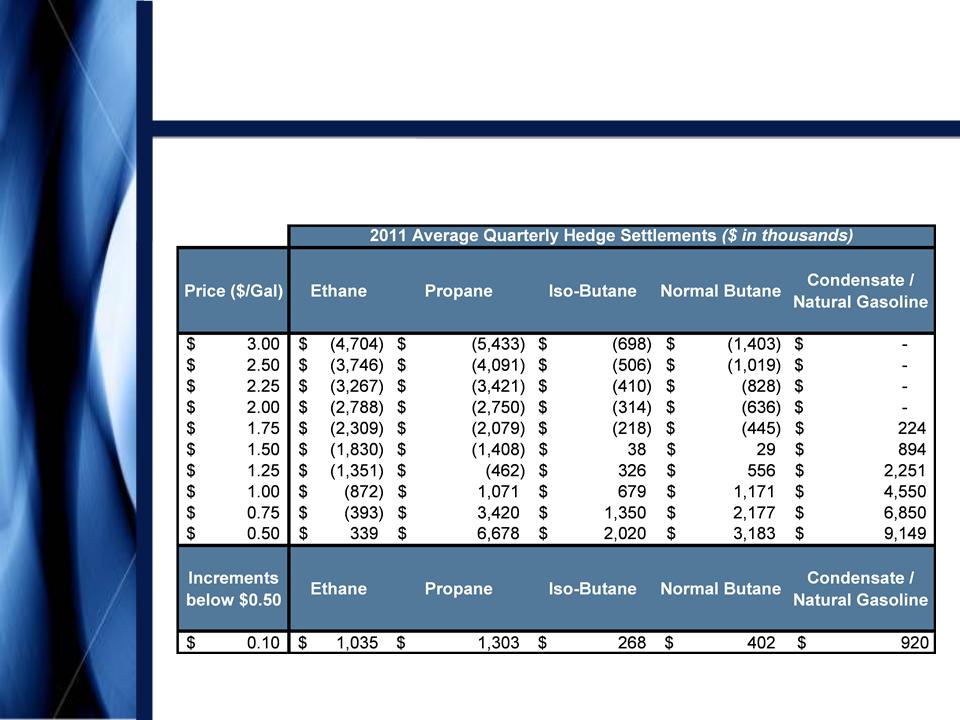

Hedging

Impact

• 2011 NGLs Hedge

Settlement Matrix

Note: All

hedge instruments are reported in Copano’s SEC filings. Hedge

settlements are based on monthly average

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Appendix

Copano

Energy

53

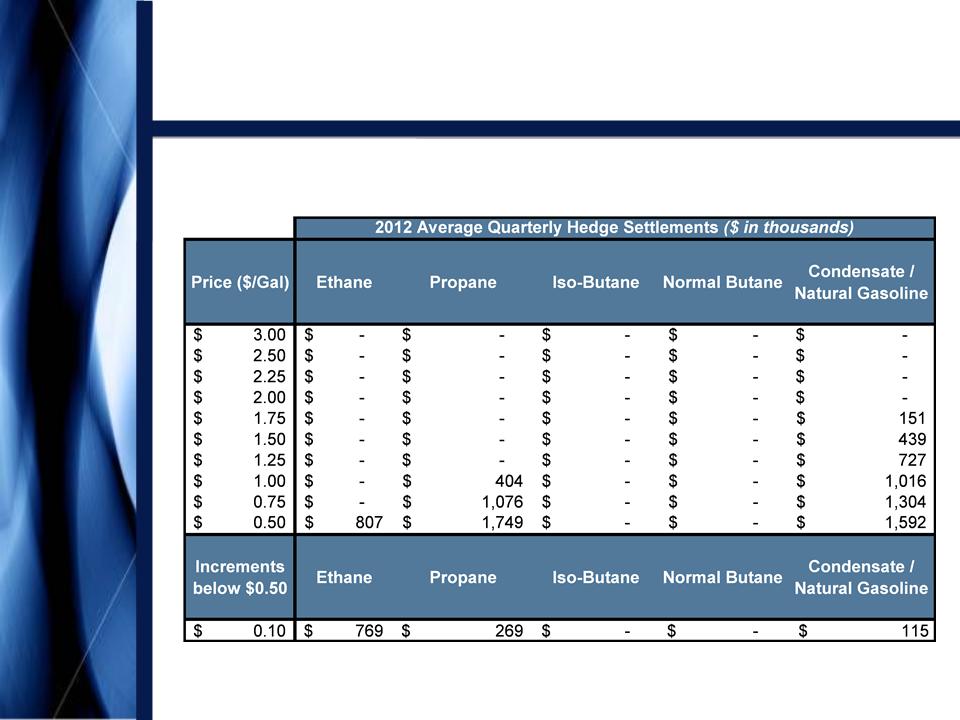

Hedging

Impact

• 2012 NGLs Hedge

Settlement Matrix

Note: All

hedge instruments are reported in Copano’s SEC filings. Hedge

settlements are based on monthly average

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Mt. Belvieu NGL and NYMEX WTI prices. Positive amounts reflect payments from hedge counterparties under

swap and put option instruments. Negative amounts reflect payments to hedge counterparties under swap

instruments.

Appendix

Copano

Energy

54

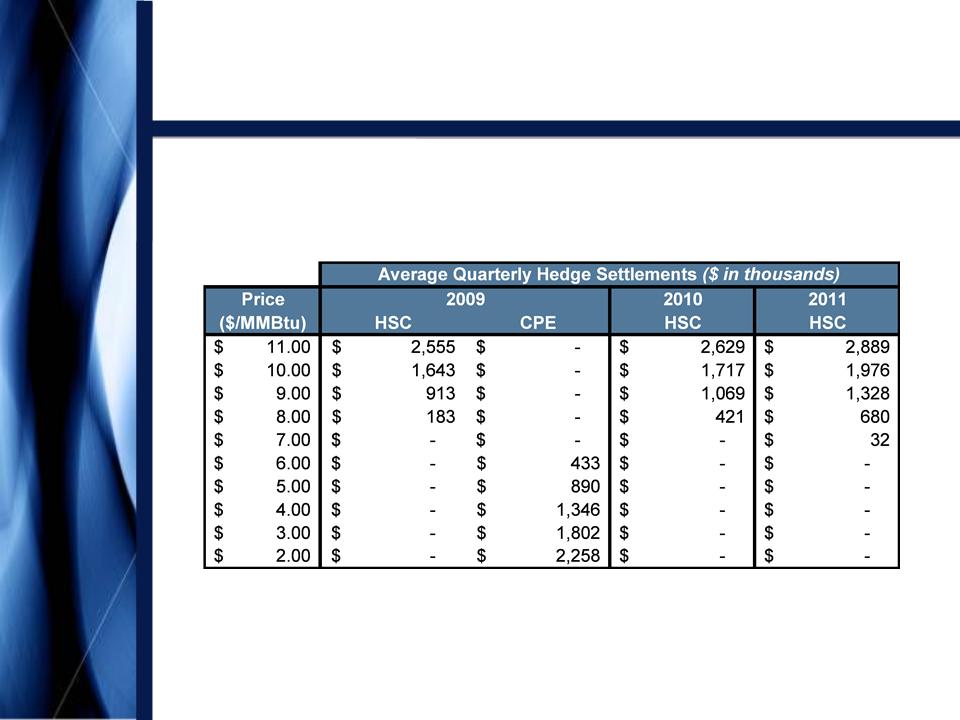

Hedging

Impact

• 2009 - 2011 Natural

Gas Hedge Settlement Matrix(1)

Note: All

hedge instruments are reported in Copano’s SEC filings. Hedge

settlements are based on first of the month

Houston Ship Channel and CenterPoint East natural gas prices. Positive amounts reflect payments from hedge

counterparties under call and put option instruments.

Houston Ship Channel and CenterPoint East natural gas prices. Positive amounts reflect payments from hedge

counterparties under call and put option instruments.

(1) Not

included in the matrix, for calendar 2010, Copano entered into a basis spread

between Houston Ship Channel

and Centerpoint East natural gas indices to lock in the basis between the two indices for 10,000 MMBtu/d of

natural gas at $0.185/MMbtu.

and Centerpoint East natural gas indices to lock in the basis between the two indices for 10,000 MMBtu/d of

natural gas at $0.185/MMbtu.

Appendix

Copano

Energy

55

Reconciliation of

Non-GAAP

Financial Measures

Financial Measures

Segment

Gross Margin and Total Segment Gross Margin

• We define segment

gross margin, with respect to a Copano operating segment, as segment revenue

less cost of sales. Cost of

sales includes the following:

cost of natural gas and NGLs purchased from third parties, cost of natural gas and NGLs purchased from affiliates, cost of crude oil purchased from third

parties, costs paid to third parties to transport volumes and costs paid to affiliates to transport volumes. Total segment gross margin is the sum of the

operating segment gross margins and the results of Copano’s risk management activities that are included in Corporate and other. We view total segment

gross margin as an important performance measure of the core profitability of our operations. Segment gross margin allows Copano’s senior management

to compare volume and price performance of the segments and to more easily identify operational or other issues within a segment. The GAAP measure

most directly comparable to total segment gross margin is operating income.

cost of natural gas and NGLs purchased from third parties, cost of natural gas and NGLs purchased from affiliates, cost of crude oil purchased from third

parties, costs paid to third parties to transport volumes and costs paid to affiliates to transport volumes. Total segment gross margin is the sum of the

operating segment gross margins and the results of Copano’s risk management activities that are included in Corporate and other. We view total segment

gross margin as an important performance measure of the core profitability of our operations. Segment gross margin allows Copano’s senior management

to compare volume and price performance of the segments and to more easily identify operational or other issues within a segment. The GAAP measure

most directly comparable to total segment gross margin is operating income.

Appendix

Copano

Energy

56

Reconciliation of

Non-GAAP

Financial Measures

Financial Measures

Adjusted

EBITDA

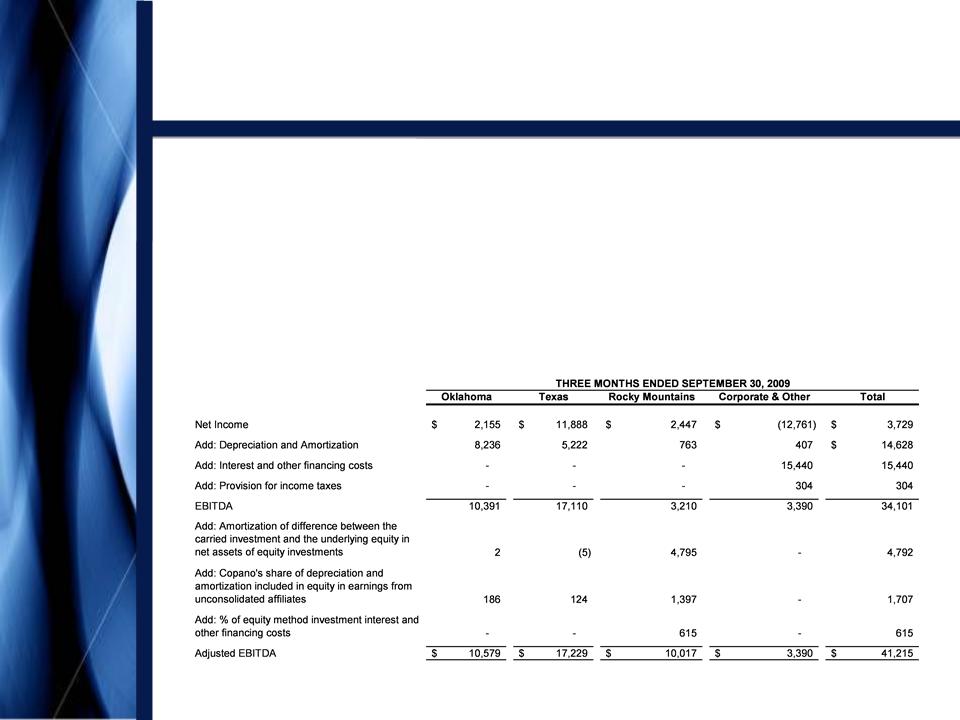

• We define EBITDA as

net income (loss) plus interest expense, provision for income taxes and

depreciation and amortization expense. Because a portion of

our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and Southern

Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in earnings (loss) from

unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization expense attributable to the

difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii) the portion of each unconsolidated

affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that unconsolidated affiliate and (iii) the portion of each

unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership interest in that unconsolidated affiliate.

our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and Southern

Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in earnings (loss) from

unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization expense attributable to the

difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii) the portion of each unconsolidated

affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that unconsolidated affiliate and (iii) the portion of each

unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership interest in that unconsolidated affiliate.

• External users of our

financial statements such as investors, commercial banks and research analysts

use EBITDA or Adjusted EBITDA, and our

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

– The financial

performance of our assets without regard to financing methods, capital structure

or historical cost basis;

– The ability of our

assets to generate cash sufficient to pay interest costs and support our

indebtedness;

– Our operating

performance and return on capital as compared to those of other companies in the

midstream energy sector, without regard to

financing or capital structure; and

financing or capital structure; and

– The viability of

acquisitions and capital expenditure projects and the overall rates of return on

alternative investment opportunities.

• The following table

presents a reconciliation of the portion of our EBITDA and Adjusted EBITDA

attributable to each of our segments to the GAAP financial

measure of net income (loss):

measure of net income (loss):

Appendix

Copano

Energy

57

Reconciliation of

Non-GAAP

Financial Measures

Financial Measures

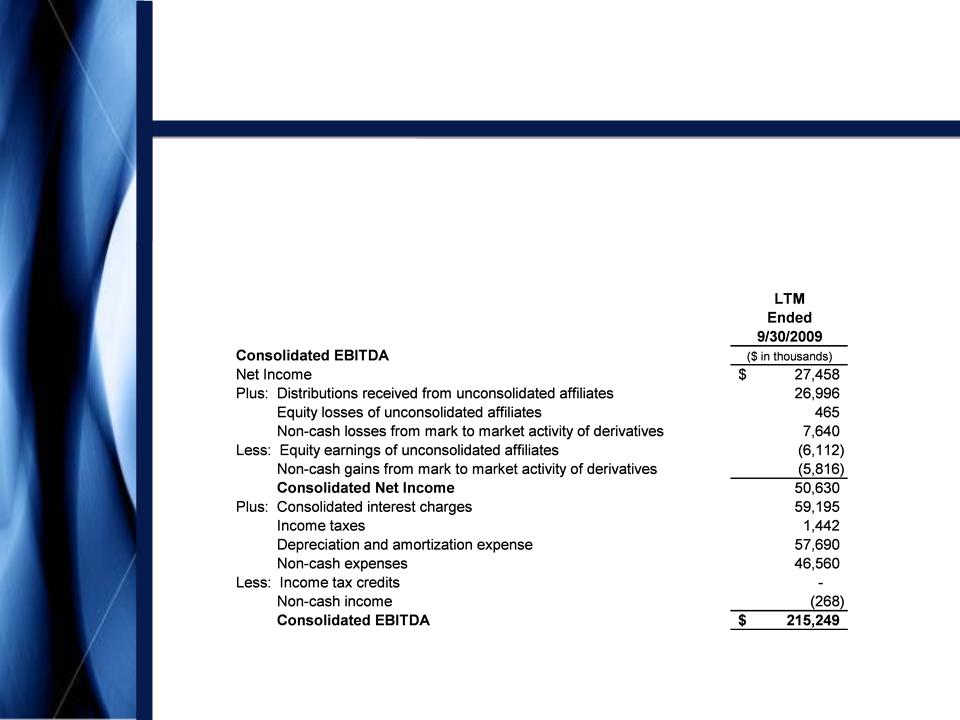

Consolidated

EBITDA

§ EBITDA is also a

financial measure that, with negotiated pro forma adjustments relating to

acquisitions completed during the

period, is reported to our lenders as Consolidated EBITDA and is used to compute our financial covenants under our senior

secured revolving credit facility.

period, is reported to our lenders as Consolidated EBITDA and is used to compute our financial covenants under our senior

secured revolving credit facility.

§ The following table

presents a reconciliation of the non-GAAP financial measure of Consolidated

EBITDA to the GAAP

financial measure of net income (loss):

financial measure of net income (loss):

Appendix

Copano

Energy

58

Definitions of

Non-GAAP

Financial Measures

Financial Measures

Total

Distributable Cash Flow

§ We define total

distributable cash flow as net income plus: (i) depreciation, amortization and

impairment expense (including

amortization expense relating to the option component of our risk management portfolio); (ii) cash distributions received from

investments in unconsolidated affiliates and equity losses from such unconsolidated affiliates; (iii) provision for deferred

income taxes; (iv) the subtraction of maintenance capital expenditures; (v) the subtraction of equity in earnings from

unconsolidated affiliates and (vi) the addition of losses or subtraction of gains relating to other miscellaneous non-cash

amounts affecting net income for the period, such as equity-based compensation, mark-to-market changes in derivative

instruments, and our line fill contributions to third-party pipelines and gas imbalances. Maintenance capital expenditures are

capital expenditures employed to replace partially or fully depreciated assets to maintain the existing operating capacity of

our assets and to extend their useful lives, or other capital expenditures that are incurred in maintaining existing system

volumes and related cash flows.

amortization expense relating to the option component of our risk management portfolio); (ii) cash distributions received from

investments in unconsolidated affiliates and equity losses from such unconsolidated affiliates; (iii) provision for deferred

income taxes; (iv) the subtraction of maintenance capital expenditures; (v) the subtraction of equity in earnings from

unconsolidated affiliates and (vi) the addition of losses or subtraction of gains relating to other miscellaneous non-cash

amounts affecting net income for the period, such as equity-based compensation, mark-to-market changes in derivative

instruments, and our line fill contributions to third-party pipelines and gas imbalances. Maintenance capital expenditures are

capital expenditures employed to replace partially or fully depreciated assets to maintain the existing operating capacity of

our assets and to extend their useful lives, or other capital expenditures that are incurred in maintaining existing system

volumes and related cash flows.

§ Total distributable

cash flow is a significant performance metric used by senior management to

compare basic cash flows

generated by us (prior to the establishment of any retained cash reserves by our Board of Directors) to the cash distributions

we expect to pay our unitholders, and it also correlates with the metrics of our existing debt covenants. Using total

distributable cash flow, management can quickly compute the coverage ratio of estimated cash flows to planned cash

distributions. Total distributable cash flow is also an important non-GAAP financial measure for our unitholders because it

serves as an indicator of our success in providing a cash return on investment — specifically, whether or not we are

generating cash flow at a level that can sustain or support an increase in our quarterly distribution rates. Total distributable

cash flow is also used by industry analysts with respect to publicly traded partnerships and limited liability companies

because the market value of such entities’ equity securities is significantly influenced by the amount of cash they can

distribute to unitholders.

generated by us (prior to the establishment of any retained cash reserves by our Board of Directors) to the cash distributions

we expect to pay our unitholders, and it also correlates with the metrics of our existing debt covenants. Using total

distributable cash flow, management can quickly compute the coverage ratio of estimated cash flows to planned cash

distributions. Total distributable cash flow is also an important non-GAAP financial measure for our unitholders because it

serves as an indicator of our success in providing a cash return on investment — specifically, whether or not we are

generating cash flow at a level that can sustain or support an increase in our quarterly distribution rates. Total distributable

cash flow is also used by industry analysts with respect to publicly traded partnerships and limited liability companies

because the market value of such entities’ equity securities is significantly influenced by the amount of cash they can

distribute to unitholders.

Appendix

Copano

Energy

NASDAQ:

CPNO

January

2010