Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. | d8k.htm |

Allscripts Investor Presentation – January, 2010 Exhibit 99.1 |

2 Forward Looking Statements This communication contains forward-looking statements within the meaning of the

federal securities laws. Statements regarding future events,

developments, the Company’s future performance, as well as

management’s expectations, beliefs, intentions, plans, estimates or projections relating to the future are forward-looking statements within the meaning of these laws. These

forward-looking statements are subject to a number of risks and

uncertainties, some of which are outlined below. As a result, actual

results may vary materially from those anticipated by the forward-looking statements. Among the important factors that could cause actual results to differ materially from

those indicated by such forward-looking statements are: the volume and

timing of systems sales and installations; length of sales cycles and the

installation process; the possibility that products will not achieve or sustain market acceptance; the timing, cost and success or failure of new product and

service introductions, development and product upgrade releases;

competitive pressures including product offerings, pricing and promotional

activities; our ability to establish and maintain strategic relationships;

undetected errors or similar problems in our software products; compliance with existing laws, regulations and industry initiatives and future changes in laws or

regulations in the healthcare industry; possible regulation of the

Company’s software by the U.S. Food and Drug Administration; the

possibility of product-related liabilities; our ability to attract and retain qualified personnel; our ability to identify and complete acquisitions, manage our growth and

integrate acquisitions; the ability to recognize the benefits of the merger

with Misys Healthcare Systems, LLC (“MHS”); the integration

of MHS with the Company; the impact of the securities class action and other pending or threatened litigation and the possible disruption of current plans and

operations as a result thereof; the implementation and speed of acceptance

of the electronic record provisions of the American Recovery and

Reinvestment Act of 2009; maintaining our intellectual property rights and litigation involving intellectual property rights; risks related to third-party suppliers; our ability to obtain, use or successfully integrate third-party licensed technology; breach of

our security by third parties; and the risk factors detailed from time to

time in our reports filed with the Securities and Exchange Commission,

including our most recent Annual Report on Form 10-K available through the Web site maintained by the Securities and Exchange Commission at www.sec.gov. The Company undertakes no obligation to update publicly any forward-looking statement, whether

as a result of new information, future events or otherwise.

|

3 Agenda › Market Opportunity is Now › Meaningful Use Update › Why Allscripts? › Financial Update |

We

are at the beginning of the single fastest transformation of any industry in US history |

5 2010: The Year of the EHR <20 % Approx. 20% EHR Physician Penetration -Early Adopters ~ $45B ~$45 Billion in Federal Funding 70 % 70% of Funding Will Be Spent in First 3 Years Lower IT Investment in Healthcare Than Any Other Sector of Economy Sources: United States Dept. of Health and Human Services: Fiscal Year 2010 Budget

in Brief, ARRA Centers for Disease Control and Prevention

|

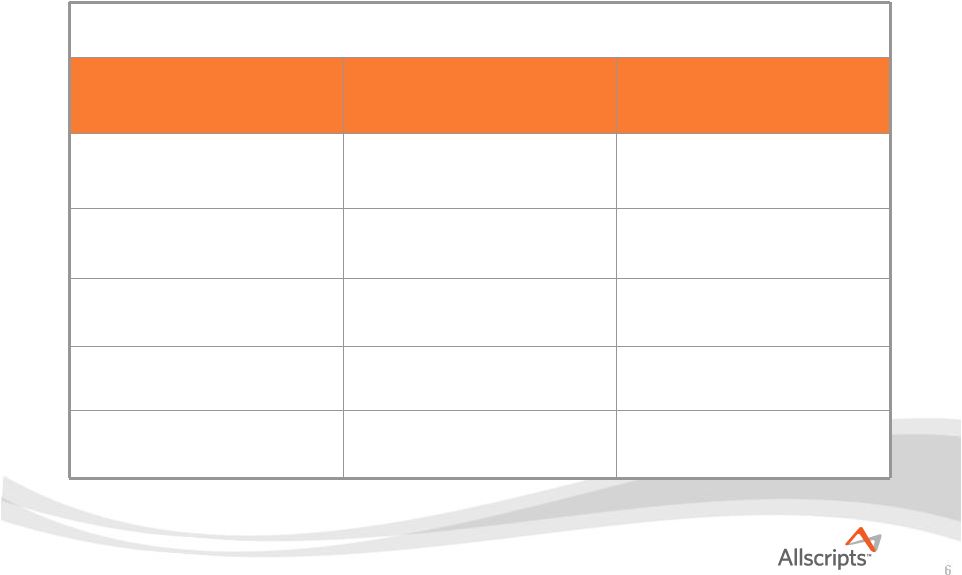

6 Market Potential Practice Size Total # of Practices EHR Penetration (FY08/09) 1-3 Physicians 163,000 ~10% 4-9 Physician 27,000 ~20% 10-25 Physicians 8,000 ~25% 26+ Physicians 2,000 ~40% Total 200,000 ~12% Source: SK&A = SK&A Information Services which sells databases for sales and marketing success in

healthcare industry 6 |

7 Once in a Lifetime Opportunity… |

8 Meaningful Use Update: The Time is Now Healthcare Reform Will Not Impact ARRA ~$45B for EHRs › Medicare - $44,000; Medicaid - $63,750 › Rules Issued December 30, 2009 › Notice of Proposed Rule Making (NPRM) – how physicians earn incentives – 60-day comment period ends March 15 › Interim Final Rule (IFR) – how products get certification – no surprises › Penalties for Not Participating |

9 Meaningful Use Update: Key Components › The EHR Must be Certified & Include e-Prescribing › The EHR Must be Connected › The EHR Must Include Reporting Capabilities on Clinical Quality Metrics › The EHR Must be Used in a Meaningful Way |

10 Why Allscripts? › Leadership – The clear leader in providing innovative software, connectivity and information solutions that empower physicians and other healthcare providers to improve the health of both their patients and their bottom line › A Safe Choice – Financially Strong – Revenue of ~ $700 mm – R&D F2010 ~$70 mm › People & Experience |

11 Our Footprint… 160,000 Physicians 8,000 Post-Acute Providers 800 Hospitals and 80 million Rx… |

12 Comprehensive Portfolio… Across the Continuum of Care |

13 |

14 Connect |

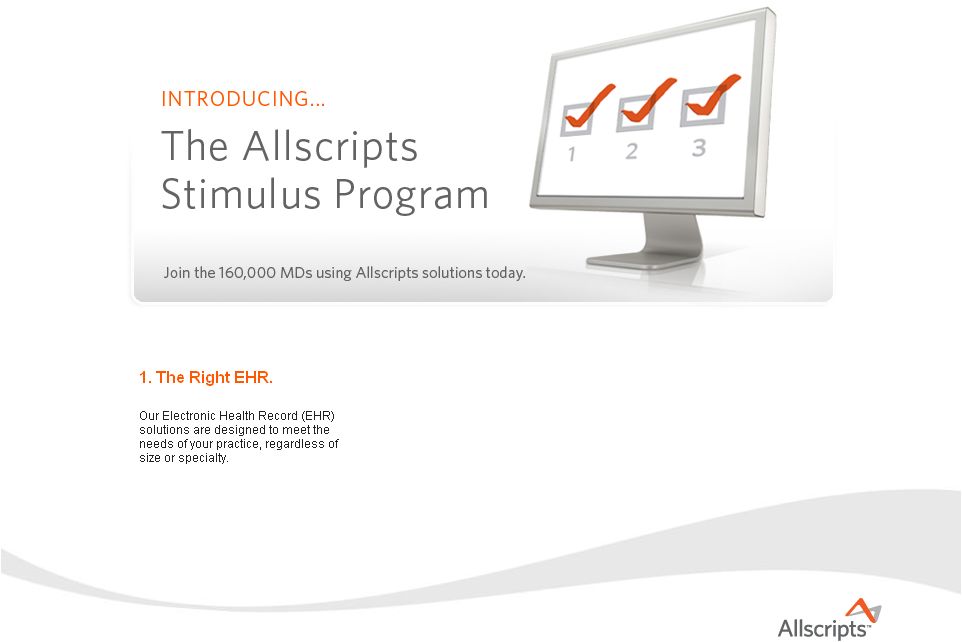

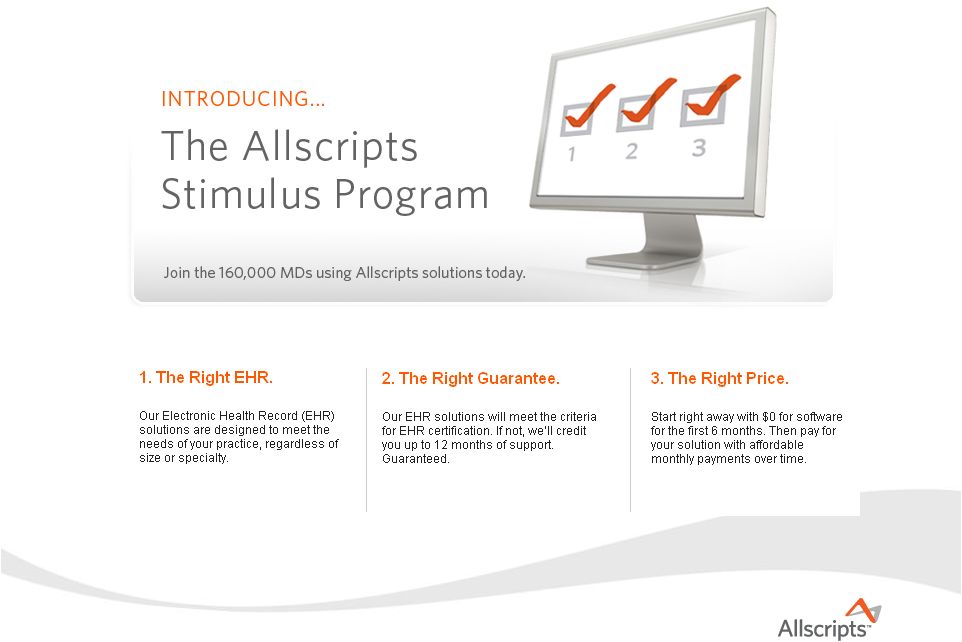

15 Powerful Engine to Drive Sales Direct Marketing Allscripts Distribution Network Exclusive Relationships: Henry Schein; Cardinal Health Hospital/Community Distribution Partners ~250 Direct Sales Professionals |

16 |

17 |

18 |

19 |

Summary - › Unparalleled Market Opportunity › Rapid Transformation › “Rules of the Road” for Capturing Stimulus in Place Allscripts – “Built to Last” |

21 Financial Overview |

22 Allscripts – Financial Highlights › Bookings Momentum – $191.3 mm in H1 Bookings – 30% growth › $680.0 mm Revenue Run Rate › Revenue Visibility – 67% Recurring in 2Q Fiscal 2010 › mix of SaaS Bookings ~24% in most recent quarter › Improving Gross Margins – 56.4% as reported in Q2 › Significant Operating Leverage › Substantial R&D Expenditures ~ $70.0 mm or ~10% of Fiscal 2010 Revenue › Strong Financial Position |

23 Fiscal 2010 2Q & YTD Bookings Results Quarter Ended 11/30/08 11/30/09 % Change Bookings $80.7 $93.8 +16% % SaaS 26% 24% Six Months Ended 11/30/08 11/30/09 % Change Bookings $147.1 $191.3 +30% % SaaS 24% 25% Strong 2Q and YTD bookings across all product offerings |

24 Fiscal 2010 2Q Revenue and Net Income Q2 ‘09 Q2 ‘10 % Change Revenue $128.6 $169.3 +32% Non-GAAP Revenue(a) $163.4 $170.7 +4% % Recurring Revenue 63% 67% Net Income ($6.0) $15.8 N/M Non-GAAP Net Income(a) $16.6 $24.0 +45% (a) Please see reconciliation and footnotes in appendix to this presentation regarding

non-GAAP revenue and net income for the three months ended November 30,

2009 and 2008. Information also available at http://investor.allscripts.com |

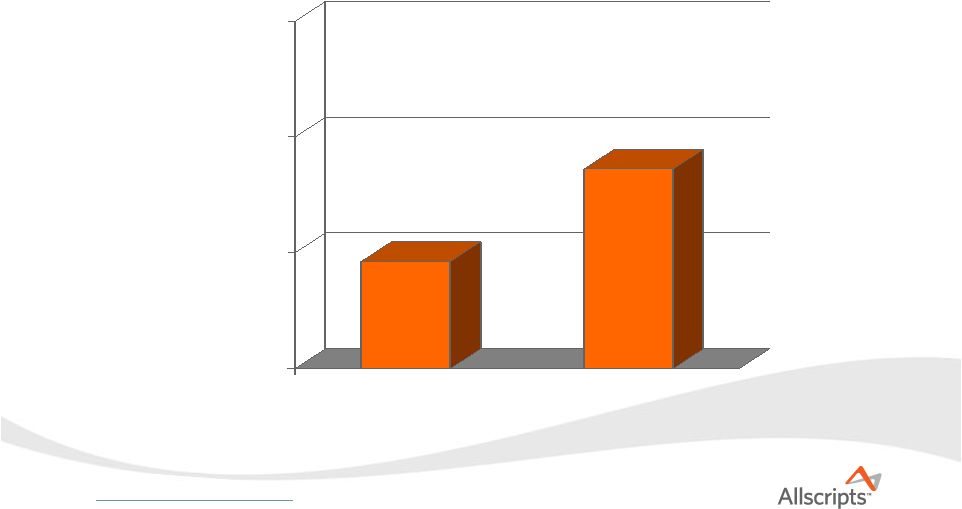

25 Non-GAAP(a) Net Income Growth:

H1 Fiscal 2010 vs. 2009 $30.0 $35.0 $40.0 $45.0 $50.0 (a) Please see reconciliation and footnotes in appendix to this presentation regarding

non-GAAP net income for the six months ended November 30, 2008 and 2009

. Additional information also available at http://investor.allscripts.com Fiscal 2009 H1 $31.5mm $46.1mm Fiscal 2010 H1 +46% Y/Y |

26 Non-GAAP(a) Net Income Margin:

H1 Fiscal 2010 vs. 2009 5.0% 10.0% 15.0% 20.0% (a) Please see reconciliation and footnotes in appendix to this presentation regarding

non-GAAP net income margin for the six months ended November 30, 2008

and 2009 . Additional information also available at http://investor.allscripts.com Fiscal 2009 H1 ~10% Fiscal 2010 H1 ~14% |

27 Fiscal 2010 Outlook 2010E Revenue $680.0 - $700.0 Net income $64.5 - $66.0 Non-GAAP net income(a) $93.5 - $95.0 Diluted EPS $0.41 - $0.43 Non-GAAP diluted EPS(a) $0.61 - $0.63 WASO 150.5 (a) Please see reconciliation and footnotes in appendix to this presentation regarding

non-GAAP revenue, net income and EPS for the year ending May 31, 2010.

Information also available at http://investor.allscripts.com › ~10% Top Line Growth › Mid 50’s Gross Margin % › Non-GAAP Net Income Growth 22-24% › Strong Operating Cash Flow |

Summary - › Excellent Sales Momentum › Large Mix of Recurring Revenue = Solid Top Line Visibility › Operating Leverage › Superior Long-Term Financial Model Allscripts – “Built to Last” |

|

30 Appendix: Non-GAAP Reconciliation › GAAP – non-GAAP revenue reconciliation for the three months ended November 30, 2008 and

2009. Q2 Q2 2009 2010 Nov-08 Nov-09 Revenue Revenue, as reported $128.6 $169.3 Allscripts pre-merger 37.4 - Deferred revenue adjustment 2.1 1.4 Elimination of prepackaged medications (4.7) - Revenue, non-GAAP $163.4 $170.7 |

31 Appendix: Non-GAAP Reconciliation › GAAP – non-GAAP net income reconciliation for the three months ended November 30, 2008 and

2009. Q2 Q2 2009 2010 Nov-08 Nov-09 Net income Net income, as reported $ (6.0) $ 15.8 Allscripts pre-merger 7.9 - Elimination of prepackaged medications (0.3) - Deferred revenue adjustment 2.0 1.5 Stock based compensation 1.0 4.4 Acquisition-related amortization expense 4.6 5.7 Transaction-related expense 22.0 1.3 Tax effect of non-GAAP adjustments (at 39%) (14.6) (5.0) Tax adjustment to bring as-reported to 39% - 0.3 Net income, non-GAAP $16.6 $24.0 |

32 Appendix: Non-GAAP Reconciliation › GAAP – non-GAAP net income reconciliation for the six months ended November 30, 2008 and 2009. H1 H1 2009 2010 Nov-08 Nov-09 Net income Net income, as reported $ (0.6) $ 28.7 Allscripts pre-merger 11.0 - Elimination of prepackaged medications (1.1) - Deferred revenue adjustment 2.0 4.0 Stock based compensation 3.4 7.7 Acquisition-related amortization expense 8.5 11.3 Transaction-related expense 28.8 5.2 Tax effect of non-GAAP adjustments (at 39%) (20.5) (11.1) Tax adjustment to bring as-reported to 39% - 0.3 Net income, non-GAAP $31.5 $46.1 |

33 Appendix: Non-GAAP Reconciliation › GAAP – non-GAAP net income margin reconciliation for the six months ended November 30,

2008 and 2009. H1 H1 2009 2010 Nov-08 Nov-09 Net income margin Net income, non-GAAP (see page 32) $31.5 $46.1 Revenue, as reported 221.4 334.3 Net income margin, as reported 14.2% 13.6% Allscripts pre-merger 109.3 - Deferred revenue adjustment 2.1 4.0 Elimination of prepackaged medications (4.7) - Revenue, non-GAAP $328.1 $338.3 Net income margin, non-GAAP 9.6% 13.6% |

34 Appendix: Non-GAAP Reconciliation › GAAP – non-GAAP Net Income and EPS reconciliation for the year ended May 31, 2009 and

2010 Fiscal 2009 Fiscal 2010 Guidance Guidance Range Net income $26.0 $65.3 $64.5 to $66.0 GAAP EPS $0.21 $0.43 $0.41 to $0.43 Adjustments* Allscripts pre-merger 11.4 - Elimination of prepackaged medications (2.4) - Deferred revenue adjustment 7.8 4.9 Stock based compensation 8.3 15.2 Acquisition-related amortization expense 20.5 22.6 Transaction-related expense 40.3 5.2 Tax effect of non-GAAP adjustments (41% in 2009 and 39% in 2010) (35.2) (18.6) Non-GAAP Net income $76.7 $94.6 $93.5 to $95.0 Share count 149.9 150.5 Non-GAAP EPS $0.51 $0.63 $.61 to $.63 |

35 Basis of Presentation The Company's GAAP results for the three and six months ended November 30, 2009

include results of Allscripts for each such period. The Company's GAAP results for the three and six months ended November 30, 2008 include the results of Misys Healthcare (Misys) for each period and the results of Allscripts subsequent to a merger effected on October 10, 2008, at which time the Company's legal name was changed to

Allscripts- Misys Healthcare Solutions, Inc. Supplemental and non-GAAP financial information is also available at http://investor.allscripts.com. Please

see next page for a further discussion of non-GAAP measures. |

36 Explanation of Non-GAAP Financial Measures Allscripts reports its financial results in accordance with generally accepted accounting principles, or

GAAP. To supplement this information, Allscripts presents in this presentation non-GAAP

revenue and net income, including non-GAAP net income on a per share basis, which are non-GAAP financial measures under Section 101 of Regulation G under the Securities Exchange Act of 1934, as amended. Non-GAAP revenue consists of GAAP revenue and legacy

Allscripts revenue for periods prior to the consummation date of the Misys merger and adds back

the deferred revenue adjustment booked for GAAP purposes and excludes revenue from prepackaged medications. Non-GAAP net income consists of GAAP net income and includes legacy Allscripts net income for periods prior to the consummation date of the

Misys merger, excludes acquisition-related amortization, stock-based compensation

expense and transaction-related expenses, adds back the deferred revenue adjustment and excludes net income from prepackaged medications, in each case net of any related tax benefit. Acquisition-Related Amortization. Acquisition-related amortization expense is a non-cash

expense arising from the acquisition of intangible assets in connection with acquisitions or investments. Allscripts excludes acquisition-related amortization expense from non-GAAP net income

because it believes (i) the amount of such expenses in any specific period may not directly

correlate to the underlying performance of Allscripts business operations and (ii) such expenses can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired intangible assets. Management believes that this adjustment

facilitates comparisons of the separate pre-merger results of legacy Misys and legacy

Allscripts to that of the Company's post-merger results. Investors should note that the use of these intangible assets contributed to revenue in the periods presented and will contribute to future revenue generation and should also note that such expense will recur in future

periods. Stock-Based Compensation Expense. Stock-based compensation expense is a non-cash expense

arising from the grant of stock awards to employees. Allscripts excludes stock- based

compensation expense from non-GAAP net income because it believes (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of Allscripts business operations and (ii) such expenses can vary significantly between periods

as a result of the timing of grants of new stock-based awards, including grants in

connection with acquisitions. Investors should note that stock-based compensation is a key incentive offered to employees whose efforts contributed to the operating results in the periods presented and are expected to contribute to operating results in future periods and should

also note that such expense will recur in future periods. Deferred Revenue Adjustment. Deferred revenue adjustment reflects the fair value adjustment to deferred

revenues acquired in connection with the Misys merger transaction consummated on October 10,

2008. The fair value of deferred revenue represents an amount equivalent to the estimated cost plus an appropriate profit margin, to perform services related to legacy Allscripts software and product support, which assumes a legal obligation to do so, based

on the deferred revenue balances as of October 10, 2008. Allscripts adds back this deferred

revenue adjustment for non-GAAP revenue and non-GAAP net income because it believes the inclusion of this amount directly correlates to the underlying performance of Allscripts operations and facilitates comparisons of the separate pre-merger results of

legacy Misys and legacy Allscripts to that of the Company's post-merger results. Non-GAAP adjustments are effected for tax at the actual as-reported effective tax rate for all

fiscal 2009 periods presented. Non-GAAP adjustments are effected for tax at the anticipated

full-year effective tax rate for all fiscal 2010 periods presented. Management also believes that non-GAAP revenue and net income provide useful supplemental information

to management and investors regarding the underlying performance of the Company's business

operations and facilitates comparisons of the separate pre-merger results of legacy Misys and legacy Allscripts to that of the Company's post-merger results. Purchase accounting adjustments made in accordance with GAAP can make it difficult to make meaningful

comparisons of the underlying operations of the business without considering the non-GAAP

adjustments that we have provided and discussed herein. Management also uses this information internally for forecasting and budgeting as it believes that the measure is indicative of the Company's core operating results. In addition, the Company uses

Non-GAAP net income to measure achievement under the Company's cash incentive compensation

plans. Note, however, that non-GAAP revenue and net income are performance measures only, and they do not provide any measure of the Company's cash flow or liquidity. Non-GAAP financial measures are not in accordance with, or an alternative for,

measures of financial performance prepared in accordance with GAAP and may be different from

non-GAAP measures used by other companies. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Allscripts' results of operations as determined in accordance with GAAP. Investors and potential investors are encouraged to

review the reconciliation of non-GAAP financial measures with GAAP financial measures

contained within the attached condensed consolidated financial statements. |