Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WELLS MID-HORIZON VALUE-ADDED FUND I LLC | d8k.htm |

Exhibit 99.1

WELLS MID-HORIZON VALUE-ADDED FUND I, LLC FACT SHEET

December 2009

INVESTMENT OBJECTIVE

The investment strategy of the Wells Mid-Horizon Value-Added Fund is to acquire office and industrial properties that we believe are undervalued or underperforming and to restabilize them in the near-term, utilizing multiple market and property-level tactics to enhance the assets’ values.

PORTFOLIO SUMMARY

Property % Leased Size (sq. ft.) Acquisition Date Total Price Price/Sq. Ft. Location

6000 Nathan Lane 100%* 183,999 Sept. 20, 2006 $25.35 million $138 Plymouth, Minn.

3000 Park Lane 100%** 105,316 Jan. 5, 2007 $11.00 million $104 Pittsburgh, Pa.

330 Commerce Street 76% 118,082 Dec. 14, 2007 $13.80 million $117 Nashville, Tenn.

Parkway at Oakhill 35% 145,789 Oct. 15, 2008 $19.00 million $130 Austin, Texas

*Currently 100% leased with Brocade leasing 148,492 square feet through April 2010. Brocade has signed an 87-month lease renewal for 44,262 square feet beginning May 2010. When this downsizing occurs, building occupancy will be 44%.

**Currently 100% leased. In July 2008, CIGNA signed a lease renewal through 2020. As part of the concessions for the lease renewal, CIGNA will pay rent on 80,000 SF as of 8/1/2008 and on 92,500 SF as of 8/1/2009. Beginning 8/1/2010, CIGNA will pay rent on the entire building.

MESSAGE FROM THE PORTFOLIO MANAGER

The Value-Added Fund experienced an activity-filled fourth quarter that included executing a significant loan extension with Bank of America and signing a 20,000-square-foot lease at Parkway at Oak Hill. These accomplishments provide continued positive momentum for the Fund as we move into 2010.

We have been keeping you up-to-date on our efforts to replace our existing line of credit with Bank of America. During the fourth quarter, we finalized our discussions with Bank of America to extend our existing loan. Ultimately, we successfully secured a six-month extension for the outstanding balance of $23.5 million as of December 1, 2009. The extension includes a potential additional six-month extension through November 30, 2010, provided we meet certain conditions.

While the loan extension is a meaningful accomplishment, it does not provide the additional capital required for continued leasing activity and projected near-term operating shortfalls due to occupancy levels and free rent associated with recent leasing activity. The Bank of America loan is secured by our first two acquisitions — 6000 Nathan Lane and 3000 Park Lane, while the other two assets are unencumbered by leverage. Therefore, we are pursuing additional financing for these two properties that is critical to cover our operating and capital needs. While we are optimistic that we can source adequate financing, the timing and ultimate structure of the financing cannot be guaranteed and could affect our broader fund operations and leasing. However, we are evaluating alternative solutions in the event that suitable financing cannot be put in place in a timely manner. For example, we might accelerate the time frame in which one or more of our assets is sold in order to free up capital.

We also want to report on the positive activity on the leasing front. We signed a new 20,000-square-foot lease at Parkway at Oak Hill with Survey And Mapping, Inc., a locally based surveying and engineering firm. This seven-year lease, along with two smaller leases completed in the fourth quarter, brings our occupancy at Parkway to 35%. We continue to see tenant prospect activity at all three of our assets that have vacancies, and we anticipate further leasing progress during early 2010.

The loan extension with Bank of America included a covenant that the Fund will not make any distributions during the term of the loan. This restriction is consistent with the recent policy of the Fund’s Board of Directors, driven by the economic climate, capital needs for near-term leasing, and the working capital needs of the Fund. The Board of Directors will continue to monitor the financial performance of the portfolio and evaluate the potential for operating distributions once the Bank of America loan is retired.

2009 was a successful year for the Value-Added Fund, and we are thankful for those successes in the midst of a challenging economy. We are also very thankful for your investment with us and look forward to 2010.

Kevin Hoover, MAI, CCIM

President, Wells Investment Management Company, LLC

FUND INVESTMENT STRATEGY

The Fund seeks to capture superior total returns for investors by selling each asset once its stabilized value has been achieved (target investment horizon 4–8 years). The Fund will create value through:

Enhanced leasing — new tenants and tenant retention

Tenant credit improvement — targeting “rising-star” tenants

Local market recovery and lease rate improvement

Property renovation and repositioning

Asset and property management operations

Please see Risk Factors on reverse.

OFFERING SUMMARY HIGHLIGHTS

The Fund offers the potential for a higher risk-adjusted return from underperforming office and industrial real estate investments across the U.S.

OFFERING DATES September 2005—September 2008

TOTAL EQUITY RAISED $51,664,669

PRICE PER UNIT $1,000

STRUCTURE Regulation “D” Private Placement

TARGET INVESTMENT

HORIZON 4–8 years*

CURRENT LEVERAGE 33% (50% leverage target)

*Although the Private Placement Memorandum allows for more time, we will work diligently to deliver the target return during a four- to eight-year period.

This informational piece must be read in conjunction with the Private Placement Memorandum (PPM) in order to understand fully all of the implications and risks of the Wells Mid-Horizon Value-Added Fund I offering. Wells Real Estate Funds is affiliated with the Dealer-Manager — Wells Investment Securities, Inc. — Member FINRA/SIPC.

Continued on reverse

WELLS MID-HORIZON VALUE-ADDED FUND I, LLC FACT SHEET

December 2009

PORTFOLIO UPDATE

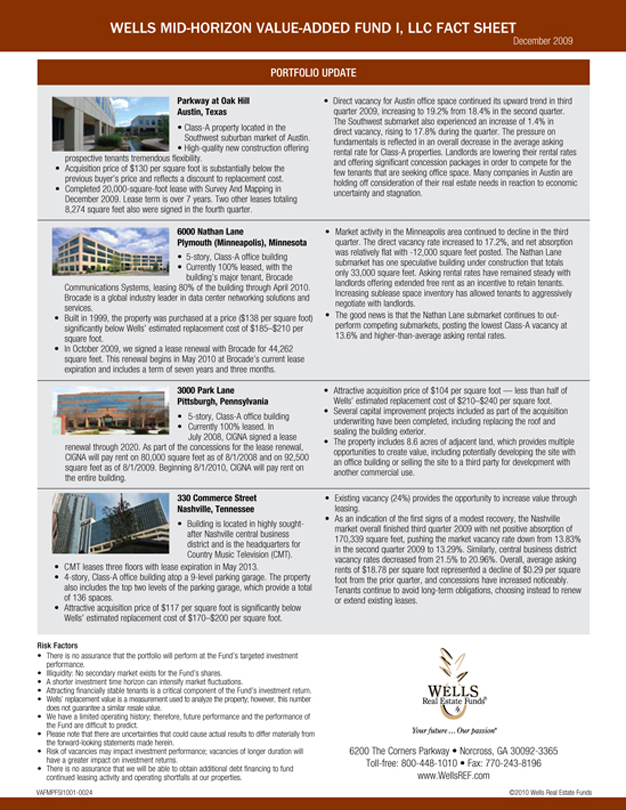

Parkway at Oak Hill Austin, Texas

Class-A property located in the Southwest suburban market of Austin.

High-quality new construction offering prospective tenants tremendous flexibility.

Acquisition price of $130 per square foot is substantially below the previous buyer’s price and reflects a discount to replacement cost.

Completed 20,000-square-foot lease with Survey And Mapping in December 2009. Lease term is over 7 years. Two other leases totaling 8,274 square feet also were signed in the fourth quarter.

Direct vacancy for Austin office space continued its upward trend in third quarter 2009, increasing to 19.2% from 18.4% in the second quarter. The Southwest submarket also experienced an increase of 1.4% in direct vacancy, rising to 17.8% during the quarter. The pressure on fundamentals is reflected in an overall decrease in the average asking rental rate for Class-A properties. Landlords are lowering their rental rates and offering significant concession packages in order to compete for the few tenants that are seeking office space. Many companies in Austin are holding off consideration of their real estate needs in reaction to economic uncertainty and stagnation.

6000 Nathan Lane Plymouth (Minneapolis), Minnesota

5-story, Class-A office building

Currently 100% leased, with the building’s major tenant, Brocade Communications Systems, leasing 80% of the building through April 2010. Brocade is a global industry leader in data center networking solutions and services.

Built in 1999, the property was purchased at a price ($138 per square foot) significantly below Wells’ estimated replacement cost of $185–$210 per square foot.

In October 2009, we signed a lease renewal with Brocade for 44,262 square feet. This renewal begins in May 2010 at Brocade’s current lease expiration and includes a term of seven years and three months.

Market activity in the Minneapolis area continued to decline in the third quarter. The direct vacancy rate increased to 17.2%, and net absorption was relatively flat with -12,000 square feet posted. The Nathan Lane submarket has one speculative building under construction that totals only 33,000 square feet. Asking rental rates have remained steady with landlords offering extended free rent as an incentive to retain tenants. Increasing sublease space inventory has allowed tenants to aggressively negotiate with landlords.

The good news is that the Nathan Lane submarket continues to out-perform competing submarkets, posting the lowest Class-A vacancy at 13.6% and higher-than-average asking rental rates.

3000 Park Lane Pittsburgh, Pennsylvania

5-story, Class-A office building

Currently 100% leased. In July 2008, CIGNA signed a lease renewal through 2020. As part of the concessions for the lease renewal, CIGNA will pay rent on 80,000 square feet as of 8/1/2008 and on 92,500 square feet as of 8/1/2009. Beginning 8/1/2010, CIGNA will pay rent on the entire building.

Attractive acquisition price of $104 per square foot — less than half of Wells’ estimated replacement cost of $210–$240 per square foot.

Several capital improvement projects included as part of the acquisition underwriting have been completed, including replacing the roof and sealing the building exterior.

The property includes 8.6 acres of adjacent land, which provides multiple opportunities to create value, including potentially developing the site with an office building or selling the site to a third party for development with another commercial use.

330 Commerce Street Nashville, Tennessee

Building is located in highly sought-after Nashville central business district and is the headquarters for Country Music Television (CMT).

CMT leases three floors with lease expiration in May 2013.

4-story, Class-A office building atop a 9-level parking garage. The property also includes the top two levels of the parking garage, which provide a total of 136 spaces.

Attractive acquisition price of $117 per square foot is significantly below Wells’ estimated replacement cost of $170–$200 per square foot.

Existing vacancy (24%) provides the opportunity to increase value through leasing.

As an indication of the first signs of a modest recovery, the Nashville market overall finished third quarter 2009 with net positive absorption of 170,339 square feet, pushing the market vacancy rate down from 13.83% in the second quarter 2009 to 13.29%. Similarly, central business district vacancy rates decreased from 21.5% to 20.96%. Overall, average asking rents of $18.78 per square foot represented a decline of $0.29 per square foot from the prior quarter, and concessions have increased noticeably. Tenants continue to avoid long-term obligations, choosing instead to renew or extend existing leases.

Risk Factors

There is no assurance that the portfolio will perform at the Fund’s targeted investment performance.

Illiquidity: No secondary market exists for the Fund’s shares.

A shorter investment time horizon can intensify market fluctuations.

Attracting financially stable tenants is a critical component of the Fund’s investment return.

Wells’ replacement value is a measurement used to analyze the property; however, this number does not guarantee a similar resale value.

We have a limited operating history; therefore, future performance and the performance of the Fund are difficult to predict.

Please note that there are uncertainties that could cause actual results to differ materially from the forward-looking statements made herein.

Risk of vacancies may impact investment performance; vacancies of longer duration will have a greater impact on investment returns.

There is no assurance that we will be able to obtain additional debt financing to fund continued leasing activity and operating shortfalls at our properties.

WELLS Real Estate Funds®

Your future… Our passion®

6200 The Corners Parkway Norcross, GA 30092-3365

Toll-free: 800-448-1010 Fax: 770-243-8196

www.WellsREF.com

VAFMPFSI1001-0024

©2010 Wells Real Estate Funds