UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 25, 2010

(Date of earliest event reported)

LABORATORY CORPORATION

OF

AMERICA HOLDINGS

| DELAWARE | 1-11353 | 13-3757370 | ||

| (State or other jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 358 SOUTH MAIN STREET, BURLINGTON, NORTH CAROLINA |

27215 | 336-229-1127 | ||

| (Address of principal executive offices) | (Zip Code) |

(Registrant's telephone number including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01. Regulation FD Disclosure

Summary information of the Company in connection with the presentation at the Jefferies 2010 Global Healthcare Services Conference on January 26, 2010.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Laboratory Corporation of America Holdings (Registrant) |

||||

| Date: January 25, 2010 | By: | /s/F. Samuel Eberts III | ||

| F. Samuel Eberts III, Chief Legal Officer and Secretary |

||||

New York, NY

January 26, 2010

Jefferies 2010 Global

Healthcare Services

Conference

2

This slide presentation contains forward-looking

statements which are subject to change based

on various important factors, including without

limitation, competitive actions in the marketplace

and adverse actions of governmental and other

third-party payors.

Actual results could differ materially from those

suggested by these forward-looking statements.

Further information on potential factors that

could affect the Company’s

financial results is

included in the Company’s Form 10-K for the

year ended December 31, 2008, and subsequent

SEC filings.

Forward Looking Statement

Introduction

3

Leading National

Lab Provider

Fastest growing national lab

$52 Billion market

Clinical, Anatomic and Genomic Testing

Serving clients in all 50 states and Canada

Foremost clinical trials testing business

Introduction

4

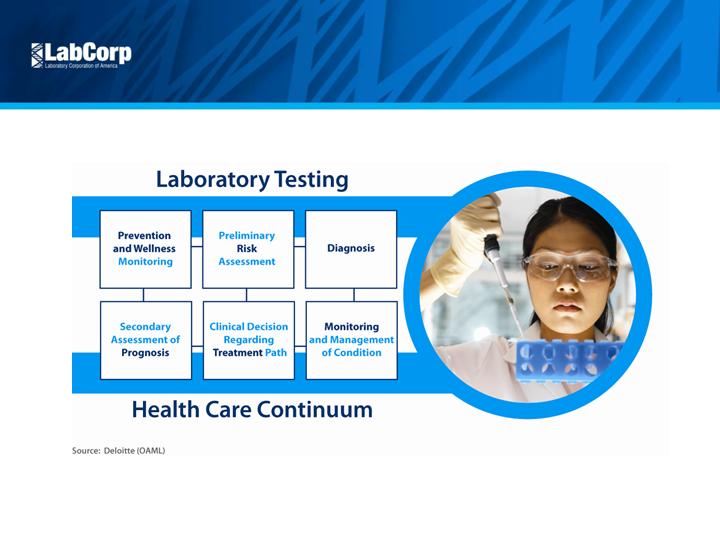

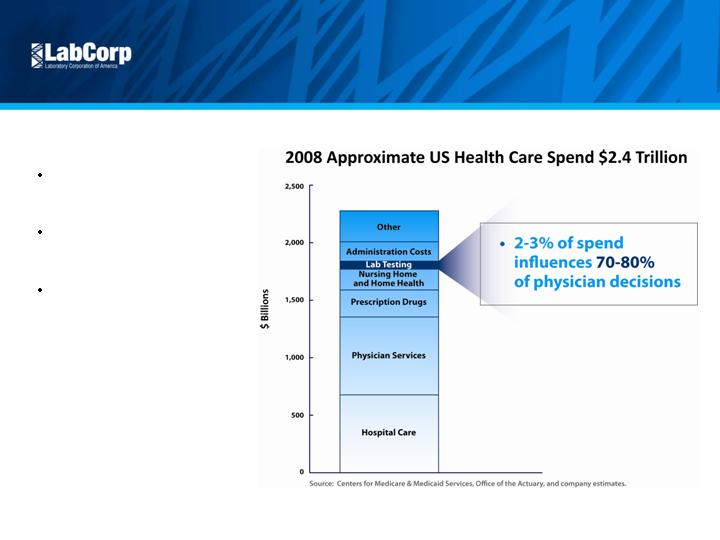

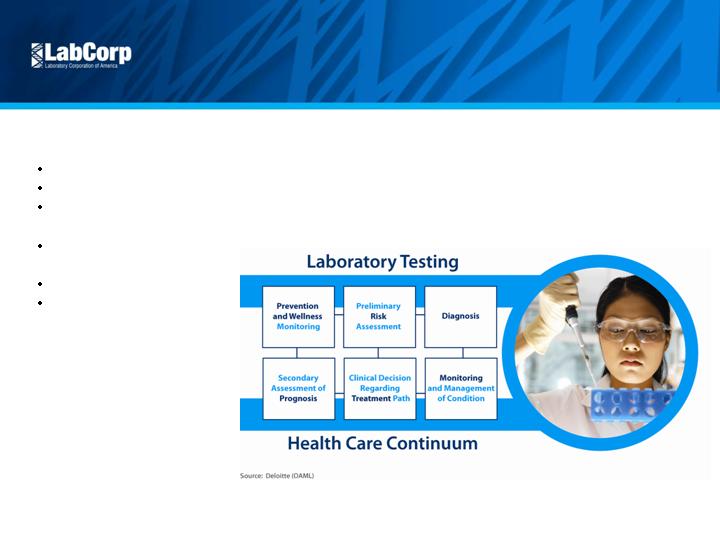

Valuable Service

Small component of total cost

influences large percentage

of clinical decisions

Screening, early detection,

and monitoring reduce

downstream costs

Companion diagnostics

improve drug efficacy and

reduce adverse drug effects

Attractive Market

5

Attractive Market

6

Growth Drivers

Aging population

Industry consolidation

Advances in genomics

Pharmacogenomics /

companion diagnostics

Cost pressures

Source: CDC National Ambulatory Medical Care Survey and Company Estimates

Attractive Market

7

Opportunity to

Take Share

5,100 independent labs

High cost competitors

Attractive Market

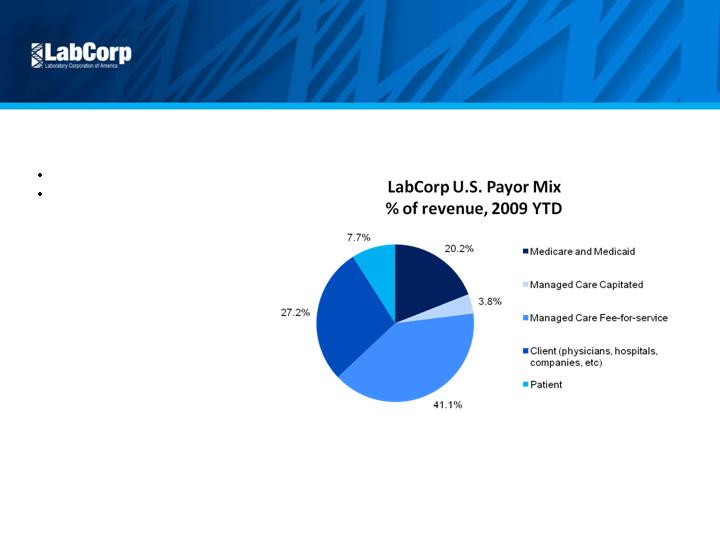

Diversified Payor Mix

No customer > 9% of revenue

Limited government exposure

8

Attractive Market

Diversified Test Mix

Esoteric 36% of revenue

Goal of 40% in 3 – 5 years

Higher priced business

9

Competitive Position

Scale and Scope

National infrastructure

Broad test offering

Managed care contracts

Economies of scale

10

Primary LabCorp Testing Locations*

Esoteric Lab Locations

(CET, CMBP, Dianon, Esoterix, Monogram Biosciences, NGI, OTS, US Labs, Viromed)

Patient Service Centers*

Competitive Position

11

Managed Care Relationships

Exclusive national laboratory for UnitedHealthcare

Sole national strategic partner for WellPoint

Significant national plans recently renewed or

extended on a multi-year basis, including

WellPoint, Cigna and Humana

Contracted with numerous local and

regional anchor plans

Scientific

Leadership

Introduction of new tests

Acquisitions and licensing

Collaborations with leading

companies and academic

institutions

Competitive Position

12

Competitive Position

13

Standardized and

Efficient Processes

Standardized lab and billing

IT systems

Automation of pre-analytics

Capacity rationalization

Logistics optimization

2010 Priorities

14

Our Focus

Profitable revenue growth

IT and client connectivity

Continue scientific

leadership

Maintain price

Control costs

2010 Priorities

15

Profitable Revenue Growth

Target specialty physicians with

breadth of menu and services

Educate payers and physicians on

value of LabCorp testing

Leverage assets from Monogram

acquisition

Continue to improve patient experience

2010 Priorities

16

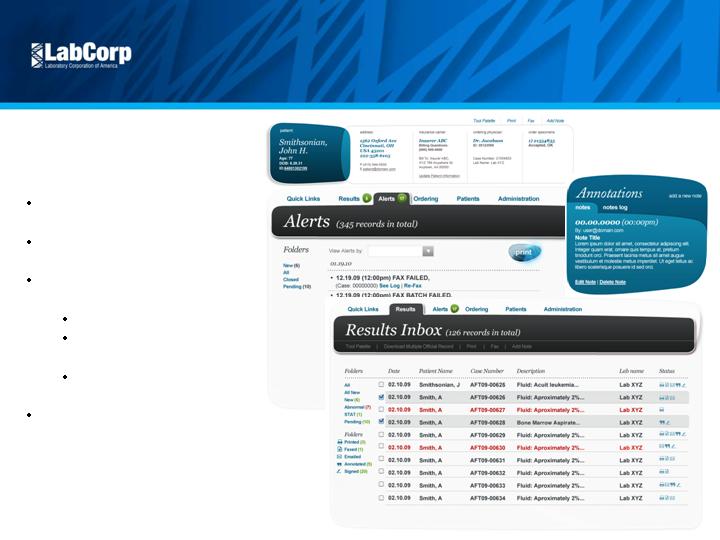

IT and Client

Connectivity

Enhance online services and

analytic tools

LabCorp Inside the Box for

superior connectivity

Improve Patient Experience

through:

Automated PSC workflow

Patient access via PHRs,

online appointments

Enterprise services

including VoIP

Continue “open platform” strategy

to maximize options for users

Continue Scientific

Leadership

Increase esoteric testing

Grow and enhance offerings in

personalized medicine:

Expand outcome improvement

programs

Develop and commercialize

companion diagnostics

2010 Priorities

17

Increase

Esoteric Testing

Introduction of new tests

Acquisitions and licensing

Collaborations with academic

institutions

Scientific Leadership

18

New Tests Include:

Collaborations Include:

BRAF Gene Mutation Detection

EGRF Mutation Analysis for Nonsmall-Cell Lung Cancer

Warfarin (P450 2C9 and VKORC1)

Clopidogrel CYP2C19 Genotyping

Duke University

National Jewish Health

Integrase – HIV Genotyping (GenoSure) and HIV Phenotyping (PhenoSense)

HERmark for Breast Cancer

????

Yale University

Enhanced Trofile

H1N1 – Flu Testing

Expand Outcomes

Improvement

Litholink kidney stone

CKD

Continual development of

valuable programs

Continue Scientific Leadership

19

Continue Scientific Leadership

20

Develop and

Commercialize

Companion Diagnostics

Invest in clinical trials

Relationships with biotech and

pharma companies

Promote key tests

K-RAS

HLA-B* 5701

BRAF Gene Mutation Detection

EGRF Mutation Analysis

CYP 450 2C19

Monogram Biosciences

Trofile

PhenoSense, PhenoSense GT

HERmark

“K-RAS testing should be routinely conducted in

all colorectal cancer patients immediately after

diagnosis to ensure the best treatment strategies

for the individual

Patient”

– Dr. Eric Van Cutsem, presenter at the June 2008 American

Society of Clinical Oncology meeting

FDA recommends genetic screening prior to

treatment with Abacavir

ROCKVILLE, Md -- July 24, 2008 -- The US Food and Drug Administration (FDA) has issued

an alert regarding serious, and sometimes fatal, hypersensitivity reactions (HSRs) caused by

abacavir (Ziagen) therapy in patients with a particular human leukocyte antigen (HLA) allele,

HLA-B* 5701.

Genetic tests for HLA-B*5701 are already available, and all patients should be screened for the

HLA-B*5701 allele before starting or restarting treatment with abacavir or abacavir-containing

medications.

“FDA has approved the expanded use of Selzentry…

to include adult patients with CCR5-tropic HIV-1

virus who are starting treatment for the first time.”

- ViiV Healthcare Press Release, November 20th, 2009

2010 Priorities

Maintain Price

Managed care stability; offsets

1.9% Medicare rate decrease

Focus on high-value tests

Promote outcome improvement

21

Control Costs

Continue focus on collections

and bad debt reduction

Optimize supply chain

Use efficiency gains to

improve patient experience

2010 Priorities

22

Excellent Performance

23

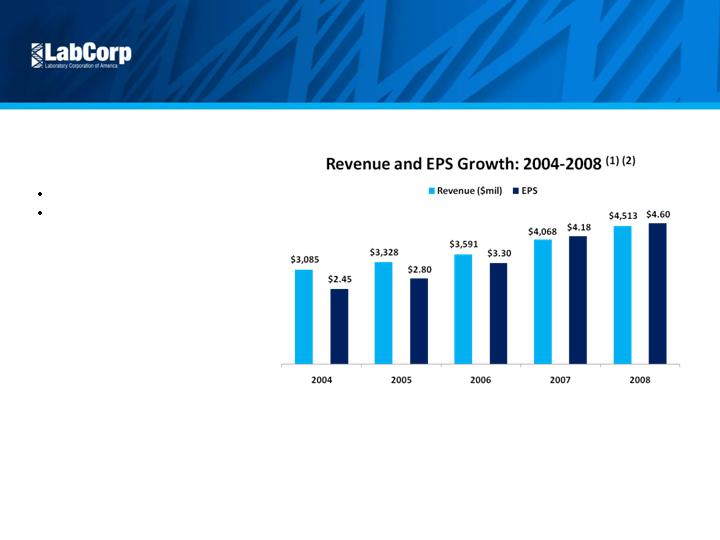

Revenue and

EPS Growth

10% Revenue CAGR

17% EPS CAGR

(1) Excluding the $0.09 per diluted share impact in 2005 of restructuring and other special

charges, and a non-recurring investment loss; excluding the $0.06 per diluted share

impact in 2006 of restructuring and other special charges; excluding the $0.25 per

diluted share impact in 2007 of restructuring and other special charges; excluding the

$0.44 per diluted share impact in 2008 of restructuring and other special items

(2) EPS, as presented, represents adjusted, non-GAAP financial measures. Diluted EPS,

as reported in the Company’s Annual Report were: $2.45 in 2004; $2.71 in 2005;

$3.24 in 2006; $3.93 in 2007; and $4.16 in 2008.

Excellent Performance

24

Leading Returns

Improving and leading returns

Leading EBIT margin

Excellent Performance

25

Cash Flow

10% OCF CAGR

$2.5 B+ share repurchase

Third Quarter and YTD 2009 Results

26

2009

2008

+/(-)

2009

2008

+/(-)

Revenue

1,185.1

$

1,135.1

$

4.4%

3,529.7

$

3,386.1

$

4.2%

Adjusted Operating Income

237.6

$

219.9

$

8.0%

733.0

$

717.2

$

2.2%

Operating Income Margin

20.0%

19.4%

60

bp

20.8%

21.2%

(40)

bp

Adjusted EPS

1.22

$

1.10

$

10.9%

3.74

$

3.48

$

7.5%

Operating Cash Flow

246.4

$

194.4

$

26.7%

637.7

$

565.6

$

12.7%

Less: Capital Expenditures

(22.7)

$

(41.5)

$

-45.3%

(77.1)

$

(120.4)

$

-36.0%

Free Cash Flow

223.7

$

152.9

$

46.3%

560.6

$

445.2

$

25.9%

Nine Months Ended Sept 30,

Three Months Ended Sept 30,

Supplemental Financial Information

27

YTD

Q1 09

Q2 09

Q3 09

2009

Bad debt as a percentage of sales

5.3%

5.3%

5.3%

5.3%

Days sales outstanding

52

50

48

48

A/R coverage (Allowance for Doubtful Accts. / A/R)

19.5%

20.6%

21.9%

21.9%

Other Financial Information

September 30, 2009

($ in million's)

Key Points

Critical position in health care delivery system

Attractive market

Strong competitive position - well positioned

to gain share

Leadership in personalized

medicine

Excellent cash flow

Strong balance sheet

Conclusion

28

29

©2009 LabCorp. All rights reserved. 6967-0409