Attached files

| file | filename |

|---|---|

| EX-10.1 - CATALYST GROUP HOLDINGS CORP. | ex10-1.htm |

| EX-10.2 - CATALYST GROUP HOLDINGS CORP. | ex10-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): January 15,

2010

CATALYST

GROUP HOLDINGS CORP.

(Exact

Name of Registrant as Specified in Its Charter)

POP

STARZ VENTURES 3, INC.

(Former

Name of Registrant)

Delaware

(State or

Other Jurisdiction of Incorporation)

|

000-53412

|

26-3142811

|

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

1739

Creekstone Circle

San

Jose, CA

|

95133

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

(408)

691-0806

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General

Instruction A.2. below):

|

o Written communications pursuant

to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

o Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

o Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

o Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Section

1 – Registrant’s Business Operations

Item

1.01 Entry into a Material Definitive Agreement

On

November 6, 2009 we entered into an agreement with Real Estate Promotional

Services, Inc., (“REPS”) a recently formed Florida corporation (the “Agreement”)

whereby we agreed to purchase all of the issued and outstanding shares of common

stock of REPS in consideration for the issuance of a convertible debenture in

the amount of $250,000. The convertible debenture provides for interest at the

rate of 10% per annum and will be due and payable six months from the closing

date of the transaction. The debenture may be converted into shares of the

Company’s common stock at the conversion rate of $1.00 per share at the option

of either the Company or Jeff Crowe, the sole shareholder of REPS. The

historical operations of the company were conducted in a sole-proprietorship

called REPS.

Prior to

the execution of the Agreement, there was no pre-existing relationship between

any officer or director of the Company or any officer, director or shareholder

of REPS.

FORWARD-LOOKING

INFORMATION

The

statements contained in this Form 8-K that are not historical fact are

forward-looking statements (as such term is defined in the Private Securities

Litigation Reform Act of 1995), within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. The forward-looking statements contained herein are

based on current expectations that involve a number of risks and uncertainties.

These statements can be identified by the use of forward-looking terminology

such as “believes,” “expects,” “may,” “will,” “should,” or “anticipates,” or the

negative thereof or other variations thereon or comparable terminology, or by

discussions of strategy that involve risks and uncertainties. The Company wishes

to caution the reader that its forward-looking statements that are not

historical facts are only predictions. No assurances can be given that the

future results indicated, whether expressed or implied, will be achieved. While

sometimes presented with numerical specificity, these projections and other

forward-looking statements are based upon a variety of assumptions relating to

the business of the Company, which, although considered reasonable by the

Company, may not be realized. Because of the number and range of assumptions

underlying the Company’s projections and forward-looking statements, many of

which are subject to significant uncertainties and contingencies that are beyond

the reasonable control of the Company, some of the assumptions inevitably will

not materialize, and unanticipated events and circumstances may occur subsequent

to the date of this report. These forward-looking statements are based on

current expectations and the Company assumes no obligation to update this

information. Therefore, the actual experience of the Company and the results

achieved during the period covered by any particular projections or

forward-looking statements may differ substantially from those projected.

Consequently, the inclusion of projections and other forward-looking statements

should not be regarded as a representation by the Company or any other person

that these estimates and projections will be realized. The Company’s actual

results may vary materially. There can be no assurance that any of these

expectations will be realized or that any of the forward-looking statements

contained herein will prove to be accurate.

Section

9 – Financial Statements and Exhibits

We

are in the process of filing an S1; expanded financial statements will be

provided in that filing which is anticipated to be in approximately 30

days.

Item

9.01 Financial Statements and Exhibits

Exhibit 10.1 Purchase & Share Exchange

Agreement

Exhibit 10.2 Convertible Debenture

2

LEVY

& ASSOCIATES

2101

NW CORPORATE BLVD. #317

BOCA

RATON, FL 33431

(561)

998-7770

AUDITOR’S

REPORT

TO THE

OWNERS

REPS

GRAPHIC DESIGN AND PRINTING

We have

audited the accompanying balance sheet of REPS GRAPHIC DESIGN AND PRINTING as of

December 31, 2007 and 2008, and the related statements of revenues and expenses,

changes in retained earnings, and cash flows for the years then

ended. These financial statements are the responsibility of

management. Our responsibility is to express an opinion on these

financial statements based on our audits.

We

conducted our audits in accordance with generally accepted auditing

standards. Those standards require that we plan and perform the audit

to obtain reasonable assurance about whether the financial statements are free

of material misstatements. An audit includes examining, on a test

basis, evidence supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting

principles used and significant estimates made by management, as well as

evaluating the overall financial statement presentation. We believe

that our audits provide a reasonable basis for our opinion.

In our

opinion, the financial statements referred to above present fairly, in all

material respects, the financial position of REPS GRAPHIC DESIGN AND PRINTING as

of December 31, 2007 and 2008 and the results of its operation and its cash flow

for the period then ended in conformity with generally accepted accounting

principles.

Respectfully

submitted,

Levy

& Associates

January

18, 2010

3

REPS

GRAPHIC DESIGN AND PRINTING

BALANCE

SHEET

AS

OF DECEMBER 31, 2008 AND 2007

| 2008 |

2007

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT

ASSETS:

|

||||||||

|

Cash

|

$ | 8,274 | $ | (4,636 | ) | |||

|

Trade

Receivables

|

8,252 | 4,618 | ||||||

|

Total

current assets

|

16,526 | (18 | ) | |||||

|

TRADE

ASSETS

|

$ | 16,526 | $ | (18 | ) | |||

|

LIABILITIES

AND OWNER'S EQUITY

|

||||||||

|

CURRENT

LIABILITIES:

|

||||||||

|

Sales

Tax Payable

|

$ | 179 | $ | 236 | ||||

|

Wells

Fargo Payable

|

7,605 | 1,938 | ||||||

|

Total

current liabilities

|

7,784 | 2,174 | ||||||

|

LONG-TERM

LIABILITIES

|

||||||||

|

Opticom

Services

|

15,765 | 29,850 | ||||||

|

Total

long-term liabilities

|

15,765 | 29,850 | ||||||

|

OWNER'S

EQUITY

|

||||||||

|

Owner's

Equity

|

$ | (32,042 | ) | $ | 33,928 | |||

|

Net

Income

|

25,019 | (65,970 | ) | |||||

|

Total

owner's equity

|

(7,023 | ) | (32,042 | ) | ||||

|

TOTAL

LIABILITIES AND OWNER'S EQUITY

|

$ | 16,526 | $ | (18 | ) | |||

See

accompanying notes and auditors' report.

4

REPS

GRAPHIC DESIGN AND PRINTING

STATEMENT

OF OPERATIONS AND OWNER’S EQUITY

FOR

THE YEARS ENDED DECEMBER 31, 2008 AND 2007

|

2008

|

2007 | |||||||

|

REVENUES

|

$ | 404,551 | $ | 503,124 | ||||

|

COST

OF GOODS SOLD

|

(56,972 | ) | (200,932 | ) | ||||

|

GROSS

PROFIT

|

347,579 | 302,192 | ||||||

|

OPERATING

EXPENSES:

|

||||||||

|

Automobile

Expense

|

233 | – | ||||||

|

Bad

Debt Expense

|

– | 300 | ||||||

|

Computer

Expense

|

4,050 | 3,791 | ||||||

|

Donations

|

1,207 | 704 | ||||||

|

Dues

and Subscriptions

|

2,817 | 6,951 | ||||||

|

Equipment

Rental

|

21,188 | 21,891 | ||||||

|

Insurance

|

5,339 | 4,395 | ||||||

|

Interest

|

23,291 | 20,332 | ||||||

|

Miscellaneous

|

188 | 13 | ||||||

|

Office

Expense

|

45,078 | 63,205 | ||||||

|

Postage

and Courier

|

10,336 | 13,754 | ||||||

|

Professional

Fees

|

3,538 | 2,904 | ||||||

|

Rent

|

14,513 | 14,948 | ||||||

|

Repairs

& Maintenance

|

43 | 231 | ||||||

|

Salaries

& Payroll Taxes

|

183,186 | 177,211 | ||||||

|

Supplies

|

1,014 | 18,207 | ||||||

|

Taxes

& Licenses

|

809 | 15,452 | ||||||

|

Telephone

|

3,335 | 1,627 | ||||||

|

Travel

|

36 | 367 | ||||||

|

Utilities

|

2,359 | 1,879 | ||||||

|

Total

Operating Expenses

|

322,560 | 368,162 | ||||||

|

INCOME

FROM OPERATIONS

|

25,019 | (65,970 | ) | |||||

|

OWNER'S

EQUITY, BEGINNING OF YEAR

|

(32,042 | ) | 33,928 | |||||

|

OWNER'S

EQUITY, END OF YEAR

|

$ | (7,023 | ) | $ | (32,042 | ) | ||

See

accompanying notes and auditors' report.

5

REPS

GRAPHIC DESIGN AND PRINTING

STATEMENT

OF CASH FLOWS

FOR

THE YEARS ENDED DECEMBER 31, 2008 AND 2007

|

|

2008

|

2007 | ||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net

Income (Loss)

|

$ | 25,019 | $ | (65,970 | ) | |||

|

Adjustments

to reconcile net income to total cash

|

||||||||

|

provided

by operating activities

|

||||||||

|

Decrease

(Increase) in:

|

||||||||

|

Accounts

Receivable

|

(3,634 | ) | 4,548 | |||||

|

Note

Receivable

|

– | 300 | ||||||

|

(Decrease)

Increase in:

|

||||||||

|

Sales

Tax Payable

|

(57 | ) | 9 | |||||

|

Lines

of credit borrowed, net of repayments

|

5,667 | 1,938 | ||||||

|

Net

cash provided by operating activities

|

26,995 | (59,175 | ) | |||||

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

| – | – | |||||||

|

Net

cash used by investing activities

|

– | – | ||||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Long-term

note net borrowing (repayments)

|

(14,085 | ) | 29,850 | |||||

|

Owner’s

distributions

|

– | (2,685 | ) | |||||

|

Net

cash used by financing activities

|

(14,085 | ) | 27,165 | |||||

|

NET

INCREASE / (DECREASE) IN CASH

|

12,910 | (32,010 | ) | |||||

|

CASH,

BEGINNING OF YEAR

|

(4,636 | ) | 27,374 | |||||

|

CASH,

END OF PERIOD

|

8,274 | (4,636 | ) | |||||

|

Supplemental

data:

|

||||||||

|

Interest

Paid

|

23,291 | 20,332 | ||||||

See

accompanying notes and auditors' report.

6

REPS

GRAPHIC DESIGN AND PRINTING

NOTES TO

FINANCIAL STATEMENTS

YEARS

ENDED DECEMBER 31, 2008 AND 2007

1. Nature

of Operations and Significant Policies

Nature of

Operations — REPS GRAPHIC DESIGN AND PRINTING (the

“Company”)

Real

Estate Promotional Services (REPS) is a Campbell, California, based company that

consults, designs, and delivers marketing collateral for the real estate

industry and individual/small businesses. The products include post cards,

glossy brochures, creative design and mailing services that promote the listing

property, real estate agent, small business or individual.

REPS

focuses on a local region. It consults designs and delivers real estate

marketing collateral and consulting to promote real estate agents and their

listed properties and help sell homes, as well as related industries like

mortgage and title company representatives who also need to promote themselves.

Recognizing similar needs of individuals and small business; REPS also services

this customer base as a small portion of the overall business. REPS was started

in 1998 by Jeff Crowe and is operated as sole proprietorship.

Use

of Estimates — Management uses estimates in preparing these financial

statements in accordance with Generally Accepted Accounting Principles. Those

estimates and assumptions affect the reported amounts of assets and liabilities,

the disclosure of contingent assets and liabilities, and the reported revenues

and expenses. Actual results could vary from the estimates that were

used.

Cash —

Cash consists of a bank checking account.

Accounts

Receivables — Accounts receivable are recorded when invoices are issued

and are presented in the balance sheet net of the allowance for doubtful

accounts. Accounts receivables are written off when they are determined to be

uncollectible. The Company considers accounts receivable to be fully

collectible; accordingly, no allowance for doubtful accounts is

required.

Income Taxes

— The Company is a sole proprietorship and taxed on the owner’s

individual tax return. As such, no provision for income taxes has been

accrued.

Revenue and Cost

Recognition — The Company recognizes revenues based on an accrual basis

in accordance with GAAP. Revenue is recognized when earned and shipment and

invoices have been executed. Selling, general, and administrative costs are

charged to expenses as incurred.

2. Current

and Long Term Debt

Current

Liability

The

current liability is a business line of credit from Wells Fargo which is

accessed by a credit card. The credit limit is $45,000 and the current interest

rate is 6.75%.

Long

Term Debt

The

long-term loan is a business instrument from Opticom Services in San Diego,

California. The term of the loan is 10 years beginning in January

2000. The loan was originally made to Jeff Crowe, individually, and

assumed by the Company in 2007. The loan carries an interest rate of 11.32% with

monthly payments of $1,395.68.

3. Concentration

of Credit Risk

The

Company maintains cash deposits in a commercial bank account, which at times may

exceed the amount covered by the insurance provided by the U. S. Federal Deposit

Insurance Corporation (FDIC). The Company has not experienced any losses in such

accounts and believes that there is no significant risk with respect to these

deposits.

4. Commitments

The

Company subleases office space from Campbell Express of the rate of $1,050 per

month. This sublease is a month-to-month arrangement with no written rental

agreement.

5. Subsequent

Event

Subsequent

to the date of these financial statements, the Company formed a Florida

corporation named Real Estate Promotional Services, Inc. (REPS) and transferred

all of its assets into this corporation. On November 6, 2009, this new entity

entered into an agreement with Catalyst Group Holdings Corp. (Catalyst) wherein

Catalyst agreed to purchase all of the issued and outstanding shares of common

stock of REPS for a convertible debenture in the amount of $250,000. The

convertible debenture provides for interest at the rate of 10% per annum and

will be due and payable six months from the closing date. The debenture may be

converted into shares of Catalyst’s common stock at the conversion rate of $1.00

per share at the option of either Catalyst or Jeff Crowe, the sole shareholder

of REPS.

7

REPS

GRAPHIC DESIGN AND PRINTING

BALANCE

SHEET

AS

OF SEPTEMBER 30, 2009

|

ASSETS

|

||||

|

CURRENT

ASSETS:

|

||||

|

Cash

|

$ | 9,233 | ||

|

Trade

Receivables

|

9,180 | |||

|

Total

current assets

|

18,413 | |||

|

TRADE

ASSETS

|

$ | 18,413 | ||

|

LIABILITIES

AND OWNER'S EQUITY

|

||||

|

CURRENT

LIABILITIES:

|

||||

|

Sales

Tax Payable

|

$ | 1,280 | ||

|

Wells

Fargo Payable

|

44,219 | |||

|

Total

current liabilities

|

45,499 | |||

|

LONG-TERM

LIABILITIES

|

||||

|

Opticom

Services

|

4,109 | |||

|

Total

long-term liabilities

|

4,109 | |||

|

OWNER'S

EQUITY

|

||||

|

Owner's

Equity

|

$ | (7,023 | ) | |

|

Net

Income

|

(24,172 | ) | ||

|

Total

owner's equity

|

(31,195 | ) | ||

|

TOTAL

LIABILITIES AND OWNER'S EQUITY

|

$ | 18,413 | ||

See

accompanying notes and auditors’ report.

8

REPS

GRAPHIC DESIGN AND PRINTING

STATEMENT

OF OPERATIONS AND OWNER’S EQUITY

FOR

THE PERIOD ENDED SEPTEMBER 30, 2009

|

REVENUES

|

$ | 240,144 | ||

|

COST

OF GOODS SOLD

|

(26,890 | ) | ||

|

GROSS

PROFIT

|

213,254 | |||

|

OPERATING

EXPENSES:

|

||||

|

Automobile

Expense

|

272 | |||

|

Computer

Expense

|

1,600 | |||

|

Donations

|

823 | |||

|

Dues

and Subscriptions

|

183 | |||

|

Equipment

Rental

|

12,956 | |||

|

Insurance

|

1,182 | |||

|

Interest

|

30,540 | |||

|

Miscellaneous

|

10,048 | |||

|

Office

Expense

|

25,499 | |||

|

Postage

and Courier

|

2,049 | |||

|

Professional

Fees

|

906 | |||

|

Rent

|

9,511 | |||

|

Repairs

& Maintenance

|

20 | |||

|

Salaries

& Payroll Taxes

|

136,730 | |||

|

Taxes

& Licenses

|

381 | |||

|

Telephone

|

2,708 | |||

|

Utilities

|

2,018 | |||

|

Total

Operating Expenses

|

237,426 | |||

|

INCOME

FROM OPERATIONS

|

(24,172 | ) | ||

|

OWNER'S

EQUITY, BEGINNING OF YEAR

|

(7,023 | ) | ||

|

OWNER'S

EQUITY, END OF YEAR

|

$ | (31,195 | ) |

See

accompanying notes and auditors’ report.

9

REPS

GRAPHIC DESIGN AND PRINTING

STATEMENT

OF CASH FLOWS

FOR

THE PERIOD ENDED SEPTEMBER 30, 2009

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

||||

|

Net

Income (Loss)

|

$ | (24,172 | ) | |

|

Adjustments

to reconcile net income to total cash

|

||||

|

provided

by operating activities

|

||||

|

Decrease

(Increase) in:

|

||||

|

Accounts

Receivable

|

(928 | ) | ||

|

(Decrease)

Increase in:

|

||||

|

Sales

Tax Payable

|

1,101 | |||

|

Lines

of credit borrowed, net of repayments

|

36,314 | |||

|

Net

cash provided by operating activities

|

12,615 | |||

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

||||

|

|

– | |||

|

Net

cash used by investing activities

|

– | |||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

||||

|

Long-term

note net borrowing (repayments)

|

(11,656 | ) | ||

|

Net

cash used by financing activities

|

(11,656 | |||

|

NET

INCREASE / (DECREASE) IN CASH

|

959 | |||

|

CASH,

BEGINNING OF YEAR

|

8,274 | |||

|

CASH,

END OF PERIOD

|

9,233 | |||

|

Supplemental

data:

|

||||

|

Interest

Paid

|

30,540 | |||

See

accompanying notes and auditors’ report.

10

REPS

GRAPHIC DESIGN AND PRINTING

STATEMENT

OF CASH FLOWS

FOR THE

PERIOD ENDED SEPTEMBER 30, 2009

1. Nature

of Operations and Significant Policies

Nature of

Operations — REPS GRAPHIC DESIGN AND PRINTING (the

"Company")

Real

Estate Promotional Services (REPS) is a Campbell, California, based company that

consults, designs, and delivers marketing collateral for the real estate

industry and individual/small businesses. The products include post cards,

glossy brochures, creative design and mailing services that promote the listing

property, real estate agent, small business or individual.

REPS

focuses on a local region. It consults designs and delivers real estate

marketing collateral and consulting to promote real estate agents and their

listed properties and help sell homes, as well as related industries like

mortgage and title company representatives who also need to promote themselves.

Recognizing similar needs of individuals and small businesses, REPS also

services this customer base as a small portion of the overall

business. REPS was started in 1998 by Jeff Crowe and is operated as a

sole proprietorship.

Use of

Estimates — Management uses estimates in preparing these financial

statements in accordance with Generally Accepted Accounting Principles. Those

estimates and assumptions affect the reported amounts of assets and liabilities,

the disclosure of contingent assets and liabilities, and the reported revenues

and expenses. Actual results could vary from the estimates that were

used.

Cash —

Cash consists of a bank checking account.

Accounts

Receivables — Accounts receivable are recorded when invoices are issued

and are presented in the balance sheet net of the allowance for doubtful

accounts. Accounts receivables are written off when they are determined to be

uncollectible. The Company considers accounts receivable to be fully

collectible; accordingly, no allowance for doubtful accounts is

required.

Income

Taxes — The Company is a sole proprietorship and taxed on the owner's

individual tax return. As such, no provision for income taxes has been

accrued.

Revenue and Cost

Recognition — The Company recognizes revenues based on an accrual basis

in accordance with GAAP. Revenue is recognized when earned and shipment and

invoices have been executed. Selling, general, and administrative costs are

charged to expenses as incurred.

2. Current

and Long Term Debt

Current

Liability

The

current liability is a business line of credit from Wells Fargo which is

accessed by a credit card. The credit limit is $45,000 and the current interest

rate is 6.75%.

Long

Term Debt

The

long-term loan is a business instrument from Opticom Services in San Diego,

California. The term of the loan is 10 years beginning in January

2000. The original loan was made to Jeff Crowe, individually, and

assumed by the Company in 2007. The loan carries an interest rate of 11.32% with

monthly payments of $1,395.68.

3. Concentration

of Credit Risk

The

Company maintains cash deposits in a commercial bank account, which at times may

exceed the amount covered by the insurance provided by the U. S. Federal Deposit

Insurance Corporation (FDIC). The Company has not experienced any losses in such

accounts and believes that here is no significant risk with respect to these

deposits.

4. Commitments

The

Company subleases office space from Campbell Express of the rate of $1,050 per

month. This sublease is a month-to-month arrangement with no written rental

agreement.

5. Subsequent

Event

Subsequent

to the date of these financial statements, the Company formed a Florida

corporation named Real Estate Promotional Services, Inc. (REPS) and transferred

all of its assets into this corporation. On November 6, 2009, this new entity

entered into an agreement with Catalyst Group Holdings Corp. (Catalyst) where

Catalyst agreed to purchase all of the issued and outstanding shares of common

stock of REPS for a convertible debenture in the amount of $250,000. The

convertible debenture provides for interest at the rate of 10% per annum and

will be due and payable six months from the closing date. The debenture may be

converted into shares of Catalyst's common stock at the conversion rate of $1.00

per share at the option of either Catalyst or Jeff Crowe, the sole shareholder

of REPS.

11

Pro-forma financial statements

|

8/31/2009

|

9/30/2009

|

|||||||||||

|

Catalyst

|

Rep's

Web

|

Proforma

|

||||||||||

|

Assets

|

||||||||||||

|

Cash

|

- | 9,233 | 9,233 | |||||||||

|

Accounts

Receivable

|

9,180 | 9,180 | ||||||||||

|

Due

from related parties

|

15,000 | - | 15,000 | |||||||||

|

Total

assets

|

15,000 | 18,413 | 33,413 | |||||||||

|

Liabilities

|

||||||||||||

|

Accounts

Payable

|

233 | 1,280 | 1,513 | |||||||||

|

Loan

payable

|

48,328 | 48,328 | ||||||||||

|

Due

to related parties

|

75,698 | - | 75,698 | |||||||||

|

Total

liabilities

|

75,931 | 49,608 | 125,539 | |||||||||

|

Additional

paid in capital

|

8,759 | 8,759 | ||||||||||

|

Common

stock

|

1,045 | 1,045 | ||||||||||

|

Retained

earnings

|

(70,735 | ) | (31,195 | ) | (101,930 | ) | ||||||

|

Total

Equity

|

(60,931 | ) | (31,195 | ) | (92,126 | ) | ||||||

|

Total

Liabilities & Equity

|

15,000 | 18,413 | 33,413 | |||||||||

|

Revenues

|

240,144 | 240,144 | ||||||||||

|

Cost

of Sales

|

- | (26,890 | ) | (26,890 | ) | |||||||

|

Gross

profit

|

213,254 | 213,254 | ||||||||||

|

G

& A

|

(67,881 | ) | (237,427 | ) | (305,308 | ) | ||||||

|

Net

income

|

(67,881 | ) | (24,173 | ) | (92,054 | ) | ||||||

12

REAL

ESTATE PROMOTIONAL SERVICES, INC.

The

Company

Real

Estate Promotional Services (REPS) is a Campbell, CA based company that

consults, designs and delivers marketing collateral for the real estate industry

and individual/small businesses. The products include post cards,

glossy brochures, creative design and mailing services that promote the listing

property, real estate agent, small business or individual.

REPS

focuses on a local region. It consults, designs and delivers real estate

marketing collateral and consulting to promote real estate agents and their

listed properties and help sell homes, as well as related industries like

mortgage and title company representatives who also need to promote

themselves. Recognizing similar needs of individuals and small

businesses, REPS also services this customer base as a small portion of the

overall business. REPS was started in 1998 by Jeff Crowe.

Relevant

Events and Acquisition

REPS was

launched with equipment, supplies and a contract with Cornish & Carey’s for

immediate business, allowing it to become profitable in its second year of

operation, 1999. In 2000, REPS acquired the design and print business

from a high-end collateral competitor in south San Jose, Opticom,

Inc. REPS purchased the piece of Opticom’s business for

$15,000. The client list that came with the purchase was for

Opticom’s high-end “showcase” customers and added this product segment to the

company portfolio.

The

Opportunity

Real

Estate

REPS is

uniquely positioned as the only marketing company solely focused on providing

individualized products and services to real estate agents and small/individual

businesses in its region. The local opportunity is over 20,000 real estate

agents in the San Francisco bay area and the Sacramento area that list houses

and use printed and web collateral to sell their

listings. Additionally, individuals that create their own business

need similar services and products as real estate agents.

Non- Real Estate

Opportunities: Individuals and Small Businesses

Individuals

starting small businesses see a similar scenario. In good economic

times, people feel OK to branch out on their own, and hence need a way to cost

effectively create an identity and marketing collateral for themselves. In tough

times with people losing their regular jobs, many will start consulting or start

a side business to try and bring in income. Again here, they will

need the same marketing materials.

In

Silicon Valley alone, there are over a hundred filings of “DBAs” per week where

people must publicly state they are going into business for

themselves. These filings are in local newspapers and some specific

newspapers focused on business in the area (i.e. Silicon Valley Business

Journal). This provides REPS with instant, continual flow of leads

every week.

These

customers typically need to get themselves established and presentable as a

business, so they will need an identity (logo, font and color scheme), business

cards, letterhead and envelopes. Some need a basic web

site.

Each

opportunity for these types of customers represents a potential of $399 to $599

per transaction, depending on the services they decide to use.

Business

Model

The

business model that has been used by REPS thus far has been to get new customers

by word of mouth, little to moderate promotion and through the purchase of

Opticom’s (formerly a full-service real estate marketing firm) collateral

business. The sales cycle is very short and decisions are made by

agents immediately.

For real

estate customers, the agent picks out a product and provides some vital

information. REPS faxes or emails a “proof” to the agent for approval

or changes. Upon acceptance, the job is printed and

delivered. Their credit card is billed upon completion of the job for

immediate payment and revenue is recognized.

For small

businesses or individuals there a very similar process is used, which is quick

turn, small print runs and creative design work.

13

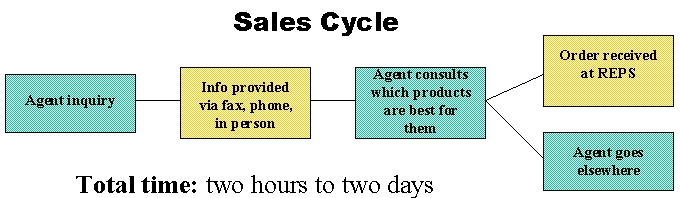

Sales

Cycle and Order Process Cycle

The sales

cycle for a collateral product is very short and many customers repeat

business. The effective pricing allows agents to “try them out” with

little monetary risk, typically about $100.

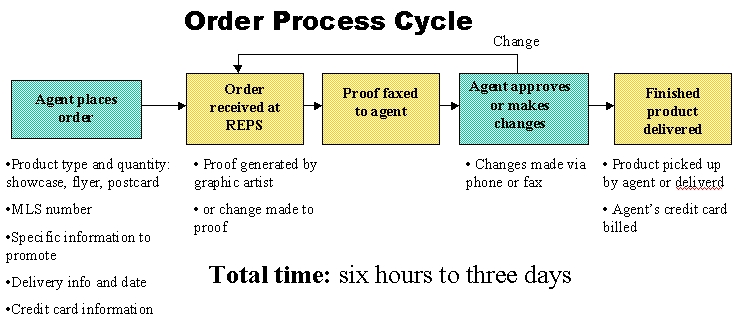

The order

process cycle is relatively quick, depending on the agent’s needs and

urgency. A product turnaround is promised in two to three days, but

REPS frequently completes jobs within 24 hours. An expedite fee is

charged for same day orders.

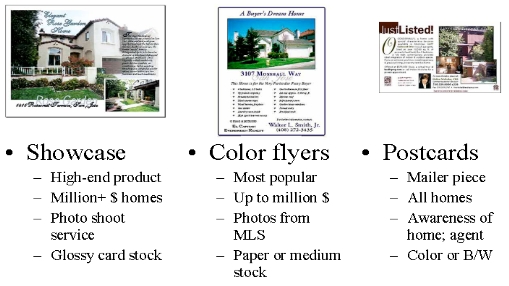

Products

and Services

REPS’

products are marketing services and collateral design to help real estate agents

sell their services and listed homes. All products and services are designed to

save agents’ time and ease their mind about marketing homes. Similar

products are offered to individuals and small businesses to promote their

businesses and products.

Post cards – “Just

Listed” or “Just Sold” cards are common for real estate and promoting a new

business for small businesses

Brochures – black and

white or color brochures combining text, graphics and images on light-weight or

heavy stock paper

14

Showcase – high-gloss

paper, high-quality brochure that contain multiple color photos and information

for high-end homes or products

Web site development

– small, personal web sites for agents or individuals

Most of

the services REPS provides are, or can be, included in the price of the

delivered products, such as delivery, design services, consulting and

photography of high-end homes. These services can be purchased without being

tied to a specific product.

Mailing

services

REPS has

direct mail capability, as well as a bulk mail indicia, so customers do not need

to get their own bulk permit. Direct mail minimum is 200 pieces and

the capability is up to 20,000 for a fast turnaround. Larger orders

can be accommodated, but will require additional time. REPS has

mailing software to manage mailing lists, clean up addresses and sort for the

lowest postage. Additionally, barcoding capability is available to

reduce postage to the lowest possible rate.

Consulting

services

These

services help agents determine which product(s) are best for their approach to

selling a listed home. Also, other selling tactics and strategies are

offered.

Design

services

The

design services are included in the development of marketing collateral, some

customers may want services for their non-real estate needs, such as personal

signs or cards. Design services are charged by the hour.

Photography

service

Photographs

can be taken of a house for use in a flyer or showcase, via digital camera or

standard film camera. This service can be available for small

businesses as well for person head-shot or product imaging.

Delivery

For

printing and delivery outside of the local area, REPS has contracted with

Kinko’s for printing and delivery for basic flyers. This allows REPS

to service customers with the same turnaround anywhere in the

country.

15

Customer

Segments, Buyer Decision Making Issues

REPS’

customer base can be divided in six segments:

|

·

|

Real

Estate Agents

|

|

·

|

Real

Estate Companies

|

|

·

|

Mortgage

Companies

|

|

·

|

Title

Companies

|

|

·

|

Individuals

operating a business

|

|

·

|

Small

businesses

|

Real

estate agents are REPS primary clients and represents 80% of its total business

today, with a growth plan to expand to individuals and small businesses and

balance the customer base. Real estate and related segments have very specific

needs in terms of the quality of the products and places a lot of value on their

time. Agents indicate they prefer to devote their energy to make contacts and

sell homes instead of developing marketing pieces for which they don’t have the

necessary equipment or time. At current REPS price levels, this customer segment

shows very low price sensitivity usually ordering the most expensive and best

quality products. Agents expect superior customer service like being able to

place orders via phone or fax and have the products available within a short

period. Once agents work with a reliable company, they demonstrate high loyalty

and are very unlikely to switch suppliers. Higher quality products and time

saving are the two main needs that REPS has been trying to satisfy during the

past three years.

Secondary

customers are mortgage and title companies and agents. These customer segments

share some of the real estate agent segment requirements in terms of high

quality products but are more price-sensitive and usually place large orders but

the purchase frequency rate is lower.

The

growth to include individuals and small businesses will diversify the customer

base and will leverage the current core competency and skill

set. Additionally, the average sale target for the new segments will

be $450, rather than the >$200 in the real estate segments.

Target

Market and Size

95% of

active agents use marketing collateral, like that produced by

REPS. In Silicon Valley, agents use REPS an in-office service or

themselves.

Customers

typically order from REPS more than once, but about 17% of the customers are the

“regulars,” that bring all their business there. These 100 or so

customers account for about 60% of the current year’s revenue.

A realtor

will have from one to twenty listings actively managed at any given

time. Gaining all the business from a single agent can be lucrative,

from $100 to $5,000 per year.

| REPS | Print Shops | Agents | |

| Time saving | Y | ? | N |

| Low cost | Y | N | Y |

| Reliability | Y | Y | ? |

| Flexibility | Y | ? | ? |

| High quality | Y | Y | ? |

| Full service | Y | ? | N |

| Ease of doing business | Y | ? | ? |

Competitive

Advantage

Their

small size provides them with three competitive advantages over their two main

competitors (agents doing it themselves and existing print shops)

|

1.

|

Ease

of doing business – small business and limited number of customers that

provide the majority of orders.

|

|

2.

|

Flexibility

– a small business can be flexible with variations and last minute

changes. Also, their wide variety of printers allow small jobs,

where their competition has larger scale

printers.

|

|

3.

|

Lower

cost, competitive prices - Due to REPS efficient equipment, the cost of

producing the marketing pieces is relatively low which allow it to price

its products lower than competitors or to have better

margins.

|

16

Marketing and Growth

Plan

With

REPS’ design and print process in a very efficient state, their process

capability (equipment and office space) can accommodate twice the current

business. With the fixed and overhead costs in place, the variable

costs to fill up the capacity is marginal, which is the labor required to design

and deliver.

Scalable

and Reproducible Process – Key to Success

Ensure

current process is scalable and easily reproducible. With the

ordering/approval and design processes in an efficient state, if an employee is

sick or out on vacation, business operations can continue

effectively. New innovations in printer/copiers, investing in new

lease agreements will expand capabilities or further improve efficiency, such as

variable data to individualize printed marketing material merging mailing lists,

as well as faster printing. With lease agreements including

consumable inks and maintenance, the COGS for print jobs is only the

paper.

Making

the process easily reproducible will enable quick launching of new office

operations when expanding to new cities.

Marketing

Budget

The

budget will be distributed between some direct mail campaign, presentations and

customer visits.

Marketing

expenses will be considerably increased. The marketing campaign will consist

mainly of direct mail and presentation to agents. Additionally, it could include

presentations on trade shows. The distribution of the costs will be the

following:

|

·

|

Direct

mail campaign. REPS is planning to send at least 10,000 pieces of mail at

$1/piece. It will be sent to agents in the Bay Area and

Sacramento.

|

|

·

|

Sales

presentation to agents. REPS will conduct at least two presentations per

week during the year.

|

Management

Team

Jeff

Crowe - Owner/founder

David Ho

– Founding employee and operations manager

Douglas

Crowe – Founding partner/Graphic Design

Cameron

T. Brett – Business Operations Manager

Risk factors

The

following is a summary of certain material risks facing our business that should

be carefully considered along with the other information contained or

incorporated by reference in this prospectus. If any other material risks of

which we are unaware later occur or become material, our business, financial

condition, and operating results could be materially harmed.

Risks

Related to our Business

Our

revenues and profitability are heavily dependent on prevailing prices for our

products and raw materials; if we are unable to pass cost increases along to our

customers our margins and operating income may decrease.

As a

producer, our revenue, gross margins and cash flow from operations are

substantially dependent on the prevailing prices we receive for our products and

the cost of our raw materials, neither of which we control. The factors

influencing the sales price of printed materials include the supply price of

paper and demand of our products and competition.

The price

of paper, our principal raw material, is subject to market volatility as a

result of numerous factors including, but not limited to, general economic

conditions, weather, transportation delays and other uncertainties that are

beyond our control. Due to such market volatility, we generally do not, nor do

we expect to, have long-term contracts with our suppliers. As a result, we

cannot assure you that the necessary raw materials will continue to be available

to us at prices currently in effect or acceptable to us. In the event raw

material prices increase materially, we may not be able to adjust our product

prices, especially in the short-term, to recover such cost

increases. If we are not able to effectively pass these cost

increases along to our customers, our margins will decrease and our operating

income will suffer accordingly.

17

Our

inability to continue to market our existing products and develop new products

to satisfy our consumers’ changing preferences and internet use could materially

adversely affect our operations and revenues.

The

printing industry is subject to changing consumer preferences and increase in

use of internet marketing, and shifts in consumer preferences may adversely

affect us if we misjudge such preferences. In addition, sales are substantially

dependent upon awareness and market acceptance of our products and brand by our

targeted consumers. We may be unable to achieve volume growth through

product and packaging initiatives. We also may be unable to penetrate new

markets. If our revenues decline, our business, financial condition and results

of operations will be adversely affected.

18

Economic

conditions have had and may continue to have an adverse effect on consumer

spending on our products.

The

worldwide economy is currently undergoing significant turmoil. The adverse

effect of a sustained international economic downturn, including sustained

periods of decreased consumer spending, high unemployment levels, or declining

consumer or business confidence, along with continued volatility and disruption

in the credit, capital and real estate markets, will likely result in reduced

demand for our products as consumers turn to cheaper substitute goods or

forego certain purchases altogether. To the extent the international

economic downturn continues or worsens, we could experience a further reduction

in sales volume, and if our operating costs and expenses are not reduced

accordingly, it would adversely affect our revenues and results of

operations.

Our

success depends substantially on the continued retention of certain key

personnel and our ability to hire and retain qualified personnel in the future

to support our growth.

If one or

more of our senior executives or other key personnel are unable or unwilling to

continue in their present positions, we may not be able to replace them easily

or at all, and our business may be disrupted and our financial condition and

results of operations may be materially and adversely affected. While we depend

on the abilities and participation of our current management team generally, we

have a particular reliance upon Mr. Jeffrey Crowe, Chief Executive Officer of

Rep’s Web. The loss of the services of Mr. Crowe for any reason could

significantly impact our business and results of operations. Competition for

senior management is intense and the pool of qualified candidates is very

limited. Accordingly, we cannot guaranty that the services of our

senior executives and other key personnel will continue to be available to us,

or that we will be able to find a suitable replacement for them if they were to

leave.

The relative lack of public company

experience of our management team may put us at a competitive

disadvantage.

Our management team lacks

public company experience, which could impair our ability to comply with legal

and regulatory requirements such as those imposed by the Sarbanes-Oxley Act of

2002 (“Sarbanes-Oxley”). Aside from our contract SEC Accountant, Bob Bates, the

individuals who now constitute our senior management have never had

responsibility for managing a publicly traded company. Such responsibilities

include complying with federal securities laws and making required disclosures

on a timely basis. Our senior management may not be able to implement programs

and policies in an effective and timely manner that adequately respond to the

increased legal, regulatory and reporting requirements associated with being a

publicly traded company. Our failure to comply with all applicable requirements

could lead to the imposition of fines and penalties and distract our management

from attending to the growth of our business.

We

may not have adequate or effective internal accounting controls.

We are

constantly striving to improve our internal accounting controls. We hope to

develop an adequate internal accounting control to budget, forecast, manage and

allocate our funds and account for them. There is no guarantee, however, that

any such improvements will be adequate or successful or that such improvements

will be carried out on a timely basis. Rep’s Web has historically had a basic,

loosely controlled bookkeeping system. As a result of these factors, we may

experience difficulty in establishing accounting and financial controls,

collecting financial data, budgeting, managing our funds and preparing financial

statements, books of account and corporate records and instituting business

practices that meet GAAP and SEC standards.

Rules

adopted by the Securities and Exchange Commission (the “SEC”) pursuant to

Section 404 of Sarbanes-Oxley require annual assessment of our internal control

over financial reporting, and attestation of this assessment by the Company’s

independent registered public accountants. The requirement that management

perform an assessment of internal controls over financial reporting first

applied to our Annual Report on Form 10-K for the fiscal year ending August 31,

2009 and the attestation requirement of management’s assessment by our

independent registered public accountants will first apply to our Annual Report

on Form 10-K for the fiscal year ending August 31, 2010. The standards that must

be met for management to assess the internal control over financial reporting as

effective are relatively new and complex, and require significant documentation,

testing and possible remediation to meet the detailed standards. Our lack of

budget to cover the costs associated with Section 404 implementation may cause

us to declare an adverse opinion on the controls audit. If, in the future,

management identifies one or more material weaknesses in our internal controls

over financial reporting, or our external auditors are unable to attest that our

management’s report is fairly stated or to express an opinion on the

effectiveness of our internal controls, this could result in a loss of investor

confidence in our financial reports, have an adverse effect on our stock price

and/or subject us to sanctions or investigation by regulatory

authorities.

19

Our operating

history may not serve as an adequate basis to judge our future prospects and

results of operations.

Although

Rep’s Web revenues have grown since its inception, we cannot guaranty that we

will maintain profitability or that we will not incur net losses in the future.

We will continue to encounter risks and difficulties including the potential

failure to:

|

•

|

obtain

sufficient working capital to support our

expansion;

|

|

•

|

expand

our product offerings and maintain the high quality of our

products;

|

|

•

|

manage

our expanding operations and continue to fill customers’ orders on

time;

|

|

•

|

maintain

adequate control of our expenses allowing us to realize anticipated

revenue growth;

|

|

•

|

implement

our product development, marketing, sales, and acquisition strategies and

adapt and modify them as

needed;

|

|

•

|

anticipate

and adapt to changing conditions in the industry resulting from changes in

mergers and acquisitions involving our competitors, technological

developments and other significant competitive and market

dynamics.

|

If we are

not successful in addressing any or all of the foregoing risks, our business may

be materially and adversely affected.

We

will encounter substantial competition in our business and any failure to

compete effectively could adversely affect our results of

operations.

There are

currently a number of well-established companies producing products that compete

directly with our product offerings, and some of those competitors have

significantly more financial and other resources than we possess. We anticipate

that our competitors will continue to improve their products and to introduce

new products with competitive price and performance characteristics. Aggressive

marketing or pricing by our competitors or the entrance of new competitors into

our markets could have a material adverse effect on our business, results of

operations and financial condition.

We

may not be able to successfully introduce new products, which could decrease our

profitability.

Our

future business and financial performance depends, in part, on our ability to

successfully respond to consumer preference by introducing new products and

improving existing products. We incur significant development and marketing

costs in connection with the introduction of new products. Successfully

launching and selling new products puts pressure on our sales and marketing

resources, and we may fail to invest sufficient funds in order to market and

sell a new product effectively. If we are not successful in marketing

and selling new products, our results of operations could be materially

adversely affected.

We may need additional capital to

fund our future operations and, if it is not available when needed, we may need

to reduce our planned development and marketing efforts, which may reduce our

sales revenues.

We

believe that our existing working capital, along with cash from operations, will

allow us to meet our working capital requirements for 2010. However,

if cash from future operations is insufficient, or if cash is used for other

currently unanticipated uses, we may need additional capital from outside

sources. Our ability to raise capital in the future will depend on a number of

factors, including our financial condition and results of operations and the

conditions in the relevant financial markets. We cannot assure you that

additional capital, if required, will be available on acceptable terms, or at

all. If we are unable to obtain financing on a timely basis and on acceptable

terms, we may be required to reduce the scope of our planned expansions, product

development and marketing efforts, and in turn our financial position,

competitive position, growth and profitability may be adversely

affected.

To the

extent that we do raise additional capital through the sale of equity or

convertible debt securities, the issuance of such securities would result in

dilution of the shares held by existing stockholders and could provide

purchasers certain rights, preferences and privileges senior to our Common

Stock.

20

We may not be

able to effectively control and manage our growthin order to meet

demand, and a failure to do so could adversely affect our operations and

financial condition.

If our

business and markets continue to grow and develop, it will be necessary for us

to finance and manage our growth effectively in order to meet demand. In

addition, we may face challenges in expanding our current facilities,

integrating acquired businesses with our own, and managing expanding product

offerings. We may not respond quickly enough to the increased demands caused by

such growth on our existing management, workforce and facilities. Failure to

effectively deal with such increased demands could interrupt or adversely affect

our operations and cause production backlogs, longer product development time

frames and administrative inefficiencies.

Our

business and results may be subject to disruption from work stoppages, terrorism

or natural disasters.

Our

operations may be subject to disruption for a variety of reasons, including work

stoppages, acts of war, terrorism, pandemics, fire, earthquake, flooding or

other natural disasters. If a major natural disaster were to occur in either of

the regions where our facilities or main offices are located, our facilities or

offices could be damaged or destroyed. Such a disruption could result in the

temporary or permanent loss of critical data, suspension of operations, delays

in shipments of product, and disruption of business generally, which would

adversely affect our revenue and results of operations.

Critical Success

Factors

A key to

success will be REPS ability to execute on the marketing promotion to gain

market share in the bay area and expand in major cities across the

US. During the growth phase, REPS needs to build on a model that is

very open, but difficult to duplicate, where customer service, flexibility and

the fastest turnaround delivery are a given.

Additionally,

the financial ability to implement marketing and growth plans is critical to

expand the proven process to service a large customer base.

21

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Catalyst Group Holdings Corp. | |||

|

Date:

January 22, 2010

|

By:

|

/s/ Kenneth Green | |

| Kenneth Green | |||

| Chief Executive Officer | |||

22