Attached files

| file | filename |

|---|---|

| 8-K - EGPI FIRECREEK, INC. | v171994_8k.htm |

| EX-10.3 - EGPI FIRECREEK, INC. | v171994_ex10-3.htm |

| EX-10.8 - EGPI FIRECREEK, INC. | v171994_ex10-8.htm |

| EX-10.2 - EGPI FIRECREEK, INC. | v171994_ex10-2.htm |

| EX-10.5 - EGPI FIRECREEK, INC. | v171994_ex10-5.htm |

| EX-10.6 - EGPI FIRECREEK, INC. | v171994_ex10-6.htm |

| EX-10.4 - EGPI FIRECREEK, INC. | v171994_ex10-4.htm |

| EX-10.1 - EGPI FIRECREEK, INC. | v171994_ex10-1.htm |

| EX-10.7 - EGPI FIRECREEK, INC. | v171994_ex10-7.htm |

________________________________

(________)

________________________________

________________________________

________________________________

Telephone: (_____)

_______________

Facsimile:

(_____) ________________

Attorney

for St. George Investments, LLC

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS

FIRST

MUNICIPAL DISTRICT

COUNTY

DEPARTMENT – LAW DIVISION

|

ST.

GEORGE INVESTMENTS, LLC, an

Illinois limited liability company, Plaintiff,

vs.

EGPI

FIRECREEK, INC., a Nevada

corporation, Defendant.

|

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

|

JUDGMENT

BY CONFESSION

Case

No.

Judge

|

Pursuant

to 735 ILCS 5/2-1301(c) and the affidavit of counsel for St. George Investments,

LLC, an Illinois limited liability company, its successors or assigns (“St. George Investments”), the

Court hereby enters judgment against EGPI Firecreek, Inc., a Nevada corporation

(“Defendant”), as

follows:

1. Defendant

failed to comply with the terms of that certain Convertible Promissory Note

dated January 15, 2010, made by Defendant in favor of St. George Investments and

executed in Cook County, Illinois, attached hereto as Exhibit A (the “Note”), in that Defendant

failed to make a required payment or payments thereunder.

2. By

virtue of Defendant’s default and violation of the Note, judgment in favor of

St. George Investments is hereby entered against Defendant in the amount of

$86,000.00, plus costs and accrued and unpaid interest, less any payments previously

made by Defendant, which net amount is $________________ (the “Judgment

Amount”).

3. Interest

shall accrue on the Judgment Amount at the rate of eighteen percent (18%) per

annum until all amounts due under the terms of this Judgment by Confession are

paid to St. George Investments.

4. It

is agreed that this Judgment by Confession shall not be filed or recorded by St.

George Investments until or unless Defendant fails to pay amounts due, when due,

under the Note.

DATED this ____day of ___________,

20___.

|

BY

THE COURT

|

|

|

|

First

Municipal District Court

Judge

|

2

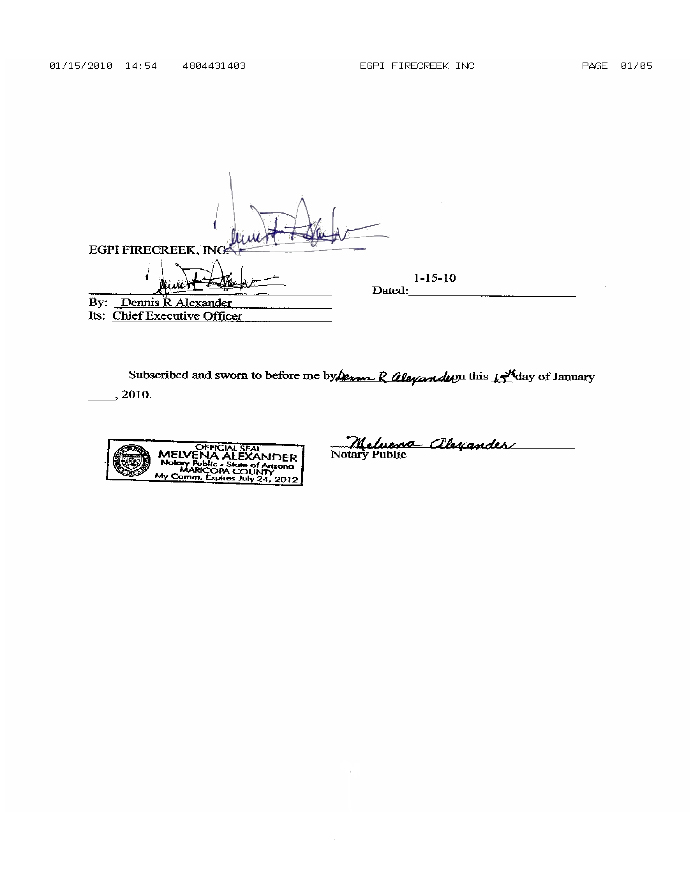

CONSENT

TO ENTRY OF JUDGMENT BY CONFESSION

|

__________________

COUNTY

|

)

|

|

)

ss.

|

|

|

STATE

OF __________________

|

)

|

Defendant, EGPI Firecreek, Inc., a

Nevada corporation (“Defendant”) hereby knowingly

and voluntarily waives service of process and consents to the entry of this

Judgment by Confession at the request of counsel for St. George Investments,

LLC, an Illinois limited liability company, its successors or assigns (“St. George Investments”), if

an Event of Default (as defined in that certain Convertible Promissory Note

dated of even date herewith (the “Note”))

occurs. The Judgment Amount (as defined in the Judgment by

Confession) shall be all unpaid amounts accrued and owing under the Note at the

time the Judgment by Confession is filed. St. George Investments

agrees it will not file the Judgment by Confession unless and until an Event of

Default has occurred; provided, however, that upon an

Event of Default, St. George Investments shall be entitled to immediately file

such Judgment by Confession in ex parte

fashion. St. George Investments’s counsel shall provide the Court

with an affidavit stating that Defendant has failed to abide by and satisfy the

terms of the Note and stating the Judgment Amount.

3

4

EXHIBIT

A

CONVERTIBLE

PROMISSORY NOTE

5