Attached files

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A1

Current Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 15, 2009

SUNSHINE BIOPHARMA, INC.

(Exact name of small business issuer as specified in its charter)

MOUNTAIN WEST BUSINESS SOLUTIONS, INC.

(Former Name)

|

Colorado |

000-0-52898 |

20-5566275 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer ID No.) |

6100 Royalmount Ave.

Montreal, Quebec, Canada H4P 2R2

(Address of principal executive offices)

9844 W Powers Circle

Littleton, CO 80123

(Former Address)

(514) 496-5197

(Issuer's Telephone Number)

Item 2.01 Completion Of Acquisition Or Disposition Of Assets.

Effective October 15, 2009, we executed an agreement to acquire Sunshine Biopharma, Inc., a Colorado corporation (“SBI”), in exchange for the issuance of 21,962,000 shares of our Common Stock and 850,000 shares of Convertible Preferred Stock, each convertible into twenty (20) shares of our Common Stock (the “Agreement”). As a result of this transaction our officers and directors resigned their positions with us and were replaced by our current management. See Item 5.02, below. The effectiveness of the Agreement was conditional upon various conditions being satisfied, including the filing of our Form 10-K for our fiscal year ended August 31, 2009 and SBI changing its name to Sunshine Etopo, Inc. As of the date of this report, these conditions have been satisfied and Sunshine Etopo (formerly SBI) is now a wholly owned subsidiary of our Company. Also as a result of this transaction we have changed our name to “Sunshine Biopharma, Inc.”

We entered into this transaction because of our former management’s belief that by doing so we will significantly increase our shareholders’ future opportunity to enhance the value of their respective ownership in our Company. In addition, our former Board of Directors approved a “spin-off” of our wholly owned subsidiary company Mountain West Beverage, Inc. The terms of this “spin-off” provide for a dividend to be issued to our shareholders of one share of common stock for every share that our shareholders owned as of October 15, 2009, the record date of the dividend.

DESCRIPTION OF BUSINESS-PLAN OF OPERATION

As a result of the transaction described above we have revised our current business plan to that of a pharmaceutical company focused on the research, development and commercialization of drugs for the treatment of various forms of cancer. Our lead compound, Difluoro-Etoposidetm, a multi-purpose anti-tumor compound, is expected to enter Phase I clinical trials in 2010. We have licensed our technology on an exclusive basis from Advanomics Corporation, a privately held Canadian company (“Advanomics”), and we are planning to initiate our own R&D program as soon as practicable, once financing is in place. There are no assurances that we will obtain the financing necessary to allow us to implement this aspect of our business plan, or to enter clinical trials.

Carbon-Difluoride Technology

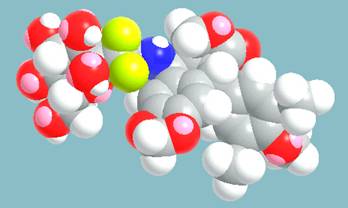

Many therapeutically important compounds contain diester bonds that link different parts of the molecule together. Diester bonds are naturally unstable often leading to suboptimal performance when the molecule is administered to patients. Diester bonds have specific three-dimensional, as well as electrostatic properties that cannot be easily mimicked by other bonds. Bonds that do not mimic the diester bond correctly invariably render the compound inactive. In collaboration with L’Institut National des Sciences Appliquées de Rouen in France (“INSA”), Advanomics has developed a way to replace the diester bond with a Carbon-Difluoride bond which acts as a diester isostere. An isostere is a different chemical structure that mimics the properties of the original. In the body, Carbon-Difluoride compounds are resistant to metabolic degradation but recognized similarly to the diester compounds (See Figure 1).

Figure 1

While no assurances can be provided, we are planning to expand our product line through acquisitions and/or in-licensing as well as in-house research & development.

Our Lead Compound (Adva-27a)

Our initial drug candidate is Difluoro-Etoposidetm (Adva-27a), a Carbon-Difluoride derivative of Etoposide, targeted for various forms of cancer. If sufficient funding can be obtained, Difluoro-Etoposidetm is expected to enter Phase I clinical trials in Canada during 2010. Etoposide is currently on the market and has been for over 20 years. It is sold under different brand names by various drug companies including, VePesid, VP-16, Etopophos and Vumon or Teniposide (Bristol-Myers Squibb, the original developer), Toposar (Sicor/Pfizer), Lastet (Nippon Kayaku Ltd) and Etoposide (TEVA, Bedford Laboratories, Supergen, American Pharmaceutical Partners, Watson Pharmaceuticals, and Genpharm). Etoposide is an effective anti-tumor compound and is currently in use to treat various types of cancer including leukemia, lymphoma, testicular cancer, breast cancer, lung cancer, brain cancer, prostate cancer, bladder cancer, colon cancer, ovarian cancer, liver cancer and several other forms of cancer. It is also being tested in clinical trials against other types of cancer, such as Kaposi's sarcoma. Etoposide is administered both intravenously and orally as liquid capsules.

This Etoposide compound which is currently in use suffers from molecular instability leading to reduced efficacy and high toxicity. Using its Carbon-Difluoride platform technology (see Figure 1), Advanomics has constructed several Difluoro derivatives of Etoposide by replacing the labile diester bond between the sugar and the toxin moieties of the existing Etoposide molecule with a Carbon-Difluoride bond (Figure 1). All Difluoro substituted constructs were found to be completely stable. Advanomics subsequently tested these constructs for their ability to kill cancer cells in vitro by conducting side-by-side experiments against the standard Etoposide compound. The results of these studies, which have been published in our patent application PCT/FR2007/000697, are summarized in Table 1. One of the constructs, Adva-27a, showed enhanced cancer cell killing activity over the existing Etoposide molecule (see Table 1).

This new compound, which we call Difluoro-Etoposidetm, is entering Phase I clinical trials in Canada in 2010. Subject to receipt of financing, we anticipate the Phase I clinical trials to be completed by late 2010 at which time we will apply for limited marketing approval (see Clinical Trials below).

Table 1

Clinical Trials

Advanomics is entering Phase I clinical trials for our lead compound, Difluoro-Etoposidetm, in Canada in 2010. The planned clinical trials for small-cell lung cancer indication will be carried out at the Jewish General Hospital, one of the McGill University Hospital Centers in Montreal (Canada). In addition, Advanomics is planning to conduct Phase I clinical trials on Multi-Drug-Resistant breast cancer patients at Hotel Dieu Hospital, one of the University of Montreal Hospital Centers. All aspects of the planned clinical trials in Canada will employ FDA standards at all levels. We anticipate the clinical trials to begin in early 2010 and be completed within twelve (12) months from the date of commencement, at which time we together with our licensor will file for limited marketing approval with the regulatory authorities in Canada and the FDA in the U.S. (see Marketing below).

Marketing

According to the American Cancer Society, nearly 1.5 million new cases of cancer are diagnosed in the U.S. each year. Given the terminal and limited treatment options available for the indications Advanomics is planning to study, we anticipate being granted limited marketing approval for our Difluoro-Etoposidetm following receipt of funding and a successful Phase I. There are no assurances that either will occur. Such limited approval will allow us to make the drug available to various hospitals and health care centers for experimental therapy/further studies, thereby generating some revenues. As with the existing Etoposide, our Difluoro-Etoposidetm is anticipated to be usable to treat virtually all forms of cancer and supervising physicians are at liberty to prescribe it once it is available on the market. Similarly to the existing Etoposide, our Difluoro-Etoposidetm product will be a single-treatment blister-pack comprised of 20 gel-caps each containing 50 milligrams of Difluoro-Etoposidetm for a total of 1 gram per pack.

Intellectual Property

We are the exclusive licensee for the US territory of Advanomics’ Difluoro-Etoposidetm which is covered by international patent applications filed on April 25, 2006 (PCT/FR2007/000697). This patent, which is issued in France and still pending elsewhere, is owned by L’Institut National des Sciences Appliquées de Rouen (France) and is licensed exclusively on a worldwide basis to Advanomics Corporation, who has subsequently issued to us an exclusive license for the US.

Our Lead Anti-Cancer Compound in 3D

Property

We have moved our principal place of business to 6100 Royalmount Ave., Montreal, Quebec, Canada H4P 2R2. This is also the location of our licensor, Advanomics Corporation, who is providing this space to us on a rent free basis as of the date of this report. If and when we are able to secure financing we expect that we will pay rent commensurate with rents for similar locations in Montreal, Canada. Our current space consists of approximately 100 square feet of executive office space and 250 square feet of laboratory space. We anticipate that this will be sufficient for our needs for the foreseeable future.

Government Regulations

Our existing and proposed business operations are subject to extensive and frequently changing federal, state, provincial and local laws and regulations. We will be subject to significant regulations in the US in order to obtain the approval of the Federal Drug Administration (“FDA”) to offer our product. The approximate procedure for obtaining FDA approval involves an initial filing of an IND (Innovative New Drug) or an NDA (New Drug Application) application following which the FDA would give the go ahead with Phase I clinical (human) trials. Following completion of Phase I, the results are filed with the FDA and a request is made to proceed to Phase II. Similarly, following completion of Phase II the data are filed with the FDA and a request is made to proceed to Phase III. Following completion of Phase III, a request is made for marketing approval. Depending on various issues and considerations, the FDA could provide limited marketing approval on a humanitarian basis if the drug treats terminally ill patients with limited treatment options available. Part of what may be required to be included in the IND are animal studies (xenografts and toxicity studies). Such studies have not as yet been carried out. We also have not as of this date made any filings with the FDA or other regulatory bodied in other jurisdictions. We have however had extensive discussions with clinicians at the Jewish General Hospital in Montreal where we plan to undertake our initial Phase I study and they believe that Health Canada is likely to grant us a so-called fast-track process on the basis of the terminal nature of the cancer which we will be treating.

Employees

As of the date of this report we have three (3) employees, our management. We anticipate that if we receive financing we will hire additional employees in the areas of accounting, regulatory affairs, marketing and laboratory personnel.

Competition

We will be competing with publicly and privately held companies engaged in developing a cure for cancer. There are numerous other entities engaged in this business that have greater resources, both financial and otherwise, than the resources presently available to us. Nearly all major pharmaceutical companies including Amgen, Genentech, Pfizer, Bristol-Myers Squibb and, Novartis, to name just a few, have on-going anti-cancer drug development program and some of the drug they may develop could be in direct competition with our drug. Also, a number of small companies are also working in the area of cancer and could develop drugs that may be in competition with ours. However, none of these competitor companies can use molecules similar to ours as they would be infringing our patents.

RISK FACTORS

An investment in our Common Stock is a risky investment. In addition to the other information contained in this Report, prospective investors should carefully consider the following risk factors before purchasing shares of our Common Stock. We believe that we have included all material risks.

RISKS RELATED TO OUR OPERATIONS

We may not be able to continue as a going concern or fund our existing capital needs.

Our independent registered public accounting firm included an explanatory paragraph in their report included herein on our financial statements related to the uncertainty in our ability to continue as a going concern. The paragraph stated that we do not have sufficient cash on-hand or other funding available to meet our obligations and sustain our operations, which raises substantial doubt about our ability to continue as a going concern. Our cash and cash equivalents were sufficient to fund our existing development commitments, indebtedness and general operating expenses through September 30, 2009, however, we will not be generating any product-based revenues or realizing cash flows from operations in the near term, if at all, and may not have sufficient cash or other funding available to complete our anticipated business activities during 2010.

We have incurred losses in the past and expect to incur greater losses until we implement our business plan.

We are a development stage company and we have not yet begun generating revenues and we do not expect to begin generating revenues until the clinical trials for our sole product candidate is completed and is successful. In particular, our multi-purpose anti-tumor compound, Difluoro-Etoposide, expects to be entering Phase I clinical trials for lung cancer and/or breast cancer indication during 2010, provided that we are successful in obtaining the funding necessary to conduct these trials. There can be no assurances that we will be successful in raising the funds necessary to conduct these trials. Further, there can be no assurance that the results obtained from laboratory or research studies will be replicated in human studies or that such human studies will not identify undesirable side effects. There can be no assurance that any of our therapeutic products will meet applicable health regulatory standards, obtain required regulatory approvals or clearances, be produced in commercial quantities at reasonable costs, be successfully marketed or be profitable enough that we will recoup the investment made in such product candidates.

We are a development stage company and may never attain product sales.

We have not received approval for any of our product candidates from the U.S. Food and Drug Administration, ("FDA"). Any compounds that we discover or in-license will require extensive and

costly development, preclinical testing and/or clinical trials prior to seeking regulatory approval for commercial sales. Our most advanced product candidate, Difluoro-Etoposide, and any other compounds we discover, develop or in-license, may never be approved for commercial sale. The time required to attain product sales and profitability is lengthy and highly uncertain, and we cannot assure you that we will be able to achieve or maintain product sales.

We expect our net operating losses to continue for at least several years, and we are unable to predict the extent of future losses or when we will become profitable, if ever. We have incurred significant net losses since our formation in 2009. We have incurred an accumulated deficit of $650,130 as of September 30, 2009. Our operating losses are due in large part to the significant research and development costs required to identify, validate and license potential product candidates, conduct preclinical studies and conduct clinical trials of our more advanced product candidates. To date, we have not generated any revenues and we do not anticipate generating any revenues in the near term, if ever. We expect to increase our operating expenses over the next several years as we plan to:

|

|

• |

Prepare and carry out for the development of Difluoro-Etoposide; |

|

|

• |

expand our research and development activities; |

|

|

• |

increase our required corporate infrastructure and overhead. |

As a result, we expect to continue to incur significant and increasing operating losses for the foreseeable future. Because of the numerous risks and uncertainties associated with our research and product development efforts, we are unable to predict the extent of any future losses or when we will become profitable, if ever. Even if we do achieve profitability, we may not be able to sustain or increase profitability on an ongoing basis.

We have not conducted any significant business operations yet and have been unprofitable to date.

There is no prior operating history by which to evaluate the likelihood of our success or our contribution to our overall profitability. We may never complete clinical trials of our product and commence significant operations or, if we do complete these clinical trials there are no assurances that the results will be positive.

We will require additional funding to satisfy our future capital needs, and future financing strategies may adversely affect holders of our common stock.

Our operations will require significant additional funding in large part due to our research and development expenses, future preclinical and clinical testing costs, and the absence of any meaningful revenues in the near future. We do not know whether additional financing will be available to us on favorable terms or at all. If we cannot raise additional funds, we may be required to reduce our capital expenditures, scale back product development programs, reduce our workforce and license to others products or technologies that we may otherwise be able to commercialize.

To the extent we raise additional capital by issuing equity securities, our stockholders could experience substantial dilution. Any additional equity securities we issue or issuances of debt we may enter into or undertake may have rights, preferences or privileges senior to those of existing holders of stock. To the extent that we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish some rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us.

We have not recorded any revenues from the sale of therapeutic products, have accumulated significant losses since inception and expect to continue to incur losses in the future.

There can be no assurance that we will ever be able to achieve or sustain sufficient sales or other revenue growth in order to achieve profitability or positive cash flow. To become profitable we, either alone or with one or more partners, must develop, manufacture and successfully market therapeutic product candidates. There can be no assurance that we will be successful in achieving the sales levels required to achieve profitability. In addition, lower than anticipated revenues may negatively impact our cash flows, which could accelerate the need for additional capital.

The FDA may change its approval policies or requirements, or apply interpretations to its policies or requirements, in a manner that could delay or prevent commercialization of Difluoro-Etoposide.

Regulatory requirements may change in a manner that requires us to conduct additional clinical trials, which may delay or prevent commercialization of Difluoro-Etoposide. We cannot provide any assurance that the FDA will not require us to repeat existing studies or conduct new or unforeseen experiments in order to demonstrate the safety and efficacy of Difluoro-Etoposide to placebo before considering the approval of Difluoro-Etoposide for the treatment of lung cancer or breast cancer indication. Further, FDA Advisory Panel meetings discussing such drug approvals may result in the heightened scrutiny of Difluoro-Etoposide for the treatment of lung cancer or breast cancer.

Our business would be materially harmed if we fail to obtain FDA approval of a new drug application for Difluoro-Etoposide.

We anticipate that our ability to generate any significant product revenues in the near future will depend solely on the successful development and commercialization of Difluoro-Etoposide, our most advanced product candidate. The FDA may not approve in a timely manner, or at all, the NDA that we submit. If we are unable to submit an NDA for other product candidates, or if the NDA we submitted is not approved by the FDA, we will be unable to commercialize those product in the United States and our business will be materially harmed. The FDA can and does reject NDAs, and often requires additional clinical trials, even when product candidates performed well or achieved favorable results in large-scale Phase III clinical trials. The FDA imposes substantial requirements on the introduction of pharmaceutical products through lengthy and detailed laboratory and clinical testing procedures, sampling activities and other costly and time-consuming procedures. Satisfaction of these requirements typically takes several years and may vary substantially based upon the type and complexity of the pharmaceutical product. Our product candidates are novel compounds or new chemical entities, which may further increase the period of time required for satisfactory testing procedures.

Data obtained from preclinical and clinical activities are susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. In addition, delays or rejections may be encountered based on changes in, or additions to, regulatory policies for drug approval during the period of product development and regulatory review. The effect of government regulation may be to delay or prevent the commencement of clinical trials or marketing of our product candidates for a considerable period of time, to impose costly procedures upon our activities and to provide an advantage to our competitors that have greater financial resources or are more experienced in regulatory affairs. The FDA may not approve our product candidates for clinical trials or marketing on a timely basis or at all. Delays in obtaining or failure to obtain such approvals would adversely affect the marketing of our product candidates and our liquidity and capital resources.

Drug products and their manufacturers are subject to continual regulatory review after the product receives FDA approval. Later discovery of previously unknown problems with a product or manufacturer may result in additional clinical testing requirements or restrictions on such product or manufacturer, including withdrawal of the product from the market. Failure to comply with applicable regulatory requirements can, among other things, result in fines, injunctions and civil penalties, suspensions or withdrawals of regulatory approvals, product recalls, operating restrictions or shutdown and criminal prosecution. We may lack sufficient resources and expertise to address these and other regulatory issues as they arise.

We may be sued or become a party to litigation, which could require significant management time and attention and result in significant legal expenses and may result in an unfavorable outcome which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

While we have no knowledge of any threatened litigation matters, we may be subject to lawsuits from time to time arising in the ordinary course of our business. We may be forced to incur costs and expenses in connection with defending ourselves with respect to such litigation and the payment of any settlement or judgment in connection therewith if there is an unfavorable outcome. The expense of defending litigation may be significant. The amount of time to resolve lawsuits is unpredictable and defending ourselves may divert management’s attention from the day-to-day operations of our business, which could adversely affect our business, results of operations and cash flows. In addition, an unfavorable outcome in any such litigation could have a material adverse effect on our business, results of operations and cash flows.

Holders of our Common Stock may suffer significant dilution in the future.

In order to fully implement our business plan we will require additional capital, either debt or equity, or both. As a result, we expect to raise additional equity capital by selling shares of our Common Stock or other securities in the future to raise the funds necessary to allow us to implement our business plan. If we do so, investors will suffer significant dilution.

Our management and principal shareholders have the ability to significantly influence or control matters requiring a shareholder vote and other shareholders may not have the ability to influence corporate transactions.

Currently, our management, including Dr. Steve N. Slilaty, own, either directly or indirectly, approximately 74.7% of our outstanding Common Stock. As a result, such persons, who may but are not legally bound to act together, will have the ability to determine the outcome on all matters requiring approval of our shareholders, including the election of directors and approval of significant corporate transactions.

If we are unable to attract and retain qualified scientific, technical and key management personnel, or if our key executive, Dr. Steve N. Slilaty, discontinues his employment with us, it may delay our research and development efforts.

We rely on the services of Dr. Slilaty for strategic and operational management, as well as for scientific and/or medical expertise in the development of our products. The loss of Dr. Slilaty would result in a significant negative impact on our ability to implement our business plan. We have not entered into an employment agreement with any member of our management, including Dr. Slilaty. In addition, we do not maintain “key person” life insurance covering Dr. Slilaty or any other executive officer. The loss of Dr. Slilaty will also significantly delay or prevent the achievement of our business objectives.

Our business will expose us to potential product liability risks and there can be no assurance that we will be able to acquire and maintain sufficient insurance to provide adequate coverage against potential liabilities.

Our business will expose us to potential product liability risks that are inherent in the testing, manufacturing and marketing of pharmaceutical products. The use of our product candidates in clinical trials also exposes us to the possibility of product liability claims and possible adverse publicity. These risks will increase to the extent our product candidates receive regulatory approval and are commercialized. We do not currently have any product liability insurance, although we plan to obtain product liability insurance in connection with future clinical trials of our product candidates. There can be no assurance that we will be able to obtain or maintain any such insurance on acceptable terms. Moreover, our product liability insurance may not provide adequate coverage against potential liabilities. On occasion, juries have awarded large judgments in class action lawsuits based on drugs that had unanticipated side effects. A successful product liability claim or series of claims brought against us would decrease our cash reserves and could cause our stock price to fall significantly.

We face regulation and risks related to hazardous materials and environmental laws, violations of which may subject us to claims for damages or fines that could materially affect our business, cash flows, financial condition and results of operations.

Our research and development activities involve the use of controlled and/or hazardous materials and chemicals. The risk of accidental contamination or injury from these materials cannot be completely eliminated. In the event of an accident, we could be held liable for any damages or fines that result, and the liability could have a material adverse effect on our business, financial condition and results of operations. We are also subject to federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of hazardous materials and waste products. If we fail to comply with these laws and regulations or with the conditions attached to our operating licenses, the licenses could be revoked, and we could be subjected to criminal sanctions and substantial liability or be required to suspend or modify our operations. In addition, we may have to incur significant costs to comply with future environmental laws and regulations. We do not currently have a pollution and remediation insurance policy.

We do not have any agreements with any collaborators or third party manufacturers to manufacture our products. If and when we do reach an agreement with these parties, they may not be able to manufacture our product candidates, which would prevent us from commercializing our product candidates.

If any of our product candidates is approved by the FDA or other regulatory agencies for commercial sale, we will need third parties to manufacture the product in larger quantities. If we are able to reach an agreement with any collaborator or third party manufacturer in the future, of which there can be no assurance, due to factors beyond our control these collaborators and/or third party manufacturers may not be able to increase their manufacturing capacity for any of our product candidates in a timely or economic manner, or at all. Significant scale-up of manufacturing may require additional validation studies, which the FDA must review and approve. If we are unable to increase the manufacturing capacity for a product candidate successfully, the regulatory approval or commercial launch of that product candidate may be delayed or there may be a shortage in the supply of the product candidate. Our product candidates require precise, high-quality manufacturing. The failure of collaborators or third party manufacturers to achieve and maintain these high manufacturing standards, including the incidence of manufacturing errors, could result in patient injury or death, product recalls or withdrawals, delays or

failures in product testing or delivery, cost overruns or other problems that could seriously harm our business.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to sell and market any products we may develop, we may be unable to generate revenues.

We do not currently have product sales and marketing capabilities. If we receive regulatory approval to commence commercial sales of any of our product candidates, we will have to establish a sales and marketing organization with appropriate technical expertise and distribution capabilities or make arrangements with third parties to perform these services in other jurisdictions. If we receive approval to commercialize Difluoro-Etoposide for the treatment of for lung cancer or breast cancer indication, we intend to engage additional pharmaceutical or health care companies with existing distribution systems and direct sales organizations to assist us in North America and abroad. We may not be able to negotiate favorable distribution partnering arrangements, if at all. To the extent we enter into co-promotion or other licensing arrangements, any revenues we receive will depend on the efforts of third parties and will not be under our control. If we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, our ability to generate product revenues, and become profitable, would be severely limited.

Our ability to generate any significant revenues in the near-term is dependent entirely on the successful commercialization and market acceptance of Difluoro-Etoposide. Factors that may inhibit our efforts to commercialize Difluoro-Etoposide or other product candidates without strategic partners or licensees include:

|

|

• |

difficulty recruiting and retaining adequate numbers of effective sales and marketing personnel; |

|

|

• |

the inability of sales personnel to obtain access to, or persuade adequate numbers of, physicians to prescribe our products; |

|

|

• |

the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage against companies with broader product lines; and |

|

|

• |

unforeseen costs associated with creating an independent sales and marketing organization. |

Even if we successfully develop and obtain approval for Difluoro-Etoposide or any of our other product candidates, our business will not be profitable if those products do not achieve and maintain market acceptance.

Even if any of our product candidates are approved for commercial sale by the FDA or other regulatory authorities, the degree of market acceptance of any approved product candidate by physicians, healthcare professionals, patients and third-party payors, and our resulting profitability and growth, will depend on a number of factors, including:

|

|

• |

our ability to provide acceptable evidence of safety and efficacy; |

|

|

• |

relative convenience and ease of administration; |

|

|

• |

the prevalence and severity of any adverse side effects; |

|

|

• |

the availability of alternative treatments; |

|

|

• |

the details of FDA labeling requirements, including the scope of approved indications and any safety warnings; |

|

|

• |

pricing and cost effectiveness; |

|

|

• |

the effectiveness of our or our collaborators' sales and marketing strategy; |

|

|

• |

our ability to obtain sufficient third-party insurance coverage or reimbursement; and |

|

|

• |

our ability to have the product listed on insurance company formularies. |

If any of our product candidates achieve market acceptance, we may not be able to maintain that market acceptance over time if new products or technologies are introduced that are received more favorably or are more cost effective. Complications may also arise, such as development of new know-how or new medical or therapeutic capabilities by other parties that render our products obsolete.

Because the results of preclinical studies for our preclinical product candidates are not necessarily predictive of future results, our product candidates may not have favorable results in later clinical trials or ultimately receive regulatory approval.

None of our product candidates have been tested in clinical trials. Positive results from preclinical studies are no assurance that later clinical trials will succeed. Preclinical trials are not designed to establish the clinical efficacy of our preclinical product candidates. We will be required to demonstrate through clinical trials that these product candidates are safe and effective for use before we can seek regulatory approvals for their commercial sale. There is typically an extremely high rate of failure as product candidates proceed through clinical trials. If our product candidates fail to demonstrate sufficient safety and efficacy in any clinical trial, we would experience potentially significant delays in, or be required to abandon, development of that product candidate. This would adversely affect our ability to generate revenues and may damage our reputation in the industry and in the investment community.

The future clinical testing of our product candidates could be delayed, resulting in increased costs to us and a delay in our ability to generate revenues.

Our product candidates will require preclinical testing and extensive clinical trials prior to submitting a regulatory application for commercial sales. We do not know whether clinical trials will begin on time, if at all. Delays in the commencement of clinical testing could significantly increase our product development costs and delay product commercialization. In addition, many of the factors that may cause, or lead to, a delay in the commencement of clinical trials may also ultimately lead to denial of regulatory approval of a product candidate. Each of these results would adversely affect our ability to generate revenues.

|

|

The commencement of clinical trials can be delayed for a variety of reasons, including delays in: |

|

|

• |

demonstrating sufficient safety to obtain regulatory approval to commence a clinical trial; |

|

|

• |

reaching agreement on acceptable terms with prospective research organizations and trial sites; |

|

|

• |

manufacturing sufficient quantities of a product candidate; |

|

|

• |

obtaining institutional review board approvals to conduct clinical trials at prospective sites; and |

|

|

• |

procuring adequate financing to fund the work. |

In addition, the commencement of clinical trials may be delayed due to insufficient patient enrollment, which is a function of many factors, including the size of the patient population, the nature of the protocol, the proximity of patients to clinical sites, the availability of effective treatments for the relevant disease, and the eligibility criteria for the clinical trial. If we are unable to enroll a sufficient number of evaluable patients, the clinical trials for our product candidates could be delayed until sufficient numbers are achieved.

We will face significant competition from other biotechnology and pharmaceutical companies, and our operating results will suffer if we fail to compete effectively.

We are a development stage company with 3 employees. Most of our competitors, such as Bristol-Myers Squibb, Pfizer, TEVA, Amgen, Genentech and others, are large pharmaceutical companies with substantially greater financial, technical and human resources than we have. The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. Many of the drugs that we are attempting to discover or develop will compete with existing therapies if we receive marketing approval. Because of their significant resources, our competitors may be able to use discovery technologies and techniques, or partnerships with collaborators, in order to develop competing products that are more effective or less costly than the product candidates we develop. This may render our technology or product candidates obsolete and noncompetitive. Academic institutions, government agencies, and other public and private research organizations may seek patent protection with respect to potentially competitive products or technologies and may establish exclusive collaborative or licensing relationships with our competitors.

As a company, we do not have any experience in conducting clinical trials for our Difluoro-Etoposide development program. Our competitors may succeed in obtaining FDA or other regulatory approvals for product candidates more rapidly than us. Companies that complete clinical trials, obtain required regulatory agency approvals and commence commercial sale of their drugs before we do may achieve a significant competitive advantage, including certain FDA marketing exclusivity rights that would delay or prevent our ability to market certain products. Any approved drugs resulting from our research and development efforts, or from our joint efforts with our existing or future collaborative partners, might not be able to compete successfully with our competitors' existing or future products.

Because our product candidates and development and collaboration efforts depend on our intellectual property rights, adverse events affecting our intellectual property rights will harm our ability to commercialize products.

Our success will depend to a large degree on our own and our licensors' ability to obtain and defend patents for each party's respective technologies and the compounds and other products, if any, resulting from the application of such technologies. The patent positions of pharmaceutical and biotechnology companies can be highly uncertain and involve complex legal and technical questions. No consistent policy regarding the breadth of claims allowed in biotechnology patents has emerged to date. Accordingly, we cannot predict the breadth of claims that will be allowed or maintained, after challenge, in our or other companies' patents.

The degree of future protection for our proprietary rights is uncertain, and we cannot ensure that:

|

|

• |

we were the first to make the inventions covered by each of our pending patent applications; |

|

|

• |

we were the first to file patent applications for these inventions; |

|

|

• |

others will not independently develop similar or alternative technologies or duplicate any of our technologies; |

|

|

• |

our pending patent applications will result in issued patents; |

|

|

• |

any patents issued to us or our collaborators will provide a basis for commercially viable products, will provide us with any competitive advantages or will not be challenged by third parties; |

|

|

• |

we will develop additional proprietary technologies that are patentable; or |

|

|

• |

the patents of others will not have a negative effect on our ability to do business. |

If we cannot maintain the confidentiality of our technology and other confidential information in connection with our collaborations, then our ability to receive patent protection or protect our proprietary information will be impaired. In addition, some of the technology we have licensed relies on patented inventions developed using U.S. and other governments’ resources. Under applicable law, the U.S. government has the right to require us to grant a nonexclusive, partially exclusive or exclusive license for such technology to a responsible applicant or applicants, upon terms that are reasonable under the circumstances, if the government determines that such action is necessary.

Confidentiality agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information and may not adequately protect our intellectual property.

We rely on trade secrets to protect our technology, particularly when we do not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. In order to protect our proprietary technology and processes, we rely in part on confidentiality and intellectual property assignment agreements with our employees, consultants, outside scientific collaborators and sponsored researchers and other advisors. These agreements may not effectively prevent disclosure of confidential information nor result in the effective assignment to us of intellectual property, and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information or other breaches of the agreements. In addition, others may independently discover our trade secrets and proprietary information, and in such case we could not assert any trade secret rights against such party. Enforcing a claim that a party illegally obtained and is using our trade secrets is difficult, expensive and time consuming, and the outcome is unpredictable. In addition, courts outside the United States may be less willing to protect trade secrets. Costly and time-consuming litigation could be necessary to seek to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position.

The implementation of our business plan will result in a period of rapid growth that will impose a significant burden on our current administrative and operational resources.

Our ability to effectively manage our growth will require us to substantially expand the capabilities of our administrative and operational resources by attracting, training, managing and retaining additional qualified personnel, including additional members of management, technicians and others. To successfully develop our products we will need to manage operating, producing, marketing and selling our products. There can be no assurances that we will be able to do so. Our failure to successfully manage our growth will have a negative impact on our anticipated results of operations.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX 404”), the Securities and Exchange Commission adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company’s financial statements must also attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting as well as the operating effectiveness of the company’s internal controls. We are evaluating our internal control systems in order to allow our management to report on, and our independent auditors to attest to, our internal controls, as a required part of our annual report on Form 10-K.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by SOX 404, there is a risk that we will not comply with all of the requirements imposed thereby. At present, there is no precedent available with which to measure compliance adequacy. Accordingly, there can be no positive assurance that we will receive a positive attestation from our independent auditors.

In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our ability to obtain equity or debt financing could suffer.

Provisions of our Articles of Incorporation and Bylaws may delay or prevent a take-over that may not be in the best interests of our stockholders.

Provisions of our Articles of Incorporation and Bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our stockholders may be called, and may delay, defer or prevent a takeover attempt. In addition, certain provisions of the Colorado Business Corporations Act also may be deemed to have certain anti-takeover effects which include that control of shares acquired in excess of certain specified thresholds will not possess any voting rights unless these voting rights are approved by a majority of a corporation’s disinterested stockholders.

In addition, our Articles of Incorporation authorizes the issuance of up to 10,000,000 shares of Preferred Stock with such rights and preferences determined from time to time by our Board of Directors. As of the date of this report 850,000 shares of our Preferred Stock are currently outstanding. Our Board of Directors may, without stockholder approval, issue additional Preferred Stock with dividends, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of our Common Stock.

RISKS RELATED TO OUR COMMON STOCK

There is a limited trading market for our securities and there can be no assurance that such a market will develop in the future.

There is no assurance that a market will develop in the future or, if developed, that it will continue. In the absence of a public trading market, an investor may be unable to liquidate his investment in our Company.

We do not have significant financial reporting experience, which may lead to delays in filing required reports with the Securities and Exchange Commission and suspension of quotation of our securities on the OTCBB or a national exchange, which will make it more difficult for you to sell your securities.

The OTCBB and other national stock exchanges each limits quotations to securities of issuers that are current in their reports filed with the Securities and Exchange Commission. Because we do not have significant financial reporting experience, we may experience delays in filing required reports with the Securities and Exchange Commission (the “SEC”). Because issuers whose securities are qualified for quotation on the OTCBB or any other national exchange are required to file these reports with the SEC in a timely manner, the failure to do so may result in a suspension of trading or delisting.

There are no automated systems for negotiating trades on the OTCBB and it is possible for the price of a stock to go up or down significantly during a lapse of time between placing a market order and its execution, which may affect your trades in our securities.

Because there are no automated systems for negotiating trades on the OTCBB, they are conducted via telephone. In times of heavy market volume, the limitations of this process may result in a significant increase in the time it takes to execute investor orders. Therefore, when investors place market orders, an order to buy or sell a specific number of shares at the current market price, it is possible for the price of a stock to go up or down significantly during the lapse of time between placing a market order and its execution.

Our stock will be considered a “penny stock” so long as it trades below $5.00 per share. This can adversely affect its liquidity.

Our Common Stock is currently considered a “penny stock” and will continue to be considered a penny stock so long as it trades below $5.00 per share and as such, trading in our Common Stock will be subject to the requirements of Rule 15g-9 under the Securities Exchange Act of 1934. Under this rule, broker/dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. The broker/dealer must make an individualized written suitability determination for the purchaser and receive the purchaser’s written consent prior to the transaction.

SEC regulations also require additional disclosure in connection with any trades involving a “penny stock,” including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from recommending transactions in our securities, which could severely limit the liquidity of our securities and consequently adversely affect the market price for our securities. In addition, few broker or dealers are likely to undertake these compliance activities. Other risks associated with trading in penny stocks could also be price fluctuations and the lack of a liquid market.

We do not anticipate payment of dividends, and investors will be wholly dependent upon the market for the Common Stock to realize economic benefit from their investment.

As holders of our Common Stock, you will only be entitled to receive those dividends that are declared by our Board of Directors out of retained earnings. We do not expect to have retained earnings available for declaration of dividends in the foreseeable future. There is no assurance that such retained earnings will ever materialize to permit payment of dividends to you. Our Board of Directors will determine future dividend policy based upon our results of operations, financial condition, capital requirements, reserve needs and other circumstances.

Any adverse effect on the market price of our Common Stock could make it difficult for us to raise additional capital through sales of equity securities at a time and at a price that we deem appropriate.

Sales of substantial amounts of our Common Stock, or in anticipation that such sales could occur, may materially and adversely affect prevailing market prices for our Common Stock.

The market price of our Common Stock may fluctuate significantly in the future.

The market price of our Common Stock may fluctuate in response to one or more of the following factors, many of which are beyond our control:

|

• |

competitive pricing pressures; |

|

|

|

|

• |

our ability to produce and sell our products on a cost-effective and timely basis; |

|

|

|

|

• |

our inability to obtain working capital financing; |

|

|

|

|

• |

the introduction and announcement of one or more new alternatives to our products by our competitors; |

|

|

|

|

• |

changing conditions in the market; |

|

|

|

|

• |

changes in market valuations of similar companies; |

|

|

|

|

• |

stock market price and volume fluctuations generally; |

|

|

|

|

• |

regulatory developments; |

|

|

|

|

• |

fluctuations in our quarterly or annual operating results; |

|

|

|

|

• |

additions or departures of key personnel; and |

|

|

|

|

• |

future sales of our Common Stock or other securities. |

The price at which you purchase shares of our Common Stock may not be indicative of the price that will prevail in the trading market. You may be unable to sell your shares of Common Stock at or above your purchase price, which may result in substantial losses to you and which may include the complete loss of your investment. In the past, securities class action litigation has often been brought against a company following periods of stock price volatility. We may be the target of similar litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and our resources away from our business. Any of the risks described above could adversely affect our sales and profitability and also the price of our Common Stock.

We cannot predict whether we will successfully effectuate our current business plan. Each prospective purchaser is encouraged to carefully analyze the risks and merits of an investment in our Common Stock and should take into consideration when making such analysis, among others, the Risk Factors discussed above.

MANAGEMENT’S DISCUSSION OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited consolidated financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with

the Securities and Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward looking statements.

OVERVIEW AND HISTORY

We were incorporated on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” Until October 15, 2009, we were engaged in the business of providing management consulting with regard to accounting, computer and general business issues for small and home-office based companies. During the period of time prior to October 15, 2009, our business was to develop and market proprietary specialized computer software to help manage electronically stored data through MWBI. On October 15, 2009, we executed an agreement to acquire Sunshine Etopo, Inc., a Colorado corporation that was formed on August 17, 2009, which resulted in a change in control. Our shareholders also authorized an amendment to our Articles of Incorporation wherein we changed our name from “Mountain West Business Solutions, Inc.” to Sunshine Biopharma, Inc. which became effective on October 15, 2009. Effective October 15, 2009 we also placed our former subsidiaries into trust in order to undertake a “spin-off” of MWBI to our shareholders of record on October 14, 2009.

As a result of this change in control and spin-off, our current business plan has been changed. See “Plan of Operation,” above for a discussion of this new business.

We have not been subject to any bankruptcy, receivership or similar proceeding.

Our new address is 6100 Royalmount Ave. Montreal, Quebec, Canada H4P 2R2. Our telephone number is (514) 496-5197.

RESULTS OF OPERATIONS

Results of Operations for the period from our inception (August 17, 2009) through September 30, 2009

During the period from our inception at August 17, 2009 through September 30, 2009, we did not generate any revenues. We do not anticipate generating revenues until our initial drug candidate, Difluoro-Etoposidetm (Adva-27a), a Carbon-Difluoride derivative of Etoposide, has undergone clinical trials and is approved by the FDA.

General and administrative expenses for the period beginning August 17, 2009 (inception) through September 30, 2009 were $650,130, including write-down of intangible assets of $645,974. The other major components of these general and administrative expenses were legal and accounting fees ($3,932).

As a result, we incurred a net loss of $650,130 (approximately $0.21 per share) for the period ended September 30, 2009.

LIQUIDITY AND CAPITAL RESOURCES

As of September 30, 2009, we had cash or cash equivalents of $336,364.

Net cash used in operating activities was $198 for the period from August 17, 2009 (inception) through September 30, 2009. We anticipate that overhead costs in current operations will increase in the future once we begin implementing our new business plan discussed herein.

Cash flows provided or used in investing activities were $-0- for the fiscal quarters ended September 30, 2009. Cash flows provided or used by financing activities were $-0- for the period from August 17, 2009 (inception) through September 30, 2009.

We are not generating revenue from our operations, and our ability to implement our new business plan for the future will depend on the future availability of financing. Such financing will be required to enable us to further develop our testing, research and development capabilities and continue operations. We intend to raise funds through private placements of our common stock or through short-term borrowing. We estimate that we will require approximately $7.5 million in debt and/or equity capital to fully implement our business plan in the future and there are no assurances that we will be able to raise this capital. While we have engaged in discussions with various investment banking firms, venture capitalists to provide us these funds, as of the date of this report we have not reached any agreement with any party that has agreed to provide us with the capital necessary to effectuate our new business plan or otherwise enter into a strategic alliance to provide such funding. Our inability to obtain sufficient funds from external sources when needed will have a material adverse affect on our plan of operation, results of operations and financial condition.

Our cost to continue operations as they are now conducted is nominal, but these are expected to increase once we commence Phase I clinical trials. We do not have sufficient funds to cover the anticipated increase in these expenses. We need to raise additional funds in order to continue our existing operations, to initiate research and development activities, and to finance our plans to expand our operations for the next year. If we are successful in raising additional funds, our research and development efforts will continue and expand.

SUBSEQUENT EVENT

Effective November 12, 2009, holders of convertible promissory notes in the aggregate principal amount of $30,000 did elect to convert their notes into shares of our Common Stock. We issued an aggregate of 6,750,000 shares of our Common Stock to seven persons/entities, one of which is a resident of the United States. We relied upon the exemption from registration provided by Section 4/2, Regulation D and Regulation S, each promulgated under the Securities Act of 1933, as amended, to issue these shares.

CRITICAL ACCOUNTING ESTIMATES

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of our critical accounting policies, defined as those policies that we believe are the most important to the portrayal of our financial condition and results of operations and that require

management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

INFLATION

Although our operations are influenced by general economic conditions, we do not believe that inflation had a material effect on our results of operations during the period from August 17, 2009 (inception) through September 30, 2009.

EXECUTIVE COMPENSATION

We do not expect to pay salaries to any of our executive officers or directors until such time as we are able to secure adequate funding for our operations.

Item 3.02 Unregistered Sales of Equity Securities

Effective October 15, 2009, we executed an agreement to acquire Sunshine Biopharma, Inc., a Colorado corporation, in exchange for the issuance of 21,962,000 shares of our Common Stock and 850,000 shares of Convertible Preferred Stock, each convertible into twenty (20) shares of our Common Stock.

Item 5.01 Changes in Control of the Registrant

As a result of the transaction described above under Item 2.01, we have experienced a change in control. The following table sets forth certain information regarding the ownership of our Common Stock as of the date of this report by (i) each person known to us to own more than 5% of our outstanding common stock as of the date of this report(ii) each of our new directors, (iii) each of our new executive officers, and (iv) all of our new directors and executive officers as a group. Unless otherwise indicated, all shares are owned directly and the indicated person has sole voting and investment power.

|

Title of Class |

|

Name and Address Of Beneficial Owner |

|

Amount and Nature Of Beneficial Ownership |

|

Percent Of Class |

|

|

|

|

|

|

|

|

|

Common |

|

Dr. Steve N. Slilaty(1) 579 rue Lajeunesse Laval, Quebec Canada H7X 3K4 |

|

34,343,567(2) |

|

73.7% |

|

|

|

|

|

|

|

|

|

Common |

|

Michele Di Turi(1) 3100 Boulevard Des Gouverneurs Laval, Quebec Canada H7E 5J3 |

|

234,373 |

|

* |

|

|

|

|

|

|

|

|

|

Common |

|

Camille Sebaaly(1) 14464 Gouin W, #B Montreal, Quebec Canada H9H 1B1 |

|

234,373 |

|

* |

|

|

|

|

|

|

|

|

|

Common |

|

All Officers and Directors As a Group (3 persons) |

|

34,812,313(2) |

|

74.7% |

|

* |

Less than 1% |

|

(1) |

Officer and Director of our Company. |

|

(2) |

Includes 17,109,194 shares held in the name of Advanomics Corporation and 850,000 shares of Series “A” Convertible Preferred Stock that is convertible into 17,000,000 shares of Common Stock held in the name of Advanomics Corporation. Dr. Slilaty is an officer, director and principal shareholder of Advanomics Corporation. |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors: Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective October 15, 2009, Ms. Lynn M. Vagi did resign her positions as President, Treasurer and as a director of our Company. There were no disagreements between Ms. Vagi and our Company regarding the operation, policies or practices of our Company. Simultaneous therewith, Dr. Steve N. Slilaty was appointed as our CEO and President, Mr. Michele Di Turi was appointed our Chief Operating Officer and Mr. Camille Sebaaly was appointed as our Chief Financial Officer and Secretary of our Company. Each of the aforesaid persons was also appointed as directors of our Company. They will hold such positions until the next annual meeting of our Board of Directors or shareholders, as applicable, their resignation, removal or death, whichever occurs first.

|

|

The following is a biographical summary of the business experience of our new management: |

Dr. Steve N. Slilaty, age 57, was appointed as our CEO, President and Chairman of our Board of Directors on October 15, 2009. In addition, since February 2002, Dr. Slilaty has been President and Chief Scientific Officer of Advanomics Corporation, Montreal, Canada, a privately held company engaged in the research, development and commercialization of drugs for the treatment of various forms of cancer. Advanomics Corporation is the third in a line of biotechnology companies that Dr. Slilaty founded and managed through their early and mid stages of development. The first, Quantum Biotechnologies Inc. later known as Qbiogene Inc., was founded in 1991 and grew to over $60 million in annual sales. Today, Qbiogene is a member of a family of companies owned by MP Biomedicals, one of the largest international suppliers of biotechnology reagents with a catalogue containing over 55,000 products. The second company which Dr. Slilaty founded, Genomics One Corporation, now known as Alert B&C Corporation, conducted an initial public offering (IPO) of its capital stock in 1999 and, on the basis of its ownership of Dr. Slilaty’s patented TrueBlue® Technology, Genomics One became one of the handful of participants in the Human Genome Project. Formerly a research team leader of the Biotechnology Research Institute, a division of the National Research Council of Canada, Dr. Slilaty also served as a consultant in a management and advisory capacity for a major Canadian biotechnology company between 1995 and 1997 during which time the company completed one of the largest biotechnology IPO‘s in Canada raising over $34 million. Dr. Slilaty received his Ph.D degree from the University of Arizona in 1983 and a Bachelor of Science degree from Cornell University in 1976. In addition, Dr. Slilaty holds a position as Adjunct Professor at Universit-é du Qu-ébec in the Department of Microbiology and Biotechnology. He intends to devote approximately 50% of his time to our business affairs.

Michele Di Turi, age 32, was appointed as our Chief Operating Officer and a Director of our Company on October 15, 2009. Since November 2008, Mr. Di Turi has been President of Sunshine Bio Investments, Inc., a privately held Canadian corporation engaged in the sale of nonregulated biotechnology and medical products. Prior, from February 2003 through November 2008, he was employed by Mazda President, Inc., Montreal, Canada, as a sales representative and director of customer service. He intends to devote approximately 60% of his time to our business affairs.

Camille Sebaaly, age 50, was appointed as our Chief Financial Officer, Secretary and a Director of our Company on October 15, 2009. Since 2001, Mr. Sebaaly was self-employed as a business consultant, primarily in the biotechnology and biopharmaceutical sectors, as well as in the hydrogen

generation and energy savings fields. He was a co-founder of Advanomics Corporation with Dr. Slilaty. He received a Bachelor of Science degree in electrical and computer engineering from the State University of New York at Buffalo in 1987. He intends to devote all of his time to our business affairs.

Item 7.01 Regulation FD Disclosure

Our Press Release relating to our acquisition described above was attached as Exhibit 99.1 to the initial Form 8-K previously filed.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements. Our audited financial statements from the date of inception (August 17, 2009) through September 30, 2009 are included herewith, along with an unaudited consolidated pro forma financial statement.

|

|

(b) Exhibits. The following exhibits are included in this amendment: |

|

No. |

Description |

|

10.2 |

License Agreement with Advanomics Corporation |

|

10.3 |

Amendment No. 1 to License Agreement with Advanomics Corp. |

|

23.2 |

Consent of Ronald R. Chadwick, P.C. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this amended report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: January 19, 2010 |

SUNSHINE BIOPHARMA, INC. |

|

|

(Registrant) |

|

|

By:s/Steve N. Slilaty____________________ |

|

|

Dr. Steve N. Slilaty |

|

|

Chief Executive Officer |

Sunshine Biopharma, Inc.

(A Development Stage Company)

FINANCIAL STATEMENTS

With Independent Accountant’s Audit Report

The period August 17, 2009 (inception) through September 30, 2009

TABLE OF CONTENTS

|

|

Page |

|

|

Independent Accountant’s Audit Report |

F-1 |

|

|

Balance Sheet |

F-2 |

|

|

Statement of Operations |

F-3 |

|

|

Statement of Cash Flows |

F-4 |

|

|

Statement of Shareholders’ Equity |

F-5 |

|

|

Notes to Financial Statements |

F-6-F-9 |

RONALD R. CHADWICK, P.C.

Certified Public Accountant

2851 South Parker Road, Suite 720

Aurora, Colorado 80014

Telephone (303)306-1967

Fax (303)306-1944

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Sunshine Biopharma, Inc.

Englewood, Colorado

I have audited the accompanying balance sheet of Sunshine Biopharma, Inc. (a development stage company) as of September 30, 2009 and the related statements of operations, stockholders' equity and cash flows for the period from August 17, 2009 (inception) through September 30, 2009. These financial statements are the responsibility of the Company's management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provides a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Sunshine Biopharma, Inc. as of September 30, 2009 and the results of its operations and its cash flows for the period from August 17, 2009 (inception) through September 30, 2009 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements the Company has suffered a loss from operations and has a working capital deficit that raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

|

Aurora, Colorado |

Ronald R. Chadwick, P.C. |

|

January 8, 2010 |

RONALD R. CHADWICK, P.C. |

F-1

Sunshine Biopharma, Inc.

(A Development Stage Company)

Balance Sheet

as of September 30, 2009

|

|

|

2009 |

|

|||

|

|

|

|

|

|||

|

ASSETS |

|

|||||

|

Current Assets |

|

|

|

|

||

|

|

|

|

|

|||

|

Cash |

|

|

$ |

336,364 |

|

|

|

|

|

|

|

|||

|

TOTAL ASSETS |

|

|

$ |

336,364 |

|

|

|

|

|

|

|

|||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) |

|

|||||

|

LIABILITIES |

|

|

|

|

||

|

|

|

|

|

|||

|

Current liabilities |

|

|

|

|

||

|

Due to related parties |

|

|

|

250 |

|

|

|

|

|

|

|

|||

|

TOTAL LIABILITIES |

|

|

|

250 |

|

|

|

|

|

|

|

|||

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

||

|

Preferred stock, par value $.001 per share; Authorized 10,000,000 shares: Series A convertible; issued and outstanding 7,300,000 shares. |

|

|

|

73,000 |

|

|

|

Common Stock, par value, $.001 per share; Authorized 200,000,000 shares; issued and outstanding 89,140,734 shares. |

|

|

|

89,141 |

|

|

|

Stock subscriptions receivable |

|

|

|

(312,688 |

) |

|

|

Common stock subscribed (4,564,789 shares) |

|

|

|

312,688 |

|

|

|

Capital paid in excess of par value |

|

|

|

824,103 |

|

|

|

(Deficit) accumulated during the development stage |

|

|

|

(650,130 |

) |

|

|

|

|

|

|

|||

|

TOTAL SHAREHOLDERS’ EQUITY |

|

|

|

336,114 |

|

|

|

|

|

|

|

|||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

$ |

336,364 |

|

|

The accompanying notes are an integral part of these financial statements.

F-2

Sunshine Biopharma, Inc.

(A Development Stage Company)

Statement of Operations

|

|

August 17, 2009 (inception) through September 30, 2009 |

|

||

|

|

|

|

||

|

Revenue |

|

$ |

— |

|

|

|

|

|

||

|

|

|

|

||

|

General and administrative expenses |

|

|

|

|

|

|

|

|

||

|

Office |

|

|

224 |

|

|

Legal and professional fees |

|

|

3,932 |

|

|

Writedown of intangible assets |

|

|

645,974 |

|

|

|

|

|

||

|

Total expenses |

|

|

650,130 |

|

|

|

|

|

||

|

Net (Loss) |

|

$ |

(650,130 |

) |

|

|

|

|

||

|

|

|

|

||

|